Investor Update September 2015 Thompson Falls

2 Forward Looking Statements Forward Looking Statements During the course of this presentation, there will be forward- looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s most recent Form 10-K and 10-Q along with other public filings with the SEC. Company Information NorthWestern Corporation dba: NorthWestern Energy www.northwesternenergy.com Corporate Support Office 3010 West 69th Street Sioux Falls, SD 57106 (605) 978-2900 Montana Operational Support Office 40 East Broadway Butte, MT 59701 (406) 497-1000 SD/NE Operational Support Office 600 Market Street West Huron, SD 57350 (605) 353-7478 Director of Investor Relations Travis Meyer 605-978-2945 travis.meyer@northwestern.com

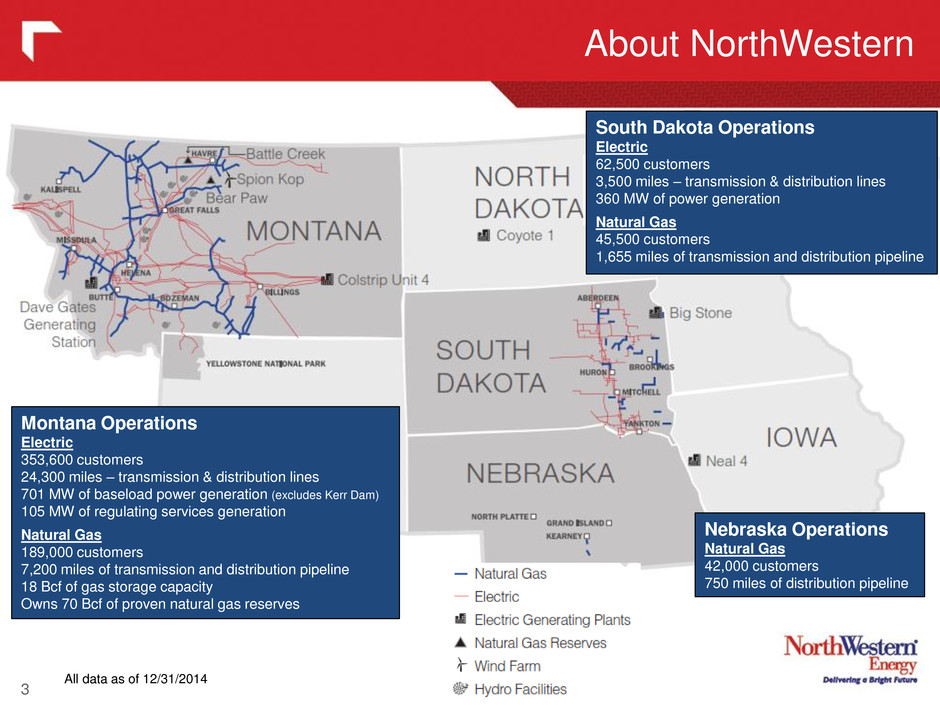

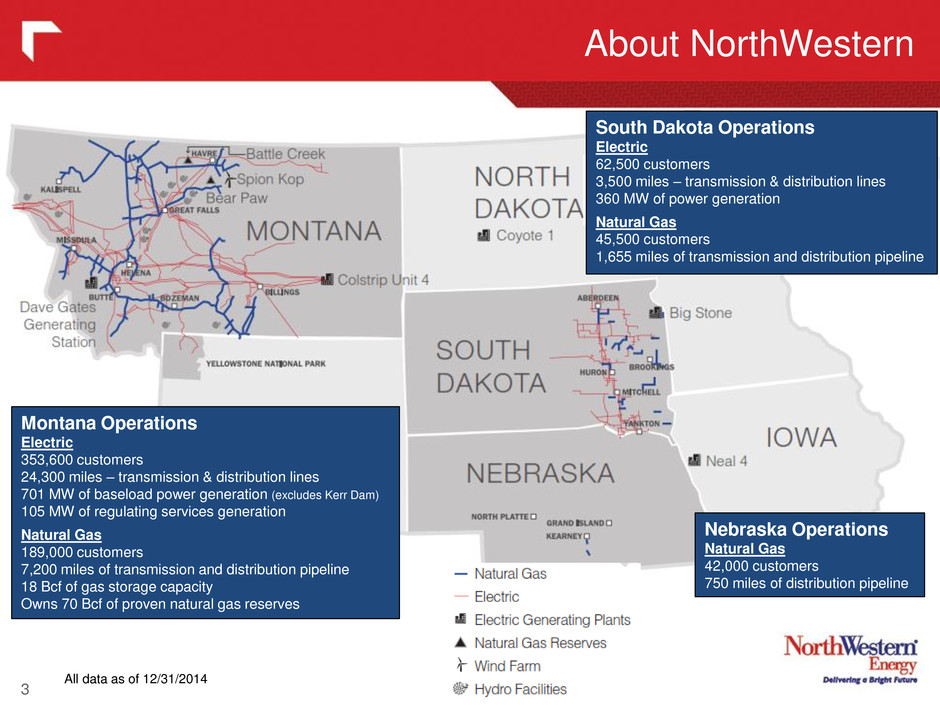

About NorthWestern 3 Montana Operations Electric 353,600 customers 24,300 miles – transmission & distribution lines 701 MW of baseload power generation (excludes Kerr Dam) 105 MW of regulating services generation Natural Gas 189,000 customers 7,200 miles of transmission and distribution pipeline 18 Bcf of gas storage capacity Owns 70 Bcf of proven natural gas reserves South Dakota Operations Electric 62,500 customers 3,500 miles – transmission & distribution lines 360 MW of power generation Natural Gas 45,500 customers 1,655 miles of transmission and distribution pipeline Nebraska Operations Natural Gas 42,000 customers 750 miles of distribution pipeline All data as of 12/31/2014

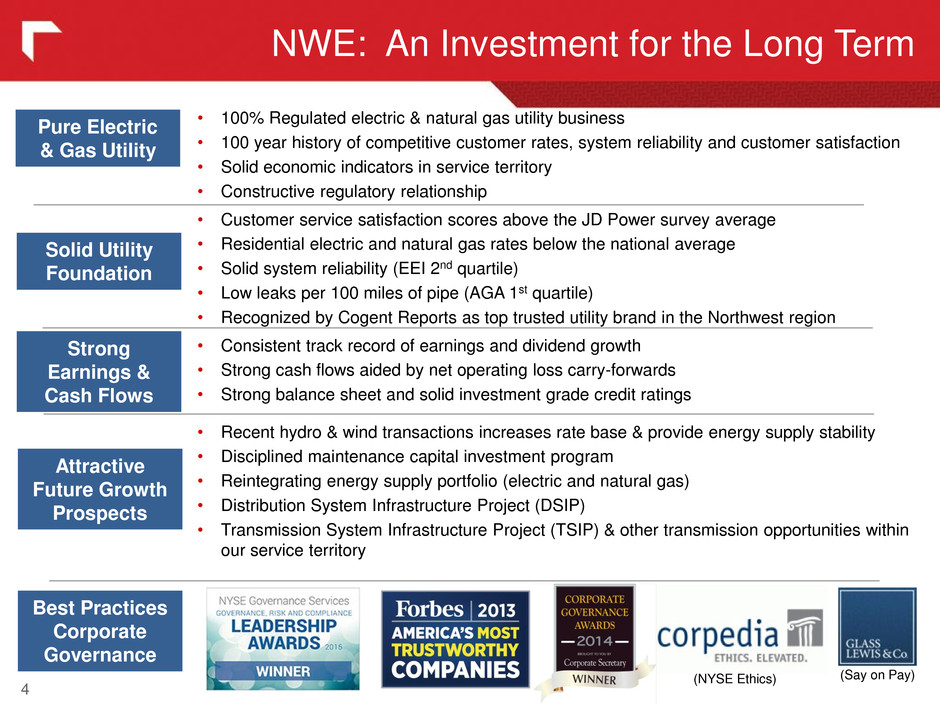

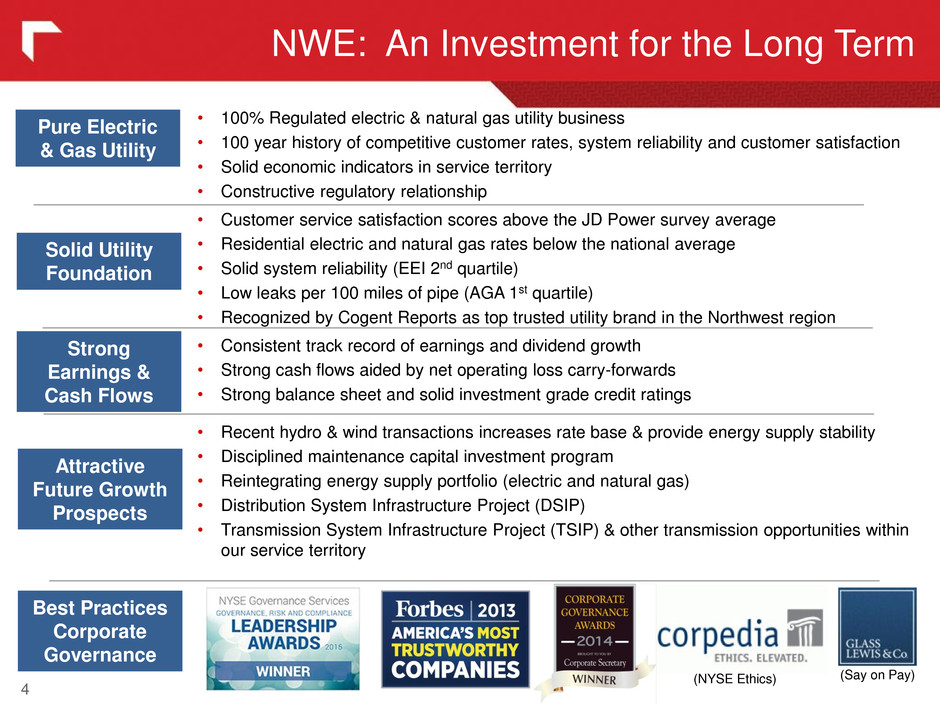

NWE: An Investment for the Long Term 4 • 100% Regulated electric & natural gas utility business • 100 year history of competitive customer rates, system reliability and customer satisfaction • Solid economic indicators in service territory • Constructive regulatory relationship • Customer service satisfaction scores above the JD Power survey average • Residential electric and natural gas rates below the national average • Solid system reliability (EEI 2nd quartile) • Low leaks per 100 miles of pipe (AGA 1st quartile) • Recognized by Cogent Reports as top trusted utility brand in the Northwest region • Consistent track record of earnings and dividend growth • Strong cash flows aided by net operating loss carry-forwards • Strong balance sheet and solid investment grade credit ratings • Recent hydro & wind transactions increases rate base & provide energy supply stability • Disciplined maintenance capital investment program • Reintegrating energy supply portfolio (electric and natural gas) • Distribution System Infrastructure Project (DSIP) • Transmission System Infrastructure Project (TSIP) & other transmission opportunities within our service territory Pure Electric & Gas Utility Solid Utility Foundation Strong Earnings & Cash Flows Attractive Future Growth Prospects Best Practices Corporate Governance (NYSE Ethics) (Say on Pay)

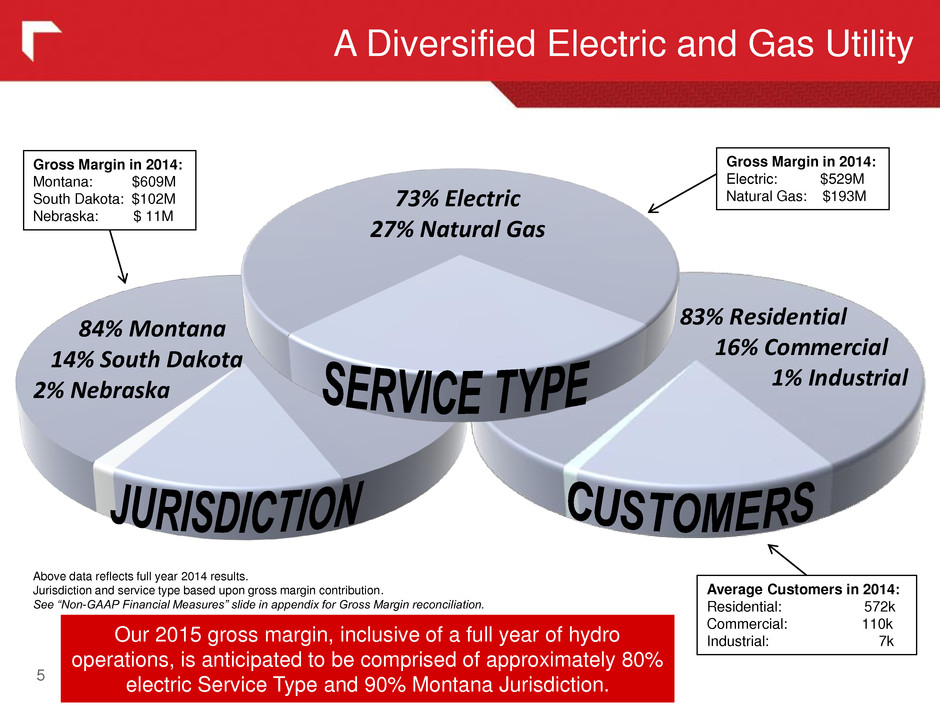

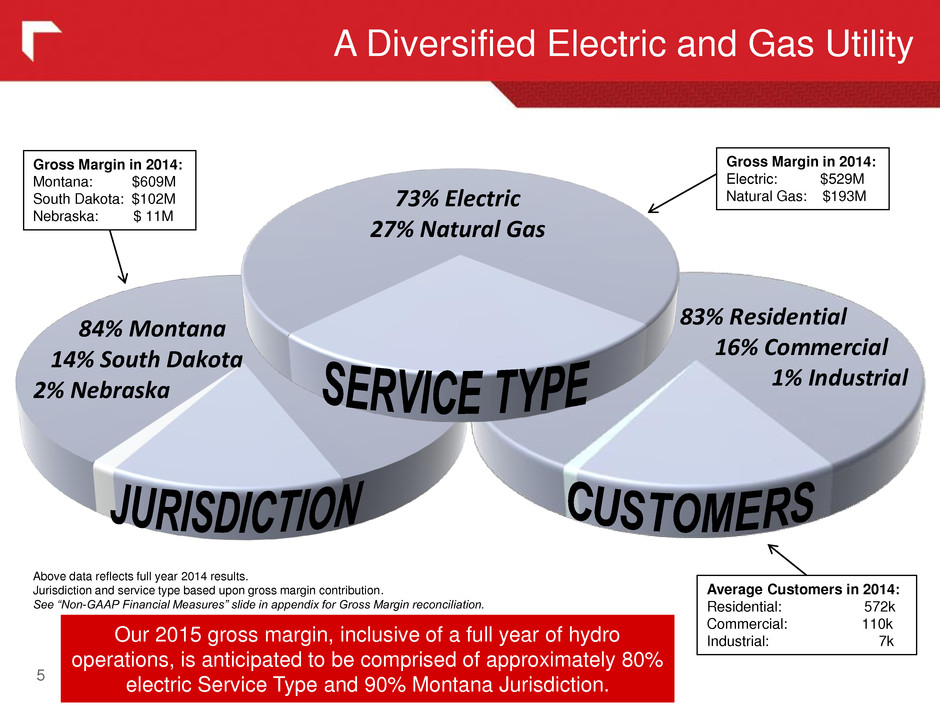

84% Montana 14% South Dakota 2% NebraskaA Diversified Electric and Gas Utility 5 Gross Margin in 2014: Electric: $529M Natural Gas: $193M Gross Margin in 2014: Montana: $609M South Dakota: $102M Nebraska: $ 11M Average Customers in 2014: Residential: 572k Commercial: 110k Industrial: 7k 83% Residential 16% Commercial 1% Industrial Our 2015 gross margin, inclusive of a full year of hydro operations, is anticipated to be comprised of approximately 80% electric Service Type and 90% Montana Jurisdiction. Above data reflects full year 2014 results. Jurisdiction and service type based upon gross margin contribution. See “Non-GAAP Financial Measures” slide in appendix for Gross Margin reconciliation. 73% Electric 27% Natural Gas

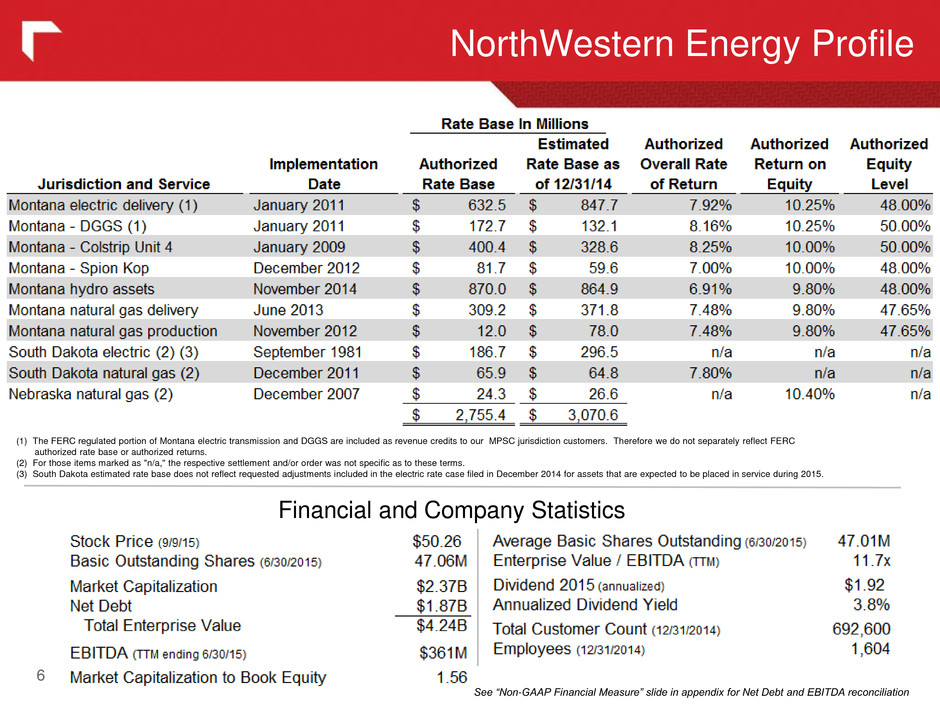

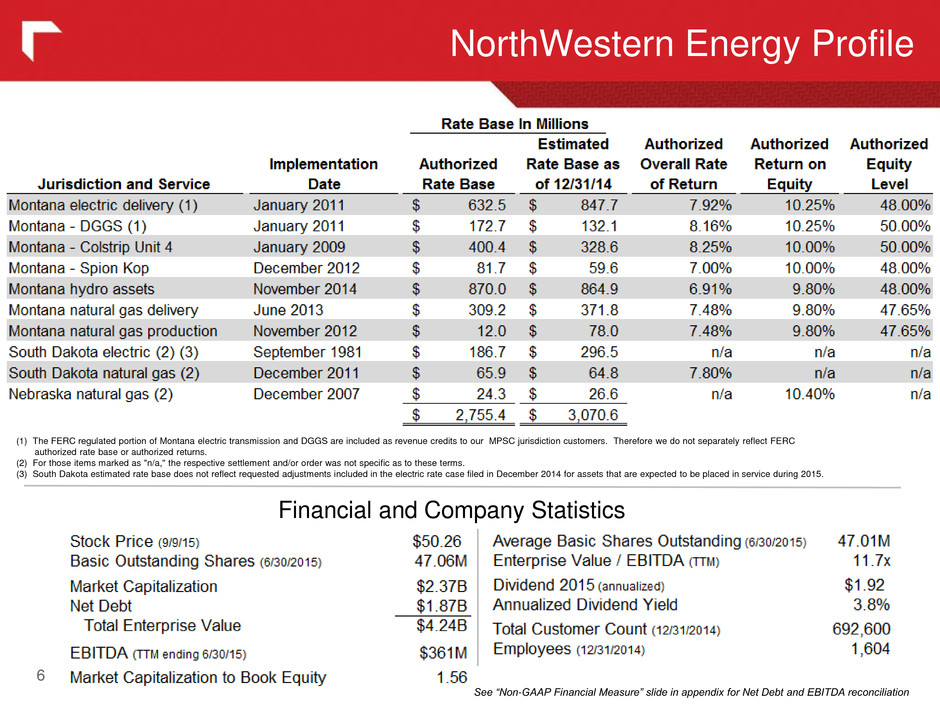

NorthWestern Energy Profile 6 Financial and Company Statistics See “Non-GAAP Financial Measure” slide in appendix for Net Debt and EBITDA reconciliation (1) The FERC regulated portion of Montana electric transmission and DGGS are included as revenue credits to our MPSC jurisdiction customers. Therefore we do not separately reflect FERC authorized rate base or authorized returns. (2) For those items marked as "n/a," the respective settlement and/or order was not specific as to these terms. (3) South Dakota estimated rate base does not reflect requested adjustments included in the electric rate case filed in December 2014 for assets that are expected to be placed in service during 2015.

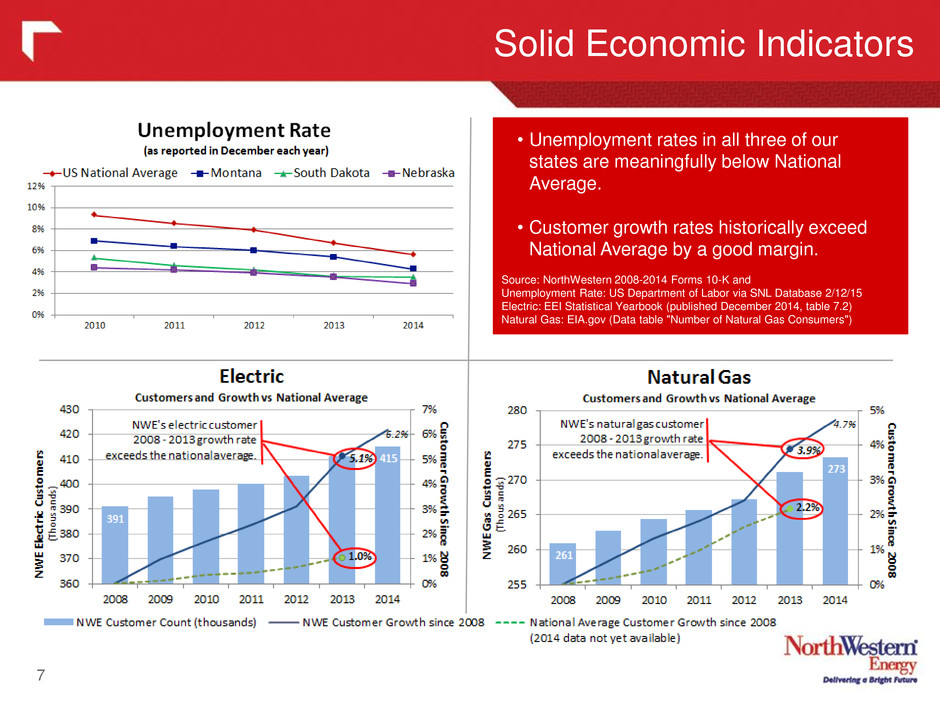

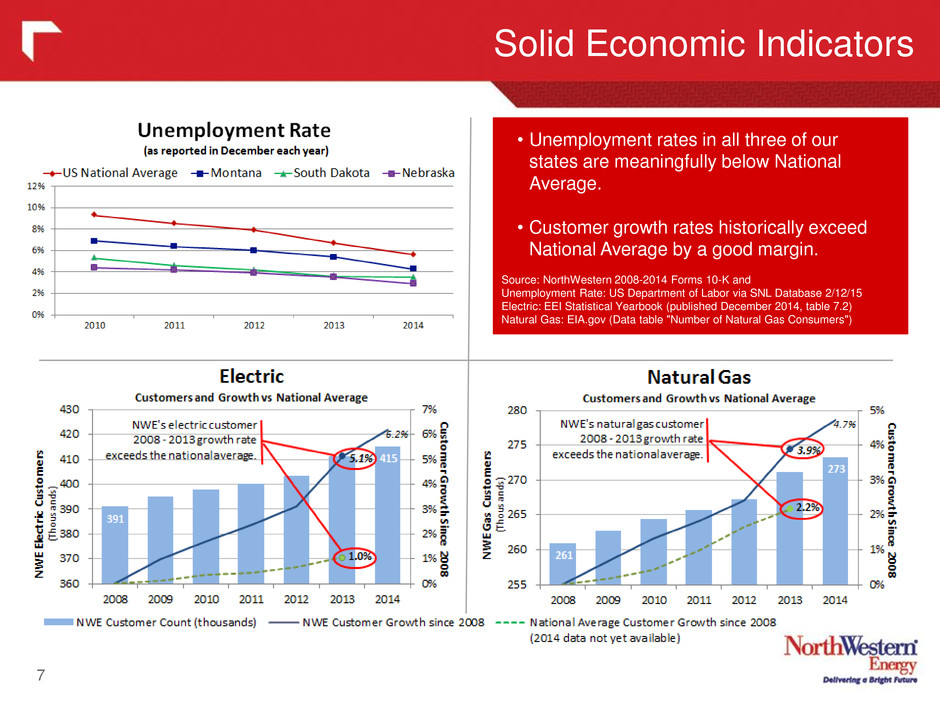

Solid Economic Indicators 7 • Unemployment rates in all three of our states are meaningfully below National Average. • Customer growth rates historically exceed National Average by a good margin. Source: NorthWestern 2008-2014 Forms 10-K and Unemployment Rate: US Department of Labor via SNL Database 2/12/15 Electric: EEI Statistical Yearbook (published December 2014, table 7.2) Natural Gas: EIA.gov (Data table "Number of Natural Gas Consumers")

Strong Utility Foundation 8 Electric source: Edison Electric Institute Typical Bills and Average Rates Report, 1/1/15 Natural gas source: US Dept of Energy Monthly residential supply and delivery rates as of 1/1/15 Customer service satisfaction scores in line or better than survey average (JD Powers) Residential electric and natural gas rates below national average Solid electric system reliability and low gas leaks per mile Customer Average Interruption Duration Index (CAIDI) NWE versus EEI System Reliability Quartiles CAIDI Reliability Indices with Major Events Excluded. 2014 EEI benchmark data not yet available. 600 700 800 2009 2010 2011 2012 2013 2014 Ind ex Sc or e NorthWestern Energy Score JD Power 26 Combination Electric and Natural Gas Company Average JD Power - Customer Service Index Score

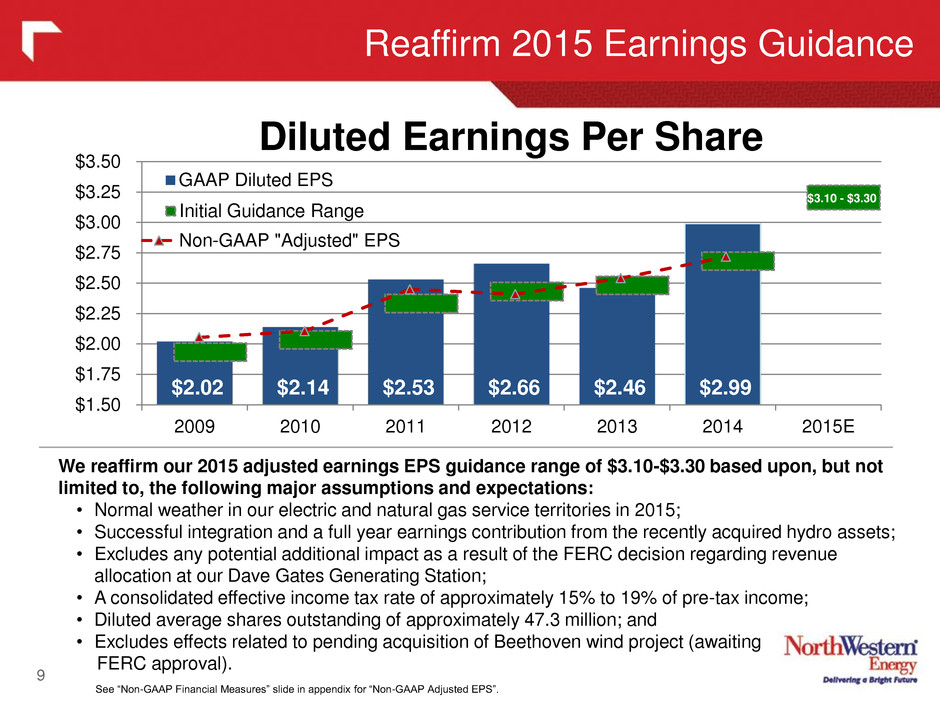

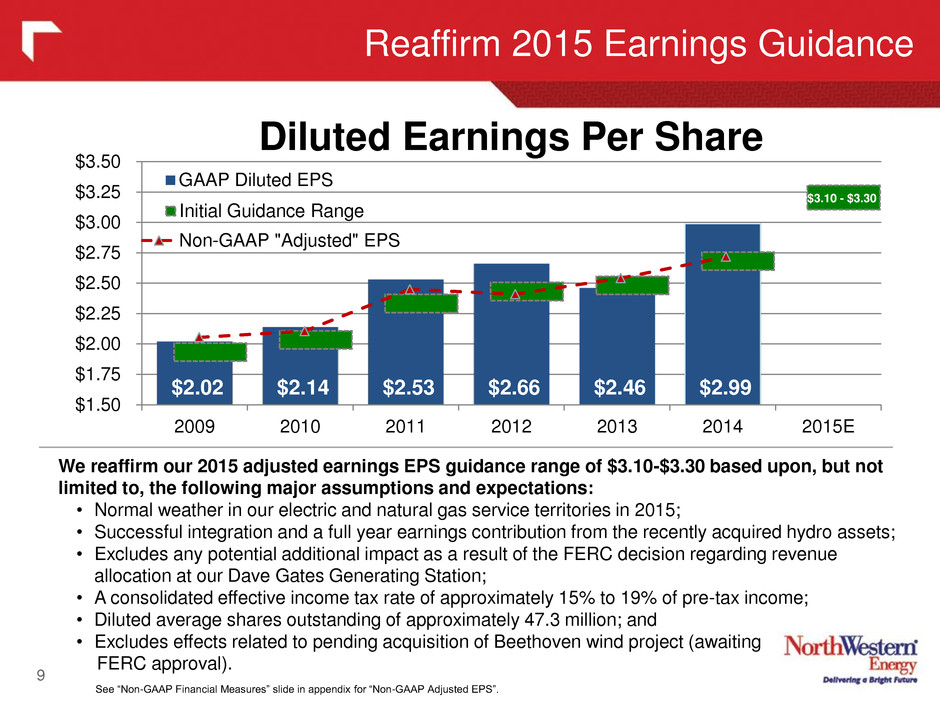

Reaffirm 2015 Earnings Guidance 9 We reaffirm our 2015 adjusted earnings EPS guidance range of $3.10-$3.30 based upon, but not limited to, the following major assumptions and expectations: • Normal weather in our electric and natural gas service territories in 2015; • Successful integration and a full year earnings contribution from the recently acquired hydro assets; • Excludes any potential additional impact as a result of the FERC decision regarding revenue allocation at our Dave Gates Generating Station; • A consolidated effective income tax rate of approximately 15% to 19% of pre-tax income; • Diluted average shares outstanding of approximately 47.3 million; and • Excludes effects related to pending acquisition of Beethoven wind project (awaiting FERC approval). See “Non-GAAP Financial Measures” slide in appendix for “Non-GAAP Adjusted EPS”. $2.02 $2.14 $2.53 $2.66 $2.46 $2.99 $- $1.50 $1.75 $2.00 $2.25 $2.50 $2.75 $3.00 $3.25 $3.50 2009 2010 2011 2012 2013 2014 2015E GAAP Diluted EPS Initial Guidance Range Non-GAAP "Adjusted" EPS Diluted Earnings Per Share $3.10 - $3.30

Track Record of Delivering Results 10 Notes: - ROE in 2010, 2011, 2012 , 2013 & 2014, on a Non-GAAP Adjusted basis, would be 9.2%, 10.5%, 9.8%, 9.6% & 9.4% respectively. - 2015 ROAE and 2015 Dividend payout ratio estimate based on midpoint of guidance range of $3.10-$3.30. - Details regarding Non-GAAP Adjusted EPS can be found in the “Adjusted EPS Schedule” page of the appendix Return on Equity within 9.5% - 11.0% band over the last 5 years. Annual dividend increases since emergence in 2004. 5 Year (2010-2014) Avg. Return on Equity: 10.3% 5 Year (2010-2014) CAGR Dividend Growth: 4.1% Current Dividend Yield Approximately 3.8%

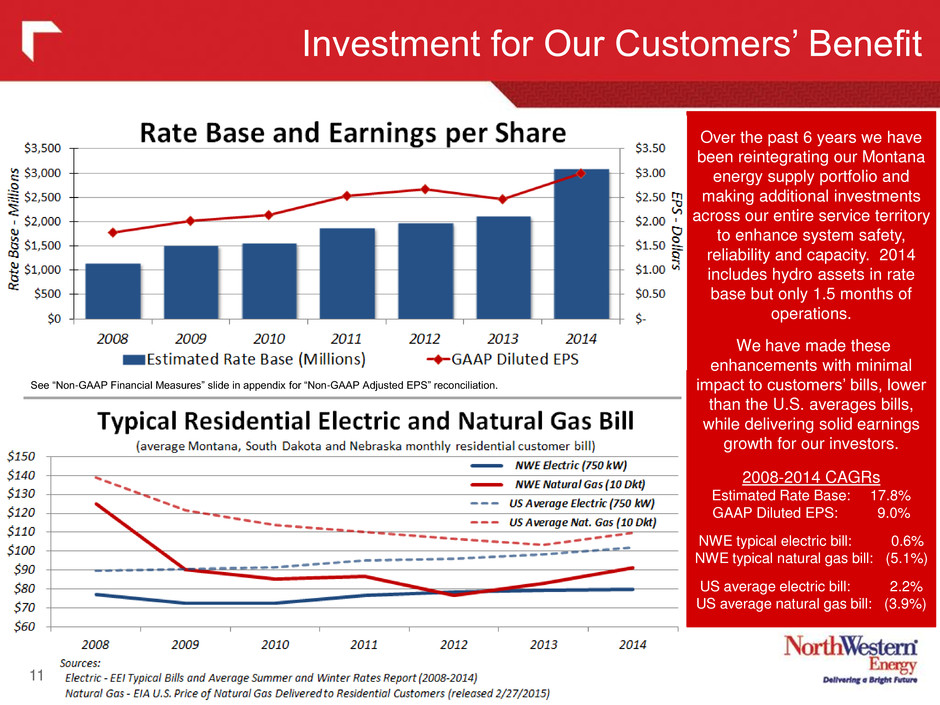

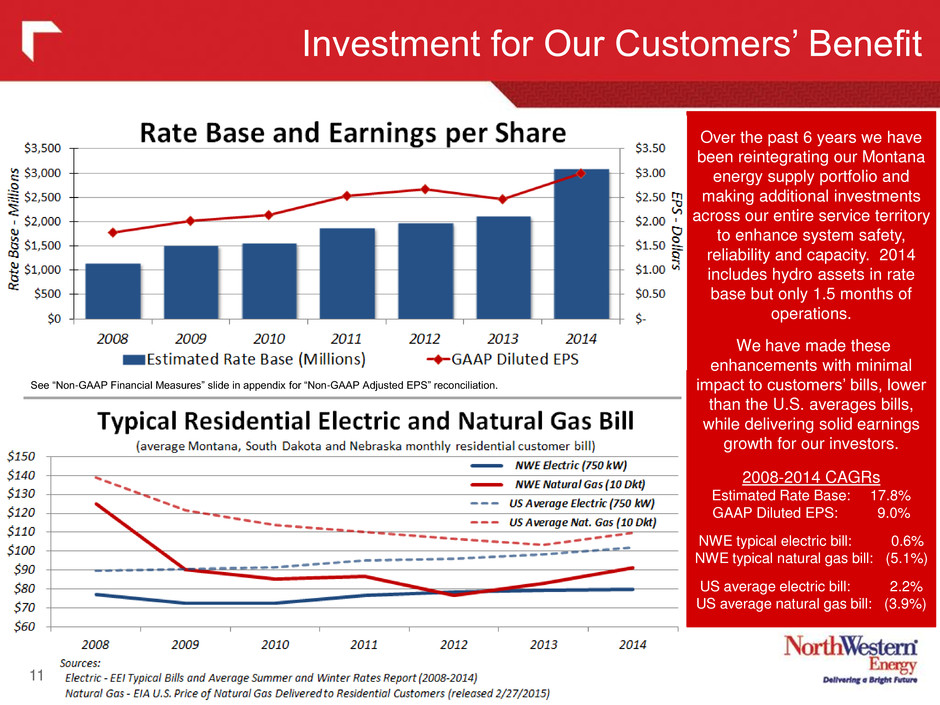

Investment for Our Customers’ Benefit Over the past 6 years we have been reintegrating our Montana energy supply portfolio and making additional investments across our entire service territory to enhance system safety, reliability and capacity. 2014 includes hydro assets in rate base but only 1.5 months of operations. We have made these enhancements with minimal impact to customers’ bills, lower than the U.S. averages bills, while delivering solid earnings growth for our investors. 2008-2014 CAGRs Estimated Rate Base: 17.8% GAAP Diluted EPS: 9.0% NWE typical electric bill: 0.6% NWE typical natural gas bill: (5.1%) US average electric bill: 2.2% US average natural gas bill: (3.9%) 11 See “Non-GAAP Financial Measures” slide in appendix for “Non-GAAP Adjusted EPS” reconciliation.

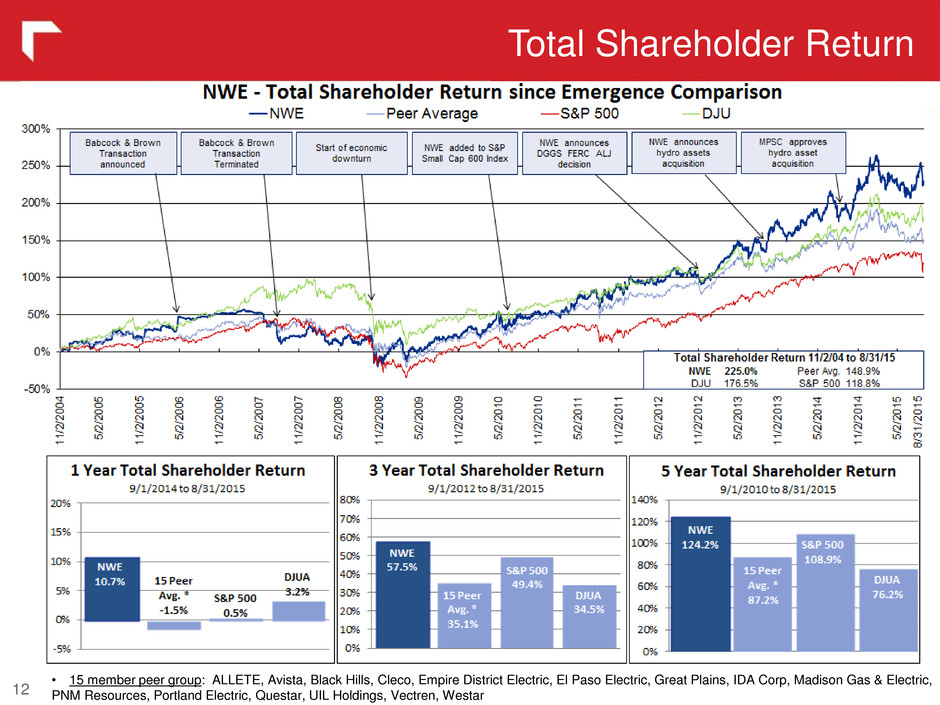

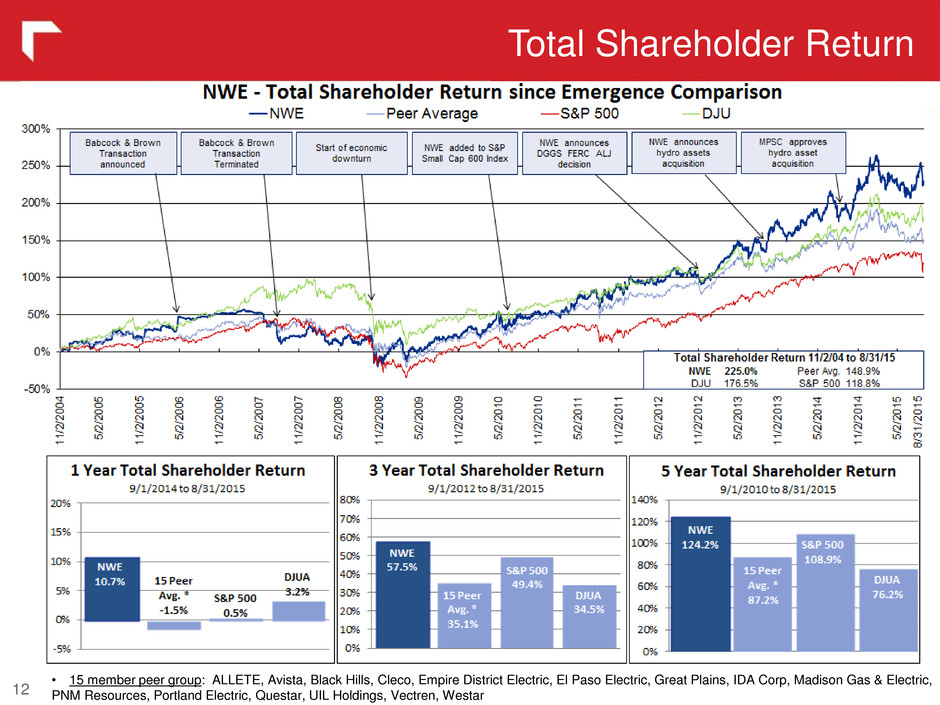

Total Shareholder Return 12 • 15 member peer group: ALLETE, Avista, Black Hills, Cleco, Empire District Electric, El Paso Electric, Great Plains, IDA Corp, Madison Gas & Electric, PNM Resources, Portland Electric, Questar, UIL Holdings, Vectren, Westar

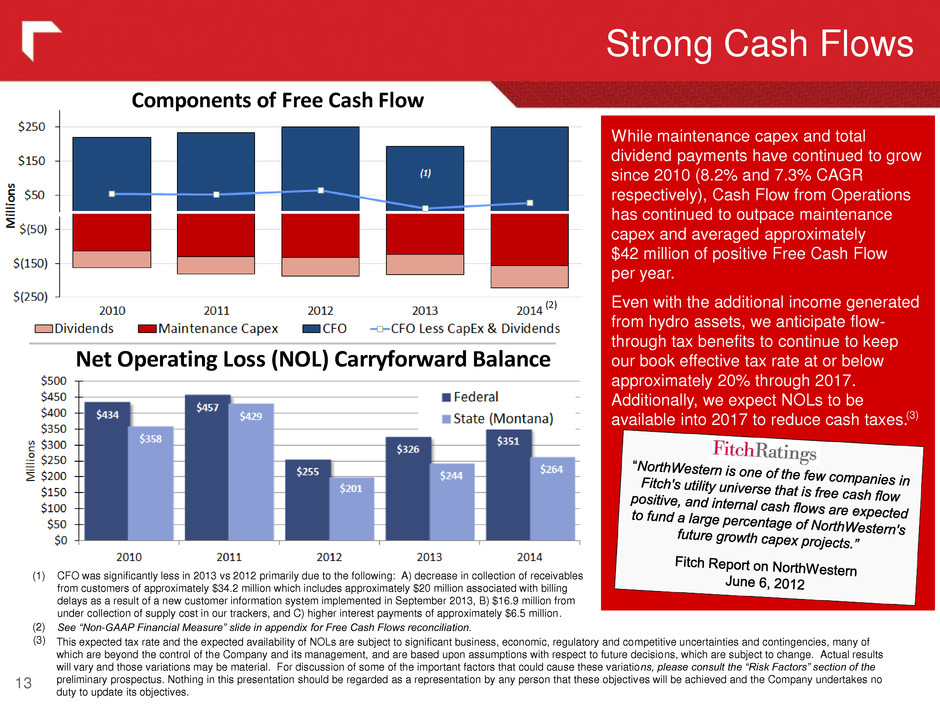

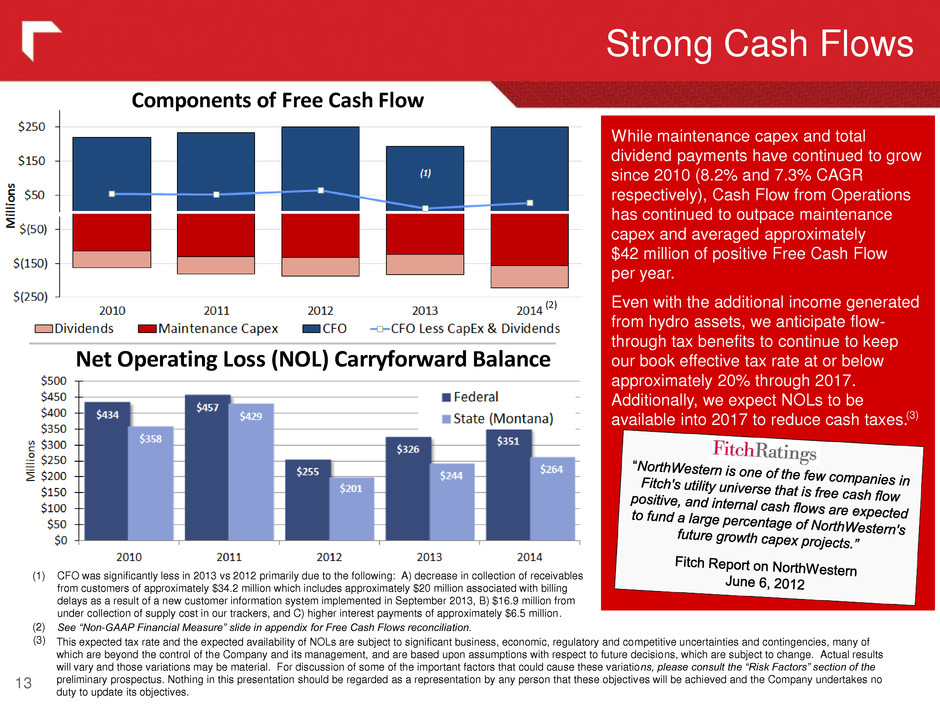

While maintenance capex and total dividend payments have continued to grow since 2010 (8.2% and 7.3% CAGR respectively), Cash Flow from Operations has continued to outpace maintenance capex and averaged approximately $42 million of positive Free Cash Flow per year. Even with the additional income generated from hydro assets, we anticipate flow- through tax benefits to continue to keep our book effective tax rate at or below approximately 20% through 2017. Additionally, we expect NOLs to be available into 2017 to reduce cash taxes. Strong Cash Flows 13 (2) CFO was significantly less in 2013 vs 2012 primarily due to the following: A) decrease in collection of receivables from customers of approximately $34.2 million which includes approximately $20 million associated with billing delays as a result of a new customer information system implemented in September 2013, B) $16.9 million from under collection of supply cost in our trackers, and C) higher interest payments of approximately $6.5 million. See “Non-GAAP Financial Measure” slide in appendix for Free Cash Flows reconciliation. Components of Free Cash Flow This expected tax rate and the expected availability of NOLs are subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For discussion of some of the important factors that could cause these variations, please consult the “Risk Factors” section of the preliminary prospectus. Nothing in this presentation should be regarded as a representation by any person that these objectives will be achieved and the Company undertakes no duty to update its objectives. (3) Net Ope ating Loss (NOL) Carryforward Balance (3) (2) (1)

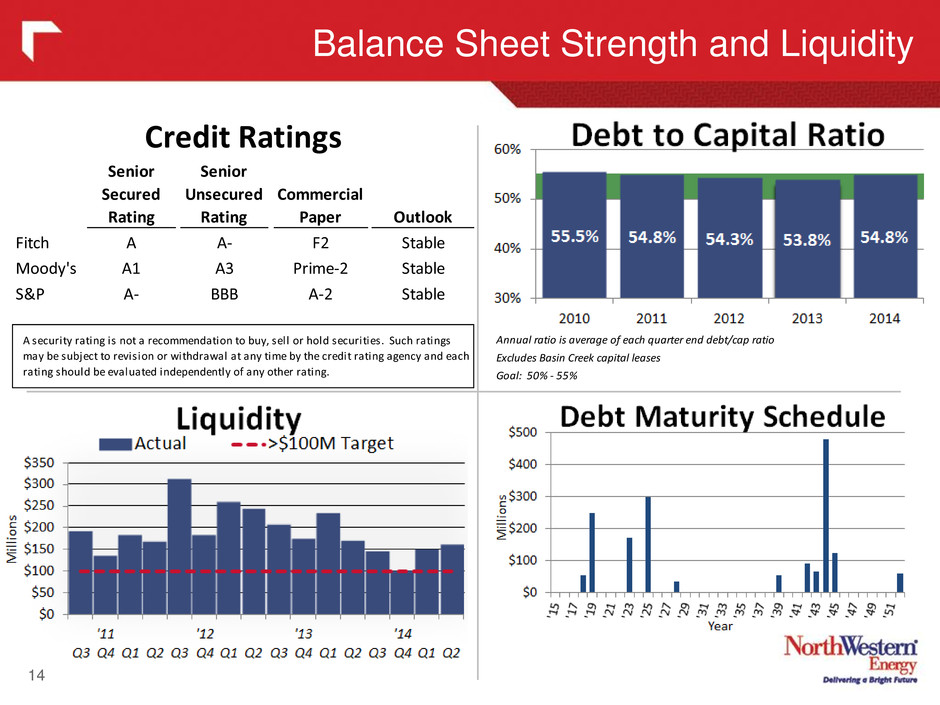

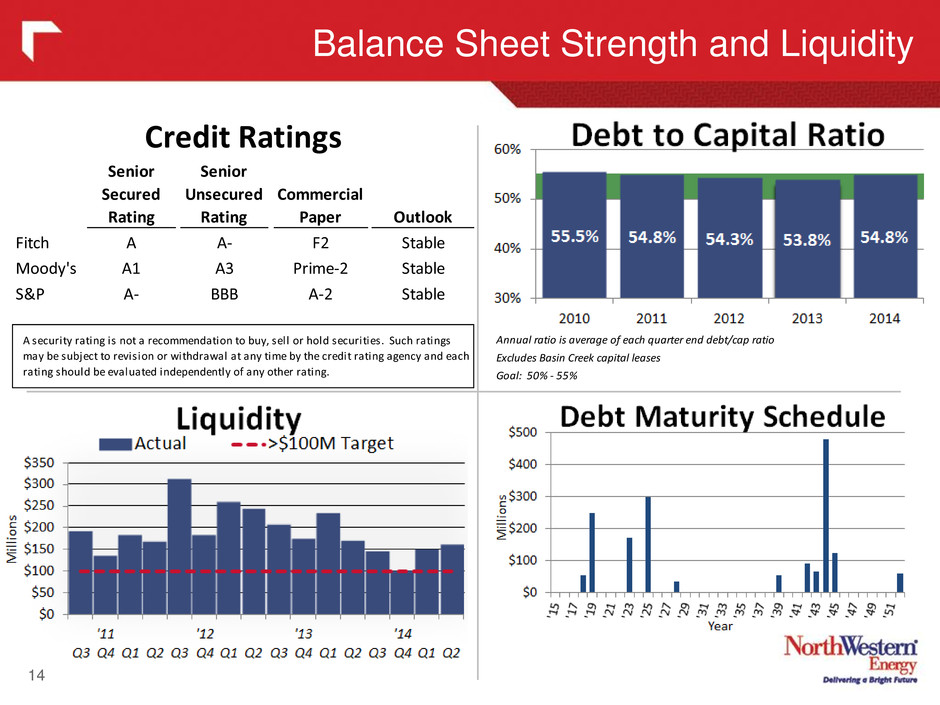

Balance Sheet Strength and Liquidity 14 Annual ratio is average of each quarter end debt/cap ratio Excludes Basin Creek capital leases Goal: 50% - 55% Senior Secured Rating Senior Unsecured Rating Commercial Paper Outlook Fitch A A- F2 Stable Moody's A1 A3 Prime-2 Stable S&P A- BBB A-2 Stable A security rating is not a recommendation to buy, sell or hold securities. Such ratings may be subject to revision or withdrawal at any time by the credit rating agency and each rating should be evalu ted independently of a y other r ting. Credit Ratings

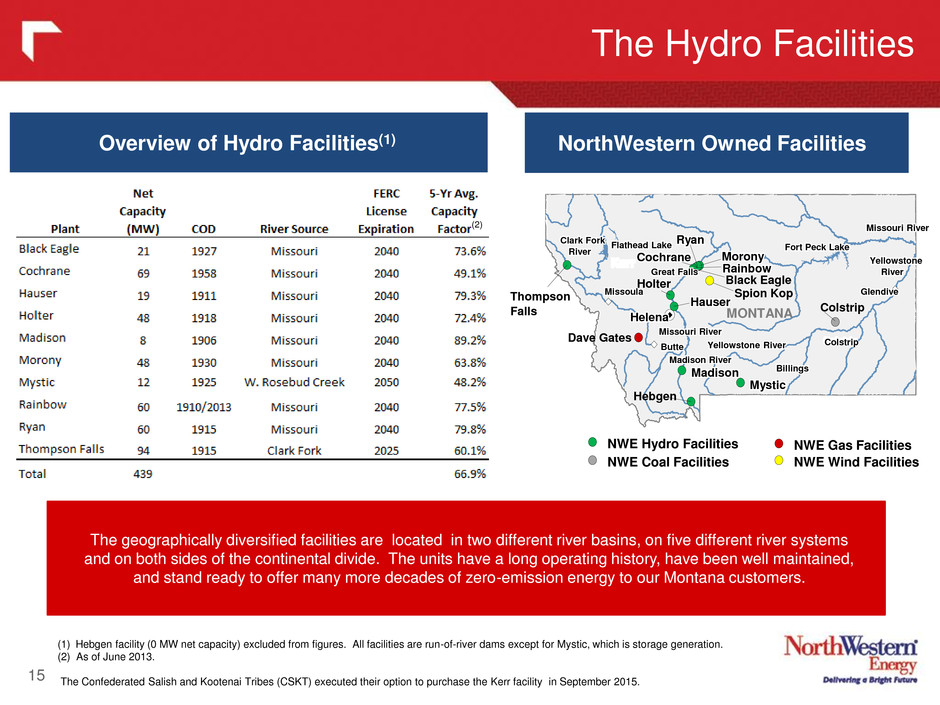

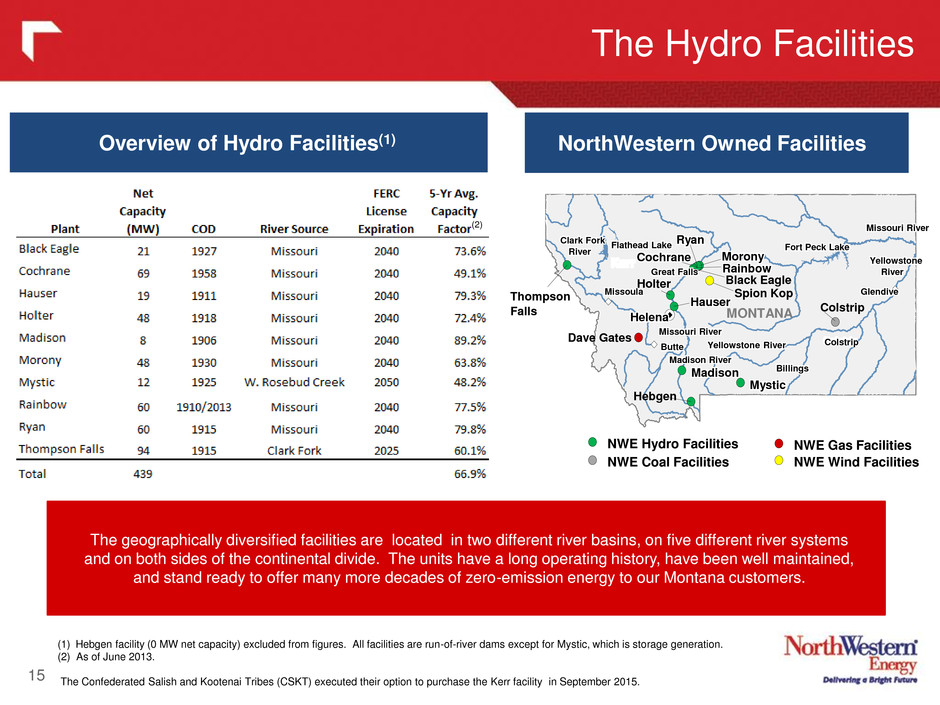

The Hydro Facilities 15 (1) Hebgen facility (0 MW net capacity) excluded from figures. All facilities are run-of-river dams except for Mystic, which is storage generation. (2) As of June 2013. The Confederated Salish and Kootenai Tribes (CSKT) executed their option to purchase the Kerr facility in September 2015. Overview of Hydro Facilities(1) Black Eagle The geographically diversified facilities are located in two different river basins, on five different river systems and on both sides of the continental divide. The units have a long operating history, have been well maintained, and stand ready to offer many more decades of zero-emission energy to our Montana customers. NorthWestern Owned Facilities MONTANA Yellowstone River ll t Yello stone River ll ll Ye lo stone River l t Ye lo stone River ll Yellowstone ll t Yello stone ll t ll t Ye lo s one l t Ye lo s one ll River River River River Missouri River i i issouri River i i i i issouri River i i issouri River i i Missouri River i i issouri River i i i i issouri River i i issouri River i i Madison River i adison River i i adison River i adison River i Clark Fork Clark Fork Clark Fork Clark Fork River River River River Fort Peck Lake t Fort Peck Lake Fort Peck Lake t Fort Peck Lake Flathead Lake l t Flathead Lake l t l t Fla head Lake l t Fla head Lake l Billings li Billings li li Billings li Billings li Colstrip l t i Colstrip l i l i olstrip l t i olstrip Glendive l i lendive l i l i lendive l i lendive l i Helena l le a l l l Great Falls t ll reat Falls ll ll reat Fa ls t l reat Fa ls ll Missoula i l issoula i l i l issoula i l issoula i l Mystic ystic ti ti Hebgen Hauser ser r r Black Eagle Holter Rainbow i i i i i Morony oro y Cochrane chra e hr hr Ryan ya Thompson s Falls ll alls ll ll ll Butte tt Butte u te t u te Kerr Kerr r r Madison i a is i i i Colstrip Spion Kop Dave Gates NWE Hydro Facilities NWE Coal Facilities NWE Wind Facilities NWE Gas Facilities (2)

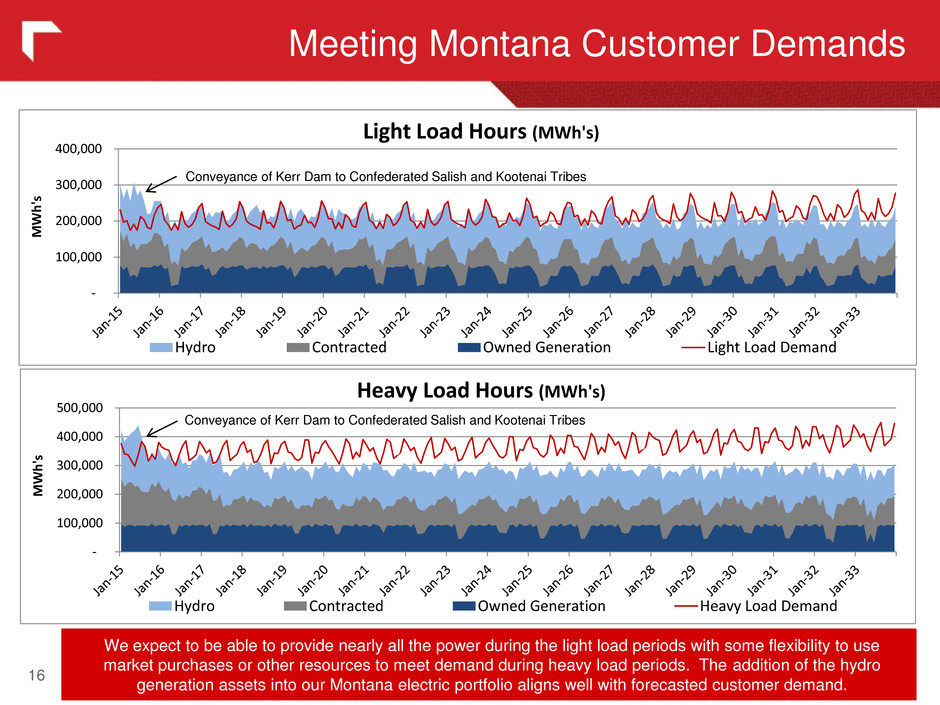

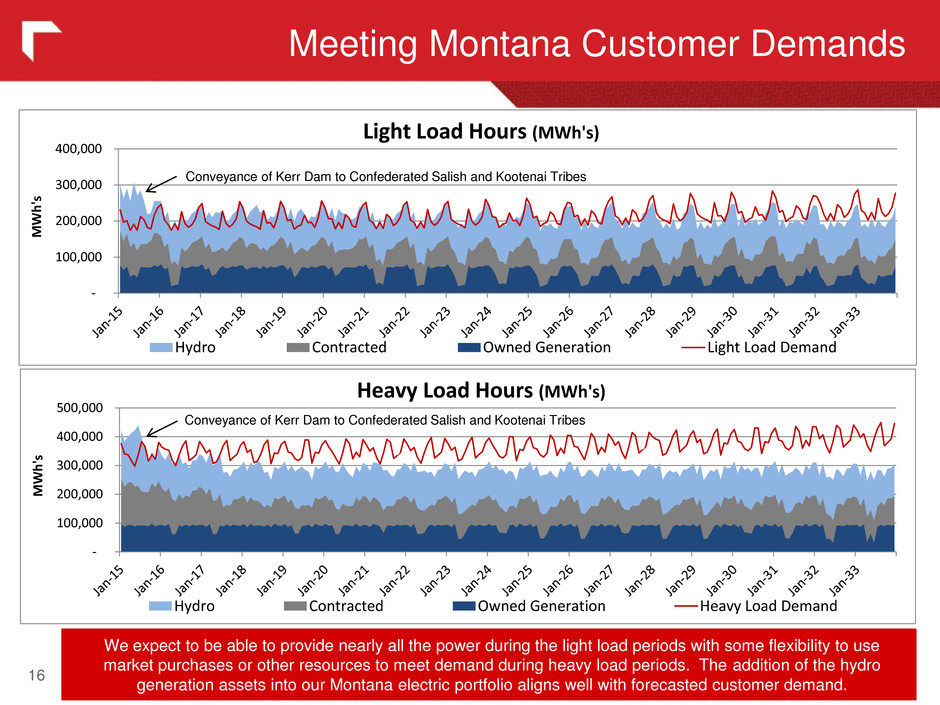

- 100,000 200,000 300,000 400,000 Hydro Contracted Owned Generation Light Load Demand Light Load Hours (MWh's) MW h's - 100,000 200,000 300,000 4 , 500,000 Hydro Contracted Owned Generation Heavy Load Demand Heavy Load Hours (MWh's) MW h's Meeting Montana Customer Demands 16 We expect to be able to provide nearly all the power during the light load periods with some flexibility to use market purchases or other resources to meet demand during heavy load periods. The addition of the hydro generation assets into our Montana electric portfolio aligns well with forecasted customer demand. Conveyance of Kerr Dam to Confederated Salish and Kootenai Tribes Conveyance of Kerr Dam to Confederated Salish and Kootenai Tribes

Big Stone and Neal Air Quality Projects 17 Big Stone Power Plant Neal Power Plant . . . . . .

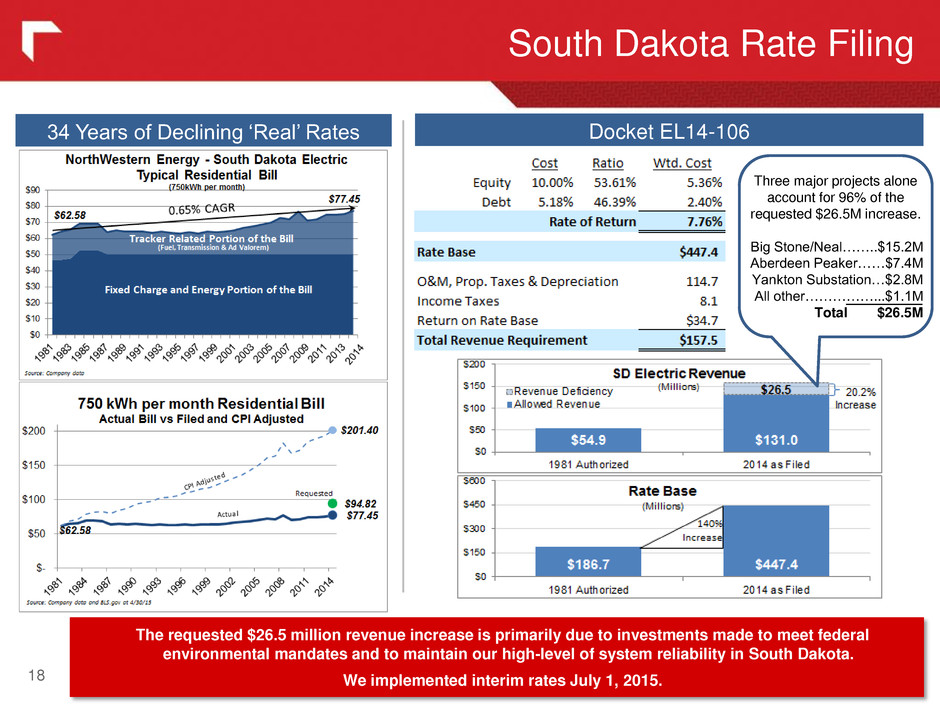

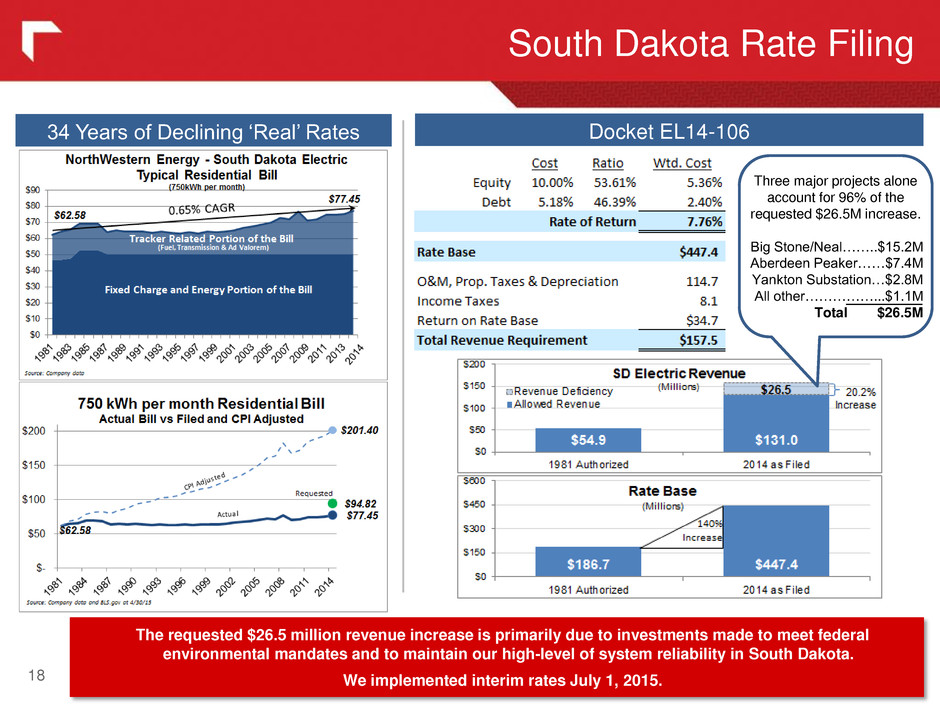

South Dakota Rate Filing 18 34 Years of Declining ‘Real’ Rates Docket EL14-106 The requested $26.5 million revenue increase is primarily due to investments made to meet federal environmental mandates and to maintain our high-level of system reliability in South Dakota. We implemented interim rates July 1, 2015. Three major projects alone account for 96% of the requested $26.5M increase. Big Stone/Neal……..$15.2M Aberdeen Peaker……$7.4M Yankton Substation…$2.8M All other……………...$1.1M Total $26.5M

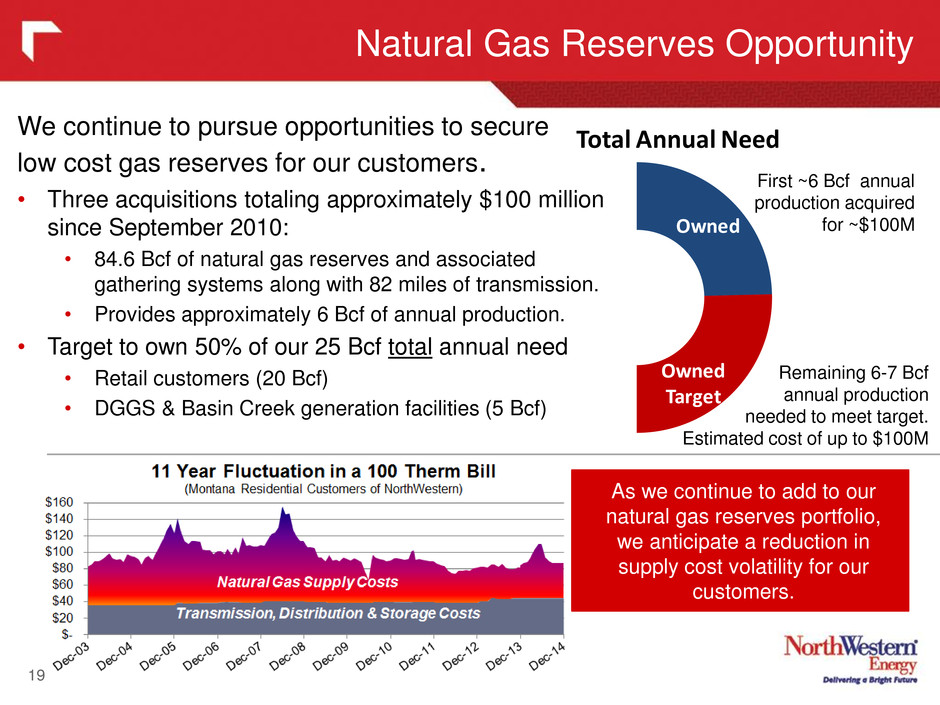

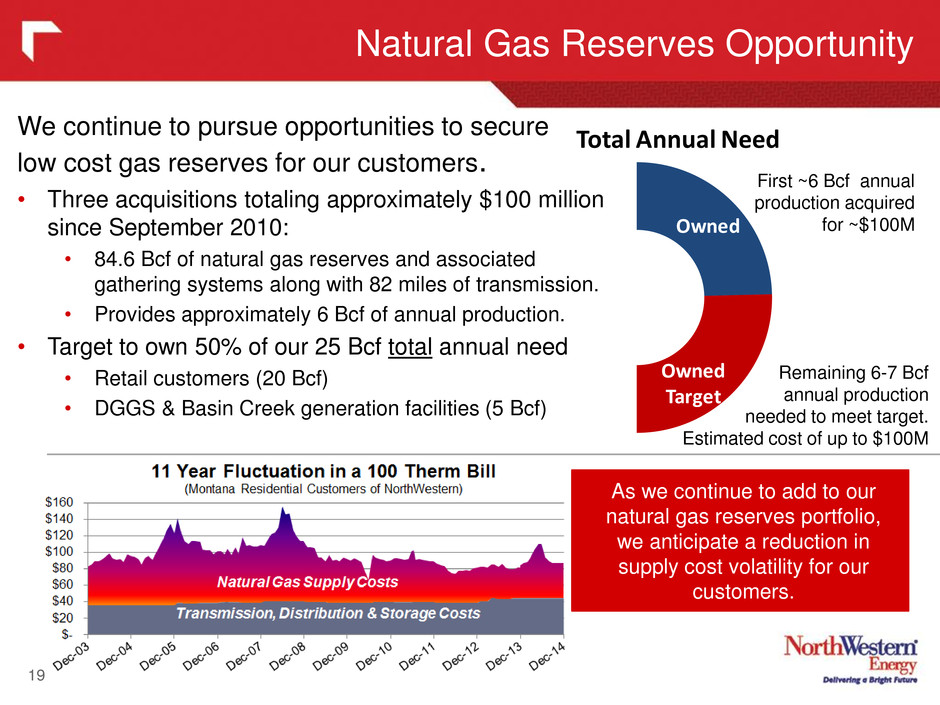

Owned Owned Target Total Annual Need Natural Gas Reserves Opportunity 19 As we continue to add to our natural gas reserves portfolio, we anticipate a reduction in supply cost volatility for our customers. First ~6 Bcf annual production acquired for ~$100M Remaining 6-7 Bcf annual production needed to meet target. Estimated cost of up to $100M We continue to pursue opportunities to secure low cost gas reserves for our customers. • Three acquisitions totaling approximately $100 million since September 2010: • 84.6 Bcf of natural gas reserves and associated gathering systems along with 82 miles of transmission. • Provides approximately 6 Bcf of annual production. • Target to own 50% of our 25 Bcf total annual need • Retail customers (20 Bcf) • DGGS & Basin Creek generation facilities (5 Bcf)

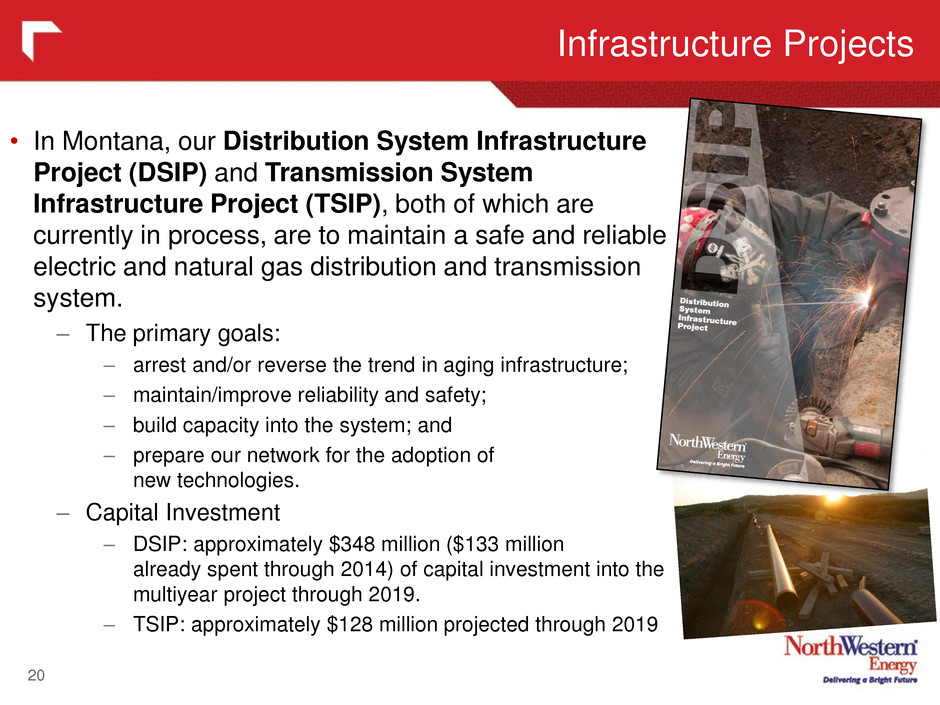

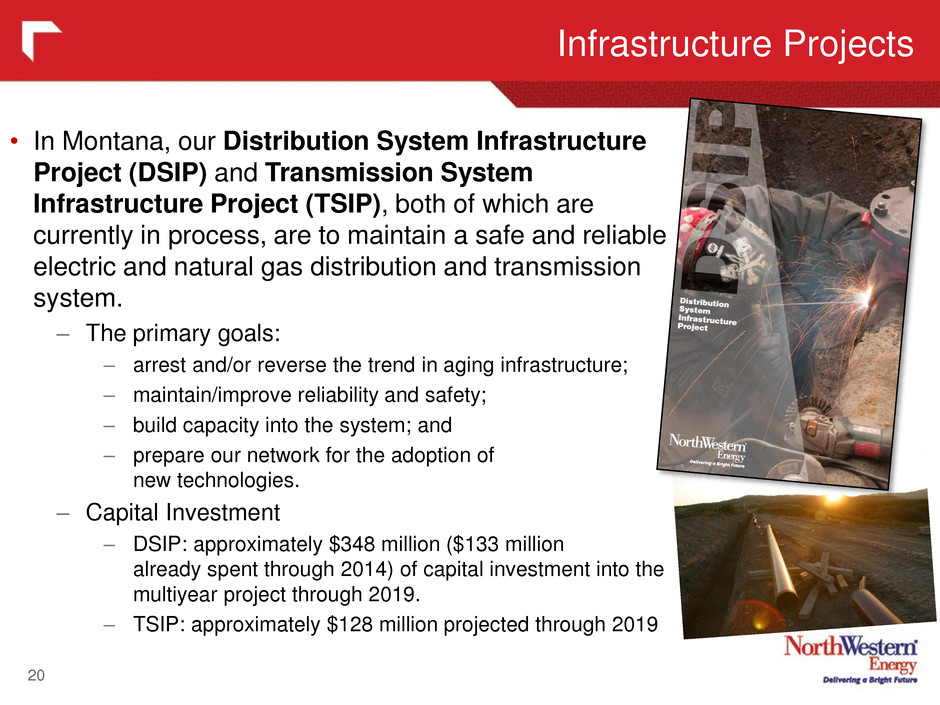

Infrastructure Projects 20 • In Montana, our Distribution System Infrastructure Project (DSIP) and Transmission System Infrastructure Project (TSIP), both of which are currently in process, are to maintain a safe and reliable electric and natural gas distribution and transmission system. – The primary goals: – arrest and/or reverse the trend in aging infrastructure; – maintain/improve reliability and safety; – build capacity into the system; and – prepare our network for the adoption of new technologies. – Capital Investment – DSIP: approximately $348 million ($133 million already spent through 2014) of capital investment into the multiyear project through 2019. – TSIP: approximately $128 million projected through 2019

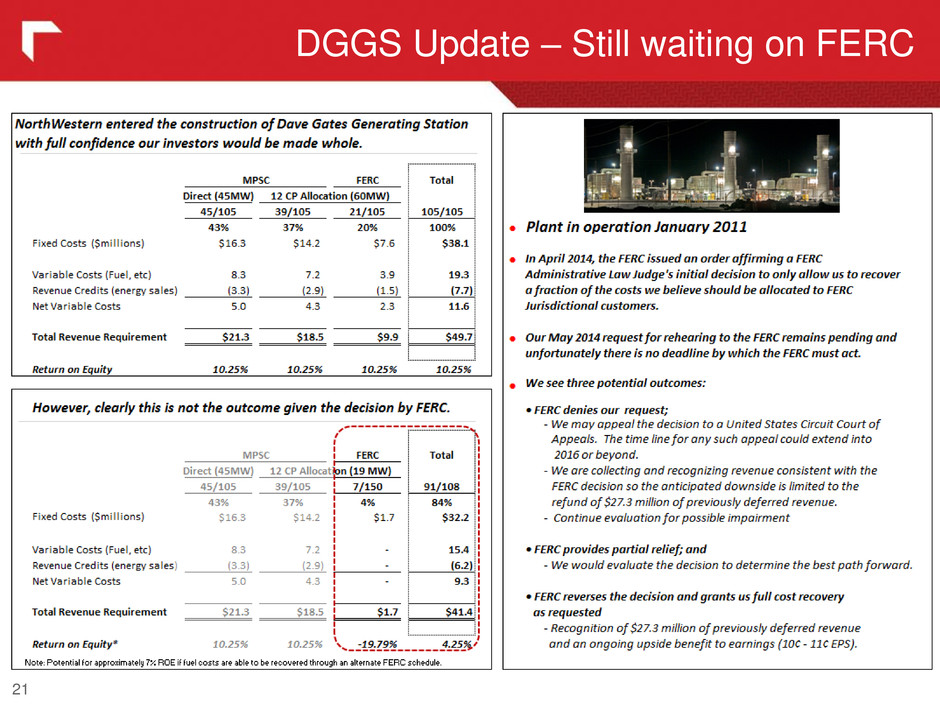

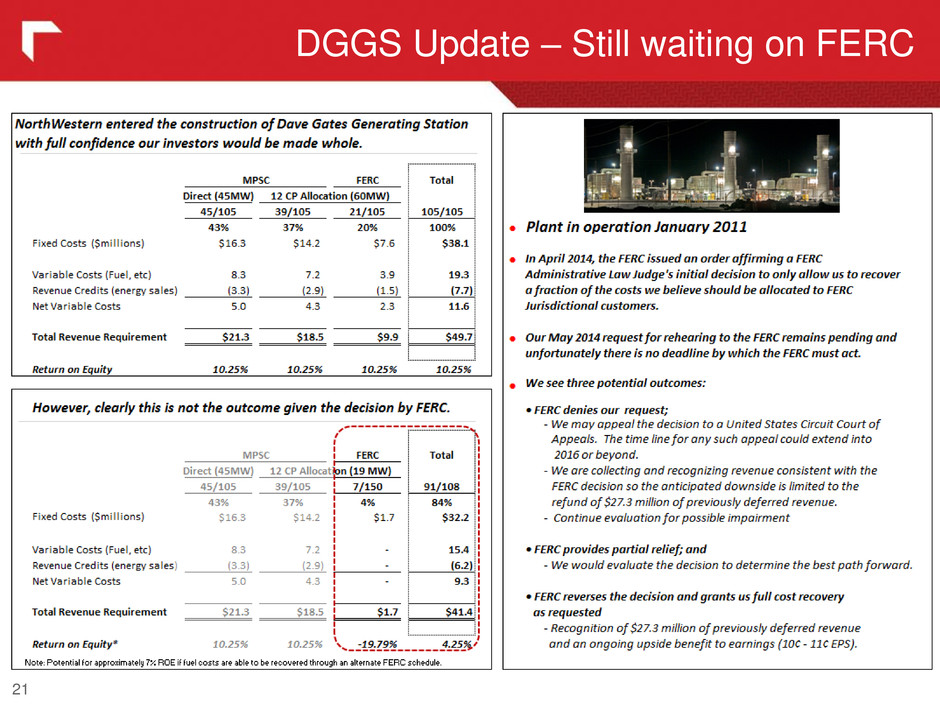

DGGS Update – Still waiting on FERC 21

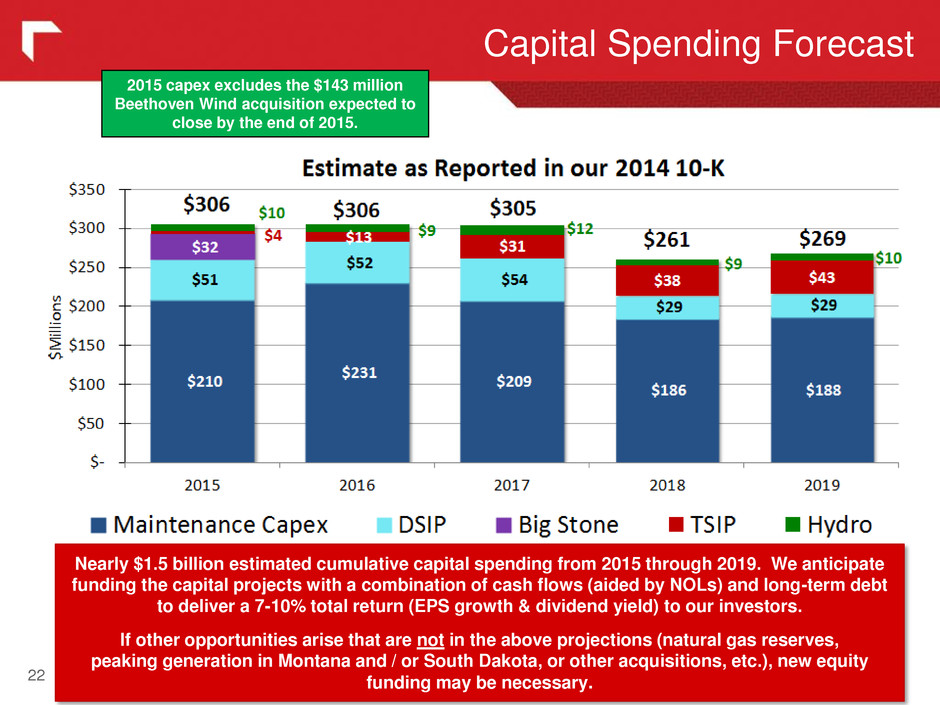

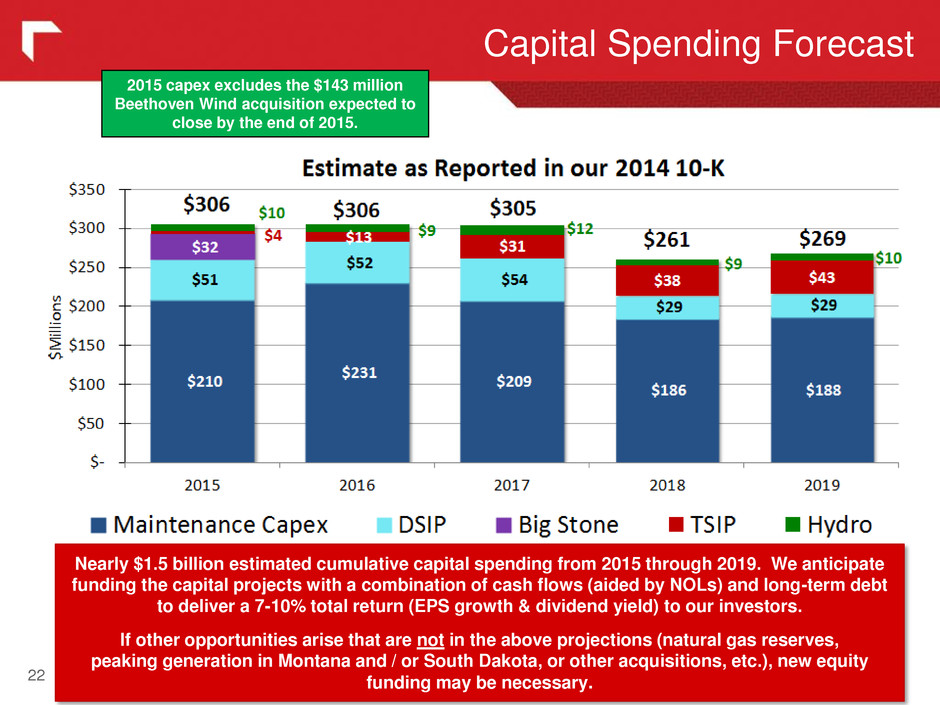

Capital Spending Forecast 22 * 2015 capex excludes the $143 million Beethoven Wind acquisition expected to close by the end of 2015. Nearly $1.5 billion estimated cumulative capital spending from 2015 through 2019. We anticipate funding the capital projects with a combination of cash flows (aided by NOLs) and long-term debt to deliver a 7-10% total return (EPS growth & dividend yield) to our investors. If other opportunities arise that are not in the above projections (natural gas reserves, peaking generation in Montana and / or South Dakota, or other acquisitions, etc.), new equity funding may be necessary.

23 Beethoven Wind Acquisition The acquisition will result in significantly lower costs to customers over the long-term and is expected to be accretive to earnings but cannot be quantified until the South Dakota Public Utility Commission makes a final determination on our general rate case, which is anticipated by the end of 2015. Opportunity: We executed an agreement with BayWa r.e. Wind LLC in July 2015 to purchase two recently completed Qualified Facilities (QF) projects in South Dakota for an aggregate purchase price of approximately $143 million. The energy and renewable energy credits associated with this 80 MW project are currently included in the company’s electricity supply portfolio under a QF power purchase agreement (PPA). The existing QF PPA will terminate upon closing and we are requesting the project be placed into rate base as part of our pending electric general rate filing as a known and measurable adjustment. The rate-based cost is expected to be significantly lower than the existing PPA benefiting our customers’ bills over the long-term. Timeline: We anticipate closing the transaction by the end of 2015. Source: BayWa r.e. Wind, LLC Beethoven Wind Red areas in map is NWE’s electric service territory in SD

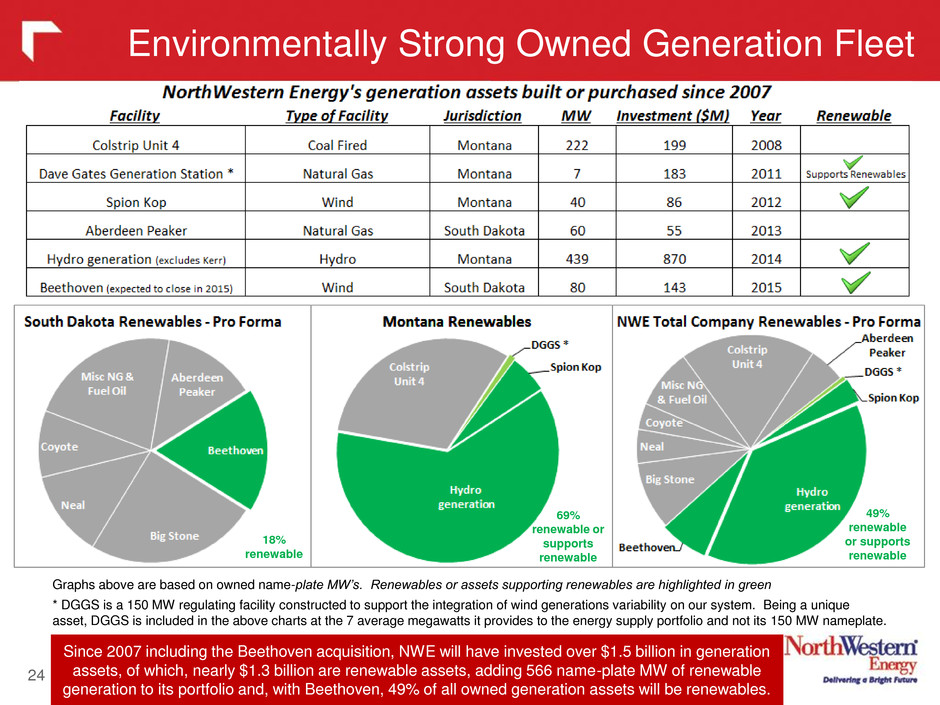

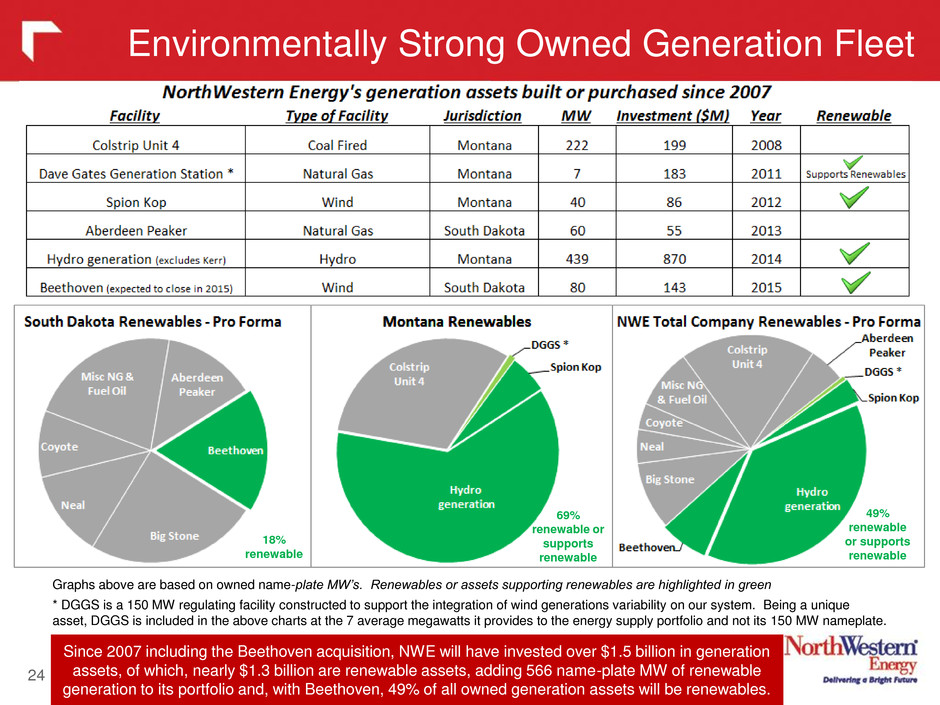

24 Environmentally Strong Owned Generation Fleet Since 2007 including the Beethoven acquisition, NWE will have invested over $1.5 billion in generation assets, of which, nearly $1.3 billion are renewable assets, adding 566 name-plate MW of renewable generation to its portfolio and, with Beethoven, 49% of all owned generation assets will be renewables. 18% renewable Graphs above are based on owned name-plate MW’s. Renewables or assets supporting renewables are highlighted in green * DGGS is a 150 MW regulating facility constructed to support the integration of wind generations variability on our system. Being a unique asset, DGGS is included in the above charts at the 7 average megawatts it provides to the energy supply portfolio and not its 150 MW nameplate. 69% renewable or supports renewable 49% renewable or supports renewable *

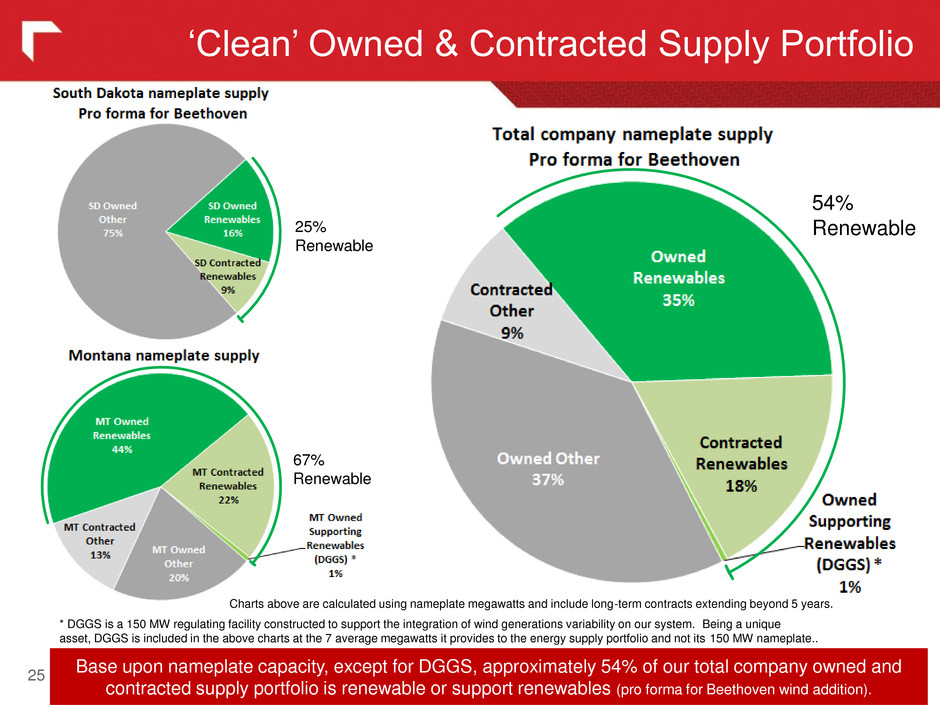

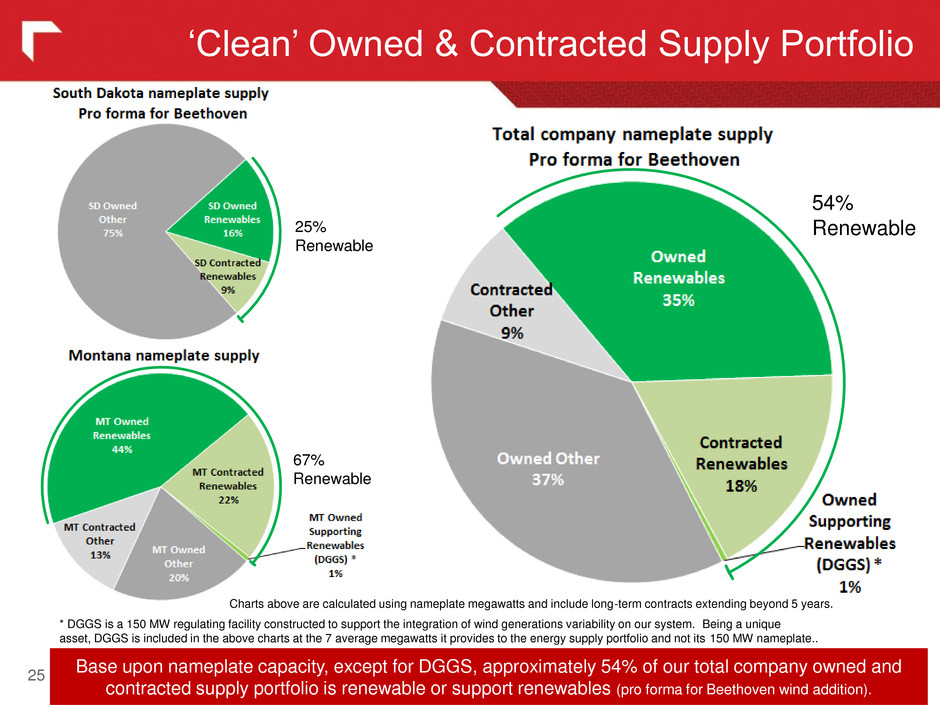

25 ‘Clean’ Owned & Contracted Supply Portfolio Base upon nameplate capacity, except for DGGS, approximately 54% of our total company owned and contracted supply portfolio is renewable or support renewables (pro forma for Beethoven wind addition). Charts above are calculated using nameplate megawatts and include long-term contracts extending beyond 5 years. 25% Renewable 67% Renewable 54% Renewable * DGGS is a 150 MW regulating facility constructed to support the integration of wind generations variability on our system. Being a unique asset, DGGS is included in the above charts at the 7 average megawatts it provides to the energy supply portfolio and not its 150 MW nameplate..

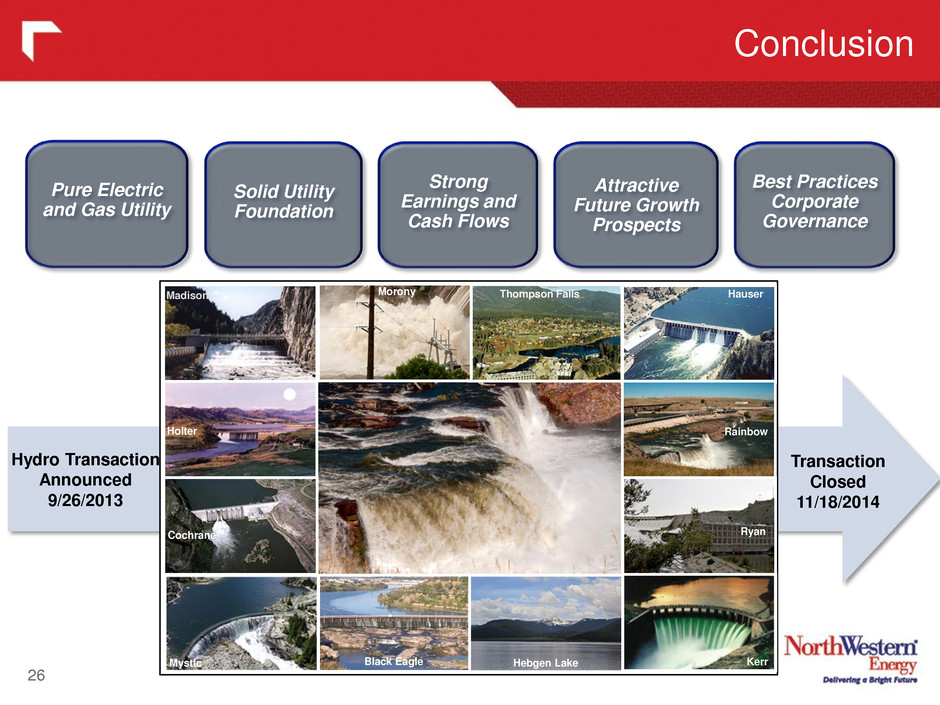

Conclusion 26 Pure Electric and Gas Utility Solid Utility Foundation Strong Earnings and Cash Flows Attractive Future Growth Prospects Best Practices Corporate Governance Hydro Transaction Announced 9/26/2013 Transaction Closed 11/18/2014 Thompson Falls Hauser Rainbow Ryan Morony Kerr Madison Holter Cochrane Mystic Black Eagle Hebgen Lake

Appendix 27

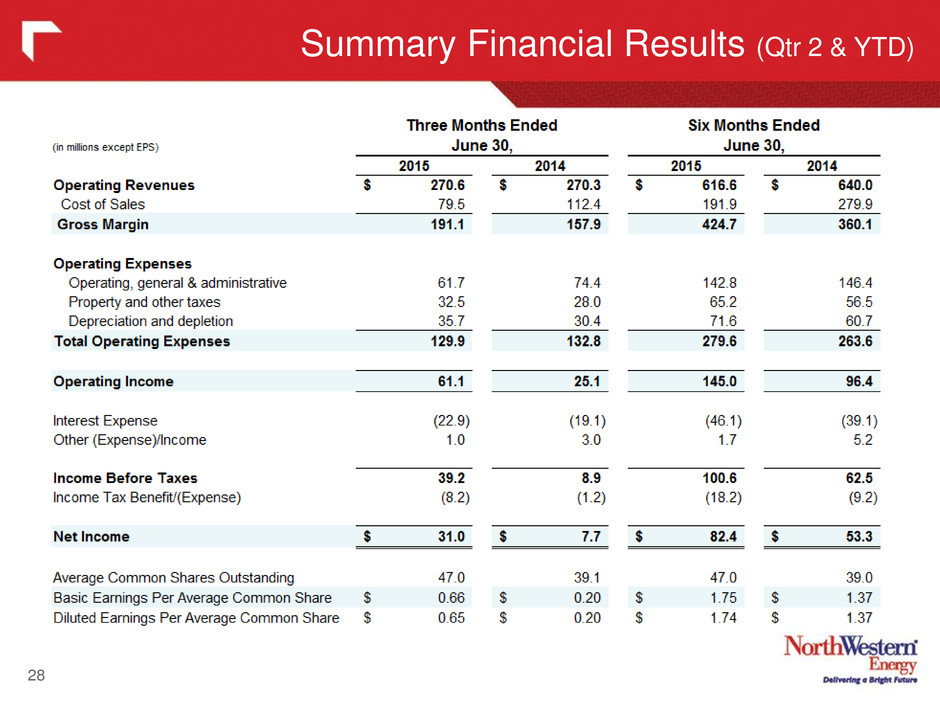

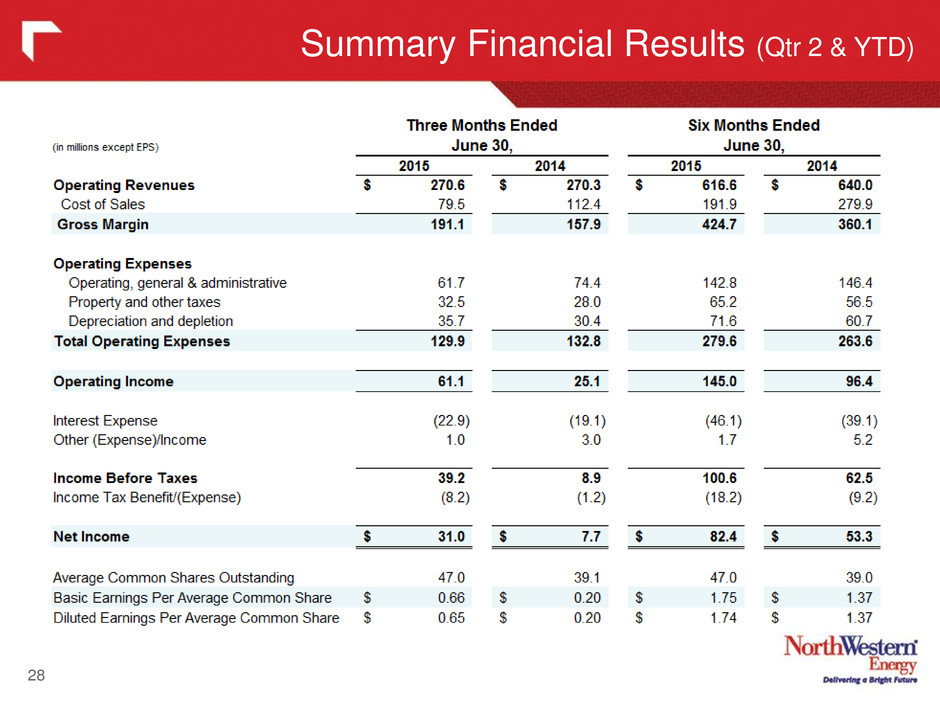

Summary Financial Results (Qtr 2 & YTD) 28

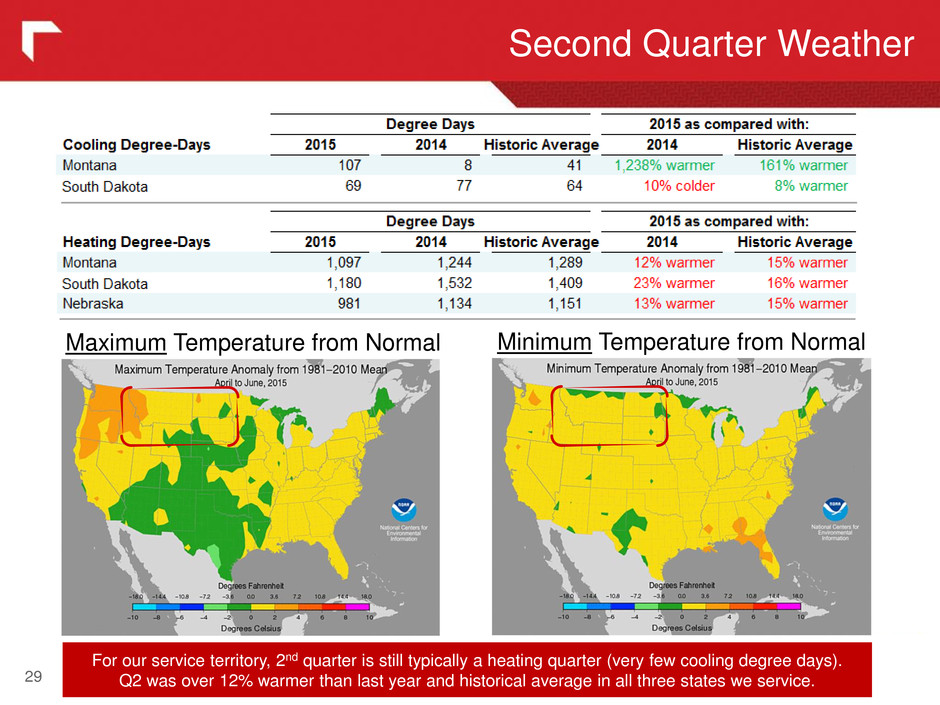

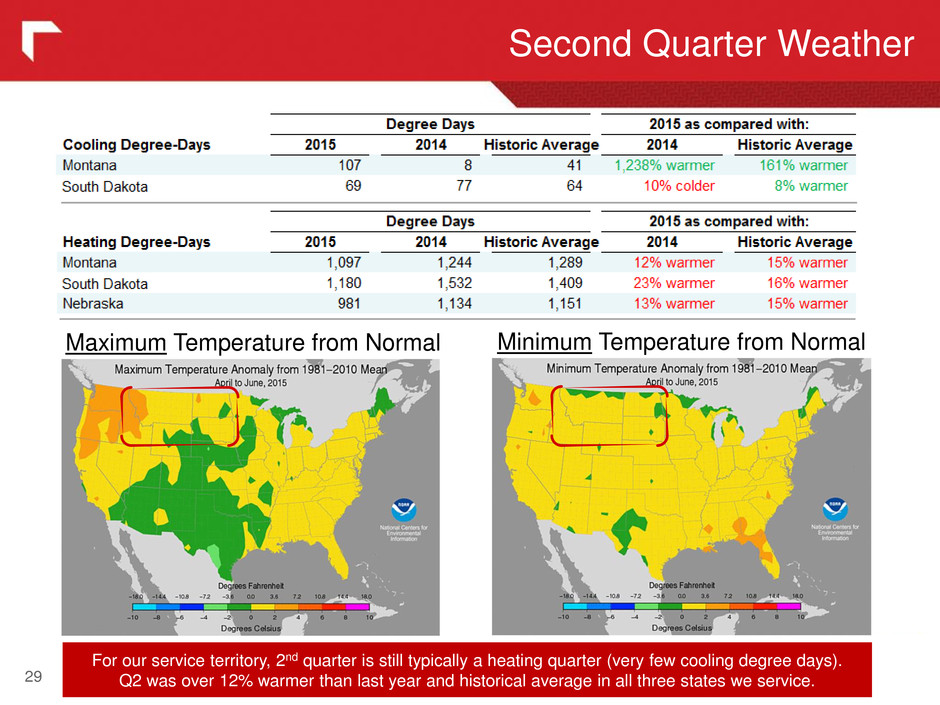

Second Quarter Weather 29 Maximum Temperature from Normal Minimum Temperature from Normal For our service territory, 2nd quarter is still typically a heating quarter (very few cooling degree days). Q2 was over 12% warmer than last year and historical average in all three states we service.

Adjusted Earnings (Second Quarter ‘15 vs ’14) 30 The non-GAAP measures presented in the table above are being shown to reflect significant items that were not contemplated in our original guidance; however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP.

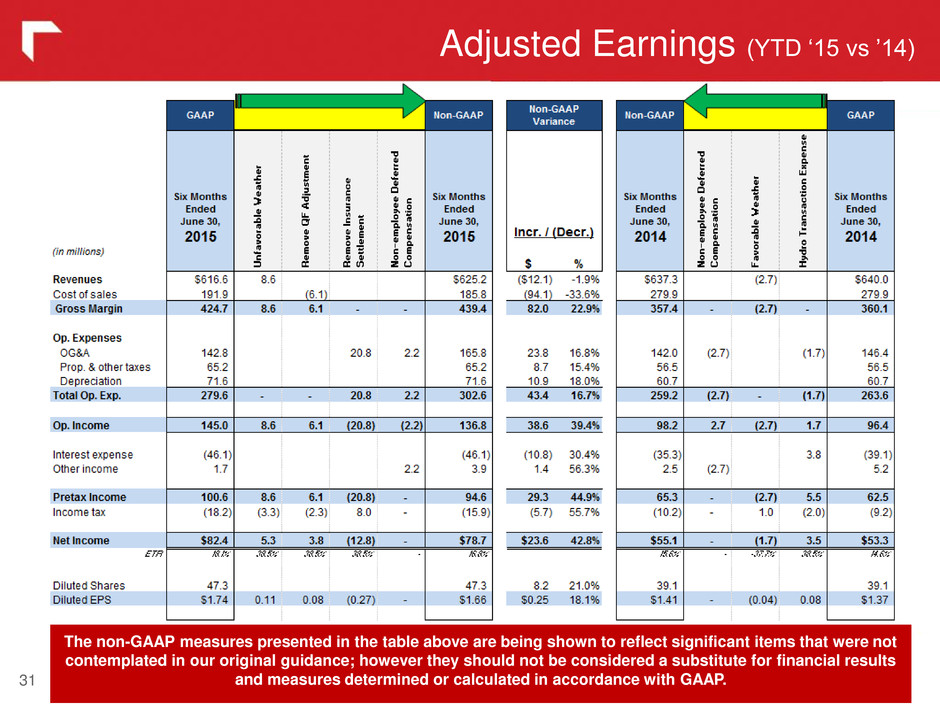

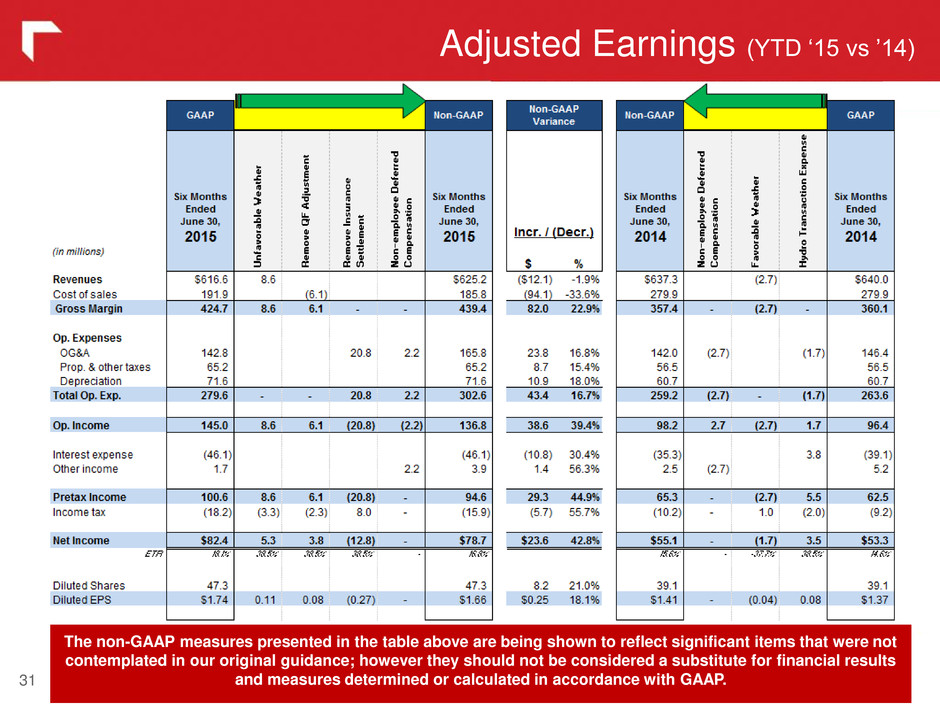

Adjusted Earnings (YTD ‘15 vs ’14) 31 The non-GAAP measures presented in the table above are being shown to reflect significant items that were not contemplated in our original guidance; however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP.

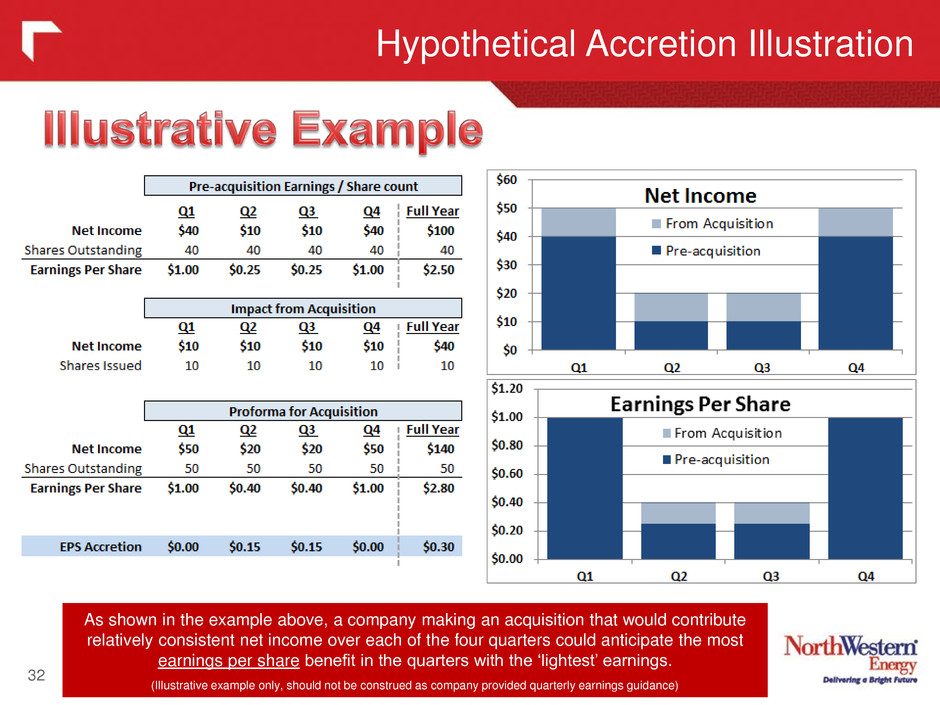

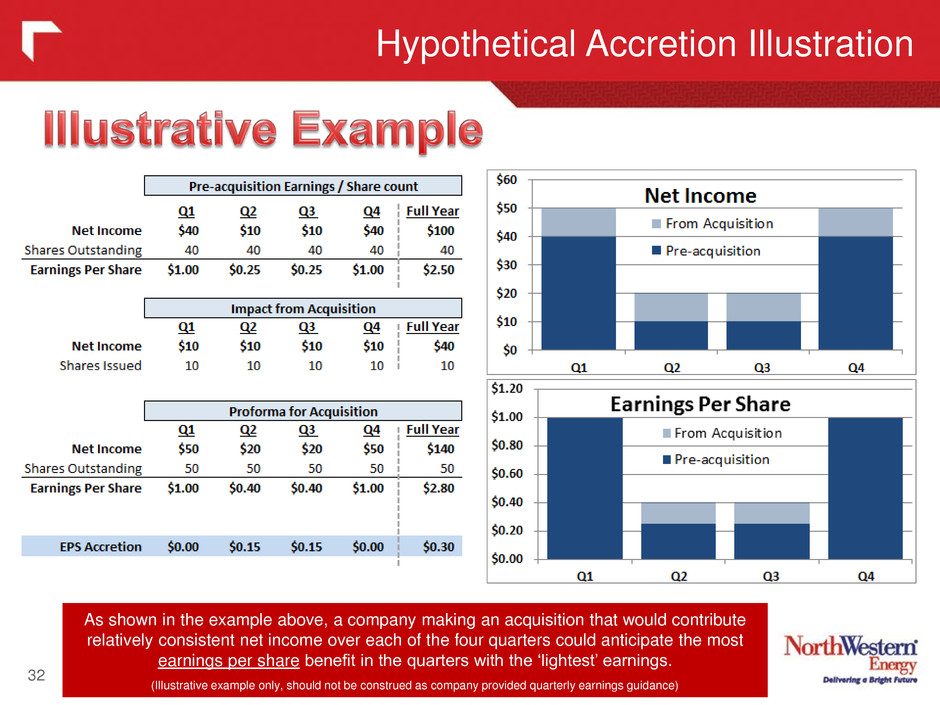

Hypothetical Accretion Illustration 32 As shown in the example above, a company making an acquisition that would contribute relatively consistent net income over each of the four quarters could anticipate the most earnings per share benefit in the quarters with the ‘lightest’ earnings. (Illustrative example only, should not be construed as company provided quarterly earnings guidance)

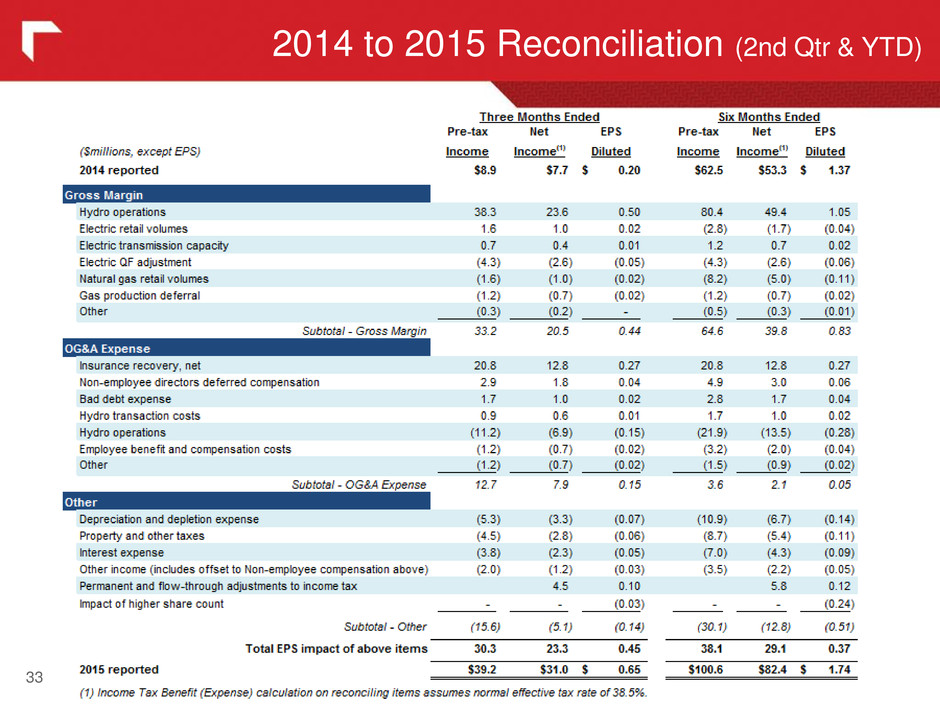

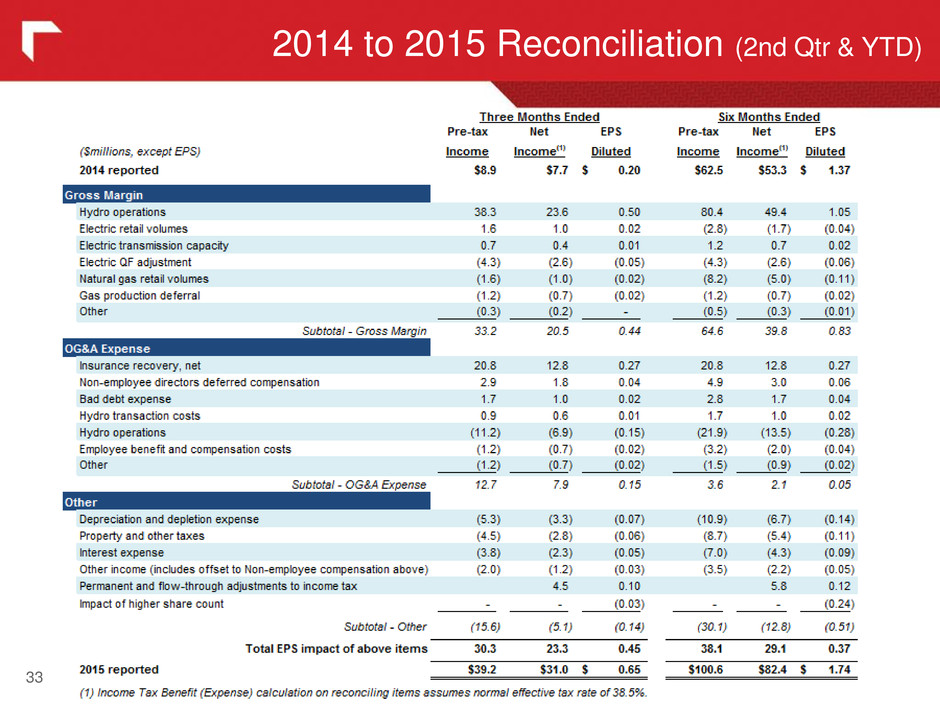

33 2014 to 2015 Reconciliation (2nd Qtr & YTD)

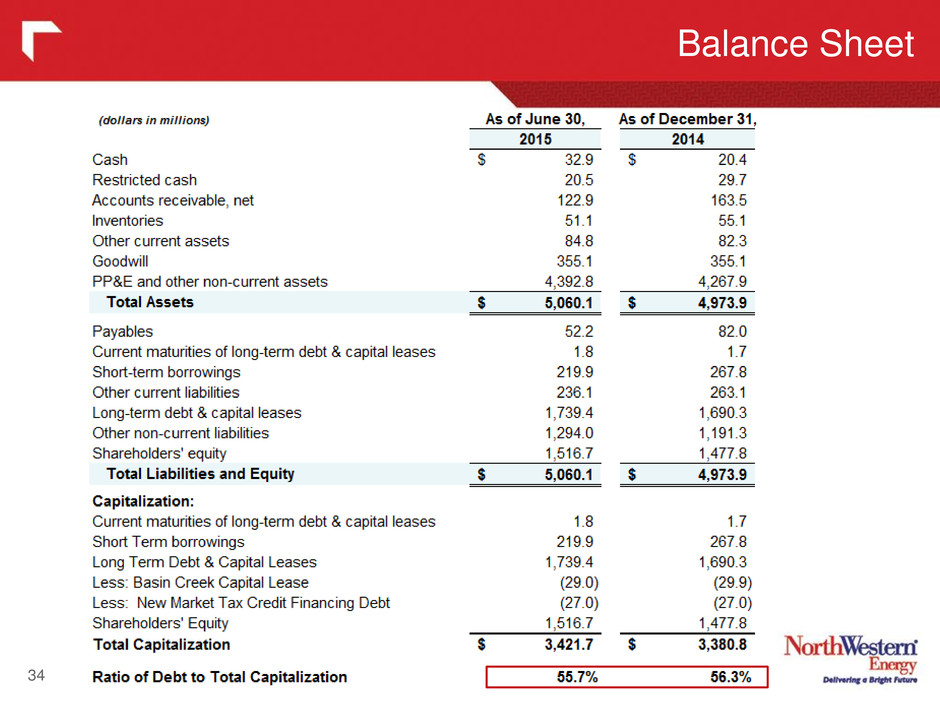

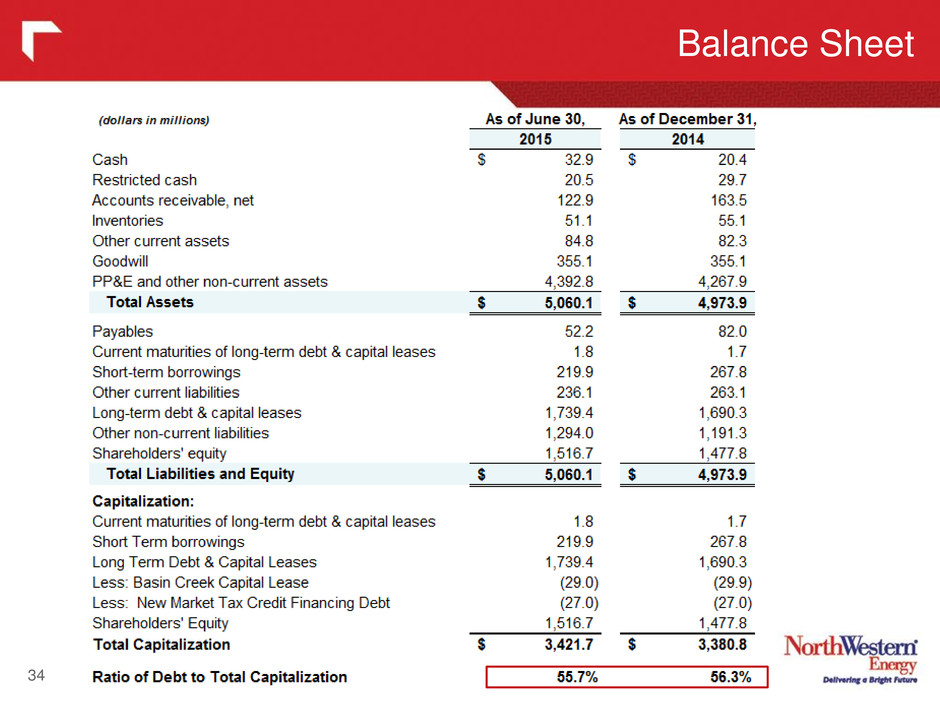

Balance Sheet 34

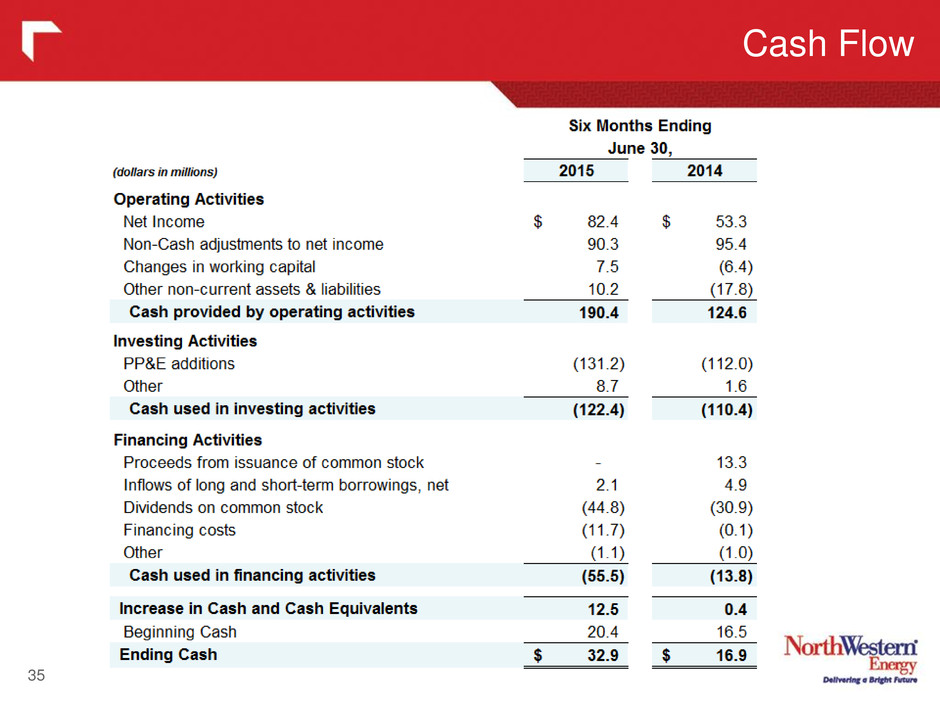

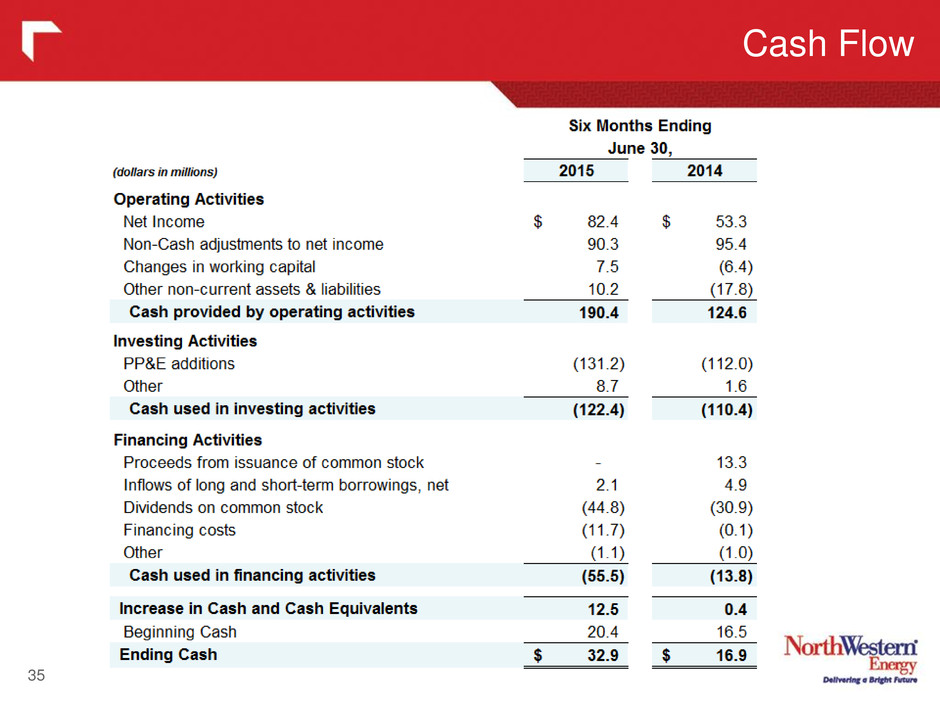

Cash Flow 35

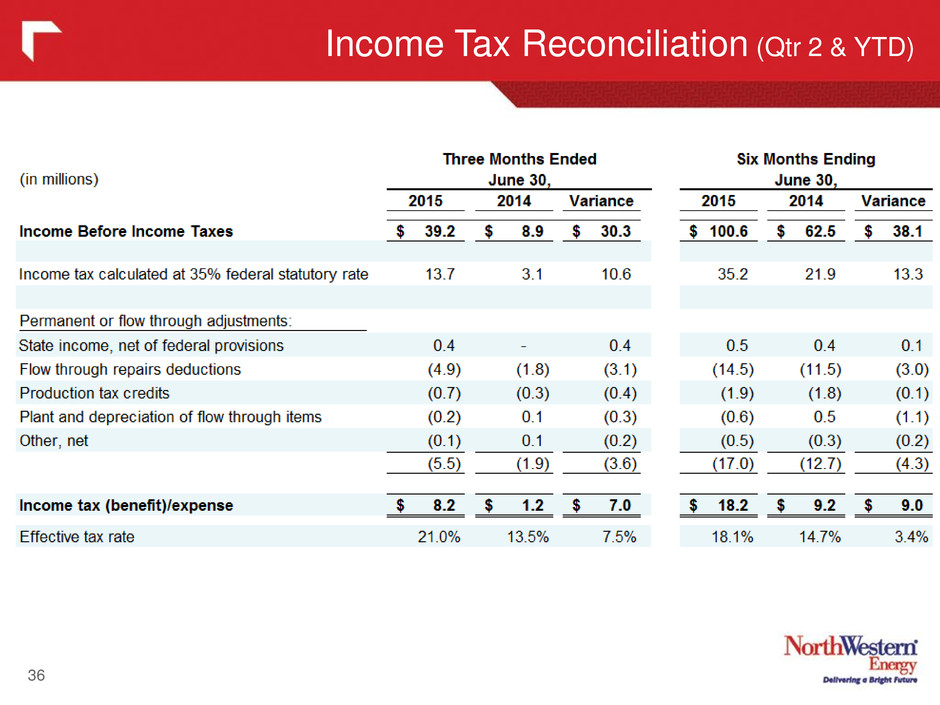

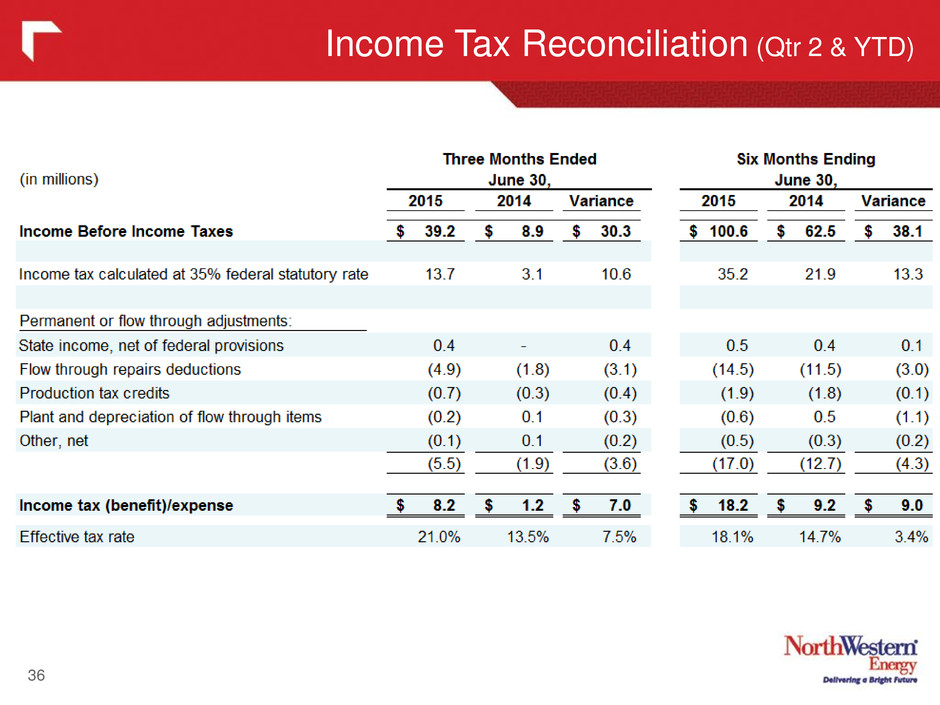

Income Tax Reconciliation (Qtr 2 & YTD) 36

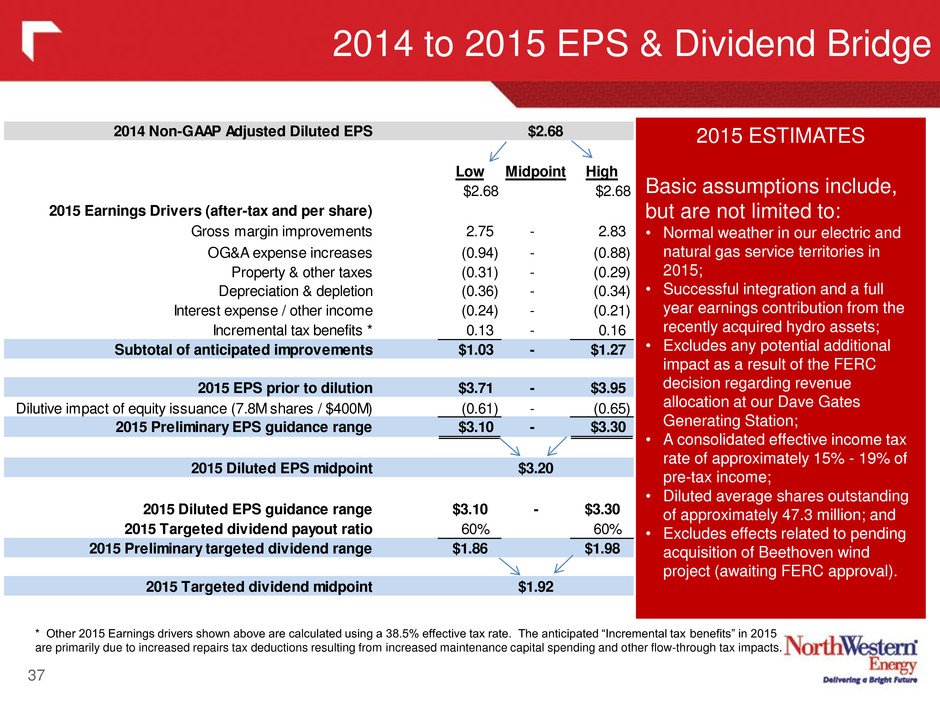

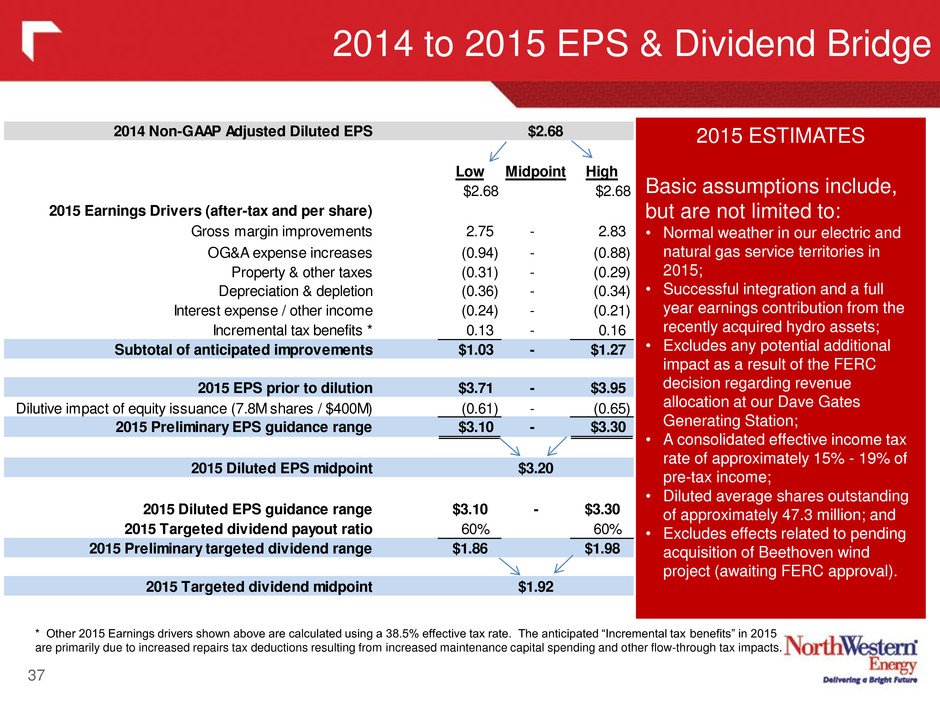

2014 to 2015 EPS & Dividend Bridge 2015 ESTIMATES Basic assumptions include, but are not limited to: • Normal weather in our electric and natural gas service territories in 2015; • Successful integration and a full year earnings contribution from the recently acquired hydro assets; • Excludes any potential additional impact as a result of the FERC decision regarding revenue allocation at our Dave Gates Generating Station; • A consolidated effective income tax rate of approximately 15% - 19% of pre-tax income; • Diluted average shares outstanding of approximately 47.3 million; and • Excludes effects related to pending acquisition of Beethoven wind project (awaiting FERC approval). * Other 2015 Earnings drivers shown above are calculated using a 38.5% effective tax rate. The anticipated “Incremental tax benefits” in 2015 are primarily due to increased repairs tax deductions resulting from increased maintenance capital spending and other flow-through tax impacts. 37 $2.68 Low Midpoint High $2.68 $2.68 2.75 - 2.83 (0.94) - (0.88) (0.31) - (0.29) (0.36) - (0.34) (0.24) - (0.21) 0.13 - 0.16 $1.03 - $1.27 $3.71 - $3.95 (0.61) - (0.65) $3.10 - $3.30 $3.20 $3.10 - $3.30 60% 60% $1.86 $1.98 $1.92 Property & other taxes Depreciation & depletion OG&A expense increases 2014 Non-GAAP Adjusted Diluted EPS 2015 Earnings Drivers (after-tax and per share) Gross margin improvements Interest expense / other income Incremental tax benefits * Subtotal of anticipated improvements 2015 EPS prior to dilution Dilutive impact of equity issuance (7.8M shares / $400M) 2015 Preliminary EPS guidance range 2015 Diluted EPS midpoint 2015 Diluted EPS guidance range 2015 Targeted dividend payout ratio 2015 Preliminary targeted dividend range 2015 Targeted dividend midpoint

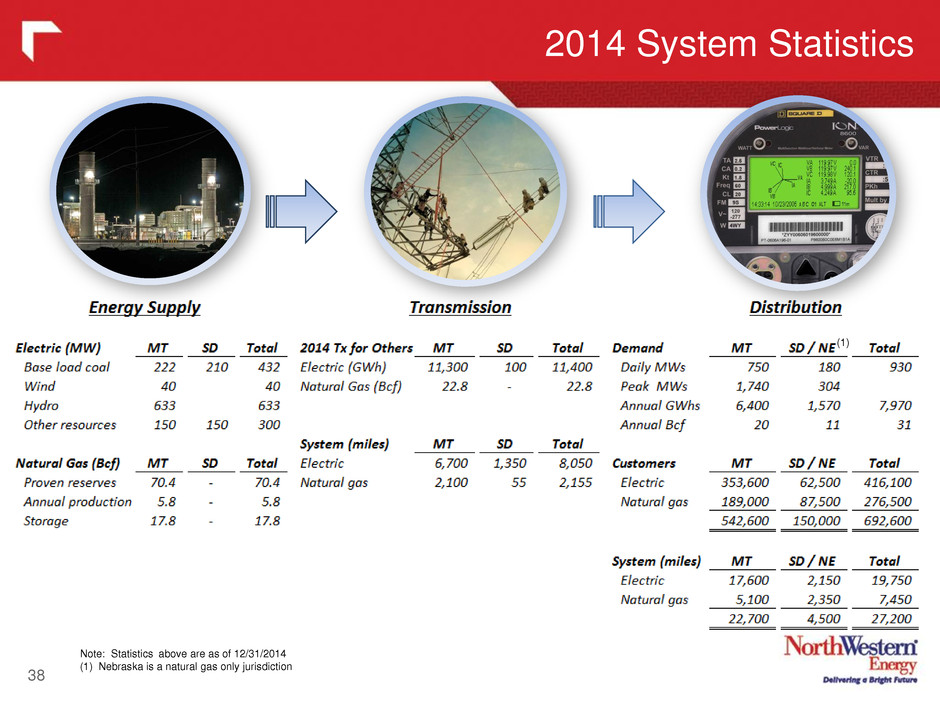

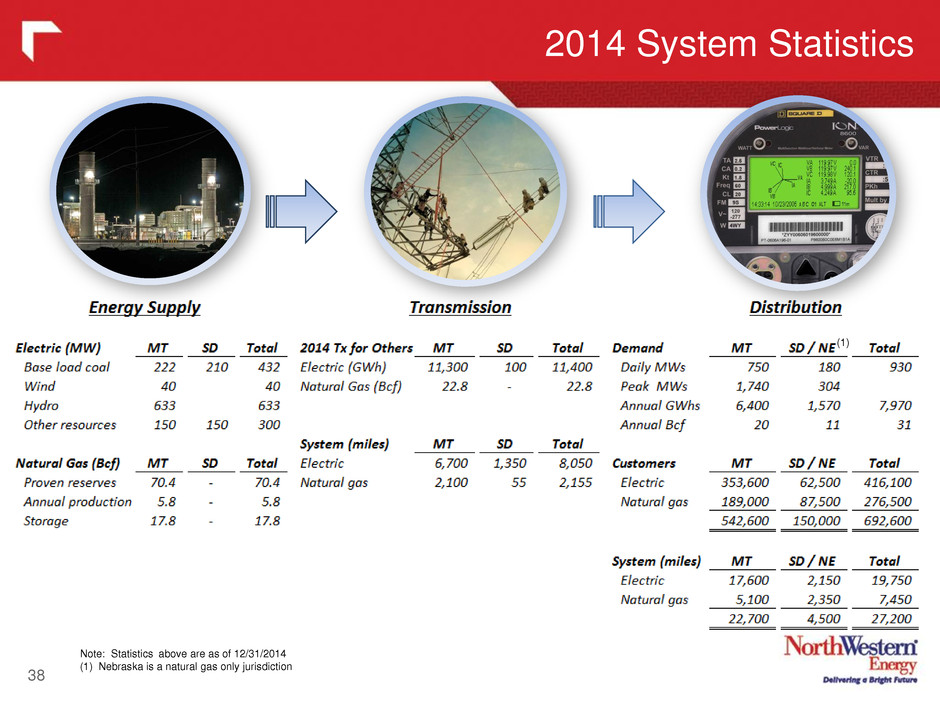

2014 System Statistics 38 Note: Statistics above are as of 12/31/2014 (1) Nebraska is a natural gas only jurisdiction (1)

Experienced & Engaged Board of Directors 39 Members of the Board of Directors tour the Madison Dam power house in Ennis, Montana. From the left are Dana J. Dykhouse, Dorothy M. Bradley, Philip L. Maslowe, E. Linn Draper Jr., Julia L. Johnson, Robert C. Rowe, Denton Louis Peoples, and Stephan P. Adik. Not pictured: Jan R. Horsfall. In 2014, NorthWestern Energy mourned the passing of our esteemed colleague, fellow Director and friend, Philip L. Maslowe. Dana J. Dykhouse - Chief Executive Officer of First PREMIER Bank. Director since 2009 Dorothy M. Bradley - Retired District Court Administrator for the 18th Judicial Court of Montana. Director since 2009 E. Linn Draper Jr. - Chairman of the Board - Retired Chairman, President and Chief Executive Officer of American Electric Power Co., Inc. Director since 2004 Julia L. Johnson - President and Founder of NetCommunications, LLC. Former Chairperson of the Florida Public Service Commission. Director since 2004 Robert C. Rowe - President and CEO of NorthWestern Corporation. Director since 2008 Denton Louis People - Retired CEO and Vice Chairman of the Board of Orange and Rockland Utilities, Inc. Director since 2006 Stephen P. Adik - Retired Vice Chairman of NiSource, Inc. Director since 2004 Jan R. Horsfall - Co-founder and CEO of Maxletics Corp. Director since 2015

Strong Executive Team 40 NorthWestern Energy’s executive officers at the Madison Dam in Ennis, Montana From the left: Patrick R. Corcoran - VP of Government and Regulatory Affairs. 35 years utility industry experience; current position since 2001 John D. Hines - VP of Supply. 25 years utility industry experience; current position since 2011 Kendall G. Kliewer - VP and Controller. 17 years finance management experience; current position since 2004 Robert C. Rowe - President and CEO. Decades of utility and regulatory experience (including 12 years on the Montana Public Service Commission); current position since 2008 Brian B. Bird - VP - CFO. 29 years financial management experience with energy and other large industrial companies; current position since 2003 Curtis T. Pohl - VP of Distribution. 28 years utility industry experience; current position since 2003 Heather H. Grahame - VP and General Counsel. 30 years legal experience (21 years representing utilites); current position since 2010 Michael R. Cashell - VP of Transmission. 28 years utility industry experience; current position since 2011 Bobbi L. Schroeppel - VP of Customer Care, Communications and Human Resources. 21 years utility industry experience; current position since 2002

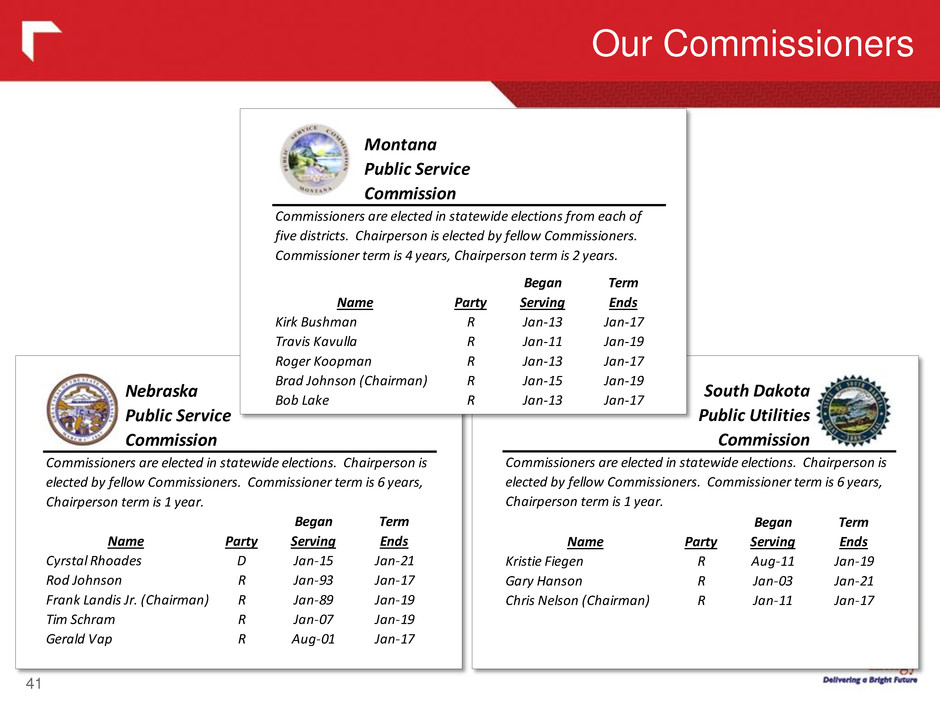

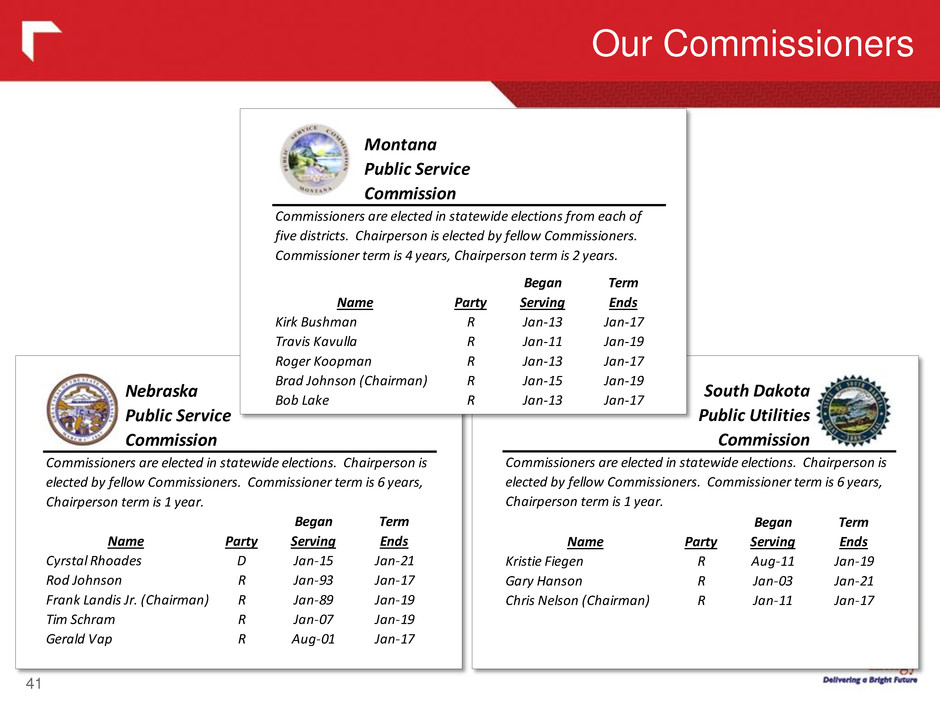

Our Commissioners 41 Name Party Began Serving Term Ends Kirk Bushman R Jan-13 Jan-17 Travis Kavulla R Jan-11 Jan-19 Roger Koopman R Jan-13 Jan-17 Brad Johnson (Chairman) R Jan-15 Jan-19 Bob Lake R Jan-13 Jan-17 Commissioners are elected in statewide elections from each of five districts. Chairperson is elected by fellow Commissioners. Commissioner term is 4 years, Chairperson term is 2 years. Montana Public Service Commission Name Party Began Serving Term Ends Kristie Fiegen R Aug-11 Jan-19 Gary Hanson R Jan-03 Jan-21 Chris Nelson (Chairman) R Jan-11 Jan-17 Commissioners are elected in statewide elections. Chairperson is elected by fellow Commissioners. Commissioner term is 6 years, Chairperson term is 1 year. South Dakota Public Utilities Commission Name Pa ty Began Serving Term Ends Cyrstal Rh ades D Jan-15 Jan-21 Rod Johnson R Jan-93 Jan-17 Frank Landis Jr. (Chairman) R Jan-89 Jan-19 Tim Schram R Jan-07 Jan-19 Gerald Vap R Aug-01 Jan-17 Commissioners are elected in statewide elections. Chairperson is elected by fellow Commissioners. Commissioner term is 6 years, Chairperson term is 1 year. Nebraska Public Service Commission

Non-GAAP Financial Measures 42 The data presented above includes financial information prepared in accordance with GAAP, as well as another financial measure, Gross Margin, Free Cash Flows, Net Debt and EBITDA, but is considered a “Non-GAAP financial measure.” Generally, a Non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. Gross Margin (Revenues less Cost of Sales), Free Cash Flows (Cash flows from operations less maintenance capex and dividends), Net Debt (Total debt less capital leases) and EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) are Non-GAAP financial measure due to the exclusion of depreciation from the measure. The presentation of Gross Margin, Free Cash Flows, Net Debt and EBITDA is intended to supplement investors’ understanding of our operating performance. Gross Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs. Net Debt is used by our company to determine whether we are properly levered to our Total Capitalization (Net Debt plus Equity). Our Gross Margin, Free Cash Flows, Net Debt and EBITDA measures may not be comparable to other companies’ Gross Margin, Free Cash Flows, Net Debt and EBITDA measures. Furthermore, these measures are not intended to replace operating income as determined in accordance with GAAP as an indicator of operating performance.

43