UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| |

| o | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

HILLS BANCORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| | x | No fee required. |

| | o | Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

|

| | |

| | o | Fee paid previously with preliminary materials: |

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

| (1) | Amount previously paid: |

| |

| (2) | Form, Schedule or Registration Statement No.: |

HILLS BANCORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 17, 2017

The Annual Meeting of the Shareholders of Hills Bancorporation, an Iowa corporation (the “Company”), will be held at the Hills Community Center, 110 E. Main Street, Hills, Iowa, on Monday, the 17th day of April, 2017, at 4:00 o’clock p.m., local time, for the following purposes:

| |

| 1. | To elect four members of the Board of Directors. |

| |

| 2. | To approve a non-binding advisory vote on executive compensation. |

| |

| 3. | To approve a non-binding advisory vote on the frequency of future non-binding advisory votes on executive compensation. |

| |

| 4. | To approve a non-binding advisory vote on the Company's appointment of its independent registered public accounting firm. |

| |

| 5. | To transact such other business as may properly be brought before the meeting or any adjournments thereof. |

The Board of Directors has fixed the close of business on March 3, 2017, as the record date for the determination of the shareholders entitled to notice of, to attend, and to vote at, the meeting. Accordingly, only shareholders of record at the close of business on that date will be entitled to attend and vote at the meeting, or any adjournments thereof.

TO ENSURE YOUR REPRESENTATION AT THE MEETING, THE BOARD OF DIRECTORS OF THE COMPANY SOLICITS YOU TO MARK, SIGN, DATE AND RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED ENVELOPE. YOUR PROXY MAY BE REVOKED AT ANY TIME BEFORE IT IS EXERCISED. IF YOU ARE ABLE TO ATTEND THE MEETING AND WISH TO VOTE YOUR SHARES PERSONALLY, YOU MAY WITHDRAW YOUR PROXY AND DO SO.

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS FOR THE

SHAREHOLDERS’ MEETING TO BE HELD ON APRIL 17, 2017.

Pursuant to the rules promulgated by the Securities and Exchange Commission, we have elected to provide access to our proxy materials both by: (i) sending you this full set of proxy materials, including a proxy card; and (ii) notifying you of the availability of our proxy materials on the internet.

This Notice of Annual Meeting, Proxy Statement, and our Annual Report to Shareholders for the fiscal year ended December 31, 2016, are available online and may be accessed at www.envisionreports.com/HBIA or www.edocumentview.com/HBIA. In accordance with applicable rules, we do not use “cookies” or other software that identifies visitors accessing these materials on this website. We encourage you to access and review all of the important information contained in the proxy materials before voting.

Date: March 17, 2017 By Order of the Board of Directors

/s/ Dwight O. Seegmiller

Hills Bancorporation Dwight O. Seegmiller

131 E. Main Street President and CEO

Hills, Iowa 52235

PROXY STATEMENT FOR THE ANNUAL MEETING OF SHAREHOLDERS OF

HILLS BANCORPORATION

To Be Held on April 17, 2017

TABLE OF CONTENTS

|

| |

| | Page |

| | |

| PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS | 3 |

| | |

| INFORMATION CONCERNING NOMINEES FOR ELECTION AS DIRECTORS | 6 |

| | |

| NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION | 8 |

| | |

| NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF FUTURE NON-BINDING ADVISORY VOTES ON EXECUTIVE COMPENSATION | 9 |

| | |

| NON-BINDING ADVISORY VOTE ON THE APPOINTMENT OF THE INDEPENDENT PUBLIC REGISTERED ACCOUNTING FIRM | 9 |

| | |

| INFORMATION CONCERNING DIRECTORS OTHER THAN NOMINEES | 10 |

| | |

| CORPORATE GOVERNANCE AND THE BOARDS OF DIRECTORS | 12 |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 16 |

| | |

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 17 |

| | |

| COMPENSATION AND INCENTIVE STOCK COMMITTEE INTERLOCKS AND CERTAIN OTHER TRANSACTIONS WITH EXECUTIVE OFFICERS AND DIRECTORS | 17 |

| | |

| COMPENSATION DISCUSSION AND ANALYSIS | 18 |

| | |

| COMPENSATION AND INCENTIVE STOCK COMMITTEE REPORT | 24 |

| | |

| SUMMARY OF CASH AND CERTAIN OTHER COMPENSATION PAID TO THE NAMED EXECUTIVE OFFICERS | 24 |

| | |

| RISK MANAGEMENT AND COMPENSATION POLICIES AND PRACTICES | 28 |

| | |

| AUDIT COMMITTEE | 29 |

| | |

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 30 |

| | |

| PROPOSALS BY SHAREHOLDERS | 30 |

| | |

| BOARD NOMINATING PROCESS | 30 |

| | |

| COMMUNICATION WITH THE BOARD OF DIRECTORS | 31 |

| | |

| AVAILABILITY OF FORM 10-K REPORT | 31 |

| | |

| OTHER MATTERS | 32 |

HILLS BANCORPORATION

131 Main Street

Hills, Iowa 52235

PROXY STATEMENT FOR ANNUAL MEETING OF SHAREHOLDERS

To Be Held on April 17, 2017

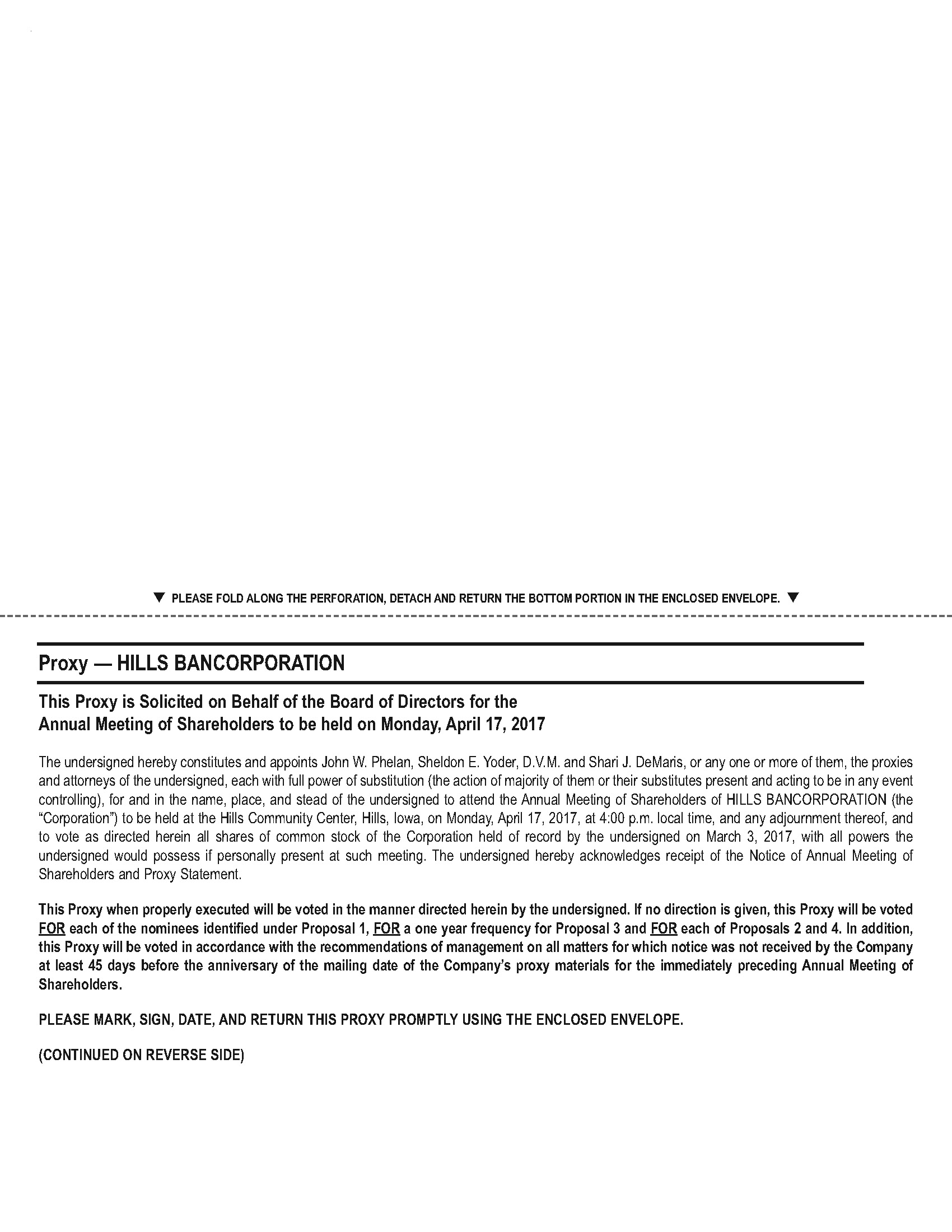

This Proxy Statement is furnished to shareholders of Hills Bancorporation (the “Company”) in connection with the solicitation of proxies by the Board of Directors of the Company for the Annual Meeting of Shareholders to be held at the Hills Community Center, 110 E. Main Street, Hills, Iowa, on Monday, April 17, 2017, at 4:00 p.m., local time, and any adjournments thereof. This Proxy Statement and form of Proxy enclosed herewith are first being sent to the shareholders of the Company entitled to vote at the Annual Meeting on or about March 17, 2017.

General Information about the Meeting and Voting Securities and Procedures

Who may vote at the meeting?

The Board of Directors has fixed the close of business on March 3, 2017 as the record date for the determination of shareholders who are entitled to notice of and to vote at the meeting. You are entitled to one vote for each share of common stock you held on the record date, including shares:

| |

| • | held directly in your name; and |

| |

| • | held for you in an account with a broker, bank or other nominee (shares held in “street name”). |

How many shares must be present to hold the meeting?

The presence in person or by proxy of a majority of the Company’s common shares entitled to vote at the Annual Meeting shall constitute a quorum for purposes of holding the meeting and conducting business. On the record date there were 9,320,392 shares of the Company's common stock outstanding, which amount includes unvested shares of restricted stock entitled to voting rights. Each of the holders of the outstanding shares and restricted stock grants, totaling 9,338,291 shares, are entitled to one vote per share. Your shares are counted as present at the meeting if you:

| |

| • | are present and vote in person at the meeting; or |

| |

| • | have properly submitted a proxy card prior to the meeting. |

Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business at the meeting.

What proposals will be voted on at the meeting?

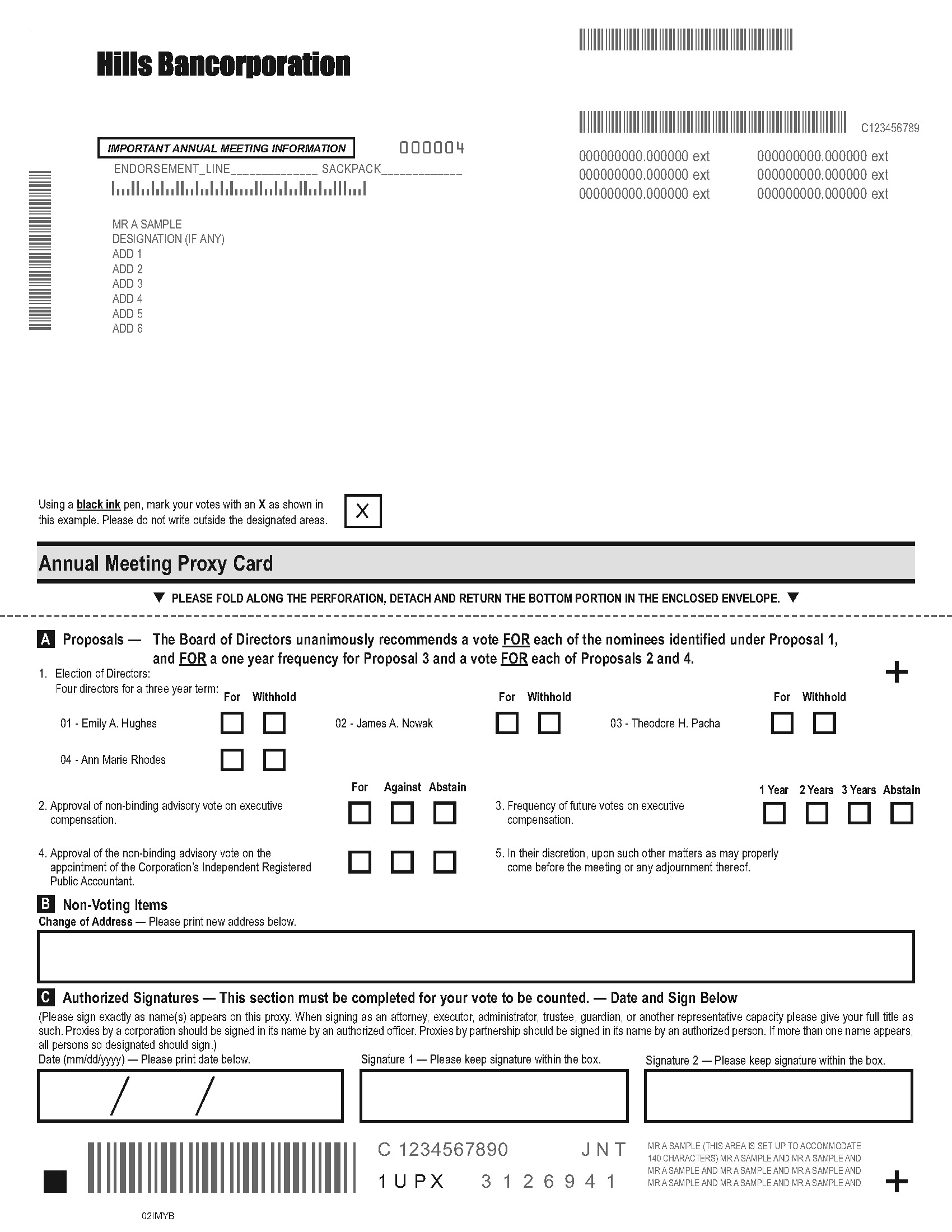

There are four proposals scheduled to be voted on at the meeting which include: (i) the election of members to serve on the Company Board of Directors; (ii) an advisory vote to approve the executive compensation programs of the Company; (iii) an advisory vote on the frequency to consider the executive compensation noted in Proposal Two; and (v) an advisory vote on the selection of our independent registered accounting firm, which gives you the opportunity to endorse or not endorse the Company’s appointment of the independent registered public accounting firm.

Who is requesting my vote?

The solicitation of proxies on the enclosed form is made on behalf of the Board of Directors of the Company and will be conducted primarily through the mail. Please mail your completed proxy in the envelope included with these proxy materials. In addition to the use of the mail, members of the Board of Directors and certain officers and employees of the Company or its subsidiary may solicit the return of proxies by telephone, facsimile, and other electronic media or through personal contact. The directors, officers and employees that participate in such solicitation will not receive additional compensation for such efforts, but will be reimbursed for out-of-pocket expenses. The cost of preparing, assembling and mailing this Proxy Statement, the Notice of Meeting and the enclosed proxy will be borne by the Company.

How many votes are required to approve each proposal?

Proposal One:

Because the election of Directors is determined by a plurality, the nominees receiving the most votes “FOR” will be elected. Shareholders of the Company do not have cumulative voting rights in the election of Directors.

Proposal Two:

Proposal Two, commonly known as a “Say-on-Pay” proposal, gives you as a shareholder the opportunity to endorse or not endorse our executive compensation programs. The affirmative vote of a majority of the votes cast by the holders of the Company’s common stock is required to approve Proposal Two, a non-binding advisory vote on executive compensation.

Proposal Three:

Proposal Three, commonly known as a “Say-on-Frequency” proposal, gives you, as a shareholder, the opportunity to express your opinion about how often the shareholders should vote concerning the Company’s executive compensation programs. Proposal Three, last voted on at the Company’s annual meeting of shareholders held in 2011, is a non-binding advisory vote on the frequency of future non-binding advisory votes on executive compensation. The frequency choice which receives the highest number of votes at the Annual Meeting will be deemed the choice of the stockholders.

Proposal Four:

The affirmative vote of a majority of the votes cast by the holders of the Company’s common stock is required to approve Proposal Four, a non-binding advisory vote on the appointment of the independent registered public accounting firm.

What are the effects of abstentions and broker non-votes on each proposal?

If you hold your shares in a trust or brokerage account (sometimes referred to as holding shares in “street name”) please note that your bank or brokerage firm has no discretionary voting authority with respect to Proposals One, Two or Three, and therefore cannot vote on any of such proposal in the absence of your instructions. As a result, unless you direct your broker on how to vote your shares with respect to those proposals, your shares will remain un-voted on Proposals One, Two and Three. Shares held in street name for which no voting instructions have been provided by the beneficial owner (and which are not voted by the broker pursuant to discretionary voting authority) are generally referred to as “broker non-votes.” Although abstentions and broker non-votes will be counted for purposes of determining the presence of a quorum, they are not considered votes cast at the meeting.

Proposal One:

Under Proposal One, Directors will be elected by a plurality of the votes cast at the Annual Meeting. This means that the four nominees who receive the largest number of “FOR” votes cast will be elected as directors. Abstentions from voting and broker non-votes, if any on Proposal One, will have no effect on the outcome on the election of Directors.

Proposal Two:

The approval of Proposal Two requires only the vote of the majority of the “votes cast” at the Annual Meeting. Because abstentions from voting and broker non-votes are not treated as “votes cast,” they will have no effect on the outcome of this proposal.

Proposal Three:

Under Proposal Three, the frequency choice which receives the highest number of votes at the Annual Meeting will be deemed the choice of the stockholders. Abstentions from voting and broker non-votes, if any on Proposal Three, will have no effect on the outcome of the Say-on-Frequency proposal.

Proposal Four:

Proposal Four requires only the vote of the majority of the “votes cast” at the Annual Meeting. Because abstentions from voting and broker non-votes are not treated as “votes cast”, they will have no effect on the outcome of this proposal.

How does the Board recommend that I vote?

The Board of Directors urges you to read the Proxy Statement carefully and then vote your shares for the Annual Meeting. The Board of Directors recommends that you vote FOR each of the Director nominees named in this Proxy Statement, FOR a one year frequency for future votes on executive compensation and FOR approval of each of Proposals 2 and 4.

How are shares voted?

For proposal One, a shareholder may:

| |

| • | Vote “FOR” each of the nominees for election to the Company’s Board of Directors |

| |

| • | ‘WITHHOLD AUTHORITY” to vote for one or more nominees |

| |

| • | Abstain from voting on the proposal |

For Proposals Two and Four, a shareholder may:

| |

| • | Vote “AGAINST” the proposal |

| |

| • | Abstain from voting on the proposal |

For Proposal Three, a shareholder may:

| |

| • | Vote for non-binding advisory votes every year |

| |

| • | Vote for non-binding advisory votes every other year |

| |

| • | Not for non-binding advisory votes every third year |

| |

| • | Abstain from voting on the proposal |

If the accompanying proxy is properly signed and returned and is not withdrawn or revoked, the shares represented thereby will be voted in accordance with the specifications thereon. If the manner of voting such shares is not indicated on the proxy, the shares will be voted FOR the election of the nominees for Directors named herein, FOR a one year frequency on future votes on executive compensation and FOR the approval of Proposals 2 and 3. Your shares will also be voted in the discretion of the proxy committee on any other business properly brought forth at the Annual Meeting

If your shares are held in street name, your bank or broker is not permitted to discretionarily vote on your behalf in the absence of voting instructions from you for any of Proposals One, Two or Three. For your vote to be counted on such proposals, you must communicate your voting decisions to your bank, broker or other holder of record before the date of the Annual Meeting.

How do I vote my shares without attending the meeting?

Whether you hold shares directly or in “street name,” you may direct your vote without attending the Annual Meeting.

If you are a shareholder of record, you may vote by signing and dating your proxy card and mailing it to the Company in the envelope provided. You should sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example as guardian, trustee, custodian, attorney or officer of a corporation), you should indicate your name and title or capacity.

For shares held in “street name,” you should follow the voting instructions provided by your broker or nominee. You may complete and mail a voting instruction card to your broker or nominee or, in some cases, submit voting instructions to you broker or nominee by telephone or the internet. If you provide specific voting instructions by mail, telephone, or internet, your broker or nominee will vote your shares as you have directed.

How do I vote my shares in person at the meeting?

Even if you plan to attend the meeting, we encourage you to submit your proxy by mail so your vote will be counted if you later decide not to attend the meeting.

If you choose to vote at the Annual Meeting:

| |

| • | If you are a shareholder of record, to vote your shares at the meeting you should bring the enclosed proxy card and proof of identity. |

| |

| • | If you hold your shares in “street name,” you must obtain a proxy in your name from your bank, broker or other holder of record in order to vote at the meeting and bring proof of beneficial ownership (such as a recent brokerage statement or a letter from your bank or broker) and proof of identity. |

What does it mean if I receive more than one proxy?

It likely means you hold shares registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy.

May I change my vote?

Yes. A shareholder may revoke his or her proxy at any time prior to the voting thereof by filing with the Treasurer of the Company at the Company’s principal office at 131 E. Main Street, Hills, Iowa 52235, a written revocation or a duly executed proxy bearing a later date. A shareholder may also withdraw the proxy at the meeting at any time before it is exercised. The presence of a shareholder at the Annual Meeting will not automatically revoke such shareholder’s previously submitted proxy.

When will the proxy and annual report be mailed to shareholders?

This Proxy Statement and the accompanying Notice of Annual Meeting of Shareholders and proxy are being mailed to the Company's shareholders on or about March 17, 2017.

How may I view the proxy statement and annual report electronically?

The Proxy Statement, and our Annual Report to Shareholders for the fiscal year ended December 31, 2016, are available online and may be accessed at www.envisionreports.com/HBIA or www.edocumentview.com/HBIA.

PROPOSAL 1

ELECTION OF DIRECTORS

INFORMATION CONCERNING NOMINEES FOR ELECTION AS DIRECTORS

The Company currently has eleven Directors with staggered terms of office. The Board of Directors has no reason to believe that any nominee will be unable to serve as a Director, if elected. However, in case any nominee should become unavailable for election, the proxy will be voted for such substitute, if any, as the Board of Directors may designate.

Each Director of the Company also serves as a Director of the Company’s wholly-owned subsidiary, Hills Bank and Trust Company (the “Bank”), which is a commercial bank. The Company anticipates that, following the election of the nominees set forth below, all Directors of the Company will continue to serve as Directors of the Bank. The Directors of the Bank are elected by the vote of the Company as the sole shareholder of the Bank.

Set forth below are the names of the four persons nominated by the Board of Directors for election as Directors of the Company at the 2017 Annual Meeting, along with certain other information concerning such persons.

|

| | | | | | |

Name and Year

First Become

Director | | Age | | Positions &

Offices Held

With Company | | Principal Occupation or Employment

During the Past Five Years and Education

Pertaining to Board of Director Qualifications |

| | | | | | | |

| Director Serving Until the 2020 Annual Meeting |

| | | | | | | |

Emily A. Hughes

2012 - Company

2012 - Bank | | 49 | | Director | | Professor, University of Iowa College of Law since 2011. From 2006 to 2011, associate professor and tenured professor at Washington University School of Law. Ms. Hughes is an attorney and obtained her law degree from the University of Michigan Law School. |

| | | | | | | |

James A. Nowak

2004 - Company

2004 - Bank | | 69 | | Director | | Partner - RSM US LLP (Retired 2004), Cedar Rapids, Iowa. Mr. Nowak is a graduate of the University of Wisconsin and a certified public accountant. |

| | | | | | | |

Theodore H. Pacha

1990 - Company

1990 - Bank | | 68 | | Director and Vice President | | President and owner of THEO Resources LLC, a business investment and consulting company in Iowa City, Iowa, May 1999 to present. Mr. Pacha previously founded and owned Hawkeye Medical Supply, Inc., a medical supplies company, located in Iowa City, Iowa, until its sale in 1998. |

| | | | | | | |

Ann Marie Rhodes

1993 - Company

1993 - Bank | | 63 | | Director | | The University of Iowa - Clinical Professor of Nursing and Instructor College of Law. Ms. Rhodes obtained a nursing degree from The College of Saint Teresa and a masters in nursing from the University of Iowa. In addition, Ms. Rhodes is an attorney receiving her law degree from the University of Iowa College of Law. |

Additional information regarding the Directors to serve until the 2020 Annual Meeting is as follows:

Emily A. Hughes: Ms. Hughes was elected to the Board of Directors in 2012. Ms. Hughes presently serves on the Audit Committee, Loan Committee and the Compensation and Incentive Stock Committee of the Board of Directors. Ms. Hughes is a professor at the University of Iowa College of Law. Before joining the University of Iowa College of Law faculty, Ms. Hughes was a professor at Washington University School of Law, and co-director of the Center for Justice in Capital Cases at DePaul University College of Law. Ms. Hughes also worked as a public defender for the Office of the Iowa State Public Defender in Iowa City. Ms. Hughes is an attorney and graduated from the University of Michigan Law School and has a master’s degree in international relations from Yale University. Ms. Hughes is a member of the Missouri, Illinois and Iowa bar associations. Ms. Hughes’ experience with the largest employer in the Company’s trade area, the University of Iowa, and her legal expertise provide important insight to the Board of Directors.

James A. Nowak: Mr. Nowak has served as a Director of the Company and the Bank since 2004. Mr. Nowak presently serves as the Chairperson of the Audit Committee and is considered its financial expert. Mr. Nowak also serves on the Risk Committee and the Compensation and Incentive Stock Committee of the Board of Directors. Mr. Nowak graduated from the University of Wisconsin with a degree in Accounting and is a CPA. Until his retirement in 2004, Mr. Nowak was an audit and accounting partner for RSM US LLP. In his duties with RSM US LLP, Mr. Nowak had review responsibilities including SEC reporting requirements for clients. Mr. Nowak was with RSM US LLP from 1970 through 2004. Mr. Nowak’s financial knowledge is a valuable contribution to the Board of Directors. Mr. Nowak is an active member of the Cedar Rapids community. Hills Bank currently has three Bank offices in Cedar Rapids and two in neighboring Marion, Mr. Nowak’s knowledge and contacts in this market has been invaluable in assisting with the expansion of this market. Mr. Nowak is a member of the American Institute of Certified Public Accountants and the Iowa Society of Certified Public Accountants.

Theodore H. Pacha: Mr. Pacha was first elected to serve as a Director in 1990 and has also served as a Director of the Bank since 1990. Mr. Pacha is currently the Chairperson of the Board of Directors of the Bank and Vice President of the Company. Mr. Pacha serves on the Employee Stock Ownership Plan Committee and the Compensation and Incentive Stock Committee of the Board of Directors. Mr. Pacha is currently the President and owner of THEO Resources LLC which is a business investment and consulting company in Iowa City, Iowa. Mr. Pacha previously founded and owned Hawkeye Medical Supply, Inc. which was a medical supply company and was located in Iowa City, Iowa. Mr. Pacha sold Hawkeye Medical Supply, Inc. in 1998.

Mr. Pacha is a life-long Iowa City resident, and a community leader and business person. Mr. Pacha has considerable knowledge of the Iowa City area which is beneficial to the Company, especially its Johnson County, Iowa offices. Mr. Pacha’s business knowledge is a valuable contribution to the Board of Directors. Mr. Pacha is also active in the Iowa City community.

Ann Marie Rhodes: Ms. Rhodes was elected to the Board of Directors in 1993. Ms. Rhodes at that time also became a member of the Board of Directors of the Bank. The Board Committees which Ms. Rhodes serves on are the Trust Committee and the Compensation and Incentive Stock Committee. Ms. Rhodes is a Clinical Professor of Nursing and Instructor in the University of Iowa College of Law. Ms. Rhodes obtained a nursing degree from The College of Saint Teresa, a Masters in Nursing at the University of Iowa and her law degree from the University of Iowa College of Law. Ms. Rhodes’ experience with the largest employer in the Company’s trade area, the University of Iowa, provides important insight to the Board of Directors. Ms. Rhodes is a member of the American and Iowa Bar Associations. In addition, Ms. Rhodes is involved in leadership roles in several community organizations.

None of the nominees currently serves, or has served in the past five years, as a Director of another company whose securities are registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or whose securities are subject to the requirements of Section 15(d) of the Exchange Act or a company registered under the Investment Company Act of 1940, as amended. There are no family relationships among the Company’s Directors, nominees for Director and executive officers.

|

| | | | |

| | The Board of Directors unanimously recommends to the Shareholders a vote “FOR” the election of the above-listed persons as Directors for the Company. | |

PROPOSAL 2

NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) and related SEC regulations, the Company is providing shareholders with an advisory (non-binding) vote on compensation programs for our Named Executive Officers (commonly referred to as “Say on Pay”). As approved by its shareholders at the 2011 annual meeting, the Company is submitting this non-binding vote to shareholders on an annual basis. Accordingly, you may vote on the following resolution at the 2017 Annual Meeting:

“Resolved, that the compensation paid to the Company’s Named Executive Officers, as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K of the SEC, including the Compensation Discussion and Analysis, compensation tables, and the related narrative disclosure is hereby approved.”

This vote is non-binding. The Board and the Compensation and Incentive Stock Committee, which is comprised of non-employee Directors, expect to take into account the outcome of the vote when considering future executive compensation decisions to the extent they can determine the cause or causes of any significant negative voting results.

Shareholders are encouraged to review the Compensation Discussion and Analysis section of this Proxy Statement for a detailed discussion of our executive compensation programs. The affirmative vote of a majority of the shares of common stock cast at the meeting, in person or by proxy, and entitled to vote thereon is required to approve Proposal 2.

|

| | | | |

| | The Board of Directors unanimously recommends that you vote “FOR” the approval, on an advisory basis, of the compensation of our Named Executive Officers as disclosed in the Compensation Discussion and Analysis, the accompanying compensation tables, and the related narrative disclosure. | |

PROPOSAL 3

NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF FUTURE

NON-BINDING ADVISORY VOTES ON EXECUTIVE COMPENSATION

In addition to providing shareholders with the opportunity to cast an advisory vote on executive compensation, the Dodd-Frank Act and SEC regulations require that the Company provide shareholders with an advisory vote on whether the advisory vote on executive compensation should be held every one, two or three years.

The Board believes that a frequency of every one year for the advisory vote on executive compensation is the optimal interval for conducting and responding to a say on pay vote. The Board recommends the one year frequency as it allows shareholders to annually express their views on the Company’s executive compensation program.

The proxy card provides shareholders with the opportunity to choose among four options (holding the vote every one, two or three years, or abstaining) and, therefore, shareholders will not be voting to approve or disapprove the Board’s recommendation.

Although this advisory vote on the frequency of the say on pay vote is non-binding, the Board and the Compensation and Incentive Stock Committee will take into account the outcome of the vote when considering the frequency of future advisory votes on executive compensation.

|

| | | | |

| | The Board of Directors unanimously recommends that you vote for the option of every one year for future advisory votes on executive compensation. | |

PROPOSAL 4

NON-BINDING ADVISORY VOTE ON THE APPOINTMENT OF THE INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors proposes and recommends that the shareholders approve the selection by the Committee of the firm of BKD LLP to serve as the Company’s independent registered public accounting firm for the 2017 fiscal year. The firm has served as independent auditors for the Company since 2012. Action by the shareholders is not required by law in the appointment of an independent registered public accounting firm, but their appointment is submitted by the Audit Committee of the Board of Directors in order to give the shareholders a voice in the designation of auditors. If the resolution approving BKD LLP as the Company’s independent registered public accounting firm is rejected by the shareholders, the Committee will reconsider its choice of independent auditors. Even if the resolution is approved, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

Proxies in the form solicited hereby which are returned to the Company will be voted in favor of this non-binding proposal unless otherwise instructed by the shareholder. The affirmative vote of a majority of the shares of common stock cast at the meeting, in person or by proxy, and entitled to vote thereon is required to approve Proposal 4.

|

| | | | |

| |

The Board of Directors unanimously recommends to the Shareholders a vote “FOR” the non-binding advisory proposal to approve the appointment of the Company’s Independent Registered Public Accounting Firm.

| |

INFORMATION CONCERNING DIRECTORS OTHER THAN NOMINEES

The following tables set forth certain information with respect to Directors of the Company who will continue to serve as Directors subsequent to the 2017 Annual Meeting and who are not nominees for election at the 2017 Annual Meeting.

|

| | | | | | |

Name and Year

First Become

Director | | Age | | Positions &

Offices Held

With Company | | Principal Occupation or Employment

During the Past Five Years and Education

Pertaining to Board of Director Qualifications |

| | | | | | | |

| Director Serving Until the 2018 Annual Meeting | | |

| | | | | | | |

Michael S. Donovan

2007 - Company

2007 - Bank

| | 54 | | Director | | Farmer and President of Donovan & Sons, Ltd., a local Johnson County, Iowa family farm corporation, and partner in PVP1, LLP, a local pork production operation. Mr. Donovan is a graduate of North Iowa Area Community College.

|

| | | | | | | |

Thomas J. Gill, D.D.S.

1993 - Company

1993 - Bank

| | 70 | | Director | | Dentist - Private Practice in Coralville, Iowa since 1980. Dr. Gill is a graduate of the University of Iowa College of Dentistry.

|

| | | | | | | |

Dwight O. Seegmiller

1986 - Company

1986 - Bank

| | 64 | | Director and

President

| | President of the Company and the Bank. Mr. Seegmiller is a graduate of Iowa State University’s Agricultural Business Honors Program and the Stonier Graduate School of Banking at Rutgers University. He joined the Company in 1975 and has been President of the Company since 1986. Prior to 1986, Mr. Seegmiller was the Senior Vice President of Lending.

|

| | | | | | | |

Thomas R. Wiele

2012 - Company

2012 - Bank

| | 64 | | Director | | President, Dealer and Operator of Wiele Motor Company, located in West Liberty and Columbus Junction, Iowa.

|

Additional information regarding the Directors to serve until the 2018 Annual Meeting is as follows:

Michael S. Donovan: Mr. Donovan was elected to the Board of Directors in 2007. Mr. Donovan at that time also became a member of the Board of Directors of the Bank. Mr. Donovan is a farmer and the President and a shareholder of Donovan and Sons, Ltd, an Iowa farm corporation. Mr. Donovan also is a partner in PVP1, LLP, a pork production operation in the Company’s trade area. Mr. Donovan is a graduate of North Iowa Area Community College. Mr. Donovan serves on the Risk Committee and Compensation and Incentive Stock Committee of the Board of Directors. Mr. Donovan’s expertise and agricultural knowledge, especially in the area of hog production, is a valuable contribution to the Board of Directors and provides important insight into the Board of Directors’ loan responsibilities.

Thomas J. Gill, D.D.S.: Dr. Gill was elected to the Board of Directors in 1993. Dr. Gill at that time also became a member of the Board of Directors of the Bank. The Board Committees on which Dr. Gill serves are the Trust Committee, the Risk Committee and the Compensation and Incentive Stock Committee. Dr. Gill is a graduate of the University of Iowa College of Dentistry and has been a dentist in private practice since 1980. Dr. Gill is a Coralville, Iowa resident and is active in local government. Dr. Gill’s experience as a small business owner and knowledge of the Johnson County, Iowa area provide an important contribution to the Board of Directors.

Dwight O. Seegmiller: Mr. Seegmiller has served as a Director of the Company and the Bank since 1986. Mr. Seegmiller is the President and Chief Executive Officer of the Company and the Bank. Prior to becoming President of the Company and the Bank in 1986, Mr. Seegmiller was the Senior Vice President of Lending. Mr. Seegmiller joined the Bank in 1975. Mr. Seegmiller graduated from Iowa State University’s Agricultural Business Honors Program. Mr. Seegmiller graduated from the Stonier Graduate School of Banking at Rutgers University in 1981. Mr. Seegmiller’s knowledge of the Company and the Bank provide consistent and valuable contributions to the Board of Directors.

Thomas R. Wiele: Mr. Wiele was elected to the Board of Directors in 2012. Mr. Wiele presently serves on the Loan Committee and the Compensation and Incentive Stock Committee of the Board of Directors. Mr. Wiele is the President, a dealer and operator of Wiele Motor Company located in West Liberty and Columbus Junction, Iowa. Wiele Motor Company is a local Chevrolet and Buick automobile dealer. Mr. Wiele has been a partner of Wiele Motor Company since 1978 and President since 1996. Mr. Wiele is a member of the National Association of Automobile Dealers, the Iowa Association of Automobile Dealers and the Chevrolet Society of Sales Executives. Mr. Wiele’s business expertise and knowledge are a valuable contribution to the Board of Directors and provides important insight into the Board of Director’s loan responsibilities. Mr. Wiele has considerable knowledge of the Company’s trade area and is active in community organizations.

|

| | | | | | |

Name and Year

First Become

Director | | Age | | Positions &

Offices Held

With Company | | Principal Occupation or Employment

During the Past Five Years and Education

Pertaining to Board of Director Qualifications |

| | | | | | | |

| Director Nominees Who Will Serve Until the 2019 Annual Meeting |

| | | | | | | |

Michael E. Hodge 2000 - Company 2000 - Bank

| | 63 | | Director | | President and shareholder of Hodge Construction Company, an Iowa City, Iowa business. Mr. Hodge obtained a BS in civil engineering from the University of Iowa.

|

| | | | | | | |

John W. Phelan 2007 - Company 2007 - Bank

| | 62 | | Director

| | Owner of Phelan Distributing LLC, a wholesale wine distributor in Cedar Rapids, Iowa. |

| | | | | | | |

Sheldon E. Yoder, D.V.M. 1997 - Company 1997 - bank

| | 64 | | Director | | President and shareholder of Kalona Veterinary Clinic, P.C., located in Kalona, Iowa. Dr. Yoder is a graduate of the Iowa State University College of Veterinary Medicine. He has been President of Kalona Veterinary Clinic since 1978. |

| | | | | | | |

Additional information regarding the Directors to serve until the 2019 Annual Meeting is as follows:

Michael E. Hodge: Mr. Hodge has served as a Director of the Company and the Bank since 2000. Mr. Hodge presently serves on the Loan Committee and the Compensation and Incentive Stock Committee of the Board of Directors. Mr. Hodge is a graduate of the University of Iowa College of Engineering with a BS in civil engineering. He is the President and principal shareholder of Hodge Construction Company founded in Iowa City, Iowa in 1981. Hodge Construction Company is a private company that is involved in real estate development and as a builder primarily in Iowa City, Coralville, North Liberty and the Cedar Rapids area. The Bank has office locations in each of these communities. Mr. Hodge is active in several professional trade associations in the Iowa City area. Mr. Hodge has significant experience in real estate development, including single family and multi-family and commercial projects and provides important insight to the Board of Directors for the Loan Committee. In addition, Mr. Hodge is actively involved in leadership roles in several non-profit organizations in the Iowa City market.

John W. Phelan: Mr. Phelan was elected to the Board of Directors in 2007. Mr. Phelan at that time also became a member of the Board of Directors of the Bank. The Board Committees which Mr. Phelan serves on are the Trust Committee and the Compensation and Incentive Stock Committee. Mr. Phelan is the owner of Phelan Distributing LLC, a wholesale wine distributor in Cedar Rapids, Iowa. Mr. Phelan is originally from Iowa City, Iowa and is currently an active member of the Cedar Rapids community. The Bank currently has three branch offices in Cedar Rapids and two in neighboring Marion so Mr. Phelan’s knowledge and contacts in this market have been invaluable in assisting with the expansion of this market. Mr. Phelan is a past president of the State of Iowa Broadcasters Association and a long-term Board member of that organization. Mr. Phelan is active as a Board member in two non-profit organizations with connections to the University of Iowa in Iowa City, Iowa as well as involvement in non-profit organizations in Cedar Rapids, Iowa.

Sheldon E. Yoder, D.V.M.: Dr. Yoder was first elected to serve as a Director in 1997 and has also served as a Director of the Bank since 1997. Dr. Yoder presently serves on the Audit Committee and the Compensation and Incentive Stock Committee of the Board of Directors. Dr. Yoder is a graduate of Iowa State University College of Veterinary Medicine. He is the President and the sole shareholder of Kalona Veterinary Clinic, P.C., which he founded in 1978 in Kalona, Iowa. Dr. Yoder is a life-long resident of the Kalona area and as a community leader and business person, has considerable knowledge that continues to be especially favorable to the Bank’s Kalona and Wellman offices. Dr. Yoder’s small business expertise and agriculture knowledge

also continues to be a valuable contribution to the Board of Directors. Dr. Yoder is active professionally with the American Veterinary and Iowa Veterinary Associations. Dr. Yoder has demonstrated active involvement in the community’s non-profit organizations in the Kalona community.

None of the Directors currently serves, or has served in the past five years, as a Director of another company whose securities are registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or whose securities are subject to the requirements of Section 15(d) of the Exchange Act or a company registered under the Investment Company Act of 1940, as amended. There are no family relationships among the Company’s Directors, nominees for Director and executive officers.

CORPORATE GOVERNANCE AND THE BOARDS OF DIRECTORS

Board of Directors of the Company

The Board of Directors of the Company meets on a regularly scheduled basis. During 2016, the Board of Directors of the Company held an annual meeting, one special meeting and twelve regular meetings. During 2016, all Directors of the Company attended at least seventy-five percent of the total number of meetings of the Board and all of the committees to which such Directors were appointed. Although the Company does not have a formal policy regarding attendance by Directors at annual shareholder meetings, such attendance is encouraged. In 2016, all eleven of the Company’s Directors attended the annual shareholders’ meeting.

The Board of Directors of the Company has established a committee (the "Governance and Nominating Committee") consisting of the ten non-employee Directors (i.e., all Directors but Mr. Seegmiller), all of whom are considered to be independent as defined under the rules of NASDAQ, except for Mr. Hodge. The Governance and Nominating Committee assists in identifying individuals qualified to become Board members, and to recommend nominees for director (including evaluating candidates recommended by shareholders), recommends the corporate governance guidelines applicable to the Company, oversees an annual review of the Board's performance, recommends director nominees for each committee, recommends a determination of each outside director's "independence" under applicable rules and guidelines, oversees the Company's engagement with stockholders and other interested parties concerning governance and other related matters, and oversees reputation risk related to Committee's responsibilities. The Governance and Nominating Committee met on April 18, 2016. Directors are not compensated for meetings of the Governance and Nominating Committee. The Board of Directors has adopted a written charter for the Governance and Nominating Committee, a copy of which is available on the Company's website at www.hillsbank.com under the heading of investor relations.

The Board of Directors of the Company has established a committee (the “Audit Committee”) consisting of three non-employee Directors, currently consisting of Directors Hughes, Nowak and Yoder. The Board of Directors has adopted a written charter for the Audit Committee. A copy of the charter is available on the Company’s website at www.hillsbank.com under the heading of investor relations. The Audit Committee is responsible for the engagement of the independent registered public accounting firm and reviews with the independent registered public accounting firm the scope and results of the audits, the Company’s internal accounting controls and the professional services furnished by the independent registered public accounting firm. All three members of the Audit Committee are “independent” as defined under the rules of NASDAQ. Due to his experience as noted above, the Board has determined that Director Nowak qualifies as an Audit Committee Financial Expert under applicable regulations. The Audit Committee met six times in 2016. Audit Committee members are compensated by the Bank as indicated below under the heading “Schedule of Directors Fees.”

The Board of Directors of the Company has established a committee (the “Compensation and Incentive Stock Committee”) consisting of the ten non-employee Directors (i.e., all Directors but Mr. Seegmiller), all of whom are considered to be independent as defined under the rules of NASDAQ, except for Mr. Hodge. The Compensation and Incentive Stock Committee makes decisions regarding executive officer salaries, bonuses, grants of awards to all officers pursuant to the Hills Bancorporation 2010 Stock Option and Incentive Plan (the “Incentive Stock Plan”), contributions to the Hills Bank and Trust Company Employee Stock Ownership Plan (the “ESOP”), and contributions to the Hills Bank and Trust Company 401(k) Profit Sharing Plan (the “Profit Sharing Plan”). The Compensation and Incentive Stock Committee held ten meetings during 2016. The ten meetings involved approval of grants of restricted stock to officers. Directors are not compensated for meetings of the Compensation and Incentive Stock Committee. The Board of Directors has adopted a written charter for the Compensation and Incentive Stock Committee, a copy of which is available on the Company's website at www.hillsbank.com under the heading of investor relations.

The Board of Directors of the Company has established a committee (the "Risk Committee") consisting of three non-employee Directors, currently consisting of Directors Donovan, Gill and Nowak. The Board of Directors has adopted a written charter

for the Risk Committee. A copy of the charter is available on the Company's website at www.hillsbank.com under the heading of investor relations. The Risk Committee oversees and approves the Company-wide risk management practices to assist the board in overseeing the management team's identification and assessment of risks facing the organization and establishment of a risk management infrastructure capable of addressing those risks, the division on risk-related responsibilities to each Board committee as clearly as possible to determine that the oversight of risks is not missed, and approving the Company's enterprise risk management framework. The Risk Committee held six meetings during 2016. All members of the Risk Committee attended at least seventy-five percent of the total number of the meeting held in 2016. Risk Committee members are compensated by the Bank as indicated below under the heading "Schedule of Directors Fees."

Each of the Company’s Directors, with the exception of Mr. Seegmiller and Mr. Hodge, has been determined by the Board of Directors to be an “Independent Director” as defined by Rule 5605(a)(2) of the Marketplace Rules of the National Association of Securities Dealers Automated Quotation system (“NASDAQ”). Mr. Seegmiller is not considered to be independent since he is the President and CEO of the Company and the Bank. Mr. Hodge is not independent under the NASDAQ definition based on certain transactions between the Company and Mr. Hodge’s affiliated companies, which are described below under “Compensation and Incentive Stock Committee Interlocks and Certain Other Transactions with Executive Officers and Directors.” In determining Director independence, the Board of Directors considers all relevant facts and circumstances, including the independence standards set forth in the rules of NASDAQ. In order to be considered independent, a Director must be free from any relationship which, in the opinion of the Company’s Board of Directors would interfere with the exercise of independent judgment. The Board of Directors considered certain transactions, relationships or arrangements which are described herein under the heading “Compensation and Incentive Stock Committee Interlocks and Certain Other Transactions with Executive Officers and Directors” in making its determination of director independence.

Board of Directors of the Bank

The business and affairs of the Bank are managed by the Board of Directors of the Bank, the membership of which is identical to that of the Board of Directors of the Company. The Board of Directors of the Bank holds regular monthly meetings. In 2016, the Board of Directors of the Bank held an annual meeting, one special meeting and twelve regular meetings. The Board of Directors of the Bank has established the Trust Committee, the Audit Committee, the Risk Committee, the Loan Committee and the Employee Stock Ownership Plan (“ESOP”) Committee as standing committees of the Board of Directors of the Bank. Directors Gill, Phelan, Rhodes and Seegmiller serve on the Trust Committee; Directors Hughes, Nowak and Yoder serve on the Audit Committee; Directors Gill, Nowak, and Donovan serve on the Risk Committee; Directors Hodge, Hughes, Wiele and Seegmiller serve on the Loan Committee; and Director Pacha serves on the ESOP Committee. The seven Directors not appointed to the Loan Committee are invited to attend meetings of that committee and are compensated for such attendance at the same rate as members of the Loan Committee for each meeting attended. The Board of Directors of the Bank has established the Governance and Nominating Committee that meets as needed as part of regularly scheduled Board meetings.

The Trust Committee of the Bank is responsible for overseeing and annually reviewing the operations of the Trust Department of the Bank and the status of all trusts for which the Bank’s Trust Department acts in a fiduciary capacity. The Trust Committee met twelve times during 2016. The Audit Committee held six meetings during 2016 and is responsible for coordinating the audit with BKD LLP and addressing internal audit functions. The Risk Committee held six meetings during 2016 and is responsible for oversight of the Bank's enterprise risk management program. The Loan Committee held twelve meetings during 2016 and is responsible for review and oversight of the loan activities of the Bank. The ESOP Committee, which is responsible for overseeing the ESOP in connection with which the Bank’s Trust Department serves as trustee, had three meetings during 2016. During 2016, all of the Directors of the Bank attended at least 75% of the total number of meetings of the Board of Directors and all of the Directors of the Bank appointed to committees attended at least 75% of the meetings of the committee to which such Directors were appointed.

Board Leadership Structure and Role in Risk Oversight

The Board of Directors leadership structure has historically separated the function of the Chairperson of the Board of the Bank and the Principal Executive Officer. This structure is expected to continue in the future with the Chairperson of the Bank’s Board of Directors being a non-employee Director. This structure promotes good corporate governance by providing a non-management leadership structure and such a leadership structure is encouraged by bank regulators. The Company’s Board of Directors has not designated a Chairperson, and Mr. Seegmiller currently acts as the de facto chair at all meetings thereof, which generally follow meetings of the Bank’s Board of Directors. The Company currently has no designated “lead independent director” with respect to its Board and believes this structure is appropriate because all significant business operations continue to be conducted at the Bank level.

The Company is exposed to risks as part of the normal course of business. Risk exposure requires sound risk management practices that comprise an comprehensive framework of programs and processes that apply to the Company. The Company has established a risk management framework to manage risks and provide reasonable assurance of the achievement of the Company's strategic objectives. The primary risks identified and managed through the framework are strategic risk, liquidity risk, market risk, credit risk, trust risk, information technology and security risk, operational risk, legal risk and reputational risk.

The principal risk management functions of the Board are to oversee processes for evaluating the adequacy of internal controls, risk management, financial reporting and compliance with laws and regulations. The Board, through its Risk Committee, has developed a formal plan to address Enterprise Risk Management ("ERM") within the Company. The Company's ERM includes a formal process to identify and document the key risk to the Company and provides a common framework and terminology to ensure consistency in identification, reporting and management of key risks. The Board annually approves, upon the recommendation of its Risk Committee, a Risk Appetite and Tolerance Statement that reflects core business principles and provides the foundation of the Company's risk appetite, which is the aggregate amount of risk the Company is willing to accept in pursuit of its mission. By establishing boundaries around risk taking and business decisions, and by incorporating the needs and goals of its shareholders, regulators, customers and other stakeholders, the Company's risk appetite is aligned with its priorities and goals.

The Board has formed an Enterprise Risk Management Committee ("ERMC") of the Company comprised of the Company's business unit leaders and led by the Company's Senior Vice President, Risk Management, to help ensure the consistent application of the Company's risk management approach. The primary activities of the ERMC include:

| |

| • | Annual comprehensive risk assessments for all of the risks identified in the Company's risk management framework; |

| |

| • | Monitoring signals that may indicate possible risk issues for the Company; |

| |

| • | Identifying risks and determining which Company areas and/or products will be affected; |

| |

| • | Ensuring there are mechanisms in place to specifically determine how risks will affect the Company or its products; |

| |

| • | Monitoring and reporting on risk tolerance thresholds approved by the Board; |

| |

| • | Reviewing the limits, policies, and procedures in place to ensure the continued appropriateness of risk controls. |

The Company has also formed an Officers Risk Management Committee ("ORMC") which consists of the next level of management from within the Company. The primary activities of the ORMC include:

| |

| • | New product and/or service risk assessments; |

| |

| • | Discussion and identification of potential risk issues to report to the ERMC; and |

| |

| • | Tactical working groups to identify additional risk management activities to be pursued by the Company. |

As part of the risk assessment process, the ERMC and ORMC each report the results of their evaluations to the Risk Committee of the Board of Directors and make recommendations to the Risk Committee regarding adjustments to controls as conditions or risk tolerances change.

Schedule of Directors Fees

Directors of the Company and the Bank who are not employees of the Company or the Bank (all Directors but Mr. Seegmiller) are compensated for their service as a Directors as indicated in the table below:

|

| | | | | | |

| Compensation Item | | Company | | Bank |

| | | | | |

| Annual Retainer (paid quarterly): | | | | |

| Chairperson of the Board | | N/A | | $ | 18,800 |

|

| Board Member | | N/A | | 14,200 |

|

| | | | | |

| Meeting Fees: | | | | |

|

| Board Meetings | | $350 | | 550 |

|

| Committee: | | | | |

|

| Audit | | N/A | | 350 |

|

| Risk | | N/A | | 350 |

|

| Governance | | N/A | | N/A |

|

| Compensation and Incentive Stock | | N/A | | N/A |

|

| Employee Stock Ownership Plan / Profit Sharing | | N/A | | 350 |

|

| Loan | | N/A | | 350 |

|

| Trust | | N/A | | 350 |

|

Director Deferral Plan:

Under the Company’s Nonqualified Deferred Compensation Plan (the “Deferred Compensation Plan”), which was initiated in 1997, each Director may elect to defer up to 50% of such Director’s cash compensation from retainers and meeting fees. Any amount so deferred is credited to the Director’s deferred compensation account and converted into units equivalent in value to the fair market value of a share of stock in Hills Bancorporation at the time of such conversion. The “stock units” are book entry only and do not represent an actual issuance of stock. The Director’s account is adjusted each year for dividends paid and the change in the market value of Hills Bancorporation stock. The liability for the deferred Directors’ fees is unfunded and unsecured for the participants.

Director Compensation Table

The following table provides information concerning the compensation of all the Directors other than Mr. Seegmiller for the fiscal year ended December 31, 2016. Compensation information for Mr. Seegmiller is discussed below in the section captioned “Summary of Cash and Certain Other Compensation Paid to the Named Executive Officers.”

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | Stock Awards ($) | | Option Awards ($) | | Non-Equity Incentive Plan Compensation ($) | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | | All Other Compensation ($) | | Total ($) |

| | | | | | | | | | | | | | | |

| Michael S. Donovan | | $ | 29,250 |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | 29,250 |

|

| Thomas J. Gill, D.D.S. | | 31,400 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 31,400 |

|

| Michael E. Hodge | | 28,150 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 28,150 |

|

| Emily A. Hughes | | 31,400 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 31,400 |

|

| James A. Nowak | | 32,500 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 32,500 |

|

| Theodore H. Pacha | | 33,700 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 33,700 |

|

| John W. Phelan | | 30,350 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 30,350 |

|

| Ann Marie Rhodes | | 32,550 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 32,550 |

|

| Thomas R. Wiele | | 28,500 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 28,500 |

|

| Sheldon E. Yoder, D.V.M. | | 29,850 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 29,850 |

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

Set forth in the following table is certain information on each person who is known to the Board of Directors to be the beneficial owner as of March 3, 2017 of more than 5% of the Company’s Common Stock, which is the only class of equity securities that the Company has outstanding.

Amount and Nature of Beneficial Ownership

|

| | | | | | | | | | | | |

Name and Address of Beneficial Owner | | Total Shares Beneficially Owned | | Sole Voting and Investment Power | | Shared Voting and Investment Power | | Percent of Class |

| | | | | | | | | |

Hills Bank and Trust Company, as trustee of the Hills Bank and Trust Company Employee Stock Ownership Plan (the “ESOP”) 131 Main Street Hills, Iowa 52235 | | 849,823 |

| | — |

| | 849,823 |

| (1) | 9.10 | % |

NOTE:

| |

| (1) | Consists of shares of Company Common Stock allocated to the accounts of employees of the Bank who are eligible to participate in the ESOP. Employees are entitled to direct the trustee how to vote shares allocated to their accounts. |

The following table sets forth as of March 3, 2017 the number of shares of the Company’s Common Stock beneficially owned by each Director, nominee for Director, the non-Director executive officers and all the Directors and the non-Director executive officers as a group. The Company has not adopted a share ownership policy or a share retention policy for the Directors or the executive officers.

Amount and Nature of Beneficial Ownership

|

| | | | | | | | | | | | | |

| | Name | | Total Shares Beneficially Owned | | Sole Voting and Investment Power | | Shared Voting and Investment Power | | Percent of Class (4) |

| |

| |

| | | | |

| | |

| | |

| | |

|

| | Directors | | |

| | |

| | |

| | |

|

| | Michael S. Donovan | | 22,223 |

| (1) | 13,294 |

| | 8,929 |

| | 0.24 | % |

| | Thomas J. Gill, D.D.S. | | 21,314 |

| | 20,256 |

| | 1,058 |

| | 0.23 | % |

| | Michael E. Hodge | | 20,643 |

| | 14,956 |

| | 5,687 |

| | 0.22 | % |

| | Emily A. Hughes | | 238,624 |

| (3) | 38,624 |

| | 200,000 |

| | 2.56 | % |

| | James A. Nowak | | 11,591 |

| | 9,867 |

| | 1,724 |

| | 0.12 | % |

| | Theodore H. Pacha | | 26,579 |

| | 26,579 |

| | — |

| | 0.28 | % |

| | John W. Phelan | | 11,744 |

| (1) | 4,580 |

| | 7,164 |

| | 0.13 | % |

| | Ann Marie Rhodes | | 500 |

| | 500 |

| | — |

| | 0.01 | % |

| | Dwight O. Seegmiller | | 254,193 |

| (2) | 164,344 |

| | 89,849 |

| | 2.72 | % |

| | Thomas R. Wiele | | 1,705 |

| | 1,218 |

| | 487 |

| | 0.02 | % |

| | Sheldon E. Yoder, D.V.M. | | 23,000 |

| | 23,000 |

| | — |

| | 0.25 | % |

| | | | |

| | |

| | |

| | |

|

| | Non-Director Executive Officers | | |

| | |

| | |

| | |

|

| | Shari J. DeMaris | | 9,284 |

| (2) | 7,488 |

| | 1,796 |

| | 0.10 | % |

| | Timothy D. Finer | | 37,062 |

| (2) | 10,500 |

| | 26,562 |

| | 0.40 | % |

| | Steven R. Ropp | | 35,028 |

| (2) | 14,880 |

| | 20,148 |

| | 0.38 | % |

| | Bradford C. Zuber | | 44,609 |

| (2) | 16,318 |

| | 28,291 |

| | 0.48 | % |

| | | |

|

| | |

| | |

| | |

|

| | All Directors and Non-Director Executive Officers as a Group (15 persons) | | 758,099 |

| (2) | 366,404 |

| | 391,695 |

| | 8.12 | % |

NOTES:

| |

| (1) | This figure includes shares subject to currently exercisable stock options granted pursuant to the 2010 Stock Option and Incentive Plan. For Directors, the options will expire ten years after the grant date or two years after the Director’s term of service on the Board of Directors of the Company ends, whichever occurs first. For Non-Director Executive Officers, the options expire ten years after the grant date. Details of the stock options are as follows: |

|

| | | | | | | | | | | |

| Name | | Grant Date | | Number of Options | | Exercise Price | | Expiration Date |

| | | | | | | | | |

| Michael S. Donovan | | 5/1/2007 | | 4,580 |

| | $ | 26.00 |

| | 5/1/2017 |

| John W. Phelan | | 5/1/2007 | | 4,580 |

| | 26.00 |

| | 5/1/2017 |

| |

| (2) | This figure includes shares held by the Bank’s ESOP which have been allocated to the executive officers for voting purposes as follows: |

|

| | | |

| Name | | ESOP Shares |

| | | |

| Shari J. DeMaris | | 1,796 |

|

| Timothy D. Finer | | 26,562 |

|

| Steven R. Ropp | | 20,148 |

|

| Dwight O. Seegmiller | | 89,849 |

|

| Bradford C. Zuber | | 28,291 |

|

| |

| (3) | This figure includes 200,000 shares owned in a limited partnership of which Director Hughes is a general partner. Ms. Hughes has shared voting and investment power in the limited partnership. |

| |

| (4) | Includes, for each such person, shares that are deemed to be beneficially owned by such person (a) because such shares are subject to options currently exercisable by such person or (b) because such shares are held by the ESOP and have been allocated to such person with shared voting power, as described in Notes 1, 2 and 3. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s Directors, executive officers and persons who own more than 10 percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership of such securities with the Securities and Exchange Commission. Directors and executive officers and greater than 10 percent beneficial owners are required by applicable regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely upon a review of the copies of the forms furnished to the Company, or written representations from certain reporting persons that no other reports were required, the Company believes that all filing requirements applicable to the Directors and executive officers were complied with during 2016.

COMPENSATION AND INCENTIVE STOCK COMMITTEE INTERLOCKS

AND CERTAIN OTHER TRANSACTIONS

WITH EXECUTIVE OFFICERS AND DIRECTORS

All compensation decisions affecting the executive officers of the Company and the Bank are made by the Compensation and Incentive Stock Committee of the Board of Directors consisting of the ten non-employee Directors (all Directors but Mr. Seegmiller). The Committee makes compensation decisions with respect to each of the Company Named Executive Officers identified in the Summary Compensation Table and other tables on the following pages of this Proxy Statement. The compensation paid to the Bank Named Executive Officers is not directly determined by the Committee, but is determined by Mr. Seegmiller and Ms. DeMaris, as the senior executives of the Company and the Bank, which determinations are then reviewed and ratified by the Committee.

Michael E. Hodge as a member of the Boards of Directors of the Company and the Bank and of the Compensation and Incentive Stock Committee, participated in deliberations concerning executive compensation matters during 2016. Within the last three fiscal years, the Bank has had certain business relationships with Hodge Construction Company, a general contractor. In addition,

Mr. Hodge is a 17.65% investor in the limited liability corporation, OC Group, L.C. that is the owner of the Old Capitol Town Center, a portion of which is leased by the Bank for a bank office location, and he is a 38% owner of Corridor Commercial Development Company ("Corridor"), from which the Bank purchased properties in 2016.

The Bank has an agreement with the OC Group, L.C. under which it leased 5,845 square feet of space in Old Capitol Town Center, a two-story building with a total of 99,612 square feet, located in downtown Iowa City. Mr. Hodge holds a 17.65% ownership interest in OC Group, L.C., the owner of Old Capitol Town Center. The ten-year lease began on June 1, 2004 and was extended in 2014 until 2019, the first renewal period under the lease. The lease term is subject to three additional five-year renewal options. The Bank’s annual lease payment on this space is currently $22.68 per square foot and increases 2% per year, plus annual common area maintenance charges of $4.00 per square foot. The Bank is also responsible for payment of the real estate taxes allocated to the leased space. The annual lease cost in 2016 was $151,337 before payment of such real estate taxes, which were $20,948 for the year. In the opinion of management, the cost of the leased space is similar to the cost of leasing comparable commercial property in downtown Iowa City.

On April 19, 2016, the Bank purchased two lots from Corridor for an aggregate purchase price of $688,271. The lots are adjacent to one of the Bank's current locations in North Liberty, Iowa. Mr. Hodge has been a 38% owner of Corridor since its formation over 10 years ago, when it was formed to purchase and develop the 80 acres of land where the lots are located. The lots purchased by the Bank are part of the current development of 7.25 acres consisting of 13 lots. Based upon management's review of similar commercial sales and current listings of commercial real estate available in the North Liberty and Coralville area, the price paid for the lots was consistent with market value and reflected the stable value of commercial and residential properties in the area.

The Board of Directors of the Bank does not believe that the participation by Mr. Hodge in the deliberations concerning executive compensation has provided the Company Named Executive Officers with more favorable compensation arrangements than would have been the case absent his participation in such deliberations. As disclosed elsewhere in this proxy statement under the caption "Corporate Governance and the Board of Directors," Mr. Hodge is not an independent Director as defined by NASDAQ's rules as he and certain of his affiliated companies will be paid more than $200,000 by the Bank in 2016.

In addition, certain of the officers and Directors of the Company, their associates or members of their families, were customers of, and have had transactions with, the Bank from time to time in the ordinary course of business, and additional transactions may be expected to take place in the ordinary course of business in the future. Regulation O requires loans made to executive officers and Directors to be made on substantially the same terms, including interest rates and collateral, and following credit-underwriting procedures that are no less stringent than those prevailing at the time for other transactions by the Company with other persons. Such loans may not involve more than the normal risk of repayment or present other unfavorable features.

The Company does not have a formal written policy regarding the review and approval of transactions between the Company and its Directors, executive officers and other related interests. However, it is the general practice of the Board of Directors to review and approve any new transactions that would exceed the $120,000 disclosure requirement. In making a determination to approve a related party transaction the Board of Directors will take into account, among other factors it deems appropriate, whether the proposed transaction is on terms no less favorable to the Company than those generally available to an unaffiliated third-party under the same or similar circumstances and the extent of the related party’s interest in the proposed transaction. On a yearly basis, the Board of Directors reviews information on any existing and ongoing transactions with the Directors as disclosed under the Compensation and Incentive Stock Committee Interlocks and Certain Other Transactions with Executive Officers and Directors section. Management of the Company anticipates that the Bank and the Company will continue to maintain such business relationships in the future on a similar basis to the extent that such goods and services are required by the Bank and the Company.

No executive officer of the Company or Bank serves or has served as a member of the Board of Directors or the Compensation Committee of any other company which employs any member of the Company's Board of Directors.

COMPENSATION DISCUSSION AND ANALYSIS

Introduction

In the following Compensation Discussion and Analysis section, the Company provides information concerning compensation and benefits provided to the two executive officers of the Company (the “Company Named Executive Officers”). The Company’s current Named Executive Officers are Dwight O. Seegmiller, who is the President and Principal Executive Officer (“PEO”) and Shari J. DeMaris, who is the Secretary/Treasurer and Principal Financial Officer (“PFO”). In addition, information is provided concerning compensation and benefits provided to three executive officers of the Bank (the “Bank Named Executive Officers”).

The Bank executive officers are Timothy D. Finer, Senior Vice President and Director of Real Estate Lending, Steven R. Ropp, Senior Vice President and Director of Commercial Banking, and Bradford C. Zuber, Senior Vice President and Director of Trust Services.

The Company’s overall compensation objectives are to pay salaries and provide benefits that are both fair and reasonable, consistent with the compensation practices of the financial services industry in general, and appropriate and competitive in the Bank’s local marketplace. The Company’s goal is to attract, develop and retain high caliber executives who are capable of increasing the Company’s performance for the benefit of its shareholders while maintaining the philosophy of community banking. Ultimately, the Company desires to base its compensation on individual performance as it affects the overall financial results of the Company. Specifically, the executive compensation program of the Company has been designed to:

| |

| l | provide a pay-for-performance policy that differentiates compensation amounts based upon corporate and individual performance; |

| |

| l | provide compensation opportunities comparable to those offered by other Iowa-based financial institutions and Midwest banks of similar asset size, thus allowing the Bank to compete for and retain talented executives who are essential to the long-term success of the Company and the Bank; |

| |

| l | align the interest of the officers with the long-term interest of the Company’s shareholders through the ownership of Company Common Stock; and |

| |

| l | maintain a corporate environment which encourages stability and long-term focus for the primary constituencies of the Company, including shareholders, employees, customers, regulatory agencies and the communities it serves. |

To achieve its objectives the Company has structured it’s compensation program: (1) to reward current corporate and individual performance through salary increases and opportunities for cash bonuses; and (2) to reward long-term corporate and individual performance through participation in the ESOP and Profit Sharing Plan, the Deferred Compensation Plan and participation in the Incentive Stock Plan. The amounts and types of compensation paid in 2016 (as set forth below) fit into the Company’s overall compensation objectives by achieving those two objectives.

Decisions Regarding Composition of Total Compensation

The Compensation and Incentive Stock Committee (the “Committee”), which is comprised of the full Board of Directors with the exception of Director Seegmiller, has responsibility for implementing and overseeing the Company’s executive compensation program. In this respect, the Committee has strategic and administrative responsibility for a broad range of issues, including ensuring that the Company compensates key management employees effectively and in a manner consistent with the Company’s compensation strategy. The Committee also oversees the administration of executive compensation plans, including the design, performance measures, and award opportunities for management compensation programs, and certain employee benefits. The Committee also makes compensation decisions with respect to each of the Company Named Executive Officers identified in the Summary Compensation Table and other tables on the following pages of this Proxy Statement. The compensation paid to the Bank Named Executive Officers is not directly determined by the Committee, but is determined by Mr. Seegmiller and Ms. DeMaris, as the senior executives of the Company and the Bank, which determinations are then reviewed and ratified by the Committee.

The Committee’s policy is to review management compensation at least annually. The Committee makes these reviews to ensure that management compensation is consistent with the Company’s compensation philosophies articulated above.