Exhibit 99

Verizon Wireless Update

Denny Strigl President and CEO

“Safe Harbor” Statement

This presentation contains statements about expected future events and financial results that are forward-looking and subject to risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The following important factors could affect future results and could cause those results to differ materially from those expressed in the forward-looking statements: materially adverse changes in economic and industry conditions and labor matters, including workforce levels and labor negotiations, and any resulting financial and/or operational impact, in the markets served by us or by companies in which we have substantial investments; material changes in available technology; technology substitution; an adverse change in the ratings afforded our debt securities by nationally accredited ratings organizations; the final results of federal and state regulatory proceedings concerning our provision of retail and wholesale services and judicial review of those results; the effects of competition in our markets; the timing, scope and financial impacts of our deployment of fiber-to-the-premises broadband technology; the ability of Verizon Wireless to continue to obtain sufficient spectrum resources; changes in our accounting assumptions that regulatory agencies, including the SEC, may require or that result from changes in the accounting rules or their application, which could result in an impact on earnings; a significant change in the timing of, or the imposition of any government conditions to, the closing of our business combination transaction with MCI, Inc., if consummated; actual and contingent liabilities in connection with the MCI transaction; and the extent and timing of our ability to obtain revenue enhancements and cost savings following the MCI transaction.

This presentation includes certain non-GAAP financial measures as defined under SEC rules. As required by those rules we have provided a reconciliation of those measures to the most directly comparable GAAP measure in materials on our website at www.verizon.com/investor.

2

Note

In connection with the proposed acquisition of MCI, Verizon filed, with the SEC on August 15, 2005, an amended proxy statement and prospectus on Form S-4 (Registration No. 333-124008), that contain important information about the proposed acquisition. These materials are not yet final and will be amended. Investors are urged to read the proxy statement and prospectus filed, and any other relevant materials filed by Verizon or MCI because they contain, or will contain, important information about Verizon, MCI and the proposed acquisition. The preliminary materials filed on August 15, 2005, the definitive versions of these materials and other relevant materials (when they become available) and any other documents filed by Verizon or MCI with the SEC, may be obtained for free at the SEC’s website at www.sec.gov . Investors may also obtain free copies of these documents at www.verizon.com/investor, or by request to Verizon Communications Inc., Investor Relations, 1095 Avenue of the Americas, 36th Floor, New York, NY 10036. Free copies of MCI’s filings are available at www.mci.com/about/investor_relations, or by request to MCI, Inc., Investor Relations, 22001 Loudoun County Parkway, Ashburn, VA 20147. Investors are urged to read the proxy statement and prospectus and the other relevant materials when such other materials become available before making any voting or investment decision with respect to the proposed acquisition.

Verizon, MCI, and their respective directors, executive officers, and other employees may be deemed to be participants in the solicitation of proxies from MCI shareowners with respect to the proposed transaction. Information about Verizon’s directors and executive officers is available in Verizon’s proxy statement for its 2005 annual meeting of shareholders, dated March 21, 2005. Information about MCI’s directors and executive officers is available in MCI’s proxy statement for its 2005 annual meeting of stockholders, dated April 20, 2005. Additional information about the interests of potential participants will be included in the registration statement and proxy statement and other materials filed with the SEC.

3

Verizon Wireless Update

Performance Distribution Strategy Network Investment Product Initiatives

4

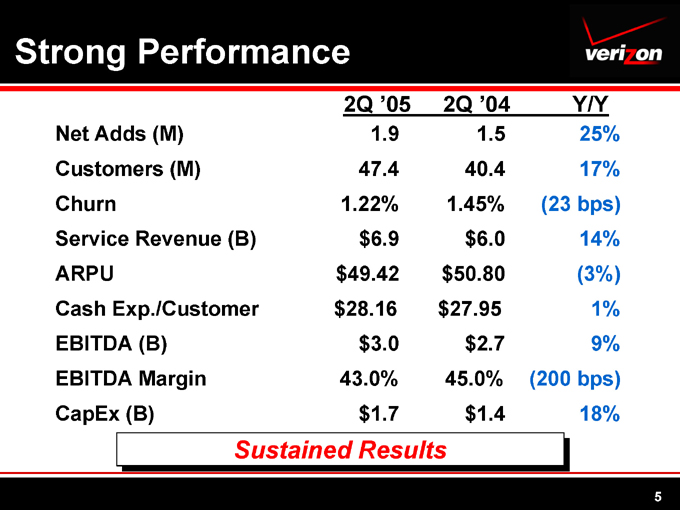

Strong Performance

2Q ‘05 2Q ‘04 Y/Y

Net Adds (M) 1.9 1.5 25%

Customers (M) 47.4 40.4 17%

Churn 1.22% 1.45% (23 bps)

Service Revenue (B) $6.9 $6.0 14%

ARPU $49.42 $50.80 (3%)

Cash Exp./Customer $28.16 $27.95 1%

EBITDA (B) $3.0 $2.7 9%

EBITDA Margin 43.0% 45.0% (200 bps)

CapEx (B) $1.7 $1.4 18%

Sustained Results

5

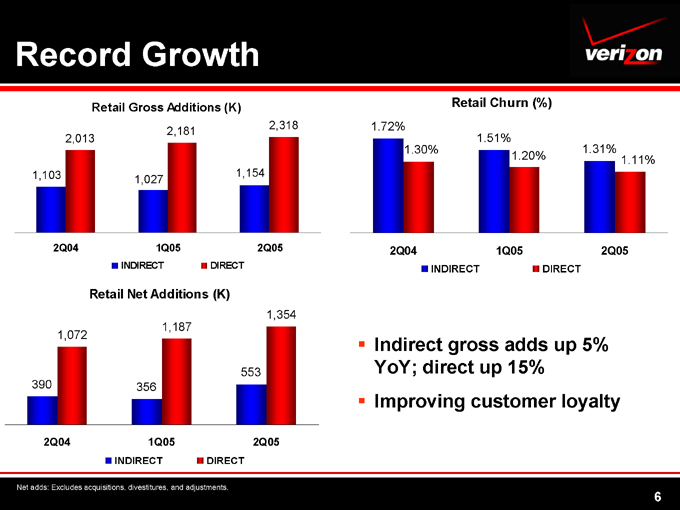

Record Growth

Retail Gross Additions (K)

1,103 2,013

2Q04

1,027 2,181

1Q05

1,154 2,318

2Q05

INDIRECT DIRECT

Retail Net Additions (K)

390 1,072

2Q04

356 1,187

1Q05

553 1,354

2Q05

INDIRECT DIRECT

Retail Churn (%)

1.72% 1.30%

2Q04

1.51% 1.20%

1Q05

1.31% 1.11%

2Q05

INDIRECT

DIRECT

Indirect gross adds up 5% YoY; direct up 15% Improving customer loyalty

Net adds: Excludes acquisitions, divestitures, and adjustments.

6

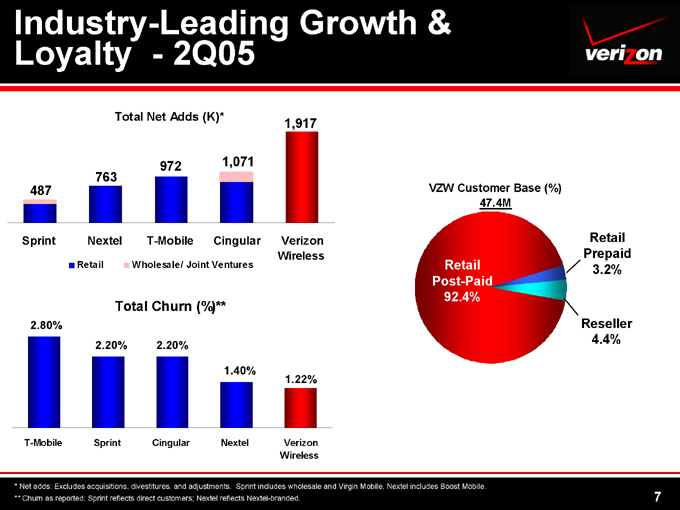

Industry-Leading Growth & Loyalty - 2Q05

Total Net Adds (K)*

487

Sprint

763

Nextel

972

T-Mobile

1,071

Cingular

1,917

Verizon Wireless

Retail Wholesale/ Joint Ventures

Total Churn (%)**

2.80%

T-Mobile

2.20%

Sprint

2.20%

Cingular

1.40%

Nextel

1.22%

Verizon Wireless

VZW Customer Base (%) 47.4M

Retail Post-Paid 92.4%

Retail Prepaid 3.2%

Reseller 4.4%

* Net adds: Excludes acquisitions, divestitures, and adjustments. Sprint includes wholesale and Virgin Mobile. Nextel includes Boost Mobile.

** Churn as reported; Sprint reflects direct customers; Nextel reflects Nextel-branded.

7

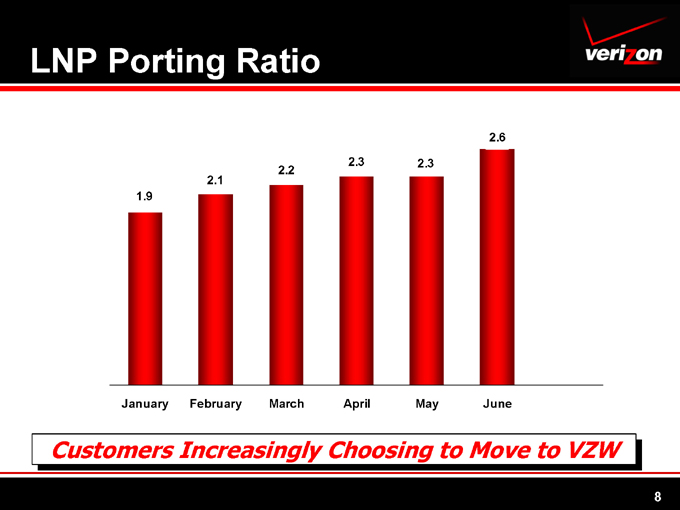

LNP Porting Ratio

1.9

January

2.1

February

2.2

March

2.3

April

2.3

May

2.6

June

Customers Increasingly Choosing to Move to VZW

8

Direct vs. Indirect Channel

ARPU - 2005 June YTD

Direct 3% higher

Direct

Indirect

Customer Life - 2005 June YTD

Direct > 15 months longer

Direct

Indirect

Churn - 2005 June YTD

Direct > 25 bps lower

Direct

Indirect

Direct channel – higher ARPU, lower churn, longer customer life Indirect channel – higher acquisition cost

Direct Focus Yielding More Valuable Customers

9

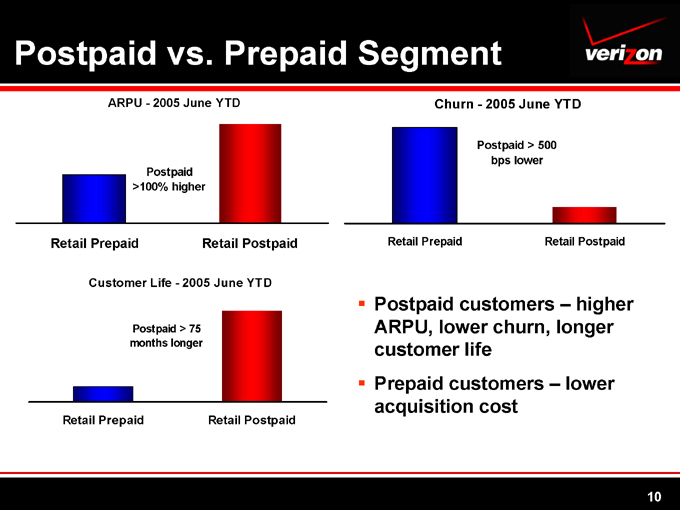

Postpaid vs. Prepaid Segment

ARPU - 2005 June YTD

Postpaid >100% higher

Retail Prepaid Retail Postpaid

Customer Life - 2005 June YTD

Postpaid > 75 months longer

Retail Prepaid Retail Postpaid

Churn - 2005 June YTD

Postpaid > 500 bps lower

Retail Prepaid Retail Postpaid

Postpaid customers – higher ARPU, lower churn, longer customer life Prepaid customers – lower acquisition cost

10

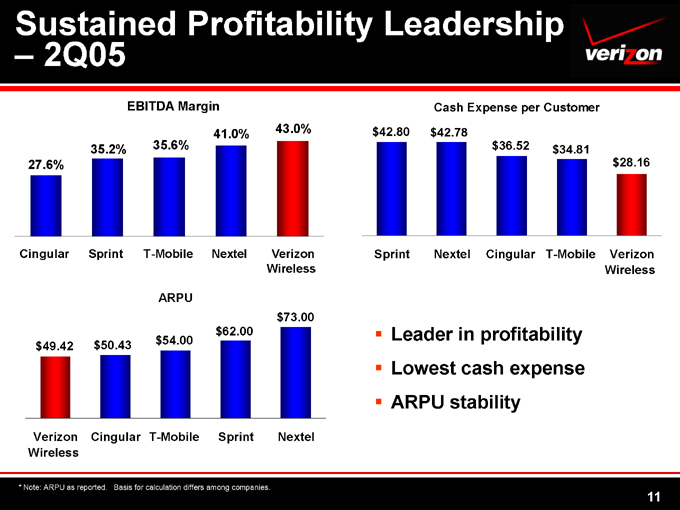

Sustained Profitability Leadership

– 2Q05

EBITDA Margin

27.6% 35.2% 35.6% 41.0% 43.0%

Cingular Sprint T-Mobile Nextel Verizon Wireless

ARPU

$49.42 $50.43 $54.00 ` $62.00 $73.00

Verizon Wireless Cingular T-Mobile Sprint Nextel

Cash Expense per Customer

$42.80 $42.78 $36.52 $34.81 $28.16

Sprint Nextel Cingular T-Mobile Verizon Wireless

Leader in profitability Lowest cash expense ARPU stability

* Note: ARPU as reported. Basis for calculation differs among companies.

11

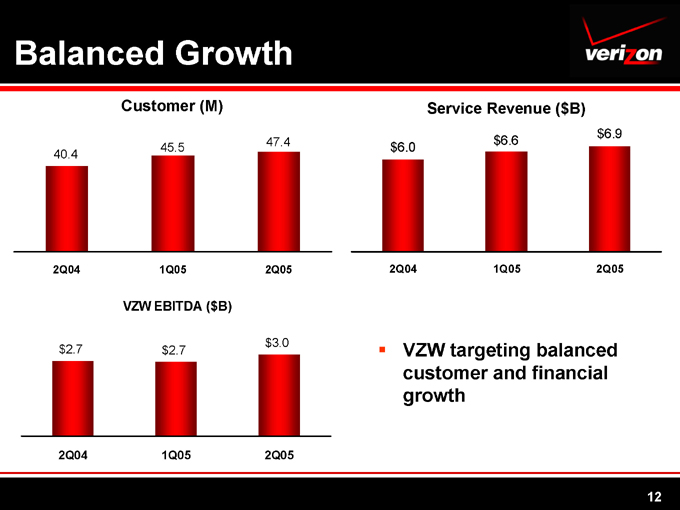

Balanced Growth

Customer (M)

40.4 45.5 47.4

2Q04 1Q05 2Q05

VZW EBITDA ($B)

$2.7 $2.7 $3.0

2Q04 1Q05 2Q05

Service Revenue ($B)

$6.0 $6.6 $6.9

2Q04 1Q05 2Q05

VZW targeting balanced customer and financial growth

12

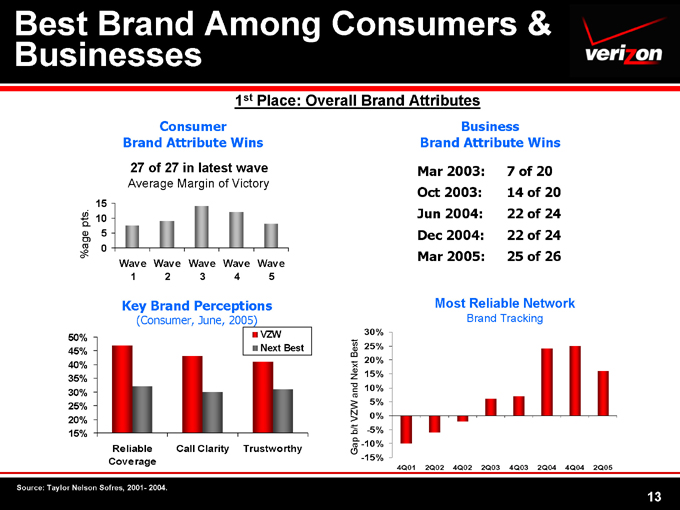

Best Brand Among Consumers & Businesses

1st Place: Overall Brand Attributes

Consumer Brand Attribute Wins

27 of 27 in latest wave

Average Margin of Victory

%age pts.

15 10 5 0

Wave 1 Wave 2 Wave 3 Wave 4 Wave 5

Key Brand Perceptions

(Consumer, June, 2005)

VZW Next Best

50% 45% 40% 35% 30% 25% 20% 15%

Reliable Coverage Call Clarity Trustworthy

Business Brand Attribute Wins

Mar 2003: 7 of 20

Oct 2003: 14 of 20

Jun 2004: 22 of 24

Dec 2004: 22 of 24

Mar 2005: 25 of 26

Most Reliable Network

Brand Tracking

Gap b/t VZW and Next Best

30% 25% 20% 15% 10% 5% 0% -5% -10% -15%

4Q01 2Q02 4Q02 2Q03 4Q03 2Q04 4Q04 2Q05

Source: Taylor Nelson Sofres, 2001- 2004.

13

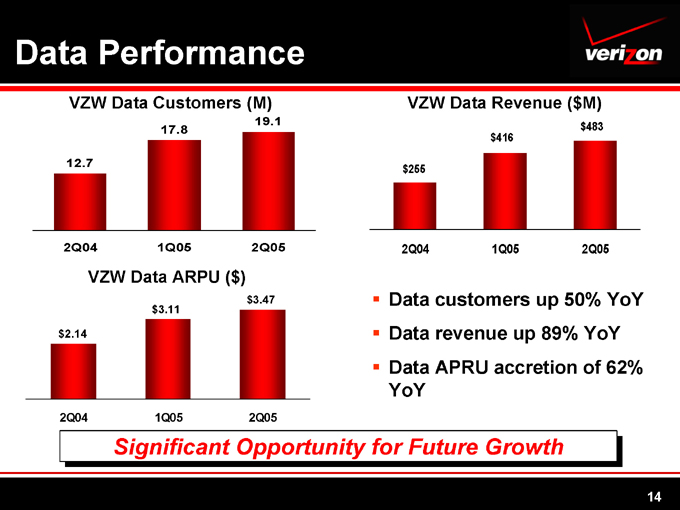

Data Performance

VZW Data Customers (M)

12.7 17.8 19.1

2Q04 1Q05 2Q05

VZW Data ARPU ($)

$2.14 $3.11 $3.47

2Q04 1Q05 2Q05

VZW Data Revenue ($M)

$255 $416 $483

2Q04 1Q05 2Q05

Data customers up 50% YoY Data revenue up 89% YoY Data APRU accretion of 62% YoY

Significant Opportunity for Future Growth

14

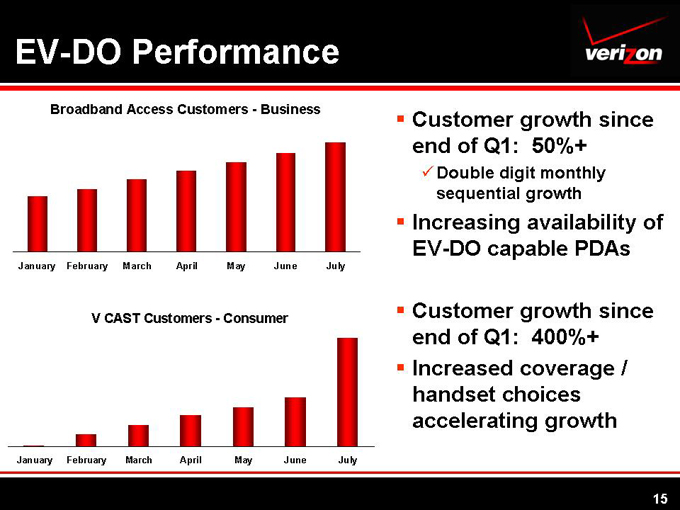

EV-DO Performance

Broadband Access Customers - Business

January February March April May June July

V CAST Customers - Consumer

January February March April May June July

Customer growth since end of Q1: 50%+

Double digit monthly sequential growth

Increasing availability of EV-DO capable PDAs

Customer growth since end of Q1: 400%+

Increased coverage / handset choices accelerating growth

15

Verizon Wireless Update

Performance Distribution Strategy Network Investment Product Initiatives

16

Distribution Plan

Continue to leverage our strong network of direct and indirect distribution

Develop new sources of direct distribution

New stores & kiosks in key locations

Pursue and implement relationships with new national retailers

Currently negotiating with a number of highly respected household names

17

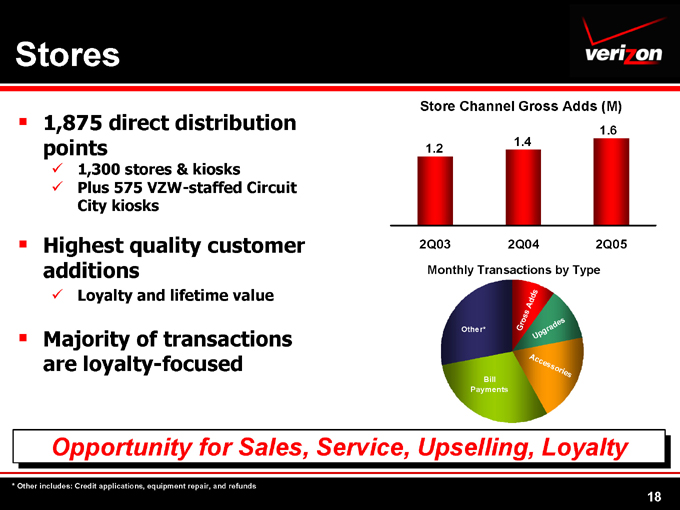

Stores

1,875 direct distribution points

1,300 stores & kiosks Plus 575 VZW-staffed Circuit City kiosks

Highest quality customer additions

Loyalty and lifetime value

Majority of transactions are loyalty-focused

Store Channel Gross Adds (M)

1.2 1.4 1.6

2Q03 2Q04 2Q05

Monthly Transactions by Type

Other*

Bill Payments

Upgrades

Accessories

Gross

Adds

Opportunity for Sales, Service, Upselling, Loyalty

* Other includes: Credit applications, equipment repair, and refunds

18

RadioShack

Worsening relative performance across several metrics Declining source of gross adds

Only 9% of total gross adds YTD; down 8% YoY

Worst sales performance per door of national indirect - 47% below average

Poor customer profile

Churn – 29 bps higher than VZW direct postpaid

High cost channel

Bottom line: RadioShack relationship does not justify the cost

Strong Direct Combined with Strategic Indirect Channels Enable Choices That Others Don’t Have

19

Strategic Retailers

Circuit City

575 VZW-staffed stores

#3 Consumer Electronics retailer VZW exclusive wireless provider

Best Buy

600+ stores through out U.S. #1 Consumer Electronics retailer Preferred carrier relationship

Costco

300+ warehouses, 43M members 6th largest retailer

Start Date

July 2004

September 2004

August 2004

Another Large Retailer…Stay Tuned

20

Verizon Wireless Update

Performance Distribution Strategy Network Investment Product Initiatives

21

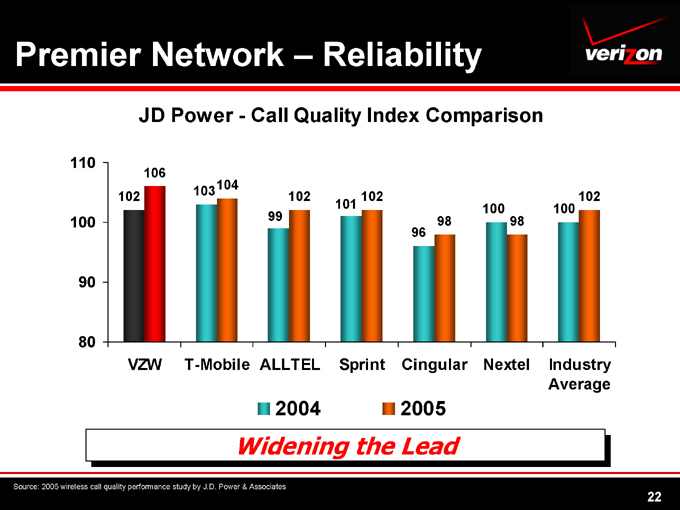

Premier Network – Reliability

JD Power - Call Quality Index Comparison

110

106 103104 102 102 102

102 99 101 98 100 100

100 98

80 90 96

VZW T-Mobile ALLTEL Sprint Cingular Nextel Industry Average

2004

2005

Widening the Lead

Source: 2005 wireless call quality performance study by J.D. Power & Associates

22

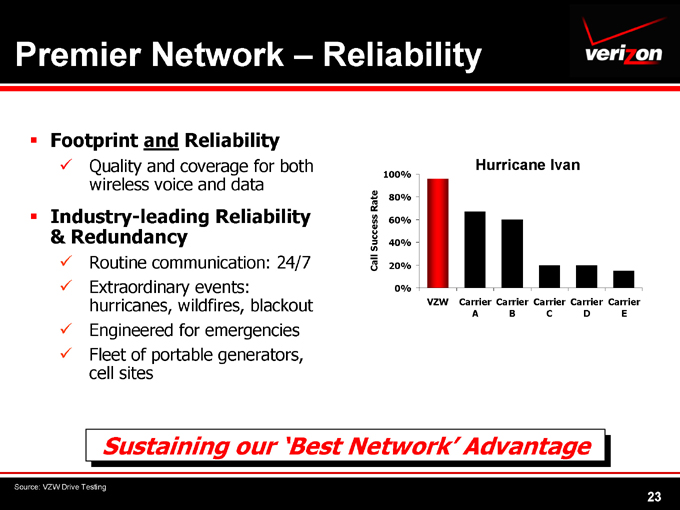

Premier Network – Reliability

Footprint and Reliability

Quality and coverage for both wireless voice and data

Industry-leading Reliability & Redundancy

Routine communication: 24/7 Extraordinary events: hurricanes, wildfires, blackout Engineered for emergencies Fleet of portable generators, cell sites

Call Success Rate

100% 80% 60% 40% 20% 0%

Hurricane Ivan

VZW Carrier A Carrier B Carrier C Carrier D Carrier E

Sustaining our ‘Best Network’ Advantage

Source: VZW Drive Testing

23

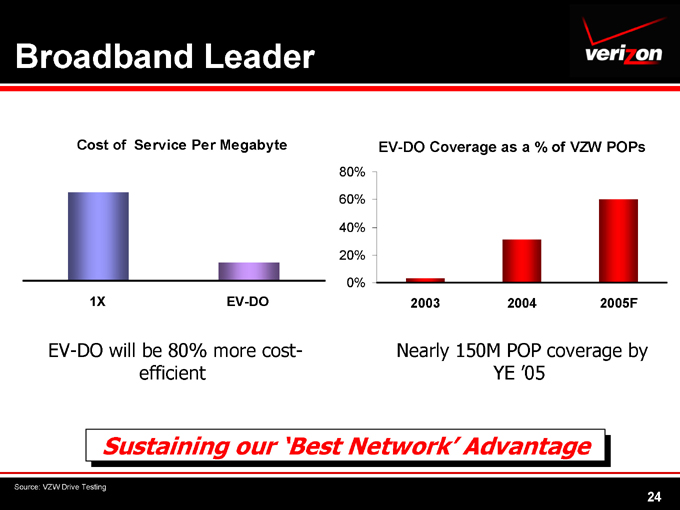

Broadband Leader

Cost of Service Per Megabyte

1X EV-DO

EV-DO will be 80% more cost-efficient

80%

60%

40%

20%

0%

EV-DO Coverage as a % of VZW POPs

2003 2004 2005F

Nearly 150M POP coverage by YE ‘05

Sustaining our ‘Best Network’ Advantage

Source: VZW Drive Testing

24

Consistent Investment

Capital Expenditures (M)

$6,000

$4,000

$2,000

$0

2001 2002 2003 2004 2005

June YTD

EV-DO

CAPEX as a % of Service Revenue

35%

25%

15%

5%

2001 2002 2003 2004 2005

June YTD

EV-DO

Funding Growth Efficiently

25

Verizon Wireless Update

Performance Distribution Strategy Network Investment Product Initiatives

26

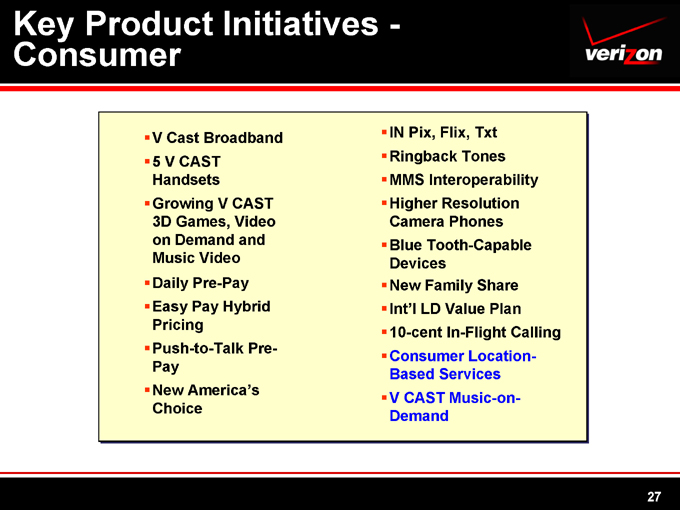

Key Product Initiatives -Consumer

V Cast Broadband 5 V CAST

Handsets Growing V CAST 3D Games, Video on Demand and Music Video Daily Pre-Pay Easy Pay Hybrid Pricing Push-to-Talk PrePay New America’s Choice

IN Pix, Flix, Txt Ringback Tones MMS Interoperability Higher Resolution Camera Phones Blue Tooth-Capable Devices New Family Share Int’l LD Value Plan 10-cent In-Flight Calling Consumer Location-Based Services V CAST Music-on-Demand

27

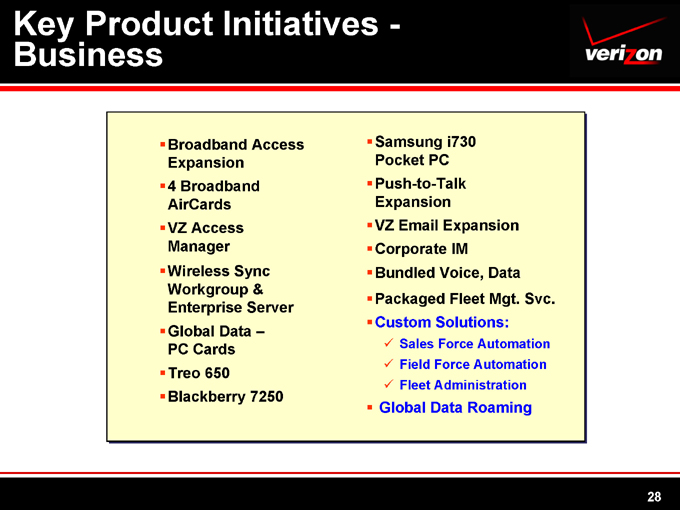

Key Product Initiatives -Business

Broadband Access Expansion 4 Broadband AirCards VZ Access Manager Wireless Sync Workgroup & Enterprise Server Global Data –PC Cards Treo 650 Blackberry 7250

Samsung i730 Pocket PC Push-to-Talk Expansion VZ Email Expansion Corporate IM Bundled Voice, Data Packaged Fleet Mgt. Svc. Custom Solutions:

Sales Force Automation Field Force Automation Fleet Administration

Global Data Roaming

28

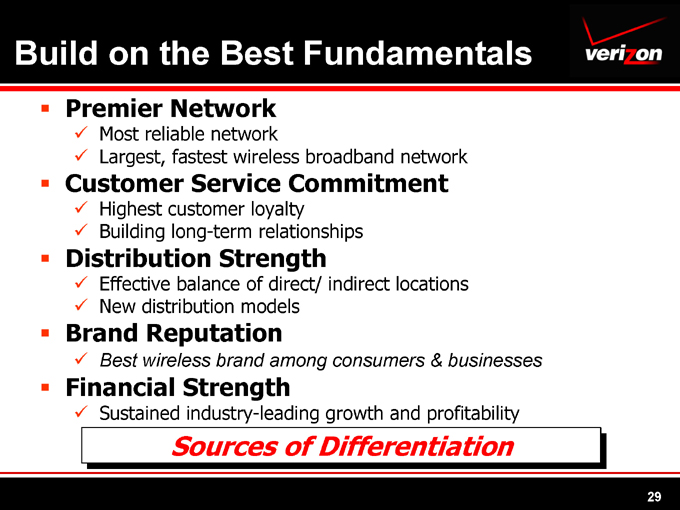

Build on the Best Fundamentals

Premier Network

Most reliable network

Largest, fastest wireless broadband network

Customer Service Commitment

Highest customer loyalty Building long-term relationships

Distribution Strength

Effective balance of direct/ indirect locations New distribution models

Brand Reputation

Best wireless brand among consumers & businesses

Financial Strength

Sustained industry-leading growth and profitability

Sources of Differentiation

29