1 northerntrust.com | © Northern Trust 2016 BancAnalysts Association of Boston Conference 2016 NORTHERN TRUST CORPORATION S. Biff Bowman Executive Vice President & Chief Financial Officer Langham Hotel Boston 3 November 2016

2 northerntrust.com | © Northern Trust 2016 FORWARD-LOOKING STATEMENTS This presentation may include statements which constitute “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified typically by words or phrases such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “likely,” “plan,” “goal,” “target,” “strategy,” and similar expressions or future or conditional verbs such as “may,” “will,” “should,” “would,” and “could”. Forward-looking statements include statements, other than those related to historical facts, that relate to Northern Trust’s financial results and outlook, capital adequacy, dividend policy, anticipated expense levels, spending related to technology and regulatory initiatives, risk management policies, contingent liabilities, strategic initiatives, industry trends, and expectations regarding the impact of recent legislation. These statements are based on Northern Trust’s current beliefs and expectations of future events or future results, and involve risks and uncertainties that are difficult to predict and subject to change. These statements are also based on assumptions about many important factors, including the factors discussed in Northern Trust’s most recent annual report on Form 10-K and other filings with the U.S. Securities and Exchange Commission, all of which are available on Northern Trust’s website. We caution you not to place undue reliance on any forward-looking statement as actual results may differ materially from those expressed or implied by forward-looking statements. Northern Trust assumes no obligation to update its forward-looking statements.

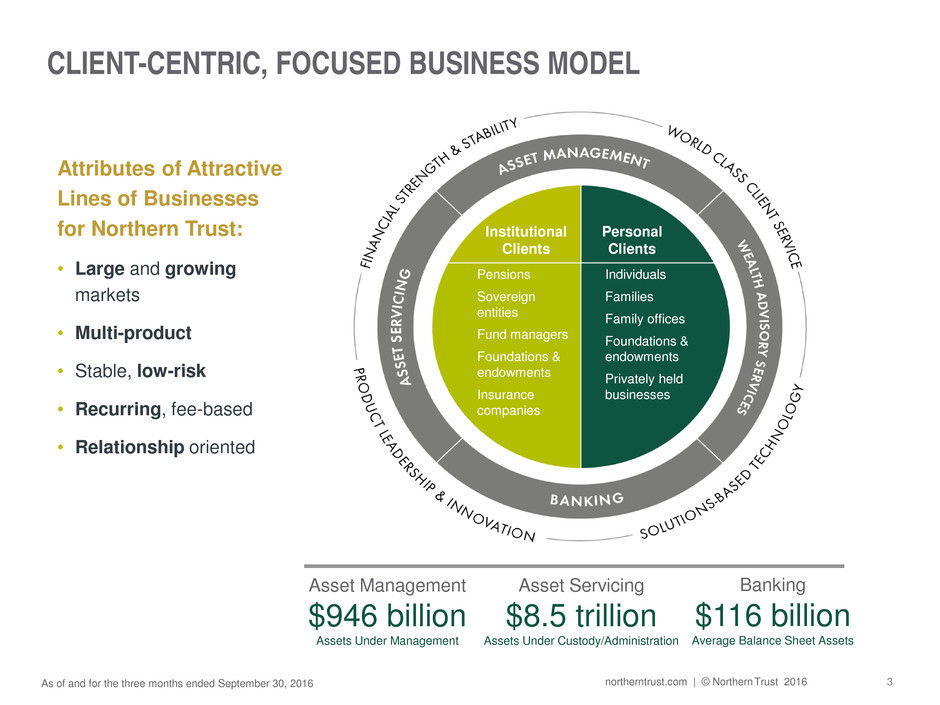

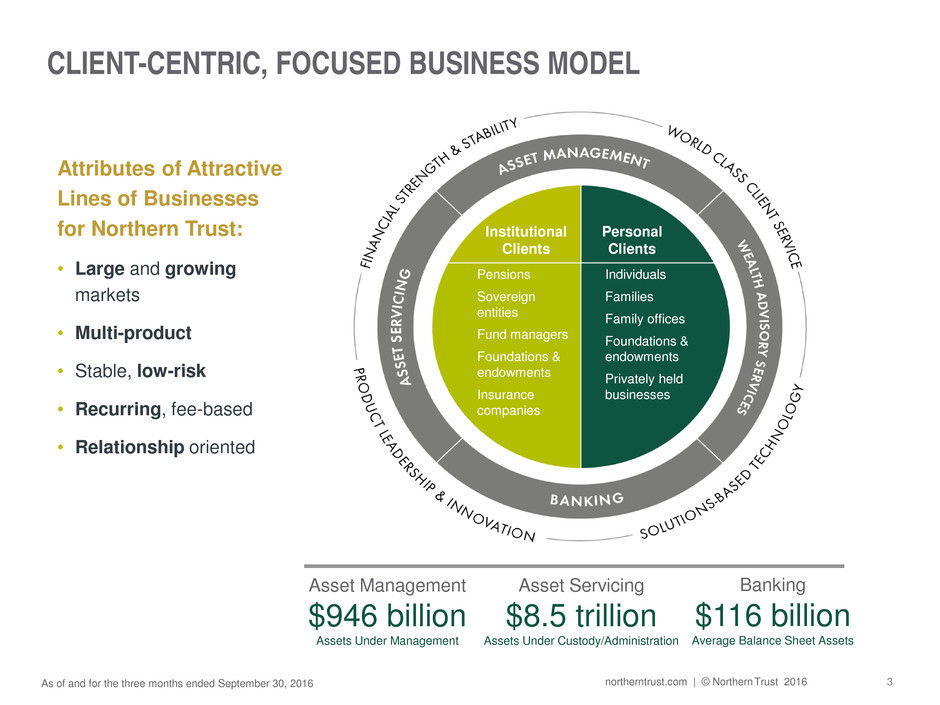

3 northerntrust.com | © Northern Trust 2016 CLIENT-CENTRIC, FOCUSED BUSINESS MODEL Pensions Sovereign entities Fund managers Foundations & endowments Insurance companies Individuals Families Family offices Foundations & endowments Privately held businesses Institutional Clients Personal Clients As of and for the three months ended September 30, 2016 Asset Management $946 billion Assets Under Management Asset Servicing $8.5 trillion Assets Under Custody/Administration Banking $116 billion Average Balance Sheet Assets Attributes of Attractive Lines of Businesses for Northern Trust: • Large and growing markets • Multi-product • Stable, low-risk • Recurring, fee-based • Relationship oriented

4 northerntrust.com | © Northern Trust 2016 WEALTH MANAGEMENT A full array of goals driven wealth management solutions for individuals, families and private businesses. Investment Management • Goals Driven Investing • Brokerage services Wealth Planning • Financial planning • Family education and governance • Tax and wealth transfer strategies • Philanthropy • Business owner services Trust & Estate Services • Wealth transfer planning • Custom trust solutions • Trust administration • Estate settlement services • Guardianship services Banking • Private banking • Business banking

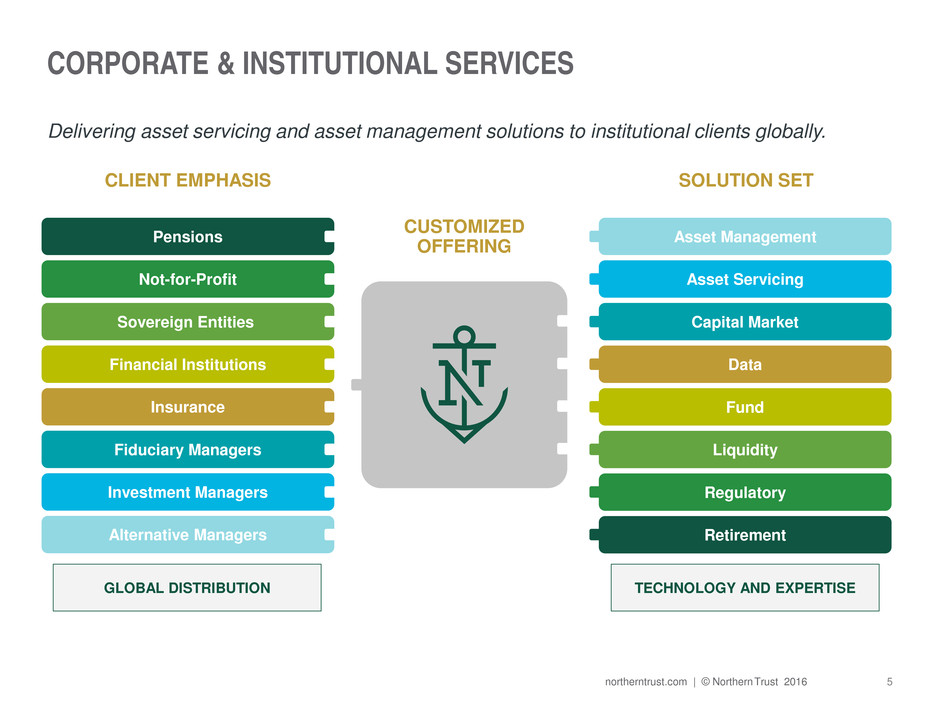

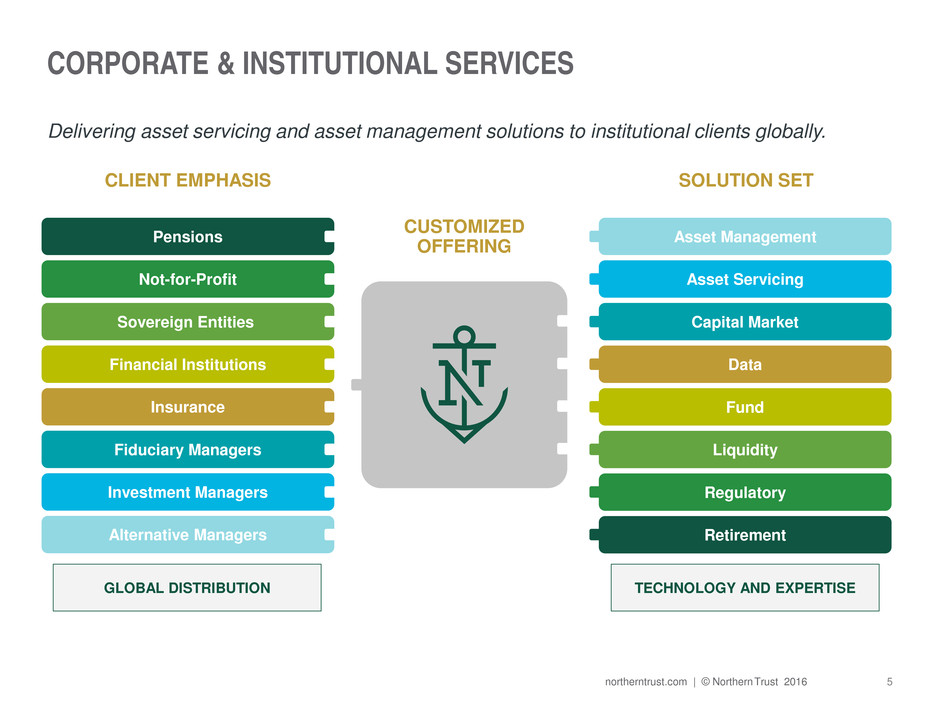

5 northerntrust.com | © Northern Trust 2016 CORPORATE & INSTITUTIONAL SERVICES Delivering asset servicing and asset management solutions to institutional clients globally. GLOBAL DISTRIBUTION TECHNOLOGY AND EXPERTISE CLIENT EMPHASIS SOLUTION SET CUSTOMIZED OFFERING Not-for-Profit Pensions Sovereign Entities Financial Institutions Insurance Fiduciary Managers Alternative Managers Investment Managers Asset Management Asset Servicing Capital Market Data Fund Liquidity Regulatory Retirement

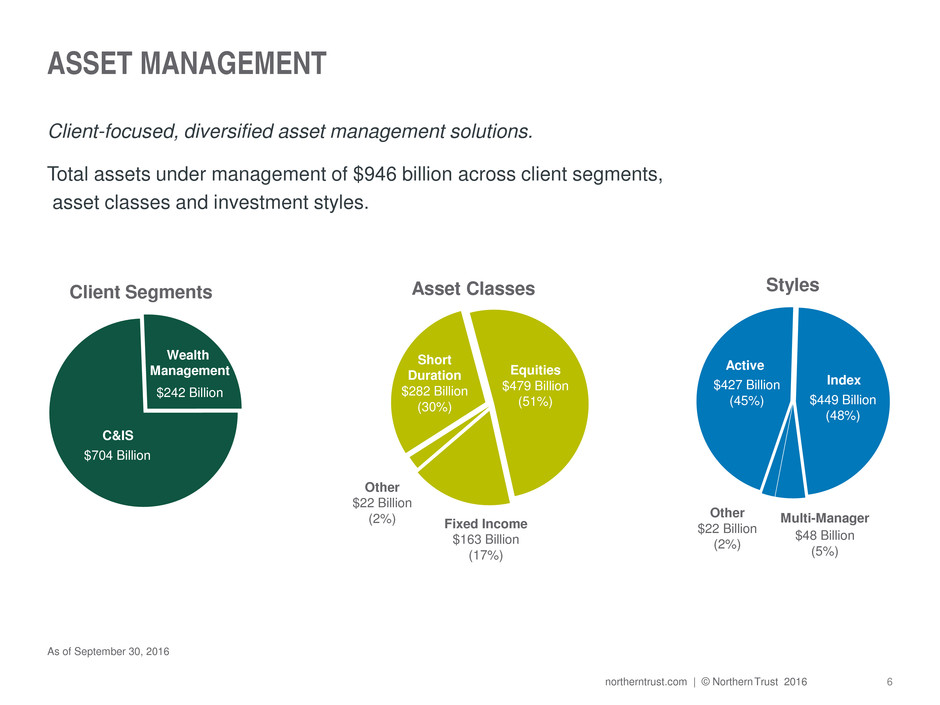

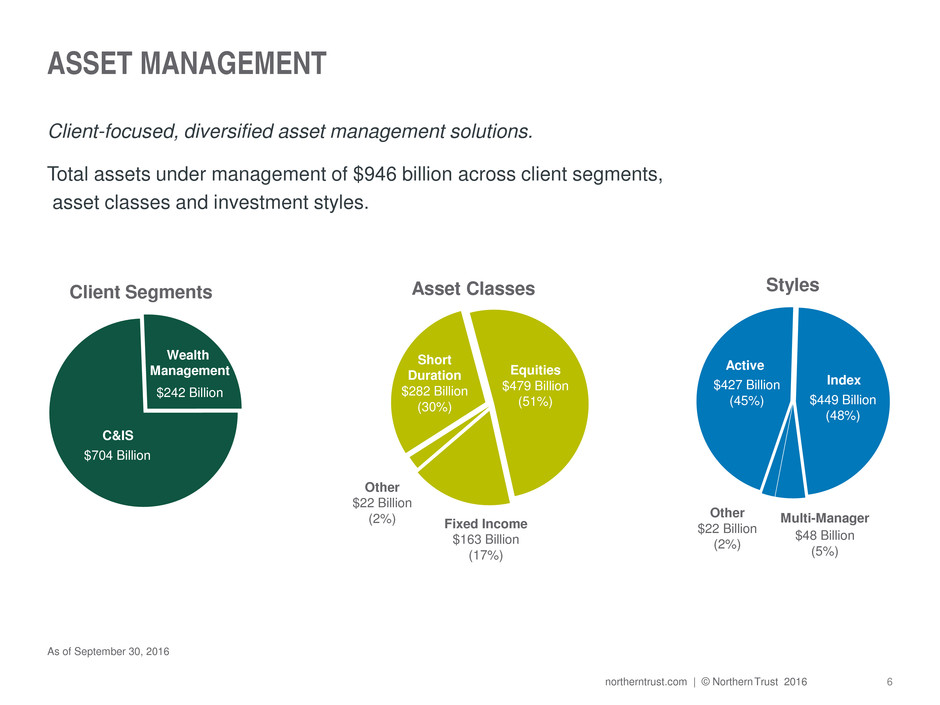

6 northerntrust.com | © Northern Trust 2016 Asset Classes Equities $479 Billion (51%) Fixed Income $163 Billion (17%) Short Duration $282 Billion (30%) Other $22 Billion (2%) Client Segments $704 Billion C&IS $242 Billion Wealth Management Styles $48 Billion (5%) $427 Billion (45%) Active $449 Billion (48%) Index Multi-Manager Other $22 Billion (2%) ASSET MANAGEMENT Total assets under management of $946 billion across client segments, asset classes and investment styles. Client-focused, diversified asset management solutions. As of September 30, 2016

7 northerntrust.com | © Northern Trust 2016 TRANSFORMING TECHNOLOGY TO ENABLE BUSINESS GROWTH How We Deliver Projects • Agile • Digital How We Build Software • Continuous Integration • Cloud • Services • User Experience Platform How We Manage Our Data • Smart “Big Data” • Data Deliveries • Governance How We Run Infrastructure • Cloud • Driving Unit Costs How We Manage Our Application Portfolio • Client Value • Optimization How We Innovate • Innovation Center • Silicon Valley • Blockchain • Robotics How We Secure Our Environment • Prevent • Detect • Respond

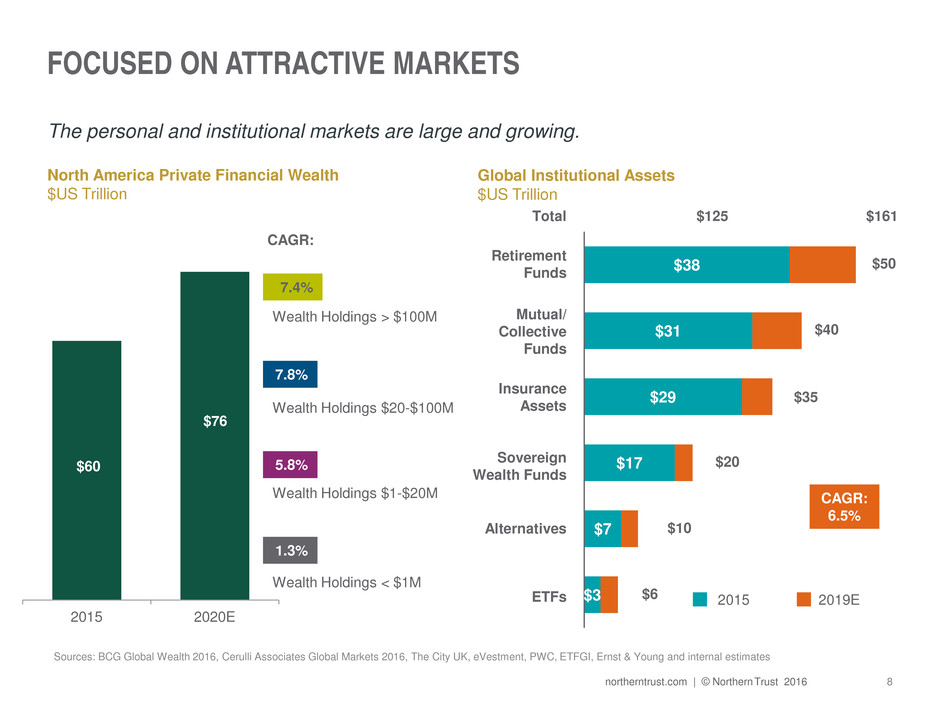

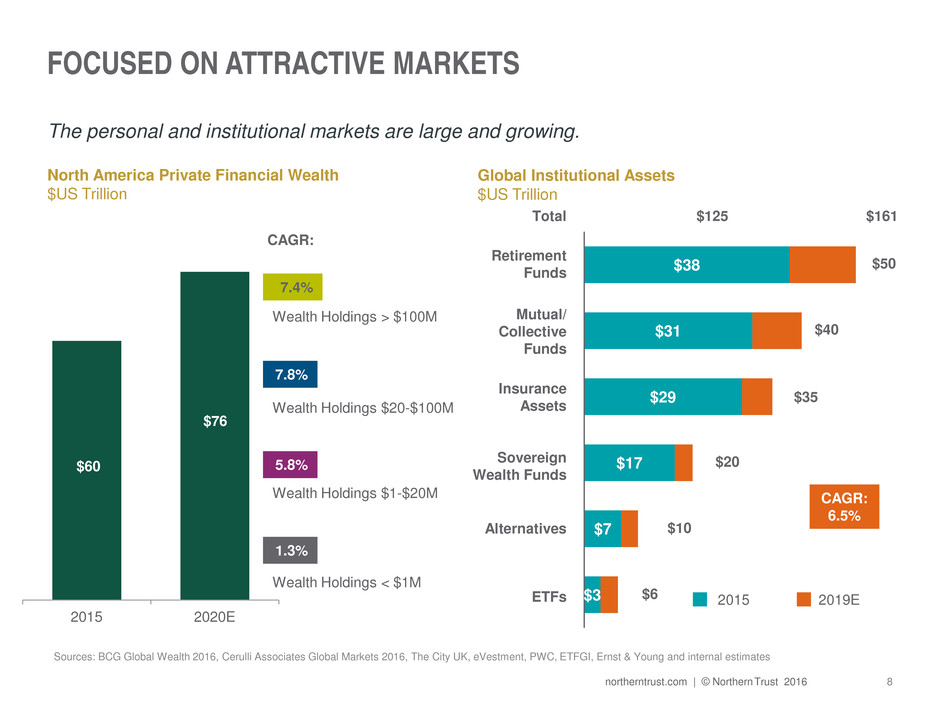

8 northerntrust.com | © Northern Trust 2016 FOCUSED ON ATTRACTIVE MARKETS The personal and institutional markets are large and growing. North America Private Financial Wealth $US Trillion $60 $76 2015 2020E CAGR: 7.8% 7.4% Sources: BCG Global Wealth 2016, Cerulli Associates Global Markets 2016, The City UK, eVestment, PWC, ETFGI, Ernst & Young and internal estimates Global Institutional Assets $US Trillion $38 $31 $29 $17 $7 $3 $161 $50 $40 $35 $20 $10 $6 2015 2019E Total $125 Retirement Funds Mutual/ Collective Funds Insurance Assets Sovereign Wealth Funds Alternatives ETFs CAGR: 6.5% 5.8% 1.3% Wealth Holdings > $100M Wealth Holdings $20-$100M Wealth Holdings $1-$20M Wealth Holdings < $1M

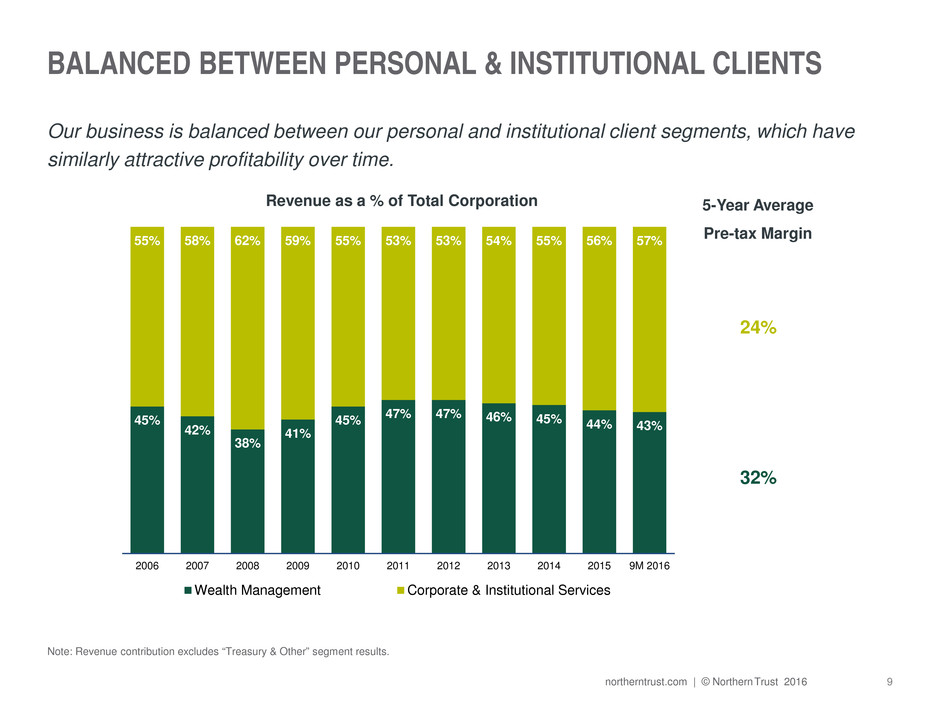

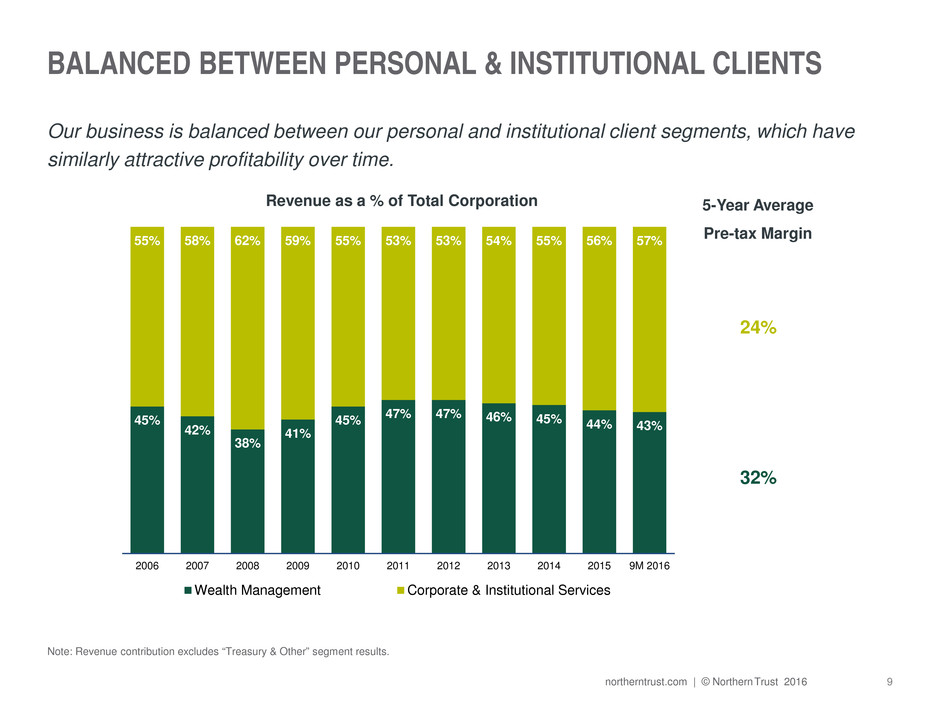

9 northerntrust.com | © Northern Trust 2016 BALANCED BETWEEN PERSONAL & INSTITUTIONAL CLIENTS Our business is balanced between our personal and institutional client segments, which have similarly attractive profitability over time. Note: Revenue contribution excludes “Treasury & Other” segment results. 45% 42% 38% 41% 45% 47% 47% 46% 45% 44% 43% 55% 58% 62% 59% 55% 53% 53% 54% 55% 56% 57% 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 9M 2016 Wealth Management Corporate & Institutional Services Revenue as a % of Total Corporation 5-Year Average Pre-tax Margin 24% 32%

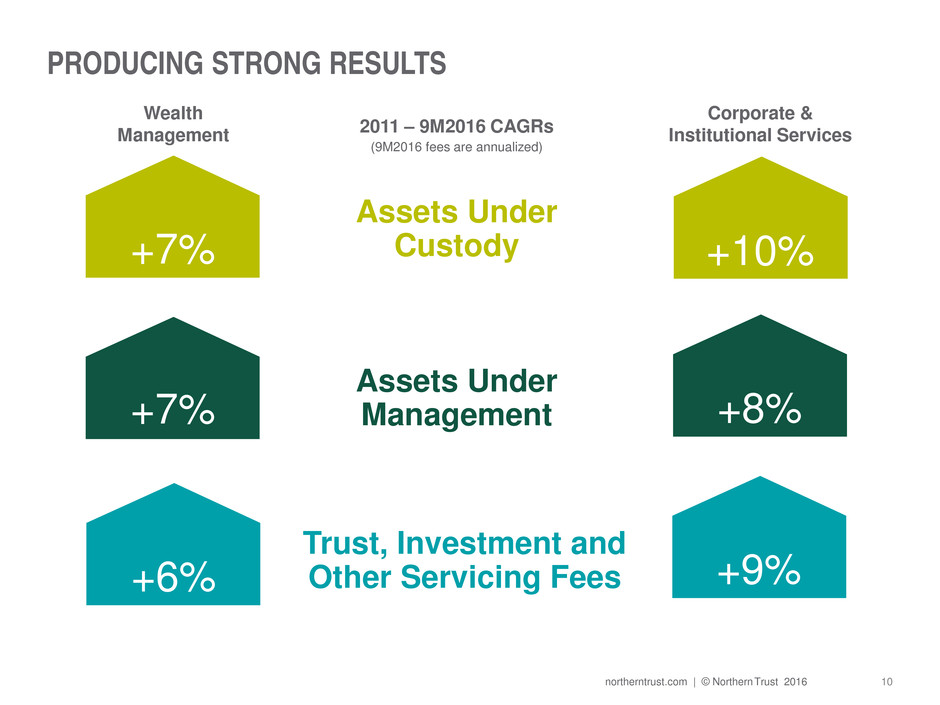

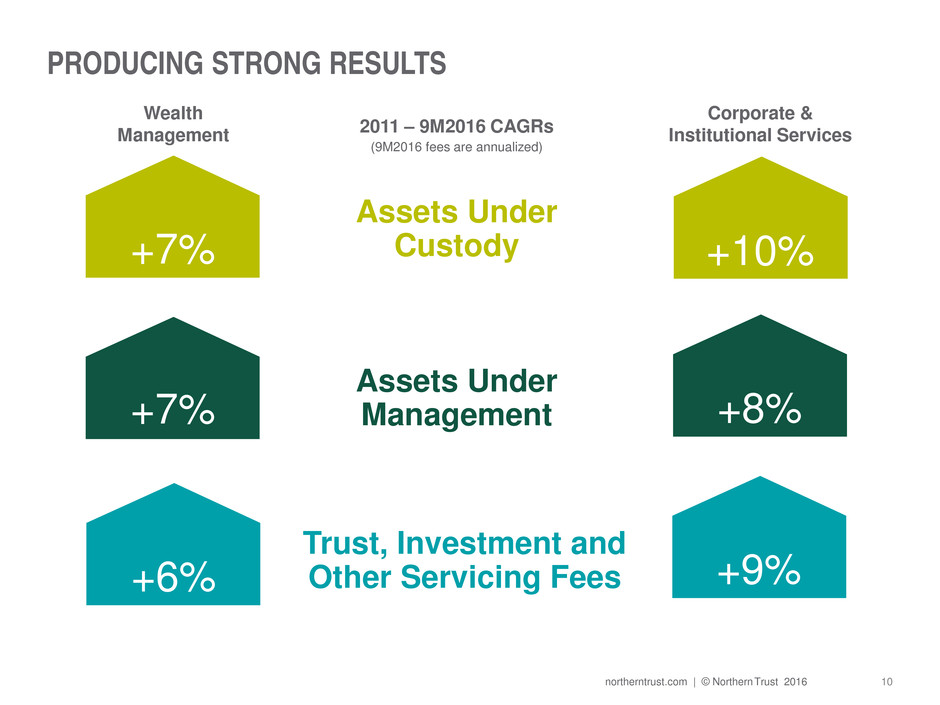

10 northerntrust.com | © Northern Trust 2016 Trust, Investment and Other Servicing Fees Assets Under Custody 2011 – 9M2016 CAGRs (9M2016 fees are annualized) +10% +9% +10% +8% +9% Assets Under Management +7% +7 +6% +10% 8% +9% PRODUCING STRONG RESULTS Wealth Management Corporate & Institutional Services

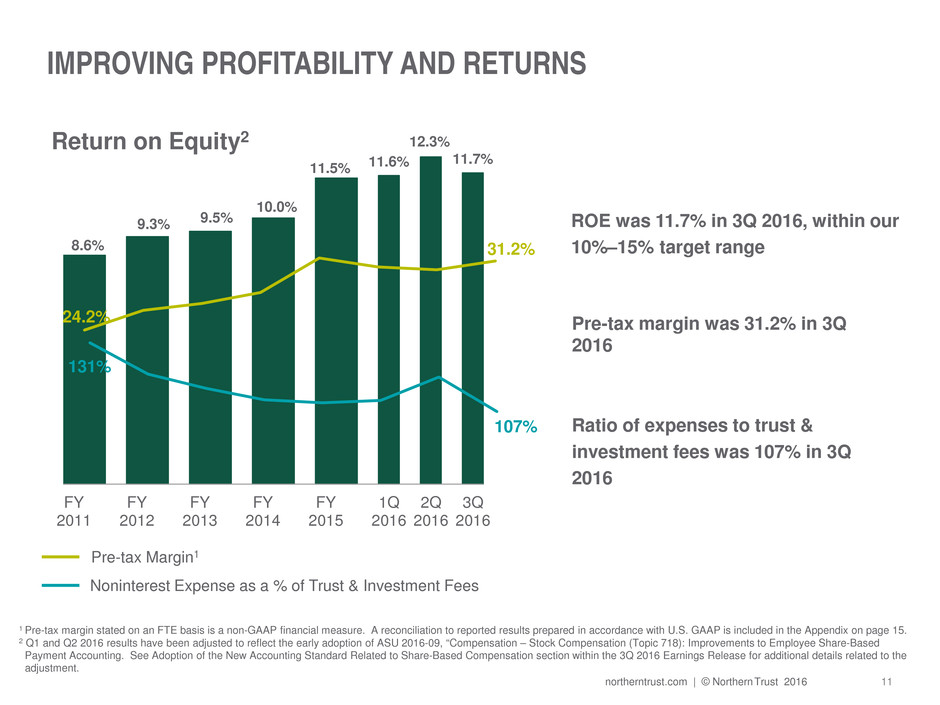

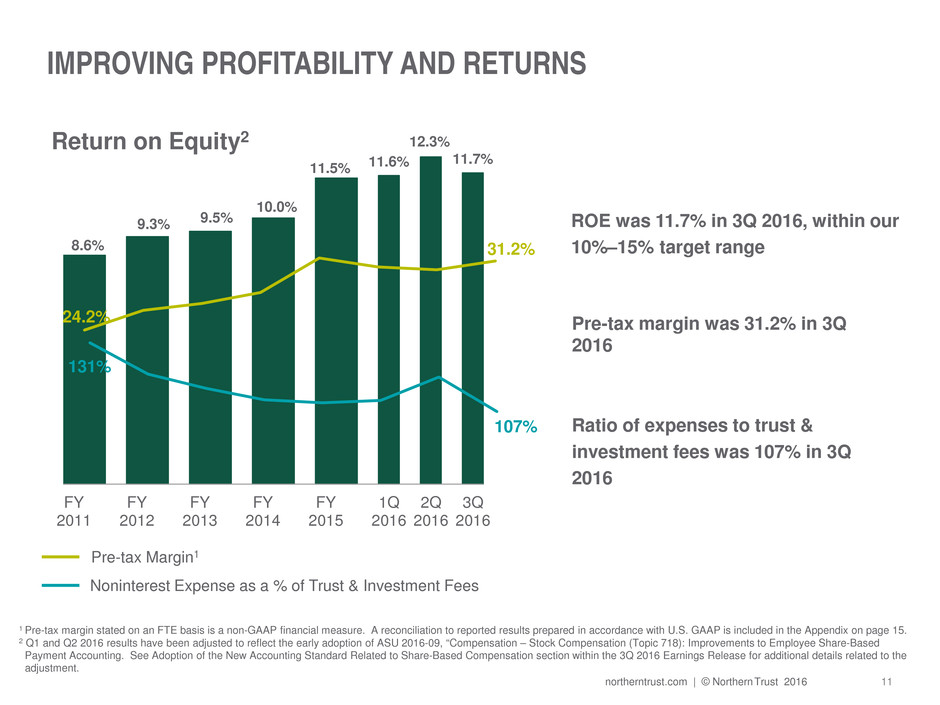

11 northerntrust.com | © Northern Trust 2016 8.6% 9.3% 9.5% 10.0% 11.5% 11.6% 12.3% 11.7% FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 1Q 2016 2Q 2016 3Q 2016 IMPROVING PROFITABILITY AND RETURNS 1 Pre-tax margin stated on an FTE basis is a non-GAAP financial measure. A reconciliation to reported results prepared in accordance with U.S. GAAP is included in the Appendix on page 15. 2 Q1 and Q2 2016 results have been adjusted to reflect the early adoption of ASU 2016-09, “Compensation – Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting. See Adoption of the New Accounting Standard Related to Share-Based Compensation section within the 3Q 2016 Earnings Release for additional details related to the adjustment. Return on Equity2 24.2% 31.2% 131% 107% Pre-tax Margin1 Noninterest Expense as a % of Trust & Investment Fees ROE was 11.7% in 3Q 2016, within our 10%–15% target range Pre-tax margin was 31.2% in 3Q 2016 Ratio of expenses to trust & investment fees was 107% in 3Q 2016

12 northerntrust.com | © Northern Trust 2016 CONSISTENTLY STRONG AND FOCUSED +8% +12% +9% +12% • Market Leader in Focused Businesses • A History of Organic Growth • Distinctive Financial Strength • Proven Record of Managing for Long-Term Growth and Profitability LONG-TERM SUCCESS THROUGH A FOCUSED STRATEGY

13 northerntrust.com | © Northern Trust 2016

14 northerntrust.com | © Northern Trust 2016 Appendix

15 northerntrust.com | © Northern Trust 2016 The following tables present a reconciliation of pre-tax income, total revenue and pre-tax margin prepared in accordance with GAAP to such measures on a fully taxable equivalent (FTE) basis, which are non-GAAP financial measures. Management believes this presentation provides a clearer indication of these financial measures for comparative purposes. Three Months Ended September 30, 2016 June 30, 2016 March 31, 2016 ($ In Millions) Reported FTE Adj. FTE Reported FTE Adj. FTE Reported FTE Adj. FTE Pre-tax Income $ 373.7 $ 7.0 $ 380.7 $ 394.7 $ 6.9 $ 401.6 $ 359.2 $ 6.2 $ 365.4 Total Revenue $ 1,213.7 $ 7.0 $ 1,220.7 $ 1,316.7 $ 6.9 $ 1,323.6 $ 1,190.0 $ 6.2 $ 1,196.2 Pre-tax Margin 30.8 % 31.2 % 30.0 % 30.3 % 30.2 % 30.6 % RECONCILIATION OF NON-GAAP FINANCIAL MEASURES Twelve Months Ended December 31, 2015 December 31, 2014 December 31, 2013 ($ In Millions) Reported FTE Adj. FTE Reported FTE Adj. FTE Reported FTE Adj. FTE Pre-tax Income $ 1,465.0 $ 25.3 $ 1,490.3 $ 1,190.2 $ 29.4 $ 1,219.6 $ 1,075.5 $ 32.5 $ 1,108.0 Total Revenue $ 4,702.6 $ 25.3 $ 4,727.9 $ 4,331.2 $ 29.4 $ 4,360.6 $ 4,089.3 $ 32.5 $ 4,121.8 Pre-tax Margin 31.2 % 31.5 % 27.5 % 28.0 % 26.3 % 26.9 % Twelve Months Ended December 31, 2012 December 31, 2011 ($ In Millions) Reported FTE Adj. FTE Reported FTE Adj. FTE Pre-tax Income $ 992.3 $ 40.8 $ 1,033.1 $ 883.7 $ 40.2 $ 923.9 Total Revenue $ 3,896.1 $ 40.8 $ 3,936.9 $ 3,769.9 $ 40.2 $ 3,810.1 Pre-tax Margin 25.5 % 26.2 % 23.4 % 24.2 %