Excess Withdrawals

Assume due to poor market performance your Account Value is reduced from $100,000 to $80,000 and you decide to make a $10,000 withdrawal, which reduces your Account Value to $70,000 ($80,000 – $10,000). As noted above, also assume that the Withdrawal Rate is 5%, making your Annual Benefit Payment $5,000 ($100,000 (your GLWB Base) x 5%). Since your $10,000 withdrawal exceeds your Annual Benefit Payment of $5,000, there will be a proportional adjustment to your GLWB Base. The proportional adjustment is equal to the excess withdrawal amount ($5,000) divided by the Account Value before such withdrawal ($80,000), which equals 6.25%. Therefore, because 6.25% of $100,000 (the GLWB Base) is $6,250, the GLWB Base would be reduced by $6,250—i.e., from $100,000 to $93,750. In addition, after such withdrawal, the Annual Benefit Payment would be reset equal to $4,687.50 (5% x $93,750).

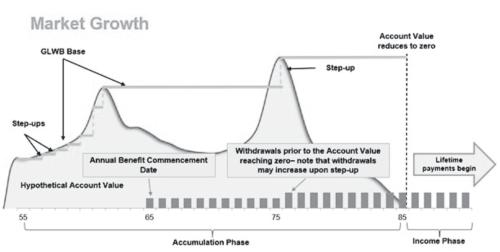

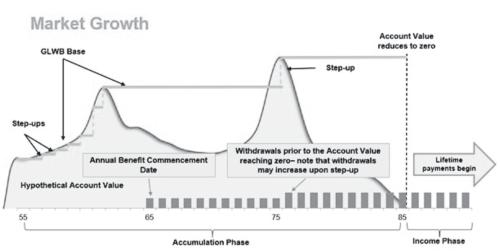

B. Automatic Step-Up

On each Contract Anniversary prior to your 91st birthday, an Automatic Step-Up will occur if the Account Value on that date exceeds the GLWB Base immediately before the Automatic Step-Up. An Automatic Step-Up: (1) increases the GLWB Base to the Account Value; and (2) increases the Annual Benefit Payment to equal the Withdrawal Rate multiplied by the GLWB Base after the Automatic Step-Up. We will deduct the Rider Charge from the Account Value before we compare the Account Value to the GLWB Base.

Example:

Assume you make a Purchase Payment of $100,000. Your initial Account Value would be $100,000 and your initial GLWB Base would be $100,000. Also assume you have reached your Annual Benefit Commencement Date resulting in a Withdrawal Rate of 5% and an Annual Benefit Payment of $5,000 ($100,000 x 5%). At the first Contract Anniversary, assume your Account Value has increased to $110,000 due to good market performance. The Automatic Step-Up will increase the GLWB Base from $100,000 to $110,000 and reset the Annual Benefit Payment to $5,500 ($110,000 x 5%).

At the second Contract Anniversary, assume your Account Value has increased to $120,000 due to good market performance. The Automatic Step-Up will increase the GLWB Base from $110,000 to $120,000 and reset the Annual Benefit Payment to $6,000 ($120,000 x 5%).

On the third through the eighth Contract Anniversaries, assume your Account Value does not exceed the GLWB Base due to poor market performance and no Excess Withdrawals are made. No Automatic Step-Up will take place on any of the third through eighth Contract Anniversaries.

At the ninth Contract Anniversary, assume your Account Value has increased to $150,000 due to good market performance, which is greater than the GLWB Base immediately before the Contract Anniversary. The Automatic Step-Up will increase the GLWB Base from $120,000 to $150,000 and reset the Annual Benefit Payment to $7,500 ($150,000 x 5%).

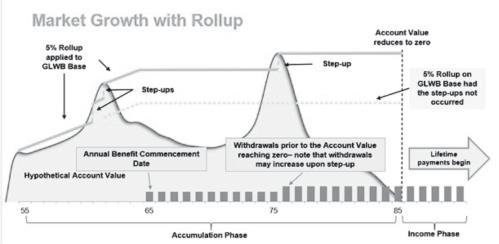

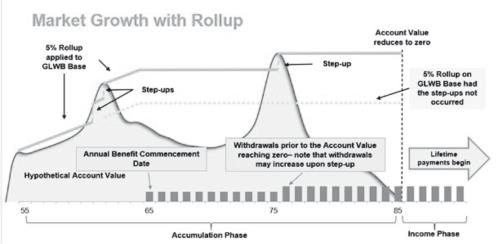

C. Rollup Rate (for Market Growth with Rollup only)

On each Contract Anniversary within the first ten Contract Years, if no withdrawals occurred in the previous Contract Year, the GLWB Base will be increased by an amount equal to the Rollup Rate multiplied by the Net Purchase Payment Amount before such increase.

The GLWB Base will not be increased by the Rollup Rate if: (1) a withdrawal has occurred in the Contract Year ending immediately prior to that Contract Anniversary, or (2) after the first ten Contract Years. The Rollup Rate is applied before deducting any Rider Charge and before taking into account any Automatic Step-Up occurring on such Contract Anniversary.

Example:

Assume you make a Purchase Payment of $100,000. Your initial Account Value would be $100,000, your initial Net Purchase Payment Amount would be $100,000 and your initial GLWB Base would be $100,000. If your Rollup Rate is 5%, your GLWB Base will increase by 5% of the Net Purchase Payment Amount on each contract anniversary for the first ten Contract Years, provided that no withdrawals occur in the previous Contract Year. If a withdrawal is not taken in the first Contract Year, your GLWB Base would increase to $105,000 ($100,000 + ($100,000 x 5%)).

If a withdrawal is taken in any Contract Year during the first ten Contract Years, the GLWB Base would not be increased by the Rollup Rate on the following Contract Anniversary. After the first ten Contract Years, the GLWB Base is not increased by the Rollup Rate.