- UNH Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

UnitedHealth (UNH) DEF 14ADefinitive proxy

Filed: 17 Apr 20, 4:19pm

Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | | Preliminary Proxy Statement |

o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material under §240.14a-12 |

| UnitedHealth Group Incorporated | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | | No fee required. | ||

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| (1) | | Title of each class of securities to which transaction applies: | |

| | (2) | | Aggregate number of securities to which transaction applies: | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| | (4) | | Proposed maximum aggregate value of transaction: | |

| | (5) | | Total fee paid: | |

o | | Fee paid previously with preliminary materials. | ||

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | | Amount Previously Paid: | |

| | (2) | | Form, Schedule or Registration Statement No.: | |

| | (3) | | Filing Party: | |

| | (4) | | Date Filed: | |

.

.

![]()

9900 Bren Road East

Minnetonka, Minnesota 55343

April 17, 2020

Dear Shareholder: |

We cordially invite you to participate in our 2020 Annual Meeting of Shareholders to be held on Monday, June 1, 2020, at 10:30 a.m. Central Time. We have been heavily engaged in and actively monitoring the coronavirus (COVID-19) outbreak and response efforts and are planning the Annual Meeting to be held solely by means of remote communication.

The safety and health of our country and the broader global community, the people we serve, our team members, their families and all our stakeholders consume all of our resources and priorities. We have fully engaged business continuity efforts to keep colleagues safe while continuing to serve the needs of our stakeholders and communities with minimal disruption. We have mobilized the full strength of our resources, grounded in clinical expertise, advanced technology and health information science, to deliver the best care for patients, support our members and care provider partners, and deliver innovative solutions and support for the benefit of the communities we serve and the entire health care system. We will continue to expand our efforts in response to the ever changing developments related to the COVID-19 pandemic as events evolve.

As a shareholder of UnitedHealth Group, you play an important role in our company by considering and taking action on the matters set forth in the attached proxy statement. We appreciate the time and attention you invest in making thoughtful decisions.

Attached you will find a notice of meeting and proxy statement containing information about the items upon which you will be asked to vote and the meeting itself, including different methods you can use to vote your proxy, including by internet, telephone and mail.

Every shareholder vote is important, and we encourage you to vote as promptly as possible. Instructions on how to participate in the Annual Meeting are included in the proxy statement.

Sincerely,

| |  |

| David S. Wichmann Chief Executive Officer | | Stephen J. Hemsley Chair of the Board |

COVID-19 Response |

Coronavirus (COVID-19) is profoundly impacting the health of people around the world, as well as our global economies. The safety and health of the people we serve, our team members, their families, our stakeholders, broader communities and the reliability of our health care systems consume our resources and our focus. Actions we have taken to date include:

Care of Our Team Members

Enlisting Our Resources to Serve Others

2020 Notice of Annual Meeting |

Items of business may also include transacting any other business that properly may come before the Annual Meeting or any adjournments or postponements of the meeting.

In light of the coronavirus (COVID-19) outbreak, we have determined that the 2020 Annual Meeting will be held in virtual format only, via the internet, with no physical in-person meeting. If you plan to participate in the Annual Meeting, please see the "Questions and Answers About the Annual Meeting and Voting" section in the attached proxy statement. Shareholders will be able to participate in, vote, view the list of shareholders of record and submit questions from any location via the internet.

Important. Even if you plan to participate in the Annual meeting, we still encourage you to submit your proxy by internet, telephone or mail prior to the meeting. If you later choose to revoke your proxy or change your vote, you may do so by following the procedures under Question 12 of the "Questions and Answers About the Annual Meeting and Voting" section in the attached proxy statement.

By Order of the Board of Directors,

![]()

Dannette L. Smith

Secretary to the Board of Directors

April 17, 2020

June 1, 2020 | | |

10:30 a.m. CT | | |

Our Annual Meeting can | | |

| | ||

Record Date | | |

April 7, 2020 | | |

| | ||

Only shareholders of record of the Company's common stock at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the meeting. | | |

| | ||

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD VIRTUALLY VIA THE INTERNET ON JUNE 1, 2020: | | |

The Notice of Internet Availability of Proxy Materials, Notice of Annual Meeting of Shareholders, Proxy Statement and Annual Report are available atwww.unitedhealthgroup.com/ | |

Table of Contents |

| | 1 | |

Board of Directors | | |

| | 5 | |

| | 5 | |

| | 9 | |

| | 10 | |

| | 11 | |

| | 14 | |

| | 15 | |

| | 15 | |

| | 16 | |

| | 20 | |

| | 23 | |

| | ||

| | 25 | |

| | 27 | |

| | 27 | |

| | 28 | |

Alignment of Environment, Social and Governance (ESG) with Our Long-Term Strategy | | 29 |

| | ||

| | 34 | |

| | 37 | |

| | 54 | |

Compensation and Human Resources Committee Interlocks and Insider Participation | | 54 |

| | 55 | |

| | 58 | |

| | 61 | |

2019 Option/Stock Appreciation Right Exercises and Stock Vested | | 63 |

| | 65 | |

| | 66 | |

| | 68 | |

| | 70 | |

| | 71 |

Proxy Summary |

We are a diversified health care company dedicated to helping people live healthier lives and helping make the health system work better for everyone. Through our family of businesses, we leverage core competencies in data and health information, advanced technology, and clinical expertise, focused on improving health outcomes, lowering health care costs and creating a better experience for patients, their caregivers and physicians. These core competencies are deployed within our two distinct, but strategically aligned, business platforms: health benefits operating under UnitedHealthcare and health services operating under Optum. We again achieved strong business results in 2019.

Financial

Awards and Recognition

2020 Proxy Statement | Proxy Summary 1

UnitedHealth Group is committed to meeting high standards of ethical behavior, corporate governance and business conduct. Our company, our Board of Directors (or the "Board") and our people are committed to the shared cultural values of integrity, compassion, innovation, relationships and performance. This commitment has led us to implement many governance best practices.

Board Structure and Composition

Our directors are elected annually by a majority vote of our shareholders. We have a Chair of the Board of Directors and a Lead Independent Director, and nine of our eleven directors are independent. Our current Board structure separates the positions of Chair of the Board and CEO.

Public Company Board Service Limits

Our directors may serve on no more than three other public company boards and our CEO may serve on no more than one other public company board.

One Share, One Vote

The Company does not have a dual-class share structure. Each share of Company common stock is entitled to one vote.

Proxy Access

A shareholder or group of shareholders who have owned at least 3% of our common stock for at least three years, and who comply with specified procedural and disclosure requirements, may include in our proxy materials shareholder-nominated director candidates representing up to 20% of the Board.

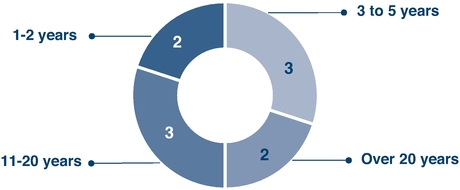

Board Refreshment and Tenure

Since January 2017, we have appointed six new directors to the Board, five of whom were independent and five of whom are standing for election this year, advancing both the skill and experience profile of the Board as well as its diversity.

Chief Executive Officer ("CEO") Succession Planning

Our succession plan, which is reviewed annually by our Board, addresses both an unexpected loss of our CEO and longer-term succession.

Nominating Advisory Committee

Our Nominating Advisory Committee, comprised of long-term shareholders of the Company and a member of the medical community, provides our Nominating and Corporate Governance Committee with additional input regarding desirable characteristics of director candidates and the composition of our Board.

Absence of Rights Plan

We do not have a shareholder rights plan, commonly referred to as a "poison pill."

Shareholder Special Meeting and Written Consent Rights

Shareholders hold the rights to call a special meeting and to act by written consent.

Prohibition on Short Sales and Hedging Transactions in Company Securities

Our insider trading policy prohibits all directors, executive officers and employees from engaging in short sales and hedging transactions relating to our common stock, and requires advance approval of the Compensation and Human Resources Committee of any pledging of common stock by directors, executive officers and other members of management.

Stock Ownership Guidelines

All of our executive officers and directors were in compliance with our stock ownership guidelines as of April 7, 2020. Mr. Wichmann, our CEO, is required to own shares equal to eight times his base salary by the fifth anniversary of his appointment as CEO. As of April 7, 2020, Mr. Wichmann owned shares equal to 172 times his base salary.

Stock Retention Policy

We generally require executive officers to hold, for at least one year, one-third of the net shares acquired upon vesting or exercise of any equity award. Our directors are generally required to hold all equity awards granted until completion of service on the Board, or until they have met our stock ownership requirements.

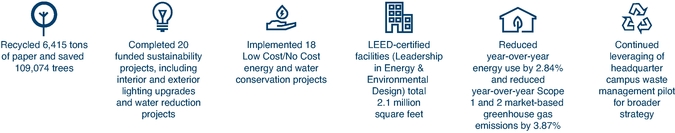

Environmental Policy

We seek to minimize our environmental impact and to heighten our employees' awareness of the importance of the environment.

Political Contributions Disclosure

We publicly disclose our political contributions and public advocacy efforts and the contributions of our federal and state political action committees.

See the "Corporate Governance" portion of this proxy statement for further information on our governance practices.

2020 Proxy Statement | Proxy Summary 2

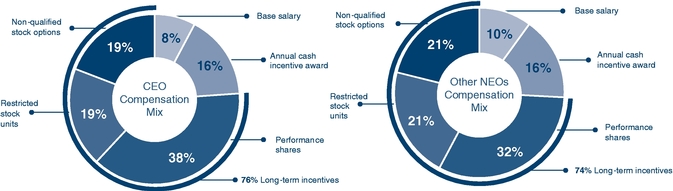

Our executive compensation program uses a mix of base salary, annual cash incentives, equity awards and broad-based benefits to attract and retain highly qualified executives and maintain a strong relationship between executive pay and Company performance. Shareholders again expressed strong support for our executive compensation program at our 2019 Annual Meeting of Shareholders, with more than 95% of the votes cast in favor of our Say-on-Pay proposal.

Compensation Program Principles | ||||||||||||

Enhance the value of the business | | | Reward long-term growth and focus management on sustained success and shareholder value creation | | | Pay-for-performance | | | Standard benefits and limited perquisites | |||

Summary of CEO David S. Wichmann's 2019 Compensation

Information regarding compensation paid to each of our named executive officers in 2019 is described in the "Compensation Discussion and Analysis" section.

Strong Governance Standards in Oversight of Executive Compensation Policies

We maintain strong governance standards in the oversight of our executive compensation policies and practices, including:

2020 Proxy Statement | Proxy Summary 3

This proxy statement and our Annual Report for the year ended December 31, 2019, are first being mailed to the Company's shareholders and made available on the internet atwww.unitedhealthgroup.com/proxymaterials on or about April 17, 2020. Website addresses included throughout this proxy statement are for reference only. The information contained on our website is not incorporated by reference into this proxy statement.

Voting Matters and Vote Recommendations

| | | Items of Business | | Board's Recommendation | | Details | ||

| 1 | | Election of ten directors | | FOR | | Page 5 | |

| | | | | | | | | |

| 2 | | Advisory Approval of Executive Compensation | | FOR | | Page 73 | |

| | | | | | | | | |

| 3 | | Ratification of Independent Registered Public Accounting Firm | | FOR | | Page 77 | |

| | | | | | | | | |

| 4 | | Approval of the 2020 Stock Incentive Plan | | FOR | | Page 78 | |

| | | | | | | | | |

| 5 | | Shareholder Proposal Regarding Non-Binding Shareholder Vote on Bylaw Amendments | | AGAINST | | Page 85 | |

| | | | | | | | | |

2020 Proxy Statement | Proxy Summary 4

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Board of Directors |

PROPOSAL 1: Election of Directors |

Our Board of Directors has nominated ten directors for election at the 2020 Annual Meeting to hold office until the next annual meeting and the election of their successors. All of the nominees are currently directors. Each agreed to be named in this proxy statement and to serve if elected. After 27 years of exceptional service as an independent director, Mr. William C. Ballard, Jr. is not standing for re-election at the 2020 Annual Meeting. All of the nominees are expected to attend the 2020 Annual Meeting. All directors attended the 2019 Annual Meeting.

Director Nomination Process |

Criteria for Nomination to the Board

The Nominating and Corporate Governance Committee performs an assessment of the skills and experiences needed to oversee the interests of the Company. We believe an effective Board consists of a diverse group of individuals who bring a variety of complementary skills and a range of personal and business experience to their positions on the Board. The Nominating and Corporate Governance Committee developed and maintains a skills matrix to assist in considering the appropriate balance of experience, skills and attributes required of a director and to be represented on the Board as a whole. The skills matrix is consistent with the Company's long-term strategic plan and is regularly reviewed and updated by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee evaluates Board candidates against the skills matrix on an annual basis to determine whether to recommend candidates for initial election to the Board and whether to recommend currently serving directors for reelection to the Board.

The skills matrix has two sections — a list of core criteria every member of the Board should meet and a list of skills and attributes to be represented collectively by the Board. The core director criteria are:

2020 Proxy Statement | Proposal 1: Election of Directors | Director Nomination Process 5

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Each of our independent director nominees has satisfied all the core director criteria set forth in the skills matrix. Messrs. Hemsley and Wichmann are not independent directors because Mr. Hemsley, until November 2019, served as an executive of the Company and Mr. Wichmann is our Chief Executive Officer.

Optimal mix of skills and expertise of director nominees

The skills matrix provides a number of substantive areas of expertise the Board as a whole should represent. The following table includes a list of these areas and the director nominees with expertise in each area.

| Director | | Corporate Governance | | Finance | | Health Care Industry | | Direct Consumer Markets | | Social Media/ Marketing | | Diversity | | Experience with Large Complex Organizations | | Technology/ Business Processes | | Clinical Practice | | Political/ Health Care Policy/ Regulatory | | Capital Markets |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | ||||||||||||

| Richard T. Burke | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Timothy P. Flynn | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Stephen J. Hemsley | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Michele J. Hooper | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

F. William McNabb III | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Valerie C. Montgomery Rice, M.D. | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

John H. Noseworthy, M.D. | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Glenn M. Renwick | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

David S. Wichmann | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

Gail R. Wilensky, Ph.D. | | | | | | | | | | | | |||||||||||

| | | | | | | | | | | | | | | | | | | | | | | |

2020 Proxy Statement | Director Nomination Process 6

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Tenure of Director Nominees

Our Nominating and Corporate Governance Committee also strives to maintain a balance of tenure on the Board. Long-serving directors bring valuable experience with our Company and familiarity with the successes and challenges the enterprise has faced over the years, while newer directors contribute fresh perspectives.

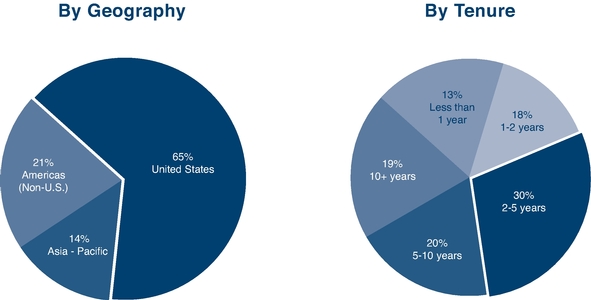

Board Diversity

UnitedHealth Group embraces and encourages a culture of inclusion and diversity. Valuing diversity makes good business sense and helps to ensure our future success, because the customers, clients and consumers we serve are as diverse as the thousands of communities where we live and work across all 50 states in the U.S. and more than 140 other countries.

While our Board has not adopted a formal definition of or policy regarding diversity, and does not establish specific goals with respect to diversity, the Board's diversity is a consideration in the director nomination process and is assessed annually when the Board evaluates overall effectiveness.

Recent Changes in Board Membership

Additions | | | Departures | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | |

2019 | | | 2018 | | | 2017 | | | 2020 | | | 2018 | | | 2017 | ||||||

| | | | | | | | | | | | | | | | | | | | | | |

John H. Noseworthy, M.D. | | | | F. William McNabb III | | | | Timothy P. Flynn Valerie C. Montgomery Sir Andrew P. Witty David S. Wichmann | | | William C. Ballard, Jr. | | | | Sir Andrew P. Witty Kenneth I. Shine, M.D. | | | | Rodger A. Lawson Robert J. Darretta | ||

For this year's election, the Board has nominated ten individuals; all are incumbent nominees who collectively bring tremendous diversity to the Board. Each nominee is a strategic thinker and has varying, specialized experience in the areas relevant to the Company and its businesses. Moreover, their collective experience covers a wide range of geographies and industries, including health care and clinical practice, insurance, consumer products, technology, capital markets and financial services, and roles in academia, corporate governance and government. The ten director nominees range in age from 57 to 76; three of the ten director nominees are women; two are African American; one is a citizen of New Zealand and one is a citizen of Canada.

2020 Proxy Statement | Director Nomination Process 7

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

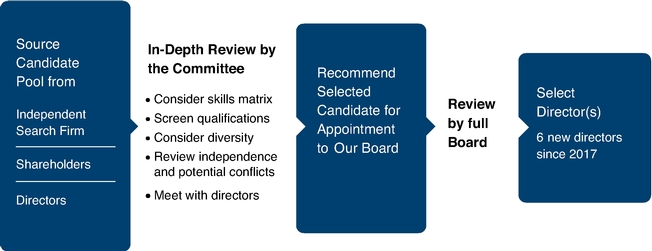

Process for Selecting Directors

The Nominating and Corporate Governance Committee screens and recommends candidates for nomination by the full Board. We have for several years maintained an active "evergreen" director candidate pipeline which reflects our continuing commitment to diversity in life, cultural and business experience among director nominees. The Nominating and Corporate Governance Committee has an outside firm on retainer to assist in identifying and evaluating director candidates. The Nominating and Corporate Governance Committee will also consider recommendations submitted by shareholders for director candidates. Recommendations should be directed to the Secretary to the Board of Directors. None of the Company's shareholders recommended candidates for the Board of Directors in connection with the 2020 Annual Meeting.

Prior to the appointment of each of the new independent directors in 2017, 2018 and 2019, the Nominating and Corporate Governance Committee considered a wide slate of potential candidates, including qualified women and minority candidates. Each eventual nominee was selected due to his or her overall skills and experience.

Nominating Advisory Committee

The Board of Directors formed the Nominating Advisory Committee in 2006 to provide the Nominating and Corporate Governance Committee with additional input from shareholders and others regarding desirable characteristics of director candidates and the composition of the Board of Directors. The key features of the skills matrix are also discussed with members of our Nominating Advisory Committee and their feedback is considered by the Nominating and Corporate Governance Committee when it updates the skills matrix. The Nominating and Corporate Governance Committee considers, but is not bound by, input provided by the Nominating Advisory Committee. The Nominating Advisory Committee currently includes four individuals affiliated with long-term shareholders of the Company and one individual who is a member of the medical community. Members of the Nominating Advisory Committee do not receive any compensation from the Company for serving on the Nominating Advisory Committee. The Nominating Advisory Committee met once in 2019. A description of the Nominating Advisory Committee, including a description of how the members of the Nominating Advisory Committee are nominated and selected, can be found on our website atwww.unitedhealthgroup.com/who-we-are/corporate-governance.

2020 Proxy Statement | Director Nomination Process 8

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Shareholder Director Candidates for Inclusion in our Proxy Statement (Proxy Access)

Our Bylaws provide a shareholder or group of shareholders (of up to 20) who have owned at least 3% of our common stock for at least three years the ability to include in our proxy statement shareholder-nominated director candidates for up to 20% of the Board. To be eligible to use this right, the shareholder(s) and the candidate(s) must satisfy the requirements specified in our Bylaws. Our Bylaws are available atwww.unitedhealthgroup.com/who-we-are/corporate-governance. For the 2021 Annual Meeting, director nominations submitted under these Bylaw provisions must be received at our principal executive offices, directed to the Secretary to the Board of Directors, no earlier than November 18, 2020 and no later than December 18, 2020.

Shareholder Nominations of Director Candidates at an Annual Meeting

Our shareholders may also nominate candidates for election to the Board of Directors from the floor of our Annual Meeting of Shareholders, instead of including the director candidate in our proxy statement, only by submitting timely written notice to the Secretary to the Board in accordance with our Bylaws. The notice must include the information required by our Bylaws, which are available atwww.unitedhealthgroup.com/who-we-are/corporate-governance. For the 2021 Annual Meeting, this notice must be received at our principal executive offices, directed to the Secretary to the Board of Directors, no earlier than February 1, 2021 and no later than March 3, 2021.

Board Leadership Structure |

Our Board of Directors believes having independent Board leadership is an important component of our governance structure. As such, our Bylaws require the Company to have either an independent Chair of the Board or a Lead Independent Director. Our Board's leadership structure also separates the positions of CEO and Chair of the Board. The Board believes this separation is appropriate for the Company at this time because it allows for a division of responsibilities and a sharing of ideas between individuals having different perspectives. The Board will continue to evaluate the Board structure on an ongoing basis.

In November 2019, Stephen J. Hemsley transitioned from his management position as Executive Chair of the Board to a non-executive director and Chair of the Board. The Board unanimously approved Mr. Hemsley's continued service as Chair of the Board due to his vision for the Company's future and his understanding of the Company and its evolving competitive environment. The Board also determined to continue the strong voice of independent directors and approved Mr. Burke's continued service as Lead Independent Director.

Our Principles of Governance outline the specific duties of the Lead Independent Director, including:

2020 Proxy Statement | Board Leadership Structure 9

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Director Independence |

Our Board of Directors has adopted the Company's Standards for Director Independence, which are available on our website atwww.unitedhealthgroup.com/who-we-are/corporate-governance. The Standards for Director Independence requirements exceed the independence standards set by the NYSE.

Our Board of Directors has determined William C. Ballard, Jr., Richard T. Burke, Timothy P. Flynn, Michele J. Hooper, F. William McNabb III, Valerie C. Montgomery Rice, M.D., John H. Noseworthy, M.D., Glenn M. Renwick and Gail R. Wilensky, Ph.D. are each "independent" under the NYSE rules and the Company's Standards for Director Independence, and have no material relationships with the Company that would prevent the directors from being considered independent. Stephen J. Hemsley, Chair of the Board, and David S. Wichmann, CEO, are not independent directors.

2020 Proxy Statement | Director Independence 10

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

In determining independence, the Board of Directors considered, among other factors, the business relationships between the Company and our directors and nominees, their immediate family members (as defined by the NYSE) and their affiliated companies. The Board of Directors considered whether any director or any nominee was a director, partner, significant shareholder or executive officer of an organization that has a relationship with the Company, and also considered charitable contributions the Company or its affiliates made to organizations with which such directors or nominees are or have been associated. In particular, the Board of Directors evaluated the following relationships and determined such relationships were in the normal course of business and did not impair the directors' ability to exercise independent judgment:

Board Committees |

The Board of Directors has established four standing committees as listed in the table below. These committees help the Board fulfill its responsibilities and assist the Board in making informed decisions. Each committee operates under a written charter, and evaluates its charter and conducts a committee performance evaluation annually.

2020 Proxy Statement | Board Committees 11

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

The following table identifies the members of each committee as of April 7, 2020:

| Director | | Audit | | Compensation and Human Resources | | Nominating and Corporate Governance | | Public Policy Strategies and Responsibility |

| William C. Ballard, Jr.* | | | | | ||||

| | | | | | | | | |

| Richard T. Burke** | | | | | ||||

| | | | | | | | | |

| Timothy P. Flynn | | | | | ||||

| | | | | | | | | |

| Stephen J. Hemsley | | | | | ||||

| | | | | | | | | |

| Michele J. Hooper | | | | | ||||

| | | | | | | | | |

| F. William McNabb III | | | | | ||||

| | | | | | | | | |

| Valerie C. Montgomery Rice, M.D. | | | | | ||||

| | | | | | | | | |

| John H. Noseworthy, M.D. | | | | | ||||

| | | | | | | | | |

| Glenn M. Renwick | | | | | ||||

| | | | | | | | | |

| David S. Wichmann | | | | | ||||

| | | | | | | | | |

| Gail R. Wilensky, Ph.D. | | | | | ||||

| | | | | | | | | |

![]() Chair

Chair ![]() Member

Member ![]() Financial Expert

Financial Expert

2020 Proxy Statement | Board Committees 12

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

| | Audit Committee | | Meetings Held in 2019: 11 | | ||

| Committee Members: | | ||||

| Glenn M. Renwick (Chair), Michele J. Hooper and F. William McNabb III | | ||||

| Primary Responsibilities: | | ||||

| The Audit Committee has responsibility for the selection and retention of the independent registered public accounting firm and oversees financial reporting, internal controls and public disclosure. The Audit Committee reviews and assesses the effectiveness of the Company's policies, procedures and resource commitments in the areas of compliance, ethics, privacy and cyber security, by interacting with personnel responsible for these functions. The Audit Committee also oversees management's processes to identify and quantify material risks facing the Company. The Audit Committee establishes procedures concerning the receipt, retention and treatment of complaints regarding accounting, internal accounting controls and auditing matters. The Audit Committee operates as a direct line of communication between the Board of Directors and our independent registered public accounting firm, as well as our internal audit, compliance and legal personnel. | | ||||

| Independence: | | ||||

| Each of the Audit Committee members is an independent director under the NYSE listing standards and the SEC rules. The Board of Directors has determined Messrs. Renwick and McNabb and Ms. Hooper are "audit committee financial experts" as defined by the SEC rules. | | ||||

| | | | | | | |

| | | ||||

| | Compensation and Human Resources Committee | | Meetings Held in 2019: 6 | | ||

| Committee Members: | | ||||

| William C. Ballard, Jr. (Chair), Timothy P. Flynn and Gail R. Wilensky, Ph.D. | | ||||

| Primary Responsibilities: | | ||||

| The Compensation and Human Resources Committee is responsible for overseeing (i) our policies and practices related to total compensation for executive officers, (ii) the administration of our incentive and equity-based plans, and (iii) the risk associated with our compensation practices and plans. The Compensation and Human Resources Committee also establishes employment arrangements with our CEO and other executive officers, conducts an annual performance review of the CEO, and reviews and monitors director compensation programs and the Company's stock ownership guidelines. | | ||||

| Independence: | | ||||

| Each of the Compensation and Human Resources Committee members is an independent director under the NYSE listing standards and the SEC rules, and a non-employee director under the SEC rules. | | ||||

| | | | | | | |

| | | ||||

2020 Proxy Statement | Board Committees 13

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

| | Nominating and Corporate Governance Committee | | Meetings Held in 2019: 4 | | ||

| Committee Members: | | ||||

| Michele J. Hooper (Chair), William C. Ballard, Jr. and Richard T. Burke | | ||||

| Primary Responsibilities: | | ||||

| The Nominating and Corporate Governance Committee's duties include (i) identifying and nominating individuals to be proposed as nominees for election as directors at each annual meeting of shareholders or to fill Board vacancies, (ii) conducting the Board evaluation process, (iii) evaluating the categorical standards which the Board of Directors uses to determine director independence, and (iv) monitoring and evaluating corporate governance practices. The Nominating and Corporate Governance Committee also oversees Board processes and corporate governance-related risk. | | ||||

| Independence: | | ||||

| Each of the Nominating and Corporate Governance Committee members is an independent director under the NYSE listing standards. | | ||||

| | | | | | | |

| | | ||||

| | Public Policy Strategies and Responsibility Committee | | Meetings Held in 2019: 4 | | ||

| Committee Members: | | ||||

| Gail R. Wilensky, Ph.D. (Chair), Valerie C. Montgomery Rice, M.D. and John H. Noseworthy, M.D. | | ||||

| Primary Responsibilities: | | ||||

| The Public Policy Strategies and Responsibility Committee is responsible for assisting the Board of Directors in fulfilling its responsibilities relating to the Company's public policy, health care reform and modernization activities, political contributions, government relations, community and charitable activities and corporate social responsibility. The Public Policy Strategies and Responsibility Committee is also responsible for overseeing the risks associated with these activities. | | ||||

| Independence: | | ||||

| Each of the Public Policy Strategies and Responsibility Committee members is an independent director under the NYSE listing standards. | | ||||

| | | | | | | |

| | | ||||

Board Meetings and Annual Meeting Attendance |

Directors are expected to attend Board meetings, meetings of committees on which they serve and the Annual Meeting of Shareholders. All eleven current directors attended the 2019 Annual Meeting of shareholders. All of the nominees are expected to attend the 2020 Annual Meeting. During the year ended December 31, 2019, the Board of Directors held eleven meetings. All current directors attended at least 75% of the meetings of the Board and any Board committees of which they were members in 2019.

2020 Proxy Statement | Board Committees | Board Meetings and Annual Meeting Attendance 14

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

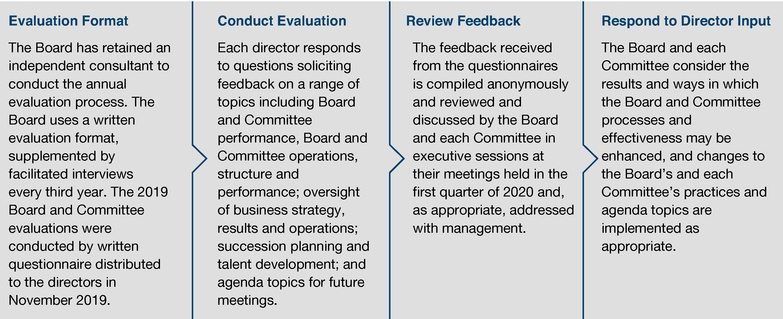

Board and Committee Evaluations |

The Nominating and Corporate Governance Committee oversees the Board and Committee evaluation process. In addition, the Chair of the Board and the Lead Independent Director meet regularly with individual directors to discuss Board and Committee performance, effectiveness and composition.

Communication with the Board of Directors |

The Board of Directors values the input and insights of our shareholders and believes effective communication strengthens the Board's role as an active, informed and engaged fiduciary. The Board has adopted a Board of Directors Communication Policy to facilitate communication between shareholders and the Board. Under this policy, the Board has designated the Company's Secretary to the Board of Directors as its agent to receive and review communications. The Secretary to the Board will not forward to the directors communications received which are of a personal nature or not related to the duties and responsibilities of the Board, including, without limitation, mass mailings, business solicitations, routine customer service complaints, new product or service suggestions and opinion surveys.

Appropriate matters to raise in communications to the Board include Board composition; Board and CEO succession planning process; executive compensation; uses of capital; and general Board oversight, including corporate governance, accounting, internal controls, auditing and other related matters.

The policy, including information on how to contact the Board of Directors, may be found in the corporate governance section of our website,www.unitedhealthgroup.com/who-we-are/corporate-governance.

2020 Proxy Statement | Board and Committee Evaluations | Communication with the Board of Directors 15

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Our Certificate of Incorporation provides that each member of our Board of Directors is elected annually by a majority of votes cast if the election is uncontested. The Board of Directors has nominated the ten directors set forth as follows for election by the shareholders at the 2020 Annual Meeting. All director nominees were elected by our shareholders at the 2019 Annual Meeting. If any nominees should become unable to serve as a director for any reason, the persons named below as proxies will elect a replacement.

Following is a brief biographical description of each director nominee. A table listing the areas of expertise in the skills matrix held by each director and which, in part, led the Board to conclude each respective director should continue to serve as a member of the Board, is included on page 6.

| | The Board of Directors recommends you voteFOR the election of each of the nominees. Executed proxies will be votedFOR the election of each nominee unless you specify otherwise. | |

| | |

| Director | | Age | | Primary Occupation | | Director Since |

|---|---|---|---|---|---|---|

| | | | | | | |

| Richard T. Burke | | 76 | | Lead Independent Director, UnitedHealth Group | | 1977 |

| | | | | | | |

| Timothy P. Flynn | | 63 | | Former Chair, KPMG International | | 2017 |

| | | | | | | |

| Stephen J. Hemsley | | 67 | | Chair, UnitedHealth Group | | 2000 |

| | | | | | | |

| Michele J. Hooper | | 68 | | President and CEO, The Directors' Council | | 2007 |

| | | | | | | |

| F. William McNabb III | | 62 | | Former Chairman and CEO, The Vanguard Group, Inc. | | 2018 |

| | | | | | | |

| Valerie C. Montgomery Rice, M.D. | | 58 | | President and Dean, Morehouse School of Medicine | | 2017 |

| | | | | | | |

| John H. Noseworthy, M.D. | | 68 | | Former CEO and President, Mayo Clinic | | 2019 |

| | | | | | | |

| Glenn M. Renwick | | 64 | | Former Chairman and CEO, The Progressive Corporation | | 2008 |

| | | | | | | |

| David S. Wichmann | | 57 | | CEO, UnitedHealth Group | | 2017 |

| | | | | | | |

| Gail R. Wilensky, Ph.D. | | 76 | | Senior Fellow, Project Hope | | 1993 |

| | | | | | | |

| Richard T. Burke | ||

Mr. Burke is Lead Independent Director of the Board of Directors of UnitedHealth Group and has served in this capacity since September 2017. Mr. Burke served as Chair of the Board from 2006 to August 2017, has been a member of our Board since 1977, and was Chief Executive Officer of UnitedHealthcare, Inc., our predecessor corporation, until 1988. From 1995 until 2001, Mr. Burke was the owner, Chief Executive Officer and Governor of the Phoenix Coyotes, a National Hockey League team. In the past five years, Mr. Burke also served as a director of Meritage Homes Corporation. | | Director since: 1977 Age: 76 Committees: Nominating and Corporate Governance Current Outside Public Directorships: None |

2020 Proxy Statement | 2020 Director Nominees 16

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

| Timothy P. Flynn | ||

Mr. Flynn was Chairman of KPMG International ("KPMG"), a global professional services organization that provides audit, tax and advisory services, from 2007 until his retirement in October 2011. From 2005 until 2010, he served as Chairman and from 2005 to 2008 as CEO of KPMG LLP in the U.S., the largest individual member firm of KPMG. Prior to serving as Chairman and CEO of KPMG LLP, Mr. Flynn was Vice Chairman, Audit and Risk Advisory Services, with operating responsibility for Audit, Risk Advisory and Financial Advisory Services practices. He previously served as a trustee of the Financial Accounting Standards Board, a member of the World Economic Forum's International Business Council, and a director of the International Integrated Reporting Council. | | Director since: 2017 Age: 63 Committees: Compensation and Human Resources Current Outside Public Directorships: Alcoa Corporation JPMorgan Chase & Co. Walmart Inc. |

| Stephen J. Hemsley | ||

Mr. Hemsley is Chair of the Board of UnitedHealth Group and has served in this capacity since November 2019. Mr. Hemsley previously served as Executive Chair of the Board from September 2017 to November 2019, Chief Executive Officer from November 2006 to August 2017, President from May 1999 to November 2014, and Chief Operating Officer from November 1998 to November 2006. He joined the Company in 1997 and has been a member of the Board of Directors since 2000. Mr. Hemsley serves as a director of Cargill, Inc. | | Director since: 2000 Age: 67 Committees: None Current Outside Public Directorships: None |

| Michele J. Hooper | ||

Ms. Hooper is President and CEO of The Directors' Council, a private company she co-founded in 2003 that works with corporate boards to increase their independence, effectiveness and diversity. She was President and CEO of Voyager Expanded Learning, a developer and provider of learning programs and teacher training for public schools, from 1999 until 2000. She previously served as President and CEO of Stadtlander Drug Company, Inc., a provider of disease specific pharmaceutical care, from 1998 until Stadtlander was acquired in 1999. Ms. Hooper is a nationally recognized corporate governance expert. | | Director since: 2007 Age: 68 Committees: Nominating and Corporate Governance (Chair) Audit Current Outside Public Directorships: PPG Industries, Inc. United Airlines Holdings, Inc. |

2020 Proxy Statement | 2020 Director Nominees 17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

| F. William McNabb III | ||

Mr. McNabb served as Chairman of The Vanguard Group, Inc. from 2010 until his retirement in 2018 and served as CEO from 2008 to 2017. He joined Vanguard in 1986. In 2010, he became Chairman of the Board of Directors and the Board of Trustees of the Vanguard group of investment companies. Earlier in his career, Mr. McNabb led each of Vanguard's client facing business divisions. Mr. McNabb is active in the investment management industry and served as the Chairman of the Investment Company Institute's Board of Governors from 2013 to 2016. Mr. McNabb is Chairman of the Board of the Zoological Society of Philadelphia and serves on the Wharton Leadership Advisory Board, the Dartmouth Athletic Advisory Board, Columbia Law School's Millstein Center Advisory Board and the Ernst & Young Independent Audit Quality Board. Mr. McNabb is a board member of CECP: The CEO Force for Good. | | Director since: 2018 Age: 62 Committees: Audit Current Outside Public Directorships: International Business Machines Corporation |

| Valerie C. Montgomery Rice, M.D | ||

Dr. Montgomery Rice is President and Dean of the Morehouse School of Medicine, a medical school in Atlanta, Georgia, and has served in this capacity since 2014. She also served as the Executive Vice President and Dean of the Morehouse School of medicine from 2011 to 2014. Morehouse School of Medicine is among the nation's leading educators of primary care physicians and was recently recognized as the top institution among U.S. medical schools for their social mission. Prior to joining Morehouse School of Medicine, she served as dean of the School of Medicine and Senior Vice President of health affairs at Meharry Medical College from March 2006 to June 2009, and as director of the Center for Women's Health Research, one of the nation's first research centers devoted to studying diseases that disproportionately impact women of color, from 2005 to 2011. Dr. Montgomery Rice also serves as a Council Member of the National Institute of Health and National Center for Advancing Translational Science, and previously on the National Institute of Health's Minority Health and Health Disparities and Office of Research on Women's Health advisory councils, and the Association of American Medical Colleges Council of Deans administrative board. Dr. Montgomery Rice is a member of the National Academy of Medicine and a renowned infertility specialist and women's health researcher. | | Director since: 2017 Age: 58 Committees: Public Policy Strategies and Responsibility Current Outside Public Directorships: None |

2020 Proxy Statement | 2020 Director Nominees 18

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

| John H. Noseworthy, M.D | ||

Dr. Noseworthy is the former Chief Executive Officer and President of Mayo Clinic, a world renowned non-profit healthcare organization. He retired at the end of 2018 after a 28 year career at Mayo Clinic, recognized by U.S. News and World Report as best in its honor roll of America's top providers of care for patients with serious and complex problems. Mayo Clinic cares for patients from every state and 143 countries worldwide. Dr. Noseworthy joined Mayo Clinic in 1990 and served in various capacities, including as Chairman of Mayo Clinic's internal Board of Governors, member of the Board of Trustees, Professor of Neurology at Mayo Clinic College of Medicine & Science, Chair of Mayo's Department of Neurology, medical director of the Department of Development and Vice Chair of the Mayo Clinic Rochester Executive Board. Dr. Noseworthy also served as editor-in-chief of Neurology, the official journal of the American Academy of Neurology, from 2007 to 2009. Dr. Noseworthy was a Health Governor of the World Economic Forum from 2012 to 2018 and, in the past five years, also served as a director of Merck & Co. | | Director since: 2019 Age: 68 Committees: Public Policy Strategies and Responsibility Current Outside Public Directorships: None |

| Glenn M. Renwick | ||

Mr. Renwick served as Chairman of the Board of Directors of The Progressive Corporation, an auto insurance holding company, from November 2013 to May 2018, including as Executive Chairman of Progressive from July 2016 to June 2017, and as President and CEO from 2001 to 2016. Before being named President and CEO in 2001, Mr. Renwick served as CEO-Insurance Operations and Business Technology Process Leader at Progressive from 1998 to 2000. Prior to that, he led Progressive's Consumer Marketing group and served as president of various divisions within Progressive. Mr. Renwick joined Progressive in 1986 as Auto Product Manager for Florida. In the past five years, Mr. Renwick also served as Chairman and a director of Fiserv. | | Director since: 2008 Age: 64 Committees: Audit (Chair) Current Outside Public Directorships: None |

| David S. Wichmann | ||

Mr. Wichmann is Chief Executive Officer of UnitedHealth Group and a member of the Board of Directors, and has served in this capacity since September 2017. Mr. Wichmann previously served as President of UnitedHealth Group from November 2014 to August 2017. Mr. Wichmann also served as Chief Financial Officer of UnitedHealth Group from January 2011 to June 2016. From April 2008 to November 2014, Mr. Wichmann served as Executive Vice President of UnitedHealth Group and President of UnitedHealth Group Operations. | | Director since: 2017 Age: 57 Committees: None Current Outside Public Directorships: Tennant Company |

2020 Proxy Statement | 2020 Director Nominees 19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

| Gail R. Wilensky, Ph.D. | ||

Dr. Wilensky has been a senior fellow at Project HOPE, an international health foundation, since 1993. From 2008 to 2009, Dr. Wilensky was President of the Department of Defense Health Board and chaired its sub-committee on health care delivery. From 2006 to 2008, Dr. Wilensky co-chaired the Department of Defense Task Force on the Future of Military Health Care. During 2007, she also served as a commissioner on the President's Commission on Care for America's Returning Wounded Warriors. From 2001 to 2003, she was the Co-Chair of the President's Task Force to Improve Health Care for our Nation's Veterans. From 1997 to 2001, she was also Chair of the Medicare Payment Advisory Commission. From 1992 to 1993, Dr. Wilensky served as the Deputy Assistant to President George H. W. Bush for policy development, and from 1990 to 1992, she was the Administrator of the Health Care Financing Administration (now known as the Centers for Medicare and Medicaid Services), directing the Medicaid and Medicare programs for the United States. Dr. Wilensky is a nationally recognized health care economist. | | Director since: 1993 Age: 76 Committees: Public Policy Strategies and Responsibility (Chair) Compensation and Human Resource Current Outside Public Directorships: Quest Diagnostics ViewRay, Inc. |

We seek to compensate our non-employee directors fairly for work required for a company of our size, complexity and scope and to align their interests with the long-term interests of our shareholders. Director compensation reflects our desire to attract, retain and benefit from the expertise of highly qualified people. The Compensation and Human Resources Committee annually reviews the compensation of our non-employee directors and makes recommendations to the Board of Directors. In August 2019, the Compensation and Human Resources Committee, with the advice of its independent compensation consultant, undertook a review of the structure, philosophy and overall mix of the director compensation program as compared to the Company's compensation peer group and also the four large publicly traded managed health care companies. Following this review, the Compensation and Human Resources Committee recommended no changes to director compensation.

2020 Proxy Statement | 2020 Director Nominees | Director Compensation 20

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

The following table highlights the material elements of our director compensation program:

Compensation Element | | Compensation Value ($) |

Annual Cash Retainer | | 125,000 |

| | | |

Annual Chair of the Board Cash Retainer | | 270,000 |

| | | |

Annual Audit Committee Chair Cash Retainer | | 25,000 |

| | | |

Annual Compensation and Human Resources Committee Chair Cash Retainer | | 20,000 |

| | | |

Annual Nominating and Corporate Governance Committee Chair Cash Retainer | | 20,000 |

| | | |

Annual Public Policy Strategies and Responsibility Committee Chair Cash Retainer | | 20,000 |

| | | |

Annual Lead Independent Director Cash Retainer | | 75,000 |

| | | |

Annual Equity Award | | 205,000 aggregate fair value of deferred stock units |

| | | |

Equity Conversion Program | | At the director's election, cash compensation may be converted into DSUs, or if the director has met the stock ownership guidelines, into common stock |

| | | |

Cash Compensation

Cash retainers are payable on a quarterly basis in arrears on the first business day following the end of each fiscal quarter, and are subject to pro rata adjustment if the director did not serve the entire quarter. Directors may elect to receive deferred stock units ("DSUs") or common stock (if the director has met the stock ownership guidelines) in lieu of their cash compensation or may defer receipt of their cash compensation to a later date pursuant to the Directors' Compensation Deferral Plan ("Director Deferral Plan"). The cash retainers are in consideration of general service and responsibilities and required meeting preparation. Effective November 2019, the Board approved an annual cash retainer in the amount of $270,000 for the newly established non-executive Chair of the Board role.

Equity-Based Compensation

Non-employee directors receive annual grants of DSUs under the 2011 Stock Incentive Plan having an aggregate fair value of $205,000. The grants are issued quarterly in arrears on the first business day following the end of each fiscal quarter and prorated if the director did not serve the entire quarter. The number of DSUs granted is determined by dividing $51,250 (the quarterly value of the annual equity award) by the closing price of our common stock on the grant date, rounded up to the nearest share. The grants are in consideration of general service and responsibilities and required meeting preparation.

The DSUs immediately vest upon grant and must be retained until completion of the director's service on the Board of Directors. Upon completion of service, the DSUs convert into an equal number of shares of the Company's common stock. A director may defer receipt of the shares for up to ten years after completion of service pursuant

2020 Proxy Statement | Director Compensation 21

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

to the Director Deferral Plan. Non-employee directors who have met their stock ownership requirement may elect to receive common stock in lieu of DSUs and/or in-service distributions on pre-selected dates.

If a director elects to convert his or her cash compensation into common stock or DSUs, such conversion grants are made on the day the eligible cash compensation becomes payable to the director. The director receives the number of shares of common stock or DSUs, as applicable, equal to the cash compensation foregone, divided by the closing price of our common stock on the date of grant, rounded up to the nearest share. The DSUs immediately vest upon grant. A director may only elect to receive common stock if he or she has met the stock ownership guidelines.

The Company pays dividend equivalents in the form of additional DSUs on all outstanding DSUs. Dividend equivalents are paid at the same rate and at the same time that dividends are paid to Company shareholders and are subject to the same vesting conditions as the underlying grant.

Stock Ownership and Retention Guidelines

Under our stock ownership guidelines, we require non-employee directors to achieve ownership of shares of the Company's common stock (excluding stock options, but including vested DSUs and vested restricted stock units) having a fair market value equal to five times the directors' annual base cash retainer. Non-employee directors must comply with the stock ownership guidelines within five years of their appointment to the Board of Directors. All of our non-employee directors have met the stock ownership requirement or have served as a director for less than five years. Our directors are required to hold all equity awards granted until completion of service on the Board or until they have met our stock ownership requirements.

Director Deferral Plan

Under the Director Deferral Plan, subject to compliance with applicable laws, non-employee directors may elect annually to defer receipt of all or a percentage of their compensation. Amounts deferred are credited to a bookkeeping account maintained for each director participant that uses a predetermined collection of unaffiliated mutual funds as measuring investments. The Director Deferral Plan does not provide for matching contributions by the Company.

Other Compensation

We reimburse directors for any reasonable out-of-pocket expenses incurred in connection with service as a director. We also provide health care coverage to directors if the director is not eligible for subsidized coverage under another group health care benefit program. Health care coverage is provided generally on the same terms and conditions as current employees. Upon retirement from the Board of Directors, directors may continue to obtain health care coverage under benefit continuation coverage, and after the lapse of such coverage, under the Company's post-employment medical plan for up to a total of 96 months if they are otherwise eligible.

The Company maintains a program through which it will match up to $15,000 of charitable donations made by each director for each calendar year. The directors do not receive any financial benefit from this program because the charitable income tax deductions accrue solely to the Company. Donations under the program may not be made to family trusts, partnerships or similar organizations.

2020 Proxy Statement | Director Compensation 22

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Our corporate aircraft use policy prohibits personal use of corporate aircraft by any independent director. However, because there is no incremental cost to the Company, the policy permits a director's family member to on occasion accompany the director on a business flight on Company aircraft provided a seat is available.

The following table provides information for the year ended December 31, 2019, relating to compensation paid to or accrued by us on behalf of our non-employee directors who served in this capacity during 2019.

2019 Director Compensation Table

| Name(1) | | Fees Earned or Paid In Cash ($)(2) | | Stock Awards ($)(3) | | All Other Compensation ($)(4) | | Total ($) | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | ||||||||

William C. Ballard, Jr. | | | 145,000 | | | 205,395 | | | 18,433 | | | 368,828 | | ||||

| | | | | | | | | | | ||||||||

Richard T. Burke | | | 200,000 | | | 205,395 | | | 28,006 | | | 433,401 | | ||||

| | | | | | | | | | | ||||||||

Timothy P. Flynn | | | — | | | 330,325 | | | 22,847 | | | 353,172 | | ||||

| | | | | | | | | | | ||||||||

Stephen J. Hemsley | | | — | | | — | | | 735 | | | 735 | | ||||

| | | | | | | | | | | ||||||||

Michele J. Hooper | | | 145,000 | | | 205,395 | | | 15,505 | | | 365,900 | | ||||

| | | | | | | | | | | ||||||||

F. William McNabb III | | | — | | | 330,325 | | | — | | | 330,325 | | ||||

| | | | | | | | | | | ||||||||

Valerie C. Montgomery Rice, M.D. | | | 125,000 | | | 205,395 | | | 16,321 | | | 346,716 | | ||||

| | | | | | | | | | | ||||||||

John H. Noseworthy, M.D. | | | — | | | 209,477 | | | 11,817 | | | 221,294 | | ||||

| | | | | | | | | | | ||||||||

Glenn M. Renwick | | | — | | | 355,404 | | | 23,874 | | | 379,278 | | ||||

| | | | | | | | | | | ||||||||

Gail R. Wilensky, Ph.D. | | | 145,000 | | | 205,395 | | | 17,880 | | | 368,275 | | ||||

| | | | | | | | | | | ||||||||

2020 Proxy Statement | 2019 Director Compensation Table 23

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

The aggregate grant date fair values of the stock awards granted in 2019, computed in accordance with FASB ASC Topic 718 based on the closing price of our common stock on the grant date, are as follows:

Name | | January 2, 2019 ($) | | April 1, 2019 ($) | | July 1, 2019 ($) | | October 1,2019 ($) | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

William C. Ballard, Jr. | | | 51,376 | | | | 51,318 | | | | 51,440 | | | | 51,262 | | | ||||

Richard T. Burke | | | 51,376 | | | | 51,318 | | | | 51,440 | | | | 51,262 | | | ||||

Timothy P. Flynn* | | | 82,543 | | | | 82,501 | | | | 82,740 | | | | 82,540 | | | ||||

Michele J. Hooper | | | 51,376 | | | | 51,318 | | | | 51,440 | | | | 51,262 | | | ||||

F. William McNabb III* | | | 82,543 | | | | 82,501 | | | | 82,740 | | | | 82,540 | | | ||||

Valerie C. Montgomery Rice, M.D. | | | 51,376 | | | | 51,318 | | | | 51,440 | | | | 51,262 | | | ||||

John H. Noseworthy, M.D.* | | | — | | | | 44,197 | | | | 82,740 | | | | 82,540 | | | ||||

Glenn M. Renwick* | | | 88,874 | | | | 88,885 | | | | 88,806 | | | | 88,839 | | | ||||

Gail R. Wilensky, Ph.D. | | | 51,376 | | | | 51,318 | | | | 51,440 | | | | 51,262 | | | ||||

As of December 31, 2019, our non-employee directors held outstanding DSU awards as follows:

Name | | Deferred Stock Units | | |||

|---|---|---|---|---|---|---|

William C. Ballard, Jr. | | | 24,452 | | | |

Richard T. Burke | | | 24,452 | | | |

Timothy P. Flynn | | | 3,936 | | | |

Michele J. Hooper | | | 31,229 | | | |

F. William McNabb III | | | 2,195 | | | |

Valerie C. Montgomery Rice, M.D. | | | 1,784 | | | |

John H. Noseworthy, M.D. | | | 909 | | | |

Glenn M. Renwick | | | 46,425 | | | |

Gail R. Wilensky, Ph.D. | | | 22,236 | | | |

2020 Proxy Statement | 2019 Director Compensation Table 24

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Corporate Governance |

UnitedHealth Group is committed to high standards of corporate governance and ethical business conduct. Important documents reflecting this commitment are listed below.

| Corporate Governance Documents | ||||||

• | | Certificate of Incorporation | | • | | Code of Conduct: Our Principles of Ethics & Integrity |

• | | Bylaws | | • | | Related-Person Transactions Approval Policy |

• | | Principles of Governance | | • | | Board of Directors Communication Policy |

• | | Board of Directors Committee Charters | | • | | Political Contributions Policy |

• | | Standards for Director Independence | | • | | Corporate Environmental Policy |

You can access these documents atwww.unitedhealthgroup.com/who-we-are/corporate-governance to learn more about our corporate governance practices. We will also provide copies of these documents without charge upon written request to the Company's Secretary to the Board of Directors.

Commitment to Effective Corporate Governance

| Board Accountability to Shareholders | ||||

Annual Election | | | All directors stand for election by majority vote annually | |

| | | | | |

| Proxy Access | | | Proxy access with market terms | |

| | | | | |

| Majority Voting Standard | | | Majority voting in uncontested director elections, and directors not receiving majority support must tender their resignation for consideration by the Board | |

| | | | | |

| Special Meeting / Written Consent Rights | | | Shareholders have the rights to call a special meeting and act by written consent | |

| | | | | |

| No Poison Pill | | | No shareholder rights plan (commonly referred to as a "poison pill") | |

| | |||

| Shareholder Voting Rights in Proportion to Economic Interests | ||||

One Share, One Vote | | | No dual class structure; each share of common stock is entitled to one vote | |

| | | | | |

| No Supermajority Requirements | | | No supermajority shareholder approval requirements | |

| | | | | |

2020 Proxy Statement | Corporate Governance Overview 25

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

| Board Responsiveness to Shareholders / Proactive Understanding of Shareholder Perspectives | ||||

Shareholder Engagement Process | | | Management and Board members met with key shareholders in 2019 Shareholder engagement topics included Board composition, leadership and refreshment, executive compensation program and sustainability and social topics | |

| | | | | |

| Nominating Advisory Committee | | | Our Nominating Advisory Committee, comprised of long-term shareholders of the Company and a member of the medical community, provides our Nominating and Corporate Governance Committee with additional input regarding desirable characteristics of director candidates and the composition of our Board | |

| | |||

| Strong Independent, Board Leadership Structure | ||||

Board Leadership | | | Separate CEO and Chair of the Board | |

| | | | | |

| Lead Independent Director | | | Strong Lead Independent Director with clearly defined and robust duties that are disclosed to shareholders | |

| | | | | |

| Annual Review | | | Board considers appropriateness of its leadership structure at least annually | |

| | | | | |

| Committee Membership | | | Strong independent Committee chairs and fully independent Committees | |

| | | | | |

| Disclosure | | | Proxy discloses why Board believes current leadership structure is appropriate | |

| | |||

| Adopt Structures and Practices Enhancing Board Effectiveness | ||||

Independence | | | As of April 7, 2020, 82% of our Board members are independent | |

| | | | | |

| Diversity | | | 33% of our independent Board members are diverse | |

| | | | | |

| Board and Committee Evaluations | | | Annual Board and Committee evaluation conducted by independent consultant and led by the Chair of Nominating and Corporate Governance Committee | |

| | | | | |

| Board Refreshment | | | Active Board refreshment plan; six new Board members added in last three years, five of whom are standing for election | |

| | | | | |

| Attendance | | | Directors attended 94% of combined total Board and applicable committee meetings in 2019 and all directors attended the 2019 Annual Meeting | |

| | | | | |

| Board Service Limits | | | Independent directors may serve on no more than three other public company boards; and our CEO may serve on no more than one other public company board | |

| | | | | |

| Executive Sessions | | | Frequent executive sessions of independent directors held | |

| | | | | |

| Disclosure | | | Full disclosure of corporate governance policies and practices | |

| | | | | |

2020 Proxy Statement | Corporate Governance Overview 26

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

| Align Management Incentive Structures with Long-Term Strategy | ||||

Say-on-Pay Results | | | Executive Compensation program received more than 95% shareholder support in 2019 and has received more than 95% of the votes cast since our inaugural vote in 2011 | |

| | | | | |

| Annual Review of Compensation Program | | | Compensation and Human Resources Committee annually reviews and approves incentive program design, goals and objectives for alignment with compensation and business strategies | |

| | | | | |

| Incentive Programs Linked to Strategy | | | Annual and long-term incentive programs are designed to reward financial and operational performance that furthers short- and long-term strategic objectives | |

| | | | | |

| Non-Financial Performance Goals | | | A portion of our annual incentive award is dependent upon the achievement of goals of customer, provider and employee satisfaction, which are viewed to be important to achieving long-term success for the Company | |

| | | | | |

Strong and effective governance practices are critical to UnitedHealth Group's long-term value creation. The Board has enhanced governance policies over time to align with best practices, drive sustained shareholder value and serve the interests of shareholders. Our corporate governance practices align with the corporate governance principles developed by the Investor Stewardship Group (ISG), which includes some of the largest institutional investors and global asset managers and advocates for best practices in corporate governance.

Code of Conduct: Our Principles of Ethics & Integrity

The Code of Conduct: Our Principles of Ethics & Integrity document is posted on our website and covers our principles and policies related to business conduct, conflicts of interest, public disclosure, legal compliance, reporting and accountability, corporate opportunities, confidentiality, fair dealing and protection and proper use of Company assets. Any waiver of the Code of Conduct for the Company's executive officers, senior financial officers or directors may be made only by the Board of Directors or a committee of the Board. We will publish any amendments to the Code of Conduct and waivers of the Code of Conduct for an executive officer or director on our website.

We strongly and broadly encourage employees to raise ethics and compliance concerns, including concerns about accounting, internal controls or auditing matters. We offer several channels for employees and third parties to report ethics and compliance concerns or incidents, including by telephone or online, and individuals may choose to remain anonymous in jurisdictions where anonymous reporting is permissible. We prohibit retaliatory action against any individual who in good faith raises concerns or questions regarding ethics and compliance matters or reports suspected violations. We train all employees annually and periodically advise them regarding the means by which they may report possible ethics or compliance issues and their affirmative responsibility to report any possible issues.

2020 Proxy Statement | Code of Conduct | Compliance and Ethics 27

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Enterprise-Wide Risk Oversight

Our Board of Directors oversees management's enterprise-wide risk management activities. Risk management activities include assessing and taking actions necessary to manage risk incurred in connection with the long-term strategic direction and operation of our business. Each director on our Board is required to have risk oversight ability for each skill and attribute the director possesses reflected in the collective skills section of our director skills matrix described in "Proposal 1 — Election of Directors — Director Nomination Process — Criteria for Nomination to the Board" above. Collectively, our Board of Directors uses its committees to assist in its risk oversight function as follows:

Our Board of Directors maintains overall responsibility for oversight of the work of its various committees by receiving regular reports from the Committee chairs regarding their work. In addition, discussions about the Company's culture, strategic plan, consolidated business results, capital structure, merger and acquisition-related activities and other business discussed with the Board of Directors include a discussion of the risks associated with the particular item under consideration. Our Board of Directors and Board committees also have authority to retain independent advisers.

2020 Proxy Statement | Risk Oversight 28

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

1 | | Board ofDirectors | | | | 2 | | CorporateGovernance | | | | 3 | | ExecutiveCompensation | | | | 4 | | Audit | | | | 5 | | AnnualMeeting | | | | 6 | | OtherInformation |

Enterprise-Wide Cybersecurity Risk Oversight

Board and Committee Oversight

Our Board recognizes the importance of maintaining the trust and confidence of our customers, clients and employees. We regularly update our Board and the Audit Committee on the Company's cybersecurity program, including tabletop exercises and ongoing efforts to ensure the security and proper use of confidential and personal information. We devote significant resources to protecting and evolving the security of our computer systems, software, networks and other technology assets in response to a continuously changing threat landscape. The Company regularly updates its cyber policies, procedures and security measures and trains employees and certain business partners on these requirements.

Enterprise-Wide Incentive Compensation Risk Assessment

Our Compensation and Human Resources Committee requested management to conduct an annual risk assessment of the Company's enterprise-wide compensation programs. The risk assessment reviewed both cash incentive compensation plans and individual cash incentive awards paid in 2019 for the presence of potential design elements that could motivate employees to incur excessive risk. The review included the ratio and level of incentive to fixed compensation, the amount of manager discretion, the level of compensation expense relative to the business units' revenues, and the presence of other design features which serve to mitigate excessive risk-taking, such as the Company's clawback policy, stock ownership and retention guidelines, multiple performance measures and similar features.