2016 Earnings Webcast February 17, 2017 Black Eagle Dam

Presenting Today 2 Bob Rowe, President & CEO Brian Bird, Vice President & CFO

3 Forward Looking Statements During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s 10-K which we filed with the SEC on February 17, 2017 and our other public filings with the SEC.

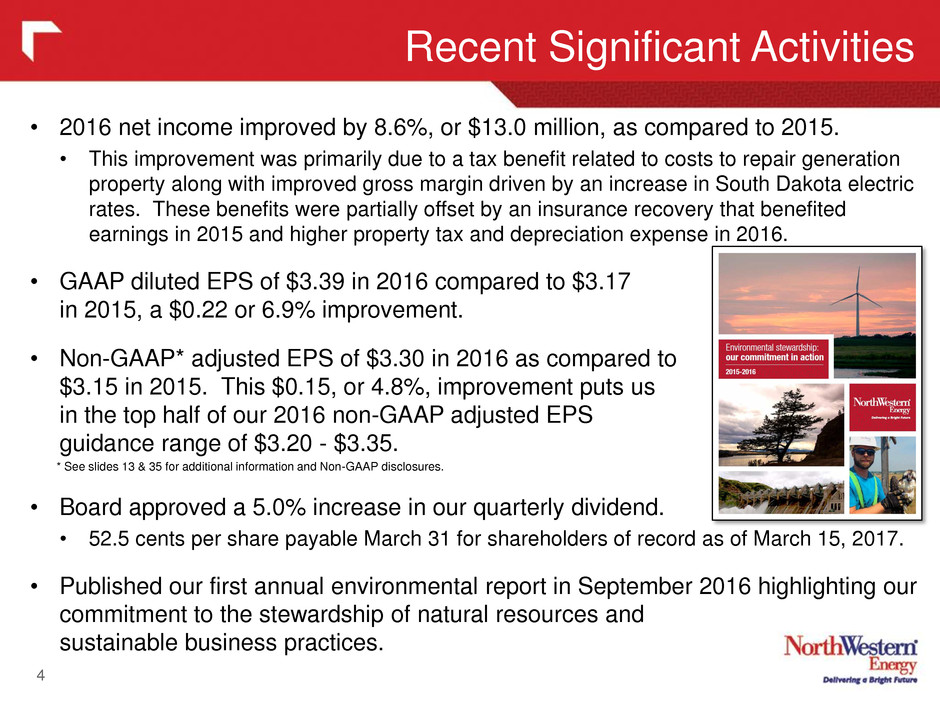

• 2016 net income improved by 8.6%, or $13.0 million, as compared to 2015. • This improvement was primarily due to a tax benefit related to costs to repair generation property along with improved gross margin driven by an increase in South Dakota electric rates. These benefits were partially offset by an insurance recovery that benefited earnings in 2015 and higher property tax and depreciation expense in 2016. • GAAP diluted EPS of $3.39 in 2016 compared to $3.17 in 2015, a $0.22 or 6.9% improvement. • Non-GAAP* adjusted EPS of $3.30 in 2016 as compared to $3.15 in 2015. This $0.15, or 4.8%, improvement puts us in the top half of our 2016 non-GAAP adjusted EPS guidance range of $3.20 - $3.35. • Board approved a 5.0% increase in our quarterly dividend. • 52.5 cents per share payable March 31 for shareholders of record as of March 15, 2017. • Published our first annual environmental report in September 2016 highlighting our commitment to the stewardship of natural resources and sustainable business practices. Recent Significant Activities 4 * See slides 13 & 35 for additional information and Non-GAAP disclosures.

Summary Financial Results (Full Year) 5

6 Gross Margin (Full Year) (dollars in millions) Twelve Months Ended December 31, 2016 2015 Variance Electric $ 678.8 $ 663.1 $ 15.7 2.4% Natural Gas 177.5 178.3 (0.8) (0.4%) Gross Margin $ 856.3 $ 841.4 $ 14.9 1.8% Increase in gross margin due to the following factors: $ 33.5 South Dakota electric rate increase 7.7 Lost revenue adjustment mechanism 6.1 Electric QF adjustment 0.2 Natural gas retail volumes (9.5) MPSC Disallowance (3.6) Electric transmission (2.0) Electric retail volumes (1.5) Hydro generation rates (1.2) Natural gas production rates (1.5) Other $ 28.2 Change in Gross Margin Impacting Net Income $ (16.5) Hydro operations (Kerr conveyance) (8.2) Production tax credits recovered in trackers (1.1) Natural gas gathering fees 12.5 Property taxes recovered in trackers $ (13.3) Change in Gross Margin Offset Within Net Income $ 14.9 Increase in Consolidated Gross Margin

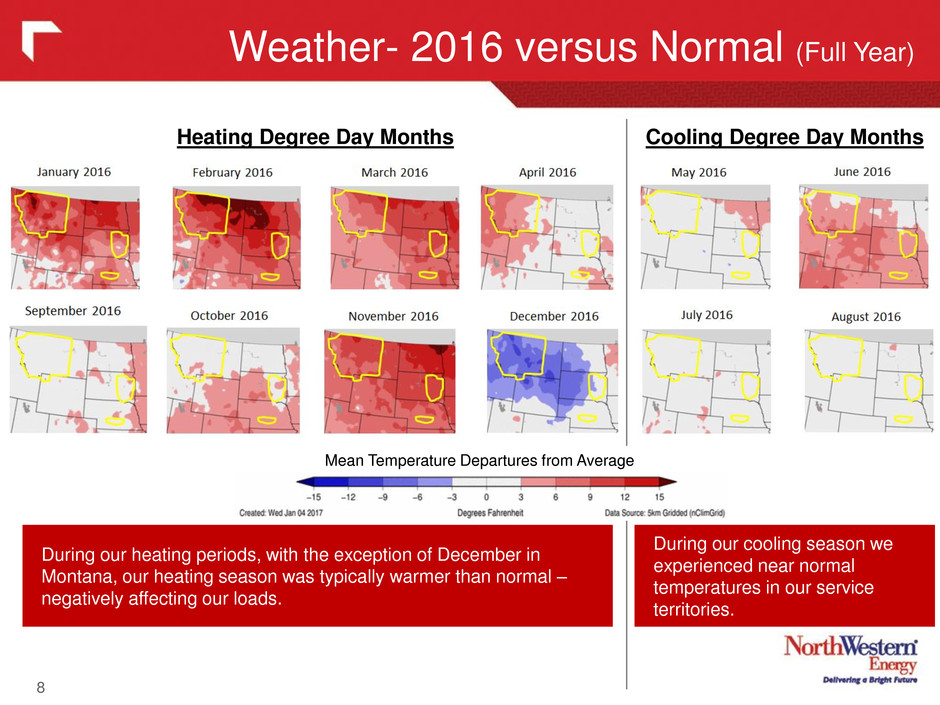

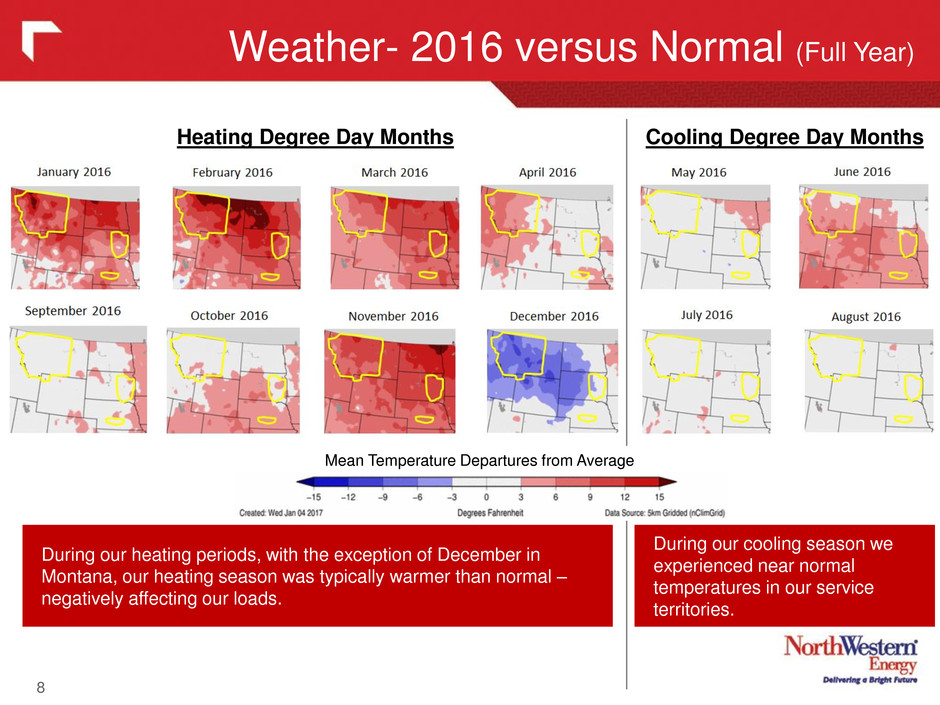

Weather (Full Year) 7 2016 has been one of the warmest years, on record, for our service territory and significantly reduced our retail natural gas sales compared to normal. Montana (3rd warmest) South Dakota (4th warmest) Nebraska (3rd warmest).

Weather- 2016 versus Normal (Full Year) 8 Heating Degree Day Months Cooling Degree Day Months During our heating periods, with the exception of December in Montana, our heating season was typically warmer than normal – negatively affecting our loads. During our cooling season we experienced near normal temperatures in our service territories. Mean Temperature Departures from Average

Operating Expenses (Full Year) 9 Increase in operating expenses due mainly to the following factors: $5.4 million increase in OG&A $ 20.8 Insurance recovery, net 2.7 Employee benefit and compensation costs 2.2 Plant operator costs 1.5 Non-employee directors deferred compensation 0.9 Insurance reserves (15.2) Hydro operations – Kerr conveyance (4.0) Distribution System Infrastructure Project (DSIP) expenses (1.1) Natural gas production gathering expense (1.0) Bad debt expense (1.4) Other $14.7 million increase in property and other taxes due primarily to plant additions and higher estimated property valuations in Montana, offset in part by a $1.3 million decrease from the conveyance of the hydro Kerr project to the CSKT in September 2015. $14.6 million increase in depreciation and depletion expense primarily due to plant additions, including approximately $4.3 million of incremental depreciation associated with the Beethoven wind project acquisition. (dollars in millions) Twelve Months Ended December 31, 2016 2015 Variance Operating, general & admin. $ 302.9 $ 297.5 $ 5.4 1.8% Property and other taxes 148.1 133.4 14.7 11.0% Depreciation and depletion 159.3 144.7 14.6 10.1% Operating Expenses $ 610.3 $ 575.6 $ 34.7 6.0%

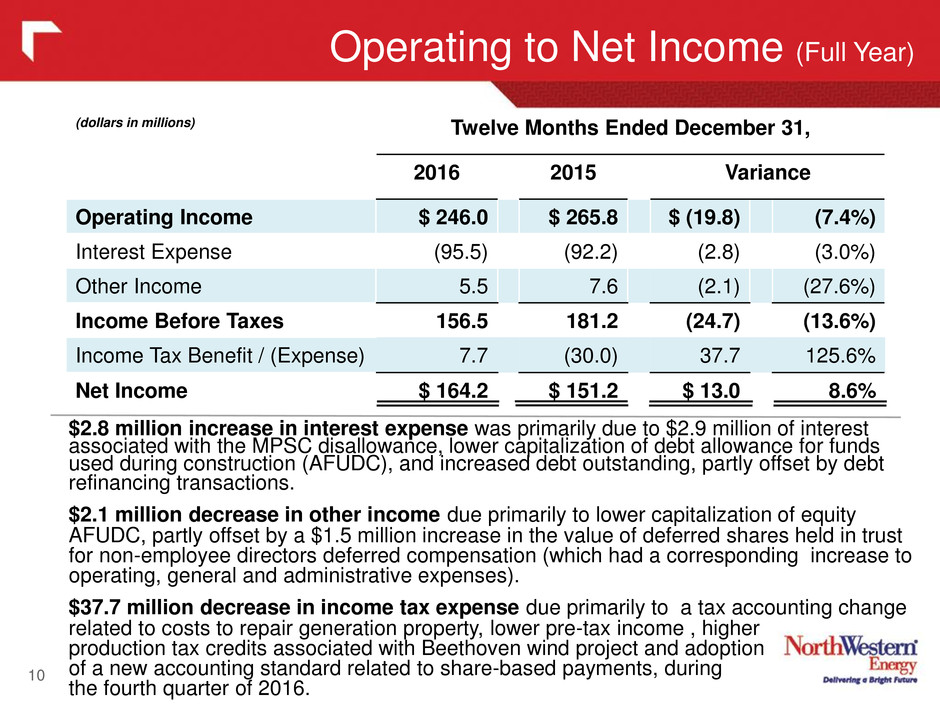

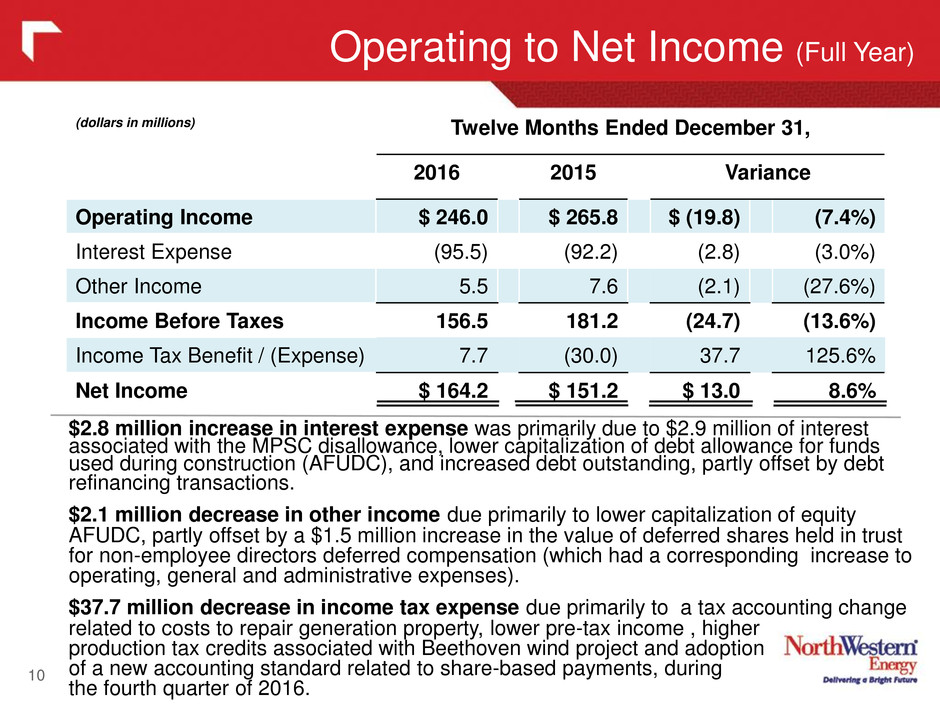

Operating to Net Income (Full Year) 10 $2.8 million increase in interest expense was primarily due to $2.9 million of interest associated with the MPSC disallowance, lower capitalization of debt allowance for funds used during construction (AFUDC), and increased debt outstanding, partly offset by debt refinancing transactions. $2.1 million decrease in other income due primarily to lower capitalization of equity AFUDC, partly offset by a $1.5 million increase in the value of deferred shares held in trust for non-employee directors deferred compensation (which had a corresponding increase to operating, general and administrative expenses). $37.7 million decrease in income tax expense due primarily to a tax accounting change related to costs to repair generation property, lower pre-tax income , higher production tax credits associated with Beethoven wind project and adoption of a new accounting standard related to share-based payments, during the fourth quarter of 2016. (dollars in millions) Twelve Months Ended December 31, 2016 2015 Variance Operating Income $ 246.0 $ 265.8 $ (19.8) (7.4%) Interest Expense (95.5) (92.2) (2.8) (3.0%) Other Income 5.5 7.6 (2.1) (27.6%) Income Before Taxes 156.5 181.2 (24.7) (13.6%) Income Tax Benefit / (Expense) 7.7 (30.0) 37.7 125.6% Net Income $ 164.2 $ 151.2 $ 13.0 8.6%

Balance Sheet 11

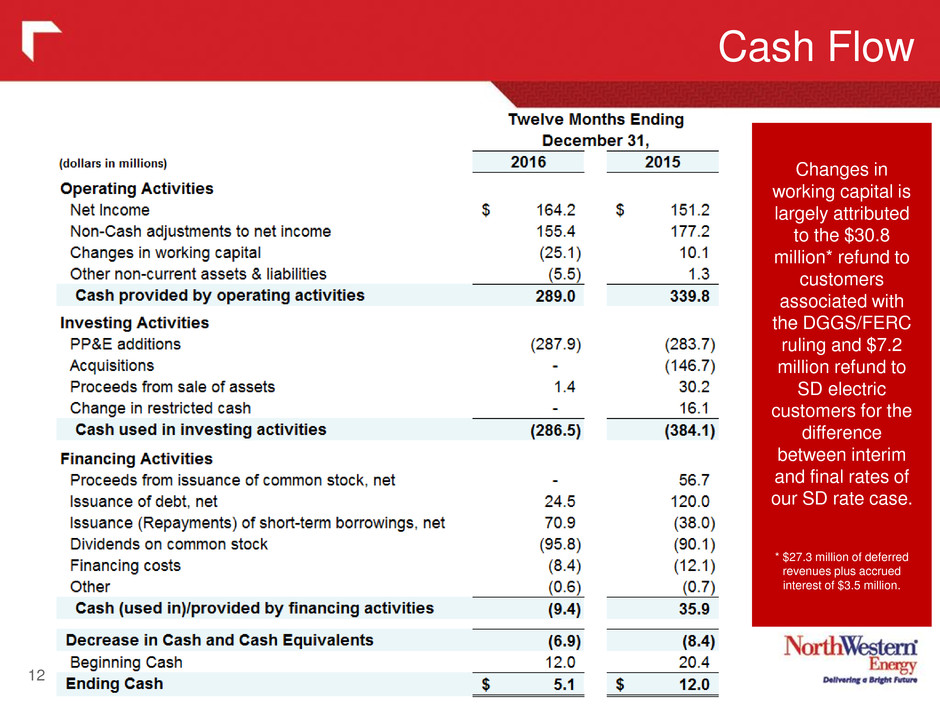

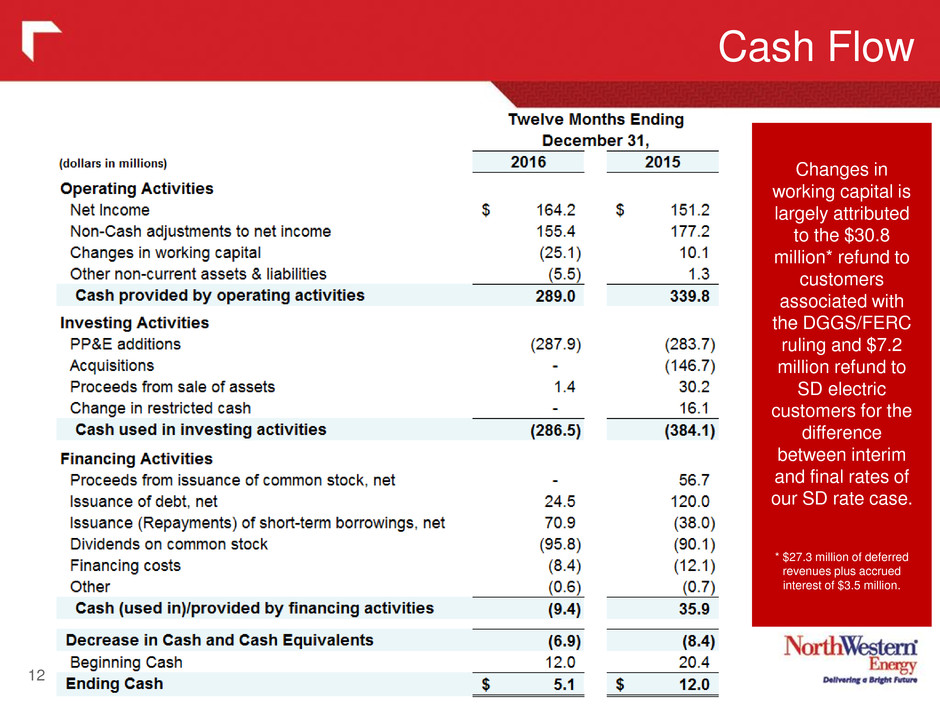

Cash Flow 12 Changes in working capital is largely attributed to the $30.8 million* refund to customers associated with the DGGS/FERC ruling and $7.2 million refund to SD electric customers for the difference between interim and final rates of our SD rate case. * $27.3 million of deferred revenues plus accrued interest of $3.5 million.

Adjusted Earnings (Full Year ‘16 vs ’15) 13 The non-GAAP measures presented in the table above are being shown to reflect significant items that were not contemplated in our original guidance, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP.

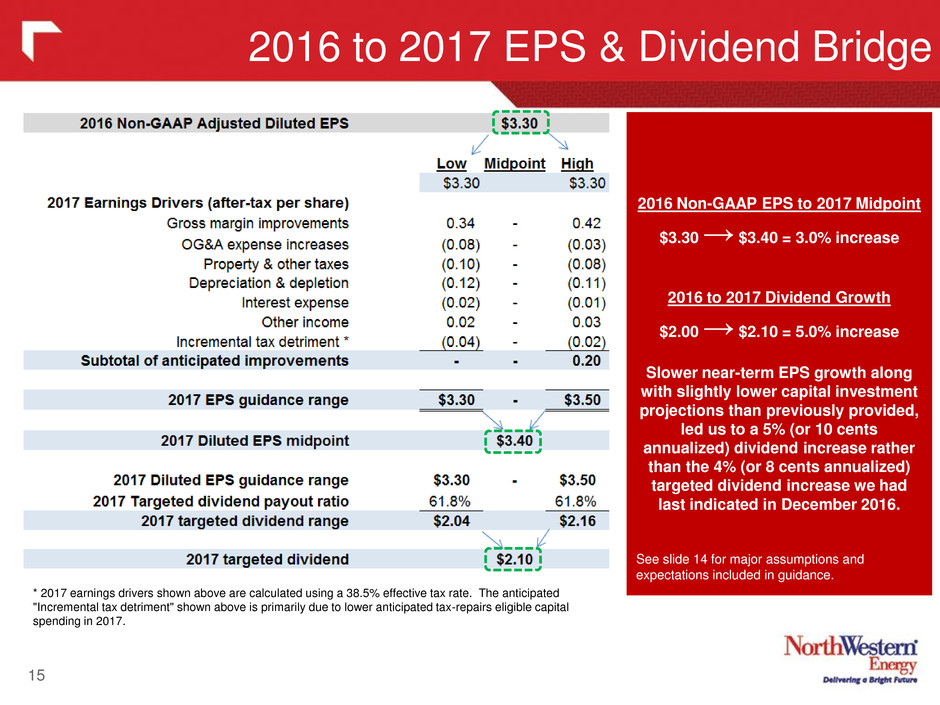

2017 Earnings Guidance 14 NorthWestern affirms 2017 earnings guidance range of $3.30 - $3.50 per diluted share is based upon, but not limited to, the following major assumptions and expectations: • Normal weather in our electric and natural gas service territories; • A consolidated income tax rate of approximately 7% to 11% of pre-tax income; and • Diluted average shares outstanding of approximately 48.5 million. Continued investment in our system to serve our customers and communities is expected to provide a targeted 7-10% total return to our investors through a combination of earnings growth and dividend yield. However in light of recent regulatory headwinds and reduced & delayed generation spending, we anticipate in the near-term to be at the lower end of the 7-10% range. See “Non-GAAP Financial Measures” slide in appendix for “Non-GAAP “Adjusted EPS”. $2.60 - $2.75 $3.10 - $3.30 $3. 0-$3.40 $3.30-$3.50

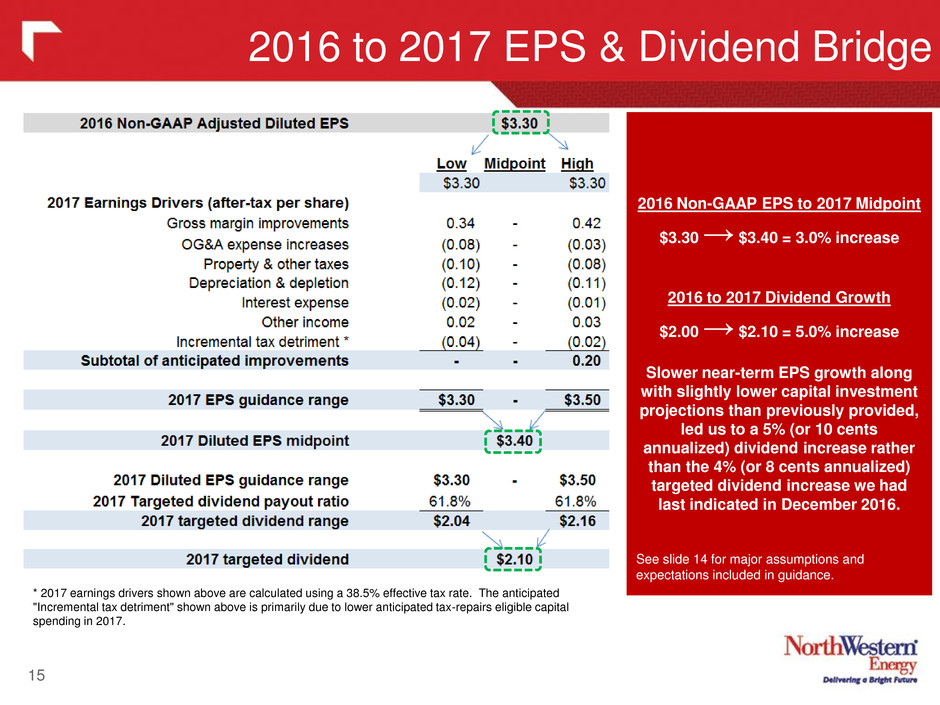

2016 to 2017 EPS & Dividend Bridge 2016 Non-GAAP EPS to 2017 Midpoint $3.30 → $3.40 = 3.0% increase 2016 to 2017 Dividend Growth $2.00 → $2.10 = 5.0% increase Slower near-term EPS growth along with slightly lower capital investment projections than previously provided, led us to a 5% (or 10 cents annualized) dividend increase rather than the 4% (or 8 cents annualized) targeted dividend increase we had last indicated in December 2016. See slide 14 for major assumptions and expectations included in guidance. 15 * 2017 earnings drivers shown above are calculated using a 38.5% effective tax rate. The anticipated "Incremental tax detriment" shown above is primarily due to lower anticipated tax-repairs eligible capital spending in 2017.

Other Significant Achievements in 2016 16 Strong year for safety at NorthWestern • Fewest OSHA recordable events of any year. • Best year for lost time incidents. Record best customer satisfaction scores with JD Power & Associates • Received our best JD Powers overall satisfaction survey score in 2016. Corporate Governance Finalist • NorthWestern’s 2016 proxy statement was recognized as a finalist in 2016 by Corporate Secretary magazine for Best Proxy Statement (Small to Mid Cap). We won the award in 2014. Echo Lake Nordic Trail Recognized for Strong Dividend • In March 2016, NorthWestern Corporation was added to the NASDAQ US Broad Dividend AchieversTM Index, which aims to represent the country’s leading stocks by dividend yield.

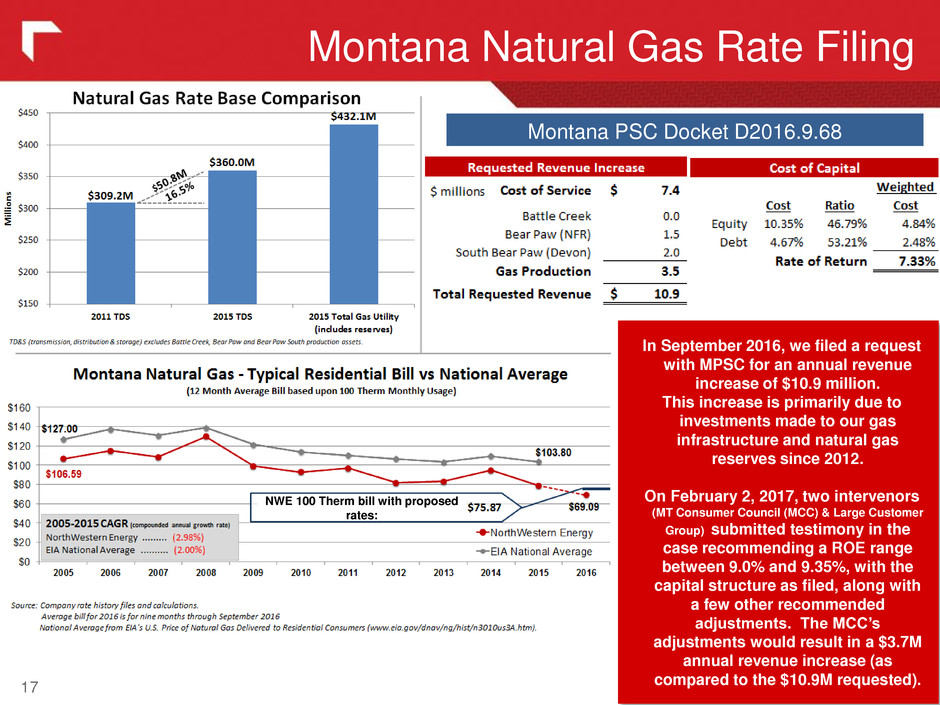

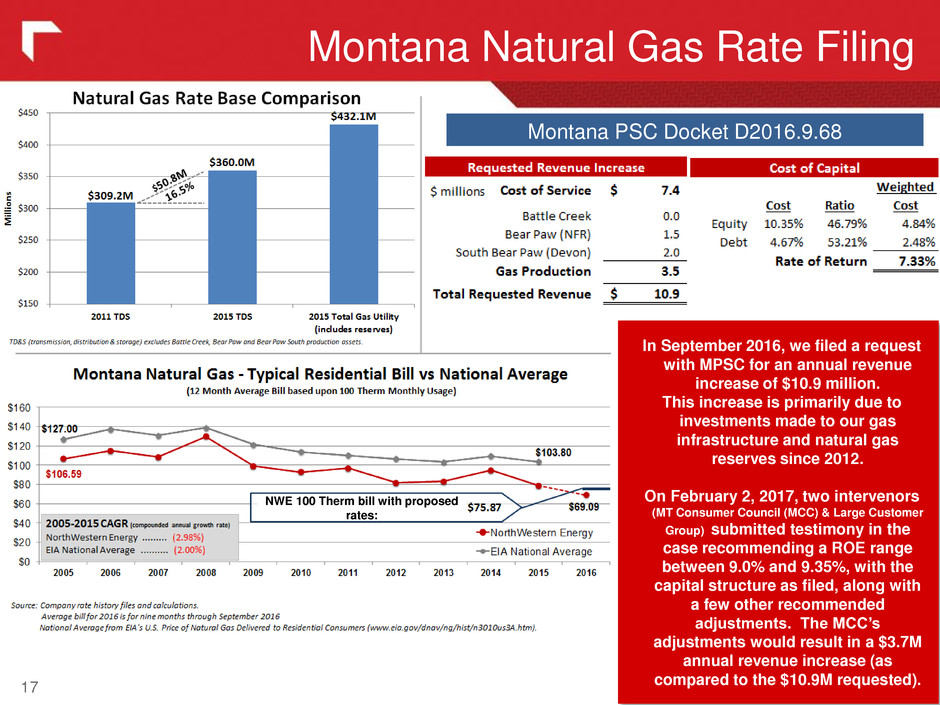

Montana Natural Gas Rate Filing 17 Montana PSC Docket D2016.9.68 In September 2016, we filed a request with MPSC for an annual revenue increase of $10.9 million. This increase is primarily due to investments made to our gas infrastructure and natural gas reserves since 2012. On February 2, 2017, two intervenors (MT Consumer Council (MCC) & Large Customer Group) submitted testimony in the case recommending a ROE range between 9.0% and 9.35%, with the capital structure as filed, along with a few other recommended adjustments. The MCC’s adjustments would result in a $3.7M annual revenue increase (as compared to the $10.9M requested). NWE 100 Therm bill with proposed rates:

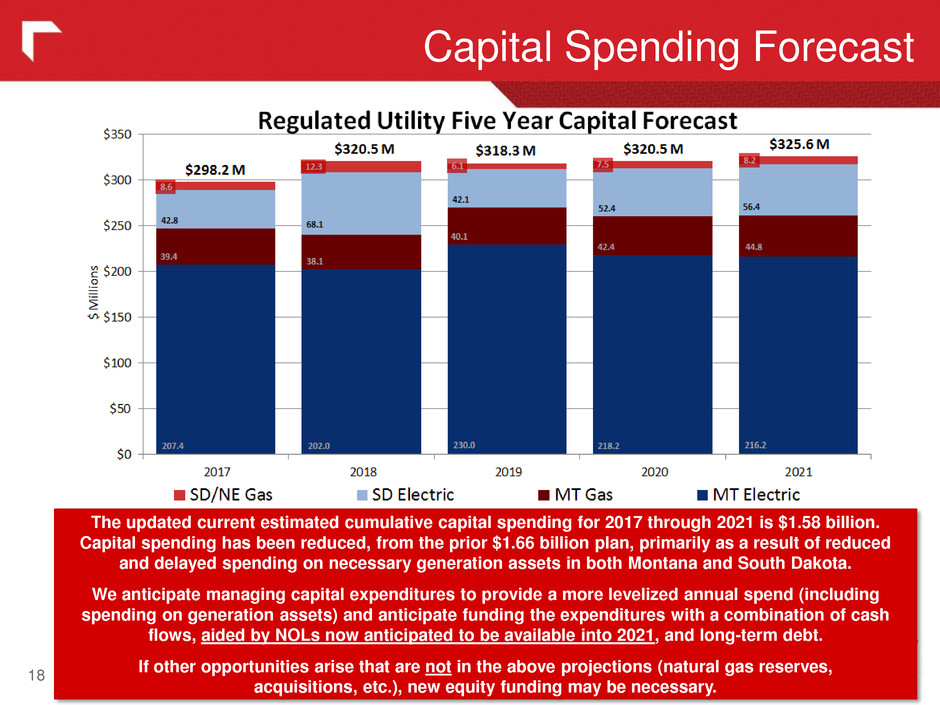

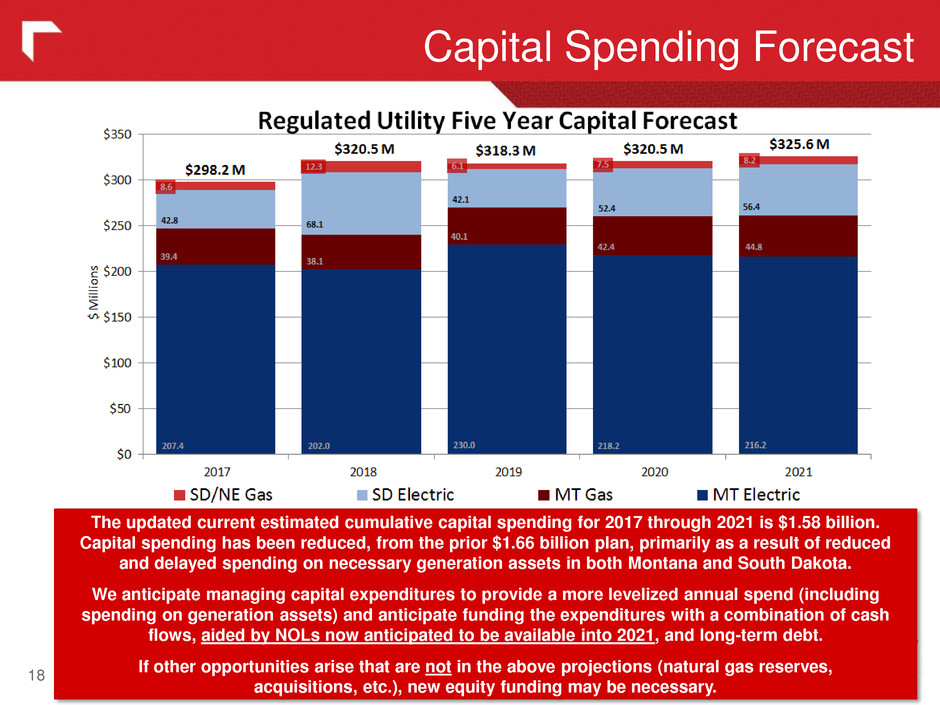

Capital Spending Forecast 18 The updated current estimated cumulative capital spending for 2017 through 2021 is $1.58 billion. Capital spending has been reduced, from the prior $1.66 billion plan, primarily as a result of reduced and delayed spending on necessary generation assets in both Montana and South Dakota. We anticipate managing capital expenditures to provide a more levelized annual spend (including spending on generation assets) and anticipate funding the expenditures with a combination of cash flows, aided by NOLs now anticipated to be available into 2021, and long-term debt. If other opportunities arise that are not in the above projections (natural gas reserves, acquisitions, etc.), new equity funding may be necessary. *

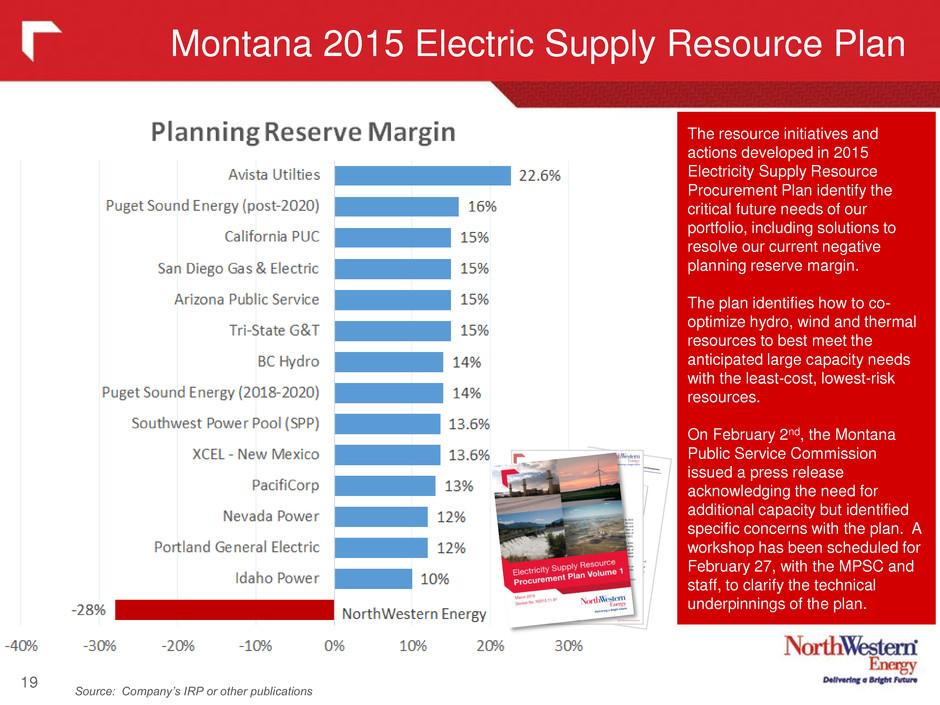

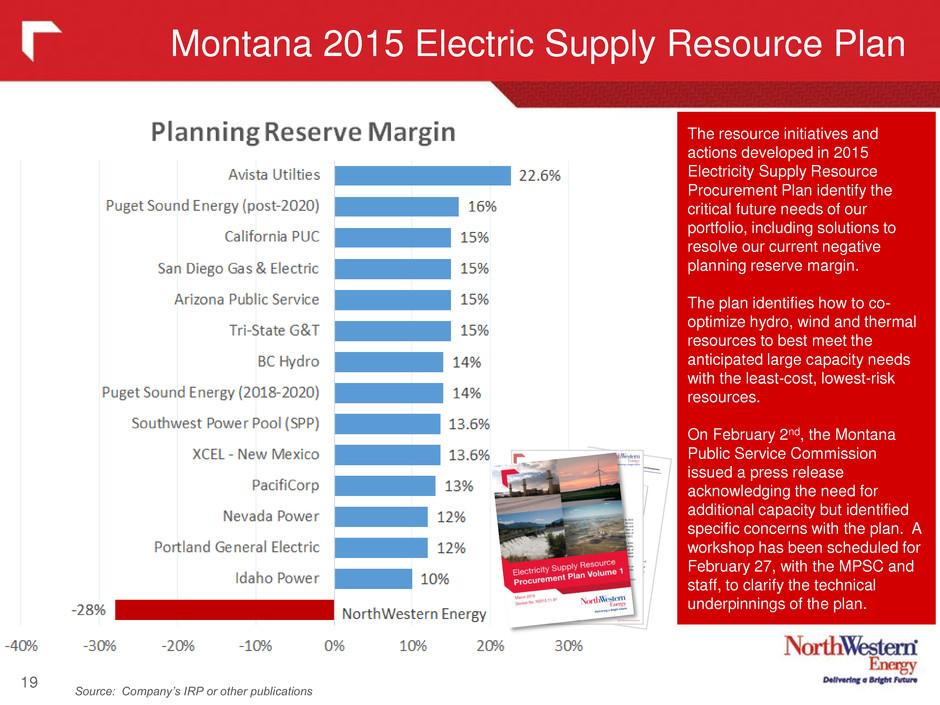

Montana 2015 Electric Supply Resource Plan 19 The resource initiatives and actions developed in 2015 Electricity Supply Resource Procurement Plan identify the critical future needs of our portfolio, including solutions to resolve our current negative planning reserve margin. The plan identifies how to co- optimize hydro, wind and thermal resources to best meet the anticipated large capacity needs with the least-cost, lowest-risk resources. On February 2nd, the Montana Public Service Commission issued a press release acknowledging the need for additional capacity but identified specific concerns with the plan. A workshop has been scheduled for February 27, with the MPSC and staff, to clarify the technical underpinnings of the plan. Spending on the generation assets will be subject to the development of a plan for clear regulatory recovery. Source: Company’s IRP or other publications

Montana 2015 Electric Supply Resource Plan 20 On February 13, 2017 we issued a Request for Proposal (RFP) to partially address NorthWestern’s negative reserve margin. Pacific Northwest planning bodies (PNUCC & NWPPC*) have reaffirmed the expected growing capacity need. NorthWestern is addressing this risk through a deliberate and incremental approach that will include subsequent RFP’s to lessen the risk of a large reliance on markets that are vulnerable to price spikes during capacity shortages. * Pacific Northwest Utilities Conference Committee & Northwest Power and Conservation Council Current Capacity Economically Optimal Portfolio (Current capacity plus identified generation additions)

Conclusion 21 Pure Electric and Gas Utility Solid Utility Foundation Strong Earnings and Cash Flows Attractive Future Growth Prospects Best Practices Corporate Governance

22 Appendix

23 Electric Segment (Full Year)

24 Natural Gas Segment (Full Year)

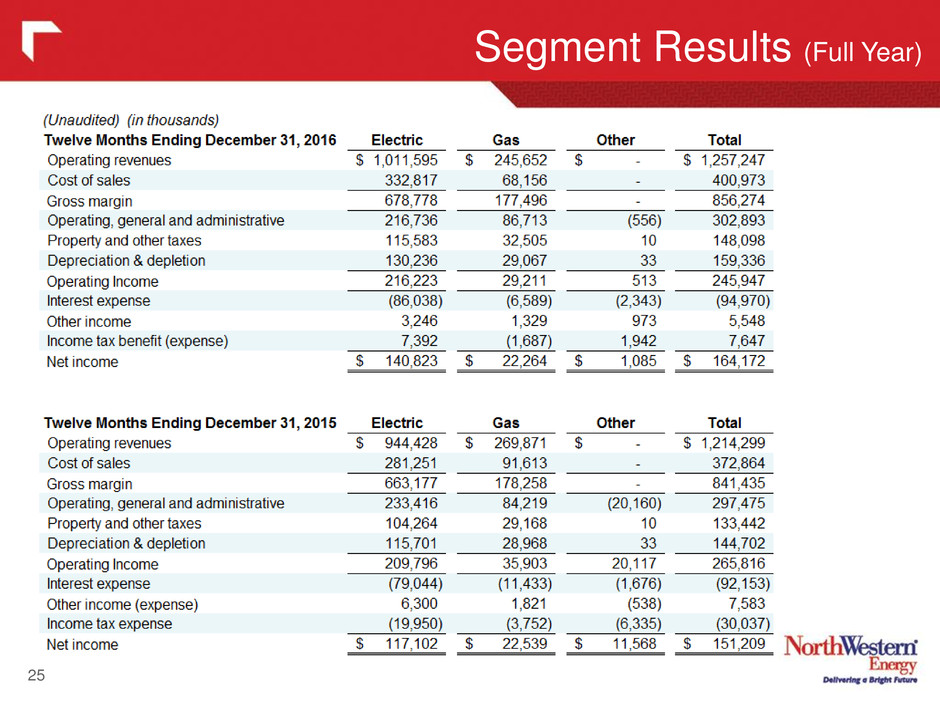

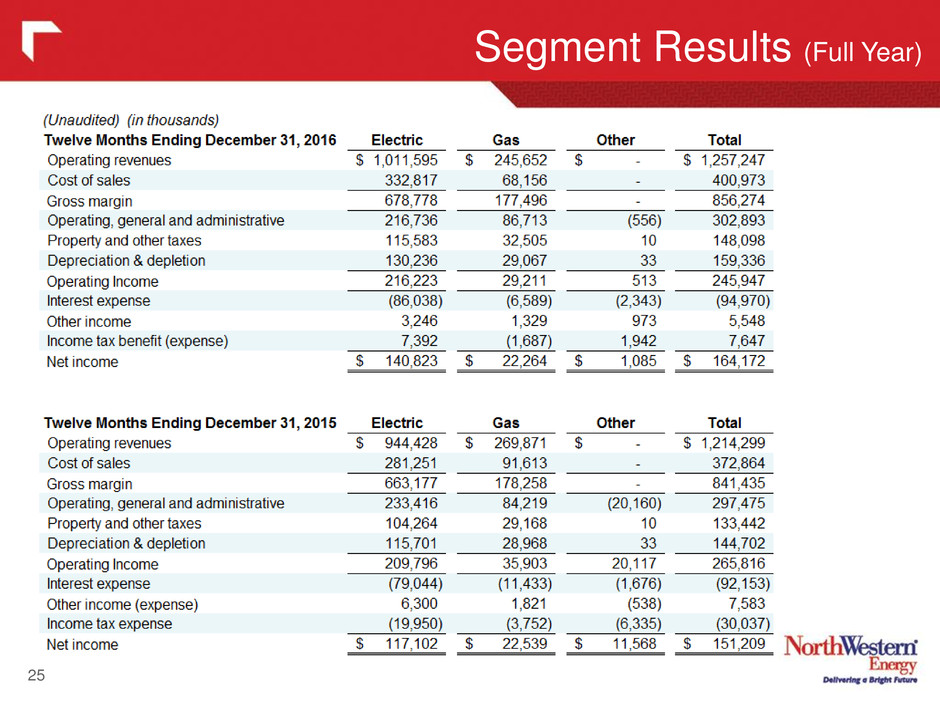

25 Segment Results (Full Year)

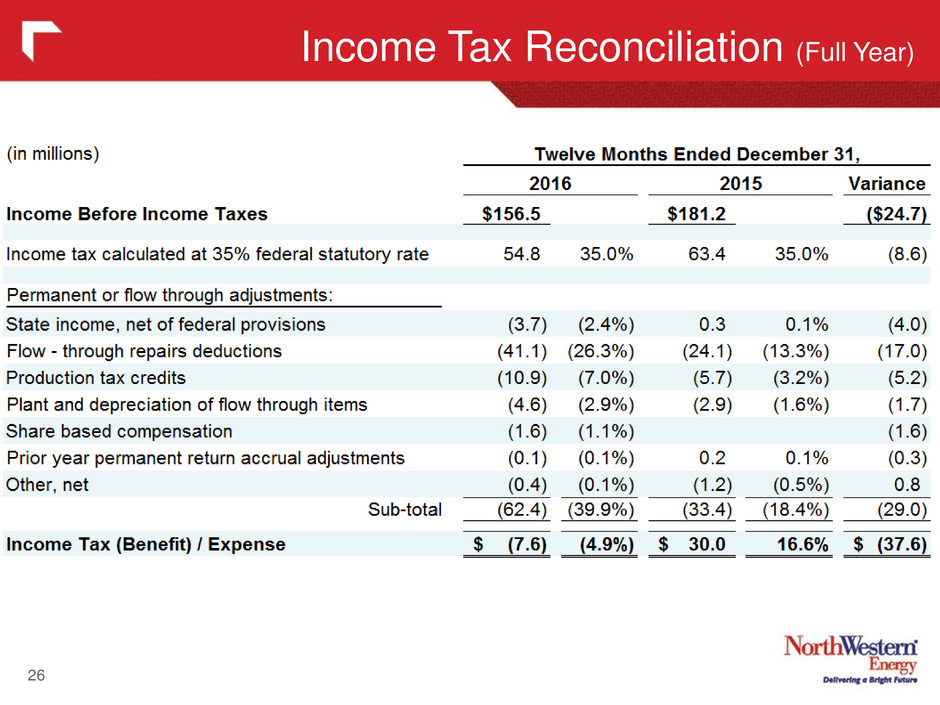

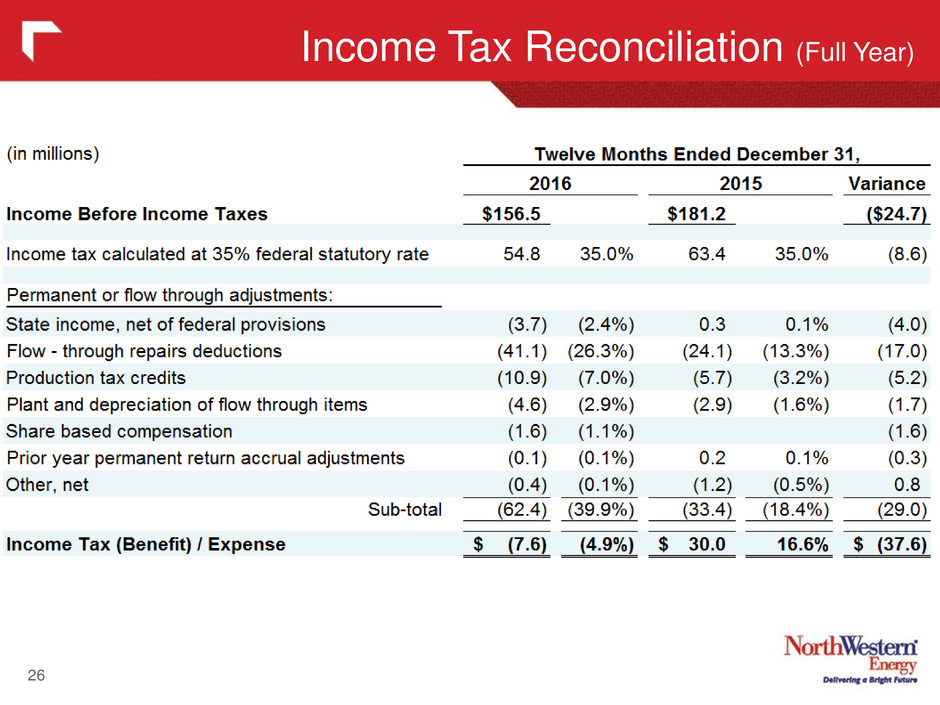

Income Tax Reconciliation (Full Year) 26

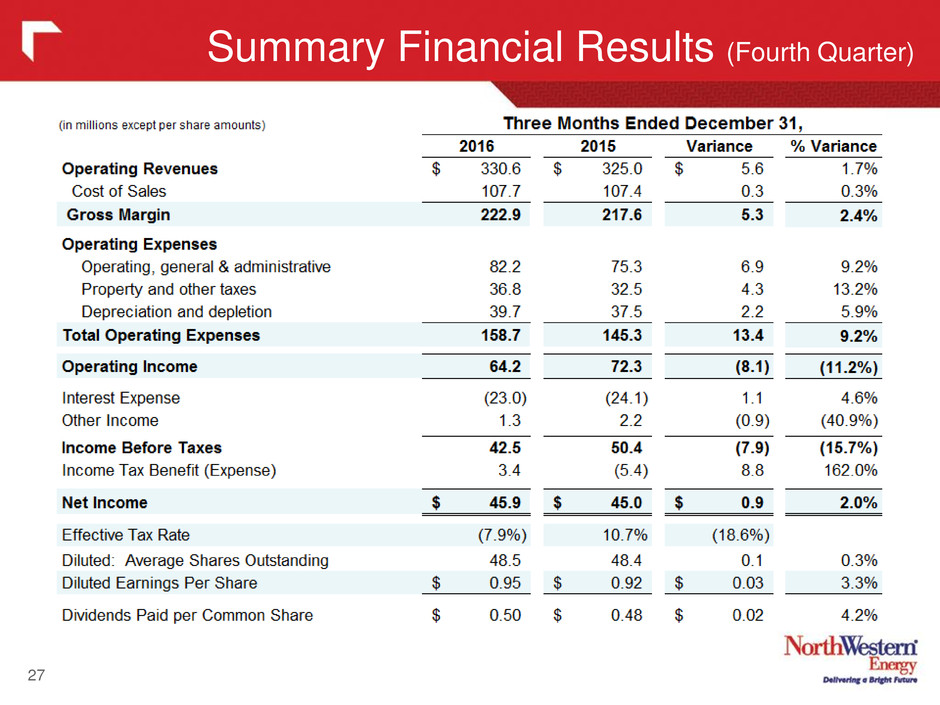

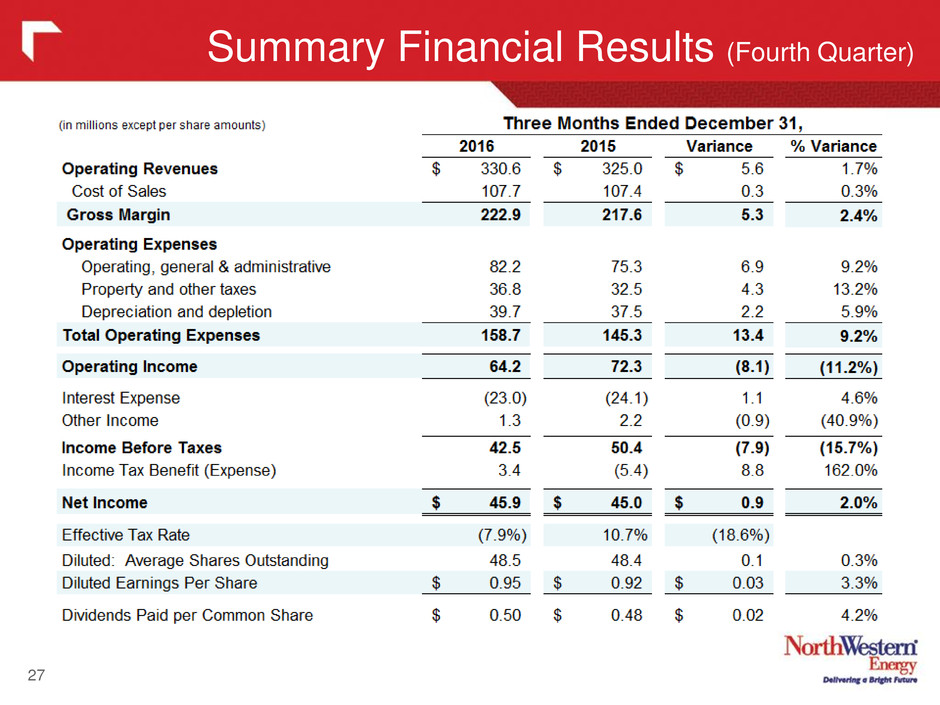

Summary Financial Results (Fourth Quarter) 27

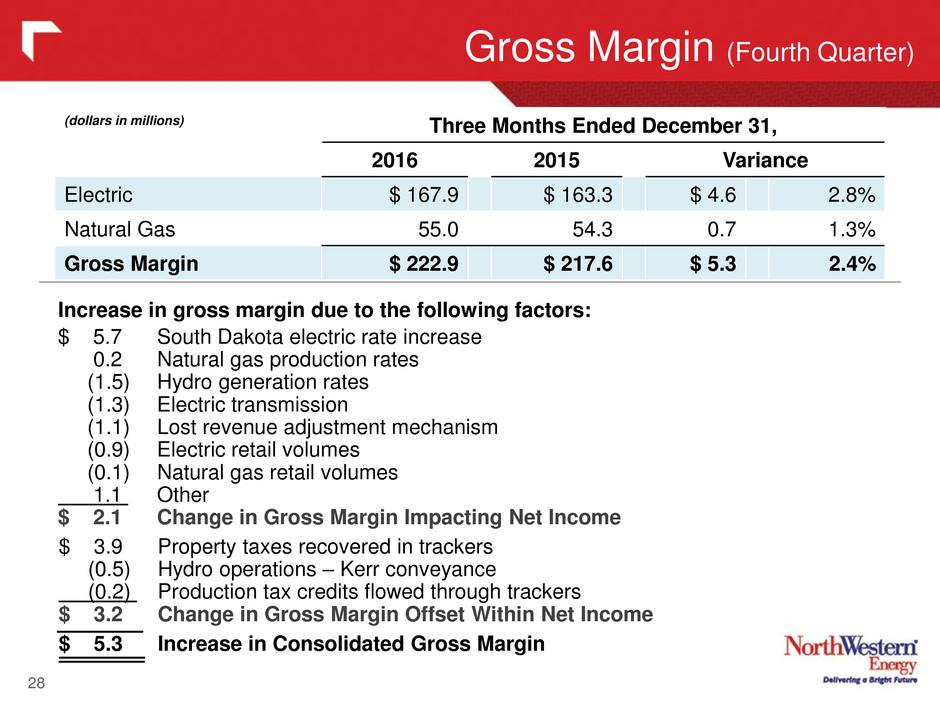

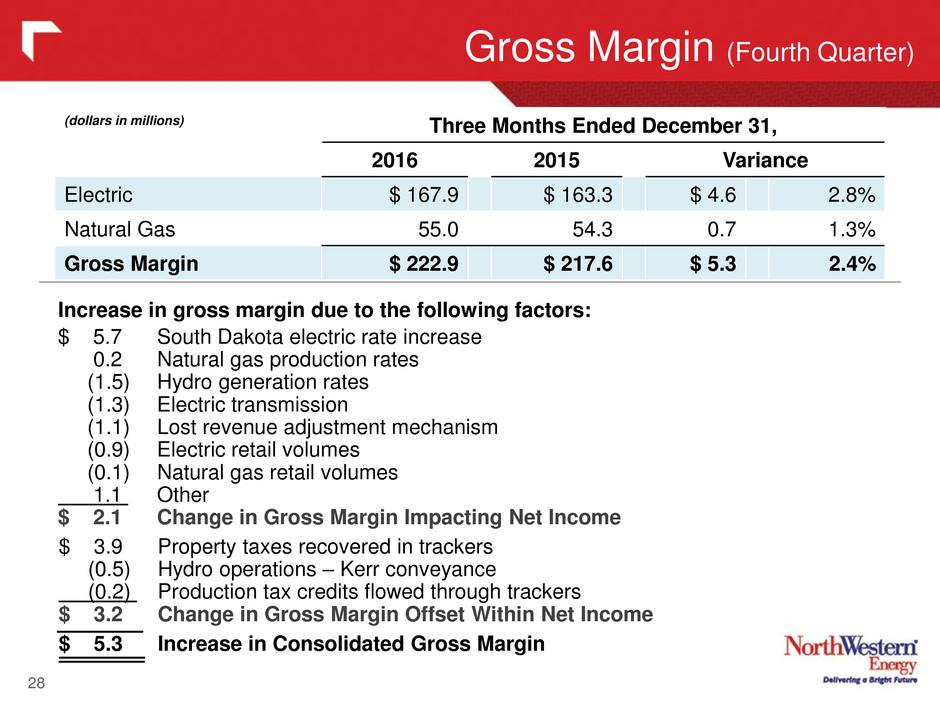

28 Gross Margin (Fourth Quarter) (dollars in millions) Three Months Ended December 31, 2016 2015 Variance Electric $ 167.9 $ 163.3 $ 4.6 2.8% Natural Gas 55.0 54.3 0.7 1.3% Gross Margin $ 222.9 $ 217.6 $ 5.3 2.4% Increase in gross margin due to the following factors: $ 5.7 South Dakota electric rate increase 0.2 Natural gas production rates (1.5) Hydro generation rates (1.3) Electric transmission (1.1) Lost revenue adjustment mechanism (0.9) Electric retail volumes (0.1) Natural gas retail volumes 1.1 Other $ 2.1 Change in Gross Margin Impacting Net Income $ 3.9 Property taxes recovered in trackers (0.5) Hydro operations – Kerr conveyance (0.2) Production tax credits flowed through trackers $ 3.2 Change in Gross Margin Offset Within Net Income $ 5.3 Increase in Consolidated Gross Margin

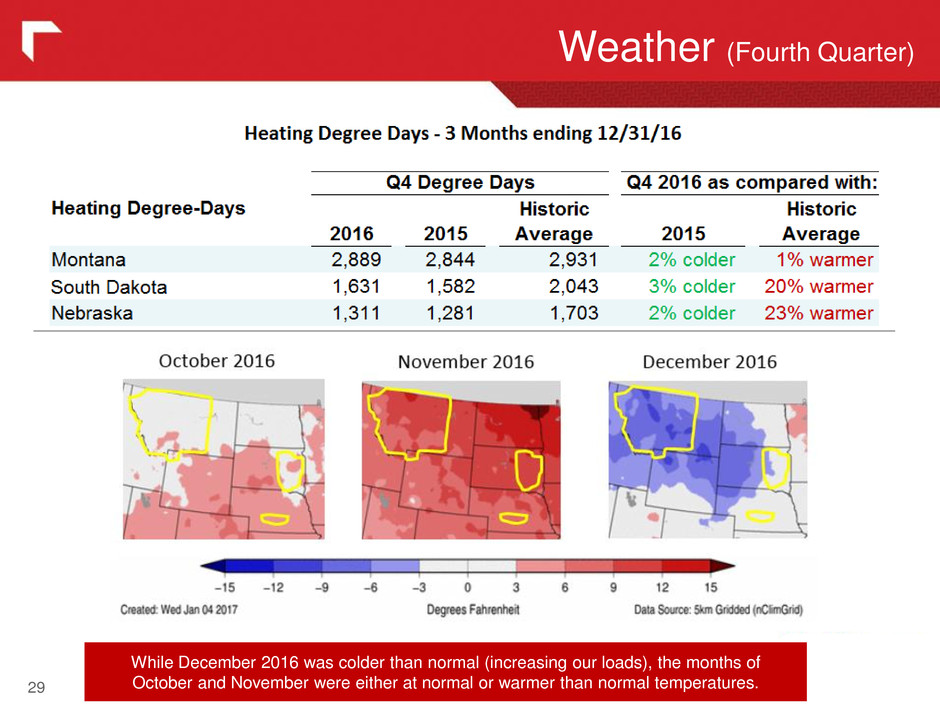

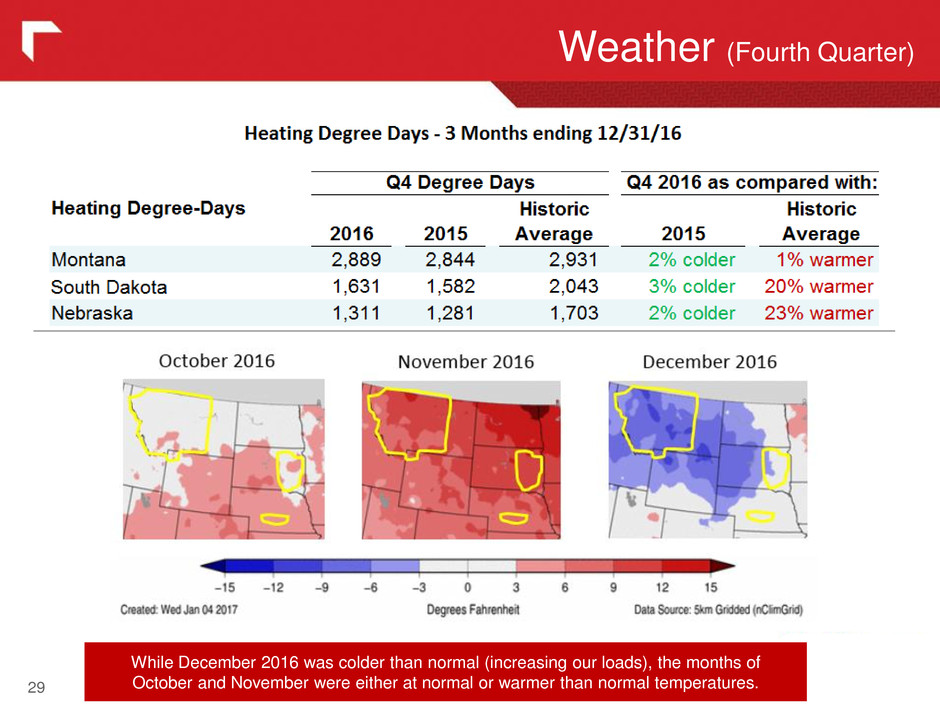

Weather (Fourth Quarter) 29 While December 2016 was colder than normal (increasing our loads), the months of October and November were either at normal or warmer than normal temperatures.

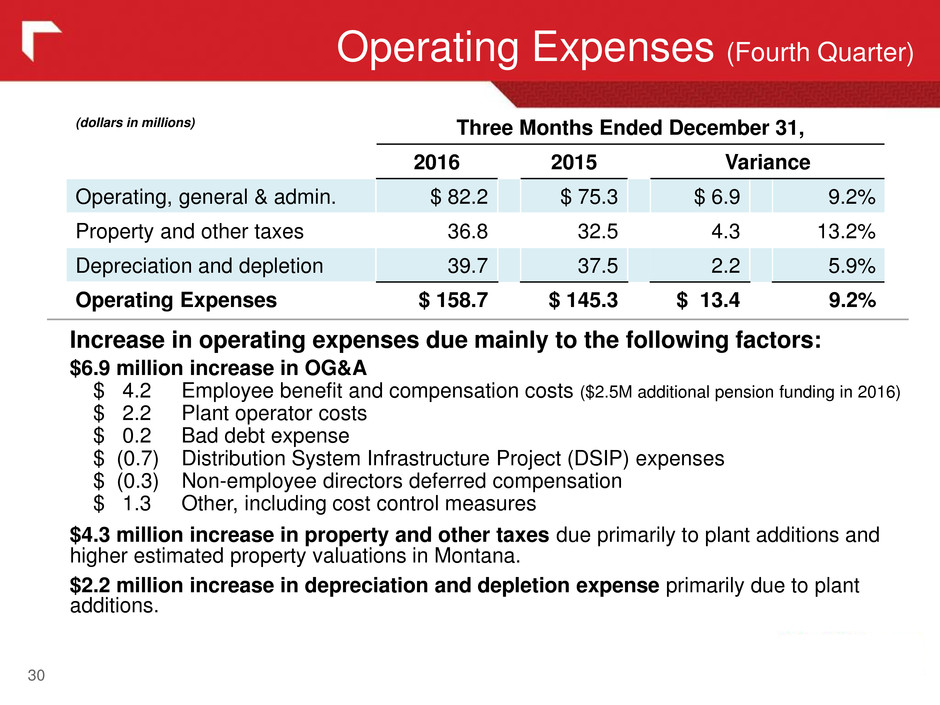

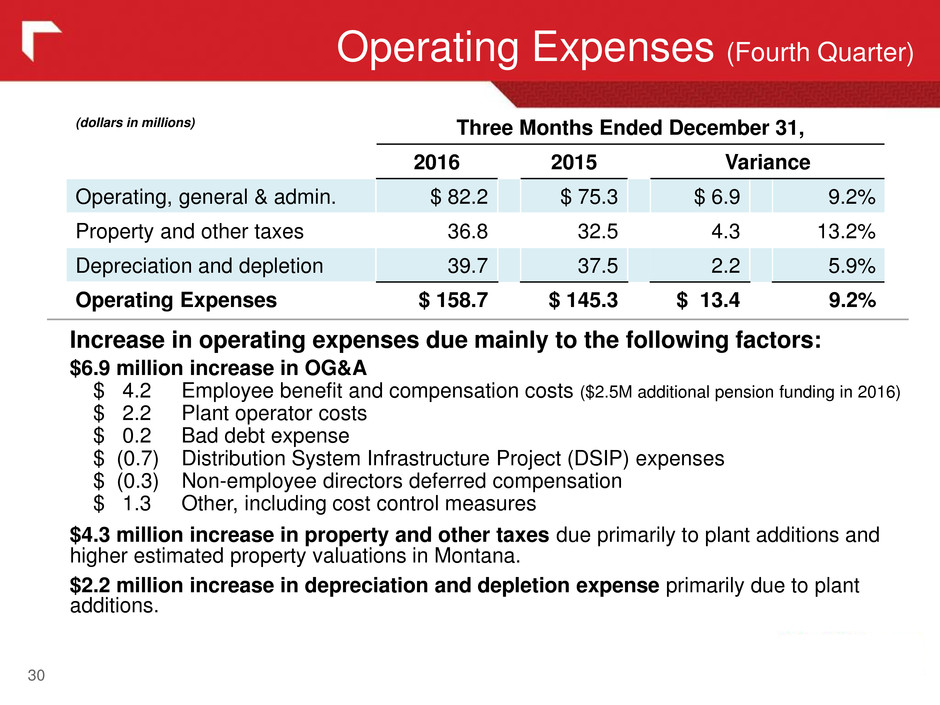

Operating Expenses (Fourth Quarter) 30 Increase in operating expenses due mainly to the following factors: $6.9 million increase in OG&A $ 4.2 Employee benefit and compensation costs ($2.5M additional pension funding in 2016) $ 2.2 Plant operator costs $ 0.2 Bad debt expense $ (0.7) Distribution System Infrastructure Project (DSIP) expenses $ (0.3) Non-employee directors deferred compensation $ 1.3 Other, including cost control measures $4.3 million increase in property and other taxes due primarily to plant additions and higher estimated property valuations in Montana. $2.2 million increase in depreciation and depletion expense primarily due to plant additions. (dollars in millions) Three Months Ended December 31, 2016 2015 Variance Operating, general & admin. $ 82.2 $ 75.3 $ 6.9 9.2% Property and other taxes 36.8 32.5 4.3 13.2% Depreciation and depletion 39.7 37.5 2.2 5.9% Operating Expenses $ 158.7 $ 145.3 $ 13.4 9.2%

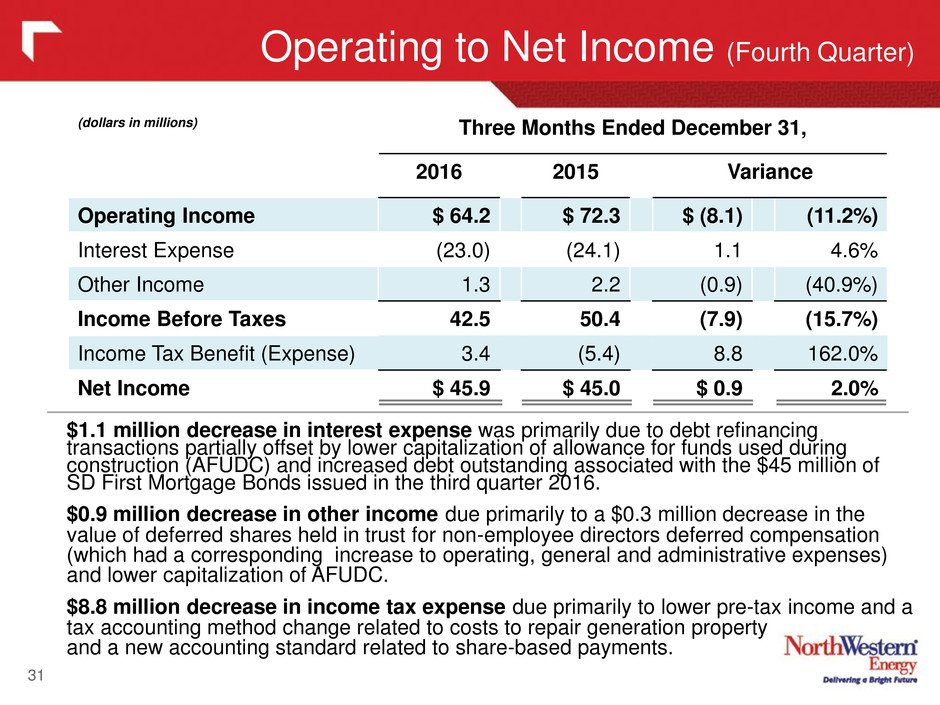

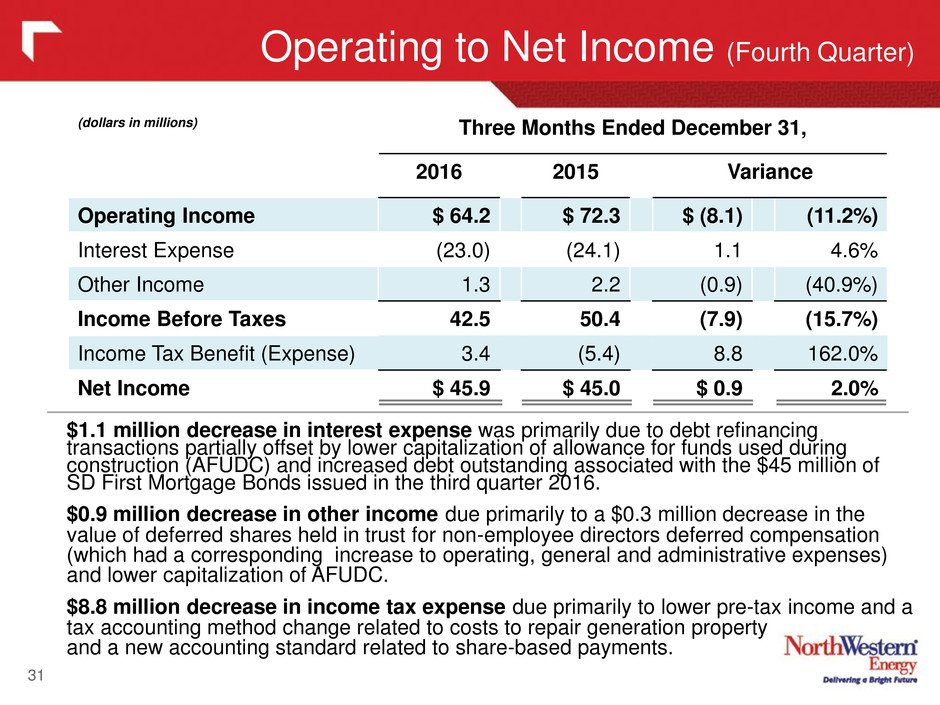

Operating to Net Income (Fourth Quarter) 31 $1.1 million decrease in interest expense was primarily due to debt refinancing transactions partially offset by lower capitalization of allowance for funds used during construction (AFUDC) and increased debt outstanding associated with the $45 million of SD First Mortgage Bonds issued in the third quarter 2016. $0.9 million decrease in other income due primarily to a $0.3 million decrease in the value of deferred shares held in trust for non-employee directors deferred compensation (which had a corresponding increase to operating, general and administrative expenses) and lower capitalization of AFUDC. $8.8 million decrease in income tax expense due primarily to lower pre-tax income and a tax accounting method change related to costs to repair generation property and a new accounting standard related to share-based payments. (dollars in millions) Three Months Ended December 31, 2016 2015 Variance Operating Income $ 64.2 $ 72.3 $ (8.1) (11.2%) Interest Expense (23.0) (24.1) 1.1 4.6% Other Income 1.3 2.2 (0.9) (40.9%) Income Before Taxes 42.5 50.4 (7.9) (15.7%) Income Tax Benefit (Expense) 3.4 (5.4) 8.8 162.0% Net Income $ 45.9 $ 45.0 $ 0.9 2.0%

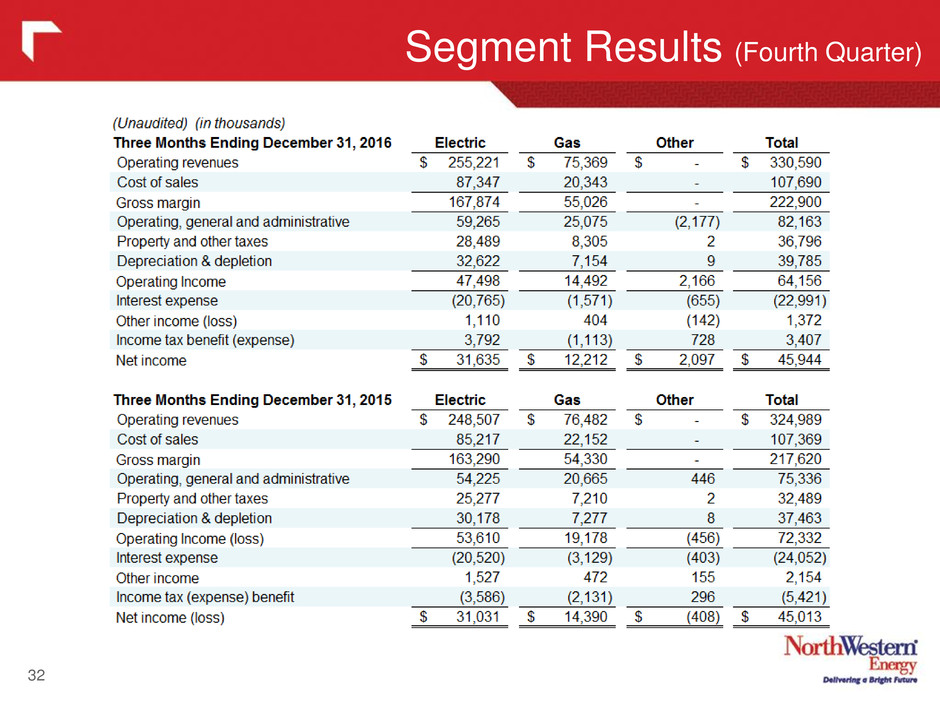

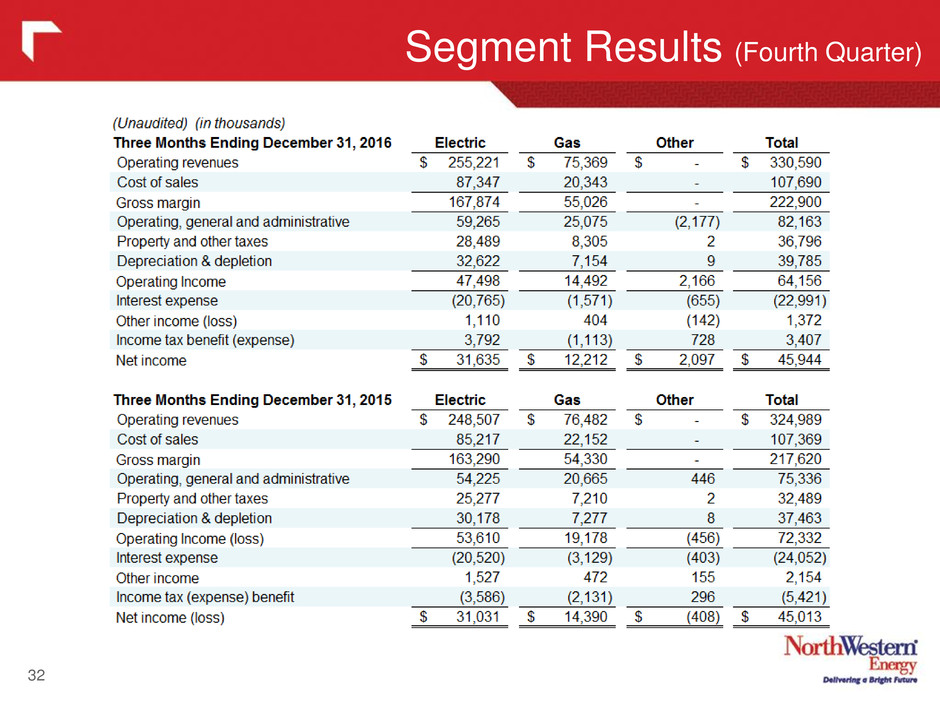

32 Segment Results (Fourth Quarter)

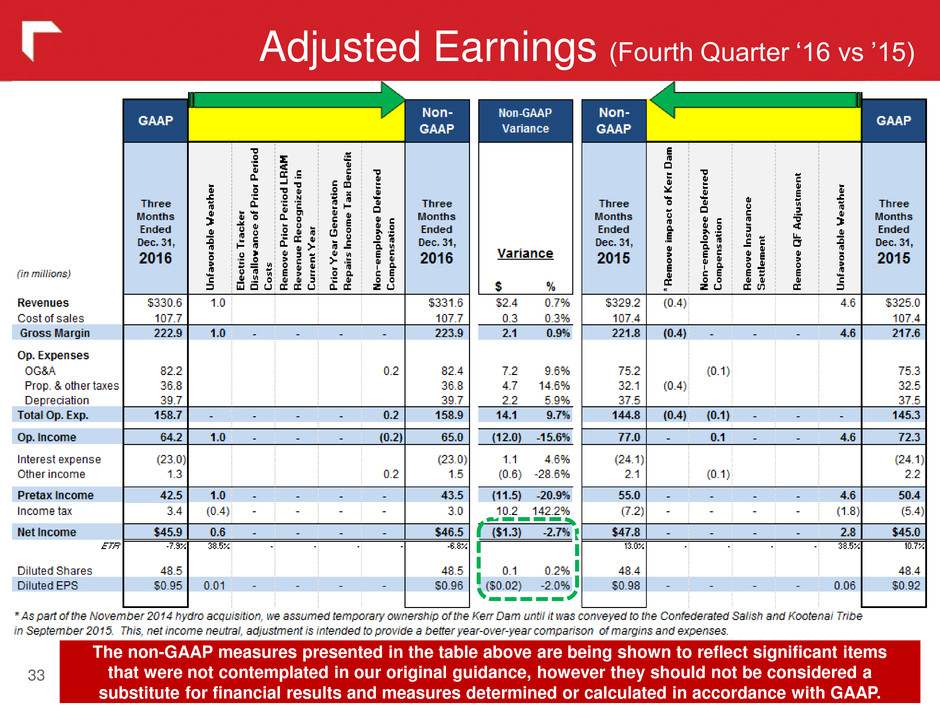

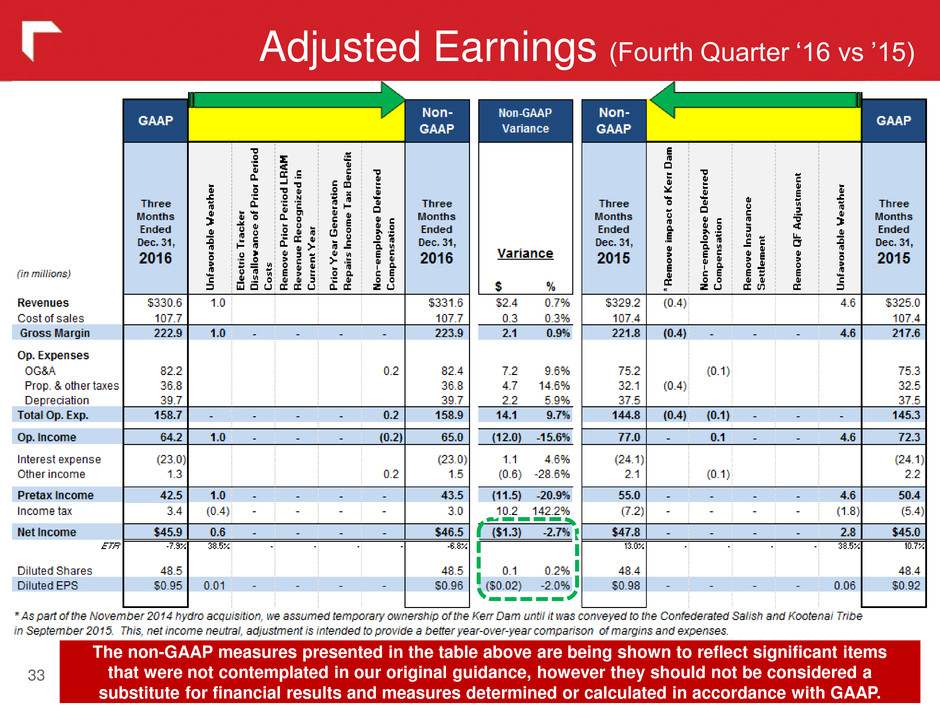

Adjusted Earnings (Fourth Quarter ‘16 vs ’15) 33 The non-GAAP measures presented in the table above are being shown to reflect significant items that were not contemplated in our original guidance, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP.

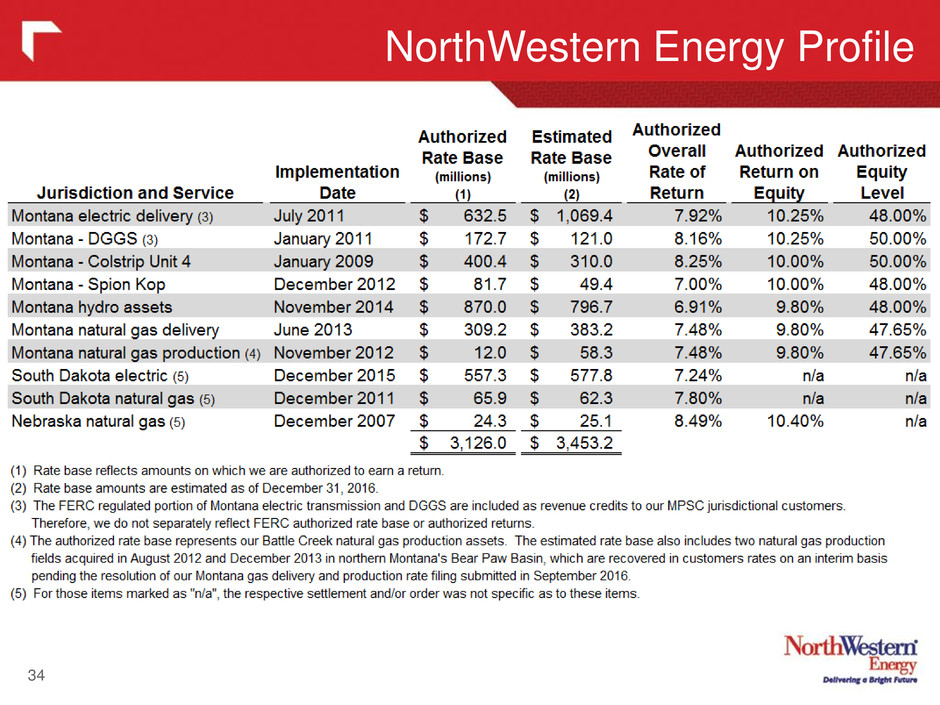

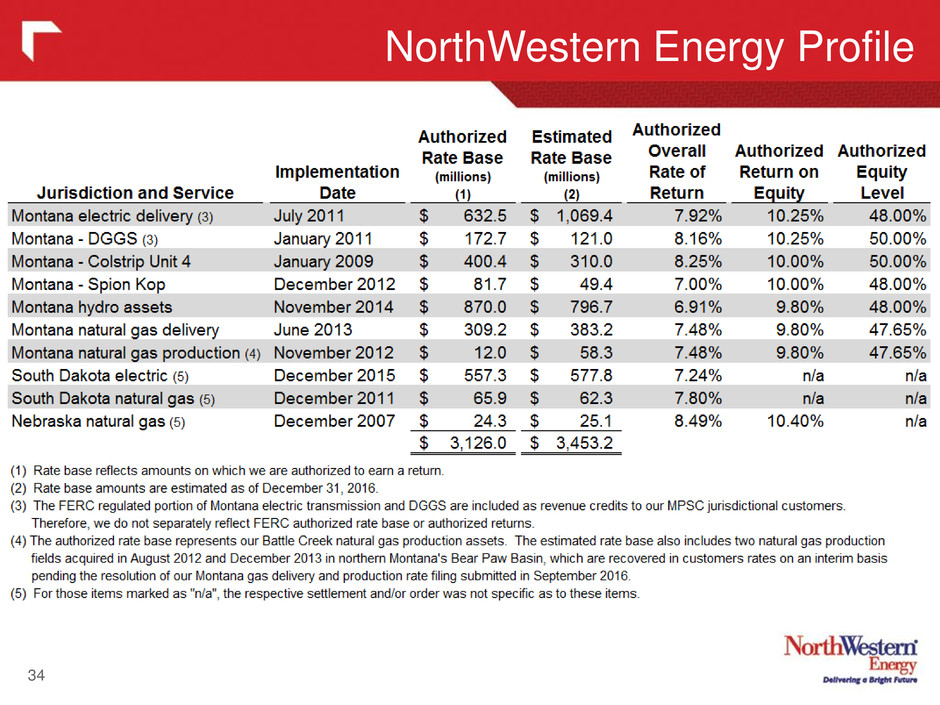

NorthWestern Energy Profile 34

These materials include financial information prepared in accordance with GAAP, as well as other financial measures, such as Gross Margin and Adjusted Diluted EPS, that are considered “non-GAAP financial measures.” Generally, a non- GAAP financial measure is a numerical measure of a company's financial performance, financial position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. Gross Margin (Revenues less Cost of Sales) is a non-GAAP financial measure due to the exclusion of depreciation from the measure. Gross Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs. Adjusted Diluted EPS is another non-GAAP measure. The Company believes the presentation of Adjusted Diluted EPS is more representative of our normal earnings than the GAAP EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures. Non-GAAP Financial Measures 35

36