MPSC Presentation

Finance Department

Five Year Progress Report

forward-looking statement…

During the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

The information in this presentation is based upon our current

expectations as of the date hereof. Our actual future business and

financial performance may differ materially and adversely from those

expressed in any forward-looking statements. We undertake no obligation

to revise or publicly update our forward-looking statements or this

presentation for any reason. Although our expectations and beliefs are

based on reasonable assumptions, actual results may differ materially.

The factors that may affect our results are listed in certain of our press

releases and disclosed in the Company’s public filings with the SEC.

agenda…

Finance department overview

5 year progress

2009 June YTD update

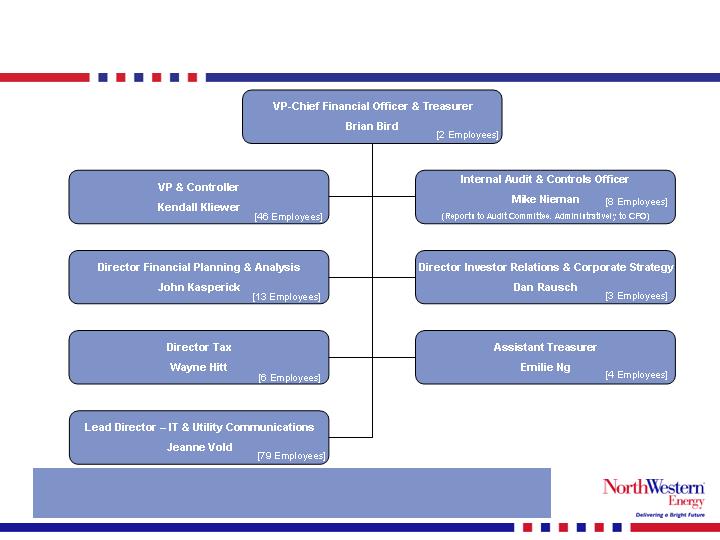

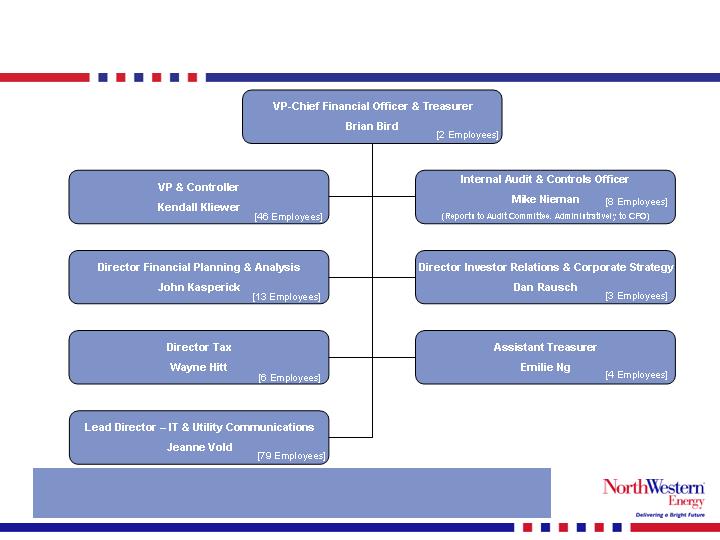

finance department org chart…

Out of 161 Finance and Information Technology & Utility

Communication employees, 121 are Montana employees.

accounting…

Accounting

Financial reporting

SEC and FERC reporting

Annual

quarterly

MPSC reporting

Annual

Support Regulatory Affairs

Accounting

Accounts Payable

Payroll

Benefits Administration

Compensation and benefits

benchmarking

Administer benefits

Medical

Retirement

Incentive

Compliance reporting

5500’s

Plan documents

achievements over past 5 years…

Accounting

Made significant improvements in

controls over financial reporting

Increased compliance and

reporting requirements

Significantly reduced external

audit fees

Significantly reduced monthly

close and reporting cycles

Reduced annual reporting cycle

by 45 days

Reduced quarterly reporting cycle

by 15 to 20 days

Currently complete pre-tax close

within 4 business days

Consistent improvement in

accounts payable process related

to support of operations and

timeliness of vendor payments

Benefits Administration

Significantly improved timeliness

of compliance reporting

Filings were three years delinquent

in 2004—now all current

Continually evaluating

compensation and benefits to

ensure they are market

competitive to attract and retain

talent

Enhanced 401(k) Plan and closed

Pension Plan to new entrants to

reduce volatility risk to company,

yet provide a competitive

retirement benefit

Improvements were accomplished while reducing headcount over

the same time period.

audit…

Internal Audit

Independent, objective assurance and

consulting. Helps organization

accomplish its objectives.

Risk management

Internal controls

Governance

Authorized by, and reports directly to,

the Audit Committee

Annual approval of Internal Audit Plan and

Charter

At least quarterly reports

Key Responsibilities -

Support management’s assessment of

internal controls over financial reporting

Operational process and project audits

Compliance reviews of contracts

Evaluate fraud risks

IIA International Standards for the

Professional Practice of Internal

Auditing

Enterprise Risk Management (ERM)

A process designed to identify, assess

and respond to risks

Audit Committee oversight

ERM Committee

70 “Risk Identifiers” throughout the

company

Incorporated into strategic planning and

corporate goals

Ongoing monitoring of risk changes

Facilitates communication!

Business Continuity

Corporate Continuity of Operations Plan

Corporate Crisis Action Team

Departmental Emergency Response Plans

Coordinate with other public entities

COSO Enterprise Risk Management

Integrated Internal Control Framework

achievements over past 5 years…

Internal Audit

Led effort to implement the requirements

of Sarbanes-Oxley

Continually improving annual independent

review of key processes

Coordinated with external auditors to

reduce fees

Re-established department which

conforms to IIA Standards

ERM

Implemented program conforming to

COSO framework

Facilitated Development of Key

Emergency Response Plans

Work Force Emergency Plan (including

Pandemic Flu Preparation)

Facilities, IT, Communications

Company Internal Controls and Compliance

Remediated Material Weakness in Internal Control in Energy Supply

Energy Risk Management Policy

Energy Supply Board

Effective front, mid, and back offices

26 documented key business processes for internal controls over

financial reporting

Disclosure Committee for SEC reporting

Annual Management Fraud Risk Assessment

Corporate Risk Appetite Statement

financial planning…

Financial Planning and Analysis

Annual Budget and Operating Plan

Responsible for development of annual

operating and capital budget

Work with each area in the company for

development of annual plans

Review and approval by Board of

Directors

Monthly Internal Reporting

Responsible for timely reporting of

monthly results v budget and prior year

Numerous managerial reports by area

and activity to assist in managing

performance

Reports available by FERC level

SAP system development for reporting

Monthly Forecasting

Responsible for monthly forecasting

and expectations

External Reporting Support, Rate

Case Support, and Key Performance

Indicator development

Long-range financial modeling and

modeling of investment growth

opportunities

Provide financial modeling and analysis

for long-range planning

Provide individual financial models to

support growth initiatives

Capital Budgeting, Forecasting and

Reporting

Work with areas on annual and long-

term capital planning and needs

Provide timely monthly reporting and

capital forecasting

Mid-Office Energy Supply

Responsible for Company’s energy

risk management policies

Controlling agent on policies and

procedures between the front and mid-

office supply procurement

achievements over past 5 years…

Financial Planning and Analysis

Refined and enhanced annual budget

process

Develop budgets by operational

activities and work needs

Budget available by individual

segments, FERC level

Working to control costs to benefit all

stakeholders

Refined and enhanced monthly

forecast process

Working with all areas to provide more

accurate expectations of performance

Refined and enhanced monthly

reporting process

Developed key performance indicators

with peer comparisons reported

monthly

SAP system development and

refinement of monthly managerial

reports

Timely executive and Board reporting

of performance

Mid-Office Supply controls

Developed energy risk management

policies and controls

Minimized risk of supply function

Capital planning and reporting

Refined system to better enable timely

reporting and capital planning

Long-range planning and financial

modeling

Developed detailed models for 5-year

and 15-year financial planning needs

Developed individual financial models

and analysis for investment growth

projects

Education and training

Working with all areas of company to

understand financial basics and

expectations

Communicating stakeholders

expectations and overall balance

Local area economy expertise and

support

investor relations / corporate strategy…

Investor Relations

Inform potential shareholders

Press releases

Conference presentations

Face to face meetings

Company strategy

Updates on Company activities

Answer questions of the shareholders

Disclosure committee on SEC reports

Manage sell side research coverage

Currently 6 sell side firms cover the

Company

Corporate Strategy

Formulate the Company’s vision and

mission

Focus on relationships between

regulators, customers, communities,

employees and shareholders

Include key concepts such as

“sustainability” and future growth

concepts such as “renewable energy”

and “technology advancement”

Match current and desired cultural

values

Prioritize corporate initiatives

Ensure adequate resources to achieve

critical near-term goals

Promote management focus

Drive reporting structure

Quarterly reassessment with Senior

Management

Quarterly updates to Board

Goal is to communicate strategy and business operations to

attract a shareholder base that matches our philosophy

and investment time horizons

achievements over past 5 years…

Investor Relations

Shareholder base has morphed to

longer term holders

Hedge holdings after bankruptcy> 50%

of the shareholders

Hedge holdings now < 15% of

shareholder base

Emerged from bankruptcy with 2 sell

side coverage firms

Currently 6 sell side firms cover the

Company

Implementing Dividend Reinvestment

Plan and Employee Stock Purchase

Plan in 2009

Looking to increase the retail

shareholder base

Corporate Strategy

“Back to basic’s” company focus

“Unregulated” segment of financial

statements is gone

Future plans seek to rate base each

investment

Considering all stakeholders in key

business decisions

Improving rate stability for customers

Increasing community involvement in

spite of tough economic environment

Significant contributions to fund

employee’s pensions

Growth projects to add economic

development to service territories and

grow earnings

Advancing “renewable” initiatives for

resource rich service territories

NorthWestern’s has attracted longer term shareholders while

serving all stakeholders

tax…

Tax Department

Tax Returns

Income Tax Returns for Federal & State

Property Tax Returns by State

Sales & Use Tax Returns by State

Income Tax Accrual for Financial Statements for SEC, FERC,

& State Commissions

Tax Audits

Income Tax for Federal & State

Property Tax by State

Sales & Use Tax by State

Goal is to minimize corporate tax liabilities within the confines

of applicable federal and state tax laws.

achievements over past 5 years…

Tax Department

Reduced the effective tax rate from 41% to 36.5% and are

working to reduce it further.

Negotiated 4-year settlement in Montana achieving lower

property taxes.

Improvements in sales & use tax process has eliminated

unexpected adverse South Dakota tax audit assessments.

As of year-end 2008, NOL as filed is $350 million offset by IRS

tax audit reserve of $201 million yielding $149 million as

accrued.

Reduction in corporate tax liabilities will yield value for

NorthWestern’s customers and shareholders.

treasury…

Treasury

Cash Management

Bank account management

Cash forecasting

Investments

Short-term borrowing

Credit

Seek credit from counter parties

Counterparty credit evaluation / determination

Collateral management

Corporate Finance (Capital Management)

Debt financing / management

Equity financing

Cost of capital support

Rating Agency and Bank Relations

achievements over past 5 years…

Treasury

Refinanced all long term debt to all in cost less

than 6%

Provided persuasive case to rating agencies

that ratings should be higher

Successful outcome on Colstrip lease buyouts

and rate-basing efforts

Instrumental in selling many of non-core assets

Provided tremendous amount of credit capacity

with our energy supply partners

audit committee – role…

Quarterly –

Review and Certify 10-Q

Assessment of Internal Controls Over Financial Reporting

Review Earnings Press Release

Report from Deloitte

Recommend Dividend Payment

Internal Audit Update

General Counsel Update, including Compliance Line Report

Executive Sessions (management, auditor, internal audit)

Annually –

Review quality of auditor and engagement letter and fee proposal

Review ERM program and top priority risks

Review Management’s Annual Fraud Risk Assessment

Review Energy Supply Risk Management Quality Assurance

Review officer expenses and aircraft use

Review Charter and Code of Business Conduct and Ethics

Approve Internal Audit Charter and Annual Internal Audit Plan

Approve Audit Committee Report in proxy statement

Conduct self-evaluation

As necessary –

Approve non-audit services (tax)

Recommend approval of equity and debt financings

Audit Committee of the Board

Steve Adik

Phil Maslowe

Lou Peoples

Dana Dykhouse

5 year progress…

Improving controls

Stronger financial position

Investing in the business

Funding pension plan

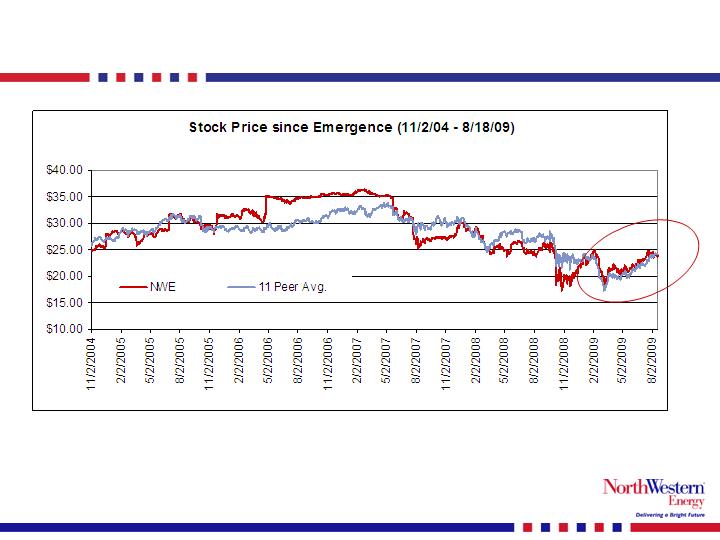

Stock performance in-line with 11 peers

Credit ratings improving

Attractive refinancing & improved liquidity

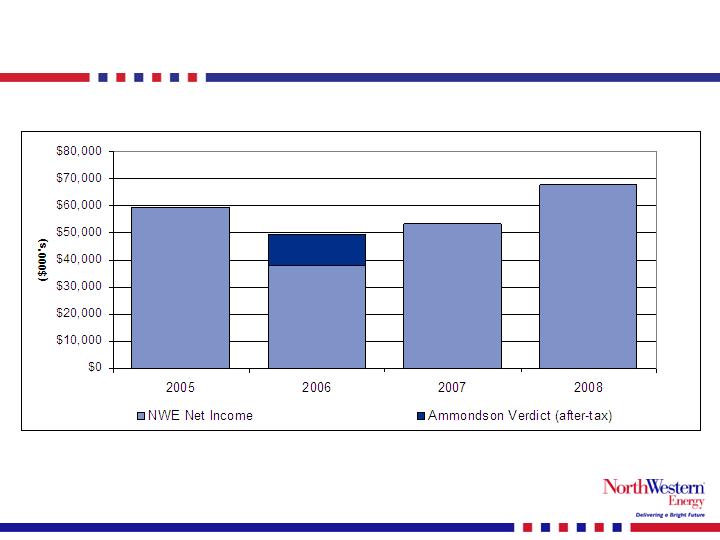

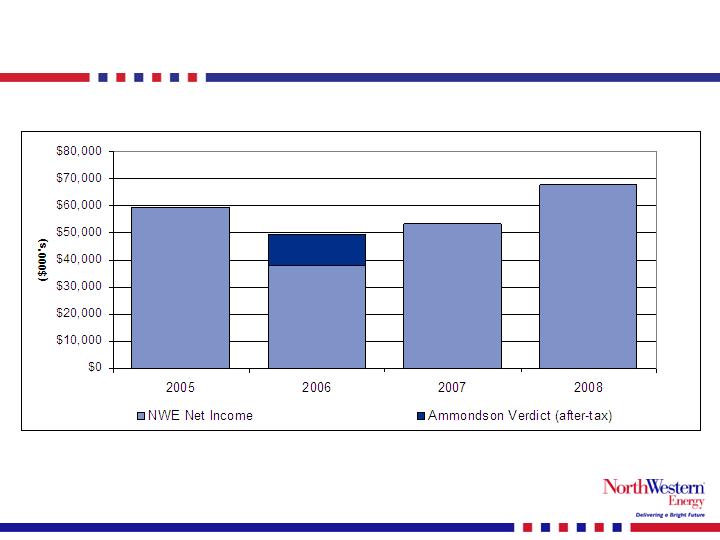

net income…

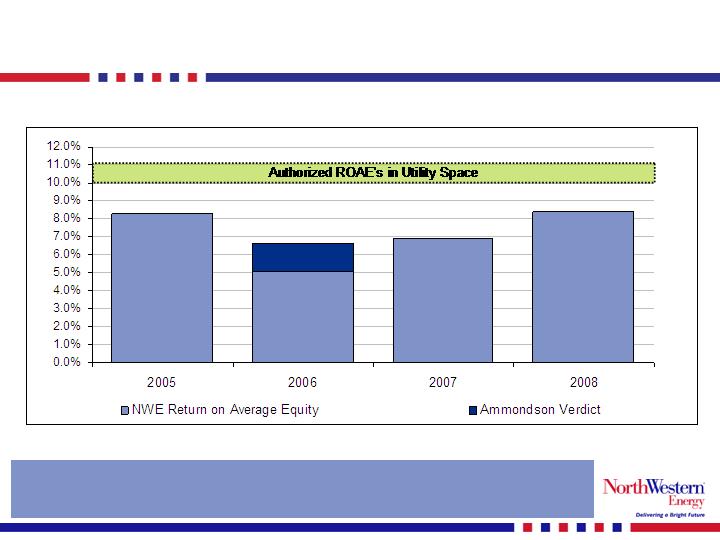

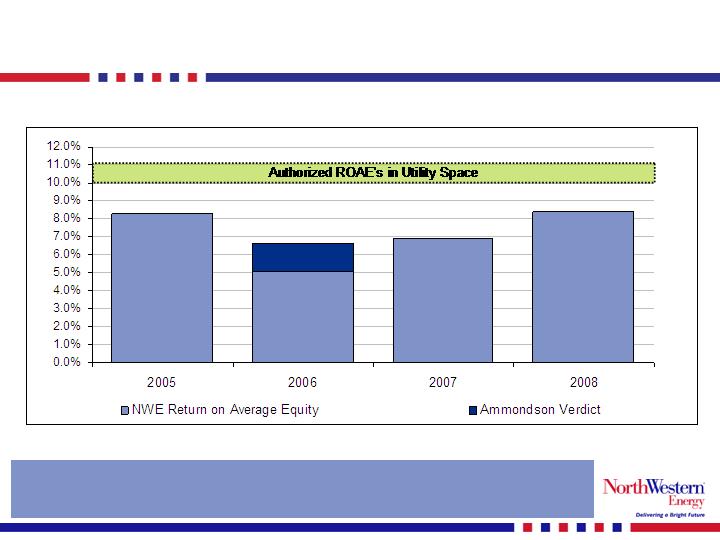

return on average equity …

Authorized Return on Average Equity (ROAE) of 10-11% in utility

space

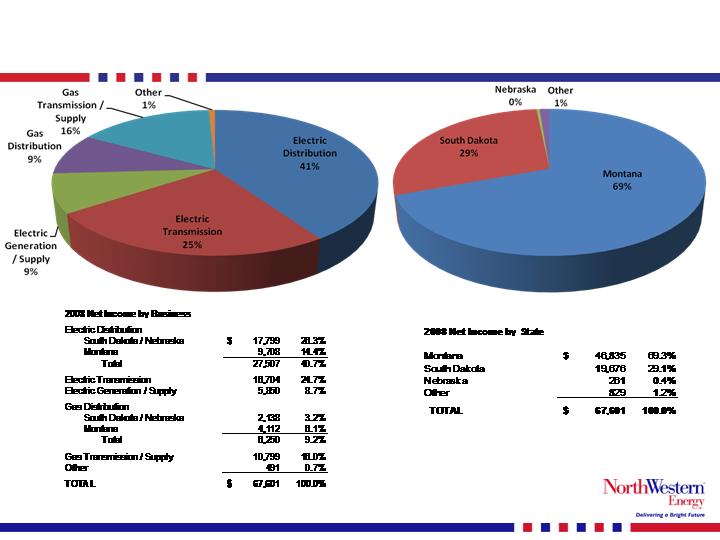

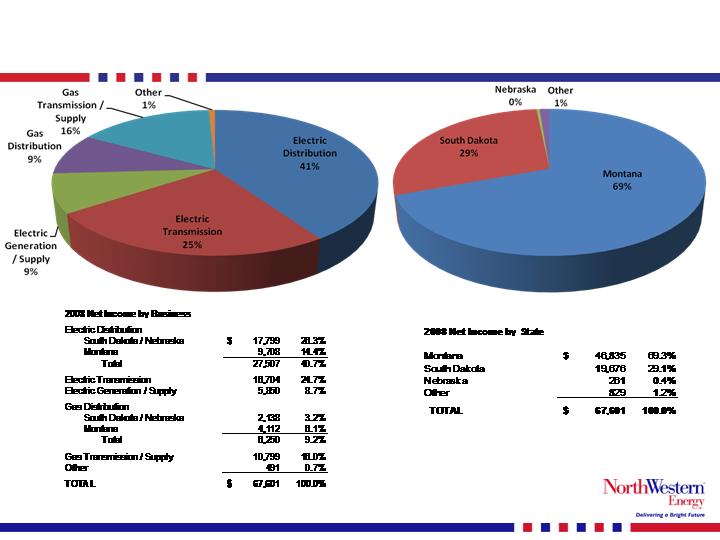

2008 NWE net income composition…

why does return on equity matter …

The Shareholders own our company

They elect a Board of Directors

The Board appoints a Chief Executive Officer – with his executive

team, they are responsible for the operation of the Company

Shareholders have expectations for return on equity

If we fail to provide a competitive rate of return on equity we may

have difficulty attracting future capital for the Company.

Underperforming share price may potentially attract non-utility type

investors.

These investors may require

a higher than utility average return

actions that provide short-term benefits to shareholders in exchange for

long-term stability for all stakeholders

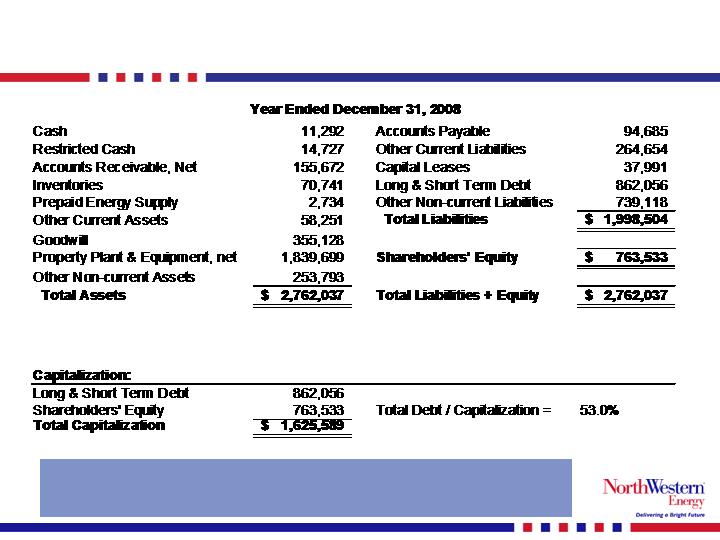

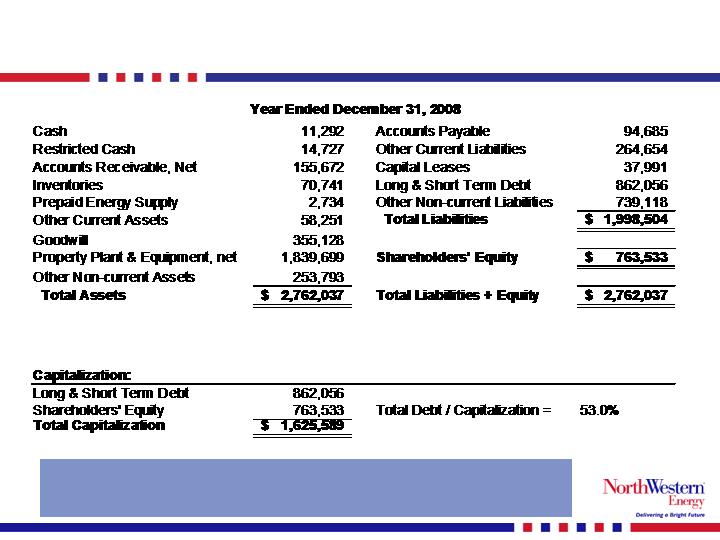

balance sheet…

12/31/2008 Debt to Capitalization 53.0%

Target of 50 – 55%

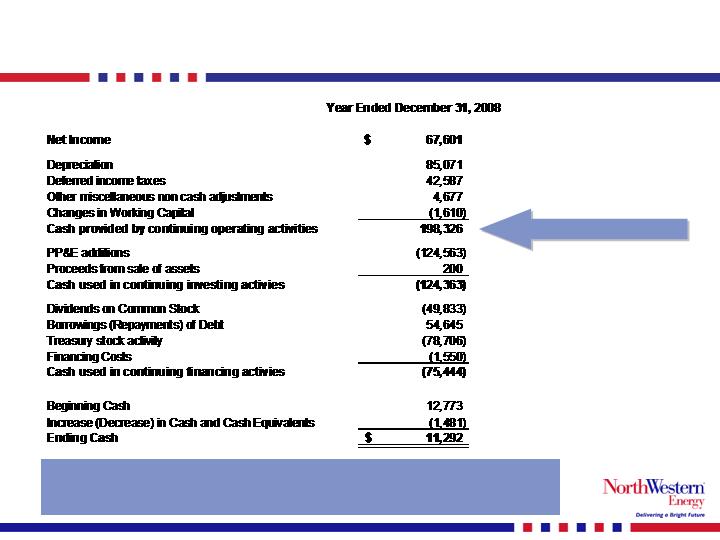

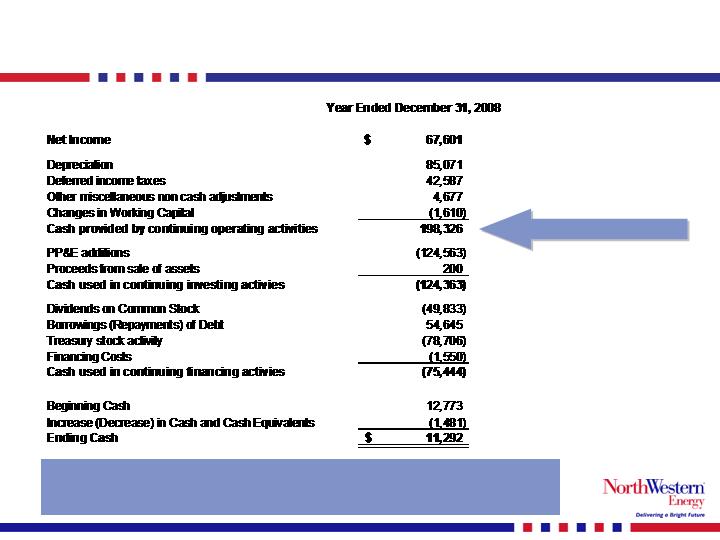

cash flow…

Ample Cash Flow to reinvest in business

Cash Flow from Operations

capital spending…

As most companies nationally have cut back capital investments

NorthWestern Energy’s Capital spend continues to grow

Historic and 2009 Budget Utility Capital

-

20,000

40,000

60,000

80,000

100,000

120,000

2005 A

2006 A

2007 A

2008 A

2009 B

SD Regulated

MT Regulated

$109M

$82M

Avg Annual

increase

7.1%

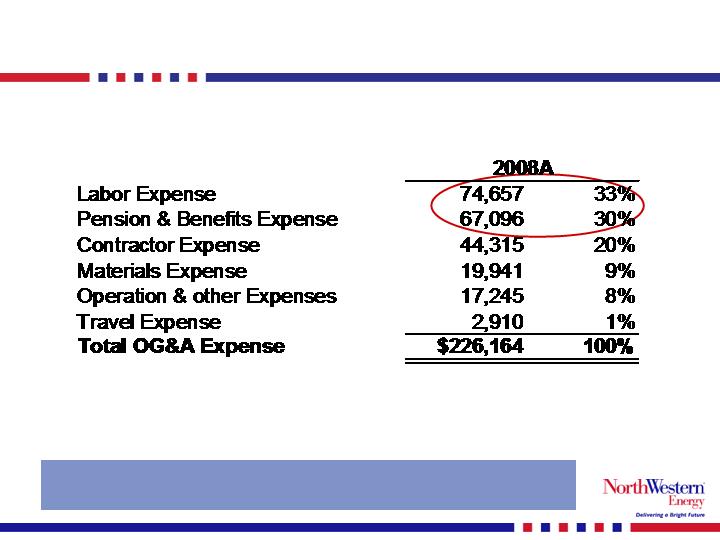

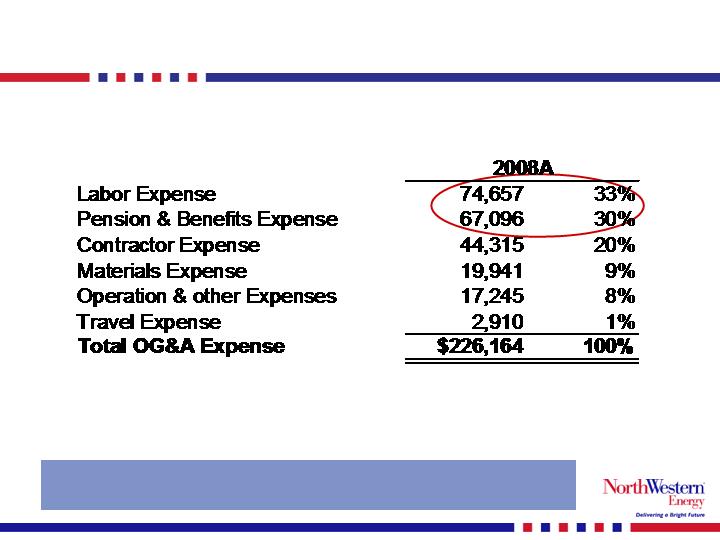

OG&A expense…

Labor, Pension & Benefits alone comprise 63% of our total

OA&G expense.

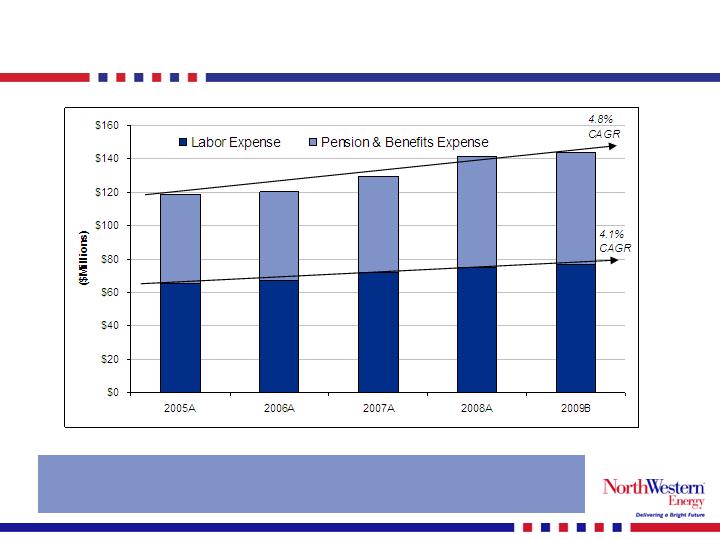

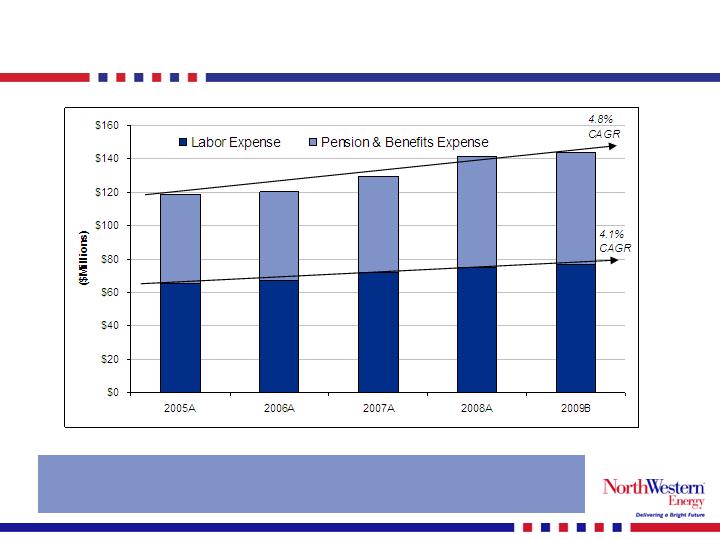

people costs…

Compounded Annual Growth Rate (CAGR) of 4.8% in total due to

new hires, cost of living increases, and increased pension

expense.

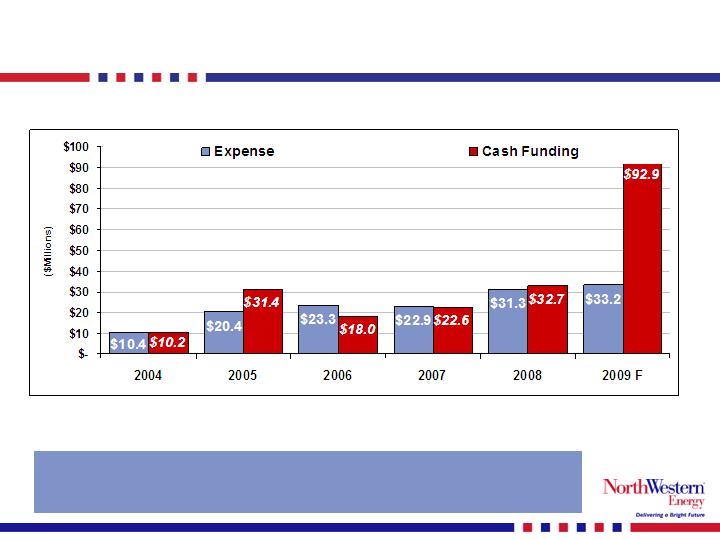

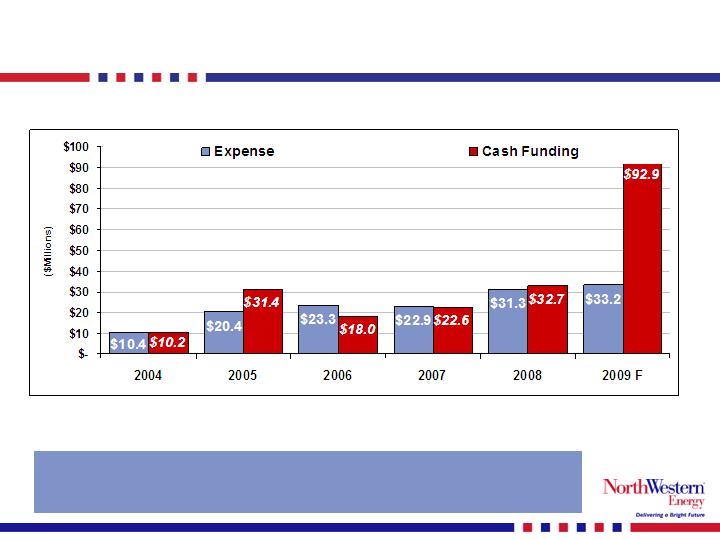

pension expense vs funding…

Significant pension increases due to past market conditions.

Prefunding in 2009 to take advantage of low equity market

conditions.

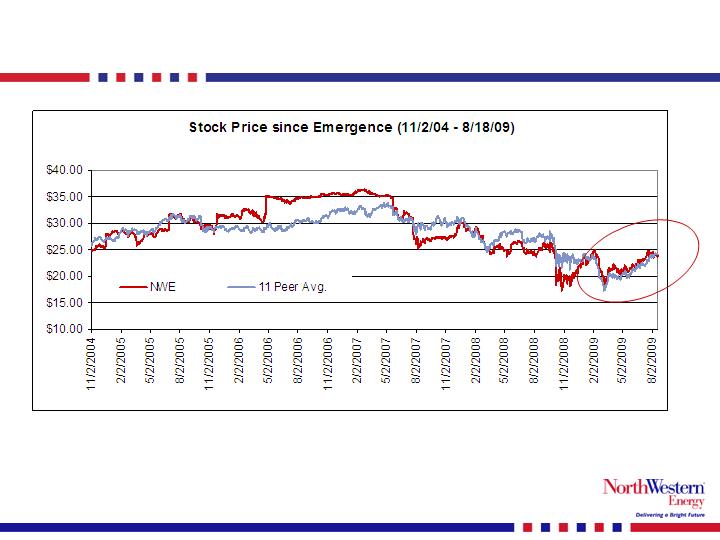

stock performance…

shareholder mix…

Shareholder mix continues to morph

More mutual funds, which includes index funds

More bank management divisions and investment banker asset

management

12/31/2008

3/31/2009

6/30/2009

Ave of peers

@ 6-30-09

Institutional:

Investment advisor

37%

36%

36%

25%

Hedge funds

31%

24%

13%

5%

Mutual Fund

20%

24%

28%

27%

Brokers & Banks

2%

7%

16%

8%

Pension Fund

2%

2%

2%

2%

Other

1%

2%

1%

1%

Total Institutional

94%

95%

96%

68%

Retail

6%

5%

4%

32%

Total

100%

100%

100%

100%

Source: SNL

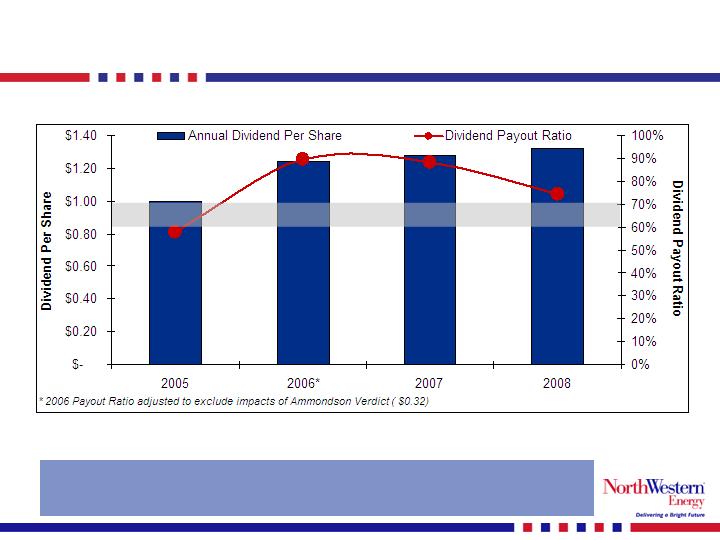

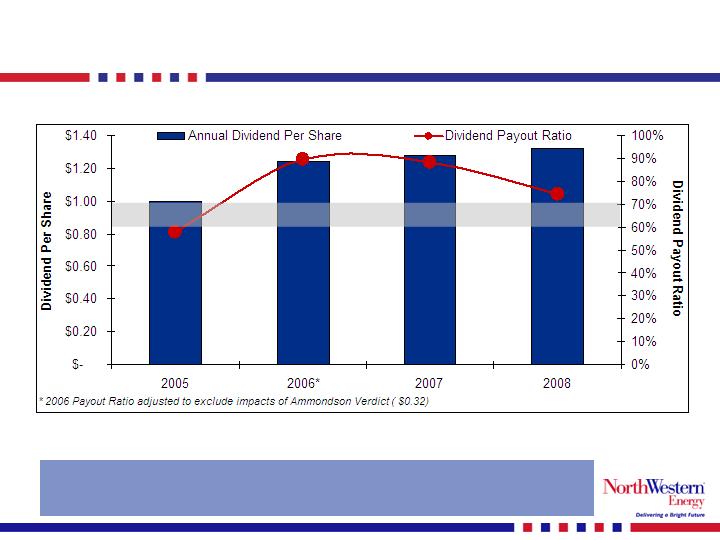

dividend history…

Long-term targeted Dividend Payout Ratio of 60-70%

improving credit ratings…

Secured Ratings

S&P A-

Moody’s A3

Fitch BBB+

NWE credit ratings

now better than

peer average

shown here.

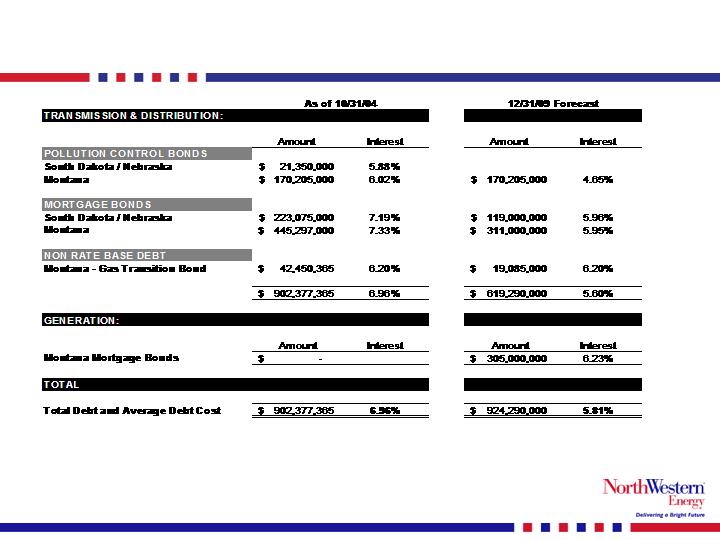

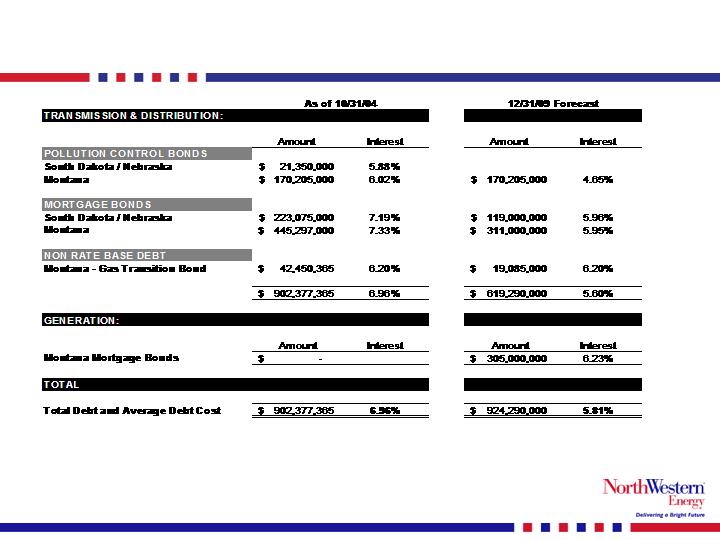

declining interest rates…

1.) Interest rate does not include other costs of debt such as debt issuance expenses, discounts or premiums, and losses on

reacquired debt.

2.) $305 million of Montana Mortgage Bonds includes the $55 million 30 year new issue priced at 5.71% in September and

expected to close mid October 2009.

2

1

1

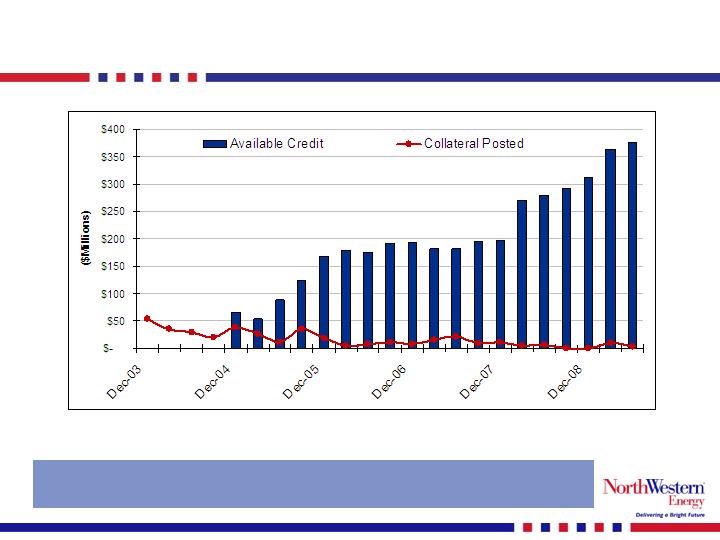

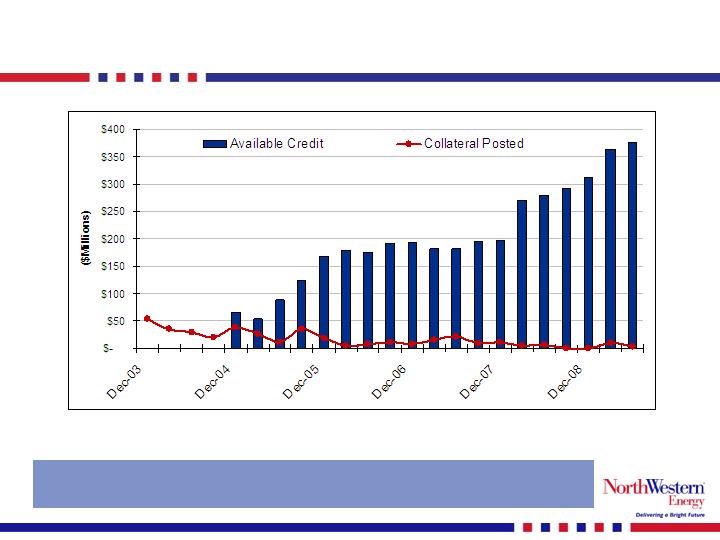

improving counterparty credit position…

Improving credit ratings has resulted in enhanced counterparty

credit and reduced collateral requirements.

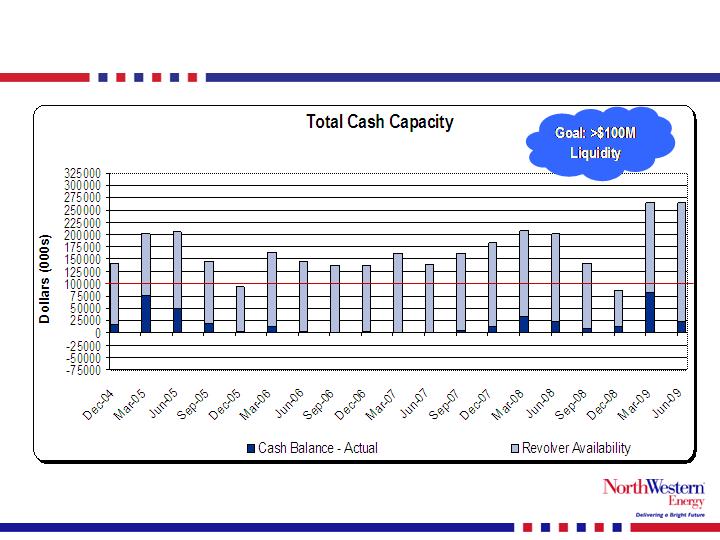

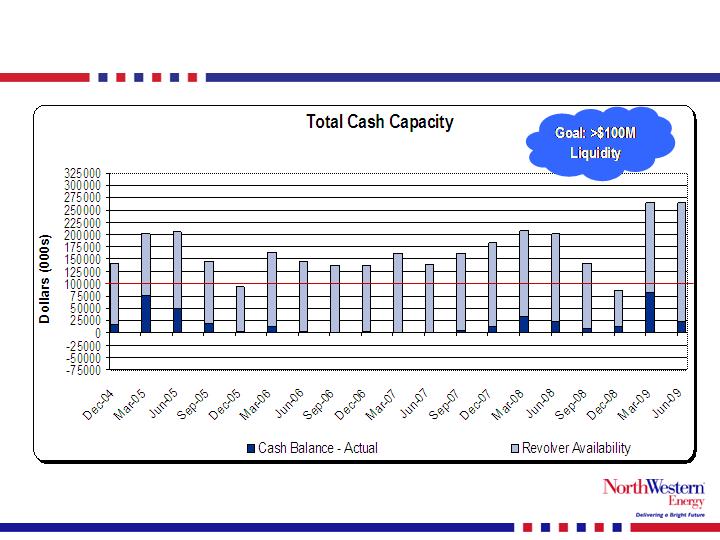

ample liquidity…

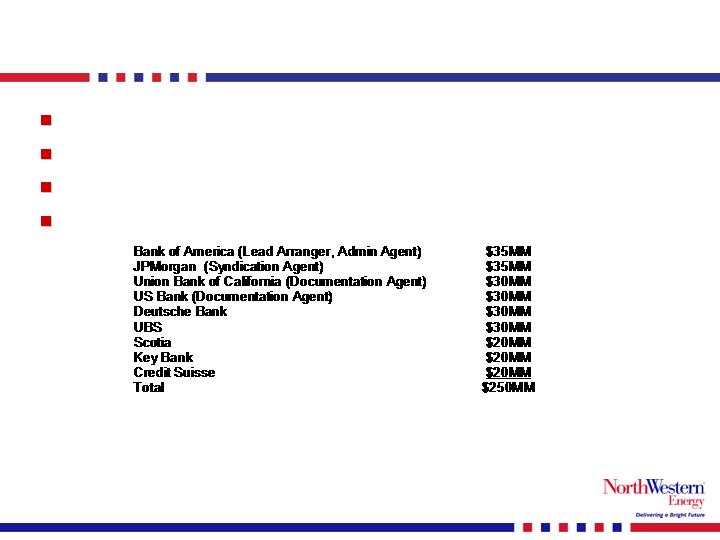

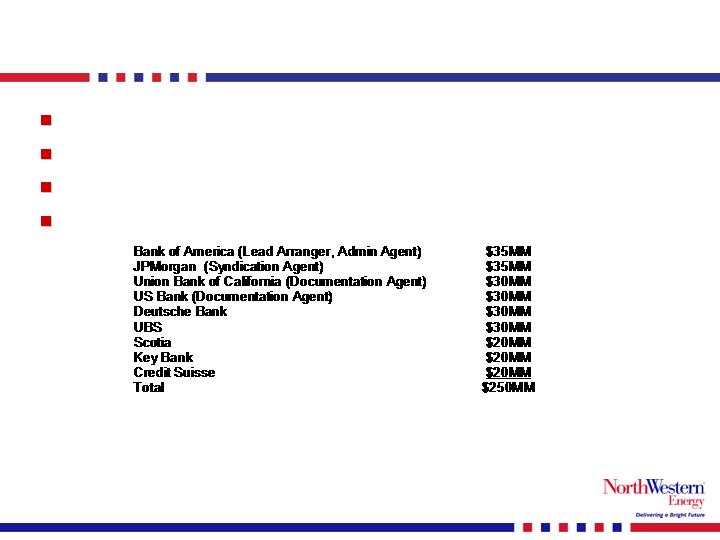

$250MM unsecured revolving credit facility…

Maturity: June 30, 2012

Pricing: Grid based on credit ratings currently at Libor + 300bps

Financial Covenant: Maximum Debt to Cap = 65%

Relationship Banks:

Note: First 3-year revolver executed in the Utility sector in the current economic environment

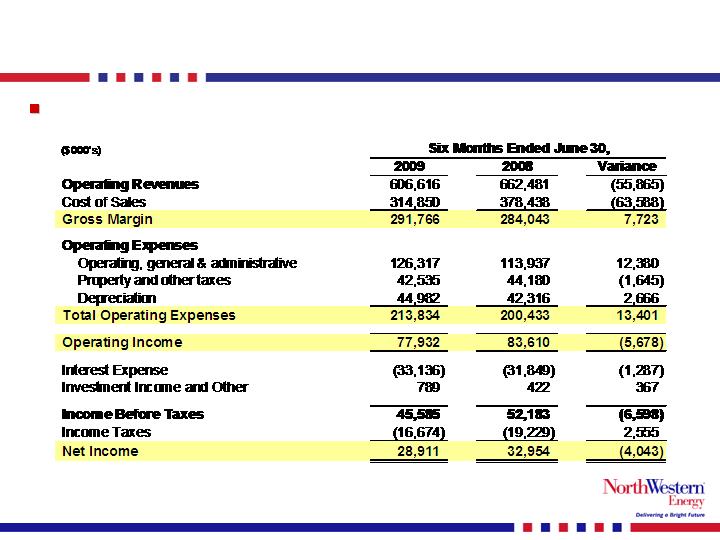

2009 June YTD performance…

2nd quarter & YTD June financials poor

Reduced guidance from $1.85-$2.00 per share

to $1.75-$1.85 per share on second quarter

earnings call.

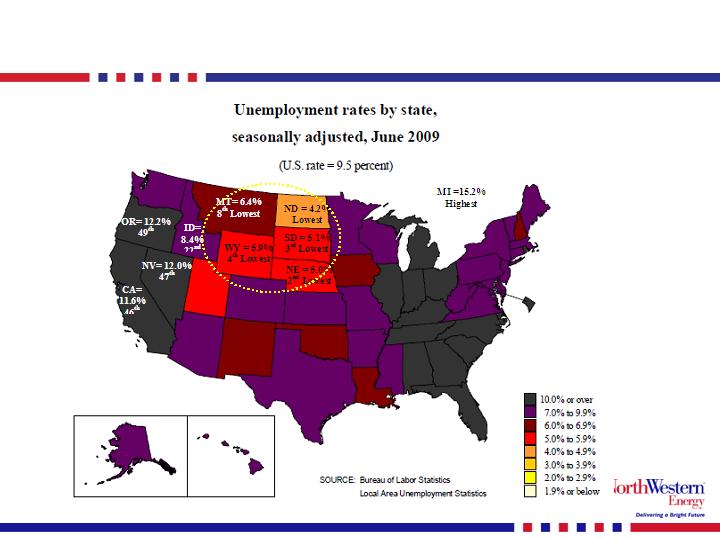

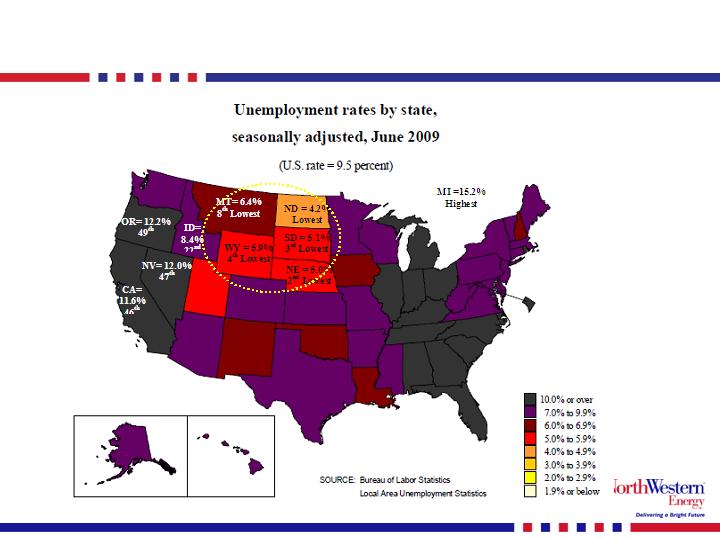

economic environment…

Our Country is in the worst national recession in the past

25 years

MT, SD, and NE fairing better than a lot of areas

NE, SD, and MT have the 2nd lowest, 3rd lowest, and 8 th lowest

unemployment respectively

Our Company has been impacted by:

reduced transmission OASIS sales,

lower SD wholesale pricing due to market demand,

increased pension funding and costs due to market

conditions, and

weather

Due to the current recession, many companies are:

reducing staff (# of unemployed nationally increased 5.5

million over the past year),

reducing capital spends,

freezing pensions,

reducing salaries, and

capital spending is being reduced as well across the nation

we are fairing better…

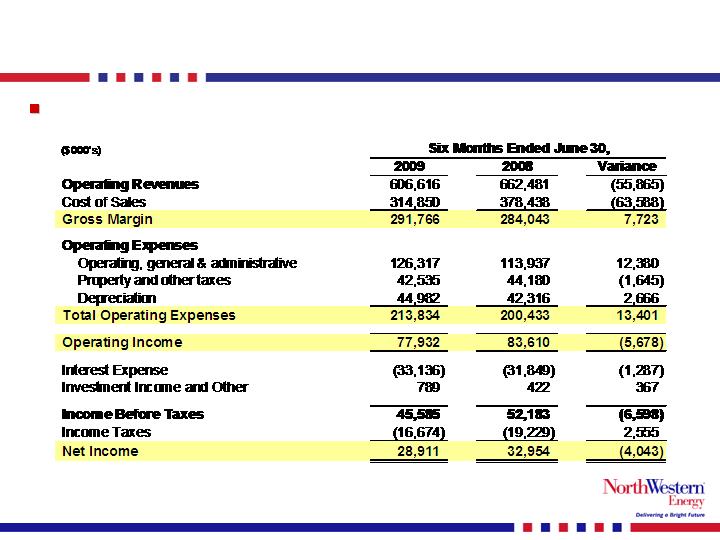

Overall company earnings behind prior year $4.0M or 12.3% through June

2009 June YTD financial performance …

2009 June YTD financial performance …

Earnings YTD impacted by:

Impacts of the economic downturn

Transmission OASIS sales – lack of demand in other states

SD wholesale loads – reduced pricing due to demand in MAPP

region

Slow down in customer growth and new connects

Write-offs growing but being managed – customers having

difficulty paying

Lower gas and electric loads due to weather

Bozeman gas incident and other claim costs

Increased benefit, compensation, and pension costs

Retail and Wholesale operating costs

Higher depreciation and interest expense

Reduced property tax expense