UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| | o | Preliminary Proxy Statement |

| | o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | þ | Definitive Proxy Statement |

| | o | Definitive Additional Materials |

| | o | Soliciting Material Pursuant to §240.14a-12 |

| PRESIDENTIAL REALTY CORPORATION |

| |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | |

| þ | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6 (i) (1) and 0-11. |

| | 1. | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | 2. | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | 4. | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | 5. | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1. | Amount Previously Paid: |

| | | |

| | | |

| | 2. | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | 3. | Filing Party: |

| | | |

| | | |

| | 4. | Date Filed: |

| | | |

PRESIDENTIAL REALTY CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 15, 2012

July 5, 2012

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Presidential Realty Corp. (the “Company”) to be held on Wednesday, August 15, 2012 at 10 a.m., at the office of Blank Rome LLP, The Chrysler Building, 405 Lexington Avenue, New York, New York 10174, for the following purposes:

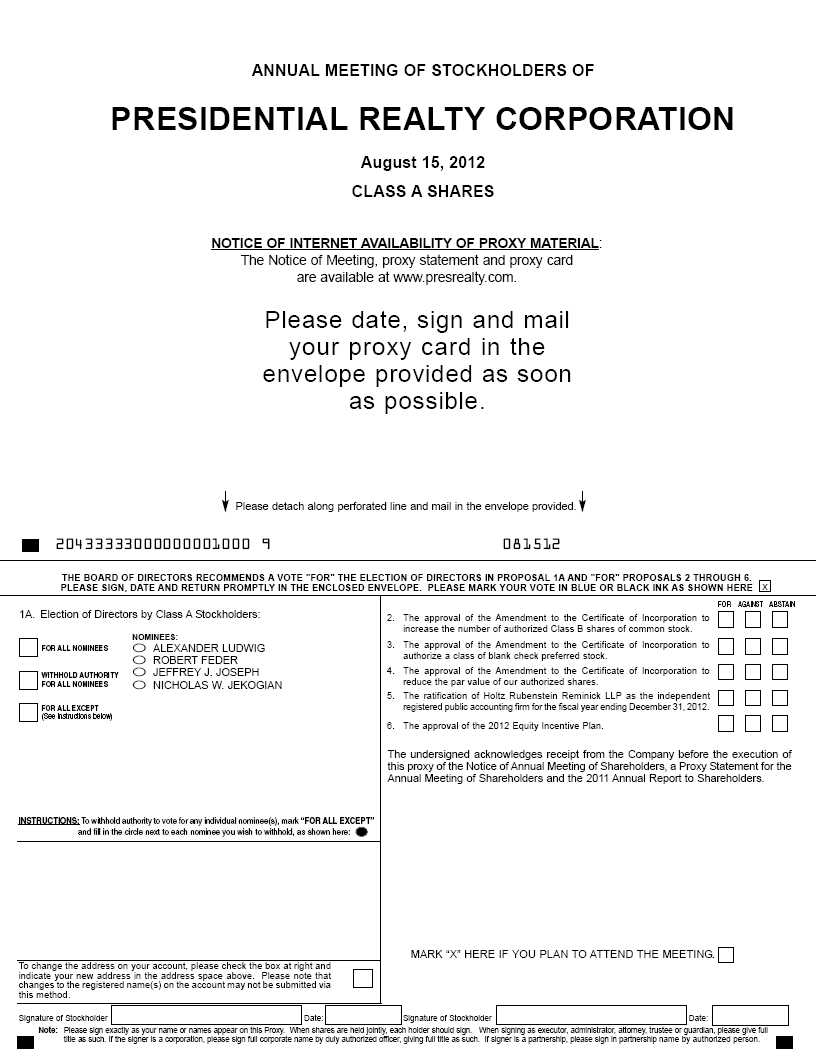

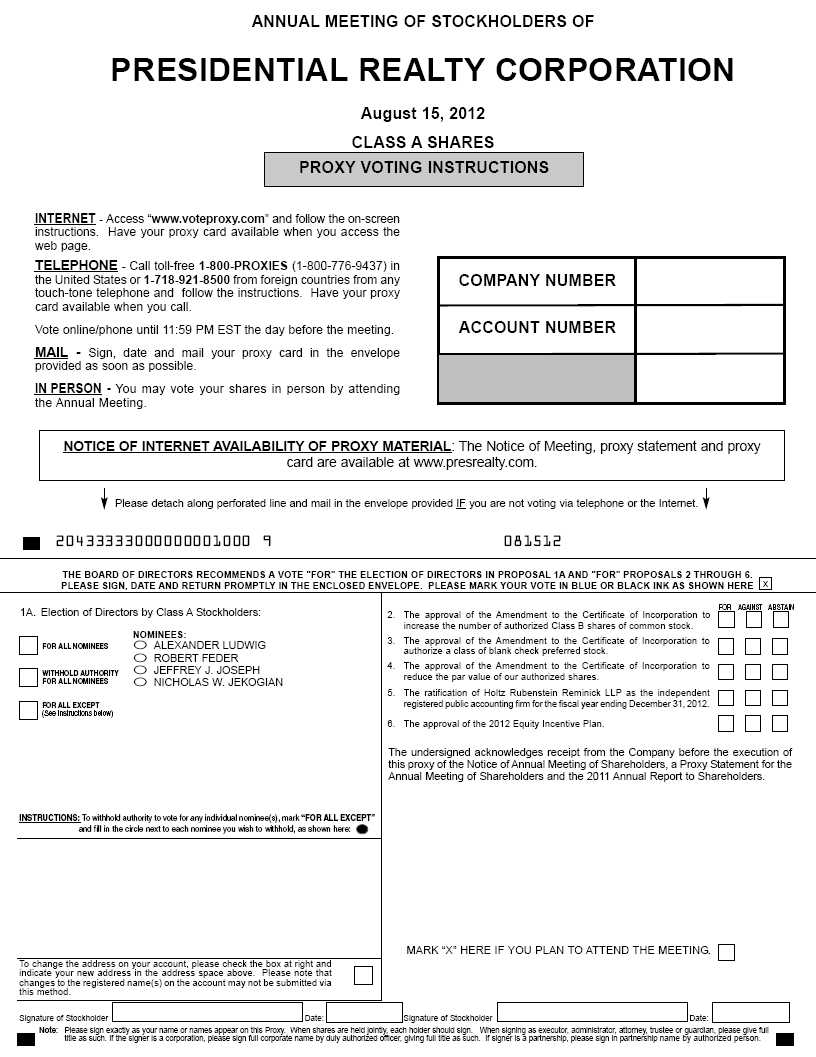

(i) the election, by vote of the Class A common shares, of four directors to serve until the 2013 annual meeting of the Company’s stockholders or until their respective successors are elected and have been qualified;

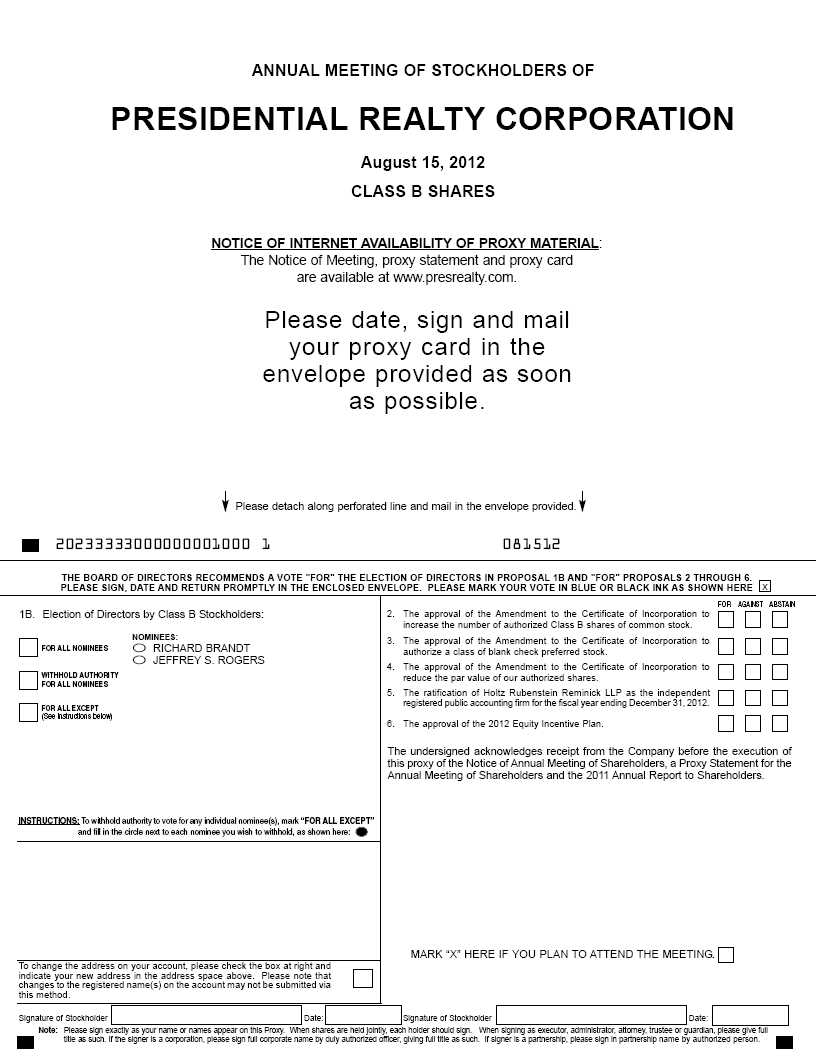

(ii) the election, by vote of the Class B common shares, of two directors to serve until the 2013 annual meeting of the Company’s stockholders or until their respective successors are elected and have been qualified-;

(iii) the approval of an amendment and restatement to our Certificate of Incorporation to increase the number of authorized Class B shares of our common stock;

(iv) the approval of an amendment and restatement to our Certificate of Incorporation to authorize a class of “blank check” preferred stock;

(v) the approval of an amendment and restatement to our Certificate of Incorporation to reduce the par value of our authorized shares of common stock;

(vi) the ratification of the appointment of Holtz Rubenstein Reminick LLP as the Company’s independent public accounting firm for the fiscal year ending December 31, 2012;

(vii) the ratification and approval of the Company’s 2012 Equity Incentive Plan;

(viii) the transaction of such other business as may properly come before the meeting or any adjournment thereof.

Detailed information concerning these matters is set forth in the attached Notice of Annual Meeting of Stockholders and Proxy Statement.

Your vote is important. You may have the option to vote your shares via a toll-free telephone number or over the Internet. Please refer to your enclosed proxy card and/or voting instruction form to see instructions on how to vote your shares. If you received a proxy card by mail, you may vote by signing, dating and mailing the proxy card in the envelope provided. If you then attend and wish to vote your shares in person, you still may do so.

I look forward to seeing you at the meeting.

| | Sincerely, | |

| | Nickolas W. Jekogian, III | |

| | Chairman and Chief Executive Officer | |

TABLE OF CONTENTS

| | | | |

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS | | | | 1 |

| QUESTIONS AND ANSWERS | | | | 3 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | | 7 |

| PROPOSAL NO. 1A ELECTION OF DIRECTORS BY CLASS A COMMON STOCKHOLDERS | | | | 10 |

| PROPOSAL NO. 1B ELECTION OF DIRECTORS BY CLASS B COMMON STOCKHOLDERS | | | | 12 |

| PROPOSAL NO. 2 APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED CLASS B SHARES OF OUR COMMON STOCK | | | | 14 |

| PROPOSAL NO. 3 APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO AUTHORIZE A CLASS OF “BLANK CHECK” PREFERRED STOCK | | | | 16 |

| PROPOSAL NO. 4 APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO REDUCE THE PAR VALUE OF OUR AUTHORIZED SHARES OF COMMON STOCK | | | | 18 |

| PROPOSAL NO. 5 RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS | | | | 19 |

| PROPOSAL NO. 6 THE RATIFICATION AND APPROVAL OF THE COMPANY’S 2012 EQUITY INCENTIVE PLAN | | | | 20 |

| EXECUTIVE COMPENSATION | | | | 26 |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | | 30 |

| SECTION16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | | | 31 |

PRESIDENTIAL REALTY CORPORATION

9 East 40th Street, Suite 900

New York, New York 10016

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

AND

PROXY STATEMENT

AUGUST 15, 2012

Notice is hereby given that the Annual Meeting of Stockholders of Presidential Realty Corporation (the “Company”) will be held on Wednesday, August 15, 2012 at 10 a.m., at Blank Rome LLP, The Chrysler Building, 405 Lexington Avenue, New York, New York 10174 or any postponements or adjournments thereof, for the following purposes:

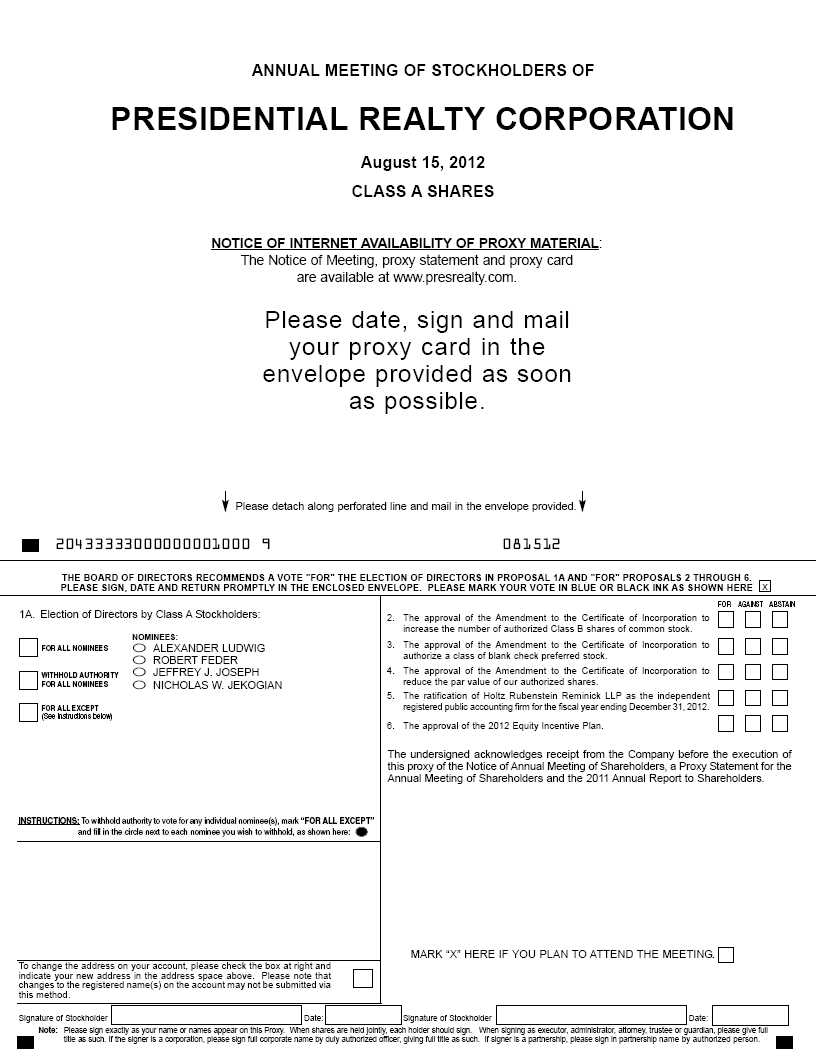

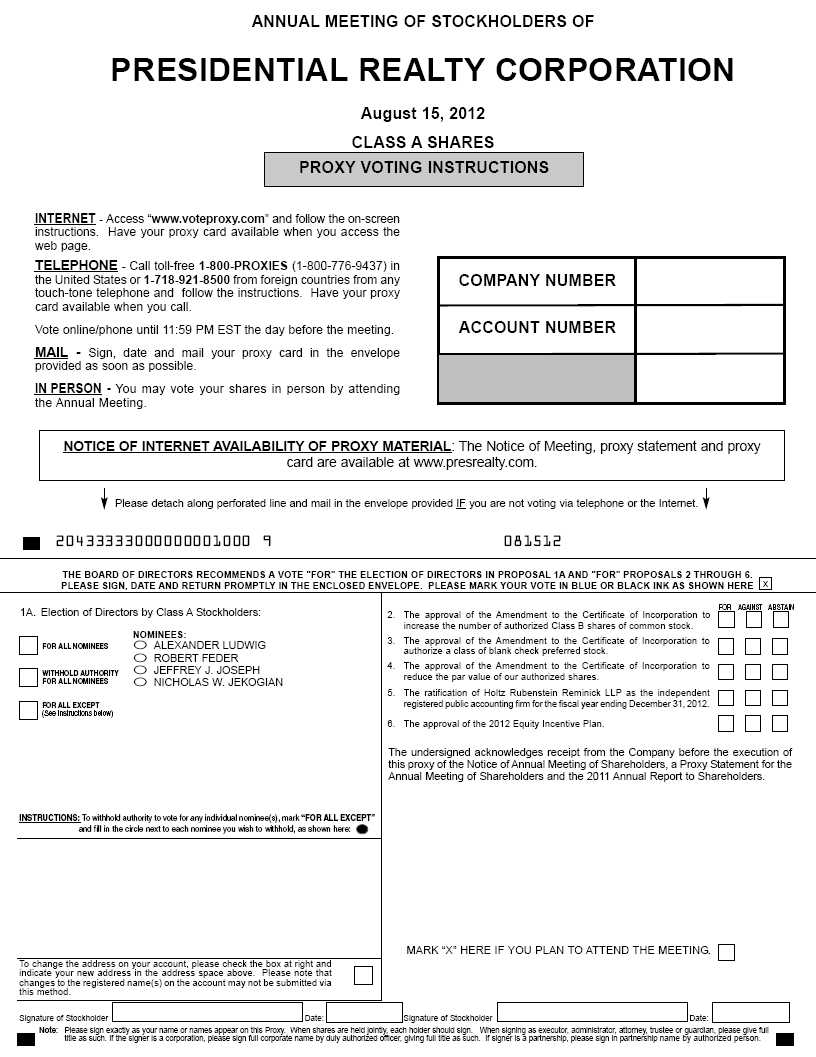

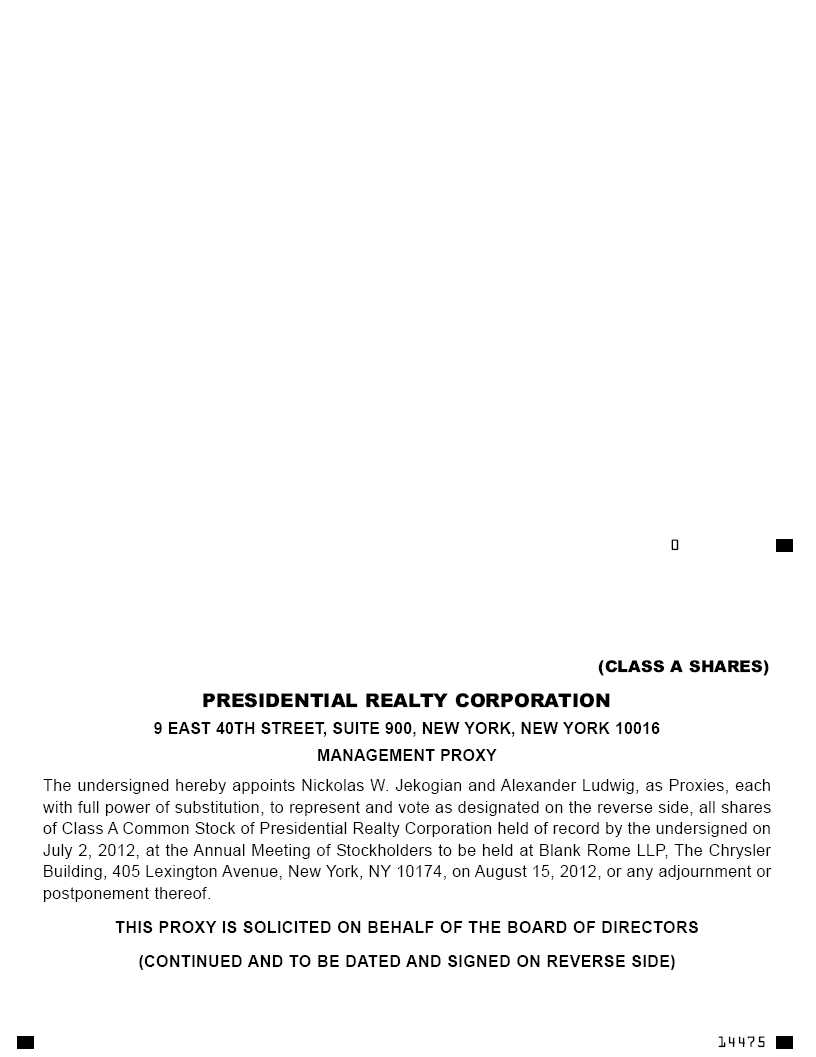

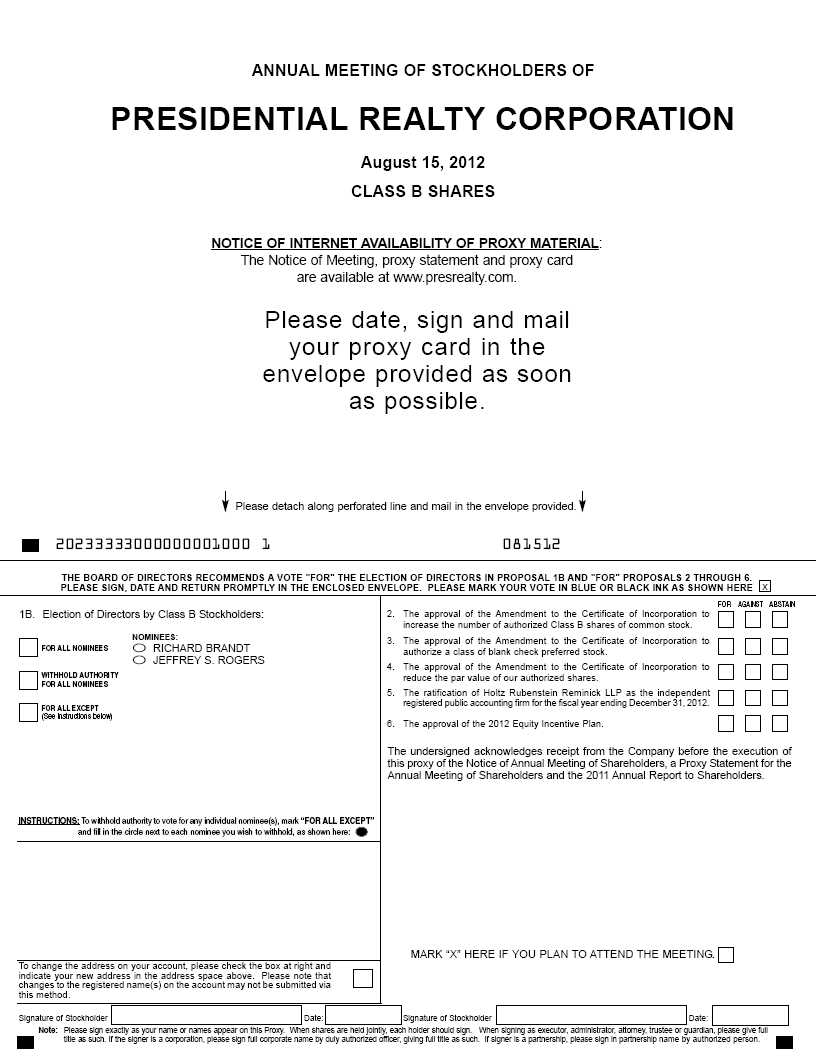

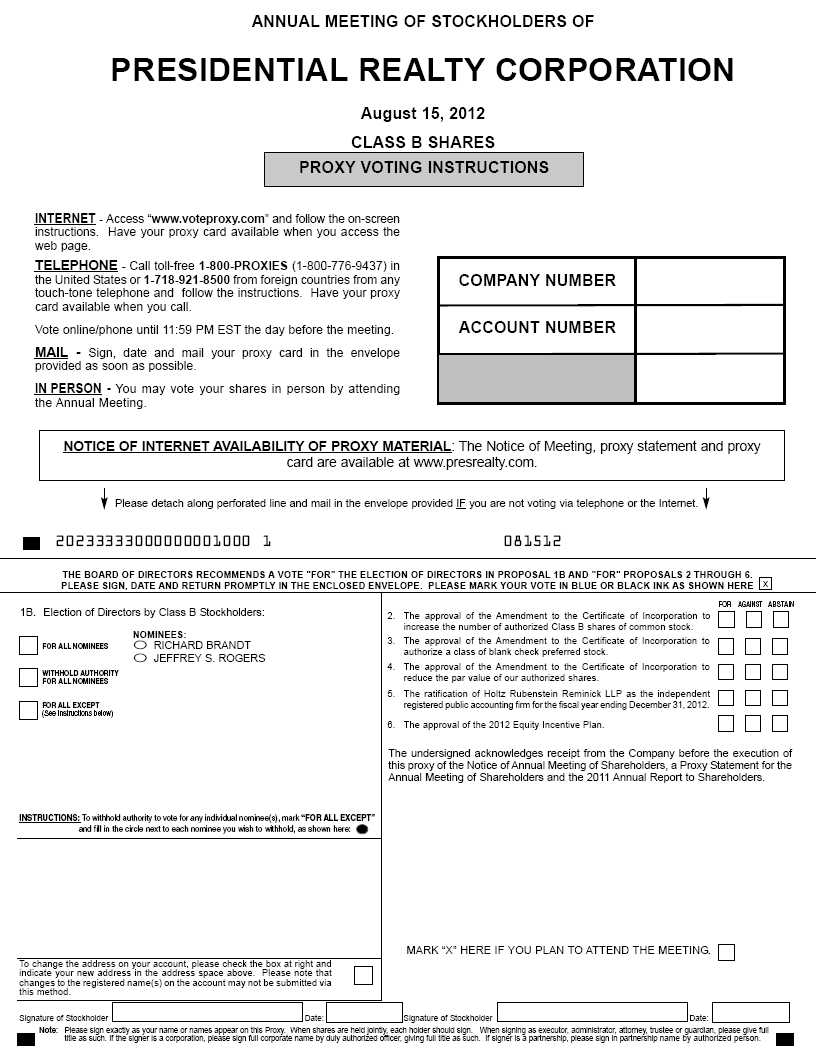

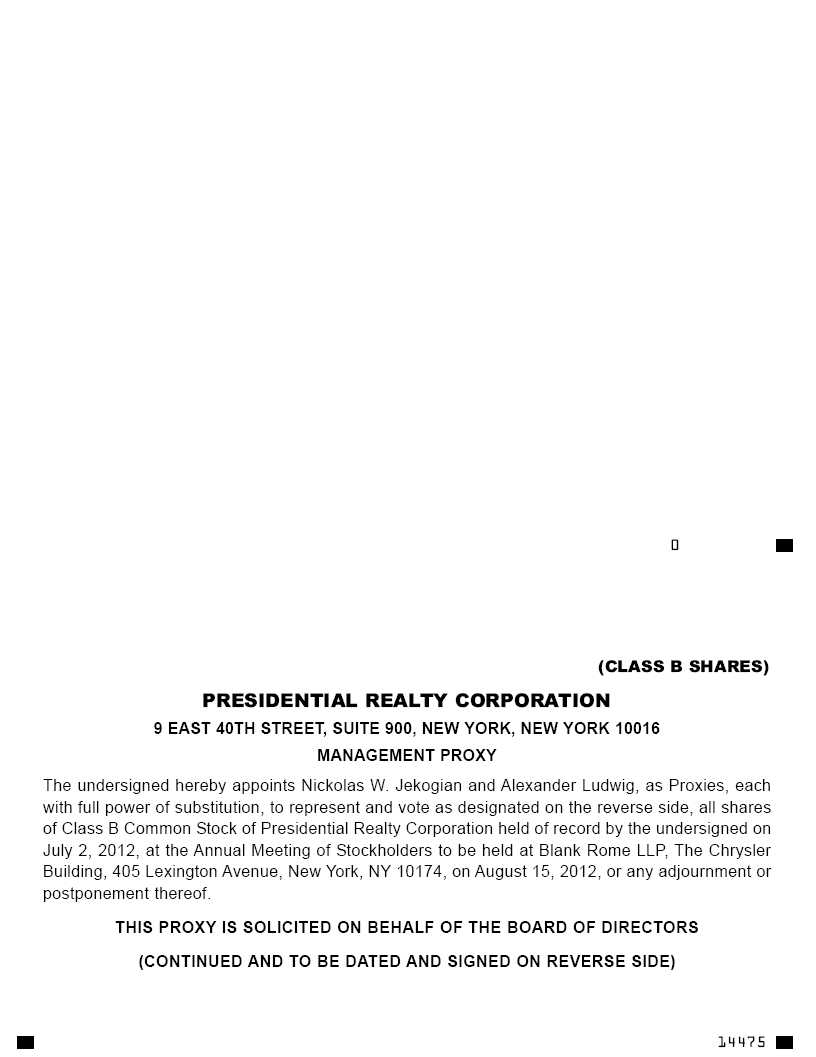

(i) the election, by vote of the Class A common shares, of four directors to serve until the 2013 annual meeting of the Company’s stockholders or until their respective successors are elected and have been qualified (“Proposal 1A”);

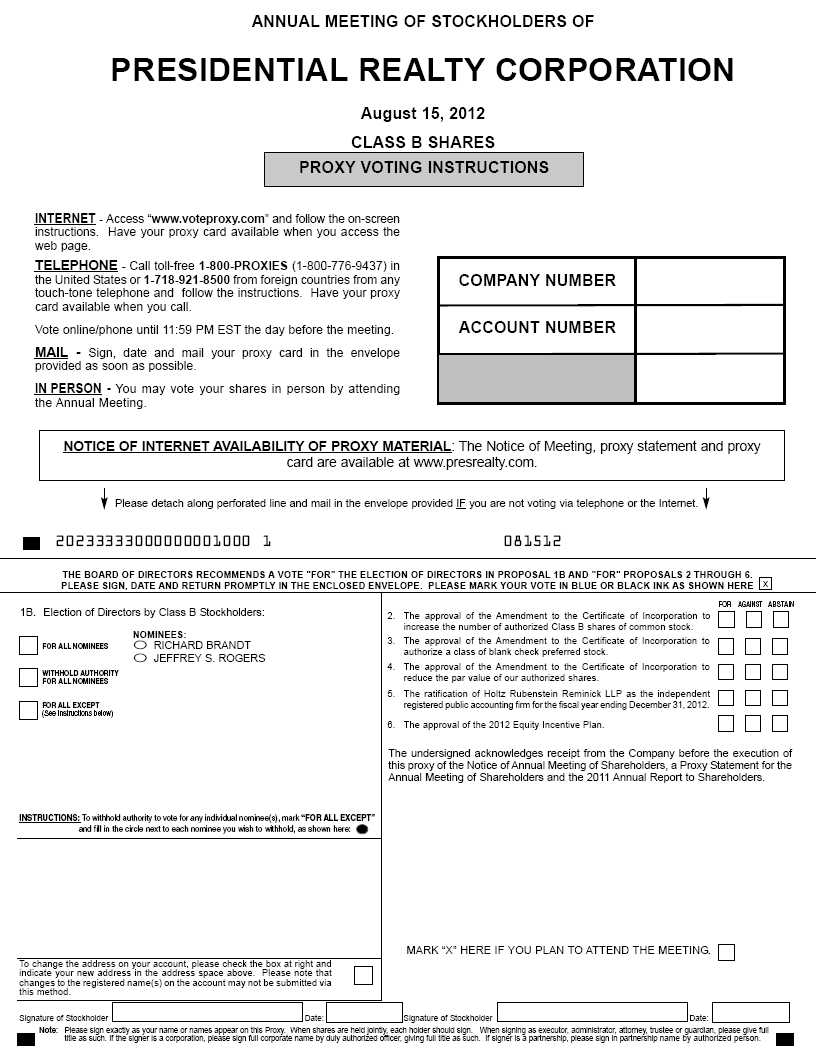

(ii) the election, by vote of the Class B common shares, of two directors to serve until the 2013 annual meeting of the Company’s stockholders or until their respective successors are elected and have been qualified (“Proposal 1B”);

(iii) the approval of an amendment and restatement to our Certificate of Incorporation to increase the number of authorized Class B shares of our common stock (“Proposal 2”);

(iv) the approval of an amendment and restatement to our Certificate of Incorporation to authorize a class of “blank check” preferred stock (“Proposal 3”);

(v) the approval of an amendment and restatement to our Certificate of Incorporation to reduce the par value of our authorized shares of common stock (“Proposal 4”);

(vi) the ratification of the appointment of Holtz Rubenstein Reminick LLP as the Company’s independent public accounting firm for the fiscal year ending December 31, 2012 (“Proposal 5”);

(vii) the ratification and approval of the Company’s 2012 Equity Incentive Plan (“Proposal 6”);

(viii) the transaction of such other business as may properly come before the meeting or any adjournment thereof.

You are entitled to vote at the Annual Meeting only if you were a Company stockholder of record at the close of business on July 2, 2012 (the “Record Date”). You are cordially invited to attend the Annual Meeting in person.

We urge you to read this Proxy Statement carefully and in its entirety, including the attached exhibits. These proxy solicitation materials are being mailed on or about July 5, 2012 to all stockholders entitled to vote at the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on August 15, 2012. Pursuant to rules of the Securities and Exchange Commission, we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of our proxy materials on the Internet. This Proxy Statement and our fiscal 2011 Annual Report are available at www.presrealty.com.

Your vote is important. Please read the Proxy Statement and the voting instructions on the enclosed proxy card. Then, whether or not you plan to attend the Annual Meeting in person, and no matter how many shares you own, you are urged to sign, date and promptly return the enclosed proxy card. A self-addressed envelope is enclosed for your convenience and no postage is required if mailed in the United States. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from the record holder.

YOU MAY REVOKE YOUR PROXY IF YOU DECIDE TO ATTEND THE ANNUAL MEETING AND WISH TO VOTE YOUR SHARES IN PERSON. PLEASE NOTE THAT ATTENDANCE AT THE ANNUAL MEETING WILL BE LIMITED TO STOCKHOLDERS OF PRESIDENTIAL REALTY CORPORATION AS OF THE RECORD DATE (OR THEIR AUTHORIZED REPRESENTATIVES) HOLDING EVIDENCE OF OWNERSHIP OF PRESIDENTIAL REALTY CORPORATION COMMON STOCK TO GAIN ADMISSION TO THE MEETING.

July 5, 2012

PRESIDENTIAL REALTY CORPORATION

9 East 40th Street, Suite 900

New York, New York 10016

QUESTIONS AND ANSWERS

| 1. | Q: | Why am I receiving these materials? |

| | A: | This Proxy Statement and enclosed forms of proxy (first mailed to stockholders on or about July 5, 2012) are furnished in connection with the solicitation by the Board of Directors of Presidential Realty Corporation (the “Company”), “we,” “us,” “our,” or “our Company” of proxies for use at the Company’s Annual Meeting of Stockholders, or at any adjournment thereof. The Annual Meeting will be held on Wednesday, August 15, 2012 at 10 a.m., at the office of Blank Rome LLP, The Chrysler Building, 405 Lexington Avenue, New York, New York 10174. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this Proxy Statement. |

| 2. | Q: | What is the purpose of the Annual Meeting? |

| | A: | The Annual Meeting is being held (1) to have our Class A common stockholders elect four directors, each to serve for a term of one year until the Company’s annual meeting of stockholders in 2013 or until the election and qualification of his successor; (2) to have our Class B common stockholders elect two directors, each to serve for a term of one year until the Company’s annual meeting of stockholders in 2013 or until the election and qualification of his successor; (3) to approve an amendment to our Certificate of Incorporation to increase the number of authorized Class B shares of our common stock; (4) to approve an amendment to our Certificate of Incorporation to authorize a class of “blank check” preferred stock; (5) to approve an amendment to our Certificate of Incorporation to reduce the par value of our authorized shares of common stock; (6) to ratify the appointment of Holtz Rubenstein Reminick LLP as the Company’s independent public accounting firm for the fiscal year ending December 31, 2012; (7) to ratify and approve the 2012 Equity Incentive Plan (the “2012 Plan”); and (8) to transact such other business as may properly be brought before the meeting or any adjournment thereof. |

| 3. | Q: | How may I obtain your Annual Report for 2011? |

| | A: | A copy of our Annual Report on Form 10-K, including financial statements, as amended, for the year ended December 31, 2011, is enclosed herewith and is available at www.presrealty.com. The Annual Report on Form 10-K is not part of this Proxy Statement. |

| 4. | Q: | Who may attend the Annual Meeting? |

| | A: | Holders of record of Class A and Class B common stock on the Record Date, or their duly appointed proxies, may attend the meeting. Stockholders whose shares are held through a broker or other nominee will need to bring a copy of a brokerage statement reflecting their ownership of our Common Stock as of the Record Date to be allowed into the meeting. |

| 5. | Q: | Who is entitled to vote at the Annual Meeting? |

| | A: | Holders of record of Class A and Class B common stock on the Record Date are entitled to vote at the Annual Meeting. |

| 6. | Q: | Who is soliciting my vote? |

| | A: | The principal solicitation of proxies is being made by our Board of Directors by mail. Certain of our officers, directors and employees, none of whom will receive additional compensation therefore, may solicit proxies by telephone or other personal contact. We will bear the cost of the solicitation of the proxies, including postage, printing and handling and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of shares. The Company has also retainedPhoenix Advisory Partners to assist us in soliciting your proxy at an estimated cost of $7,000. Phoenix Advisory Partners will ask brokerage houses and other custodians and nominees whether other persons are beneficial owners of our common stock. If so, we will reimburse banks, nominees, fiduciaries, brokers and other custodians for their costs of sending the proxy materials to the beneficial owners of our common stock. |

| 7. | Q: | How does the Board of Directors recommend that I vote? |

| | A: | The Board of Directors recommends that stockholders vote shares “FOR” the election of the nominees to the Board of Directors (Proposals 1A and 1B); “FOR” the approval of the amendment to our Certificate of Incorporation to increase the number of authorized Class B shares of our common stock (Proposal 2), to authorize a class of preferred stock (Proposal 3) and to reduce the par value of our authorized shares (Proposal 4); “FOR” ratification of the appointment of Holtz (Proposal 5) and “FOR” the approval of the 2012 Plan (Proposal 6). |

| 8. | Q: | How will voting on any other business be conducted? |

| | A: | Other than the items of business described in this Proxy Statement, we know of no other business to be presented for action at the Annual Meeting. As for any other business that may properly come before the Annual Meeting, your signed proxy gives authority to the persons named therein. Those persons may vote on such matters at their discretion and will use their best judgment with respect thereto. |

| 9. | Q: | What is the difference between a “stockholder of record” and a “street name” holder? |

| | A: | These terms describe how your shares are held. If your shares are registered directly in your name with American Stock Transfer & Trust Company, our transfer agent, you are a “stockholder of record.” If your shares are held in the name of a brokerage, bank, trust or other nominee as a custodian, you are a “street name” holder. |

| 10. | Q: | How do I vote my shares if I am a stockholder of record? |

| | A: | If you hold your shares in your own name as a holder of record, you may instruct the proxy holders how to vote your common stock by following the voting instructions included in the enclosed proxy card. You can appoint a proxy to vote your shares: • by using the Internet (http://www.voteproxy.com); • by calling the toll-free telephone number – 1-800-PROXIES (1-800-776-9437) within the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone; or • by completing, signing and dating the proxy card where indicated and by mailing or otherwise returning the card to us so that we receive it by 11:59 p.m., Eastern Time, on August 14, 2012. The Proxy Statement, including the exhibits thereto, the proxy card and any other proxy solicitation materials will be available on the Internet at www.presrealty.com. Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern Time, on August 14, 2012. If you vote using the Internet or by calling the toll-free telephone number, please have your proxy card in hand when you call and then follow the instructions. Of course, you may also choose to attend the meeting and vote your shares in person. The proxy holders will vote your shares in accordance with your instructions. If you sign and return a proxy card without giving specific voting instructions, your shares will be voted as recommended by the Board. |

| 11. | Q: | How do I vote my shares if they are held in “street name”? |

| | A: | If your shares are held in street name, your broker or other nominee will provide you with a form seeking instruction on how your shares should be voted. You should receive this form along with a proxy statement. You should follow the instructions on this form to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a legal proxy from the broker, bank or agent that holds your shares to present at the meeting. |

| 12. | Q: | Can I change or revoke my vote? |

| | A: | Yes. Any proxy executed and returned to us is revocable by delivering a later signed and dated proxy or other written notice to our Secretary at any time prior to its exercise. Your proxy is also subject to revocation if you are present at the meeting and choose to vote in person. |

| 13. | Q: | What constitutes a “quorum”? |

| | A: | As of the Record Date, there were outstanding and entitled to vote at the Annual Meeting 442,533 shares of the Company’s Class A common stock (held by approximately 73 holders of record) and 3,213,147 shares of the Company’s Class B common stock (held by approximately 386 holders of record). The presence at the Annual Meeting of holders of a majority, or 221,267, of the outstanding shares of the Company’s Class A common stock and holders of a majority, or 1,606,574, of the outstanding shares of the Company’s Class B common stock, either in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting. If, prior to the Annual Meeting, the Board determines that a quorum will not be present at the Annual Meeting or that continuing to solicit proxies for approval of the proposals is desirable, it may postpone the Annual Meeting to such time and place as it deems appropriate. |

| 14. | Q: | What are the voting requirements to approve each proposal? |

| | A. | Holders of Class A common stock will vote as a class for Proposal 1A, the election of four directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified, and holders of Class B common stock will vote as a class for Proposal 1B, the election of two directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified. Directors are elected by a plurality of the votes of the shares of common stock present, represented and voted at the Annual Meeting. This means that the director-nominee with the most affirmative votes for a particular position is elected for that position. The affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of both the Class A common stock and the Class B common stock, voting as a single class is required to approve Proposals 2, 3 and 4, the amendment to our Certificate of Incorporation to increase the number of authorized Class B shares of our common stock, to authorize a class of “blank check” preferred stock and to reduce the par value of our authorized common stock. In addition, the affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of Class A common stock is required to approve Proposals 2, 3 and 4 to increase the number of authorized Class B shares of our common stock, to authorize a class of “blank check” preferred stock and to reduce the par value of our authorized Class A common stock. The affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of Class B common stock is required to approve Proposals 2, 3 and 4 to increase the number of authorized Class B shares of our common stock, to authorize a class of “blank check” preferred stock and to reduce the par value of our authorized Class B common stock. |

| | | The affirmative vote of the holders of a majority of the shares present at the Annual Meeting either in person or by proxy and entitled to vote of the Company’s Class A and Class B common stock outstanding on the Record Date, voting together as one class, is required to approve Proposal 5, the ratification of Holtz, and Proposal 6, the approval of the 2012 Plan. |

| 15. | Q: | What if I abstain from voting or withhold my vote? |

| | A: | Under Delaware law and our Certificate of Incorporation and Bylaws, assuming a quorum exists at the meeting, only actual votes will be counted towards election of directors or approval of the other proposals. Stockholders entitled to vote for the election of directors can abstain from voting or withhold the authority to vote for any nominee. If you attend the meeting or send in your signed proxy with instructions to withhold authority to vote for one or more nominees, you will be counted for the purposes of determining whether a quorum exists. Abstentions and instructions on the proxy card to withhold authority to vote will result in the respective nominees receiving fewer votes. Since the vote on the election of directors is determined by a plurality of the votes cast, neither abstentions, nor broker non-votes (as described below), will have any effect on the election of directors. |

However, the number of votes otherwise received by the nominee will not be reduced by such action. If you abstain from voting on the approval of the amendment to the Certificate of Incorporation, your abstention will have the same effect as a vote against this proposal. If you are otherwise present at the meeting, and you abstain from voting on either the ratification of the Company’s independent auditors or of the 2012 Plan, your abstention will have the same effect as a vote against this proposal.

| 16. | Q: | Will my shares be voted if I am a stockholder of record and do not sign and return my proxy card at the Annual Meeting? |

| | A: | If you are a stockholder of record and you do not sign and return your proxy card or vote in person at the Annual Meeting, your shares will not be voted at the Annual Meeting and your shares will not be counted towards a quorum. |

| 17. | Q: | What is a “broker non-vote”? |

| | A: | “Broker non-votes” are shares held by brokers or nominees which are present in person or represented by proxy, but which are not voted on a particular matter because instructions have not been received from the beneficial owner. Under the rules of FINRA, member brokers generally may not vote shares held by them in street name for customers unless they are permitted to do so under the rules of any national securities exchange of which they are a member. Brokers who hold shares of Common Stock in street name for their customers and have transmitted our proxy solicitation materials to their customers, but do not receive voting instructions from these customers, are not permitted to vote on non-routine matters. Since the ratification of the appointment of Holtz is a routine matter, a broker may turn in a proxy card voting shares at its discretion and without receiving instructions from you. Because the election of directors, the amendment to the Certificate of Incorporation and the approval of the 2012 Plan are not routine matters, your broker or nominee may not vote your shares on these matters without receiving instructions. Thus, if stockholders do not give their broker or nominee specific instructions, their shares will not be voted on any matter other than Proposal 5 and will not be counted in determining the number of shares necessary for approval. However, shares represented by such “broker non-votes” will be counted when determining whether there is a quorum. |

| 18. | Q: | What is the effect of a broker non-vote? |

| | A: | Broker non-votes will be counted for the purpose of determining the presence or absence of a quorum and will result in the respective nominees for director receiving fewer votes. With regard to the proposals to amend the Certificate of Incorporation, to approve the Company’s 2012 Plan and the ratification of our accountants, broker non-votes will have the same effect as “AGAINST” votes. |

| 19. | Q: | When are stockholder proposals due in order to be included in our Proxy Statement for the 2013 Annual Meeting? |

| | A: | Stockholders who wish to present proposals appropriate for consideration at our annual meeting of stockholders to be held in the year 2013 must submit the proposal in proper form to us at our address set forth on the first page of this proxy statement and in accordance with applicable regulations under Rule 14a-8 of the Exchange Act not later than March 4, 2013 in order for the proposition to be considered for inclusion in our proxy statement and form of proxy relating to such annual meeting, provided that if the Company changes the date of the 2013 annual meeting by more than 30 days from the date of the 2012 Annual Meeting, then the deadline for submitting shareholder proposals will be a reasonable time before the Company begins to print and send its proxy materials for the 2013 annual meeting. Any such proposals, should contain the name and record address of the stockholder, the class and number of shares of our common stock beneficially owned as of the record date established for the meeting, a description of, and reasons for, the proposal and all information that would be require to be included in the proxy statement file with the SEC if such stockholder was a participant in the solicitation subject to Section 14 of the Securities Exchange Act of 1934. The proposal and as well as any questions related thereto, should be directed to the Company’s Secretary. |

If a stockholder submits a proposal after the March 4, 2013 deadline required under Rule 14a-8 of the Exchange Act but still wishes to present the proposal at our Annual Meeting of Stockholders (but not in our proxy statement) for the fiscal year ending December 31, 2012 to be held in 2013, the proposal, which must be presented in a manner consistent with our By-Laws and applicable law, must be submitted to the Secretary of the Company in proper form at the address set forth above so that it is received by the Company’s Secretary not less than 50 nor more than 75 days prior to the meeting unless less than 65 days notice or prior public disclosure of the date of the meeting is given or made to stockholders, in which case, no less than the close of business on the tenth day following the date on which the notice of the date of the meeting was mailed or other public disclosure of the date of the meeting was made.

We did not receive notice of any proposed matter to be submitted by stockholders for a vote at this Annual Meeting and, therefore, in accordance with Exchange Act Rule 14a-4(c) any proxies held by persons designated as proxies by our Board of Directors and received in respect of this Annual Meeting will be voted in the discretion of our management on such other matter which may properly come before the Annual Meeting.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

As of May 15, 2012, there were 442,533 shares of Class A common stock and 3,213,147 shares of Class B common stock outstanding.

The following tables set forth certain information regarding our Class A and Class B common stock beneficially owned as of May 15, 2012, for (i) each stockholder known to be the beneficial owner of 5% or more of our outstanding shares of common stock, (ii) each named executive officer and director, and (iii) all executive officers and directors as a group. A person is considered to beneficially own any shares: (i) over which such person, directly or indirectly, exercises sole or shared voting or investment power, or (ii) of which such person has the right to acquire beneficial ownership at any time within 60 days through an exercise of stock options or warrants. Unless otherwise indicated, voting and investment power relating to the shares shown in the table for our directors and executive officers is exercised solely by the beneficial owner or shared by the owner and the owner’s spouse or children.

For purposes of these tables, a person or group of persons is deemed to have “beneficial ownership” of any shares of common stock that such person has the right to acquire within 60 days of May 15, 2012. For purposes of computing the percentage of outstanding shares of our common stock held by each person or group of persons named above, any shares that such person or persons has the right to acquire within 60 days of May 15, 2012 is deemed to be outstanding, but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership.

Security Ownership of Management

As of May 15, 2012, the directors and executive officers of Presidential owned beneficially the following amounts and percentages of the Class A and Class B common stock of Presidential:

| Name of Beneficial Owner | | Class A Common Beneficially

Owned and Percentage of

Class | | | Class B Common Beneficially

Owned and Percentage of

Class | | | Percentage

of all

Outstanding

Stock (Class

A and B

Combined) | |

| | | Number of shares | | | % | | | Number of shares | | | % | | | % | |

| Richard Brandt, Director | | | – | | | | – | | | | 19,000 | | | | * | | | | * | |

| Robert Feder, Director | | | 916 | (1) | | | * | | | | 22,552 | | | | * | | | | * | |

| Jeffrey F. Joseph, Director | | | 5,344 | | | | 1.2 | % | | | 134,721 | | | | * | | | | * | |

Nickolas W. Jekogian, III,

Director, Chairman of the

Board and Chief Executive

Officer | | | - | | | | - | | | | 74,000 | (2) | | | * | | | | * | |

Alexander Ludwig, Director,

Chief Operating Officer and

Principal Financial Officer

and Secretary | | | - | | | | - | | | | 74,000 | (2) | | | * | | | | * | |

| Jeffrey S. Rogers, Director | | | - | | | | - | | | | 75 | | | | * | | | | * | |

All officers and directors as a

group (6 persons) | | | 6,260 | | | | * | | | | 324,348 | | | | 1.0 | % | | | * | |

| * Less than 1% of the class of stock. |

| |

| (1) | Includes 916 Class A shares and 6,552 Class B shares held by Mr. Feder’s wife, the beneficial ownership of which is disclaimed. |

| | |

| (2) | Includes 74,000 shares of Class B common stock subject to an option granted on November 8, 2011 which is currently exercisable or which will become exercisable within 60 days. These shares are deemed outstanding for purposes of calculating the percentage of outstanding Class B common stock owned by a person individually and by all directors and executive officers as a group but are not deemed outstanding for the purpose of calculating the individual ownership percentage of any other person. Mr. Jekogian’s father is the trustee of the BBJ Irrevocable Family Trust (the “Trust”) which owns 177,013 shares of Class A common stock. None of the shares owned by the Trust are included in the share owned by Mr. Jekogian, and Mr. Jekogian disclaims beneficial ownership of any of the shares owned by the Trust. |

| Except as set forth in the notes to the table, each of the owners of the shares set forth in the table has the sole voting and dispositive power over such shares except that any such owner has no voting or dispositive power over shares the beneficial ownership of which is disclaimed. |

Security Ownership of Certain Beneficial Owners

As of May 15, 2012, the following persons owned beneficially more than 5% of either the outstanding Class A common stock or the outstanding Class B common stock of the Company.

| | | Class A Common Stock

Beneficially Owned and

Percentage of Class | | | Class B Common Stock

Beneficially Owned and

Percentage of Class | | | Percentage of

all

Outstanding

Stock (Class

A and B

Combined) | |

| Name and Address | | Number of

Shares | | | % | | | Number of

Shares | | | % | | | % | |

| | | | | | | | | | | | | | | | |

Nickolas W. Jekogian, Jr.,

Trustee of the BBJ Irrevocable

Family Trust

312 Lewis Rd

Broomall, PA 19008 | | | 177,013 | | | | 40.0 | % | | | None | | | | None | | | | 4.8 | % |

| | | | | | | | | | | | | | | | | | | | | |

Singley Capital Management, Inc.(5)

14781 Memorial Drive, Suite 2081

Houston, TX 77079 | | | 32,203 | (1)(3) | | | 7.3 | % | | | 379,552 | (1)(3) | | | 11.8 | % | | | 11.3 | %(6) |

| | | | | | | | | | | | | | | | | | | | | |

Singley Capital Partners, LP(5)

Singley Capital GP, Inc.

14781 Memorial Drive, Suite 2081

Houston, TX 77079 | | | 32,203 | (2) (3) | | | 7.3 | % | | | 379,552 | (2) (3) | | | 11.8 | % | | | 11.3 | %(6) |

| | | | | | | | | | | | | | | | | | | | | |

Christopher Singley(5)

c/o Singley Capital Management, Inc.

14781 Memorial Drive, Suite 2081

Houston, TX 77079 | | | 32,203 | (2) (3) | | | 7.3 | % | | | 523,327 | (3)(4) | | | 16.3 | % | | | 15.2 | %(6) |

| (1) | Is deemed the beneficial owner of these shares because it has shared dispositive power over these shares. |

| (2) | Is deemed the beneficial owner of these shares because it has shared voting and dispositive power over these shares. |

| (3) | Mr. Christopher Singley is the President of Singley Capital Management, Inc., a registered investment adviser which serves as the investment manager of Singley Capital Partners, LP. Mr. Singley is also the President of Singley Capital GP, Inc., an entity which acts as the general partner of Singley Capital Partners., LP. |

| (4) | Includes 379,552 shares held in the name of Singley Capital Partners, LP; 74,325 shares held in the name of Singley Capital 401(k) Plan for which Mr. Singley is the trustee; 19,477 shares held in the name of Christopher Singley CFBO Sophia Singley ESA for which Mr. Singley is the custodian; 23,000 shares held in the name of Christopher Singley Roth IRA and 1,600 shares held in the name of Christopher Singley IRA which Mr. Singley has the sole dispositive and voting power; and 25,373 shares held in the name of Ting Singley Roth IRA. Mr. Singley is the husband of Ting Singley. |

| (5) | This information is derived from the beneficial owners on June 11, 2012. |

| (6) | The shares reported as beneficially owned exceed the 9.2% ownership limitation contained in our Certificate of Incorporation, as amended. All shares in excess of the ownership limitation are deemed Excess Shares under our Certificate of Incorporation, as amended, and are not entitled to vote. |

The Company’s management knows of no other persons owning beneficially more than 5% of either the outstanding Class A common stock or the outstanding Class B common stock of the Company.

BBJ Irrevocable Family Trust has agreed to vote its shares of Class A common stock for Mr. Robert Feder and/or Mr. Richard Brandt, current independent directors, as directors (subject to their desire to remain as directors); provided that each of them continues to qualify as an independent director under applicable rules, including the rules of any exchange on which either the Class A common stock or the shares of Class B common stock may then be listed and until the occurrence of a Capital Event. “Capital Event” means the receipt by us of at least $20,000,000 in cash or property from a capital raising activity including the following: (a) the sale for cash of shares of the Class A common stock or Class B common stock or securities convertible into shares of the Class A common stock or Class B common stock; (b) the exchange of shares of Class A common stock or Class B common stock for real estate assets consistent with our status as a REIT; (c) the sale of unsecured subordinated debt instruments issued by us, the proceeds of which may be used to acquire real estate assets which are consistent with our status as a REIT.

Our certificate of incorporation contains certain restrictions on the ownership of our shares in order to assure that we continue to qualify as a REIT. Shares of our common stock cannot be transferred to any person if such transfer would cause that person to be the owner of more than 9.2% of our outstanding shares. Mr. Singley and his related companies have exceeded that limit. Under the terms of our certificate of incorporation, the excess shares (shares owned in excess of the 9.2% limitation) shall be deemed to have been transferred to the Company as trustee for the benefit of the person to whom the shares will later be transferred; the person who would have been the owner shall not be entitled to exercise any voting rights with respect to the excess shares, the excess shares will not be deemed to be outstanding for the purpose of determining a quorum at any meeting of shareholders and any dividends or other distributions with respect to the excess shares shall be accumulated and deposited in a savings account for the benefit of the person to whom the excess shares are transferred. Our certificate of incorporation further provides that excess shares are deemed offered for sale to the Company or its designee for a period of ninety (90) days from the date of the transfer (or the date the Company learns of the transfer) at the fair market value (as defined in our certificate of incorporation) of the excess shares. If notwithstanding the terms of the certificate of incorporation, a person knowingly would own shares in excess of the limit and we would have been a REIT but for the fact that more than 50% of the value of our shares are held in violation of the Code, then that person and all legal entities which constitute that person shall be jointly and severally liable for and pay to the Company, such amounts will, after taking into account of all taxes imposed with respect to the receipt or accrual of such amount and all costs incurred by the Company as a result of such loss, put the Company in the same financial position as it would have been had it not lost its REIT qualification. If the Board determines that a transfer has taken place in violation of the limitations set forth above, or that a person intends to acquire or has acquired ownership of excess shares, the Board may take such action as it deems advisable to prevent or to refuse to give effect to such transfer or acquisition, including but not limited to refusing to give effect to such transfer or acquisition or instituting proceedings to enjoin the transfer or acquisition.

The ownership restrictions in our certificate of incorporation define ownership under both Subchapter M, Part II of the Code and Rule 13d-3 under the Securities Exchange Act of 1934. Mr. Singley has advised us that the ownership of the excess shares by Mr. Singley and his affiliates does not constitute ownership of the shares for purposes of Subchapter M, Part II of the Code and therefore, does not jeopardize our REIT status. Mr. Singley has advised the Board that he would like to continue to hold the excess shares until such time as we issue additional shares which would reduce his ownership percentage. Our Board has elected to exercise the Company’s rights under its Certificate of Incorporation, as amended, to require the sale of 144,433 shares held by Mr. Singley and his affiliates to the Company or its designees that the Board has determined are Excess Shares.

PROPOSAL NOS. 1A AND 1B

ELECTION OF DIRECTORS

Election of Directors by Class A Stockholders

It is intended that proxies in the accompanying form received from the holders of Class A common stock will be voted “FOR” the four persons listed below, each of whom is presently a director, as directors until the next annual meeting of stockholders and until their successors are elected and qualified. If, for any reason, any of these nominees becomes unable to serve as a director, it is intended that such proxies will be voted for the election, in his place, of any substituted nominee as management may recommend, and of the other nominees listed. Management, however, has no reason to believe that any nominee will be unable to serve as director. The directors so elected will serve until the next annual meeting and until their respective successors are duly elected and have qualified.

| | | | | | | |

| | | | | First |

| | | | | Became Director |

| | | Occupation or Principal Employment | | of Presidential or its |

| Name and Age of Director | | for the Past 5 Years | | Predecessor Company |

| Alexander Ludwig (41) | | Director, President, Chief Operating Officer and Principal Financial Officer | | | 2011 | |

| Robert Feder (81) | | Director, Partner, Cuddy & Feder, Attorneys | | | 1981 | |

| Jeffrey F. Joseph (70) | | Director | | | 1993 | |

| Nickolas W. Jekogian (42) | | Director, Chairman and Chief Executive Officer; Owner and Chief Executive Officer of Signature Community Investment Group LLC | | | 2011 | |

Alexander Ludwig. Since February 2011, Mr. Ludwig, has provided and will continue to provide consulting services for Signature. From 2009 to October of 2011 he worked at Urban Real Estate Growth Fund LLC, a real estate development and financing company, where he oversaw new investments. Prior to joining Urban Real Estate Growth Fund LLC, Mr. Ludwig worked from 2003 to 2008 for ADG Capital LLC, a real estate development and financing company, where he oversaw multiple real estate development projects. Mr. Ludwig also held various positions in banking, where he structured debt and corporate finance transactions, most recently as a Vice President at Societe Generale, where he was employed from 1997 until 2002. Previously he worked for First Union National Bank and First Fidelity Bank from 1993 to 1997 underwriting and structuring loan transactions. Mr. Ludwig holds a BA degree in history from The University of Pennsylvania. Mr. Ludwig brings substantial leadership skills and knowledge to our board of directors through his experience in the real estate and financial industries.

Robert Feder. Mr. Feder has been a practicing attorney for over 50 years and is a founding partner of Cuddy & Feder, a prominent law firm in White Plains, New York, specializing in real estate law, and is a Fellow of the American College of Real Estate Lawyers. Mr. Feder has been a Director of Presidential, and a member of its Audit and Compensation committees, since 1981. Mr. Feder has also been a director and member of the Executive Committee of Interplex Industries, a privately owned multinational manufacturer of precision parts for the electronic industry, for over 35 years. Presidential’s Board and stockholders benefit from Mr. Feder’s extensive legal and business experience and his thorough understanding of the business of Presidential.

Jeffrey F. Joseph. Mr. Joseph has been employed by Presidential for many years in many capacities. Mr. Joseph initially served as General Counsel for Presidential and was its President and Chief Executive Officer from 1992 to 2011. Mr. Joseph has served as a director of Presidential since 1993. As a result of his long experience in the real estate business in general and with Presidential, Mr. Joseph has a deep understanding of Presidential’s business, finances and operational requirements and is a valuable member of our Board.

Nickolas W. Jekogian, III. Mr. Jekogian, is the founder, owner and President of Signature Community Investment Group LLC, a Delaware limited liability company (together with its affiliates, "Signature"). Mr. Jekogian founded Signature in 1991 while in college with the purchase of an apartment building in Center City Philadelphia. Since that time, Mr. Jekogian has obtained extensive experience in the real estate industry focusing Signature primarily on multi-family rental properties and at the same time gaining experience in developing commercial properties for third parties. He has built Signature into an integrated real estate company that has an ownership interest in and operates approximately 3,000 apartment units in 17 markets throughout the United States from New York City to Las Vegas. Mr. Jekogian is a licensed real estate broker in New York. He has a business Administration degree from Drexel University and a Masters degree in Management from the University of Pennsylvania. Mr. Jekogian has more than 15 years experience developing commercial projects in the New York and Philadelphia Metropolitan areas for retailers such as CVS Drugs, Commerce Bank and Blockbuster Video. During the last five years, prior to joining Presidential, Mr. Jekogian worked exclusively with Signature. Through his extensive experience in the real estate industry, his involvement in strategic transactions within the industry and educational background, Mr. Jekogian provides important expertise to the Board of Directors.

Vote Required

Holders of Class A common stock will vote as a class for Proposal 1A, the election of four directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified. Directors are elected by a plurality of the votes of the shares of common stock present, represented and voted at the Annual Meeting. This means that the director-nominee with the most affirmative votes for a particular position is elected for that position.

Election of Directors by Class B Stockholders

It is intended that proxies in the accompanying form received from the holders of Class B common stock will be voted “FOR” the two persons listed below, each of whom is at present a director, as directors until the next annual meeting of stockholders and until their successors are elected and qualified. If for any reason any of these nominees becomes unable to serve as a director, it is intended that such proxies will be voted for the election, in his place, of any substituted nominee as management may recommend, and of the other nominees listed. Management, however, has no reason to believe that any nominee will be unable or unwilling to serve as a director. The directors so elected will serve until the next annual meeting and until their respective successors are duly elected and have qualified.

| | | | | First |

| | | | | Became Director |

| | | Occupation or Principal Employment | | of Presidential or its |

| Name and Age of Director | | for Past 5 Years | | Predecessor Company |

| Richard Brandt (84) | | Director | | | 1972 | |

| Jeffrey Rogers (42) | | Director, President and Chief Operating Officer of

Integra Realty Services, Inc. | | | 2011 | |

Richard Brandt. Mr. Brandt has been a member of the Board of Directors of Presidential and the chairman of its Audit and Compensation Committees since 1972. He became President of Trans-Lux Corporation, a diversified entertainment and electronic communications company, in 1962 and then served as Chairman of the Board of Directors of Trans-Lux from 1974 until 2003. Mr. Brandt brings extensive experience to the Board of Directors as a chief executive of a public company and from his thorough knowledge of Presidential’s business.

Jeffrey S. Rogers. Mr. Rogers has served as President and Chief Operating Officer since February 2005 and as Chief Operating Officer between February 2004 and February 2005 of Integra Realty Resources, Inc., a commercial real estate valuation and counseling firm, where he oversees corporate operations, technology and software initiatives, and all aspects of financial reporting and audit procedures. Mr. Rogers also serves on the Board of Directors of Integra Realty Resources, Inc. Prior to joining Integra Realty Resources, Inc. in February 2004, Mr. Rogers worked from November 2002 to February 2004 as a consultant for Regeneration, LLC, a management consulting firm. Between September 1999 and November 2002, Mr. Rogers held various positions at ReturnBuy, Inc., a technology and software solutions company, including President of ReturnBuy Ventures, a division of ReturnBuy, Inc., between August 2001 and November 2002, Chief Financial Officer between September 1999 and August 2001 and member of the Board of Directors between September 1999 and August 2001. In January 2003, ReturnBuy, Inc. filed for Chapter 11 bankruptcy as part of a restructuring transaction in which it was acquired by Jabil Circuit, Inc. Since March 2009, Mr. Rogers has served as Director of TNP Strategic Retail Trust, Inc., a real estate investment trust that files periodic reports under the Securities Exchange Act of 1934. Mr. Rogers also serves on TNP’s audit committee and investment committee. Mr. Rogers has also served on the Finance Committee of the Young Presidents Organization from March 2009 to March 2010 and as Audit Committee Chairman beginning in July 2010. Mr. Rogers earned a Master of Business Administration degree from The Darden School, University of Virginia in Charlottesville, Virginia, a Juris Doctorate degree from Washington and Lee University School of Law in Lexington, Virginia and a Bachelor of Arts degree in Economics from the Washington and Lee University.

Our Board of Directors, excluding Mr. Rogers, has determined that Mr. Rogers’ previous leadership position with a commercial real estate valuation and counseling firm, his professional experience as an attorney and as a director and member of the audit committee of another REIT are relevant experiences, attributes and skills that make Mr. Rogers a valuable addition to our Board of Directors. In addition, our Board of Directors believes that Mr. Rogers, with his extensive experience with financial reporting as a former Chief Financial Officer, is well-equipped to serve as a member of the Audit Committee.

Vote Required

Holders of Class B common stock will vote as a class for Proposal 1B, the election of two directors to serve until the next annual meeting of stockholders and until their successors are elected and qualified. Directors are elected by a plurality of the votes of the shares of common stock present, represented and voted at the Annual Meeting. This means that the director-nominee with the most affirmative votes for a particular position is elected for that position.

Related Party Transactions

Property Management Agreement. On November 8, 2011, as part of the strategic transactions, we and Signature entered into a Property Management Agreement pursuant to which we retained Signature as the exclusive managing and leasing agent for our Mapletree Industrial Center in Palmer, Massachusetts. Signature is required to manage the Mapletree property in accordance with specific management guidelines and leasing guidelines and is required to meet specific reporting requirements and vendor insurance requirements. Signature will receive a compensation of 5% of monthly rental income actually received from tenants at the Mapletree property. We will reimburse Signature for all reasonable expenses incurred by it in performance of its duties under the Property Management Agreement that are either in accordance with the annual budget or which have been approved in writing by us. Such expense shall include, but not be limited to, Signature’s costs of the salaries, benefits and appropriate and prudent training for Signature’s employees who are engaged solely in management or operation of the Mapletree property, but excluding certain expenses that will be borne by Signature, as specified in the Property Management Agreement. The Property Management Agreement has a term of one year and will be automatically renewable for one year terms until it is terminated by either party upon written notice. The Company incurred and owed management fees of $3,357 for the year ended December 31, 2011 and paid in the early part of 2012.

Asset Management Agreement. On November 8, 2011, the Company and Signature entered into an Asset Management Agreement pursuant to which the Company engaged Signature to oversee the Mapletree property and our Hato Rey center in Hato Rey, Puerto Rico. Signature’s duties include leasing, marketing and advertising, financing, construction and dispositions of the properties. Signature will receive a construction fee for any major renovations or capital projects, subject to the approval of our Board of Directors, an asset management fee of 1.5% of the monthly gross rental revenues collected for the properties (provided that the monthly fee for the Hato Rey property will be accrued and not paid until the receipt of mortgage proceeds, if any, on the Mapletree Property), a finance fee of 1% on any debt placement, and a disposition fee of 1% on the sale of any assets, as specified in the Asset Management Agreement. The Asset Management Agreement has a term of one year and will be automatically renewable for one year terms until it is terminated by either party upon written notice. During 2011 we paid $0 to Signature under this Agreement.

Family Relationships

There are no family relationships between any director and any executive officer.

Audit Committee

The members of the Audit Committee are Richard Brandt, Robert Feder and Jeffrey Rogers. The function of the Audit Committee, which is established in accordance with Section 3(a)(58)(A) of the Securities and Exchange Act, is to oversee the accounting and financial reporting process of the Company and the audits of the financial statements of the Company. Each member of the Audit Committee is independent (as defined in Section 803A(2) of the NYSE Amex Company Guide). The Board of Directors has adopted a written Charter for the Audit Committee. The Audit Committee held four meetings during our last fiscal year.

The Board of Directors has determined that Richard Brandt, a member of the Audit Committee, is financially sophisticated as defined by Section 803B(2)(a)(iii) of the NYSE Amex Company Guide. The Board does not believe that it is necessary to have a member of the Audit Committee who meets the definition of a financial expert pursuant to Item 407(d) of Regulation S-K because all of the members of the Audit Committee satisfy the NYSE Amex requirements for Audit Committee membership applicable to NYSE Amex listed companies and, as mentioned above, all the members of the Audit Committee are financially sophisticated individuals as defined by the NYSE Amex Company Guide. In addition, all members of the Audit Committee with the exception of Mr. Rogers have been members for at least ten years and are familiar with the business and accounting practices of the Company. The Charter of the Audit Committee is filed as Exhibit A to the Company’s Proxy Statement for the Annual Meeting of Stockholders held June 15, 2009, filed with the SEC on April 27, 2009, and is available on the SEC’s website, www.sec.gov.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NOMINEES SPECIFIED ABOVE AS DIRECTORS IN PROPOSALS 1A AND 1B.

PROPOSALS NOS. 2, 3 AND 4

APPROVAL OF AN AMENDMENT AND RESTATEMENT TOOUR CERTIFICATE OF INCORPORATION

On June 2, 2012, the Board of Directors adopted a resolution declaring it advisable to amend and restate our Certificate of Incorporation (i) to increase the number of authorized shares of Common Stock from 10,700,000 to 1,050,000,000, consisting of (a) 700,000 shares of Class A Common Stock; (b) 999,300,000 shares of Class B Common Stock and (c) 50,000,000 shares of Preferred Stock, par value $.00001; (ii) to authorize the Board to provide for the issuance of Preferred Stock from time to time in one or more series and to fix, as to such series, the rights, preferences, privileges, etc. of such series; and (iii) to reduce the par value for all classes of the Company’s common stock from $.10 to $.00001 per share, all subject to approval by the stockholders. The form of the proposed amended and restated Certificate of Incorporation (the “Amendment”) is attached as Annex A.

PROPOSAL NO. 2

APPROVAL OF AN AMENDMENT TOOUR CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED CLASS B SHARES OF OUR COMMON STOCK

Our Certificate of Incorporation currently authorizes 10,000,000 shares of Class B common stock, $.10 par value per share. We are asking our stockholders to approve an increase in the authorized shares of Class B common stock to 999,300,000 shares. At May 15, 2012, there were 3,213,147 shares of our Class B common stock outstanding. As of the same date, 740,000 shares of our Class B common stock were reserved for issuance upon exercise of outstanding stock options and 44,500 shares of our Class B common stock were reserved for issuance under our 2005 Equity Incentive Plan. Assuming exercise of all of the outstanding stock options and the issuance of all Class B common stock reserved for issuance under the 2005 Equity Incentive Plan, we would have a total of 3,997,647 shares of our of our Class B common stock outstanding.

In connection with the 2012 Plan, we intend to reserve 1,000,000 additional shares of Class B common stock for issuance to our officers, directors, employees and consultants effective upon the approval of an amendment to the Certificate of Incorporation that will increase the number of authorized shares of our Class B common stock to a number that accommodates such reservation. The Amendment, if approved, will accommodate the 1,000,000 additional shares of Class B common stock reserved under the Plan.

We believe that the Amendment is in the best interests of the Company and its stockholders to maintain flexibility in responding to business and financing needs and opportunities. In addition to the additional 1,000,000 shares of Class B common stock that will be available under the 2012 Plan if the Amendment and the 2012 Plan are approved, the additional approved Class B common shares that would become available pursuant to the Amendment may be used for any proper corporate purposes without further stockholder approval. These purposes may include raising capital, providing equity incentives to employees, officers or directors, establishing strategic relationships with other companies, expanding our business through acquisitions and other investment opportunities and other purposes. Management is unaware of any specific effort to obtain control of the Company, and has no present intention of using the proposed increase in the number of authorized shares of Class B common stock as an anti-takeover device. However, our authorized but unissued Class B common stock could be used to make an attempt to effect a change in control more difficult.

The Company’s stockholders will not realize any dilution in their voting rights as a result of the increase in authorized shares of Class B common stock but will experience dilution to the extent additional shares would be issued.

Issuance of significant numbers of additional shares of the Company’s Class B common stock in the future (i) will dilute stockholders’ percentage ownership, and (ii) if such shares are issued at prices below what current stockholders’ paid for their shares, may dilute the value of current stockholders’ shares.

It is not the present intention of the board of directors to seek shareholder approval prior to any issuance of shares of Class B common stock that would become authorized by the amendment unless otherwise required by law or regulation. Frequently, opportunities arise that require prompt action, and it is the belief of the board of directors that the delay necessitated for shareholder approval of a specific issuance could be to the detriment of the Company and its shareholders.

When issued, the additional shares of Class B common stock authorized by the amendment will have the same rights and privileges as the shares of Class B common stock currently authorized and outstanding.

Shares of authorized and unissued common stock could be issued in one or more transactions that could make it more difficult, and therefore less likely, that any takeover of the Company could occur. Issuance of additional common stock could have a deterrent effect on persons seeking to acquire control. The Board also could, although it has no present intention of so doing, authorize the issuance of shares of common stock to a holder who might thereby obtain sufficient voting power to assure that any proposal to effect certain business combinations or amendment to the Company’s Certificate of Incorporation or Bylaws would not receive the required stockholder approval. Accordingly, the power to issue additional shares of common stock could enable the Board to make it more difficult to replace incumbent directors and to accomplish business combinations opposed by the incumbent Board.

Vote Required

The affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of both the Class A common stock and the Class B common stock, voting as a single class is required to approve Proposal 2, the amendment to our Certificate of Incorporation to increase the number of authorized Class B shares of our common stock. In addition, the affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of Class A common stock is required to approve Proposal 2. The affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of Class B common stock is required to approve Proposal 2.

If you abstain from voting on Proposal 2, your abstention will have the same effect as a vote AGAINST this proposal. Votes withheld on this proposal will be counted for purposes of determining the presence or absence of a quorum for the transaction of business and will be treated as shares represented and voting on this proposal at the meeting. Similarly, broker non-votes will be counted for purposes of determining both the presence of a quorum and the total the number of shares represented and voting on this proposal. Accordingly, withheld votes, abstentions and broker non-votes will have the effect of a vote against this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 2 TO AMEND AND RESTATE THE CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED CLASS B SHARES OF OUR COMMON STOCK.

PROPOSAL NO. 3

APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION

TO AUTHORIZE A CLASS OF BLANK CHECK PREFERRED STOCK

We are also asking our stockholders to approve the designation of 50,000,000 shares of authorized preferred stock, par value $0.00001, as a class of “blank check” preferred stock so as to enable our board of directors to prescribe the series and the number of the shares of each series of preferred stock and the voting powers, designations, preferences, limitations, restrictions and relative rights of the shares of each series of preferred stock. The Board believes that the amendment would provide the Company greater flexibility with respect to the Company’s capital structure for such purposes as additional equity financing and acquisitions. Our board of directors believes that the Amendment is in the best interest of the Company and its shareholders.

If our Certificate of Incorporation is amended to authorize the issuance of “blank check” preferred stock, the board of directors would have discretion to prescribe the series and the number of the shares of each series of preferred stock and the voting powers, designations, preferences, limitations, restrictions and relative rights of the shares of each series of preferred stock. If this proposal is approved by our stockholders, our board of directors does not intend to solicit further stockholder approval prior to the issuance of any shares of preferred stock, except as may be required by applicable law or rules. The term “blank check” preferred stock refer to stock for which the designations, preferences, conversion rights, cumulative, relative, participating, optional or other rights, including voting rights, qualifications, limitations or restrictions thereof are determined by the board of directors of a company.

Upon the effectiveness of the Amendment allowing the board of directors to issue blank check preferred stock, the board of directors will have the express authority to execute and file a certificate of designation setting forth the series and the number of the shares of each series of preferred stock and the voting powers, designations, preferences, limitations, restrictions and relative rights of the shares of each series of our preferred stock.

Our board of directors recommends the Amendment to allow the board of directors to issue blank check preferred stock. Our board of directors believes that the complexity of modern business financing and acquisition transactions requires greater flexibility in the Company’s capital structure than now exists. If the proposed amendment is approved, the board of directors would be empowered, without the necessity of further action or authorization by the Company’s shareholders, unless required in a specific case by applicable laws or regulations, to authorize the issuance of the Preferred Stock from time to time in one or more series, and to fix by resolution or resolutions, designations, preferences, limitations and relative rights of each such series. Each series of Preferred Stock could, as determined by the board of directors at the time of issuance, rank, with respect to dividends and redemption and liquidation rights, senior to the Company’s Class A and/or Class B common stock. No preferred stock is presently authorized by the Company’s Certificate of Incorporation.

Our board of directors has no current intention to issue any shares of preferred stock. However, the future issuance of shares of our preferred stock may adversely affect the rights of the holders of our common stock. If this amendment to allow the board of directors to issue blank check preferred stock is approved by our stockholders, out board of directors will be authorized to issue shares of preferred stock with certain designations, rights, qualifications, preferences, limitations and terms, any of which may dilute the voting power and economic interest of the holders of our common stock. For example, in the absence of a proportionate increase in our earnings and book value, an increase in the aggregate number of outstanding shares caused by the issuance of our preferred stock would dilute the earnings per share and book value per share of all outstanding shares of our common stock. In addition, in a liquidation, the holders of our preferred stock may be entitled to receive a certain amount per share of our preferred stock before the holders of our common stock receive any distribution. In addition, the holders of our preferred stock may be entitled to vote and such votes may dilute the voting rights of the holders of our common stock when we seek to take corporate action. Our preferred stock also may be convertible into shares of a class of our common stock. Furthermore, our preferred stock could be issued with certain preferences over the holders of our common stock with respect to dividends or the power to approve the declaration of a dividend. The aforementioned are only examples of how shares of our preferred stock, if issued, could result in:

| · | reduction of the amount of funds otherwise available for payment of dividends on our common stock; |

| · | restrictions on dividends on our common stock; |

| · | dilution of the voting power of our common stock; and |

| · | restrictions on the rights of holders of our common stock to share in our assets on liquidation until satisfaction of any liquidation preference granted to the holders of our preferred stock. |

In addition to financing purposes, we could also issue blank check preferred stock that may, depending on the terms of such series, make it more difficult or discourage an attempt to obtain control of our Company by means of a merger, tender offer, proxy contest or other means. When, in the judgment of our board of directors, this action would be in the best interest of our Company and stockholders, such shares could be used to create voting or other impediments or to discourage persons seeking to gain control of our Company. Such blank check preferred shares also could be privately placed with purchasers favorable to our board of directors in opposing such action. In addition, our board of directors could authorize holders of a series of our preferred stock to vote either separately as a class or with the holders of our common stock, on any merger, sale or exchange of assets by our company or any other extraordinary corporate transaction. The existence of the additional authorized shares could have the effect of discouraging unsolicited takeover attempts. The issuance of new blank check preferred shares also could be used to dilute the stock ownership of a person or entity seeking to obtain control of our Company should our board of directors consider the action of such entity or person not to be in the best interest of our stockholders. The issuance of new blank check preferred shares also could be used to entrench current management or deter an attempt to replace our board of directors by diluting the number or rights of shares held by individuals seeking to control our Company by obtaining a certain number of seats on our board of directors.

Vote Required

The affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of both the Class A common stock and the Class B common stock, voting as a single class is required to approve Proposal 3, the amendment to our Certificate of Incorporation to authorize a class of “blank check” preferred stock. In addition, the affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of Class A common stock is required to approve Proposal 3. The affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of Class B common stock is required to approve Proposal 3.

If you abstain from voting on Proposal 3, your abstention will have the same effect as a vote AGAINST this proposal. Votes withheld on this proposal will be counted for purposes of determining the presence or absence of a quorum for the transaction of business and will be treated as shares represented and voting on this proposal at the meeting. Similarly, broker non-votes will be counted for purposes of determining both the presence of a quorum and the total the number of shares represented and voting on this proposal. Accordingly, withheld votes, abstentions and broker non-votes will have the effect of a vote against this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 3 TO AMEND AND RESTATE THE CERTIFICATE OF INCORPORATION TO AUTHORIZE A CLASS OF BLANK CHECK PREFERRED STOCK.

PROPOSAL NO. 4

APPROVAL OF AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION

TO REDUCE THE PAR VALUE OF OUR AUTHORIZED SHARES

Our Certificate of Incorporation currently authorizes 700,000 shares of Class A common stock, $0.10 par value per share, and 10,000,000 shares of Class B common stock, $0.10 par value per share. Our board of directors has approved an amendment to our Certificate of Incorporation to decrease the par value of our Class A and Class B common stock from $0.10 per share to $0.00001 per share.The Board believes it is in the best interests of the Company to reduce the par value of our Class A and Class B common stock to $0.00001 per share. The reduction in par value is intended to bring the Company in line with the practice of other public companies with respect to par value.

We further believe that a change from a par value of $0.10 per share to $0.00001 per share will provide the Company with greater flexibility with respect to the issuance of stock and stock-based compensation because Delaware law requires that we receive at least the par value per share as consideration for the issuance of common stock.

Historically, the concept of par value served to protect creditors and senior security holders by ensuring that a company received at least the par value as consideration for issuance of stock. Over time, the concept of par value has lost its significance, generally. Many companies that incorporate today use a nominal par value or have no par value.

There are possible negative ramifications associated with lowering the par value of the common stock. For example, the ability to issue shares of common stock at a lower price may afford the Company added flexibility to deter a potential takeover of the Company that may otherwise be beneficial to stockholders by diluting the shares held by a potential suitor or issuing shares to a stockholder that will vote in accordance with the Board’s desires. A takeover may be beneficial to independent stockholders because, among other reasons, a potential suitor may offer such stockholders a premium for their shares of common stock compared to the then-existing market price. The Company does not have any plans or proposals to adopt provisions or enter into agreements that may have material anti-takeover consequences. Although there are these negative possibilities, and possibly others, the Company’s management and Board believe that the benefits to the Company’s stockholders outweigh the negatives.

We will not exchange certificates for currently outstanding shares of our common stock to reflect the decrease in par value. Rather, we will issue new stock certificates only as old certificates are submitted to our transfer agent in connection with a sale of stock.

Vote Required

The affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of both the Class A common stock and the Class B common stock, voting as a single class is required to approve Proposal 4, the amendment to our Certificate of Incorporation to reduce the par value of our authorized common stock. In addition, the affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of Class A common stock is required to approve Proposal 4 to reduce the par value of our authorized Class A common stock. The affirmative vote of the holders of a majority of the shares outstanding and entitled to vote as of the Record Date of Class B common stock is required to approve Proposal 4 to reduce the par value of our authorized Class B common stock.

If you abstain from voting on Proposal 4, your abstention will have the same effect as a vote AGAINST this proposal. Votes withheld on this proposal will be counted for purposes of determining the presence or absence of a quorum for the transaction of business and will be treated as shares represented and voting on this proposal at the meeting. Similarly, broker non-votes will be counted for purposes of determining both the presence of a quorum and the total the number of shares represented and voting on this proposal. Accordingly, withheld votes, abstentions and broker non-votes will have the effect of a vote against this proposal.

Effective Date of the Amendment

If the Amendment pursuant to Proposals 2, 3 and/or 4, is approved by our stockholders, we have to file the Amendment with the Delaware Secretary of State in order for the Amendment to become effective. If we obtain stockholder approval of any of these proposals, we intend to file the Amendment as soon as practicable.

Our board of directors reserves the right, notwithstanding stockholder approval of the Amendment and without further action by our stockholders, not to proceed with the Amendment at any time before the effective date of the amendment and restatement of our Certificate of Incorporation.

If the Amendment is adopted, it will become effective upon the acceptance for filing of a Certificate of Amendment to our Certificate of Incorporation by the Secretary of State of the State of Delaware.

No Dissenters' Rights

Under the Delaware General Corporation Law, our common stockholders are not entitled to dissenters' rights with respect to the Amendment, and we will not independently provide common stockholders with any such right.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 4 TO AMEND AND RESTATE THE CERTIFICATE OF INCORPORATION TO REDUCE THE PAR VALUE OF OUR AUTHORIZED SHARES.

PROPOSAL NO. 5

RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS