AT&T Second-Quarter Results Demonstrate Consistent, Strong 5G and Fiber Customer Growth

Connectivity investments continue to attract and retain

high-value subscribers who choose both wireless and fiber service

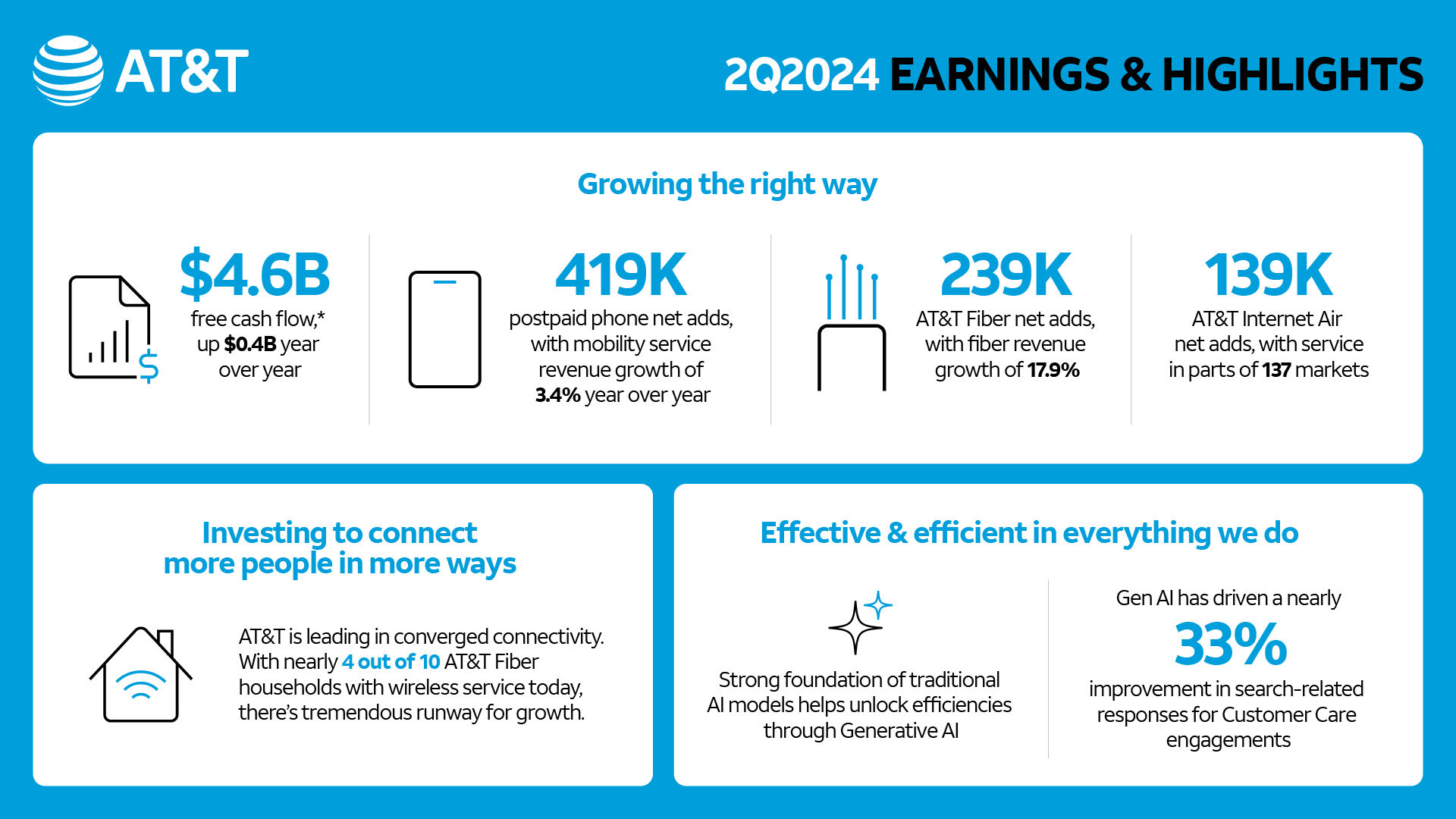

DALLAS, July 24, 2024 — AT&T Inc. (NYSE: T) reported second-quarter results that delivered durable and profitable 5G and fiber customer growth with increasing Mobility service and broadband revenues. Following consistent first-half performance, the Company reiterates all full-year 2024 financial guidance.

Second-Quarter Consolidated Results

•Revenues of $29.8 billion

•Diluted EPS of $0.49; adjusted EPS* of $0.57

•Operating income of $5.8 billion; adjusted operating income* of $6.3 billion

•Net income of $3.9 billion; adjusted EBITDA* of $11.3 billion

•Cash from operating activities of $9.1 billion, down $0.8 billion year over year

•Capital expenditures of $4.4 billion; capital investment* of $4.9 billion

•Free cash flow* of $4.6 billion, up $0.4 billion year over year

Second-Quarter Highlights

•419,000 postpaid phone net adds with an expected industry-leading postpaid

phone churn of 0.70%

•Mobility service revenues of $16.3 billion, up 3.4% year over year

•239,000 AT&T Fiber net adds; 200,000+ net adds for 18 consecutive quarters

•Consumer broadband revenues of $2.7 billion, up 7.0% year over year

•27.8 million consumer and business locations passed with fiber

“For the past four years, we’ve delivered consistent, positive results that have repositioned AT&T. Our solid performance this quarter demonstrates the durable benefits of our investment-led strategy,” said John Stankey, AT&T CEO. “AT&T is leading the way in converged connectivity as customers increasingly seek one provider who can seamlessly connect them in their home, at work and on the go. This is proving to be a winning strategy. Today, nearly four of every 10 AT&T Fiber households also choose AT&T wireless service. As the nation’s largest consumer fiber builder, we see this as an opportunity to continue to grow subscribers and revenues, while deepening customer relationships.”

* Further clarification and explanation of non-GAAP measures and reconciliations to their most comparable GAAP measures can be found in the “Non-GAAP Measures and Reconciliations to GAAP Measures” section of the release and at https://investors.att.com.

© 2024 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.

2024 Outlook

For the full year, AT&T reiterates guidance of:

•Wireless service revenue growth in the 3% range.

•Broadband revenue growth of 7%+.

•Adjusted EBITDA* growth in the 3% range.

•Capital investment* in the $21-$22 billion range.

•Free cash flow* in the $17-$18 billion range.

•Adjusted EPS* in the $2.15-$2.25 range.

•In 2025, the company expects to deliver Adjusted EPS* growth.

•The company continues to expect to achieve net debt-to-adjusted EBITDA* in the 2.5x range in the first half of 2025.

•On track to pass 30 million-plus consumer and business locations with fiber by the end of 2025.

Note: AT&T’s second-quarter earnings conference call will be webcast at 8:30 a.m. ET on Wednesday, July 24, 2024. The webcast and related materials, including financial highlights, will be available at https://investors.att.com.

* Further clarification and explanation of non-GAAP measures and reconciliations to their most comparable GAAP measures can be found in the “Non-GAAP Measures and Reconciliations to GAAP Measures” section of the release and at https://investors.att.com.

© 2024 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.

Consolidated Financial Results

•Revenues for the second quarter totaled $29.8 billion versus $29.9 billion in the year-ago quarter, down 0.4%. This was due to lower Business Wireline service revenues and declines in Mobility equipment revenues driven by lower sales volumes. These decreases were mostly offset by higher Mobility service, Consumer Wireline and Mexico revenues.

•Operating expenses were $24.0 billion versus $23.5 billion in the year-ago quarter. Operating expenses increased primarily due to our Open RAN network modernization efforts, including restructuring costs and accelerated depreciation on wireless network equipment, and higher depreciation related to our continued fiber and 5G investment. This was largely offset by lower Mobility equipment costs from lower sales volumes and benefits from continued transformation.

•Operating income was $5.8 billion versus $6.4 billion in the year-ago quarter. When adjusting for certain items, adjusted operating income* was $6.3 billion, versus $6.4 billion in the year-ago quarter.

•Equity in net income of affiliates was $0.3 billion, primarily from the DIRECTV investment. With adjustment for our proportionate share of intangible amortization, adjusted equity in net income from the DIRECTV investment* was $0.6 billion.

•Net income was $3.9 billion versus $4.8 billion in the year-ago quarter.

•Net income attributable to common stock was $3.5 billion versus $4.4 billion in the year-ago quarter. Earnings per diluted common share was $0.49 versus $0.61 in the year-ago quarter. Adjusting for $0.08, which includes restructuring costs, our proportionate share of intangible amortization from the DIRECTV equity method investment, and other items, adjusted earnings per diluted common share* was $0.57 compared to $0.63 in the year-ago quarter.

•Adjusted EBITDA* was $11.3 billion versus $11.1 billion in the year-ago quarter.

•Cash from operating activities was $9.1 billion, down $0.8 billion year over year, due to timing of working capital, including lower receivable sales partly offset by lower device payments.

•Capital expenditures were $4.4 billion in the quarter versus $4.3 billion in the year-ago quarter.

Capital investment* totaled $4.9 billion versus $5.9 billion in the year-ago quarter. In the quarter, cash payments for vendor financing totaled $0.6 billion versus $1.6 billion in the year-ago quarter.

•Free cash flow* was $4.6 billion for the quarter versus $4.2 billion in the year-ago quarter.

•Total debt was $130.6 billion at the end of the second quarter, and net debt* was $126.9 billion. In the quarter, the company repaid $2.2 billion of long-term debt.

* Further clarification and explanation of non-GAAP measures and reconciliations to their most comparable GAAP measures can be found in the “Non-GAAP Measures and Reconciliations to GAAP Measures” section of the release and at https://investors.att.com.

© 2024 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.

Segment and Business Unit Results

| Communications Segment | |||||||||||

| Dollars in millions | Second Quarter | Percent | |||||||||

| Unaudited | 2024 | 2023 | Change | ||||||||

| Operating Revenues | $ | 28,582 | $ | 28,845 | (0.9)% | ||||||

| Operating Income | 7,005 | 7,177 | (2.4)% | ||||||||

| Operating Income Margin | 24.5% | 24.9% | (40 BP) | ||||||||

Communications segment revenues were $28.6 billion, down 0.9% year over year, with operating income down 2.4%.

| Mobility | |||||||||||

| Dollars in millions; Subscribers in thousands | Second Quarter | Percent | |||||||||

| Unaudited | 2024 | 2023 | Change | ||||||||

| Operating Revenues | $ | 20,480 | $ | 20,315 | 0.8% | ||||||

| Service | 16,277 | 15,745 | 3.4% | ||||||||

| Equipment | 4,203 | 4,570 | (8.0%) | ||||||||

| Operating Expenses | 13,761 | 13,702 | 0.4% | ||||||||

| Operating Income | 6,719 | 6,613 | 1.6% | ||||||||

| Operating Income Margin | 32.8% | 32.6% | 20 BP | ||||||||

| EBITDA* | $ | 9,195 | $ | 8,736 | 5.3% | ||||||

| EBITDA Margin* | 44.9% | 43.0% | 190 BP | ||||||||

| EBITDA Service Margin* | 56.5% | 55.5% | 100 BP | ||||||||

Total Wireless Net Adds (excl. Connected Devices)1 | 997 | 1,063 | |||||||||

| Postpaid | 593 | 464 | |||||||||

| Postpaid Phone | 419 | 326 | |||||||||

| Postpaid Other | 174 | 138 | |||||||||

| Prepaid Phone | 35 | 123 | |||||||||

| Postpaid Churn | 0.85% | 0.95% | (10 BP) | ||||||||

| Postpaid Phone-Only Churn | 0.70% | 0.79% | (9 BP) | ||||||||

| Prepaid Churn | 2.57% | 2.50% | 7 BP | ||||||||

| Postpaid Phone ARPU | $56.42 | $55.63 | 1.4% | ||||||||

Mobility revenues were up 0.8% year over year, driven by service revenue growth of 3.4% from subscriber gains and postpaid phone average revenue per subscriber (ARPU) growth, offset by lower equipment revenues due to lower sales volumes. Operating expenses were up 0.4% year over year due to higher depreciation expense from Open RAN deployment and network transformation, partially offset by lower equipment expenses resulting from lower sales volumes. Operating income was $6.7 billion, up 1.6% year over year. EBITDA* was $9.2 billion, up $459 million year over year, driven by service revenue growth. This was the company’s highest-ever second-quarter Mobility EBITDA*.

* Further clarification and explanation of non-GAAP measures and reconciliations to their most comparable GAAP measures can be found in the “Non-GAAP Measures and Reconciliations to GAAP Measures” section of the release and at https://investors.att.com.

© 2024 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.

| Business Wireline | |||||||||||

| Dollars in millions | Second Quarter | Percent | |||||||||

| Unaudited | 2024 | 2023 | Change | ||||||||

| Operating Revenues | $ | 4,755 | $ | 5,279 | (9.9)% | ||||||

| Operating Expenses | 4,653 | 4,883 | (4.7)% | ||||||||

| Operating Income | 102 | 396 | (74.2)% | ||||||||

| Operating Income Margin | 2.1% | 7.5% | (540 BP) | ||||||||

| EBITDA* | $ | 1,488 | $ | 1,729 | (13.9)% | ||||||

| EBITDA Margin* | 31.3% | 32.8% | (150 BP) | ||||||||

Business Wireline revenues and profitability declined year over year driven by continued secular pressures on legacy voice and data services that were partially offset by growth in fiber and other advanced connectivity services.

Business Wireline revenues were down 9.9% year over year, primarily due to lower demand for legacy voice and data services as well as product simplification, partially offset by growth in connectivity services. Results also reflect the second-quarter 2024 contribution of our cybersecurity business into a new joint venture. Operating expenses were down 4.7% year over year due to lower personnel, network access and customer support expenses, partially offset by higher vendor credits in the prior year quarter. Operating income was $102 million versus $396 million in the prior-year quarter, and EBITDA* was $1.5 billion, down $241 million year over year.

| Consumer Wireline | |||||||||||

| Dollars in millions; Subscribers in thousands | Second Quarter | Percent | |||||||||

| Unaudited | 2024 | 2023 | Change | ||||||||

| Operating Revenues | $ | 3,347 | $ | 3,251 | 3.0% | ||||||

| Broadband | 2,741 | 2,561 | 7.0% | ||||||||

| Operating Expenses | 3,163 | 3,083 | 2.6% | ||||||||

| Operating Income | 184 | 168 | 9.5% | ||||||||

| Operating Income Margin | 5.5% | 5.2% | 30 BP | ||||||||

| EBITDA* | $ | 1,098 | $ | 1,025 | 7.1% | ||||||

| EBITDA Margin* | 32.8% | 31.5% | 130 BP | ||||||||

| Broadband Net Adds (excluding DSL) | 52 | (35) | |||||||||

| Fiber | 239 | 251 | |||||||||

| Non Fiber | (187) | (286) | |||||||||

| AT&T Internet Air | 139 | 2 | |||||||||

| Broadband ARPU | $ | 66.17 | $ | 62.26 | 6.3% | ||||||

| Fiber ARPU | $ | 69.00 | $ | 66.70 | 3.4% | ||||||

Consumer Wireline achieved strong revenue growth with improving EBITDA margins*. Consumer Wireline also delivered positive broadband net adds for the fourth consecutive quarter, driven by 239,000 AT&T Fiber net adds and 139,000 AT&T Internet Air net adds.

Consumer Wireline revenues were up 3.0% year over year driven by growth in broadband revenues attributable to fiber revenues, which grew 17.9%, partially offset by declines in legacy voice and data services and other services. Operating expenses were up 2.6% year over year, primarily due to higher depreciation and increased network-related costs, which were largely offset by lower customer support costs. Operating income was $184 million versus $168 million in the prior-year quarter, and EBITDA* was $1.1 billion, up $73 million year over year.

* Further clarification and explanation of non-GAAP measures and reconciliations to their most comparable GAAP measures can be found in the “Non-GAAP Measures and Reconciliations to GAAP Measures” section of the release and at https://investors.att.com.

© 2024 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.

| Latin America Segment - Mexico | |||||||||||

| Dollars in millions; Subscribers in thousands | Second Quarter | Percent | |||||||||

| Unaudited | 2024 | 2023 | Change | ||||||||

| Operating Revenues | $ | 1,103 | $ | 967 | 14% | ||||||

| Service | 699 | 635 | 10% | ||||||||

| Equipment | 404 | 332 | 22% | ||||||||

| Operating Expenses | 1,097 | 1,006 | 9% | ||||||||

| Operating Income/(Loss) | 6 | (39) | —% | ||||||||

| EBITDA* | 178 | 146 | 22% | ||||||||

| Total Wireless Net Adds | 177 | 76 | |||||||||

| Postpaid | 142 | 56 | |||||||||

| Prepaid | 67 | 50 | |||||||||

| Reseller | (32) | (30) | |||||||||

Latin America segment revenues were up 14.1% year over year, primarily due to higher equipment sales, subscriber growth, and favorable impacts of foreign exchange rates. Operating expenses were up 9.0% due to higher equipment and selling costs attributable to subscriber growth and unfavorable impact of foreign exchange. Operating income was $6 million compared to ($39) million in the year-ago quarter. EBITDA* was $178 million, up $32 million year over year.

1 Effective with our first-quarter 2024 reporting, we have removed connected devices from our total Mobility subscribers, consistent with industry standards and our key performance metrics. Connected devices include data-centric devices such as session-based tablets, monitoring devices and primarily wholesale automobile systems.

About AT&T

We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect to greater possibility. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. (NYSE:T), please visit us at about.att.com. Investors can learn more at investors.att.com.

Cautionary Language Concerning Forward-Looking Statements

Information set forth in this news release contains financial estimates and other forward-looking statements that are subject to risks and uncertainties, and actual results might differ materially. A discussion of factors that may affect future results is contained in AT&T’s filings with the Securities and Exchange Commission. AT&T disclaims any obligation to update and revise statements contained in this news release based on new information or otherwise. This news release may contain certain non-GAAP financial measures. Reconciliations between the non-GAAP financial measures and the GAAP financial measures are available on the company’s website at https://investors.att.com.

Non-GAAP Measures and Reconciliations to GAAP Measures

Schedules and reconciliations of non-GAAP financial measures cited in this document to the most directly comparable financial measures under generally accepted accounting principles (GAAP) can be found at https://investors.att.com and in our Form 8-K dated July 24, 2024. Adjusted diluted EPS, adjusted operating income, EBITDA, adjusted EBITDA, free cash flow, net debt and net debt-to-adjusted EBITDA are non-GAAP financial measures frequently used by investors and credit rating agencies.

* Further clarification and explanation of non-GAAP measures and reconciliations to their most comparable GAAP measures can be found in the “Non-GAAP Measures and Reconciliations to GAAP Measures” section of the release and at https://investors.att.com.

© 2024 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.

Adjusted diluted EPS is calculated by excluding from operating revenues, operating expenses, other income (expenses) and income tax expense, certain significant items that are non-operational or non-recurring in nature, including dispositions and merger integration and transaction costs, actuarial gains and losses, significant abandonments and impairments, benefit-related gains and losses, employee separation and other material gains and losses.

Non-operational items arising from asset acquisitions and dispositions include the amortization of intangible assets. While the expense associated with the amortization of certain wireless licenses and customer lists is excluded, the revenue of the acquired companies is reflected in the measure and those assets contribute to revenue generation.

We also adjust for net actuarial gains or losses associated with our pension and postemployment benefit plans due to the often-significant impact on our results (we immediately recognize this gain or loss in the income statement, pursuant to our accounting policy for the recognition of actuarial gains and losses). Consequently, our adjusted results reflect an expected return on plan assets rather than the actual return on plan assets, as included in the GAAP measure of income.

The tax impact of adjusting items is calculated using the effective tax rate during the quarter except for adjustments that, given their magnitude, can drive a change in the effective tax rate, in these cases we use the actual tax expense or combined marginal rate of approximately 25%.

For 2Q24, adjusted EPS of $0.57 is diluted EPS of $0.49 adjusted for $0.05 restructuring costs and $0.03 proportionate share of intangible amortization at the DIRECTV equity method investment.

For 2Q23, adjusted EPS of $0.63 is diluted EPS of $0.61 adjusted for $0.03 proportionate share of intangible amortization at the DIRECTV equity method investment, minus $0.01 net actuarial and settlement gains on benefit plans.

The company expects adjustments to 2024 reported diluted EPS to include our proportionate share of intangible amortization at the DIRECTV equity method investment in the range of $0.5-$0.7 billion, a non-cash mark-to-market benefit plan gain/loss, and other items. The company expects the mark-to-market adjustment, which is driven by interest rates and investment returns that are not reasonably estimable at this time, to be a significant item. Our projected 2024 and 2025 adjusted EPS depend on future levels of revenues and expenses, most of which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between these projected non-GAAP metrics and the reported GAAP metrics without unreasonable effort.

Adjusted operating income is operating income adjusted for revenues and costs we consider non-operational in nature, including items arising from asset acquisitions or dispositions. For 2Q24, adjusted operating income of $6.3 billion is calculated as operating income of $5.8 billion plus $520 million of adjustments. For 2Q23, adjusted operating income of $6.4 billion is calculated as operating income of $6.4 billion minus $11 million of adjustments. Adjustments for all periods are detailed in the Discussion and Reconciliation of Non-GAAP Measures included in our Form 8-K dated July 24, 2024.

EBITDA is net income plus income tax, interest, and depreciation and amortization expenses minus equity in net income of affiliates and other income (expense) – net. Adjusted EBITDA is calculated by excluding from EBITDA certain significant items that are non-operational or non-recurring in nature, including dispositions and merger integration and transaction costs, significant abandonments and impairments, benefit-related gains and losses, employee separation and other material gains and losses. Adjusted EBITDA estimates depend on future levels of revenues and expenses which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between projected adjusted EBITDA and the most comparable GAAP metrics without unreasonable effort.

* Further clarification and explanation of non-GAAP measures and reconciliations to their most comparable GAAP measures can be found in the “Non-GAAP Measures and Reconciliations to GAAP Measures” section of the release and at https://investors.att.com.

© 2024 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.

For 2Q24, adjusted EBITDA of $11.3 billion is calculated as net income of $3.9 billion, plus income tax expense of $1.1 billion, plus interest expense of $1.7 billion, minus equity in net income of affiliates of $0.3 billion, minus other income (expense) – net of $0.7 billion, plus depreciation and amortization of $5.1 billion, plus adjustments of $505 million. For 2Q23, adjusted EBITDA of $11.1 billion is calculated as net income of $4.8 billion, plus income tax expense of $1.4 billion, plus interest expense of $1.6 billion, minus equity in net income of affiliates of $0.4 billion, minus other income (expense) – net of $1.0 billion, plus depreciation and amortization of $4.7 billion, minus adjustments of $28 million. Adjustments for all periods are detailed in the Discussion and Reconciliation of Non-GAAP Measures included in our Form 8-K dated July 24, 2024.

At the segment or business unit level, EBITDA is operating income before depreciation and amortization. EBITDA margin is operating income before depreciation and amortization, divided by total revenues. EBITDA service margin is operating income before depreciation and amortization, divided by total service revenues.

Free cash flow for 2Q24 of $4.6 billion is cash from operating activities of $9.1 billion, plus cash distributions from DIRECTV classified as investing activities of $0.4 billion, minus capital expenditures of $4.4 billion and cash paid for vendor financing of $0.6 billion. For 2Q23, free cash flow of $4.2 billion is cash from operating activities of $9.9 billion, plus cash distributions from DIRECTV classified as investing activities of $0.2 billion, minus capital expenditures of $4.3 billion and cash paid for vendor financing of $1.6 billion. Due to high variability and difficulty in predicting items that impact cash from operating activities, cash distributions from DIRECTV, capital expenditures and vendor financing payments, the company is not able to provide a reconciliation between projected free cash flow and the most comparable GAAP metric without unreasonable effort.

Capital investment provides a comprehensive view of cash used to invest in our networks, product developments and support systems. In connection with capital improvements, we have favorable payment terms of 120 days or more with certain vendors, referred to as vendor financing, which are excluded from capital expenditures and reported as financing activities. Capital investment includes capital expenditures and cash paid for vendor financing ($0.6 billion in 2Q24 and $1.6 billion in 2Q23). For 2024, capital investment is expected to be in the $21-$22 billion range. Due to high variability and difficulty in predicting items that impact capital expenditures and vendor financing payments, the company is not able to provide a reconciliation between projected capital investment and the most comparable GAAP metrics without unreasonable effort.

Adjusted equity in net income from DIRECTV investment of $0.6 billion for 2Q24 is calculated as equity income from DIRECTV of $0.4 billion reported in Equity in Net Income of Affiliates and excludes $0.3 billion of AT&T’s proportionate share of the noncash depreciation and amortization of fair value accretion from DIRECTV’s revaluation of assets and purchase price allocation.

Net debt of $126.9 billion at June 30, 2024, is calculated as total debt of $130.6 billion less cash and cash equivalents of $3.1 billion and time deposits (i.e. deposits at financial institutions that are greater than 90 days) of $0.7 billion.

Net debt-to-adjusted EBITDA is calculated by dividing net debt by the sum of the most recent four quarters of adjusted EBITDA. Net debt and adjusted EBITDA are calculated as defined above. Net debt and adjusted EBITDA estimates depend on future levels of revenues, expenses and other metrics which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between projected net debt-to-adjusted EBITDA and the most comparable GAAP metrics and related ratios without unreasonable effort.

For more information, contact:

Brittany Siwald

AT&T Inc.

Phone: (214) 202-6630

Email: brittany.a.siwald@att.com

* Further clarification and explanation of non-GAAP measures and reconciliations to their most comparable GAAP measures can be found in the “Non-GAAP Measures and Reconciliations to GAAP Measures” section of the release and at https://investors.att.com.

© 2024 AT&T Intellectual Property. All rights reserved. AT&T and the Globe logo are registered trademarks of AT&T Intellectual Property.