Acquisition of PPL Montana’s Baseload Hydro Assets September 27th 2013 Mystic Dam

Safe Harbor Statement During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s public filings with the SEC. 2

Presenters 3 Robert C. Rowe President and Chief Executive Officer Brian B. Bird Vice President and Chief Financial Officer John D. Hines Vice President – Supply

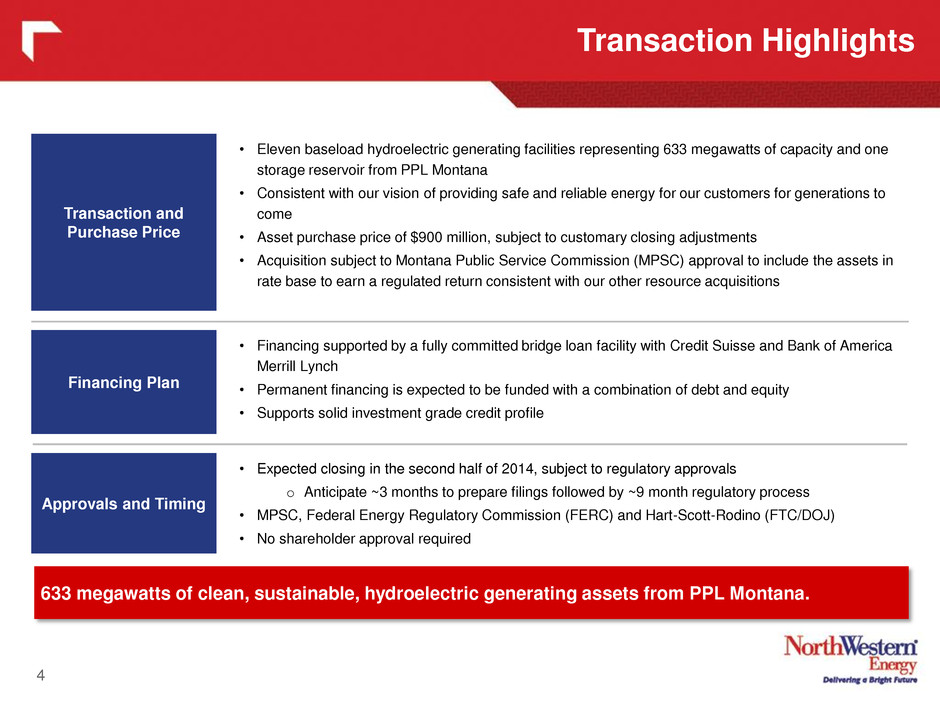

Transaction Highlights 633 megawatts of clean, sustainable, hydroelectric generating assets from PPL Montana. • Eleven baseload hydroelectric generating facilities representing 633 megawatts of capacity and one storage reservoir from PPL Montana • Consistent with our vision of providing safe and reliable energy for our customers for generations to come • Asset purchase price of $900 million, subject to customary closing adjustments • Acquisition subject to Montana Public Service Commission (MPSC) approval to include the assets in rate base to earn a regulated return consistent with our other resource acquisitions • Financing supported by a fully committed bridge loan facility with Credit Suisse and Bank of America Merrill Lynch • Permanent financing is expected to be funded with a combination of debt and equity • Supports solid investment grade credit profile • Expected closing in the second half of 2014, subject to regulatory approvals o Anticipate ~3 months to prepare filings followed by ~9 month regulatory process • MPSC, Federal Energy Regulatory Commission (FERC) and Hart-Scott-Rodino (FTC/DOJ) • No shareholder approval required Transaction and Purchase Price Financing Plan Approvals and Timing 4

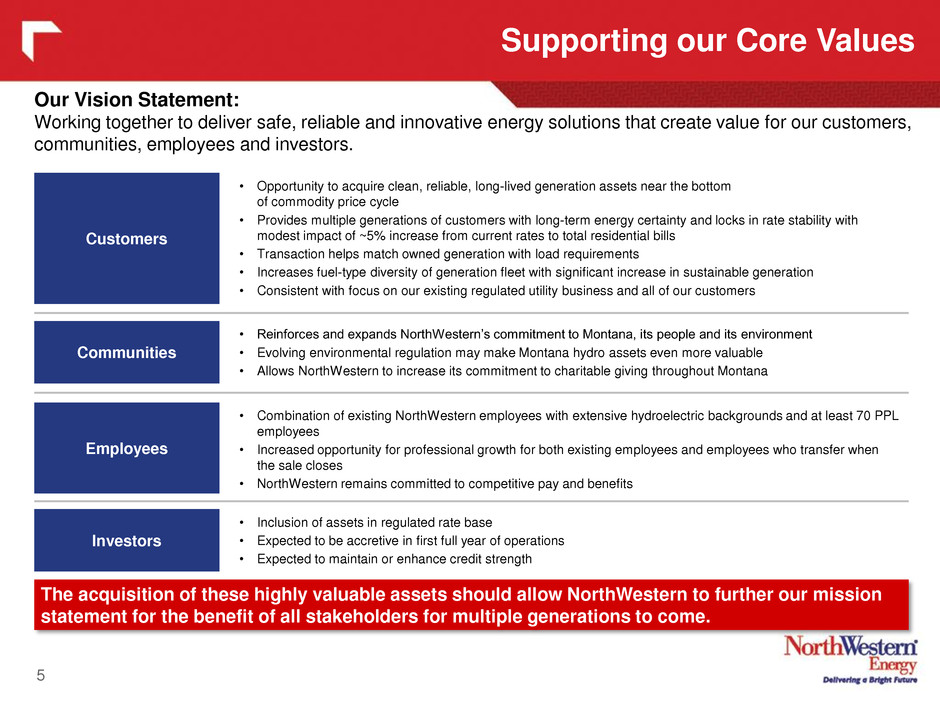

Supporting our Core Values Our Vision Statement: Working together to deliver safe, reliable and innovative energy solutions that create value for our customers, communities, employees and investors. The acquisition of these highly valuable assets should allow NorthWestern to further our mission statement for the benefit of all stakeholders for multiple generations to come. • Opportunity to acquire clean, reliable, long-lived generation assets near the bottom of commodity price cycle • Provides multiple generations of customers with long-term energy certainty and locks in rate stability with modest impact of ~5% increase from current rates to total residential bills • Transaction helps match owned generation with load requirements • Increases fuel-type diversity of generation fleet with significant increase in sustainable generation • Consistent with focus on our existing regulated utility business and all of our customers Customers • Reinforces and expands NorthWestern’s commitment to Montana, its people and its environment • Evolving environmental regulation may make Montana hydro assets even more valuable • Allows NorthWestern to increase its commitment to charitable giving throughout Montana Communities • Combination of existing NorthWestern employees with extensive hydroelectric backgrounds and at least 70 PPL employees • Increased opportunity for professional growth for both existing employees and employees who transfer when the sale closes • NorthWestern remains committed to competitive pay and benefits Employees • Inclusion of assets in regulated rate base • Expected to be accretive in first full year of operations • Expected to maintain or enhance credit strength Investors 5

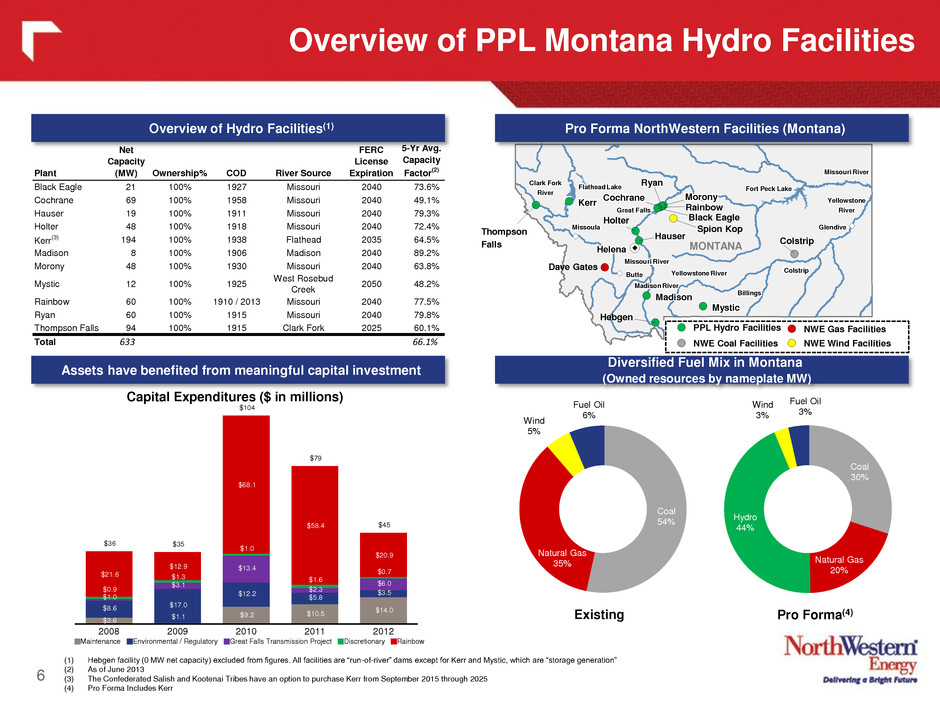

Overview of PPL Montana Hydro Facilities 6 NY0074ZU_1.wor . 0074 _1. r ..0074 _1. r . 0074 _1. r MONTANA Yellowstone River ll t i r Yellowstone River ll t i r ll t i r Ye lowstone River l t i r Ye lowstone River ll t i r Yellowstone ll t Yellowstone ll t ll t Ye lowstone l t Ye lowstone ll t River i r River i r i r River i r River i r Missouri River i ri i r Missouri River i ri i r i ri i r Missouri River i ri i r Missouri River i ri i r Missouri River i ri i r Missouri River i ri i r i ri i r Missouri River i ri i r Missouri River i ri i r Madison River i i r Madison River i i r i i r Madison River i i r Madison River i i r Clark Fork l r r Clark Fork l r r l r r Clark Fork l r r Clark Fork l r r River i r River i r i r River i r River i r Fort Peck Lake rt Fort Peck Lake rt rt Fort Peck Lake rt Fort Peck Lake rt Flathead Lake l t Flathead Lake l t l t Flathead Lake l t Flathead Lake l t Billings illi Billings illi illi Bi lings i li Bi lings illi Colstrip l tri Colstrip l tri l tri Colstrip l tri Colstrip Glendive l i Glendive l i l i Glendive l i Glendive l i Helena l Helena l l Helena l Helena l Great Falls r t ll Great Falls r t ll r t ll Great Fa ls r t l Great Fa ls r t ll Missoula i l Missoula i l i l Missoula i l Missoula i l Mystic i ystic i i ystic i ystic i Hebgen Hebgen Hebgen Hebgen Hebgen Hauser Hauser Hauser Hauser Black Eagle Holter Rainbow i Rainbo i i Rainbo i Rainbo i Morony orony orony orony Cochrane ochrane ochrane ochrane Ryan yan yan yan Thompson Tho pson Tho pson Tho pson Falls ll Falls ll ll Fa ls l Fa ls ll Butte tt Butte tt tt Butte tt Butte tt Kerr Kerr Kerr Kerr Madison i adison i i adison i adison i Colstrip Spion Kop Dave Gates PPL Hydro Facilities NWE Coal Facilities NWE Wind Facilities NWE Gas Facilities Overview of Hydro Facilities(1) Pro Forma NorthWestern Facilities (Montana) Diversified Fuel Mix in Montana (Owned resources by nameplate MW) (1) Hebgen facility (0 MW net capacity) excluded from figures. All facilities are “run-of-river” dams except for Kerr and Mystic, which are “storage generation” (2) As of June 2013 (3) The Confederated Salish and Kootenai Tribes have an option to purchase Kerr from September 2015 through 2025 (4) Pro Forma Includes Kerr Assets have benefited from meaningful capital investment $3.6 $1.1 $9.2 $10.5 $14.0 $8.6 $17.0 $12.2 $5.8 $3.5 $0.9 $3.1 $13.4 $2.3 $6.0 $1.0 $1.3 $1.0 $1.6 $0.7 $21.6 $12.9 $68.1 $58.4 $20.9 $36 $35 $104 $79 $45 2008 2009 2010 2011 2012 Maintenance Environmental / Regulatory Great Falls Transmission Project Discretionary RainbowStandalone Pro Fo ma(4) Capital Expenditures ($ in millions) Plant Net Capacity (MW) Ownership% COD River Source FERC License Expiration 5-Yr Avg. Capacity Factor (2) Black Eagle 21 100% 1927 Missouri 2040 73.6% Cochrane 69 100% 1958 Missouri 2040 49.1% Hauser 19 100% 1911 Missouri 2040 79.3% Holter 48 100% 1918 Missouri 2040 72.4% Kerr(3) 194 100% 1938 Flathead 2035 64.5% Madison 8 100% 1906 Madison 2040 89.2% Morony 48 100% 1930 Missouri 2040 63.8% Mystic 12 100% 1925 West Rosebud Creek 2050 48.2% Rainbow 60 100% 1910 / 2013 Missouri 2040 77.5% Ryan 60 100% 1915 Missouri 2040 79.8% Thompson Falls 94 100% 1915 Clark Fork 2025 60.1% Total 633 66.1% Coal 54% Natural Gas 35% Wind 5% Fuel Oil 6% Coal 30% Natural Gas 20% Hydro 44% Wind 3% Fuel Oil 3% Existing

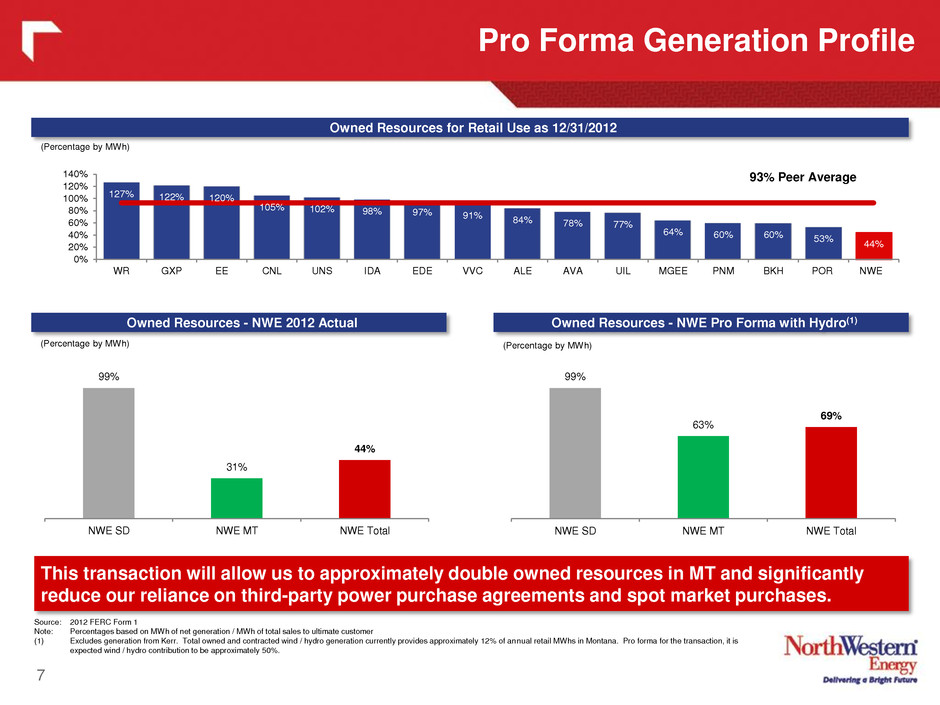

127% 122% 120% 105% 102% 98% 97% 91% 84% 78% 77% 64% 60% 60% 53% 44% 0% 20 40% 60 80% 100 120% 140 WR GXP EE CNL UNS IDA EDE VVC ALE AVA UIL MGEE PNM BKH POR NWE 93% Peer Average Pro Forma Generation Profile 7 This transaction will allow us to approximately double owned resources in MT and significantly reduce our reliance on third-party power purchase agreements and spot market purchases. Source: 2012 FERC Form 1 Note: Percentages based on MWh of net generation / MWh of total sales to ultimate customer (1) Excludes generation from Kerr. Total owned and contracted wind / hydro generation currently provides approximately 12% of annual retail MWhs in Montana. Pro forma for the transaction, it is expected wind / hydro contribution to be approximately 50%. Owned Resources for Retail Use as 12/31/2012 Owned Resources - NWE Pro Forma with Hydro(1) Owned Resources - NWE 2012 Actual (Percentage by MWh) (Percentage by MWh) (Percentage by MWh) 99% 31% 44% NWE SD NWE MT NWE Total 99% 63% 69% NWE SD NWE MT NWE Total

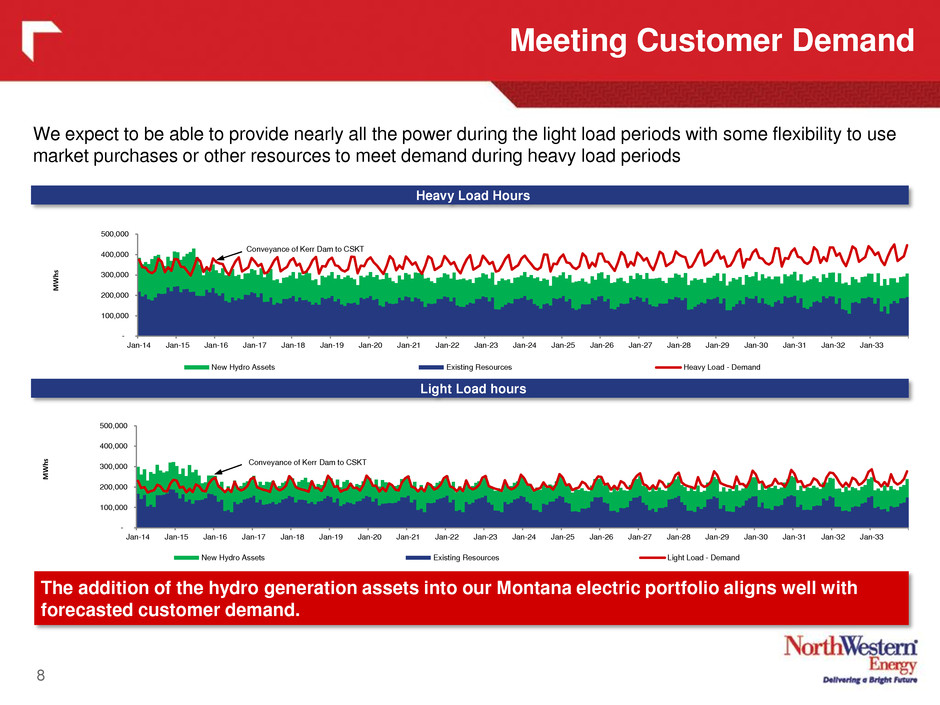

Meeting Customer Demand 8 The addition of the hydro generation assets into our Montana electric portfolio aligns well with forecasted customer demand. We expect to be able to provide nearly all the power during the light load periods with some flexibility to use market purchases or other resources to meet demand during heavy load periods Heavy Load Hours Light Load hours - 100,000 200,000 300,000 400,000 500,000 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23 Jan-24 Jan-25 Jan-26 Jan-27 Jan-28 Jan-29 Jan-30 Jan-31 Jan-32 Jan-33 New Hydro Assets Existing Resources Heavy Load - Demand Conveyance of Kerr Dam to CSKT MWhs - 100,000 200,000 300,000 400,000 500,000 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Jan-20 Jan-21 Jan-22 Jan-23 Jan-24 Jan-25 Jan-26 Jan-27 Jan-28 Jan-29 Jan-30 Jan-31 Jan-32 Jan-33 New Hydro Assets Existing Resources Light Load - Demand Conveyance of Kerr Dam to CSKTMWhs

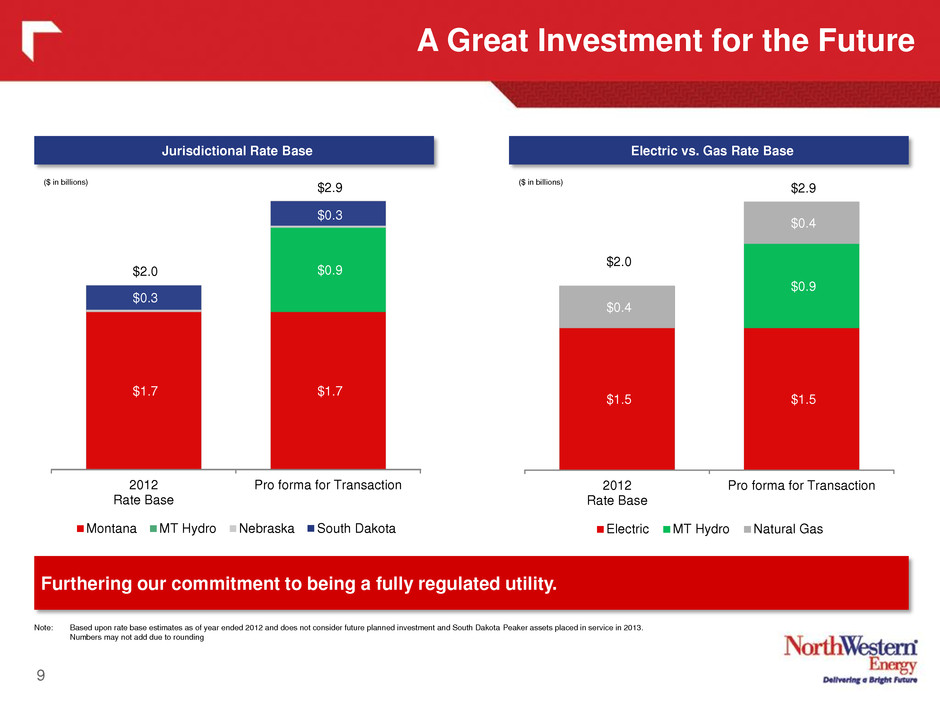

A Great Investment for the Future 9 Note: Based upon rate base estimates as of year ended 2012 and does not consider future planned investment and South Dakota Peaker assets placed in service in 2013. Numbers may not add due to rounding Furthering our commitment to being a fully regulated utility. Electric vs. Gas Rate Base Jurisdictional Rate Base ($ in billions) ($ in billions) 2012 Rate Base Pro forma for Transaction $1.7 $1.7 $0.9 $0.3 $0.3 $2.0 $2.9 Montana MT Hydro Nebraska South Dakota 2012 Rate Base Pro forma for Transaction $1.5 $1.5 $0.9 $0.4 $0.4 $2.0 $2.9 Electric MT Hydro Natural Gas

Financing Strategy 10 Conservative, low-risk financing strategy supports earnings and cash flow accretion. Low Risk Financing Strategy • Assets will become fully regulated by MPSC as part of NorthWestern rate base upon closing • Fully committed initial bridge from Credit Suisse and Bank of America Merrill Lynch for full $900 million purchase price • In conjunction with syndicating the Bridge Facility, NorthWestern may seek to extend its current $300 million revolver to a 2018 final maturity • Maintain ample liquidity post closing Permanent Financing • To be funded with approximately 50 - 55% long-term debt with the remainder through a combination of new equity issuance and cash flow from operations • Acquisition expected to be immediately earnings and cash flow accretive • Supports solid investment grade profile

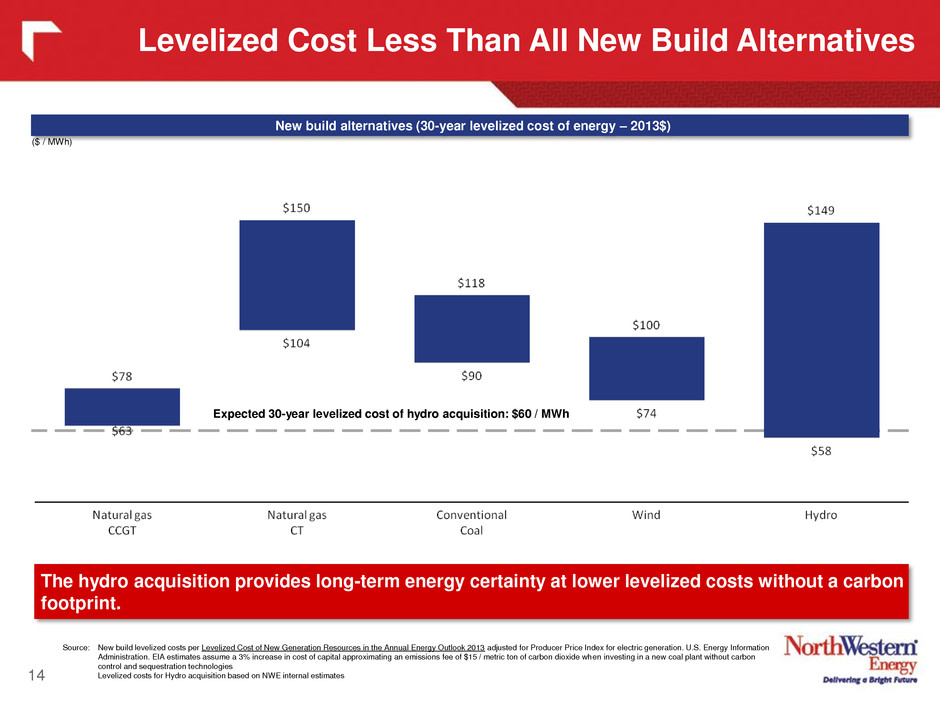

Compelling Value Proposition 11 Levelized cost less than all new build alternatives Implied multiples well within the range of recent comparable hydroelectric transactions Expected immediate earnings accretion in line with an asset acquisition of this size Earnings accretion supports our commitment to sustainable dividend growth and targeted payout ratio of 60 – 70% Improved business risk and credit profile Substantial increase in scale should improve access to capital markets for the benefit of both customers and shareholders o Enhances ability to invest in all parts of our business

Questions and Answers 12 Ryan Dam

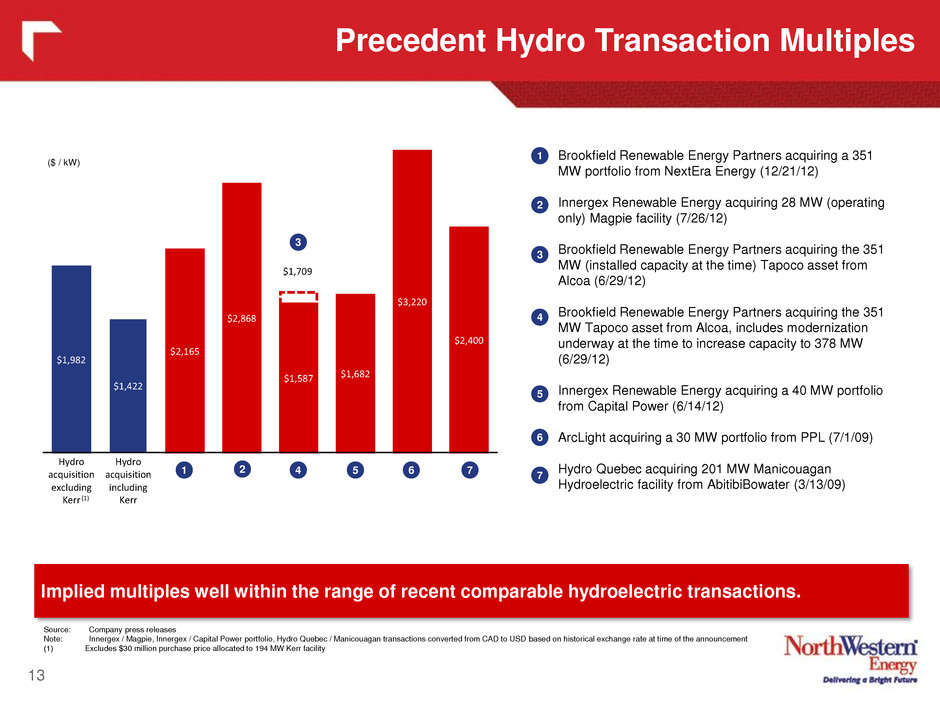

$1,982 $1,422 $2,165 $2,868 $1,587 $1,682 $3,220 $2,400 $1,709 Hydro acquisition excluding Kerr Hydro acquisition including Kerr (1) ($ / kW) 13 Brookfield Renewable Energy Partners acquiring a 351 MW portfolio from NextEra Energy (12/21/12) Innergex Renewable Energy acquiring 28 MW (operating only) Magpie facility (7/26/12) Brookfield Renewable Energy Partners acquiring the 351 MW (installed capacity at the time) Tapoco asset from Alcoa (6/29/12) Brookfield Renewable Energy Partners acquiring the 351 MW Tapoco asset from Alcoa, includes modernization underway at the time to increase capacity to 378 MW (6/29/12) Innergex Renewable Energy acquiring a 40 MW portfolio from Capital Power (6/14/12) ArcLight acquiring a 30 MW portfolio from PPL (7/1/09) Hydro Quebec acquiring 201 MW Manicouagan Hydroelectric facility from AbitibiBowater (3/13/09) 1 2 3 4 5 6 7 1 2 4 5 6 7 3 Source: Company press releases Note: Innergex / Magpie, Innergex / Capital Power portfolio, Hydro Quebec / Manicouagan transactions converted from CAD to USD based on historical exchange rate at time of the announcement (1) Excludes $30 million purchase price allocated to 194 MW Kerr facility Implied multiples well within the range of recent comparable hydroelectric transactions. Precedent Hydro Transaction Multiples

14 New build alternatives (30-year levelized cost of energy – 2013$) Source: New build levelized costs per Levelized Cost of New Generation Resources in the Annual Energy Outlook 2013 adjusted for Producer Price Index for electric generation. U.S. Energy Information Administration. EIA estimates assume a 3% increase in cost of capital approximating an emissions fee of $15 / metric ton of carbon dioxide when investing in a new coal plant without carbon control and sequestration technologies Levelized costs for Hydro acquisition based on NWE internal estimates ($ / MWh) The hydro acquisition provides long-term energy certainty at lower levelized costs without a carbon footprint. Expected 30-year levelized cost of hydro acquisition: $60 / MWh Levelized Cost Less Than All New Build Alternatives

15