Investor Update

Boston, Philadelphia, Cincinnati,

Columbus & Cleveland

September 29 – October 1, 2009

2

forward-looking statement…

During the course of this presentation, there will be forward-looking

statements within the meaning of the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements often address our expected future business and financial

performance, and often contain words such as “expects,�� “anticipates,”

“intends,” “plans,” “believes,” “seeks,” or “will.”

Except as noted herein, the information in this presentation is based upon

our current expectations as of the date hereof. Our actual future business

and financial performance may differ materially and adversely from those

expressed in any forward-looking statements. We undertake no obligation

to revise or publicly update our forward-looking statements or this

presentation for any reason. Although our expectations and beliefs are

based on reasonable assumptions, actual results may differ materially.

The factors that may affect our results are listed in certain of our press

releases and disclosed in the Company’s public filings with the SEC.

3

who we are…

(1)

As of 6/30/09

(2)

Book capitalization calculated as total debt, excluding capital leases, plus shareholders’ equity.

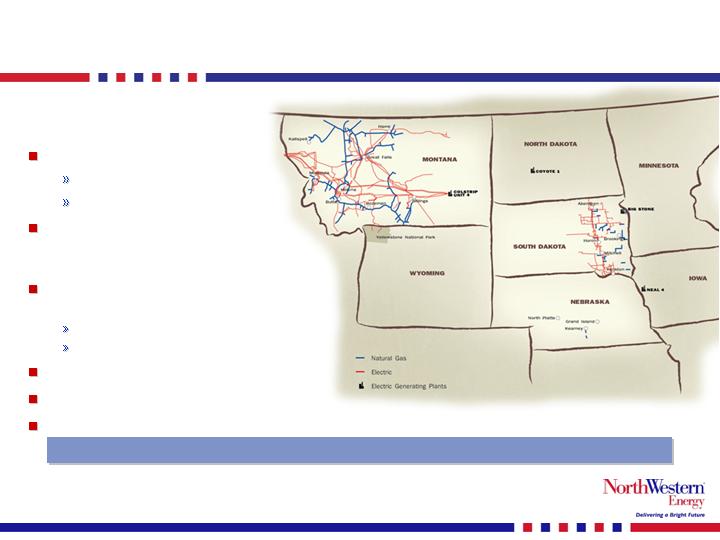

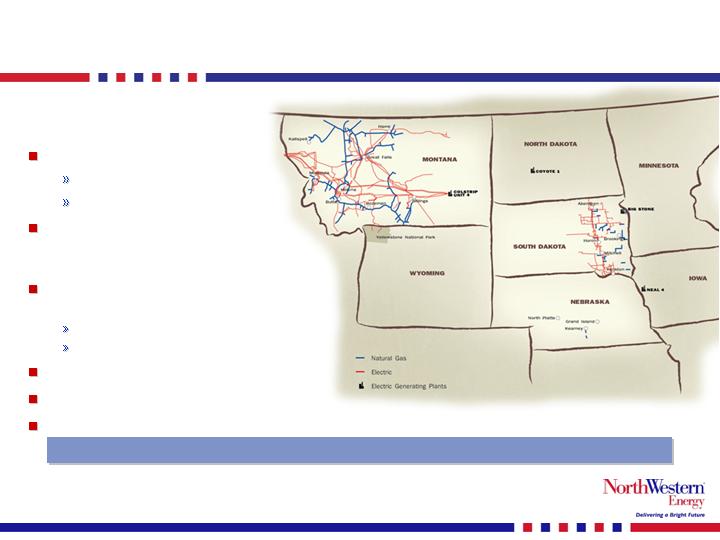

656,000 customers

392,000 electric

264,000 natural gas

Approximately 123,000 square

miles of service territory in

Montana, Nebraska and South Dakota

Total generation (mostly base load coal)

MT – 222 MW – regulated as of 1/1/09

SD – 312 MW – regulated

Total Assets: $2,720 MM (1)

Total Capitalization: $1,638 MM (1)(2)

Total Employees: 1,385 (1)

Located in relatively stable economies with potential grid expansion in the Northwest.

4

NorthWestern’s attributes…

Solid operations

Cost competitive

Above-average reliability

Award-winning customer service

Improving debt ratings and strong balance sheet and liquidity

Secured credit ratings of A-(MT) BBB+(SD) / BBB+ / Baa3

Moody’s has on “positive” outlook

Competitive dividend

Current yield approximately 5.5%

Positive earnings and ROE trend

Colstrip Unit 4 into rates effective Jan. 1, 2009

Delivery services rate case to be filed in MT for electric and nat. gas in October ‘09

Strong cash flows

NOLs provide an effective tax shield until at least 2012

Realistic growth prospects

Electric generation and transmission opportunities

Solid operations with strong growth prospects.

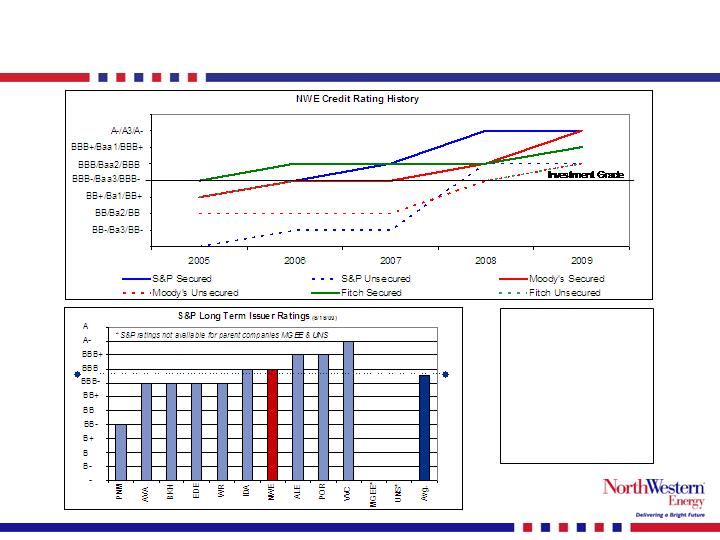

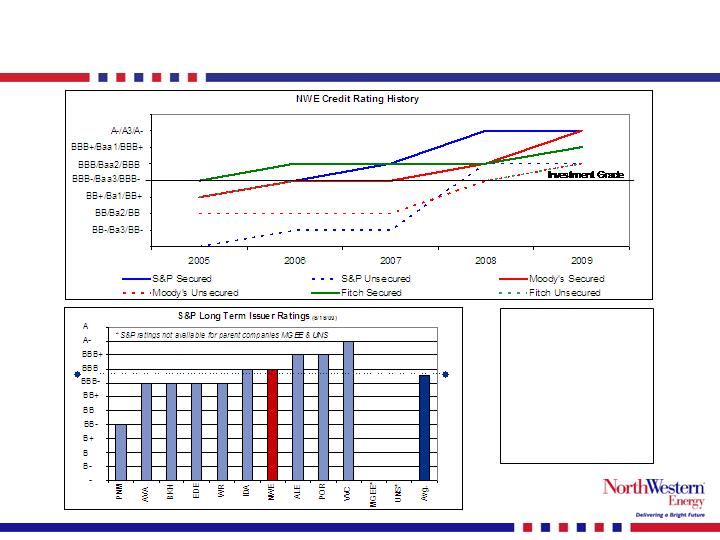

improving credit ratings…

Secured Ratings

S&P A-

Moody’s A3

Fitch BBB+

NWE credit ratings

now better than peer

average shown here.

5

6

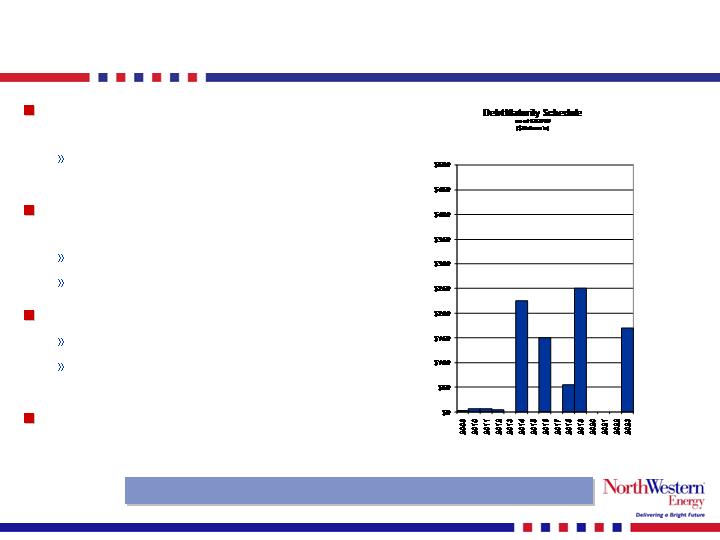

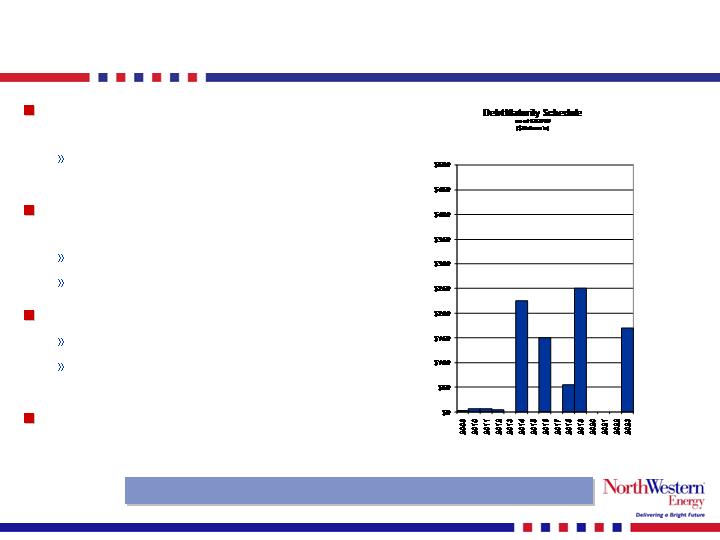

liquidity highlights…

Recently issued $250 million in

First Mortgage Bonds

10 year maturity with interest rate

of 6.34%

Priced $55 million additional First

Mortgage Bonds

30 year maturity at 5.71%

Expect to close in mid-October

Extended unsecured revolver

Maturity date now June 30, 2012

Added $50 million in availability to

increase to $250 million

Total liquidity currently in the

$250 million range

Nearly all long-term debt matures after 2014.

7

strong balance sheet…

Plan to maintain a 50%-55% debt to total capitalization ratio.

(Dollars in 000's)

June 30,

December 31,

2009

2008

Cash

22,963

11,292

Restricted Cash

16,640

14,727

Accounts Receivable, Net

97,962

155,672

Inventories

47,350

70,741

Other Current Assets

75,459

60,985

Goodwill

355,128

355,128

PP&E and Other Non-current Assets

2,104,468

2,093,492

Total Assets

2,719,970

$

2,762,037

$

Payables

56,121

94,685

Other Current Liabilities

258,520

264,654

Long & Short Term Capital Leases

36,202

37,991

Long & Short Term Debt

868,979

862,056

Other Non-current Liabilities

731,187

739,118

Shareholders' Equity

768,961

763,533

Total Liabilities and Equity

2,719,970

$

2,762,037

$

Long & Short Term Debt / Total Capitalization

53.1%

53.0%

8

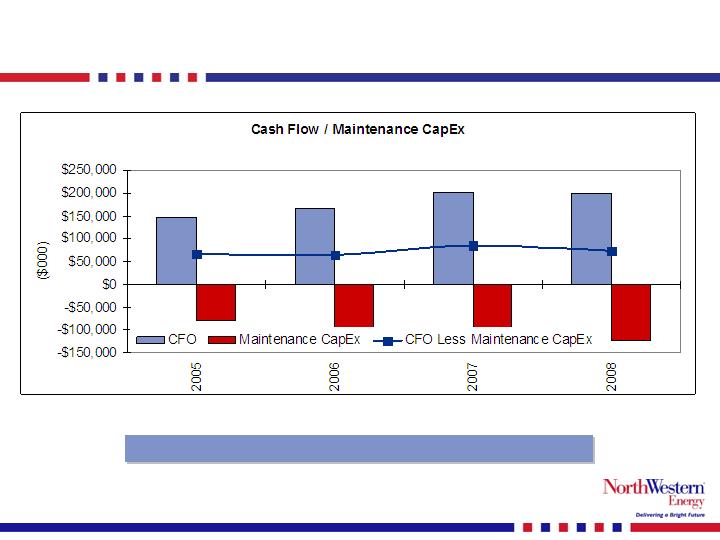

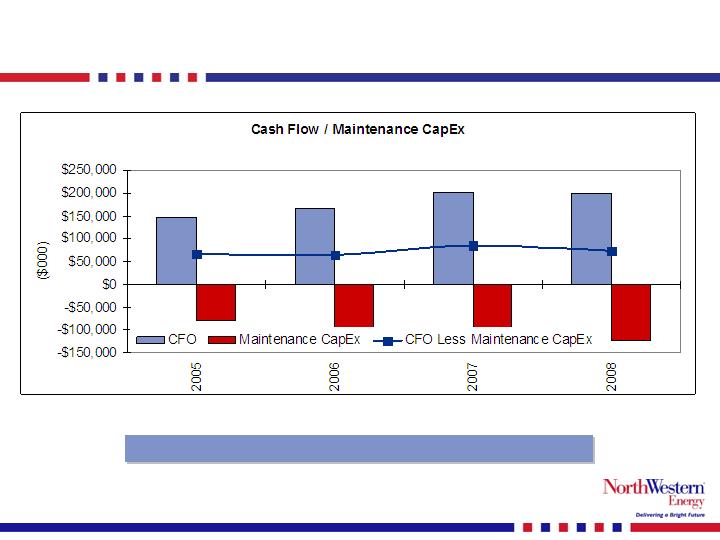

free cash flow…

Free cash flow available to fund future growth projects.

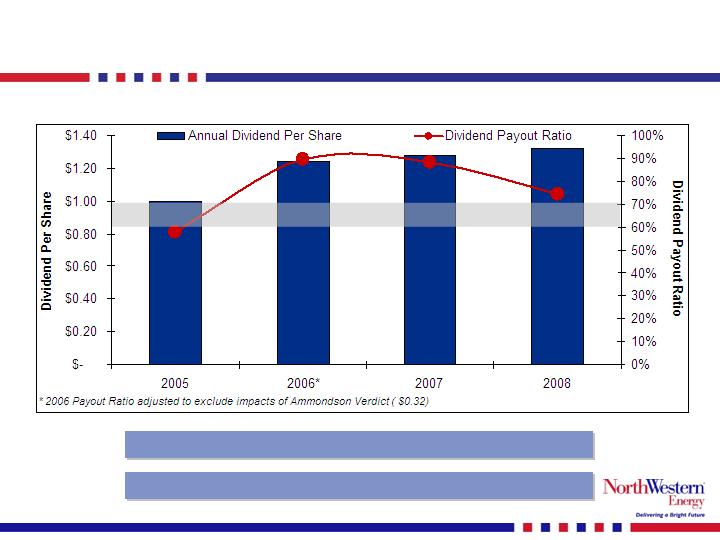

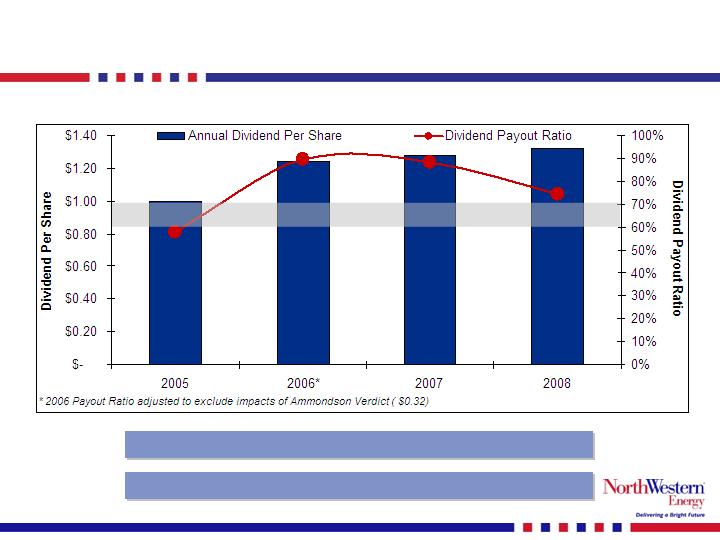

dividend history…

Current yield of approximately 5.5%.

9

Goal for dividend payout ratio of 60% to 70%.

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

11.0%

12.0%

2005

2006

2007

2008

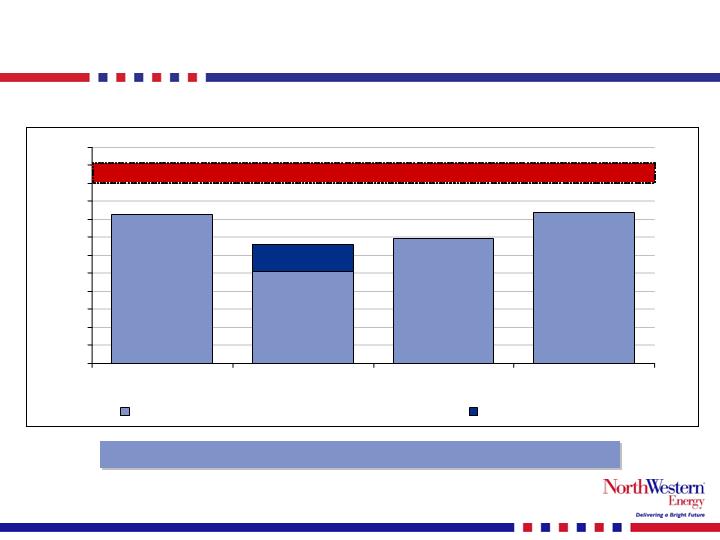

NWE Return on Average Equity

Ammondson Verdict

Authorized ROAE's in Utility Industry

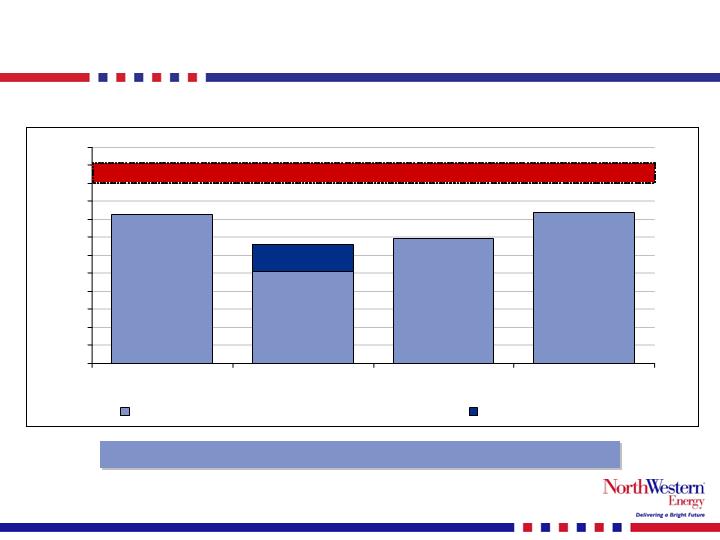

return on average equity…

Authorized Return on Average Equity (ROAE) of 10-11% in utility industry.

10

11

potential earnings drivers…

2010

Expecting flat volumes

Not impacted like other utilities due to higher mix of

residential/commercial vs. industrial customers

68% Residential and Commercial vs. 32% Industrial and Other

Delivery services rate adjustment expected to take effect 3Q 2010 for

rate case to be filed in October 2009

2011

Full year effect of rate adjustment

Mill Creek in rate base starting 2Q 2011

Approximately $10 million annualized contribution to net income

2012 and beyond

Transmission projects to provide additional earnings potential

Near term earnings drivers independent of transmission projects.

12

regulatory update…

Rate case to be filed 4Q in Montana

Filing to include both electric and natural gas distribution businesses

Based on 2008 test year

Expect decision in 3Q 2010

Mill Creek Generation Station filed with MPSC

MPSC approval in 2Q 2009

Construction underway

Working with FERC for MSTI rate design

FERC encouraged Company to develop MSTI on a cost of service

basis by requesting appropriate tariff waivers from existing OATT

FERC acknowledged the need for innovative proposals to develop new

transmission projects

Continuing the development of the project without interruption

Establishing constructive regulatory regulations in all jurisdictions.

13

generation growth highlights…

In service date for Mill Creek Generation Station is 4Q 2010

Mill Creek Generating Unit in Montana

Existing regulating services are

becoming more expensive and scarce

150 MW plant near Anaconda, MT

To be built for regulation services to

balance supply and load for NWE’s

Balancing Area

Rate-based cost of service investment

Estimated to cost approximately

$200 million

MPSC approved plant in 2Q ‘09

Capital structure of 50/50

Authorized ROE of 10.25%

Construction underway

Artist rendering of completed plant.

14

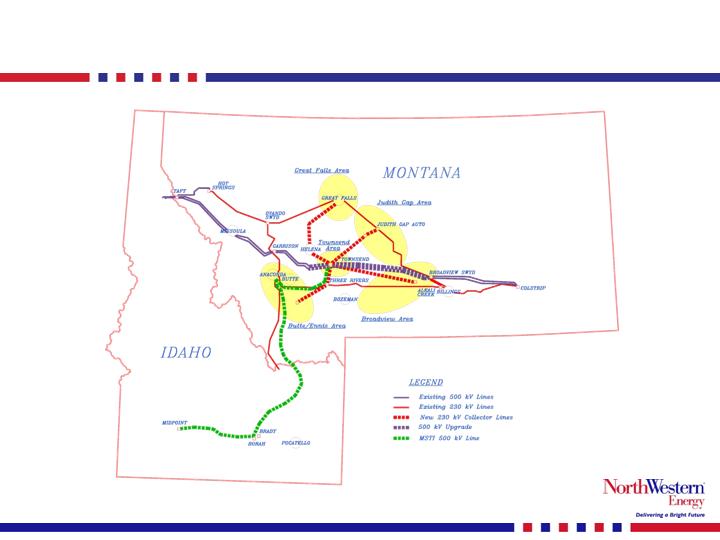

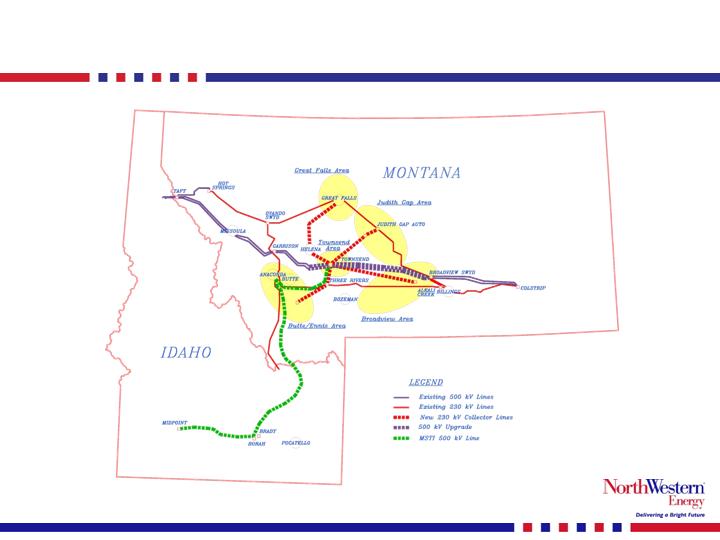

our proposed transmission projects…

15

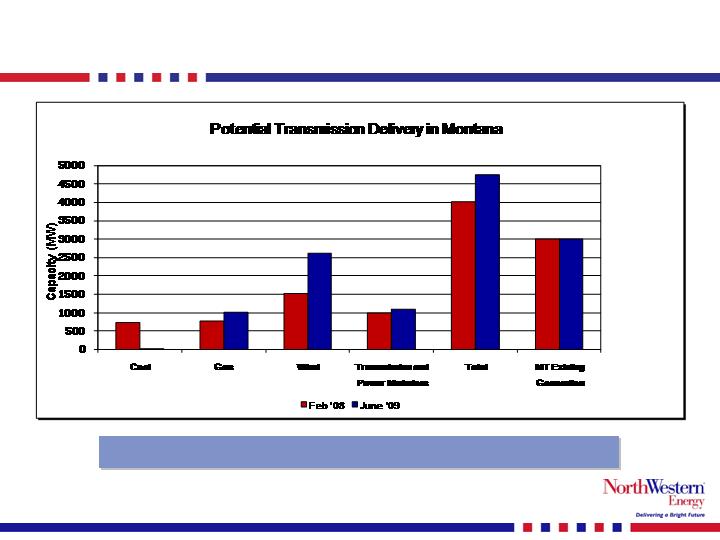

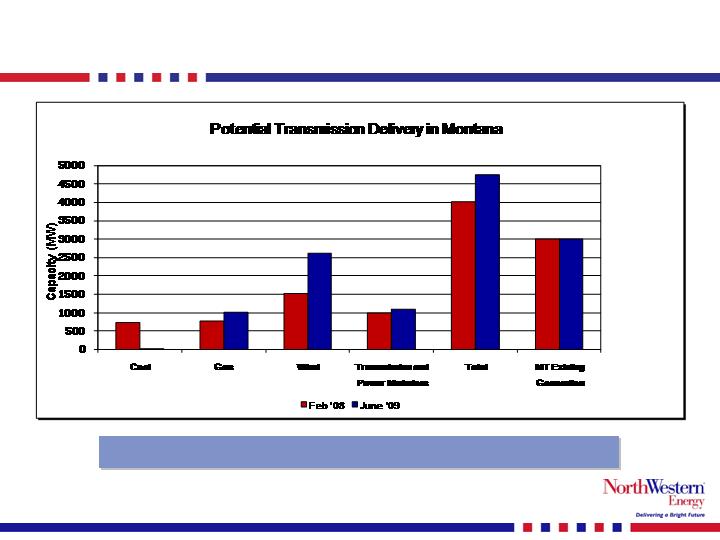

generation plans shifting to wind…

New generation in Montana mostly wind and will need to find an end user.

16

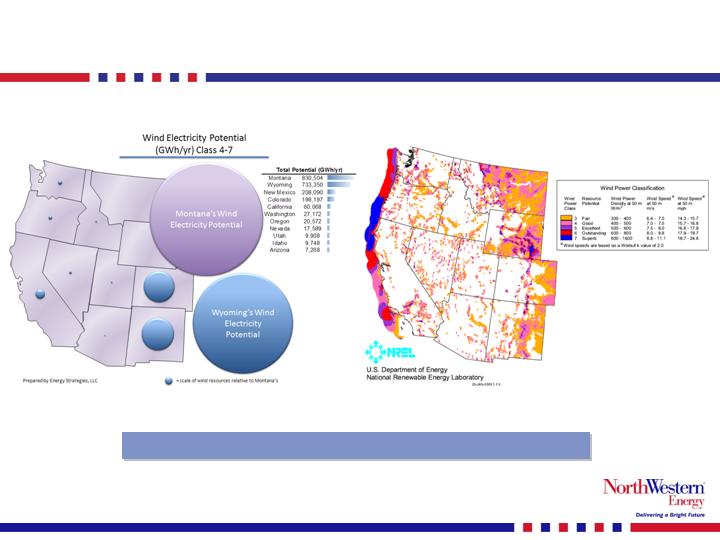

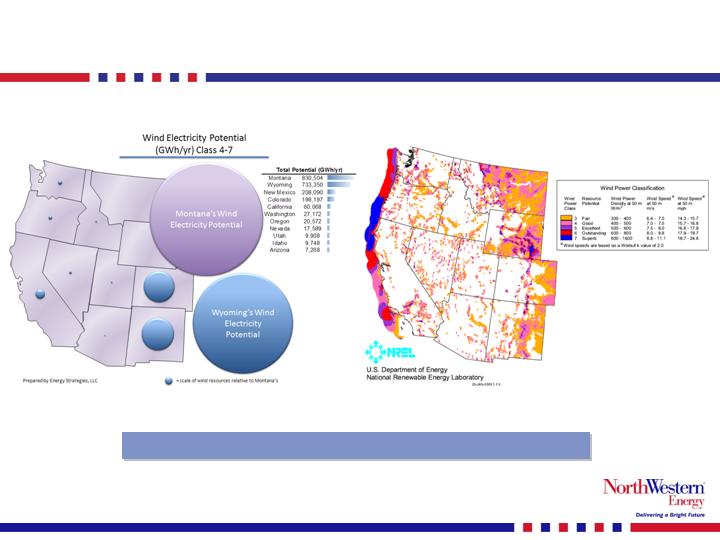

supply – Montana wind potential…

Very strong wind regime in Montana.

17

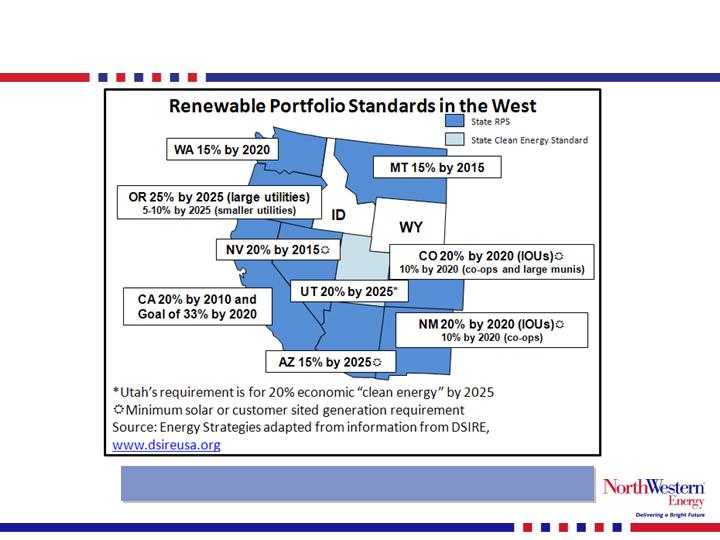

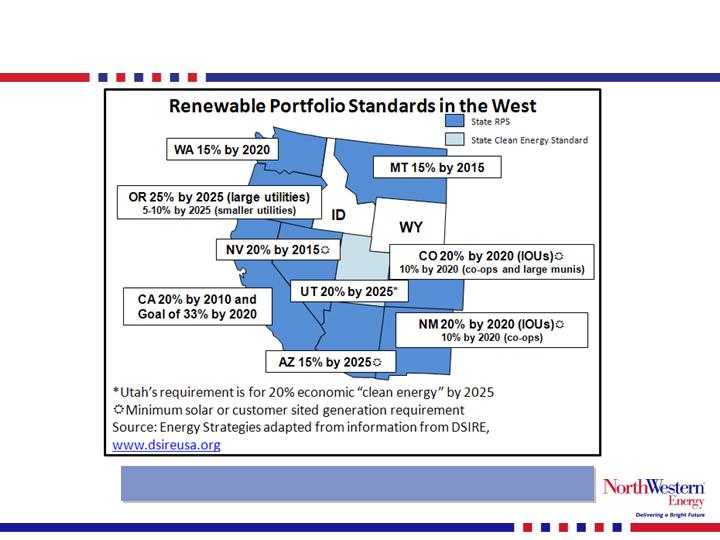

demand – renewable standards…

The current renewable percentage of NorthWestern’s

electric supply in Montana is a little more than 8%.

18

our transmission developments…

Line already exists – represents an

upgrade

Upgrades substation capacity

Increases load capacity of existing line by 500-600 MWs

Needed to relieve congestion to the West

Market interest is increasing for

Montana’s high quality wind profile

NorthWestern announced joint

development agreement with others

Portland General

Puget Sound Energy

Pacificorp

Avista

Bonneville Power Authority

Cost estimate of ourportion of 500 kV

upgrade = $50M - $75M

Anticipated ownership interest of 30% on upgrade

In service date of January 1, 2012.

Colstrip 500 kV Upgrade

19

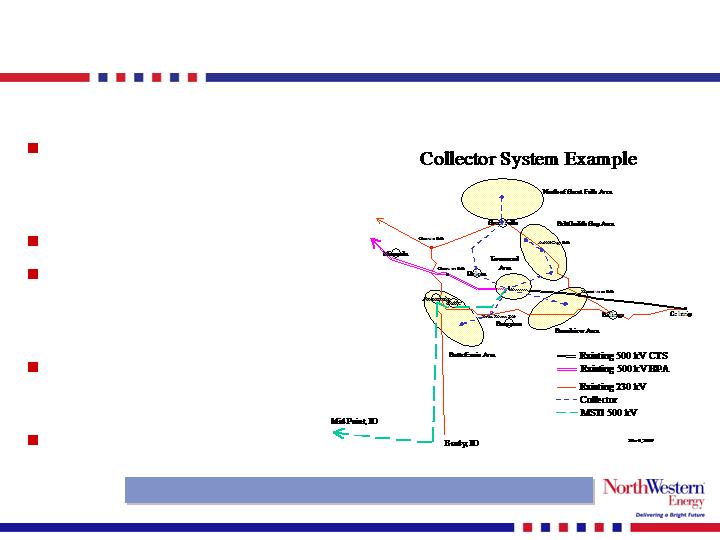

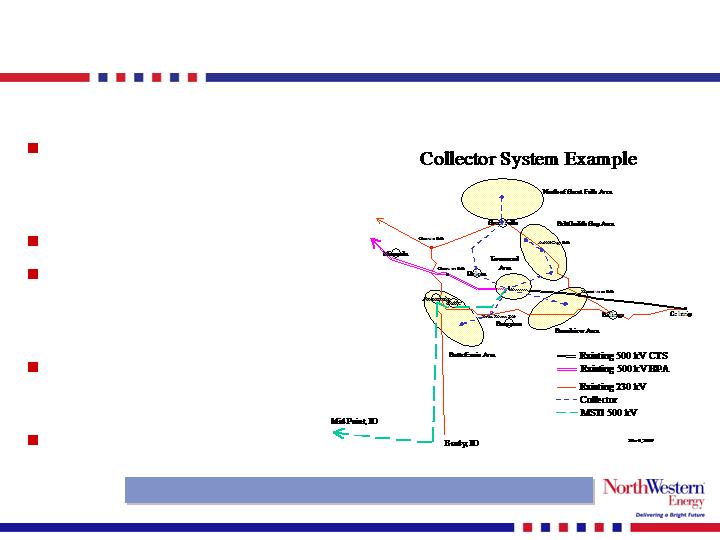

transmission project developments…

In service date in 2014.

230 kV “Collector System”

Provides gathering system for

new generation to access

MSTI and network system

benefits

Our project with no partners

In 2Q ’09, FERC approved

NorthWestern’s proposal to

directly assign the cost of the

project to the generators

The FERC found that the

project is an innovative

proposal

Cost estimate of “collector”

project = $200M

20

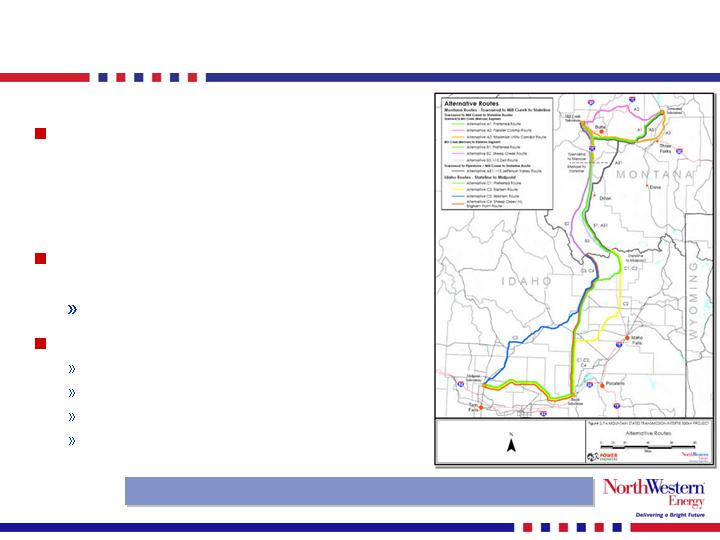

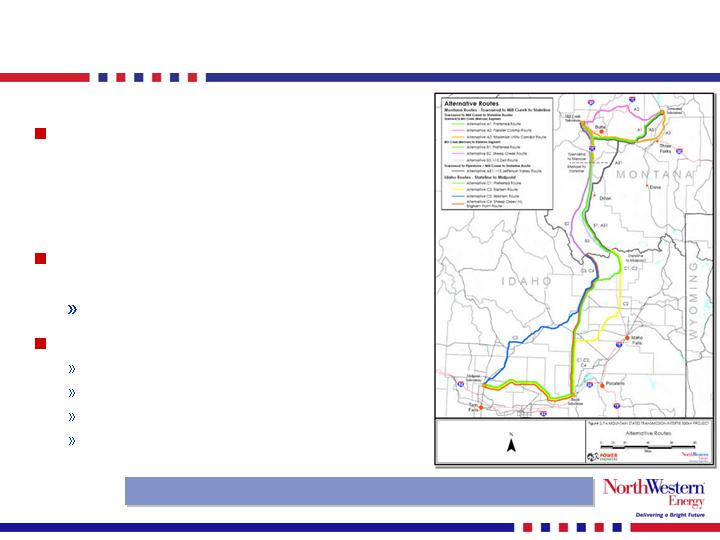

transmission project developments cont’d…

Provides additional capacity on a

historically constrained path, and

connects expanding new

renewable markets in Idaho, Utah

and the Southwest U.S.

Total project cost estimated from

$800 million to $1 billion

Considering strategic partners

Plan to be operational in 2014

Continuing filings with FERC

Open Season to be conducted

Start construction 2011

For current information:

www.MSTI500kV.com

Estimated to be on line early 2014.

MSTI

21

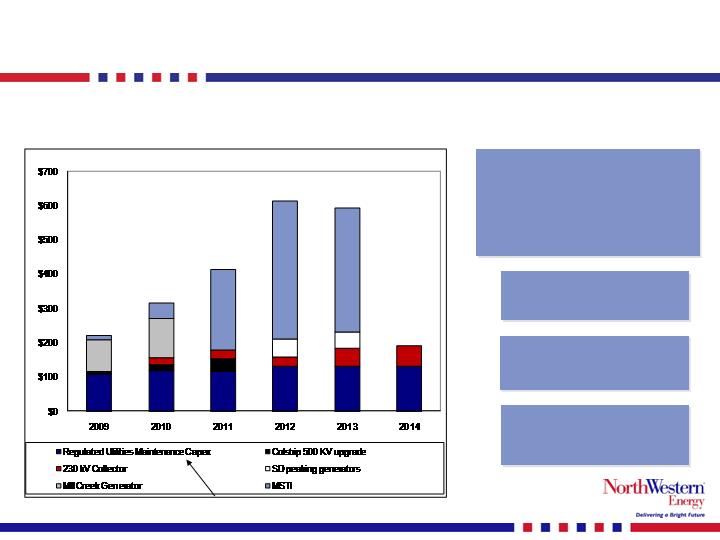

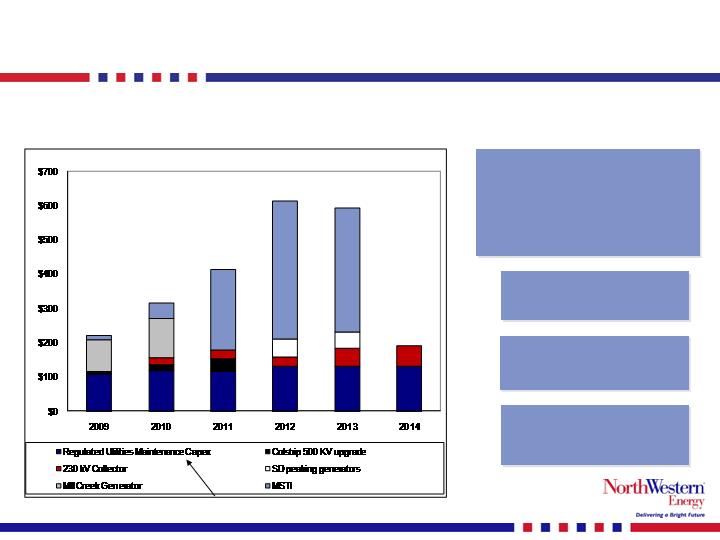

capex spending – next few years…

Includes more than $1 billion of potential generation

and transmission growth projects.

Non-discretionary

capex is funded 100%

by free cash flow.

Company doesn’t anticipate

needing equity unless we

proceed with MSTI.

We will move forward with

the funding of these projects

only when they make

economic sense.

MSTI project is now slated for

early 2014 and capex has

been modified accordingly.

Non-discretionary

22

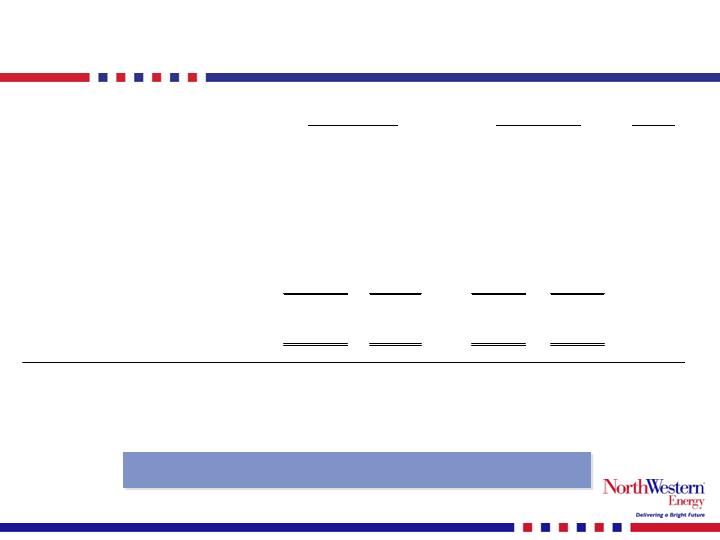

growth project potential…

Possibility to double and diversify earnings as compared with our

existing $1.5 billion rate base as of 1/1/09.

(in millions)

Timing

Mill Creek Generation Station

200

$

to

200

$

10.0

$

to

10.0

$

Dec 2010

Colstrip 500 kV transmission upgrade **

50

$

to

75

$

2.5

$

to

3.8

$

Jan 2012

South Dakota Peaking generation

75

$

to

90

$

3.8

$

to

4.5

$

Jan 2013

230 kV Wind Collector system

150

$

to

200

$

7.5

$

to

10.0

$

Jan 2014

MSTI transmission line

800

$

to

1,000

$

40.0

$

to

50.0

$

Jan 2014

Totals

1,275

$

to

1,565

$

63.8

$

to

78.3

$

* For illustrative purposes = Cost of project times 50% equity ratio times estimated ROE of 10%.

** Assumes a 30% ownership of the $200 million project.

Cost of Project

Annual Earnings

Opportunity *

23

growth project milestones ’09 & ’10…

Mill Creek

2009

Expect decision from the MPSC (APPROVED) Q2

Begin construction Q3

500 kV upgrade

2009

Complete engineering and planning studies Q4

WECC regional planning process begins Q4

Finalize commercial terms w/partners Q4

230 kV Collector system

2009

Information meeting with customers Q2

FERC ruling allowing “open season” Q2

Conduct “open season” Q4

Complete commercial terms Q4

MSTI

2009

Continue discussions w/possible JV partner Q4

Work with FERC to clarify filings process Q4

Conduct “open season”/commercial terms Q4

EIS draft for public review due Q4

Mill Creek

2010

Complete construction Q4

Start up, commissioning and completion Q4

500 kV upgrade

2010

Run subscription process Q1

Complete regional planning process Q4

Begin construction Q4

230 kV Collector system

2010

WECC regional planning process Q2

Siting and permitting process begins Q3

MSTI

2010

Draft EIS Q1

Record of decision Q3

Begin right of way procurement Q4

Final Engineering Q4

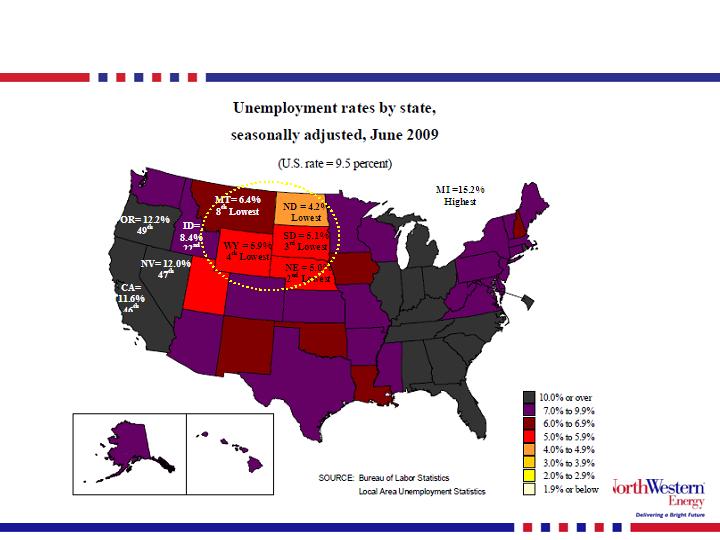

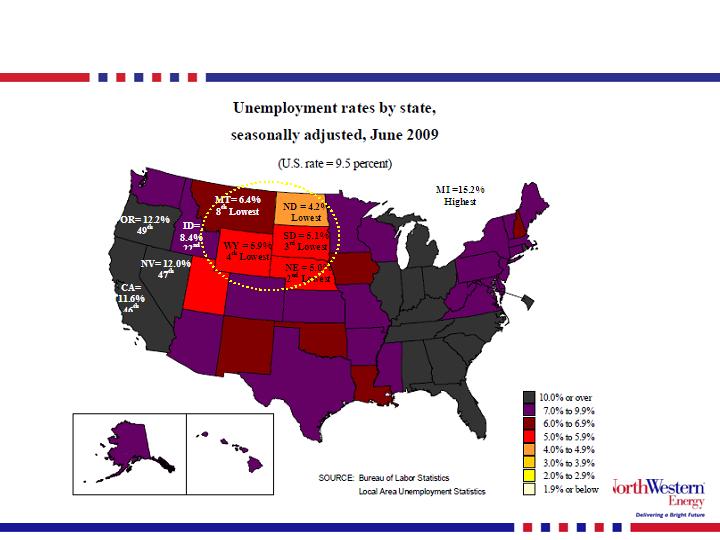

economic environment…

Worst national recession for past 25 years:

MT, SD, and NE better than a lot of areas

NE, SD, and MT have the 2ndlowest, 3rdlowest, and 8thlowest

unemployment respectively

Due to the current recession, many companies are:

reducing staff (# of unemployed nationally increased 5.5 million over

the past year),

reducing capital spends,

freezing pensions,

reducing salaries

capital spending is being reduced as well across the nation

Our Company has been impacted by:

reduced transmission OASIS sales,

lower SD wholesale pricing due to market demand,

increased pension funding and costs due to market conditions

weather

24

our service territory…

25

26

2009 results through June…

Earnings guidance range for 2009 reduced to $1.75 - $1.85 on the

earnings call on July 29, 2009 and is not being updated here.

Gross Margin increased

mainly due to transfer of

interest in CU4 into regulated

electric and offset by reduced

wholesale revenues

OG&A increased mainly due

to higher pension ($5.1M),

labor and benefits ($4.9M),

and insurance reserves

($2.6M)

Property and other taxes

decreased due to lower

property assessments.

Depreciation increased

primarily due to 2008 plant

additions.

Interest Expense increased

primarily due to increased

debt outstanding

Unaudited (Dollars in 000's)

2009

2008

Variance

Operating Revenues

606,616

662,481

(55,865)

Cost of Sales

314,850

378,438

(63,588)

Gross Margin

291,766

284,043

7,723

Operating Expenses

OG&A Expense

126,317

113,937

12,380

Property and other taxes

42,535

44,180

(1,645)

Depreciation

44,982

42,316

2,666

Total Operating Expenses

213,834

200,433

13,401

Operating Income

77,932

83,610

(5,678)

Interest Expense

(33,136)

(31,849)

(1,287)

Investment Income and Other

789

422

367

Income Before Taxes

45,585

52,183

(6,598)

Income Taxes

(16,674)

(19,229)

2,555

Net Income

28,911

32,954

(4,043)

Six Months Ended June 30,

27

summary…

Value

Dividend yield of approx. 5.5%

Strong financial profile

All debt is investment grade rated

Strong cash flows from operations and NOLs expected into 2012

Improving regulatory relationships

Opportunity for growth

Montana rate case to be filed in October 2009

expecting a rate increase

expect new rates effective during 3Q 2010

Possibility of increasing rate base on growth projects with

investment in excess of $1 billion

Potential additional annual earnings of more than $60 million post 2014

Current value with growth opportunities.