OMB APPROVAL

OMB Number: 3235-0570

Expires: September 30, 2025

Estimated average burden hours per response...20.59

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-4815

Ultra Series Fund

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

Steven J. Fredricks

Madison Legal and Compliance Department

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Certified Financial Statement

| ULTRA SERIES FUND | Annual Report December 31, 2023 |

| | Conservative Allocation Fund |

| | Moderate Allocation Fund |

| | Aggressive Allocation Fund |

| | Diversified Income Fund |

| | Core Bond Fund |

| | High Income Fund |

| | Large Cap Value Fund |

| | Large Cap Growth Fund |

| | Mid Cap Fund |

| | International Stock Fund |

| | Madison Target Retirement 2020 Fund |

| | Madison Target Retirement 2030 Fund |

| | Madison Target Retirement 2040 Fund |

| | Madison Target Retirement 2050 Fund |

Ultra Series Fund | December 31, 2023

Table of Contents

| | Page |

| Management’s Discussion of Fund Performance | |

| Period in Review | 2 |

| Allocation Funds | 3 |

| Conservative Allocation Fund | 3 |

| Moderate Allocation Fund | 5 |

| Aggressive Allocation Fund | 6 |

| Diversified Income Fund | 8 |

| Core Bond Fund | 10 |

| High Income Fund | 12 |

| Large Cap Value Fund | 14 |

| Large Cap Growth Fund | 15 |

| Mid Cap Fund | 16 |

| International Stock Fund | 18 |

| Madison Target Retirement 2020 Fund | 20 |

| Madison Target Retirement 2030 Fund | 22 |

| Madison Target Retirement 2040 Fund | 23 |

| Madison Target Retirement 2050 Fund | 25 |

| Notes to Management’s Discussion of Fund Performance | 27 |

| Portfolios of Investments | |

| Conservative Allocation Fund | 30 |

| Moderate Allocation Fund | 31 |

| Aggressive Allocation Fund | 32 |

| Diversified Income Fund | 33 |

| Core Bond Fund | 34 |

| High Income Fund | 40 |

| Large Cap Value Fund | 42 |

| Large Cap Growth Fund | 43 |

| Mid Cap Fund | 44 |

| International Stock Fund | 45 |

| Madison Target Retirement 2020 Fund | 47 |

| Madison Target Retirement 2030 Fund | 48 |

| Madison Target Retirement 2040 Fund | 49 |

| Madison Target Retirement 2050 Fund | 50 |

| Financial Statements | |

| Statements of Assets and Liabilities | 51 |

| Statements of Operations | 53 |

| Statements of Changes in Net Assets | 55 |

| Financial Highlights for a Share of Beneficial Interest Outstanding | 59 |

| Notes to Financial Statements | 73 |

| Audit Opinion Letter | 91 |

| Other Information | 92 |

| Trustees and Officers | 102 |

Nondeposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of or guaranteed by any financial institution. For more complete information about Ultra Series Fund, including charges and expenses, request a prospectus from your financial advisor or from CMFG Life Insurance Company, 2000 Heritage Way, Waverly, IA 50677. Consider the investment objectives, risks, and charges and expenses of any Fund carefully before investing. The prospectus contains this and other information about the investment company. For more current Ultra Series Fund performance information, please call 1-800-SEC-0330. Current performance may be lower or higher than the performance data quoted within this report. Past performance does not guarantee future results. Nothing in this report represents a recommendation of a security by the investment adviser. Portfolio holdings may have changed since the date of this report.

Ultra Series Fund | December 31, 2023

Management’s Discussion of Fund Performance (unaudited)

PERIOD IN REVIEW

The final two months of 2023 soothed the spirits of fixed income and non-Magnificent 7 (Apple, Amazon, Alphabet, Meta Platforms, Microsoft, NVIDIA, & Tesla) stock investors who were staring down a rather modest, if not bleak year. Fueled by a 180-degree flip from the devastating notion that interest rates would need to be “higher for longer” to a new paradigm of “lower and sooner” where the Federal Reserve (Fed) would be cutting interest rates by springtime, and by as much as 1.5% over the course of 2024, an eyepopping near everything rally saved the year. When the ball dropped to ring in the new year, not a soul would remember that back on Halloween many major US market indexes, the Russell 2000, Russell Mid Cap, S&P 500 Equal Weighted, and especially the broad Bloomberg US Aggregate Bond Index were all in negative territory, woefully underperforming cash and lightyears behind the Mag-7 driven S&P 500 Index. Instead, after the stunning change in fortune, investors were rejoicing the outsized gains for the year with the S&P 500 Index generating a +26.3% return, international stocks advanced +15.6% (MSCI ACWI ex USA Net Index) and bonds up a very respectable +5.5% (Bloomberg US Aggregate Bond Index). So, after experiencing the worst return on record in 2022, a balanced portfolio (60% stocks / 40% bonds), produced a double-digit gain for 2023. The vast majority of the advance was attributed to the closing quarter where the S&P 500 Index jumped +11.7%, the MSCI ACWI ex USA Index +9.8%, and the Bloomberg US Agg Bond Index +6.8% as the 10-year US Treasury yield plunged from a late October high of 5% to below 4% to close the year.

Today’s ebullient equity market sentiment and faith that an economic “soft landing” will be achieved stand in stark contrast to the imminent recession fears that marked the run-up to 2023. Oddly enough, the market spent 10 months fighting the Fed, pricing in rate cuts that never came and were pushed into 2024 as inflation remained sticky and the labor market strong. In the end, a recession was averted through a combination of titanic fiscal spending and consumer consumption on the back of excess COVID savings (past stimulus) and rising wage growth from a strong labor market. While GDP growth was solid, the same cannot be said for corporate earnings, as 2023 was all about multiple expansion rather than improving fundamentals. According to FactSet data on 12/31/23, S&P 500 earnings growth was expected to have increased by just 24 cents over 2022’s results, or +0.1%, however the P/E multiple for 2023 expanded from 16.7x to 21.7x resulting in an equity boom.

Overall, the year was remarkable for a host of reasons. First and foremost, the performance differential between the Mag-7 and the rest of the US equity market was truly staggering. The median Mag-7 stock was up +80.9% for the year while the median for the rest of the S&P 500 was +11.5%, and the S&P 500 Equal Weighted Index returned +13.9%. This lopsided performance drove the weighting of the Mag-7 from roughly 21.5% of the index at the beginning of 2023 to 30% at year-end. There was an all-out mania in everything related to artificial intelligence that boosted the market mid-year. However, the most notable aspect of 2023 was the equity market’s uncanny ability to look past the flashing redlights of the leading economic indicators (down for 20 consecutive months), zero earnings growth, the most inverted yield curve since the early 1980s, a banking crisis that rivaled 2008 in terms of asset size, and a hot war in the Middle East. None of that mattered. What mattered was the performance of seven stocks, GDP growth pleasantly surprised, consumers (and the government) kept spending, and a strong belief that recession sized interest rate cuts are on the way. . . without a recession.

Moving forward, expectations for 2024 are as high today as they were low entering 2023. Risky assets have priced out all risk of recession and the US stock market is betting on double-digit earnings growth. After being dead wrong on inflation and letting it ravage the US economy, the Fed ended the year willing to roll the dice that their 2% target is achievable without further tightening, a recession will be avoided, and they can gently lower rates

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

over the course of 2024. However, the bond market has a much more aggressive outlook for cuts over the next 12 months, looking for at least six versus the Fed’s three. The market pricing of 1.5% worth of cuts seems quite aggressive and alarmingly recessionary. Much is riding on inflation to keep slowing without a corresponding negative impact on economic conditions. Or maybe, more likely, the impacts of the rapid rate hikes of 2022-2023 have yet to reach the economy as monetary policy notoriously works with a long and uncertain lag. It could prove difficult for inflation to be brought under control without an economic slowdown, especially after the cumulative +20% increase in prices post-COVID. Wages are still behind on an inflation-adjusted basis, if economic growth holds, workers will expect to see continued gains, increasing costs while top-line pricing power is being eroded. This is not a recipe for double-digit earnings growth. The labor market now holds the key to this cycle, and initial jobless claims will be under the microscope. If claims remain tepid, the falling inflation narrative will come under scrutiny, and we could see a return to the “higher for longer” interest rate narrative that brutalized stocks and bonds this past fall. If jobless claims start to rise, the consumer will come under pressure, removing the biggest source of economic growth. In this case the bond market has it right, and yields and inflation will continue to fall, but equities would be vulnerable.

The mix of elevated index valuations and likely increase in volatility present a favorable backdrop for active portfolio management in 2024.

ALLOCATION FUNDS

The Ultra Series Conservative Allocation, Moderate Allocation, Aggressive Allocation and Diversified Income Funds (collectively, the “Allocation Funds”) invest primarily in shares of registered investment companies (the “Underlying Funds”). The Allocation Funds are diversified among a number of asset classes and their allocation among Underlying Funds is based on an asset allocation model developed by Madison Asset Management, LLC (“Madison”), the Funds’ investment adviser. The team may use multiple analytical approaches to determine the appropriate asset allocation, including:

| • | | Asset allocation optimization analysis – considers the degree to which returns in different asset classes do or do not move together, and the Funds’ aim to achieve a favorable overall risk profile for any targeted portfolio return. |

| • | | Scenario analysis – historical and expected return data is analyzed to model how individual asset classes and combinations of asset classes would affect the Funds under different economic and market conditions. |

| • | | Fundamental analysis – draws upon Madison’s investment teams to judge each asset class against current and forecasted market conditions. Economic, industry and security analysis is used to develop return and risk expectations that may influence asset class selection. In addition, Madison has a flexible mandate which permits the Funds, at the sole discretion of Madison, to materially reduce equity risk exposures when and if conditions are deemed to warrant such an action. |

CONSERVATIVE ALLOCATION FUND

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Ultra Series Conservative Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 35% equity investments and 65% fixed income investments. Underlying Funds in which the Fund invests may include funds advised by Madison and/or its affiliates, including the Madison Funds (the “Affiliated Underlying Funds”). Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

PERFORMANCE DISCUSSION

The Ultra Series Conservative Allocation Fund (Class I) returned 8.33% for the year, compared to its Custom Blended Index return of 11.41%. The Fund underperformed its Morningstar Allocation 30% to 50% Equity peer group, which returned 11.36%.

Our more conservative DNA had us positioned defensively in the Fund throughout the year as nearly all the forward-looking indicators we track, outside of initial jobless claims, were pointing towards a likely near-term recession. A seemingly fully valued US equity market and a modest outlook for earnings growth added to the cautionary signpost. This assessment had us favoring short-term floating rate US Treasuries yielding north of 5%, over stocks in a highly uncertain market environment. Through the first 10 months of the year, this stance served the Fund well as our floating rate position outperformed many areas of the equity market. US small and mid-cap indexes were negative through 10/31/2023, and international stocks (MSCI ACWI ex-USA Index), where the bulk of our equity underweight resided, were up only 1% for the year on that date. However, a revolutionary change in the outlook for interest rate policy set off a breathtaking rally in both stocks and bonds, boosted by the forced covering of high-frequency traders that were largely short of both stocks and bonds. This quick change in the market narrative generated double digit returns for equities and a sizeable 8.5% gain for the Bloomberg US Aggregate Bond Index over the final two months of 2023.

In the end, our overweight to cash and cash-like holdings resulted in a significant drag on performance. Our holdings in the energy and commodities markets, which we like as a hedge against interest rate risk, also provided a material detraction from performance. Contributing positively to performance was the Fund’s relative overweight to US versus international stocks, as well as an above benchmark allocation to Japanese stocks, the US Technology sector and outperformance from the Fund’s largest active stock and bond holdings.

In hindsight, we overlooked the degree to which government largess and continued consumer spending, in the face of immense price increases, would keep the economy rolling and investors willingness to push valuation measures back to historically rich levels. So, while the Fund generated a very rewarding absolute return for the year, our defensive posturing dampened relative results.

Looking ahead, expectations for 2024 are as high today as they were low entering 2023. Risky assets have priced out all risk of recession and the US stock market is betting on double-digit earnings growth. And with valuations back to stretched levels in both the S&P 500 and the credit markets, we don’t see any reason to move away from our defensive positioning in the near term. We believe this environment heavily favors active/flexible asset allocation management and we stand ready to take advantage of any opportunities that might arise during what we think will be a volatile 2024.

Cumulative Performance of $10,000 Investment1,2

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

Average Annual Total Return (%) through December 31, 20231,2

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Conservative Allocation, Class I | | | 6/30/2006 | | | | 8.33 | % | | | -0.86 | % | | | 3.80 | % | | | 3.69 | % |

| Ultra Series Conservative Allocation, Class II | | | 5/1/2009 | | | | 8.06 | % | | | -1.11 | % | | | 3.54 | % | | | 3.43 | % |

| Conservative Allocation Fund Custom Index | | | 6/30/2006 | | | | 11.41 | % | | | 0.19 | % | | | 5.36 | % | | | 4.57 | % |

| ICE BofA US Corp, Govt & Mortg Index | | | 6/30/2006 | | | | 5.39 | % | | | -3.49 | % | | | 1.06 | % | | | 1.83 | % |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Bond Funds | | | 64.1 | % |

| Foreign Stock Funds | | | 5.7 | % |

| Short-Term Investments | | | 12.1 | % |

| Stock Funds | | | 23.4 | % |

| Net Other Assets and Liabilities | | | (5.3 | )% |

MODERATE ALLOCATION FUND

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Ultra Series Moderate Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 60% equity investments and 40% fixed income investments. Underlying Funds in which the Fund invests may include Affiliated Underlying Funds. Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds.

PERFORMANCE DISCUSSION

The Ultra Series Moderate Allocation Fund (Class I) returned 10.82% for the year, compared to its Custom Blended Index return of 15.72%. The Fund underperformed its Morningstar Allocation 50% to 70% Equity peer group, which returned 14.76%.

Our more conservative DNA had us positioned defensively in the Fund throughout the year as nearly all the forward-looking indicators we track, outside of initial jobless claims, were pointing towards a likely near-term recession. A seemingly fully valued US equity market and a modest outlook for earnings growth added to the cautionary signpost. This assessment had us favoring short-term floating rate US Treasuries yielding north of 5%, over stocks in a highly uncertain market environment. Through the first 10 months of the year, this stance served the Fund well as our floating rate position outperformed many areas of the equity market. US small and mid-cap indexes were negative through 10/31/2023, and international stocks (MSCI ACWI ex-USA Index), where the bulk of our equity underweight resided, were up only 1% for the year on that date. However, a revolutionary change in the outlook for interest rate policy set off a breathtaking rally in both stocks and bonds, boosted by the forced covering of high-frequency traders that were largely short of both stocks and bonds. This quick change in the market narrative generated double digit returns for equities and a sizeable 8.5% gain for the Bloomberg US Aggregate Bond Index over the final two months of 2023.

In the end, our overweight to cash and cash-like holdings resulted in a significant drag on performance. Our holdings in the energy and commodities markets, which we like as a hedge against interest rate risk, also provided a material detraction from performance. Contributing positively to performance was the Fund’s relative overweight to US versus international stocks, as well as an above benchmark allocation to Japanese stocks, the US Technology sector and outperformance from the Fund’s largest active stock and bond holdings.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

In hindsight, we overlooked the degree to which government largess and continued consumer spending, in the face of immense price increases, would keep the economy rolling and investors willingness to push valuation measures back to historically rich levels. So, while the Fund generated a very rewarding absolute return for the year, our defensive posturing dampened relative results.

Looking ahead, expectations for 2024 are as high today as they were low entering 2023. Risky assets have priced out all risk of recession and the US stock market is betting on double-digit earnings growth. And with valuations back to stretched levels in both the S&P 500 and the credit markets, we don’t see any reason to move away from our defensive positioning in the near term. We believe this environment heavily favors active/flexible asset allocation management and we stand ready to take advantage of any opportunities that might arise during what we think will be a volatile 2024.

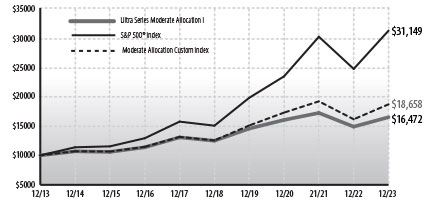

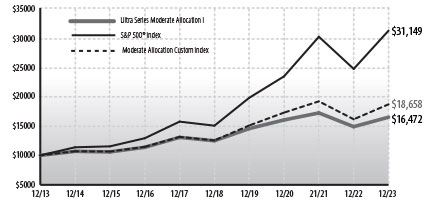

Cumulative Performance of $10,000 Investment1,2

Average Annual Total Return (%) through December 31, 20231,2

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Moderate Allocation, Class I | | | 6/30/2006 | | | | 10.82 | % | | | 0.96 | % | | | 5.71 | % | | | 5.12 | % |

| Ultra Series Moderate Allocation, Class II | | | 5/1/2009 | | | | 10.54 | % | | | 0.70 | % | | | 5.45 | % | | | 4.85 | % |

| Moderate Allocation Fund Custom Index | | | 6/30/2006 | | | | 15.72 | % | | | 2.65 | % | | | 8.29 | % | | | 6.44 | % |

| S&P 500® Index | | | | | | | 26.29 | % | | | 10.00 | % | | | 15.69 | % | | | 12.03 | % |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Bond Funds | | | 42.8 | % |

| Foreign Stock Funds | | | 11.0 | % |

| Short-Term Investments | | | 10.1 | % |

| Stock Funds | | | 39.4 | % |

| Net Other Assets and Liabilities | | | (3.3 | )% |

AGGRESSIVE ALLOCATION FUND

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Ultra Series Aggressive Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including ETFs, with target allocations over time of approximately 80% equity investments and 20% fixed income investments. Underlying Funds in which the Fund invests may include Affiliated Underlying Funds. Generally, Madison will not invest more than 75% of Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

PERFORMANCE DISCUSSION

The Ultra Series Aggressive Allocation Fund (Class I) returned 12.88% for the year, compared to its Custom Blended Index return of 19.24%. The Fund underperformed its Morningstar Allocation 70% to 85% Equity peer group, which returned 16.21%.

Our more conservative DNA had us positioned defensively in the Fund throughout the year as nearly all the forward-looking indicators we track, outside of initial jobless claims, were pointing towards a likely near-term recession. A seemingly fully valued US equity market and a modest outlook for earnings growth added to the cautionary signpost. This assessment had us favoring short-term floating rate US Treasuries yielding north of 5%, over stocks in a highly uncertain market environment. Through the first 10 months of the year, this stance served the Fund well as our floating rate position outperformed many areas of the equity market. US small and mid-cap indexes were negative through 10/31/2023, and international stocks (MSCI ACWI ex-USA Index), where the bulk of our equity underweight resided, were up only 1% for the year on that date. However, a revolutionary change in the outlook for interest rate policy set off a breathtaking rally in both stocks and bonds, boosted by the forced covering of high-frequency traders that were largely short of both stocks and bonds. This quick change in the market narrative generated double digit returns for equities and a sizeable 8.5% gain for the Bloomberg US Aggregate Bond Index over the final two months of 2023.

In the end, our overweight to cash and cash-like holdings resulted in a significant drag on performance. Our holdings in the energy and commodities markets, which we like as a hedge against interest rate risk, also provided a material detraction from performance. Contributing positively to performance was the Fund’s relative overweight to US versus international stocks, as well as an above benchmark allocation to Japanese stocks, the US Technology sector and outperformance from the Fund’s largest active stock and bond holdings.

In hindsight, we overlooked the degree to which government largess and continued consumer spending, in the face of immense price increases, would keep the economy rolling and investors willingness to push valuation measures back to historically rich levels. So, while the Fund generated a very rewarding absolute return for the year, our defensive posturing dampened relative results.

Looking ahead, expectations for 2024 are as high today as they were low entering 2023. Risky assets have priced out all risk of recession and the US stock market is betting on double-digit earnings growth. And with valuations back to stretched levels in both the S&P 500 and the credit markets, we don’t see any reason to move away from our defensive positioning in the near term. We believe this environment heavily favors active/flexible asset allocation management and we stand ready to take advantage of any opportunities that might arise during what we think will be a volatile 2024.

Cumulative Performance of $10,000 Investment1,2

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

Average Annual Total Return (%) through December 31, 20231,2

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Aggressive Allocation, Class I | | | 6/30/2006 | | | | 12.88 | % | | | 2.13 | % | | | 7.01 | % | | | 6.09 | % |

| Ultra Series Aggressive Allocation, Class II | | | 5/1/2009 | | | | 12.60 | % | | | 1.87 | % | | | 6.74 | % | | | 5.82 | % |

| Aggressive Allocation Fund Custom Index | | | 6/30/2006 | | | | 19.24 | % | | | 4.58 | % | | | 10.56 | % | | | 7.85 | % |

| S&P 500® Index | | | | | | | 26.29 | % | | | 10.00 | % | | | 15.69 | % | | | 12.03 | % |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Bond Funds | | | 25.4 | % |

| Foreign Stock Funds | | | 15.9 | % |

| Short-Term Investments | | | 9.6 | % |

| Stock Funds | | | 50.9 | % |

| Net Other Assets and Liabilities | | | (1.8 | )% |

ULTRA SERIES DIVERSIFIED INCOME FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Fund invests primarily in shares of other registered investment companies (the “underlying funds”). The Fund will be diversified among several asset classes and its allocation among underlying funds will be based on an asset allocation model developed by Madison Asset Management (“Madison”), the Fund’s investment adviser. Under normal circumstances, the Fund’s total net assets will be allocated among various asset classes and underlying funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 60% equity investments and 40% fixed income investments. Underlying funds in which the Fund invests may include funds advised by Madison and/or its affiliates, including other Madison Funds and ETFs (the “affiliated underlying funds”). Generally, Madison will not invest more than 80% of the Fund’s net assets, at the time of purchase, in affiliated underlying funds.

PERFORMANCE DISCUSSION

The Ultra Series Diversified Income Fund (Class I) returned 3.77% for the year, compared to its Custom Blended Index return of 15.51%. The Fund underperformed its Morningstar Allocation 50-70% Equity peer group, which returned 14.76%.

What a year! 2023 had it all, from aggressive rate hikes and sharply rising yields to financial concerns and geopolitical turmoil, all culminating with a powerful year-end rally based on changing market expectations for monetary policy. As we look toward 2024, while the Federal Reserve (Fed) is indeed transitioning toward easing monetary policy, we remain cautious now that markets appear priced for perfection.

The Fed and the bond market appear to finally agree that the tightening cycle began in 2022 will be coming to an end sometime in 2024. Dovish comments made by Federal Reserve Chairman Jerome Powell in the fourth quarter combined with better inflation data suggest that discussions within the Fed have shifted towards when the first cut will occur versus whether interest rates were sufficiently restrictive. Inflation measures have softened considerably since the beginning of 2023 with year over year core personal consumption expenditure inflation currently at 3.16%. However, the labor markets remain strong with initial jobless claims running below 250,000, continuing claims at roughly 2 million, and overall wage growth still running around 4%. Finally, falling interest rates along with strong equity performance in recent months have significantly eased financial conditions which may, or may not, be what the Fed wants.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

As the end of the tightening cycle approaches, the Fed has indicated an openness to cut rates as inflation moderates to avoid pushing monetary policy from becoming too restrictive. Current market pricing has the trough in rates occurring in late-2025 at nearly 3%, somewhat higher than what the Fed currently believes policy should be at. So far, the “soft” landing most market participants once thought would be impossible seems to be increasingly likely although there may be some time, and volatility, before investors know for sure.

The Fed shifted its summary of economic projections in December towards a lower path for interest rates in 2024 and thus has moved towards focusing more about economic growth versus taming inflation. The Fed chose not to hike rates in December as was projected in September. It also projected lower rates at the end of 2024, 4.625% versus a prior level of 5.125%, given recent lower inflation levels. The dovish shift by the Fed, in both the dots and recent commentary, sent interest rates plummeting during the quarter with the 2-year, 10-year and 30-year Treasury falling by 79, 69 and 67 basis points (bps), to 4.25%, 3.88% and 4.03%, respectively. The fall in rates pushed total returns significantly higher with the Bloomberg U.S. Treasury Index returning 5.66% during the quarter and 4.05% for 2023.

The current market pricing projects many more cuts, cumulative 150 bps in 2024, versus current Fed projections of 75 bps. Given this shift lower in projected interest rates, it could be argued that a significant amount of performance in fixed income has been pulled forward following the Fed’s presumed ‘pivot’ to easier policy. From here, further deterioration in economic conditions would be needed to push interest rates lower as markets appear to be fully pricing the ‘soft landing’ scenario. Fundamental data will be closely watched in the coming months to evaluate whether the Fed has indeed successfully negotiated a controlled calming of inflation while not damaging the economy.

The pivot towards lower rates and progress slowing inflation sent risk assets higher as the odds of economic pain to cure the economy’s inflation woes quickly dissipated. All risk assets did better with lower quality doing the best. The Bloomberg U.S. High Yield Bond Index returned 331 bps more than similar maturity Treasuries during the quarter and earned a 13.44% return for the full year. Similarly, the Bloomberg U.S. Credit Baa-rated Index returned 240 bps more than Treasuries during the quarter and had a total return of 9.41%. If the ‘soft landing’ is indeed achieved, credit assets should continue to do well. However, by most measures, current spreads on credit sensitive assets offer limited upside to further tightening and if the economy does slow significantly, might widen.

Mortgage-backed securities (MBS) did very well during the quarter as concerns about higher rates fell and wide valuations attracted buyers. The Bloomberg U.S. Mortgage-Backed Securities Index outperformed similar maturity Treasuries by 133 bps during the quarter. Given the tightness of the credit markets, current spreads within MBS make it an attractive asset class, but with many banks still generally on the sidelines given liquidity concerns, the recent move tighter might make asset managers hold off for a better entry point.

We remain wary of how quickly financial markets have adopted an economic ‘soft landing’. Clearly, we are nearing the end of Fed rate hikes but the Fed’s ability to continue pushing inflation lower without economic damage may be harder than markets are estimating. Falling rates in recent months have brought positive returns to fixed income markets and eased rate burdens on consumers. We expect further yield declines will be dictated by changing economic fundamentals and stand ready to take advantage of market volatility as monetary policy adjusts.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

Cumulative Performance of $10,000 Investment1

Average Annual Total Return (%) through December 31, 20231

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Diversified Income, Class I | | | 1/1/1985 | | | | 3.77 | % | | | 3.27 | % | | | 7.27 | % | | | 6.44 | % |

| Ultra Series Diversified Income, Class II | | | 5/1/2009 | | | | 3.51 | % | | | 3.02 | % | | | 7.01 | % | | | 6.18 | % |

| Custom Blended Index (50% Fixed, 50% Equity) | | | 1/1/1985 | | | | 15.51 | % | | | 3.28 | % | | | 8.51 | % | | | 7.09 | % |

| ICE BofA US Corp, Govt & Mortg Index | | | | | | | 5.39 | % | | | -3.49 | % | | | 1.06 | % | | | 1.83 | % |

| S&P 500® Index | | | | | | | 26.29 | % | | | 10.00 | % | | | 15.69 | % | | | 12.03 | % |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Asset Backed Securities | | | 0.1 | % |

| Collateralized Mortgage Obligations | | | 0.0 | %* |

| Investment Companies | | | 97.4 | % |

| Mortgage Backed Securities | | | 0.0 | %* |

| Short-Term Investments | | | 2.6 | % |

| Net Other Assets and Liabilities | | | (0.1 | )% |

*less than 0.05%

ULTRA SERIES CORE BOND FUND

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Ultra Series Core Bond Fund invests at least 80% of its net assets in bonds. To keep current income relatively stable and to limit share price volatility, the Fund emphasizes investment grade securities and maintains an intermediate (typically 3-7 year) average portfolio duration, with the goal of being between 85-115% of the market benchmark duration. The Fund also strives to add incremental return in the portfolio by making strategic decisions relating to credit risk, sector exposure and yield curve positioning. The Fund may invest in corporate debt securities, U.S. Government debt securities, foreign government debt securities, non-rated debt securities, and asset-backed, mortgage-backed and commercial mortgage-backed securities.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

PERFORMANCE DISCUSSION

The Ultra Core Bond Fund (Class I) returned 6.16% for the year, compared to its benchmark the Bloomberg U.S. Aggregate Bond Index return of 5.53%. The Fund outperformed its Morningstar Intermediate Core Bond per group, which returned 5.65%.

The Federal Reserve (Fed) and the bond market are in agreement that the aggressive tightening cycle which began in 2022 will be ending in 2024. Dovish commentary by Federal Reserve Chairman Jerome Powell in the fourth quarter along with better inflation data suggests that discussions within the Fed have shifted towards when the first cut will occur versus whether interest rates have reached a sufficiently restrictive level. Inflation has softened considerably since the beginning of 2023 with year over year Personal Consumption Expenditure Core Price Index currently at 3.16%. However, the labor market remains strong with initial jobless claims running below 250,000, continuing claims at roughly 2 million and overall wage growth still running around 4%. Finally, financial conditions have eased significantly, which may, or may not be, what the Fed wants.

The Fed has indicated an openness to cut rates as inflation moderates to maintain policy at a level that isn’t too restrictive. Current market pricing has the trough in rates occurring in late-2025 at nearly 3%, somewhat higher than what the Fed currently believes policy should be at. So far, the “soft” landing most market participants thought would be impossible seems to be the most likely outcome but there may be significant volatility before investors know for sure.

With the expectation that the Fed will cut interest rates in 2024, shorter maturity Treasuries ended the year lower. The two-year and five-year Treasuries fell 0.18% and 0.16% while ten-year Treasuries didn’t change, and thirty-year Treasuries rose by 0.07%. Higher starting yields and falling front-end rates, produced a total return of 4.05% for the Bloomberg U.S. Treasury Index in 2023.

As the odds of a soft landing improved, financial conditions eased and risk assets outperformed. All risk assets did well with lower quality doing the best. The Bloomberg U.S. High Yield Bond Index returned 13.44% and the Bloomberg U.S. Credit Baa-rated Index had a total return of 9.41% for 2023. Higher quality lagged with the Bloomberg U.S. Credit A-rated Index only returning 7.70%.

Mortgage-backed securities (MBS) also did well during the year as concerns about higher rates fell and wide valuations attracted buyers. The Bloomberg U.S. Mortgage-Backed Securities Index returned 5.05% during the year, outperforming similar maturity Treasuries. The Fund was less aggressive in adding corporate bonds when compared to prior years. The Fund added MBS and ABS during the year and trimmed treasury positions.

Cumulative Performance of $10,000 Investment1

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

Average Annual Total Return (%) through December 31, 20231

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Core Bond, Class I | | | 1/1/1985 | | | | 6.16 | % | | | -3.19 | % | | | 1.39 | % | | | 1.69 | % |

| Ultra Series Core Bond, Class II | | | 5/1/2009 | | | | 5.89 | % | | | -3.44 | % | | | 1.13 | % | | | 1.44 | % |

| Bloomberg U.S. Aggregate Bond Index | | | 1/1/1985 | | | | 5.53 | % | | | -3.31 | % | | | 1.10 | % | | | 1.81 | % |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Asset Backed Securities | | | 3.4 | % |

| Collateralized Mortgage Obligations | | | 3.7 | % |

| Commercial Mortgage-Backed Securities | | | 2.2 | % |

| Corporate Notes and Bonds | | | 31.4 | % |

| Foreign Corporate Bonds | | | 3.9 | % |

| Long Term Municipal Bonds | | | 1.0 | % |

| Mortgage Backed Securities | | | 31.1 | % |

| Short-Term Investments | | | 2.4 | % |

| U.S. Government and Agency Obligations | | | 22.2 | % |

| Net Other Assets and Liabilities | | | (1.3 | )% |

ULTRA SERIES HIGH INCOME FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series High Income Fund invests primarily in lower-rated, higher-yielding income bearing securities, such as “junk” bonds. Because the performance of these securities has historically been strongly influenced by economic conditions, the Fund may rotate securities selection by business sector according to the economic outlook. Under normal market conditions, the Fund invests at least 80% of its net assets in bonds rated lower than investment grade (BBB/Baa) and their unrated equivalents or other high-yielding securities.

PERFORMANCE DISCUSSION

The Ultra Series High Income Fund (Class I) returned 9.27% for the year, compared to its benchmark the ICE BofA U.S. High Yield Constrained® Index’s return of 13.47%. The Fund underperformed its Morningstar High Yield Bond peer group, which returned 11.74%.

In 2023, the high yield market experienced a significant gain, particularly during the final two months of the year. We believe the market gain was broadly driven by 1) declining U.S. inflation and 2) a strong prospect for declining interest rates in the quarters ahead. On a fundamental level, many high yield issuers also successfully passed through price increases and were able to hold profitability margins better-than-expected. Taken all together, bond market participants greatly reduced the expectation for a deep recession over the near term. Consequently, as bond prices improved, the high yield index’s yield-to-worst (YTW) ended the year at 7.65%, a 133-basis point decrease when compared to YTW of 8.98% at the start of the year.

Within the high yield rating categories, higher quality bonds underperformed during the year. BB-rated bonds (49% of the total market) underperformed with a 11.40% total return. B-rated bonds (40% of the total market) slightly outperformed with a total return of 14.03%. CCC-rated corporate bonds (11% of the total market) significantly outperformed the overall market with a total return of 20.57%. Importantly, however, we note that shorter-dated bonds with 1-5 year maturities substantially underperformed similarly rated 7-10 year maturities.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

The Fund underperformed, in part, due to its negative contribution from holding a much lower duration and having an underweight within CCC-rated bonds relative to the benchmark. Additional negatives include poor bond selection in the Healthcare sector, as well as underperformance within the Telecommunications, Services and Leisure sectors. Partially offsetting these negatives, the Fund was positively impacted by its bond selection within the Banking and Financial Services sectors, as well as in the Media sector. In general, we anticipate underperforming in strong upward markets given our higher quality positioning in accordance with our strategy. As of December 31, 2023, the yield-to-worst of the fund was 7.6% and the average rating within the fund was Ba3.

The Fund will continue to emphasize BB-rated and B-rated corporate bonds. We will also continue to be conservative when adding duration to the portfolio. Thus, we enter 2024 with the anticipation that the total return for the high yield market could be in the mid-to-high single-digit range. Our targeted total return factors in a modest earnings growth expectation and that interest rates will steadily decline throughout the year. We also believe the outlook for lower interest rates is largely factored into current bond prices at year-end. Consequently, we anticipate the bulk of the high yield total return will be derived by interest income from the bond coupons. We intend to maintain our bias towards higher quality credit and a low single-digit cash position.

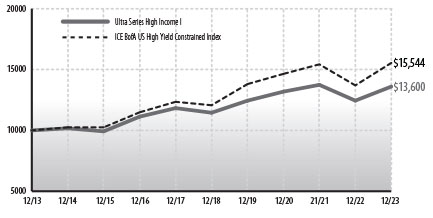

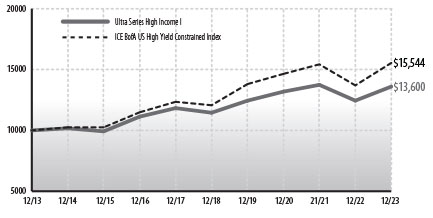

Cumulative Performance of $10,000 Investment1

Average Annual Total Return (%) through December 31, 20231

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series High Income, Class I | | | 10/31/2000 | | | | 9.27 | % | | | 1.04 | % | | | 3.50 | % | | | 3.12 | % |

| Ultra Series High Income, Class II | | | 5/1/2009 | | | | 9.00 | % | | | 0.78 | % | | | 3.24 | % | | | 2.87 | % |

| ICE BofA US High Yield Constrained Index | | | 10/31/2000 | | | | 13.47 | % | | | 2.01 | % | | | 5.19 | % | | | 4.51 | % |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Bond Funds | | | 3.9 | % |

| Communication Services | | | 18.6 | % |

| Consumer Discretionary | | | 19.9 | % |

| Consumer Staples | | | 8.2 | % |

| Energy | | | 5.3 | % |

| Financials | | | 13.4 | % |

| Health Care | | | 3.5 | % |

| Industrials | | | 17.8 | % |

| Information Technology | | | 3.3 | % |

| Short-Term Investments | | | 12.3 | % |

| Utilities | | | 1.1 | % |

| Net Other Assets and Liabilities | | | (7.3 | )% |

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

ULTRA SERIES LARGE CAP VALUE FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Large Cap Value Fund will, under normal market conditions, maintain at least 80% of its net assets in large cap stocks. The Fund follows a “value” approach, meaning the portfolio managers seek to invest in stocks at prices below their perceived intrinsic value as estimated based on fundamental analysis of the issuing company and its prospects. By investing in value stocks, the Fund attempts to limit the downside risk over time but may also produce smaller gains than other stock funds if their intrinsic values are not realized by the market or if growth-oriented investments are favored by investors. The Fund will diversify its holdings among various industries and among companies within those industries.

PERFORMANCE DISCUSSION

The Ultra Series Large Cap Value Fund (Class I) returned 2.56% for the year, compared to its benchmark the Russell 1000® Value Index return of 11.46%. The Fund underperformed its Morningstar Large Value peer group, which returned 10.53%.

Relative to the index, sector allocation and stock selection were detractive to results. For sector allocation, an underweight position in Communication Services negatively impacted performance. For stock selection, there were positive contributions from Energy, which was more than offset by weakness in Technology, Health Care, Consumer Staples, Materials, Industrials, and Utilities.

Within Industrials, industrial distributor Fastenal (FAST) was the most additive stock in the portfolio as it benefitted from strong demand for its tools. Construction equipment manufacturer Caterpillar (CAT) and railroad Union Pacific (UNP) were other industrial holdings that contributed positively to performance. In Financials, financial exchange operator CME Group (CME) was a notable outperforming stock as it experienced solid volumes in its interest rate derivatives contracts. Another notable outperforming stock was media conglomerate Comcast (CMCSA) in the Communications Sector. On the negative side, in Consumer Staples, agricultural commodity producer Archer-Daniels-Midland (ADM) was the most detractive stock in the portfolio. It was hurt in the short-term by falling commodity prices. In Utilities, electricity and renewable power provider NextEra Energy (NEE) negatively impacted results. It experienced slower growth than expected for some of its renewable power projects. Within Health Care, pharmaceutical companies Pfizer (PFE) and Bristol-Myers Squibb (BMY) were notable underperforming stocks due in part to concerns about their drug development pipelines. Another notable underperforming stock was Air Products (APD) in the Materials sector. The fund continues to hold all stocks mentioned above.

Cumulative Performance of $10,000 Investment1

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

Average Annual Total Return (%) through December 31, 20231

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Large Cap Value, Class I | | | 1/1/1985 | | | | 2.56 | % | | | 6.07 | % | | | 7.44 | % | | | 6.04 | % |

| Ultra Series Large Cap Value, Class II | | | 5/1/2009 | | | | 2.31 | % | | | 5.80 | % | | | 7.17 | % | | | 5.78 | % |

| Russell 1000® Value Index | | | 1/1/1985 | | | | 11.46 | % | | | 8.86 | % | | | 10.91 | % | | | 8.40 | % |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Communication Services | | | 3.3 | % |

| Consumer Discretionary | | | 9.7 | % |

| Consumer Staples | | | 10.2 | % |

| Energy | | | 10.6 | % |

| Equity Real Estate Investment Trusts (REITs) | | | 3.2 | % |

| Financials | | | 17.5 | % |

| Health Care | | | 12.2 | % |

| Industrials | | | 18.1 | % |

| Information Technology | | | 7.1 | % |

| Materials | | | 3.3 | % |

| Short-Term Investments | | | 1.1 | % |

| Utilities | | | 3.5 | % |

| Net Other Assets and Liabilities | | | 0.2 | % |

ULTRA SERIES LARGE CAP GROWTH FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Large Cap Growth Fund invests primarily in common stocks of larger companies and will, under normal market conditions, maintain at least 80% of its net assets in large cap stocks. The Fund invests in well established companies with competitive advantages that have demonstrated patterns of consistent growth. To a lesser extent, the Fund may invest in the stocks of less established companies that may offer more rapid growth potential. The Fund invests when a stock trades at a good price in relation to underlying value and the Fund looks to sell or trim a stock when the portfolio manager deems a stock to be overpriced compared to underlying value.

PERFORMANCE DISCUSSION

The Ultra Series Large Cap Growth Fund (Class I) returned 26.38% for the year, compared to its benchmark the Russell 1000® Growth Index return of 42.68%. The Fund outperformed its Morningstar U.S. Large Growth category peer group, which returned 23.46%.

Relative to the index, sector allocation and stock selection were detractive to results. For sector allocation, an underweight position in Communication Services negatively impacted performance. For stock selection, there were positive contributions from Energy, which was more than offset by weakness in Technology, Health Care, Consumer Staples, Materials, Industrials, and Utilities.

Within Industrials, industrial distributor Fastenal (FAST) was the most additive stock in the portfolio as it benefitted from strong demand for its tools. Construction equipment manufacturer Caterpillar (CAT) and railroad Union Pacific (UNP) were other industrial holdings that contributed positively to performance. In Financials, financial exchange operator CME Group (CME) was a notable outperforming stock as it experienced solid volumes in its interest rate derivatives contracts. Another notable outperforming stock was media conglomerate Comcast

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

(CMCSA) in the Communications Sector. On the negative side, in Consumer Staples, agricultural commodity producer Archer-Daniels-Midland (ADM) was the most detractive stock in the portfolio. It was hurt in the short-term by falling commodity prices. In Utilities, electricity and renewable power provider NextEra Energy (NEE) negatively impacted results. It experienced slower growth than expected for some of its renewable power projects. Within Health Care, pharmaceutical companies Pfizer (PFE) and Bristol-Myers Squibb (BMY) were notable underperforming stocks due in part to concerns about their drug development pipelines. Another notable underperforming stock was Air Products (APD) in the Materials sector. The Fund continues to hold all stocks mentioned above.

Cumulative Performance of $10,000 Investment1

Average Annual Total Return (%) through December 31, 20231

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Large Cap Growth, Class I | | | 12/31/1993 | | | | 26.38 | % | | | 10.38 | % | | | 14.98 | % | | | 11.61 | % |

| Ultra Series Large Cap Growth, Class II | | | 5/1/2009 | | | | 26.07 | % | | | 10.11 | % | | | 14.69 | % | | | 11.33 | % |

| Russell 1000® Growth Index | | | 12/31/1993 | | | | 42.68 | % | | | 8.86 | % | | | 19.50 | % | | | 14.86 | % |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Communication Services | | | 10.3 | % |

| Consumer Discretionary | | | 13.1 | % |

| Consumer Staples | | | 3.7 | % |

| Financials | | | 31.2 | % |

| Health Care | | | 14.9 | % |

| Industrials | | | 14.3 | % |

| Information Technology | | | 11.1 | % |

| Short-Term Investments | | | 2.4 | % |

| Net Other Assets and Liabilities | | | (1.0 | )% |

ULTRA SERIES MID CAP FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Mid Cap Fund generally invests in common stocks of midsize companies and will, under normal market conditions, maintain at least 80% of its net assets in mid cap securities. The Fund seeks attractive long-term returns through bottom-up security selection based on fundamental analysis in a diversified portfolio of high-quality companies with attractive valuations. These will typically be industry leading companies in niches with strong growth prospects. The Fund’s portfolio managers believe in selecting stocks for the Fund that show

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

steady, sustainable growth and reasonable valuations. As a result, stocks of issuers that are believed to have a blend of both value and growth potential will be selected for investment.

PERFORMANCE DISCUSSION

The Ultra Series Mid Cap Fund (Class I) returned 26.85% for the year, compared to its benchmark the Russell Midcap® Index return of 17.23%. The Fund outperformed its Morningstar Mid-Cap Core peer group, which returned 15.69%.

Stock selection accounted for most of our outperformance. The top three contributors were Arista Networks, Copart, and PACCAR. The top three detractors were Glacier Bancorp, Dollar Tree, and Laboratory Corporation of America. True to our bottom-up approach, our strongest contributors to performance came from some of our largest and highest conviction holdings. Sector allocation also helped, most notably our underweight in Utilities and Health Care, along with our overweight in Information Technology.

Arista Networks continues to produce robust revenue growth. Its industry-leading network switches are in high demand as cloud service providers and large enterprises demand faster and easier-to-manage equipment. Salvage auction marketplace provider Copart has continued to post strong performance despite higher operating costs and lower average selling prices for vehicles. It is gaining market share from its largest competitor due to farsighted investments it made many years ago. Longer term, several trends support more vehicles being sent to Copart’s auctions, most notably greater technology incorporated into automobiles, which increase the cost to repair post-accident, thereby increasing the number of vehicles sent to auction. Heavy duty truck manufacturer PACCAR was quietly one of our best performers over the past year. While the truck market is slowing, PACCAR’s steady parts business should act as a moderate stabilizer. We believe the stock remains reasonably priced compared with our view of normalized earnings.

Portfolio turnover was 13%, which was below our historical average of 20% to 30%, primarily due to our continued high conviction in our largest holdings and their reasonable stock valuations. During the year, we established one new position and exited six positions.

We bought Waters Corporation, a leading manufacturer of high-end scientific instruments used for chemical measurements. These instruments are used especially in the pharma industry to help develop drugs and assure their quality when being manufactured. We are attracted to the company’s large established instrument installed base, as well as the concentrated industry structure. Although we’ve followed the business for a long time, we only decided to purchase shares this year for two reasons: 1) a new CEO joined a few years ago and has reinvigorated the company, enhancing the growth outlook, and, 2) the stock price dropped to an attractive discount to our appraisal of value, as investors seem overly focused on recent moderating growth after two years of strong results.

We sold Markel Group and Progressive to reduce our allocation to property and casualty insurance after a period of strong performance led to an outsized exposure to the industry. In addition, Progressive’s market cap had risen significantly above the mid cap range. We sold Black Knight while it was in the process of being acquired by Intercontinental Exchange, because of the uncertainty in the antitrust environment and believing the situation had increasingly become the domain of risk arbitrageurs.

We sold the small ownership positions in Liberty Live and Atlanta Braves Holdings that we received due to their spin-offs from our holding in Liberty Formula One. Similarly, we sold Fortrea Holdings after its spin-off from Laboratory Corporation.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

Cumulative Performance of $10,000 Investment1

Average Annual Total Return (%) through December 31, 20231

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Mid Cap, Class I | | | 10/31/2000 | | | | 26.85 | % | | | 11.66 | % | | | 15.44 | % | | | 11.34 | % |

| Ultra Series Mid Cap, Class II | | | 5/1/2009 | | | | 26.53 | % | | | 11.38 | % | | | 15.15 | % | | | 11.06 | % |

| Russell Midcap® Index | | | 10/31/2000 | | | | 17.23 | % | | | 5.92 | % | | | 12.68 | % | | | 9.42 | % |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Communication Services | | | 6.7 | % |

| Consumer Discretionary | | | 14.8 | % |

| Consumer Staples | | | 6.6 | % |

| Financials | | | 22.4 | % |

| Health Care | | | 6.1 | % |

| Industrials | | | 17.1 | % |

| Information Technology | | | 21.4 | % |

| Short-Term Investments | | | 6.2 | % |

| Net Other Assets and Liabilities | | | (1.3 | )% |

ULTRA SERIES INTERNATIONAL STOCK FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series International Stock Fund will invest, under normal market conditions, at least 80% of its net assets in the stock of foreign companies. Typically, a majority of the Fund’s assets are invested in relatively large cap stocks of companies located or operating in developed countries. The Fund may also invest up to 30% of its assets in securities of companies whose principal business activities are located in emerging market countries. The portfolio managers typically maintain this segment of the Fund’s portfolio in such stocks which it believes have a low market price relative to their perceived value based on fundamental analysis of the issuing company and its prospects. The Fund may also invest in foreign debt and other income bearing securities at times when it believes that income bearing securities have greater capital appreciation potential than equity securities.

PERFORMANCE DISCUSSION

The Ultra Series International Stock Fund (Class I) returned 15.87% during the period, compared to its benchmark the MSCI ACWII Ex USA Index (net) return of 15.62%. The Fund underperformed its Morningstar Foreign Large Blend peer group, which returned 16.85%.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

International equity markets rose in 2023. While conflict in Ukraine and Israel has been a headwind for international equity markets, macro-economic conditions have overcome this heightened risk. During the year, inflation started to decline once central banks belatedly applied monetary tightening. This may perhaps allow interest rates to first peak, then decline in 2024. Whether or not pivoting towards easier monetary policy will come sufficiently quickly and, in a magnitude, to avoid the economy dipping into recession and the desired “soft landing” can be achieved, then markets will have a favorable environment for 2024 subject to geopolitical risks not getting any worse.

Upon review of the sector and regional category breakdown that make up the overall benchmark’s performance over the period, all regions had a total return that was positive, with the largest increase in Japan and Europe. The sectors with leading returns were Information Technology and Industrials, while Consumer Staples and Real Estate despite a positive return were relative laggards.

Over the one-year period, the Fund was largely in-line relative to the benchmark. A relative underweight in Emerging Markets and positive stock selection led to it being the region with the most positive contribution. Canada was a close leading contributor driven mainly by stock selection. From a sector view, Financials detracted the most while Materials and Information Technology were the largest contributors, with the former driven by stock selection and the latter driven by both stock selection and allocation affect. The cash position had a negative contribution because the benchmark performance was positive.

Portfolio sector and regional weights are determined through bottom-up stock selection, with internal sector and regional guardrails that keep exposure within modest tilts of the benchmark to ensure diversification and to manage risk. Fund composition did change to some extent over the period. Among the three geographic buckets the Fund is viewed on relative to the benchmark, all increased because a portion of cash was reallocated across the Fund. From a sector perspective, there were several notable changes. One fewer stock in Healthcare and Financials led to a more underweight position in these sectors. One new stock in Consumer Staples increased the relative overweight position. There was a major index reclassification between Information Technology and Financials during the year that shifted two stocks to Financials, but we kept the overweight in Information Technology and underweight in Financials. Lastly, the Consumer Discretionary slight underweight moved to overweight because of increased weights in Fund holdings mostly in Japan. Over the period, three stocks were bought and five were sold. Three were sold for a better opportunity, the other two were sold to take profits and manage risk.

Looking forward into 2024, the revived optimism about central banks pausing monetary tightening and ultimately easing policy will have to delicately factor in the distinct possibility that, in the short-term, economies may not achieve the desired “soft landing” but instead dive into recession prior to expanding later. Irrespective of the economic backdrop, our strategy focuses on searching for companies that consistently achieve high profitability and faster business growth while maintaining strong financial conditions.

Cumulative Performance of $10,000 Investment1

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

Average Annual Total Return (%) through December 31, 20231

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series International Stock, Class I | | | 10/31/2000 | | | | 15.87 | % | | | -2.01 | % | | | 4.26 | % | | | 1.31 | % |

| Ultra Series International Stock, Class II | | | 5/1/2009 | | | | 15.58 | % | | | -2.26 | % | | | 4.00 | % | | | 1.05 | % |

| MSCI ACWI ex-USA Index (net) | | | 10/31/2000 | | | | 15.62 | % | | | 1.55 | % | | | 7.08 | % | | | 3.83 | % |

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Communication Services | | | 5.4 | % |

| Consumer Discretionary | | | 12.4 | % |

| Consumer Staples | | | 9.7 | % |

| Energy | | | 4.9 | % |

| Financials | | | 17.0 | % |

| Health Care | | | 6.0 | % |

| Industrials | | | 12.7 | % |

| Information Technology | | | 18.0 | % |

| Materials | | | 12.1 | % |

| Short-Term Investments | | | 2.9 | % |

| Net Other Assets and Liabilities | | | (1.1 | )% |

| GEOGRAPHICAL ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Japan | | | 18.2 | % |

| Germany | | | 12.4 | % |

| United Kingdom | | | 9.6 | % |

| France | | | 8.6 | % |

| India | | | 8.3 | % |

| Switzerland | | | 6.9 | % |

| China | | | 5.9 | % |

| Canada | | | 5.8 | % |

| Mexico | | | 5.8 | % |

| Netherlands | | | 4.2 | % |

| United States | | | 2.9 | % |

| Ireland | | | 1.9 | % |

| Israel | | | 1.9 | % |

| Brazil | | | 1.6 | % |

| Taiwan | | | 1.4 | % |

| Australia | | | 1.3 | % |

| Hong Kong | | | 1.3 | % |

| Norway | | | 1.2 | % |

| Denmark | | | 1.0 | % |

| Italy | | | 0.9 | % |

| Other Net Assets | | | (1.1 | )% |

ULTRA SERIES TARGET RETIREMENT 2020 FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Madison Target Retirement 2020 Fund invests primarily in shares of registered investment companies according to an asset allocation strategy developed by the Fund’s investment adviser for investors planning to retire in or within a few years of 2020. Over time, the Fund’s asset allocation will gradually shift until it reaches the more conservative allocation target of approximately 10-30% in stock funds and 70-90% in bond

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

funds. The asset allocation strategy is designed to reduce the volatility of investment returns in the later years while still providing the potential for higher total returns over the target period.

PERFORMANCE DISCUSSION

The Ultra Series Target Retirement 2020 Fund (Class I) returned 4.17% for the year, compared to its benchmark the S&P Target Date to 2020® Index return of 10.92%. The Fund underperformed its Morningstar Target-Date 2020 peer group, which returned 10.42%.

For asset class returns, 2023 proved to be a year of two distinctly different periods. The first from the beginning of the year to the end of October, and the second, from November through the end of the year. Throughout the first period, the narrative revolved around a regional banking crisis, additional monetary tightening, and an equity market dominated by the largest 7 stocks. In fact, through October 31st, cash and cash equivalents were one of the top performing asset classes for the year, behind US stocks, as bonds were down -2.77%, as measured by the Bloomberg US Aggregate Bond index, and international stocks were only up 0.99% as measured by the MSCI ACWI Ex USA NR index. A perceived pivot in monetary policy from the Federal Reserve at their meeting in late October was the catalyst that changed the narrative for the remainder of the year. As a result, interest rates across the yield curve cascaded lower in just two short months. This movement was widely accepted by market participants as the end of the monetary tightening regime and spurred a risk-on rally late in the year that ultimately pushed the lagging assets classes higher.

The Fund had entered the year in a defensive posture as a combination of an aging restrictive monetary policy cycle and leading recessionary indicators had led us to believe it was prudent to be cautious. While this posture benefited the Fund at times, the underweight to equities and an overweight to cash and cash equivalents proved to be a drag on performance. In addition, our commodities exposure, that we hold partially as a hedge against interest rate risk, was also detractive. The Fund did benefit from an overweight to US relative international equites, an overweight to the US Technology sector, as well as an overweight to Japan relative to Europe within the international equity allocation.

As a recession did not materialize in 2023 and the fundamentals underlying the global economy continue to appear weak, the Fund remains postured defensively entering 2024. Risk assets ended the year fully valued with equities trading at a premium and spreads on corporate bonds at levels equivalent to those seen coinciding with a period of sustained economic growth. As such, the Fund is positioned in high quality sectors of fixed income including an overweight to the Treasury and Securitized sectors, while underweight corporate bonds. We remain underweight equity within the fund while emphasizing stocks that exhibit quality across equity allocations and continue to prefer the opportunities within US equities relative to those in international equities.

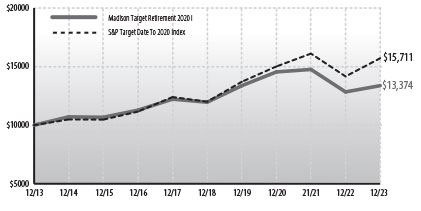

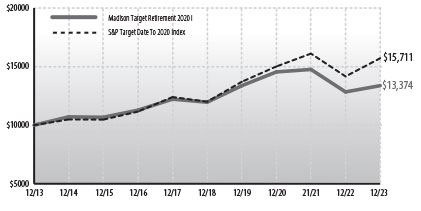

Cumulative Performance of $10,000 Investment1,3

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

Average Annual Total Return (%) through December 31, 20231,3

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Target Retirement 2020, Class I | | | 10/1/2007 | | | | 4.17 | % | | | -2.76 | % | | | 2.26 | % | | | 2.95 | % |

| S&P Target Date To 2020 Index | | | | | | | 10.92 | % | | | 1.53 | % | | | 5.53 | % | | | 4.62 | % |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Alternative Funds | | | 2.6 | % |

| Bond Funds | | | 77.3 | % |

| Foreign Stock Funds | | | 5.0 | % |

| Short-Term Investments | | | 2.8 | % |

| Stock Funds | | | 12.2 | % |

| Net Other Assets and Liabilities | | | 0.1 | % |

ULTRA SERIES TARGET RETIREMENT 2030 FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Madison Target Retirement 2030 Fund invests primarily in shares of registered investment companies according to an asset allocation strategy developed by the Fund’s investment adviser for investors planning to retire in or within a few years of 2030. Over time, the Fund’s asset allocation will gradually shift until it reaches the more conservative allocation target of approximately 10-30% in stock funds and 70-90% in bond funds. The asset allocation strategy is designed to reduce the volatility of investment returns in the later years while still providing the potential for higher total returns over the target period.

PERFORMANCE DISCUSSION

The Ultra Series Target Retirement 2030 Fund (Class I) returned 5.72% for the year, compared to its benchmark the S&P Target Date to 2030® Index return of 14.44%. The Fund underperformed its Morningstar Target-Date 2030 peer group, which returned 12.92%.

For asset class returns, 2023 proved to be a year of two distinctly different periods. The first from the beginning of the year to the end of October, and the second, from November through the end of the year. Throughout the first period, the narrative revolved around a regional banking crisis, additional monetary tightening, and an equity market dominated by the largest 7 stocks. In fact, through October 31st, cash and cash equivalents were one of the top performing asset classes for the year, behind US stocks, as bonds were down -2.77%, as measured by the Bloomberg US Agg Bond index, and international stocks were only up 0.99% as measured by the MSCI ACWI Ex USA NR index. A perceived pivot in monetary policy from the Federal Reserve at their meeting in late October was the catalyst that changed the narrative for the remainder of the year. As a result, interest rates across the yield curve cascaded lower in just two short months. This movement was widely accepted by market participants as the end of the monetary tightening regime and spurred a risk-on rally late in the year that ultimately pushed the lagging assets classes higher.

The Fund had entered the year in a defensive posture as a combination of an aging restrictive monetary policy cycle and leading recessionary indicators had led us to believe it was prudent to be cautious. While this posture benefited the Fund at times, the underweight to equities and an overweight to cash and cash equivalents proved to be a drag on performance. In addition, our commodities exposure, that we hold partially as a hedge against interest rate risk, was also detractive. The Fund did benefit from an overweight to US relative international equites, an overweight to the US Technology sector, as well as an overweight to Japan relative to Europe within the international equity allocation.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

As a recession did not materialize in 2023 and the fundamentals underlying the global economy continue to appear weak, the Fund remains postured defensively entering 2024. Risk assets ended the year fully valued with equities trading at a premium and spreads on corporate bonds at levels equivalent to those seen coinciding with a period of sustained economic growth. As such, the Fund is positioned in high quality sectors of fixed income including an overweight to the Treasury and Securitized sectors, while underweight corporate bonds. We remain underweight equity within the Fund while emphasizing stocks that exhibit quality across equity allocations and continue to prefer the opportunities within US equities relative to those in international equities.

Cumulative Performance of $10,000 Investment1,3

Average Annual Total Return (%) through December 31, 20231,3

| | | Inception | | | 1 Year | | | 3 Year | | | 5 Year | | | 10 Year | |

| | | Date | | | Return | | | Return | | | Return | | | Return | |

| Ultra Series Target Retirement 2030, Class I | | | 10/1/2007 | | | | 5.72 | % | | | -0.01 | % | | | 5.52 | % | | | 5.03 | % |

| S&P Target Date To 2030 Index | | | | | | | 14.44 | % | | | 3.35 | % | | | 7.90 | % | | | 6.01 | % |

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 12/31/23 | | | |

| Alternative Funds | | | 4.6 | % |

| Bond Funds | | | 56.0 | % |

| Foreign Stock Funds | | | 9.6 | % |

| Short-Term Investments | | | 1.4 | % |

| Stock Funds | | | 28.5 | % |

| Net Other Assets and Liabilities | | | (0.1 | )% |

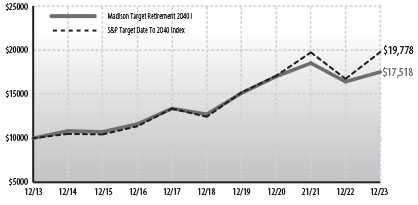

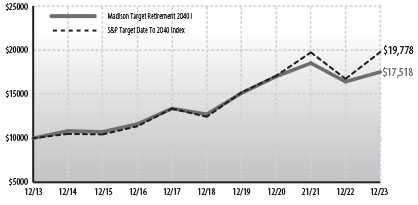

ULTRA SERIES TARGET RETIREMENT 2040 FUND

INVESTMENT STRATEGY HIGHLIGHTS

The Ultra Series Madison Target Retirement 2040 Fund invests primarily in shares of registered investment companies according to an asset allocation strategy developed by the Fund’s investment adviser for investors planning to retire in or within a few years of 2040. Over time, the Fund’s asset allocation will gradually shift until it reaches the more conservative allocation target of approximately 10-30% in stock funds and 70-90% in bond funds. The asset allocation strategy is designed to reduce the volatility of investment returns in the later years while still providing the potential for higher total returns over the target period.

PERFORMANCE DISCUSSION

The Ultra Series Target Retirement 2040 Fund (Class I) returned 6.70% for the year, compared to its benchmark the S&P Target Date to 2040® Index return of 18.16%. The Fund underperformed its Morningstar Target-Date 2040 peer group, which returned 15.92%.

Ultra Series Fund | Management’s Discussion of Fund Performance (unaudited) - continued | December 31, 2023

For asset class returns, 2023 proved to be a year of two distinctly different periods. The first from the beginning of the year to the end of October, and the second, from November through the end of the year. Throughout the first period, the narrative revolved around a regional banking crisis, additional monetary tightening, and an equity market dominated by the largest 7 stocks. In fact, through October 31st, cash and cash equivalents were one of the top performing asset classes for the year, behind US stocks, as bonds were down -2.77%, as measured by the Bloomberg US Agg Bond index, and international stocks were only up 0.99% as measured by the MSCI ACWI Ex USA NR index. A perceived pivot in monetary policy from the Federal Reserve at their meeting in late October was the catalyst that changed the narrative for the remainder of the year. As a result, interest rates across the yield curve cascaded lower in just two short months. This movement was widely accepted by market participants as the end of the monetary tightening regime and spurred a risk-on rally late in the year that ultimately pushed the lagging assets classes higher.