- ATO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Atmos Energy (ATO) DEF 14ADefinitive proxy

Filed: 20 Dec 19, 6:08am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☒ | Definitive Proxy Statement | |||||

☐ | Definitive Additional Materials | |||||

☐ | Soliciting Material Pursuant to §240.14a-12 |

Atmos Energy Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|  |

December 20, 2019

DEAR SHAREHOLDER:

We are pleased to invite you to attend the annual meeting of shareholders on Wednesday, February 5, 2020, at 9:00 a.m. Central Standard Time, at the Westin Galleria Dallas, 13340 Dallas Parkway, Dallas, TX 75240.

The annual meeting will include a report on our operations and consideration of the matters set forth in the accompanying Notice of Annual Meeting and Proxy Statement. All shareholders of record as of December 13, 2019, are entitled to vote.

Your vote is very important.Whether or not you plan to attend the meeting in person, please cast your vote over the internet, by telephone or by mailing back a proxy card as soon as possible.

On behalf of your Board of Directors, thank you for your continued support and interest in Atmos Energy Corporation.

| Sincerely, | ||||

|  | |||

| Kim R. Cocklin | J. Kevin Akers | |||

| Executive Chairman of the Board | President and Chief Executive Officer | |||

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

2020 ANNUAL MEETING INFORMATION

|

|

|

| |||||||||||||||||||||

Meeting Date: February 5, 2020 | Meeting Place: Westin Galleria Dallas 13340 Dallas Parkway Dallas, TX 75240 | Meeting Time: 9:00 a.m. (Central) | Record Date: December 13, 2019 |

ANNUAL MEETING BUSINESS

Atmos Energy Corporation’s annual meeting of shareholders will be held February 5, 2020 to:

| 1. | elect the 13 directors named in the proxy statement forone-year terms expiring in 2021; |

| 2. | ratify the Audit Committee’s appointment of Ernst & Young LLP (“Ernst & Young” or “E&Y”) to serve as the Company’s independent registered public accounting firm for fiscal 2020; |

| 3. | approve, on an advisory basis, the compensation of the named executive officers of the Company for fiscal 2019(“Say-on-Pay”); and |

| 4. | transact such other business as may properly come before the meeting or any adjournment thereof. |

VOTING

YOUR VOTE IS VERY IMPORTANT TO US. Shareholders of record of our common stock at the close of business on December 13, 2019, will be entitled to notice of, and to vote at, our meeting. Whether or not you plan to attend the annual meeting in person, we urge you to vote as soon as possible by one of these methods.

|

|

| ||

By Internet www.proxyvote.com | By Telephone 1.800.690.6903 | By Mail Follow the instructions on your proxy card or voting instruction form |

If you are a beneficial owner of shares held through a broker, bank or other holder of record, you must follow the voting instructions you receive from the holder of record to vote your shares. Shareholders may also vote in person at the annual meeting. For more information on how to vote your shares, please refer to “Information About the Meeting” beginning on page 61.

|

| Karen E. Hartsfield |

Senior Vice President, General Counsel and Corporate Secretary |

December 20, 2019

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING

OF SHAREHOLDERS TO BE HELD ON FEBRUARY 5, 2020:

This Proxy Statement, along with the Company’s Annual Report, which includes our Annual

Report on Form10-K for the fiscal year ended September 30, 2019, are available atwww.proxyvote.com.

| PROXY STATEMENT OVERVIEW | 1 | |||

| CORPORATE GOVERNANCE AND OTHER BOARD MATTERS | 7 | |||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 11 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| PROPOSAL ONE—ELECTION OF DIRECTORS | 17 | |||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| DIRECTOR COMPENSATION | 25 | |||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| PROPOSAL TWO—RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 28 | |||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| PROPOSAL THREE—APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | 30 | |||

| 30 | ||||

| 30 | ||||

| COMPENSATION DISCUSSION AND ANALYSIS | 31 | |||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 35 | ||||

Additional Information on Named Executive Officer Compensation | 39 | |||

| 40 | ||||

| 41 | ||||

Management’s Role in Setting Named Executive Officer Compensation | 41 | |||

| 42 | ||||

| 42 | ||||

| NAMED EXECUTIVE OFFICER COMPENSATION | 43 | |||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| OTHER EXECUTIVE COMPENSATION MATTERS | 57 | |||

| 57 | ||||

Human Resources Committee Interlocks and Insider Participation | 57 | |||

| 57 | ||||

| 58 | ||||

| BENEFICIAL OWNERSHIP OF COMMON STOCK | 59 | |||

| 59 | ||||

| 60 | ||||

| INFORMATION ABOUT THE MEETING | 61 | |||

| 61 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

| 62 | ||||

| 62 | ||||

| 62 | ||||

| 63 | ||||

| APPENDIX A—RECONCILIATION OF NON-GAAP PERFORMANCE MEASURES TO GAAP | A-1 | |||

| 2020 Proxy Statement |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider before casting your vote. Please read this entire proxy statement carefully before voting.

2020 Annual Meeting Information

For additional information about our Annual Meeting, see “Information About the Meeting” on page 61.

|  |  |  | |||

Meeting Date: February 5, 2020 | Meeting Place: Westin Galleria Dallas 13340 Dallas Parkway Dallas, TX 75240 | Meeting Time: 9:00 a.m. (Central) | Record Date: December 13, 2019 | |||

Meeting Agenda and Voting Recommendations

The Atmos Energy Corporation Board of Directors asks shareholders to vote on these matters:

Items of Business | Board Recommendation | Page Number | ||||

1. |

Election of the 13 directors named as nominees in the proxy statement |

FOR |

17 | |||

2. |

Ratification of selection of independent registered public accounting firm |

FOR |

28 | |||

3. |

Approval, on an advisory basis, of the compensation of our named executive officers |

FOR |

30 | |||

In addition to the above matters, we will transact any other business that is properly brought before the shareholders at the annual meeting.

Advance Voting Methods

Even if you plan to attend the 2020 annual meeting of shareholders in person and you are a shareholder of record, we urge you to vote in advance of the meeting using one of these advance voting methods.

| ||||

|  |  | ||

Via the Internet: www.proxyvote.com | Call Toll-Free: 1.800.690.6903 | Mail Signed Proxy Card: Follow the instructions on your proxy card or voting instruction form | ||

If you are a beneficial owner of shares held through a broker, bank or other holder of record, you must follow the voting instructions you receive from the holder of record to vote your shares.

| 2020 Proxy Statement | 1 |

About Atmos Energy

An S&P 500 company headquartered in Dallas, Atmos Energy (the “Company”) serves more than 3 million distribution customers in over 1,400 communities across eight states and manages proprietary pipeline and storage assets, including one of the largest intrastate natural gas pipeline systems in Texas. As part of our vision to be the safest provider of natural gas services, we are modernizing our business and our infrastructure while continuing to invest in safety, innovation, environmental sustainability and our communities.

| Our Company | Our Vision | Our Strategy | ||||||||||||||

| We are the nation’s largest fully regulated, naturalgas-only distributor of safe, clean, efficient and affordable energy. | Our vision is for Atmos Energy to be thesafest provider of natural gas services. We will be recognized forexceptional customer service, for being agreat employer, and for achievingsuperior financial results.

| Atmos Energy’s strategy is to:

• operate ourbusiness exceptionally well • invest in ourpeople and ourinfrastructure • enhance ourculture | ||||||||||||||

2019 Financial Results and Accomplishments

2019 was a strong year for Atmos Energy. Earnings and earnings per share increased for a 17th consecutive year. In fiscal 2019, we generated net income of $511.4 million or $4.35 per diluted share, compared with net income of $603.1 million, or $5.43 per diluted share, in the prior year. Adjusted net income for the year ended September 30, 2018, was $444.3 million, or $4.00 per diluted share, after excluding the effects of implementing the Tax Cuts and Jobs Act of 2017 (“TCJA”) from the prior year.* Capital expenditures for fiscal 2019 totaled approximately $1.7 billion, with approximately 87% of this amount invested to improve the safety and reliability of our distribution and transmission systems.

In August 2019, consistent with the long-term leadership succession plan conducted by our Board of Directors (the “Board”), we announced that J. Kevin Akers, Executive Vice President, would assume the role of President and Chief Executive Officer, effective October 1, 2019. Mr. Akers and his leadership team are committed to maintaining Atmos Energy’s vision to be the safest provider of natural gas services.

DILUTED EARNINGS PER SHARE* | DECLARED DIVIDENDS PER SHARE | TOTAL SHAREHOLDER RETURN | ||||||||||||||

| $4.35 | $2.10 | 23.8% | ||||||||||||||

17th Consecutive Year of EPS Growth | Up from $1.94 for FY2018 | 3-year cumulative total shareholder return of 63.3% |

8th Year of Organic Growth Strategy | Significant Regulatory Developments | |||

✓ EPS of $4.35*; 17th consecutive year of EPS

✓ FY 2019 Dividend of $2.10; 8.2% growth over FY 2018

✓ Capital spending of $1.7 billion

✓ Maintained strong balance sheet; equity capitalization of 59% as of September 30, 2019 |

✓Implemented $117 million of annualized regulatory outcomes during fiscal 2019

✓Continued to implement tax reform into customer bills | |||

| * | Represents a measure of performance that is calculated and presented other than in accordance with generally accepted accounting principles (“GAAP”). See Appendix A for an explanation of these non-GAAP measures, a full reconciliation of these non-GAAP results to our GAAP net income and diluted net income per share results, and a brief discussion of why we use these non-GAAP performance measures. |

| 2 | ATMOS ENERGY |

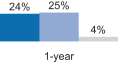

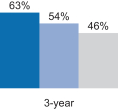

Total Shareholder Return

We have also continued to deliver positive returns to our shareholders, generating total shareholder returns (stock price appreciation and reinvested dividends) (“TSR”) over the latest one, three and five-year periods, as shown in the following chart:

|  |  | ||

| ∎ Atmos Energy ∎ Peer Group ∎ S&P 500 Index | ||||

The Atmos Energy peer group used in this chart is the same peer group used for executive compensation benchmarking for fiscal 2019, as approved by our Board, and is comprised of the following companies: Alliant Energy Corporation; Ameren Corporation; CenterPoint Energy, Inc.; CMS Energy Corporation; DTE Energy Company; National Fuel Gas Company; NiSource Inc.; ONE Gas, Inc.; Spire, Inc.; WEC Energy Group, Inc.; and Xcel Energy Inc. See “Competitive Executive Compensation Benchmarking,” beginning on page 40 below for further information on these peer group companies.

Corporate Governance Highlights

Our corporate governance policies and practices promote the long-term interests of our shareholders, strengthen the accountability of our Board and management, and help build public trust in the Company. Below is a summary of some of the highlights of our corporate governance framework.

BOARD PRACTICES ✓ independent lead director ✓ separation of board chair and CEO ✓ 10 of 13 director nominees are independent ✓ annual election of all directors ✓ regular executive sessions of independent directors ✓ comprehensive and strategic risk oversight ✓ mandatory retirement age for directors ✓ annual board and committee evaluations ✓ all committees chaired by independent directors

SHAREHOLDER MATTERS ✓ robust shareholder engagement ✓ annualsay-on-pay voting ✓ majority voting for director elections ✓ no poison pill in force

| OTHER GOVERNANCE PRACTICES ✓ executive and director stock ownership guidelines ✓���clawback policy ✓ prohibition on hedging or pledging stock |

| 2020 Proxy Statement | 3 |

Director Nominees

We have included summary information about each director nominee in the table below. Each director is elected annually by a majority of votes. See“Nominees for Director” beginning on page 18 for more information regarding our director nominees.

COMMITTEES

| ||||||||||||||||

Name and Primary Occupation

| Age

|

Director Since

| Independent

| AC

| HR

| NC

| CR

| EC

| ||||||||

J. Kevin Akers(a) President and Chief Executive Officer, Atmos Energy

|

56 |

2019 | ||||||||||||||

Robert W. Best Director, Associated Electric & Gas Insurance Services Limited

|

73 |

1997 |

● |

M | ||||||||||||

Kim R. Cocklin(a) Executive Chairman of Board, Atmos Energy

|

68 |

2009 | ||||||||||||||

Kelly H. Compton Executive Director, Hoglund Foundation

|

62 |

2016 |

● |

M |

M | |||||||||||

Sean Donohue Chief Executive Officer, DFW International Airport

|

58 |

2018 |

● |

M |

M | |||||||||||

Rafael G. Garza President and Founder, RGG Capital Partners, LLC

|

59 |

2016 |

● |

M |

M | |||||||||||

Richard K. Gordon General Partner, Juniper Capital LP, Juniper Energy LP, Juniper Capital II, and Juniper Capital III

|

70 |

2001 |

● Lead |

M |

M |

C |

C | |||||||||

Robert C. Grable Founding Partner, Kelly Hart & Hallman LLP

|

73 |

2009 |

● |

M |

C |

M | ||||||||||

Nancy K. Quinn Director, Helix Energy Solutions Group, Inc.

|

66 |

2004 |

● |

M |

C |

M |

M | |||||||||

Richard A. Sampson General Partner and Founder, RS Core Capital, LLC

|

69 |

2012 |

● |

C |

M |

M | ||||||||||

Stephen R. Springer(a) Director, Atmos Energy

|

73 |

2005 |

M | |||||||||||||

Diana J. Walters Founder and Managing Member, Amichel, LLC

|

56 |

2018 |

● |

M |

M | |||||||||||

Richard Ware II Chairman, Amarillo National Bank

|

73 |

1994 |

● |

M |

M | |||||||||||

AC = Audit HR = Human Resources NC = Nominating and Corporate Governance CR = Corporate Responsibility, Sustainability, & Safety EC = Executive

M = Member C = Chair

| (a) | The director is not independent and accordingly is not eligible to be a member of any of the committees except the Executive Committee and/or the Corporate Responsibility, Sustainability, & Safety Committee, pursuant to the rules of the New York Stock Exchange. |

| 4 | ATMOS ENERGY |

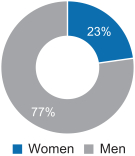

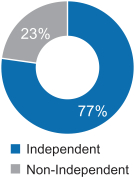

Director Nominee Composition

| Gender Diversity | Tenure | Independence | ||

|

|  | ||

Compensation Highlights

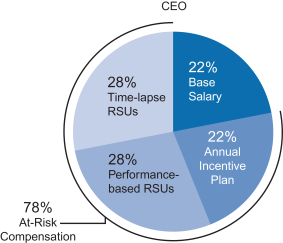

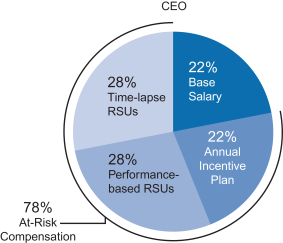

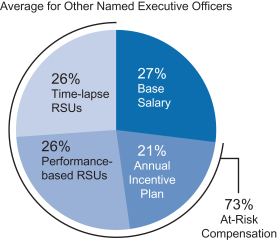

Our compensation programs are designed to both attract and retaintop-level executive talent and align the long- and short-term interests of our executives with those of our shareholders. We received more than 95% shareholder support for our“Say-on-Pay” vote in 2019, which our Human Resources Committee considers to be among the most important items of feedback about our compensation programs. We recognize and reward our executive officers through compensation arrangements that directly link their pay to the Company’s performance, and we ensure a strong alignment of interests with our shareholders by including a significant amount of equity in the overall mix of pay. Our pay mix includes base salary, an annual incentive cash bonus plan (“Incentive Plan”), and a long-term incentive plan (“LTIP”) under which we grant time-based and performance-based restricted stock units (“RSUs”).

Fiscal 2019 Target Compensation Mix

|  |

| 2020 Proxy Statement | 5 |

Key Features of Our Executive Compensation Program

| Executive Incentive Plan awards are capped at 200% of target. |

| Fifty percent of long-term incentive compensation is performance-contingent. |

| We have in place a clawback policy that provides for the repayment or forfeiture of all incentive-based compensation in certain circumstances. |

| Executives and directors are subject to stock ownership guidelines and retention requirements. |

| Our change in control severance arrangements do not exceed three times the sum of a named executive officer’s base salary and their most recent annual award of incentive compensation. |

| Our change in control severance arrangements are triggered only by an involuntary job loss or substantial diminution of duties. |

| We have no employment agreements with our officers. |

| We prohibit hedging and pledging of our securities at any time by any employees and directors. |

| There is no single trigger, immediate vesting of outstanding grants of awards under our LTIP upon a change in control. |

| Our change in control severance arrangements do not contain excise taxgross-up payments. |

| We have no excessive perquisites for executives. |

| We pay dividends on performance-contingent stock awards when vesting is complete and then only if performance targets are met. |

| 6 | ATMOS ENERGY |

CORPORATE GOVERNANCE AND OTHER BOARD MATTERS

Our Corporate Governance Guidelines and the listing requirements of the New York Stock Exchange (“NYSE”) each require that a majority of the Board be comprised of “independent” directors, as defined from time to time by law, NYSE standards, and any specific requirements established by the Board. A director may be determined to be independent only if the Board has determined that he or she has no material relationship with the Company, either directly or as a partner, shareholder, or officer of the Company. To assist it in making its determination of the independence of each of itsnon-employee members, the Board has adopted its Categorical Standards of Director Independence (“Standards”). The Standards specify the criteria by which the independence of ournon-employee directors will be determined and the types of relationships the Board has determined to be categorically immaterial, including relationships of such directors and their immediate families with respect to past employment or affiliation with the Company, our management or our independent registered public accounting firm. The Standards and our Guidelines are posted on our website at www.atmosenergy.com/esg/corporate-governance.

The Nominating Committee considers all relevant facts and circumstances in evaluating the independence of directors, including without limitation, written responses to submitted questionnaires completed annually by each of our directors. On the basis of this information, the Nominating Committee advised the full Board of its conclusions regarding director independence. After considering the committee’s recommendation, the Board affirmatively determined that each of the Company’s directors other than Mr. Akers, Mr. Cocklin, and Mr. Springer is independent in accordance with applicable NYSE and Securities and Exchange Commission (“SEC”) independence rules and requirements and the standards described above. The Board determined that Mr. Akers is not independent because he is the President and Chief Executive Officer of the Company; that Mr. Cocklin is not independent because he is the Executive Chairman of the Company; and that Mr. Springer is not independent because hisson-in-law is a partner with the firm of E&Y, our independent registered public accounting firm. Mr. Springer’sson-in-law is not involved in our audit and is not considered a “covered person” with respect to us, as defined under the SEC’s independence-related rules and regulations for auditors. Thus, this relationship has no effect on E&Y’s independence as our independent registered public accounting firm.

The Company’s Corporate Governance Guidelines provide that our Board has the right to exercise its discretion to either separate or combine the offices of the Chairman of the Board and the CEO. This decision is based upon the Board’s determination of what is in the best interests of the Company and its shareholders, in light of the circumstances and taking into consideration succession planning, skills and experience of the individuals filling those positions and other relevant factors. The current leadership structure is based on the experienced leadership provided by an Executive Chairman of the Board (currently Mr. Cocklin) and a full-time President and CEO (currently Mr. Akers), with both positions being subject to oversight and review by the Company’s independent directors. The Board recognizes that if the circumstances change in the future, other leadership structures might also be appropriate and it has the discretion to revisit this determination of the Company’s leadership structure.

The Board’s leadership structure is designed so that independent directors exercise oversight of the Company’s management and key issues related to strategy and risk. Only independent directors serve on our Audit Committee, Human Resources Committee (“HR Committee”) and Nominating and Corporate Governance Committee (“Nominating Committee”), and all standing Board committees are chaired by independent directors. Additionally, independent directors regularly hold executive sessions of the Board led by the Lead Director (defined below) outside the presence of the Executive Chairman, the President and CEO or any other Company employee, and they generally meet in a private session with the Executive Chairman and the President and CEO at regularly scheduled Board meetings.

| 2020 Proxy Statement | 7 |

Each year, the independent directors of the Board select an independent director to serve as a lead director (the “Lead Director”). The Lead Director is expected to consult with the chairs of the appropriate Board committees and solicit their participation. The Lead Director also has the authority to call meetings of the independent directors as well as thenon-management directors; and if requested by major shareholders, will ensure that he or she is available for consultation and direct communication. In 2019, the independent directors of the Board designated Mr. Richard K. Gordon as the Lead Director.

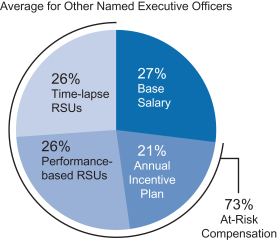

Risk Management and Oversight Framework

The Board is actively involved in the oversight of risks that could affect the Company. This oversight is conducted primarily through committees of the Board pursuant to the charters of each committee, as described in the summaries of each of the committees beginning on page 10. The full Board has retained responsibility for oversight of strategic risks. The Board satisfies this responsibility through reports by each committee chair regarding the committee’s consideration and actions, as well as through regular reports directly from officers responsible for management of particular risks within the Company.

| 8 | ATMOS ENERGY |

While the Board and its committees have responsibility for general risk oversight, Company management is charged with managing risk. Through the Company’s Risk Management and Compliance Committee, the Company has a robust strategic planning and enterprise risk management process that facilitates the identification and management of risks. Our enterprise risk management program is supported by regular internal audits and audits by our independent public accounting firm. KPMG LLP (“KPMG”), which serves as the Company’s internal auditor, presents to the Audit Committee at its regularly scheduled quarterly meetings on its internal audit activities, including the audit activities performed the previous quarter, which address the key business risks identified by the Audit Committee, including evaluations and assessments of internal controls and procedures.

Corporate Governance Guidelines

In accordance with, and pursuant to, the corporate governance standards of the NYSE, the Board has adopted and periodically updates our Corporate Governance Guidelines, which govern the structure and proceedings of the Board and contain the Board’s position on many governance issues. The Corporate Governance Guidelines are available on our website at www.atmosenergy.com/esg/corporate-governance.

| 2020 Proxy Statement | 9 |

Committees of the Board of Directors

Atmos Energy’s Board committee structure is organized around key strategic issues to facilitate oversight of management. Committee chairs regularly coordinate with one another to ensure appropriate information sharing. To further facilitate information sharing, all committees provide a summary of significant actions to the full Board. As required under our Corporate Governance Guidelines, each standing committee conducts an annual self-assessment and review of its charter.

AUDIT COMMITTEE

Richard A. Sampson (Chair) Kelly H. Compton Rafael G. Garza Robert C. Grable Nancy K. Quinn Richard Ware II

Meetings Held in Fiscal 2019: 4 |

The Audit Committee oversees our accounting and financial reporting processes and procedures, reviews the scope and procedures of the internal audit function, appoints our independent registered public accounting firm and is responsible for the oversight of its work and the review of the results of its independent audits. The Audit Committee charter is available on our website at www.atmosenergy.com/esg/corporate-governance.

The Board has determined that each member of the Audit Committee satisfies the independence requirements of the NYSE and SEC applicable to members of an audit committee.

All members arefinancially literate within the meaning of stock exchange listing rules.

The Board has determined that the following individuals are each anaudit committee financial expert, as defined by the SEC: Mr. Garza, Ms. Quinn, Mr. Sampson, and Mr. Ware. | |

HUMAN RESOURCES COMMITTEE

Nancy K. Quinn (Chair) Kelly H. Compton Richard K. Gordon Richard A. Sampson Diana J. Walters

Meetings Held in Fiscal 2019: 4 |

The Human Resources Committee reviews and makes recommendations to the Board regarding executive compensation policy and strategy, and specific compensation recommendations for the Executive Chairman, the President and CEO, as well as our other officers. In addition, the committee determines, develops and makes recommendations to the Board regarding severance agreements, succession planning and other related matters concerning our Executive Chairman, the President and CEO, as well as other officers. This committee also administers our LTIP and our Incentive Plan. The Human Resources Committee charter is available on our website at www.atmosenergy.com/esg/corporate-governance.

The Board has determined that each member of the committee satisfies the independence requirements of the NYSE and SEC applicable to members of a compensation committee. | |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE

Robert C. Grable (Chair) Sean Donohue Rafael G. Garza Richard K. Gordon Richard Ware II

Meetings Held in Fiscal 2019: 2 |

The Nominating and Corporate Governance Committee makes recommendations to the Board regarding the nominees for director to be submitted to our shareholders for election at each annual meeting of shareholders, selects candidates for consideration by the full Board to fill any vacancies on the Board which may occur from time to time and oversees all of our corporate governance matters. The Nominating and Corporate Governance Committee charter is available on our website at www.atmosenergy.com/esg/corporate-governance.

The Board has determined that each member of the committee satisfies the independence requirements of the NYSE and SEC. | |

| 10 | ATMOS ENERGY |

CORPORATE RESPONSIBILITY, SUSTAINABILITY, & SAFETY COMMITTEE

Richard K. Gordon (Chair) Robert W. Best Sean Donohue Nancy K. Quinn Stephen R. Springer Diana J. Walters

Meetings Held in Fiscal 2019: 2 |

The Corporate Responsibility, Sustainability, & Safety Committee oversees matters relating to responsibility, sustainability, and the Company’s vision, values, culture, and diversity. The Committee also assists management in setting strategy, establishing goals and integrating responsibility and sustainability into strategic and tactical business activities across the Company to create long-term shareholder value. The Corporate Responsibility, Sustainability, & Safety Committee charter is available on our website at www.atmosenergy.com/esg/corporate-governance. | |

EXECUTIVE COMMITTEE

Richard K. Gordon (Chair) Robert C. Grable Nancy K. Quinn Richard A. Sampson

Meetings Held in Fiscal 2019: 0 |

The Executive Committee has, and may exercise, all of the powers of the Board of Directors during the intervals between the Board’s meetings, subject to certain limitations and restrictions as set forth in the bylaws or as may be established by resolution of the Board from time to time. The Executive Committee charter is available on our website at www.atmosenergy.com/esg/corporate-governance. |

Board and Committee Meetings in 2019

In fiscal 2019, each of the directors attended at least 75% of the total meetings of the Board and the Committees on which he or she served. In addition, we strongly support and encourage each member of our Board to attend our annual meeting of shareholders. All members of the Board attended our annual meeting of shareholders in person on February 6, 2019.

The Board is actively engaged and involved in succession planning. This includes a detailed discussion of the Company’s leadership and succession plans with a focus on key positions at the senior officer level. As part of these activities, the Board engages in a robust CEO succession planning process, including reviewing development plans for potential CEO candidates and engaging with potential successors at board meetings and in less formal settings to allow directors to personally assess candidates.

| 2020 Proxy Statement | 11 |

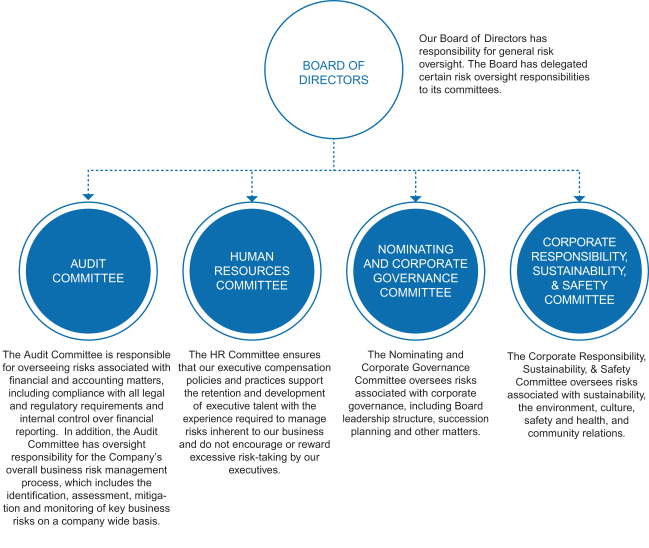

We believe that maintaining an active dialogue with our shareholders is important to our commitment to deliver sustainable, long-term value to our shareholders. We engage with shareholders on a variety of topics throughout the year to ensure we are addressing questions and concerns, to seek input, and to provide perspective on our policies and practices. We also engage with proxy and other advisory firms that represent the interests of various shareholders. Shareholder feedback is regularly reviewed and considered by the Board and is reflected in adjustments or enhancements to our policies and practices. We remain committed to investing time with our shareholders to maintain transparency and to better understand their views on key issues.

Corporate Responsibility and Sustainability

Operating our business safely, ethically, and transparently, and meeting our responsibilities to the environment, to our employees, and to the communities in which we operate and live, are among our highest priorities. To learn more about our corporate responsibility and sustainability efforts, see our 2019 Corporate Responsibility and Sustainability Report on our website at www.atmosenergy.com/esg/reports.

The Board has also adopted and periodically updates the Code of Conduct for our directors and employees. The Code of Conduct provides guidance to the Board and management in areas of ethical business conduct and risk, and provides guidance to employees and directors by helping them to recognize and deal with ethical issues including, but not limited to (i) conflicts of interest, (ii) gifts and entertainment, (iii) confidential information, (iv) fair dealing, (v) protection of corporate assets and (vi) compliance with rules and regulations. We have provided to our directors, employees, customers, and any other member of the public a toll-free compliance helpline and website by which they may report on an anonymous basis any suggestions, recommendations, questions, observations of unethical behavior, or any suspected violations of our Code of Conduct. A copy of the Code of Conduct may be found at www.atmosenergy.com/esg/corporate-governance.

Executive and Director Share Ownership Requirements

We have share ownership guidelines for our named executive officers and directors that require each named executive officer and director to hold a multiple of his or her base salary (or annual retainer) in shares of Company stock. The HR Committee believes that executive share ownership promotes better alignment of the interests of our

| 12 | ATMOS ENERGY |

named executive officers with those of our shareholders, and it monitors compliance with the ownership guidelines each year. Minimum ownership levels are as follows:

Position | Holding Requirement | |

Executive Chairman | 5X base salary value | |

President and CEO | 5X base salary value | |

Other Named Executive Officers | 3X base salary value | |

Non-Employee Directors | 5X annual retainer | |

Ownership Sources Included | ||

● Direct or indirect ownership of common stock ● Unvested time-lapse RSUs ● Share units held under our Directors Plan (defined on page 25) and the LTIP

| ||

Our Board has adopted an incentive compensation clawback policy to help ensure that incentive compensation is paid based on accurate financial and operating data, and the correct calculation of performance against incentive targets. Our policy addresses recoupment of amounts from performance-based awards paid to employees under the Incentive Plan and LTIP to the extent that they would have been materially less due to inaccurate financial statements, fraud, or intentional, willful or gross misconduct.

Anti-Hedging and Pledging Policy

Our Insider Trading Policy prohibits our directors and employees (including officers) from engaging in transactions that hedge or offset, or are designed to hedge or offset any decrease in the market value of Company stock including engaging in short sales or trading in options, puts, calls, or other derivative instruments related to Company stock or debt. The policy also prohibits directors and executive officers from pledging Company stock, borrowing against an account in which our common stock is held, or trading Company stock on margin.

Related Party Transactions Review and Approval Policy

The Board recognizes that related party transactions can present a heightened risk of potential or actual conflicts of interest and may create the appearance that Company decisions are based on considerations other than the best interests of the Company and its shareholders. As a result, the Board prefers to avoid related party transactions, while also recognizing that there are situations where related party transactions may be in the best interests of or may not be inconsistent with the best interests of the Company and its shareholders. The Board has adopted and periodically reviews written guidelines with respect to related party transactions delegated to the Nominating Committee the responsibility to review and, if not adverse to the Company’s best interests, approve, related party transactions.

A related party transaction is any transaction (or series of related transactions) involving the Company and in which the amount involved exceeds $120,000 and a related person has a direct or indirect material interest. A “related person” is:

| • | A director or executive officer of the Company; |

| • | A shareholder who beneficially owns more than 5% of the Company’s stock or any immediate family member of such shareholder; |

| • | An immediate family member of any of the Company’s directors or executive officers; or |

| • | A company or charitable organization or entity in which any of these persons has a role similar to that of an officer or general partner or beneficially owns 10% or more of the entity. |

| 2020 Proxy Statement | 13 |

Under the guidelines, all named executive officers, directors and director nominees are required to identify, to the best of their knowledge after reasonable inquiry, business and financial affiliations involving themselves or their immediate family members, which could reasonably be expected to give rise to a related person transaction. Named executive officers, directors and director nominees are required to advise the Corporate Secretary promptly of any change in the information provided and are asked periodically to review and reaffirm this information.

In accordance with the guidelines, the Nominating Committee reviews the material facts of all related person transactions and either approves or disapproves of the entry into any such transaction. However, if advance committee approval of a related person transaction is not feasible, then it shall be considered and, if the committee determines it to be appropriate, ratified at the committee’s next regularly scheduled meeting.

The Nominating Committee has considered and adopted standing pre-approvals under the guidelines for limited types of transactions that meet specific criteria. Such pre-approved transactions are limited to:

| ● | certain transactions in the ordinary course of business with an entity for which a related person serves as an employee or director, provided the aggregate amount involved in any such transactions during any particular fiscal year does not exceed the greater of (a) $1 million or (b) two percent (2%) of the entity’s gross revenues for the most recently completed fiscal year; |

| ● | certain charitable contributions made to a foundation, university or other charitable organization for which a related person serves as an employee or a director, provided the aggregate amount of contributions during any particular fiscal year does not exceed the greater of (a) $500,000 or (b) two percent (2%) of the charitable organization’s annual receipts for its most recently completed fiscal year; |

| ● | employment by the Company of a family member of a named executive officer, provided the named executive officer does not participate in decisions regarding the hiring, performance evaluation or compensation of the family member; and |

| ● | payments under the Company’s employee benefit plans and other programs that are available generally to the Company’s employees. |

Mr. Cocklin and Mr. Best each have ason-in-law employed by the Company in anon-executive officer position whose total compensation exceeds the SEC’s reporting threshold of $120,000 per fiscal year. Kevin Freel, Mr. Cocklin’s son-in-law, received $147,482 in total compensation for fiscal 2019. Robert Cook, Mr. Best’s son-in-law, received $279,838 in total compensation for fiscal 2019.

State Street is a beneficial owner of more than five percent (5%) of the Company’s common stock outstanding as of the record date of December 13, 2019. During fiscal 2019, State Street (i) acted as trustee of several benefits plans and trusts; (ii) provided fiduciary services for a benefits plan; and (iii) provided retiree benefit payment processing services for several benefits plans and trusts, for which the Company paid a total of approximately $200,000 in fees. For the Master Trust, State Street (i) acted as trustee; (ii) provided fiduciary services for a benefits plan; (iii) provided retiree benefit processing services for a benefit plan whose assets are held in the Master Trust; and (iv) provided investment management services relating to assets held in the Master Trust. For such services, the Master Trust paid a total of approximately $220,000 in fees during fiscal 2019. All such services provided to the Company and the Master Trust were made in the ordinary course of business and on substantially the same terms as other comparable transactions with third parties.

| 14 | ATMOS ENERGY |

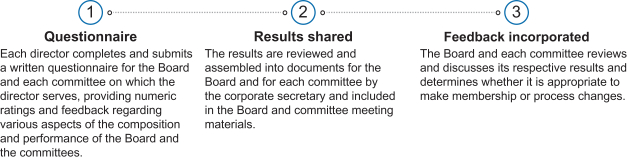

The Board is committed to assessing its own performance as a board in order to identify its strengths as well as areas in which it may improve its performance. The self-evaluation process, which is established by the Nominating Committee, involves the completion of annual written questionnaires of the Board and its committees, review and discussion of the results of the evaluations by both the committee and full board, and consideration of action plans to address any issues.

Identifying and Evaluating Nominees for Directors

The Nominating Committee uses a variety of methods for identifying and evaluating nominees for director. In the event vacancies are anticipated, or arise, the Nominating Committee considers various potential candidates for director, considering the skill areas and characteristics discussed above and qualifications of the individual candidate. The Nominating Committee will consider candidates that come to their attention through current board members, professional search firms, shareholders, or other persons. The Nominating Committee may interview potential candidates to further assess the qualifications possessed by the candidates and their ability to serve as a director. The Committee then determines the best qualified candidates based on the established criteria and recommends those candidates to the Board for election at the next annual meeting of shareholders.

If a shareholder wishes to nominate a candidate for election to the Board at the annual meeting, he or she should write to the Corporate Secretary, Atmos Energy Corporation, 1800 Three Lincoln Centre, 5430 LBJ Freeway, Dallas, Texas 75240, no later than the close of business on January 14, 2020, the 25th day following the day on which notice of the meeting is to be sent, December 20, 2019. Such notice should set forth (i) the name and address of the shareholder who intends to make the nomination and of the person or persons to be nominated; (ii) the class and number of shares of stock held of record, owned beneficially and represented by proxy by such shareholder as of the record date for the meeting (December 13, 2019) and of the date of such notice; (iii) a representation that the shareholder is a record holder of the Company’s stock entitled to vote at the meeting and that the shareholder intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (iv) a description of all arrangements or understandings between such shareholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by such shareholder; (v) such other information regarding each nominee proposed by such shareholder as would be required to be disclosed in solicitations for proxies for election of directors pursuant to the proxy rules of the Securities and Exchange Commission; and (vi) the consent of each nominee to serve as director of the Company if so elected. The chairman of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.

| 2020 Proxy Statement | 15 |

Communications to the Board, any Board committee, the independent directors, or any individual director (including the Lead Director) may be sent to the Board of Directors, Atmos Energy Corporation, P.O. Box 650205, Dallas, Texas 75265-0205. Communications may also be sent by email toboardofdirectors@atmosenergy.com. If you wish to contact the Lead Director or the independent directors on an anonymous and confidential basis, you may do so by contacting the Company’s Compliance Helpline at 1-866-543-4065 orhttps://www.compliance-helpline.com/welcomeAtmosEnergy.jsp.

| 16 | ATMOS ENERGY |

PROPOSAL ONE—ELECTION OF DIRECTORS

The Board is nominating the 13 individuals below to continue serving as directors and whoseone-year terms will expire in 2021. All nominees were recommended for nomination by the Nominating Committee.The names, ages, biographical summaries and qualifications of the persons who have been nominated to serve as our directors are set forth under “Nominees for Director,” beginning on page 18. Each of the nominees has consented to be a nominee and to serve as a director if elected.

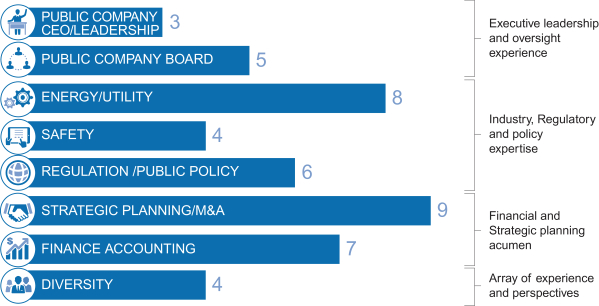

Nominees for director must possess, at a minimum, the level of education, experience, sophistication and expertise required to perform the duties of a member of the board of directors of a public company of our size and scope. Once a person is nominated, the committee will assess the qualifications of the nominee, including an evaluation of his or her judgment and skills. The Board has adopted guidelines outlining the qualifications sought when consideringnon-employee director nominees, which are discussed in our Corporate Governance Guidelines on our website at www.atmosenergy.com/esg/corporate-governance.

Based on the Corporate Governance Guidelines, the specific qualifications and skills the Board seeks across its membership to achieve a balance of experiences important to the Company include, but are not limited to, outstanding achievement in personal careers; prior board experience; wisdom, integrity and ability to make independent, analytical inquiries; understanding of our business environment and a willingness to devote adequate time to Board duties. Other required specific qualifications and skills include a basic understanding of principal operational and financial objectives, and plans and strategies of a corporation or organization of our stature; results of operations and financial condition of an organization and of any significant subsidiaries or business segments and a relative understanding of an organization and its business segments in relation to its competitors.

The Board is committed to diversified membership and does not discriminate based on race, color, national origin, gender, religion or disability in selecting nominees. The Board and the Nominating Committee believe it is important that our directors represent diverse viewpoints and backgrounds. Our Corporate Governance Guidelines provide that the Nominating Committee shall evaluate each director’s continued service on the Board, at least annually, by considering the appropriate skills and characteristics of members of the Board in the context of the then current makeup of the Board. This assessment includes the following factors: diversity (including diversity of skills, background and experience); age; business or professional background; financial literacy and expertise; availability and commitment; independence and other criteria that the committee or the full Board finds to be relevant. It is also the practice of the committee to consider these factors when screening and evaluating candidates for nomination to the Board.

| 2020 Proxy Statement | 17 |

Director Nominees’ Skills and Experience

Each of the following current directors has been nominated to serve an additionalone-year term on the Board of Directors with such term expiring in 2021.

J. Kevin Akers

| ||

Director since 2019

Age:56

| President and Chief Executive Officer since October 1, 2019; formerly Executive Vice President from November 2018 through September 2019; Senior Vice President, Safety and Enterprise Services from January 2017 through November 2018; President of theKentucky/Mid-States Division of the Company from May 2007 through December 2016; and President of the Company’s Mississippi Division from 2002 to 2007

Qualifications: Mr. Akers has more than 30 years’ experience in the natural gas industry, including 28 with the Company. Over the course of his career, he has gained extensive management and operational experience. Such experience and management skills, as well as his demonstration of those attributes discussed in the “Qualifications for Directors” section, has led the Board to nominate Mr. Akers to continue serving as a director of Atmos Energy.

| |

| 18 | ATMOS ENERGY |

Robert W. Best

| ||

Director since1997

Age:73

| Formerly Chairman of the Board of Atmos Energy from April 2013 through September 2017 and Executive Chairman of the Board of Atmos Energy from October 2010 through March 2013

Board Committees: Corporate Responsibility, Sustainability, & Safety

Qualifications: Mr. Best led the senior management team of Atmos Energy from March 1997 until his retirement as the Executive Chairman in April 2013. Prior to joining Atmos Energy, Mr. Best had an extensive background in the natural gas industry, especially in the interstate pipeline, gas marketing and gas distribution segments of the industry, while serving in leadership roles at Consolidated Natural Gas Company, Transco Energy Company and Texas Gas Transmission Corporation during his almost40-year career. Mr. Best also has outside board experience as a member of the boards of Associated Electric & Gas Insurance Services Limited and the Gas Technology Institute, with leadership experience as chairman of the boards of Atmos Energy, the American Gas Association, the Southern Gas Association and the Dallas Regional Chamber of Commerce.

Mr. Best’s knowledge and expertise in the energy industry and leadership abilities developed while with Atmos Energy, other energy companies and industry associations, as well as his demonstration of those attributes discussed in the “Qualifications for Directors” section, has led the Board to nominate Mr. Best to continue serving as a director of Atmos Energy.

| |

Kim R. Cocklin

| ||

Director since2009

Age:68

| Executive Chairman of the Board since October 1, 2017; formerly Chief Executive Officer of Atmos Energy from October 2015 through September 2017 and President and Chief Executive Officer of Atmos Energy from October 2010 through September 2015

Qualifications: Mr. Cocklin was appointed as Executive Chairman of the Board, effective October 1, 2017, after having served as Chief Executive Officer or President and Chief Executive Officer from October 2010 through September 2017. Mr. Cocklin has served on the Company’s senior management team since June 2006, having served as President and Chief Operating Officer from October 2008 through September 2010, Senior Vice President, Regulated Operations from October 2006 through September 2008 and Senior Vice President from June 2006 through September 2006. Mr. Cocklin has over 35 years of experience in the natural gas industry, most of that serving in senior management positions at Atmos Energy, Piedmont Natural Gas Company and The Williams Companies. Mr. Cocklin has a strong background in the natural gas industry, including interstate pipeline companies, local distribution companies and gas treatment facilities. He also has extensive experience in rates and regulatory matters, business development and Sarbanes-Oxley compliance matters. In addition, Mr. Cocklin has held leadership roles within leading natural gas industry associations, including the Southern Gas Association and the American Gas Association.

Due to his professional experience in the energy industry and leadership roles with Atmos Energy, other energy companies and industry associations, as well as possessing those attributes discussed in the “Qualifications for Directors” section, the Board has nominated Mr. Cocklin to continue serving as a director of Atmos Energy.

| |

| 2020 Proxy Statement | 19 |

Kelly H. Compton

| ||

Director since2016

Age:62

| Executive Director of The Hoglund Foundation in Dallas, Texas since 1992

Board Committees: Audit and Human Resources

Qualifications: Ms. Compton has been a philanthropic leader for over 30 years with The Hoglund Foundation, which partners with education and family support agencies in Dallas, Texas. Prior to managing operations for The Hoglund Foundation, Ms. Compton served as Vice President of Commercial Lending for NationsBank Texas and its predecessors for 13 years. Her responsibilities included loan production and administration for large national corporations as well as middle market companies in the Dallas area. Ms. Compton also currently serves on the Board of Trustees for the Southern Methodist University and the Board of Trustees for The Perot Museum of Nature and Science.

As a result of Ms. Compton’s leadership abilities and experience in public and private finance, development and strategic matters, in addition to displaying those attributes discussed in the “Qualifications for Directors” section, the Board has nominated Ms. Compton to continue serving as a director of Atmos Energy.

| |

Sean Donohue

| ||

Director since2018

Age:58

| Chief Executive Officer of Dallas Fort Worth International Airport since 2013

Board Committees: Nominating and Corporate Governance and Corporate Responsibility, Sustainability, & Safety

Qualifications: In his role as Chief Executive Officer of Dallas Fort Worth International Airport (the “Airport”), Mr. Donohue is responsible for the management, operation and future strategy and development of the Airport. Mr. Donohue joined the Airport following a28-year career in the airline industry. Prior to his arrival at the Airport, Mr. Donohue served for three years as the Chief Operating Officer for Virgin Australia Airlines, where he ledday-to-day operations for Australia’s second largest air carrier. Prior to that, Mr. Donohue served for 25 years with United Airlines in a variety of executive roles that included operations, sales and commercial startups.

As a result of Mr. Donohue’s leadership abilities and experience in strategy and development matters, in addition to displaying those attributes discussed in the “Qualifications for Directors” section, the Board has nominated Mr. Donohue to continue serving as a director of Atmos Energy.

| |

| 20 | ATMOS ENERGY |

Rafael G. Garza

| ||

Director since2016

Age:59

| President and Founder of RGG Capital Partners, LLC in Ft. Worth, Texas since 2000, andCo-Founder and Managing Director of Bravo Equity Partners, LP

Board Committees: Audit and Nominating and Corporate Governance

Qualifications: For Bravo Equity Partners and RGG Capital Partners, LLC, private investment companies, Mr. Garza has been responsible for managing various portfolio companies with a particular focus on the U.S. and Mexico. Prior to working with Bravo Equity Partners, Mr. Garza held numerous senior leadership positions with E&Y’s Audit and Advisory and Corporate Finance divisions. Mr. Garza also has served as a leader on the boards of severalnon-profit organizations, including Texas Christian University, the Modern Art Museum of Fort Worth and Baylor Scott & White Holdings.

Mr. Garza’sin-depth experience with financial management and strategic planning, his leadership abilities and his display of the attributes discussed in the “Qualifications for Directors” section have resulted in the Board’s nomination of Mr. Garza to continue serving as a director of Atmos Energy.

| |

Richard K. Gordon

| ||

Director since2001

Age:70

| General Partner of Juniper Capital LP in Houston, Texas since March 2003; General Partner of Juniper Energy LP in Houston, Texas since August 2006; General Partner of Juniper Capital II in Houston, Texas since September 2014; and General Partner of Juniper Capital III in Houston, Texas since November 2017

Board Committees: Human Resources, Nominating and Corporate Governance, Executive (Chair), Corporate Responsibility, Sustainability, & Safety (Chair)

Other Public Company Boards: ExoStat Medical, Inc.

Qualifications: For private equity funds Juniper Capital LP, Juniper Energy LP, Juniper Capital II and Juniper Capital III, Mr. Gordon has been responsible for managing various portfolios that collectively include power generation, mineral, oil and gas, natural gas gathering and oilfield services assets. Prior to working with Juniper Capital, Juniper Energy, Juniper Capital II and Juniper Capital III, Mr. Gordon spent 29 years working with such financial services firms as Dillon, Read & Co., The First Boston Corporation and Merrill Lynch & Co. At such firms, Mr. Gordon was responsible for investment banking activities related to energy and power companies, including natural gas distribution companies.

Based upon his extensive business experience in investment banking and the energy industry, hisin-depth leadership experience as the Lead Director of the Company and as the former Chair of the HR Committee and as a member of the board of ExoStat Medical, Inc., as well as possessing those attributes discussed in the “Qualifications for Directors” section, the Board has nominated Mr. Gordon to continue serving as a director of Atmos Energy.

| |

| 2020 Proxy Statement | 21 |

Robert C. Grable

| ||

Director since2009

Age:73

| Founding Partner, Kelly Hart & Hallman LLP in Fort Worth, Texas since April 1979

Board Committees: Audit, Nominating and Corporate Governance (Chair), and Executive

Qualifications: Mr. Grable possesses advanced leadership skills developed as a partner and one of seven founders of Kelly Hart & Hallman LLP, a large regional law firm. Mr. Grable has extensive experience in representing companies in the oil and gas industry, having represented oil and gas producers, pipelines and utilities in transactions, regulatory matters and litigation, for over 40 years. Mr. Grable also has outside board experience as a Trustee of the University of Texas Law School Foundation and as an advisory board member for the local division of a global financial services firm. Mr. Grable is also a member of the McDonald Observatory and Astronomy Board of Visitors at the University of Texas at Austin.

As a result of his extensive legal experience with clients in the energy industry and leadership experience with boards offor-profit andnon-profit organizations, as well as possessing those attributes discussed in the “Qualifications for Directors” section, the Board has nominated Mr. Grable to continue serving as a director of Atmos Energy.

| |

Nancy K. Quinn

| ||

Director since2004

Age:66

| Independent energy consultant since July 1996; currently a director and chair of the audit committee of Helix Energy Solutions Group, Inc., a New York Stock Exchange company

Board Committees: Audit, Human Resources (Chair), Corporate Responsibility, Sustainability, & Safety, and Executive

Other Public Company Boards: Helix Energy Solutions Group, Inc.

Qualifications: Ms. Quinn provides senior financial and strategic advice, primarily to clients in the energy and natural resources industries. Prior to 2000, Ms. Quinn also held a senior advisory role with the Beacon Group, focusing on energy industry private equity opportunities and merger and acquisition transactions. Ms. Quinn gained extensive experience in independent exploration and production, as well as in diversified natural gas and oilfield service sectors, while holding leadership positions at PaineWebber Incorporated and Kidder, Peabody & Co. Incorporated. Ms. Quinn has extensive corporate governance leadership experience as Chair of the HR Committee as well as the former Lead Director and Chair of the Audit Committee of Atmos Energy, and as a member of the board and chair of the audit committee of Helix Energy Solutions Group. Ms. Quinn was also previously a member of the boards of Louis Dreyfus Natural Gas Corp. and DeepTech International Inc.

The Board has nominated Ms. Quinn, based upon her considerable experience in the natural gas industry, her demonstrated leadership abilities as a board leader in several public companies and her exhibition of those attributes discussed in the “Qualifications for Directors” section, to continue serving as a director of Atmos Energy.

| |

| 22 | ATMOS ENERGY |

Richard A. Sampson

| ||

Director since2012

Age:69

| General Partner and Founder of RS Core Capital, LLC, a registered investment advisory firm in Denver, Colorado since January 2013; formerly Managing Director and Client Adviser of JPMorgan Chase & Co. in New York, San Francisco and Denver from May 2006 to May 2012.

Board Committees: Audit (Chair), Human Resources, and Executive

Qualifications: Mr. Sampson held numerous senior leadership positions with JPMorgan Chase, a global financial services firm, through which he gained extensive knowledge of portfolio management, investment concepts, strategies and analytical methodologies. Mr. Sampson’s experience of over 30 years in investment management has provided him with an understanding of global and domestic macroeconomics and capital market issues, financial markets, securities and a solid understanding of state and federal laws, regulations and policies.

In addition to his display of the attributes discussed in the “Qualifications for Directors” section, his substantial experience in investment management, his leadership as Chair of the Audit Committee and his knowledge of complex financial transactions, has led the Board to nominate Mr. Sampson to continue serving as a director of Atmos Energy.

| |

Stephen R. Springer

| ||

Director since2005

Age:73

| Formerly Senior Vice President and General Manager, Midstream Division, The Williams Companies, Inc.

Board Committees: Corporate Responsibility, Sustainability, & Safety

Qualifications: Mr. Springer’s professional career includes 32 years of experience in the regulated and nonregulated energy industry, while holding leadership roles at Texas Gas Transmission Corporation, Transco Energy Company and The Williams Companies. Mr. Springer’s knowledge of the natural gas industry is based on his experience in the natural gas transmission, marketing, supply, transportation, business development, distribution and gathering and processing segments of the industry. Mr. Springer has outside board experience as an honorary director on the Indiana University Foundation Board and formerly on the board of DCP Midstream Partners, LP, a New York Stock Exchange company.

The Board has nominated Mr. Springer to continue serving as a director of Atmos Energy in light of his considerable experience in the natural gas industry, his leadership abilities developed while with The Williams Companies and service on the boards of other public companies, andnon-profit institutions, as well as his exhibition of those attributes discussed in the “Qualifications for Directors” section.

| |

| 2020 Proxy Statement | 23 |

Diana J. Walters

| ||

Director since2018

Age:56

| Founder and Managing Member of Amichel, LLC since 2019

Board Committees: Human Resources and Corporate Responsibility, Sustainability, & Safety

Other Public Company Boards: Alta Mesa Resources, Inc., Platinum Group Metals Ltd., Trilogy Metals, Inc.

Qualifications: Ms. Walters has more than 30 years of experience in the natural resources sector, as an equity investor and investment banker, and in other roles within the sector. Ms. Walters is the owner and sole manager of Amichel, LLC, a company that provides advisory services in the field of natural resources. She was the founder of 575 Grant, LLC, a natural resources advisory firm, from 2014 to 2019. She served as the President of Liberty Metals & Mining Holdings, LLC managing direct equity investments in the mining sector and as a member of senior management of Liberty Mutual Asset Management from 2010 to 2014. Ms. Walters has extensive investment experience with both debt and equity through various leadership roles at Credit Suisse, HSBC and other firms. She also served previously as Chief Financial Officer of Tatham Offshore Inc., an independent oil and gas company with assets in the Gulf of Mexico.

As a result of Ms. Walters’ leadership abilities and investments experience, in addition to displaying those attributes discussed in the “Qualifications for Directors” section, the Board has nominated Ms. Walters to continue serving as a director of Atmos Energy.

| |

Richard Ware II

| ||

Director since1994

Age:73

| Chairman of Amarillo National Bank in Amarillo, Texas since May 2014, formerly President of Amarillo National Bank from January 1982 to January 2018

Board Committees: Audit and Nominating and Corporate Governance

Qualifications: Mr. Ware has developed substantial knowledge of the financial services industry during his over45-year career with a nationally recognized banking institution. Mr. Ware has a strong background in assessing and overseeing complex financial matters, as well as leadership experience in supervising principal financial officers and experience on the audit or finance committees of Atmos Energy, Southwest Coca Cola Bottling Company and the board of trustees of Southern Methodist University.

Due to his valuable insight into financial-related matters gained through his extensive banking industry experience and demonstrated leadership, including in his past and present directorships, as well as his demonstration of those attributes discussed in the “Qualifications for Directors” section, the Board has nominated Mr. Ware to continue serving as a director of Atmos Energy.

| |

| The Board of Directors recommends that our shareholders voteFOR each of the nominees named above for election to the Board. |

| 24 | ATMOS ENERGY |

The Board believes that the level ofnon-employee director compensation should be based on Board and committee responsibilities and be competitive with comparable companies. The Board generally targets compensation near the median of our proxy peer group (discussed below). In addition, the Board believes that a significant portion ofnon-employee director compensation should be awarded in the form of equity to align director interests with the long-term interests of shareholders.

In fiscal 2019, our director fees included the following components:

Retainer and Fees | ||

Annual Board Retainer | $100,000 | |

Committee Chair Annual Fees | $15,000 Audit | |

$12,500 Human Resources | ||

$10,000 Nominating & Corporate Governance | ||

$10,000 Corporate Responsibility, Sustainability, & Safety | ||

Lead Director Fee | $25,000 | |

Annual Grant of Share Units | $150,000 | |

The Company provides ournon-employee directors the option to receive all or part of their director fees (in 10% increments) in Atmos Energy common stock through the LTIP. The selected common stock portion of the fee earned in each quarter is issued as soon as possible following the first business day of each quarter. The number of shares issued is equal to the amount of the cash fee that would have been paid to thenon-employee director during a quarter divided by the fair market value (average of the highest and lowest prices as reported on the NYSE Consolidated Tape) on the first business day of such quarter. Only whole numbers of shares of common stock may be issued. Fractional shares are paid in cash. Two of our directors elected this option during fiscal 2019.

All directors are reimbursed for reasonable expenses incurred in connection with attendance at Board and committee meetings. A director who is also an officer or employee receives no compensation for his or her service as a director. We provide business travel accident insurance fornon-employee directors and their spouses. The policy provides $100,000 coverage to directors and $50,000 coverage to their spouses per accident while traveling on Company business.

Eachnon-employee director is also eligible to participate in the Atmos Energy Corporation Equity Incentive and Deferred Compensation Plan forNon-Employee Directors (“Directors Plan”). This plan allows each such director to defer receipt of his or her annual retainer fee or other director fees and to invest such deferred fees in either a cash account or a stock account (in 10% increments). The amount of the fee allocated as a credit to the cash account is converted to a cash balance as of the first business day of each quarter to be credited with interest at a rate equal to 2.5% plus the annual yield reported on a10-year U.S. Treasury Note for the first business day of January for each plan year. Interest on the accumulated balance of the cash account is credited monthly. The amount of the fee allocated as a credit to the stock account is converted to share units. The fee payable for the quarter is converted to a number of whole and, if applicable, fractional share units on the first business day of that quarter. Share units are also

| 2020 Proxy Statement | 25 |

credited with dividend equivalents whenever dividends are declared on shares of the Company’s common stock. Such dividend equivalent credits are converted to whole and, if applicable, fractional share units on the same day on which such dividends are paid. At the time of a participating director’s separation from service, plan benefits paid from the cash account are paid in the form of cash. At this time, plan benefits paid from the stock account are paid in the form of shares of common stock issued, which are equal in number to whole share units in the director’s stock account. Any fractional share units are rounded up to a whole share unit prior to distribution.

Each non-employee director also receives an annual grant of share units under the LTIP each year he or she serves on the Company’s Board of Directors. The grants generally occur on the 30th day following the Company’s annual meeting of shareholders each year and must be held until the director’s separation from service. Such share units accrue dividend equivalents and are settled in the same manner as share units under the Directors Plan. On November 5, 2019, the Board approved a change to the annual grant of share units for Directors. Beginning in January 2020, Directors may elect to receive restricted stock units with a one-year vest period in lieu of share units of the same dollar amount.

The Company’snon-employee director compensation program reflects best practices, as follows:

| ● | Retainer-only compensation with no fees for attending meetings, which is an expected part of board service; |

| ● | Additional retainers for special roles such as lead director and committee chairs to recognize incremental time and effort involved; |

| ● | Equity delivered in the form of full-value shares; and |

| ● | Director stock ownership requirements of five times the annual cash retainer. |

Together with its independent compensation consultant, the HR Committee annually reviews thenon-employee director pay program to ensure it remains competitive.

Summary of Cash and Other Compensation

The following table sets forth all compensation paid to ournon-employee directors for fiscal 2019:

Director Compensation for Fiscal Year 2019(a)

Name | Fees Earned or Paid in Cash ($)(b) | Stock Awards ($)(c) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(d) | All Other Compensation ($)(e) | Total ($) | |||||||||||||||||||||||||

Robert W. Best |

| 100,000 |

| 150,000 |

| — |

| — |

| 250,000 | ||||||||||||||||||||

Kelly H. Compton |

| 100,000 |

| 150,000 |

| — |

| — |

| 250,000 | ||||||||||||||||||||

Sean Donohue |

| 93,750 |

| 150,000 |

| — |

| — |

| 243,750 | ||||||||||||||||||||

Ruben E. Esquivel(f) |

| 35,125 |

| 150,000 |

| 9,559 |

| 57,245 |

| 251,929 | ||||||||||||||||||||

Rafael G. Garza |

| 100,000 |

| 150,000 |

| — |

| — |

| 250,000 | ||||||||||||||||||||

Richard K. Gordon |

| 129,011 |

| 150,000 |

| — |

| — |

| 279,011 | ||||||||||||||||||||

Robert C. Grable |

| 110,000 |

| 150,000 |

| — |

| — |

| 260,000 | ||||||||||||||||||||

Nancy K. Quinn |

| 112,500 |

| 150,000 |

| 4 |

| 5 |

| 262,509 | ||||||||||||||||||||

Richard A. Sampson |

| 115,000 |

| 150,000 |

| — |

| — |

| 265,000 | ||||||||||||||||||||

Stephen R. Springer |

| 100,000 |

| 150,000 |

| — |

| — |

| 250,000 | ||||||||||||||||||||

Diana J. Walters |

| 93,750 |

| 150,000 |

| 169 |

| 269 |

| 244,188 | ||||||||||||||||||||

Richard Ware II |

| 100,000 |

| 150,000 |

| — |

| — |

| 250,000 | ||||||||||||||||||||

| 26 | ATMOS ENERGY |

| (a) | No stock options were awarded to our directors and nonon-equity incentive plan compensation was earned by our directors in fiscal 2019. |

| (b) | Non-employee directors may defer all or a part of their annual cash retainer under our Directors Plan. During fiscal 2019, Mr. Esquivel, Ms. Quinn, Mr. Springer, and Ms. Walters elected to defer a portion of their director fees (a total of $106,375), under such plan, which amounts are included in this column and are described in the table below. Deferred amounts are invested, at the election of the participating director, either in a stock account or a cash account. Mr. Grable elected to forego the receipt in cash of a total of 30% of his director fees ($33,000) and instead received shares of our common stock under our LTIP in fiscal 2019, while Mr. Ware elected to receive in lieu of cash a total of 70% of his director fees ($70,000) in common stock under our LTIP. These shares do not contain any restrictions and were awarded on the first trading day of the quarter in which such fees were earned based on the fair market value of our stock on that date. As a result of such elections, a total of 337 shares were issued to Mr. Grable and 717 shares to Mr. Ware on the following dates and at the following fair market values during fiscal 2019: (i) October 1, 2018, at a fair market value of $93.40 per share; (ii) January 2, 2019, at a fair market value of $91.02 per share; (iii) April 1, 2019, at a fair market value of $102.25 per share and (iv) July 1, 2019, at a fair market value of $105.01 per share. Fractional shares were paid in cash subsequent to the end of fiscal 2019. |

| (c) | The amounts in this column represent the fair market value on the date of grant, calculated in accordance with FASB ASC Topic 718, of the share units awarded to each of ournon-employee directors (except Mr. Esquivel) under our LTIP for service on the Board in fiscal 2019 on March 8, 2019 at a fair market value of $99.73 per share. As of the last day of fiscal 2019, nonon-employee director held any stock options or unvested stock awards. The amount for Mr. Esquivel was calculated as of the effective date of his retirement, February 6, 2019. |

| (d) | The amounts in this column represent the amount of above-market interest earned during fiscal 2019 on the accumulated amount of Board fees deferred to cash accounts. Interest considered above-market is the incremental rate of interest earned above 120% of the10-year U.S. Treasury Note rate, which is reset on January 1 each year. |