- CLR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC TO-T Filing

Continental Resources Inc (CLR) SC TO-TThird party tender offer statement

Filed: 24 Oct 22, 5:23pm

Exhibit (a)(1)(ii)

CONTINENTAL RESOURCES, INC.

LETTER OF TRANSMITTAL

To Tender Shares of Common Stock of Continental Resources, Inc. at $74.28 Per Share in Cash Pursuant to the Offer to Purchase dated October 24, 2022 by Omega Acquisition, Inc., an entity wholly-owned by Harold G. Hamm

THE OFFER AND WITHDRAWAL RIGHTS EXPIRE AT ONE MINUTE AFTER 11:59 P.M., NEW YORK CITY TIME, ON MONDAY, NOVEMBER 21, 2022, UNLESS THE OFFER IS EXTENDED (SUCH TIME, AS IT MAY BE EXTENDED, THE “EXPIRATION TIME”) OR EARLIER TERMINATED.

Method of delivery of the certificate(s) is at the option and risk of the owner thereof. See Instruction 2.

Mail or deliver this Letter of Transmittal, together with the certificate(s) representing your shares, to:

| By Overnight Courier: | By Regular, Registered, Certified or Express Mail: | |

American Stock Transfer & Trust Company, LLC c/o Operations Center Attn: Reorganization Department 6201 15th Avenue Brooklyn, New York 11219 | American Stock Transfer & Trust Company, LLC c/o Operations Center Attn: Reorganization Department 6201 15th Avenue Brooklyn, New York 11219 |

By Facsimile: (718) 765-8758

Pursuant to the offer of Omega Acquisition, Inc. to purchase any and all outstanding Shares (as defined below) of Continental Resources, Inc. (other than: (i) Shares owned by the Founder (as defined below), certain of the Founder’s family members and their affiliated entities; and (ii) Shares underlying unvested Company restricted stock awards (such Shares, together with the Shares referred to in clause (i), the “Rollover Shares”)), the undersigned encloses herewith and surrenders the following certificate(s) representing Shares:

DESCRIPTION OF SHARES SURRENDERED | ||||||||

Name(s) and Address(es) of Registered Owner(s) (If blank, please fill in exactly as name(s) appear(s) on share certificate(s)) | Shares Surrendered (attached additional list if necessary) | |||||||

Certificated Shares** | ||||||||

Certificate Number(s)* | Total Number of Shares Represented by Certificate(s)* | Number of Shares Surrendered** | Book Entry Shares Surrendered | |||||

| Total Shares | ||||||||

* Need not be completed by book-entry shareholders. ** Unless otherwise indicated, it will be assumed that all shares of common stock represented by certificates described above are being tendered and surrendered hereby. | ||||||||

PLEASE READ THE INSTRUCTIONS ACCOMPANYING THIS LETTER OF TRANSMITTAL CAREFULLY BEFORE COMPLETING THIS LETTER OF TRANSMITTAL.

IF YOU WOULD LIKE ADDITIONAL COPIES OF THIS LETTER OF TRANSMITTAL OR ANY OF THE OTHER OFFERING DOCUMENTS, YOU SHOULD CONTACT THE INFORMATION AGENT, D.F. KING & CO., INC., FOR SHAREHOLDERS AT (800) 714-3312 (TOLL FREE), OR FOR BANKS AND BROKERS AT (212) 269-5550.

You have received this Letter of Transmittal in connection with the offer of Omega Acquisition, Inc., an Oklahoma corporation, 100% of the capital stock of which is owned by Harold G. Hamm (the “Founder”), a natural person residing in the State of Oklahoma and an affiliate of Continental Resources, Inc., an Oklahoma corporation (the “Company”), to purchase any and all outstanding shares of common stock, par value $0.01 per share (the “Shares”), of the Company, other than: (i) Shares owned by the Founder, certain of the Founder’s family members and their affiliated entities; and (ii) Shares underlying unvested Company restricted stock awards, for $74.28 per Share, in cash, without interest and subject to deduction for any required withholding taxes as described in the Offer to Purchase, dated October 24, 2022 (as it may be amended or supplemented from time to time, the “Offer to Purchase” and which, together with this Letter of Transmittal, as it may be amended or supplemented from time to time, constitutes the “Offer”).

You should use this Letter of Transmittal to deliver to American Stock Transfer & Trust Company, LLC (the “Depositary”) Shares represented by stock certificates, or held in book-entry form on the books of the Company, for tender. If you are delivering your Shares by book-entry transfer to an account maintained by the Depositary at The Depository Trust Company (“DTC”), you must use an Agent’s Message (as defined in Instruction 2 below). In this Letter of Transmittal, shareholders who deliver certificates representing their Shares are referred to as “Certificate Shareholders,” and shareholders who deliver their Shares through book-entry transfer are referred to as “Book-Entry Shareholders.”

If certificates for your Shares are not immediately available or you cannot deliver your certificates and all other required documents to the Depositary prior to the Expiration Time or you cannot complete the book-entry transfer procedures prior to the Expiration Time, you may nevertheless tender your Shares according to the guaranteed delivery procedures set forth in Section 3 of the Offer to Purchase. See Instruction 2 below. Delivery of documents to DTC will not constitute delivery to the Depositary.

☐ CHECK HERE IF TENDERED SHARES ARE BEING DELIVERED BY BOOK-ENTRY TRANSFER TO THE ACCOUNT MAINTAINED BY THE DEPOSITARY WITH DTC AND COMPLETE THE FOLLOWING (ONLY FINANCIAL INSTITUTIONS THAT ARE PARTICIPANTS IN DTC MAY DELIVER SHARES BY BOOK-ENTRY TRANSFER):

Name of Tendering Institution:

DTC Participant Number:

Transaction Code Number:

☐ CHECK HERE IF TENDERED SHARES ARE BEING DELIVERED PURSUANT TO A NOTICE OF GUARANTEED DELIVERY PREVIOUSLY SENT TO THE DEPOSITARY AND COMPLETE THE FOLLOWING (PLEASE ENCLOSE A PHOTOCOPY OF SUCH NOTICE OF GUARANTEED DELIVERY):

Name(s) of Registered Owner(s):

Window Ticket Number (if any) or DTC Participant Number:

Date of Execution of Notice of Guaranteed Delivery:

Name of Institution which Guaranteed Delivery: |

2

NOTE: SIGNATURES MUST BE PROVIDED BELOW.

PLEASE READ THE ACCOMPANYING INSTRUCTIONS CAREFULLY.

Ladies and Gentlemen:

The undersigned hereby tenders to Omega Acquisition, Inc., an Oklahoma corporation (the “Purchaser”), 100% of the capital stock of which is owned by Harold G. Hamm (the “Founder”), a natural person residing in the State of Oklahoma and an affiliate of Continental Resources, Inc., an Oklahoma corporation (the “Company”), the above described shares of common stock, par value $0.01 per share (the “Shares”) of the Company in exchange for $74.28 per Share, in cash, without interest and subject to deduction for any required withholding taxes, on the terms and subject to the conditions set forth in the Offer to Purchase, dated October 24, 2022 (as it may be amended or supplemented from time to time, the “Offer to Purchase”), receipt of which is hereby acknowledged, and this Letter of Transmittal (as it may be amended or supplemented from time to time, this “Letter of Transmittal” and which, together with the Offer to Purchase, as it may be amended or supplemented from time to time, constitutes the “Offer”). The Offer is being made pursuant to the Agreement and Plan of Merger, dated as of October 16, 2022 (as amended from time to time, the “Merger Agreement”), between the Company and the Purchaser. The Merger Agreement provides that promptly (and, in any event, within two business days) after the expiration of the Offer, and subject to the terms and conditions of the Merger Agreement, the Purchaser will accept for payment and pay for, or cause to be paid for, all Shares validly tendered and not withdrawn pursuant to the Offer (the time at which Shares may be first accepted for payment under the Offer, the “Acceptance Time”). Immediately prior to the Acceptance Time, the Founder will contribute 100% of the capital stock of the Purchaser to the Company, as a result of which the Purchaser will become a wholly-owned subsidiary of the Company. The Merger Agreement provides, among other things, that as soon as practicable following the Acceptance Time, and under the terms of the Merger Agreement as described in the Offer to Purchase, the Purchaser will effect the Merger (defined in the Offer to Purchase). The undersigned understands that the Purchaser reserves the right to transfer or assign, from time to time, in whole or in part, to one or more of its affiliates, the right to purchase the Shares tendered herewith.

On the terms and subject to the conditions of the Offer (including, if the Offer is extended or amended, the terms and conditions of such extension or amendment), subject to, and effective upon, acceptance for payment and payment for the Shares validly tendered herewith, and not properly withdrawn, prior to the Expiration Time in accordance with the terms of the Offer, the undersigned hereby sells, assigns and transfers to, or upon the order of, the Purchaser, all right, title and interest in and to all of the Shares being tendered hereby. In addition, the undersigned hereby irrevocably appoints American Stock Transfer & Trust Company, LLC (the “Depositary”) the true and lawful agent and attorney-in-fact and proxy of the undersigned with respect to such Shares with full power of substitution (such proxies and power of attorney being deemed to be an irrevocable power coupled with an interest in the tendered shares) to the full extent of such shareholder’s rights with respect to such Shares: (a) to deliver certificates representing Shares (the “Share Certificates”), or transfer of ownership of such Shares on the account books maintained by DTC, together, in either such case, with all accompanying evidence of transfer and authenticity, to or upon the order of the Purchaser; (b) to present such Shares for transfer on the books of the Company; and (c) to receive all benefits and otherwise exercise all rights of beneficial ownership of such Shares, all in accordance with the terms and subject to the conditions of the Offer.

The undersigned hereby irrevocably appoints each of the designees of the Purchaser the attorneys-in-fact and proxies of the undersigned, each with full power of substitution, to the full extent of such shareholder’s rights with respect to the Shares tendered hereby which have been accepted for payment. The designees of the Purchaser will, with respect to the Shares for which the appointment is effective, be empowered to exercise all voting and any other rights of such shareholder, as they, in their sole discretion, may deem proper at any annual, special, adjourned or postponed meeting of the Company’s shareholders, by written consent in lieu of any such meeting or otherwise. This proxy and power of attorney shall be irrevocable and coupled with an interest in the tendered Shares. Such appointment is effective when, and only to the extent that, the Purchaser accepts the Shares tendered with this Letter of Transmittal for payment pursuant to the Offer. Upon the effectiveness of such appointment, without further action, all prior powers of attorney, proxies and consents given by the undersigned with respect to such Shares will be revoked and no subsequent powers of attorney, proxies, consents or revocations may be given (and, if given, will not be deemed effective). The Purchaser reserves the right to require that, in order for Shares to be deemed validly tendered, immediately upon the Purchaser’s acceptance for payment of such Shares, the Purchaser must be able to exercise full voting, consent and other rights, to the extent permitted under applicable law, with respect to such Shares, including voting at any meeting of shareholders or executing a written consent concerning any matter.

3

The undersigned hereby represents and warrants that the undersigned has full power and authority to tender, sell, assign and transfer the Shares tendered hereby and, when the same are accepted for payment by the Purchaser, the Purchaser will acquire good, marketable and unencumbered title thereto, free and clear of all liens, restrictions, charges and encumbrances, and the same will not be subject to any adverse claim. The undersigned hereby represents and warrants that the undersigned is the registered owner of the Shares, or the Share Certificate(s) have been endorsed to the undersigned in blank, or the undersigned is a participant in DTC whose name appears on a security position listing as the owner of the Shares. The undersigned will, upon request, execute and deliver any additional documents deemed by the Depositary or the Purchaser to be necessary or desirable to complete the sale, assignment and transfer of the Shares tendered hereby.

It is understood that the undersigned will not receive payment for the Shares unless and until the Shares are accepted for payment and until the Share Certificate(s) owned by the undersigned are received by the Depositary at the address set forth above, together with such additional documents as the Depositary may require, or, in the case of Shares held in book-entry form, ownership of Shares is validly transferred on the account books maintained by DTC, and until the same are processed for payment by the Depositary.

IT IS UNDERSTOOD THAT THE METHOD OF DELIVERY OF THE SHARES, THE SHARE CERTIFICATE(S) AND ALL OTHER REQUIRED DOCUMENTS (INCLUDING DELIVERY THROUGH DTC) IS AT THE OPTION AND RISK OF THE UNDERSIGNED AND THAT THE RISK OF LOSS OF SUCH SHARES, SHARE CERTIFICATE(S) AND OTHER DOCUMENTS SHALL PASS ONLY AFTER THE DEPOSITARY HAS ACTUALLY RECEIVED THE SHARES OR SHARE CERTIFICATE(S) (INCLUDING, IN THE CASE OF A BOOK-ENTRY TRANSFER, BY BOOK-ENTRY CONFIRMATION (AS DEFINED BELOW)). IF DELIVERY IS BY MAIL, IT IS RECOMMENDED THAT ALL SUCH DOCUMENTS BE SENT BY PROPERLY INSURED REGISTERED MAIL WITH RETURN RECEIPT REQUESTED. DELIVERY WILL BE DEEMED EFFECTIVE AND RISK OF LOSS AND TITLE WILL PASS FROM THE OWNER ONLY WHEN RECEIVED BY THE DEPOSITARY. IN ALL CASES, SUFFICIENT TIME SHOULD BE ALLOWED TO ENSURE TIMELY DELIVERY.

All authority conferred or agreed to be conferred pursuant to this Letter of Transmittal shall not be affected by, and shall survive, the death or incapacity of the undersigned and any obligation of the undersigned hereunder shall be binding upon the heirs, executors, administrators, trustees in bankruptcy, personal representatives, successors and assigns of the undersigned. Except as stated in the Offer to Purchase, this tender is irrevocable.

The undersigned understands that the acceptance for payment by the Purchaser of Shares tendered pursuant to one of the procedures described in Section 3 of the Offer to Purchase and in the instructions hereto will constitute a binding agreement between the undersigned and the Purchaser upon the terms and subject to the conditions of the Offer.

Unless otherwise indicated herein under “Special Payment Instructions,” please issue the check for the purchase price in the name(s) of, and/or return any Share Certificates representing Shares not tendered or accepted for payment to, the registered owner(s) appearing under “Description of Shares Tendered.” Similarly, unless otherwise indicated under “Special Delivery Instructions,” please mail the check for the purchase price and/or return any Share Certificates representing Shares not tendered or accepted for payment (and accompanying documents, as appropriate) to the address(es) of the registered owner(s) appearing under “Description of Shares Tendered.” In the event that both the Special Delivery Instructions and the Special Payment Instructions are completed, please issue the check for the purchase price and/or issue any Share Certificates representing Shares not tendered or accepted for payment (and any accompanying documents, as appropriate) in the name of, and deliver such check and/or return such Share Certificates (and any accompanying documents, as appropriate) to, the person or persons so indicated. Unless otherwise indicated herein in the box titled “Special Payment Instructions,” please credit any Shares tendered hereby or by an Agent’s Message and delivered by book-entry transfer, but which are not purchased, by crediting the account at DTC designated above. The undersigned recognizes that the Purchaser has no obligation pursuant to the Special Payment Instructions to transfer any Shares from the name of the registered owner thereof if the Purchaser does not accept for payment any of the Shares so tendered.

4

SPECIAL PAYMENT INSTRUCTIONS

(See Instructions 1, 4, 5 and 7)

To be completed ONLY if Share Certificate(s) not tendered or not accepted for payment and/or the check for the purchase price in consideration of Shares accepted for payment are to be issued in the name of someone other than the undersigned or if Shares tendered by book-entry transfer which are not accepted for payment are to be returned by credit to an account maintained at DTC other than that designated above.

| Issue: ☐ Check and/or ☐ Share Certificates to: | ||

| Name: | ||

| (Please Print) | ||

| Address: | ||

| ||

| ||

| (Include Zip Code) | ||

| ||

| (Tax Identification or Social Security Number) | ||

☐ Credit Shares tendered by book-entry transfer that are not accepted for payment to the DTC account set forth below.

| ||

(DTC Account Number) | ||

SPECIAL DELIVERY INSTRUCTIONS

(See Instructions 1, 4, 5 and 7)

To be completed ONLY if Share Certificate(s) not tendered or not accepted for payment and/or the check for the purchase price of Shares accepted for payment are to be sent to someone other than the undersigned or to the undersigned at an address other than that shown in the box titled “Description of Shares Tendered” above.

| Deliver: ☐ Check(s) and/or ☐ Share Certificates to: | ||

| Name: | ||

| (Please Print) | ||

| Address: | ||

| ||

| ||

| (Include Zip Code) | ||

5

IMPORTANT—SIGN HERE

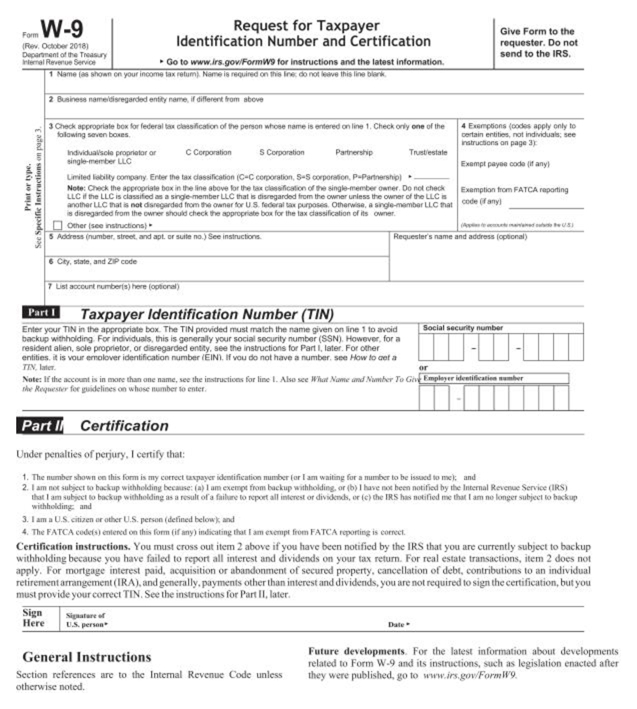

(U.S. Holders Please Also Complete the Enclosed IRS Form W-9)

(Non-U.S. Holders Please Obtain and Complete Appropriate IRS Form W-8)

(Signature(s) of Shareholder(s))

Dated: , 2022

(Must be signed by registered owner(s) exactly as name(s) appear(s) on Share Certificate(s) or on a security position listing or by person(s) authorized to become registered owner(s) by certificates and documents transmitted herewith. If signature is by trustees, executors, administrators, guardians, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, please set forth full title and see Instruction 5. For information concerning signature guarantees, see Instruction 1.)

| Name(s): | ||

| (Please Print) | ||

| Capacity (full title): | ||

| Address: | ||

| ||

| ||

| (Include Zip Code) | ||

| Area Code and Telephone Number: | ||

| Email Address: | ||

| Tax Identification or Social Security No.: | ||

GUARANTEE OF SIGNATURE(S)

(For use by Eligible Institutions only:

see Instructions 1 and 5)

| Name of Firm: | ||

| ||

| (Include Zip Code) | ||

| Authorized Signature: | ||

| Name: | ||

| ||

| (Please Type or Print) | ||

| Area Code and Telephone Number: | ||

Dated: ______________, 20__

| ||

Place medallion guarantee in space below: | ||

6

INSTRUCTIONS

Forming Part of the Terms and Conditions of the Offer

1. Guarantee of Signatures. Except as otherwise provided below, all signatures on this Letter of Transmittal must be guaranteed by a financial institution (including most commercial banks, savings and loan associations and brokerage houses) that is a member in good standing of a recognized Medallion Program approved by the Securities Transfer Association, Inc., including the Security Transfer Agents Medallion Program, the New York Stock Exchange Medallion Signature Program and the Stock Exchanges Medallion Program (each, an “Eligible Institution”). Signatures on this Letter of Transmittal need not be guaranteed (a) if this Letter of Transmittal is signed by the registered owner(s) (which term, for purposes of this document, includes any participant in any of DTC’s systems whose name appears on a security position listing as the owner of the Shares) of Shares tendered herewith and such registered owner has not completed the box titled “Special Payment Instructions” or the box titled “Special Delivery Instructions” on this Letter of Transmittal or (b) if such Shares are tendered for the account of an Eligible Institution. See Instruction 5.

2. Delivery of Letter of Transmittal and Certificates or Book-Entry Confirmations. This Letter of Transmittal is to be completed by shareholders if Share Certificates are to be forwarded herewith. If tenders are to be made pursuant to the procedures for tender by book-entry transfer at DTC set forth in Section 3 of the Offer to Purchase, an Agent’s Message must be utilized. A manually executed facsimile of this document may be used in lieu of the original. Share Certificates representing all physically tendered Shares, or confirmation of any book-entry transfer into the Depositary’s account at DTC of Shares tendered by book-entry transfer (“Book Entry Confirmation”), as well as this Letter of Transmittal properly completed and duly executed with any required signature guarantees, or an Agent’s Message in the case of a book-entry transfer at DTC, and any other documents required by this Letter of Transmittal, must be received by the Depositary at its address set forth herein prior to the Expiration Time (as defined in Section 1 of the Offer to Purchase). Please do not send your Share Certificates directly to the Purchaser, the Founder or the Company.

Shareholders whose Share Certificates are not immediately available or who cannot deliver all other required documents to the Depositary prior to the Expiration Time or who cannot complete the procedures for book-entry transfer prior to the Expiration Time may nevertheless tender their Shares by properly completing and duly executing a Notice of Guaranteed Delivery pursuant to the guaranteed delivery procedure set forth in Section 3 of the Offer to Purchase. Pursuant to such procedure: (a) such tender must be made by or through an Eligible Institution, (b) a properly completed and duly executed Notice of Guaranteed Delivery substantially in the form provided by the Purchaser must be received by the Depositary prior to the Expiration Time, and (c) Share Certificates representing all tendered Shares, in proper form for transfer (or a Book Entry Confirmation with respect to such Shares), this Letter of Transmittal (or facsimile thereof), properly completed and duly executed with any required signature guarantees (or, in the case of a book-entry transfer, an Agent’s Message), and all other documents required by this Letter of Transmittal, if any, must be received by the Depositary within two New York Stock Exchange trading days after the date of execution of such Notice of Guaranteed Delivery.

A properly completed and duly executed Letter of Transmittal (or facsimile thereof) must accompany each such delivery of Share Certificates to the Depositary.

The term “Agent’s Message” means a message, transmitted through electronic means by DTC to, and received by, the Depositary and forming part of a Book-Entry Confirmation, which states that DTC has received an express acknowledgment from the participant in DTC tendering the Shares which are the subject of such Book-Entry Confirmation that such participant has received and agrees to be bound by the terms of this Letter of Transmittal and that the Purchaser may enforce such agreement against the participant. The term “Agent’s Message” also includes any hard copy printout evidencing such message generated by a computer terminal maintained at the Depositary’s office.

THE METHOD OF DELIVERY OF THE SHARES, THIS LETTER OF TRANSMITTAL AND ALL OTHER REQUIRED DOCUMENTS, INCLUDING DELIVERY THROUGH DTC, IS AT THE ELECTION AND RISK OF THE TENDERING SHAREHOLDER. DELIVERY OF ALL SUCH DOCUMENTS WILL BE DEEMED MADE AND RISK OF LOSS OF THE SHARE CERTIFICATES SHALL PASS ONLY WHEN ACTUALLY RECEIVED BY THE DEPOSITARY (INCLUDING, IN THE CASE OF A BOOK-ENTRY TRANSFER, BY BOOK-ENTRY CONFIRMATION). IF SUCH DELIVERY IS BY MAIL, IT IS RECOMMENDED THAT ALL SUCH DOCUMENTS BE SENT BY PROPERLY INSURED REGISTERED MAIL WITH RETURN RECEIPT REQUESTED. IN ALL CASES, SUFFICIENT TIME SHOULD BE ALLOWED TO ENSURE TIMELY DELIVERY.

7

No alternative, conditional or contingent tenders will be accepted and no fractional Shares will be purchased. All tendering shareholders, by execution of this Letter of Transmittal (or facsimile thereof), waive any right to receive any notice of the acceptance of their Shares for payment.

All questions as to validity, form and eligibility (including time of receipt) of the surrender of any Share Certificate hereunder, including questions as to the proper completion or execution of any Letter of Transmittal, Notice of Guaranteed Delivery or other required documents and as to the proper form for transfer of any certificate of Shares, will be determined by the Purchaser in its sole and absolute discretion (which may delegate power in whole or in part to the Depositary), which determination will be final and binding. The Purchaser reserves the absolute right to reject any and all tenders determined by it not to be in proper form or the acceptance for payment of or payment for which may be unlawful. The Purchaser also reserves the absolute right to waive any defect or irregularity in the surrender of any Shares or Share Certificate(s) whether or not similar defects or irregularities are waived in the case of any other shareholder. A surrender will not be deemed to have been validly made until all defects and irregularities have been cured or waived. The Purchaser and the Depositary shall make reasonable efforts to notify any person of any defect in any Letter of Transmittal submitted to the Depositary.

3. Inadequate Space. If the space provided herein is inadequate, the certificate numbers and/or the number of Shares should be listed on a separate schedule attached hereto and separately signed on each page thereof in the same manner as this Letter of Transmittal is signed.

4. Partial Tenders (Applicable to Certificate Shareholders Only). If fewer than all the Shares evidenced by any Share Certificate delivered to the Depositary are to be tendered, fill in the number of Shares which are to be tendered in the column titled “Number of Shares Tendered” in the box titled “Description of Shares Tendered.” In such cases, new certificate(s) for the remainder of the Shares that were evidenced by the old certificate(s) but not tendered will be sent to the registered owner, unless otherwise provided in the appropriate box on this Letter of Transmittal, as soon as practicable after the Expiration Time. All Shares represented by Share Certificates delivered to the Depositary will be deemed to have been tendered unless otherwise indicated.

5. Signatures on Letter of Transmittal; Stock Powers and Endorsements. If this Letter of Transmittal is signed by the registered owner(s) of the Shares tendered hereby, the signature(s) must correspond with the name(s) as written on the face of the Share Certificate(s) without alteration or any other change whatsoever.

If any Shares tendered hereby are owned of record by two or more joint owners, all such owners must sign this Letter of Transmittal.

If any tendered Shares are registered in the names of different holder(s), it will be necessary to complete, sign and submit as many separate Letters of Transmittal (or facsimiles thereof) as there are different registrations of such Shares.

If this Letter of Transmittal or any certificates or stock powers are signed by trustees, executors, administrators, guardians, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, such persons should so indicate when signing, and proper evidence satisfactory to the Purchaser of their authority so to act must be submitted.

If this Letter of Transmittal is signed by the registered owner(s) of the Shares listed and transmitted hereby, no endorsements of Share Certificates or separate stock powers are required unless payment is to be made to, or Share Certificates representing Shares not tendered or accepted for payment are to be issued in the name of, a person other than the registered owner(s), in which case the Share Certificates representing the Shares tendered by this Letter of Transmittal must be endorsed or accompanied by appropriate stock powers, in either case, signed exactly as the name(s) of the registered owner(s) or holder(s) appear(s) on the Share Certificates. Signatures on such Share Certificates or stock powers must be guaranteed by an Eligible Institution.

8

If this Letter of Transmittal is signed by a person other than the registered owner(s) of the Share(s) listed, the Share Certificate(s) must be endorsed or accompanied by the appropriate stock powers, in either case, signed exactly as the name or names of the registered owner(s) or holder(s) appear(s) on the Share Certificate(s). Signatures on such Share Certificates or stock powers must be guaranteed by an Eligible Institution.

6. Transfer Taxes. The Purchaser will pay any stock transfer taxes with respect to the transfer and sale of Shares to it or to its order pursuant to the Offer (for the avoidance of doubt, transfer taxes do not include United States federal income or backup withholding taxes). If, however, payment of the purchase price is to be made to, or (in the circumstances permitted hereby) if Share Certificates not tendered or accepted for payment are to be registered in the name of, any person other than the registered owner(s), or if tendered Share Certificates are registered in the name of any person other than the person signing this Letter of Transmittal, the amount of any stock transfer taxes (whether imposed on the registered owner(s) or such person) payable on account of the transfer to such person will be deducted from the purchase price unless satisfactory evidence of the payment of such taxes, or exemption therefrom, is submitted with this Letter of Transmittal.

Except as provided in this Instruction 6, it will not be necessary for transfer tax stamps to be affixed to the Share Certificates listed in this Letter of Transmittal.

7. Special Payment and Delivery Instructions. If a check for the purchase price is to be issued, and/or Share Certificates representing Shares not tendered or accepted for payment are to be issued or returned to, a person other than the signer(s) of this Letter of Transmittal or to an address other than that shown in the box titled “Description of Shares Tendered” above, the appropriate boxes on this Letter of Transmittal should be completed. Shareholders delivering Shares tendered hereby or by Agent’s Message by book-entry transfer may request that Shares not purchased be credited to an account maintained at DTC as such shareholder may designate in the box titled “Special Payment Instructions” herein. If no such instructions are given, all such Shares not purchased will be returned by crediting the same account at DTC as the account from which such Shares were delivered.

8. Requests for Assistance or Additional Copies. Questions or requests for assistance may be directed to the Information Agent at its address and telephone number set forth below or to your broker, dealer, commercial bank or trust company. Additional copies of the Offer to Purchase, this Letter of Transmittal, the Notice of Guaranteed Delivery and other tender offer materials may be obtained from the Information Agent as set forth below, and will be furnished at the Purchaser’s expense.

9. Withholding. Under the U.S. federal income tax laws, unless certain certification requirements are met, the Depositary generally will be required to withhold at the applicable backup withholding rate (currently 24%) from any payments made to a shareholder pursuant to the Offer or the Merger, as applicable. In order to avoid such backup withholding, each tendering shareholder, and, if applicable, each other payee, must provide the Depositary with such shareholder’s or payee’s correct taxpayer identification number and certify that such shareholder or payee is not subject to such backup withholding by providing a properly completed and executed IRS Form W-9. Please see instructions to the enclosed IRS Form W-9. In general, if a shareholder or payee is an individual, the taxpayer identification number is the social security number of such individual. If the shareholder or payee does not provide the Depositary with its correct taxpayer identification number, the shareholder or payee may be subject to a $50 penalty imposed by the Internal Revenue Service (the “IRS”). Certain shareholders or payees (including, generally, domestic corporations and non-U.S. shareholders) are not subject to these backup withholding and reporting requirements. In order to satisfy the Depositary that a non-U.S. shareholder or payee is exempt, such shareholder or payee must submit to the Depositary a properly completed and executed appropriate IRS Form W-8, signed under penalties of perjury, attesting to that shareholder’s or payee’s foreign status. Such Form W-8 can be obtained from the Depositary or the IRS (www.irs.gov/formspubs/index.html). Such shareholders or payees should consult a tax advisor to determine which Form W-8 is appropriate.

Failure to provide a Form W-9 or the appropriate Form W-8 will not, by itself, cause Shares to be deemed invalidly tendered, but may require the Depositary to withhold (currently, at a rate of 24%) from the amount of any payments made pursuant to the Offer or the Merger, as applicable. Backup withholding is not an additional U.S. federal income tax. Rather, the U.S. federal income tax liability of a person subject to backup withholding will be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund may be obtained provided that the required information is furnished to the IRS. Failure to complete and provide a Form W-9 or the appropriate Form W-8 may result in backup withholding (currently, at a rate of 24%) from any payments made to you pursuant to the Offer or the Merger, as applicable.

9

10. Lost, Destroyed, Mutilated or Stolen Share Certificates. If any Share Certificate has been lost, destroyed, mutilated or stolen, the shareholder should promptly notify the Company’s stock transfer agent, American Stock Transfer & Trust Company, LLC. The shareholder will then be instructed as to the steps that must be taken in order to replace the Share Certificate. This Letter of Transmittal and related documents cannot be processed until the procedures for replacing lost, mutilated, destroyed or stolen Share Certificates have been followed.

11. Waiver of Conditions. Subject to the terms and conditions of the Merger Agreement (as defined in the Offer to Purchase) and the applicable rules and regulations of the Securities and Exchange Commission, the conditions of the Offer may be waived by the Purchaser in whole or in part at any time and from time to time in its sole discretion.

IMPORTANT: THIS LETTER OF TRANSMITTAL (OR A MANUALLY EXECUTED FACSIMILE COPY THEREOF) OR AN AGENT’S MESSAGE, TOGETHER WITH SHARE CERTIFICATE(S) OR BOOK-ENTRY CONFIRMATION OR A PROPERLY COMPLETED AND DULY EXECUTED NOTICE OF GUARANTEED DELIVERY AND ALL OTHER REQUIRED DOCUMENTS, MUST BE RECEIVED BY THE DEPOSITARY PRIOR TO THE EXPIRATION TIME.

10

Request for Taxpayer Identification Number and Certification Under penalties of petjury. I certify that: The number shown uo this rami is my correct uvpayvr idcntificBticn number l or I am wailmg for a number to be issued to me I; and 2 8cnr»ew n8me»di!Feganted enWty rwrrr if different from above 3 Omk*appropnale box kr federal a* the person wbcee name is eiferedi on line 1 Check ony one of the 4 Exampdons (notes apply only to talnwinq sa.cr. boxes cartain erblies. rw! indotoaaB. see tod.viduak’sota proprietor or C CcrpcralionS CocpamlxxiPartrershp Towl’eolale rtstrudJcrs on page 3) single-member LLC Exampl payee coda {If any| . milMi tatilty trrrpAny Frix the lax daMirrwtinn iC-C corporationrrrporaaon P*Partrwnhp| â–º Hole: Oeck the uppivmte box >n the line above lo» the tax uWe^cmon of Fe single-member oner Do not check Examplton Iran FATCA reporting LLC ri Pw LLC is ciasaihed as a srtfe member LLC Inal s disregarded bum the owner urless the owner of the LLC a code (tf anyj another LLC mat w not ditre^ardad from T* ownnr flor U S fwteral ptxpoMS Othfirwata, a argfo-znamber LLC Fiat e drsregmeed from the owner should check the appreprate bow for the lax dassifralrar of its cwner Q Other |scc nivucbcnsf • h6»» HVJI 5 Address (number street and apt. or soite no.) See instructions Requester s name and address loptorai) 6 Cty. stale. and Z* code I am nix subject ui backup withholding because: ia>I am exempt from backup withholding, ar (b>I kise not been notified by the Internal Revenue Sen ice (IRS i that I am subject to bock up withholding as a remit ufa failure to re|xwt all interest or diSKkixb. or (c>the IRS has nut lik’d me that I am no longer subject to backup withholding; and I am o U.S citizen nr other U.S. person t defined below K and The FATCA code!si entered on this forrn (if any) indKating that I am exenipt from FATCA reporting is correct. Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you arc currently subject to backup withholding because you have failed to report all interest and dividends on your tax return For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. Sec the instructions for Part II. later Sign sit»s<i«« «r Here | Udk per win* Dole* General Instructions Section references arc to the Internal Revenue Code unless otherwise noted. Future developments Fur the latest information about developments related to Form W-9 and its instructions, such as legislation enacted after they were published, go to iimwin.gov/F’o/wHV

11

Purpose of Form An individual or entity (Form W-9 requester) who is required to file an information return with the IRS must obtain your correct taxpayer identification number (TIN) which may be your social security number (SSN). individual taxpayer identification number (ITIN), adoption taxpayer identification number (AT1N), or employer identification number (EIN). to report on an information return the amount paid to you, or other amount reportable on an information return. Examples of information returns include, but arc not limited to, the follow ing. • Form 1099-INT I interest earned ix paid) CM No 10231X Fixm lUW-DIV (dividends. tfh.lu-Ji.irig those Irum stocks or mutual flands) Form 1099-MISC I varxius types of income, prize*, awards, or urrns proceeds) Form 1099-R | stock or mutual fund sale* and certain other transactions by hnAers) Form 1099-S (proceeds from real estate transactions) form 1099-K (merchant card and third party network tnmMK’i»o<v>l Fotm I09K (home mortgage interest). I09H-E (student loan interest), I09S T i t iirtKi n) Form 1099-C I canceled dchtl Fonti Il J9*>- (Kquisitton or abandonment of secured property) Use Form W-9 only if you arc a U.S. person (including a resident alien ), to provide your correct TIN. 0 iwr do not return Form H -9 to the requester wr/fr <r 77.V. now mrsiht be n»6, htA A.v.t .i.’ifriii-AZ’ii-..’ kv SVIut i> Kiiikiip withholding, .Linz Form W-91 Ro 10-201R)

12

By signing (he filled-out form, you: Certify thm the TIN you giving is correct (or you are mailing for a number to be wuedk Certify ihat you are nor subject to backup withholding. or Claim exemption frtxn backup withholding ifyou arc a U.S. exempt payee. If applicable, you are abv certifying that aw a U.S. pentun, yxiur allocable share ol any partnership income from a U-S trade or business is not Mjbjcvi to (he withholding Uli on foreign partners’ share of effectively connected income, and Certify that FATCA codelsf entered on this form (if any) indicating that you are exempt from the FATCA reporting. is correct. See HAor is fj4TCA reporting, taler, for further mforrnalton. Note: If you arc a U.S. person and a requester gives you a form other than Form W-9 to request your TIN’, you must use the requester’s form if it is substantially similar to this Form W-9. Ileflultkia of • I .S. perton. For federal tax purposes. you arc considered a U.S. person ifyou orc: An individual who is a U.S. citizen ar U.S resident alien; A partnership. corporation. company. or asmtciMion created or organized in the United Stales or under die laws of the United Slates; An estate (other than a foreign estate); or A domestic trust (as defined in Regulation* section 3OI.77OI-7); Special rules for partnerships. Partnerships that conduct a trade or business in the United States are generally required to pay a withholding tax under section 1446 on any foreign partners’ share of effectively connected taxable income from such business. Further, in certain cases where a Form W-9 has not been received, the rules under section 1446 require a partnership to presume that a partner is a foreign person, and pay the section 1446 withholding tax. Therefore, if you are a U.S. person that is a partner in a partnership conducting a trade or business in the United States, provide Form W-9 to the partnership to establish your U.S. status and avoid section 1446 withholding on your share of partnership income. In the cases below, the following person must give Form W-9 to the partnership for purposes of establishing its U.S. status and avoiding withholding on its allocable share of net income from the partnership conducting a trade or business in the United States. In the case of a disregarded entity w irti a US owner, the U.S. owner of the disregarded entity and not the entity; In the caw of a grantor trust with a U.S. grantor or other U.S owner, generally, rhe U S grantor or other U.S. owner of the grantor mist and not the tnist; and In die case of a U.S. trust (ollx-r Ilian a grantor trusty the U.S. Uusl (other than a grantor trust) and not the beneficiaries of the trust Foreign person. If you are a foreign person or the U.S. branch of a foreign bank that has elected to be treated as a U.S. person, do not use Form W-9. Instead, use the appropriate Form W-8 or Form 8233 (see Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities). Nonresident alien who becomes a resident alien. Generally, only a nonresident alien individual may use the terms of a tax treaty to reduce or eliminate U.S. tax on certain types of income. However, most tax treaties contain a provision known as a “saving clause.” Exceptions specified in the saving clause may pennit an exemption from tax to continue for certain types of income even after the payee has otherwise become a U.S. resident alien for tax purposes. it vou arc a u s. resident alien wno is reiving on an exception contained in the saving clause of a tax treaty fo claim an exemption from U.S. tax on certain tvpcs of income, you must attach a statement to Form W-9 that specifies the following five items. 1. The treaty country. Generally, this must be the same treaty under which you claimed exempbon Irani tax as a tionresadent alien. 2flic treaty article addressing Ibe income. 3. The article number (or location) in the tax treaty that contains the raving clause and its exceptions. 4 The type and amount of income that qualifies forthe exemption from lax. SulTicienl facts lo pistils the exemption Irum tax under the terms ofthe ‘ rliclc.

13

Exemplt.Article 20 of the U.S.-China income tax treaty allows an exemption from tax fur scholarship iretome received by a Chinese student temporarily present in the United States. Under U.S law. this student will become a resident alien for tax purposes if his or her stay in the I n i ted States exceeds 5 calendar years However, paragraph 2 of the first Protocol to the U.S.- China treaty (dated April 30. 19841 allows the provisions of Article 20 to erwtinue to apply even after the Chinese student becomes a resident alien of the United States. A Chinese student who qualifies fcr this exception (under paragraph 2 of the first protocol) and is relying on this exception to claim an exemption from lax on his or her scholarship or fellowship income would attach to Form W-91 statement that includes the information described above to support that exemption, If you arc a nonresident alien or a foreign entity, give the requester the Certain payees arc exempt front FATCA reporting. See Exemption from FATCA reportingcode later, and lhe Instructions for the Updating Your Information You must provide updated information to any person to whom you claimed to be an exempt payee if you are no longer an exempt payee and anticipate receiving reportable payments in the future from this person. For example, you may need to provide updated information if you ate a C corporatian that elects to be an S corporation, or if you no longer ire tax exempt In addition, you must furnish a new Form W-9 if the name or TIN changes for the account; for example. if the grantor oft grantor trust dies. Penalties Failure Io furnish TIN. If you fail lu furnish your correct TIN to a requester, you arc subject to a perulty of S50 for each ruch failure unless your failure is due to reasonable cause and not to willful neglect. Ch II ptnaliy for talw inhrnwrkin »Uh rrsprvi to vlttihoillng. If >x>u nuke ii fuhe MuiniaH * Ki IN icmuuiibfc ta* liwi K&ullii n no bu’kup *ith)>okliii£. you subject to a (500 fftwlry Backup Withholding Whit is had up withholding? Persons making certain payments to you must under certain conditions withhold and pay io the IRS 24“.. of such payments This is called “hackup withholding.” Payments that may be subject to backup withholding indude interest, Irx-excmpt interest, dividends, broker and barter exchange transtctions, tents, royalties, noncmployee pay , payments made in settlement of payment card and third purty network transactions, and certain payments from fishing boat operators Real estate transactions are not subject to backup withholding. You will not be subject to backup withholding on payments you receive if you give the requester your correct TIN. make the proper certifications, and report all your taxable interest and dividends on your tax return. Payments you receive will be subject to backup withholding if: 1. You cb not finush sour TIN to the requester. 2 Vctu<i« rsot evrtify yniir TIM whirr rw|iM>wl ifw inctnirtMM for Purl II fardeUilx), The IRS telhthe rantcNerthai vojfurnkhed as imrurxct TN. The IRS lellsyixi thit you jrc suhtevt to^ku* withholdingtecuiMe you did not report all your interest and tlividcids nn your uk renin 4 for reportable Niftiest and dividends only), or You cb not certify to the ruptcuc thw you arc not subject tohackuj wlliikildlitj; uinki 4 ubutc (fur iqiwiaWc imocM mM div*tikd oucoMiiis opened nfter IW3 only). Certain payees and payments air exempt from backup withholding. See Etempt payee code, later, and the separate Instructions foi die Requester of Form XX-9 for inure information. Aho wc SperU nrtet iir pomerMin. carter What is FATCA Reporting? The Foreign Account Tax Compliance Act (FATCA) requires a participating foreign financial institution to report all Unted States account holders that are specified United States persons.

14

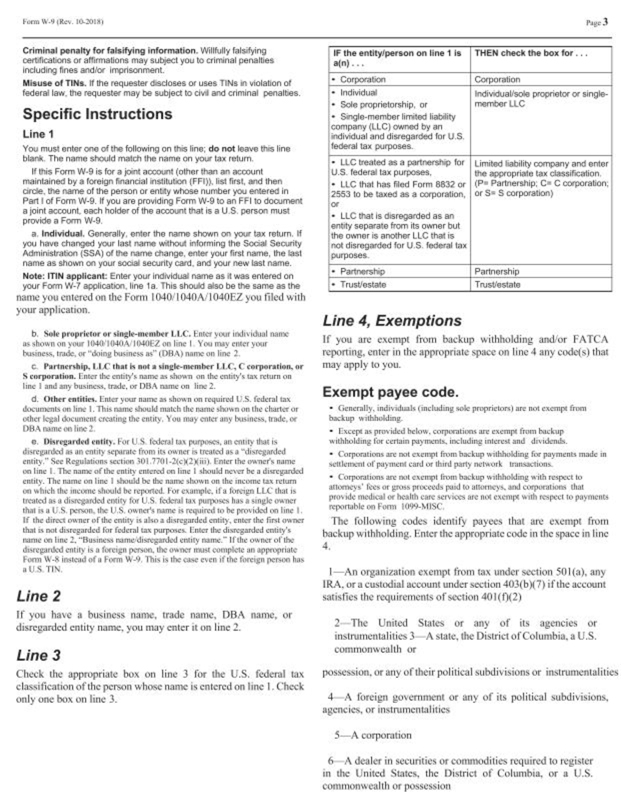

Criminal penalty for falsifying information Willfully falsifying certifications or affirmations may subject you to criminal penalties Including fines and/or imprisonment. Misuse of TINs. tt the requester discloses or uses TtNs m violation of federal law. the requester may be subject to ciW and criminal penalties. Specific Instructions Line 1 You musl enter one of the following on this line; do not leave th<$ line blank The name should m.-drh the name on yoir lax return. If this Form W-9 is for a jcwX account (other than an account maintained by a foreign financial institution (FFI», list first, and then arete, the name of the person or entity whose number you entered in Part I of Form W-9. If you are providing Form W-9 to an FFI to document a joint account, each holder of the account that is a U S person must provide a Form W-9. a Individual. Generally, enter the name shown on your tax return. W you have changed your last name without informing the Social Security Administration (SSA) of the name change, enter your first name, the test name as shown on your social security card and your new last name. Note: ITIN applicant: Enter your indrvlduai name as ft was entered on your Form W-7 application, line fa. This shotAd also be the same as the name you entered on the Form 1040 ID40A . 1040EZ you filed with your application. b Sole prtiprivmf er tfngle-meintar I LC. Enter your indindtiul name as shown on your I ONI IfMOA I iMtifZ on Imc I You may enter your huuncui. trade, or “doing huuncss n$” (DBA) name on line 2 C f’artncrdiip. I .IX” that k not auitgk-member LLC, C corporation, or S corporation. I nter the entity?, name as shown on the entity’s tax return an line 1 and any business, trade, ix DBA name an line 2. d. Other entities. I nter your name as shown on required U.S. federal tax documents on line 1. This name should match the name shown cm the charter ur ixhct Iqeal document creating the entity. You may enter any busmen*trade, or DB A fume on line 2 o Dkregatdcd entiry. For U S federal tax purposes, an entity ilwt is disregarded as an entity sefwnie hum its owner is treated as a “disregarded entity.” Sec Regulations section to 1.7701 -2<c KlX ii’) Enter the owner’s name on line I The name of the entity entered on line I should never be a disregarded entity. The name on line 1 should be the name shown on the incorne tax return mi which the income should be repotted. For example, if a foreign LLC that is treated as a disregarded entity for U.S. federal tax purposes has a moilIc owner that i* a U.S. perxin. the U.S. owner’s name « required in be provided on line ‘ If the direct owner of the entity k also a disregarded entity, enter the first owner that w not disregarded lor federal tax purposes. Enter the disregarded entity’s name on line 2. “Business name disregarded entity name.“If the owner ot the diMCgarded entity is u foreign person, the owner must cxmipkic an appropriate Form W-S instend of a Form W-9, This is the case even if rhe foreign person tins ns Line 2 If you have a business name, trade name, DBA name, or disregarded entity name, you may enter it on line 2. Line 3 Check the appropriate box on line 3 for the U.S. federal tax classification of the person whose name is entered on line I—Check only one box on line 3. IF the entity/person on line 1 is a(n)... THEN check the box for... • Cnrpcxatxxi Corporation Individual Sole proprietorship, or Soigle-member limned liabdity company (LLC) owned by an individual and disregarded for U S federal tax purposes Indiwdualisole proprietor or singlemember LLC LLC treated as a partnership for U.S. federal tax purposes, LLC lhat has filed Form 8832 or 2553 lo be taxed as a corporation, or LLC that is disregarded as an entity separate from its owner but the owner is another LLC that is not disregarded for U S federal lax purposes Limited liability company and enter the appropriate tax classification (P- Partnership. C» C corporation, or S« S corporation) • Partncrstvp Partnership • Trust’estate TrusVestate Line 4, Exemptions If you are exempt from backup withholding and/or FATCA reporting, enter in the appropriate space on line 4 any codefs) that may apply to you. Exempt payee code. Generally, indiv.dink (including vole proprietor.) nre no) cxcmpl from backup w itohoMine Except to provided below, corporation, are exempt from backup w ithholding for certain payments, including inleren and dividends. Corporation, are not exempt from backup withholding for payment, made tn seltlctnenl of payment card or third party nelwxirk transactions Corporation, are not exempi Iron’, backup withholding with respect to attorneys* lees or gross proceeds [xwd to attorney., and corporations dial provide medical or hcalih cure services are not exempt with respect to payments reportable on Form lOW-MISC Tire following codes identify payees that are exempt from backup withholding. Enter the apfiropriatc code in the space in line 4. I —An organization exempt from tax under section 501(a). any IRA. or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2) 2 The United States or any of its agencies or instrumentalities 3 A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions or instrumentalities 4 A foreign government or any of its political subdivisions, agencies, or instrumentalities 5—A corporation 6 A dealer in securities or commodities required to register in the United States, the District of Columbia, or a U.S. commonwealth or possession

15

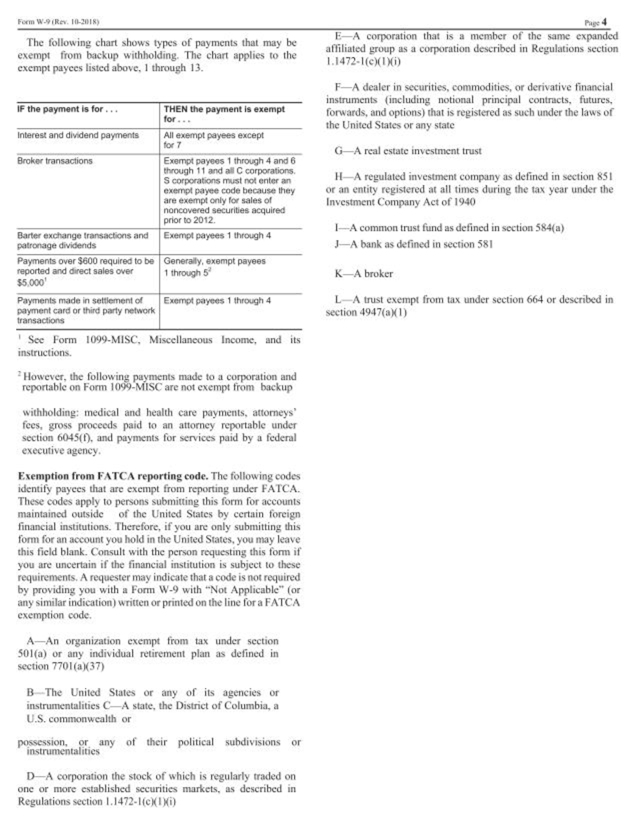

Fenn W-0 (Rev 10-201H) J 7—A futures commission merchant registered with the Commodity futures t rading Commission 8—A real estate investment trust 9 An entity registered at all times during the tax year under the Investment Company Act of 1940 10—A common trust fund operated by a bank under section 584(a) 11—A financial institution A middleman known in the investment community as a nominee or custodian .A trust exempt from tax under section 664 or described in section 4947

16

The following chart shows types of payments that may be exempt from backup withholding. The chart applies to the exempt payees listed above. 1 through 13. IF the payment is for,., THEN the payment is exempt for... Interest and dividend payments All exempt payees except tor 7 Broke*- transactions Exempt payees 1 through 4 and 6 through 11 and a* C corporations S corporations must not enter an exempt payee code because they are exempt only for sales of noncovered securities acquired prior to 2012. Barter exchange transactions and patronage dividends Exempt payees 1 through 4 Payments over $600 required to be reported and direct sales over $5000’ Generally, exempt payees 1 through 5‘ Payments made in settlement of payment card or third party network transactions Exempt payees 1 through 4 1See Form 1099-M1SC. Miscellaneous Income, and its instructions. E—A corporation that is a member of the same expanded affiliated group as a corporation described in Regulations section 1.1472-1(0(1 Mi) F—A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any state G—A real estate investment trust II A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment C ompany Act of 1940 I—A common trust fund as defined in section 584(a) J—A bank as defined in section 581 K—A broker L A trust exempt from tax under section 664 or described in section 4947(a)(1)

17

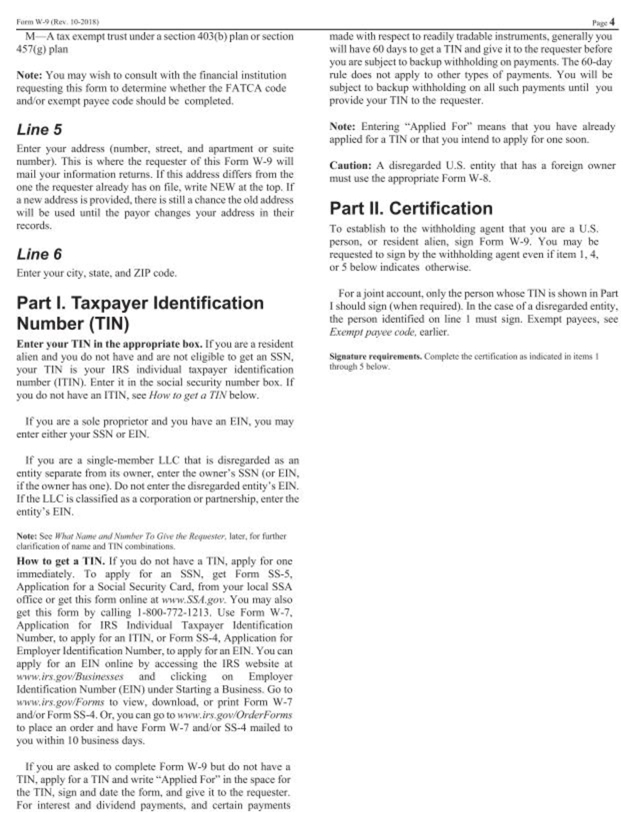

M A tax exempt trust under a section 403(b) plan or section 457(g) plan Note: You may wish to consult with the financial institution requesting this form to determine whether the FATCA code and’or exempt payee code should be completed. Line 5 Enter your address (number, street, and apartment or suite number). This is where the requester of this Form W-9 will mail your information returns. If this address differs from the one tlie requester already has on file, write NEW at the top. If a new address is provided, there is still a chance the old address will be used until the payor changes your address in their records. Line 6 Enter your city, state, and ZIP code. Part I. Taxpayer Identification Number (TIN) Enter your TIN ill the appropriate box. If you are a resident alien and you do not have and are not eligible to get an SSN, your TIN is your IRS individual taxpayer identification number (ITIN). Enter it in the social security number box. If you do not have an ITIN. see How to get a TINbelow. If you arc a sole proprietor and you have an EIN, you may enter cither your SSN or EIN. If you arc a single-member EEC that is disregarded as an entity separate from its owner, enter the owner’s SSN (or EIN. if die owner has one). Do not enter the disregarded entity’s EIN. If the LLC is classified as a corporation or partnership, enter the entity’s EIN. Note: See W’Nrt iV«me woJ Vinnh>r fo GAv lAe Ka/wester. later, for funher clarification of name and TIN combinations How to get a TIN. If you do not have a TIN, apply for one immediately. To apply for an SSN, get Form SS-5, Application for a Social Security Card, from your local SSA office or get this form online at www.SS4.gov. You may also get this form by calling 1-800-772-1213. Use Form W-7. Application for IRS Individual Taxpayer Identification Number, to apply for an 11 IN, or Form SS-4, Application for Employer Identification Number, to apply for an EIN. You can apply for an EIN online by accessing the IRS website at www.irs.gov/Butinessesand clicking on Employer Identification Number (EIN) under Starting a Business. Go to Hww.ir.r.gov/Fomsto view, download, or print Form W-7 and’or Form SS-4. Or, you can go to www.irs.gov/OrderFormsto place an order and have Form W-7 and’or SS-4 mailed to you within 10 business days. If you are asked to complete Form W-9 but do not have a TIN. apply fora TIN and write “Applied For“in the space for the TIN, sign and date the form, and give it to the requester. For interest and dividend payments, and certain payments Pwp 4 made with respect to readily tradable instruments, generally you will have 60 days to get a TIN and give it to the requester before you are subject to backup w ithholding on payments. The 60-day rule docs not apply to other types of payments. You will be subject to backup withholding on all such payments until you provide your TIN to the requester. Note: Entering “Applied For” means that you have already applied for a TIN or that you intend to apply for one soon. Caution: A disregarded U.S. entity that has a foreign owner must use the appropriate Form W-8. Part II. Certification To establish to the withholding agent that you arc a U.S. person, or resident alien, sign Form W-9. You may he requested to sign by the withholding agent even if item 1,4, or 5 below indicates otherwise. For a joint account, only the person whose TIN is shown in Part 1 should sign (when required). In the case of a disregarded entity, the person identified on line I must sign. Exempt payees, see Exempt payee cade,earlier. Signature requirements. Complete live certification as indscMcd in items 1 thiough 5 below.

18

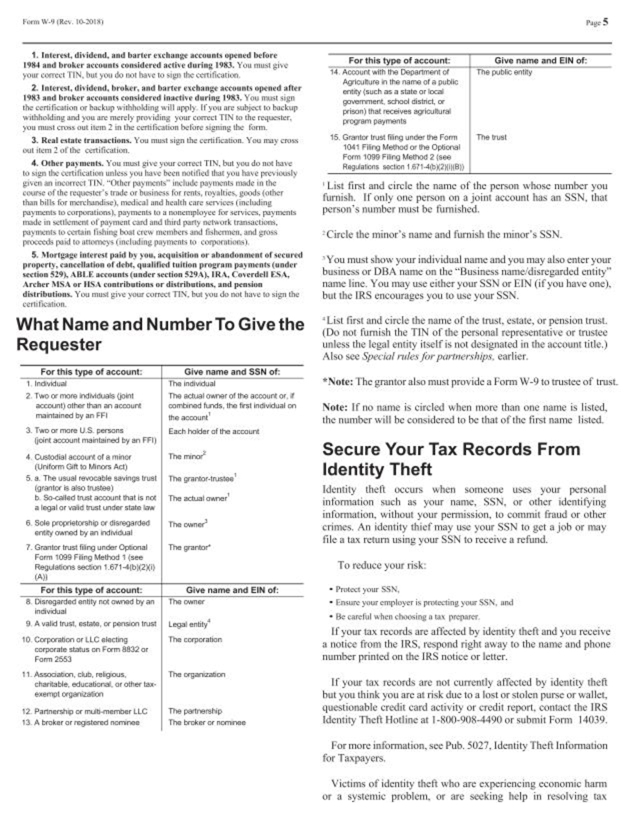

Interest, dividend, and barter exchangt ccuunli opened before 1*84 and broker aiTuenfv considered aclhe during 1983. You must givv your correct TIN. but you do not have to wgn the certification. Ink-rot, dhidend. broker, and barter exchange aeconnK opened after 1983 and broker acconnts considered Inactive during |9t3. ou must sign the certification or backup withholding will apply If you arc subject to backup -A ilhhokling and you arc merely providing your correct TIN to the requester, you must cross out item 2 m the certification before signing the form. Real estate transactions. You must sign the certification. You noy cross out item 2 of the certificaliuri. Other pay ments. You must give your correct TIN. but you do not base to sign the certification unless you base been notified that you have prcv lously given ari tncotTcet TIN. “Other payments” include payments made in rbe course of the requester’s trade or business lor rents, royalties, goods (other than bill* for merchandise 1, medical and health care services (including payments to corporations), payments to a nonemployee for services, payments made in settlement of payment card and third party network transactions, payments to certain lishing boat crew members arid fishermen. and gross proceeds pud to attorneys (including payments to coeponiDore), 5 Mortgage interest paid by you, acquisition or abandonment of secured property, cancellation of debt, quallhrd tuition program payments (under section 529k KBi t accounts (under section 329A k IR A, Coverdell ESA, Archer MSA or I ISA contributions or distributions, and pension distributions. You must give your correct TIN. but yuu do not have to sign the certification. What Name and Number To Give the Requester For this type of account: Give name and SSN of: 1 IndMduni The indtvriual 2 Two or more odMduals (Jomt rhe actual owner oi the acoourt or / account i alhar than an account oombtnod funds, tho trsl individual rxr maintained by an PF 1 the account1 3. Two or mare U.S persons (joint jtfxujnt maintained by an FFI | Each holder of the account 4 Custodial account of a minor (Uniterm GR io Miners Act) The mino< 5 a. The usual revocable savings trust (grantor is also trustee) rhe granbor-trusiee1 b So-caHud trust account that is not a legal ar .-aid trust under state Law Fne actual oener’ 6 Sole proprietorship o disregarded enter oramd by an ndMdual rhe owner3 7. Grantor trust fling under Op&tonal Form 1099 Fang Method 1 (see Reqdaoont sec&iyi i.67l-4|b|<2XC (A» The grantor* For Uils type of account: Give name and EIN of: 8 Disregarded entity not owned by an individual the owner 9 A valid trust, estate, or pension trust Legal entity”* 10 Corporation or LLC electing corporate status on Form 8832 or Farm 2S53 rhe corporatior. 11 Association, club, rciqojs, charitable, educations*. ar other taa- enernpt orgarnzason The organization 12 Partncrshp or frubrocrocr LLC T>>e padnemhip 13 A broker ar registered nemnoe the broker or ncronec For this type of account: Give name and EIN of: 14 Account with the Departmont of AgricuBuro r the name of a public entcy (such as a state ar local government school distnet, or prison) that receives agriculluras pr egram payments The pubic entity 15. Grantor trust fiwg under the Form 1041 Fling Method or the Optional Form 1099 Fling Method 2 (ses Regiiatcns eeclcn 15?t4fl>X2HI|lB}) The trust ‘ List first and circle the name of the person whose number you furnish. If only one person on a joint account lias an SSN. that person’s number must be furnished.—Circle the minor’s name and furnish the minor’s SSN. ’ Vou must show your individual name and you may also enter your business or DBA name on the “Business name. disregarded entity” name line. You may use cither your SSN or EIN (if you have one), but the IRS encourages you to use your SSN. * List first and circle the name of the trust, estate, or pension trust (Do not furnish the TIN of the personal representative or trustee unless the legal entity ilself is not designated in the account title.) Also see Special rules for partnerships. earlier. •Note: The grantor also must provide a Form W-9 to trustee of trust. Note: If no name is circled when more than one name is listed, the number will he considered to be that of the first name listed. Secure Your Tax Records From Identity Theft Identity theft occurs when someone uses your personal information such as your name, SSN, or other identifying information, without your permission, to commit fraud or other crimes. An identity thief may use your SSN to get a job or may file a tax return using your SSN to receive a refund. To reduce your risk Protect ynur SSN, Fnvurc your employer is protecting your SSN, and Be careful when choosing n tax preparer If your tax records are affected by identity theft and you receive a notice from the IRS. respond right away to the name and phone number printed on the IRS notice or letter. If your tax records are not currently affected by identity theft but you think you arc at risk due to a lost or stolen purse or wallet, questionable credit card activity or credit report, contact the IRS Identity Theft Hotline at I-K00-9OX-449O or submit Form 14(139. For more information, see Pub. 5027, identity Theft Information for Taxpayers. Victims of identity theft who arc experiencing economic harm or a systemic problem, or are seeking help in resolving tax

19

problems that have not been resolved through normal channels, may be eligible for Taxpayer Advocate Service (TAS) assistance. You can reach TAS by calling the TAS toll-free case intake lineal I-877-777-4778 or TTY TDD 1-800-829-4059. Protect yourself front suspicious emails or phishing schemes. Phishing is the creation and use of email and websites designed to mimic legitimate business emails and websites. The most common act is sending an email to a user falsely claiming to be an established legitimate enterprise in an attempt to scam the user into surrendering private information that will be used for identity theft.

20

The IRS does not initiate contacts with taxpayers via emails. Also, the IRS does not request personal detailed information through email or ask taxpayers for the PIN numbers, passwords, or similar secret access information for their credit card, bank, or other financial accounts.

If you receive an unsolicited email claiming to be from the IRS, forward this message to phishing@irs.gov. You may also report misuse of the IRS name, logo, or other IRS property to the Treasury Inspector General for Tax Administration (TIGTA) at 1-800-366-4484. You can forward suspicious emails to the Federal Trade Commission at spam@uce.gov or report them at www.ftc.gov/complaint. You can contact the FTC at www.ftc.gov/idtheft or 877-IDTHEFT (877-438-4338). If you have been the victim of identity theft, see www.IdentityTheft.gov and Pub. 5027.

Visit www.irs.gov/IdentityTheft to learn more about identity theft and how to reduce your risk.

21

Privacy Act Notice

Section 6109 of the Internal Revenue Code requires you to provide your correct Taxpayer Identification Number (“TIN”) to persons (including federal agencies) who are required to file information returns with the IRS to report interest, dividends, or certain other income paid to you; mortgage interest you paid; the acquisition or abandonment of secured property; the cancellation of debt; or contributions you made to an IRA, Archer MSA, or HSA. The person collecting this form uses the information on the form to file information returns with the IRS, reporting the above information.

Routine uses of this information include giving it to the Department of Justice for civil and criminal litigation and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in administering their laws. The information also may be disclosed to other countries under a treaty, to federal and state agencies to enforce civil and criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. You must provide your TIN whether or not you are required to file a tax return. Under section 3406, payers must generally withhold a percentage of taxable interest, dividend, and certain other payments to a payee who does not give a TIN to the payer. Certain penalties may also apply for providing false or fraudulent information.

22

The Depositary for the Offer is:

| By Overnight Courier: | By Regular, Registered, Certified or Express Mail: | |

American Stock Transfer & Trust Company, LLC c/o Operations Center Attn: Reorganization Department 6201 15th Avenue Brooklyn, New York 11219 | American Stock Transfer & Trust Company, LLC c/o Operations Center Attn: Reorganization Department 6201 15th Avenue Brooklyn, New York 11219 |

DELIVERY OF THIS LETTER OF TRANSMITTAL TO AN ADDRESS OTHER THAN AS SET FORTH ABOVE WILL NOT CONSTITUTE A VALID DELIVERY TO THE DEPOSITARY.

Any questions or requests for assistance may be directed to the Information Agent at its telephone number and location listed below. Requests for additional copies of this Offer to Purchase and the Letter of Transmittal may be directed to the Information Agent at its telephone number and location listed below. You may also contact your broker, dealer, commercial bank or trust company or other nominee for assistance concerning the Offer.

The Information Agent for the Offer is:

D.F. King & Co., Inc.

48 Wall Street, 22nd Floor

New York, New York 10005

Shareholders (toll-free): (800) 283-9185

Banks and Brokers: (212) 269-5550

Email: CLR@dfking.com

23