1 NorthWestern Corporation Annual Meeting of Stockholders April 25, 2013

2 FORWARD LOOKING STATEMENT During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s public filings with the SEC.

3 Our Vision: Enriching lives through a safe, sustainable energy future Our Mission: Working together to deliver safe, reliable and innovative energy solutions Our Values: ABOUT NORTHWESTERN S - safety E - excellence R - respect V - value I - integrity C - community E - environment

4 NWE: AN INVESTMENT FOR THE LONG TERM We’re a fully regulated and financially solid utility; with – Diversity across states, service type and customer segments – A 100 year history of competitive customer rates, system reliability and customer satisfaction – 5 years of significant earnings and dividend growth – Strong cash flows aided by net operating loss carryforwards – Solid investment grade credit ratings Best practices corporate governance; and – A strong and well rounded board and executive team – Forbes “Americas Most Trustworthy” companies Attractive future growth prospects – Reintegrating energy supply portfolio (natural gas and electric) – Distribution System Infrastructure Program (DSIP) – Transmission opportunities within our service territory

5 2012 SYSTEM STATISTICS Note: Statistics above are as of 12/31/2012 (1) Includes 60 MW Aberdeen Peaker to be placed in service during 2013 (2) Nebraska is a natural gas only jurisdiction (2) •MT electric supply increased 40 MW in 2012 due to the addition of Spion Kop wind. •MT NG reserves includes 13.4 Bcf Bear Paw acquisition in 2012. (1)

6 ONE HUNDRED YEARS LATER. . . . After One Hundred Years, Electricity is still a great value

7 A STRONG & WELL ROUNDED BOARD & EXECUTIVE TEAM

8 NWE CORPORATE RESPONSIBILITY

9 A DIVERSIFIED ELECTRIC AND GAS UTILITY Above data reflects full year 2012 results . Jurisdiction and service type based upon gross margin contribution. The “80/20” rules of NorthWestern Gross Margin in 2012: Electric: $528M Natural Gas: $146M Other $ 1M Gross Margin in 2012 Montana: $570M South Dakota: $ 95M Nebraska: $ 10M Average Customers in 2012: Residential: 557k Commercial: 107k Industrial: 6k

10 2013 EARNINGS GUIDANCE 2013 guidance range of $2.40-$2.55 based upon, but not limited to, the following major assumptions and expectations: • A consolidated income tax rate of approximately 12%; • Colstrip Unit 4, Big Stone, and Coyote generation plants are scheduled for routine maintenance; • Diluted average shares outstanding of 38.1 million; and • Continued normal weather in our service territories for the remainder of 2013. 2013 Diluted GAAP EPS Range of $2.40-2.55 Midpoint 1 Continued investment in our system to serve our customers and communities is expected to provide average earnings per share growth and dividend growth of 4-6% annually. That, coupled with a dividend yield of 3-4%, should provide good results for investors over foreseeable future.

11 5 YEAR TRACK RECORD OF DELIVERING RESULTS Return on Equity steadily improved each year from 2008 – 2012 and Dividend per Share increased each of the last 5 years. 5 Year (2008-12) Average Return on Equity : 9.8% 5 Year (2008-12) CAGR Dividend: 2.9% Current Dividend Yield Approximately 4.0% 1. ROE in 2011 & 2012, on a Non-GAAP “adjusted” basis, would be 10.5% and 9.8% respectively. 2. 2013 ROE and 2013 Dividend payout ratio estimate based on midpoint of GAAP guidance range of $2.40 - $2.55. 3. 2011 and 2012 Dividend Payout Ratio based upon Non-GAAP Adjusted EPS would be 60% and 62% respectively. 1 3 3 1 2 2

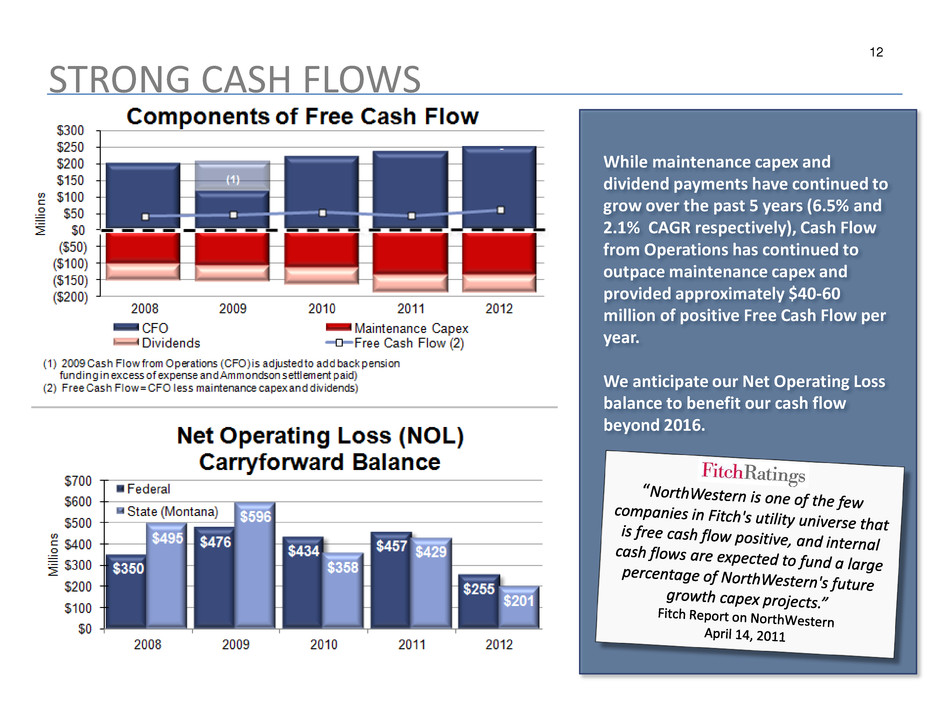

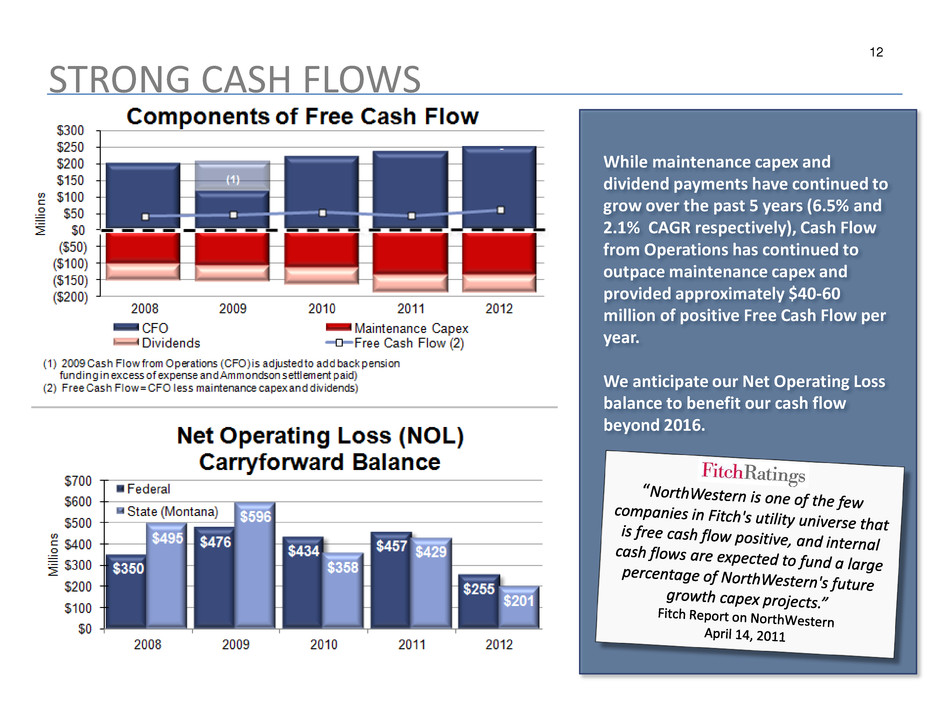

12 STRONG CASH FLOWS While maintenance capex and dividend payments have continued to grow over the past 5 years (6.5% and 2.1% CAGR respectively), Cash Flow from Operations has continued to outpace maintenance capex and provided approximately $40-60 million of positive Free Cash Flow per year. We anticipate our Net Operating Loss balance to benefit our cash flow beyond 2016.

13 BALANCE SHEET STRENGTH AND LIQUIDITY

14 HARD ASSETS PROVIDING REAL VALUE (Left) We believe continued investment in our system to provide safe, reliable, environmentally responsible and cost- effective service for our customers will produce additional value for our shareholders. (Below) NWE Total Shareholder Return has outperformed our peer group average, the S&P 600 index (on which we are listed) and the Dow Jones Utility Average thru December 31, 2012.

15 INVESTING IN INFRASTRUCTURE TO SERVE OUR CUSTOMERS Over the past 5 years we have begun to rebuild our Montana energy supply portfolio and invested to enhance system safety, reliability and capacity. We have made these enhancements while delivering solid earnings growth to our investors with minimal impact to our customers’ bills. 2008-2012 CAGRs Estimated Rate Base: 14.5% GAAP Diluted EPS: 10.6% El. retail rev./ MWh : 1.9% N. Gas retail rev./Dkt: (6.2%)

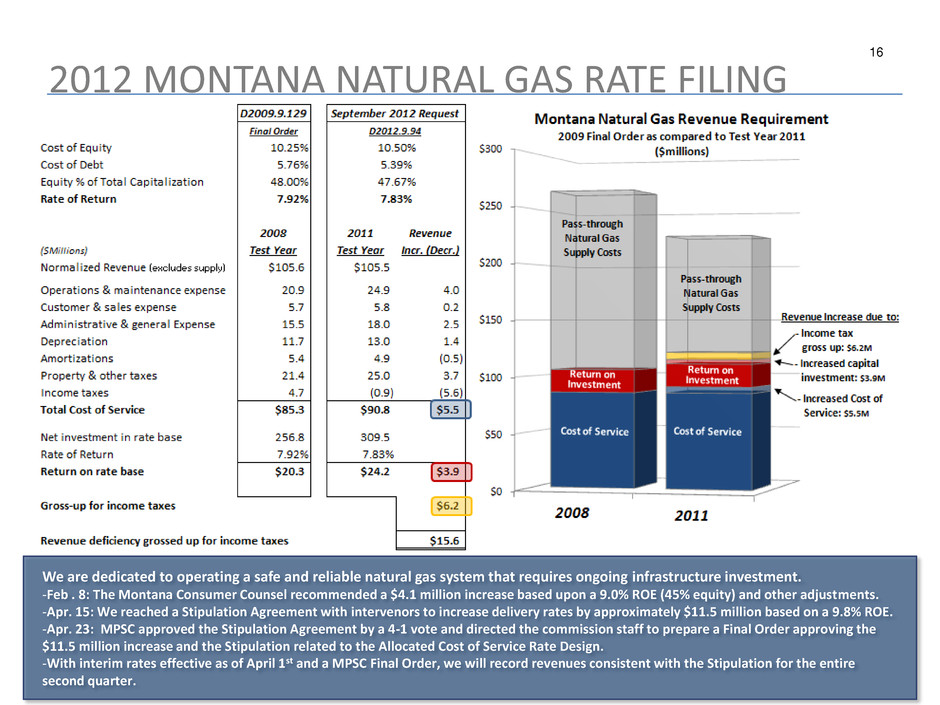

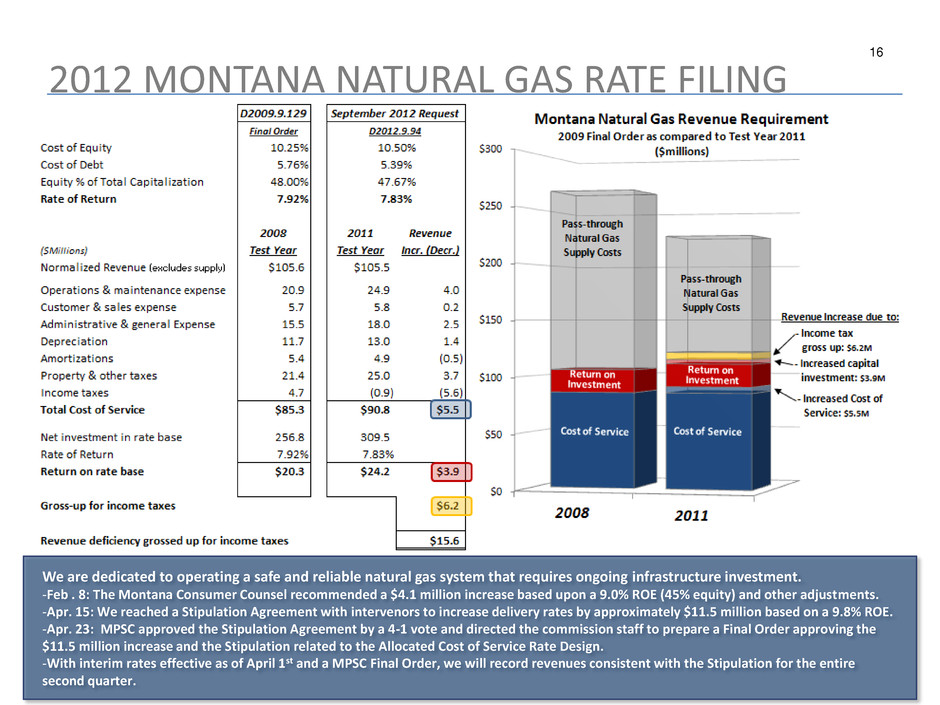

16 2012 MONTANA NATURAL GAS RATE FILING We are dedicated to operating a safe and reliable natural gas system that requires ongoing infrastructure investment. -Feb . 8: The Montana Consumer Counsel recommended a $4.1 million increase based upon a 9.0% ROE (45% equity) and other adjustments. -Apr. 15: We reached a Stipulation Agreement with intervenors to increase delivery rates by approximately $11.5 million based on a 9.8% ROE. -Apr. 23: MPSC approved the Stipulation Agreement by a 4-1 vote and directed the commission staff to prepare a Final Order approving the $11.5 million increase and the Stipulation related to the Allocated Cost of Service Rate Design. -With interim rates effective as of April 1st and a MPSC Final Order, we will record revenues consistent with the Stipulation for the entire second quarter.

17 INVESTMENT OPPORTUNITY OUTLOOK Energy Supply – Big Stone/Neal pollution control – South Dakota natural gas peaking generation – Montana Spion Kop Wind facility - completed – Other vertical integration opportunities in Montana including gas reserves or base load electric generation Transmission – Network upgrades – Jack Rabbit-Big Sky 161kV line – Columbus-Chrome 100kV – Colstrip 500kV upgrade Distribution – Distribution System Infrastructure Project (DSIP)

18 INVESTMENT PROJECT SUMMARY Several opportunities exist to further increase and diversify earnings as compared to our approximately $1.8 billion of rate base today. Additional opportunities for baseload generation in Montana are currently being evaluated and may be incorporated as their scope and timeline become more defined. Figures above do not include maintenance capital investment in excess of depreciation. Note: Color / label indicate NorthWestern Energy's current probability of execution and timing of expenditures. COMPLETED IN 2012

19 NATURAL GAS NEEDS AND SUPPLY Top Left: Approximately 14% of our total natural gas needs go toward electric generation and the remaining 86% is sold to our retail customers Top: We own approximately 11% of our total retail needs in Montana Left: As we continue to add to our natural gas reserves to our portfolio, we can significantly reduce supply cost volatility for our customers

20 MONTANA ELECTRIC GENERATION OPPORTUNITY The total load served over our Montana system is approximately 11 million MWh. The load we currently have responsibility for providing supply is approximately 6 million MWh. Our owned generation in Montana, including the addition of Spion Kop in 2013, would serve approximately 17% of the system load and 31% of the load for which we provide supply. 2011 Resource Procurement Plan filed with the MPSC explored several options, most of which involved a new build generation resource online in 2018.

21 DISTRIBUTION INVESTMENT OUTLOOK Distribution System Integrity Program (DSIP) The Project addresses the emerging issue of our aging infrastructure and prepares our natural gas and electric distribution systems for the next generation of technology. For the electric distribution system, the Program’s goals are: • Arrest and reverse the trend of aging infrastructure; • Build appropriate margin (capacity) back into the system; • Maintain reliability over the long-term, and improve it for our rural customers; and, • Position NWE to adopt Smart Grid, by accomplishing those tasks that are necessary, whether or not Smart Grid is eventually deployed on a wide scale, and regardless of what form of Smart Grid is eventually deployed. For the natural gas distribution system, the Program's goals are: • Embrace the industry's new performance-driven model Natural Gas Distribution Integrity Management Program (DIMP); • Employ state-of-the-art analytical capabilities to proactively manage safety; and, • Improve leak rate performance. NorthWestern, Delivering quality at a great value — yesterday, today and tomorrow… As a NorthWestern Energy customer, you expect and deserve top quality at a reasonable cost – in other words, great value. We agree. NorthWestern Energy has one of the safest and most reliable electric and natural gas distribution systems in the country, and we want to keep it that way. That’s why we created a multi-year project to aggressively replace aging infrastructure and to prepare our network to support the next generation of new technology. We requested and received MPSC approval of an accounting order to defer certain incremental O&M expenses during 2011 and 2012 and amortize these expenses associated with the phase-in portion of the DSIP. The amortization of the 2011 & 2012 expenses will be approximately $3.1 million annually over five years beginning in 2013.

22 CAPITAL SPENDING DSIP – Distribution System Infrastructure Project - $253M over the next 5 years. Energy Supply includes the planned environmental spending in South Dakota on Big Stone and Neal 4 power plants, and completion of the new Aberdeen Peaker plant in 2013. * A natural gas transmission system enhancement plan intended to move us beyond basic compliance with federal safety regulations to systematic prioritization and addressing of pipeline integrity management for long-term customer benefit. Capital spending projections do not include potential future electric or natural gas energy supply additions or capital related to our Gas Transmission Infrastructure Plan (GTIP*). Source: 2012 10-K. Energy Supply estimates updated to reflect reduction in Big Stone AQCS budget in April 2013.

23 CONCLUSION Fully- regulated utility Best practices corporate governance Financially sound Strong cash flows Attractive dividend Realistic investment opportunities to invest Free Cash Flow

24 NorthWestern Corporation Annual Meeting of Stockholders April 25, 2013