UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

FRONTIER COMMUNICATIONS PARENT, INC.

(Name of Registrant as Specified in Its Charter)

VERIZON COMMUNICATIONS INC.

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

This filing contains the following communications:

| 1. | A press release issued by Verizon Communications Inc. (“Verizon”) on October 22, 2024. |

| 2. | Select slides from an investor presentation delivered at a sell-side analyst meeting on October 22, 2024. |

1. The following is the text of a press release issued by Verizon on October 22, 2024.

News Release

| FOR IMMEDIATE RELEASE | Media contact: | |

| October 22, 2024 | Katie Magnotta | |

| katie.magnotta@verizon.com | ||

| 201-602-9235 |

Verizon updates broadband strategy to bring more

choice, flexibility and value to millions

Key Takeaways:

| • | Verizon reaches fixed wireless access subscriber target 15 months ahead of schedule |

| • | Customer demand for broadband solutions accelerates fixed wireless and fiber rollout |

| • | Fixed wireless subscribers on path to double to 8-9 million by 2028 |

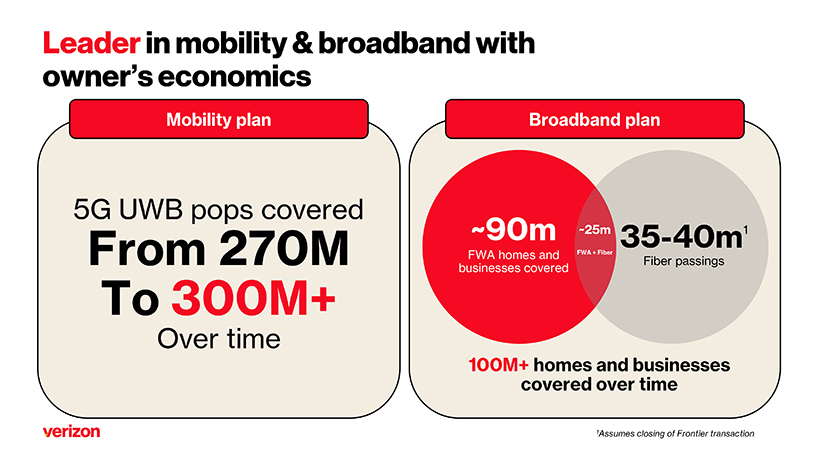

| • | Fiber network expected to expand to 35-40 million passings over time |

NEW YORK, N.Y.—Verizon Communications Inc. (NYSE, Nasdaq: VZ) today announced an update to its broadband strategy, with new fixed wireless subscriber goals, household targets and broadband offerings to accelerate its premium broadband and mobility services to millions more customers nationwide. Verizon has more than 11.9 million total broadband connections as of the end of third-quarter 2024, up nearly 16 percent year over year. The update was given today at a sell side analyst event following the release of the company’s third-quarter 2024 results.

“This is a game changing moment for Verizon and for connectivity across the country,” said Hans Vestberg, Verizon Chairman and CEO. “Our ambitious targets for fixed wireless access, combined with our fiber expansion including the planned Frontier acquisition, will bring unmatched broadband coverage to millions more homes and businesses nationwide. We are creating an integrated connectivity experience that gives customers freedom in how they connect and use our services. This is about delivering the network of the future, and setting a new bar for the entire industry.”

Fixed Wireless subscribers on path to double by 2028

| • | At the end of third-quarter 2024, the company had nearly 4.2 million fixed wireless subscribers, representing an increase of nearly 57 percent year over year. The company hit its previous goal of 4-5 million subscribers 15 months earlier than expected due to the demand from consumer and business customers as they continue to trust the reliability of the product and speed and ease of deployment. |

| • | Verizon is expecting 8-9 million fixed wireless subscribers, doubling its current base, by 2028 and accelerating coverage to 90 million households in the same time period. |

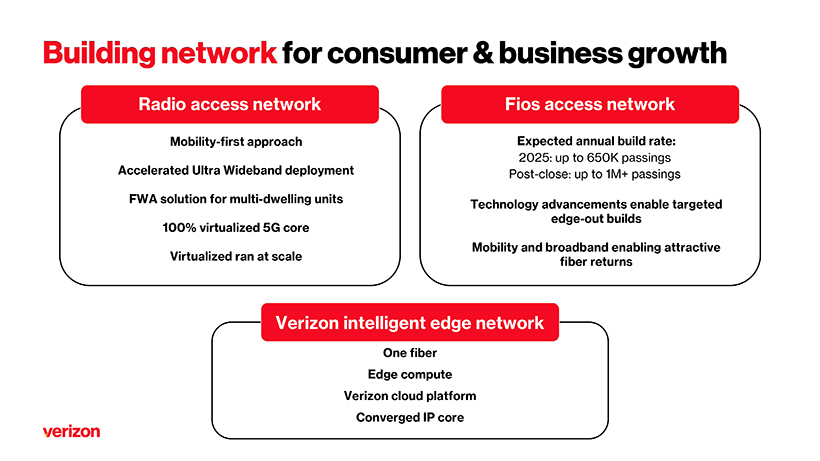

| • | Verizon will commercially launch its advanced mmWave solution for apartment and office buildings to address high population areas. The technology leverages existing infrastructure making it less expensive to build and faster to deploy. Continued deployment of C-band and mmWave will provide the performance and capacity needed to meet these goals and deliver the best-in-class experience that customers expect from Verizon. |

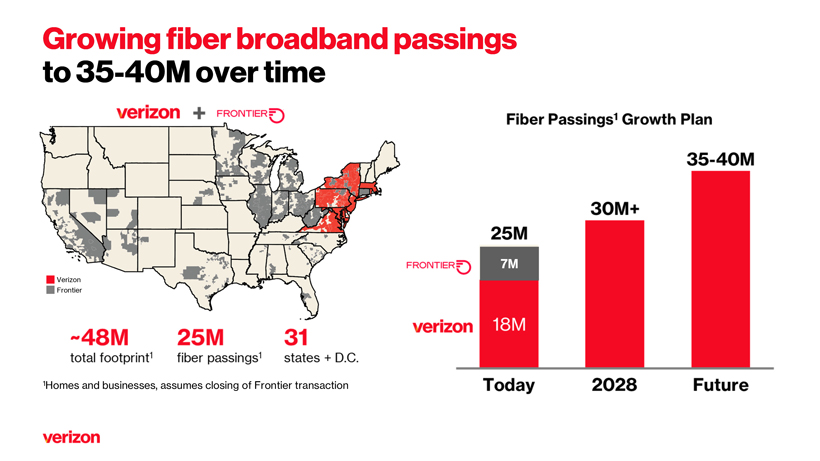

Fiber network expected to grow to 35-40 million passings

| • | Verizon will continue to look for opportunities to accelerate its ongoing Fios builds within the current footprint in nine states and Washington, D.C., giving more customers access to the industry-leading product. Verizon’s recent agreement to acquire Frontier, the largest pure-play fiber internet provider in the U.S., is expected to expand Verizon’s share of the nationwide broadband market, building upon Verizon’s two decades of leadership at the forefront of fiber. |

| • | Upon closing, Frontier is expected to bring in approximately 9-10 million fiber passings. |

| • | In 2025 Verizon is targeting an expansion of Fios builds to up to 650,000 passings annually. Following the closing of the Frontier acquisition, Verizon expects the combined build to be up to 1 million or more passings annually. |

| • | Verizon is expecting more than 30 million fiber passings in the combined Verizon/Frontier footprint by 2028. Over time, Verizon is expecting 35-40 million fiber passings. This will significantly expand Verizon’s fiber footprint, accelerating the company’s delivery of premium mobility and broadband services to current and new customers. |

| • | Frontier’s consumer fiber network can be immediately and seamlessly integrated upon closing directly into Verizon’s award-winning Fios network, meeting existing Fios standards. |

Outlook and Guidance: Priorities remain unchanged

| • | The company will maintain its capital allocation priorities, characterized by prudent investment in the business, a commitment to maintaining an industry-leading dividend, continued debt reduction, and efficient return of cash to shareholders, with buybacks to be considered when net unsecured debt to adjusted EBITDA ratio* is at 2.25x. |

| • | For 2025, the company expects capital expenditures of $17.5-$18.5 billion, consistent with historical levels of capital intensity. |

| • | Revised net unsecured debt to adjusted EBITDA ratio* target of 2.0 to 2.25x. |

| * | Non-GAAP financial measure. See www.verizon.com/about/investors for additional information about non-GAAP financial measures. |

About Verizon

Verizon Communications Inc. (NYSE, Nasdaq: VZ) powers and empowers how its millions of customers live, work and play, delivering on their demand for mobility, reliable network connectivity and security. Headquartered in New York City, serving countries worldwide and nearly all of the Fortune 500, Verizon generated revenues of $134.0 billion in 2023. Verizon’s world-class team never stops innovating to meet customers where they are today and equip them for the needs of tomorrow. For more, visit verizon.com or find a retail location at verizon.com/stores.

Forward-Looking Statements

In this communication we have made forward-looking statements. These statements are based on our estimates and assumptions and are subject to risks and uncertainties. Forward-looking statements include the information concerning our possible or assumed future results of operations. Forward-looking statements also include those preceded or followed by the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “forecasts,” “hopes,” “intends,” “plans,” “targets” or similar expressions. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. The following important factors, along with those discussed in our filings with the Securities and Exchange Commission (the “SEC”), could affect future results and could cause those results to differ materially from those expressed in the forward-looking statements: the effects of competition in the markets in which we operate, including the inability to successfully respond to competitive factors such as prices, promotional incentives and evolving consumer preferences; failure to take advantage of, or respond to competitors’ use of, developments in technology and address changes in consumer demand; performance issues or delays in the deployment of our 5G network resulting in significant costs or a reduction in the anticipated benefits of the enhancement to our networks; the inability to implement our business strategy; adverse conditions in the U.S. and international economies, including inflation and changing interest rates in the markets in which we operate; cyber attacks impacting our networks or systems and any resulting financial or reputational impact; damage to our infrastructure or disruption of our operations from natural disasters, extreme weather conditions, acts of war, terrorist attacks or other hostile acts and any resulting financial or reputational impact; disruption of our key suppliers’ or vendors’ provisioning of products or services, including as a result of geopolitical factors or the potential impacts of global climate change; material adverse changes in labor matters and any resulting financial or operational impact; damage to our reputation or brands; the impact of public health crises on our operations, our employees and the ways in which our customers use our networks and other products and services; changes in the regulatory environment in which we operate, including any increase in restrictions on our ability to operate our networks or businesses; allegations regarding the release of hazardous materials or pollutants into the environment from our, or our predecessors’, network assets and any related government investigations, regulatory developments, litigation, penalties and other liability, remediation and compliance costs, operational impacts or reputational damage; our high level of indebtedness; significant litigation and any resulting material expenses incurred in defending against lawsuits or paying awards or settlements; an adverse change in the ratings afforded our debt securities by nationally accredited ratings organizations or adverse conditions in the credit markets affecting the cost, including interest rates, and/or availability of further financing; significant increases in benefit plan costs or lower investment returns on plan assets; changes in tax laws or regulations, or in their interpretation, or challenges to our tax positions, resulting in additional tax expense or liabilities; changes in accounting assumptions that regulatory agencies, including the SEC, may require or that result from changes in the accounting rules or their application, which could result in an impact on earnings; and risks associated with mergers, acquisitions and other strategic transactions, including our ability to consummate the proposed acquisition of Frontier Communications Parent, Inc. and obtain cost savings, synergies and other anticipated benefits within the expected time period or at all.

2. The following contains excerpts from an investor presentation delivered on October 22, 2024.

“Safe Harbor” Statement In this presentation we have made forward-looking statements. These statements are based on our estimates and assumptions and are subject to risks and uncertainties. Forward-looking statements include the information concerning our possible or assumed future results of operations. Forward-looking statements also include those preceded or followed by the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “forecasts,” “hopes,” “intends,” “plans,” “targets” or similar expressions. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. The following important factors, along with those discussed in our filings with the Securities and Exchange Commission (the “SEC”), could affect future results and could cause those results to differ materially from those expressed in the forward-looking statements: the effects of competition in the markets in which we operate, including the inability to successfully respond to competitive factors such as prices, promotional incentives and evolving consumer preferences; failure to take advantage of, or respond to competitors’ use of, developments in technology and address changes in consumer demand; performance issues or delays in the deployment of our 5G network resulting in significant costs or a reduction in the anticipated benefits of the enhancement to our networks; the inability to implement our business strategy; adverse conditions in the U.S. and international economies, including inflation and changing interest rates in the markets in which we operate; cyber attacks impacting our networks or systems and any resulting financial or reputational impact; damage to our infrastructure or disruption of our operations from natural disasters, extreme weather conditions, acts of war, terrorist attacks or other hostile acts and any resulting financial or reputational impact; disruption of our key suppliers’ or vendors’ provisioning of products or services, including as a result of geopolitical factors or the potential impacts of global climate change; material adverse changes in labor matters and any resulting financial or operational impact; damage to our reputation or brands; the impact of public health crises on our operations, our employees and the ways in which our customers use our networks and other products and services; changes in the regulatory environment in which we operate, including any increase in restrictions on our ability to operate our networks or businesses; allegations regarding the release of hazardous materials or pollutants into the environment from our, or our predecessors’, network assets and any related government investigations, regulatory developments, litigation, penalties and other liability, remediation and compliance costs, operational impacts or reputational damage; our high level of indebtedness; significant litigation and any resulting material expenses incurred in defending against lawsuits or paying awards or settlements; an adverse change in the ratings afforded our debt securities by nationally accredited ratings organizations or adverse conditions in the credit markets affecting the cost, including interest rates, and/or availability of further financing; significant increases in benefit plan costs or lower investment returns on plan assets; changes in tax laws or regulations, or in their interpretation, or challenges to our tax positions, resulting in additional tax expense or liabilities; changes in accounting assumptions that regulatory agencies, including the SEC, may require or that result from changes in the accounting rules or their application, which could result in an impact on earnings; and risks associated with mergers, acquisitions and other strategic transactions, including our ability to consummate the proposed acquisition of Frontier Communications Parent, Inc. and obtain cost savings, synergies and other anticipated benefits within the expected time period or at all. As required by SEC rules, we have provided a reconciliation of the non-GAAP financial measures included in this presentation to the most directly comparable GAAP measures in materials on our website at www.verizon.com/about/investors. 1

Important Additional Information and Where to Find It In connection with the proposed transactions, Frontier filed with the SEC a definitive proxy statement on Schedule 14A (the “Definitive Proxy Statement”) on October 7, 2024. The Definitive Proxy Statement and a form of proxy card have been mailed to the stockholders of Frontier. Verizon or Frontier may also file other documents with the SEC regarding the proposed transactions. This document is not a substitute for the Definitive Proxy Statement or any other relevant document which Frontier or Verizon may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITVE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC (WHEN THEY ARE AVAILABLE), AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTIONS BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND RELATED MATTERS. Investors and security holders may obtain free copies of the Definitive Proxy Statement and other documents that are filed or will be filed with the SEC by Frontier or Verizon (when they are available) through the website maintained by the SEC at www.sec.gov, Frontier’s investor relations website at investor.frontier.com or Verizon’s investor relations website at verizon.com/about/investors. Participants in the Solicitation Verizon may be deemed to be a “participant” in the solicitation of proxies from the stockholders of Frontier in connection with the proposed transactions. Additional information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is included in the Definitive Proxy Statement relating to the proposed transactions filed by Frontier on October 7, 2024. The Definitive Proxy Statement (and any other filings related to proposed transactions that have been or may be made) may be obtained free of charge from the SEC’s website at www.sec.gov or Frontier’s website at investor.frontier.com.

Growing fiber broadband passings to 35-40M over time 7M Verizon Frontier 1Homes and businesses, assumes closing of Frontier transaction

Building network for consumer & business growth Radio access network Fios access network Mobility-first approach Expected annual build rate: 2025: up to 650K passings Accelerated Ultra Wideband deployment Post-close: up to 1M+ passings FWA solution for multi-dwelling units Technology advancements enable targeted edge-out builds 100% virtualized 5G core Mobility and broadband enabling attractive Virtualized ran at scale fiber returns Verizon intelligent edge network One fiber Edge compute Verizon cloud platform Converged IP core

Leader in mobility & broadband broadband with owner’s economics Mobility plan Broadband plan 5G UWB pops covered ~90m ~25m 35-40m1 From 270M FWA homes and FWA + Fiber Fiber passings businesses covered To 300M+ Over time 100M+ homes and businesses covered over time 1Assumes closing of Frontier transaction

Forward-Looking Statements

In this communication, we have made forward-looking statements. These statements are based on our estimates and assumptions and are subject to risks and uncertainties. Forward-looking statements include the information concerning our possible or assumed future results of operations. Forward-looking statements also include those preceded or followed by the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “forecasts,” “hopes,” “intends,” “plans,” “targets” or similar expressions. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. For a discussion of some of the risks and important factors that could affect such forward-looking statements, see our and Frontier’s most recent annual and quarterly reports and other filings filed with the SEC.

Factors which could have an adverse effect on our operations and future prospects include, but are not limited to, the following: risks relating to the proposed transactions, including in respect of the ability to obtain required regulatory approvals and approval by Frontier’s stockholders, and the satisfaction of other closing conditions on a timely basis or at all; unanticipated difficulties and/or expenditures relating to the proposed transactions and any related financing; uncertainties as to the timing of the completion of the proposed transactions; litigation relating to the proposed transactions; the impact of the proposed transactions on each company’s business operations (including the threatened or actual loss of subscribers, employees or suppliers); the inability to obtain, or delays in obtaining cost savings, synergies and other anticipated benefits from the proposed transactions, including benefits to our financial and operating performance following the completion of the proposed transactions; incurrence of unexpected costs and expenses in connection with the proposed transactions; risks related to changes in the financial, equity and debt markets; and risks related to political, economic and market conditions. In addition, the risks to which Frontier’s business is subject, including those risks set forth in Part I, Item 1A of Frontier’s most recent Annual Report on Form 10-K and its periodic reports filed with the SEC, could adversely affect the proposed transactions and, following the completion of the proposed transactions, our operations and future prospects.

Important Additional Information and Where to Find It

In connection with the proposed transactions, Frontier filed with the SEC a definitive proxy statement on Schedule 14A (the “Definitive Proxy Statement”) on October 7, 2024. The Definitive Proxy Statement and a form of proxy has been mailed to the stockholders of Frontier. Verizon or Frontier may also file other documents with the SEC regarding the proposed transactions.

This document is not a substitute for the Definitive Proxy Statement or any other relevant document which Frontier or Verizon may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITVE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC (WHEN THEY ARE AVAILABLE), AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTIONS BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND RELATED MATTERS. Investors and security holders may obtain free copies of the Definitive Proxy Statement and other documents that are filed or will be filed with the SEC by Frontier or Verizon (when they are available) through the website maintained by the SEC at www.sec.gov, Frontier’s investor relations website at investor.frontier.com or Verizon’s investor relations website at verizon.com/about/investors.

Participants in the Solicitation

Verizon may be deemed to be a “participant” in the solicitation of proxies from the stockholders of Frontier in connection with the proposed transactions. Additional information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, is included in the Definitive Proxy Statement relating to the proposed transactions filed by Frontier on October 7, 2024. The Definitive Proxy Statement (and any other filings related to proposed transactions that have been or may be made) may be obtained free of charge from the SEC’s website at www.sec.gov or Frontier’s website at investor.frontier.com.