Exhibit 99

September 12, 2005

MCI / Verizon

Disclaimer / Forward looking statements

This document contains statements about expected future events and financial results that are forward-looking and subject to risks and uncertainties. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The following important factors could affect future results and could cause those results to differ materially from those expressed in the forward-looking statements: a significant change in the timing of, or the imposition of any government conditions to, the closing of the previously announced proposed transaction between MCI and Verizon, if consummated; actual and contingent liabilities; and the extent and timing of our ability to obtain revenue enhancements and cost savings following the previously announced proposed transaction between MCI and Verizon. Additional factors that may affect the future results of MCI and Verizon are set forth in their respective filings with the Securities and Exchange Commission (“SEC”), including in the risk factors set forth in the proxy statement and prospectus described below and in the risk factors set forth in MCI’s report on Form 10-K for the year ended December 31, 2004 and in the cautionary statement concerning forward-looking statements in Verizon’s Form 10-K for the year ended December 31, 2004. These documents are available at www.mci.com/about/investor_relations/sec/ and www.verizon.com/investor/.

In connection with the proposed transaction between Verizon and MCI, Verizon has filed a registration statement on Form S-4 on August 31, 2005 with the Securities and Exchange Commission (Registration No. 333-124008), containing a definitive proxy statement and prospectus. Investors are urged to read the proxy statement and prospectus filed, and any other relevant materials filed by MCI or Verizon because they contain, or will contain, important information about MCI, Verizon and the proposed transaction between MCI and Verizon. These materials and other relevant materials (when they become available) and any other documents filed by MCI or Verizon with the SEC, may be obtained for free at the SEC’s website at www.sec.gov. Investors may also obtain free copies of these documents at www.mci.com/about/investor_relations, or by request to MCI, Inc., Investor Relations, 22001 Loudoun County Parkway, Ashburn, VA 20147. Free copies of Verizon’s filings are available at www.verizon.com/investor, or by request to Verizon Communications Inc., Investor Relations, 1095 Avenue of the Americas, 36th Floor, New York, NY 10036. Investors are urged to read the proxy statement and prospectus and the other relevant materials when such other materials become available before making any voting or investment decision with respect to the previously announced proposed transaction between MCI and Verizon.

MCI, Verizon, and their respective directors, executive officers, and other employees may be deemed to be participants in the solicitation of proxies from MCI shareowners with respect to the previously announced proposed transaction between MCI and Verizon. Information about MCI’s directors and executive officers is available in MCI’s proxy statement for its 2005 annual meeting of shareholders, dated April 20, 2005. Information about Verizon’s directors and executive officers is available in Verizon’s proxy statement for its 2005 annual meeting of shareholders, dated March 21, 2005. Additional information about the interests of potential participants is included in the proxy statement and prospectus and other materials filed with the SEC.

1

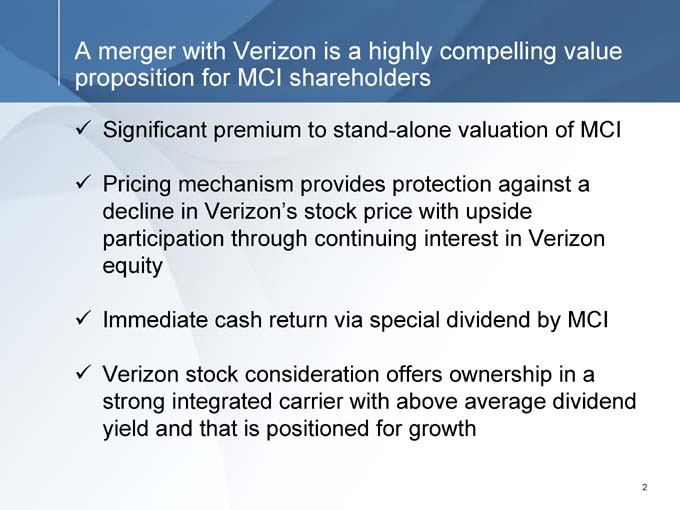

A merger with Verizon is a highly compelling value proposition for MCI shareholders

Significant premium to stand-alone valuation of MCI

Pricing mechanism provides protection against a decline in Verizon’s stock price with upside participation through continuing interest in Verizon equity

Immediate cash return via special dividend by MCI

Verizon stock consideration offers ownership in a strong integrated carrier with above average dividend yield and that is positioned for growth

2

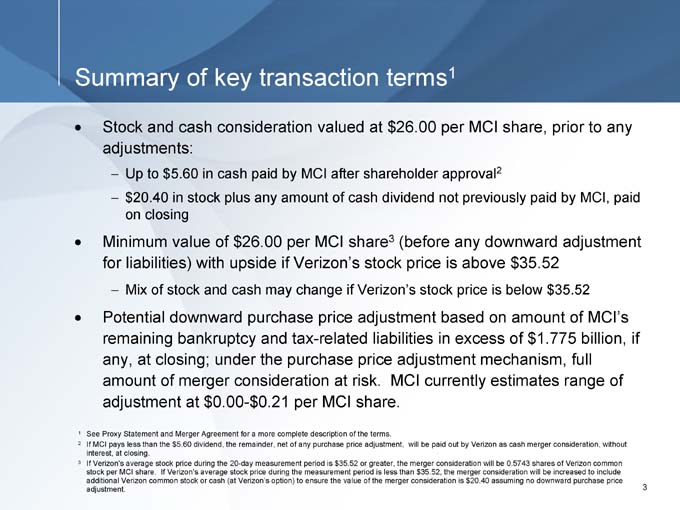

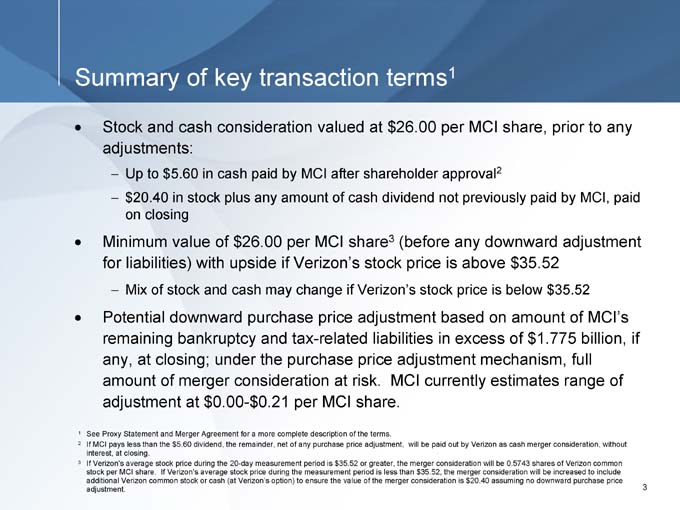

Summary of key transaction terms1

Stock and cash consideration valued at $26.00 per MCI share, prior to any adjustments:

Up to $5.60 in cash paid by MCI after shareholder approval2

20.40 in stock plus any amount of cash dividend not previously paid by MCI, paid on closing

Minimum value of $26.00 per MCI share3 (before any downward adjustment for liabilities) with upside if Verizon’s stock price is above $35.52

Mix of stock and cash may change if Verizon’s stock price is below $35.52

Potential downward purchase price adjustment based on amount of MCI’s remaining bankruptcy and tax-related liabilities in excess of $1.775 billion, if any, at closing; under the purchase price adjustment mechanism, full amount of merger consideration at risk. MCI currently estimates range of adjustment at $0.00-$0.21 per MCI share.

1 See Proxy Statement and Merger Agreement for a more complete description of the terms.

2 If MCI pays less than the $5.60 dividend, the remainder, net of any purchase price adjustment, will be paid out by Verizon as cash merger consideration, without interest, at closing.

3 If Verizon’s average stock price during the 20-day measurement period is $35.52 or greater, the merger consideration will be 0.5743 shares of Verizon common stock per MCI share. If Verizon’s average stock price during the measurement period is less than $35.52, the merger consideration will be increased to include additional Verizon common stock or cash (at Verizon’s option) to ensure the value of the merger consideration is $20.40 assuming no downward purchase price adjustment.

3

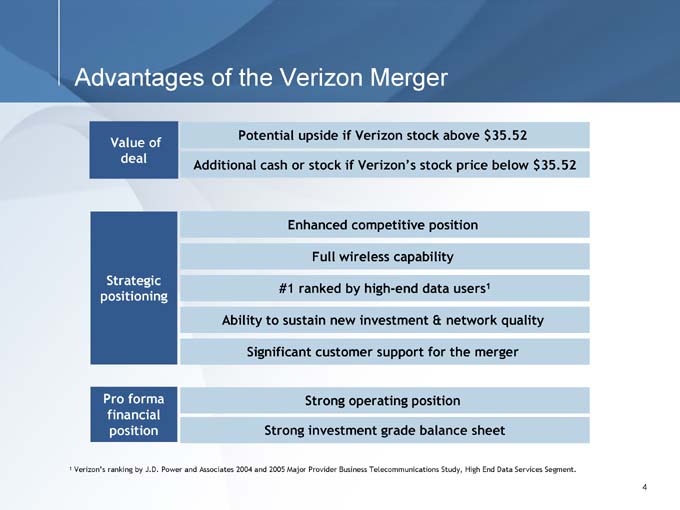

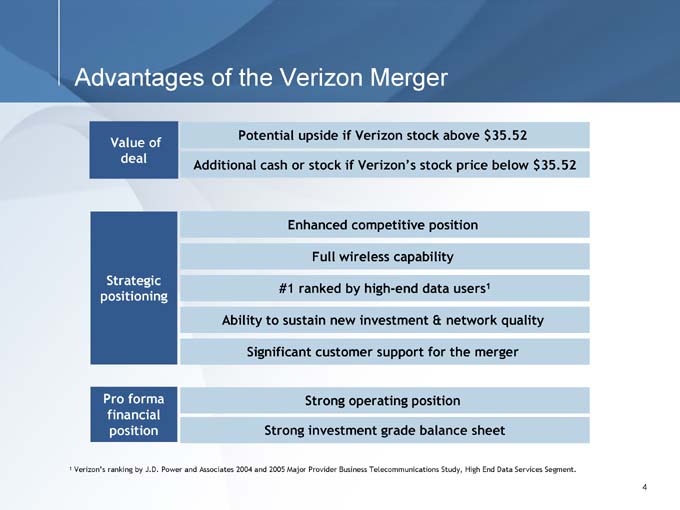

Advantages of the Verizon Merger

Value of deal

Potential upside if Verizon stock above $35.52

Additional cash or stock if Verizon’s stock price below $35.52

Strategic positioning

Enhanced competitive position Full wireless capability #1 ranked by high-end data users1

Ability to sustain new investment & network quality

Significant customer support for the merger

Pro forma financial position

Strong operating position

Strong investment grade balance sheet

1 Verizon’s ranking by J.D. Power and Associates 2004 and 2005 Major Provider Business Telecommunications Study, High End Data Services Segment.

4

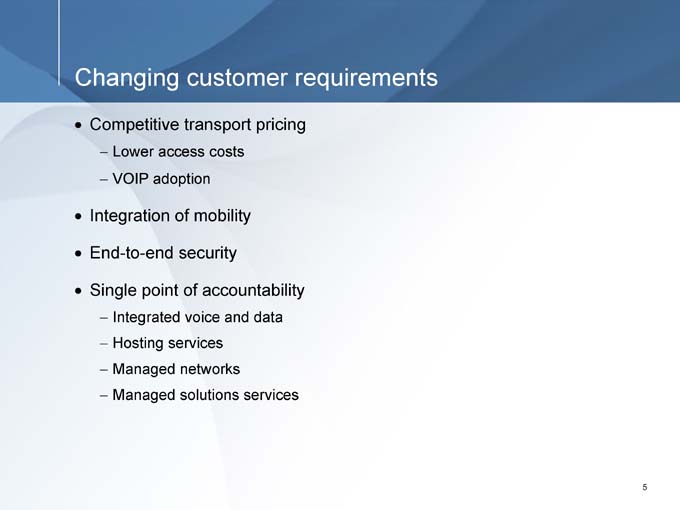

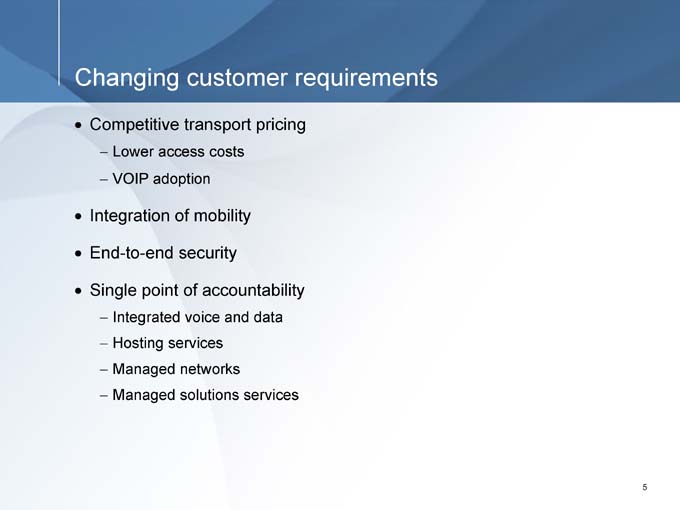

Changing customer requirements

Competitive transport pricing

Lower access costs

VOIP adoption

Integration of mobility

End-to-end security

Single point of accountability

Integrated voice and data

Hosting services

Managed networks

Managed solutions services

5

Compelling Strategic rationale

Positioned to migrate up the enterprise value chain

Upside opportunities

Enterprise leadership Next generation services Enterprise mobility Achievable synergies

Financial strength and stability

Largest US carrier with global footprint Strong, stable business mix Industry leading balance sheet

6

A “change the game” opportunity

Strong Regional Footprint

Global Presence

Global Service Provider

Customer Relationships

Enterprise & Multi-National Corp. Depth

Broadest Market Reach

National Mobile Reach

IP Centric

Solutions Focus

Converged Services Platform

All Access Modes End-to-end IP Solutions Centric

7

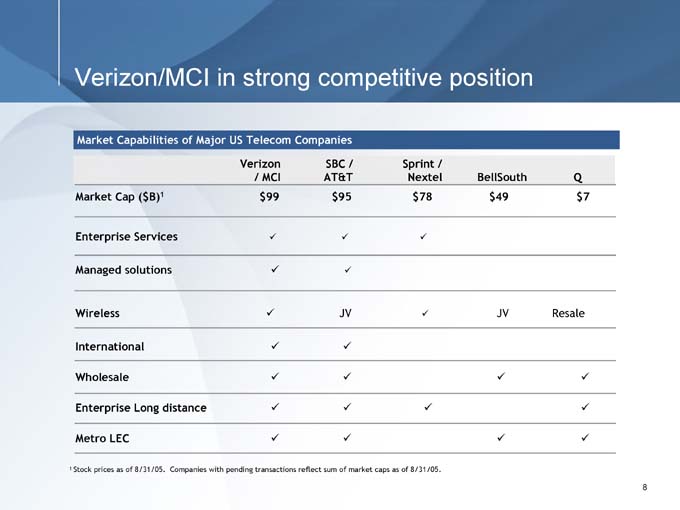

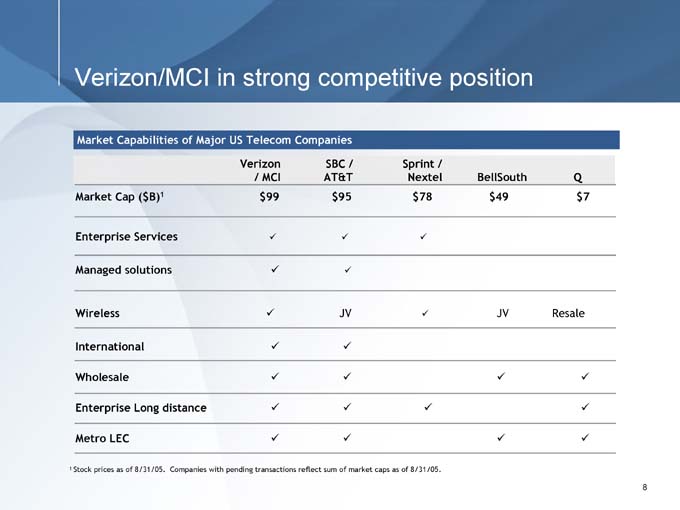

Verizon/MCI in strong competitive position

Market Capabilities of Major US Telecom Companies

Verizon / MCI SBC / AT&T Sprint / Nextel BellSouth Q

Market Cap ($B)1 $99 $95 $78 $49 $7

Enterprise Services

Managed solutions

Wireless JV JV Resale

International

Wholesale

Enterprise Long distance

Metro LEC

1 Stock prices as of 8/31/05. Companies with pending transactions reflect sum of market caps as of 8/31/05.

8

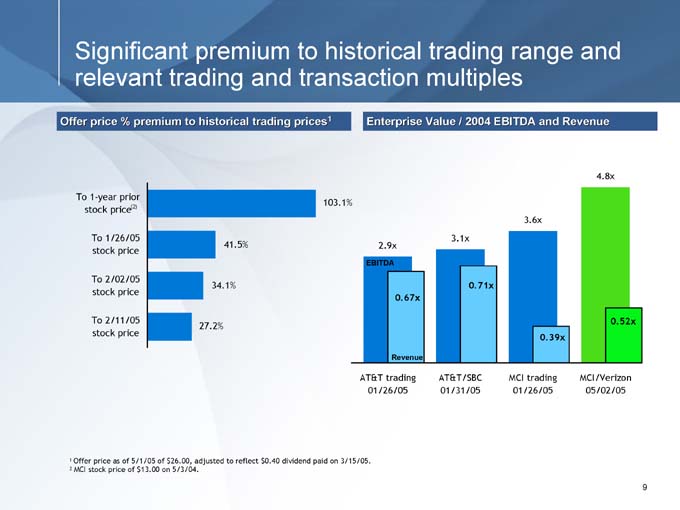

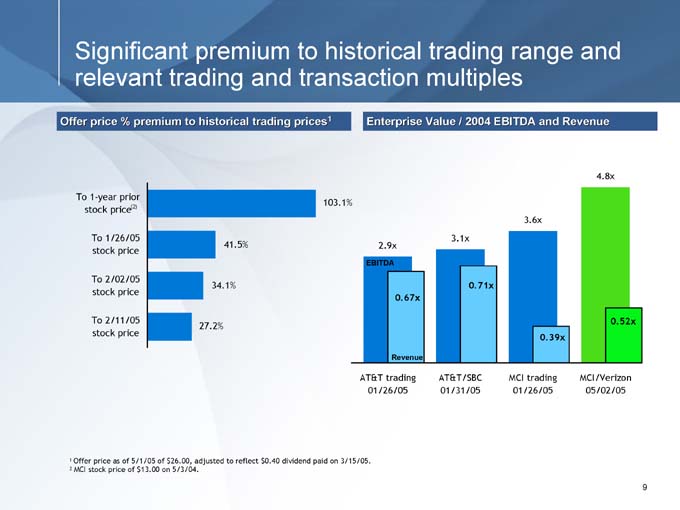

Significant premium to historical trading range and relevant trading and transaction multiples

Offer price % premium to historical trading prices1

To 1-year prior stock price(2)

To 1/26/05 stock price

To 2/02/05 stock price

To 2/11/05 stock price

103.1%

41.5%

34.1%

27.2%

AT&T trading AT&T/SBC MCI trading MCI/Verizon 01/26/05 01/31/05 01/26/05 05/02/05

Revenue

0.67x

EBITDA

2.9x

0.71x

3.1x

0.39x

3.6x

0.52x

4.8x

1 Offer price as of 5/1/05 of $26.00, adjusted to reflect $0.40 dividend paid on 3/15/05.

2 MCI stock price of $13.00 on 5/3/04.

9

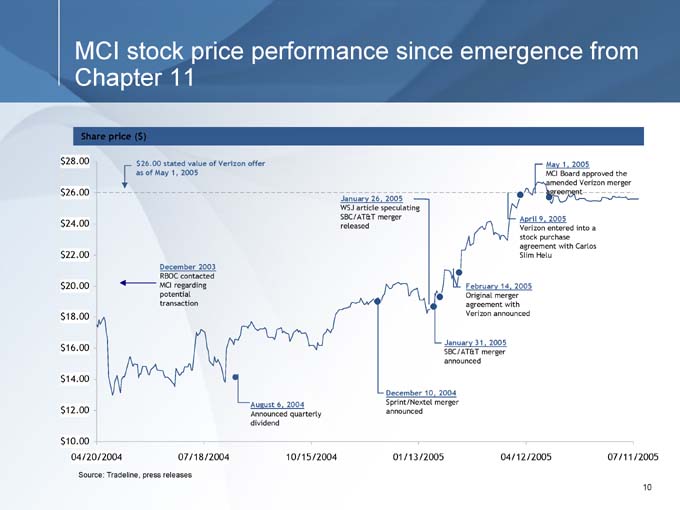

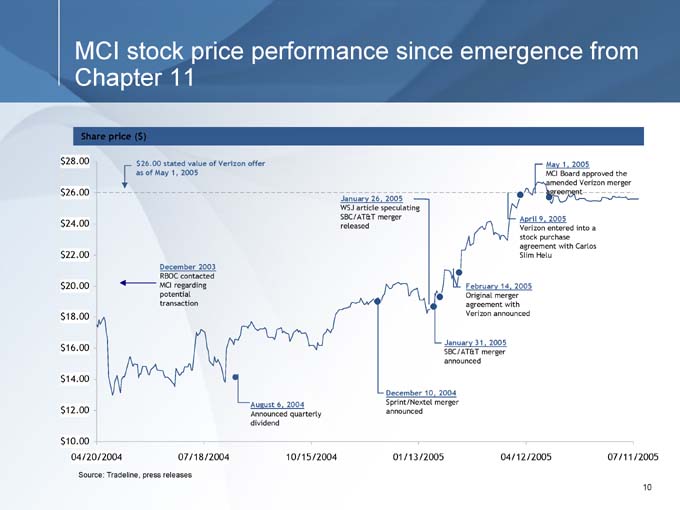

MCI stock price performance since emergence from Chapter 11

Share price ($) $28.00 $26.00 $24.00 $22.00 $20.00 $18.00 $16.00 $14.00 $12.00 $10.00

04/20/2004 07/18/2004 10/15/2004 01/13/2005 04/12/2005 07/11/2005 $26.00 stated value of Verizon offer as of May 1, 2005

December 2003

RBOC contacted MCI regarding potential transaction

August 6, 2004

Announced quarterly dividend

January 26, 2005

WSJ article speculating SBC/AT&T merger released

December 10, 2004

Sprint/Nextel merger announced

January 31, 2005

SBC/AT&T merger announced

February 14, 2005

Original merger agreement with Verizon announced

April 9, 2005

Verizon entered into a stock purchase agreement with Carlos Slim Helu

May 1, 2005

MCI Board approved the amended Verizon merger agreement

Source: Tradeline, press releases

10

MCI’s Deal Process

MCI’s Board conducted a thorough, fair and transparent process:

Extensive and even-handed negotiations with Verizon, Qwest and other parties throughout 2004 and 2005

Thoroughly considered all aspects of potential strategic alternatives

All directors and former SEC Chairman Richard Breeden, MCI’s corporate monitor, participated throughout

MCI’s Board had concerns about Qwest’s proposals:

Risk of significant decline in Qwest stock price during extended period prior to closing

Impact on MCI enterprise business from significant negative customer reaction to a transaction with Qwest

Achievability of Qwest’s claimed level of synergies

Qwest much less attractive partner than Verizon in competing against SBC / AT&T

Expected financial condition of Qwest after transaction (liquidity profile, debt level)

Qwest’s contingent liabilities

11

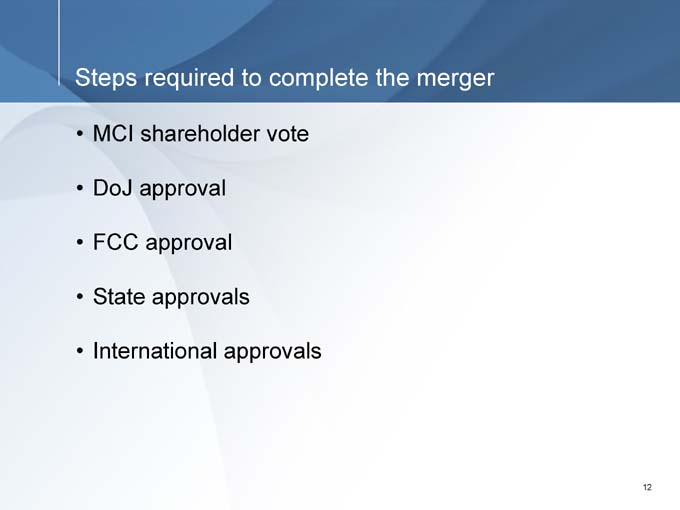

Steps required to complete the merger

MCI shareholder vote DoJ approval FCC approval State approvals International approvals

12

Shareholder meeting on October 6

Approval by a majority of the outstanding MCI shares required No Verizon shareholder vote on the transaction is required No alternative offer for MCI is now available

If shareholders vote against the Verizon merger (or simply do not vote), then MCI will:

Lose the benefits of combining with Verizon including access economics and wireless capabilities

Face the challenges of competing on a stand-alone basis against AT&T/SBC and Sprint/Nextel

If another offer emerges, could require up to 12 to 18 months to obtain regulatory approvals with the potential of not closing until 2007

13

Important progress being made toward transaction completion in late 2005/early 2006

HSR notification and report forms filed in February 2005

Applications for FCC approval filed on March 11th

MCI and Verizon certified substantial compliance with DoJ 2nd Request on June 17th and May 27th, respectively

Approvals being sought from various state public service or public utility commissions or similar state regulatory bodies

Fifteen approvals already received from State PUC or other regulatory bodies

European Commission and other international approvals proceeding on course

Six international approvals secured

14

In conclusion

MCI Board unanimously approved and recommends a vote in favor of this merger

Customers prefer the Verizon merger

Merger with Verizon provides significant financial and operational strength

Merger with Verizon is a highly compelling value proposition for MCI shareholders

15