| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

FORM N-CSR |

| |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| |

| |

| |

| Investment Company Act File Number: 811-3894 |

|

| |

| T. Rowe Price Short-Term Bond Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

| |

| |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| |

| |

| Date of fiscal year end: May 31 |

| |

| |

| Date of reporting period: November 30, 2008 |

Item 1: Report to Shareholders| Short-Term Bond Fund | November 30, 2008 |

The views and opinions in this report were current as of November 30, 2008. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

Bond returns were widely mixed, as frozen credit markets and heightened risk aversion prompted investors to sell higher-yielding securities in favor of U.S. Treasuries. Your fund was not immune to the broad market weakness but managed to perform relatively well in an environment that punished most segments of the fixed-income market except for the highest-quality securities.

HIGHLIGHTS

• Short-term bonds posted losses during the past six months in an environment dominated by a flight to the safety of Treasury securities.

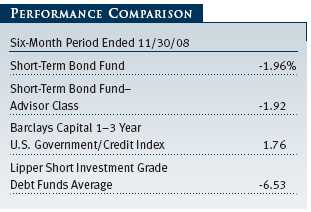

• The fund’s return lagged the performance of the benchmark index but surpassed that of our Lipper peer group average during the period.

• Our underweight in Treasuries hurt relative performance versus the benchmark index, but our overall strategy aided results within our peer group.

• We are maintaining our cautious outlook for the fixed-income market and will remain committed to the disciplined investment philosophy and long-term perspective that have helped us weather volatile market conditions in the past.

MARKET ENVIRONMENT

The stagnating economy has clearly deflated any lingering concerns about inflation and partially offset the negative impact of rising unemployment, slower income growth, declining asset prices, and tight credit conditions. A disinflationary trend is likely to unfold in the months ahead, and outright deflation (broad-based price declines), which we have not experienced in at least 60 years, cannot be ruled out. Against this backdrop, the Department of Labor reported that new claims for unemployment benefits soared to a 16-year high at the end of the period, reinforcing earlier signs of a rapidly weakening job market. U.S. employers cut 533,000 jobs from the nation’s payrolls in November, the largest monthly job loss in 34 years, propelling the unemployment rate from 6.5% in October to 6.7%, a 15-year high. According to the National Bureau of Economic Research, the U.S. has been in a recession since December 2007, making official what most Americans have already believed about the state of the economy.

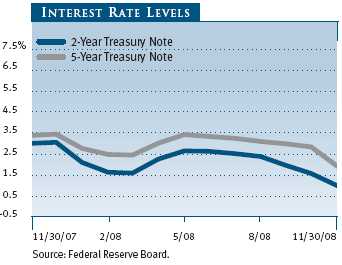

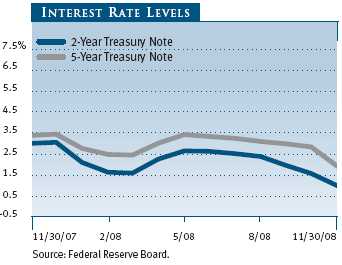

The past six months witnessed continuing downward pressure on Treasury yields thanks to strong demand for U.S. Treasuries as investors grappled with the ramifications of a $700 billion bailout program by the federal government to shore up the financial system. Fears that U.S. automakers and other major companies would be forced to file for bankruptcy also depressed investor sentiment. U.S. Treasury bonds far outpaced riskier fixed-income assets in the flight to quality. At the end of the period, the financial markets stabilized somewhat as the government acted to rescue Citigroup and introduced new initiatives to unfreeze the mortgage and consumer loan markets.

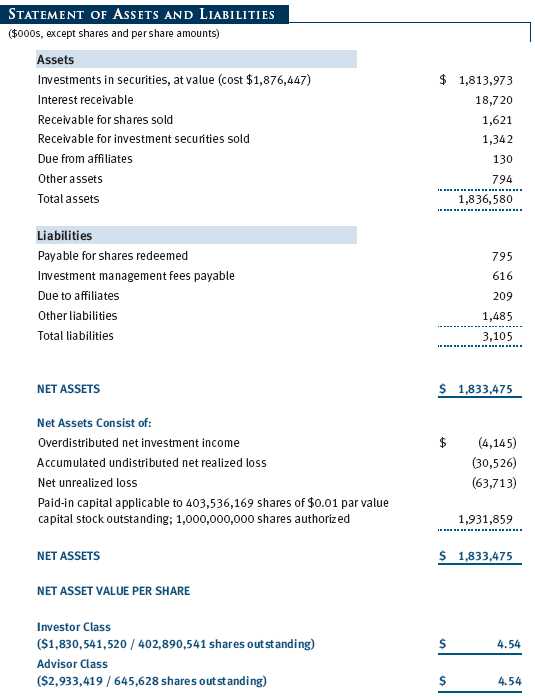

PERFORMANCE

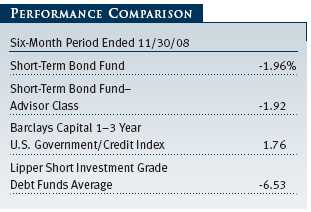

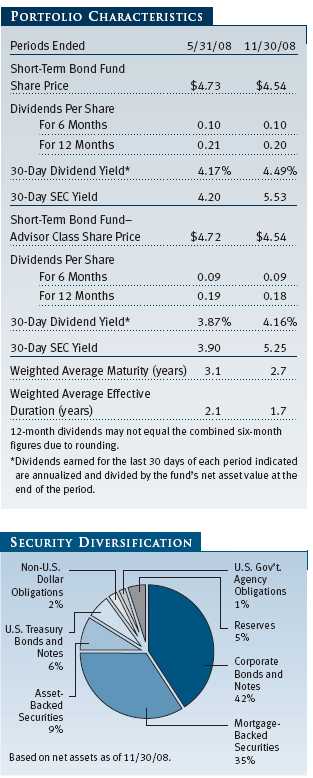

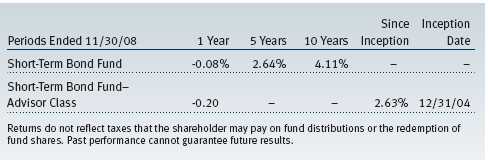

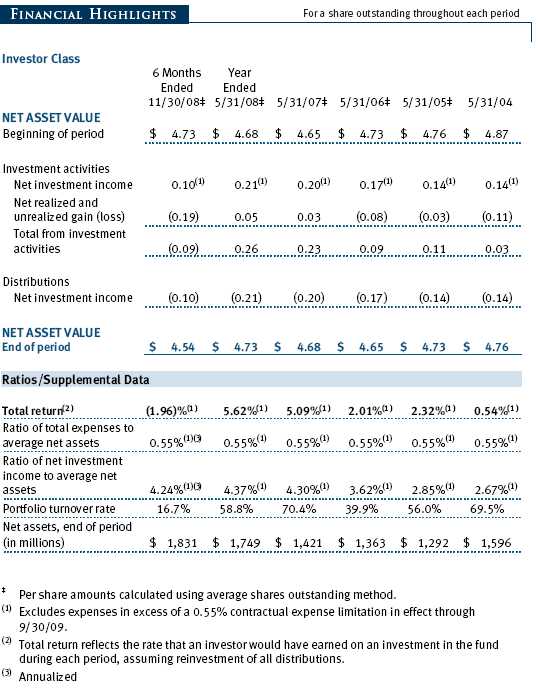

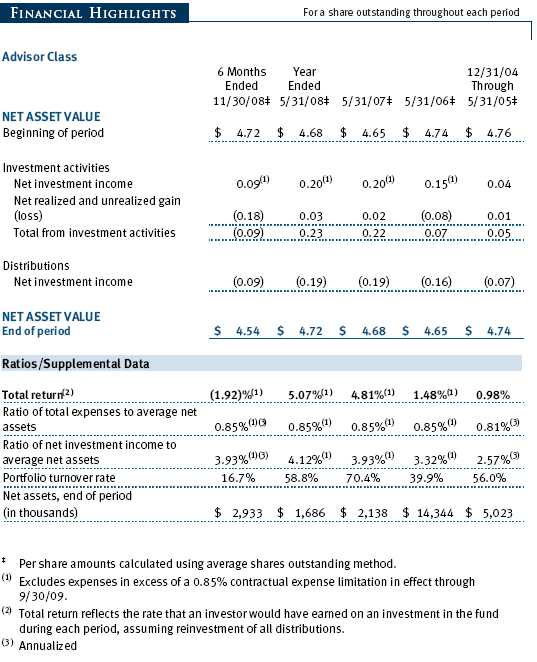

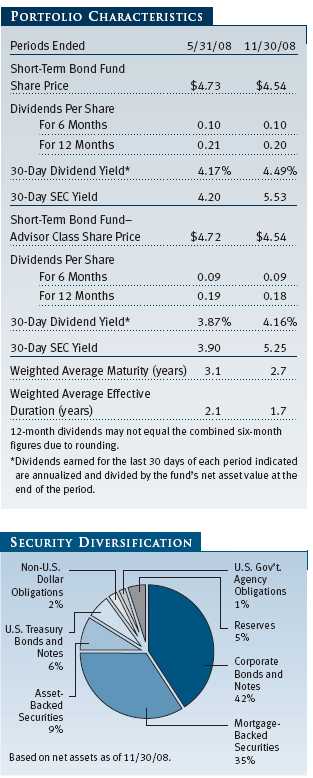

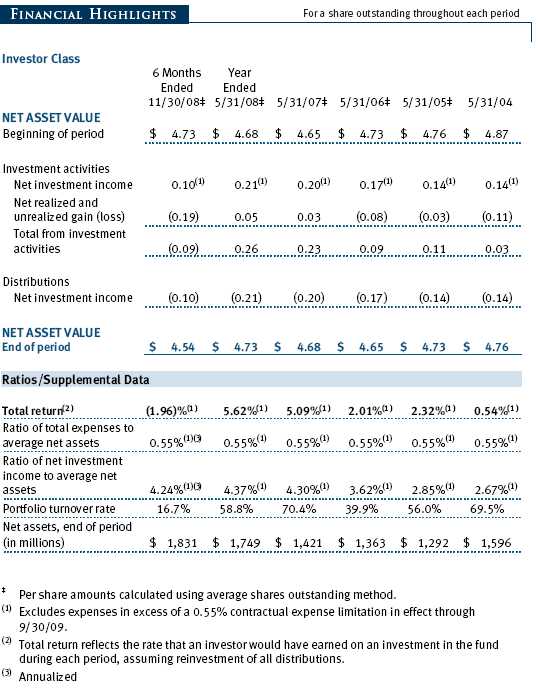

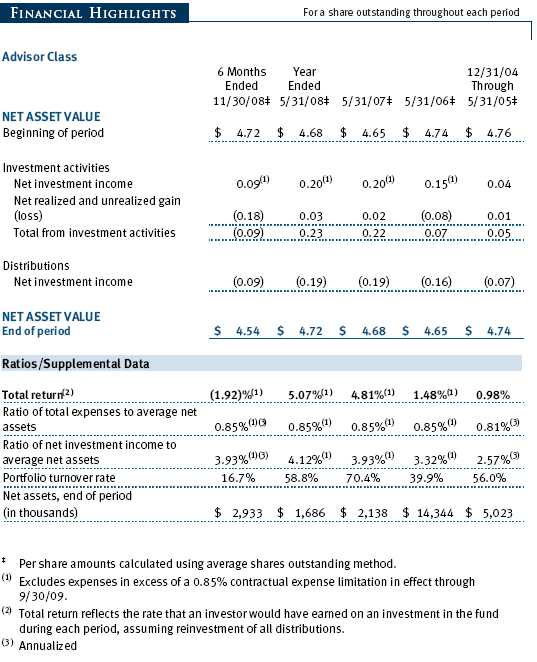

Your fund generated a loss during the six months ended November 30, 2008, trailing the Barclays Capital 1–3 Year U.S. Government/Credit Index (formerly the Lehman Brothers 1–3 Year U.S. Government/Credit Index) but surpassing its Lipper peer group average. Our shortfall versus the benchmark index was due primarily to our underweight in Treasuries versus the index. The fund’s net asset value fell from $4.73 at the end of May 2008 to $4.54 at the end of the current period, and dividends contributed $0.10 per share. (Performance for the Advisor Class shares was slightly better than the fund’s; its net asset value was the same but declined from $4.72 at the end of May and dividends contributed $0.09 per share.) As we have stated in the past, the objective of the fund is to provide greater income than is available from a money market fund, but with a higher degree of principal risk.

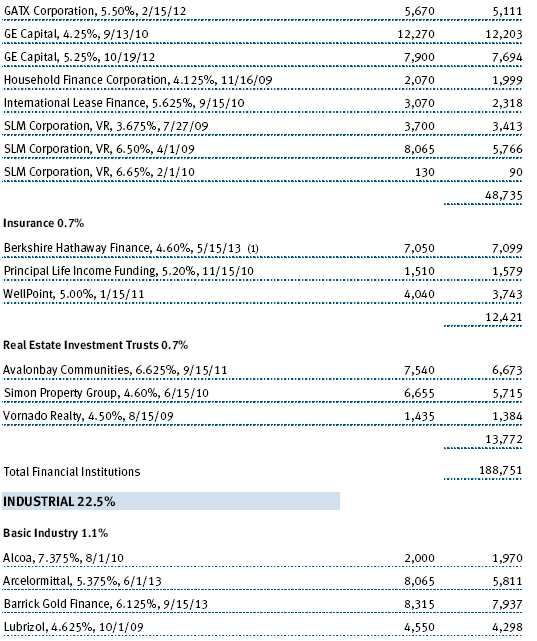

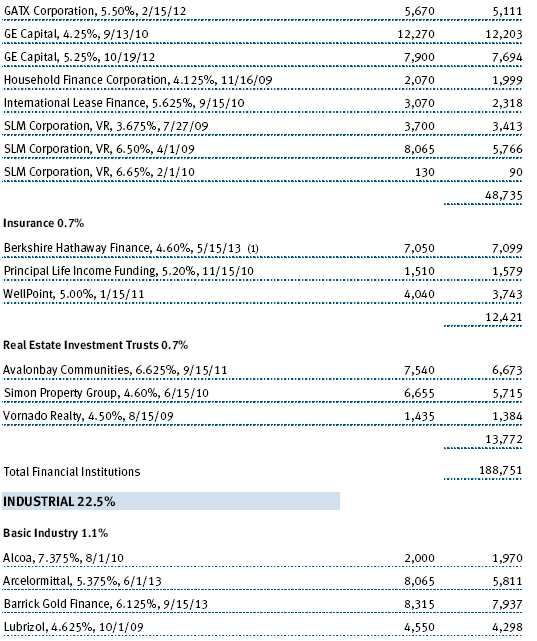

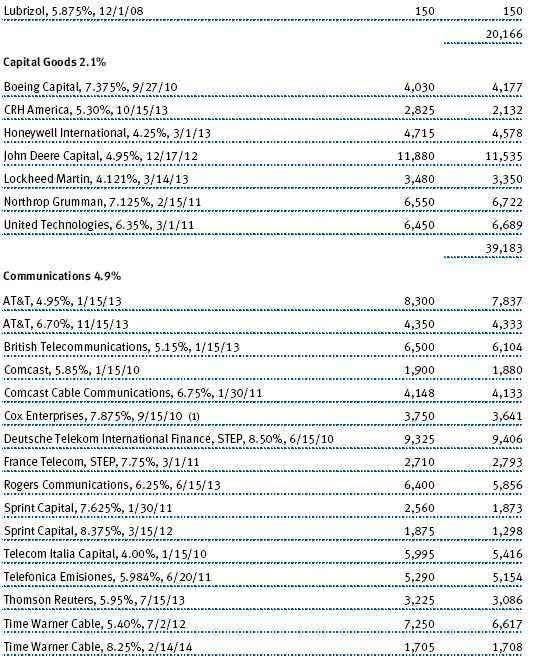

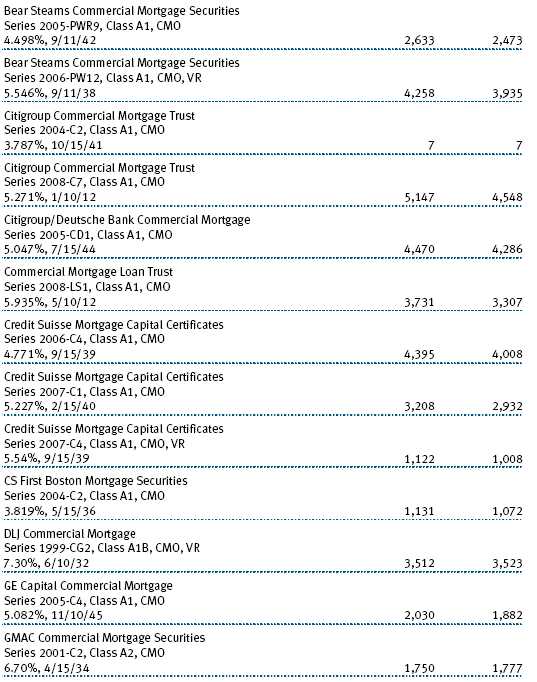

Our strategic underweight in U.S. Treasury securities and an overweight in corporate bonds versus our benchmark index weighed on the fund’s relative results—although our overall strategy helped us in relation to our Lipper peer group. Our exposure to commercial mortgage-backed securities (CMBS), which are not represented in the index, also detracted from relative performance.

Against the backdrop of extreme volatility in October, the yields on corporate bonds expanded to an all-time high compared with Treasury yields as U.S. companies posted more than $680 billion in write-downs so far in 2008, with more expected to come. Throughout the period, we selectively purchased corporate issues in an effort to increase the overall yield of the portfolio in the belief that investment-grade corporate securities offered exceptional value. As the economic turmoil has continued to unfold, we feel most comfortable holding the securities of noncyclical companies that, in our view, are positioned to weather a difficult economic downturn.

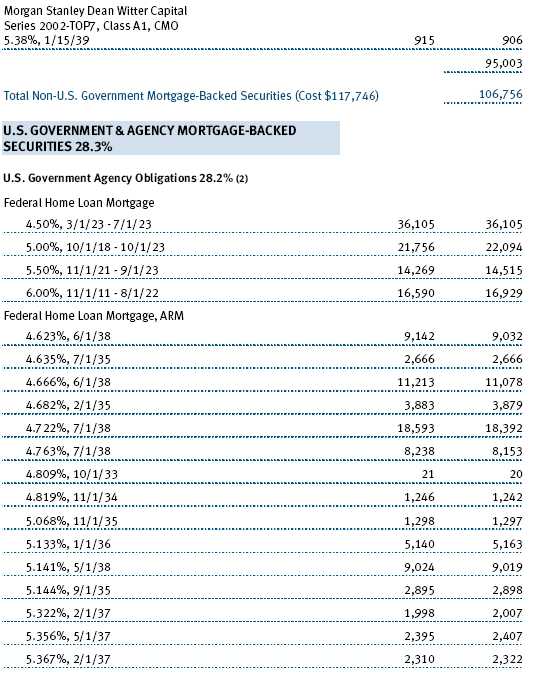

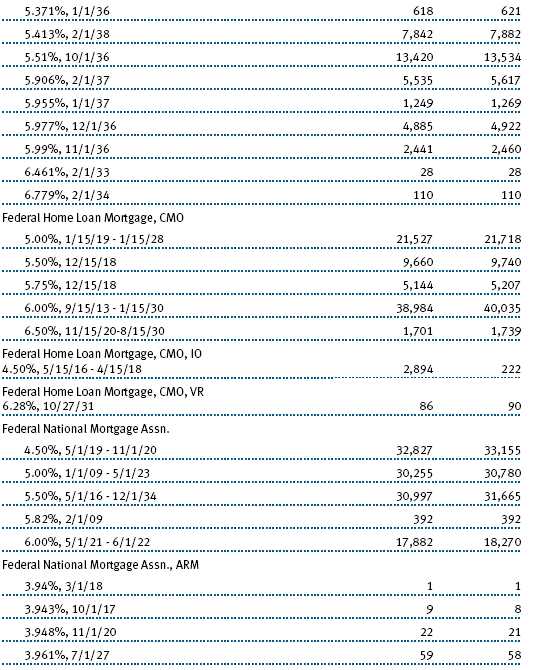

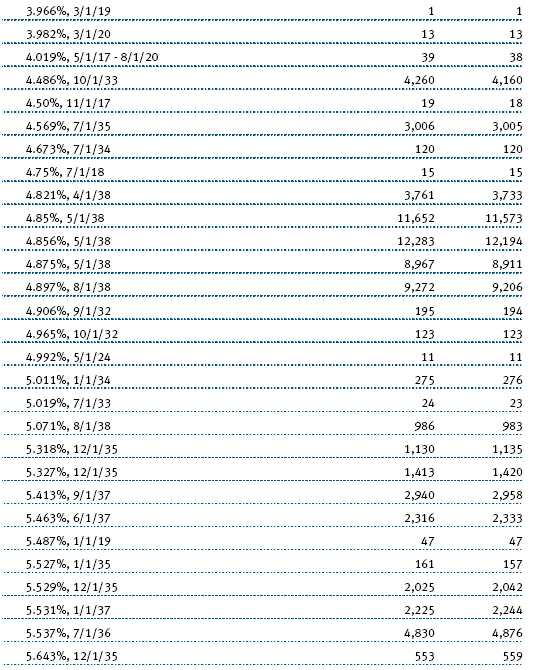

October and November were particularly dismal months for the CMBS sector. Their yield spreads versus Treasuries also expanded to all-time high levels when concerns about increasing defaults on loans secured by commercial properties began to mount. Additionally, the announcement that funds from the government’s Troubled Asset Relief Program would not be used for the direct purchase of securities from financial institutions negatively impacted the CMBS sector. Our investments in this area are focused on AAA, credit-enhanced securities that should be able to hold up during continuing economic weakness. After relatively flat performance for most of the period, the mortgage-backed security (MBS) sector rallied in November after the Federal Reserve announced a program to directly purchase $500 billion in agency MBS. Our exposure to this sector, which was the best-performing group outside of Treasuries over the six-month period, contributed positively to fund results.

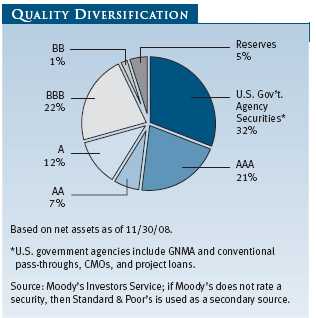

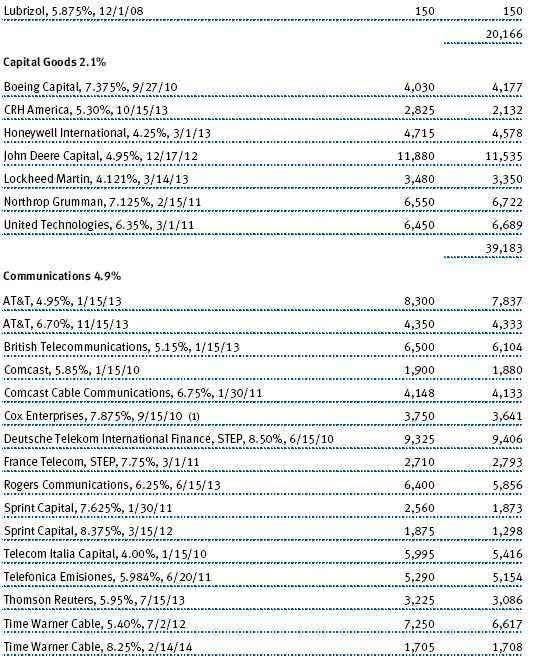

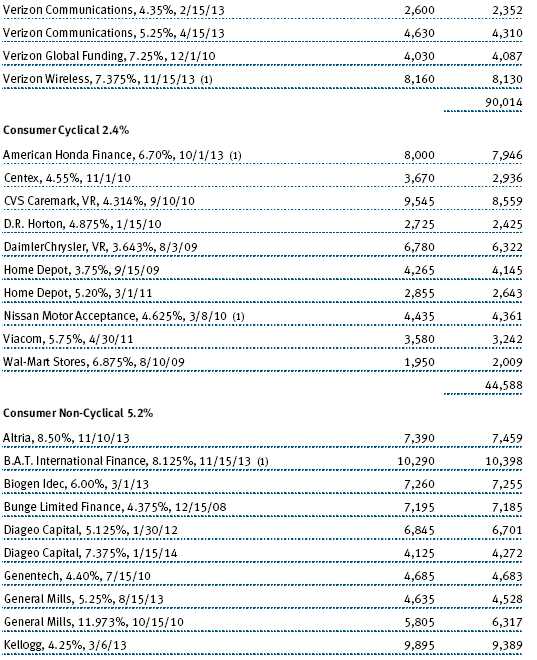

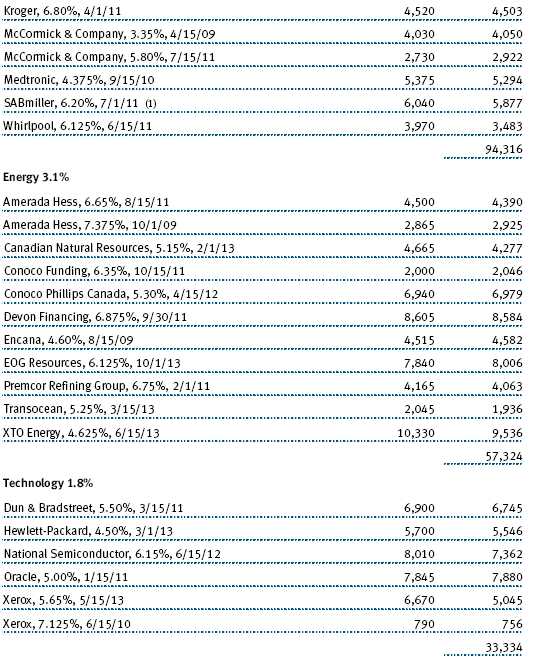

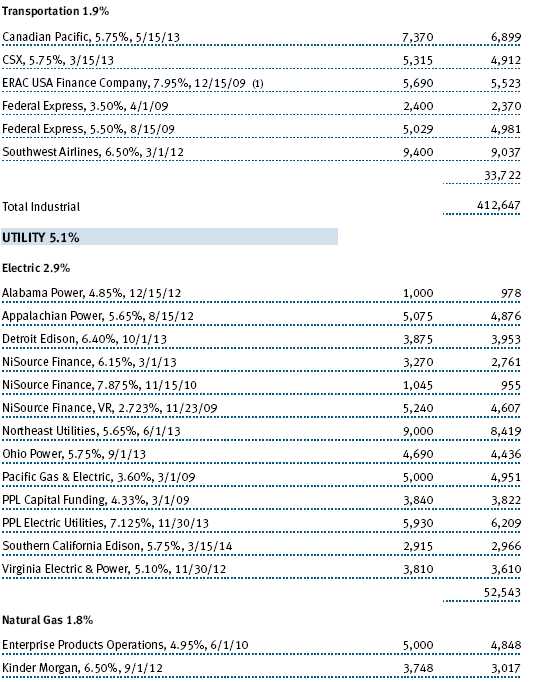

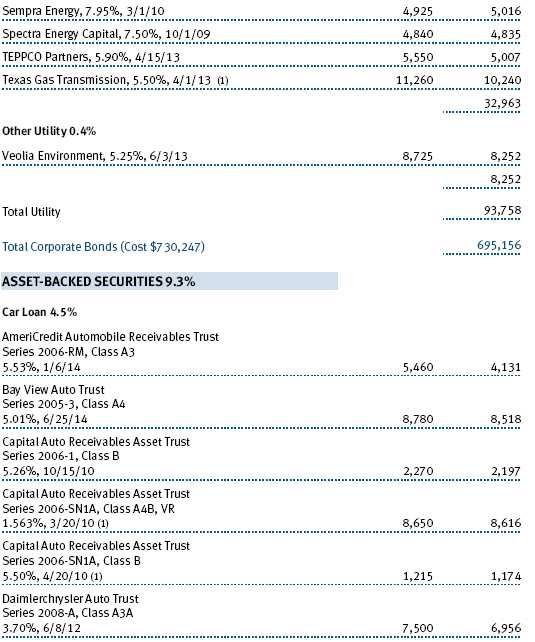

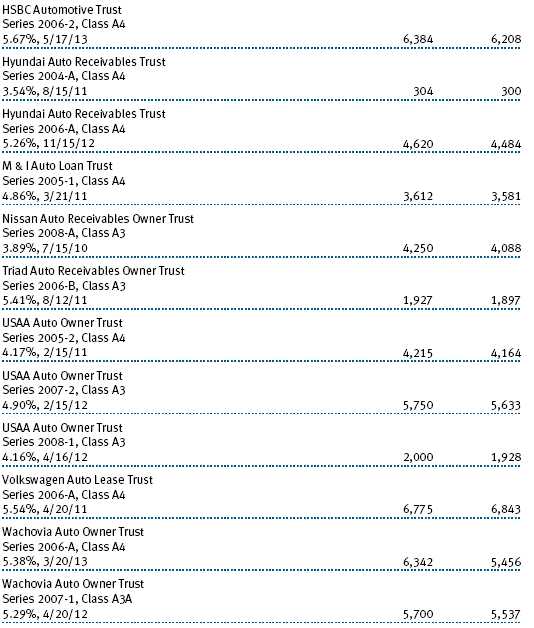

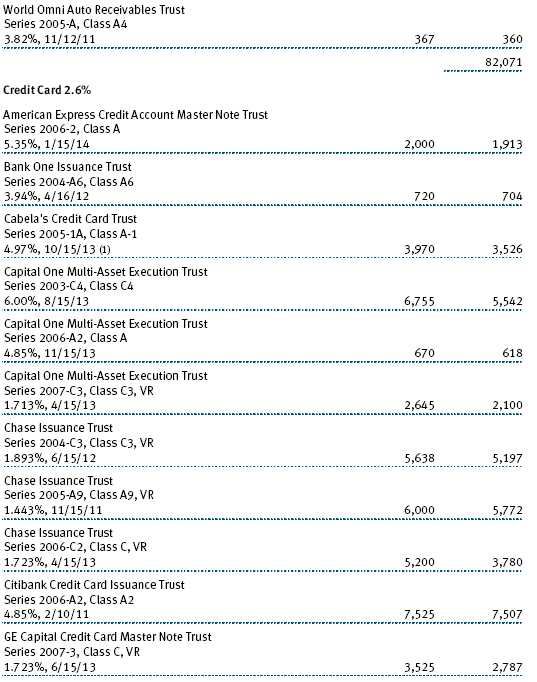

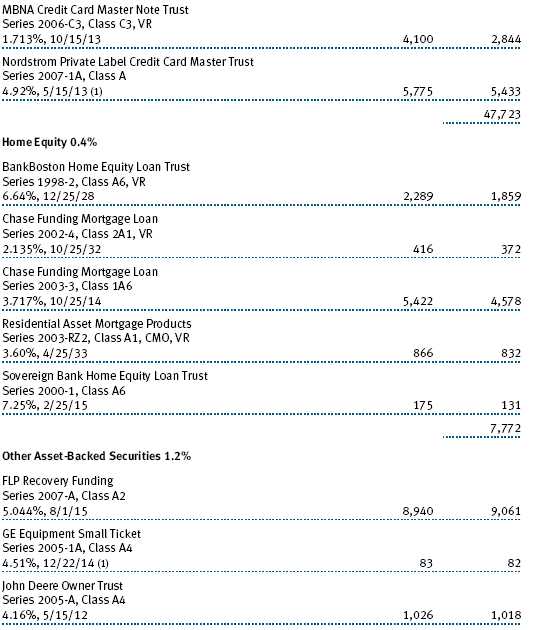

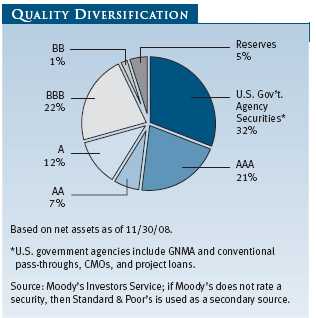

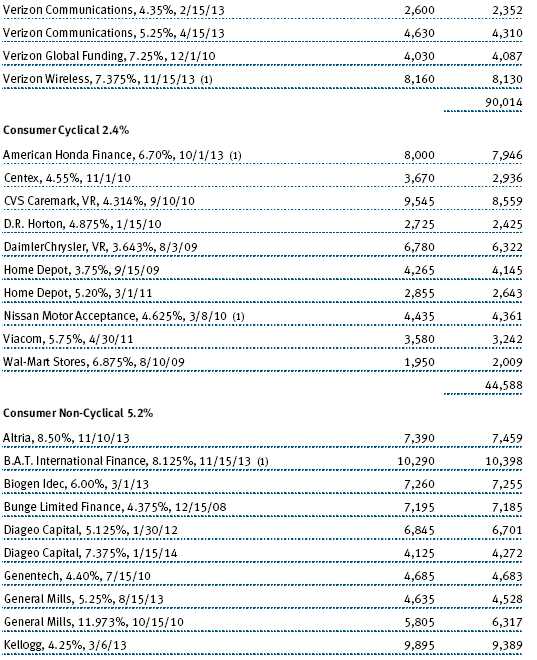

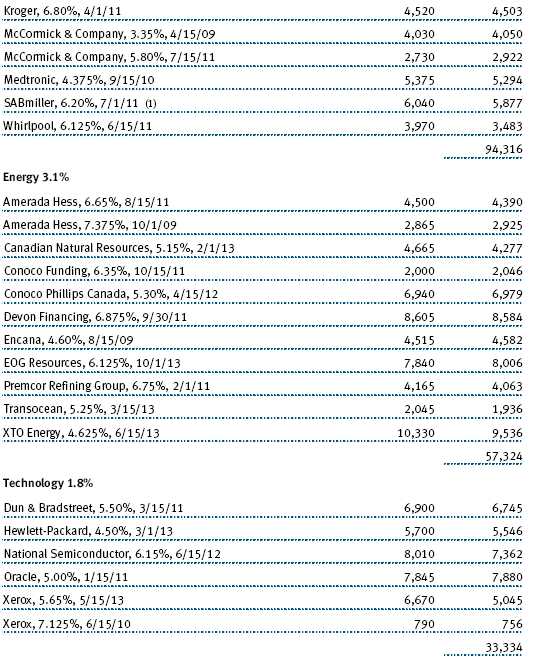

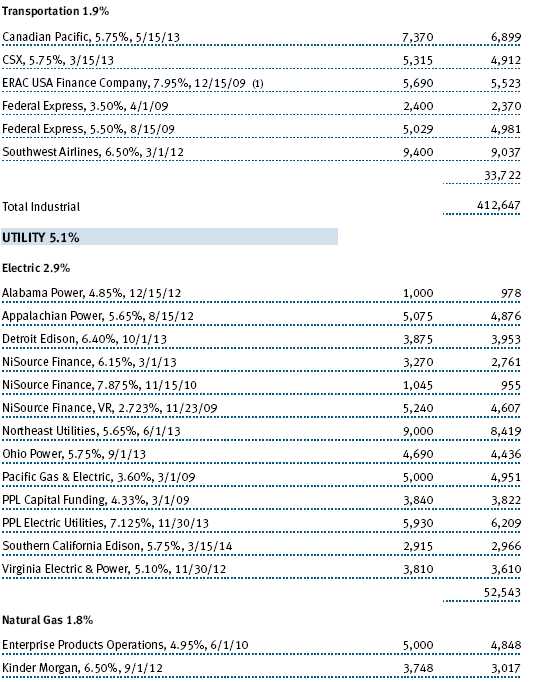

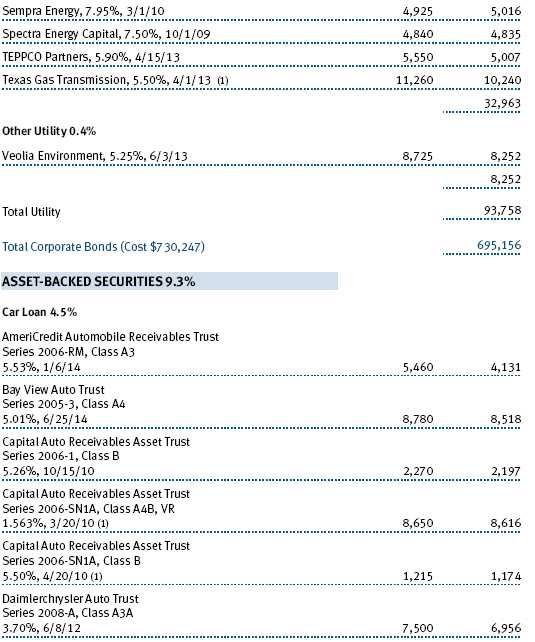

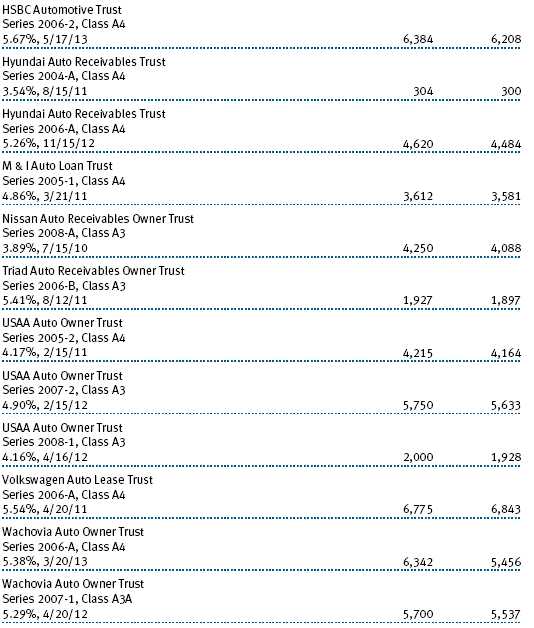

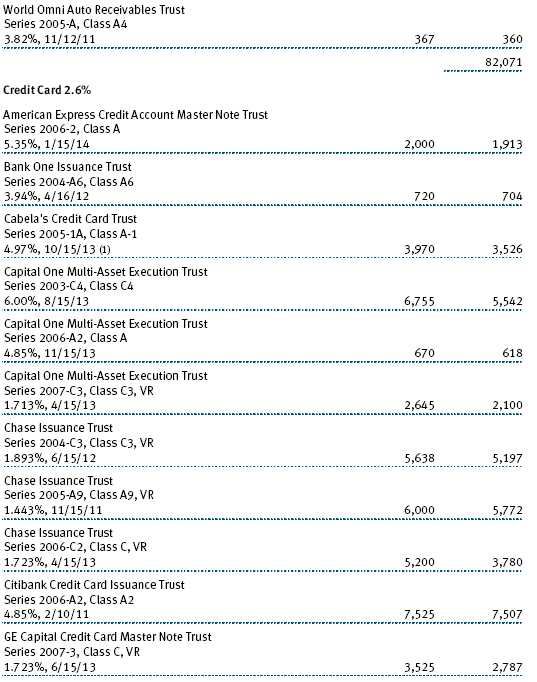

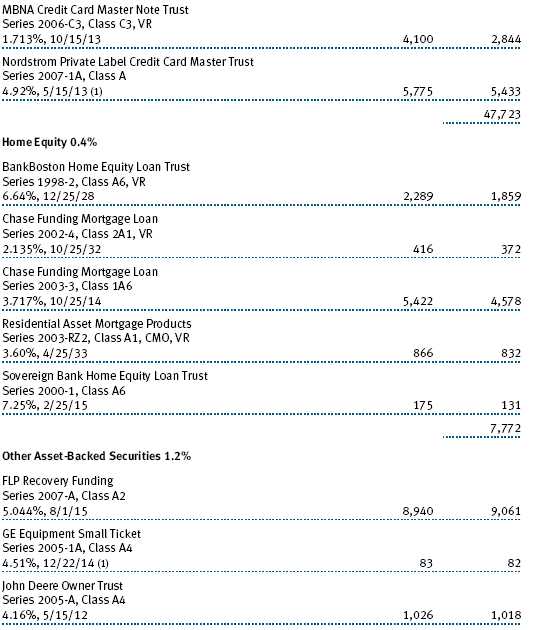

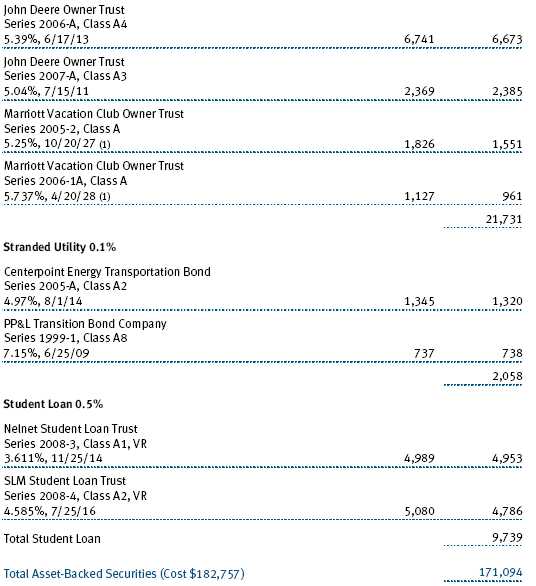

At the end of November, 42% of the portfolio was allocated to corporate bonds and notes, 35% to mortgage-backed securities, 9% to asset-backed securities, and the remaining 14% to U.S. Treasury bonds and notes, non-U.S. dollar obligations, U.S. government agency obligations, and reserves. Only 22% of the portfolio was invested in BBB securities (the lowest end of the investment-grade range) and 1% in BB bonds, while 5% was in cash reserves and 72% was rated A or higher.

OUTLOOK

The global financial crisis has intensified over the last few months. As a result, investor confidence was damaged and liquidity has diminished in our market. While we expect the government’s unprecedented financial rescue program to prevent further systemic deterioration, investors should not expect these measures to provide an immediate cure for the current financial stress. Therefore, we anticipate that heightened volatility will continue in the near term.

However, with credit spreads hovering at or near all-time wide levels for several fixed-income sectors, we believe that we will be well compensated over the next few years as we add measured risk to our portfolio. Our outlook for the fixed-income market is cautious, and our experienced team will remain committed to our risk-conscious, disciplined investment philosophy and long-term perspective that have helped us weather volatile market conditions in the past. As you are aware, in this fund we purchase securities with short-term maturities, which are less vulnerable to market volatility than long-term bonds.

As always, we will continue to monitor bond market conditions closely and look for investment opportunities as they become available. Thank you for investing with T. Rowe Price.

Respectfully submitted,

Edward A. Wiese

President and chairman of the fund’s Investment Advisory Committee

December 12, 2008

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF FIXED-INCOME INVESTING

Bonds are subject to interest rate risk (the decline in bond prices that usually accompanies a rise in interest rates) and credit risk (the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default by failing to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. Mortgage-backed securities are subject to prepayment risk, particularly if falling rates lead to heavy refinancing activity, and extension risk, which is an increase in interest rates that causes a fund’s average maturity to lengthen unexpectedly due to a drop in mortgage prepayments. This could increase the fund’s sensitivity to rising interest rates and its potential for price declines.

GLOSSARY

Barclays Capital 1–3 Year U.S. Government/Credit Index: A total return index that incorporates all bonds in the Treasury Bond Index and the Agency Bond Index, as well as U.S. corporate and some foreign debentures and secured notes, with maturities of one to three years.

Duration: A measure of a bond fund’s sensitivity to changes in interest rates. For example, a fund with a duration of two years would fall about 2% in price in response to a one-percentage-point rise in interest rates, and vice versa.

Fed funds rate: The interest rate charged on overnight loans of reserves by one financial institution to another in the United States. The Federal Reserve sets a target federal funds rate to affect the direction of interest rates.

Lipper averages: The averages of available mutual fund performance returns for specified time periods in defined categories as tracked by Lipper Inc.

30-day SEC yield: A method of calculating a fund’s yield that assumes all portfolio securities are held until maturity. The Securities and Exchange Commission (SEC) requires all bond funds to calculate this yield. Yield will vary and is not guaranteed.

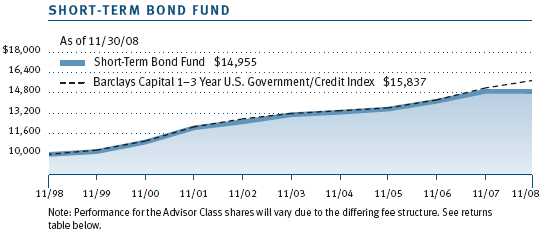

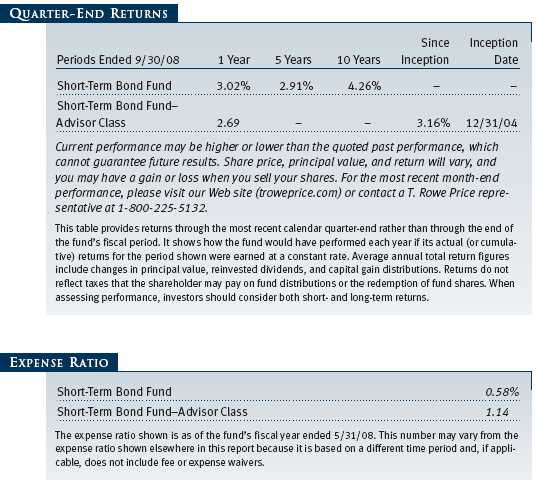

Performance and Expenses

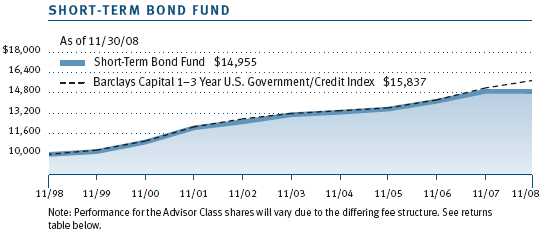

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

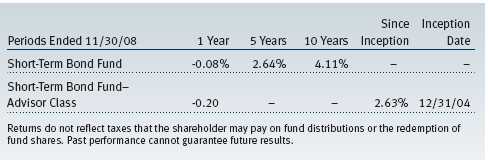

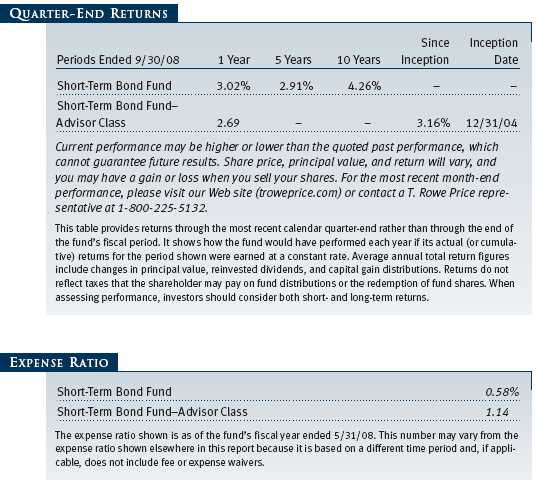

| AVERAGE ANNUAL COMPOUND TOTAL RETURN |

This table shows how the fund would have performed each year if its actual (or cumulative) returns for the periods shown had been earned at a constant rate.

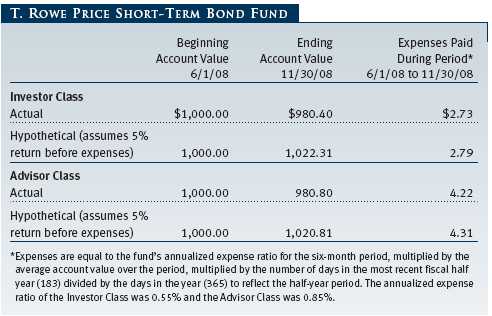

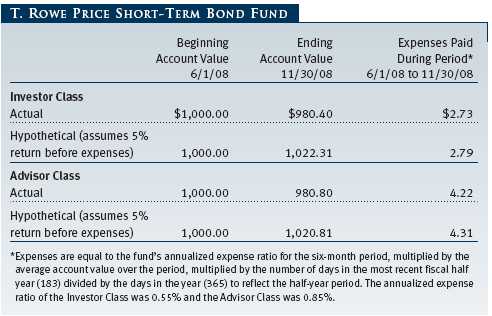

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has two share classes: The original share class (“investor class”) charges no distribution and service (12b-1) fee. Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

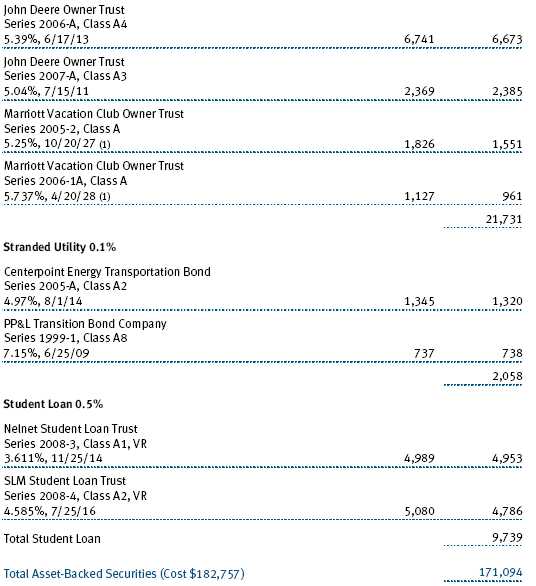

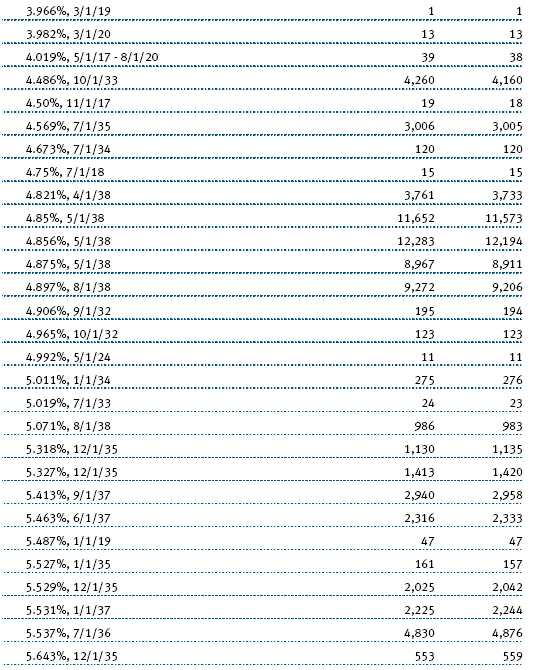

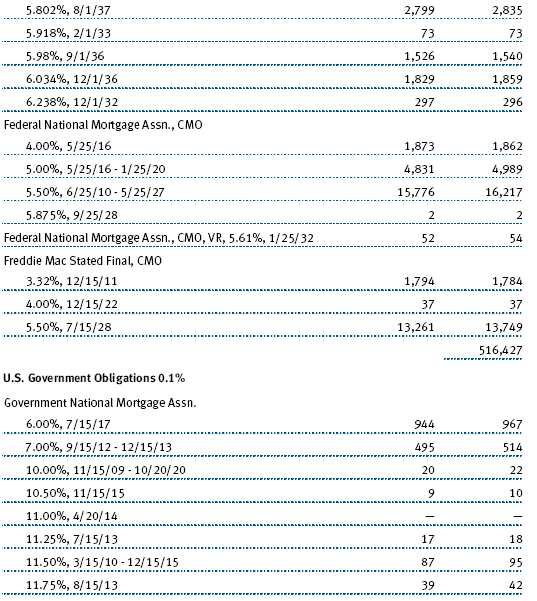

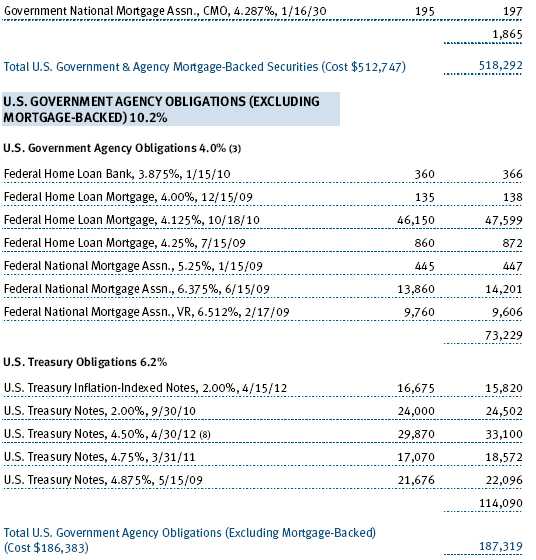

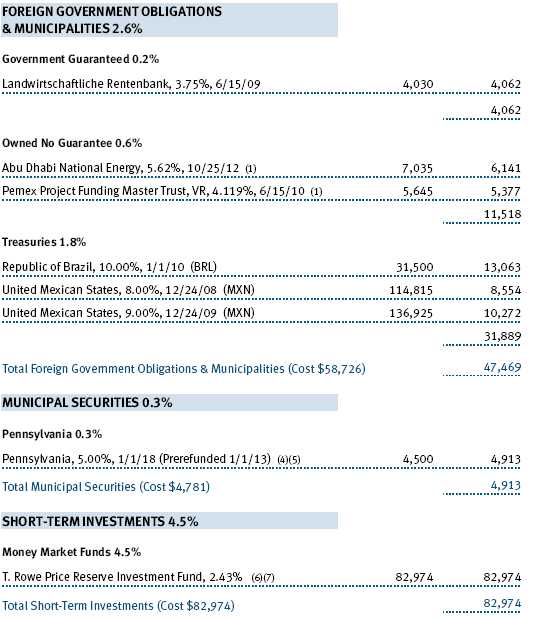

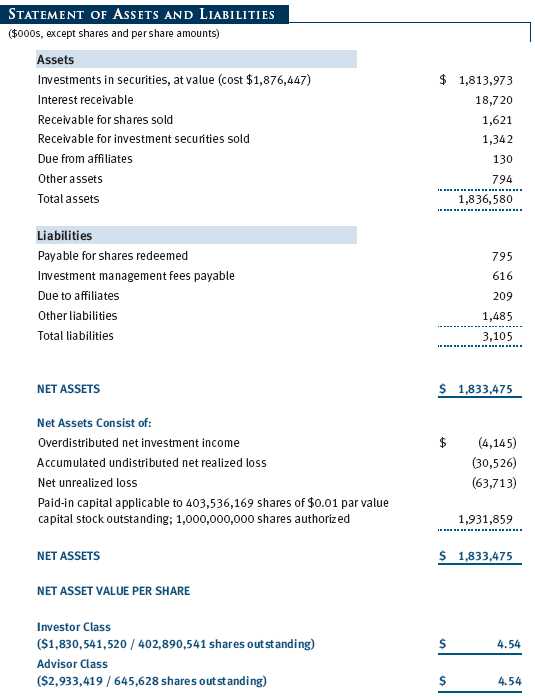

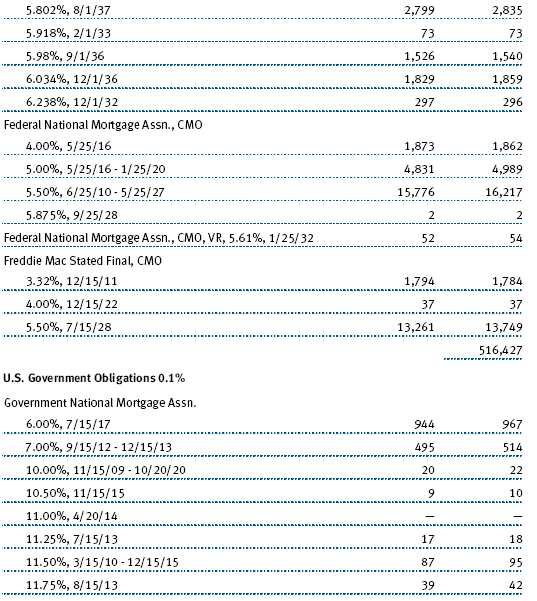

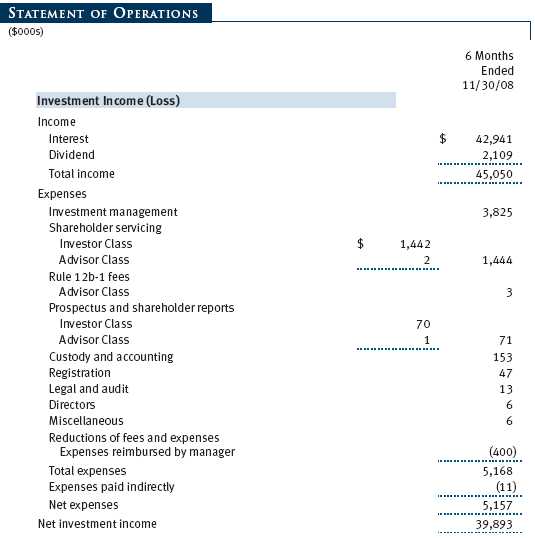

Unaudited

The accompanying notes are an integral part of these financial statements.

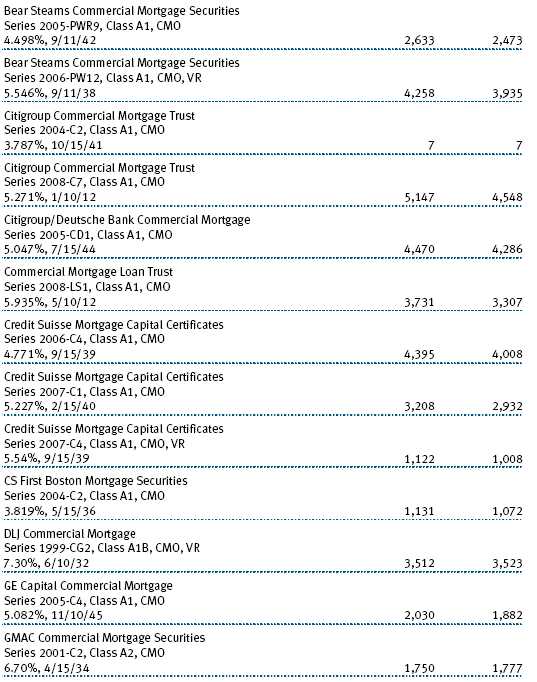

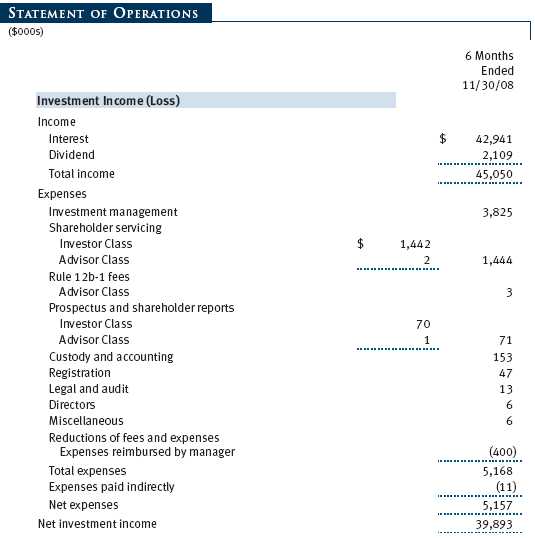

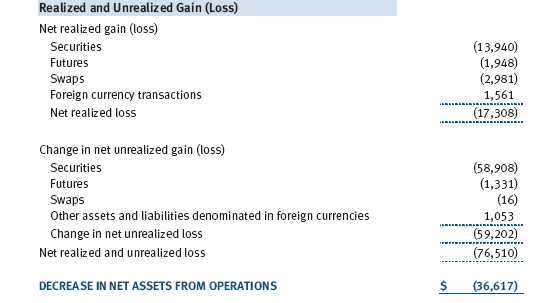

Unaudited

The accompanying notes are an integral part of these financial statements.

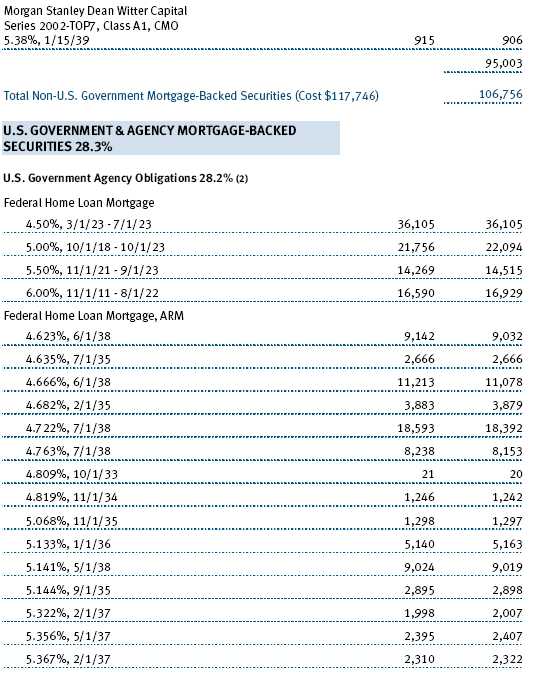

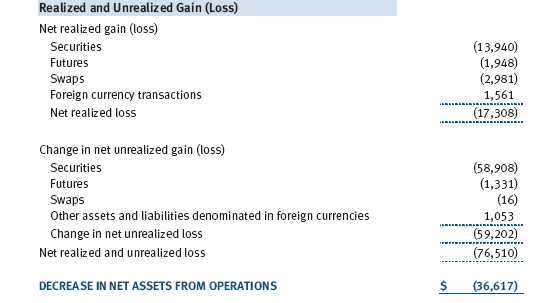

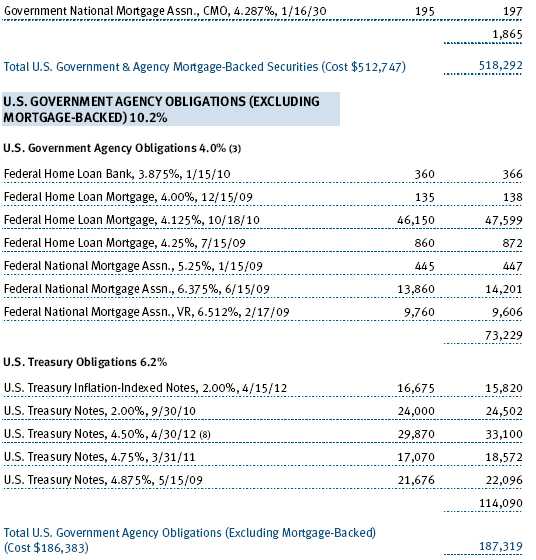

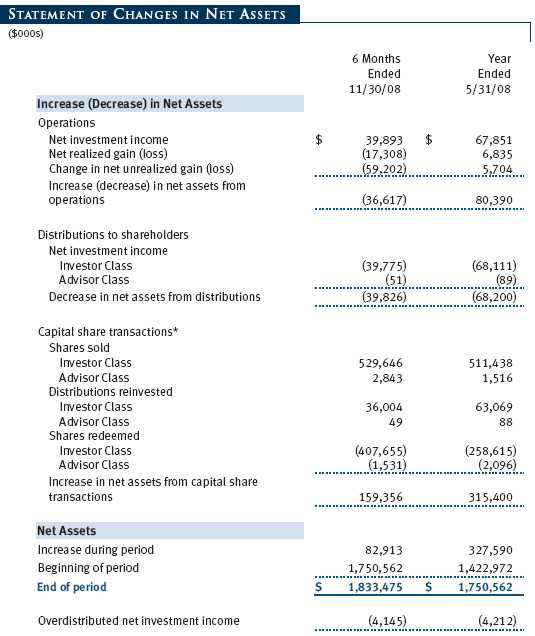

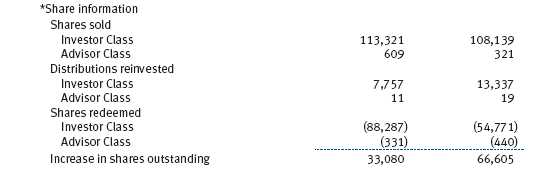

Unaudited

The accompanying notes are an integral part of these financial statements.

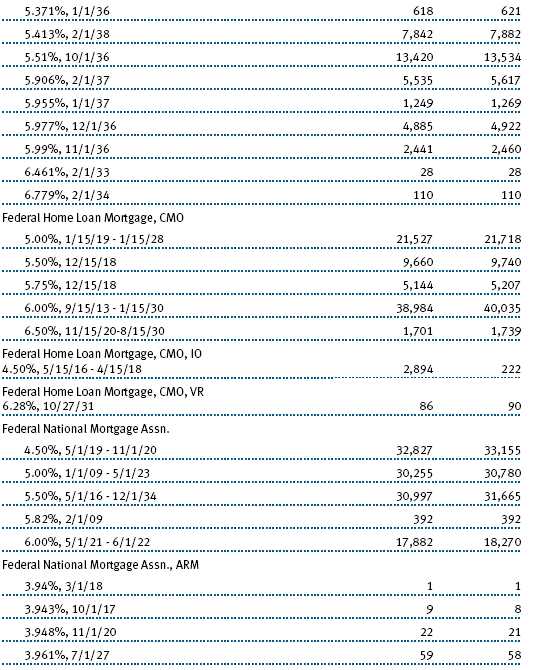

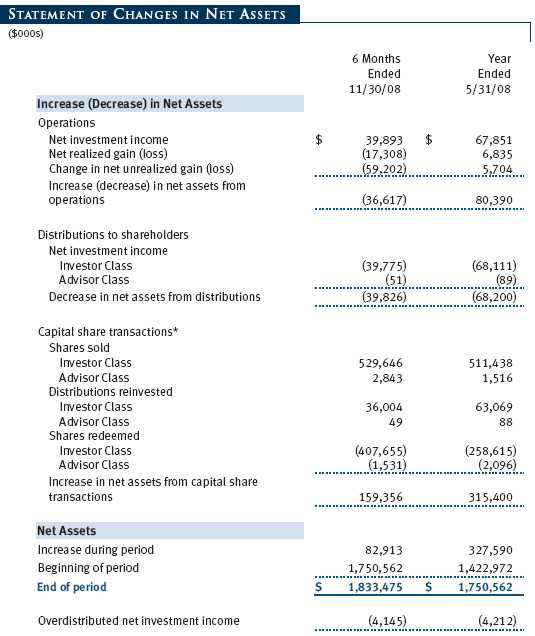

Unaudited

The accompanying notes are an integral part of these financial statements.

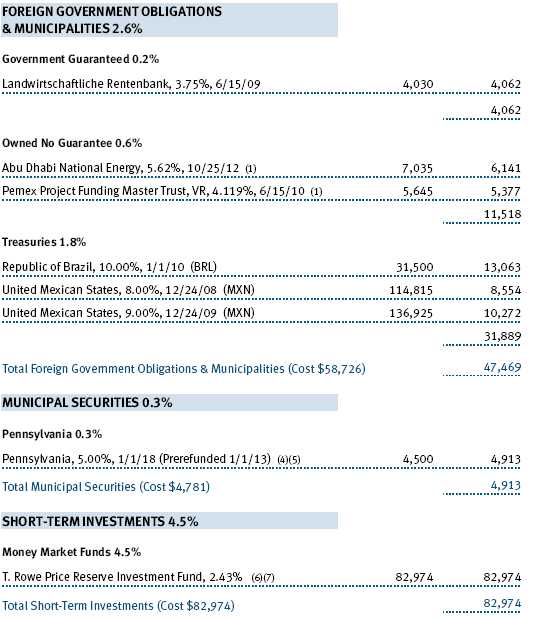

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

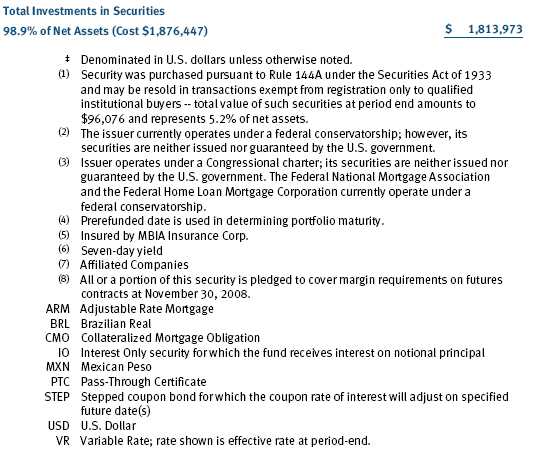

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

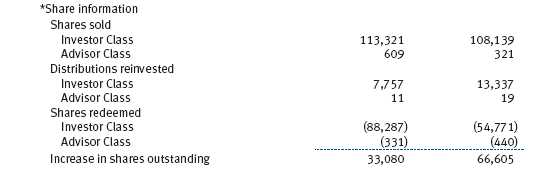

T. Rowe Price Short-Term Bond Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks a high level of income consistent with minimal fluctuation in principal value and liquidity. The fund has two classes of shares: the Short-Term Bond Fund original share class, referred to in this report as the Investor Class, offered since March 2, 1984, and Short-Term Bond Fund—Advisor Class (Advisor Class), offered since December 31, 2004. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries that are compensated by the class for distribution, shareholder servicing, and/or certain administrative services under a Board-approved Rule 12b-1 plan. Each class has exclusive voting rights on matters related solely to that class, separate voting rights on matters that relate to both classes, and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America, which require the use of estimates made by fund management. Fund management believes that estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the fund ultimately realizes upon sale of the securities.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Inflation adjustments to the principal amount of inflation-indexed bonds are reflected as interest income. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Payments (“variation margin”) made or received to settle the daily fluctuations in the value of futures contracts are recorded as unrealized gains or losses until the contracts are closed. Unsettled variation margin on futures contracts is reflected as other assets or liabilities, and unrealized gains and losses on futures contracts are reflected as the change in net unrealized gain or loss in the accompanying financial statements. Unrealized gains and losses on forward currency exchange contracts are reflected as the change in net unrealized gain or loss in the accompanying financial statements. Net periodic receipts or payments required by swaps are accrued daily and recorded as realized gain or loss in the accompanying financial statements. Fluctuations in the fair value of swaps are reflected in the change in net unrealized gain or loss and are reclassified to realized gain or loss upon termination prior to maturity or cash settlement. Paydown gains and losses are recorded as an adjustment to interest income. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared on a daily basis and paid monthly. Capital gain distributions, if any, are declared and paid by the fund, typically on an annual basis.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting The Advisor Class pays distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to both classes and investment income are allocated to the classes based upon the relative daily net assets of each class’s settled shares; realized and unrealized gains and losses are allocated based upon the relative daily net assets of each class’s outstanding shares.

Credits The fund earns credits on temporarily uninvested cash balances at the custodian that reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits, which are reflected as expenses paid indirectly.

New Accounting Pronouncements On June 1, 2008, the fund adopted Statement of Financial Accounting Standards No. 157 (FAS 157), Fair Value Measurements. FAS 157 defines fair value, establishes the framework for measuring fair value, and expands the disclosures of fair value measurements in the financial statements. Adoption of FAS 157 did not have a material impact on the fund’s net assets or results of operations.

In March 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 161 (FAS 161), Disclosures about Derivative Instruments and Hedging Activities, which is effective for fiscal years and interim periods beginning after November 15, 2008. FAS 161 requires enhanced disclosures about derivative and hedging activities, including how such activities are accounted for and their effect on financial position, performance and cash flows. Management is currently evaluating the impact the adoption of FAS 161 will have on the fund’s financial statements and related disclosures.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined under FAS 157. The fund values its investments and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Debt securities are generally traded in the over-the-counter (OTC) market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation. Financial futures contracts are valued at closing settlement prices. Forward currency exchange contracts are valued using the prevailing forward exchange rate. Swaps are valued at prices furnished by independent swap dealers or by an independent pricing service.

Other investments, including restricted securities, and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares closing prices, the next day’s opening prices in the same markets, and adjusted prices.

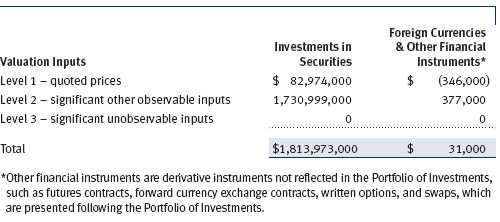

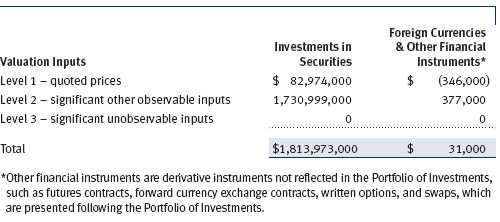

Valuation Inputs Various inputs are used to determine the value of the fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical securities

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar securities, interest rates, prepayment speeds, credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example, non-U.S. equity securities actively traded in foreign markets generally are reflected in Level 2 despite the availability of closing prices, because the fund evaluates and determines whether those closing prices reflect fair value at the close of the NYSE or require adjustment, as described above. The following table summarizes the fund’s investments, based on the inputs used to determine their values on November 30, 2008:

NOTE 3 - INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

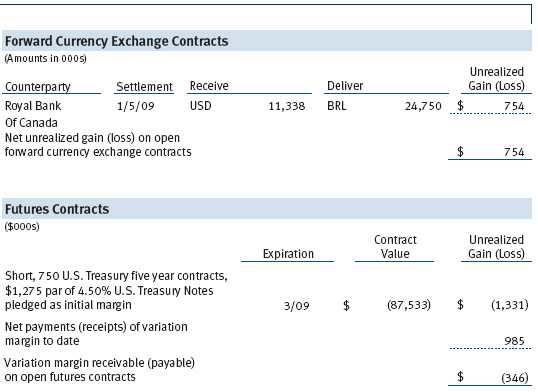

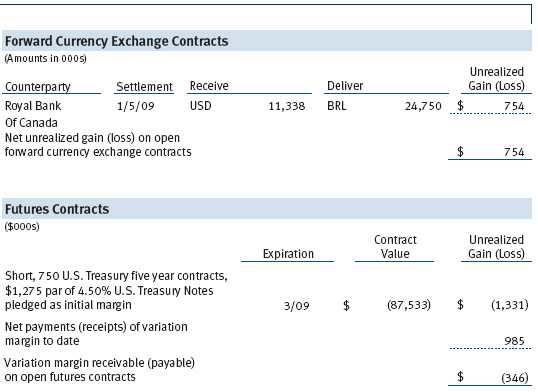

Forward Currency Exchange Contracts During the six months ended November 30, 2008, the fund was a party to forward currency exchange contracts under which it is obligated to exchange currencies at specified future dates and exchange rates. Risks arise from the possible inability of counterparties to meet the terms of their agreements and from movements in currency values.

Futures Contracts During the six months ended November 30, 2008, the fund was a party to futures contracts, which provide for the future sale by one party and purchase by another of a specified amount of a specific financial instrument at an agreed upon price, date, time, and place. Risks arise from possible illiquidity of the futures market and from movements in security values and/or interest rates and/or currency values.

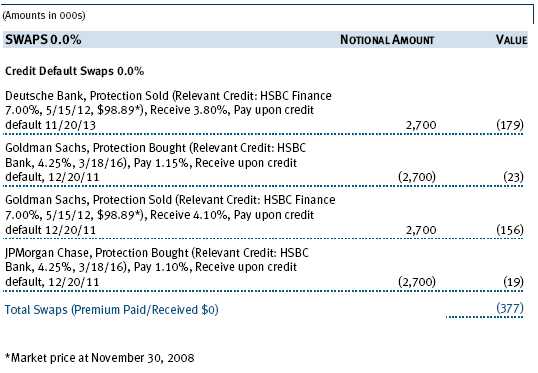

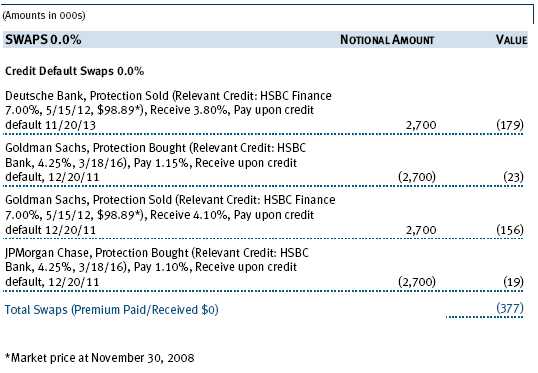

Credit Default Swaps During the six-months ended November 30, 2008, the fund was a party to credit default swaps. The fund may use swaps in an effort to manage exposure to changes in credit quality, to adjust overall exposure to certain markets, to enhance total return or protect the value of portfolio securities, to serve as a cash management tool, and/or to adjust portfolio duration or credit exposure. Credit default swaps are agreements where one party (the protection buyer) will make periodic payments to another party (the protection seller) in exchange for protection against specified credit events, such as certain defaults and bankruptcies related to an underlying credit instrument or issuer thereof. Upon occurrence of a specified credit event, the protection seller is required to pay the buyer the difference between the notional amount of the swap and the value of the underlying credit, either in the form of a net cash settlement or by paying the gross notional amount and accepting delivery of the relevant underlying credit. Generally, the payment risk for the seller of protection is inversely related to the current market price of the underlying credit; therefore, the payment risk increases as the price of the relevant underlying credit declines due to market valuations of credit quality. At November 30, 2008, the notional amount of protection sold by the fund totaled $5,400,000 (0.0% of net assets), which reflects the maximum potential amount the fund could be required to pay under such contracts. Risks related to the use of credit default swaps include the possible inability of the fund to accurately assess the current and future creditworthiness of underlying issuers and the possible failure of a counterparty to perform in accordance with the terms of the swap agreements.

Collateral Agreements The fund has entered collateral agreements with certain counterparties to mitigate counterparty risk on over-the-counter derivatives, including swaps and forward currency exchange contracts. Subject to established minimum levels, collateral is generally determined based on the net aggregate unrealized gain or loss on contracts with a particular counterparty. Collateral pledged to the fund is held in a segregated account by a third-party agent and can be in the form of cash or debt securities issued by the U.S. government or related agencies; collateral posted by the fund is noted in the accompanying Portfolio of Investments. As of November 30, 2008, no collateral was pledged by either the fund or counterparties.

TBA Purchase Commitments During the six months ended November 30, 2008, the fund entered into to be announced (TBA) purchase commitments, pursuant to which it agrees to purchase mortgage-backed securities for a fixed unit price, with payment and delivery at a scheduled future date beyond the customary settlement period for that security. With TBA transactions, the particular securities to be delivered are not identified at the trade date; however, delivered securities must meet specified terms, including issuer, rate, and mortgage term, and be within industry-accepted “good delivery” standards. The fund generally enters into TBAs with the intention of taking possession of the underlying mortgage securities. Until settlement, the fund maintains cash reserves and liquid assets sufficient to settle its TBAs.

Other Purchases and sales of portfolio securities, other than short-term and U.S. government securities, aggregated $306,664,000 and $138,970,000, respectively, for the six months ended November 30, 2008. Purchases and sales of U.S. government securities aggregated $149,843,000 and $147,596,000, respectively, for the six months ended November 30, 2008.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions are determined in accordance with Federal income tax regulations, which differ from generally accepted accounting principles, and, therefore, may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of November 30, 2008.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. As of May 31, 2008, the fund had $14,380,000 of unused capital loss carryforwards, of which $117,000 expire in fiscal 2009, $447,000 expire in fiscal 2012, $4,473,000 expire in fiscal 2013, $6,329,000 expire in fiscal 2014, and $3,014,000 expire in fiscal 2015. Additionally, $1,554,000 of the fund’s unused capital loss carryforwards may be subject to certain limitations on amount and/or timing of use related to being acquired through tax-free reorganizations.

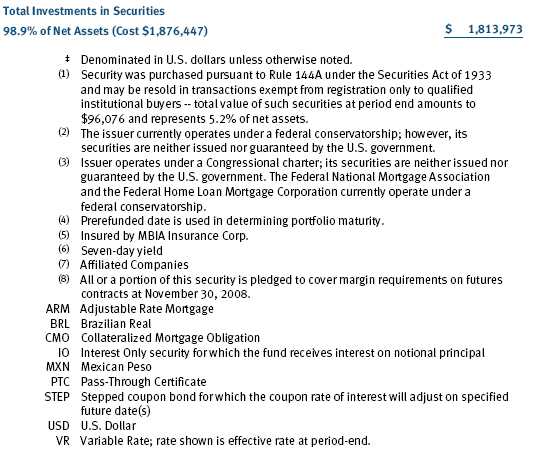

At November 30, 2008, the cost of investments for federal income tax purposes was $1,876,447,000. Net unrealized loss aggregated $63,713,000 at period-end, of which $13,204,000 related to appreciated investments and $76,917,000 related to depreciated investments.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.10% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At November 30, 2008, the effective annual group fee rate was 0.31%.

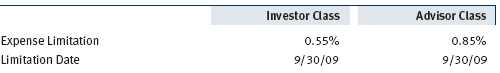

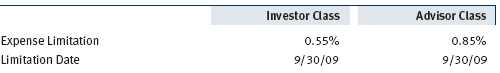

The Investor Class and Advisor Class are also subject to a contractual expense limitation through the limitation dates indicated in the table below. During the limitation period, the manager is required to waive its management fee and/or reimburse expenses, excluding interest, taxes, brokerage commissions, and extraordinary expenses, that would otherwise cause the class’s ratio of annualized total expenses to average net assets (expense ratio) to exceed its expense limitation. For a period of three years after the date of any reimbursement or waiver, each class is required to repay the manager for expenses previously reimbursed and management fees waived to the extent the class’s net assets have grown or expenses have declined sufficiently to allow repayment without causing the class’s expense ratio to exceed its expense limitation.

Pursuant to this agreement, expenses in the amount of $400,000 were reimbursed by the manager during the six months ended November 30, 2008. Including these amounts, expenses previously reimbursed by the manager in the amount of $2,490,000 remain subject to repayment at November 30, 2008.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share prices and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class. For the six months ended November 30, 2008, expenses incurred pursuant to these service agreements were $93,000 for Price Associates, $432,000 for T. Rowe Price Services, Inc., and $73,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the six months ended November 30, 2008, the fund was charged $207,000 for shareholder servicing costs related to the college savings plans, of which $182,000 was for services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At November 30, 2008, approximately 1% of the outstanding shares of the Investor Class were held by college savings plans.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Spectrum Funds (Spectrum Funds) may invest. The Spectrum Funds do not invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to a special servicing agreement, expenses associated with the operation of the Spectrum Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum Funds. Expenses allocated under this agreement are reflected as shareholder servicing expense in the accompanying financial statements. For the six-months ended November 30, 2008, the fund was allocated $438,000 of Spectrum Funds’ expenses, of which $330,000 related to services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At November 30, 2008, approximately 25% of the oustanding shares of the Investor Class were held by the Spectrum Funds.

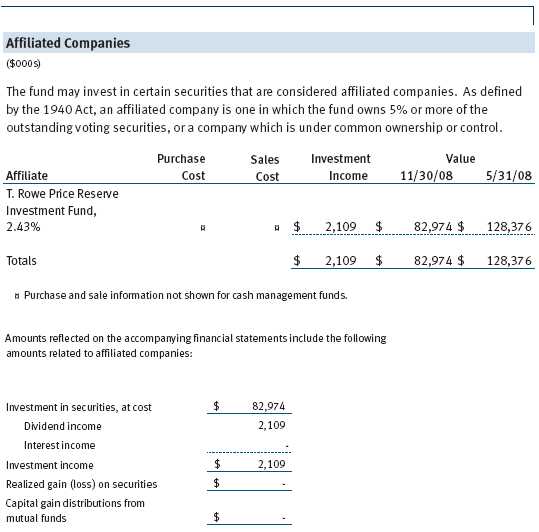

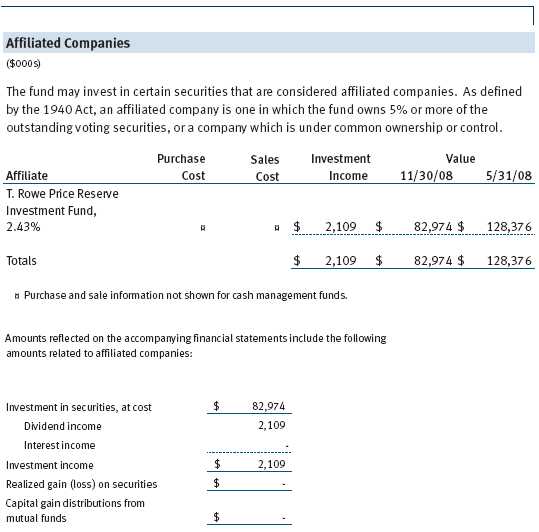

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

As of November 30, 2008, T. Rowe Price Group, Inc., and/or its wholly owned subsidiaries owned 4,862,561 shares of the Investor Class, representing 1% of the fund’s net assets.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

| | |

SIGNATURES |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the |

| undersigned, thereunto duly authorized. |

| |

| T. Rowe Price Short-Term Bond Fund, Inc. |

| |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | January 15, 2009 |

| |

| |

| |

| | Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment |

| Company Act of 1940, this report has been signed below by the following persons on behalf of |

| the registrant and in the capacities and on the dates indicated. |

| |

| |

| By | /s/ Edward C. Bernard |

| | Edward C. Bernard |

| | Principal Executive Officer |

| |

| Date | January 15, 2009 |

| |

| |

| |

| By | /s/ Gregory K. Hinkle |

| | Gregory K. Hinkle |

| | Principal Financial Officer |

| |

| Date | January 15, 2009 |