The Company’s By-Laws provide that the entire Board shall be constituted of not less than three and not more than 29 persons, with the actual number serving set by the Board. In connection with the nomination of the persons listed below to the Board of Directors, the Board set the number of directors at 7. The Board recommends that the shareholders elect the seven persons nominated by the Board.

All of the nominees for directors were nominated by the Board and recommended by management.

The following is a description of each of the nominees for director setting forth their ages, their principal occupations and employment during the past five years and their tenure on the Board.

YOSEF A. MAIMAN has been the Chairman of the Board of Ampal since April 25, 2002. Mr. Maiman has been President and Chief Executive Officer of Merhav Mnf. Ltd. (“Merhav”), one of the largest international project development companies based in Israel, since its founding in 1975. Mr. Maiman is also the Chairman of the Board of Directors of Channel Ten, a commercial television station in Israel, the Chairman of the Board of Eltek, Ltd. (“Eltek”), a developer and manufacturer of printed circuit boards, a member of the Board of Directors of the Middle East Task Force of the New York Council on Foreign Relations, Honorary Consul to Israel of Peru and Special Ambassador for the Government of Turkmenistan. Mr. Maiman is also member of the Board of Trustees of the Tel Aviv University, Chairman of the Israeli Board of the Jaffee Center for Strategic Studies at Tel Aviv University, a member of the Board of Governors of Ben Gurion University, and the Chairman of the Board of Trustees of the International Policy Institute for Counter Terrorism.

JACK BIGIO, has been the President and Chief Executive Officer of Ampal since April 25, 2002, and a director of Ampal since March 2002. From 1998 until April 2002, Mr. Bigio held various officer positions at Merhav, most recently as the Senior Vice President — Operations and Finance. Mr. Bigio is also a director of Eltek.

LEO MALAMUD has been a director of Ampal since March 2002. Since 1996, Mr. Malamud was the Senior Vice President of Merhav. Mr. Malamud is also a director of Eltek.

MICHAEL ARNON was Chairman of the Board of Directors of Ampal from November 1990 until July 1994, when he retired. Mr. Arnon has been a director of Ampal since 1986. From July 1986 until November 1990, Mr. Arnon was President and Chief Executive Officer of Ampal.

Dr. JOSEPH YERUSHALMI has been Senior Vice President — Head of Energy and Infrastructure Projects of Merhav since 1995. He has been a director of Ampal since August 16, 2002.

YEHUDA KARNI was a senior partner in the law firm of Firon Karni Sarov & Firon, from 1961 until his retirement in 2000. He has been a director of Ampal since August 16, 2002.

EITAN HABER was the Head of Bureau for the former Prime Minister of Israel, Yitzhak Rabin, from July 1993 until November 1995. Since 1996, Mr. Haber has been the President and Chief Executive Officer of Geopol Ltd., which represents the Korean conglomerate Samsung in Israel and the Middle East; Kavim Ltd., a production and project development company; and Adar Real Estate Ltd., a real estate company. Mr. Haber is also a member of various non-profit organizations. He has been a director of Ampal since August 16, 2002.

Q: What happens if a nominee becomes unavailable for election?

In case any nominee should become unavailable for election to the Board for any reason, which is presently neither known nor contemplated, the persons named in the proxy will have discretionary authority in that instance to vote the proxies for a substitute.

Q: How long will each director serve?

Each director will serve for a term of one year and until his successor shall be elected and qualified.

Q: What type of compensation do directors receive?

Directors of Ampal (other than Mr. Bigio) receive $750 per meeting of the Board attended. The Chairman of the Board receives $2,000 per meeting of the Board attended. Such persons also receive the same amount for attendance at meetings of committees of the Board, provided that such committee meetings are on separate days and on a day other than the day of a regularly scheduled Board meeting.

On August 16, 2002, each of Yehuda Karni, Michael Arnon and Eitan Haber, each of whom is a non-employee director of the Company, were issued 15,000 options under the 2000 Plan to purchase shares of Class A Stock of the Company at an exercise price of $3.12 per share, the closing price of the Class A Stock on The Nasdaq Stock Market, Inc. on the date of issuance. On August 16, 2002, Dr. Joseph Yerushalmi and Leo Malamud, each of whom is a non-employee director of the Company, were issued 100,000 and 150,000 options, respectively, under the 2000 Plan to purchase shares of Class A Stock of the Company at an exercise price of $3.12 per share, the closing price of the Class A Stock on The Nasdaq Stock Market, Inc. on the date of issuance.

Q: Does the Board of Directors have any committees?

Yes. The Board of Directors has the following standing committees: Audit Committee, Executive Committee and Stock Option and Compensation Committee. The Board will elect new members to the committees following the Annual Meeting. For the fiscal year ended December 31, 2002, the members, activities and functions of the various committees are set forth below. In addition, the reports of the Audit Committee and Stock Option and Compensation Committee are also set forth below.

6

Audit Committee

The Audit Committee assists the Board of Directors in fulfilling its responsibility to oversee management’s conduct of the Company’s financial reporting process, including the review of the financial reports and other financial information provided by the Company to any governmental or regulatory body, the public or other users thereof, the Company’s systems of internal accounting and financial controls, and the annual independent audit of the Company’s financial statements. The Audit Committee also has the duty and responsibility of approving all transactions between the Company, on the one hand, and any officer, director, or affiliate thereof, on the other hand, or in which any officer, director or affiliate has a material interest. In accordance with the requirements of the Sarbanes-Oxley Act of 2002, the Audit Committee shall pre-approve all audit, review and attest engagements and permissible non-audited services provided to the Company by the independent auditor of the Company’s financial statements. During the Company’s fiscal year ended December 31, 2002, the Audit Committee was composed of the following board members until August 16, 2002: Michael Arnon, Mr. Hillel Peled and Mr. Eliyahu Wagner. Since August 16, 2002, the members of the Audit Committee are Michael Arnon, Yehuda Karni and Eitan Haber.

The Audit Committee held six meetings during the last fiscal year and did not act by written consent. The Board of Directors has adopted a charter for the Audit Committee, which was filed with the Company’s proxy statement for its annual meeting of shareholders in 2001. All of the members of the Audit Committee are independent directors under the rules of the NASD listing standards currently applicable to the Company.

Report of the Audit Committee

| | To the Board of Directors of Ampal-American Israel Corporation:

We have reviewed and discussed with management the Company’s audited financial statements as of and for the year ended December 31, 2002. |

| | We have discussed with Kesselman & Kesselman the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended. |

| | We have received the written disclosures and the letter from Kesselman & Kesselman required by Independence Standards Board Standard No. 1, Independence Discussions withAudit Committees, as amended, and have discussed with them their independence from the Company and management. |

| | Based on the reviews and discussions referred to above, we recommended to the Board of Directors that the audited financial statements referred to above be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2002. |

| | AUDIT COMMITTEE

Michael Arnon, Chairman

Yehuda Karni

Eitan Haber

|

7

Audit Fees: Fees billed to the Company by Kesselman & Kesselman for auditing the Company’s annual financial statements for the fiscal year ended December 31, 2002 and reviewing the financial statements included in the Company’s quarterly reports on Form 10-Q amounted to $150,000. Fees billed to the Company by Andersen for reviewing the financial statements included in the Company’s quarterly report for the fiscal quarter ended March 31, 2002 amounted to $37,000.

Financial Information Systems Design and Implementation Fees: No services were performed by, or fees incurred to, Kesselman & Kesselman or Andersen in connection with the financial information services design and implementation projects for the fiscal year ended December 31, 2002.

All Other Fees: Additional fees billed to the Company by Kesselman & Kesselman relating to Israeli tax services amounted to $25,000 for the fiscal year ended December 31, 2002. No additional fees were billed for services rendered by Andersen for the fiscal year ended December 31, 2002.

The Audit Committee has considered whether Kesselman & Kesselman’s provision of non-audit services is compatible with maintaining the independent auditors’ independence and has concluded that it is compatible.

Executive Committee

The Executive Committee meets as necessary between regularly scheduled meetings of the Board of Directors and, consistent with certain statutory limitations, exercises all authority of the Board of Directors. During the fiscal year ended December 31, 2002, members of the Executive Committee of the Board of Directors, which had functioned as the compensation committee of Ampal, was composed of the following board members until April 25, 2002: Mr. Daniel Steinmetz, Mr. Hillel Peled and Mr. Raz Steinmetz. Since August 16, 2002, the members of the Executive Committee are Jack Bigio, Leo Malamud, Dr. Joseph Yerushalmi and Yehuda Karni.

The Executive Committee did not meet and did not act by written consent during the fiscal year ended December 31, 2002.

Stock Option and Compensation Committee

The Stock Option and Compensation Committee administers the Company’s stock option plans and other option grants and determines the Company’s policies regarding executive compensation. Since August 16, 2002, the members of the Stock Option and Compensation Committee are Michael Arnon, Yehuda Karni and Eitan Haber. The Stock Option and Compensation Committee met two times and did not act by written consent during the fiscal year ended December 31, 2002.

In addition, Ampal’s Stock Option Committee of the Board of Directors, which administered Ampal’s stock option plans and is the predecessor committee to the Stock Option and Compensation Committee, was composed of the following board members until August 16, 2002: Mr. Michael Arnon, Mr. Hillel Peled and Mr. Eliyahu Wagner. The Stock Option Committee met once during the fiscal year ended December 31, 2002 and did not act by written consent.

8

Report of the Stock Option and Compensation Committee

| | The Stock Option and Compensation Committee’s executive compensation policy strives to provide compensation rewards based upon both corporate and individual performance while maintaining a relatively simple compensation program in order to avoid the administrative costs which the Stock Option and Compensation Committee believes are inherent in multiple complex compensation plans and agreements.

The determination of compensation ranges for executive officers reflect a review of salaries and bonuses for executive officers holding similar positions in companies of relatively comparable size and orientation. However, in making compensation decisions, the Stock Option and Compensation Committee remains cognizant of the Board of Directors’ responsibility to enhance shareholder value. The Stock Option and Compensation Committee utilizes cash bonuses, when it feels a bonus is merited, based on factors such as an executive’s individual performance. The Company has available a long-term incentive for executives to both remain in the employ of the Company and to strive to maximize shareholder value through the 1998 Plan and 2000 Plan, which aligns the interests of executives with those of shareholders.

Determination of Jack Bigio’s compensation as the Company’s Chief Executive Officer for the fiscal year ended December 31, 2002 reflects a comparison with chief executive officer compensation of companies of relatively comparable size and orientation, but also reflects recognition of Mr. Bigio’s ongoing contribution to the growth, success and profitability of the Company. On August 16, 2002, Mr. Bigio was granted 150,000 options pursuant to the 2000 Plan to purchase shares of Class A Stock of the Company at an exercise price of $3.12 per share, the closing price of the Class A Stock on The Nasdaq Stock Market, Inc. on the date of issuance. These options vest in equal installments of 9,375 shares beginning on November 16, 2002 and each three month anniversary thereafter, except that a portion of the options may vest on an accelerated basis upon the achievement of certain performance criteria. In negotiating the number of shares subject to the option grant, the Stock Option and Compensation Committee took into account the past option grants made to other executive officers, Mr. Bigio’s rank and responsibilities and Mr. Bigio’s expected contributions to the Company. In addition, the Compensation Committee sought to provide a significant incentive for Mr. Bigio to enhance stockholder value. Mr. Bigio did not receive an additional option grant during 2002. |

| | STOCK OPTION AND COMPENSATION COMMITTEE

|

| | Michael Arnon, Chairman

Yehuda Karni

Eitan Haber |

9

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Until April 25, 2002, members of the Executive Committee of the Board of Directors, which functioned as the compensation committee of Ampal, included: Mr. Daniel Steinmetz Chairman of the Board of Directors of Ampal; Mr. Hillel Peled; President of Inveco International Inc., and Mr. Raz Steinmetz; Chief Executive Officer and President of Ampal. Additionally, until August 16, 2002, Ampal’s Stock Option Committee of the Board of Directors, which administered Ampal’s stock option plans, was composed of the following board members who also served as members of the Audit Committee of the Board of Directors until August 16, 2002: Mr. Michael Arnon, Mr. Hillel Peled and Mr. Eliyahu Wagner. Since August 16, 2002, the newly formed Stock Option and Compensation Committee functions as both the compensation and stock option committee of Ampal. The members of this Committee include Mr. Michael Arnon, Mr. Yehuda Karni and Mr. Eitan Haber. Since August 16, 2002, the members of the Stock Option and Compensation Committee also serve as members of the Audit Committee of Ampal.

Q: Did all directors attend all of the Board and Committee meetings in 2002?

All directors attended more than 75% of the aggregate of (1) the total number of meetings of the Board of Directors held during the fiscal year ended December 31, 2002 for which such individual was a director and (2) the total number of meetings held by all committees of the Board of Directors on which such individual served in the fiscal year ended December 31, 2002 (during the period of such service). In total, the Board of Directors held eight regularly scheduled meetings during the fiscal year ended December 31, 2002 and acted once by written consent during fiscal 2002.

Q: Who are the Company’s executive officers?

Executive officers are elected annually by the Board of Directors. The persons appointed by the Board of Directors to serve as executive officers are described below. The descriptions of Mr. Maiman, Chairman of the Board of Directors of Ampal, and Mr. Bigio, Chief Executive Officer and President of Ampal, can be found above with the descriptions of the nominees for the Board. The following is a description of the executive officers, other than Messrs. Maiman and Bigio, their ages, their positions and offices with Ampal or its subsidiaries and their principal occupations and employment during the past five years.

SHLOMO SHALEV, 41, has been Senior Vice President — Investments since May 2002. From August 1997 through April 2002, Mr. Shalev was Vice President in Ampal Industries (Israel) Ltd, a wholly owned subsidiary of the Company. From August 1994 through July 1997, Mr. Shalev was the Israeli Consul for Economic Affairs in the northwest region of the United States.

DAFNA SHARIR, 34, has been Senior Vice President — Investments since May 2002. From March 1999 through April 2002, Ms. Sharir was a Director of Mergers and Acquisitions of Amdocs Limited. From July 1998 through February 1999, Ms. Sharir was an international tax consultant at Kost Forer & Gabay, a member of Ernst & Young International.

IRIT ELUZ, 36, has been the Chief Financial Officer, Vice President — Finance and Treasurer since May 2002. From January 2000 through April 2002, Ms. Eluz was the Associate Chief Financial Officer of Merhav. From June 1995 through December 1999, Ms. Eluz was the Chief Financial Officer of Kamor Group.

YORAM FIRON, 34, has been Secretary and Vice President — Investments and Corporate Affairs since May 2002. During the preceding five years, Mr. Firon was a Vice President of Merhav and a partner in the law firm of Firon Karni Sarov & Firon.

AMIT MANTSUR, 33, has been Vice President – Investments since March 2003. From September 2000 through December 2002, Mr. Mantsur served at Alrov Group as Strategy & Business Development Manager. From February 1997 through September 2000, Mr. Mantsur was a projects manager at the Financial Advisory Services of KPMG Somekh Chaikin.

10

GIORA BAR-NIR, 46, has been the Controller since March 2002. During the preceding five years, Mr. Bar-Nir was the Controller of the Israeli subsidiaries of Ampal.

ALLA KANTER, 45, has been Vice President-Accounting since September 1995. Ms. Kanter was the Controller from August 1990 until March 2002.

Q: How are the Company’s executives compensated?

The table below presents information regarding remuneration paid or accrued for services to Ampal and its subsidiaries by the executive officers named below during the three fiscal years ended December 31, 2002, 2001 and 2000.

| | Annual Compensation

| Long-Term

Compensation

| | | |

|---|

Name and Principal

Position

| Year

| Salaries

$ | | Bonus

$ | Other

Annual

Compensation(10)

$ | Awards

Number of

Securities

Underlying

Options(11)

| | All

Other

Compensation(16)

$ | |

|---|

| Yosef A. Maiman(1) | | | | | | | | | |

| Chairman of the Board | 2002 | 324,376 | | - | 15,765 | 250,000 | | 410 | |

| Jack Bigio(2) | | | | | | | | | |

| President and CEO | 2002 | 280,130 | (8) | - | 43,498 | 150,000 | | 40,740 | |

| Nitsan Yanovski(3) | 2002 | 194,975 | | 77,712 | 27,526 | 78,500 | | 98,711 | |

| (Former Vice President - | 2001 | 142,691 | | 75,634 | 17,984 | 20,000 | (15) | 34,329 | |

| Business Development) | 2000 | 132,187 | | 60,000 | 13,048 | 495,000 | (15) | 93,237 | |

| Shlomo Shalev(4) | 2002 | 149,225 | | 63,240 | 27,815 | 90,000 | | 37,279 | |

| Senior Vice President | 2001 | 143,093 | | 61,406 | 17,408 | 20,000 | | 36,137 | |

| Investments | 2000 | 146,873 | | 65,000 | 14,178 | 545,000 | | 39,300 | |

| Alla Kanter(5) | 2002 | 133,598 | | 11,105 | | 78,500 | | 18,757 | |

| (Vice President- | 2001 | 133,538 | | 11,105 | | 15,000 | (14) | 18,138 | |

| Accounting and | 2000 | 126,036 | | 10,476 | | 15,000 | (14) | 17,007 | |

| Controller) |

| Raz Steinmetz(6) | 2002 | 82,993 | | - | 9,792 | | | 189,707 | (9) |

| (Former CEO and President) | 2001 | 318,344 | | 98,459 | 24,859 | 30,000 | (12) | 74,997 | |

| | 2000 | 175,369 | | 49,822 | 20,555 | 655,000 | (12) | 51,644 | |

| Shlomo Meichor(7) | 2002 | 170,525 | | 48,427 | 28,784 | | | 49,514 | |

| (FormerVice | 2001 | 169,567 | | 53,578 | 15,205 | 24,000 | (13) | 51,110 | |

| President-Finance and | 2000 | 156,150 | | 44,056 | 14,849 | 374,000 | (13) | 46,281 | |

| Treasurer) |

11

| | (1) | Mr. Maiman has been employed by Ampal since April 25, 2002 as Chairman of the Board. Mr. Maiman is entitled to receive a base salary of $420,000 (payable in NIS) per annum (plus benefits). |

| | (2) | Mr. Bigio has been employed by Ampal since April 25, 2002 as President and CEO. Mr. Bigio is entitled to receive a base salary of $250,000 (payable in NIS) per annum (plus benefits). |

| | (3) | Mr. Yanovski was appointed Vice President Business Development on May 21, 2002. Mr. Yanovski retired from Ampal on December 31, 2002 (the amounts include salary for an additional three months). |

| | (4) | Mr. Shalev was appointed Senior Vice President of Investments on May 21, 2002. Mr. Shalev is entitled to receive a base salary of $150,000 (payable in NIS) per annum (plus benefits). |

| | (5) | Ms. Kanter has been Vice President – Accounting of Ampal since September 1995 and Controller of Ampal since August 1990. |

| | (6) | Mr. Steinmetz was employed by Ampal from January 1, 1997 until April 25, 2002 and was appointed CEO and President effective July 1, 1999. Mr. Steinmetz was entitled to receive a base salary of $250,000 (payable in NIS) per annum (plus benefits). Mr. Steinmetz resigned from all positions he held in Ampal on April 25, 2002. |

| | (7) | Mr. Meichor had been employed by Ampal since March 1, 1998, and served as Vice President-Finance and Treasurer of Ampal from April 1, 1998 until May 21, 2002. Mr. Meichor receives a base salary of $164,000 per annum, adjusted annually in accordance with the United States Consumer Price Index (payable in NIS) plus benefits and use of a car. Based on his agreement with Ampal, Mr. Meichor received an additional 8 months of salary (2 months notice and 6 months as the result of a change in control of Ampal). Mr. Meichor ceased to receive additional salary from Ampal on January 19, 2003. |

| | (8) | Includes $86,481 payment advance that has been returned on February 1, 2003. |

| | (9) | Consists of payment for accrued vacation. |

| | (10) | Consists of amounts reimbursed for the payment of taxes. |

| | (11) | Represents the number of shares of Class A Stock underlying options granted to the named executive officers. |

| | (12) | Expired on April 25, 2002. |

| | (13) | Expired on January 26, 2003. |

| | (14) | Expired on February 20, 2003. |

| | (15) | Expired on January 7, 2003. |

| | (16) | Comprised of Ampal (Israel)‘s contribution pursuant to: (i) Ampal (Israel)‘s pension plan, (ii) Ampal’s (Israel)‘s education fund, (iii) use of car and (iv) use of automobile. |

12

Q: How many options do the executive officers own?

Fiscal Year-End Option Values

| Shares

Acquired on

Exercise

| Value Realized

| Number of Securities Underlying

Unexercised Options at Fiscal

Year-End(1)

|

|---|

Name

| | | Exercisable

| Unexercisable

|

|---|

| Yosef A. Maiman | - | - | 15,625 | 234,375 |

| Jack Bigio | - | - | 9,375 | 140,625 |

| Nitsan Yanovski | 40,000 | $240,000 | 499,906 | 73,594 |

| Shlomo Shalev | 40,000 | $240,000 | 550,625 | 84,375 |

| Alla Kanter | 30,000 | $180,000 | 19,906 | 73,594 |

| Raz Steinmetz | 60,000 | $360,000 | - | - |

| Shlomo Meichor | 48,000 | $288,000 | 372,000 | - |

| | (1) | This table represents the total number of shares of Class A Stock subject to stock options held by each of the named executive officers as of December 31, 2002. None of the outstanding options are in-the-money. |

Option Grants In Last Fiscal Year

The following table sets forth certain information regarding stock options granted to purchase our Class A Stock to our named executive officers during the fiscal year ended December 31, 2002:

Annual Compensation

Name

| Option

Plan

| Number of

Securities

Underlying

Option

Granted

| % of

Total

Options

Granted to

Employees

in Fiscal

Year

| Exercise

Price Per

Share

| Market

Price on

Date of

Grant

| Expiration

Date

| Potential Realizable Value

at Assumed Annual Rates of

Stock Price Appreciation For

Option Term

|

|---|

| | | | | | | 5%

| 10%

|

|---|

| Yosef A. Maiman | 2000 | 250,000(1) | 19% | $ 3.12 | $ 3.12 | 08-15-12 | $490,538 | $1,234,119 |

| | | | | | | | |

| Jack Bigio | 2000 | 150,000(2) | 12% | $ 3.12 | $ 3.12 | 08-15-12 | $294,323 | $ 745,871 |

| | | | | | | | |

| Nitsan Yanovski | 2000 | 78,500(3) | 6% | $ 3.12 | $ 3.12 | 08-15-12 | $154,029 | $ 390,339 |

| Shlomo Shalev | 2000 | 90,000(4) | 7% | $ 3.12 | $ 3.12 | 08-15-12 | $176,594 | $ 447,523 |

| Alla Kanter | 2000 | 78,500(3) | 6% | $ 3.12 | $ 3.12 | 08-15-12 | $154,029 | $ 390,339 |

| | (1) | The options vest in equal installments of 15,625 shares beginning on November 16, 2002 and each three month anniversary thereafter. |

| | (2) | The options vest in equal installments of 9,375 shares beginning on November 16, 2002 and each three month anniversary thereafter, except that a portion of the options may vest on an accelerated basis upon the achievement of certain performance criteria. |

| | (3) | The options vest in equal installments of 4,906.25 shares beginning on November 16, 2002 and each three month anniversary thereafter. |

| | (4) | The options vest in equal installments of 5,625 shares beginning on November 16, 2002 and each three month anniversary thereafter, except that a portion of the options may vest on an accelerated basis upon the achievement of certain performance criteria. |

13

Q: What other benefits does the Company provide for its employees?

Ampal maintains a money purchase pension plan (“Pension Plan”) for its eligible employees. Eligible employees are all full-time employees of Ampal except non-resident aliens, night-shift employees and employees represented by a collective bargaining unit. Ampal’s contribution is equal to 7% of each employee’s compensation plus 5.7% of the compensation in excess of the Social Security taxable wage base for that year.

Employees become vested in amounts contributed by Ampal depending on the number of years of service, as provided in the following table:

Years of Service

| Vested

Percentage

|

|---|

| less than 2 years | 0% |

| 2 but less than 3 years | 20% |

| 3 but less than 4 years | 40% |

| 4 but less than 5 years | 60% |

| 5 but less than 6 years | 80% |

| 6 or more years | 100% |

Benefits under the Pension Plan are paid in a lump sum, in an annuity form or in installments.

Ampal maintains a savings plan (the “Savings Plan”) for its eligible employees pursuant to Section 401(k) of the Internal Revenue Code of 1986, as amended (the “Code”). Eligible employees are all employees of Ampal except non-resident aliens, night-shift employees and employees represented by a collective bargaining unit. Participation by employees in the Savings Plan is voluntary. Participating employees may direct that a specific percentage of their annual compensation (up to 15%) be contributed to a self-directed 401(k) savings account. The amount which any employee could contribute to his or her 401(k)savings account in 2002 was limited under the Code to $11,000. Effective January 1, 1996, the Savings Plan was amended so that Ampal matches 50% of each employee’s contribution up to a maximum of 3% of the employee’s compensation. Employees who were eligible to participate in the Savings Plan as of December 31, 1995, are 100% vested at all times in the account balances maintained in their 401(k) savings account. Employees who became eligible to participate in the Savings Plan on or after January 1, 1996, become vested in amounts contributed by Ampal depending on the number of years of service, as provided in the following table:

Years of Service

| Vested

Percentage

|

|---|

| less than 2 years | 0% |

| 2 but less than 3 years | 20% |

| 3 but less than 4 years | 40% |

| 4 but less than 5 years | 60% |

| 5 but less than 6 years | 80% |

| 6 or more years | 100% |

Benefits under the Savings Plan are required to be paid in a single, lump-sum distribution. Payment is usually made after termination of employment.

14

Q: Does Ampal have an active stock option plan?

In March 1998, the Board approved a Long-Term Incentive Plan (“1998 Plan”) permitting the granting of options to all employees, officers, directors and consultants of the Company and its subsidiaries to purchase up to an aggregate of 400,000 shares of Class A Stock. The 1998 Plan was approved by a majority of the Company’s shareholders at the June 19, 1998 annual meeting of shareholders. The plan remains in effect for a period of ten years. As of December 31, 2002, 204,500 options of the 1998 Plan are outstanding.

On February 15, 2000, the Stock Option Committee approved a new Incentive Plan (“2000 Plan”), under which the Company has reserved 4 million shares of class A Stock, permitting the granting of options to all employees, officers and directors. The 2000 Plan was approved by the Board of Directors at a meeting held on March 27, 2000 and was approved by a majority of the Company’s shareholders at the June 29, 2000 annual meeting of shareholders. The plan remains in effect for a period of ten years. As of December 31, 2002, 2,647,500 options of the 2000 Plan are outstanding.

The options granted under the 1998 Plan and the 2000 Plan (collectively, the “Plans”) may be either incentive stock options, at an exercise price to be determined by the Stock Option and Compensation Committee (“the Committee”) but not less than 100% of the fair market value of the underlying options on the date of grant, or non-incentive stock options, at an exercise price to be determined by the Committee. The Committee may also grant, at its discretion, “restricted stock,” “dividend equivalent awards,” which entitle the recipient to receive dividends in the form of Class A Stock, cash or a combination of both and “stock appreciation rights,” which permit the recipient to receive an amount in the form of Class A Stock, cash or a combination of both, equal to the number of shares of Class A Stock with respect to which the rights are exercised multiplied by the excess of the fair market value of the Class A Stock on the exercise date over the exercise price. The options granted under the Plans were granted either at market value or above.

Under each of the Plans, all granted but unvested options become immediately exercisable upon the occurrence of a change in control of the Company. On February 26, 2002, the controlling shareholder of the Company, Rebar Financial Corp., agreed to sell all of its stock in the Company to Y.M. Noy Investments Ltd. Accordingly, all options granted but unvested under the Plans were immediately exercisable.

THE FOLLOWING QUESTIONS AND ANSWERS RELATE TO THE COMPANY’S

CLASS A STOCK

Q: How has the Company’s stock performed over the past five years?

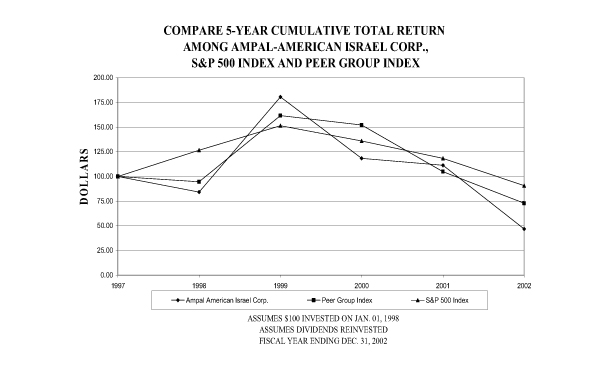

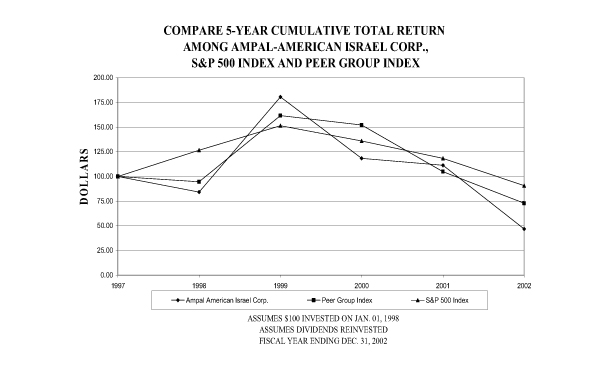

The following graph compares the percentage change in cumulative total return (change in the stock price plus reinvested dividends) of Ampal Class A Stock, the S&P composite — 500 Index and a peer group index composed of Koor Industries (an Israeli holding company) and First Israeli Fund (an American closed-end fund that acquires equity interests in companies located in Israel) for the period December 31, 1997 through December 31, 2002. The stock price performances shown on the graph are not intended to forecast or be indicative of future price performance.

15

Q: Who are Ampal’s principal shareholders?

The following table sets forth information as of August 6, 2003, as to the holders known to Ampal who beneficially own more than 5% of the Class A Stock, the only outstanding series of voting securities of Ampal. For purposes of computation of the percentage ownership of Class A Stock set forth in the table, conversion of any 4% Cumulative Convertible Preferred Stock (the “4% Preferred Stock”) and 6 1/2% Cumulative Convertible Preferred Stock (the “6 1/2% Preferred Stock”) owned by such beneficial owner has been assumed, without increasing the number of shares of Class A Stock outstanding by amounts arising from possible conversions of convertible securities held by shareholders other than such beneficial owner. As of August 6, 2003, there were 19,722,800 (not including treasury shares) shares of Class A Stock of Ampal outstanding. In addition, as of August 6, 2003, there were 575,916 (not including treasury shares)non-voting shares of 6 1/2% Preferred Stock outstanding (each convertible into 3 shares of Class A Stock) outstanding and 130,313 (not including treasury shares) non-voting shares of 4% Preferred Stock outstanding (each convertible into 5 shares of Class A Stock).

16

Security Ownership of Certain Beneficial Owners

Name and Address

of Beneficial Owner

| Title of Class

| Amount of Shares

and Nature

of Beneficial Ownership

| Percent

of Outstanding

Shares of

Class A Stock

|

|---|

| Y.M Noy Investments Ltd., of 33 | Class A Stock | 11,750,132 shs.(1) | 59.58% |

| Havazelet Hasharon st., |

| Herzliya, Israel |

| Yosef A. Maiman | Class A Stock | 11,812,632 shs.(1)(2) | 59.70% |

| Y.M Noy Investments Ltd., of 33 |

| Havazelet Hasharon st., |

| Herzliya, Israel |

| Ohad. Maiman | Class A Stock | 11,750,132 shs.(1) | 59.58% |

| Y.M Noy Investments Ltd., of 33 |

| Havazelet Hasharon st., |

| Herzliya, Israel |

| Noa. Maiman | Class A Stock | 11,750,132 shs.(1) | 59.58% |

| Y.M Noy Investments Ltd., of 33 |

| Havazelet Hasharon st., |

| Herzliya, Israel |

| | (1) | Consists of 11,750,132 shares of Class A Stock held directly by Y.M Noy Investments Ltd. Yosef A. Maiman owns 100% of the economic shares and one-third of the voting shares of Noy. In addition, Mr. Maiman holds an option to acquire the remaining two-thirds of the voting shares of Noy (which are currently owned by Ohad Maiman and Noa Maiman, the son and daughter, respectively, of Mr. Maiman). |

| | (2) | Includes 62,500 shares of Class A Stock underlying options which are presently exercisable as of August 6, 2003 or exercisable within 60 days of such date by Mr. Maiman. |

17

Q: What percentage of Class A Stock do the directors and officers own?

The following table sets forth information as of August 6, 2003 as to each class of equity securities of Ampal or any of its subsidiaries beneficially owned by each director and named executive officer of Ampal listed in the Summary Compensation Table and by all directors and named executive officers of Ampal as a group. All ownership is direct unless otherwise noted. The table does not include directors or named executive officers who do not own any such shares:

Name

| Amount of Shares and Nature

of Beneficial Ownership

of Class A Stock

| | Percent of Outstanding

Shares of

Class A Stock

|

|---|

| Yosef Maiman | 11,812,632 | (1) | 59.70% |

| Jack Bigio | 37,500 | (2) | * |

| Shlomo Shalev | 22,500 | (2)(3) | * |

| Alla Kanter | 19,624 | (2)(4) | * |

| Leo Malamud | 37,500 | (2) | * |

| Dr. Josef Yerushalmi | 25,000 | (2) | * |

| Eitan Haber | 3,752 | (2) | * |

| Yehuda Karni | 3,752 | (2) | * |

| Michael Arnon | 18,752 | (2) | |

| Raz Steinmetz | 0 | | 0 |

| Shlomo Meichor | 0 | | 0 |

| Nitsan Yanovski | 0 | | 0 |

| All Directors and Executive Officers as a Group | 11,981,012 | | 60.05% |

* Represents less than 1% of the class of securities.

| | (1) | Attributable to 11,750,132 shares of Class A Stock held directly by Y.M Noy Investments Ltd.. See “Security Ownership of Certain Beneficial Owners.” In addition, this represents 62,500 shares underlying options for Yosef Maiman which are presently exercisable or exercisable within 60 days by Mr. Maiman. |

| | (2) | Represents shares underlying options which are presently exercisable as of August 6, 2003 or exercisable within 60 days of such date. |

| | (3) | On February 20, 2003, 545,000 of Mr. Shalev’s options were cancelled pursuant to an agreement between the Company and Mr. Shalev. Mr. Shalev received no value in connection with such cancellation. |

| | (4) | On February 20, 2003, 15,000 of Ms. Kanter’s options were cancelled pursuant to an agreement between the Company and Ms. Kanter. Ms. Kanter received no value in connection with such cancellation. |

18

MISCELLANEOUS INFORMATION

Q: Have the Company’s officers, directors and shareholders filed all appropriate beneficial ownershipreports with the SEC?

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Ampal’s executive officers and directors, and persons who own more than 10% of a registered class of Ampal’s equity securities, to file with the Securities and Exchange Commission initial statements of beneficial ownership (Form 3), and statements of changes in beneficial ownership (Forms 4 and 5), of Class A Stock of Ampal.

Nitsan Yanovski, the Vice President — Business Development of Ampal from May 21, 2002 until his retirement at December 31, 2002, did not file a Form 3 reporting his initial beneficial ownership of equity securities of Ampal nor did he file a Form 4 reporting the grant of stock options by Ampal to him on August 16, 2002. Each of Giora Bar-Nir, Shlomo Shalev, Dafna Sharir and Yoram Firon did not timely file a Form 3 reporting their respective initial beneficial ownership of equity securities of Ampal.

Q: Does the Company enter into transactions with affiliated parties?

The Audit Committee of Ampal has the duty and responsibility of approving all transactions between Ampal, on the one hand, and any officer, director, or affiliate thereof, on the other hand, or in which any officer, director or affiliate has a material interest. The Audit Committee reviews and passes upon the fairness of any business dealings and arrangements between Ampal and any such affiliated party. With certain exceptions, Ampal may not enter into transactions with any officer, director or principal shareholder of Ampal, without first obtaining the approval of the Audit Committee or a majority of the disinterested members of the Board of Directors or the shareholders.

The management of Ampal believes that all of the following transactions were concluded on terms which were no less advantageous to Ampal than could have been obtained from unaffiliated third parties.

Until October 15, 2002, Ampal subleased an office at 660 Madison Avenue in New York City from Cavallo Capital Inc.. The annual rent for this sublease was $50,000. Avi Vigder, a former member of the Board of Directors of Ampal, is a controlling person of Cavallo Capital Inc.

Q: Does the Company have directors and officer liability insurance?

Effective January 29, 2003, the Company purchased a directors and officers liability policies in the aggregate amount of $15,000,000 issued by Navigators Insurance Company, Liberty Mutual Insurance Company (U.K.) Limited, Zurich and Hartford Fire Insurance Company. The cost of the policies, which expire January 28, 2004, was $900,000. These policies provide coverage to all of the officers and directors of the Company and of those subsidiaries of which the Company owns more than 50% of the outstanding voting stock.

19

Q: When are shareholder proposals for the 2004 meeting due?

Any holder of Class A Stock who wishes to submit a proposal to be presented at the next annual meeting of shareholders must forward such proposal to the Secretary of the Company at the address in the Notice of Annual Meeting so that it is received by the Company no later than April 29, 2004. Such a proposal must comply with such rules as may be prescribed from time to time by the SEC regarding proposals of security holders.

| | By Order of the Board of Directors,

JACK BIGIO

President and Chief Executive Officer

|

August 29, 2003

20