INVESTOR UPDATE March 2013 March 21, 2013

2 FORWARD LOOKING STATEMENT During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s public filings with the SEC.

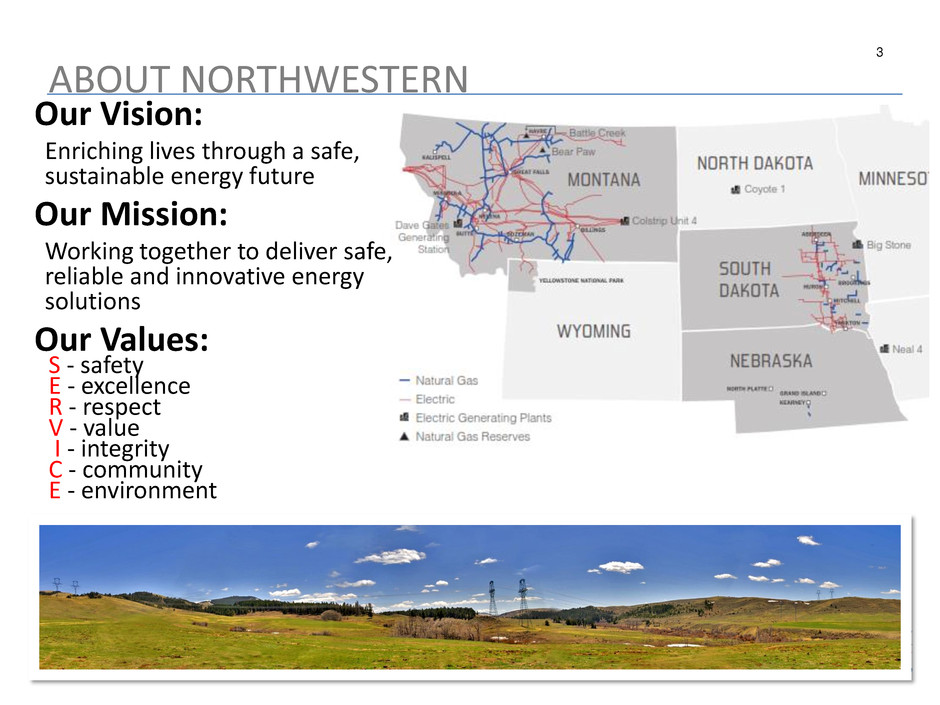

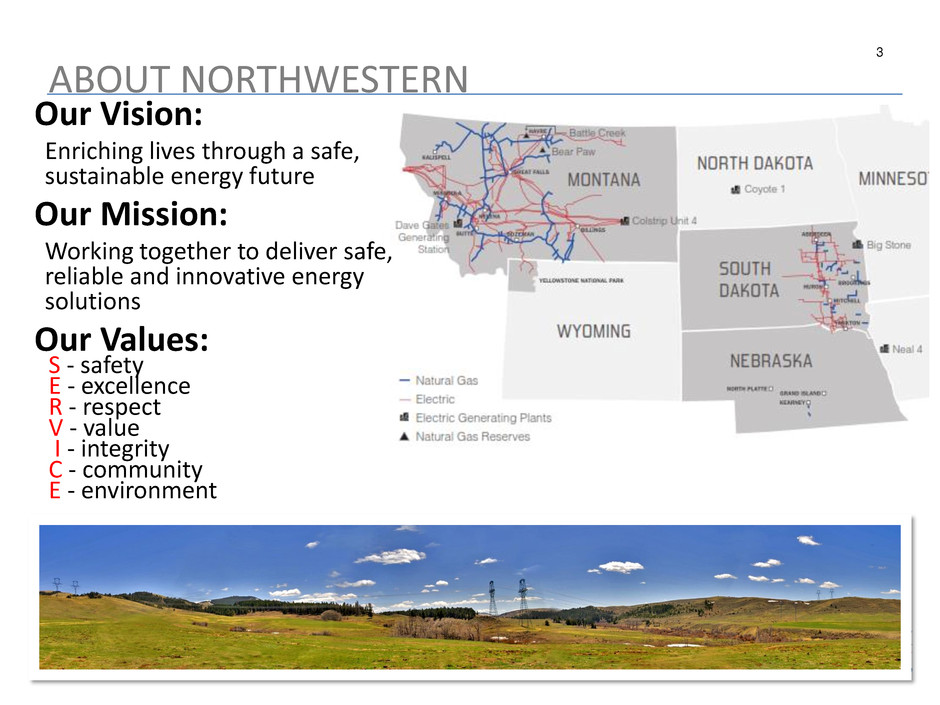

3 Our Vision: Enriching lives through a safe, sustainable energy future Our Mission: Working together to deliver safe, reliable and innovative energy solutions Our Values: ABOUT NORTHWESTERN S - safety E - excellence R - respect V - value I - integrity C - community E - environment

4 NWE: AN INVESTMENT FOR THE LONG TERM We’re a fully regulated and financially solid utility; with – Diversity across states, service type and customer segments – A 100 year history of competitive customer rates, system reliability and customer satisfaction – 5 years of significant earnings and dividend growth – Strong cash flows aided by net operating loss carryforwards – Solid investment grade credit ratings Best practices corporate governance; and – A strong and well rounded board and executive team – Forbes “Americas Most Trustworthy” companies Attractive future growth prospects – Reintegrating energy supply portfolio (natural gas and electric) – Distribution System Infrastructure Program (DSIP) – Transmission opportunities within our service territory

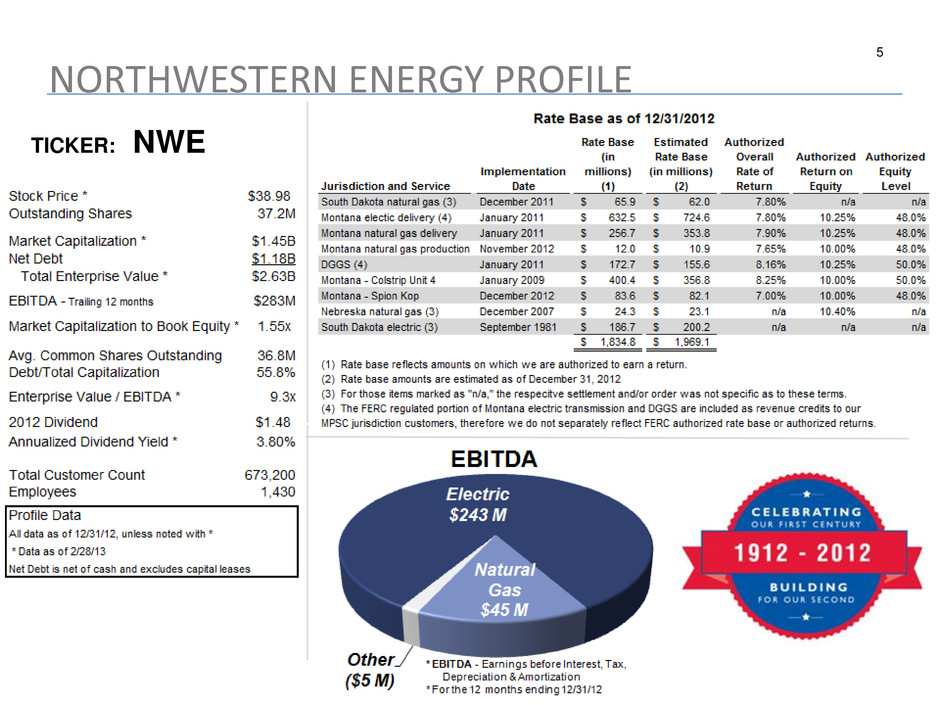

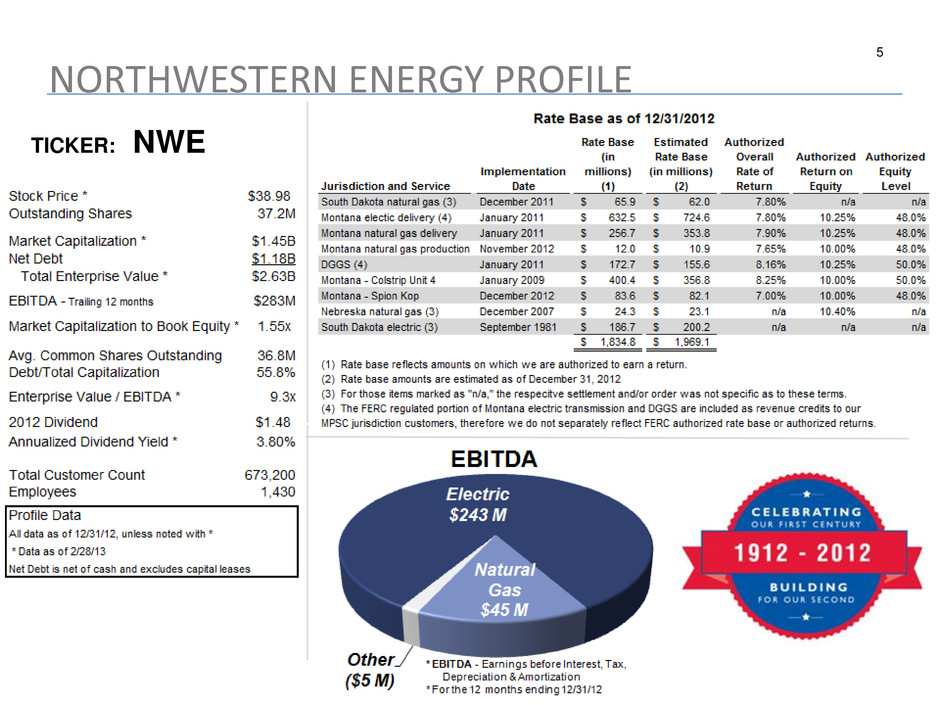

5 NORTHWESTERN ENERGY PROFILE TICKER: NWE

6 A STRONG & WELL ROUNDED BOARD & EXECUTIVE TEAM

7 NWE CORPORATE RESPONSIBILITY

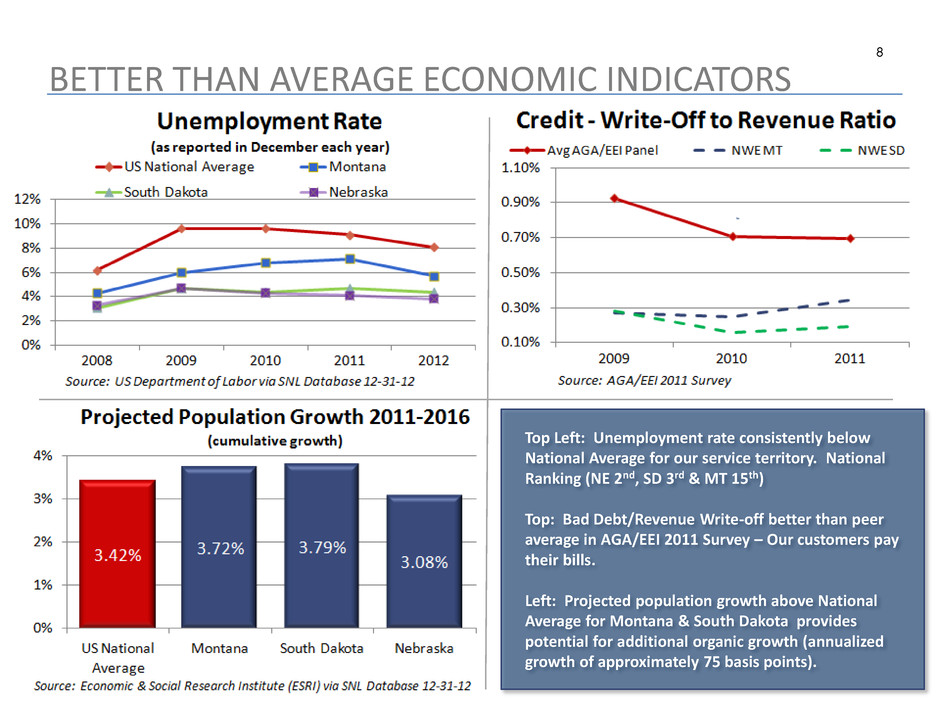

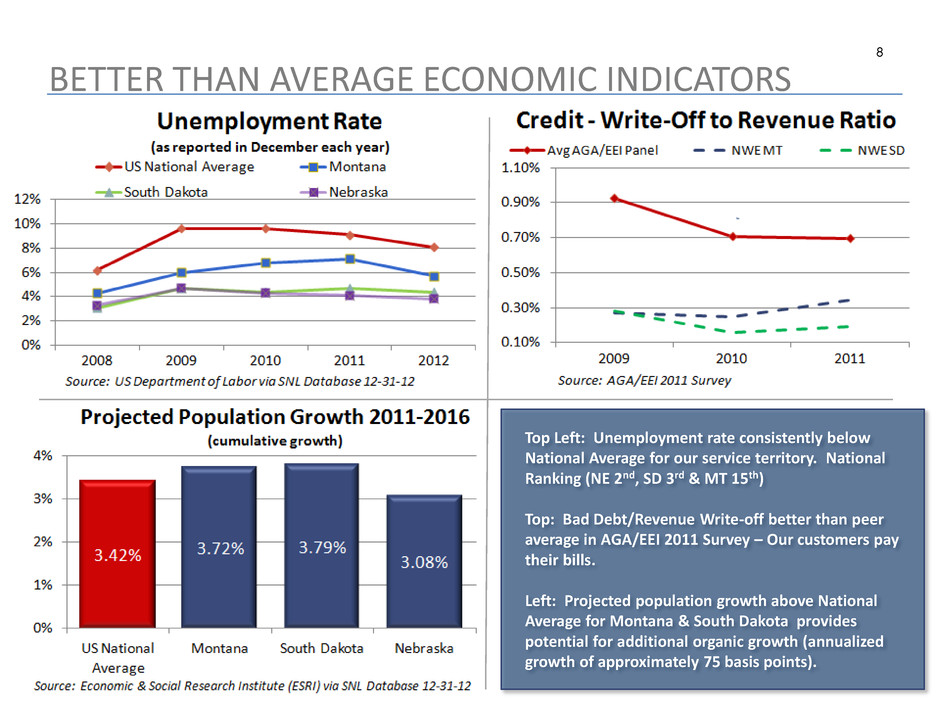

8 BETTER THAN AVERAGE ECONOMIC INDICATORS Top Left: Unemployment rate consistently below National Average for our service territory. National Ranking (NE 2nd, SD 3rd & MT 15th) Top: Bad Debt/Revenue Write-off better than peer average in AGA/EEI 2011 Survey – Our customers pay their bills. Left: Projected population growth above National Average for Montana & South Dakota provides potential for additional organic growth (annualized growth of approximately 75 basis points).

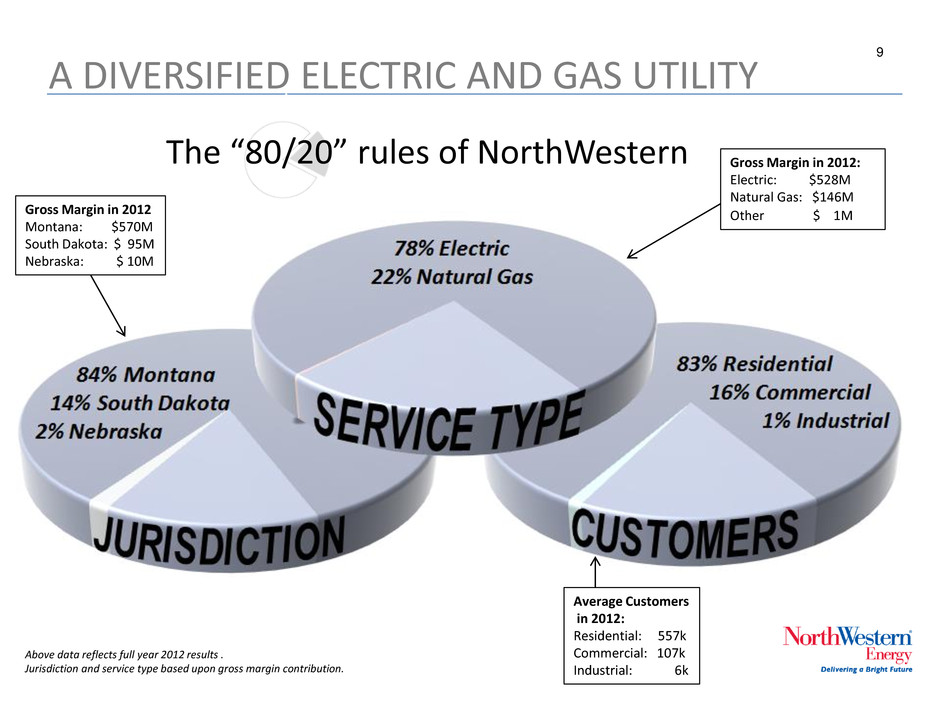

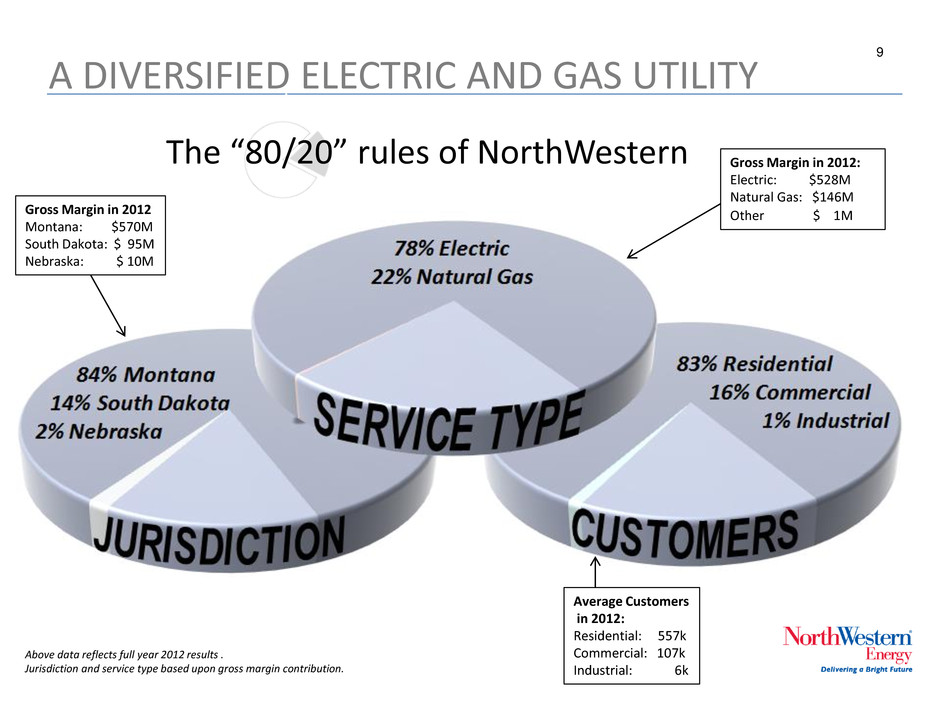

9 A DIVERSIFIED ELECTRIC AND GAS UTILITY Above data reflects full year 2012 results . Jurisdiction and service type based upon gross margin contribution. The “80/20” rules of NorthWestern Gross Margin in 2012: Electric: $528M Natural Gas: $146M Other $ 1M Gross Margin in 2012 Montana: $570M South Dakota: $ 95M Nebraska: $ 10M Average Customers in 2012: Residential: 557k Commercial: 107k Industrial: 6k

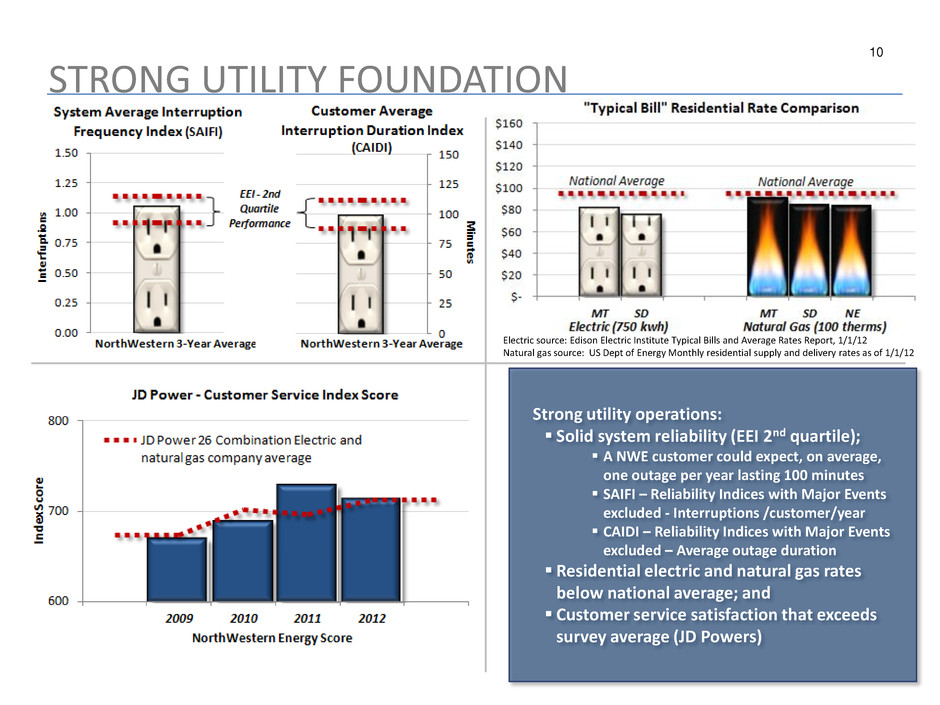

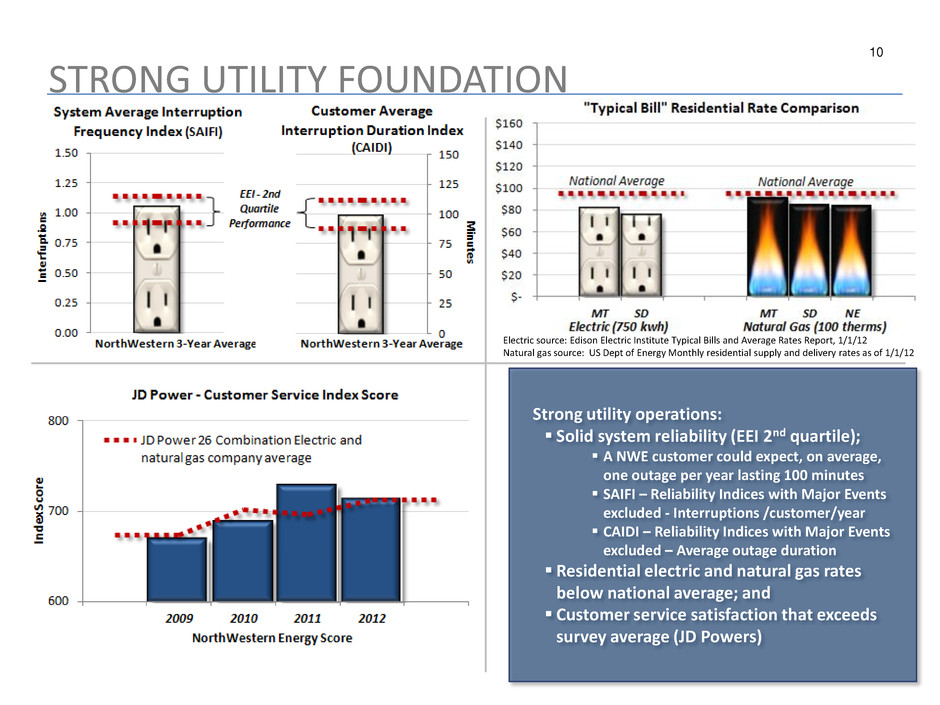

10 STRONG UTILITY FOUNDATION Electric source: Edison Electric Institute Typical Bills and Average Rates Report, 1/1/12 Natural gas source: US Dept of Energy Monthly residential supply and delivery rates as of 1/1/12 Strong utility operations: Solid system reliability (EEI 2nd quartile); A NWE customer could expect, on average, one outage per year lasting 100 minutes SAIFI – Reliability Indices with Major Events excluded - Interruptions /customer/year CAIDI – Reliability Indices with Major Events excluded – Average outage duration Residential electric and natural gas rates below national average; and Customer service satisfaction that exceeds survey average (JD Powers)

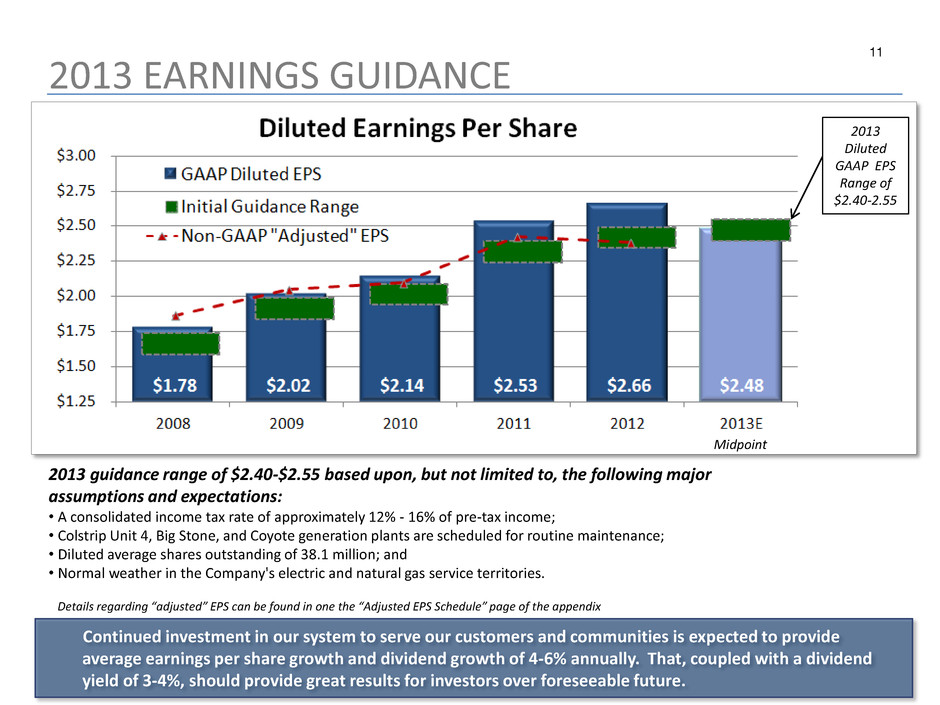

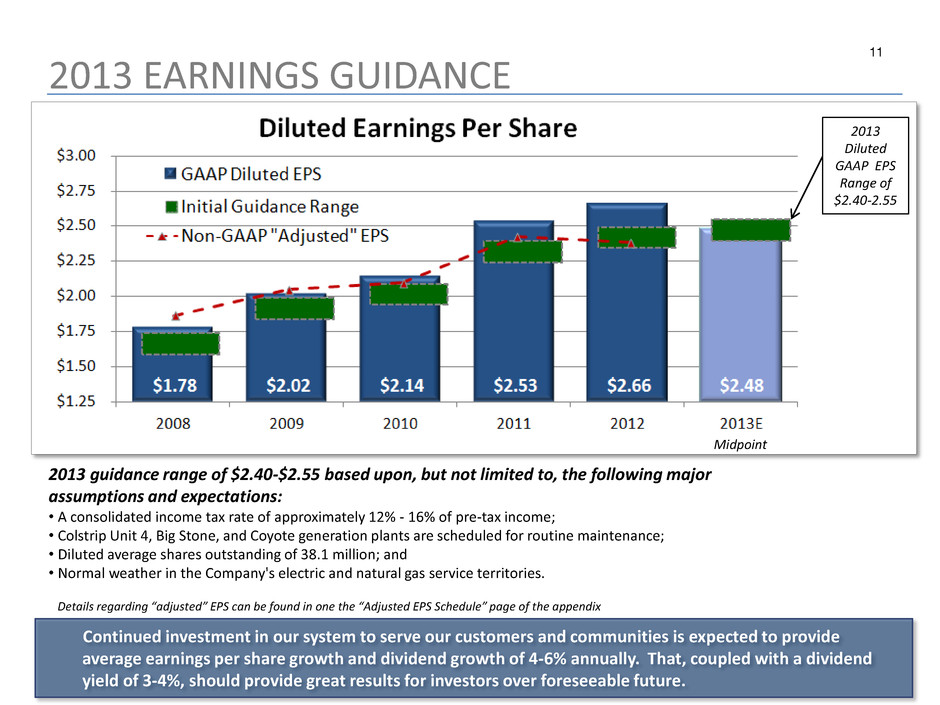

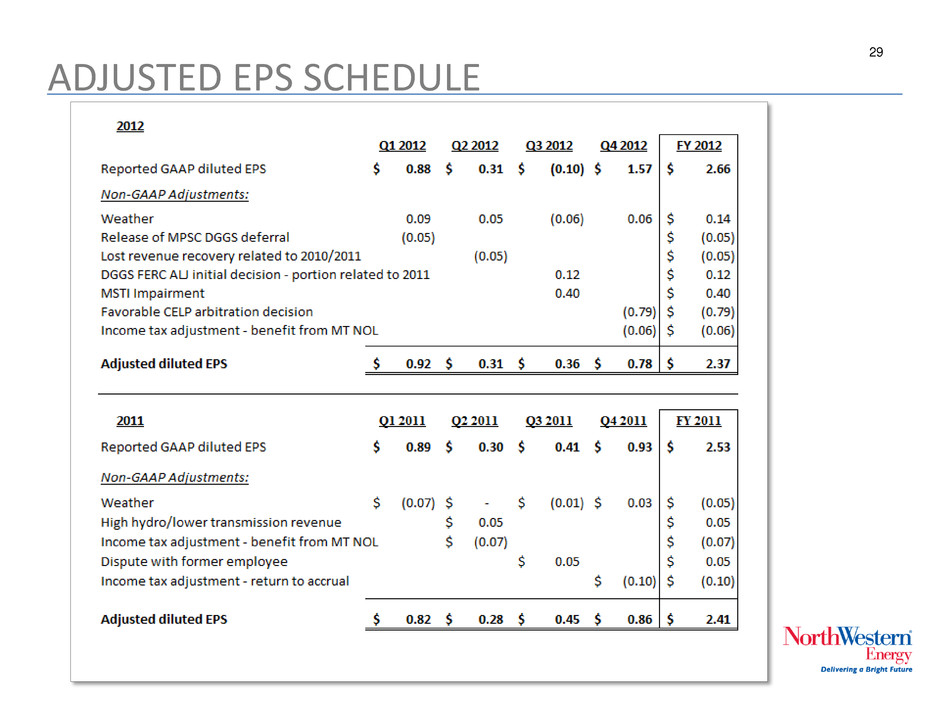

11 2013 EARNINGS GUIDANCE 2013 guidance range of $2.40-$2.55 based upon, but not limited to, the following major assumptions and expectations: • A consolidated income tax rate of approximately 12% - 16% of pre-tax income; • Colstrip Unit 4, Big Stone, and Coyote generation plants are scheduled for routine maintenance; • Diluted average shares outstanding of 38.1 million; and • Normal weather in the Company's electric and natural gas service territories. 2013 Diluted GAAP EPS Range of $2.40-2.55 Midpoint 1 Continued investment in our system to serve our customers and communities is expected to provide average earnings per share growth and dividend growth of 4-6% annually. That, coupled with a dividend yield of 3-4%, should provide great results for investors over foreseeable future. Details regarding “adjusted” EPS can be found in one the “Adjusted EPS Schedule” page of the appendix

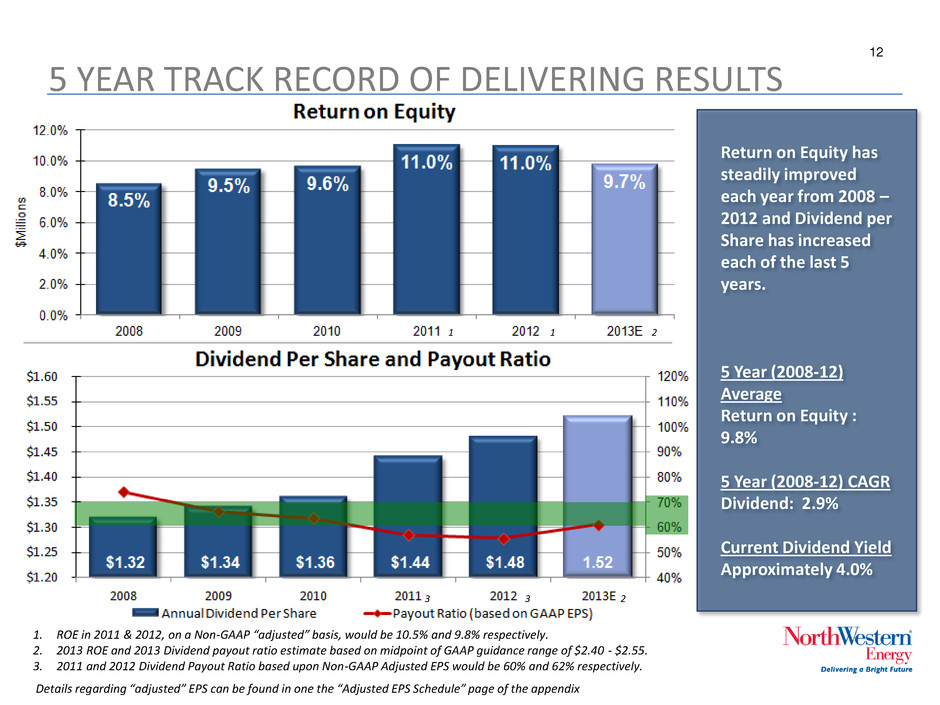

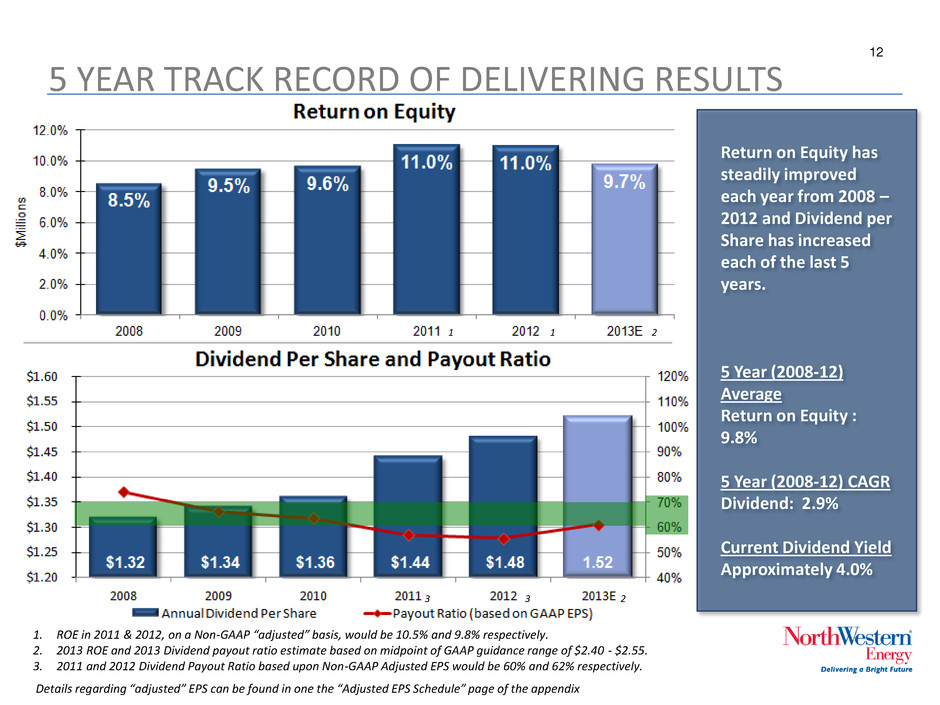

12 5 YEAR TRACK RECORD OF DELIVERING RESULTS Return on Equity has steadily improved each year from 2008 – 2012 and Dividend per Share has increased each of the last 5 years. 5 Year (2008-12) Average Return on Equity : 9.8% 5 Year (2008-12) CAGR Dividend: 2.9% Current Dividend Yield Approximately 4.0% 1. ROE in 2011 & 2012, on a Non-GAAP “adjusted” basis, would be 10.5% and 9.8% respectively. 2. 2013 ROE and 2013 Dividend payout ratio estimate based on midpoint of GAAP guidance range of $2.40 - $2.55. 3. 2011 and 2012 Dividend Payout Ratio based upon Non-GAAP Adjusted EPS would be 60% and 62% respectively. 1 3 3 1 2 2 Details regarding “adjusted” EPS can be found in one the “Adjusted EPS Schedule” page of the appendix

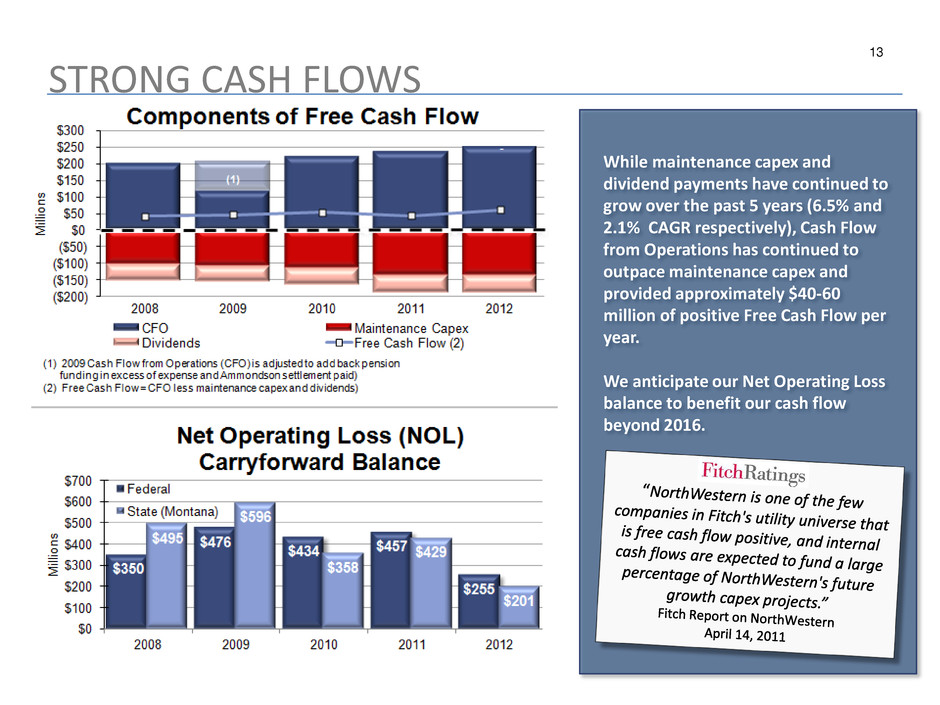

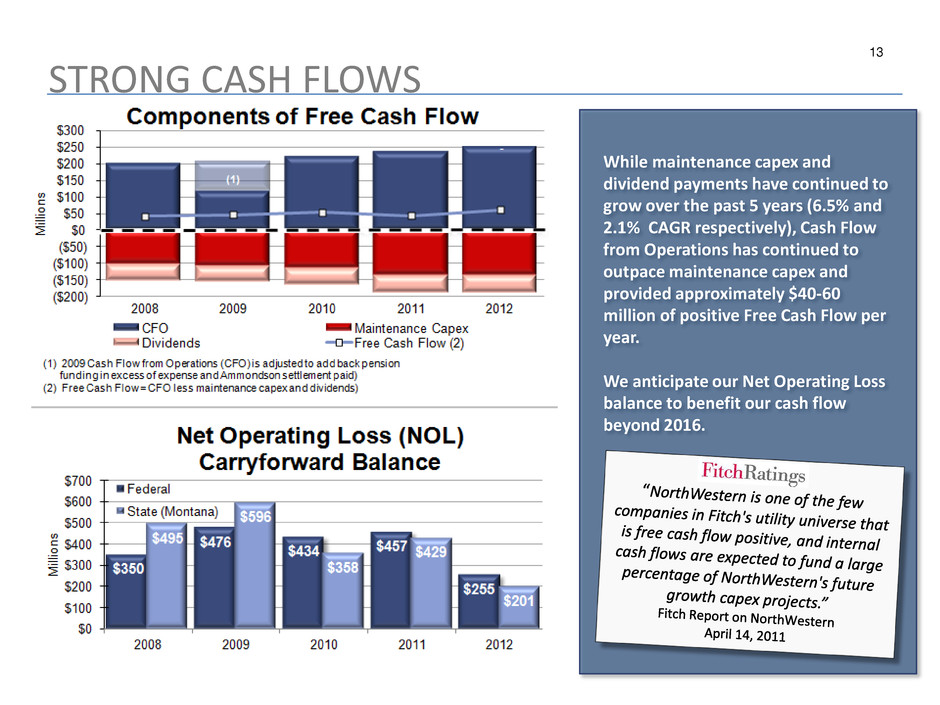

13 STRONG CASH FLOWS While maintenance capex and dividend payments have continued to grow over the past 5 years (6.5% and 2.1% CAGR respectively), Cash Flow from Operations has continued to outpace maintenance capex and provided approximately $40-60 million of positive Free Cash Flow per year. We anticipate our Net Operating Loss balance to benefit our cash flow beyond 2016.

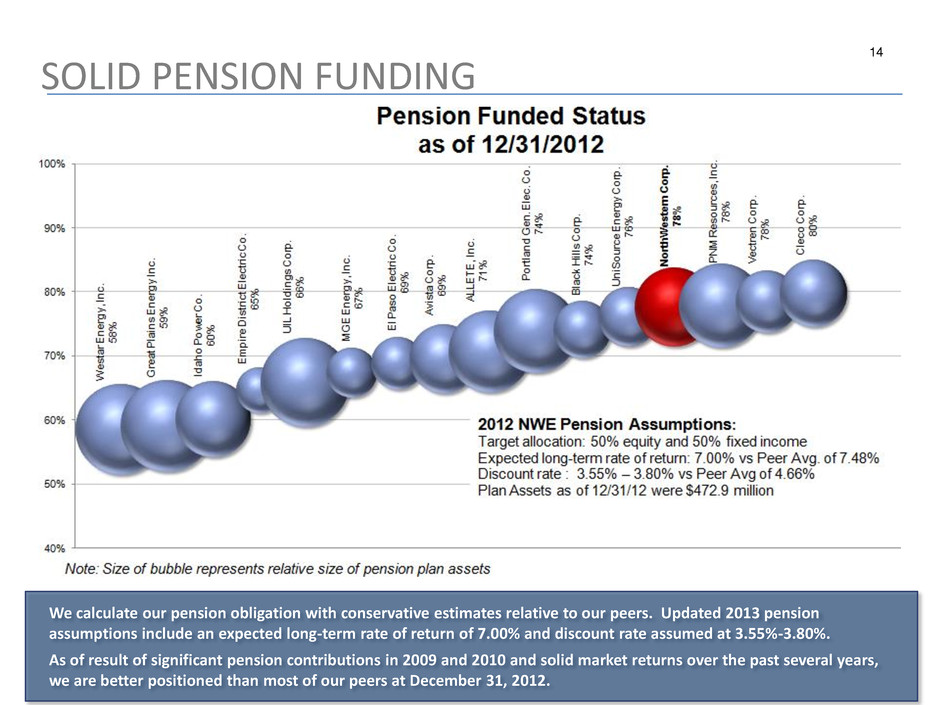

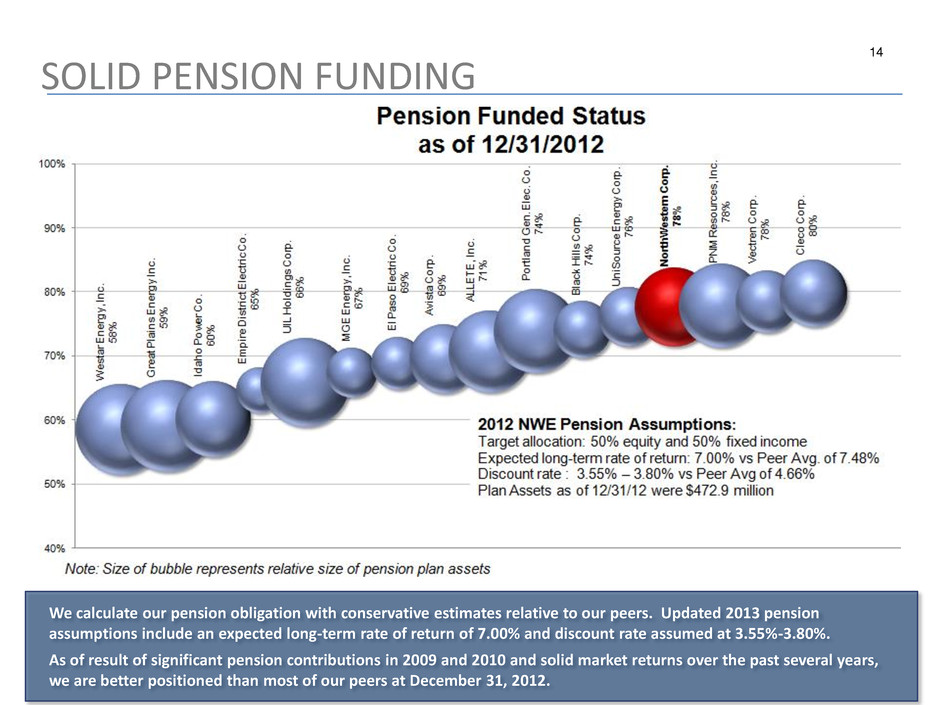

14 SOLID PENSION FUNDING We calculate our pension obligation with conservative estimates relative to our peers. Updated 2013 pension assumptions include an expected long-term rate of return of 7.00% and discount rate assumed at 3.55%-3.80%. As of result of significant pension contributions in 2009 and 2010 and solid market returns over the past several years, we are better positioned than most of our peers at December 31, 2012.

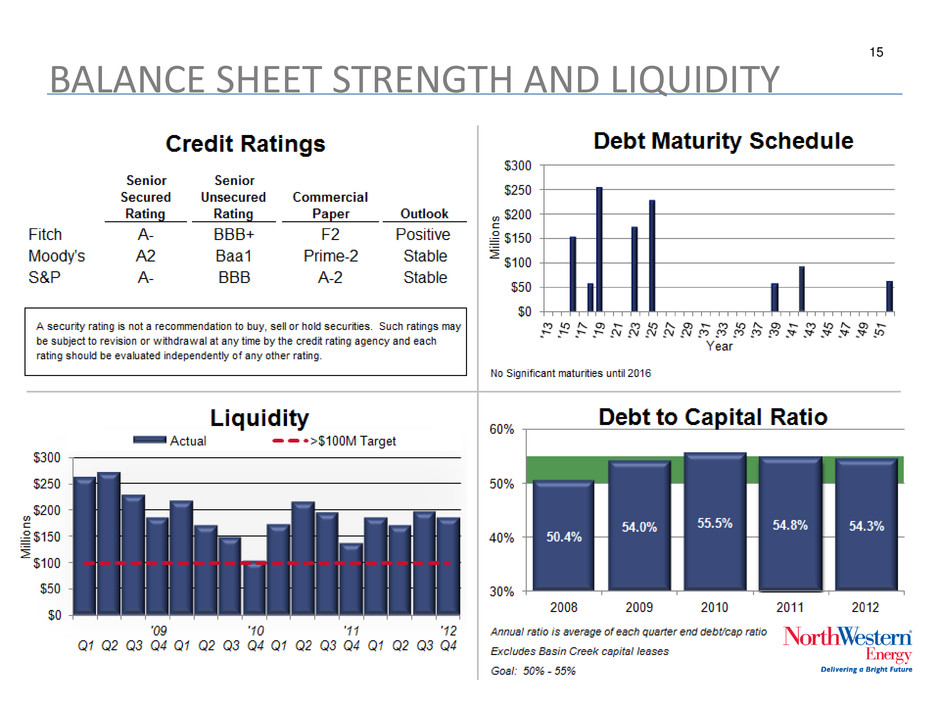

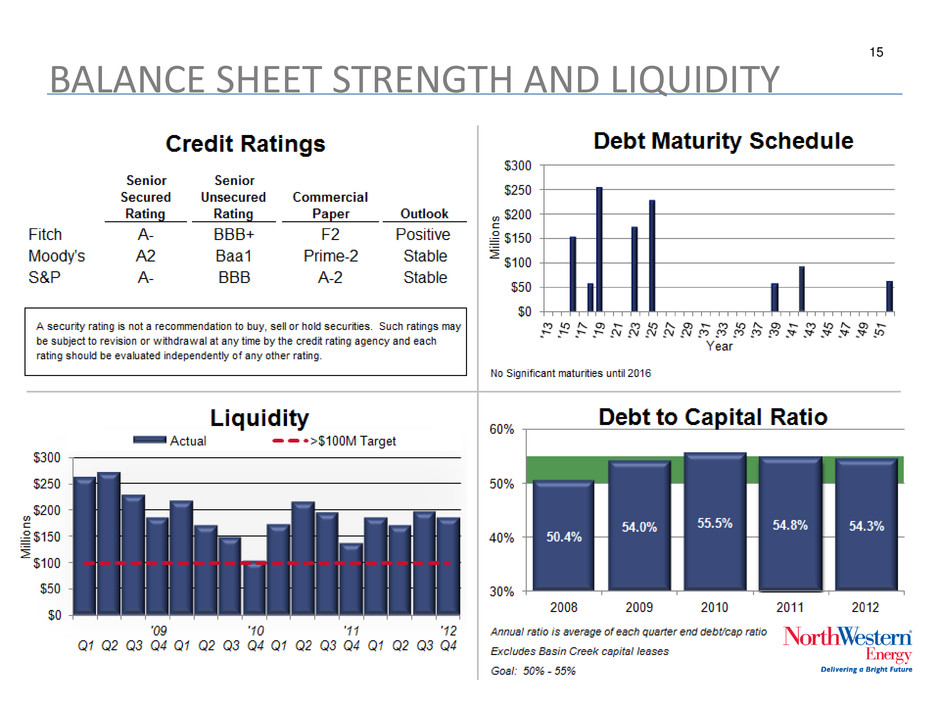

15 BALANCE SHEET STRENGTH AND LIQUIDITY

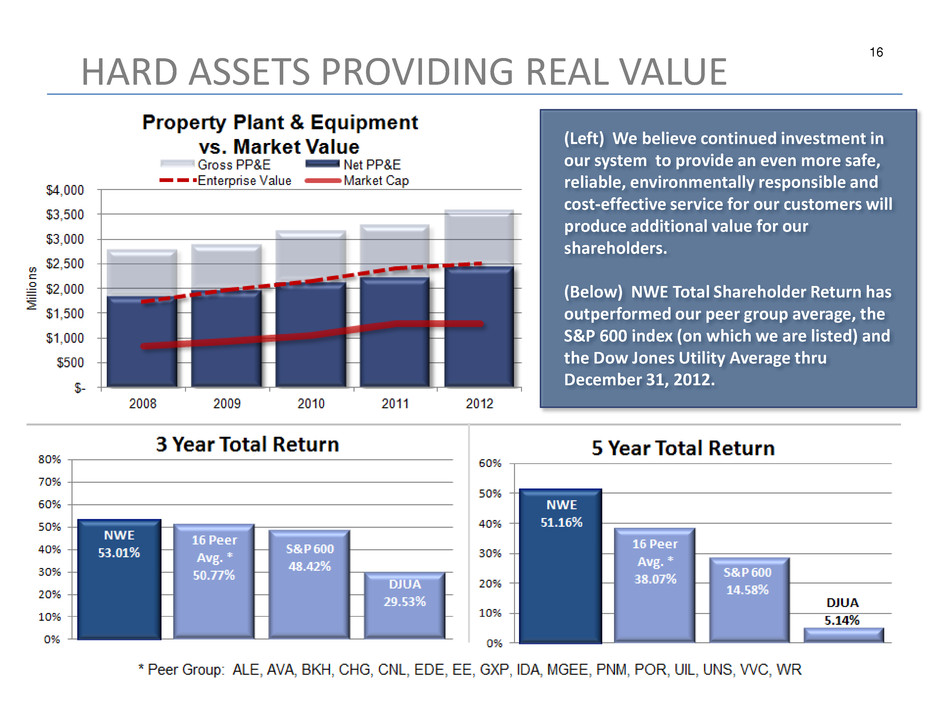

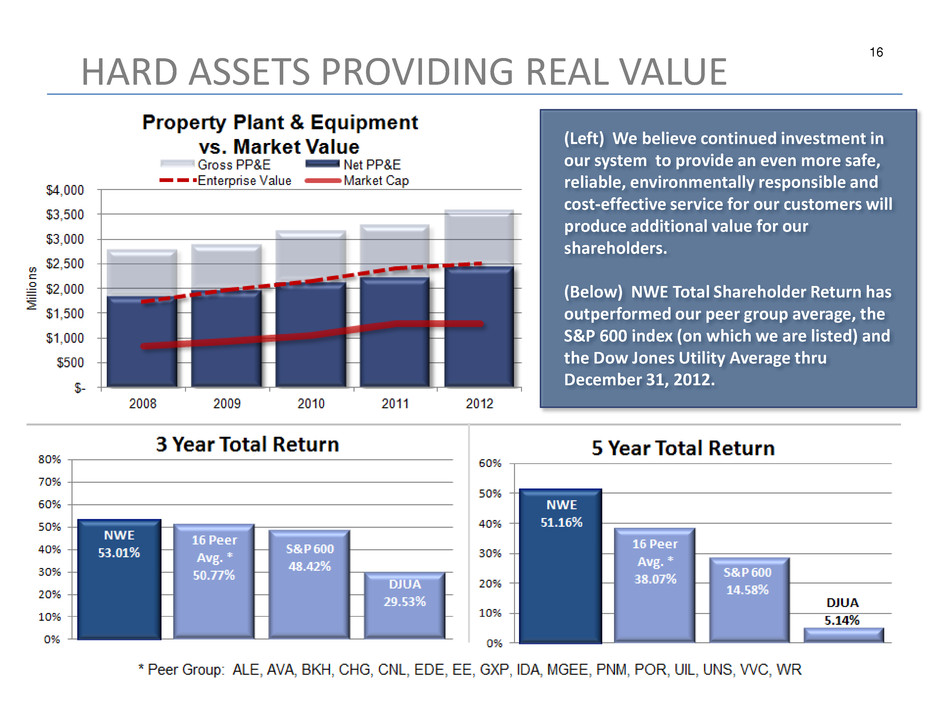

16 HARD ASSETS PROVIDING REAL VALUE (Left) We believe continued investment in our system to provide an even more safe, reliable, environmentally responsible and cost-effective service for our customers will produce additional value for our shareholders. (Below) NWE Total Shareholder Return has outperformed our peer group average, the S&P 600 index (on which we are listed) and the Dow Jones Utility Average thru December 31, 2012.

17 GROWING WITHOUT IMPACT TO CUSTOMERS Over the past 5 years we have begun to rebuild our energy supply portfolio and invested to enhance system safety, reliability and capacity. We have made these enhancements while delivering solid earnings growth to our investors with minimal impact to our customers’ bills. 2008-2012 CAGRs Estimated Rate Base: 14.5% GAAP Diluted EPS: 10.6% El. retail rev./ MWh : 1.9% N. Gas retail rev./Dkt: (6.2%)

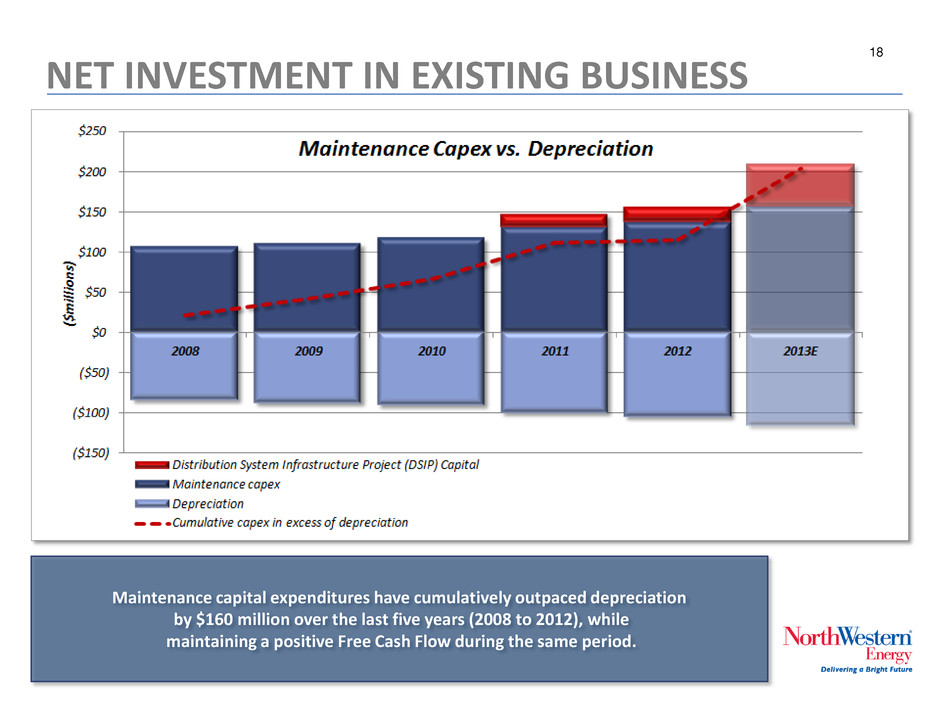

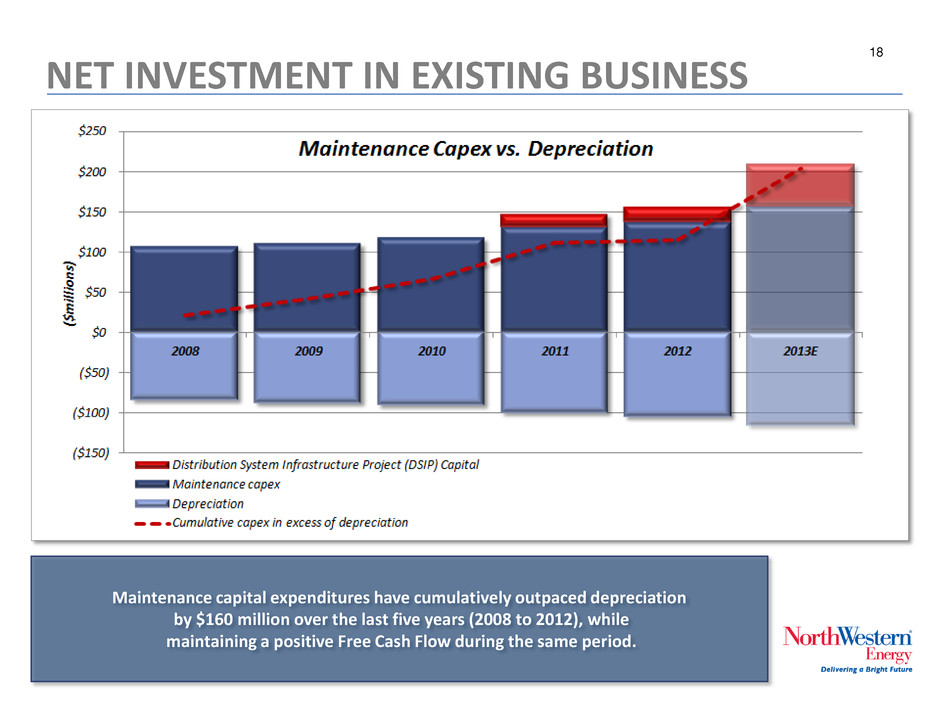

18 NET INVESTMENT IN EXISTING BUSINESS Maintenance capital expenditures have cumulatively outpaced depreciation by $160 million over the last five years (2008 to 2012), while maintaining a positive Free Cash Flow during the same period.

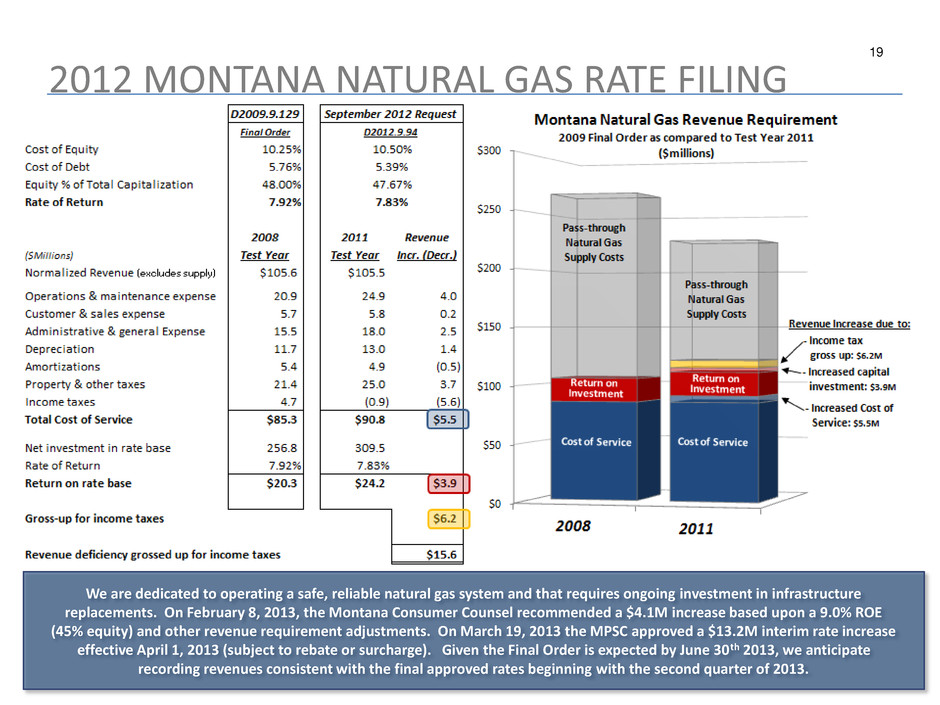

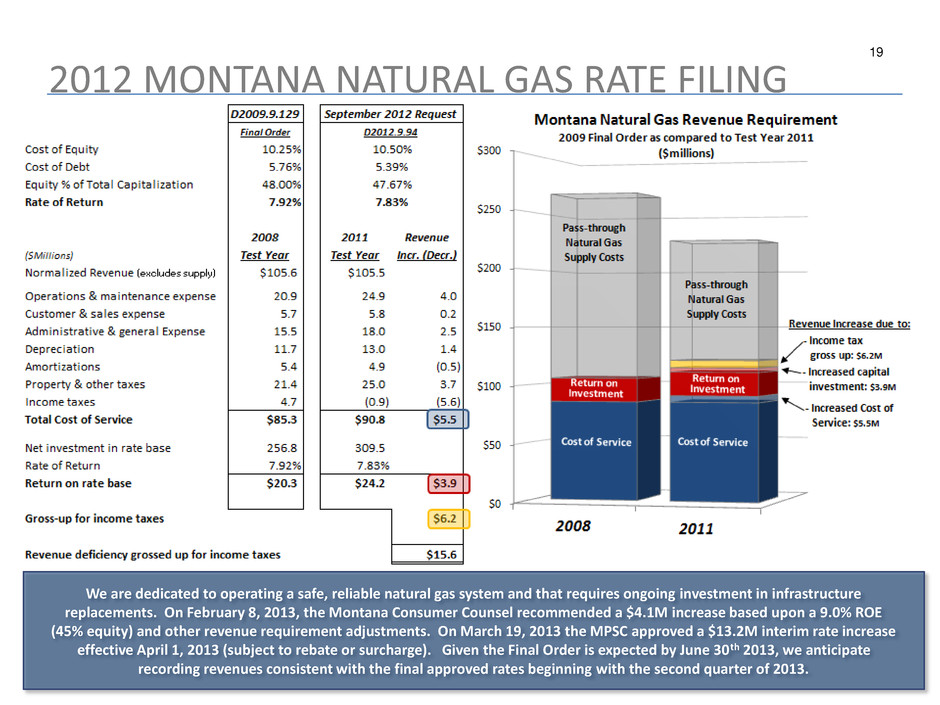

19 2012 MONTANA NATURAL GAS RATE FILING We are dedicated to operating a safe, reliable natural gas system and that requires ongoing investment in infrastructure replacements. On February 8, 2013, the Montana Consumer Counsel recommended a $4.1M increase based upon a 9.0% ROE (45% equity) and other revenue requirement adjustments. On March 19, 2013 the MPSC approved a $13.2M interim rate increase effective April 1, 2013 (subject to rebate or surcharge). Given the Final Order is expected by June 30th 2013, we anticipate recording revenues consistent with the final approved rates beginning with the second quarter of 2013.

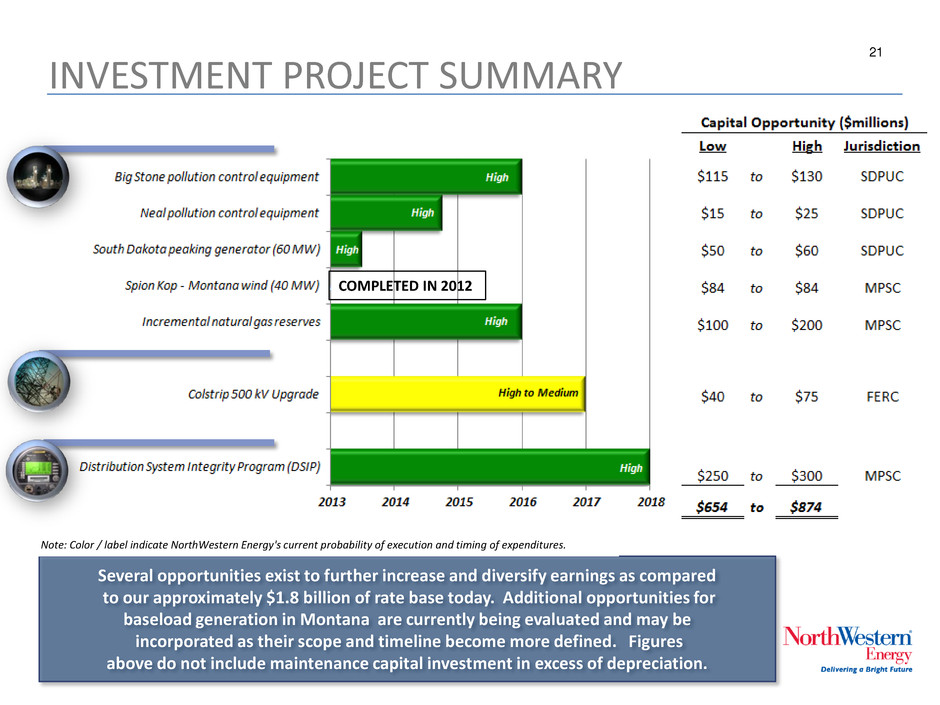

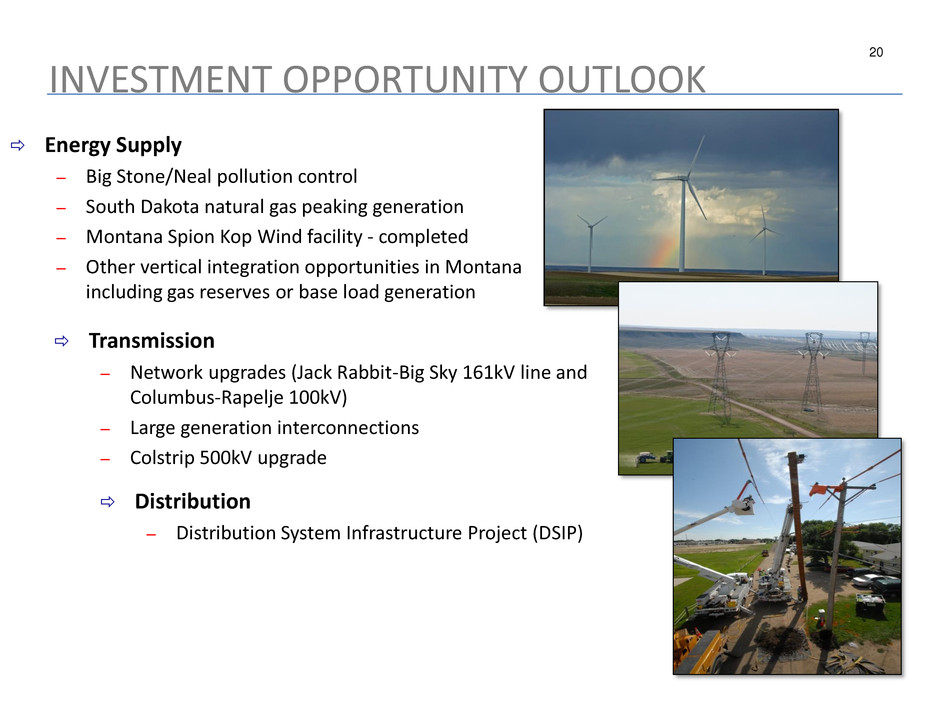

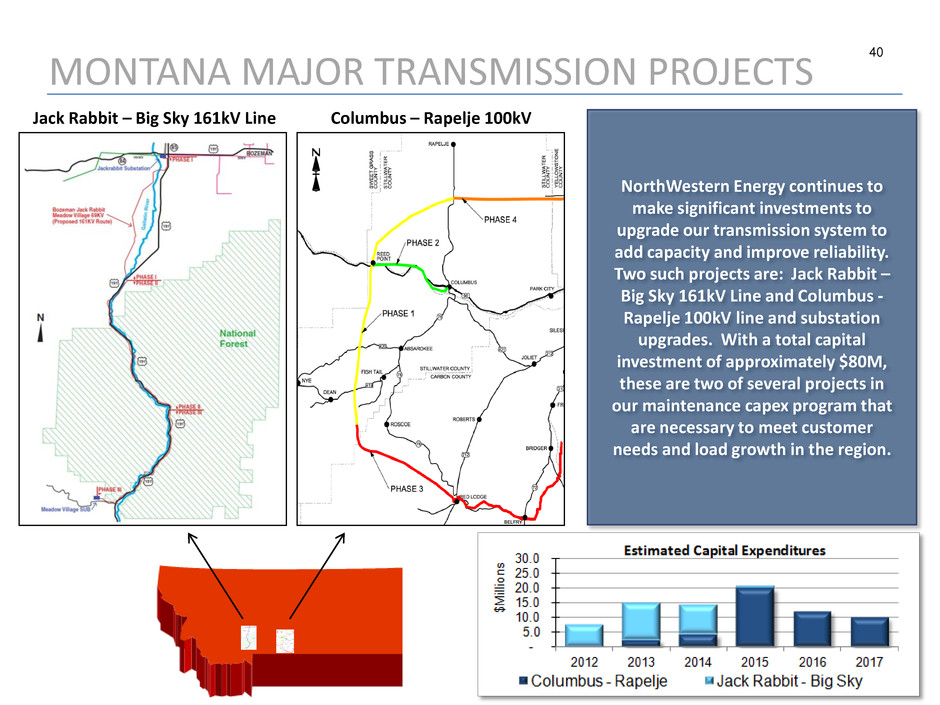

20 INVESTMENT OPPORTUNITY OUTLOOK Energy Supply – Big Stone/Neal pollution control – South Dakota natural gas peaking generation – Montana Spion Kop Wind facility - completed – Other vertical integration opportunities in Montana including gas reserves or base load generation Transmission – Network upgrades (Jack Rabbit-Big Sky 161kV line and Columbus-Rapelje 100kV) – Large generation interconnections – Colstrip 500kV upgrade Distribution – Distribution System Infrastructure Project (DSIP)

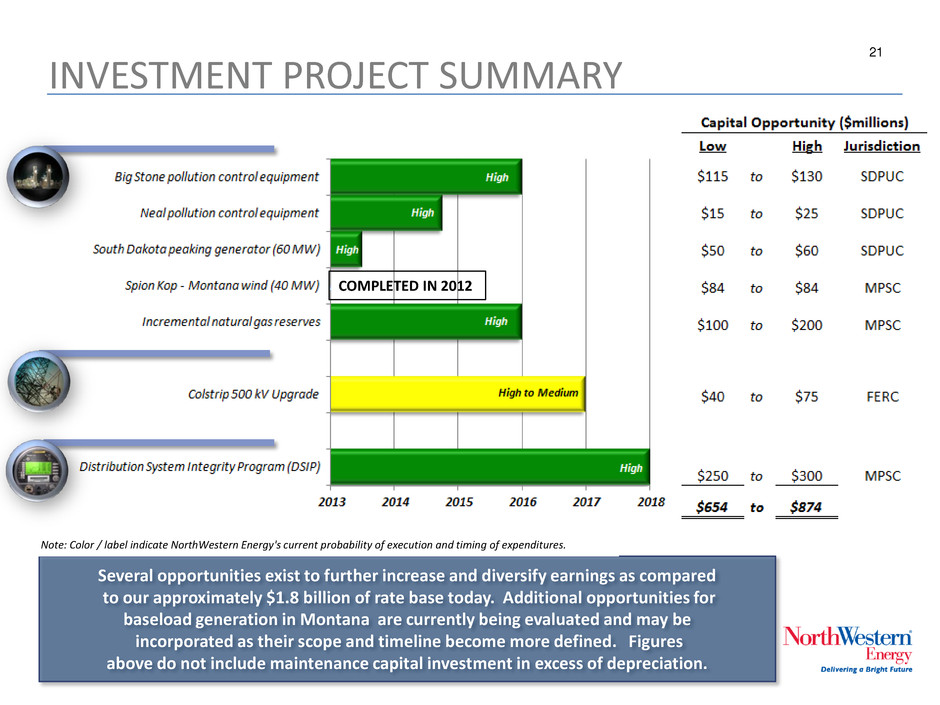

21 INVESTMENT PROJECT SUMMARY Several opportunities exist to further increase and diversify earnings as compared to our approximately $1.8 billion of rate base today. Additional opportunities for baseload generation in Montana are currently being evaluated and may be incorporated as their scope and timeline become more defined. Figures above do not include maintenance capital investment in excess of depreciation. Note: Color / label indicate NorthWestern Energy's current probability of execution and timing of expenditures. COMPLETED IN 2012

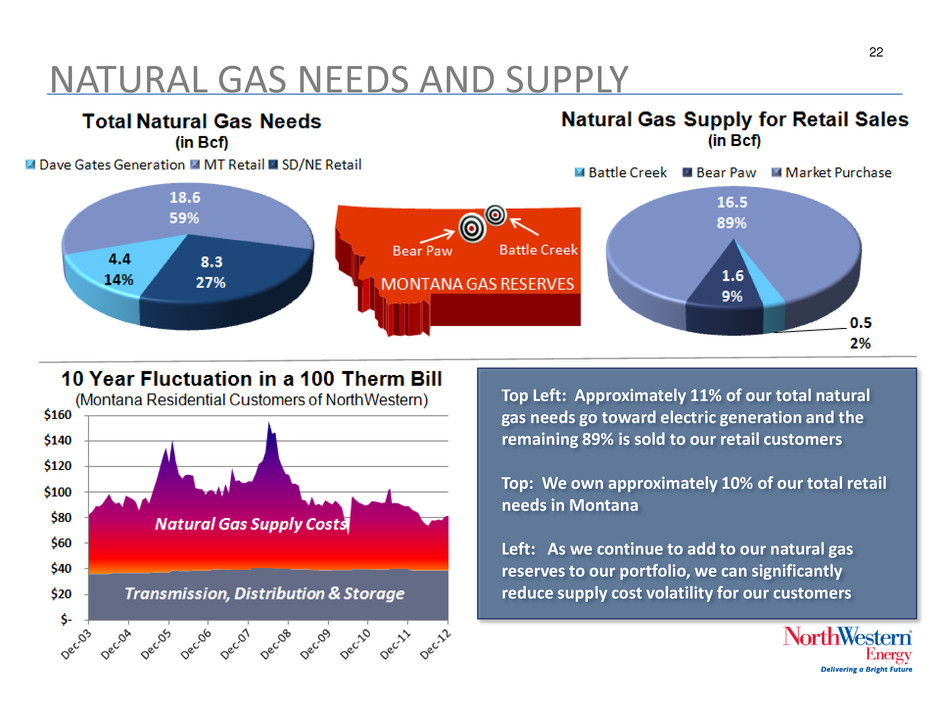

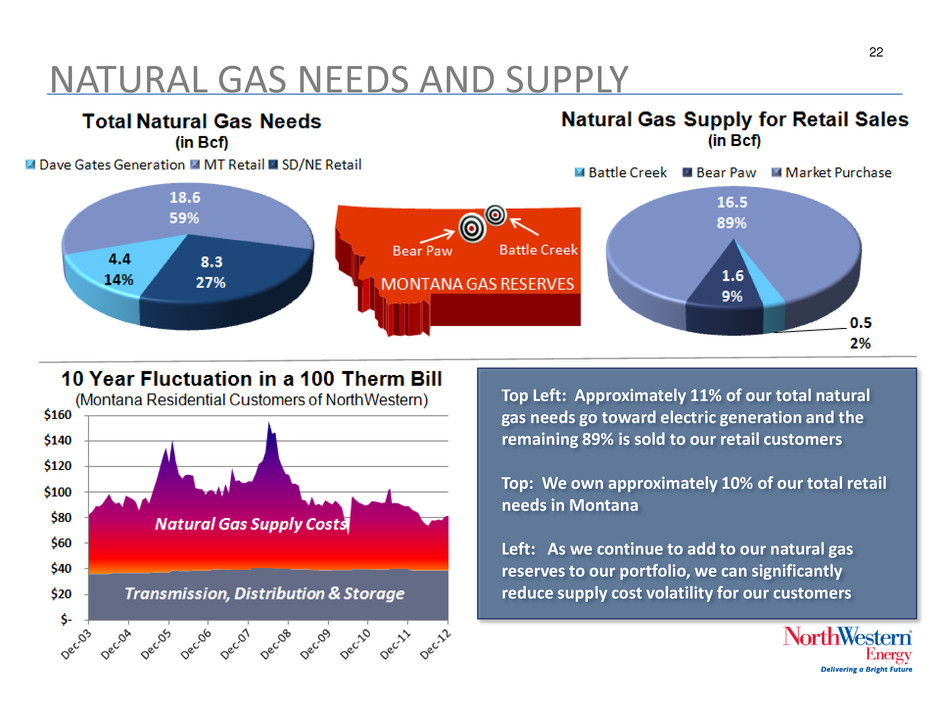

22 NATURAL GAS NEEDS AND SUPPLY Top Left: Approximately 11% of our total natural gas needs go toward electric generation and the remaining 89% is sold to our retail customers Top: We own approximately 10% of our total retail needs in Montana Left: As we continue to add to our natural gas reserves to our portfolio, we can significantly reduce supply cost volatility for our customers

23 MONTANA ELECTRIC GENERATION OPPORTUNITY The total load served over our Montana system is approximately 11 million MWh. The load we currently have responsibility for providing supply is approximately 6 million MWh. Our owned generation in Montana , including the addition of Spion Kop in 2013, would serve approximately 17% of the system load and 31% of the load for which we provide supply. 2011 Resource Procurement Plan filed with the MPSC explored several options, most of which involved a new build generation resource online in 2018.

24 DISTRIBUTION INVESTMENT OUTLOOK Distribution System Integrity Program (DSIP) The Project addresses the emerging issue of our aging infrastructure and prepares our natural gas and electric distribution systems for the next generation of technology. For the electric distribution system, the Program’s goals are: • Arrest and reverse the trend of aging infrastructure; • Build appropriate margin (capacity) back into the system; • Maintain reliability over the long-term, and improve it for our rural customers; and, • Position NWE to adopt Smart Grid, by accomplishing those tasks that are necessary, whether or not Smart Grid is eventually deployed on a wide scale, and regardless of what form of Smart Grid is eventually deployed. For the natural gas distribution system, the Program's goals are: • Embrace the industry's new performance-driven model Natural Gas Distribution Integrity Management Program (DIMP); • Employ state-of-the-art analytical capabilities to proactively manage safety; and, • Improve leak rate performance. NorthWestern, Delivering quality at a great value — yesterday, today and tomorrow… As a NorthWestern Energy customer, you expect and deserve top quality at a reasonable cost – in other words, great value. We agree. NorthWestern Energy has one of the safest and most reliable electric and natural gas distribution systems in the country, and we want to keep it that way. That’s why we created a multi-year project to aggressively replace aging infrastructure and to prepare our network to support the next generation of new technology. We requested and received MPSC approval of an accounting order to defer certain incremental O&M expenses during 2011 and 2012 and amortize these expenses associated with the phase-in portion of the DSIP. The amortization of the 2011 & 2012 expenses will be approximately $3.1 million annually over five years beginning in 2013.

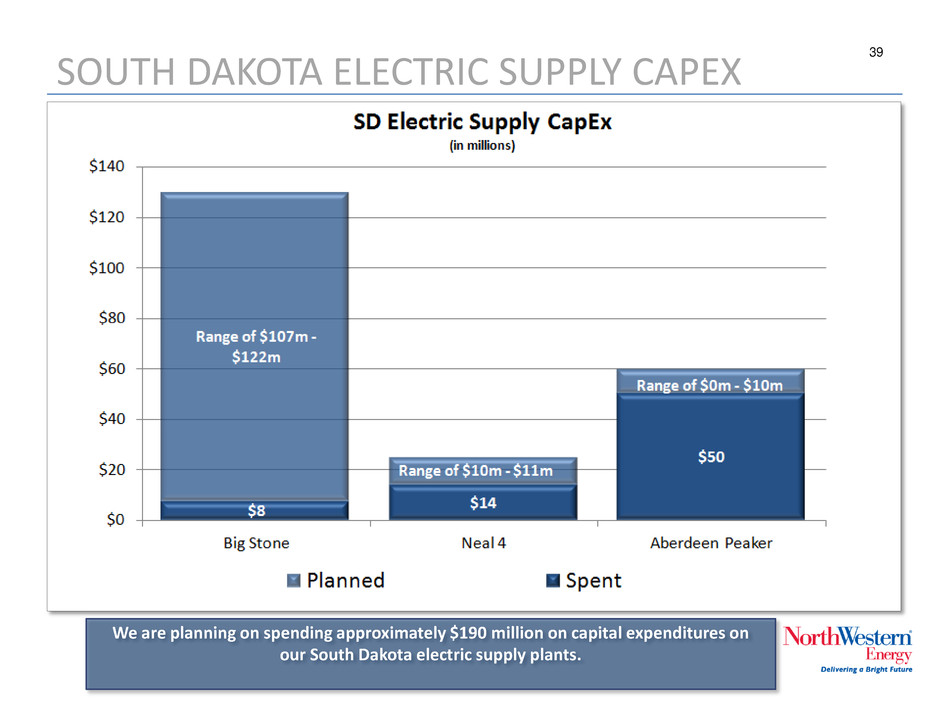

25 CAPITAL SPENDING DSIP – Distribution System Infrastructure Project - $253M over the next 5 years. Energy Supply includes the planned environmental spending in South Dakota on Big Stone and Neal 4 power plants, and completion of the new Aberdeen Peaker plant in 2013. * A natural gas transmission system enhancement plan intended to move us beyond basic compliance with federal safety regulations to systematic prioritization and addressing of pipeline integrity management for long-term customer benefit. Capital spending projections do not include potential future electric or natural gas energy supply additions or capital related to our Gas Transmission Infrastructure Plan (GTIP*).

26 CONCLUSION We’re a fully- regulated and financially sound utility; with Best practices corporate governance and Attractive future growth prospects

27 APPENDIX

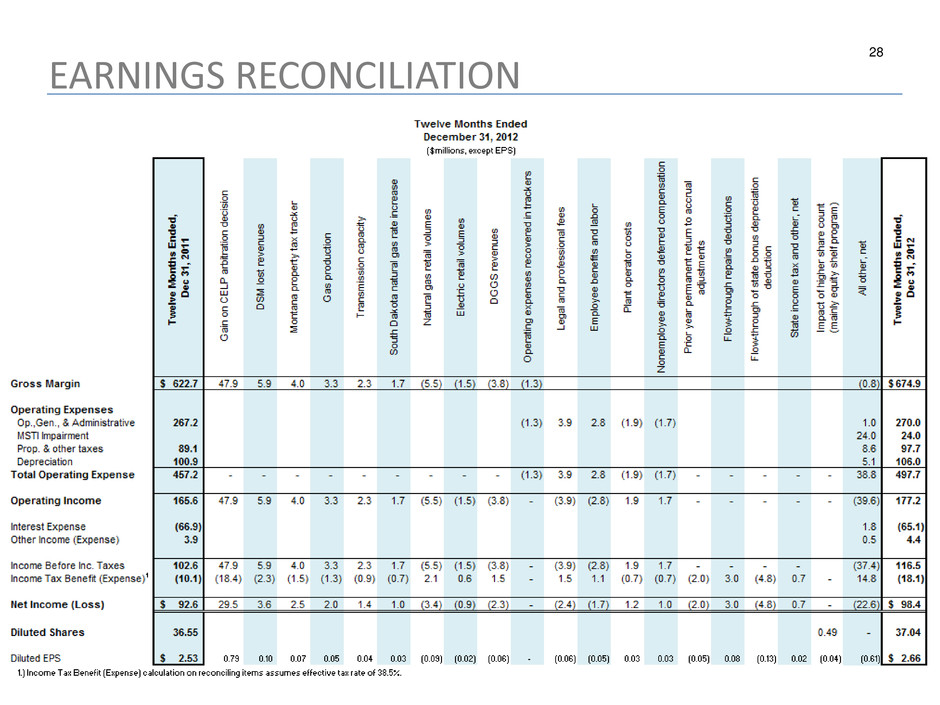

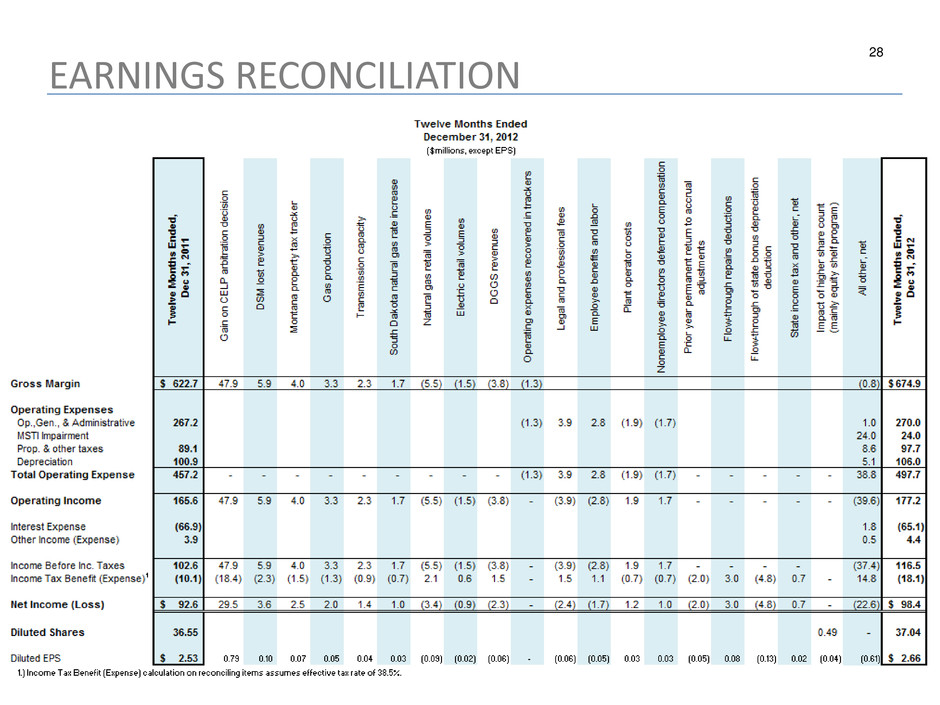

28 EARNINGS RECONCILIATION

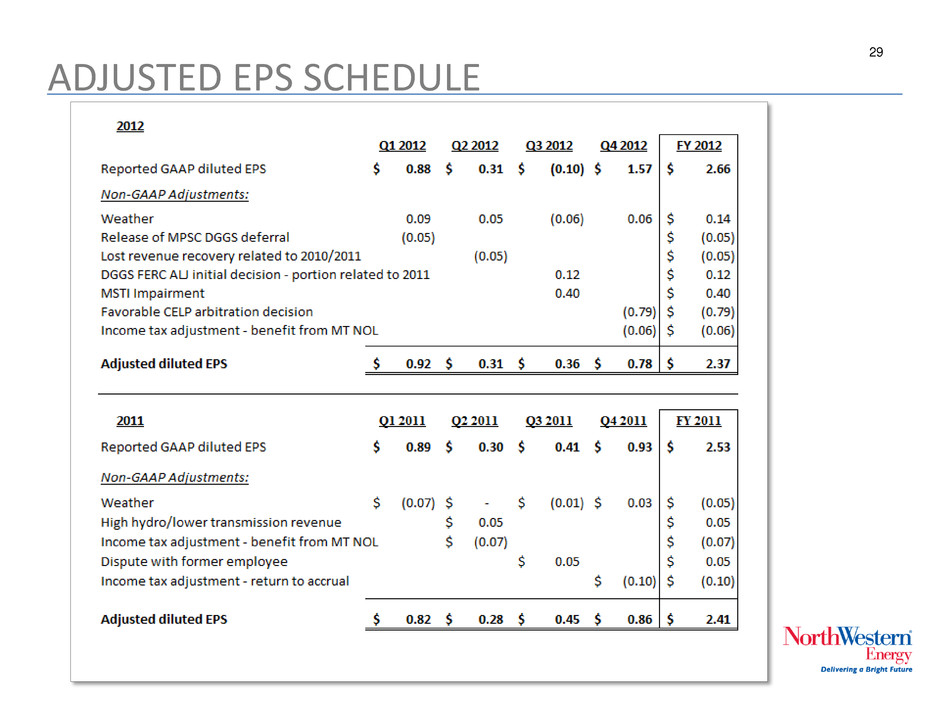

29 ADJUSTED EPS SCHEDULE

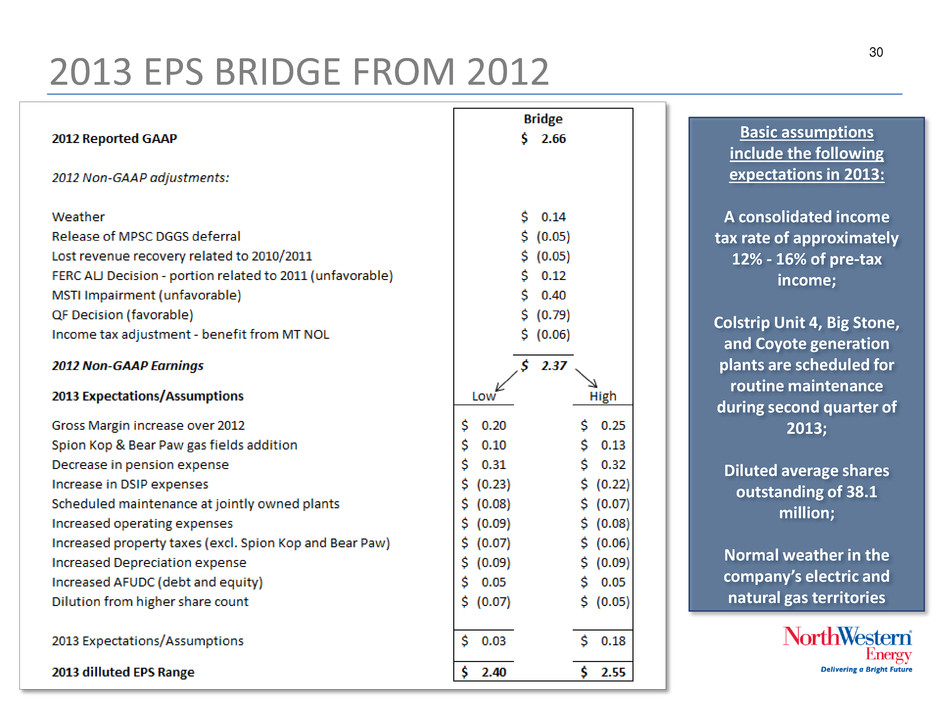

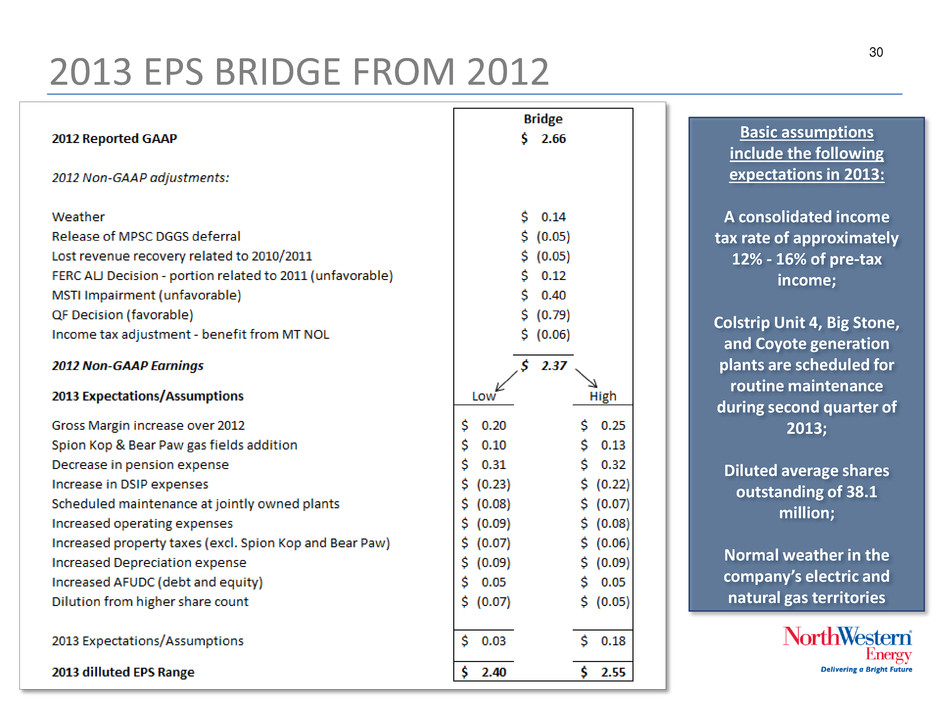

30 2013 EPS BRIDGE FROM 2012 Basic assumptions include the following expectations in 2013: A consolidated income tax rate of approximately 12% - 16% of pre-tax income; Colstrip Unit 4, Big Stone, and Coyote generation plants are scheduled for routine maintenance during second quarter of 2013; Diluted average shares outstanding of 38.1 million; Normal weather in the company’s electric and natural gas territories

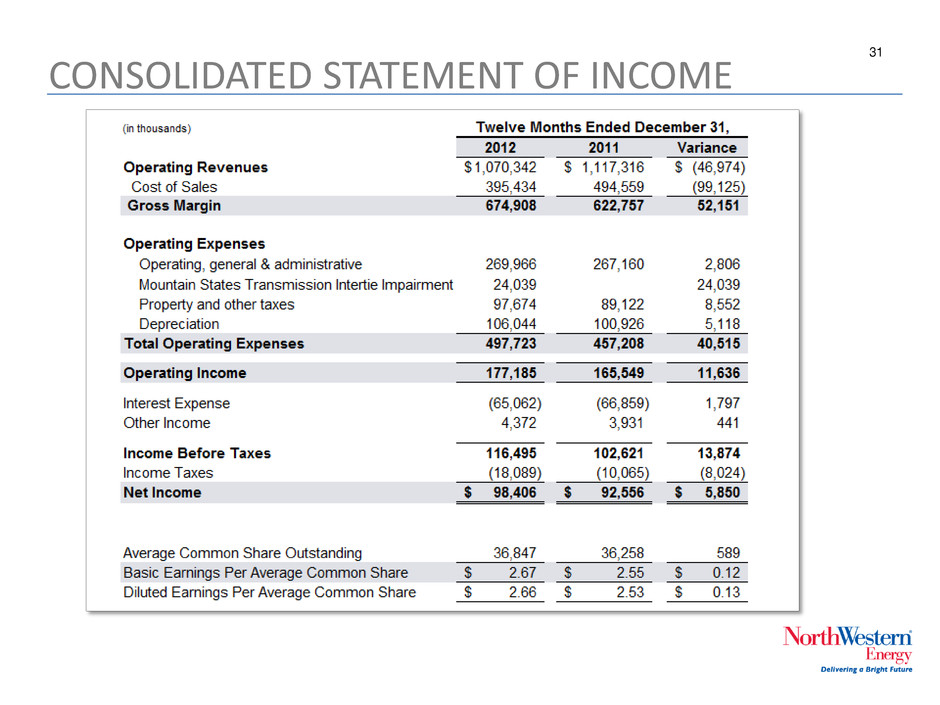

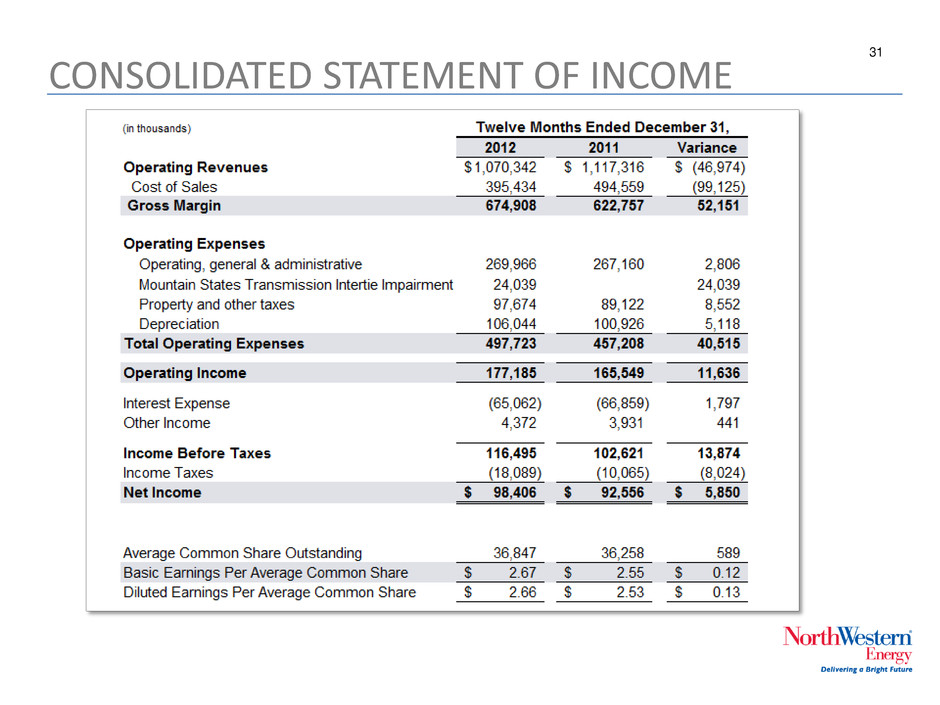

31 CONSOLIDATED STATEMENT OF INCOME

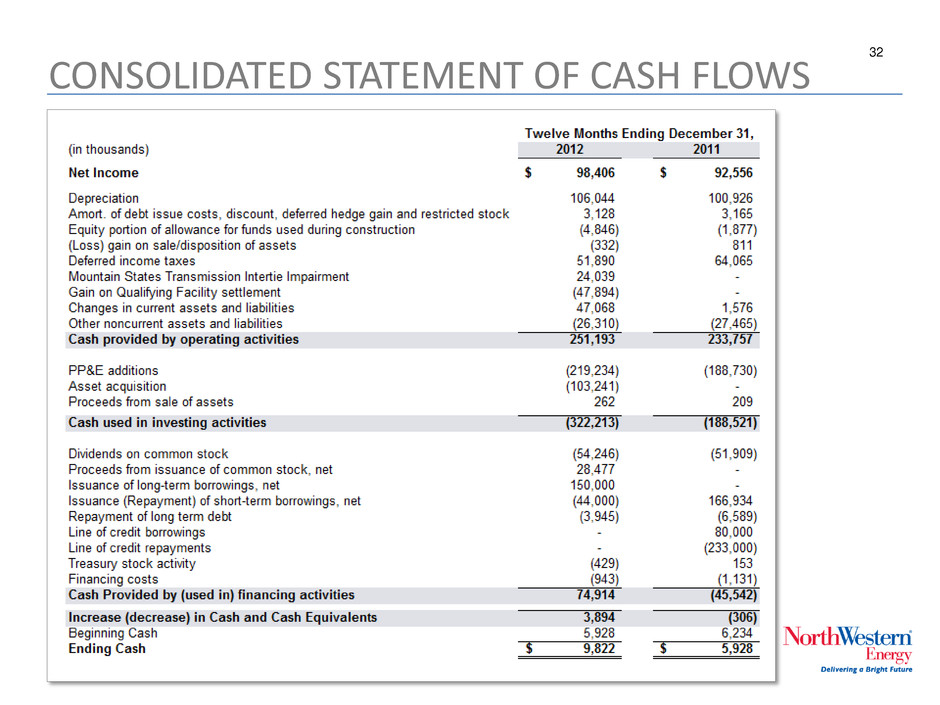

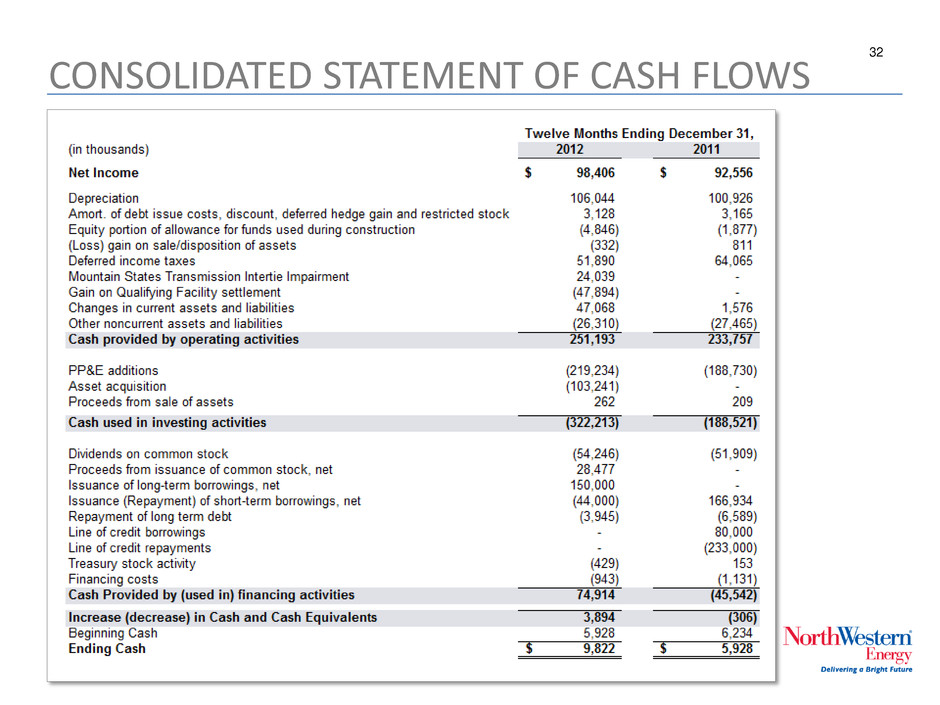

32 CONSOLIDATED STATEMENT OF CASH FLOWS

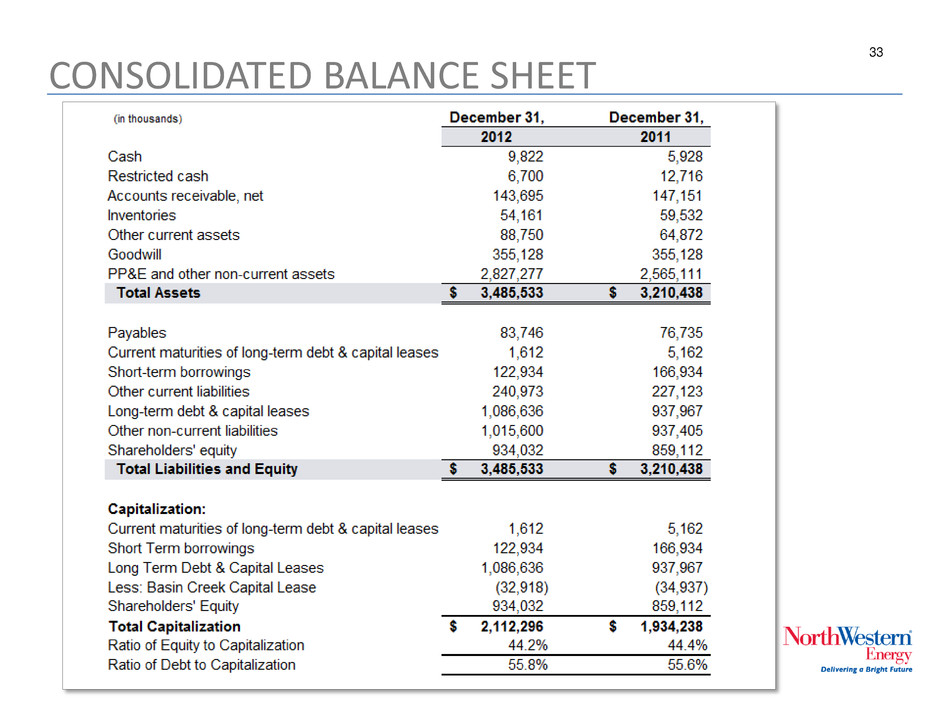

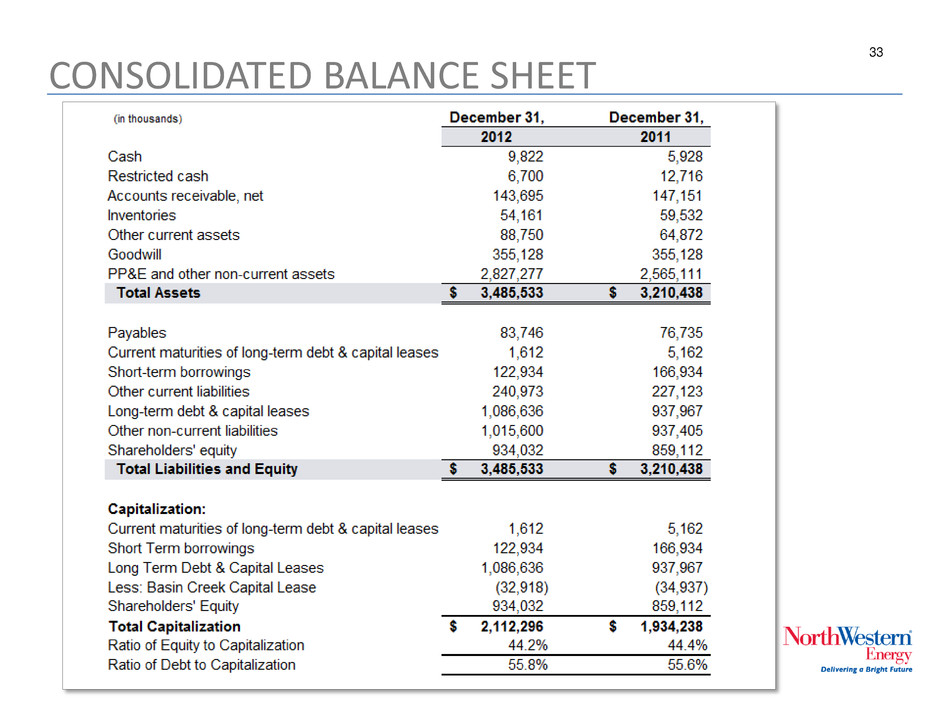

33 CONSOLIDATED BALANCE SHEET

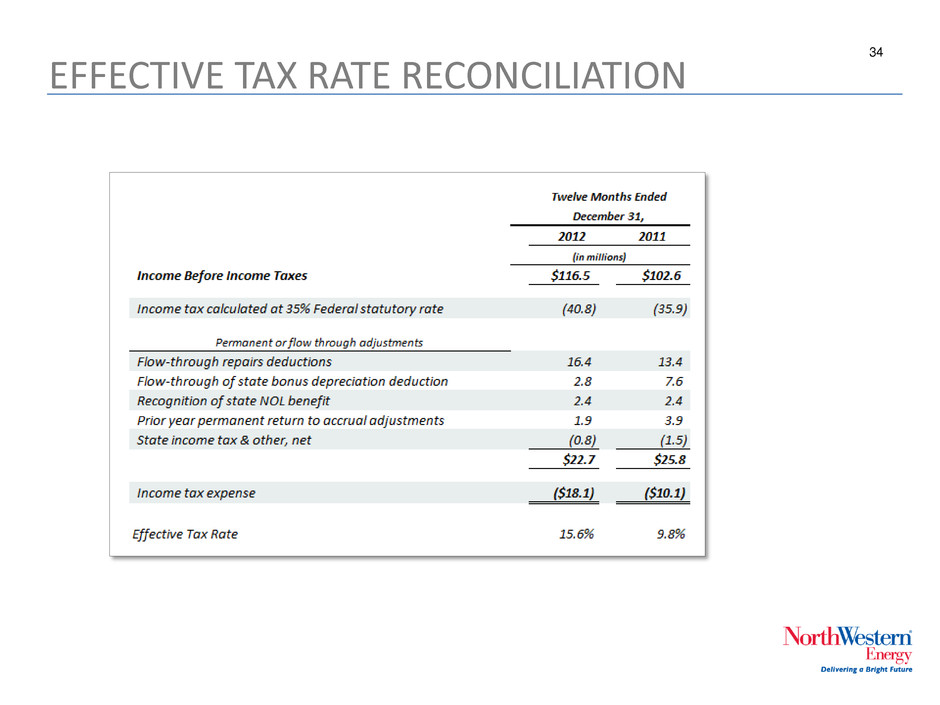

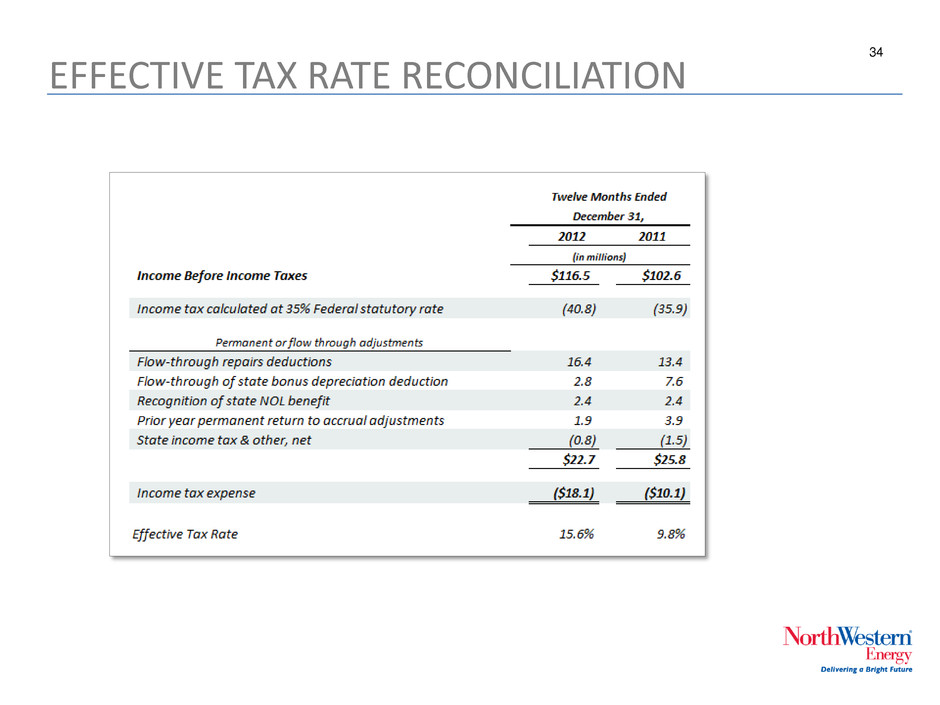

34 EFFECTIVE TAX RATE RECONCILIATION

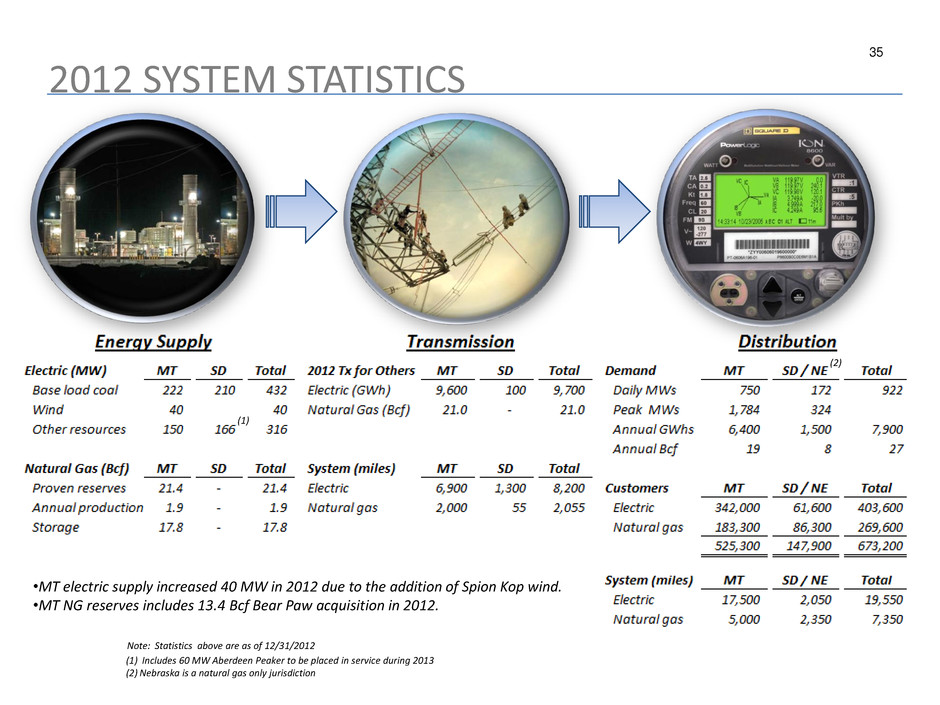

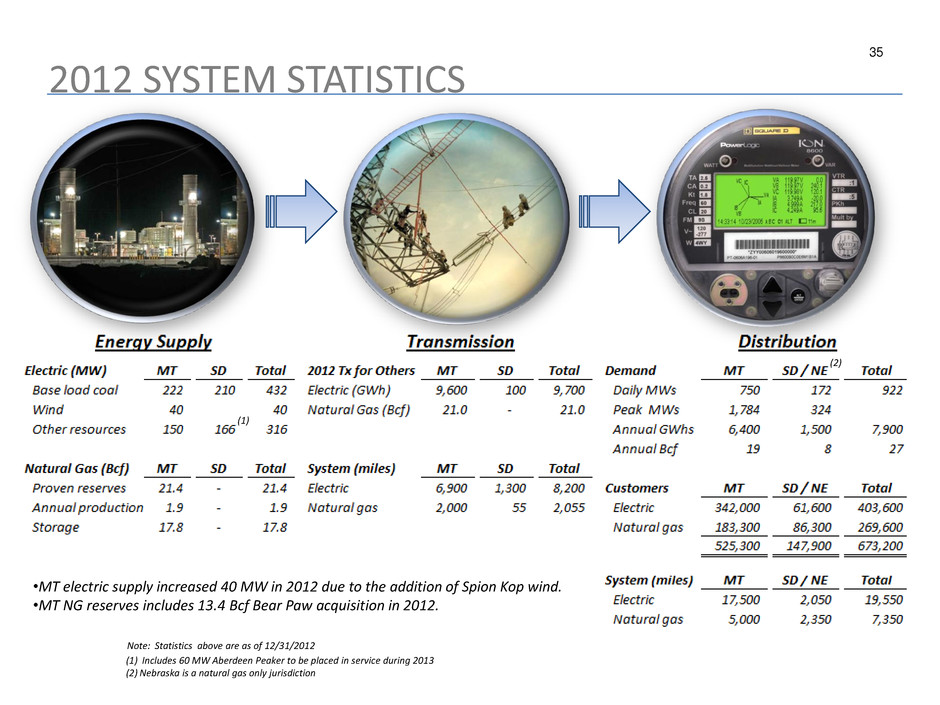

35 2012 SYSTEM STATISTICS Note: Statistics above are as of 12/31/2012 (1) Includes 60 MW Aberdeen Peaker to be placed in service during 2013 (2) Nebraska is a natural gas only jurisdiction (2) •MT electric supply increased 40 MW in 2012 due to the addition of Spion Kop wind. •MT NG reserves includes 13.4 Bcf Bear Paw acquisition in 2012. (1)

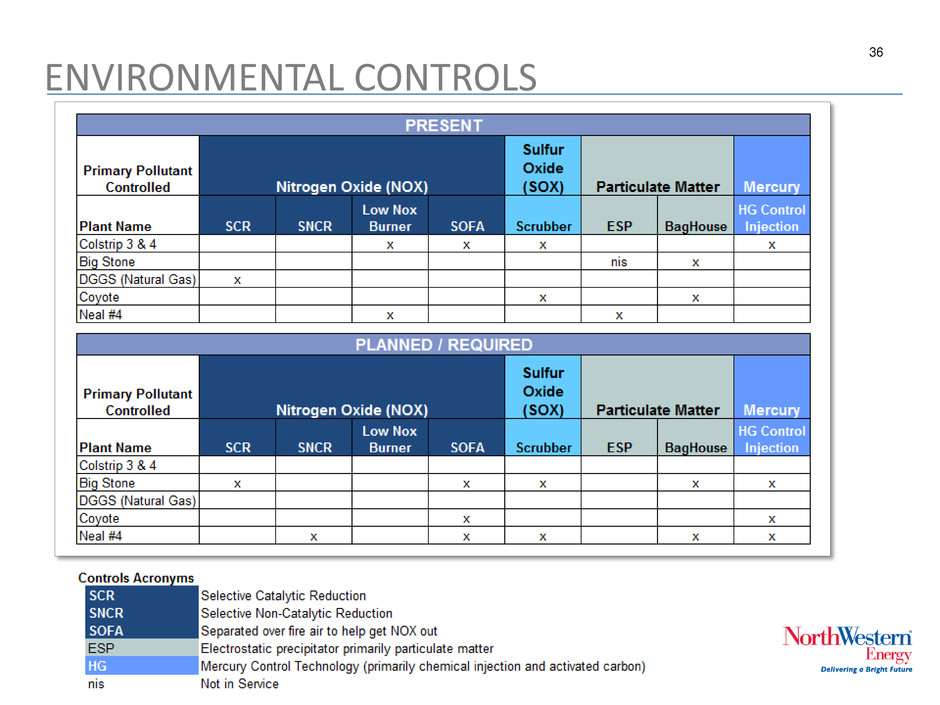

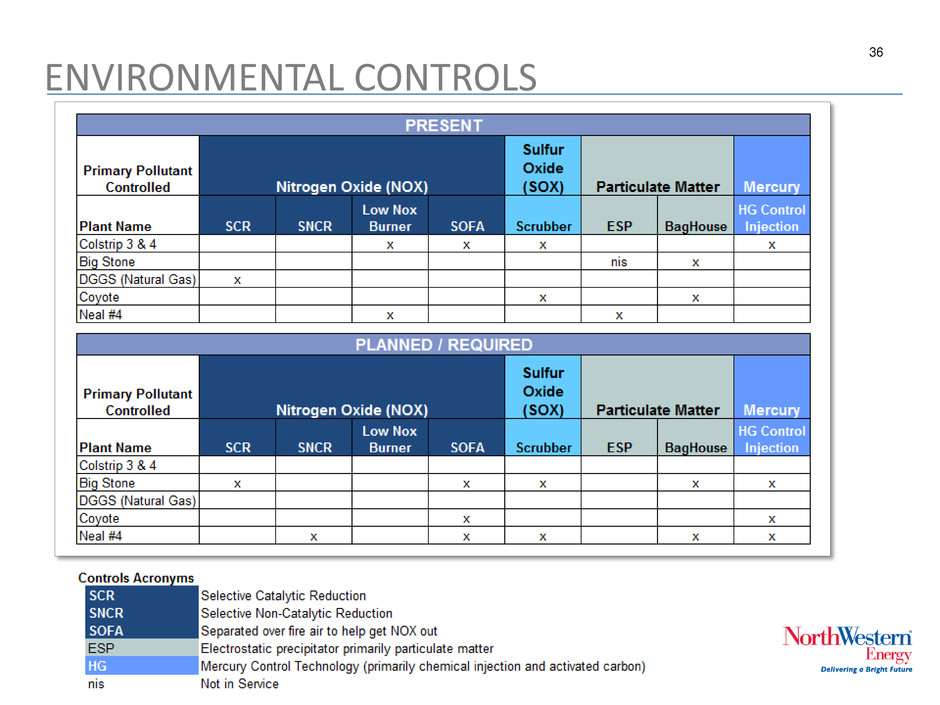

36 ENVIRONMENTAL CONTROLS

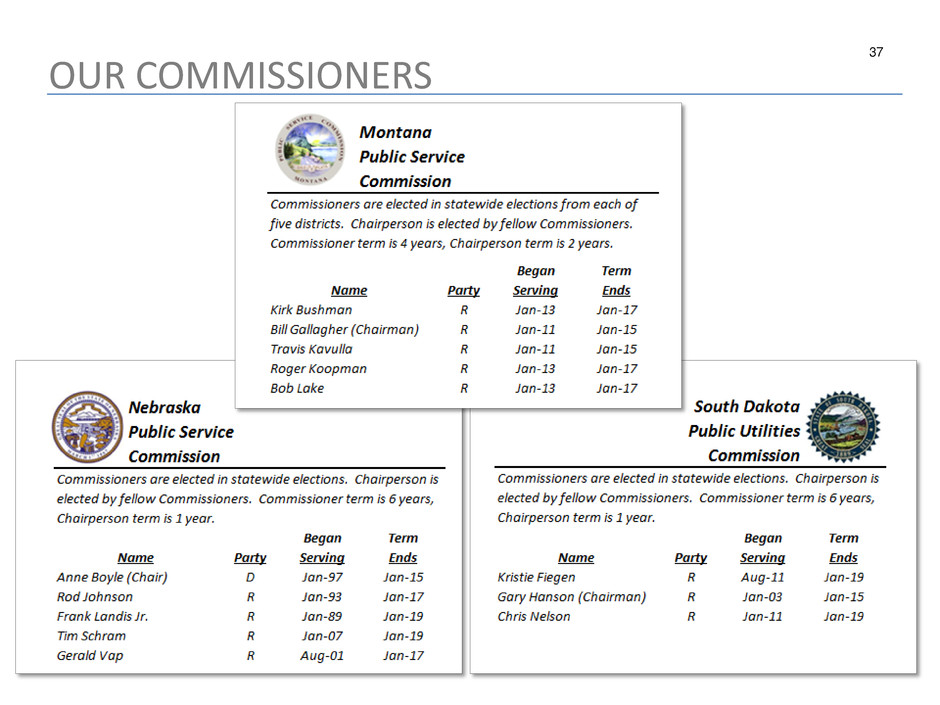

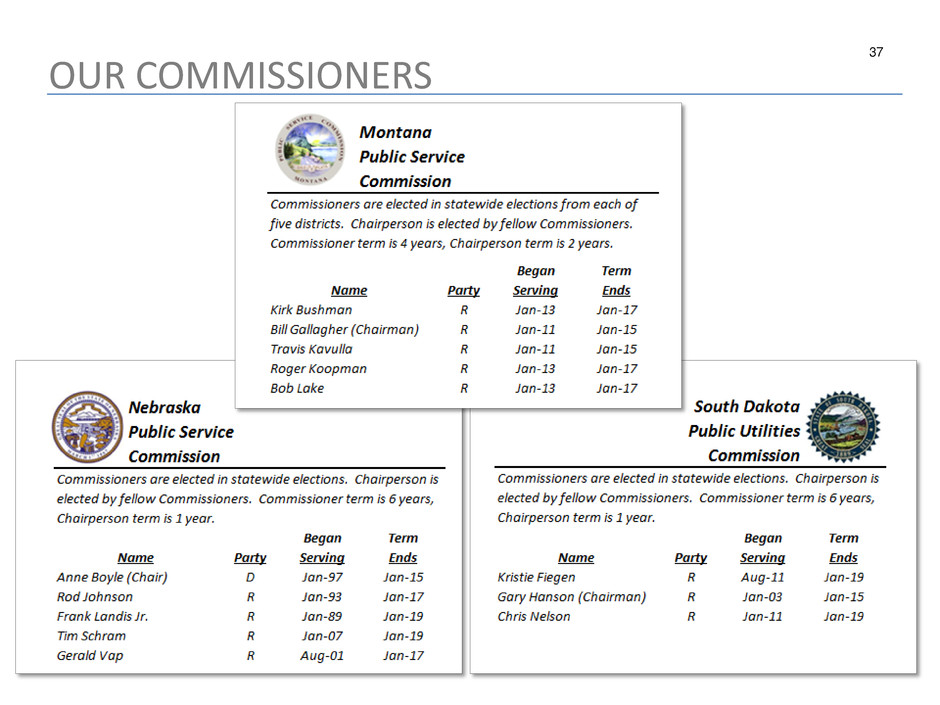

37 OUR COMMISSIONERS

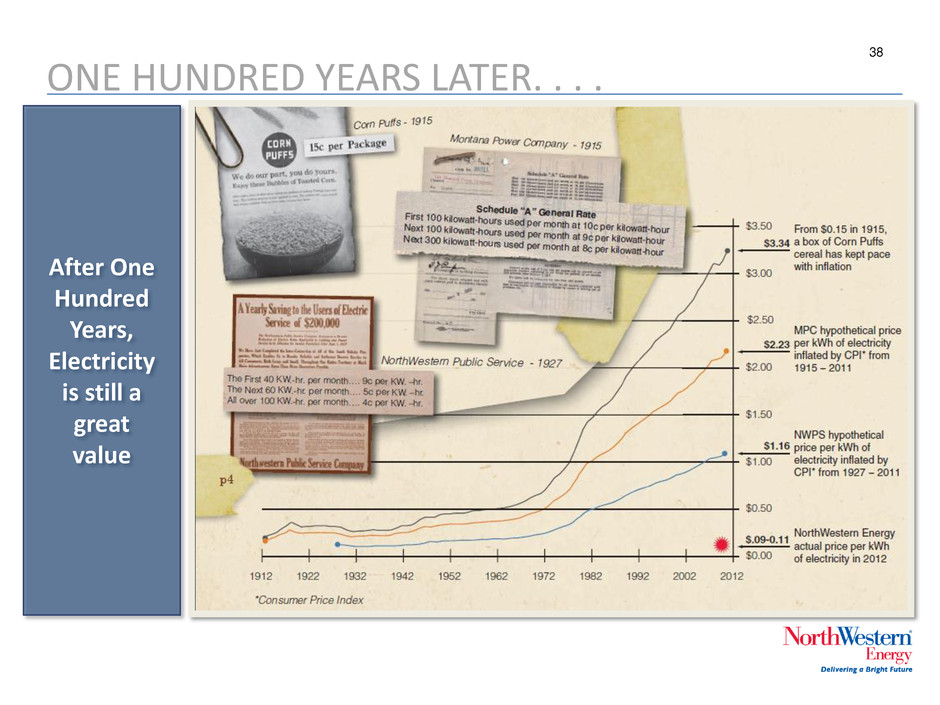

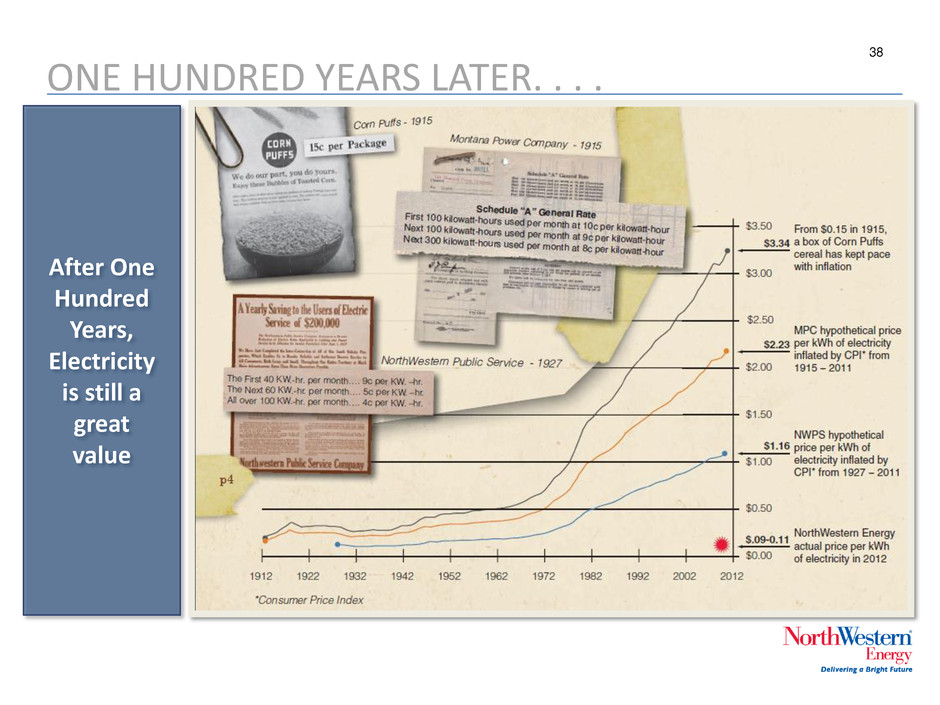

38 ONE HUNDRED YEARS LATER. . . . After One Hundred Years, Electricity is still a great value

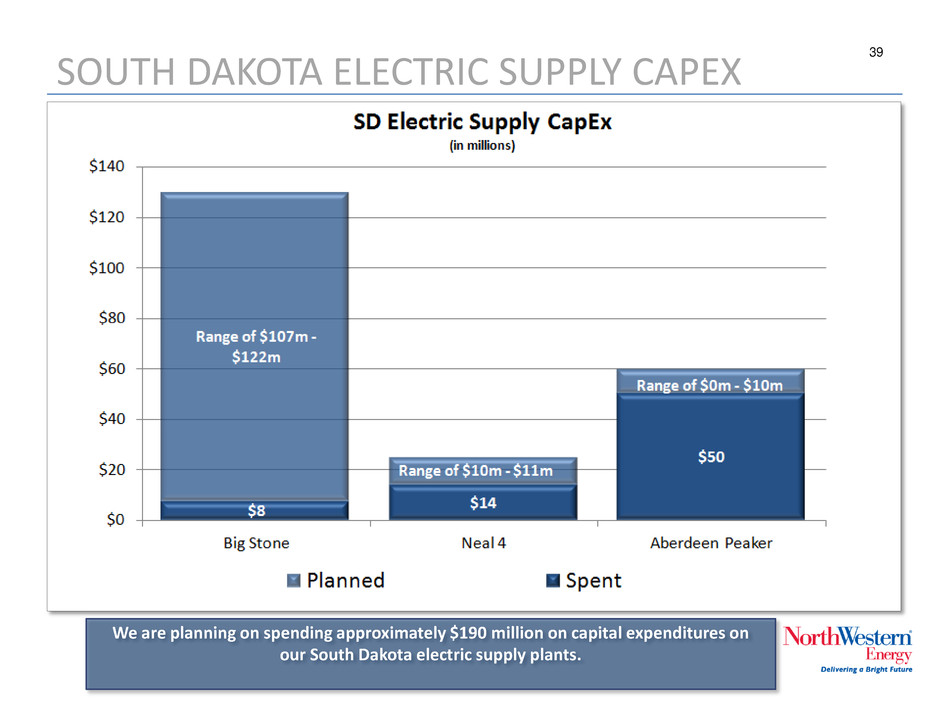

39 SOUTH DAKOTA ELECTRIC SUPPLY CAPEX We are planning on spending approximately $190 million on capital expenditures on our South Dakota electric supply plants.

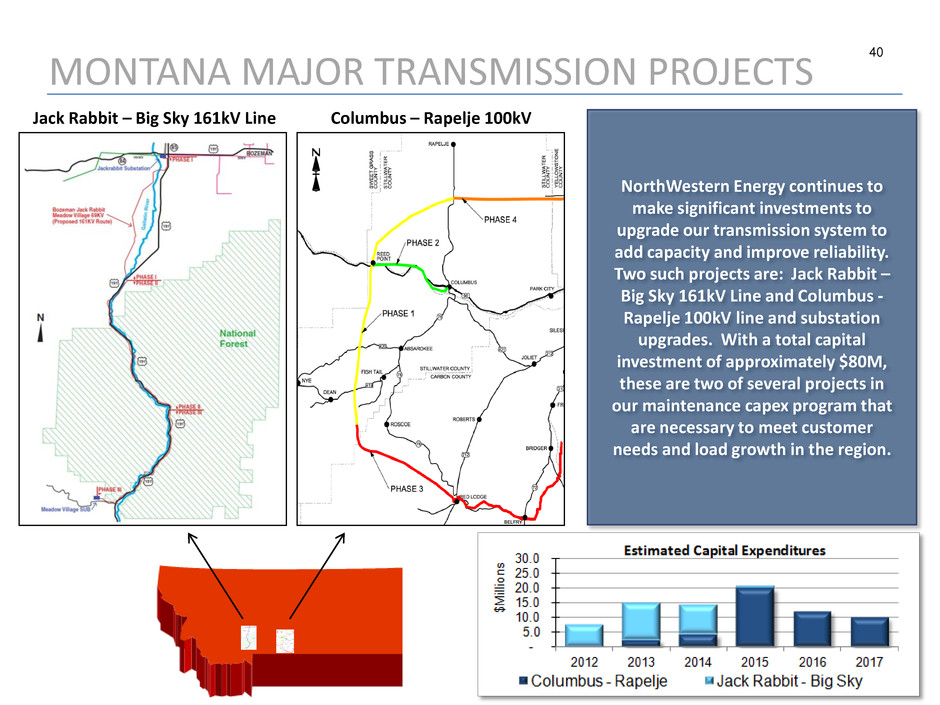

40 MONTANA MAJOR TRANSMISSION PROJECTS NorthWestern Energy continues to make significant investments to upgrade our transmission system to add capacity and improve reliability. Two such projects are: Jack Rabbit – Big Sky 161kV Line and Columbus - Rapelje 100kV line and substation upgrades. With a total capital investment of approximately $80M, these are two of several projects in our maintenance capex program that are necessary to meet customer needs and load growth in the region. Jack Rabbit – Big Sky 161kV Line Columbus – Rapelje 100kV

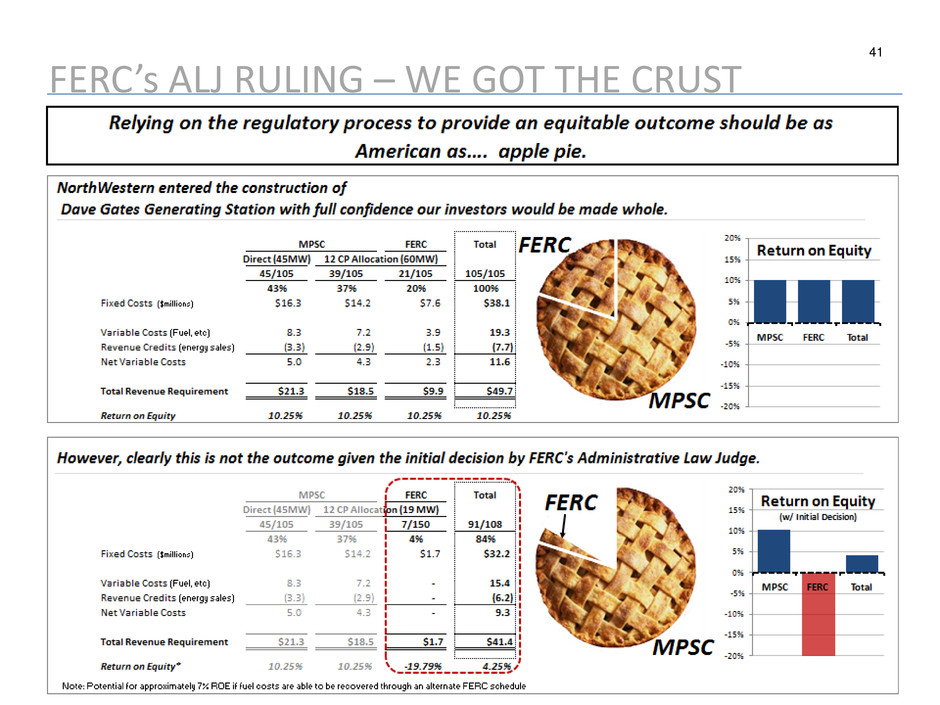

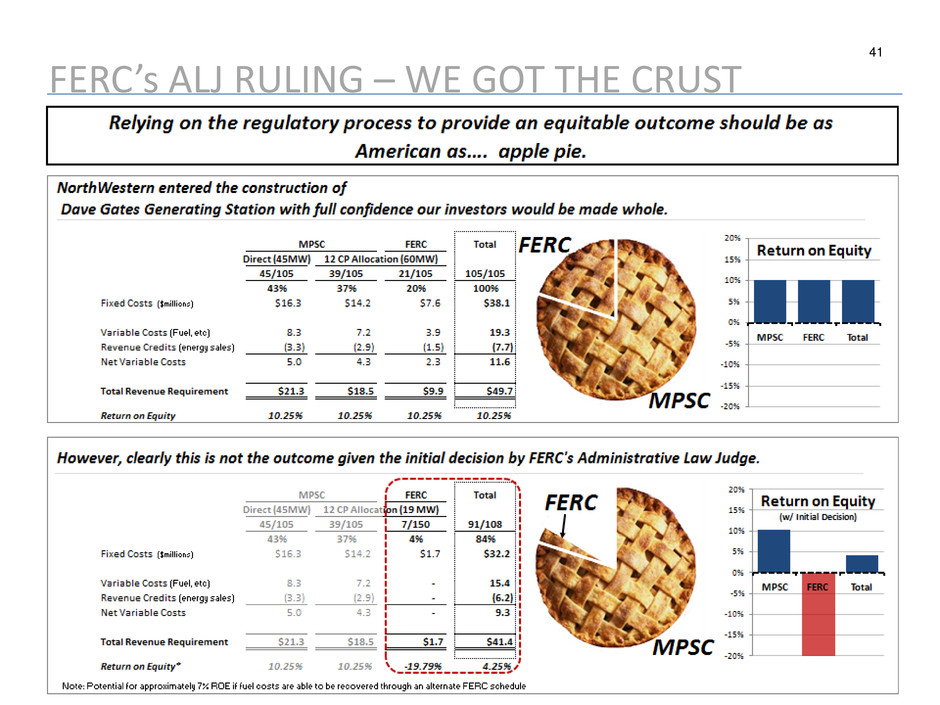

41 FERC’s ALJ RULING – WE GOT THE CRUST 41

42 THE BACK STORY ON DGGS Background •NorthWestern Energy operates a transmission system and balancing authority within Montana and is charged with the responsibility of providing safe and reliable electric service to all of its customers. This includes retail and wholesale customers. • Part of NorthWestern’s responsibility is to continually balance all customer loads on the system with all resources on the system. This is a moment to moment requirement and is measured by NERC (North American Reliability Corporation) and WECC (Western Electricity Coordinating Council) criteria. Ultimately the FERC (Federal Energy Regulatory Commission) enforces these NERC and WECC reliability criteria and stiff civil penalties and sanctions can be imposed for non-compliance. • NorthWestern meets this reliability requirement by assuring that it has regulating resources available to constantly balance loads with resources. Regulating resources are sources of energy that can be ramped up or down quickly to balance changing customer load profiles with the energy supply resources available. • For many years, since NorthWestern did not own any resources of its own to provide this service, NorthWestern was forced to rely on the volatile wholesale market to purchase regulating resources from third parties, from systems often very distant from NorthWestern. Support for DGGS • On May 20, 2009, the MPSC issued a Final Order approving DGGS finding that: “The Commission finds NWE provided compelling evidence of the imprudence and risk of continuing to rely exclusively on its longtime practice of contracting with other utilities in the region to meet its need for mandatory regulation service. NWE demonstrated its current need for 91 MW of regulating reserves in order to meet balancing authority requirements, provide safe and reliable service, and avoid the risk of significant financial penalties for violations of reliability standards. NWE’s projection that it will need 115 MW of regulation service by 2015 is reasonable as well”. •FERC stated in its November 2007 Order approving the third party purchase from Powerex: “We also find that NorthWestern has adequately addressed interveners’ arguments. Specifically, we find that NorthWestern has supported the term and level of services contained in the Agreement and explained why it did not elect to provide a back-stop bid based on its ownership interest in Colstrip Unit No. 4. In addition, NorthWestern has provided evidence that its circumstances are temporary because it now may build or otherwise acquire generation that may alleviate its need to purchase ancillary services from third parties. Therefore, we accept the Agreement for filing and grant Powerex’s request for waiver of Section 3 of its Rate Schedule No. 1 for the term of the Agreement (January 1, 2008 through December 31, 2008)”.

43 THE BACK STORY ON DGGS (CONTINUED) Support for DGGS (continued) • On April 29, 2010, NorthWestern made a filing with FERC proposing to collect costs associated with DGGS under the same cost allocation methodology and for the same magnitude of Regulating Resource as had been previously approved by FERC when NorthWestern was providing such service under third party contracts. Unfortunately, the Initial Order from the Administrative Law Judge doesn’t support FERC’s previous positions. •The Initial Order from the FERC Administrative Law Judge: • Does not challenge the prudency or costs of the DGGS. In fact, the parties agreed, through stipulation, on the total revenue requirement of DGGS. • Instead, the Initial Order would seek to penalize NorthWestern for its decision to follow FERC precedent on the issue of the magnitude and allocation of costs. Ironically, the rate for DGGS advocated by the Montana Large Customer Group and which appeared to be adopted by the Initial Order would be approximately one-half of the rate that NorthWestern was previously recovering as a pass-through of costs under the third party contracts and approved by FERC! As a result • One side of FERC has ordered NorthWestern to meet reliability criteria and another side of FERC seeks to strip NorthWestern of its tools to meet such criteria (or at least the cost recovery of the tools). • It is important to note that NorthWestern still must meet its reliability criteria obligations or face stiff penalties, ultimately from FERC, the same regulatory agency that has found in this initial order that NorthWestern only needs a fraction of the regulating service that it has constructed into DGGS and has been required traditionally to meet reliability criteria. In Summary • NorthWestern finds itself in a position where regulatory worlds have collided. No one disagrees that the generating plant is needed. No one argues the costs aren’t prudent. The Montana Public Service Commission issued a thoughtful and fact-based decision concerning the part of the Plant under its jurisdiction. The FERC process and initial decision would seek to either shift costs to state jurisdictional customers or allow them simply to fall between the cracks.