Searchable text section of graphics shown above

[GRAPHIC]

[LOGO]

First Quarter 2005 Update

May 2005

Mike Hanson

President & CEO

[LOGO]

2

Forward-Looking Statement

During the course of this presentation today, we will be discussing certain subjects including those pertaining to our strategy, and our discussions may contain forward-looking information. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. These factors also are listed in each of our press releases and disclosed in the company’s public filings with the SEC.

3

Introduction

• Following emergence, NorthWestern is a much stronger company

• Significantly reduced debt, strong balance sheet, significant excess free cash flow

• Focused on our transmission and distribution utility operations

• Better positioned to serve our customers

• Able to grow with the communities we serve

4

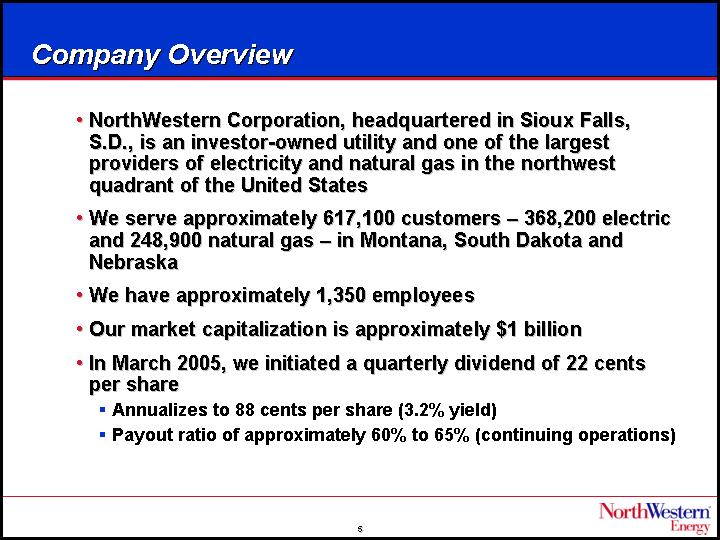

Company Overview

• NorthWestern Corporation, headquartered in Sioux Falls, S.D., is an investor-owned utility and one of the largest providers of electricity and natural gas in the northwest quadrant of the United States

• We serve approximately 617,100 customers – 368,200 electric and 248,900 natural gas – in Montana, South Dakota and Nebraska

• We have approximately 1,350 employees

• Our market capitalization is approximately $1 billion

• In March 2005, we initiated a quarterly dividend of 22 cents per share

• Annualizes to 88 cents per share (3.2% yield)

• Payout ratio of approximately 60% to 65% (continuing operations)

5

Service Territory

[GRAPHIC]

6

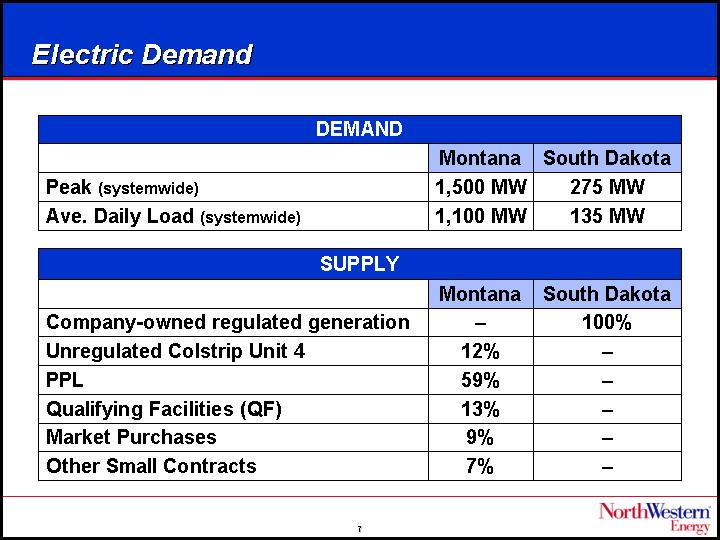

Electric Demand

DEMAND

| | Montana | | South Dakota | |

Peak (systemwide) | | 1,500 MW | | 275 MW | |

Ave. Daily Load (systemwide) | | 1,100 MW | | 135 MW | |

SUPPLY

| | Montana | | South Dakota | |

Company-owned regulated generation | | — | | 100 | % |

Unregulated Colstrip Unit 4 | | 12 | % | — | |

PPL | | 59 | % | — | |

Qualifying Facilities (QF) | | 13 | % | — | |

Market Purchases | | 9 | % | — | |

Other Small Contracts | | 7 | % | — | |

7

Montana Regulated Electric Portfolio

Resource Mix

(6 million MWh)

[CHART]

Yearly Resource Cost

($249 million)

[CHART]

84% of the forecasted energy requirement is under contract through 6/30/07

8

Significant Events Since End of Q1 2005

Regulatory

• Stipulation reached with MPSC to recover $4.6 million in natural gas previously disallowed

• MPSC had disallowed $10.4 million in natural gas purchases from November 2002 to June 2004

• Will record on income statement upon final approval

• NorthWestern has formed a Technical Advisory Committee to advise on future Gas procurement activities

• MPSC Approved Judith Gap Wind Project

• First time MPSC approved a project without the endorsement of the Montana Consumer Council

Financial

• Agreement in principal with PPL

• Settles all claims and counter claims that are part of bankruptcy

• NorthWestern gets $9 million

• NorthWestern keeps the asset

• Made a prepayment of $25 million in debt

• Reduces the long-term debt balance to $795 million

• Reduces the debt-to-cap ratio to 52%

9

Value Drivers

• T&D business focus

• Solid and reliable operations

• Complete default supply portfolio procurement

• Continue to improve regulatory environment

• Efficiency improvement and cost control

• Asset sales

• Attain investment grade rating

• Resolve outstanding bankruptcy claims

• Intercreditor issues, not shareholder issues

• Develop strategy to redeploy excess free cash flow

10

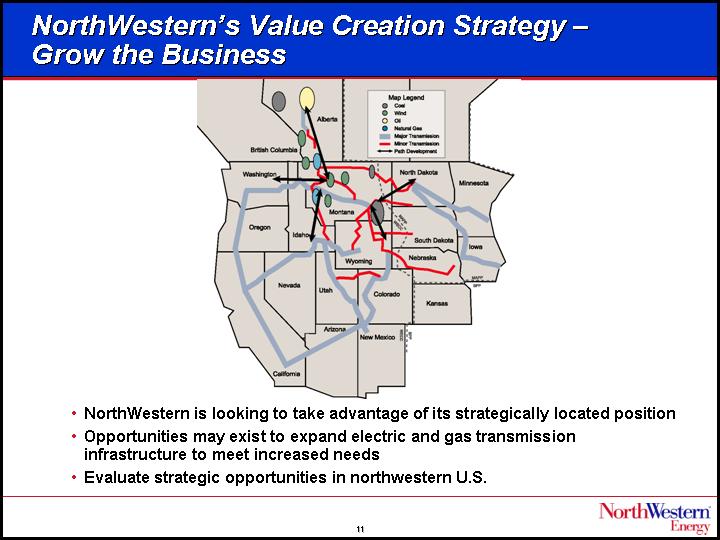

NorthWestern’s Value Creation Strategy – Grow the Business

[GRAPHIC]

• NorthWestern is looking to take advantage of its strategically located position

• Opportunities may exist to expand electric and gas transmission infrastructure to meet increased needs

• Evaluate strategic opportunities in northwestern U.S.

11

Brian Bird

Chief Financial Officer

12

2004 P&L Summary

| | UNAUDITED | |

| | Successor | | Reorganization | | | |

| | and | | Impacts | | | |

| | Predecessor | | and Other | | | |

| | Combined | | Significant | | 2004 | |

(in millions) | | Dec. 31, 2004 | | Items | | as Adjusted | |

OPERATING REVENUES | | $ | 1,039.0 | | $ | — | | $ | 1,039.0 | |

COST OF SALES | | 563.8 | | (10.0 | )(b) | 553.8 | |

GROSS MARGIN | | 475.2 | | 10.0 | | 485.2 | |

OPERATING EXPENSES | | | | | | | |

Operating, general and administrative | | 221.7 | | — | | 221.7 | |

Property and other taxes | | 65.1 | | — | | 65.1 | |

Depreciation | | 72.8 | | — | | 72.8 | |

Reorganization items | | (532.6 | ) | 532.6 | | — | |

Impairment on assets held for sale | | 10.0 | | (10.0 | ) | — | |

Total Operating Expenses | | (163.0 | ) | 522.6 | | 359.6 | |

OPERATING INCOME | | 638.2 | | (512.6 | ) | 125.6 | |

Interest Expense | | (83.8 | ) | — | | (83.8 | ) |

Gain (Loss) on Debt Extinguishment | | (21.3 | ) | 21.3 | | — | |

Investment Income and Other | | 3.2 | | — | | 3.2 | |

Income (Loss) from Continuing Operations Before Income Taxes | | 536.3 | | (491.3 | ) | 45.0 | |

Benefit (Provision) for Income Taxes | | 6.3 | | (23.6 | ) | (17.3 | )(a) |

Income (Loss) from Continuing Operations | | $ | 542.6 | | $ | (514.9 | ) | $ | 27.7 | |

Estimated Basic EPS from Continuing Operations (35.6 million shares) | | | | | | $ | 0.78 | |

(a) 2004 as Adjusted assumed an effective book tax rate of 38.75%.

(b) Consists of losses on fixed-price natural gas and electric contracts and disallowed natural gas costs.

We believe presenting adjustments for the reorganization and other significant items above provides investors with a more meaningful analysis of 2004 for comparison with future operating results. While we believe this to be useful information, it should not be used in isolation or as a substitute for consolidated statement of income (loss) data prepared in accordance with generally accepted accounting principles.

13

2005 Outlook

• Projecting earnings from continuing operations of $1.30 to $1.45 per share (basic)

• Absent any unusual weather

• Bridge from 2004 to 2005

• Significant reduction in interest expense

• Reduced G&A expense

• Modest increase in margins due to organic growth

14

NorthWestern’s 2005 Strategy

| | | T&D | | Asset sales = $65-$70 million |

| | | Business | | |

| | | | | |

| | | • Optimize operations | | |

| Grow the

Business | | • Maintain service levels | | Cash |

| • Improve regulatory environment | | |

| | | • Train and retain employees | | |

| | | | | |

| • Transmission Investment | | | | |

| • Territory Expansion | | | | |

| • Energy-related Businesses | | | | Maintain

and Grow

Operations |

| | | | |

| | | | |

| Pay | | | | |

| Dividends | | | | • Maintenance Cap Ex |

| | | | | • Service Territory Growth |

| | | Reduce | | | $75-$80 |

| | | Debt | | | million |

| $30-$35 | | | | |

| million | | $70-$75 | | |

| | | million | | |

15

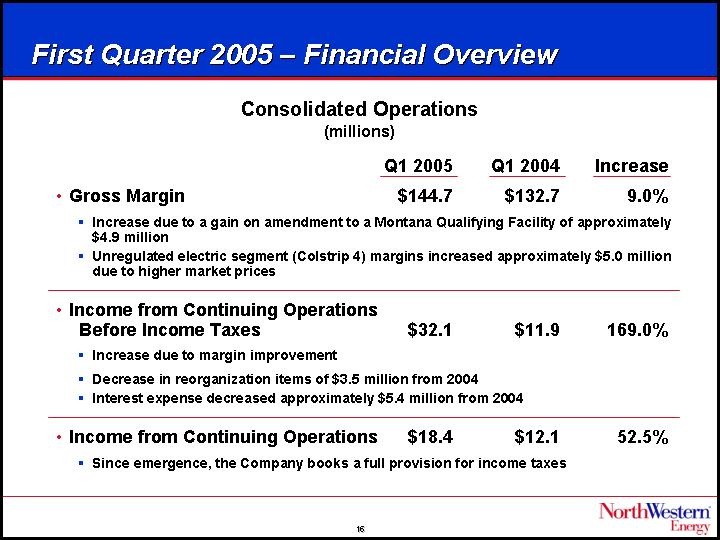

First Quarter 2005 – Financial Overview

Consolidated Operations

(millions)

| | Q1 2005 | | Q1 2004 | | Increase | |

• Gross Margin | | $ | 144.7 | | $ | 132.7 | | 9.0 | % |

• Increase due to a gain on amendment to a Montana Qualifying Facility of approximately $4.9 million | | | | | | | |

• Unregulated electric segment (Colstrip 4) margins increased approximately $5.0 million due to higher market prices | | | | | | | |

| | | | | | | |

• Income from Continuing Operations Before Income Taxes | | $ | 32.1 | | $ | 11.9 | | 169.0 | % |

• Increase due to margin improvement | | | | | | | |

• Decrease in reorganization items of $3.5 million from 2004 | | | | | | | |

• Interest expense decreased approximately $5.4 million from 2004 | | | | | | | |

| | | | | | | |

• Income from Continuing Operations | | $ | 18.4 | | $ | 12.1 | | 52.5 | % |

• Since emergence, the Company books a full provision for income taxes | | | | | | | |

16

First Quarter 2005 – P&L Summary

| | Successor | | Predecessor | |

| | Company | | Company | |

| | Three Months Ended March 31, | |

(000’s) | | 2005 | | 2004 | |

Operating Revenues | | $ | 335,093 | | $ | 305,627 | |

Cost of Sales | | 190,381 | | 172,918 | |

Gross Margin | | 144,712 | | 132,709 | |

Operating Expenses | | | | | |

Operating, general and administrative | | 56,655 | | 56,805 | |

Property and other taxes | | 18,205 | | 17,903 | |

Depreciation | | 18,690 | | 18,176 | |

Reorganization Items | | 3,363 | | 6,830 | |

Total Operating Expenses | | 96,913 | | 99,714 | |

Operating Income | | 47,799 | | 32,995 | |

Interest Expense | | (16,342 | ) | (21,775 | ) |

Investment Income and Other | | 607 | | 701 | |

Income from Continuing Operations Before Income Taxes | | 32,064 | | 11,921 | |

(Provision) Benefit for Income Taxes | | (13,670 | ) | 138 | |

Income from Continuing Operations | | 18,394 | | 12,059 | |

Discontinued Operations, Net of Taxes | | 524 | | 4,922 | |

Net Income | | $ | 18,918 | | $ | 16,981 | |

17

First Quarter 2005 – Electric and Natural Gas Operations

Q1 2005 Revenues

(millions)

[CHART]

Q1 2005 Gross Margin

(millions)

[CHART]

18

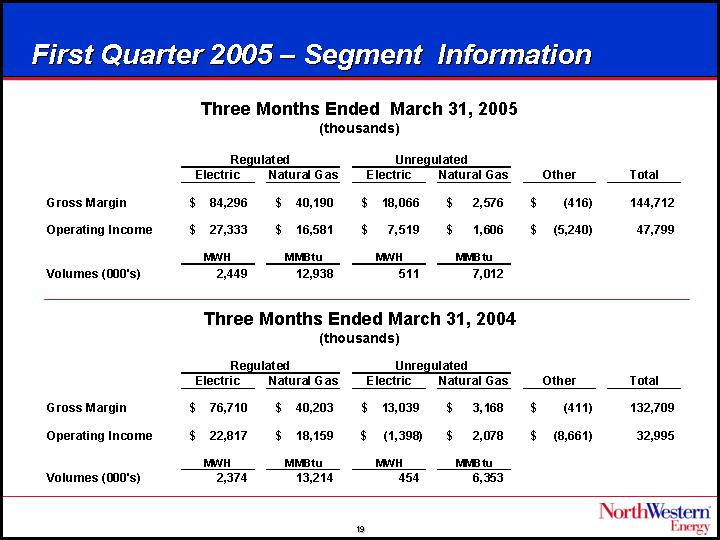

First Quarter 2005 – Segment Information

Three Months Ended March 31, 2005

(thousands)

| | Regulated | | Unregulated | | | | | |

| | Electric | | Natural Gas | | Electric | | Natural Gas | | Other | | Total | |

Gross Margin | | $ | 84,296 | | $ | 40,190 | | $ | 18,066 | | $ | 2,576 | | $ | (416 | ) | 144,712 | |

Operating Income | | $ | 27,333 | | $ | 16,581 | | $ | 7,519 | | $ | 1,606 | | $ | (5,240 | ) | 47,799 | |

| | MWH | | MMBtu | | MWH | | MMBtu | |

Volumes (000’s) | | 2,449 | | 12,938 | | 511 | | 7,012 | |

Three Months Ended March 31, 2004

(thousands)

| | Regulated | | Unregulated | | | | | |

| | Electric | | Natural Gas | | Electric | | Natural Gas | | Other | | Total | |

Gross Margin | | $ | 76,710 | | $ | 40,203 | | $ | 13,039 | | $ | 3,168 | | $ | (411 | ) | 132,709 | |

Operating Income | | $ | 22,817 | | $ | 18,159 | | $ | (1,398 | ) | $ | 2,078 | | $ | (8,661 | ) | 32,995 | |

| | MWH | | MMBtu | | MWH | | MMBtu | |

Volumes (000’s) | | 2,374 | | 13,214 | | 454 | | 6,353 | |

19

Cash Flow – First Quarter 2005

| | Successor | | Predecessor | |

| | Company | | Company | |

| | Three Months Ended March 31, | |

(000’s) | | 2005 | | 2004 | |

Net Income | | $ | 18,918 | | $ | 16,981 | |

| | | | | |

Depreciation | | 18,690 | | 18,176 | |

(Gain) Loss on QF Contract Restructuring | | (4,888 | ) | — | |

Deferred Income Taxes | | 13,387 | | (916 | ) |

(Income) Loss on Disco. Ops., Net | | (524 | ) | (4,922 | ) |

Working Capital and Other Non-cash | | 48,373 | | 68,662 | |

Cash Flow from Operations | | 93,956 | | 97,981 | |

| | | | | |

Capital Expenditures & Investment Activities | | (13,395 | ) | (12,899 | ) |

Free Cash Flow | | 80,561 | | 85,082 | |

| | | | | |

Dividends on Common Stock | | (7,834 | ) | — | |

Debt Increase / (Decrease), Net | | (12,039 | ) | (4,215 | ) |

Other | | (432 | ) | — | |

Increase / (Decrease) in Cash | | 60,256 | | 80,867 | |

| | | | | |

Beginning Cash | | 17,058 | | 15,183 | |

Ending Cash | | $ | 77,314 | | $ | 96,050 | |

20

First Quarter 2005 – Balance Sheet

| | Successor Company | |

| | Mar. 31, | | Dec. 31, | |

(000’s) | | 2005 | | 2004 | |

ASSETS | | | | | |

Cash | | $ | 77,314 | | $ | 17,058 | |

Other Current Assets | | 294,518 | | 330,620 | |

Property, Plant and Equipment, Net | | 1,378,468 | | 1,379,060 | |

Goodwill | | 435,076 | | 435,076 | |

Regulatory Assets | | 218,964 | | 224,192 | |

Other Noncurrent Assets | | 29,426 | | 27,510 | |

Total assets | | $ | 2,433,766 | | $ | 2,413,516 | |

| | | | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | |

Current maturities of long term debt | | $ | 67,665 | | $ | 73,380 | |

Current Liabilities | | 270,261 | | 254,688 | |

Long-term Debt | | 757,354 | | 763,566 | |

Noncurrent Regulatory Liabilities | | 164,425 | | 160,750 | |

Other Noncurrent Liabilities | | 453,496 | | 451,797 | |

Total liabilities | | 1,713,201 | | 1,704,181 | |

| | | | | |

Total shareholders’ equity | | 720,565 | | 709,335 | |

| | | | | |

Total liabilities and shareholders’ equity | | $ | 2,433,766 | | $ | 2,413,516 | |

21

Rating Agency Update

| | Secured | | Unsecured | |

| | Rating | | Outlook | | Rating | | Outlook | |

Fitch | | BB+ | | Positive | | N/A | | N/A | |

Moody’s | | Ba1 | | Stable | | Ba2 | | Stable | |

S&P | | BB | | Positive | | BB- | | Positive | |

Steps necessary for investment grade rating

1. Financial performance track record

2. Asset sales proceeds received

3. Progress on outstanding litigation

4. Pay down debt

• Currently at 52% debt to total capitalization

22

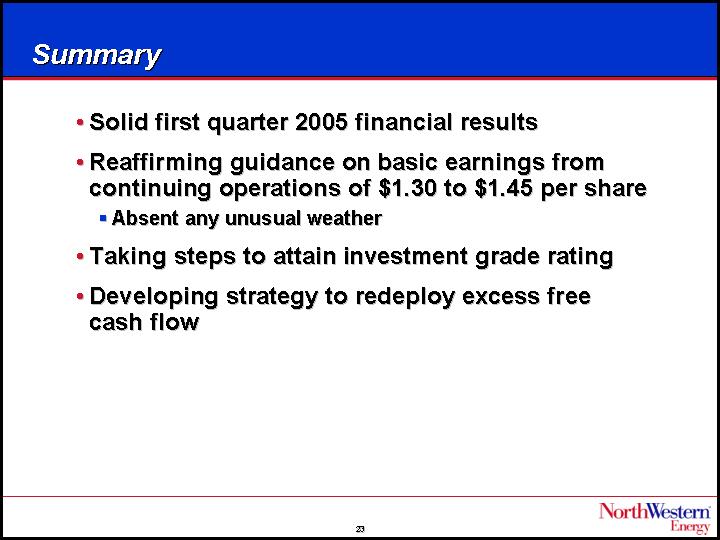

Summary

• Solid first quarter 2005 financial results

• Reaffirming guidance on basic earnings from continuing operations of $1.30 to $1.45 per share

• Absent any unusual weather

• Taking steps to attain investment grade rating

• Developing strategy to redeploy excess free cash flow

23