EXHIBIT 99.2

| PART II |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| Overview |

Verizon Communications Inc. (Verizon or the Company) is a holding company that, acting through its subsidiaries, is one of the world’s leading providers of communications, information and entertainment products and services to consumers, businesses and government entities. With a presence around the world, we offer voice, data and video services and solutions on our networks that are designed to meet customers’ demand for mobility, reliable network connectivity, security and control. We have a highly diverse workforce of approximately 144,500 employees as of December 31, 2018.

To compete effectively in today’s dynamic marketplace, we are focused on transforming around the capabilities of our high-performing networks to drive growth based on delivering what customers want and need in the new digital world. During 2018, we focused on leveraging our network leadership; retaining and growing our high-quality customer base while balancing profitability; enhancing ecosystems in growth businesses; and driving monetization of our networks and solutions. Our strategy requires significant capital investments primarily to acquire wireless spectrum, put the spectrum into service, provide additional capacity for growth in our networks, invest in the fiber that supports our businesses, evolve and maintain our networks and develop and maintain significant advanced information technology systems and data system capabilities. We believe that steady and consistent investments in our networks and platforms will drive innovative products and services and fuel our growth.

We are consistently deploying new network architecture and technologies to extend our leadership in both fourth-generation (4G) and fifth-generation (5G) wireless networks. We expect that our Intelligent Edge Network design will allow us to realize significant efficiencies by utilizing multi-purpose infrastructure utilizing common architecture within the core and providing flexibility to meet customer demands. In addition, protecting the privacy of our customers’ information and the security of our systems and networks continues to be a priority at Verizon. Our network leadership is the hallmark of our brand and the foundation for the connectivity, platform and solutions upon which we build our competitive advantage.

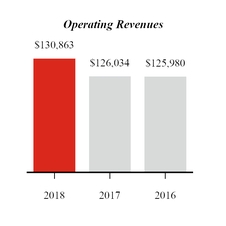

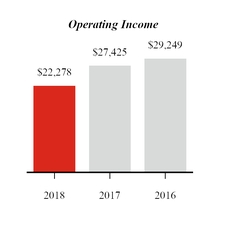

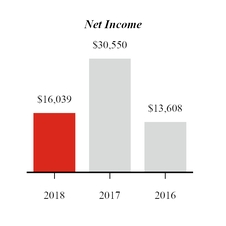

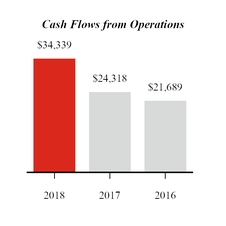

Highlights of Our 2018 Financial Results

(dollars in millions)

Business Overview

In November 2018, we announced a strategic reorganization of our business. Under the new structure, effective April 1, 2019, there are two reportable segments that we operate and manage as strategic business units - Verizon Consumer Group (Consumer) and Verizon Business Group (Business). In conjunction with the new reporting structure, we recast our segment disclosures for all periods presented.

Revenue by Segment

———

Note: Excludes eliminations.

Verizon Consumer Group

Our Consumer segment provides consumer-focused wireless and wireline communications services and products. Our wireless services are provided across one of the most extensive wireless networks in the United States (U.S.) under the Verizon Wireless brand and through wholesale and other arrangements. Our wireline services are provided in nine states in the Mid-Atlantic and Northeastern U.S., as well as Washington D.C., over our 100% fiber-optic network under the Fios brand and over a traditional copper-based network to customers who are not served by Fios. Our Consumer segment's wireless and wireline products and services are available to our retail customers, as well as resellers that purchase wireless network access from us on a wholesale basis.

Customers can obtain our wireless services on a postpaid or prepaid basis. A retail postpaid connection represents an individual line of service for a wireless device for which a customer is generally billed one month in advance for a monthly access charge in return for access to and usage of network services. Our prepaid service is offered only to Consumer customers and enables individuals to obtain wireless services without credit verification by paying for all services in advance. The Consumer segment also offers several categories of wireless equipment to customers, including a variety of smartphone and other handsets, wireless-enabled Internet devices, such as tablets, laptop computers and netbooks, and other wireless-enabled connected devices, such as smart watches and other wearables.

In addition to the wireless services and equipment discussed above, Consumer sells residential fixed connectivity solutions, including Internet, video and voice services, and wireless network access to resellers on a wholesale basis. Consumer segment operating revenues for the year ended December 31, 2018 totaled $89.8 billion, an increase of $2.7 billion, or 3.1%, compared to the year ended December 31, 2017. As of December 31, 2018, Consumer had approximately 95 million wireless retail connections, 6 million broadband connections and 4 million Fios video connections.

Verizon Business Group

Our Business segment provides wireless and wireline communications services and products, video and data services, corporate networking solutions, security and managed network services, local and long distance voice services and network access to deliver various Internet of Things (IoT) services and products, including Verizon Connect’s solutions which support fleet tracking management, compliance management, field service management, asset tracking and other types of mobile resource management. We provide these products and services to businesses, government customers and wireless and wireline carriers across the U.S. and select products and services to customers around the world. The Business segment's total operating revenues for the year ended December 31, 2018 totaled $31.5 billion, an increase of $0.6 billion, or 2.0%, compared to the year ended December 31, 2017. As of December 31, 2018, Business had approximately 23 million wireless retail postpaid connections and approximately 500 thousand broadband connections.

Corporate and Other

Corporate and other includes the results of our media business, Verizon Media Group (Verizon Media), which operated under the "Oath" brand until January 2019, and other businesses, investments in unconsolidated businesses, unallocated corporate expenses, certain pension and other employee benefit related costs and interest and financing expenses. Corporate and other also includes the historical results of divested businesses and other adjustments and gains and losses that are not allocated in assessing segment performance due to their nature. Although such transactions are excluded from the business segment results, they are included in reported consolidated earnings. Gains and losses from these transactions that are not individually significant are included in segment results as these items are included in the chief operating decision maker’s assessment of segment performance.

Verizon Media includes diverse media and technology brands that serve both consumers and businesses. Verizon Media provides consumers with owned and operated search properties and finance, news, sports and entertainment offerings, and provides other businesses and partners access to consumers through digital advertising platforms. Verizon Media's total operating revenues were $7.7 billion for the year ended December 31, 2018. This was an increase of 28.8% from the year ended December 31, 2017, primarily due to the acquisition of Yahoo's operating business in June of 2017.

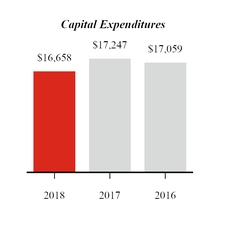

Capital Expenditures and Investments

We continue to invest in our wireless networks, high-speed fiber and other advanced technologies to position ourselves at the center of growth trends for the future. During the year ended December 31, 2018, these investments included $16.7 billion for capital expenditures. See "Cash Flows Used in Investing Activities" and "Operating Environment and Trends" for additional information. We believe that our investments aimed at expanding our portfolio of products and services will provide our customers with an efficient, reliable infrastructure for competing in the information economy.

Global Network and Technology

We are focusing our capital spending on adding capacity and density to our 4G Long-Term Evolution (LTE) network. We are densifying our 4G LTE network by utilizing small cell technology, in-building solutions and distributed antenna systems. Network densification not only enables us to add capacity to address increasing mobile video consumption and the growing demand for IoT products and services, but it also positions us for the deployment of 5G technology. Over the past several years, we have been leading the development of 5G wireless technology industry standards and the ecosystems for fixed and mobile 5G wireless services. In late 2015, we launched the Verizon 5G Technology Forum with key industry partners to develop 5G requirements and standards and conduct testing to accelerate the introduction of 5G technology. We expect that 5G technology will provide higher throughput and lower latency than the current 4G LTE technology and enable our networks to handle more traffic as the number of Internet-connected devices grows. During 2018, we commercially launched 5G Home on proprietary standards in four U.S. markets: Sacramento, Los Angeles, Houston and Indianapolis.

To compensate for the shrinking market for traditional copper-based products, we continue to build our wireline business around fiber-based networks supporting data, video and advanced business services - areas where demand for reliable high-speed connections is growing. We are evolving the architecture of our networks to a next-generation multi-use platform, providing improved efficiency and virtualization, increased automation and opportunities for edge computing services that will support both our fiber-based and radio access network technologies. We call this the Intelligent Edge Network. We expect that this new architecture will simplify operations by eliminating legacy network elements, improve our 4G LTE wireless coverage, speed the deployment of 5G wireless technology, and create new opportunities in the business market.

Recent Developments

In September 2018, Verizon announced a voluntary separation program for select U.S.-based management employees which impacts approximately 10,400 eligible employees, with nearly half of these employees separating from the Company in December of 2018. Principally as a result of this program but also as a result of other headcount reduction initiatives, the Company recorded a severance charge of $1.8 billion ($1.4 billion after-tax) during the year ended December 31, 2018, which was recorded in Selling, general and administrative expense in our consolidated statement of income. During 2018, we also recorded $0.3 billion in severance costs under our other existing separation plans.

| Consolidated Results of Operations |

In this section, we discuss our overall results of operations and highlight special items that are not included in our segment results. In "Segment Results of Operations," we review the performance of our two reportable segments in more detail.

Consolidated Revenues

| (dollars in millions) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Consumer | $ | 89,762 | $ | 87,054 | $ | 89,501 | $ | 2,708 | 3.1 | % | $ | (2,447 | ) | (2.7 | )% | ||||||||||

| Business | 31,534 | 30,913 | 29,537 | 621 | 2.0 | 1,376 | 4.7 | ||||||||||||||||||

| Corporate and other | 9,936 | 8,466 | 7,287 | 1,470 | 17.4 | 1,179 | 16.2 | ||||||||||||||||||

| Eliminations | (369 | ) | (399 | ) | (345 | ) | 30 | (7.5 | ) | (54 | ) | 15.7 | |||||||||||||

| Consolidated Revenues | $ | 130,863 | $ | 126,034 | $ | 125,980 | $ | 4,829 | 3.8 | $ | 54 | — | |||||||||||||

2018 Compared to 2017

Consolidated revenues increased $4.8 billion, or 3.8%, during 2018 compared to 2017, primarily due to increases in revenues at our Consumer and Business segments, as well as Corporate and other. In addition, $0.4 billion of the increase in consolidated revenues was attributable to the adoption of Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers (Topic 606), which was adopted on January 1, 2018, using a modified retrospective approach.

Revenues for our segments are discussed separately below under the heading "Segment Results of Operations."

Corporate and other revenues increased $1.5 billion, or 17.4%, during 2018 compared to 2017, primarily due to an increase of $1.7 billion in revenues within Verizon Media, as a result of the acquisition of Yahoo's operating business on June 13, 2017, partially offset by the sale of 23 customer-facing data center sites in the U.S. and Latin America (Data Center Sale) on May 1, 2017 and other insignificant transactions (see "Operating Results From Divested Businesses" below).

2017 Compared to 2016

Consolidated revenues remained consistent, during 2017 compared to 2016, primarily due to a decline in revenues at our Consumer segment, partially offset by an increase in revenues within our Business segment and Corporate and other.

Revenues for our segments are discussed separately below under the heading "Segment Results of Operations."

Corporate and other revenues increased $1.2 billion, or 16.2%, during 2017 compared to 2016 primarily due to an increase in revenue as a result of the acquisition of Yahoo's operating business on June 13, 2017. The increase was partially offset by the sale (Access Line Sale) of our local exchange business and related landline activities in California, Florida and Texas, including Fios Internet and video customers, switched and special access lines and DSL services and long distance voice accounts in these three states, to Frontier Communications Corporation (Frontier) on April 1, 2016 and the Data Center Sale on May 1, 2017, and other insignificant transactions (see "Operating Results From Divested Businesses" below). During 2017, Verizon Media generated $6.0 billion in revenues which represented approximately 71% of revenues in Corporate and Other.

Consolidated Operating Expenses

| (dollars in millions) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Cost of services | $ | 32,185 | $ | 30,916 | $ | 30,463 | $ | 1,269 | 4.1 | % | $ | 453 | 1.5 | % | |||||||||||

| Cost of wireless equipment | 23,323 | 22,147 | 22,238 | 1,176 | 5.3 | (91 | ) | (0.4 | ) | ||||||||||||||||

| Selling, general and administrative expense | 31,083 | 28,592 | 28,102 | 2,491 | 8.7 | 490 | 1.7 | ||||||||||||||||||

| Depreciation and amortization expense | 17,403 | 16,954 | 15,928 | 449 | 2.6 | 1,026 | 6.4 | ||||||||||||||||||

| Oath goodwill impairment | 4,591 | — | — | 4,591 | nm | — | — | ||||||||||||||||||

| Consolidated Operating Expenses | $ | 108,585 | $ | 98,609 | $ | 96,731 | $ | 9,976 | 10.1 | $ | 1,878 | 1.9 | |||||||||||||

nm - not meaningful

Operating expenses for our segments are discussed separately below under the heading "Segment Results of Operations."

2018 Compared to 2017

Cost of Services

Cost of services includes the following costs directly attributable to a service: salaries and wages, benefits, materials and supplies, content costs, contracted services, network access and transport costs, customer provisioning costs, computer systems support, and costs to support our outsourcing contracts and technical facilities. Aggregate customer care costs, which include billing and service provisioning, are allocated between Cost of services and Selling, general and administrative expense.

Cost of services increased $1.3 billion, or 4.1%, during 2018 compared to 2017, primarily due to higher rent expense as a result of adding capacity to the networks to support demand, increases in content costs associated with continued increases in the cost of programming license fees, new pricing and a volume-driven increase in costs related to the wireless device protection package offered to our customers at our Consumer segment, as well as other direct costs at our Business segment.

Cost of Wireless Equipment

Cost of wireless equipment increased $1.2 billion, or 5.3%, during 2018 compared to 2017, primarily as a result of shifts to higher priced units in the mix of devices sold within our Consumer segment, as well as an increase in the number of smartphone units sold within our Business segment.

Selling, General and Administrative Expense

Selling, general and administrative expense includes: salaries and wages and benefits not directly attributable to a service or product, bad debt charges, taxes other than income taxes, advertising and sales commission costs, customer billing costs, call center and information technology costs, regulatory fees, professional service fees, and rent and utilities for administrative space. Also included is a portion of the aggregate customer care costs as discussed in "Cost of Services" above.

Selling, general and administrative expense increased $2.5 billion, or 8.7%, during 2018 primarily due to a net gain on the sale of divested businesses in 2017 (see "Special Items"), as well as an increase in severance expenses in 2018 primarily a result of the voluntary separation program for selected U.S.-based management employees (see "Severance, pension and benefit charges (credits)" under "Special Items"). These increases were partially offset by a decrease in acquisition and integration related charges primarily related to the acquisition of Yahoo's operating business (see "Special Items") and a decrease in commission expense following the adoption of Topic 606.

Depreciation and Amortization Expense

Depreciation and amortization expense increased $0.4 billion, or 2.6%, during 2018 primarily due to an increase in depreciable assets.

Oath Goodwill Impairment

The goodwill impairment charge recorded in 2018 related to Verizon Media, and was a result of the Company's annual goodwill impairment test performed in the fourth quarter (see "Critical Accounting Estimates").

2017 Compared to 2016

Cost of Services

Cost of services increased $0.5 billion, or 1.5%, during 2017 primarily due to an increase in expenses as a result of the acquisition of Yahoo's operating business, an increase in content costs associated with continued programming license fee increases and an increase in access costs as a result of the acquisition of XO Holdings' business (XO) at our Business segment. These increases were partially offset by the completion of the Access Line Sale on April 1, 2016, the Data Center Sale on May 1, 2017 and other insignificant transactions (see "Operating Results From Divested Businesses"), and the fact that we incurred incremental costs in 2016 as a result of the union work stoppage that commenced on April 13, 2016 and ended on June 1, 2016 (2016 Work Stoppage), which did not recur in 2017.

Cost of Wireless Equipment

Cost of wireless equipment decreased $0.1 billion, or 0.4%, during 2017 primarily as a result of a decline in the number of smartphone and Internet units sold, substantially offset by a shift to higher priced units in the mix of wireless devices sold.

Selling, General and Administrative Expense

Selling, general and administrative expense increased $0.5 billion, or 1.7%, during 2017 primarily due to an increase in expenses as a result of the acquisition of Yahoo's operating business on June 13, 2017, acquisition and integration charges primarily in connection with the acquisition of Yahoo's operating business, product realignment charges (see "Special Items") and an increase in expenses as a result of the acquisition of XO. These increases were partially offset by an increase in the net gain on sale of divested businesses (see "Special Items"), a decline at our Consumer segment in sales commission expense, employee related costs, bad debt expense, and advertising expense, a decrease due to the Access Line Sale on April 1, 2016 and the Data Center Sale on May 1, 2017, and other insignificant transactions (see "Operating Results From Divested Businesses").

Depreciation and Amortization Expense

Depreciation and amortization expense increased $1.0 billion, or 6.4%, during 2017 primarily due to the acquisitions of Yahoo's operating business and XO.

Operating Results From Divested Businesses

In April 2016, we completed the Access Line Sale. In May 2017, we completed the Data Center Sale. The results of operations related to these divestitures and other insignificant transactions are included within Corporate and other for all periods presented to reflect comparable segment operating results consistent with the information regularly reviewed by our chief operating decision maker. The results of operations related to these divestitures included within Corporate and other are as follows:

| (dollars in millions) | |||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | ||||||||

| Operating Results From Divested Businesses | |||||||||||

| Operating revenues | $ | — | $ | 368 | $ | 2,115 | |||||

| Cost of services | — | 129 | 747 | ||||||||

| Selling, general and administrative expense | — | 68 | 246 | ||||||||

| Depreciation and amortization expense | — | 22 | 127 | ||||||||

Other Consolidated Results

Other Income (Expense), Net

Additional information relating to Other income (expense), net is as follows:

| (dollars in millions) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Interest income | $ | 94 | $ | 82 | $ | 59 | $ | 12 | 14.6 | % | $ | 23 | 39.0 | % | |||||||||||

| Other components of net periodic benefit cost | 3,068 | (11 | ) | (2,190 | ) | 3,079 | nm | 2,179 | 99.5 | ||||||||||||||||

| Other, net | (798 | ) | (2,092 | ) | (1,658 | ) | 1,294 | 61.9 | (434 | ) | (26.2 | ) | |||||||||||||

| Total | $ | 2,364 | $ | (2,021 | ) | $ | (3,789 | ) | $ | 4,385 | nm | $ | 1,768 | 46.7 | |||||||||||

nm - not meaningful

The change in Other income (expense), net during the year ended December 31, 2018, compared to the similar period in 2017, was primarily driven by pension and benefits credits of $2.1 billion recorded during 2018, compared with pension and benefit charges of approximately $0.9 billion recorded in 2017 (see "Special Items") as well as early debt redemption costs of $0.7 billion recorded during 2018, compared to $2.0 billion recorded during 2017 (see "Special Items"). The change in Other income (expense), net during the year ended December 31, 2017, compared to the similar period in 2016, was primarily driven by a decrease in components of net periodic benefit cost. The change was partially offset by early debt redemption costs of $2.0 billion, compared to $1.8 billion recorded during 2016 (see "Special Items"), as well as a net loss on foreign currency translation adjustments compared to a net gain in the 2016 period.

Interest Expense

| (dollars in millions) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Total interest costs on debt balances | $ | 5,573 | $ | 5,411 | $ | 5,080 | $ | 162 | 3.0 | % | $ | 331 | 6.5 | % | |||||||||||

| Less capitalized interest costs | 740 | 678 | 704 | 62 | 9.1 | (26 | ) | (3.7 | ) | ||||||||||||||||

| Total | $ | 4,833 | $ | 4,733 | $ | 4,376 | $ | 100 | 2.1 | $ | 357 | 8.2 | |||||||||||||

| Average debt outstanding | $ | 115,858 | $ | 115,693 | $ | 106,113 | |||||||||||||||||||

| Effective interest rate | 4.8 | % | 4.7 | % | 4.8 | % | |||||||||||||||||||

Total interest costs on debt balances increased during 2018 primarily due to an increase in our effective interest rate. Total interest costs on debt balances increased during 2017 primarily due to higher average debt balances.

Provision (Benefit) for Income Taxes

| (dollars in millions) | |||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||

| Provision (benefit) for income taxes | $ | 3,584 | $ | (9,956 | ) | $ | 7,378 | $ | 13,540 | nm | $ | (17,334 | ) | nm | |||||||||

| Effective income tax rate | 18.3 | % | (48.3 | )% | 35.2 | % | |||||||||||||||||

nm - not meaningful

The effective income tax rate is calculated by dividing the provision (benefit) for income taxes by income before income taxes. The effective income tax rate for 2018 was 18.3% compared to (48.3)% for 2017. The increase in the effective income tax rate and the provision for income taxes was primarily due to the non-recurring, non-cash income tax benefit of $16.8 billion recorded in 2017 for the re-measurement of U.S. deferred tax liabilities at the lower 21% U.S. federal corporate income tax rate as a result of the enactment of the Tax Cuts and Jobs Act (TCJA) on December 22, 2017. In addition, the current period provision for income taxes includes the tax impact of the Oath goodwill impairment charge not deductible for tax purposes, offset by the current year reduction in the statutory U.S. federal corporate income tax rate from 35% to 21%, effective January 1, 2018 under the TCJA and a non-recurring deferred tax benefit of approximately $2.1 billion as a result of an internal reorganization of legal entities within the historical Wireless business.

In December 2017, the Securities and Exchange Commission (SEC) staff issued Staff Accounting Bulletin (SAB) 118 to provide guidance for companies that had not completed their accounting for the income tax effects of the TCJA. Due to the complexities involved in accounting for the enactment of the TCJA, SAB 118 allowed for a provisional estimate of the impacts of the TCJA in our earnings for the year ended December 31, 2017, as well as up to a one year measurement period that ended on December 22, 2018, for any subsequent adjustments to such provisional estimate. Pursuant to SAB 118, Verizon recorded a provisional estimate of $16.8 billion for the impacts of the TCJA, primarily due to the re-

measurement of its U.S. deferred income tax liabilities at the lower 21% U.S. federal corporate income tax rate, with no significant impact from the transition tax on repatriation, the implementation of the territorial tax system, or limitations on the deduction of interest expense. Verizon has completed its analysis of the impacts of the TCJA, including analyzing the effects of any Internal Revenue Service (IRS) and U.S. Treasury guidance issued, and state tax law changes enacted, within the maximum one year measurement period resulting in no significant adjustments to the $16.8 billion provisional amount previously recorded.

The effective income tax rate for 2017 was (48.3)% compared to 35.2% for 2016. The decrease in the effective income tax rate and the provision for income taxes was primarily due to a non-recurring, non-cash income tax benefit recorded in 2017 as a result of the enactment of the TCJA described above.

A reconciliation of the statutory federal income tax rate to the effective income tax rate for each period is included in Note 12 to the consolidated financial statements.

Consolidated Net Income, Consolidated EBITDA and Consolidated Adjusted EBITDA

Consolidated earnings before interest, taxes, depreciation and amortization expenses (Consolidated EBITDA) and Consolidated Adjusted EBITDA, which are presented below, are non-GAAP measures that we believe are useful to management, investors and other users of our financial information in evaluating operating profitability on a more variable cost basis as they exclude the depreciation and amortization expense related primarily to capital expenditures and acquisitions that occurred in prior years, as well as in evaluating operating performance in relation to Verizon’s competitors. Consolidated EBITDA is calculated by adding back interest, taxes, and depreciation and amortization expenses to net income.

Consolidated Adjusted EBITDA is calculated by excluding from Consolidated EBITDA the effect of the following non-operational items: equity in losses of unconsolidated businesses and other income and expense, net, as well as the effect of special items. We believe that this measure is useful to management, investors and other users of our financial information in evaluating the effectiveness of our operations and underlying business trends in a manner that is consistent with management’s evaluation of business performance. We believe that Consolidated Adjusted EBITDA is widely used by investors to compare a company’s operating performance to its competitors by minimizing impacts caused by differences in capital structure, taxes and depreciation policies. Further, the exclusion of non-operational items and special items enables comparability to prior period performance and trend analysis. See "Special Items" for additional information.

It is management’s intent to provide non-GAAP financial information to enhance the understanding of Verizon’s GAAP financial information, and it should be considered by the reader in addition to, but not instead of, the financial statements prepared in accordance with GAAP. Each non-GAAP financial measure is presented along with the corresponding GAAP measure so as not to imply that more emphasis should be placed on the non-GAAP measure. We believe that non-GAAP measures provide relevant and useful information, which is used by management, investors and other users of our financial information as well as by our management in assessing both consolidated and segment performance. The non-GAAP financial information presented may be determined or calculated differently by other companies and may not be directly comparable to that of other companies.

| (dollars in millions) | |||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | ||||||||

| Consolidated Net Income | $ | 16,039 | $ | 30,550 | $ | 13,608 | |||||

| Add (Less): | |||||||||||

| Provision (benefit) for income taxes | 3,584 | (9,956 | ) | 7,378 | |||||||

| Interest expense | 4,833 | 4,733 | 4,376 | ||||||||

| Depreciation and amortization expense | 17,403 | 16,954 | 15,928 | ||||||||

| Consolidated EBITDA* | 41,859 | 42,281 | 41,290 | ||||||||

| Add (Less): | |||||||||||

| Other (income) expense, net† | (2,364 | ) | 2,021 | 3,789 | |||||||

| Equity in losses of unconsolidated businesses‡ | 186 | 77 | 98 | ||||||||

| Severance charges | 2,157 | 497 | 421 | ||||||||

| Gain on spectrum license transaction | — | (270 | ) | (142 | ) | ||||||

| Acquisition and integration related charges§ | 531 | 879 | — | ||||||||

| Product realignment charges§ | 450 | 463 | — | ||||||||

| Oath goodwill impairment | 4,591 | — | — | ||||||||

| Net gain on sale of divested businesses | — | (1,774 | ) | (1,007 | ) | ||||||

| Consolidated Adjusted EBITDA | $ | 47,410 | $ | 44,174 | $ | 44,449 | |||||

* Prior period figures have been amended to conform to the current period's calculation of Consolidated EBITDA.

† Includes Pension and benefits mark-to-market adjustments and early debt redemption costs, where applicable.

‡ Includes Product realignment charges, where applicable.

§ Excludes depreciation and amortization expense.

The changes in Consolidated Net Income, Consolidated EBITDA and Consolidated Adjusted EBITDA in the table above were primarily a result of the factors described in connection with operating revenues and operating expenses.

| Segment Results of Operations |

We have two reportable segments that we operate and manage as strategic business units, Consumer and Business. We measure and evaluate our reportable segments based on segment operating income. The use of segment operating income is consistent with the chief operating decision maker’s assessment of segment performance.

To aid in the understanding of segment performance as it relates to segment operating income, we use the following operating statistics to evaluate the overall effectiveness of our segments:

Wireless retail connections are retail customer device postpaid and prepaid connections. Retail connections under an account may include those from smartphones and basic phones (collectively, phones) as well as tablets and other Internet devices, including wearables and retail IoT devices.

Wireless retail postpaid connections are retail postpaid customer device connections. Retail connections under an account may include those from phones, as well as tablets and other Internet devices, including wearables and retail IoT devices.

Fios Internet connections are the total number of connections to the Internet using Fios Internet services.

Fios video connections are the total number of connections to traditional linear video programming using Fios video services.

Broadband connections are the total number of connections to the Internet using Digital Subscriber Line (DSL) and Fios Internet services.

Voice connections are the total number of traditional switched access lines in service and Fios digital voice connections.

Wireless retail connections, net additions are the total number of additional retail customer device postpaid and prepaid connections, less the number of device disconnects within the current period.

Wireless retail postpaid connections, net additions are the total number of additional retail customer device postpaid connections, less the number of device disconnects within the current period.

Churn is the rate at which service to either retail or postpaid retail connections is terminated on a monthly basis.

Wireless retail postpaid ARPA is the calculated average service revenue per account (ARPA) from retail postpaid accounts, which does not include recurring device payment plan billings related to the Verizon device payment program.

Wireless retail postpaid accounts are retail customers that are directly served and managed under the Verizon Wireless brand and use its services. Accounts include unlimited plans, shared data plans and corporate accounts, as well as legacy single connection plans and family plans. A single account may include monthly wireless services for a variety of connected devices.

Wireless retail postpaid connections per account is calculated by dividing the total number of retail postpaid connections by the number of retail postpaid accounts as of the end of the period.

Segment earnings before interest, taxes, depreciation and amortization (Segment EBITDA), which is presented below, is a non-GAAP measure and does not purport to be an alternative to operating income (loss) as a measure of operating performance. We believe this measure is useful to management, investors and other users of our financial information in evaluating operating profitability on a more variable cost basis as it excludes the depreciation and amortization expenses related primarily to capital expenditures and acquisitions that occurred in prior years, as well as in evaluating operating performance in relation to our competitors. Segment EBITDA is calculated by adding back depreciation and amortization expense to segment operating income (loss). Segment EBITDA margin is calculated by dividing Segment EBITDA by total segment operating revenues. You can find additional information about our segments in Note 13 to the consolidated financial statements.

Verizon Consumer Group

Our Consumer segment provides consumer-focused wireless and wireline communications services and products. Our wireless services are provided across one of the most extensive wireless networks in the United States under the Verizon Wireless brand and through wholesale and other arrangements. Our wireline services are provided in nine states in the Mid-Atlantic and Northeastern U.S., as well as Washington D.C., over our 100% fiber-optic network under the Fios brand and over a traditional copper-based network to customers who are not served by Fios.

Operating Revenues and Selected Operating Statistics

| (dollars in millions, except ARPA) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Service | $ | 64,223 | $ | 63,833 | $ | 67,485 | $ | 390 | 0.6 | % | $ | (3,652 | ) | (5.4 | )% | ||||||||||

| Wireless equipment | 18,875 | 17,292 | 16,372 | 1,583 | 9.2 | 920 | 5.6 | ||||||||||||||||||

| Other | 6,664 | 5,929 | 5,644 | 735 | 12.4 | 285 | 5.0 | ||||||||||||||||||

| Total Operating Revenues | $ | 89,762 | $ | 87,054 | $ | 89,501 | $ | 2,708 | 3.1 | $ | (2,447 | ) | (2.7 | ) | |||||||||||

Connections (‘000):(1) | |||||||||||||||||||||||||

| Wireless retail connections | 94,507 | 94,471 | 94,021 | 36 | — | 450 | 0.5 | ||||||||||||||||||

| Wireless retail postpaid connections | 89,861 | 89,068 | 88,574 | 793 | 0.9 | 494 | 0.6 | ||||||||||||||||||

| Fios Internet connections | 5,760 | 5,565 | 5,386 | 195 | 3.5 | 179 | 3.3 | ||||||||||||||||||

| Fios video connections | 4,377 | 4,548 | 4,626 | (171 | ) | (3.8 | ) | (78 | ) | (1.7 | ) | ||||||||||||||

| Broadband connections | 6,460 | 6,441 | 6,498 | 19 | 0.3 | (57 | ) | (0.9 | ) | ||||||||||||||||

| Voice connections | 6,332 | 6,928 | 7,500 | (596 | ) | (8.6 | ) | (572 | ) | (7.6 | ) | ||||||||||||||

Net Additions in Period (‘000):(2) | |||||||||||||||||||||||||

| Wireless retail | 372 | 719 | 1,064 | (347 | ) | (48.3 | ) | (345 | ) | (32.4 | ) | ||||||||||||||

| Wireless retail postpaid | 1,129 | 762 | 1,197 | 367 | 48.2 | (435 | ) | (36.3 | ) | ||||||||||||||||

| Wireless retail postpaid phones | 498 | 198 | (282 | ) | 300 | nm | 480 | nm | |||||||||||||||||

| Churn Rate: | |||||||||||||||||||||||||

| Wireless retail | 1.25 | % | 1.28 | % | 1.29 | % | |||||||||||||||||||

| Wireless retail postpaid | 1.00 | % | 0.99 | % | 0.99 | % | |||||||||||||||||||

| Wireless retail postpaid phones | 0.76 | % | 0.75 | % | 0.81 | % | |||||||||||||||||||

| Account Statistics: | |||||||||||||||||||||||||

Wireless retail postpaid ARPA(3) | $ | 115.48 | $ | 114.79 | $ | 123.51 | $ | 0.69 | 0.6 | $ | (8.72 | ) | (7.1 | ) | |||||||||||

Wireless retail postpaid accounts (‘000)(1) | 34,086 | 34,220 | 34,377 | (134 | ) | (0.4 | ) | (157 | ) | (0.5 | ) | ||||||||||||||

Wireless retail postpaid connections per account(1) | 2.64 | 2.60 | 2.58 | 0.04 | 1.5 | 0.02 | 0.8 | ||||||||||||||||||

nm - not meaningful

(1) | As of end of period |

(2) | Excluding acquisitions and adjustments |

(3) | ARPA for periods beginning after January 1, 2018 reflect the adoption of Topic 606. ARPA for periods ending prior to January 1, 2018 were calculated based on the guidance per ASC Topic 605, "Revenue Recognition." Accordingly, amounts are not calculated on a comparative basis. |

2018 Compared to 2017

Consumer revenues increased $2.7 billion, or 3.1%, during 2018 compared to 2017, primarily as a result of increases in Service, Wireless equipment and Other revenues.

Service Revenue

Service revenue increased $0.4 billion, or 0.6%, during 2018 compared to 2017, primarily due to increases in wireless service and Fios revenues.

Wireless service revenue increased 1.0%, during 2018 compared to 2017, due to an increase in subscribers and data usage growth from reseller accounts. Wireless retail postpaid ARPA increased 0.6%. Overage revenue pressure began in 2017, following the introduction of unlimited pricing plans, and has subsided during 2018 as the pace of transition to Consumer plans with features that limit overages has reduced.

For the year ended December 31, 2018, Fios revenues totaled $11.1 billion and increased $0.2 billion, or 1.4%, compared to 2017. This increase was due to a 3.5% increase in Fios Internet connections, resulting from subscriber growth and higher value customer mix, reflecting increased

demand in higher broadband speeds, partially offset by a 3.8% decrease in Fios video connections, reflecting the ongoing shift from traditional linear video to over-the-top (OTT) offerings.

Wireless Equipment Revenue

Wireless equipment revenue increased $1.6 billion, or 9.2%, during 2018 compared to 2017, as a result of a shift to higher priced units in the mix of wireless devices sold and a higher amount of revenue allocated to wireless equipment revenue following the adoption of Topic 606 on January 1, 2018, using a modified retrospective approach. See Notes 1 and 2 to the consolidated financial statements for additional information. These increases were partially offset by overall declines in wireless device sales.

Other Revenue

Other revenue includes non-service revenues such as regulatory fees, cost recovery surcharges, revenues associated with our device protection package, leasing and interest on equipment financed under a device payment plan agreement when sold to the customer by an authorized agent.

Other revenue increased $0.7 billion, or 12.4%, during 2018 compared to 2017, primarily due to volume and rate-driven increases in revenues related to our device protection package.

2017 Compared to 2016

Consumer’s total operating revenues decreased $2.4 billion, or 2.7%, during 2017 compared to 2016, primarily as a result of a decline in Service revenues, partially offset by an increase in Wireless equipment and Other revenues.

Service Revenue

Service revenue decreased $3.7 billion, or 5.4%, during 2017 compared to 2016, primarily due to a decrease in wireless service revenue, partially offset by an increase in Fios revenue.

Wireless service revenue decreased 6.6%, during 2017 compared to 2016, due to lower postpaid service revenue, including decreased overage revenue and decreased wireless access revenue. Overage revenue pressure was primarily related to the introduction of unlimited pricing plans in 2017 and the ongoing migration to the pricing plans introduced in 2016 that feature safety mode and carryover data. Service revenue was also negatively impacted as a result of the ongoing customer migration to plans with unsubsidized service pricing. Wireless retail postpaid ARPA decreased 7.1%, as a result of the aforementioned factors impacting wireless service revenue.

For the year ended December 31, 2017, Fios revenues totaled $10.9 billion and increased $0.4 billion, or 3.8%, during 2017 compared to 2016. This increase was due to a 3.3% increase in Fios Internet connections, resulting from subscriber growth fueled by the introduction of gigabit speed data services, as well as higher pay-per-view sales due to marquee events during the third quarter of 2017. These increases were partially offset by a 1.7% decrease in Fios video connections, reflecting the ongoing shift from traditional linear video to OTT offerings.

Wireless Equipment Revenue

Wireless equipment revenue increased $0.9 billion, or 5.6%, during 2017 compared to 2016, as a result of an increase in the Verizon device payment program take rate and an increase in the price of wireless devices, partially offset by an overall decline in wireless device sales volumes.

Other Revenue

Other revenue increased $0.3 billion, or 5.0%, during 2017 compared to 2016, primarily due to an increase in financing revenues from our wireless device payment program and volume-driven increases in revenues related to our wireless device protection package.

Operating Expenses

| (dollars in millions) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Cost of services | $ | 15,335 | $ | 14,981 | $ | 15,101 | $ | 354 | 2.4 | % | $ | (120 | ) | (0.8 | )% | ||||||||||

| Cost of wireless equipment | 18,763 | 17,713 | 18,247 | 1,050 | 5.9 | (534 | ) | (2.9 | ) | ||||||||||||||||

| Selling, general and administrative expense | 15,701 | 17,292 | 18,832 | (1,591 | ) | (9.2 | ) | (1,540 | ) | (8.2 | ) | ||||||||||||||

| Depreciation and amortization expense | 11,952 | 11,308 | 10,792 | 644 | 5.7 | 516 | 4.8 | ||||||||||||||||||

| Total Operating Expenses | $ | 61,751 | $ | 61,294 | $ | 62,972 | $ | 457 | 0.7 | $ | (1,678 | ) | (2.7 | ) | |||||||||||

Cost of Services

Cost of services increased $0.4 billion, or 2.4%, during 2018 compared to 2017, primarily due to higher rent expense as a result of adding capacity to the network to support higher demand, increases in content costs associated with continued increases in the cost of programming license fees, as well as new pricing and a volume-driven increase in costs related to the wireless device protection package offered to our customers. Partially offsetting these increases were decreases in costs related to roaming and access costs.

Cost of services decreased $0.1 billion, or 0.8%, during 2017 compared to 2016, primarily due to not incurring incremental costs in 2017 that were incurred in 2016 as a result of the 2016 Work Stoppage, declines in net pension and postretirement benefit costs primarily driven by collective bargaining agreements ratified in June 2016, as well as decreases in costs related to roaming, and cost of data. Partially offsetting these decreases was an increase in rent expense as a result of an increase in macro and small cell sites supporting network capacity expansion and densification, and a volume-driven increase in costs related to the wireless device protection package offered to our customers.

Cost of Wireless Equipment

Cost of wireless equipment increased $1.1 billion, or 5.9%, during 2018 compared to 2017, primarily as a result of shifts to higher priced units in the mix of wireless devices sold, partially offset by declines in the number of smartphones sold.

Cost of wireless equipment decreased $0.5 billion, or 2.9%, during 2017 compared to 2016, primarily as a result of a decline in the number of smartphone and Internet units sold, substantially offset by a shift to higher priced units in the mix of wireless devices sold.

Selling, General and Administrative Expense

Selling, general and administrative expense decreased $1.6 billion, or 9.2%, during 2018 compared to 2017, primarily due to declines in sales commission expense and employee related costs, due to lower headcount, as well as a decline in bad debt expense. The decline in sales commission expense during 2018 compared to 2017, was driven primarily from the deferral of commission costs following the adoption of Topic 606 on January 1, 2018 using a modified retrospective approach.

Selling, general and administrative expense decreased $1.5 billion, or 8.2%, during 2017 compared to 2016, primarily due to a decline in sales commission expense, a decline in employee related costs, primarily due to lower headcount, as well as declines in bad debt expense and advertising expense. The decline in sales commission expense was driven by an increase in the proportion of activations under the Verizon device payment program, which has a lower commission per unit than activations under traditional fixed-term service plans, as well as an overall decline in activations.

Depreciation and Amortization Expense

Depreciation and amortization expense increased $0.6 billion, or 5.7%, during 2018 compared to 2017, and increased $0.5 billion, or 4.8%, during 2017 compared to 2016, driven by the change in the mix of total Verizon depreciable assets and Consumer's usage of those assets.

Segment Operating Income and EBITDA

| (dollars in millions) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Segment Operating Income | $ | 28,011 | $ | 25,760 | $ | 26,529 | $ | 2,251 | 8.7 | % | $ | (769 | ) | (2.9 | )% | ||||||||||

| Add Depreciation and amortization expense | 11,952 | 11,308 | 10,792 | 644 | 5.7 | 516 | 4.8 | ||||||||||||||||||

| Segment EBITDA | $ | 39,963 | $ | 37,068 | $ | 37,321 | $ | 2,895 | 7.8 | $ | (253 | ) | (0.7 | ) | |||||||||||

| Segment operating income margin | 31.2 | % | 29.6 | % | 29.6 | % | |||||||||||||||||||

| Segment EBITDA margin | 44.5 | % | 42.6 | % | 41.7 | % | |||||||||||||||||||

The changes in the table above during the periods presented were primarily a result of the factors described in connection with operating revenues and operating expenses.

Verizon Business Group

Our Business segment provides wireless and wireline communications services and products, video and data services, corporate networking solutions, security and managed network services, local and long distance voice services and network access to deliver various Internet of Things services and products. We provide these products and services to businesses, government customers and wireless and wireline carriers across the U.S. and select products and services to customers around the world. The Business segment is organized in four customer groups: Global Enterprise; Small and Medium Business; Public Sector and Other; and Wholesale.

The operating revenues from XO are included in the Business segment results as of February 2017, following the completion of the acquisition, and are included within all four customer groups. In 2016, we completed the acquisitions of Fleetmatics and Telogis, the results from which are included in our Public Sector and Other customer group.

The operating results and statistics for all periods presented below exclude the results of the Data Center Sale in 2017 and other insignificant transactions (see "Operating Results From Divested Businesses"). The results were adjusted to reflect comparable segment operating results consistent with the information regularly reviewed by our chief operating decision maker.

Operating Revenues and Selected Operating Statistics

| (dollars in millions) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Global Enterprise | $ | 11,201 | $ | 11,449 | $ | 11,364 | $ | (248 | ) | (2.2 | )% | $ | 85 | 0.7 | % | ||||||||||

| Small and Medium Business | 10,752 | 9,811 | 9,034 | 941 | 9.6 | 777 | 8.6 | ||||||||||||||||||

| Public Sector and Other | 5,833 | 5,655 | 5,118 | 178 | 3.1 | 537 | 10.5 | ||||||||||||||||||

| Wholesale | 3,748 | 3,998 | 4,021 | (250 | ) | (6.3 | ) | (23 | ) | (0.6 | ) | ||||||||||||||

Total Operating Revenues(1) | $ | 31,534 | $ | 30,913 | $ | 29,537 | $ | 621 | 2.0 | $ | 1,376 | 4.7 | |||||||||||||

Connections (‘000):(2) | |||||||||||||||||||||||||

| Wireless retail postpaid connections | 23,492 | 21,786 | 20,222 | 1,706 | 7.8 | 1,564 | 7.7 | ||||||||||||||||||

| Fios Internet connections | 307 | 285 | 267 | 22 | 7.7 | 18 | 6.7 | ||||||||||||||||||

| Fios video connections | 74 | 71 | 68 | 3 | 4.2 | 3 | 4.4 | ||||||||||||||||||

| Broadband connections | 501 | 518 | 540 | (17 | ) | (3.3 | ) | (22 | ) | (4.1 | ) | ||||||||||||||

| Voice connections | 5,400 | 5,893 | 6,439 | (493 | ) | (8.4 | ) | (546 | ) | (8.5 | ) | ||||||||||||||

Net Additions in Period ('000): (3) | |||||||||||||||||||||||||

| Wireless retail postpaid | 1,397 | 1,322 | 1,091 | 75 | 5.7 | 231 | 21.2 | ||||||||||||||||||

| Wireless retail postpaid phones | 625 | 576 | 498 | 49 | 8.5 | 78 | 15.7 | ||||||||||||||||||

| Churn Rate: | |||||||||||||||||||||||||

| Wireless retail postpaid | 1.19 | % | 1.12 | % | 1.14 | % | |||||||||||||||||||

| Wireless retail postpaid phones | 0.98 | % | 0.92 | % | 0.96 | % | |||||||||||||||||||

(1) | Service and other revenues included in our Business segment amounted to approximately $28.1 billion, $29.3 billion and $28.4 billion for the years ended December 31, 2018, 2017 and 2016, respectively. Wireless equipment revenues included in our Business segment amounted to approximately $3.4 billion, $1.6 billion and $1.1 billion for the years ended December 31, 2018, 2017 and 2016, respectively. |

(2) | As of end of period |

(3) | Excluding acquisitions and adjustments |

2018 Compared to 2017

Business revenues increased $0.6 billion, or 2.0%, during 2018 compared to 2017, primarily due to increases in Small and Medium Business and Public Sector and Other revenues, partially offset by decreases in Global Enterprise and Wholesale revenues. The year ended 2018 includes one additional month of operating revenues from XO compared to the similar period in 2017.

Global Enterprise

The Global Enterprise group offers services to large businesses, which are identified based on their size and volume of business with Verizon, as well as non-U.S. public sector customers.

Global Enterprise revenues decreased $0.2 billion, or 2.2%, during 2018 compared to 2017, primarily due to declines in traditional data and voice communication services as a result of competitive price pressures. These declines were partially offset by an increase in wireless revenue as a result of higher priced units in the mix of devices sold partially offset by overall decline in sales. The increase in wireless revenue was also driven by a higher amount of revenue allocated to wireless equipment revenue partially offset by a decline in postpaid service revenue following the adoption of Topic 606 on January 1, 2018.

Small and Medium Business

The Small and Medium Business group offers wireless services and equipment, tailored voice and networking products, Fios services, IP Networking, advanced voice solutions, security, and managed information technology services to our U.S.-based customers that do not meet the requirements to be categorized as Global Enterprise.

Small and Medium Business revenues increased $0.9 billion, or 9.6%, during 2018 compared to 2017, primarily due to a higher amount of revenue allocated to wireless equipment revenue following the adoption of Topic 606 on January 1, 2018, using a modified retrospective approach; an increase in wireless sales volumes on device payment plans and an increase in wireless postpaid net adds. The increase was partially offset by a decline in wireless postpaid service revenue, driven by the adoption of Topic 606.

For the year ended December 31, 2018, Small and Medium Business Fios revenues totaled $0.8 billion and increased $0.1 billion, or 9.8%. during 2018 compared to 2017, reflecting increased demand for higher broadband speeds.

Public Sector and Other

The Public Sector and Other group offers wireless products and services, as well as wireline connectivity solutions, to U.S. federal, state and local governments and educational institutions. These services include the services offered by Consumer discussed above and business services and connectivity similar to the products and services offered by the Global Enterprise group, in each case, with features and pricing designed to address the needs of governments and educational institutions.

Public Sector and Other revenues increased $0.2 billion, or 3.1%, during 2018 compared to 2017, driven by an increase in wireless postpaid service revenue and wireless equipment revenue due to an increase in wireless retail postpaid net additions.

Wholesale

The Wholesale group offers wireline communications services including data, voice, local dial tone and broadband services primarily to local, long distance, and wireless carriers that use our facilities to provide services to their customers.

Wholesale revenues decreased $0.3 billion, or 6.3%, during 2018 compared to 2017, primarily due to declines in core data and traditional voice services, resulting from the effect of technology substitution and continuing contraction of market rates due to competition. Data declines were partially offset by growth in higher bandwidth services, including dark fiber transport.

2017 Compared to 2016

Business revenues increased $1.4 billion, or 4.7%, during 2017 compared to 2016, primarily due to increases in Global Enterprise revenue, Small and Medium Business revenue and Public Sector and Other revenue, partially offset by a decrease in Wholesale revenue.

Global Enterprise

Global Enterprise revenues increased $0.1 billion, or 0.7%, during 2017 compared to 2016, primarily due to an increase in wireless postpaid service and wireless equipment revenues related to an increase in wireless retail postpaid net additions and the acquisition of XO. These increases were partially offset by declines in traditional data and voice communications services as a result of competitive price pressures.

Small and Medium Business

Small and Medium Business revenues increased $0.8 billion, or 8.6%, during 2017 compared to 2016, primarily related to an increase in wireless equipment revenue due an increase in volume and the price of devices. The increase was further driven by other revenue related to a volume-driven increase in device protection plans and the acquisition of XO. These increases were partially offset by a decrease in wireless postpaid service revenue, as well as revenue declines related to the loss of traditional voice and DSL connections, as a result of competitive price pressures.

For the year ended December 31, 2017, Small and Medium Business Fios revenues totaled $0.7 billion and increased

7.6%, during 2017 compared to 2016, reflecting increased demand for higher broadband speeds.

7.6%, during 2017 compared to 2016, reflecting increased demand for higher broadband speeds.

Public Sector and Other

Public Sector and Other revenues increased $0.5 billion, or 10.5%, during 2017 compared to 2016, primarily due to the revenue increase related to the acquisitions of Fleetmatics and Telogis and an increase in wireless postpaid service and wireless equipment revenues due to an increase in wireless postpaid net additions.

Wholesale

Wholesale revenues remained consistent during 2017 compared to 2016, primarily due to the revenue increase related to the acquisition of XO, fully offset by revenue declines related to the loss of traditional voice and low speed broadband connections, as a result of competitive price pressures.

Operating Expenses

| (dollars in millions) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Cost of services | $ | 10,859 | $ | 11,094 | $ | 11,436 | $ | (235 | ) | (2.1 | )% | $ | (342 | ) | (3.0 | )% | |||||||||

| Cost of wireless equipment | 4,560 | 4,434 | 3,991 | 126 | 2.8 | 443 | 11.1 | ||||||||||||||||||

| Selling, general and administrative expense | 7,689 | 7,448 | 6,827 | 241 | 3.2 | 621 | 9.1 | ||||||||||||||||||

| Depreciation and amortization expense | 4,258 | 4,483 | 4,472 | (225 | ) | (5.0 | ) | 11 | 0.2 | ||||||||||||||||

| Total Operating Expenses | $ | 27,366 | $ | 27,459 | $ | 26,726 | $ | (93 | ) | (0.3 | ) | $ | 733 | 2.7 | |||||||||||

Cost of Services

Cost of services decreased $0.2 billion, or 2.1%, during 2018 compared to 2017, primarily due to decreases in personnel costs, cost of equipment and access costs, which were partially offset by increases in other direct costs.

Cost of services decreased $0.3 billion, or 3.0%, during 2017 compared to 2016, primarily due to not incurring incremental costs in 2017 that were incurred in 2016 as a result of the 2016 Work Stoppage, as well as a decline in net pension and postretirement benefit costs primarily driven by collective bargaining agreements ratified in June 2016. These decreases were partially offset by an increase in access costs as a result of the acquisition of XO.

Cost of Wireless Equipment

Cost of wireless equipment increased $0.1 billion, or 2.8%, during 2018 compared to 2017, and increased $0.4 billion, or 11.1%, during 2017 compared to 2016, primarily driven by an increase in the number of smartphone units sold, along with a shift to higher priced units in the mix of wireless devices sold.

Selling, General and Administrative Expense

Selling, general and administrative expense increased $0.2 billion, or 3.2%, during 2018 compared to 2017, due to an increase in personnel costs, partially offset by a decrease in commission costs arising from the deferral of commission costs, as a result of the adoption of Topic 606 on January 1, 2018 using a modified retrospective approach.

Selling, general and administrative expense increased $0.6 billion, or 9.1%, during 2017 compared to 2016, primarily related to an increase in expenses resulting from the acquisitions of XO, Fleetmatics and Telogis.

Depreciation and Amortization Expense

Depreciation and amortization expense decreased $0.2 billion, or 5.0%, during 2018 compared to 2017, driven by the change in the mix of total Verizon depreciable assets and Business's usage of those assets.

Depreciation and amortization expense remained consistent during 2017 compared to 2016.

Segment Operating Income and EBITDA

| (dollars in millions) | |||||||||||||||||||||||||

| Increase/(Decrease) | |||||||||||||||||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | 2018 vs. 2017 | 2017 vs. 2016 | ||||||||||||||||||||

| Segment Operating Income | $ | 4,168 | $ | 3,454 | $ | 2,811 | $ | 714 | 20.7 | % | $ | 643 | 22.9 | % | |||||||||||

| Add Depreciation and amortization expense | 4,258 | 4,483 | 4,472 | (225 | ) | (5.0 | )% | 11 | 0.2 | % | |||||||||||||||

| Segment EBITDA | $ | 8,426 | $ | 7,937 | $ | 7,283 | $ | 489 | 6.2 | $ | 654 | 9.0 | |||||||||||||

| Segment operating income margin | 13.2 | % | 11.2 | % | 9.5 | % | |||||||||||||||||||

| Segment EBITDA margin | 26.7 | % | 25.7 | % | 24.7 | % | |||||||||||||||||||

The changes in the table above during the periods presented were primarily a result of the factors described in connection with operating revenues and operating expenses.

| Special Items |

Special items included in Income Before (Provision) Benefit For Income Taxes were as follows:

| (dollars in millions) | |||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | ||||||||

| Severance, pension and benefits charges (credits) | |||||||||||

| Selling, general and administrative expense | $ | 2,157 | $ | 497 | $ | 421 | |||||

| Other income (expense), net | (2,107 | ) | 894 | 2,502 | |||||||

| Gain on spectrum license transactions | |||||||||||

| Selling, general and administrative expense | — | (270 | ) | (142 | ) | ||||||

| Acquisition and integration related charges | |||||||||||

| Selling, general and administrative expense | 531 | 879 | — | ||||||||

| Depreciation and amortization expense | 22 | 5 | — | ||||||||

| Product realignment charges | |||||||||||

| Cost of services | 303 | 171 | — | ||||||||

| Selling, general and administrative expense | 147 | 292 | — | ||||||||

| Equity in losses of unconsolidated businesses | 207 | (11 | ) | — | |||||||

| Depreciation and amortization expense | 1 | 219 | — | ||||||||

| Oath goodwill impairment | |||||||||||

| Oath goodwill impairment | 4,591 | — | — | ||||||||

| Net gain on sale of divested businesses | |||||||||||

| Selling, general and administrative expense | — | (1,774 | ) | (1,007 | ) | ||||||

| Early debt redemption costs | |||||||||||

| Other income (expense), net | 725 | 1,983 | 1,822 | ||||||||

| Total | $ | 6,577 | $ | 2,885 | $ | 3,596 | |||||

The Consolidated Adjusted EBITDA non-GAAP measure presented in the Consolidated Net Income, Consolidated EBITDA and Consolidated Adjusted EBITDA discussion (see "Consolidated Results of Operations") excludes all of the amounts included above, as described below.

The income and expenses related to special items included in our consolidated results of operations were as follows:

| (dollars in millions) | |||||||||||

| Years Ended December 31, | 2018 | 2017 | 2016 | ||||||||

| Within Total Operating Expenses | $ | 7,752 | $ | 19 | $ | (728 | ) | ||||

| Within Equity in losses of unconsolidated businesses | 207 | (11 | ) | — | |||||||

| Within Other income (expense), net | (1,382 | ) | 2,877 | 4,324 | |||||||

| Total | $ | 6,577 | $ | 2,885 | $ | 3,596 | |||||

Severance, Pension and Benefits Charges (Credits)

During 2018, we recorded net pre-tax pension and benefits credits of $2.1 billion in accordance with our accounting policy to recognize actuarial gains and losses in the period in which they occur. The pension and benefits remeasurement credits of $2.3 billion, which were recorded in Other income (expense), net in our consolidated statements of income, were primarily driven by an increase in our discount rate assumption used to determine the current year liabilities of our pension plans and postretirement benefit plans from a weighted-average of 3.7% at December 31, 2017 to a weighted-average of 4.4% at December 31, 2018 ($2.6 billion), and mortality and other assumption adjustments of $1.7 billion, $1.6 billion of which related to healthcare claims and trend adjustments, offset by the difference between our estimated return on assets of 7.0% and our actual return on assets of (2.7)% ($1.9 billion). The credits were partially offset by $0.2 billion due to the effects of participants retiring under the voluntary separation program. During 2018, we also recorded net pre-tax severance charges of $2.2 billion in Selling, general and administrative expense, primarily driven by the voluntary separation program for select U.S.-based management employees and other headcount reduction initiatives, which resulted in a severance charge of $1.8 billion ($1.4 billion after-tax), and $0.3 billion in severance costs recorded under other existing separation plans.

During 2017, we recorded net pre-tax severance, pension and benefits charges of $1.4 billion, exclusive of acquisition related severance charges, in accordance with our accounting policy to recognize actuarial gains and losses in the period in which they occur. The pension and benefits remeasurement charges of approximately $0.9 billion, which were recorded in Other income (expense), net in our consolidated statements of income, were primarily driven by a decrease in our discount rate assumption used to determine the current year liabilities of our pension and postretirement benefit plans from a weighted-average of 4.2% at December 31, 2016 to a weighted-average of 3.7% at December 31, 2017 ($2.6 billion). The charges were partially offset by the difference between our estimated return on assets of 7.0% and our actual return on assets of 14.0% ($1.2 billion), a change in mortality assumptions primarily driven by the use of updated actuarial tables (MP-2017) issued by the Society of Actuaries ($0.2 billion) and other assumption adjustments ($0.3 billion). As part of these charges, we also recorded severance costs

of $0.5 billion under our existing separation plans, which were recorded in Selling, general and administrative expense in our consolidated statements of income.

During 2016, we recorded net pre-tax severance, pension and benefits charges of $2.9 billion in accordance with our accounting policy to recognize actuarial gains and losses in the period in which they occur. The pension and benefits remeasurement charges of $2.5 billion, which were recorded in Other income (expense), net, in our consolidated statements of income, were primarily driven by a decrease in our discount rate assumption used to determine the current year liabilities of our pension and other postretirement benefit plans from a weighted-average of 4.6% at December 31, 2015 to a weighted-average of 4.2% at December 31, 2016 ($2.1 billion), updated health care trend cost assumptions ($0.9 billion), the difference between our estimated return on assets of 7.0% and our actual return on assets of 6.0% ($0.2 billion) and other assumption adjustments ($0.3 billion). These charges were partially offset by a change in mortality assumptions primarily driven by the use of updated actuarial tables (MP-2016) issued by the Society of Actuaries ($0.5 billion) and lower negotiated prescription drug pricing ($0.5 billion). As part of these charges, we also recorded severance costs of $0.4 billion under our existing separation plans, which were recorded in Selling, general and administrative expense in our consolidated statements of income.

The net pre-tax severance, pension and benefits charges during 2016 were comprised of a net pre-tax pension remeasurement charge of $0.2 billion measured as of March 31, 2016 related to settlements for employees who received lump-sum distributions in one of our defined benefit pension plans, a net pre-tax pension and benefits remeasurement charge of $0.8 billion measured as of April 1, 2016 related to curtailments in three of our defined benefit pension and one of our other postretirement plans, a net pre-tax pension and benefits remeasurement charge of $2.7 billion measured as of May 31, 2016 in two defined benefit pension plans and three other postretirement benefit plans as a result of our accounting for the contractual healthcare caps and bargained for changes, a net pre-tax pension remeasurement charge of $0.1 billion measured as of May 31, 2016 related to settlements for employees who received lump-sum distributions in three of our defined benefit pension plans, a net pre-tax pension remeasurement charge of $0.6 billion measured as of August 31, 2016 related to settlements for employees who received lump-sum distributions in five of our defined benefit pension plans, and a net pre-tax pension and benefits credit of $1.9 billion as a result of our fourth quarter remeasurement of our pension and other postretirement assets and liabilities based on updated actuarial assumptions.

Due to the presentation of the other components of net periodic benefit cost, we recognize a portion of the pension and benefits charges (credits) in Other income (expense), net, in our consolidated statements of income.

Gain on Spectrum License Transactions

During the fourth quarter of 2017, we completed a license exchange transaction with affiliates of T-Mobile USA Inc. (T-Mobile USA) to exchange certain Advanced Wireless Services (AWS) and Personal Communication Services (PCS) spectrum licenses. As a result of this agreement, we received $0.4 billion of AWS and PCS spectrum licenses at fair value and recorded a pre-tax gain of $0.1 billion in Selling, general and administrative expense in our consolidated statement of income for the year ended December 31, 2017.

During the first quarter of 2017, we completed a license exchange transaction with affiliates of AT&T Inc. (AT&T) to exchange certain AWS and PCS spectrum licenses. As a result of this non-cash exchange, we received $1.0 billion of AWS and PCS spectrum licenses at fair value and recorded a pre-tax gain of $0.1 billion in Selling, general and administrative expense in our consolidated statement of income for the year ended December 31, 2017.

During the first quarter of 2016, we completed a license exchange transaction with affiliates of AT&T to exchange certain AWS and PCS spectrum licenses. As a result of this non-cash exchange, we received $0.4 billion of AWS and PCS spectrum licenses at fair value and we recorded a pre-tax gain of approximately $0.1 billion in Selling, general and administrative expense in our consolidated statement of income for the year ended December 31, 2016.

Acquisition and Integration Related Charges

Acquisition and integration related charges of $0.6 billion and $0.9 billion recorded during the years ended December 31, 2018 and 2017 primarily related to the acquisition of Yahoo’s operating business in June 2017.

Product Realignment Charges

Product realignment charges of $0.7 billion recorded during the year ended December 31, 2018 primarily related to the discontinuation of the go90 platform and associated content during the second quarter of 2018.

Product realignment charges of $0.7 billion recorded during the year ended December 31, 2017 primarily related to charges taken against certain early-stage developmental technologies during the fourth quarter of 2017.

Oath Goodwill Impairment

The Oath goodwill impairment charge of $4.6 billion recorded during the year ended December 31, 2018 for our Media business, branded Oath, was a result of the Company's annual goodwill impairment test performed in the fourth quarter (see "Critical Accounting Estimates").

Net Gain on Sale of Divested Businesses

The net gain on the sale of divested businesses of $1.8 billion recorded during 2017 related to the Data Center Sale in May 2017 and other insignificant transactions.

The net gain on the sale of divested businesses of $1.0 billion recorded during 2016 related to the Access Line Sale. The gain recorded included a $0.5 billion pension and postretirement benefit curtailment gain due to the elimination of the accrual of pension and other postretirement benefits for some or all future services of a significant number of employees covered in three of our defined benefit pension plans and one of our other postretirement benefit plans.

Early Debt Redemption Costs

During 2018, 2017, and 2016, we recorded losses on early debt redemptions of $0.7 billion, $2.0 billion, and $1.8 billion, respectively.

We recognize losses on early debt redemptions in Other income (expense), net in our consolidated statements of income. See Note 7 to the consolidated financial statements for additional information related to our early debt redemptions.

| Operating Environment and Trends |

The telecommunications industry is highly competitive. We expect competition to intensify further with traditional and non-traditional participants seeking increased market share. Our high-quality customer base and networks differentiate us from our competitors and give us the ability to plan and manage through changing economic and competitive conditions. We remain focused on executing on the fundamentals of the business: maintaining a high-quality customer base, delivering strong financial and operating results and strengthening our balance sheet. We will continue to invest for growth, which we believe is the key to creating value for our shareholders. We continue to lead in 4G LTE performance while building momentum for our 5G network. Our strategy lays the foundation for the future through investments in our Intelligent Edge Network that enable efficiencies throughout our core infrastructure and deliver flexibility to meet customer requirements.

The U.S. wireless market has achieved a high penetration of smartphones, which reduces the opportunity for new phone connection growth for the industry. We expect future revenue growth in the industry to be driven by expanding existing customer relationships, increasing the number of ways customers can connect with wireless networks and services and increasing the penetration of other connected devices including wearables, tablets and IoT devices. We expect 5G technology will provide a significant opportunity for growth in the industry in 2020 and beyond. With respect to our wireless connectivity products and services, we compete against other national wireless service providers, including AT&T Inc., Sprint Corporation and T-Mobile USA, Inc., as well as various regional wireless service providers. We also compete for retail activations with resellers that buy bulk wholesale service from wireless service providers for resale, including resellers that buy from us. We face competition from other communications and technology companies seeking to increase their brand recognition and capture customer revenue with respect to the provision of wireless products and services, in addition to non-traditional offerings in mobile data. For example, Microsoft Corporation, Alphabet Inc., Apple Inc. and others are offering alternative means for making wireless voice calls that, in certain cases, can be used in lieu of the wireless provider’s voice service, as well as alternative means of accessing video content.

With respect to wireless services and equipment, pricing plays an important role in the wireless competitive landscape. We compete in this area by offering our customers services and devices that we believe they will regard as the best available value for the price. As the demand for wireless services continues to grow, wireless service providers are offering a range of service plans at competitive prices. These service offerings will vary from time to time based on customer needs, technology changes and market conditions and may be provided as standard plans or as part of limited time promotional offers.

We expect future service revenue growth opportunities to arise from increased access revenue as customers shift to higher access plans, as well as from increased connections per account. Future service revenue growth opportunities will be dependent on expanding the penetration of our services, increasing the number of ways that our customers can connect with our networks and services and the development of new ecosystems.We and other wireless service providers, as well as equipment manufacturers, offer device payment options, which provide customers with the ability to pay for their device over a period of time, and some providers offer device leasing arrangements.

Current and potential competitors in the wireline service market include cable companies, wireless service providers, domestic and foreign telecommunications providers, satellite television companies, Internet service providers, over-the-top providers and other companies that offer network services and managed enterprise solutions.