Sidoti Virtual Conference September 2022 8-K September 22, 2022

2 Forward Looking Statements Forward Looking Statements During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s most recent Form 10-K and 10-Q along with other public filings with the SEC. NorthWestern Corporation dba: NorthWestern Energy Ticker: NWE (Nasdaq) www.northwesternenergy.com Corporate Office 3010 West 69th Street Sioux Falls, SD 57108 (605) 978-2900 Investor Relations Officer Travis Meyer 605-978-2967 travis.meyer@northwestern.com Company Information O’Dell Creek - Madison River Valley - Montana Boulder River in Montana

NWE - An Investment for the Long Term 3 • 100% pure electric & natural gas utility business with over 100 years of operating history • Solid economic indicators in service territory • Diverse electric supply portfolio ~56% hydro, wind & solar Black Eagle dam Pure Electric & Gas Utility Solid Utility Foundation Strong Earnings & Cash Flow Attractive Future Growth Prospects Financial Goals & Metrics Best Practices Corporate Governance • Residential electric & gas rates below national average • Solid system reliability • Low leaks per 100 miles of pipe • Solid JD Power Overall Customer Satisfaction scores • Disciplined maintenance capital investment program to ensure safety and reliability • Significant investment in renewable resources (hydro & wind) will provide long-term energy supply pricing stability for the benefit of customers for many years to come • Further opportunity for energy supply investment to meet significant capacity shortfalls • Consistent track record of earnings & dividend growth • Strong cash flows (aided by Production Tax Credit carryforwards) • Solid balance sheet & investment grade credit ratings • Target debt to capitalization ratio of 50%-55% with liquidity of $100 million or greater • Target 3%-6% EPS growth plus dividend yield to provide competitive total return • Target dividend long-term payout ratio of 60%-70% 5th Best Governance Score

About NorthWestern 4 Montana Operations Electric 391,400 customers 24,996 miles – transmission & distribution lines 876 MW maximum capacity owned power generation Natural Gas 206,600 customers 7,111 miles of transmission and distribution pipeline 17.75 Bcf of gas storage capacity Own 38.8 Bcf of proven natural gas reserves Nebraska Operations Natural Gas 42,800 customers 813 miles of distribution pipeline Data as of 12/31/2021 South Dakota Operations Electric 64,200 customers 3,628 miles – transmission & distribution lines 395 MW nameplate owned power generation Natural Gas 48,600 customers 1,759 miles of transmission and distribution pipeline

A Diversified Electric and Gas Utility 5 NorthWestern’s ‘80/20’ rules: Approximately 80% Electric and 80% Montana. Nearly $4.2 billion of rate base investment to serve our customers Data as reported in our 2021 10-K (1) Utility Margin is a non-GAAP Measure. See appendix for additional disclosure. (1) (1)

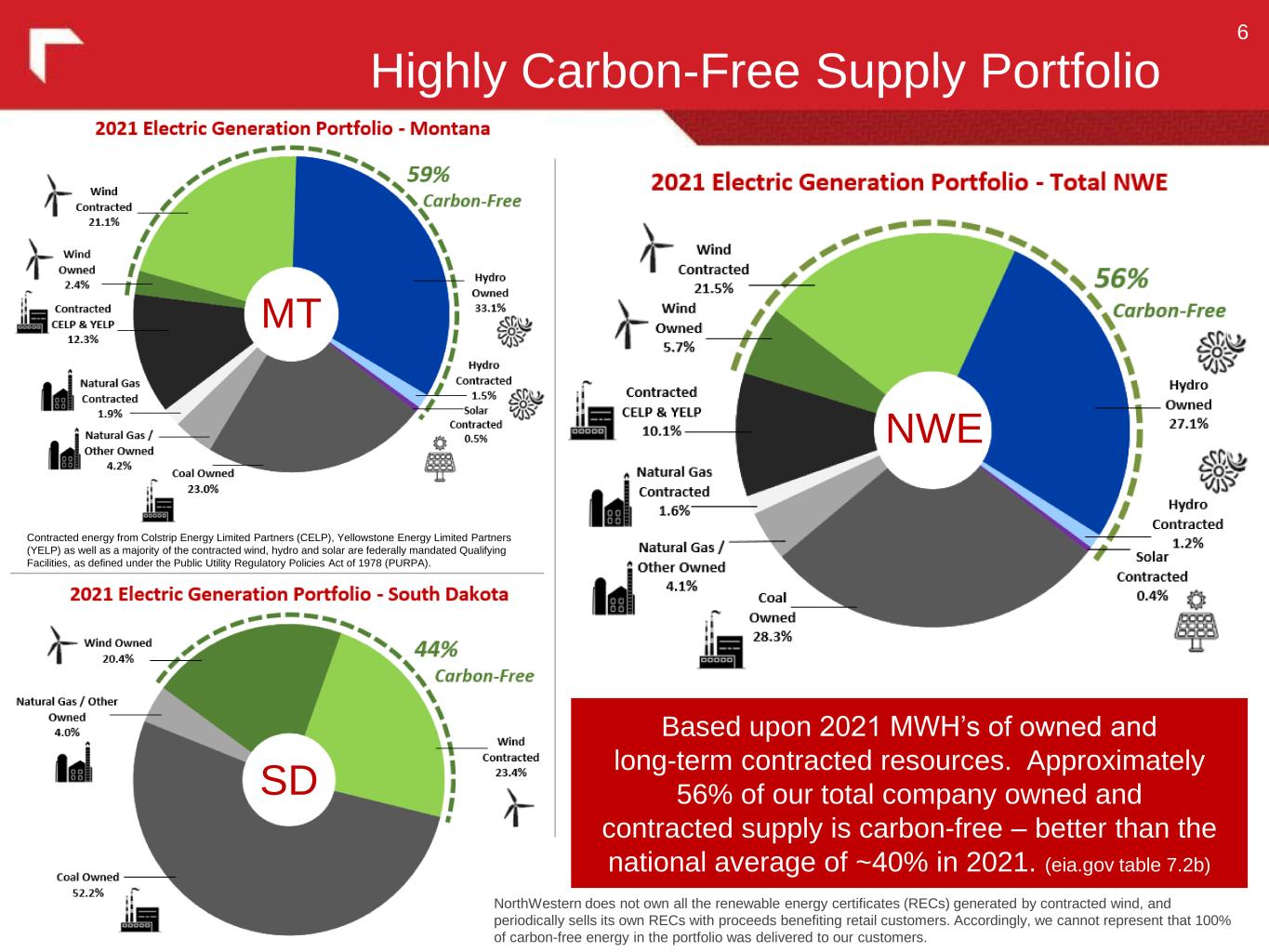

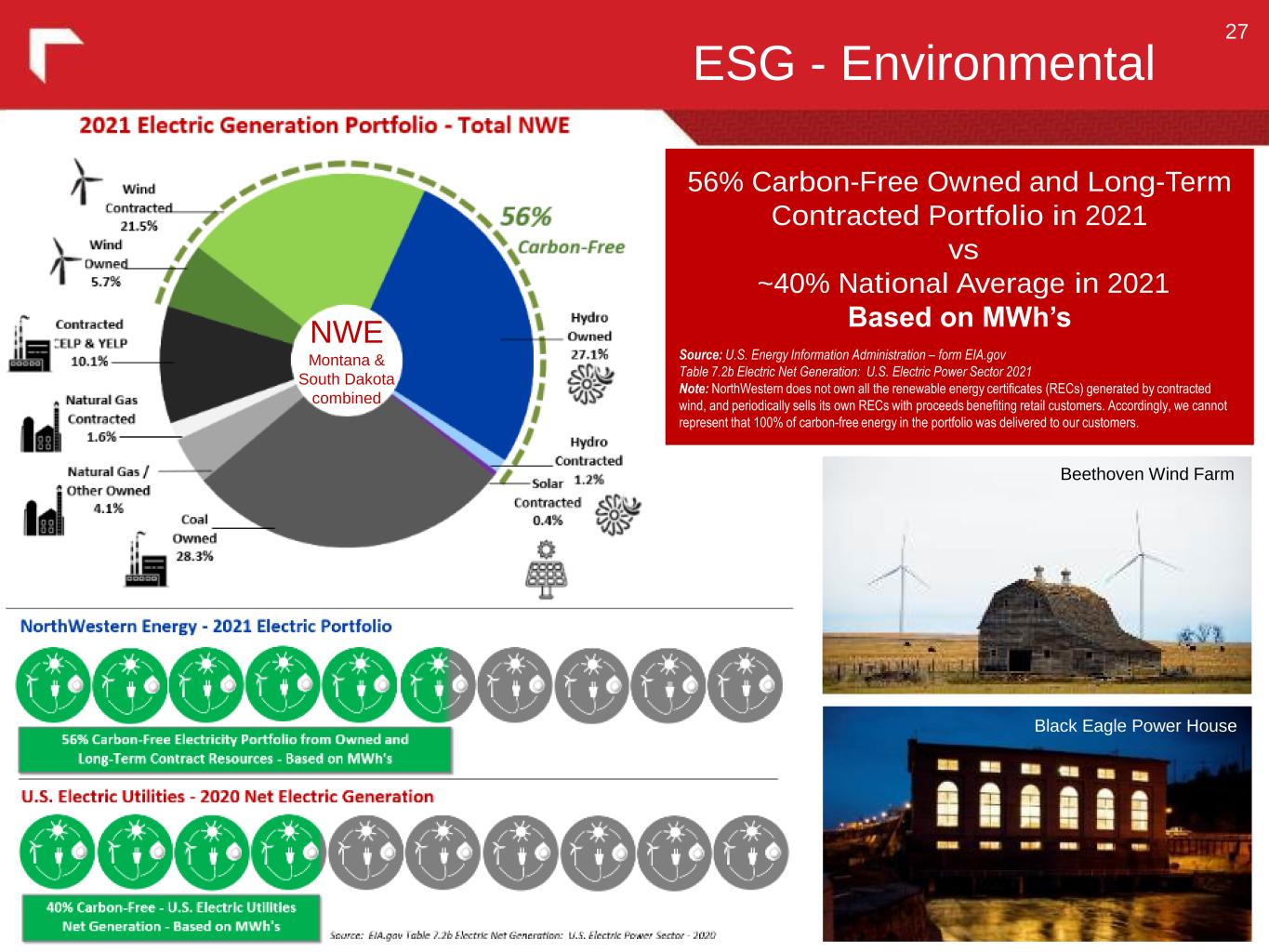

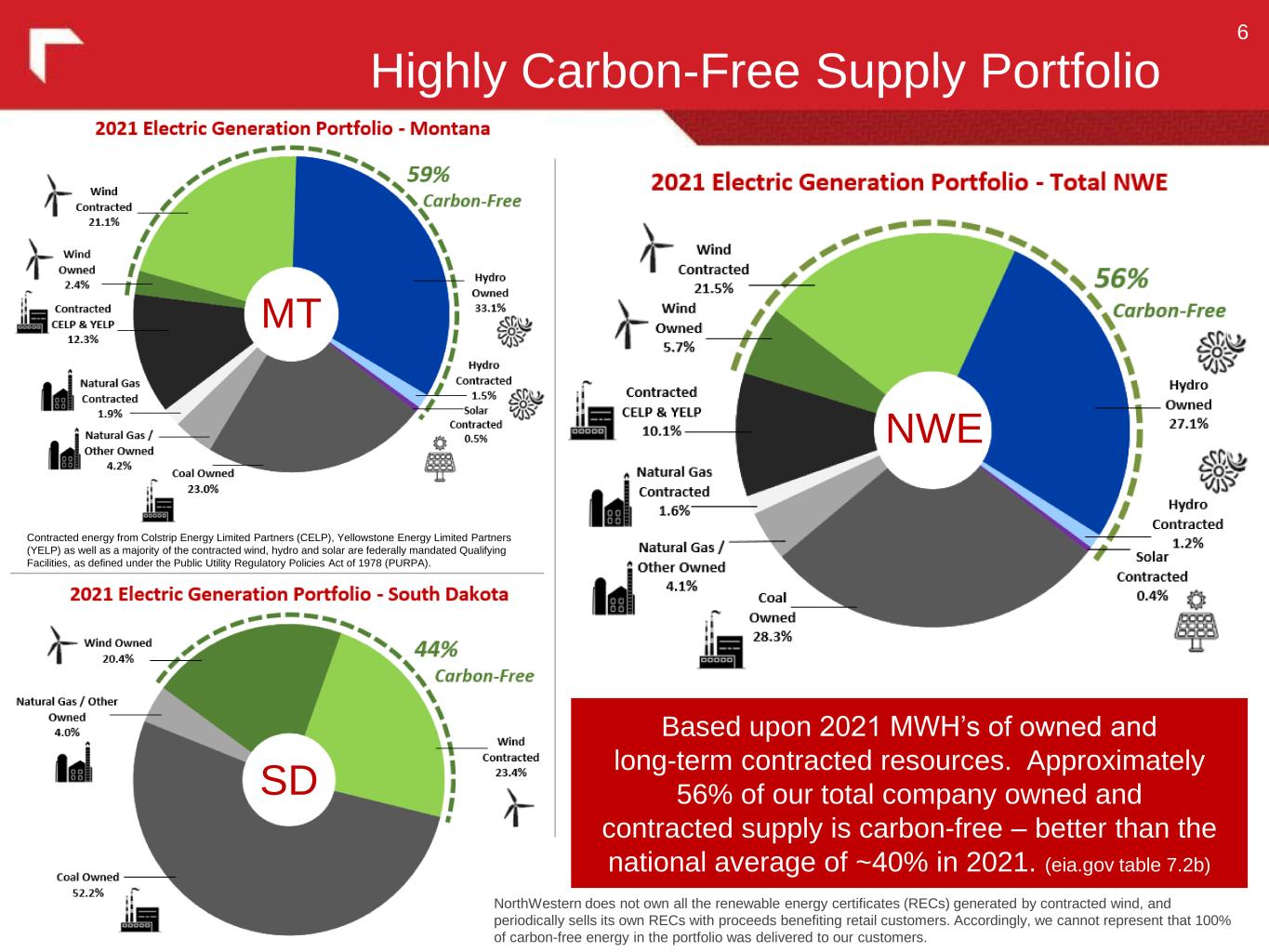

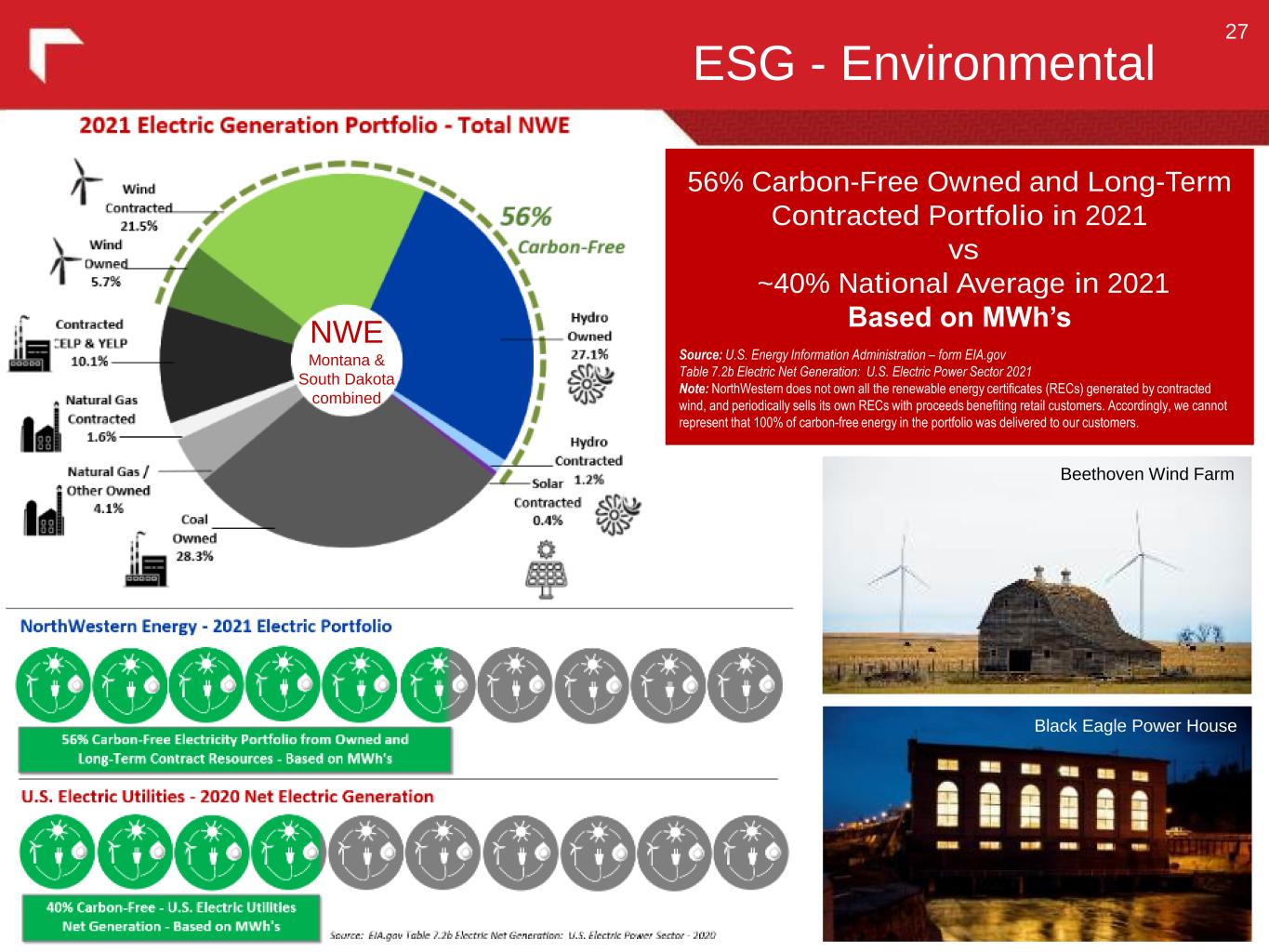

6 Highly Carbon-Free Supply Portfolio Based upon 2021 MWH’s of owned and long-term contracted resources. Approximately 56% of our total company owned and contracted supply is carbon-free – better than the national average of ~40% in 2021. (eia.gov table 7.2b) NorthWestern does not own all the renewable energy certificates (RECs) generated by contracted wind, and periodically sells its own RECs with proceeds benefiting retail customers. Accordingly, we cannot represent that 100% of carbon-free energy in the portfolio was delivered to our customers. Contracted energy from Colstrip Energy Limited Partners (CELP), Yellowstone Energy Limited Partners (YELP) as well as a majority of the contracted wind, hydro and solar are federally mandated Qualifying Facilities, as defined under the Public Utility Regulatory Policies Act of 1978 (PURPA). MT SD NWE

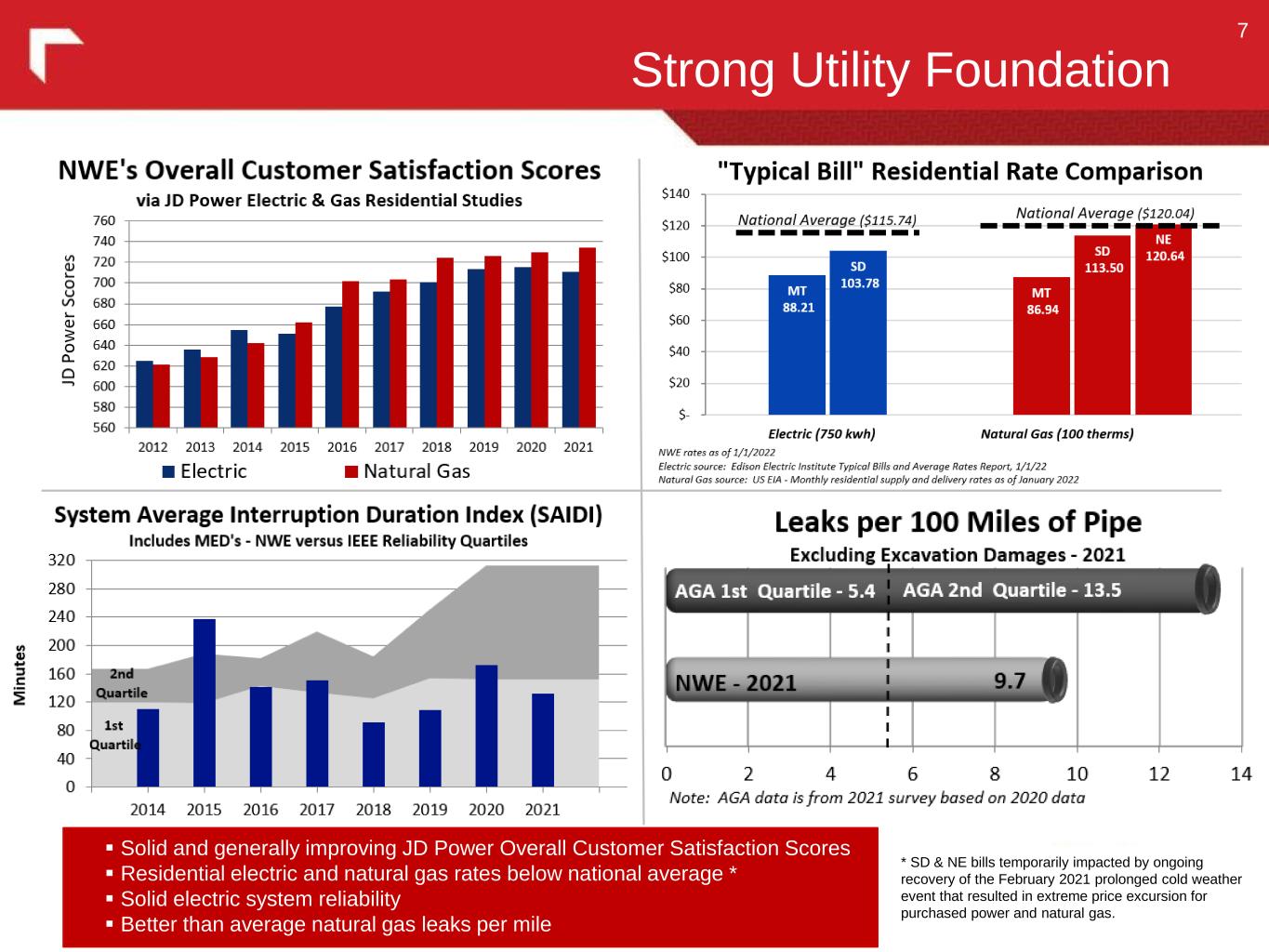

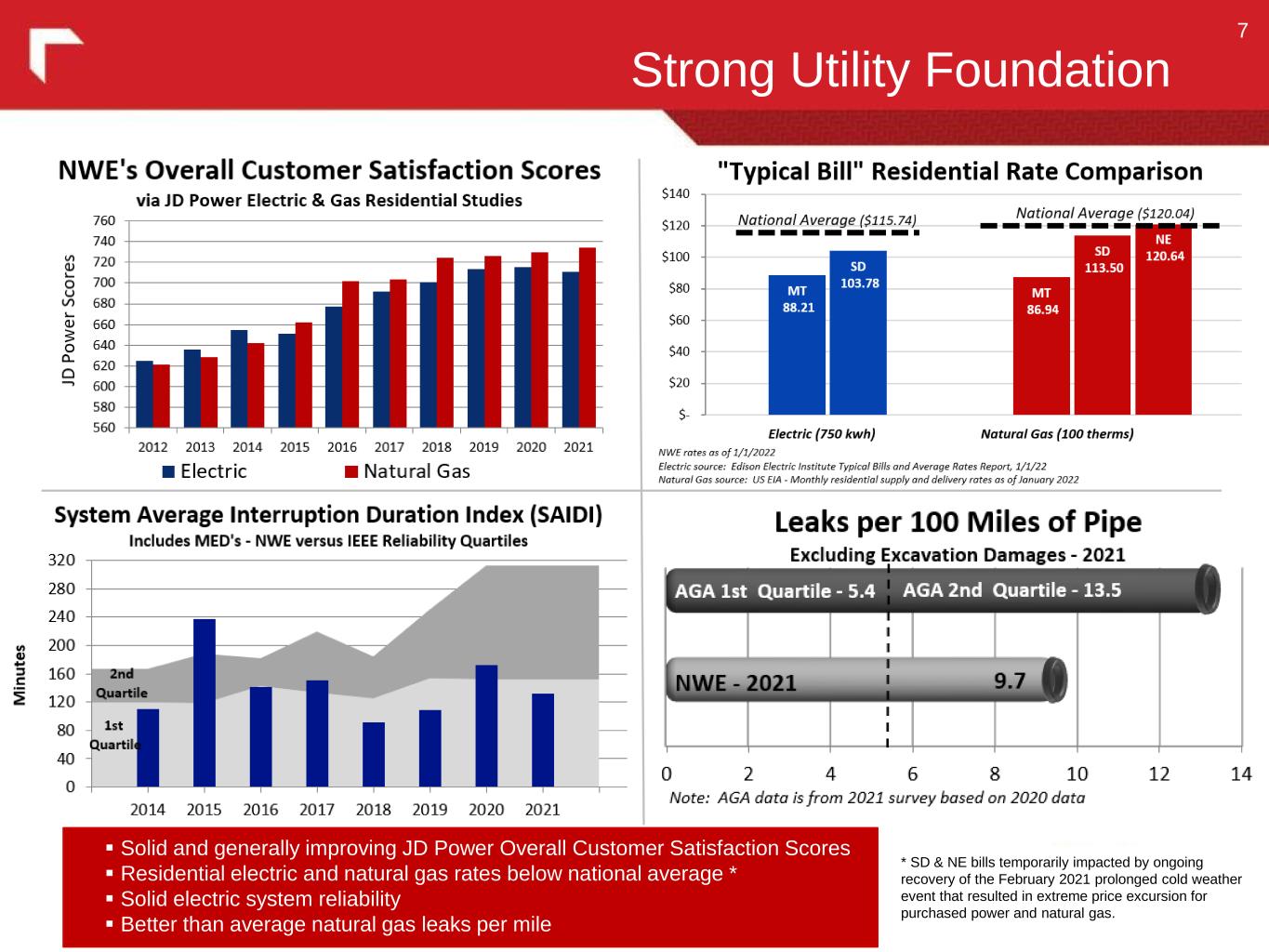

Strong Utility Foundation 7 Solid and generally improving JD Power Overall Customer Satisfaction Scores Residential electric and natural gas rates below national average * Solid electric system reliability Better than average natural gas leaks per mile * SD & NE bills temporarily impacted by ongoing recovery of the February 2021 prolonged cold weather event that resulted in extreme price excursion for purchased power and natural gas.

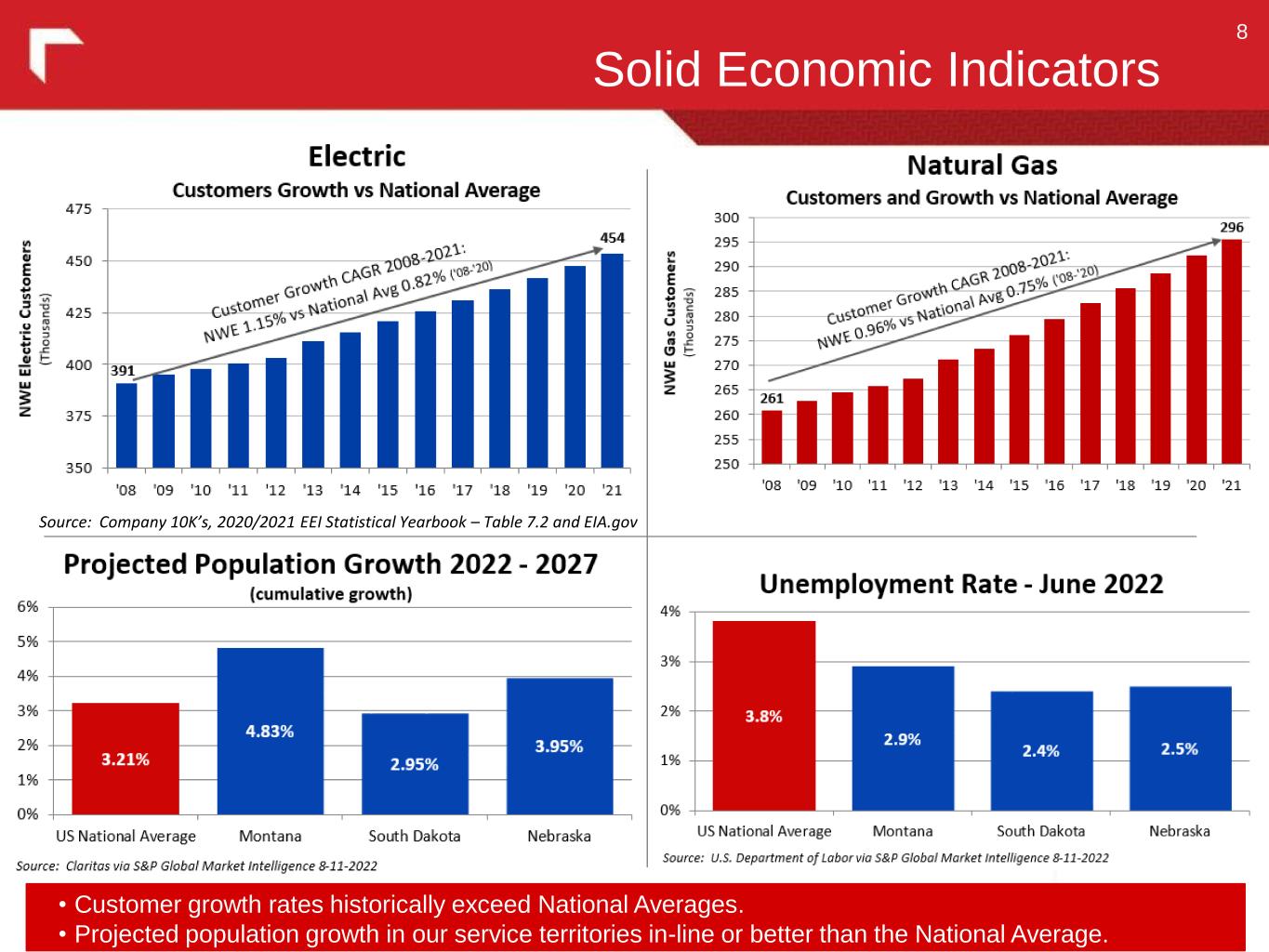

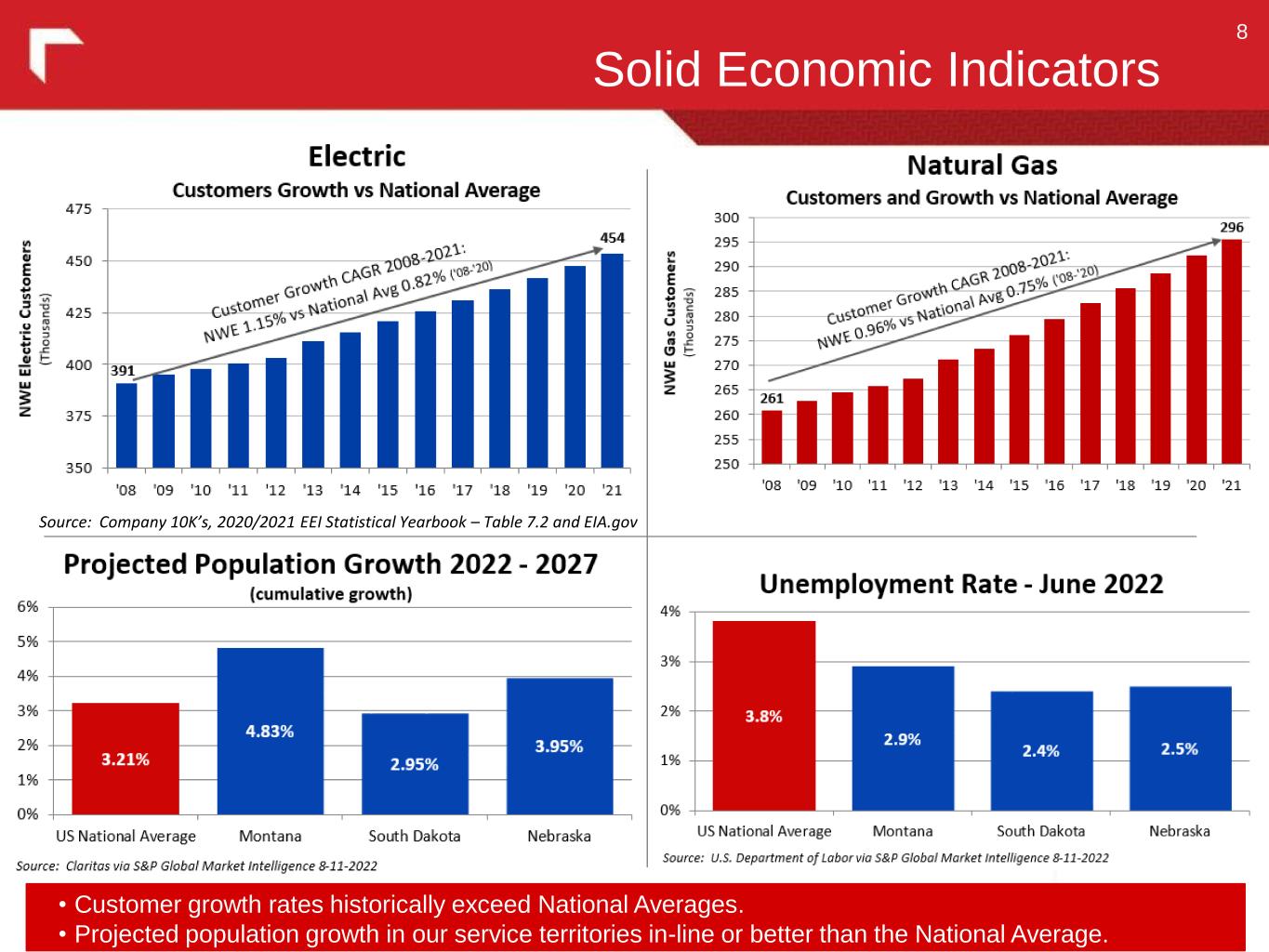

Solid Economic Indicators 8 • Customer growth rates historically exceed National Averages. • Projected population growth in our service territories in-line or better than the National Average. Source: NorthWestern customer growth - 2008-2016 Forms 10-K Unemployment Rate: US Department of Labor via SNL Database 2/21/17 Electric: EEI Statistical Yearbook (published December 2015, table 7.2) Natural Gas: EIA.gov (Data table "Number of Natural Gas Consumers") Source: Company 10K’s, 2020/2021 EEI Statistical Yearbook – Table 7.2 and EIA.gov

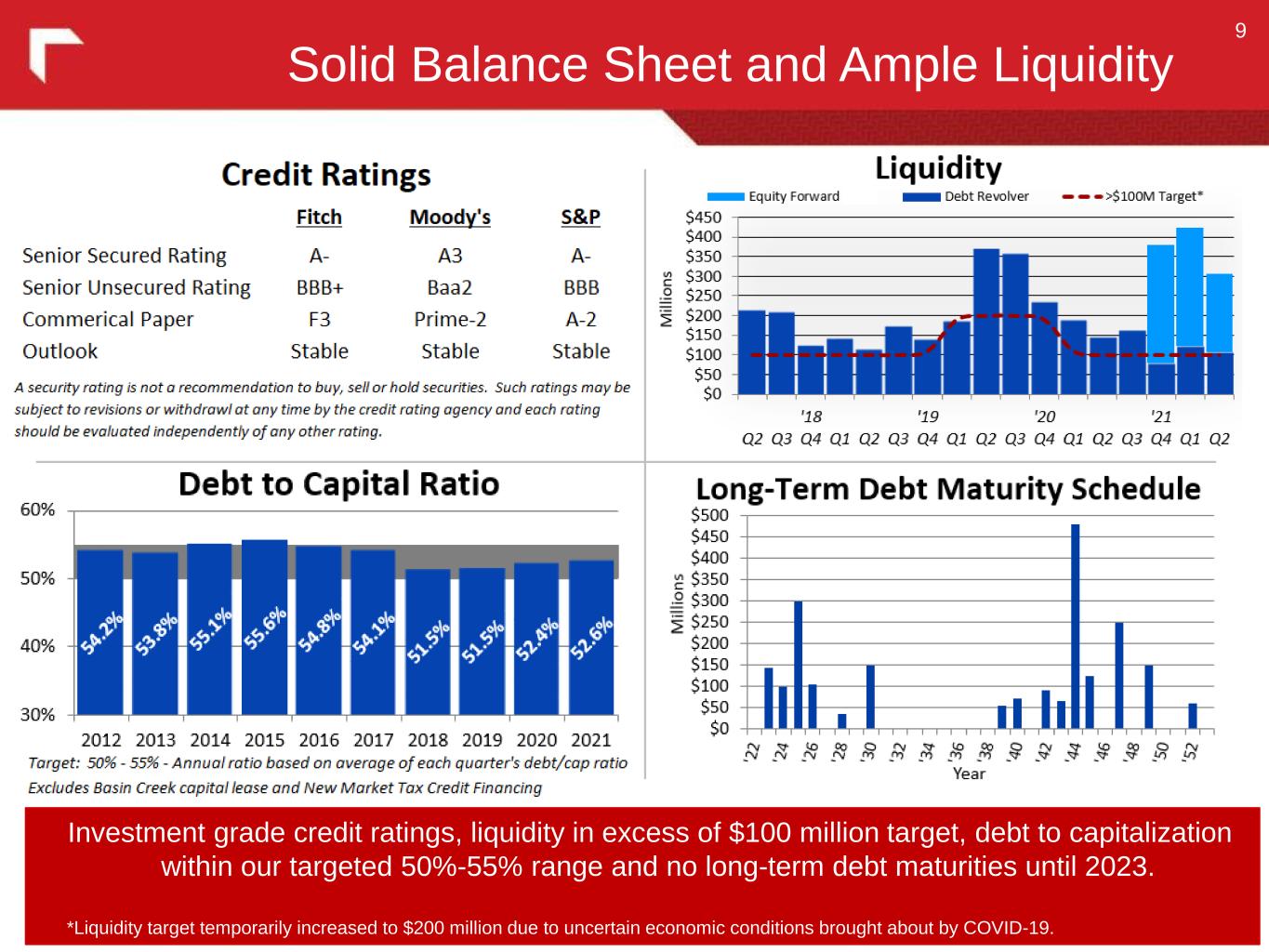

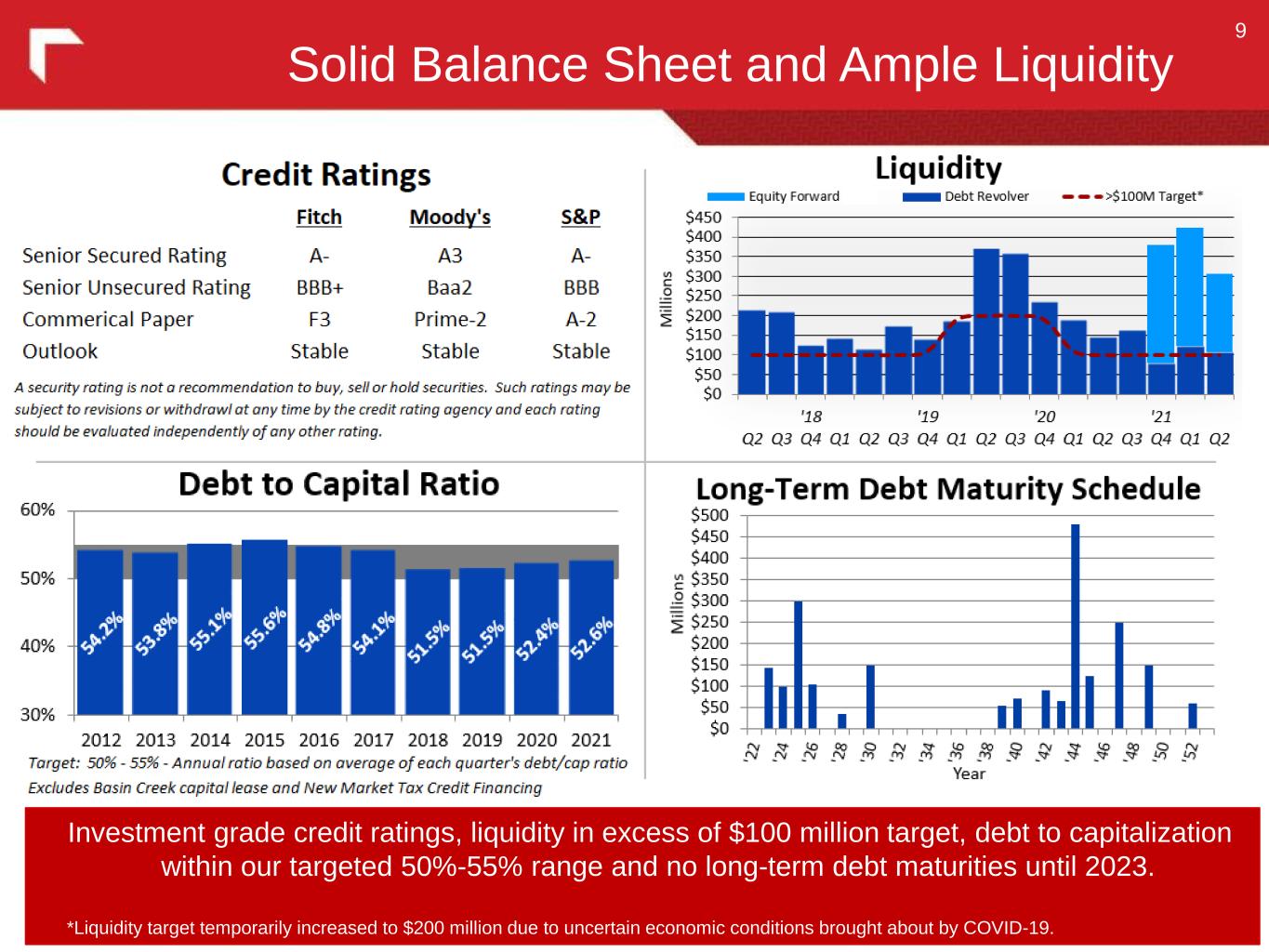

Solid Balance Sheet and Ample Liquidity 9 Investment grade credit ratings, liquidity in excess of $100 million target, debt to capitalization within our targeted 50%-55% range and no long-term debt maturities until 2023. *Liquidity target temporarily increased to $200 million due to uncertain economic conditions brought about by COVID-19.

A History of Growth 10 2012-2021 CAGR’s: GAAP EPS: 3.4% - Non-GAAP EPS: 4.5% - Dividend: 5.9% See appendix for “Non-GAAP Financial Measures” $2.60 - $2.75 $3.10 - $3.30 $3. 0-$3.40 $3.30-$3.50

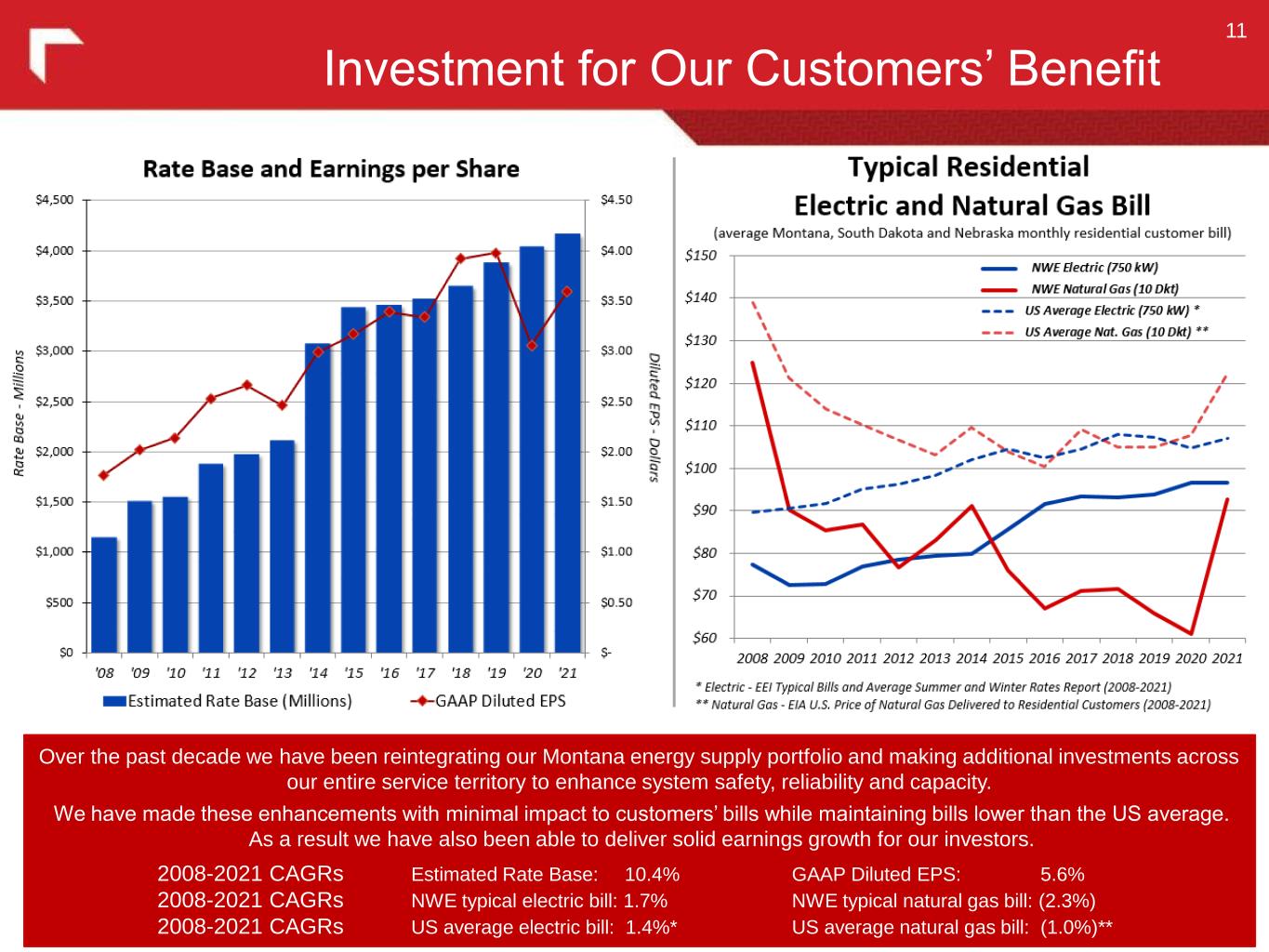

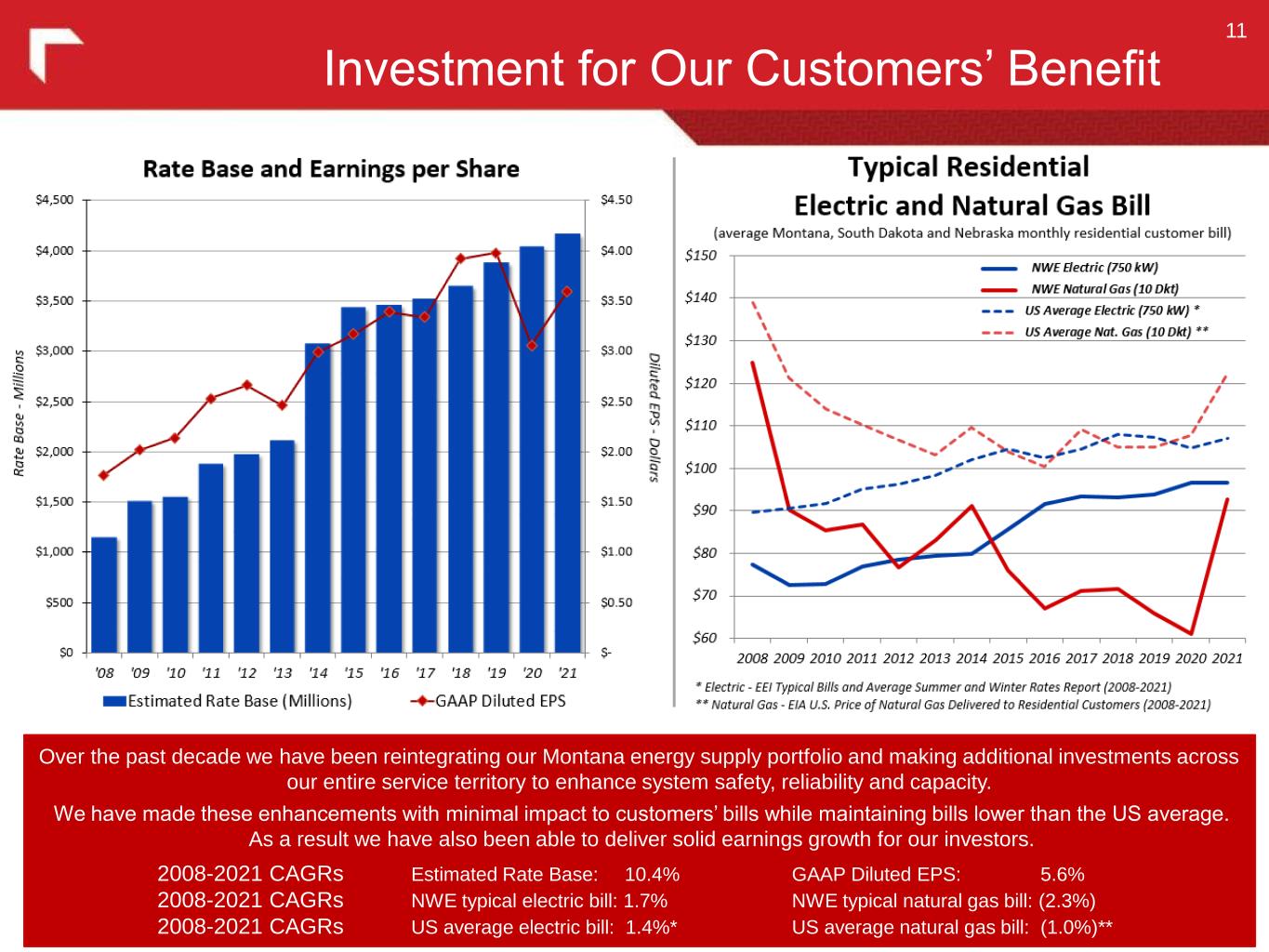

Investment for Our Customers’ Benefit 11 Over the past decade we have been reintegrating our Montana energy supply portfolio and making additional investments across our entire service territory to enhance system safety, reliability and capacity. We have made these enhancements with minimal impact to customers’ bills while maintaining bills lower than the US average. As a result we have also been able to deliver solid earnings growth for our investors. 2008-2021 CAGRs Estimated Rate Base: 10.4% GAAP Diluted EPS: 5.6% 2008-2021 CAGRs NWE typical electric bill: 1.7% NWE typical natural gas bill: (2.3%) 2008-2021 CAGRs US average electric bill: 1.4%* US average natural gas bill: (1.0%)**

12 Looking Forward

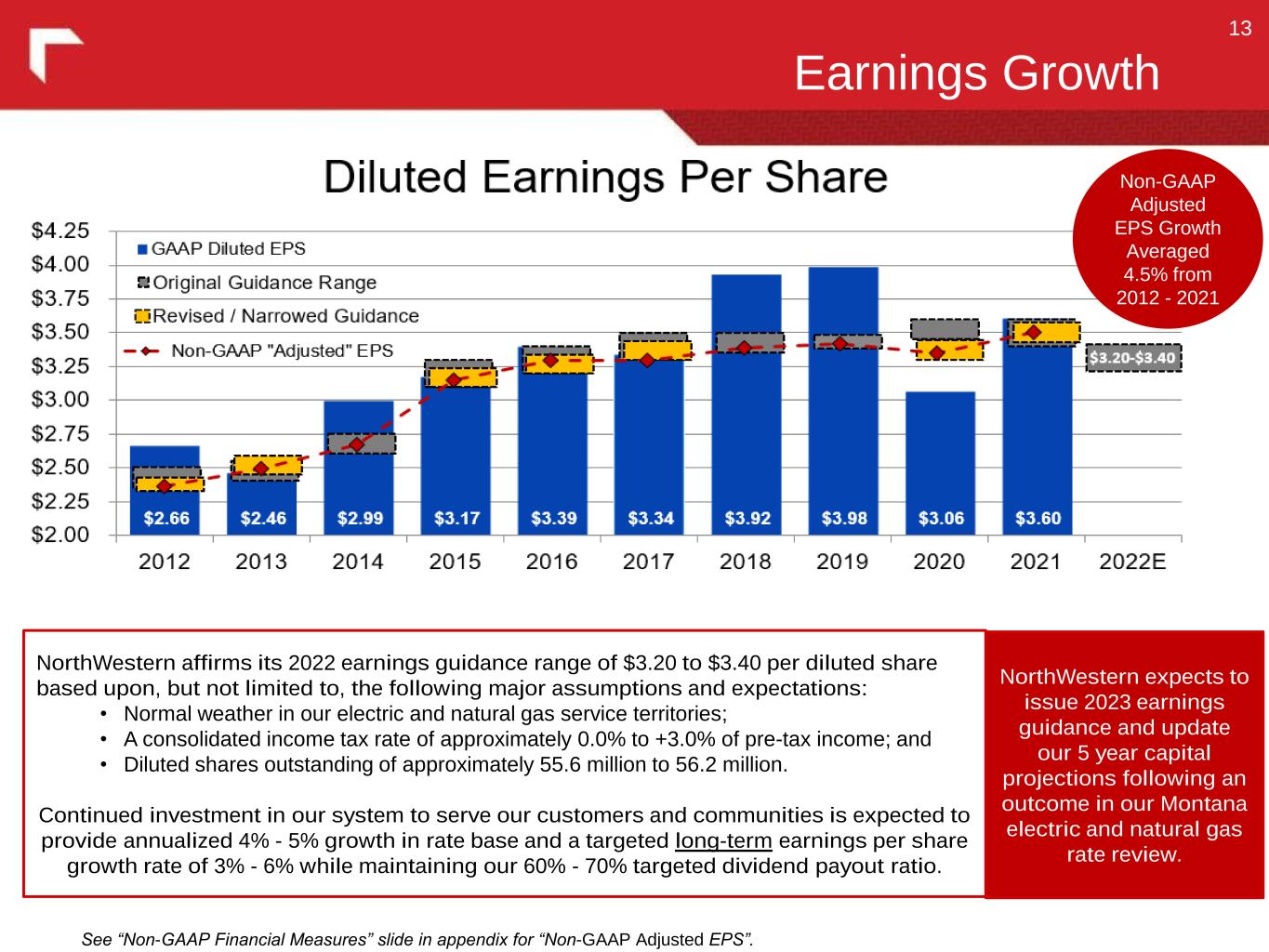

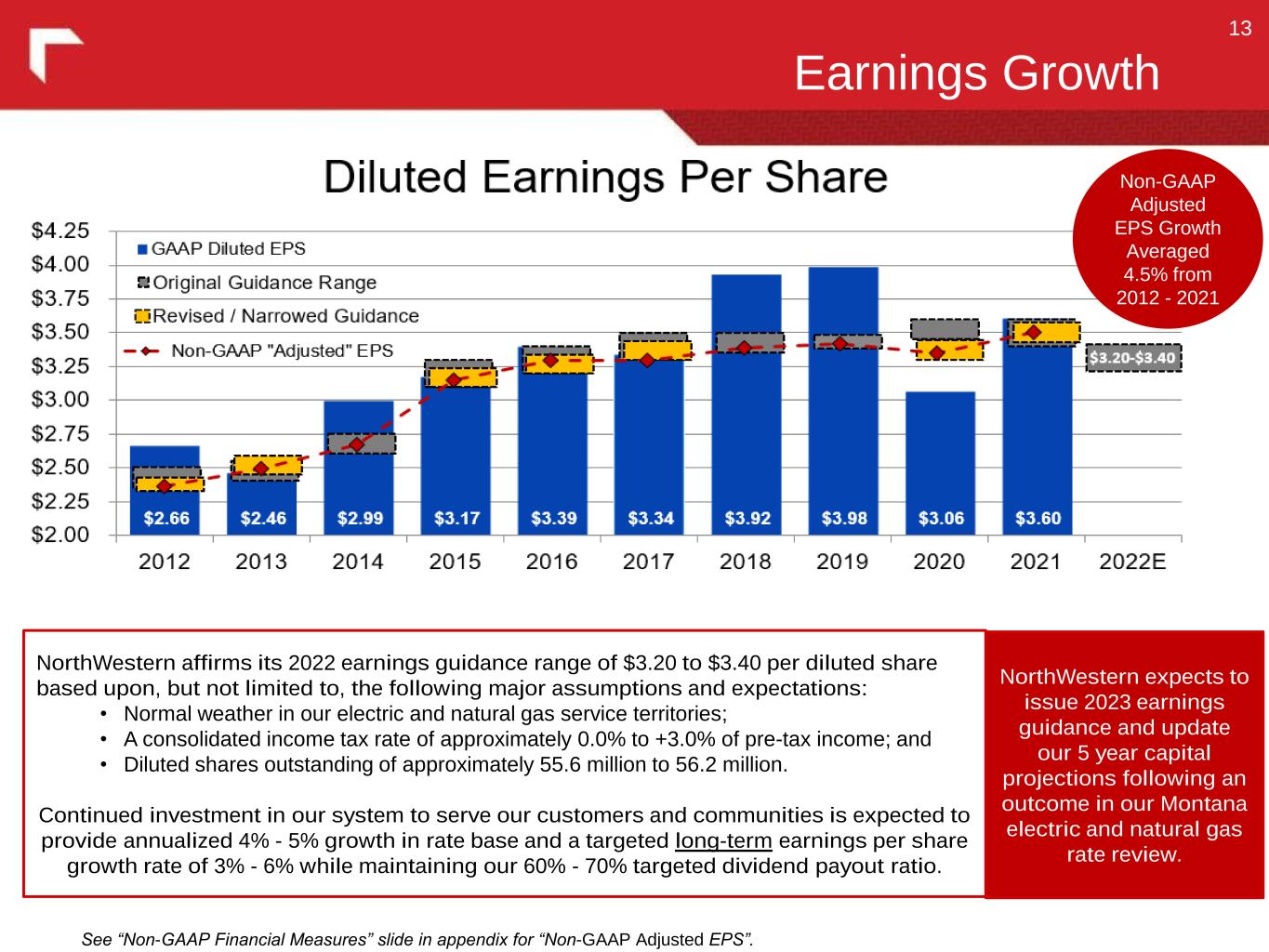

Earnings Growth 13 See appendix for additional disclosures regarding “Non-GAAP Financial Measures” See “Non-GAAP Financial Measures” slide in appendix for “Non-GAAP Adjusted EPS”. NorthWestern affirms its 2022 earnings guidance range of $3.20 to $3.40 per diluted share based upon, but not limited to, the following major assumptions and expectations: • Normal weather in our electric and natural gas service territories; • A consolidated income tax rate of approximately 0.0% to +3.0% of pre-tax income; and • Diluted shares outstanding of approximately 55.6 million to 56.2 million. Continued investment in our system to serve our customers and communities is expected to provide annualized 4% - 5% growth in rate base and a targeted long-term earnings per share growth rate of 3% - 6% while maintaining our 60% - 70% targeted dividend payout ratio. Non-GAAP Adjusted EPS Growth Averaged 4.5% from 2012 - 2021 NorthWestern expects to issue 2023 earnings guidance and update our 5 year capital projections following an outcome in our Montana electric and natural gas rate review.

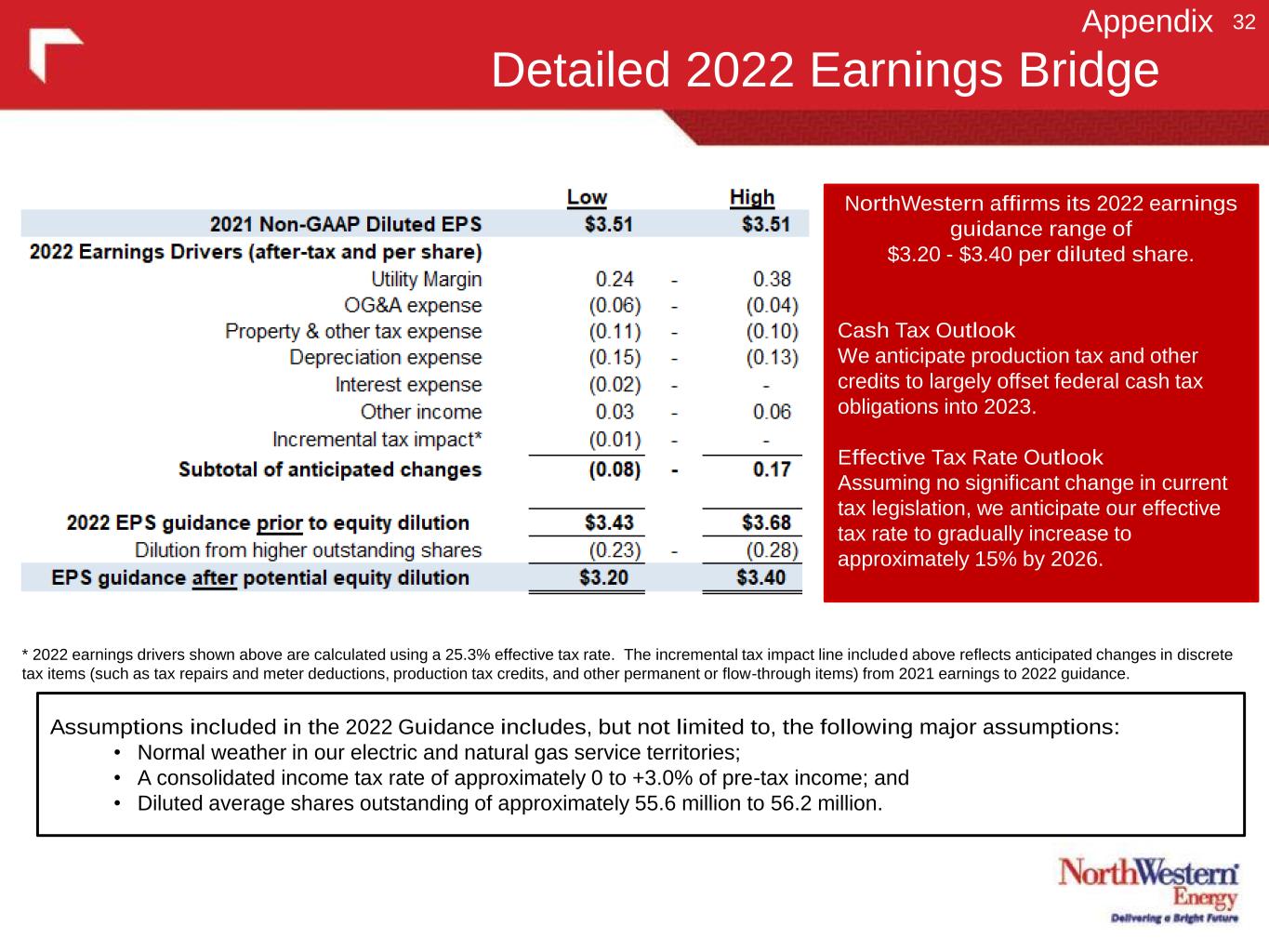

2022 Earnings Bridge 14 NorthWestern affirms 2022 earnings guidance range of $3.20 to $3.40 per diluted share based upon, but not limited to, the following major assumptions and expectations: • Normal weather in our electric and natural gas service territories; • A consolidated income tax rate of approximately 0% to 3% of pre-tax income; and • Diluted shares outstanding of approximately 55.6 million to 56.2 million. Note: See “Detailed 2022 Earnings Bridge” slide in the Appendix for additional information. • An increased, yet more sustainable, level of operating expenses, along with dilution from equity financing of capital investment, is expected to be partially offset by organic growth and rate recovery*. • Dividend payout ratio is expected to exceed 60%-70% targeted range for 2022. • We continue to target a long-term earnings per share growth rate of 3%-6% off a 2020 base year. * Rate recovery primarily a result of FERC formula rates and property tax trackers. Guiding down to $3.20 to $3.40 primarily due to equity needed to support increased capital investment.

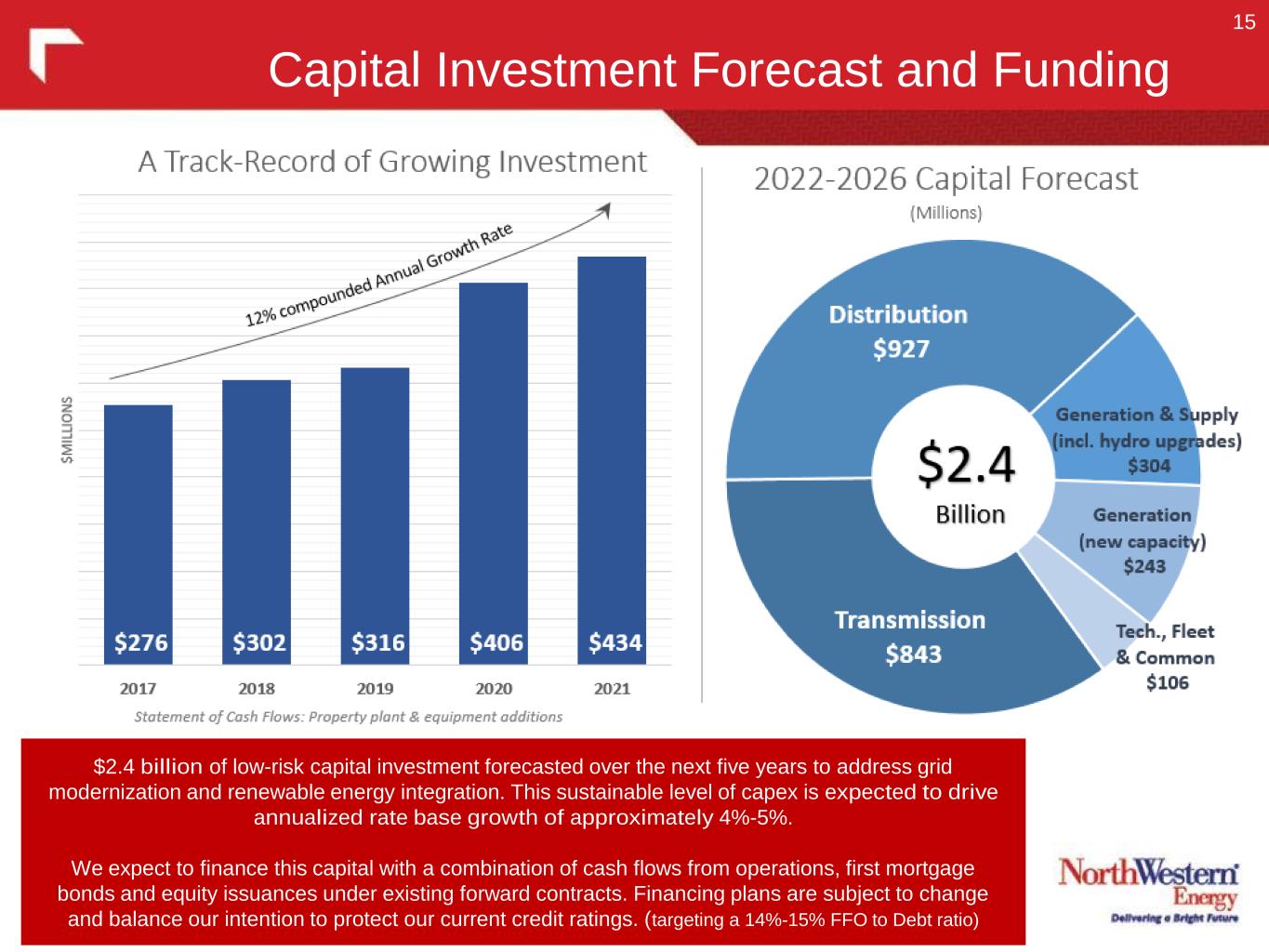

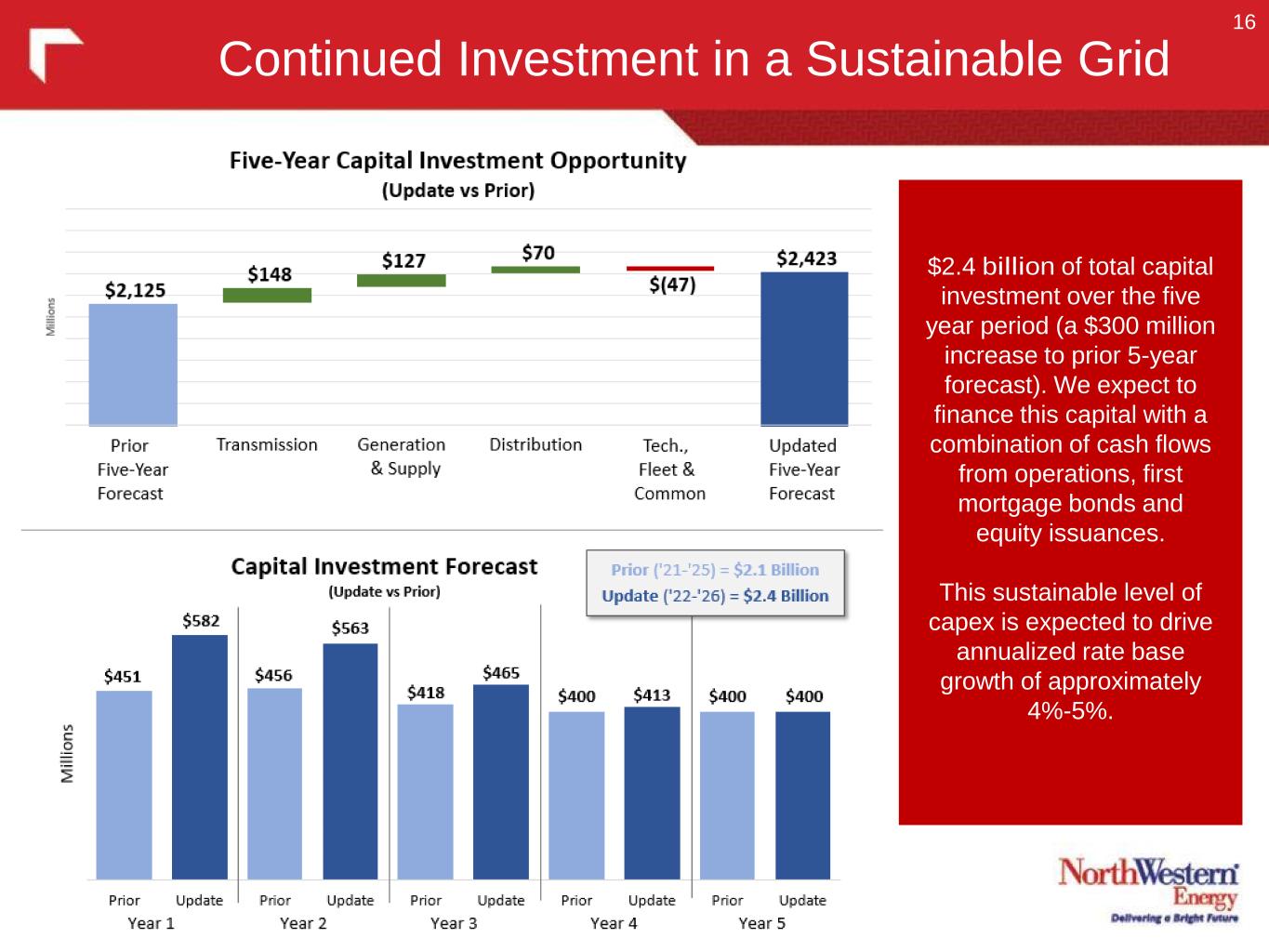

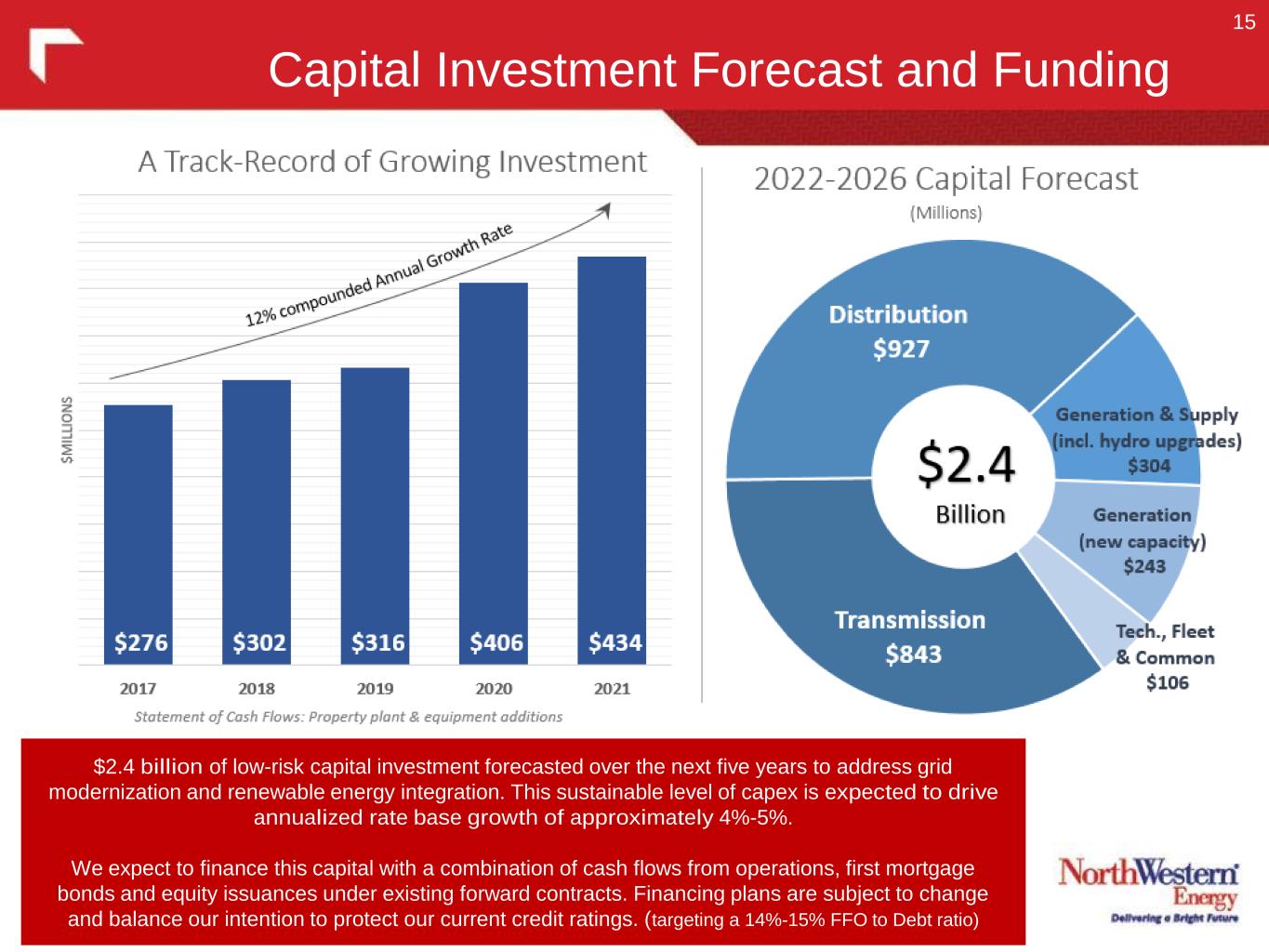

Capital Investment Forecast and Funding 15 $2.4 billion of low-risk capital investment forecasted over the next five years to address grid modernization and renewable energy integration. This sustainable level of capex is expected to drive annualized rate base growth of approximately 4%-5%. We expect to finance this capital with a combination of cash flows from operations, first mortgage bonds and equity issuances under existing forward contracts. Financing plans are subject to change and balance our intention to protect our current credit ratings. (targeting a 14%-15% FFO to Debt ratio)

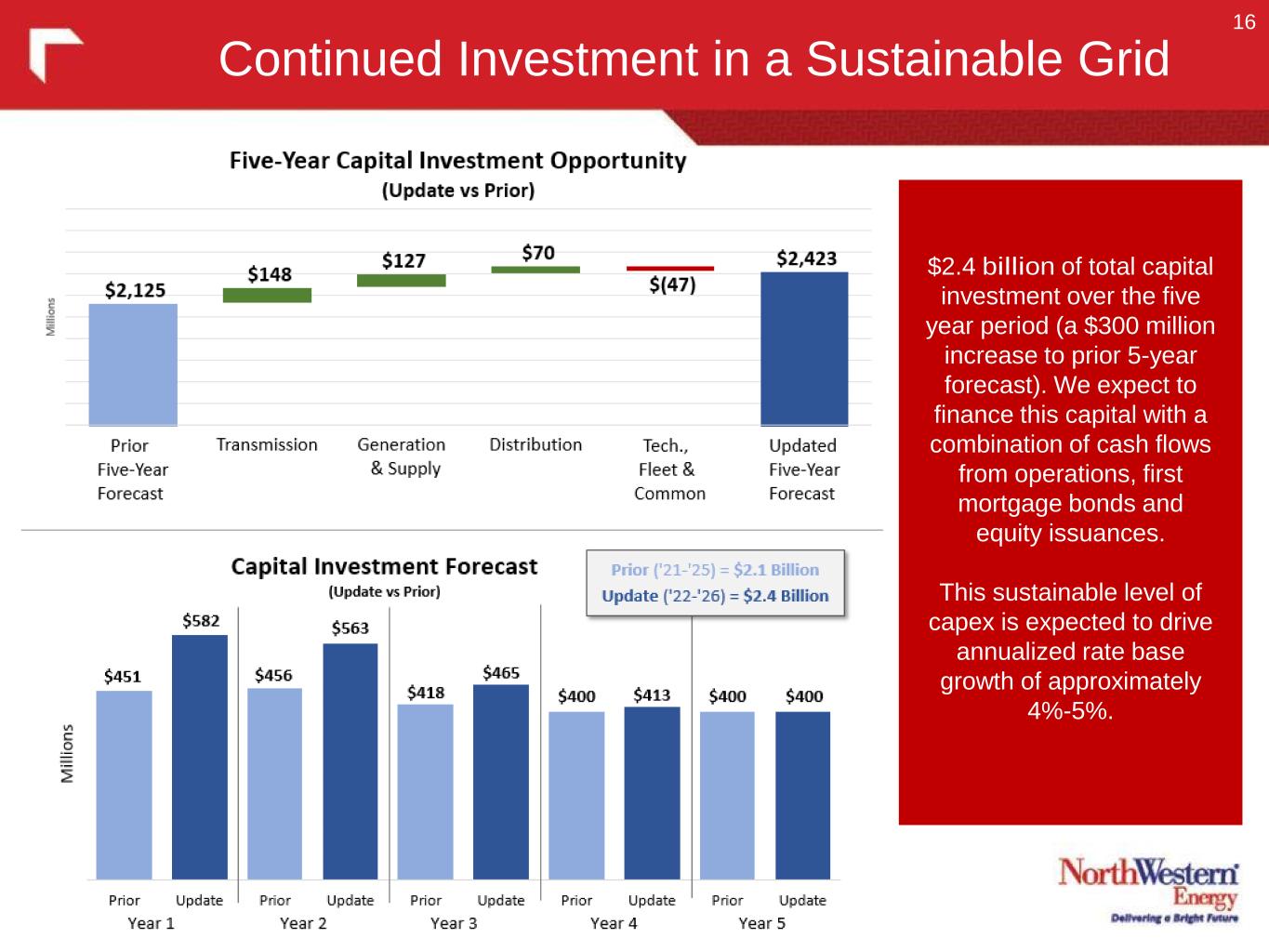

Continued Investment in a Sustainable Grid the Capital Investment Forecast 16 $2.4 billion of total capital investment over the five year period (a $300 million increase to prior 5-year forecast). We expect to finance this capital with a combination of cash flows from operations, first mortgage bonds and equity issuances. This sustainable level of capex is expected to drive annualized rate base growth of approximately 4%-5%.

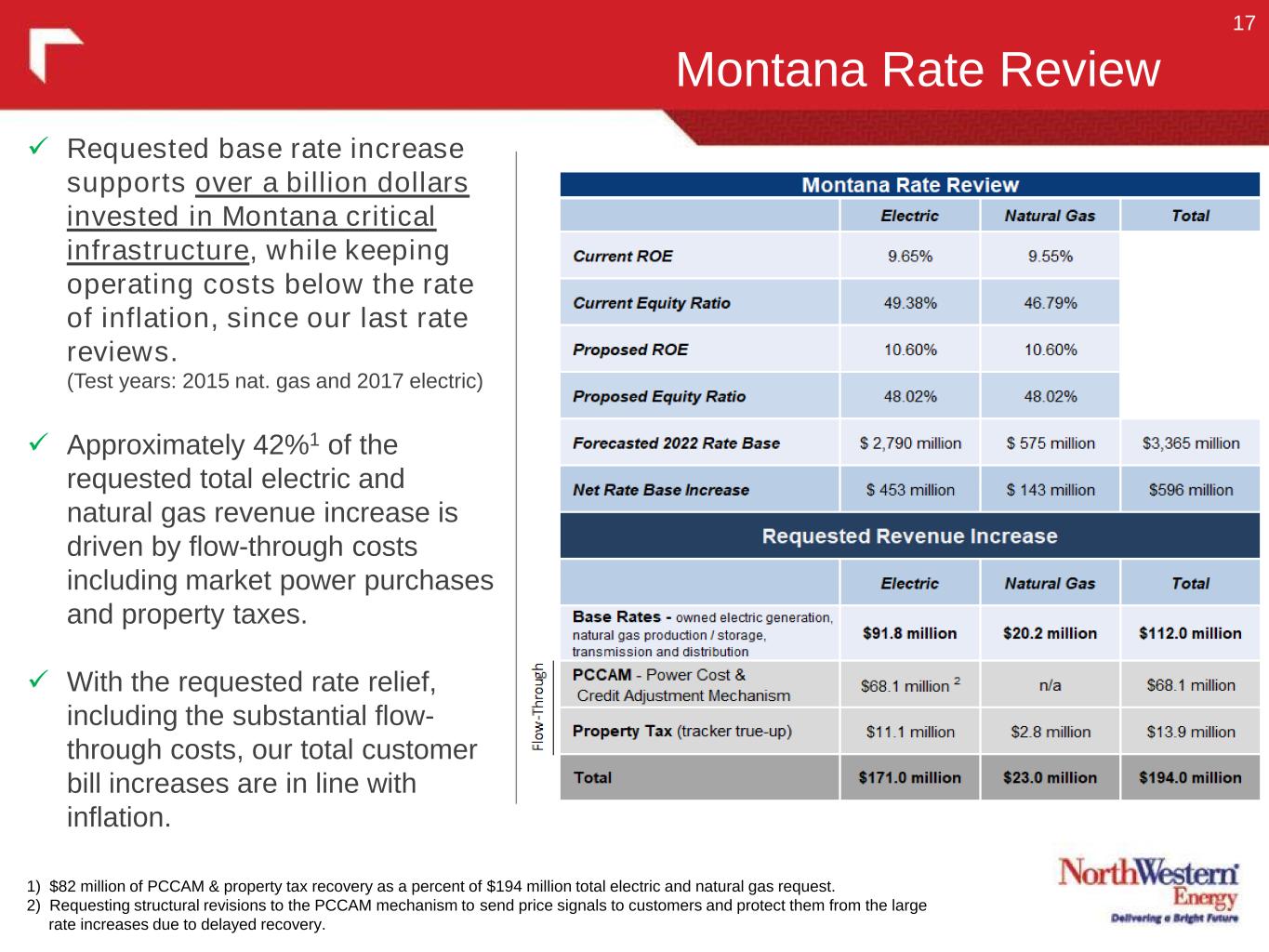

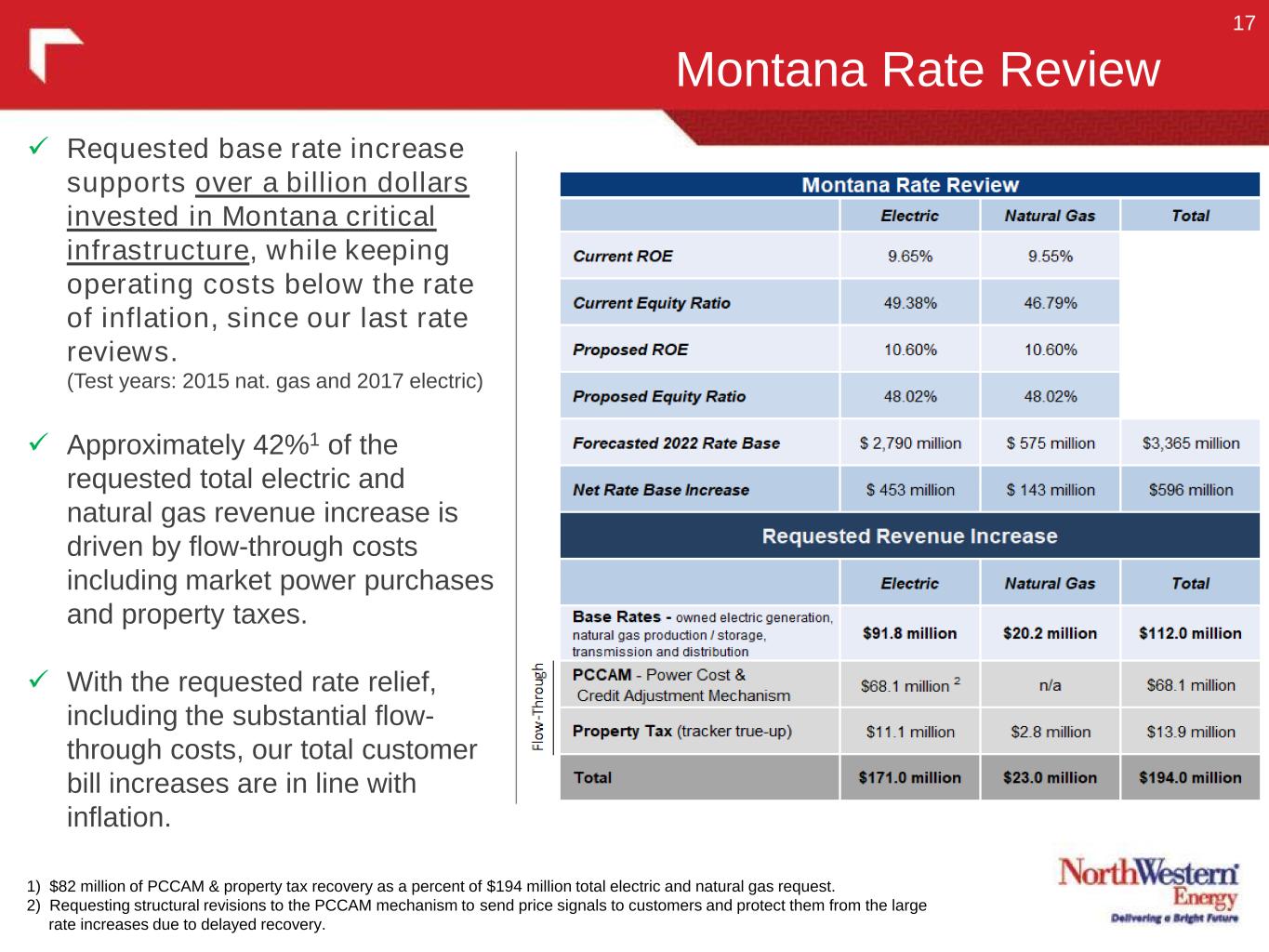

Requested base rate increase supports over a billion dollars invested in Montana critical infrastructure, while keeping operating costs below the rate of inflation, since our last rate reviews. (Test years: 2015 nat. gas and 2017 electric) Approximately 42%1 of the requested total electric and natural gas revenue increase is driven by flow-through costs including market power purchases and property taxes. With the requested rate relief, including the substantial flow- through costs, our total customer bill increases are in line with inflation. Montana Rate Review 17 1) $82 million of PCCAM & property tax recovery as a percent of $194 million total electric and natural gas request. 2) Requesting structural revisions to the PCCAM mechanism to send price signals to customers and protect them from the large rate increases due to delayed recovery.

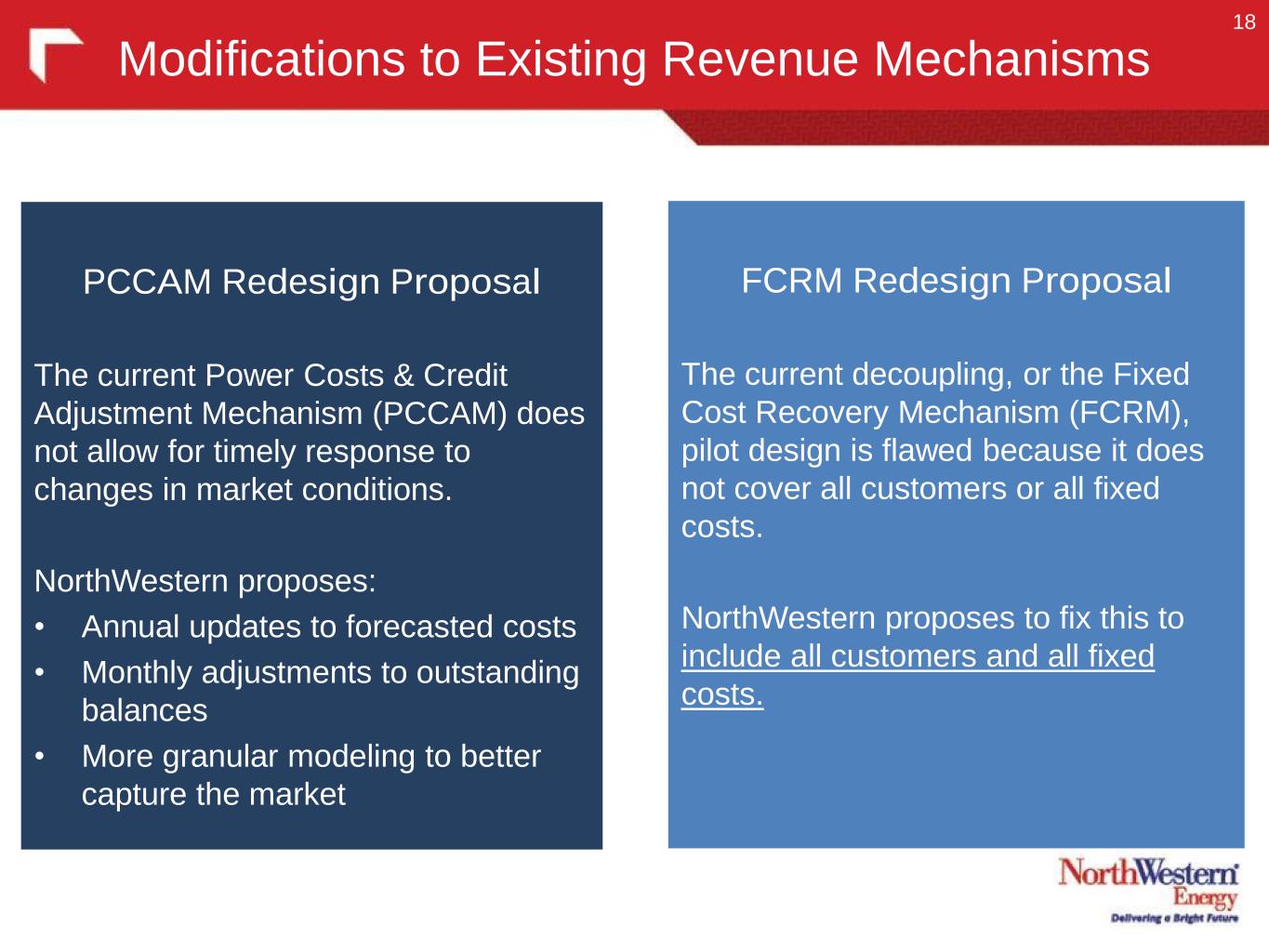

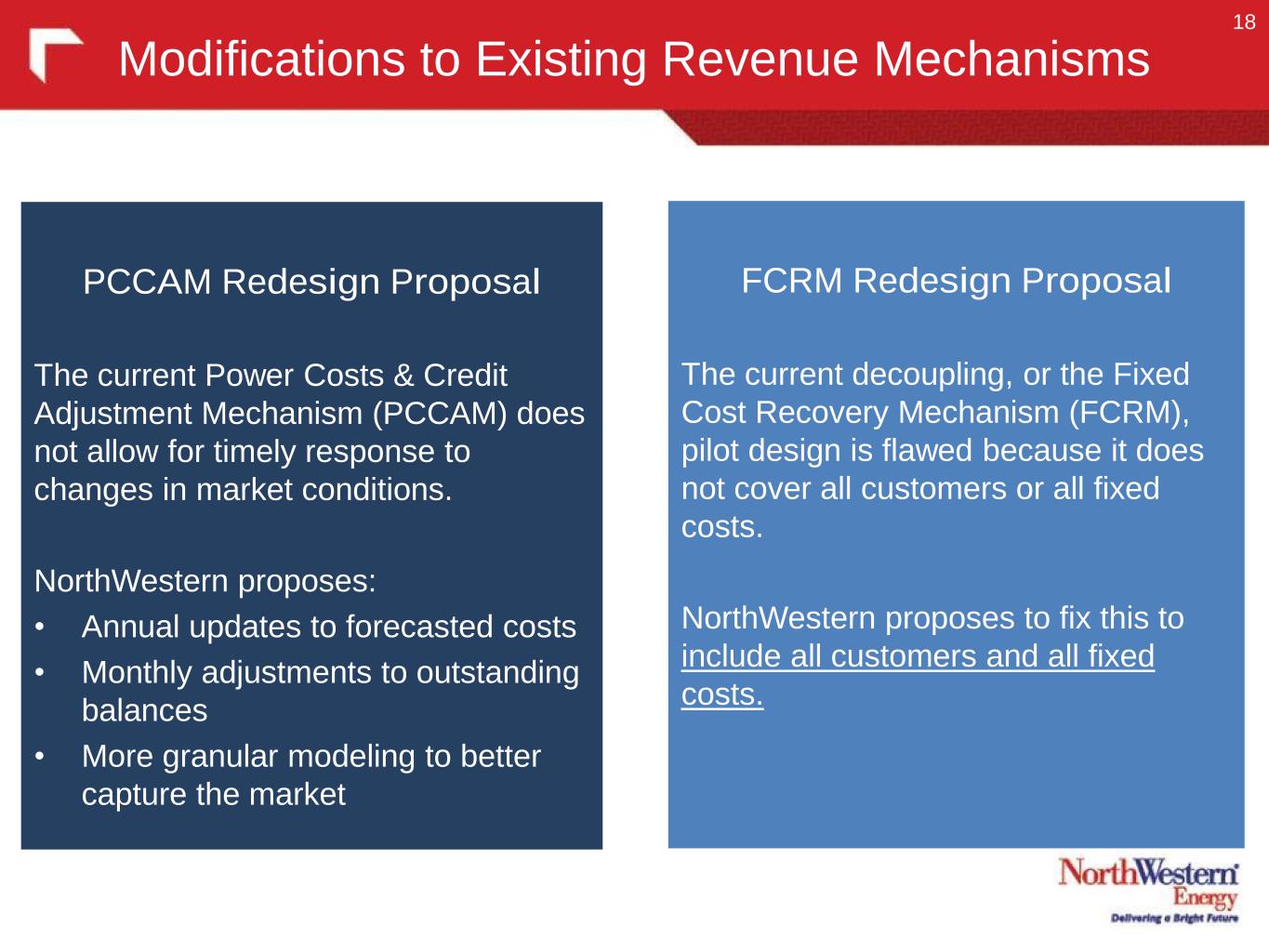

Modifications to Existing Revenue Mechanisms 18 FCRM Redesign Proposal The current decoupling, or the Fixed Cost Recovery Mechanism (FCRM), pilot design is flawed because it does not cover all customers or all fixed costs. NorthWestern proposes to fix this to include all customers and all fixed costs. PCCAM Redesign Proposal The current Power Costs & Credit Adjustment Mechanism (PCCAM) does not allow for timely response to changes in market conditions. NorthWestern proposes: • Annual updates to forecasted costs • Monthly adjustments to outstanding balances • More granular modeling to better capture the market

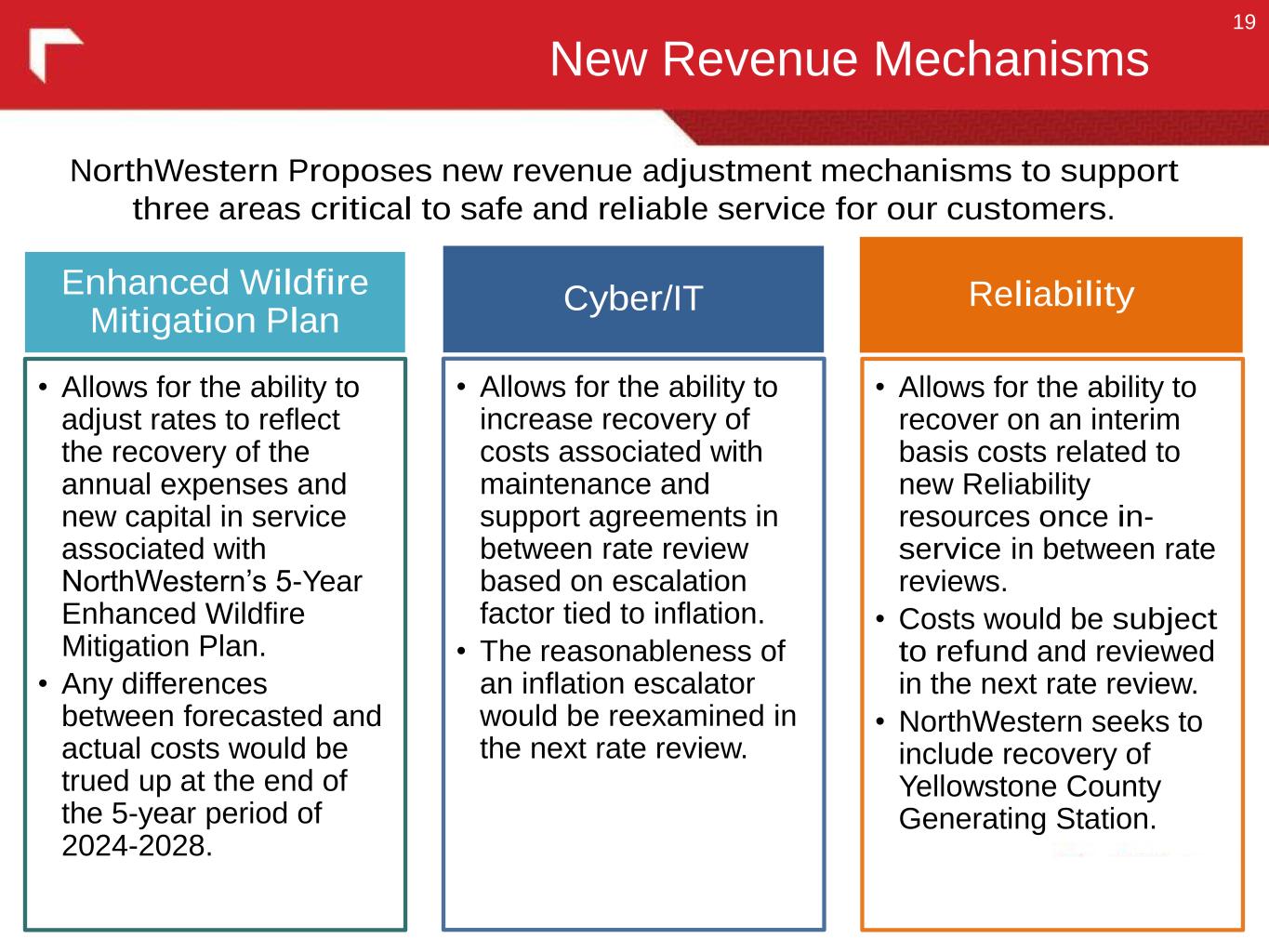

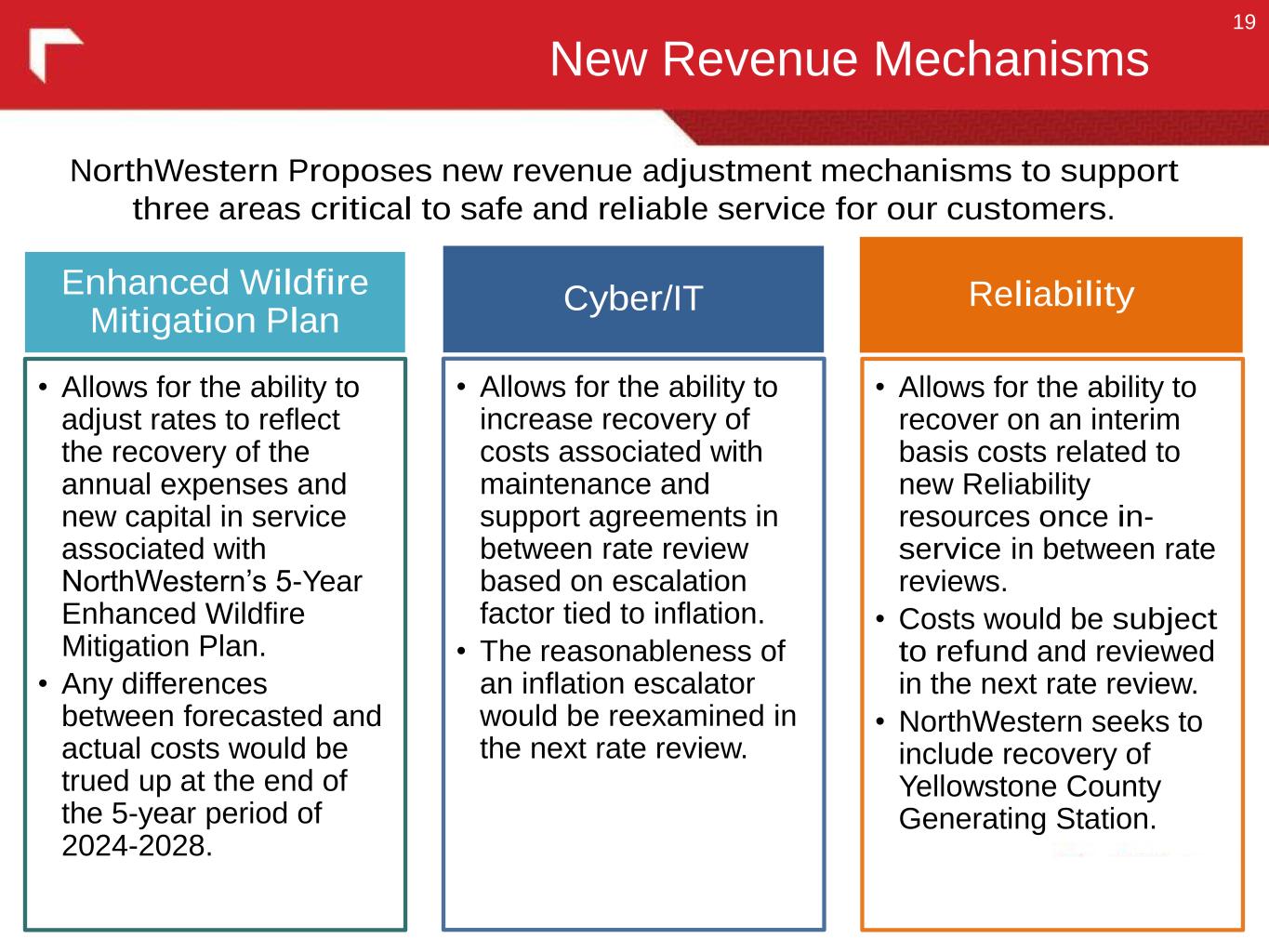

New Revenue Mechanisms 19 NorthWestern Proposes new revenue adjustment mechanisms to support three areas critical to safe and reliable service for our customers. Enhanced Wildfire Mitigation Plan • Allows for the ability to adjust rates to reflect the recovery of the annual expenses and new capital in service associated with NorthWestern’s 5-Year Enhanced Wildfire Mitigation Plan. • Any differences between forecasted and actual costs would be trued up at the end of the 5-year period of 2024-2028. Cyber/IT • Allows for the ability to increase recovery of costs associated with maintenance and support agreements in between rate review based on escalation factor tied to inflation. • The reasonableness of an inflation escalator would be reexamined in the next rate review. Reliability • Allows for the ability to recover on an interim basis costs related to new Reliability resources once in- service in between rate reviews. • Costs would be subject to refund and reviewed in the next rate review. • NorthWestern seeks to include recovery of Yellowstone County Generating Station.

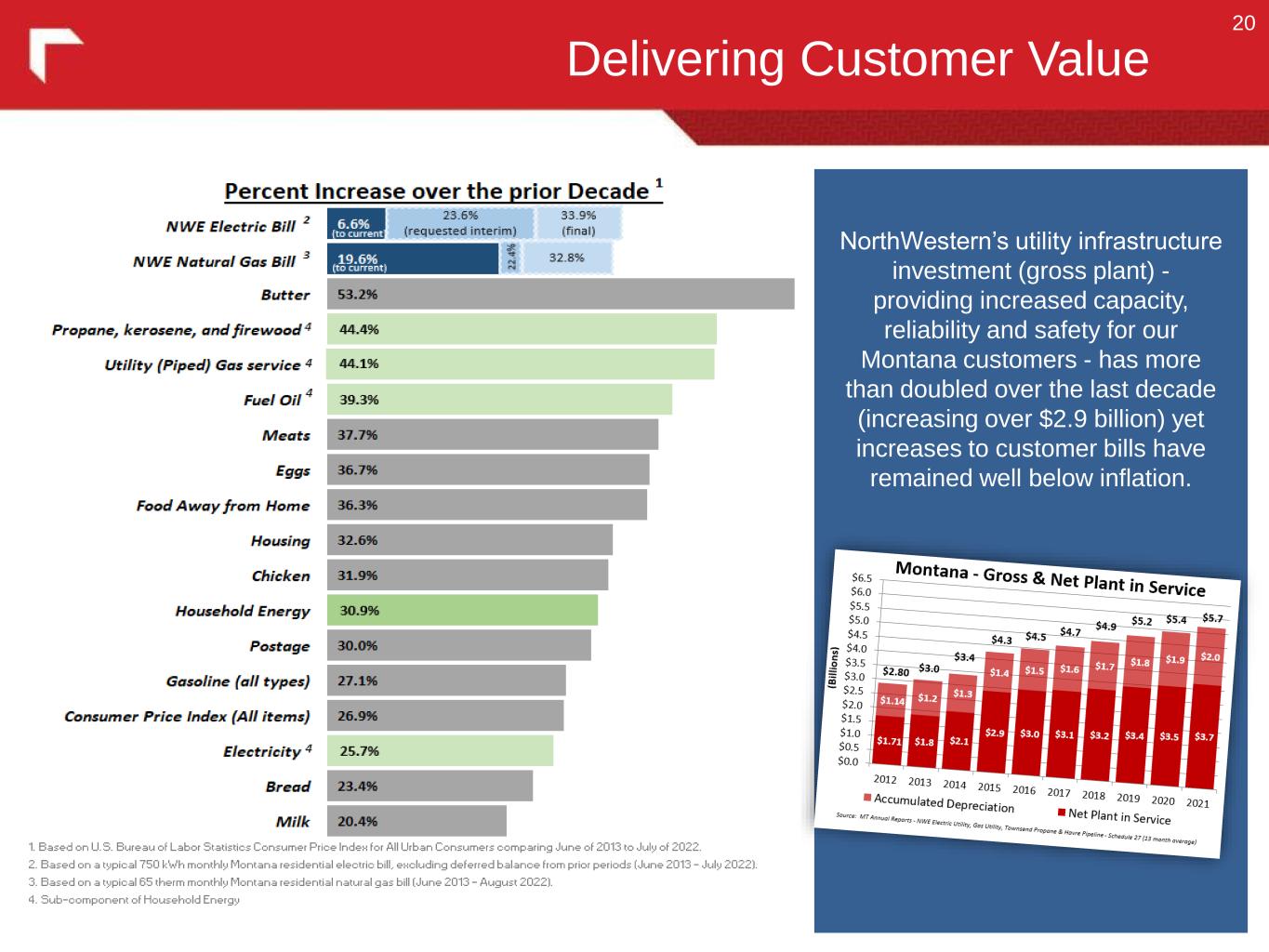

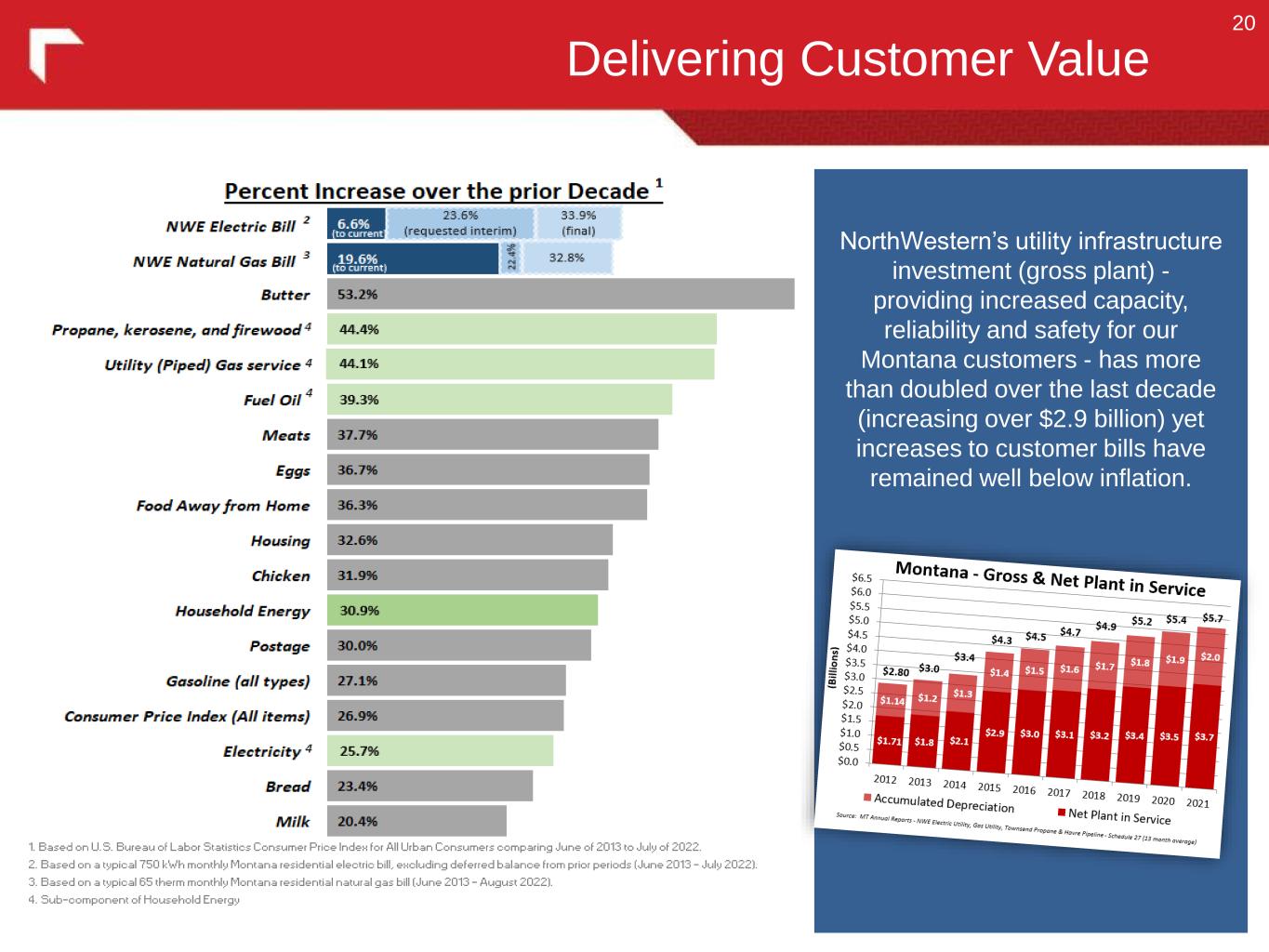

Delivering Customer Value 20 NorthWestern’s utility infrastructure investment (gross plant) - providing increased capacity, reliability and safety for our Montana customers - has more than doubled over the last decade (increasing over $2.9 billion) yet increases to customer bills have remained well below inflation.

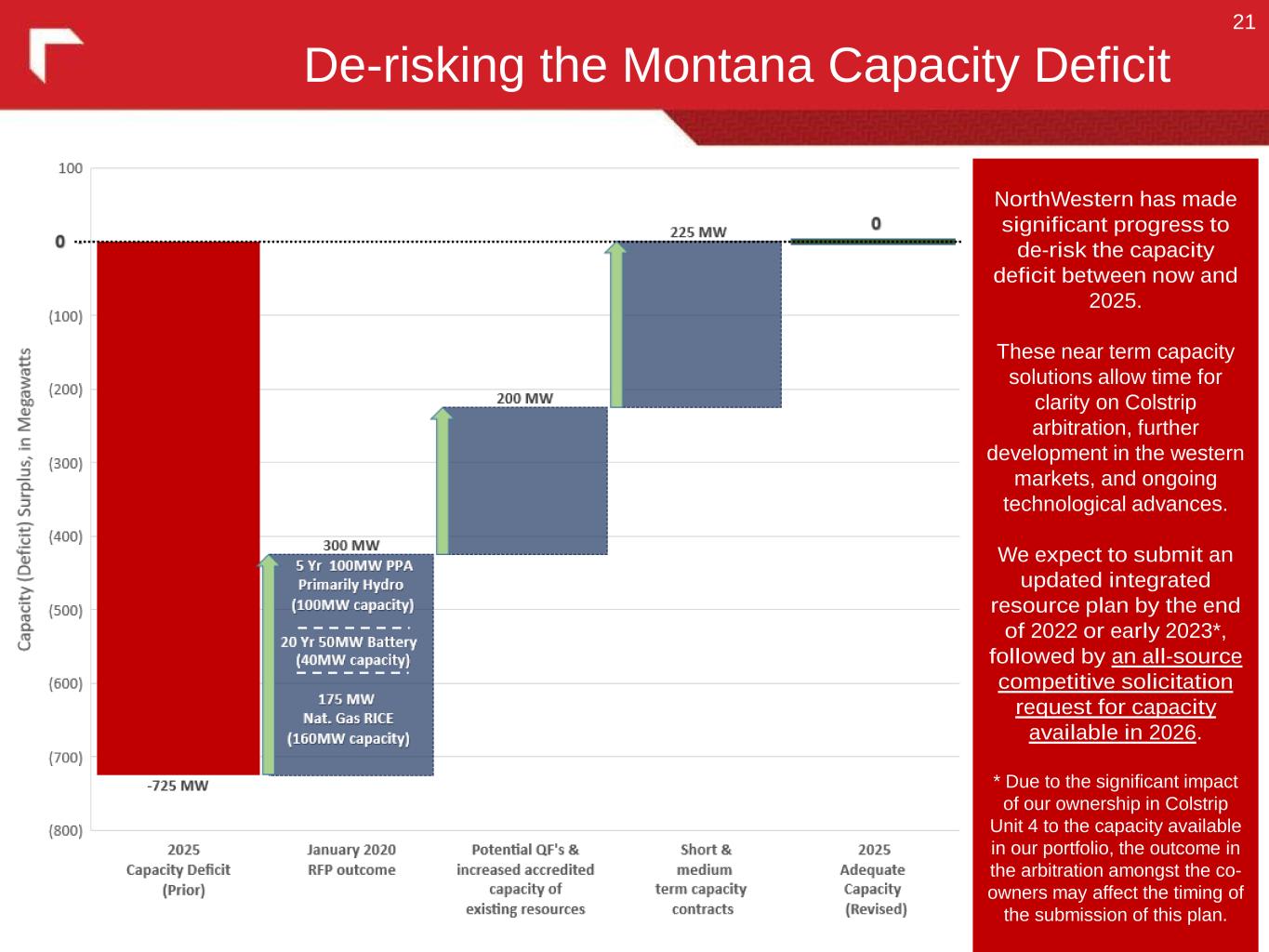

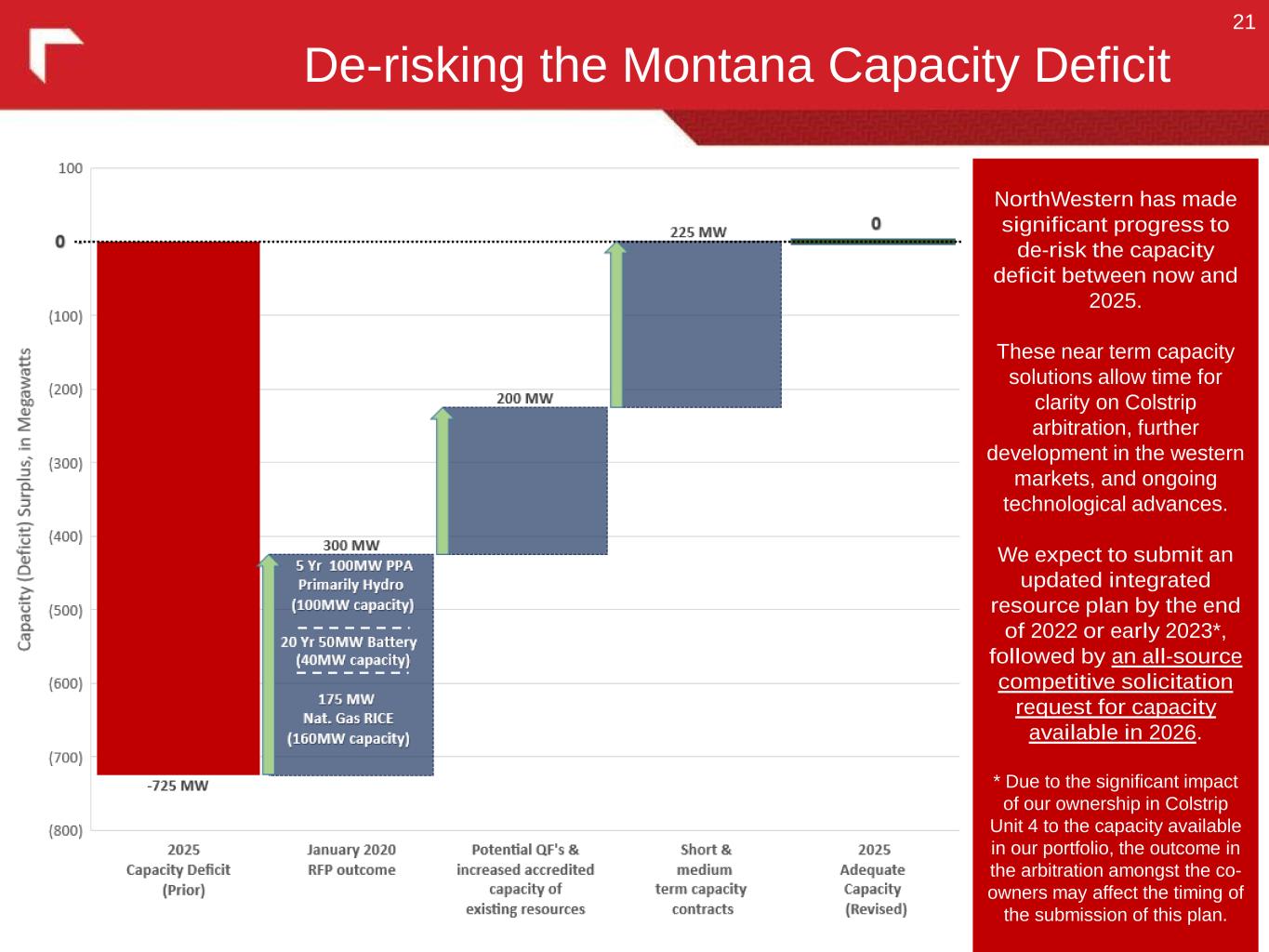

De-risking the Montana Capacity Deficit 21 NorthWestern has made significant progress to de-risk the capacity deficit between now and 2025. These near term capacity solutions allow time for clarity on Colstrip arbitration, further development in the western markets, and ongoing technological advances. We expect to submit an updated integrated resource plan by the end of 2022 or early 2023*, followed by an all-source competitive solicitation request for capacity available in 2026. * Due to the significant impact of our ownership in Colstrip Unit 4 to the capacity available in our portfolio, the outcome in the arbitration amongst the co- owners may affect the timing of the submission of this plan.

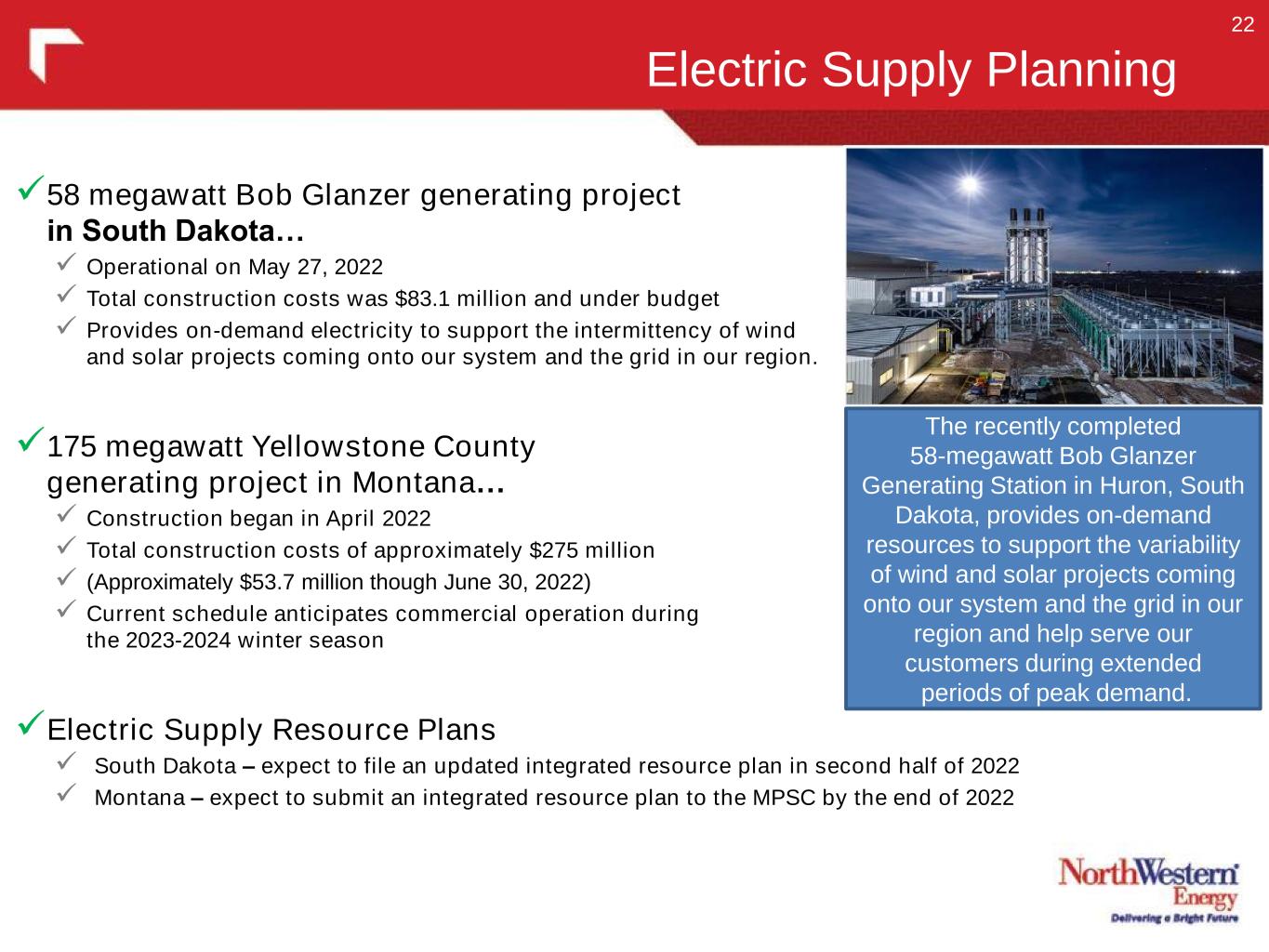

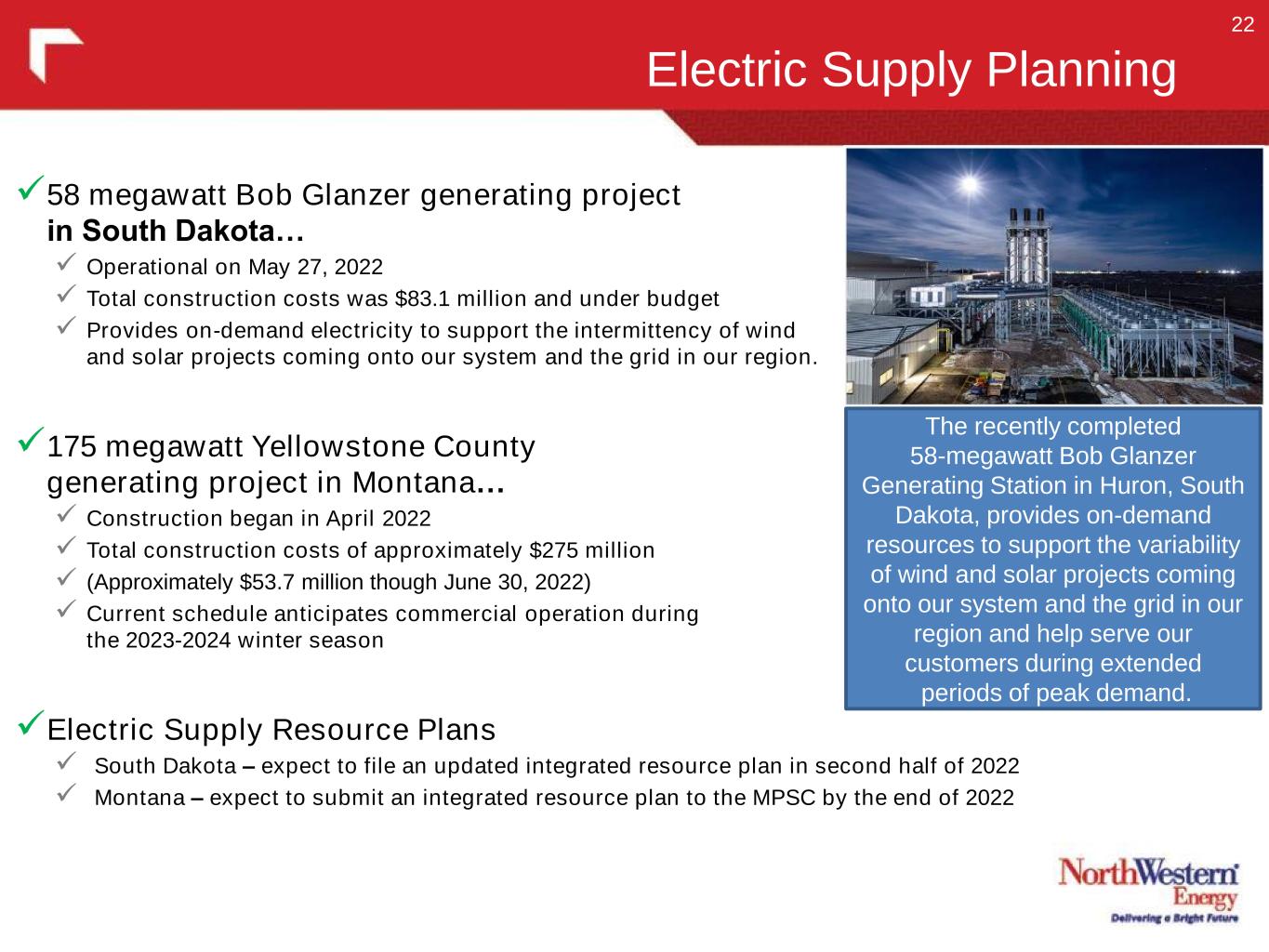

58 megawatt Bob Glanzer generating project in South Dakota… Operational on May 27, 2022 Total construction costs was $83.1 million and under budget Provides on-demand electricity to support the intermittency of wind and solar projects coming onto our system and the grid in our region. 175 megawatt Yellowstone County generating project in Montana… Construction began in April 2022 Total construction costs of approximately $275 million (Approximately $53.7 million though June 30, 2022) Current schedule anticipates commercial operation during the 2023-2024 winter season Electric Supply Resource Plans South Dakota – expect to file an updated integrated resource plan in second half of 2022 Montana – expect to submit an integrated resource plan to the MPSC by the end of 2022 Electric Supply Planning 22 The recently completed 58-megawatt Bob Glanzer Generating Station in Huron, South Dakota, provides on-demand resources to support the variability of wind and solar projects coming onto our system and the grid in our region and help serve our customers during extended periods of peak demand.

Distribution System Update 23 Five Year Projects Grid of the Future System Efficiencies • Advanced Distribution Management Systems (ADMS) Enhancements • Fault Location, Isolation and Service Restoration (FLISR) Implementation • Distribution Energy Resource (DER) Integration Operational Efficiencies • Determination of Compliance (DOC) Transitions Control • Montana Advanced Metering Infrastructure (AMI) Customer Experience • Customer Portals • Smart Apps Actionable Data • Key Performance Indicators • Predictive Analytics • Enterprise Connectivity New Technology • Electric Vehicle Charging / Infrastructure • Micro Management Systems (MGMS) • Advanced Distribution Energy Resource Integration Customer Experience • Advanced Apps & Controls • Predictive Analytics (i.e. Customer Bills) • Home Area Networks • Customized Solutions Data Sharing • Multitenant Solutions • Transactive Controls LED Streetlights AMI Installation

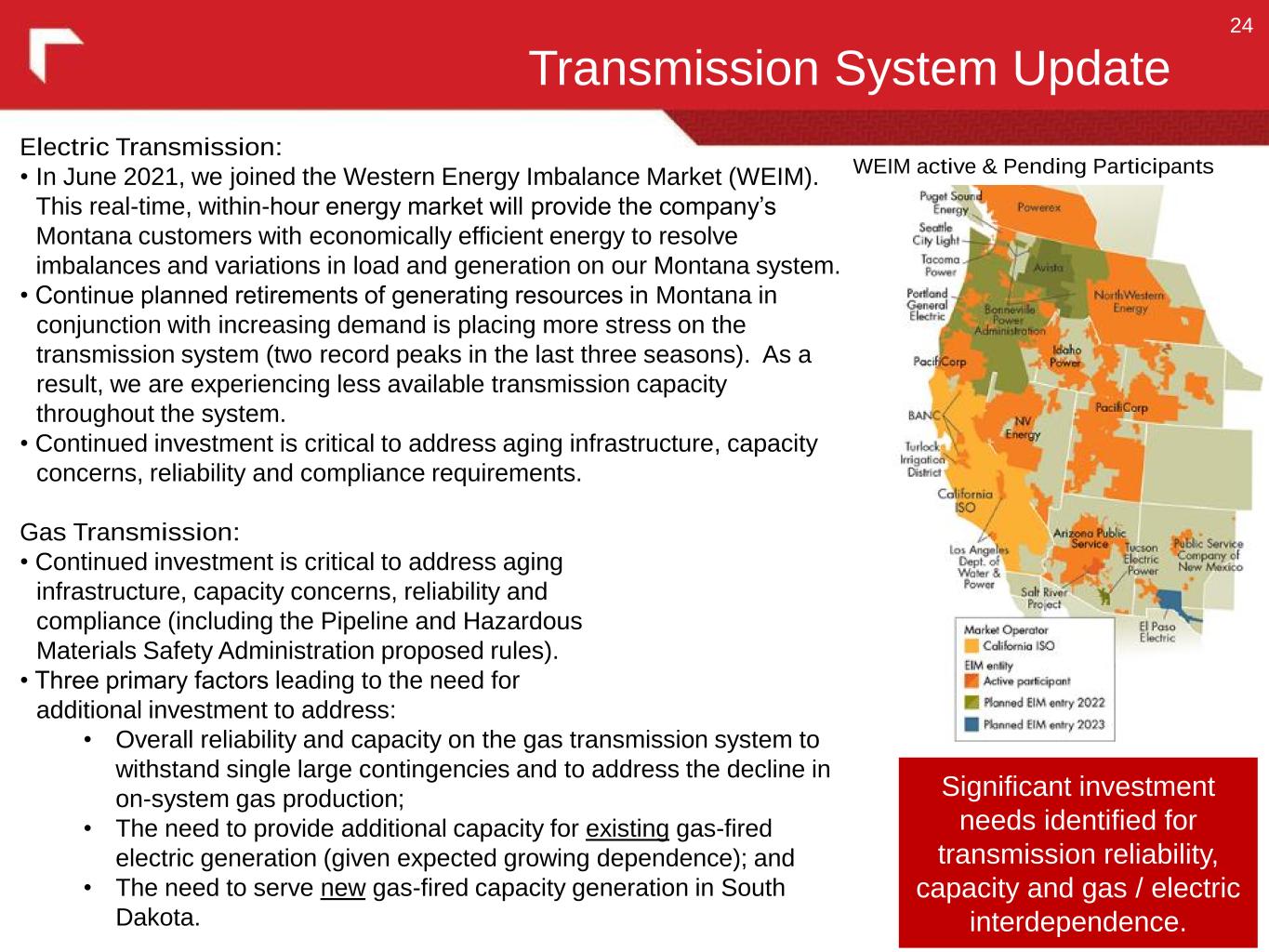

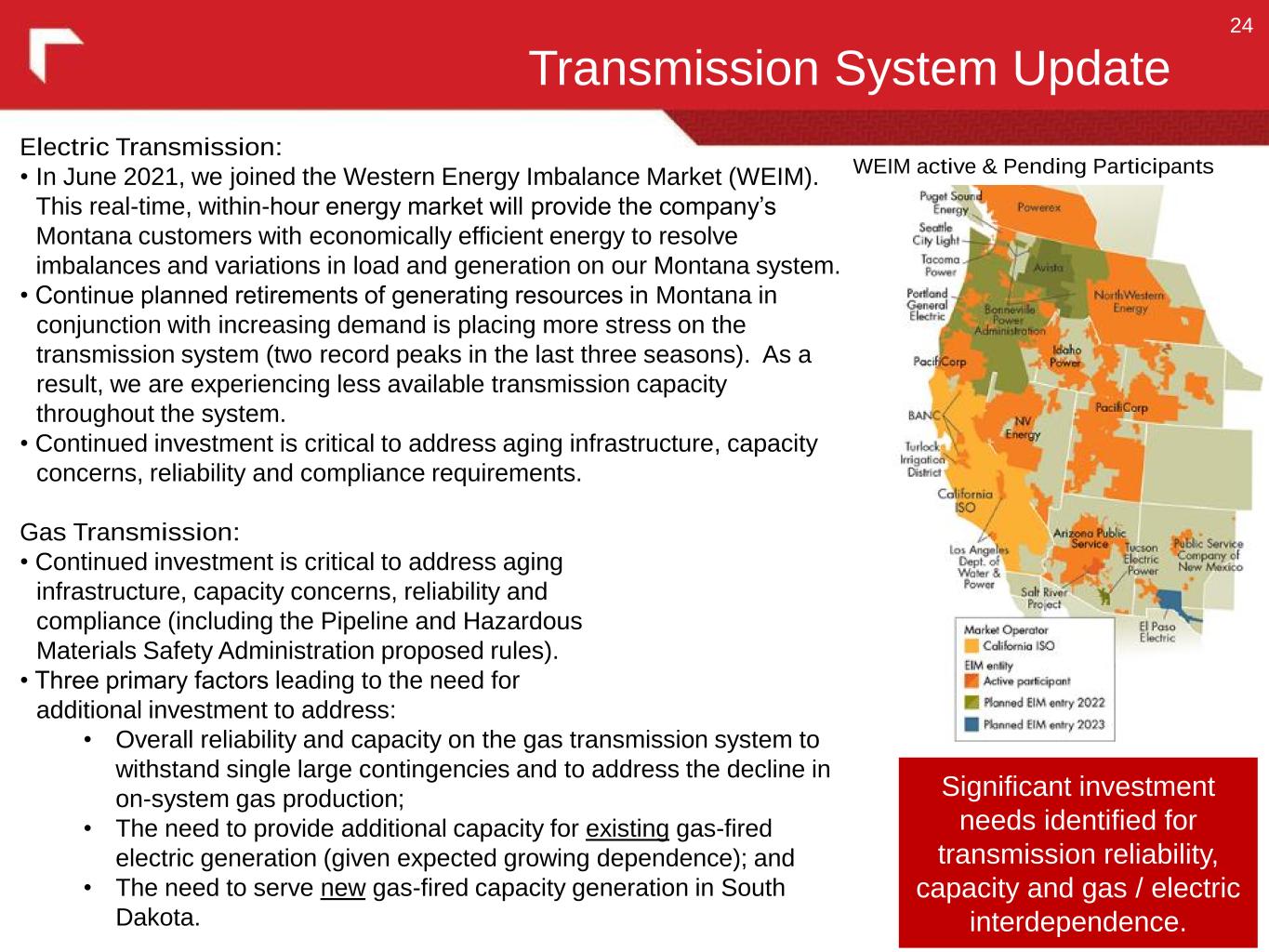

Transmission System Update 24 Electric Transmission: • In June 2021, we joined the Western Energy Imbalance Market (WEIM). This real-time, within-hour energy market will provide the company’s Montana customers with economically efficient energy to resolve imbalances and variations in load and generation on our Montana system. • Continue planned retirements of generating resources in Montana in conjunction with increasing demand is placing more stress on the transmission system (two record peaks in the last three seasons). As a result, we are experiencing less available transmission capacity throughout the system. • Continued investment is critical to address aging infrastructure, capacity concerns, reliability and compliance requirements. Gas Transmission: • Continued investment is critical to address aging infrastructure, capacity concerns, reliability and compliance (including the Pipeline and Hazardous Materials Safety Administration proposed rules). • Three primary factors leading to the need for additional investment to address: • Overall reliability and capacity on the gas transmission system to withstand single large contingencies and to address the decline in on-system gas production; • The need to provide additional capacity for existing gas-fired electric generation (given expected growing dependence); and • The need to serve new gas-fired capacity generation in South Dakota. Significant investment needs identified for transmission reliability, capacity and gas / electric interdependence. WEIM active & Pending Participants

Our Net-Zero Vision 25 Over the past 100 years, NorthWestern Energy has maintained our commitment to provide customers with reliable and affordable electric and natural gas service while also being good stewards of the environment. We have responded to climate change, its implications and risks, by increasing our environmental sustainability efforts and our access to clean energy resources. But more must be done. We are committed to achieving net zero emissions by 2050. • Committed to achieving net-zero by 2050 for Scope 1 and 2 emissions • Balance Affordability, Reliability and Sustainability in this transition • No new carbon emitting generation additions after 2035 • Pipeline modernization, enhanced leak detection and development of alternative fuels for natural gas business • Electrify fleet and add charging infrastructure • Carbon offsets likely needed to ultimately achieve net-zero • Please visit www.NorthWesternEnergy.com/NetZero to see our Net Zero Vision.

ESG Publications 26 Environmental Social Governance These eight publications* provide valuable insight into NorthWestern Energy’s Environmental, Social and Governance (ESG) Sustainability practices. * Available at: https://www.northwesternenergy.com/about-us/environmental-social-governance and https://www.northwesternenergy.com/about-us/investors/financials

ESG - Environmental 27 Beethoven Wind Farm NWE Montana & South Dakota combined 56% Carbon-Free Owned and Long-Term Contracted Portfolio in 2021 vs ~40% National Average in 2021 Based on MWh’s Source: U.S. Energy Information Administration – form EIA.gov Table 7.2b Electric Net Generation: U.S. Electric Power Sector 2021 Note: NorthWestern does not own all the renewable energy certificates (RECs) generated by contracted wind, and periodically sells its own RECs with proceeds benefiting retail customers. Accordingly, we cannot represent that 100% of carbon-free energy in the portfolio was delivered to our customers. Black Eagle Power House

ESG - Social 28 Community EmployeesCustomers $2.6 Billion Economic Output in 2021 ($2.30B in Montana & $300M in SD/NE) Over $5 million Donations, Sponsorships, Economic Development, Scholarship Funding, Public Recreation Support, Safety Awareness and Volunteer Program Grants in 2021 411 Number of nonprofits that received grants through Employee Volunteer Program $8.6 Million Low-Income Energy Assistance in 2021 Safety Culture Transformation Typical Residential Bills Lower than National Average Building on Our Best – Improved Customer Satisfaction Scores Diverse Employment Over the last 13 years, our energy efficiency programs have helped customers save 685,041 MWh’s of energy – enough to power 76,000 homes for a year.

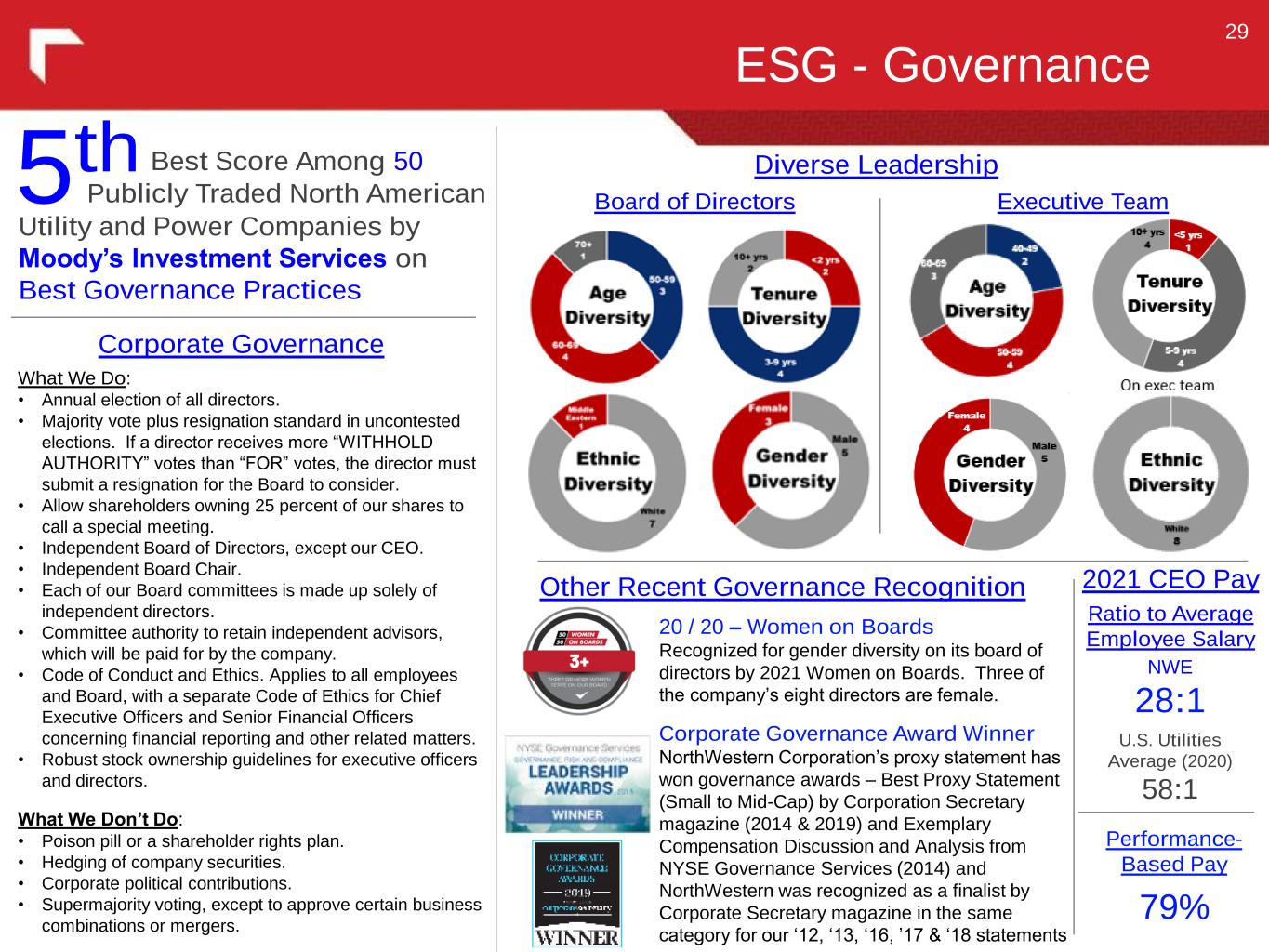

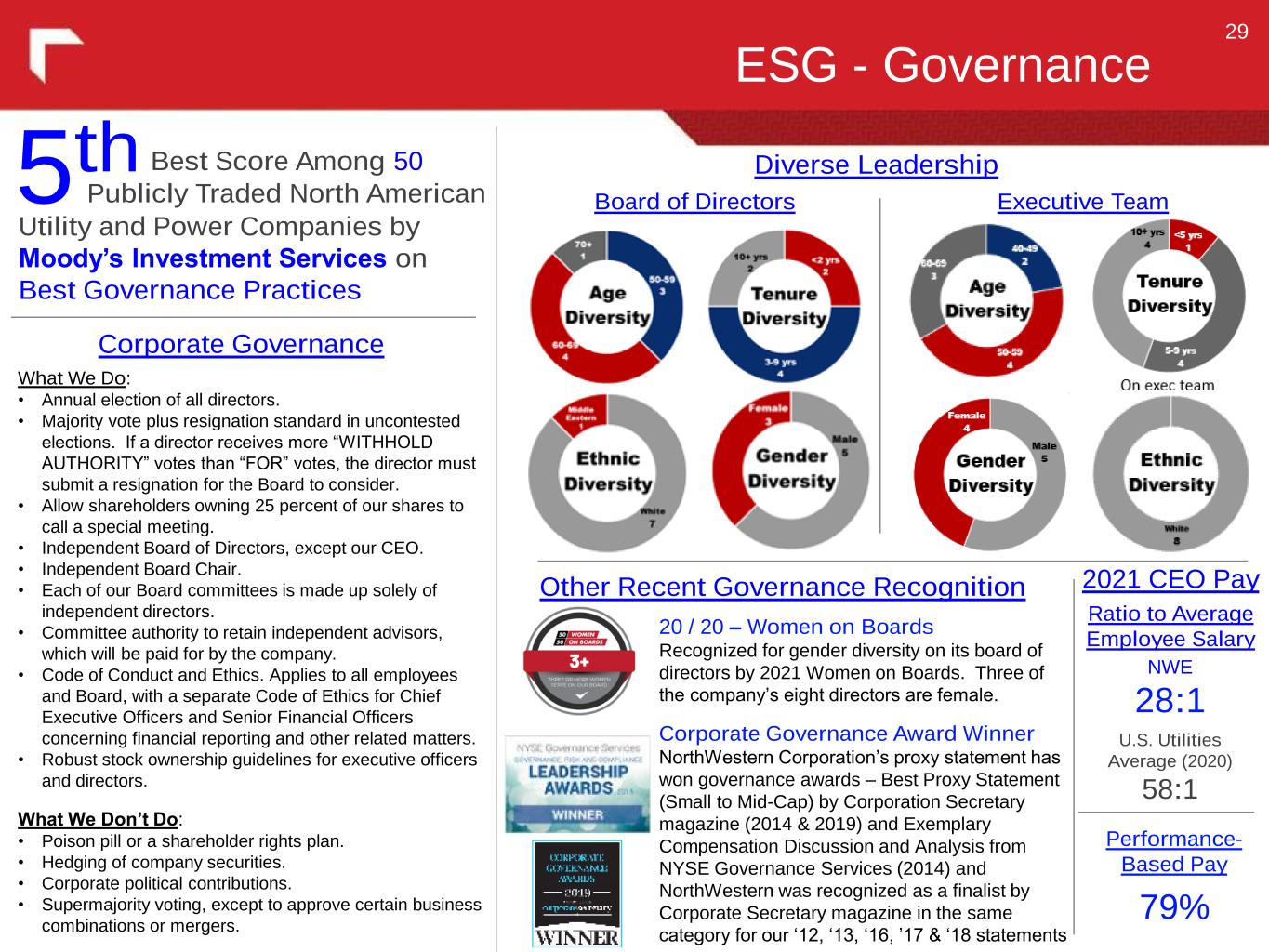

EO ESG - Governance 29 What We Do: • Annual election of all directors. • Majority vote plus resignation standard in uncontested elections. If a director receives more “WITHHOLD AUTHORITY” votes than “FOR” votes, the director must submit a resignation for the Board to consider. • Allow shareholders owning 25 percent of our shares to call a special meeting. • Independent Board of Directors, except our CEO. • Independent Board Chair. • Each of our Board committees is made up solely of independent directors. • Committee authority to retain independent advisors, which will be paid for by the company. • Code of Conduct and Ethics. Applies to all employees and Board, with a separate Code of Ethics for Chief Executive Officers and Senior Financial Officers concerning financial reporting and other related matters. • Robust stock ownership guidelines for executive officers and directors. 20 / 20 – Women on Boards Recognized for gender diversity on its board of directors by 2021 Women on Boards. Three of the company’s eight directors are female. Corporate Governance Award Winner NorthWestern Corporation’s proxy statement has won governance awards – Best Proxy Statement (Small to Mid-Cap) by Corporation Secretary magazine (2014 & 2019) and Exemplary Compensation Discussion and Analysis from NYSE Governance Services (2014) and NorthWestern was recognized as a finalist by Corporate Secretary magazine in the same category for our ‘12, ‘13, ‘16, ’17 & ‘18 statements Board of Directors Executive Team5th Best Score Among 50 Publicly Traded North American Utility and Power Companies by Moody’s Investment Services on Best Governance Practices Other Recent Governance Recognition What We Don’t Do: • Poison pill or a shareholder rights plan. • Hedging of company securities. • Corporate political contributions. • Supermajority voting, except to approve certain business combinations or mergers. Corporate Governance Diverse Leadership 2021 CEO Pay Ratio to Average Employee Salary NWE 28:1 U.S. Utilities Average (2020) 58:1 Performance- Based Pay 79%

Conclusion 30 Pure Electric & Gas Utility Solid Utility Foundation Best Practices Corporate Governance Attractive Future Growth Prospects Strong Earnings & Cash Flows

31

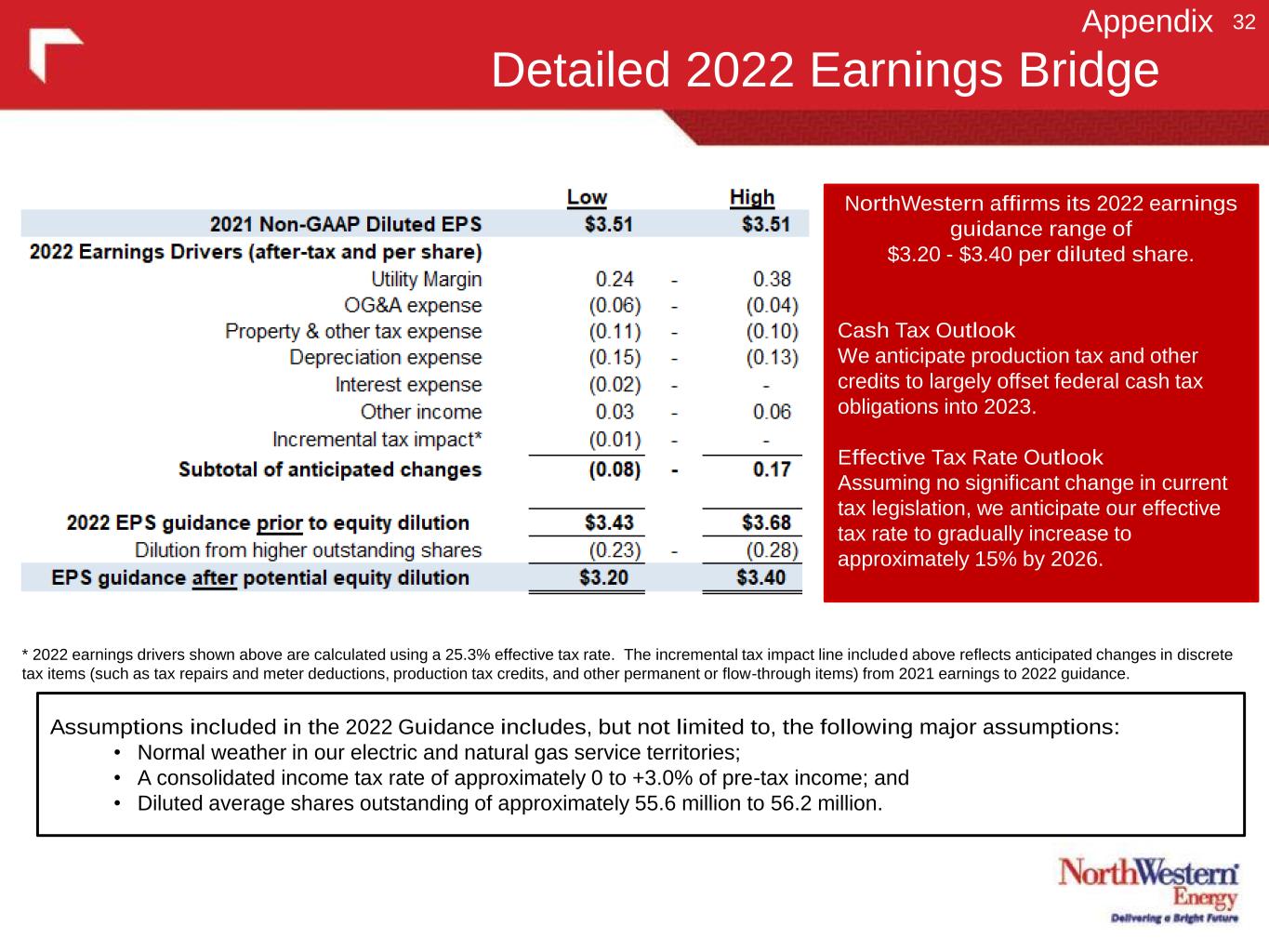

Detailed 2022 Earnings Bridge 32Appendix Assumptions included in the 2022 Guidance includes, but not limited to, the following major assumptions: • Normal weather in our electric and natural gas service territories; • A consolidated income tax rate of approximately 0 to +3.0% of pre-tax income; and • Diluted average shares outstanding of approximately 55.6 million to 56.2 million. NorthWestern affirms its 2022 earnings guidance range of $3.20 - $3.40 per diluted share. Cash Tax Outlook We anticipate production tax and other credits to largely offset federal cash tax obligations into 2023. Effective Tax Rate Outlook Assuming no significant change in current tax legislation, we anticipate our effective tax rate to gradually increase to approximately 15% by 2026. * 2022 earnings drivers shown above are calculated using a 25.3% effective tax rate. The incremental tax impact line included above reflects anticipated changes in discrete tax items (such as tax repairs and meter deductions, production tax credits, and other permanent or flow-through items) from 2021 earnings to 2022 guidance.

NWE Rate Base and Earnings Profile 33Appendix (1) The revenue requirement associated with the FERC regulated portion of Montana electric transmission and ancillary services are included as revenue credits to our MPSC jurisdictional customers. Therefore, we do not separately reflect FERC authorized rate base or authorized returns. (2) The Montana gas revenue requirement includes a step down which approximates annual depletion of our natural gas production assets included in rate base. (3) For those items marked as "n/a," the respective settlement and/or order was not specific as to these terms. Data as reported in our 2021 10-K Coal Generation Rate Base as a percentage of Total Rate Base Revenue from coal generation is not easily identifiable due to the use of bundled rates in South Dakota and other rate design and accounting considerations. However, NorthWestern is a fully regulated utility company for which rate base is the primary driver for earnings. The data to the left illustrates that NorthWestern only derives approximately 10 -14% of earnings from its jointly owned coal generation rate base.

Accredited Capacity Contribution in Montana 34Appendix On a megawatt basis, wind generation comprises a very significant portion of our electric generation portfolio. However, based upon its ~13% accredited capacity, it provides a much less significant contribution to our overall capacity deficit. Accredited Capacity Contribution is the ability of each resource fuel-type to contribute to meet demand during peak energy usage by customers. Accredited Capacity Contribution or Peak Load Contribution is based on Effective Load Carrying Capability (ELCC) E3 Study on Peak Load Measurement for NorthWestern Energy's resources that are on-line or in service as of 12/31/2021 and the ELCC is based on 2021 values. Coal & Other: 222MW Colstrip (30% ownership in jointly owned coal plant) and 87 MW of Federally mandated Qualifying Facilities (52MW Petroleum-coke contract with Yellowstone Energy Limited Partnership and 35MW waste coal contract with Colstrip Energy Limited Partnership).

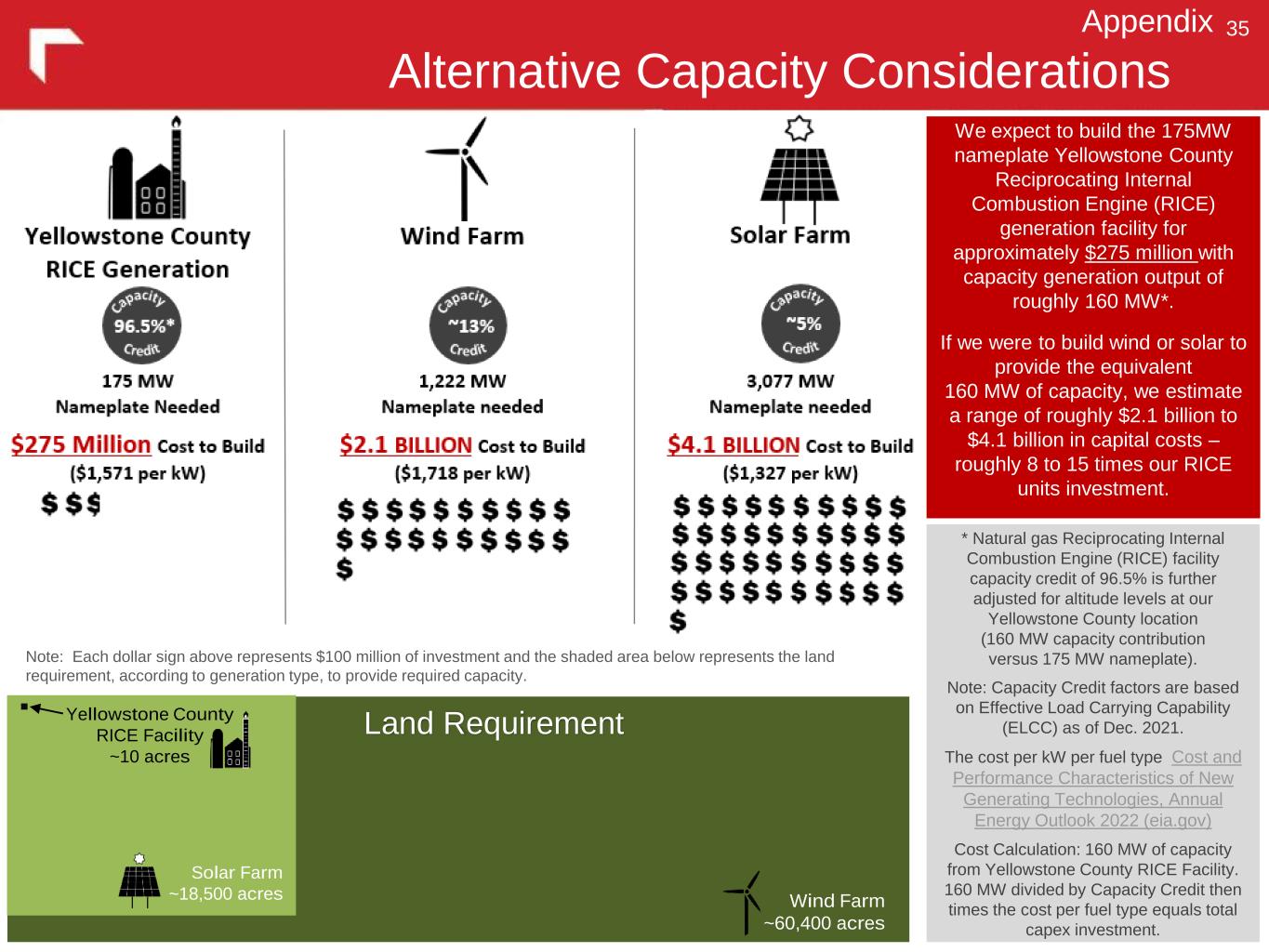

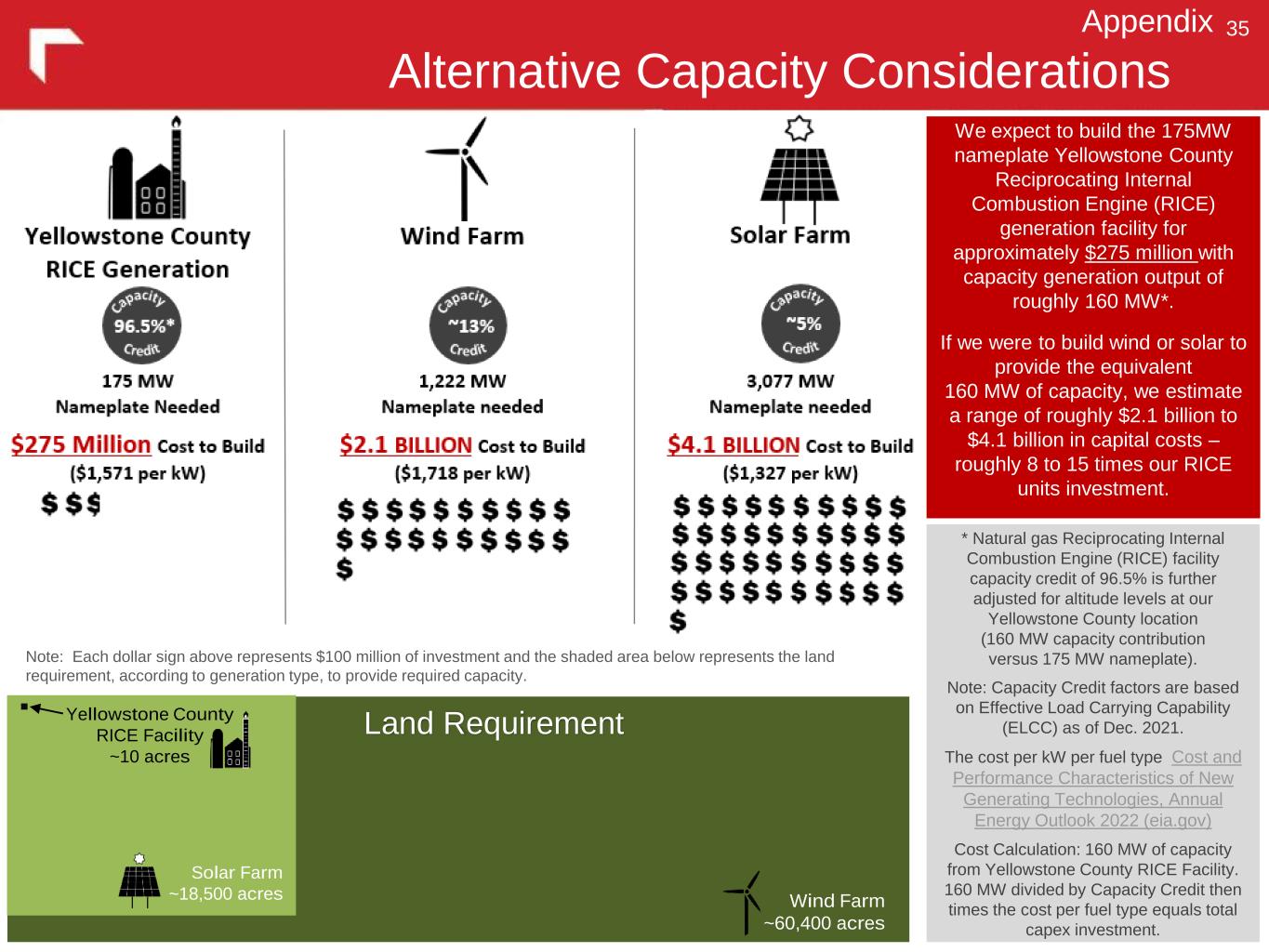

Alternative Capacity Considerations 35 We expect to build the 175MW nameplate Yellowstone County Reciprocating Internal Combustion Engine (RICE) generation facility for approximately $275 million with capacity generation output of roughly 160 MW*. If we were to build wind or solar to provide the equivalent 160 MW of capacity, we estimate a range of roughly $2.1 billion to $4.1 billion in capital costs – roughly 8 to 15 times our RICE units investment. * Natural gas Reciprocating Internal Combustion Engine (RICE) facility capacity credit of 96.5% is further adjusted for altitude levels at our Yellowstone County location (160 MW capacity contribution versus 175 MW nameplate). Note: Capacity Credit factors are based on Effective Load Carrying Capability (ELCC) as of Dec. 2021. The cost per kW per fuel type Cost and Performance Characteristics of New Generating Technologies, Annual Energy Outlook 2022 (eia.gov) Cost Calculation: 160 MW of capacity from Yellowstone County RICE Facility. 160 MW divided by Capacity Credit then times the cost per fuel type equals total capex investment. Note: Each dollar sign above represents $100 million of investment and the shaded area below represents the land requirement, according to generation type, to provide required capacity. Wind Farm ~60,400 acres Solar Farm ~18,500 acres Land RequirementYellowstone County RICE Facility ~10 acres Appendix

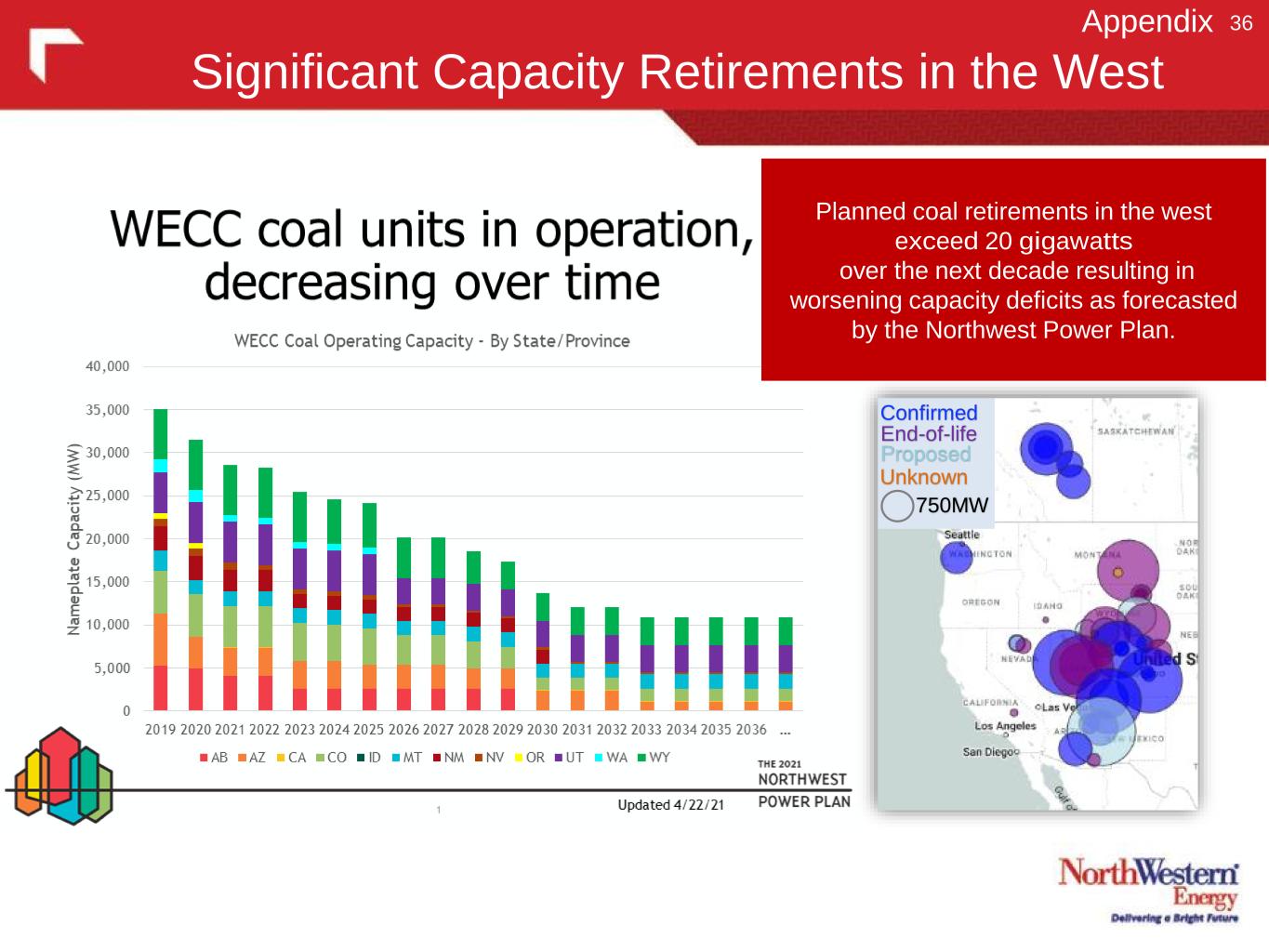

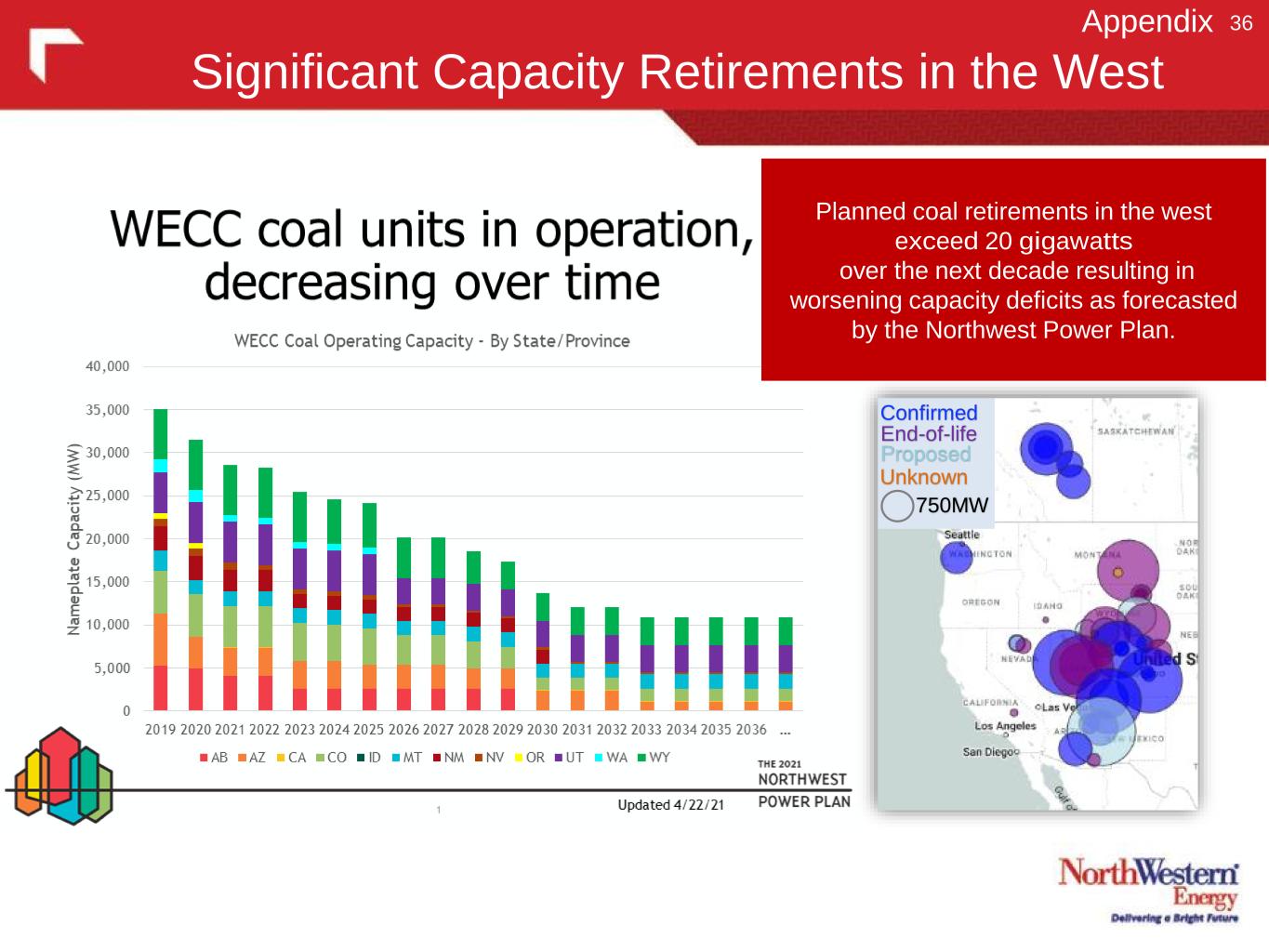

Significant Capacity Retirements in the West 36 Planned coal retirements in the west exceed 20 gigawatts over the next decade resulting in worsening capacity deficits as forecasted by the Northwest Power Plan. Appendix Confirmed End-of-life Proposed Unknown 750MW

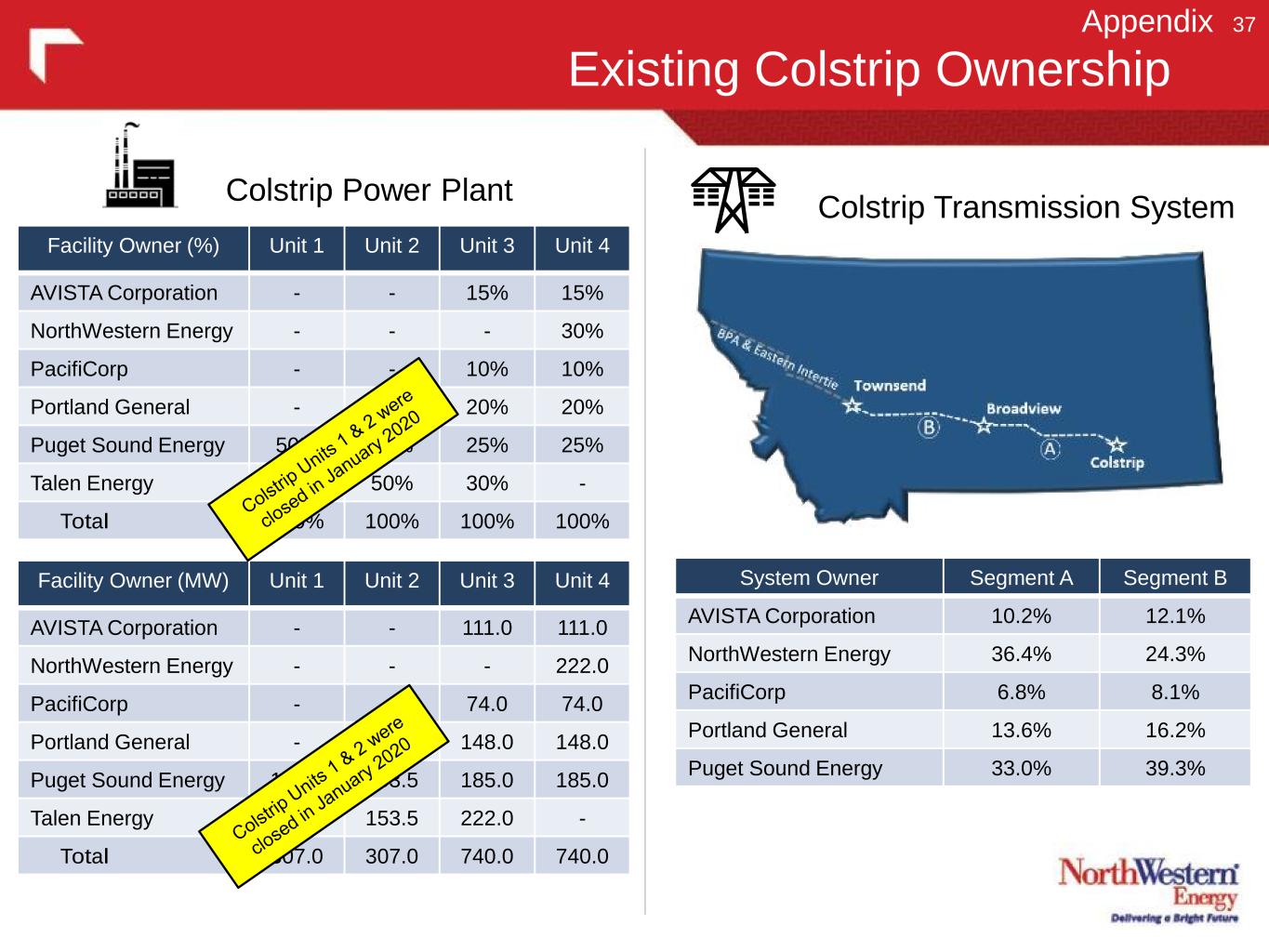

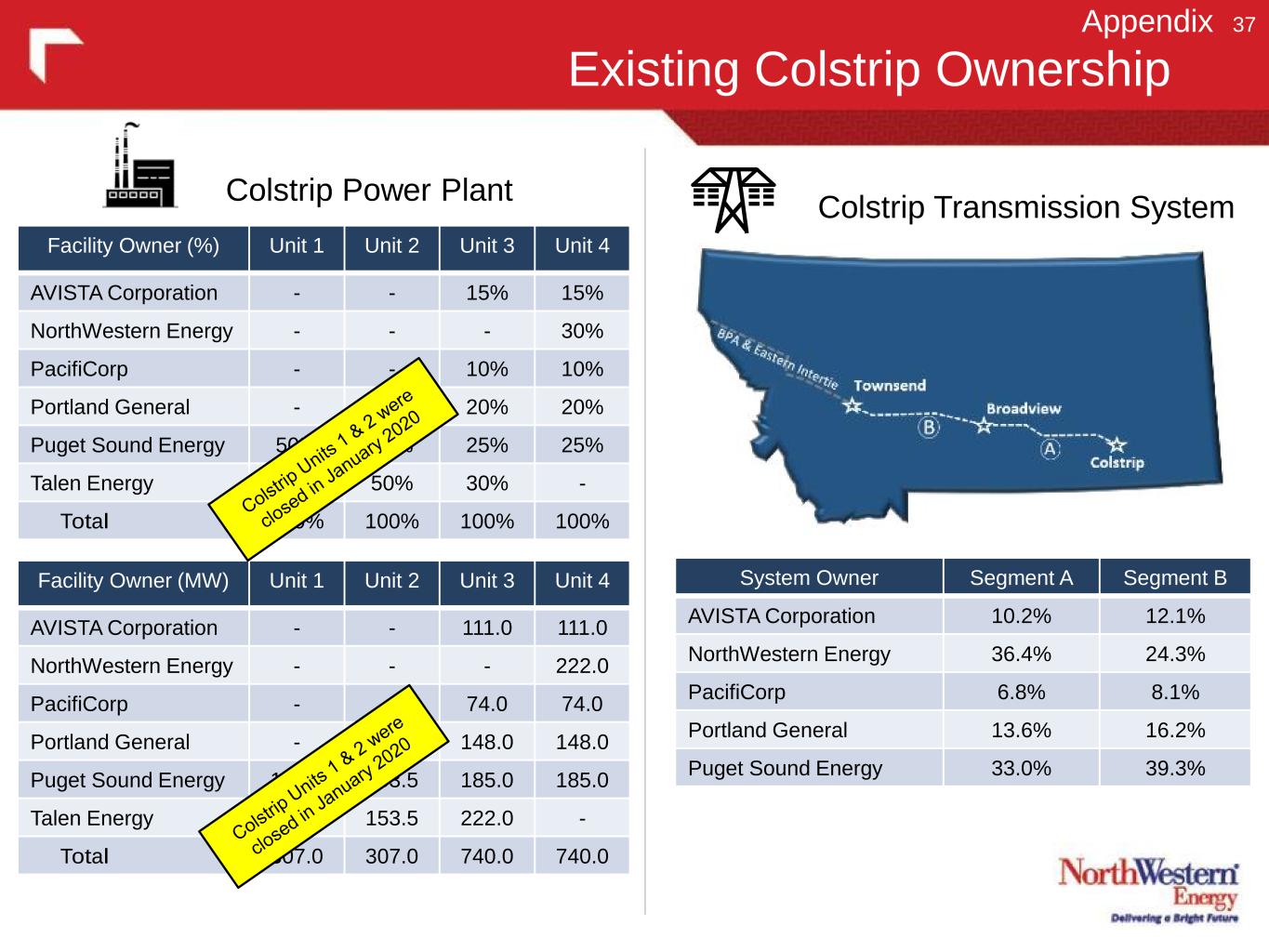

Existing Colstrip Ownership Colstrip Power Plant Colstrip Transmission System System Owner Segment A Segment B AVISTA Corporation 10.2% 12.1% NorthWestern Energy 36.4% 24.3% PacifiCorp 6.8% 8.1% Portland General 13.6% 16.2% Puget Sound Energy 33.0% 39.3% Facility Owner (%) Unit 1 Unit 2 Unit 3 Unit 4 AVISTA Corporation - - 15% 15% NorthWestern Energy - - - 30% PacifiCorp - - 10% 10% Portland General - - 20% 20% Puget Sound Energy 50% 50% 25% 25% Talen Energy 50% 50% 30% - Total 100% 100% 100% 100% Facility Owner (MW) Unit 1 Unit 2 Unit 3 Unit 4 AVISTA Corporation - - 111.0 111.0 NorthWestern Energy - - - 222.0 PacifiCorp - - 74.0 74.0 Portland General - - 148.0 148.0 Puget Sound Energy 153.5 153.5 185.0 185.0 Talen Energy 153.5 153.5 222.0 - Total 307.0 307.0 740.0 740.0 37Appendix

Timeline of Montana Generation Portfolio 38 Since 2011, we have added approximately 780 MW, both owned and long- term contract, to our generation portfolio, all of which is from carbon-free resources. Appendix Owned and Long-Term Resource Portfolio Timeline

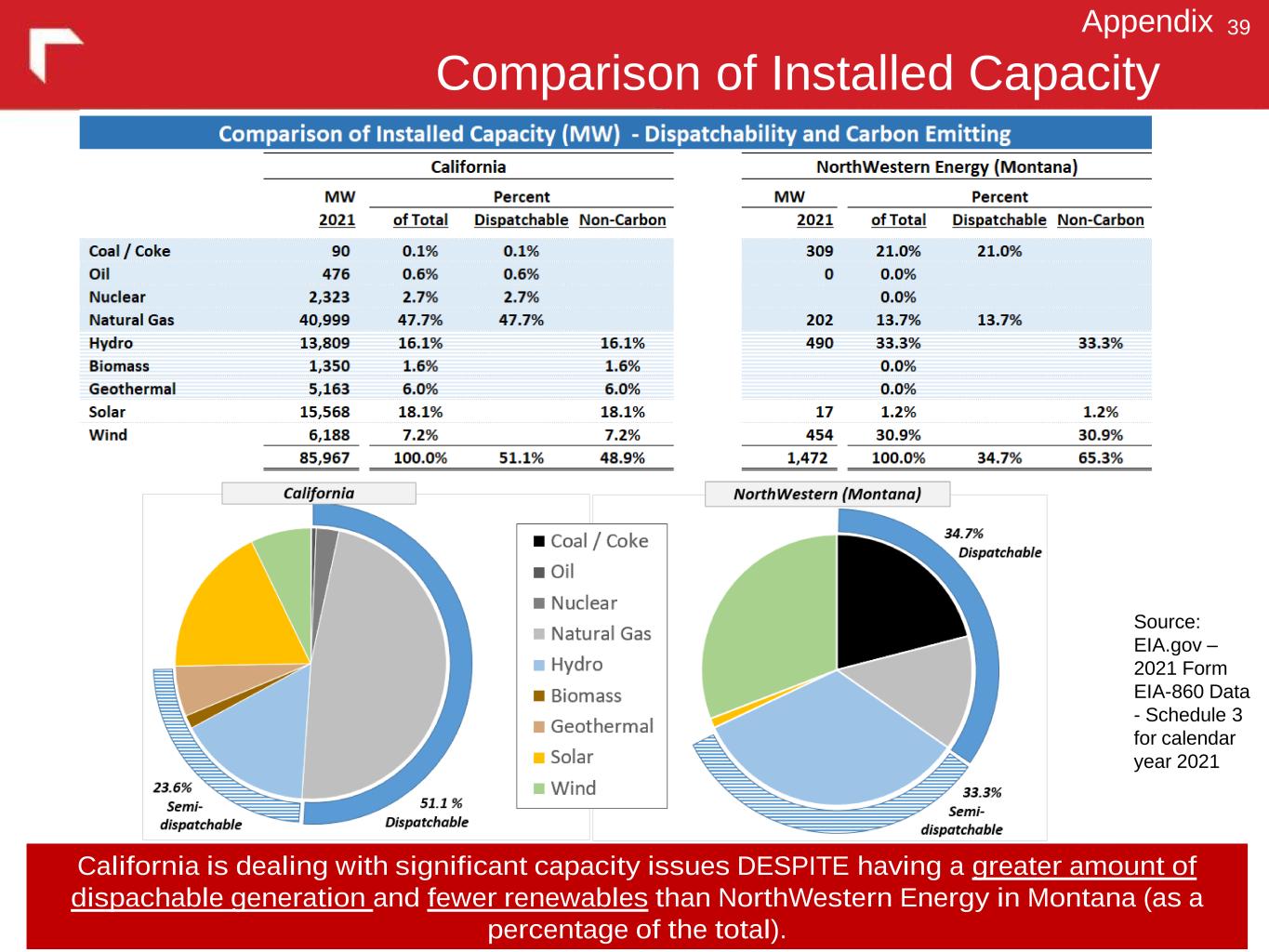

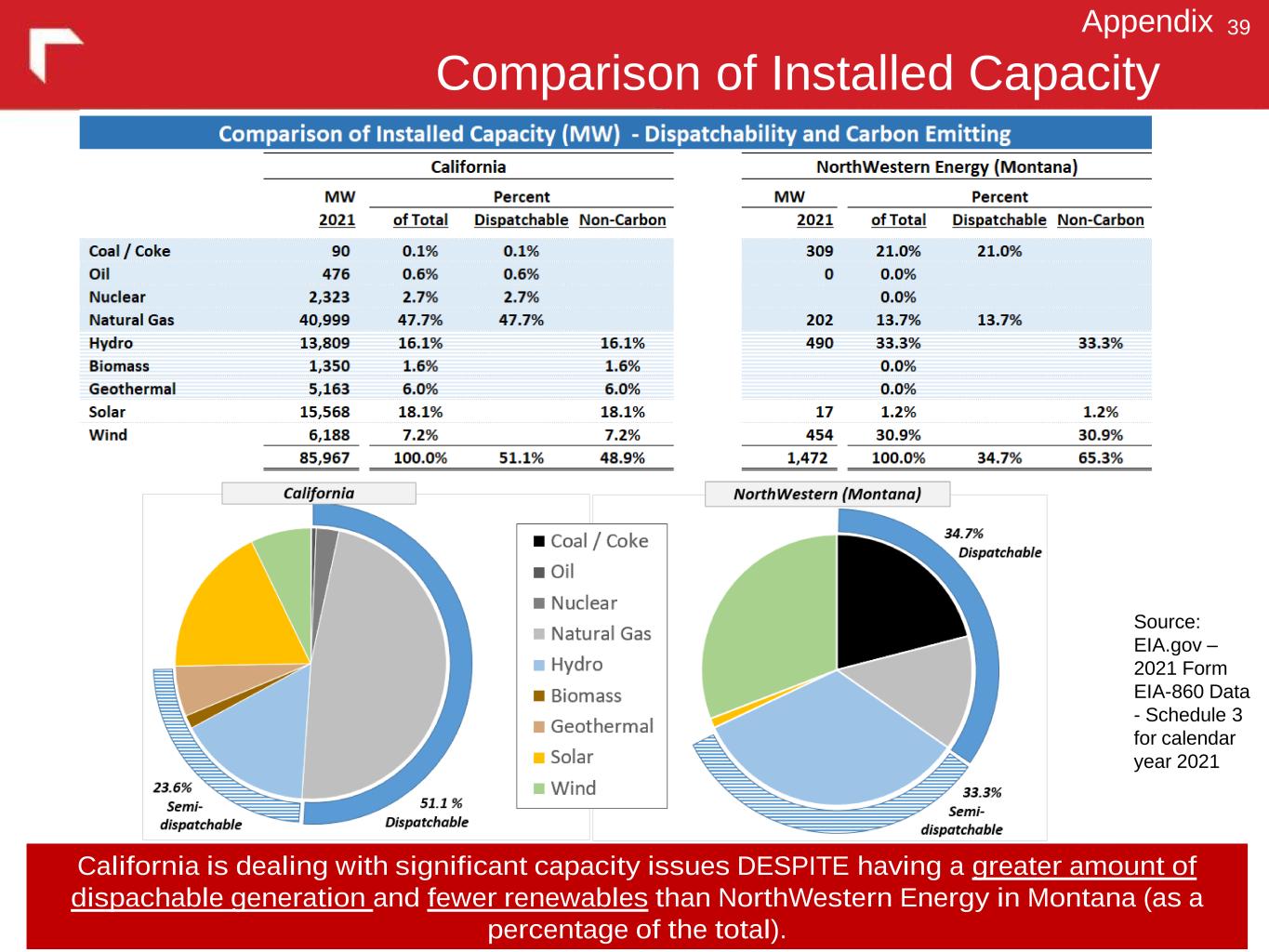

Comparison of Installed Capacity 39 California is dealing with significant capacity issues DESPITE having a greater amount of dispachable generation and fewer renewables than NorthWestern Energy in Montana (as a percentage of the total). Appendix Source: EIA.gov – 2021 Form EIA-860 Data - Schedule 3 for calendar year 2021

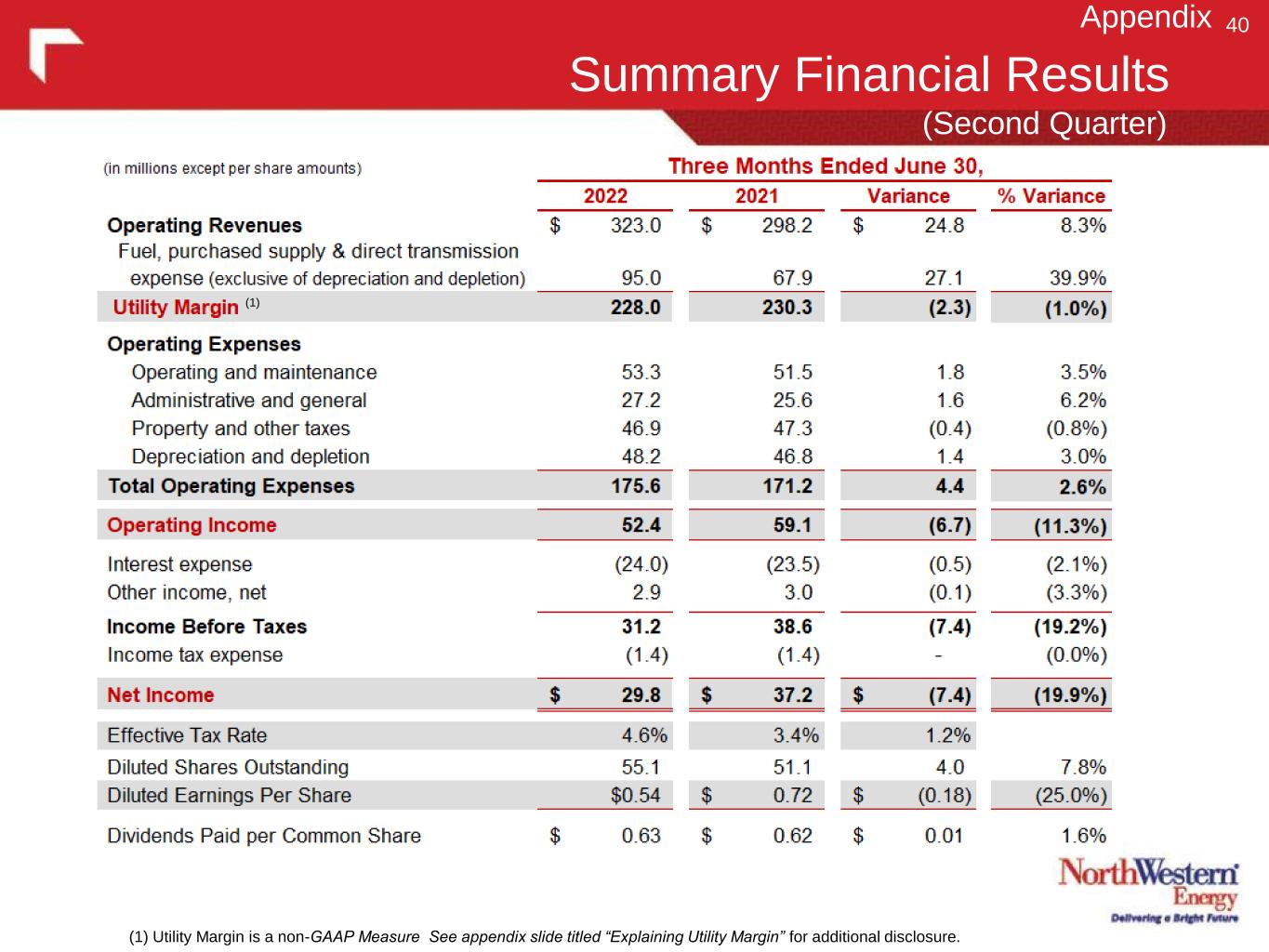

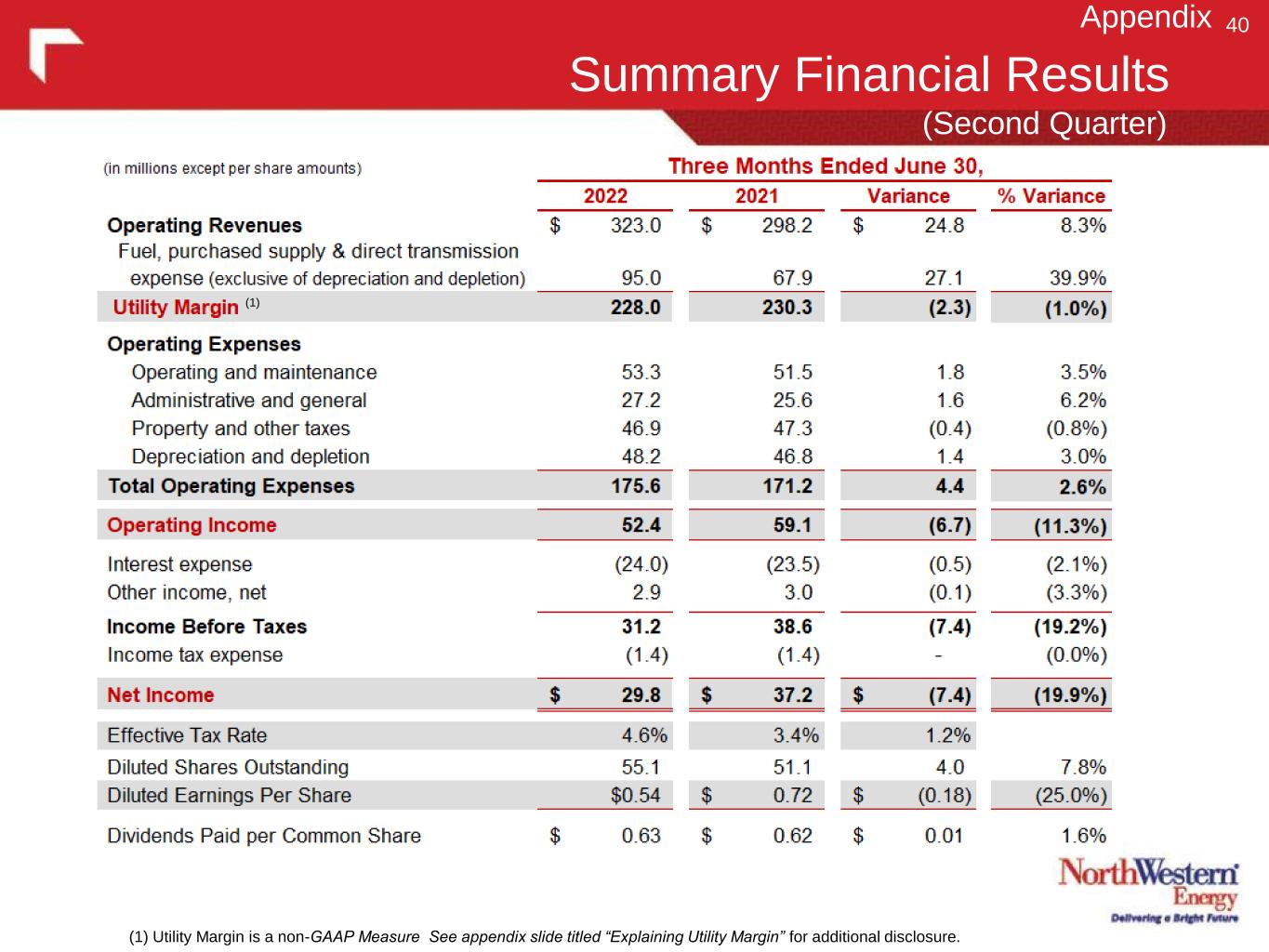

Summary Financial Results 40 (1) (Second Quarter) Appendix (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure.

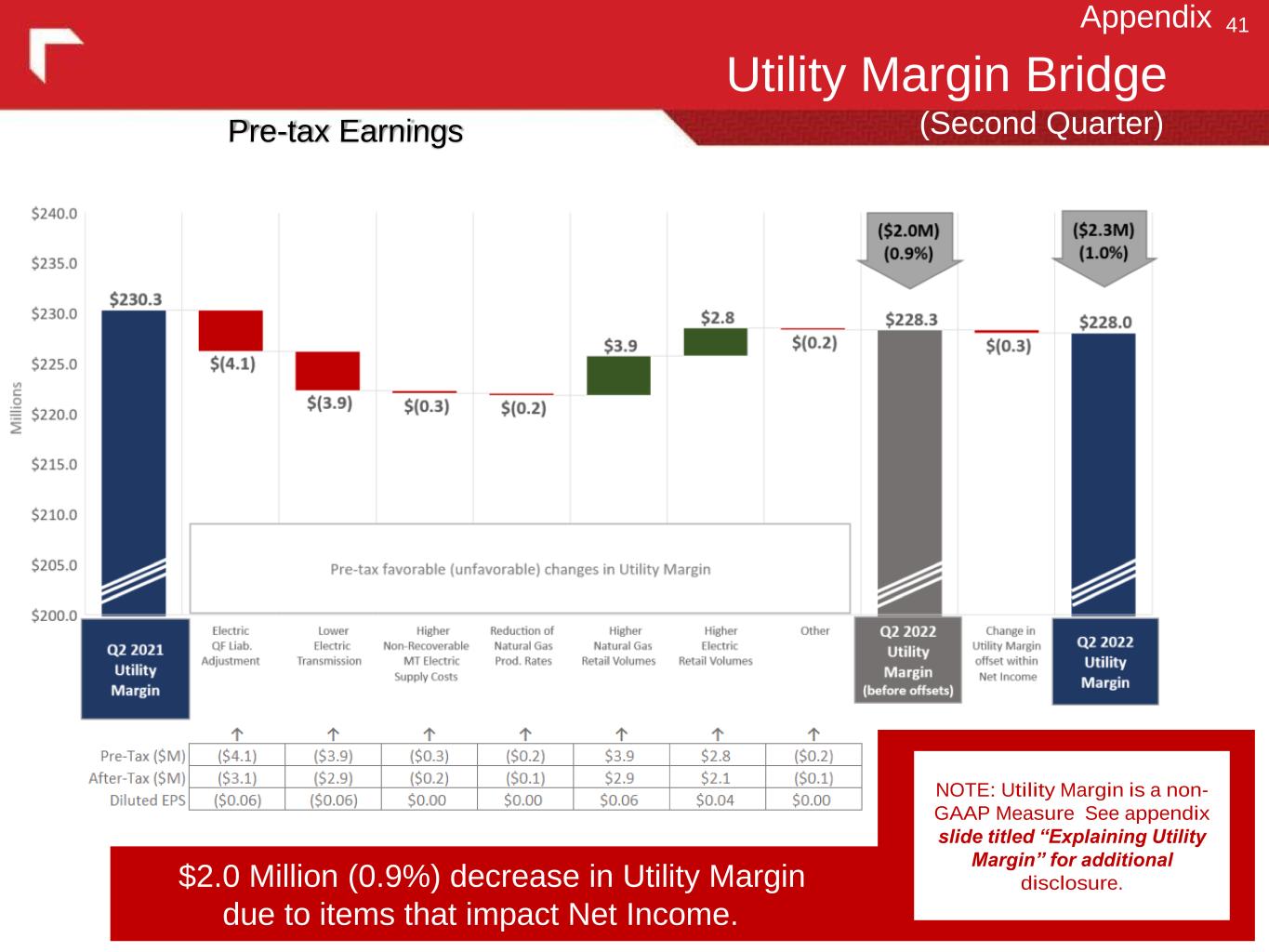

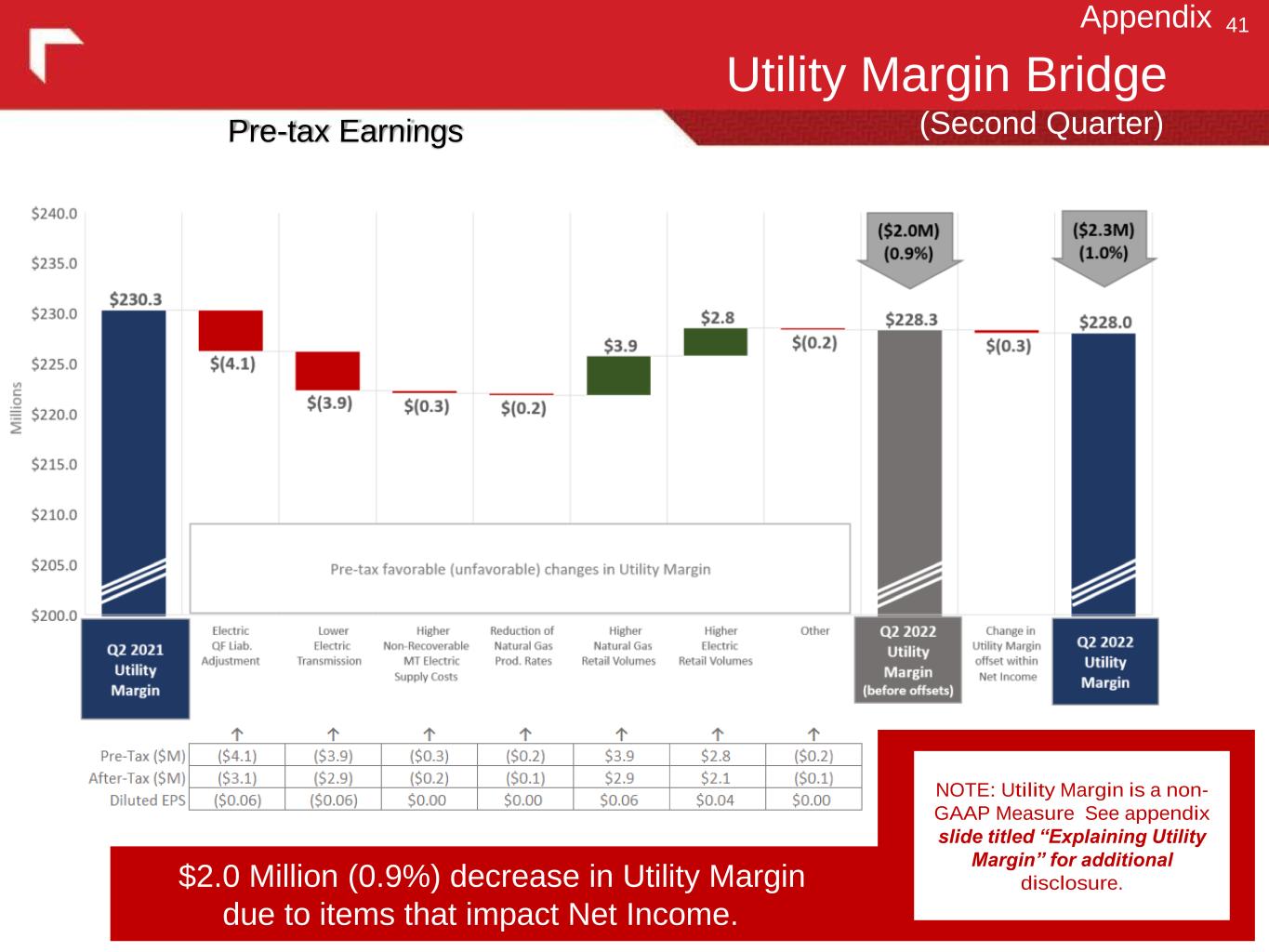

Utility Margin Bridge 41 (Second Quarter) Appendix $2.0 Million (0.9%) decrease in Utility Margin due to items that impact Net Income. Pre-tax Earnings NOTE: Utility Margin is a non- GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure.

$2.8 Million (1.6%) increase in Operating Expenses due to items that impact Net Income. Operating Expense Bridge 42 (Second Quarter) Appendix Pre-tax Earnings NOTE: Operating Expense excludes fuel, purchased supply and direct transmission expense.

Decrease in utility margin due to the following factors: $ (4.1) Electric QF liability adjustment (3.9) Lower transmission revenue (0.3) Higher non-recoverable Montana electric supply costs (0.2) Lower Montana natural gas production rates (annual step down) 3.9 Higher natural gas retail volumes 2.8 Higher electric retail volumes (0.2) Other $ (2.0) Change in Utility Margin Items Impacting Net Income 43 Utility Margin (Second Quarter) (dollars in millions) Three Months Ended June 30, 2022 2021 Variance Electric $ 185.7 $ 192.2 $ (6.5) (3.4%) Natural Gas 42.3 38.1 4.2 11.0% Total Utility Margin $ 228.0 $ 230.3 $ (2.3) (1.0%) (1) $ (0.7) Lower revenue from higher production tax credits, offset in income tax expense (0.4) Lower property taxes recovered in revenue, offset in property tax expense 0.5 Higher operating expenses recovered in revenue, offset in O&M expense 0.3 Higher gas prod. taxes recovered in revenue, offset in property and other taxes $ (0.3) Change in Utility Margin Offset Within Net Income $ (2.3) Decrease in Utility Margin (1) Utility Margin is a non-GAAP Measure See appendix slide titled “Explaining Utility Margin” for additional disclosure. (1) Appendix

Increase in operating expenses due to the following factors: $ 1.6 Higher insurance expense 1.4 Higher depreciation expense due to plant additions 0.5 Higher technology implementation and maintenance expense 0.4 Increase in uncollectible accounts (due to prior year collection of previously written off balances) (0.4) Decrease in expenses at our generation facilities (0.4) Lower property tax expense due to a decrease in the estimated state and local taxes (0.1) Lower labor and benefits (1) (0.2) Other miscellaneous $ 2.8 Change in Operating Expense Items Impacting Net Income Operating Expenses 44 (Second Quarter) (dollars in millions) Three Months Ended June 30, 2022 2021 Variance Operating & maintenance $ 53.3 $ 51.5 $ 1.8 3.5% Administrative & general 27.2 25.6 1.6 6.3% Property and other taxes 46.9 47.3 (0.4) (0.8%) Depreciation and depletion 48.2 46.8 1.4 3.0% Operating Expenses $ 175.6 $ 171.2 $ 4.4 2.6% $ 1.3 Higher pension and other postretirement benefits, offset in other income 0.5 Higher operating and maintenance expenses recovered in trackers, offset in revenue 0.2 Higher non-employee directors deferred compensation, offset in other income (0.4) Lower property and other taxes recovered in trackers, offset in revenue $ 1.6 Change in Operating Expense Items Offset Within Net Income $ 4.4 Increase in Operating Expenses $3.4 Appendix (1) We have included the change in the non- service cost component of our pension and other postretirement benefits, which is recorded within other income on our Condensed Consolidated Statements of Income, within the labor and benefits amount above in order to present the total change in labor benefits expenses. This change is offset below within this table as it does not affect our operating expenses.

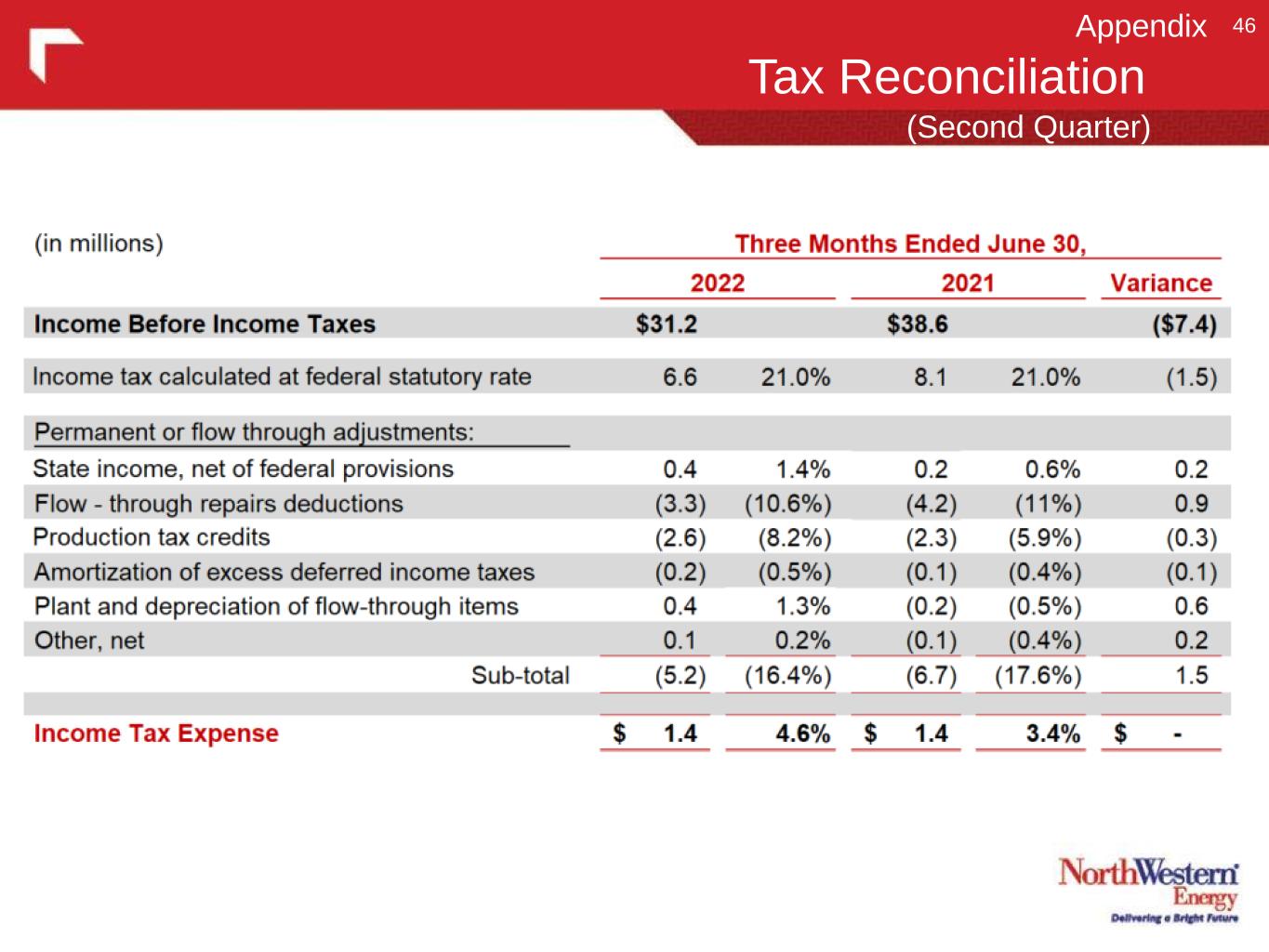

Operating to Net Income 45 (dollars in millions) Three Months Ended June 30, 2022 2021 Variance Operating Income $ 52.4 $ 59.1 $ (6.7) (11.3%) Interest expense (24.0) (23.5) (0.5) (2.1%) Other income, net 2.9 3.0 (0.1) (3.3%) Income Before Taxes 31.2 38.6 (7.4) (19.2%) Income tax expense (1.4) (1.4) - 0.0% Net Income $ 29.8 $ 37.2 $ (7.4) (19.9%) (Second Quarter) $0.5 million increase in interest expenses was primarily due to higher interest on borrowings under our revolving credit facilities, partly offset by higher capitalization of AFUDC. $0.1 million decrease in other income includes a $2.5 million CREP penalty, partly offset by decrease in the non-service costs component of pension expense of $1.3 million and higher capitalization of AFUDC. Flat income tax expense was primarily lower pre-tax income offset by lower discrete flow-through repairs deductions in 2022 Q2 compared to the same period last year. Appendix

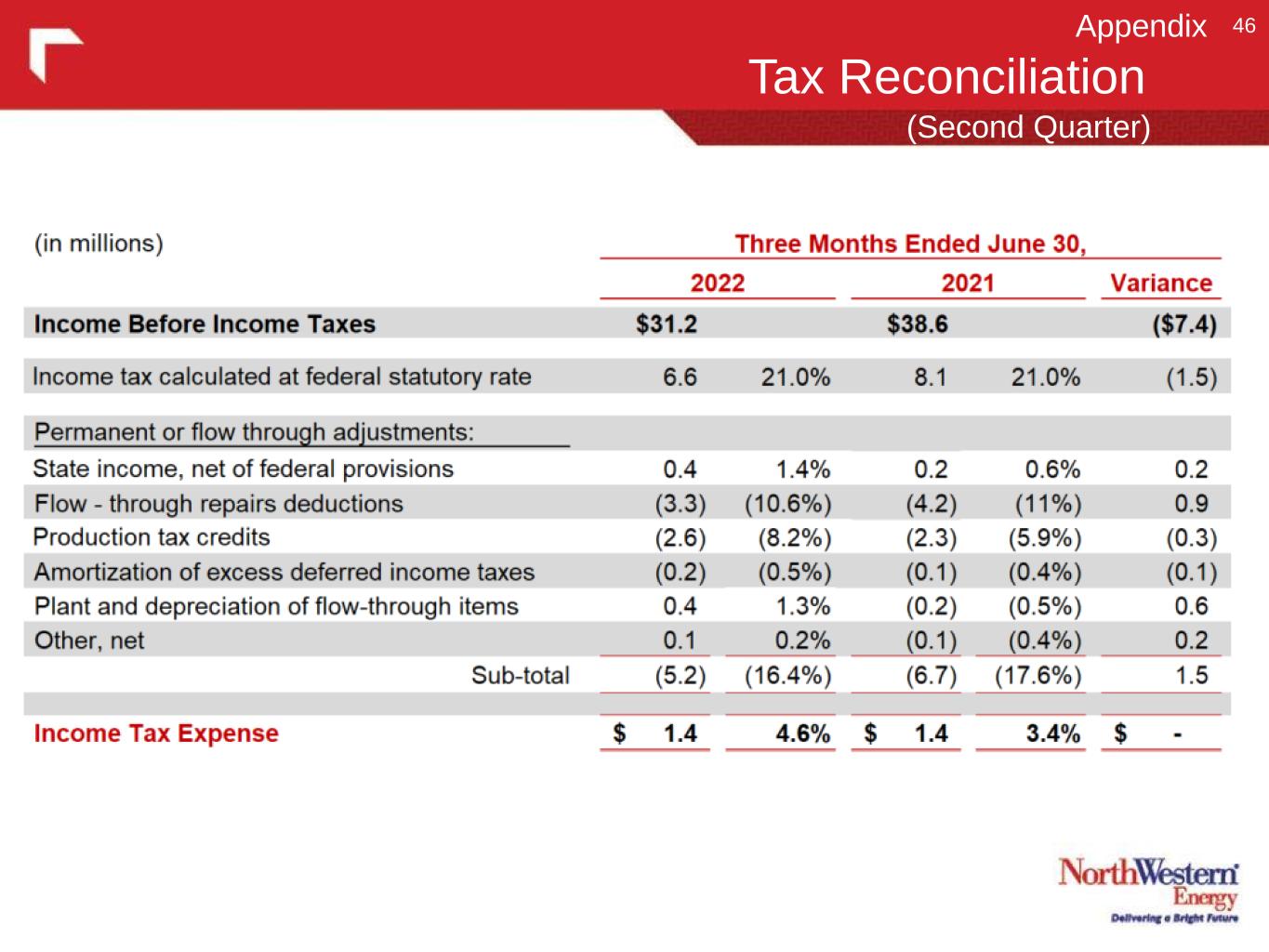

Tax Reconciliation 46Appendix (Second Quarter)

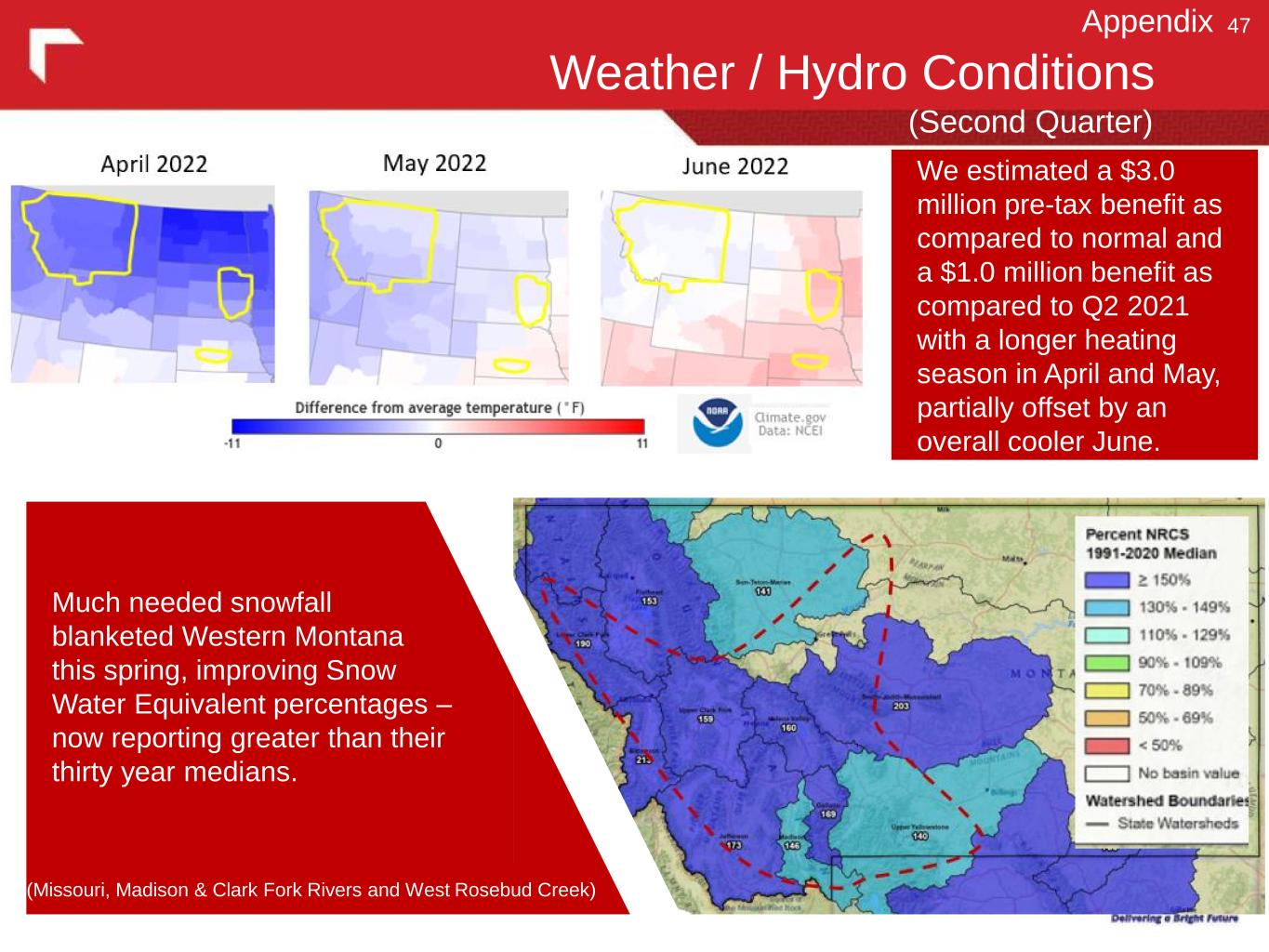

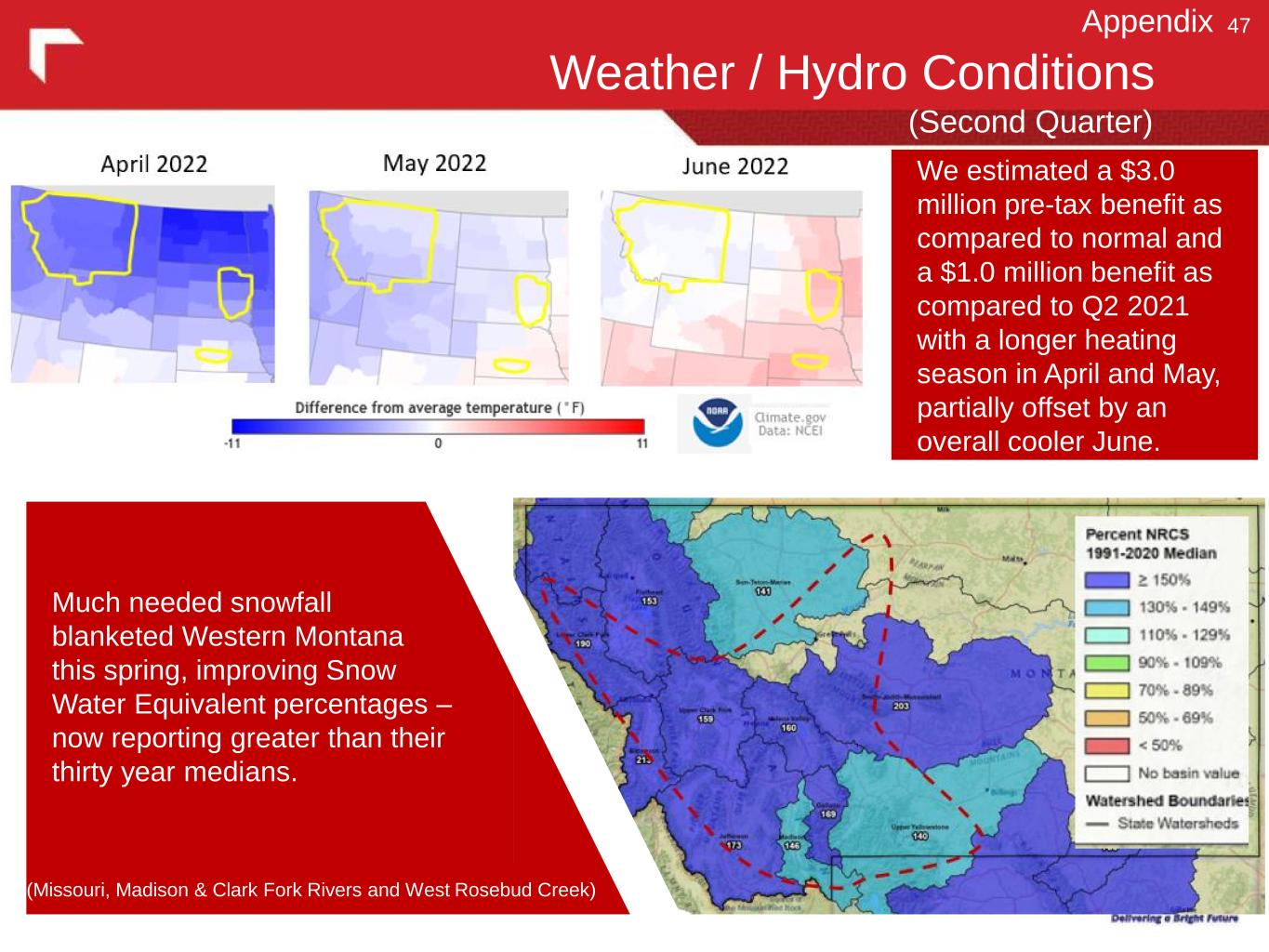

Weather / Hydro Conditions 47 (Second Quarter) Appendix Much needed snowfall blanketed Western Montana this spring, improving Snow Water Equivalent percentages – now reporting greater than their thirty year medians. (Missouri, Madison & Clark Fork Rivers and West Rosebud Creek) We estimated a $3.0 million pre-tax benefit as compared to normal and a $1.0 million benefit as compared to Q2 2021 with a longer heating season in April and May, partially offset by an overall cooler June.

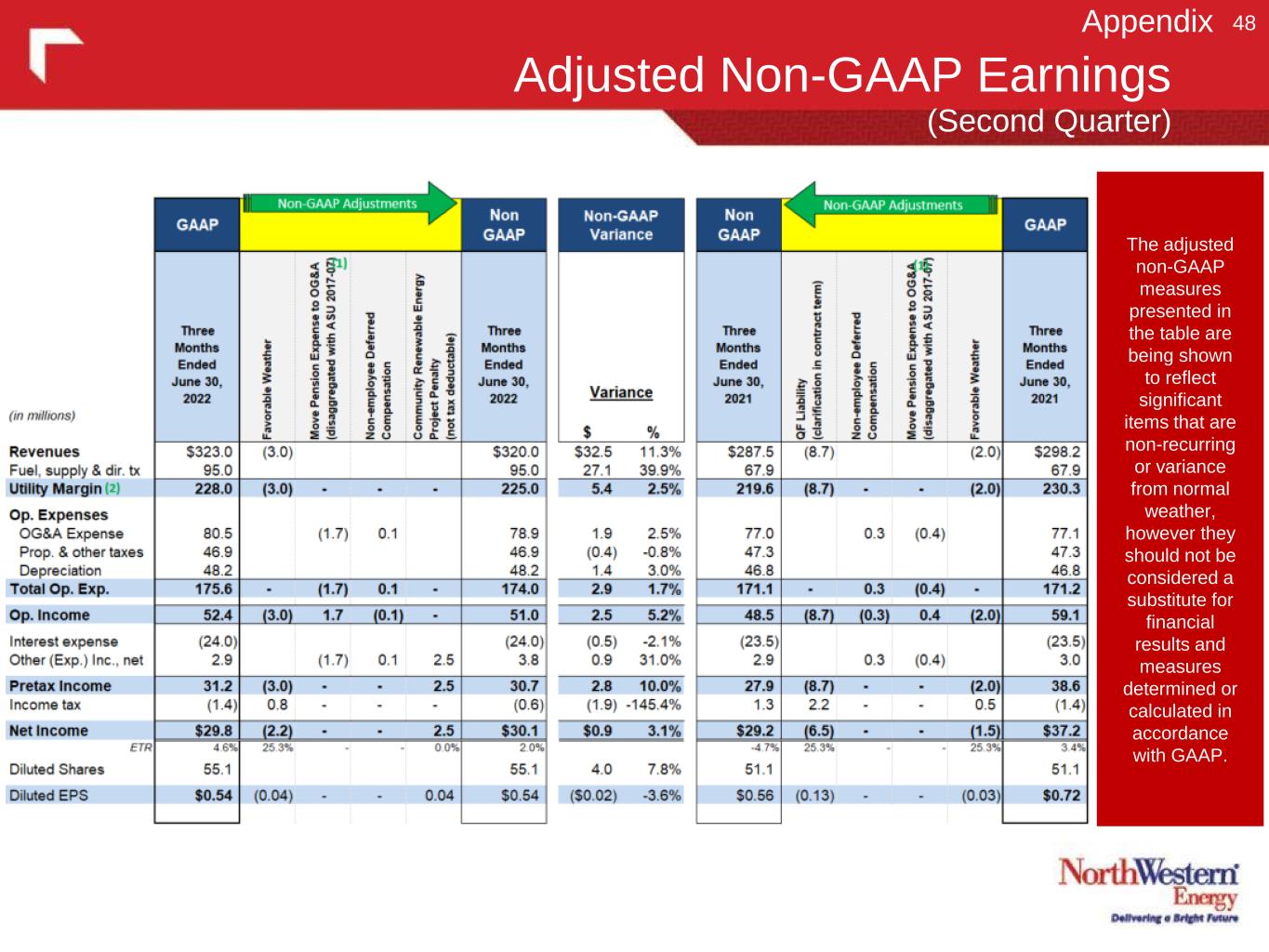

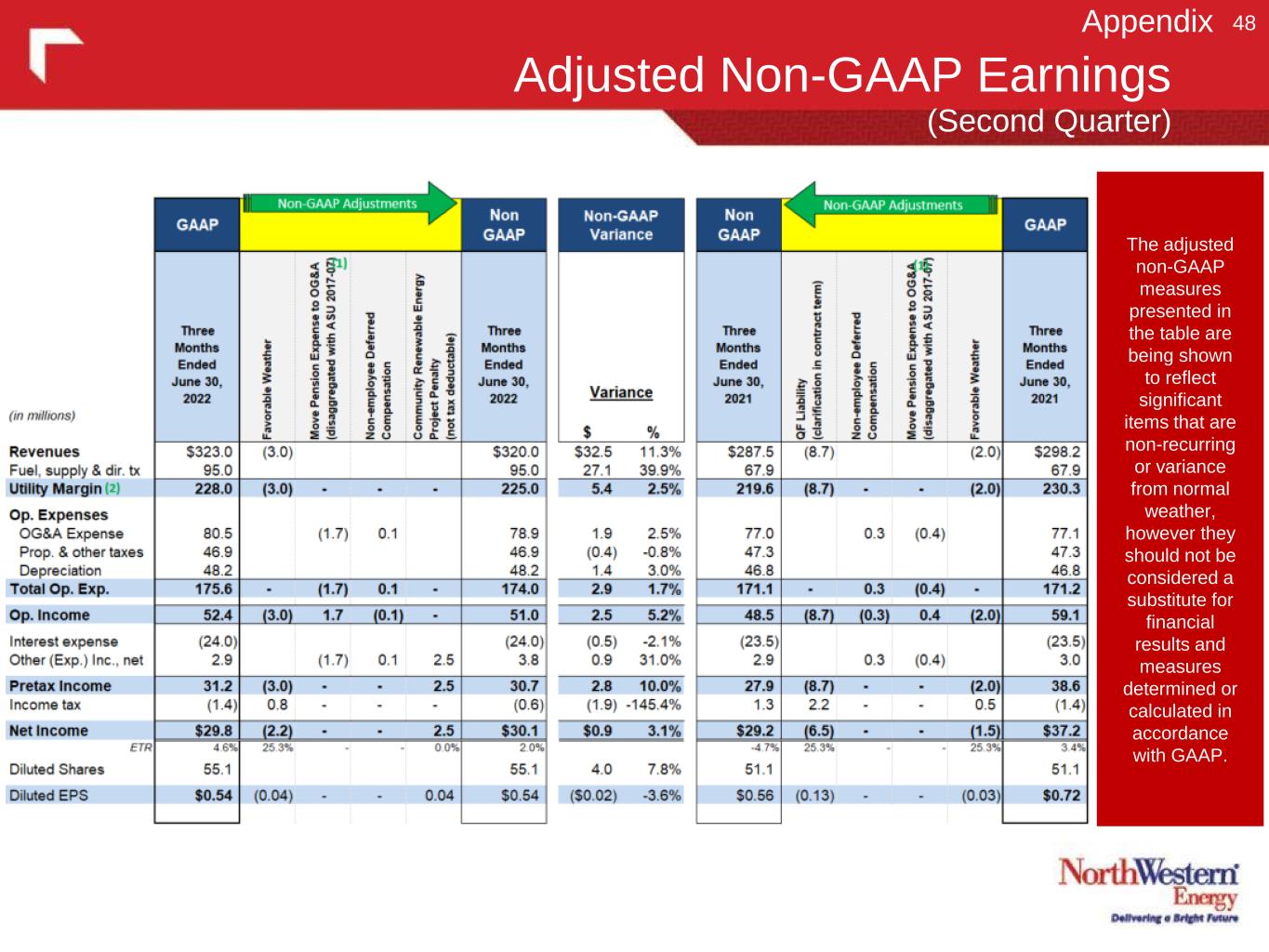

Adjusted Non-GAAP Earnings 48 (Second Quarter) Appendix The adjusted non-GAAP measures presented in the table are being shown to reflect significant items that are non-recurring or variance from normal weather, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP.

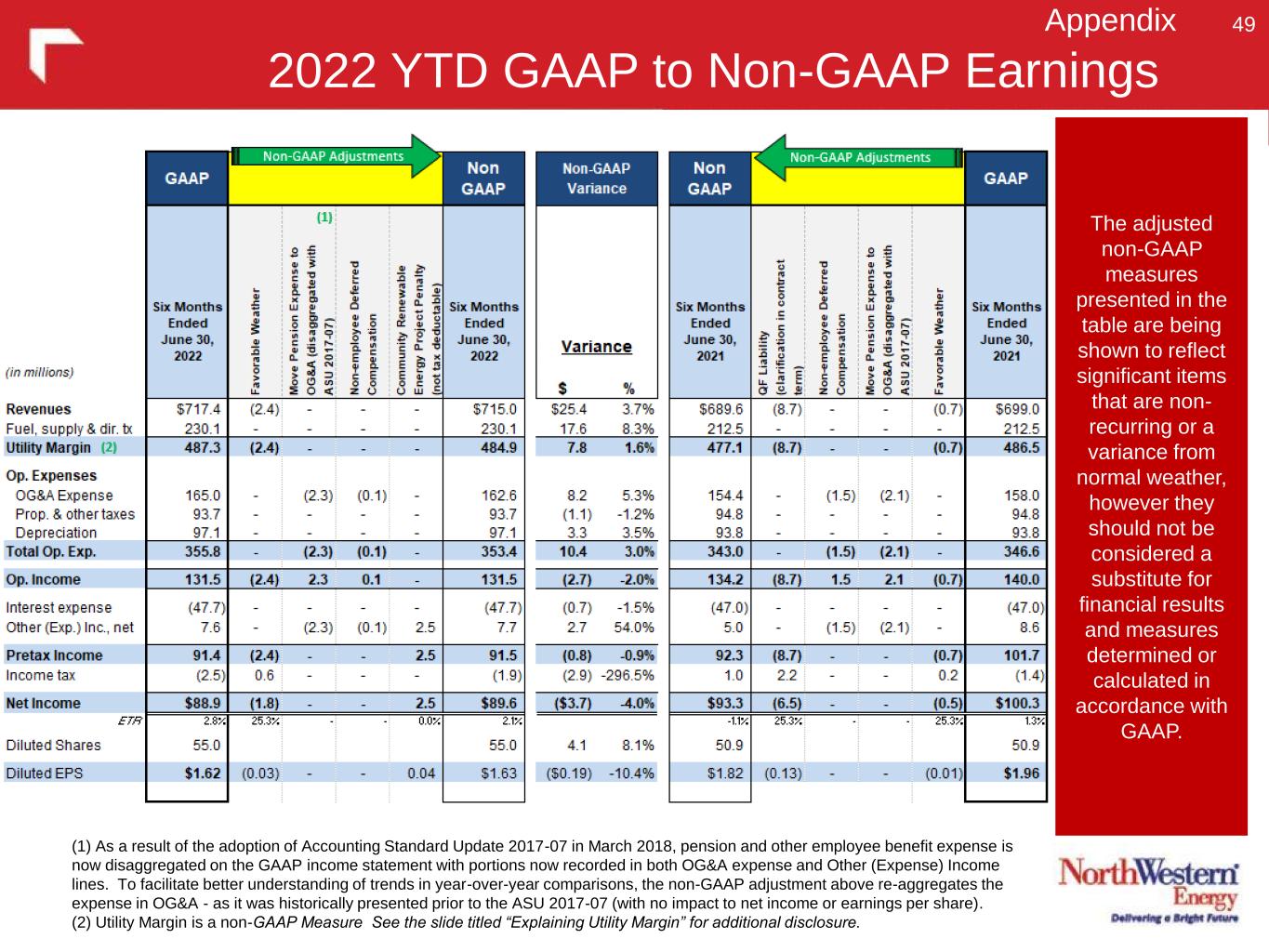

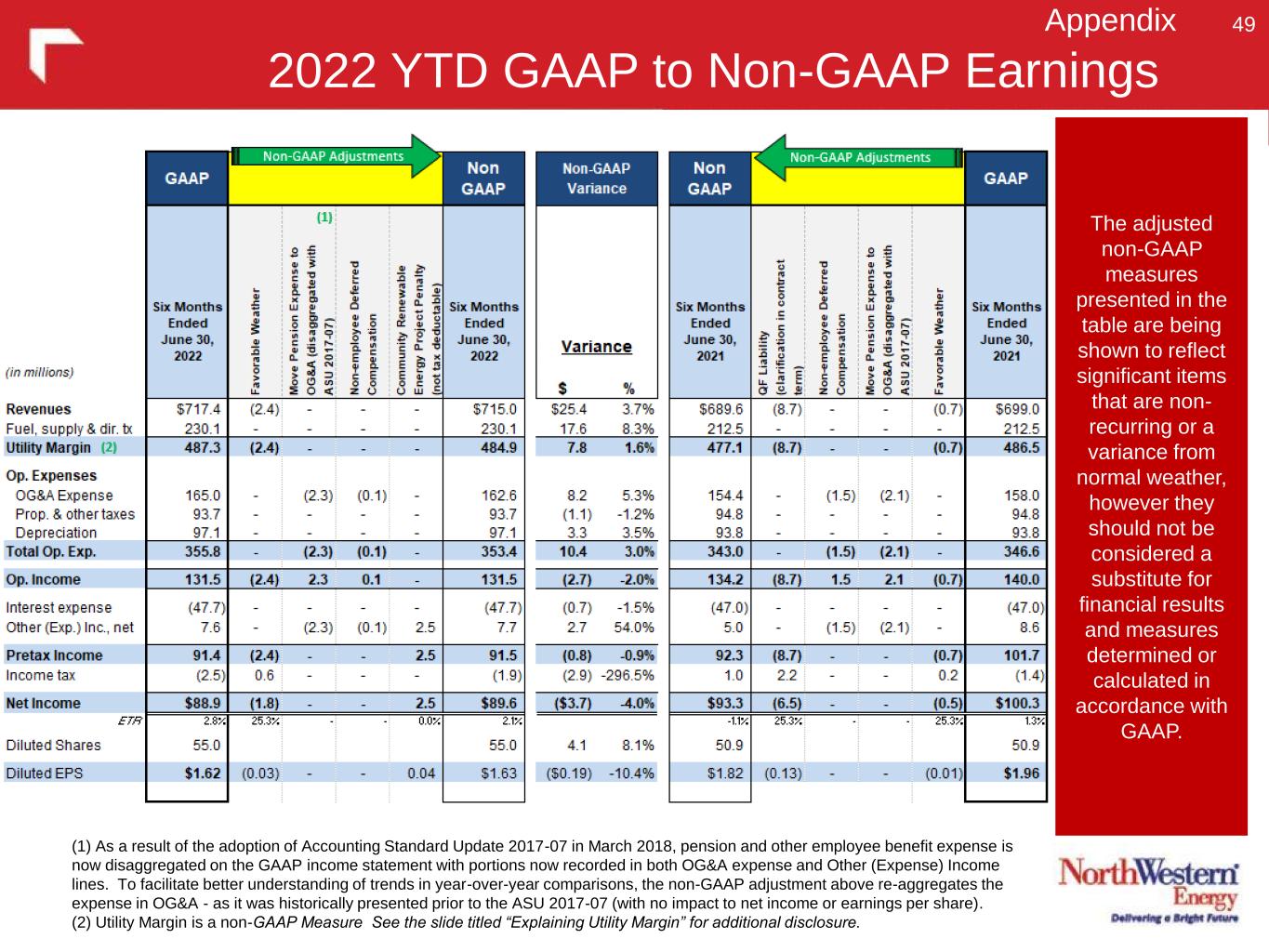

2022 YTD GAAP to Non-GAAP Earnings 49 The adjusted non-GAAP measures presented in the table are being shown to reflect significant items that are non- recurring or a variance from normal weather, however they should not be considered a substitute for financial results and measures determined or calculated in accordance with GAAP. (1) As a result of the adoption of Accounting Standard Update 2017-07 in March 2018, pension and other employee benefit expense is now disaggregated on the GAAP income statement with portions now recorded in both OG&A expense and Other (Expense) Income lines. To facilitate better understanding of trends in year-over-year comparisons, the non-GAAP adjustment above re-aggregates the expense in OG&A - as it was historically presented prior to the ASU 2017-07 (with no impact to net income or earnings per share). (2) Utility Margin is a non-GAAP Measure See the slide titled “Explaining Utility Margin” for additional disclosure. Appendix

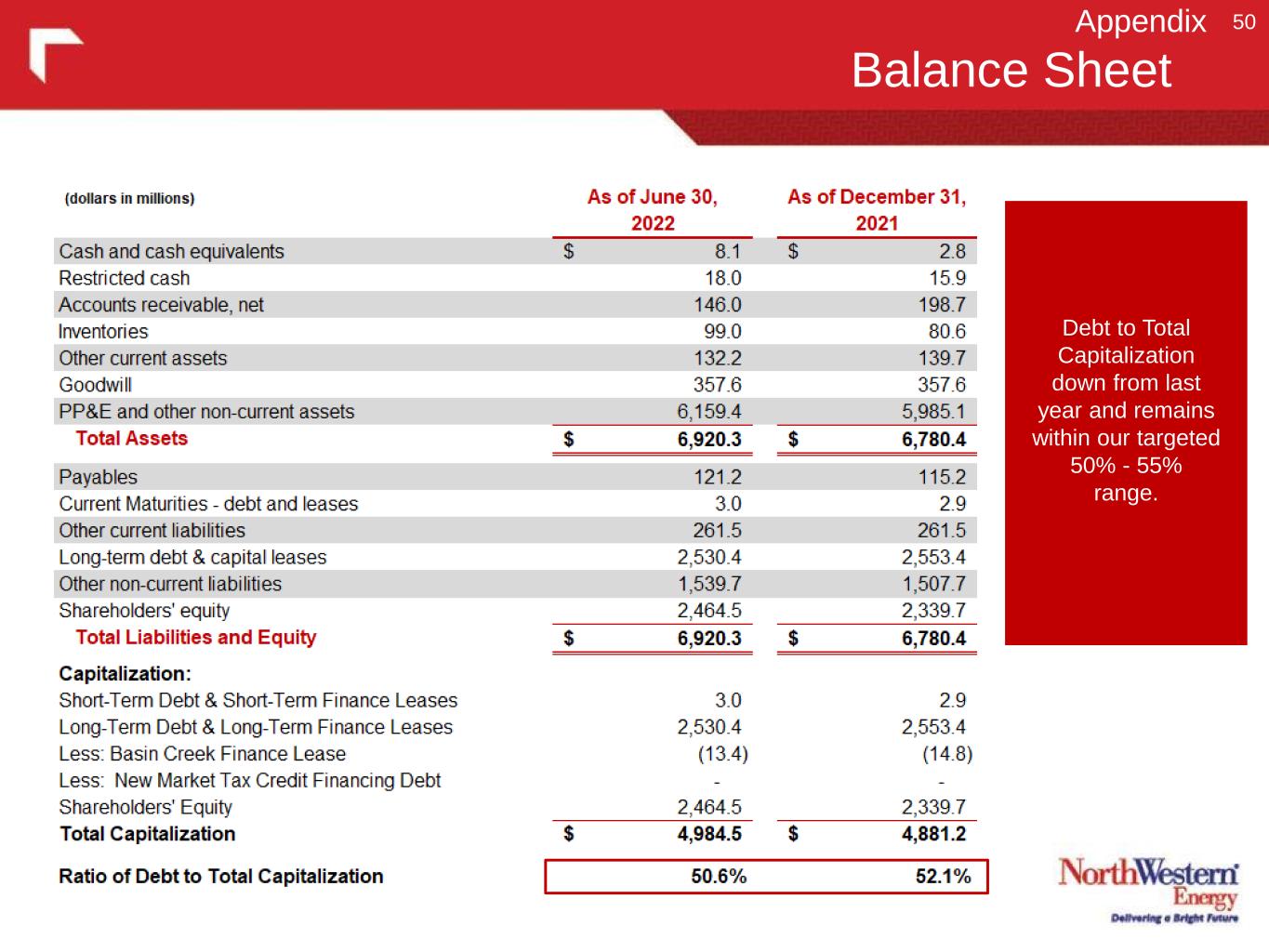

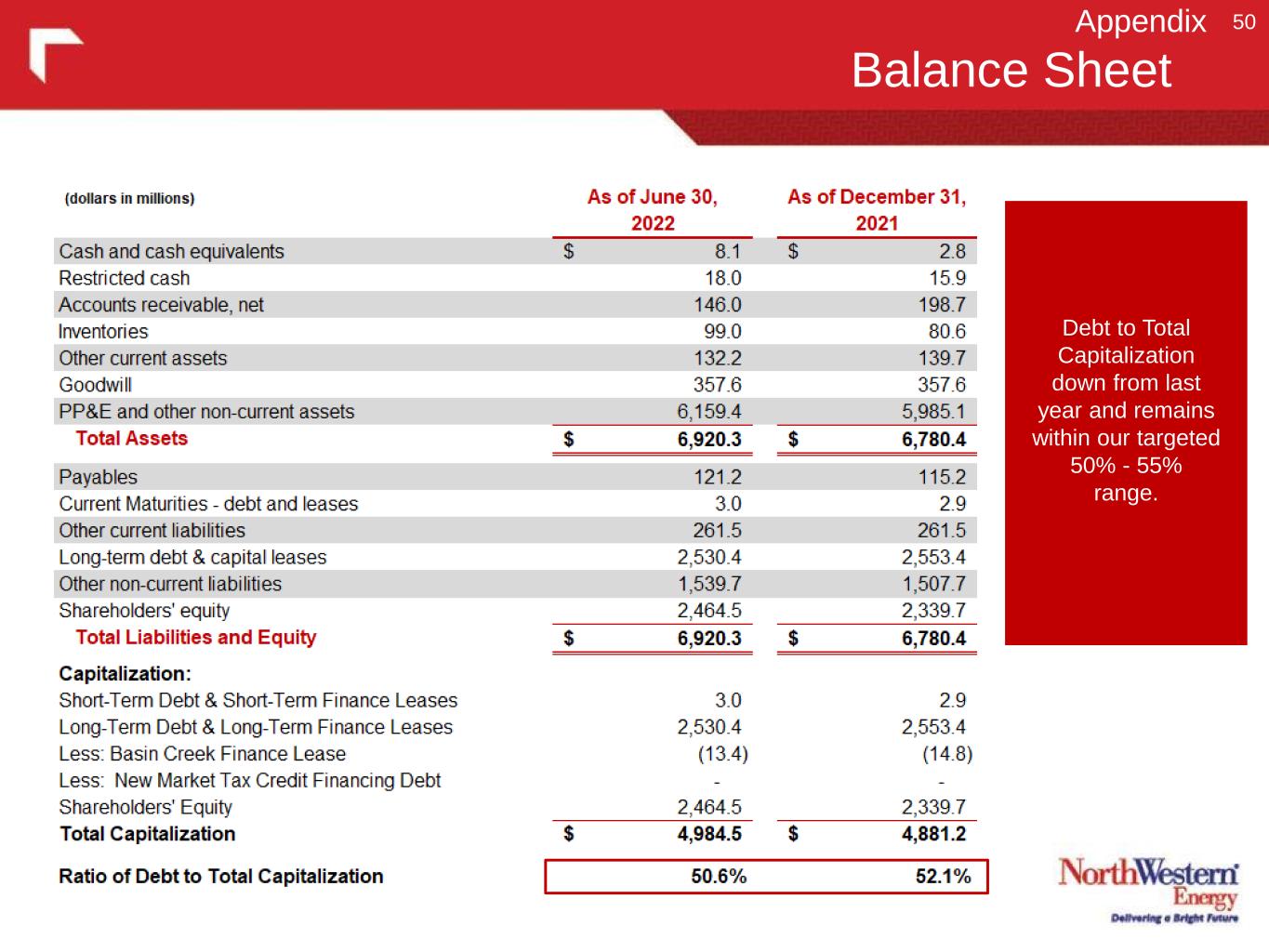

Balance Sheet 50Appendix Debt to Total Capitalization down from last year and remains within our targeted 50% - 55% range.

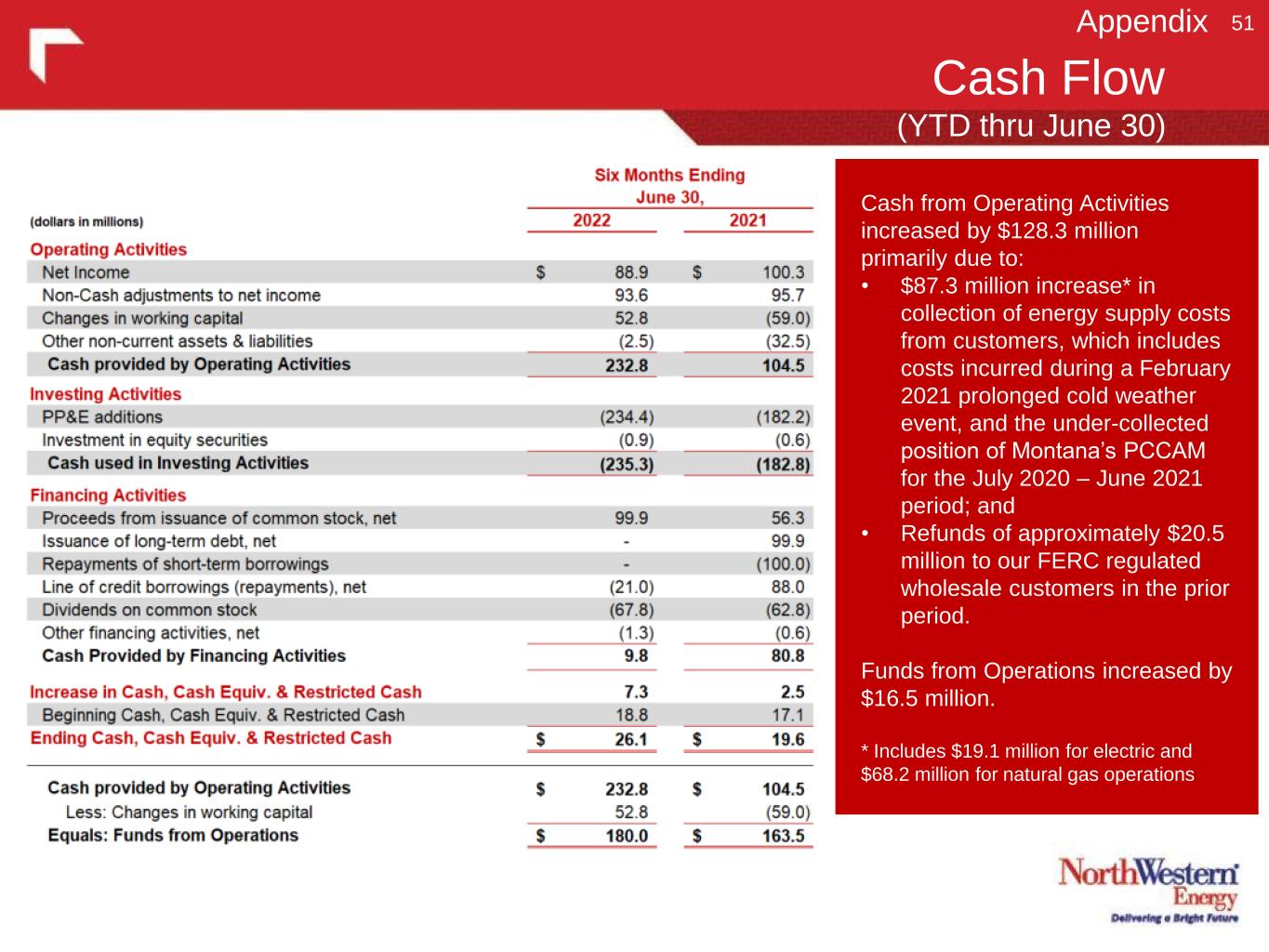

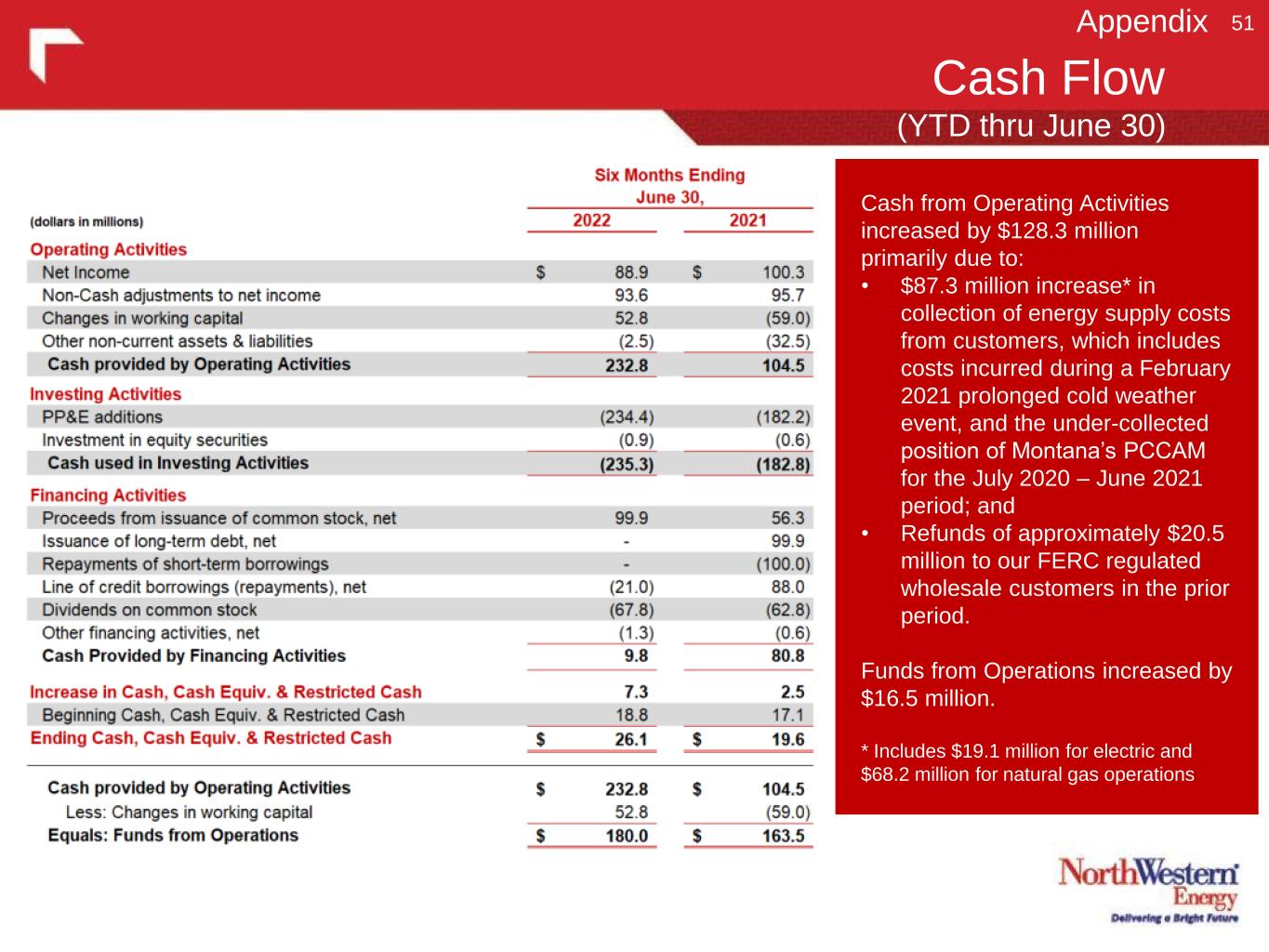

Cash Flow 51Appendix (YTD thru June 30) Cash from Operating Activities increased by $128.3 million primarily due to: • $87.3 million increase* in collection of energy supply costs from customers, which includes costs incurred during a February 2021 prolonged cold weather event, and the under-collected position of Montana’s PCCAM for the July 2020 – June 2021 period; and • Refunds of approximately $20.5 million to our FERC regulated wholesale customers in the prior period. Funds from Operations increased by $16.5 million. * Includes $19.1 million for electric and $68.2 million for natural gas operations

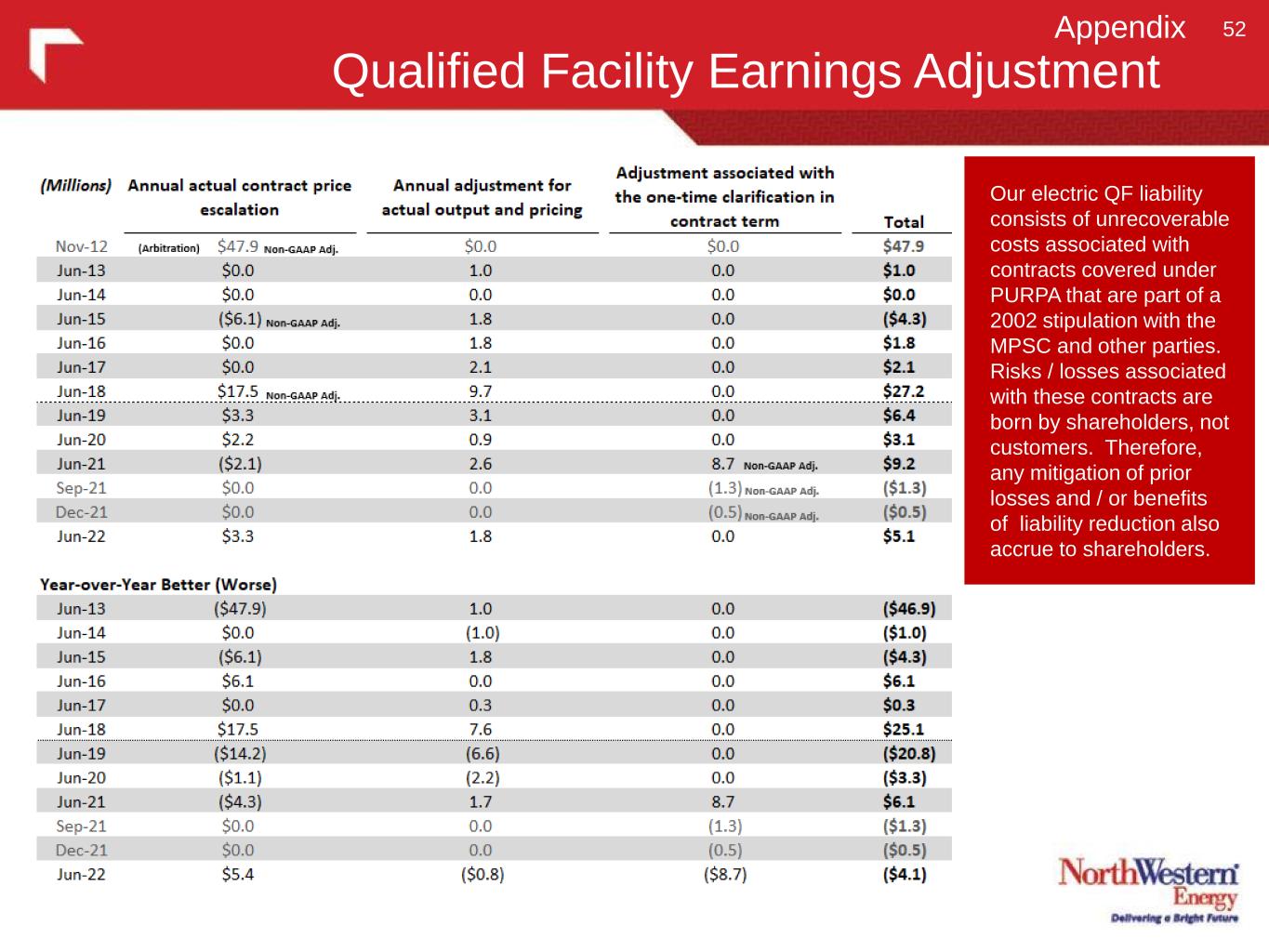

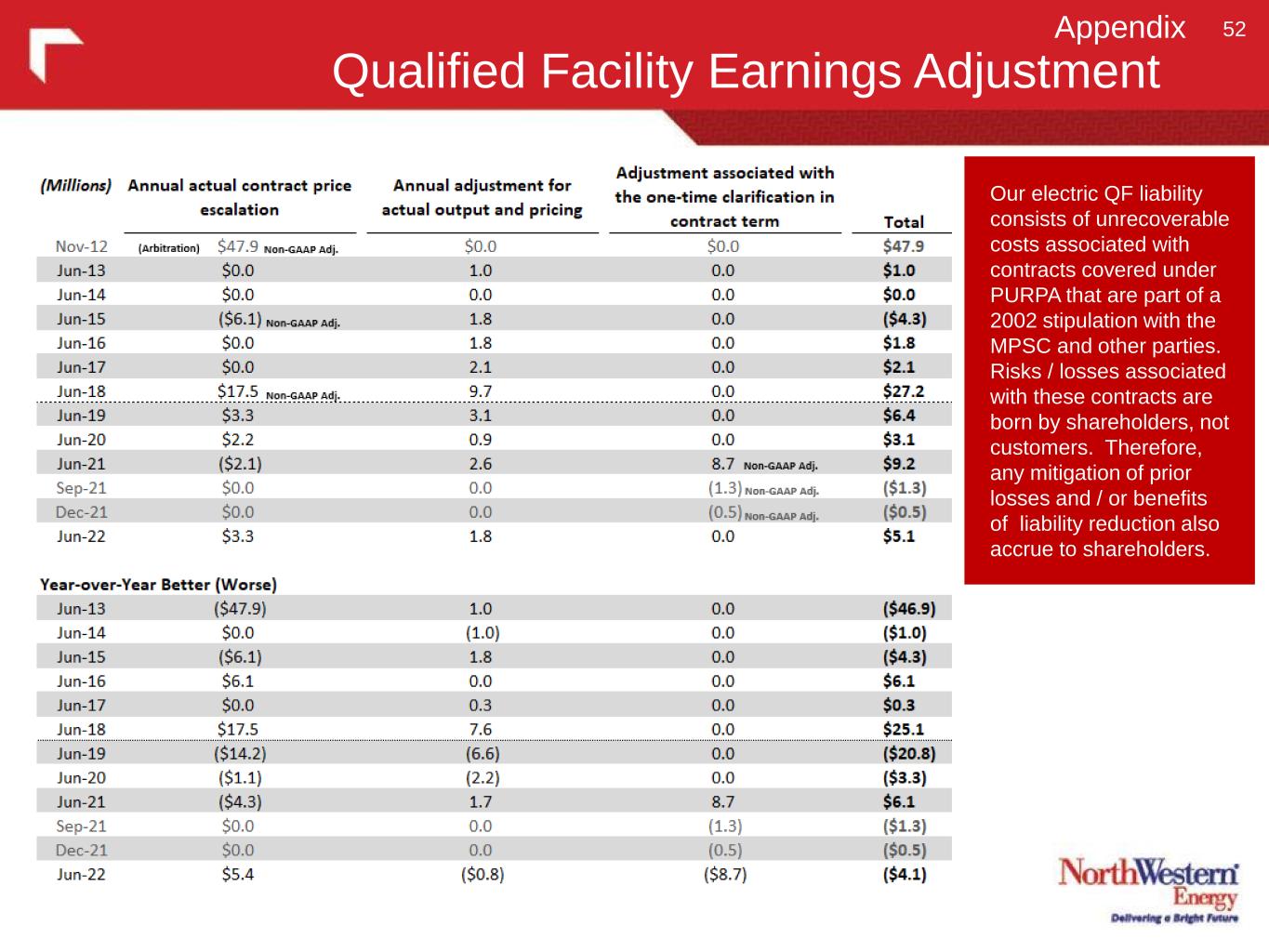

Qualified Facility Earnings Adjustment 52Appendix Our electric QF liability consists of unrecoverable costs associated with contracts covered under PURPA that are part of a 2002 stipulation with the MPSC and other parties. Risks / losses associated with these contracts are born by shareholders, not customers. Therefore, any mitigation of prior losses and / or benefits of liability reduction also accrue to shareholders.

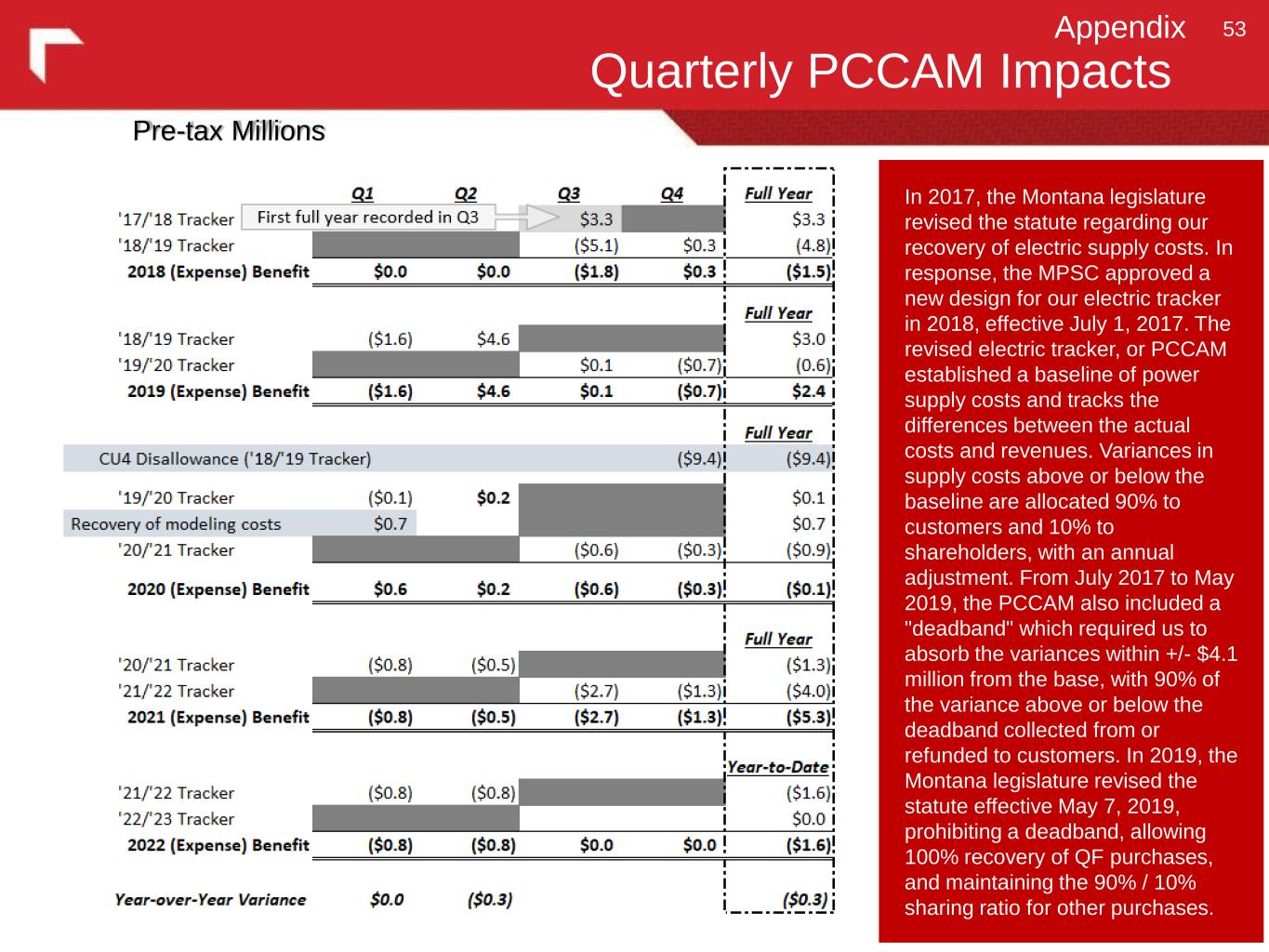

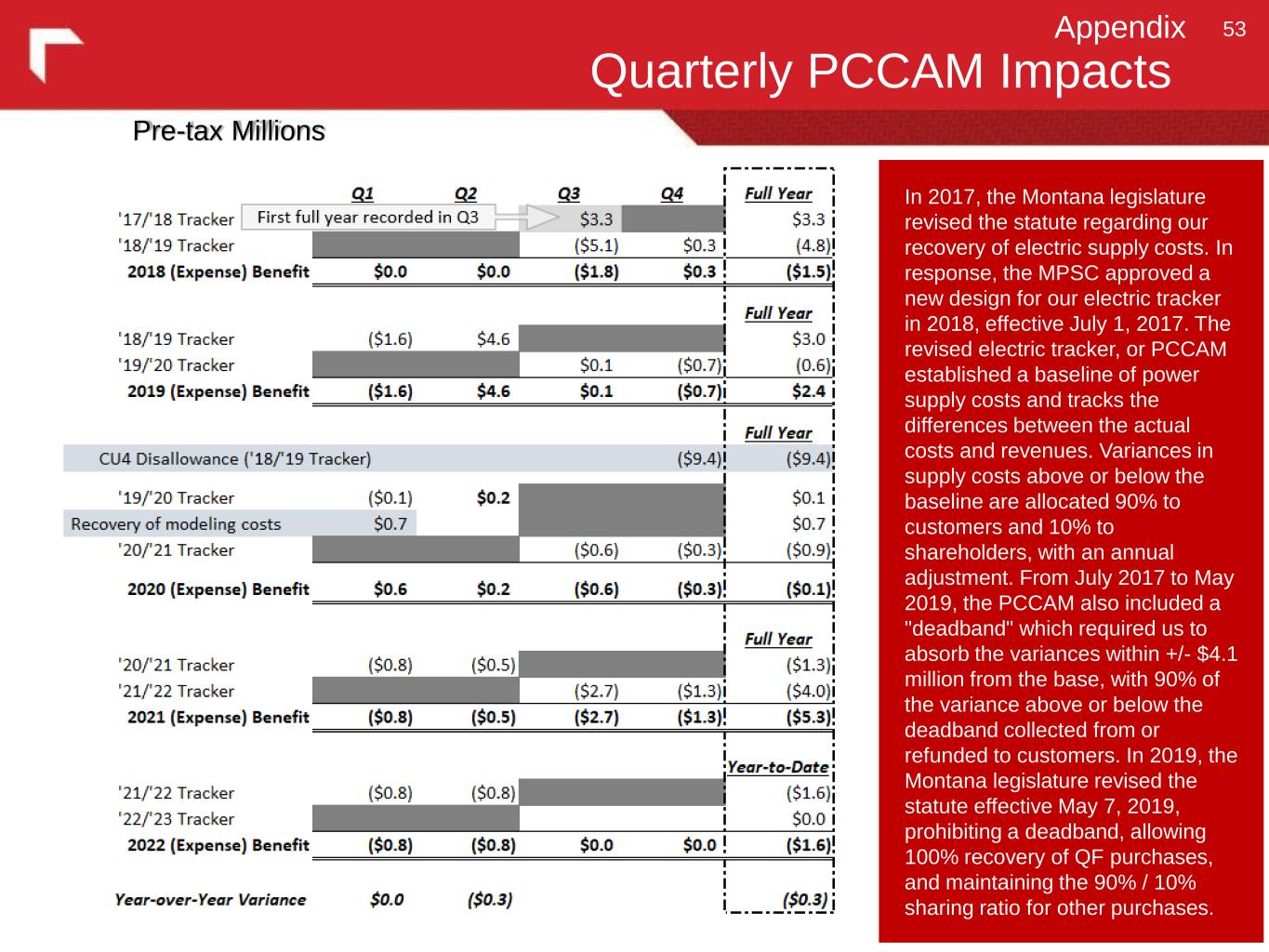

Quarterly PCCAM Impacts 53Appendix In 2017, the Montana legislature revised the statute regarding our recovery of electric supply costs. In response, the MPSC approved a new design for our electric tracker in 2018, effective July 1, 2017. The revised electric tracker, or PCCAM established a baseline of power supply costs and tracks the differences between the actual costs and revenues. Variances in supply costs above or below the baseline are allocated 90% to customers and 10% to shareholders, with an annual adjustment. From July 2017 to May 2019, the PCCAM also included a "deadband" which required us to absorb the variances within +/- $4.1 million from the base, with 90% of the variance above or below the deadband collected from or refunded to customers. In 2019, the Montana legislature revised the statute effective May 7, 2019, prohibiting a deadband, allowing 100% recovery of QF purchases, and maintaining the 90% / 10% sharing ratio for other purchases. Pre-tax Millions

2021 System Statistics 54 Note: Statistics above are as of 12/31/2021 except for electric transmission for others which is 2020 data (1) Nebraska is a natural gas only jurisdiction (2) Dave Gates Generating Station (DGGS) in Montana is a 150 MW nameplate facility but consider it a 105 MW (60 MW FERC & 45MW MPSC jurisdictions) peaker (1) (2) Appendix

Our Commissioners 55Appendix November 2022 Election Randy Pinocci will run unopposed John Rempke (D) will run against Ann Bukacek (R) to replace Brad Johnson November 2022 Election Chris Nelson - incumbent (R) will run against Jeff Barth (D) November 2022 Election Eric Kamler (R) defeated Rod Johnson in the primary and Kevin Stocker (R) defeated Mary Ridder in the primary. Both Kamler and Stocker will run unopposed in the general election

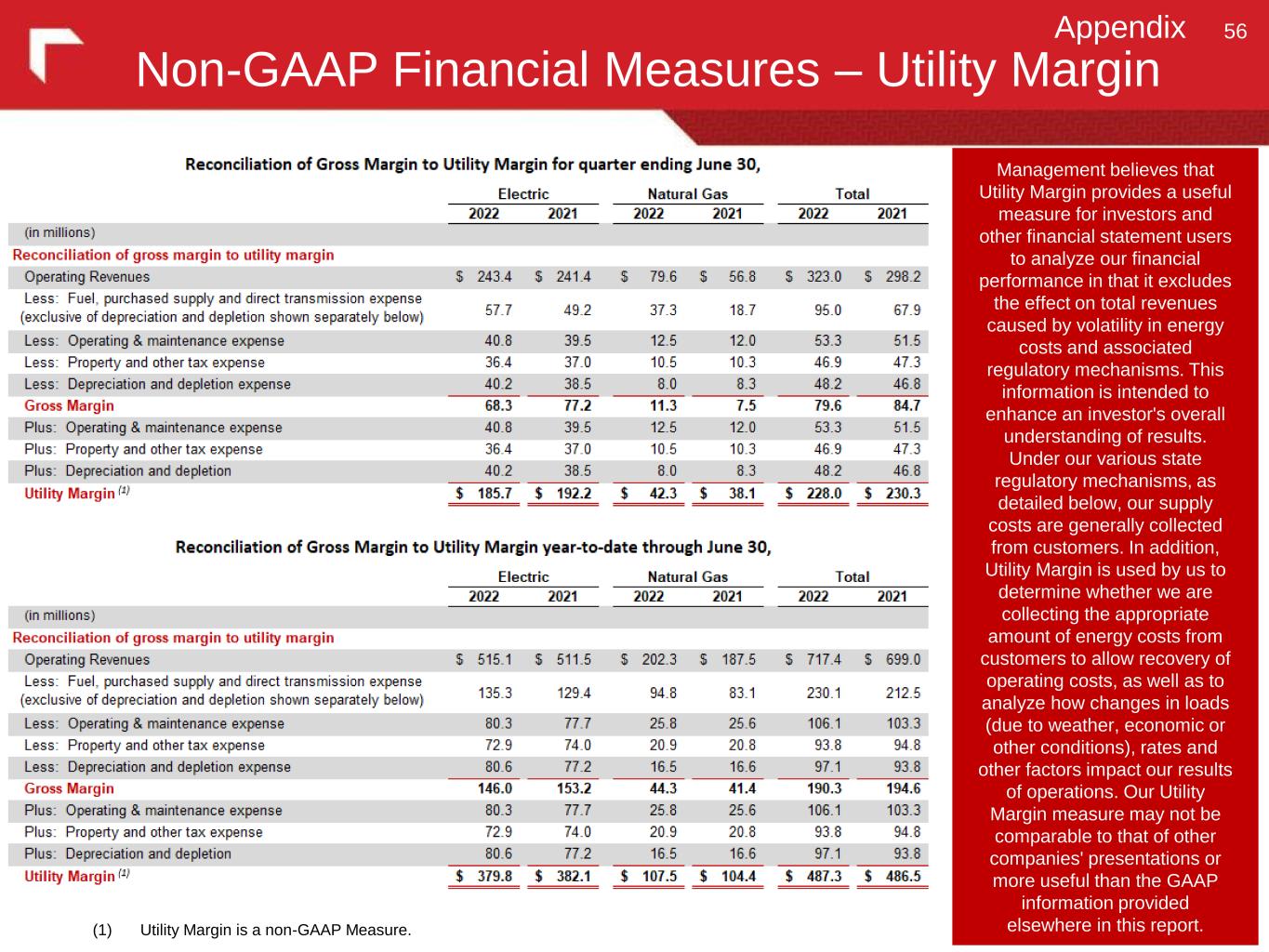

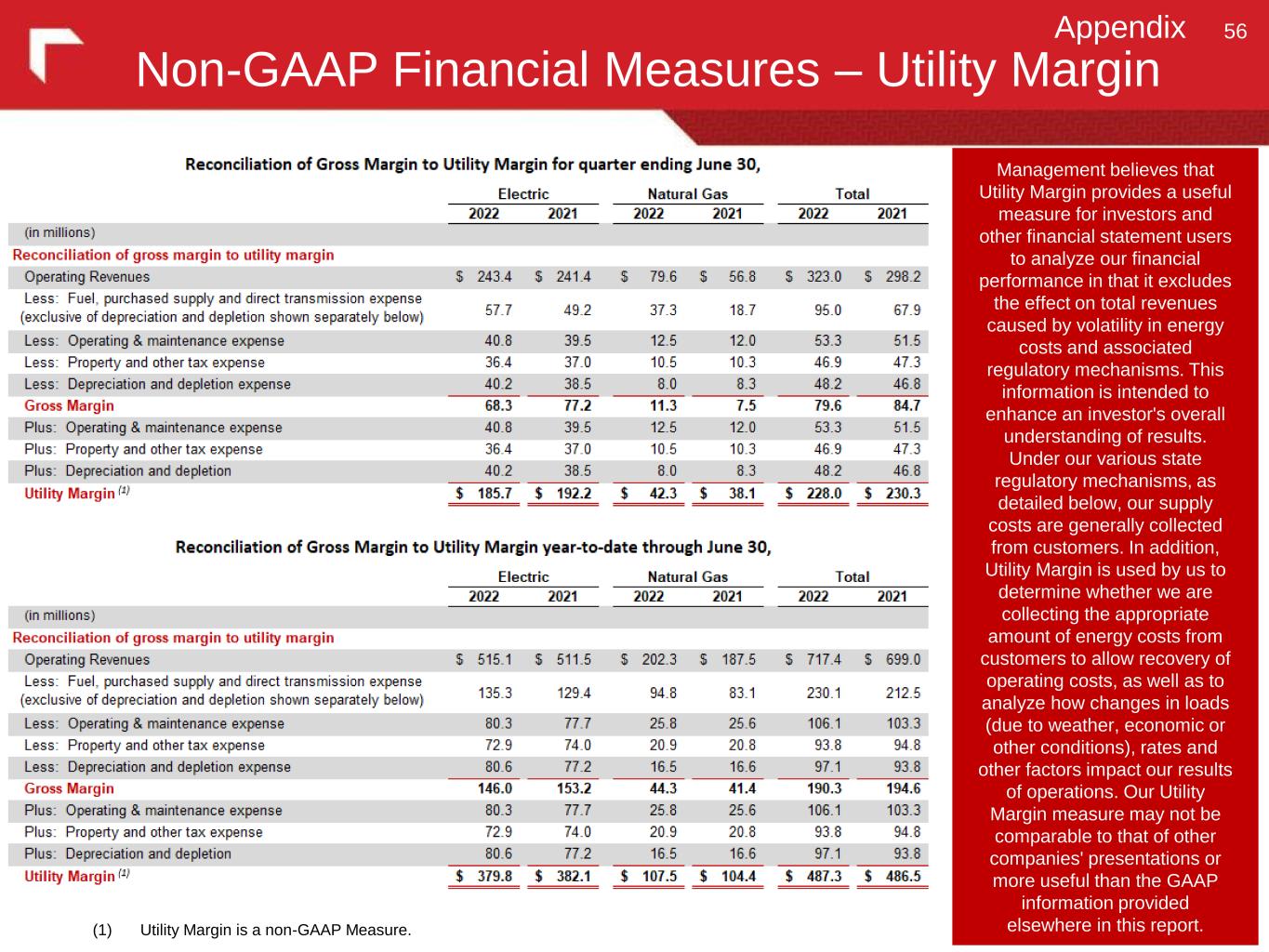

Non-GAAP Financial Measures – Utility Margin 56Appendix (1) Utility Margin is a non-GAAP Measure. Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report.

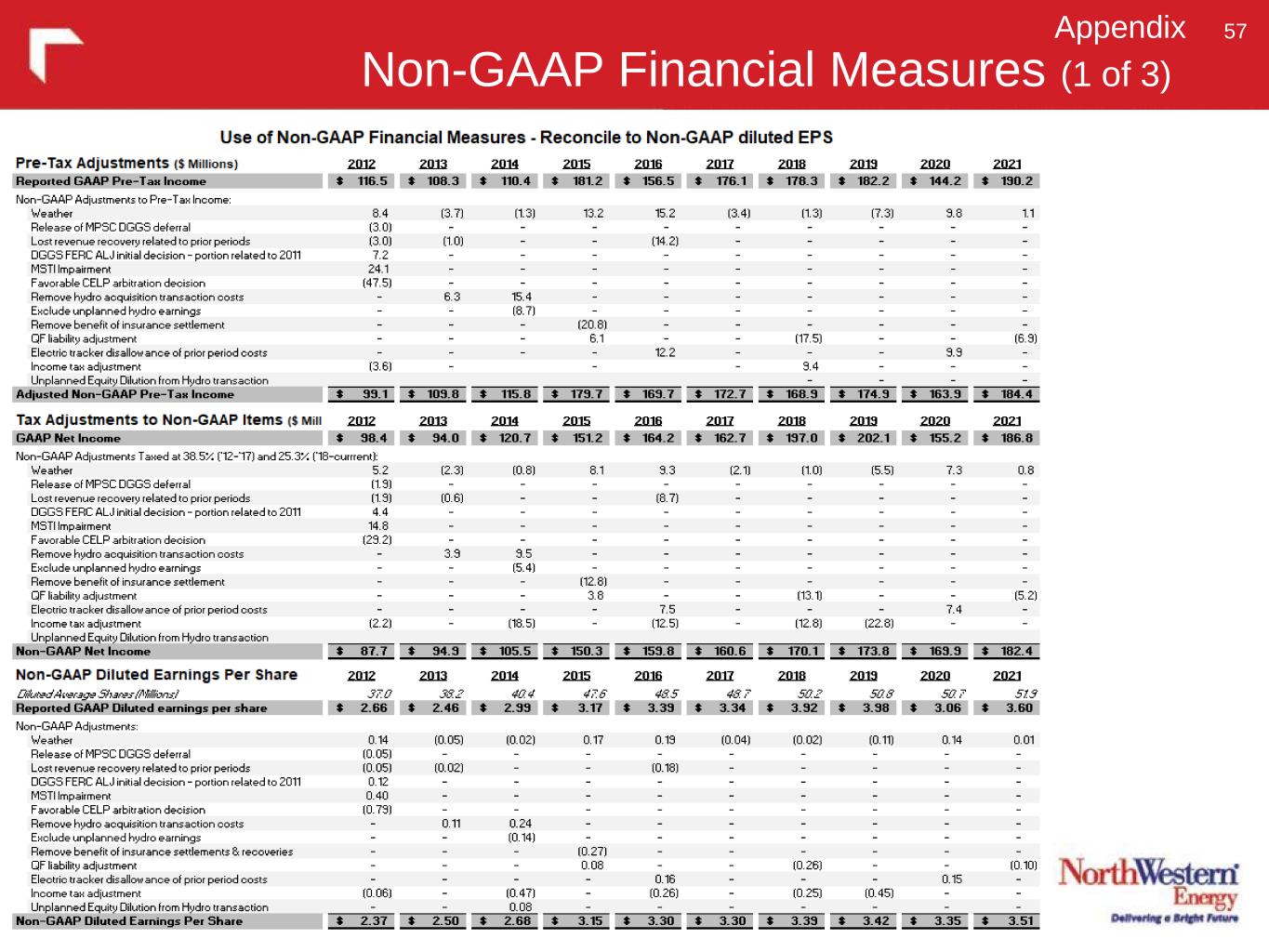

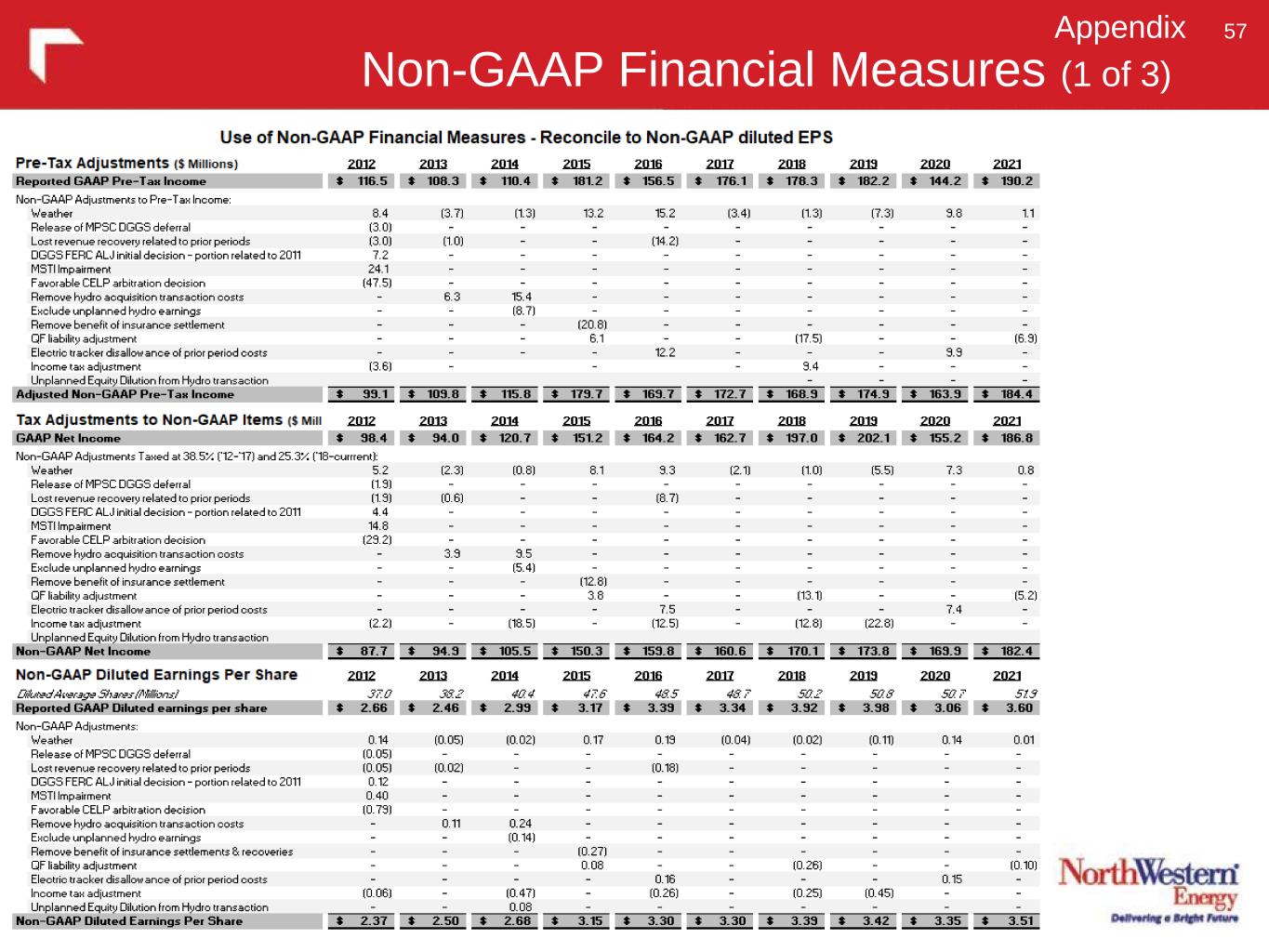

Non-GAAP Financial Measures (1 of 3) 57Appendix

Non-GAAP Financial Measures (2 of 3) 58Appendix This presentation includes financial information prepared in accordance with GAAP, as well as other financial measures, such as Utility Margin, Adjusted Non-GAAP pretax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that excludes (or includes) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. We define Utility Margin as Operating Revenues less fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion) as presented in our Consolidated Statements of Income. This measure differs from the GAAP definition of Gross Margin due to the exclusion of Operating and maintenance, Property and other taxes, and Depreciation and depletion expenses, which are presented separately in our Consolidated Statements of Income. A reconciliation of Utility Margin to Gross Margin, the most directly comparable GAAP measure, is included in this presentation. Management believes that Utility Margin provides a useful measure for investors and other financial statement users to analyze our financial performance in that it excludes the effect on total revenues caused by volatility in energy costs and associated regulatory mechanisms. This information is intended to enhance an investor's overall understanding of results. Under our various state regulatory mechanisms, as detailed below, our supply costs are generally collected from customers. In addition, Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs, as well as to analyze how changes in loads (due to weather, economic or other conditions), rates and other factors impact our results of operations. Our Utility Margin measure may not be comparable to that of other companies' presentations or more useful than the GAAP information provided elsewhere in this report. Management also believes the presentation of Adjusted Non-GAAP pre-tax income, Adjusted Non-GAAP net income and Adjusted Non-GAAP Diluted EPS is more representative of normal earnings than GAAP pre-tax income, net income and EPS due to the exclusion (or inclusion) of certain impacts that are not reflective of ongoing earnings. The presentation of these non-GAAP measures is intended to supplement investors' understanding of our financial performance and not to replace other GAAP measures as an indicator of actual operating performance. Our measures may not be comparable to other companies' similarly titled measures.

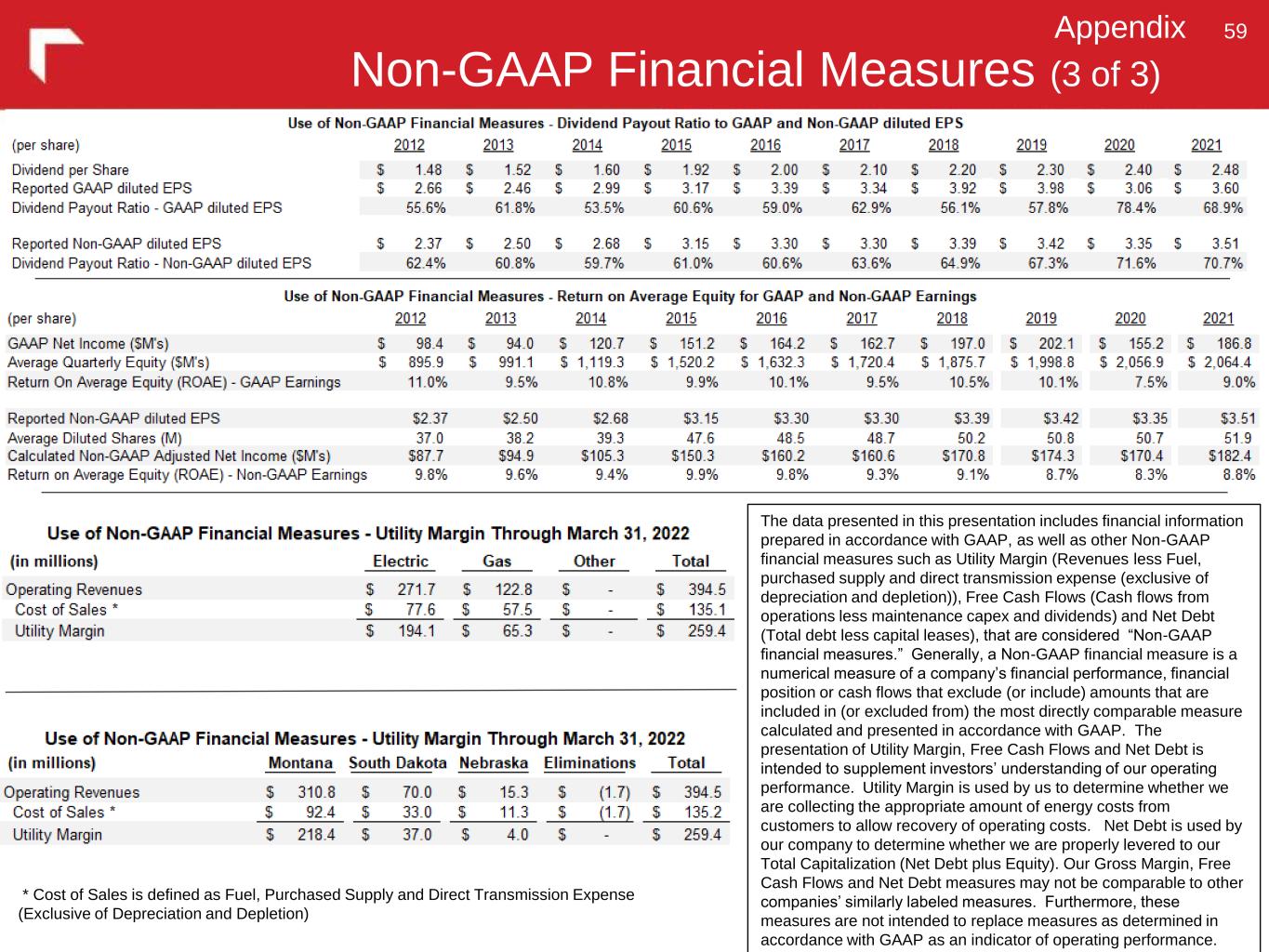

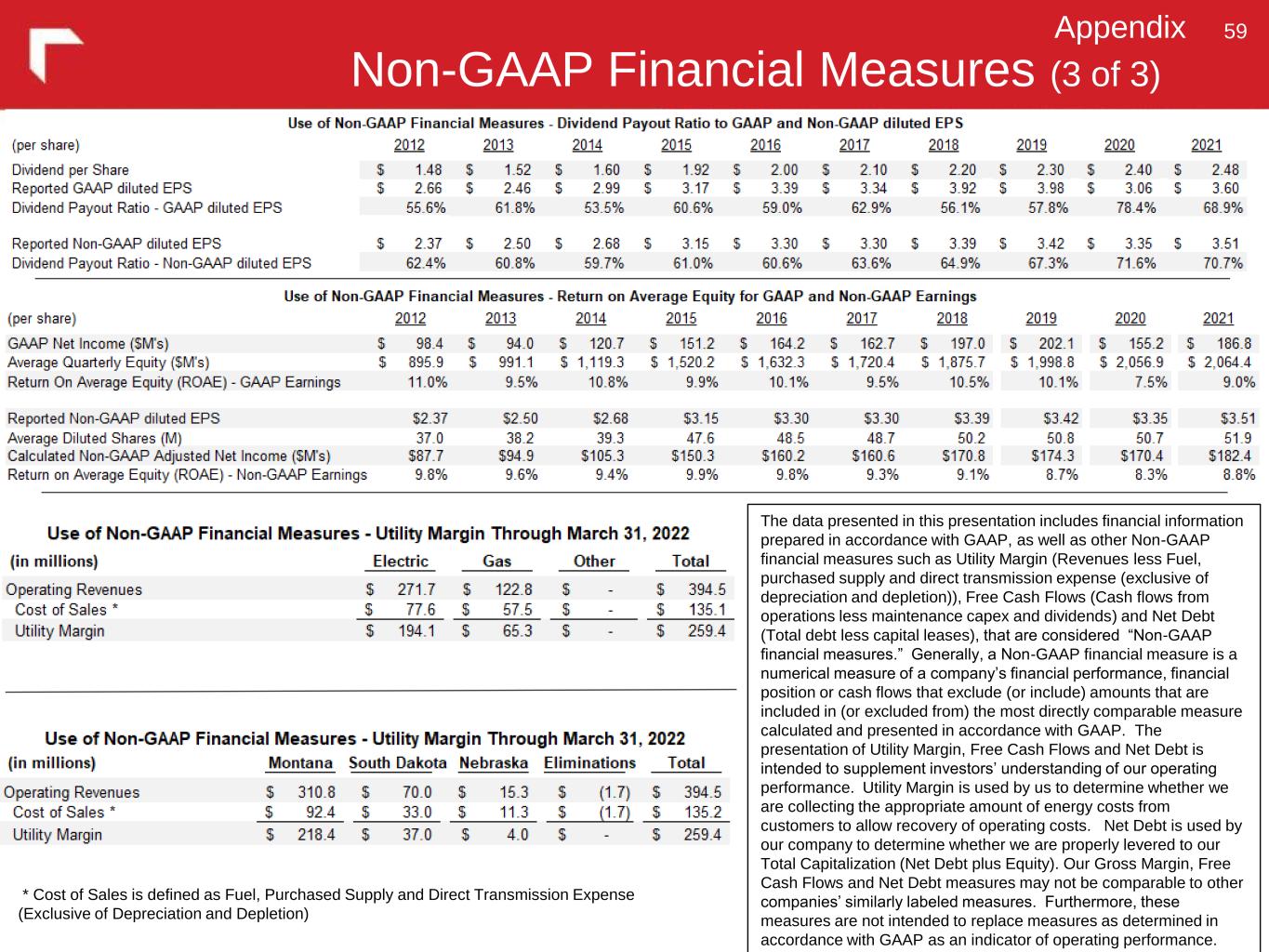

Non-GAAP Financial Measures (3 of 3) 59Appendix The data presented in this presentation includes financial information prepared in accordance with GAAP, as well as other Non-GAAP financial measures such as Utility Margin (Revenues less Fuel, purchased supply and direct transmission expense (exclusive of depreciation and depletion)), Free Cash Flows (Cash flows from operations less maintenance capex and dividends) and Net Debt (Total debt less capital leases), that are considered “Non-GAAP financial measures.” Generally, a Non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. The presentation of Utility Margin, Free Cash Flows and Net Debt is intended to supplement investors’ understanding of our operating performance. Utility Margin is used by us to determine whether we are collecting the appropriate amount of energy costs from customers to allow recovery of operating costs. Net Debt is used by our company to determine whether we are properly levered to our Total Capitalization (Net Debt plus Equity). Our Gross Margin, Free Cash Flows and Net Debt measures may not be comparable to other companies’ similarly labeled measures. Furthermore, these measures are not intended to replace measures as determined in accordance with GAAP as an indicator of operating performance. * Cost of Sales is defined as Fuel, Purchased Supply and Direct Transmission Expense (Exclusive of Depreciation and Depletion)

60