UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o | Definitive Proxy Statement |

o | Definitive Additional Materials |

ý | Soliciting Material Pursuant to §240.14a-12 |

|

NorthWestern Corporation |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | |

| | | |

THE FOLLOWING IS A SLIDE PRESENTATION THAT WILL BE PRESENTED BY NORTHWESTERN CORPORATION TO COMMUNITY GROUPS, GOVERNMENT REGULATORS AND MEMBERS OF THE NEWS MEDIA BEGINNING ON MAY 10, 2006, AND POSTED ON NORTHWESTERN CORPORATION’S WEB SITE AT WWW.NORTHWESTERNENERGY.COM ON MAY 10, 2006.

Searchable text section of graphics shown above

[GRAPHIC]

[LOGO]

NorthWestern’s Future Unfolds

[LOGO]

Agenda

• Executive Summary

• Who is Babcock & Brown Infrastructure (BBI)

• Outcomes

• What the transaction means to our employees and retirees

• What the transaction means to the communities we serve

• What the transaction means to our shareholders

• Sale Process

• Questions

[LOGO]

2

Special Note Regarding Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” These statements are based upon our current expectations and speak only as of the date hereof. Our actual future business and financial performance may differ materially and adversely from those expressed in any forward-looking statements as a result of various factors and uncertainties, including, but not limited to:

• our ability to maintain normal terms with vendors and service providers;

• our ability to fund and execute our business plan;

• our ability to avoid or mitigate adverse rulings or judgments against us in our pending litigation arising from our bankruptcy proceeding, litigation related to our acquisition of the electric and natural gas transmission and distribution business formerly held by The Montana Power Company, and the formal investigation being conducted by the Securities and Exchange Commission;

3

• unscheduled generation outages, maintenance or repairs which may reduce revenues and increase cost of sales or may require additional capital expenditures or other increased operating costs;

• unanticipated changes in availability of trade credit, usage, commodity prices, fuel supply costs or availability due to higher demand, shortages, weather conditions, transportation problems or other developments, may reduce revenues or may increase operating costs, each of which would adversely affect our liquidity;

• adverse changes in general economic and competitive conditions in our service territories; and

• potential additional adverse federal, state, or local legislation or regulation or adverse determinations by regulators could have a material adverse affect on our liquidity, results of operations and financial condition.

In addition, we may not be able to complete the proposed transaction on the terms summarized above or other acceptable terms, or at all, due to a number of factors, including the failure to obtain approval of our stockholders, regulatory approvals or to satisfy other customary closing conditions. Our Annual Report on Form 10-K, recent and forthcoming Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K and other Securities and Exchange Commission filings discuss some of the important risk factors that may affect our business, results of operations and financial condition. We undertake no obligation to revise or publicly update any forward-looking statements for any reason.

4

• Important Legal Information

• In connection with the proposed transaction, Northwestern Corporation will file a proxy statement with the Securities and Exchange Commission. Before making any voting or investment decision, investors and security holders of Northwestern Corporation are urged to carefully read the entire proxy statement, when it becomes available, and any other relevant documents filed with the Securities and Exchange Commission, as well as any amendments or supplements to those documents, because they will contain important information about the proposed transaction. A definitive proxy statement will be sent to the stockholders of Northwestern Corporation in connection with the proposed transaction. Investors and security holders may obtain a free copy of the proxy statement (when available) and other documents filed by Northwestern Corporation at the Securities and Exchange Commission’s Web site at http://www.sec.gov. The proxy statement and such other documents may also be obtained for free from Northwestern Corporation by directing such request to Northwestern Corporation, 125 South Dakota Avenue, Sioux Falls, SD 57104, Attention: Dan Rausch, Director of Investor Relations, telephone: (605) 978-2902.

• Northwestern Corporation, its directors, executive officers and other members of its management, employees, and certain other persons may be deemed to be participants in the solicitation of proxies from Northwestern Corporation stockholders in connection with the proposed transaction. Information about the interests of Northwestern Corporation’s participants in the solicitation is set forth in Northwestern Corporation’s proxy statements and Annual Reports on Form 10-K, previously filed with the Securities and Exchange Commission, and in the proxy statement relating to the transaction when it becomes available.

5

Executive Summary

• The Board of Directors of NorthWestern (“the Board”) announced that it has entered into a definitive agreement to sell the Company to Babcock & Brown Infrastructure (“BBI”) in an all-cash transaction at $37 per share, valuing the Company at $2.2 billion.

• The Board believes that a sale to BBI represents the best outcome for all of NorthWestern’s stakeholders – customers, communities, employees, regulators and stockholders.

6

• Why did the Board decide to sell NorthWestern Energy to BBI?

• NorthWestern Energy today is much stronger. We have significantly reduced debt, a strong balance sheet, and a solid cash flow. We are focused on our transmission and distribution utility operations.

• Through this transaction current shareholders will be replaced by a long-term investor with a proven track record in owning, managing, and growing distribution utility, transmission and power generation businesses.

• BBI is the type of owner who will support NorthWestern’s commitment to service excellence and community growth in the future.

7

Grow the Business…

[GRAPHIC]

• BBI will better allow NorthWestern and its customers to benefit from our strategic geographic location. Strategic energy opportunities exist in our own “backyard”

8

Who is Babcock and Brown Infrastructure?

BBI is a long-term conservative utility owner with a proven track record of owning energy distribution and transmission, and power generation companies and assets.

[LOGO]

• Listing: ASX: BBI (on Australian Stock Exchange)

• Total Assets (Mil): $4500

• 2005 Revenue (Mil): $745

• Employees: 3000+

• Headquarters: Sydney, New South Wales, Australia

• Website: www.bbinfrastructure.com

9

• BBI was attracted to NorthWestern because it is similar to the other assets it already owns, such as:

Energy distribution

• | Powerco, the second largest electricity and gas distribution business in New Zealand. | | [LOGO] |

| | | |

• | IEG, which provides natural gas and LPG transmission, distribution and supply located in the United Kingdom, the Channel Islands, Isle of Man and Portugal. | | [LOGO] |

| | | |

• | Cross Sound Cable, a high-voltage DC transmission cable, which links the electricity grids of New York and Connecticut. | | [LOGO] |

10

Transport Infrastructure

• Dalrymple Bay Coal Terminal, which is one of the world’s largest coal export facilities serving the Bowen Basin, Queensland, Australia.

[GRAPHIC]

• PD Ports, the second largest port operator and the owner of the largest port in the industrial north-east of the United Kingdom.

[LOGO]

11

Power Generation

• Ecogen Power (50% stake) controls the Newport and Jeeralang gas-fired generation power plants in Victoria, Australia.

• Redbank Power Station (50% stake), a coal tailings fired power station in Hunter Valley, New South Wales Australia.

• Babcock and Brown Wind Partners – a 16.5% equity stake in a portfolio of 15 wind energy farms in the United States, Spain, Germany, and Australia.

[GRAPHIC]

[LOGO]

12

• International company with United States roots.

• Babcock & Brown was founded in the U.S. and has been working in the U.S. utility sector for more than 25 years.

• Starting in 1978, BBI arranged lease financings for rural electric cooperatives such as Basin Electric, Associated Electric, Tri-State and Hoosier.

• Other U.S. BBI businesses include:

• Cross Sound Cable, a high voltage direct current transmission cable linking the electricity grids of New York and Connecticut;

• 16.5% stake in Babcock & Brown Wind Partners, which includes 10 wind projects in the U.S., making them now the 3rd largest wind owner in the United States.

[GRAPHIC]

13

• BBI’s business approach emphasizes local management, local jobs, and local growth, including investing in infrastructure replacement, transmission and power production, including renewables.

• “Back to basics” approach and philosophy of owning its assets indefinitely have seen BBI grow to become one of the global leaders in its field.

• BBI is committed to providing NorthWestern capital to fund future investments.

14

Best Outcome for NorthWestern Customers and Employees

• BBI is committed to maintaining existing employee and customer service levels.

• NorthWestern Energy management team to stay in-place.

• NWE’s senior leadership has more than 220 years of combined utility experience.

• BBI’s supporting energy sector management are utility executives with an average of over 25 years experience in the electric and gas transmission and distribution business.

15

[GRAPHIC]

NorthWestern remains committed to serving our customers and the communities in which we operate.

• Our successful reorganization has focused the Company on its core utility operations and put us on far stronger financial footing.

• The sale of the Company to a long-term owner with access to capital ensures that we can continue to make substantial capital investment in our utility operations to ensure the long-term provision of reliable and cost-efficient service.

16

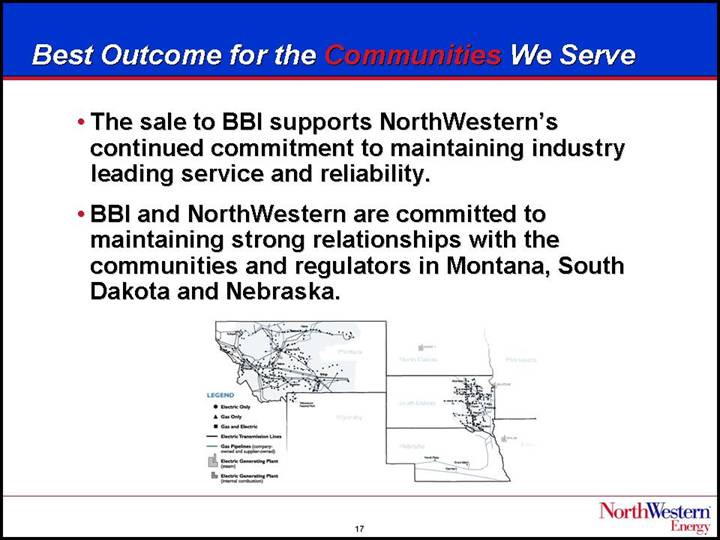

Best Outcome for the Communities We Serve

• The sale to BBI supports NorthWestern’s continued commitment to maintaining industry leading service and reliability.

• BBI and NorthWestern are committed to maintaining strong relationships with the communities and regulators in Montana, South Dakota and Nebraska.

[GRAPHIC]

17

• BBI recognizes the importance of local decision-making and will look to build upon the key business units throughout our service territory.

• BBI has indicated an intention to ensure local management accountability with a focus on a continuation of excellent customer service.

[GRAPHIC]

18

Best Outcome for NorthWestern Stockholders

• The Board-led process has yielded an extremely positive outcome for NWE stockholders – one that is far superior to the unsolicited proposals received during 2005, and the best value for stockholders of the proposals we received as part of the process.

• The agreed upon all-cash acquisition price represents a 15.3% premium to NorthWestern’s share price of $32.09 upon market close April 25, 2006.

19

[GRAPHIC]

• The Board strongly believes the BBI proposal presents far less risk to our stockholders and the communities we serve.

• The offer does not require an increase in NorthWestern’s debt and includes adequate protections for NorthWestern stockholders.

20

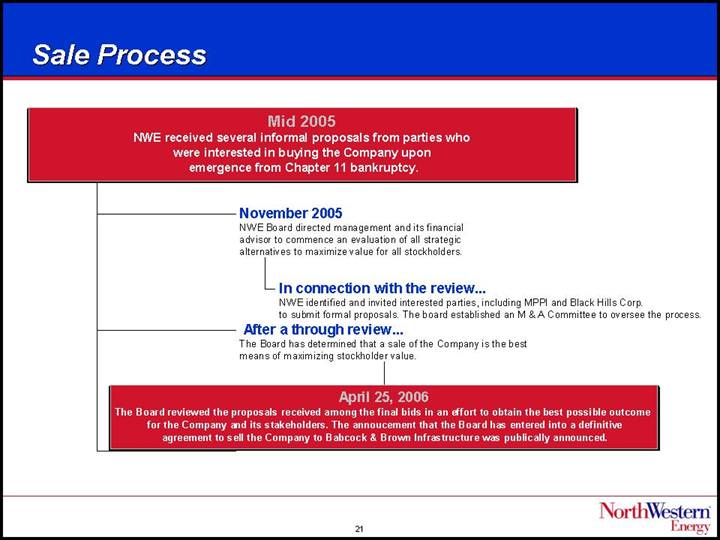

Sale Process

| Mid 2005 | |

| NWE received several informal proposals from parties who were interested in buying the Company upon emergence from Chapter 11 bankruptcy. | |

| | |

| November 2005 | |

| NWE Board directed management and its financial advisor to commence an evaluation of all strategic alternatives to maximize value for all stockholders. | |

| | |

| In connection with the review |

| NWE identified and invited interested parties, including MPPI and Black Hills Corp. to submit formal proposals. The board established an M & A Committee to oversee the process. |

| | |

| After a through review | |

| The Board has determined that a sale of the Company is the best means of maximizing stockholder value. | |

| | |

| April 25, 2006 | |

| The Board reviewed the proposals received among the final bids in an effort to obtain the best possible outcome for the Company and its stakeholders. The annoucement that the Board has entered into a definitive agreement to sell the Company to Babcock & Brown Infrastructure was publically announced. | |

| | | | | | |

21

• What’s Next?

• The transaction is subject to the approval of NorthWestern’s shareholders and federal and state regulatory agencies, which are expected to take between 9 to 18 months to obtain.

[GRAPHIC]

22