SECURITIES AND EXCHANGE COMMISSION

UNDER THE SECURITIES ACT OF 1933

(980) 365-7100

of registrant’s principal executive offices)

c/o The Corporation Trust Company

1209 Orange Street

Corporation Trust Center

Wilmington, DE 19801

(302) 658-7581

including area code, of agent for service)

Carlton Fields

1025 Thomas Jefferson St., N.W.

Suite 400 West

Washington, DC 20007-5208

Large accelerated filer ☐ | Accelerated filer ☐ |

Non-accelerated filer ☒ | Smaller reporting company ☐ |

Emerging growth company ☐ |

The information in this supplement is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This supplement is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

BRIGHTHOUSE LIFE INSURANCE COMPANY

SUPPLEMENT DATED January 13, 2023

To the following prospectus:

Brighthouse Shield® Level Select 3-Year Annuity Prospectus dated August 1, 2022

For Brighthouse Shield® Level Select 3-Year Annuity Contracts

Issued On or After May 1, 2023

For the Shield® Level Annuity Contracts (the “Contracts”) referenced above issued by Brighthouse Life Insurance Company (“BLIC,” the “Company,” “we,” “our” or “us”), this supplement describes certain enhancements to the Contracts that add (1) Shield Options that come with a new rate crediting type called Step Rate Edge, (2) new 2-year Terms available with certain Shield Options, (3) the Nasdaq-100 Index® available with Shield Options, and (4) additional 1-year Terms for Shield Options with Step Rate.

This supplement should be read in conjunction with the current prospectus for your Contract, i.e. the Brighthouse Shield® Level Select 3-Year Annuity Prospectus dated August 1, 2022, and should be retained for future reference. This supplement incorporates the prospectus by reference. The supplement amends certain information in your prospectus to reflect the addition of the enhancements. All other information in your prospectus remains unchanged. Unless specifically defined in this supplement, the terms used in this supplement have the same meaning as in your Contract’s prospectus. We will send you another copy of your prospectus without charge upon request. Please contact the Annuity Service Office at (888) 243-1932 or write to us at Brighthouse Life Insurance Company, Annuity Service Office, P.O. Box 305075, Nashville, TN 37230-5075.

SHIELD OPTIONS

To reflect the new Shield Options available, the following chart replaces the chart in your prospectus that lists the Shield Options available (each of which is issued with a Cap Rate unless otherwise noted as a Step Rate or Step Rate Edge) and indicates the availability of the Performance Lock Rider.

| SHIELD OPTIONS | ||||

| TERM | INDEX | PERFORMANCE LOCK AVAILABLE | ||

| SHIELD 15 (up to 15% downside protection) | ||||

| 1 Year | S&P 500® Index | ☑ | ||

| S&P 500® Index Step Rate | ☒ | |||

| S&P 500® Index Step Rate Edge | ☒ | |||

| Russell 2000® Index | ☑ | |||

| Russell 2000® Index Step Rate | ☒ | |||

| Russell 2000® Index Step Rate Edge | ☒ | |||

| MSCI EAFE Index | ☑ | |||

| MSCI EAFE Index Step Rate | ☒ | |||

| MSCI EAFE Index Step Rate Edge | ☒ | |||

| Nasdaq-100 Index® | ☑ | |||

| Nasdaq-100 Index® Step Rate | ☒ | |||

| Nasdaq-100 Index® Step Rate Edge | ☒ | |||

| 2 Year | S&P 500® Index Step Rate | ☒ | ||

| S&P 500® Index Step Rate Edge | ☒ | |||

| Russell 2000® Index Step Rate | ☒ | |||

| Russell 2000® Index Step Rate Edge | ☒ | |||

| MSCI EAFE Index Step Rate | ☒ | |||

| MSCI EAFE Index Step Rate Edge | ☒ | |||

| Nasdaq-100 Index® Step Rate | ☒ | |||

| Nasdaq-100 Index® Step Rate Edge | ☒ | |||

| 3 Year | S&P 500® Index | ☑ | ||

| Russell 2000® Index | ☑ | |||

| MSCI EAFE Index | ☑ | |||

| Nasdaq-100 Index® | ☑ | |||

| SHIELD 10 (up to 10% downside protection) | ||||

| 1 Year | S&P 500® Index | ☑ | ||

| S&P 500® Index Step Rate | ☒ | |||

| S&P 500® Index Step Rate Edge | ☒ | |||

| Russell 2000® Index | ☑ | |||

| Russell 2000® Index Step Rate | ☒ | |||

| Russell 2000® Index Step Rate Edge | ☒ | |||

| MSCI EAFE Index | ☑ | |||

| MSCI EAFE Index Step Rate | ☒ | |||

| MSCI EAFE Index Step Rate Edge | ☒ | |||

| Nasdaq-100 Index® | ☑ | |||

| Nasdaq-100 Index® Step Rate | ☒ | |||

| Nasdaq-100 Index® Step Rate Edge | ☒ | |||

| 2 Year | S&P 500® Index Step Rate | ☒ | ||

| S&P 500® Index Step Rate Edge | ☒ | |||

| Russell 2000® Index Step Rate | ☒ | |||

| Russell 2000® Index Step Rate Edge | ☒ | |||

| MSCI EAFE Index Step Rate | ☒ | |||

| MSCI EAFE Index Step Rate Edge | ☒ | |||

| Nasdaq-100 Index® Step Rate | ☒ | |||

| Nasdaq-100 Index® Step Rate Edge | ☒ | |||

| 3 Year | S&P 500® Index | ☑ | ||

| Russell 2000® Index | ☑ | |||

| MSCI EAFE Index | ☑ | |||

| Nasdaq-100 Index® | ☑ | |||

The following amends the prospectus as necessary to reflect the addition of the enhancements to your Contract.

RISK FACTORS

Shield Options with Higher Shield Rates

In deciding whether to choose a Shield Option with Step Rate Edge with a higher Shield Rate, you should consider that such Shield Options offering higher Shield Rates tend to have lower Edge Rates than Shield Options with lower Shield Rates that have the same index and term. This is because of the additional protection provided by the higher Shield Rates.

Risks Associated with Nasdaq-100 Index®

Because the Nasdaq-100 Index® (Price Return Index) is comprised of a collection of equity securities, the value of the component securities is subject to market risk, or the risk that market fluctuations may cause the value of the component securities to go up or down, sometimes rapidly and unpredictably. In addition, the value of equity securities may increase or decline for reasons directly related to the issuers of the securities.

An Index may be Substituted for Shield Option(s) with Step Rate Edge

We have the right to substitute a comparable index for Shield Options with Step Rate Edge prior to the Term End Date if any Index is discontinued, or, at our sole discretion, we determine that our use of such Index should be discontinued, or if the calculation of an Index is substantially changed. We would attempt to choose a substitute index that has a similar investment objective and risk profile to the replaced index. Upon substitution of an Index, we will calculate your Index Performance on the replaced Index up until the date of substitution and the substitute Index from the date of substitution to the Term End Date. An Index substitution will not change the Shield Rate or Edge Rate for an existing Shield Option. The performance of the new Index may not be as good as the one that is substituted and as a result your Index Performance may have been better if there had been no substitution.

TERM

2-year Terms are available with Shield Options with Step Rate and Step Rate Edge. Additional 1-Year Terms are available with Shield Options with Step Rate and a Shield Rate 15.

INDICES

Nasdaq-100 Index® is newly available with certain Shield Options. The following description is added to the “INDICES” section of your prospectus:

Nasdaq-100 Index® (Price Return Index). The Nasdaq-100 Index® includes 100 of the largest domestic and international non-financial securities listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies. The Nasdaq-100 Index® does not include dividends declared by any of the companies in this Index.

SHIELD OPTIONS WITH STEP RATE EDGE

The Shield Options with Step Rate Edge described in this supplement are similar to the Shield Options with Step Rate described in the prospectus, except that you will receive the Edge Rate even if the Index Performance is negative, as long as the negative Index Performance is greater than or equal to the Shield Rate.

STEP RATE EDGE CREDITING TYPE

Step Rate Edge

For Shield Options with Step Rate Edge, the Edge Rate is the rate credited at the Term End Date if the Index Performance is greater than or equal to the Shield Rate. For example, a 3% Index Performance with a 7% Step Rate Edge rate and a 10% Shield Rate will result in a 7% Performance Rate, or, a -10% Index Performance with a 7% Edge Rate and a 10% Shield Rate will result in a 7% Performance Rate. The Edge Rate is measured from the Term Start Date to the Term End Date, and the full Edge Rate only applies if you hold the Shield Option until the Term End Date. The Edge Rate may vary between Shield Options and it is not an annual rate. For renewals into the same Shield Option a new Edge Rate is declared for each subsequent Term, and such rate will not be less than the minimum guaranteed Edge Rate(s) stated in your Contract, but will never be less than 1.5%.

In deciding whether to purchase a Shield Option with a Cap Rate or Edge Rate, you should consider that Edge Rates are generally lower than Cap Rates. If Index Performance is equal to or greater than zero but less than the Edge Rate, and you chose a Cap rate for your Shield Option, your Performance Rate adjustment will be lower than it otherwise would be had you chosen Step Rate Edge. Alternatively, if the Index Performance is positive and exceeds the Edge Rate, and you chose Step Rate Edge for your Shield Option, your Performance Rate Adjustment will be lower than it would otherwise be had you chosen a Cap Rate. For example, if you chose a Shield Option with a 10% Cap Rate and there is a 15% Index Performance, your Performance Rate is 10%; however, if instead you were to choose a Shield Option with an 8% Edge Rate, your Performance Rate would instead be 8%. Alternatively, if you chose a Shield Option with a 10% Cap Rate and there is a 0% Index Performance, your Performance Rate is 0%; however, if instead you were to choose a Shield Option with an 8% Edge Rate, your Performance Rate would be 8%.

In deciding whether to purchase a Shield Option with a Step Rate or Step Rate Edge, you should consider that Edge Rates are generally lower than Step Rates. If Index Performance is negative but does not exceed the Shield Rate, and you chose a Step Rate, your Performance Rate Adjustment will be lower than it otherwise would be had you chosen Step Rate Edge. For example, if you chose a Shield Option with an 8% Step Rate, a 15% Shield Rate and there is a -10% Index Performance, your Performance Rate would be zero. Alternatively, if you chose a Shield Option with a 7% Edge Rate, a 15% Shield Rate and there is a -10% Index Performance, your Performance Rate would be 7%.

Performance Lock is not available with Shield Option(s) with Step Rate Edge.

INVESTMENT AMOUNT CALCUALTION WITH STEP RATE EDGE

The Investment Amount, for each Shield Option, is the amount that is allocated to the Shield Option at Term Start Date and subsequently reflects all withdrawals and adjustments at the Term End Date. The Investment Amount will be reduced for any withdrawal by the same percentage that the withdrawal reduces the Interim Value attributable to that Shield Option.

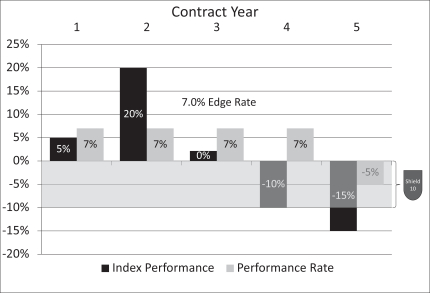

The following example is added to “Example 1.1 – Calculating your Investment Amount without Performance Lock on a Term End Date” section as Example 1.1C. This example is intended to show how the Investment Amount on a Term End Date is calculated with Step Rate Edge. The example assumes that Owner 1 allocates a $50,000 Purchase Payment into a 1-Year Term/ Shield 10/ S&P 500® Index/Edge Rate of 7% and she allows her allocation to renew year to year for five years. For purposes of this example, assume no withdrawals are made during the five-year example period, and the Edge Rate stays at 7% for all five years. If a withdrawal were made before the Term End Date, we would calculate an Interim Value and consequently, the Investment Amount for the Term would be adjusted accordingly.

Example 1.1C—Shield Option with Step Rate Edge:

Owner 1 allocates her $50,000 Purchase Payment into a 1-Year Term / Shield 10 / S&P 500® Index with an Edge Rate of 7% and lets it renew year after year for five years. The following example illustrates how her initial $50,000 Purchase Payment could perform over a five-year period given fluctuating Index Values. For renewals into the same Shield Option a new Edge Rate would be declared and go into effect on the Contract Anniversary that coincides with the beginning of the new Shield Option.

| Contract Year | 1 | 2 | 3 | 4 | 5 | |||||

Term Start Date | ||||||||||

Investment Amount(1) | $50,000 | $53,500 | $57,245 | $61,252 | $65,540 | |||||

Index Value | 1,000 | 1,050 | 1,260 | 1,260 | 1,134 | |||||

Term End Date | ||||||||||

Index Value | 1,050 | 1,260 | 1,260 | 1,134 | 964 | |||||

Index Performance(2) | 5% | 20% | 0% | -10% | -15% | |||||

Edge Rate | 7% | 7% | 7% | 7% | 7% | |||||

Shield Rate | 10% | 10% | 10% | 10% | 10% | |||||

Performance Rate (one year)(3) | 7% | 7% | 7% | 7% | -5% | |||||

Performance Rate Adjustment(4) | $3,500 | $3,745 | $4,007 | $4,288 | -$3,277 | |||||

Investment Amount(5) | $53,500 | $57,245 | $61,252 | $65,540 | $62,263 | |||||

Notes to the table above:

| (1) | The Investment Amount at Term Start Date in year one is the $50,000 Purchase Payment. In years two through five, the Investment Amount at the Term Start Date would be $53,500, $57,245, $61,252 and $65,540, respectively, which was the Investment Amount at the Term End Date for the prior year. |

| (2) | Index Performance is equal to the percentage change in the Index Value measured from the Term Start Date to the Term End Date. For example, in year one, Index Performance is calculated as follows: |

(1,050 [Index Value at Term End Date] — 1,000 [Index Value at Term Start Date]) ÷ 1,000 [Index

Value at Term Start Date]) = 5%

| (3) | In years one, two and three the Performance Rate is equal to the Edge Rate because the Index Performance is positive or zero. It should be noted that although Index Performance was 20% in year two, the Performance Rate is capped at 7% by Step Rate Edge. In |

| year four the Performance Rate is 7% because the Index Performance is –10% and does not exceed the Shield 10 which absorbs up to 10% of the negative Index Performance. In year five, the Performance Rate is –5% because the Index Performance is -15% and the Shield 10 absorbs up to 10% of the negative Index Performance. |

| (4) | The Performance Rate Adjustment is equal to the product of the Investment Amount at the Term Start Date adjusted for any withdrawals (there are no withdrawals in the example) multiplied by the Performance Rate. For example, in year one the Performance Rate Adjustment is calculated as follows: |

$50,000 [Investment Amount at Term Start Date] x 7% [Performance Rate] = $3,500

| (5) | The Investment Amount at the Term End Date is equal to the Investment Amount at Term Start Date adjusted for any withdrawals (there are no withdrawals in the example) plus the Performance Rate Adjustment. For example, in year one the Investment Amount at the Term End Date is calculated as follows: |

$50,000 [Investment Amount at Term Start Date] + $3,500 [Performance Rate Adjustment] = $53,500

INTERIM VALUE CALCUATION WITH STEP RATE EDGE

We calculate an Interim Value on each Business Day between the Term Start Date and prior to the Term End Date. We use Interim Value to calculate the amount that is available if you make a withdrawal, Surrender the Contract, annuitize or we pay a death benefit. It is equal to the Investment amount at the Term Start Date, adjusted for any withdrawals, in the Shield Option, adjusted for the Index Performance of the associated Index and subject to the applicable Accrued Shield Rate, and Accrued Edge Rate.

Accrued Edge Rate

Accrued Edge Rate is the portion of the Edge Rate that has accrued from the Term Start Date to any day within the Term. This is the rate that will be applied in calculating the Interim Value on any day prior to the Term End Date if Index Performance is equal to or greater than the Accrued Shield Rate. The Accrued Edge Rate is equal to the Edge Rate multiplied by the number of days elapsed since the Term Start Date, divided by the total number of days in the Term. For purposes of determining the Accrued Edge Rate, the total number of days in each calendar year of a Term is 365.

Performance Rate for Determination of Interim Value with Accrued Edge Rate

For Shield Option(s) with Step Rate Edge, the Performance Rate during a particular Term is the Index Performance adjusted for the applicable Accrued Shield Rate or Accrued Edge Rate.

APPENDIX A – INDEX PUBLISHERS

The following is added to the end of Appendix A:

Nasdaq, Inc. requires that the following disclaimer be included in this prospectus: Brighthouse Shield® Level Select 3-Year Annuity is not sponsored, endorsed, sold or promoted by Nasdaq, Inc. or its affiliates (Nasdaq®, with its affiliates, are referred to as the “Corporations”). The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, Brighthouse Shield® Level Select 3-Year Annuity. The Corporations make no representation or warranty, express or implied to the owners of Brighthouse Shield® Level Select 3-Year Annuity or any member of the public regarding the advisability of investing in securities generally or in Brighthouse Shield® Level Select 3-Year Annuity particularly, or the ability of the Nasdaq-100 Index® to track general stock market performance. The Corporations’ only relationship to Brighthouse Life Insurance Company (“Licensee”) is in the licensing of the Nasdaq-100 Index®, and certain trade names of the Corporations and the use of the Nasdaq-100 Index® which is determined, composed and calculated by Nasdaq® without regard to Licensee or Brighthouse Shield® Level Select 3-Year Annuity. Nasdaq® has no obligation to take the needs of the Licensee or the owners of Brighthouse Shield® Level Select 3-Year Annuity into consideration in determining, composing or

calculating the Nasdaq-100 Index®. The Corporations are not responsible for and have not participated in the determination of the timing of, prices at, or quantities of Brighthouse Shield® Level Select 3-Year Annuity to be issued or in the determination or calculation of the equation by which Brighthouse Shield® Level Select 3-Year Annuity is to be converted into cash. The Corporations have no liability in connection with the administration, marketing or trading of Brighthouse Shield® Level Select 3-Year Annuity.

THE CORPORATIONSDONOTGUARANTEETHEACCURACYAND/ORUNINTERRUPTEDCALCULATIONOF NASDAQ-100 INDEX®ORANYDATAINCLUDEDTHEREIN. THE CORPORATIONSMAKENOWARRANTY,EXPRESSORIMPLIED,ASTORESULTSTOBEOBTAINEDBY LICENSEE,OWNERSOF BRIGHTHOUSE SHIELD® LEVELSELECT 3-YEARANNUITY,ORANYOTHERPERSONORENTITYFROMTHEUSEOFTHE NASDAQ-100 INDEX®ORANYDATAINCLUDEDTHEREIN. THE CORPORATIONSMAKENOEXPRESSORIMPLIEDWARRANTIES,ANDEXPRESSLYDISCLAIMALLWARRANTIESOFMERCHANTABILITYORFITNESSFORAPARTICULARPURPOSEORUSEWITHRESPECTTOTHE NASDAQ-100 INDEX®ORANYDATAINCLUDEDTHEREIN.WITHOUTLIMITINGANYOFTHEFOREGOING,INNOEVENTSHALLTHE CORPORATIONSHAVEANYLIABILITYFORANYLOSTPROFITSORSPECIAL,INCIDENTAL,PUNITIVE,INDIRECT,ORCONSEQUENTIALDAMAGES,EVENIFNOTIFIEDOFTHEPOSSIBILITYOFSUCHDAMAGES.

THIS SUPPLEMENT SHOULD BE READ AND RETAINED FOR FUTURE REFERENCE

Number

NumberDescription

(Registrant)

Donald A. Leintz

/s/ Eric Steigerwalt* Eric Steigerwalt | Chairman of the Board, President, Chief Executive Officer and a Director |

/s/ Myles Lambert* Myles Lambert | Director and Vice President |

/s/ David A. Rosenbaum* David A. Rosenbaum | Director and Vice President |

/s/ Jonathan Rosenthal* Jonathan Rosenthal | Director, Vice President and Chief Investment Officer |

/s/ Edward A. Spehar* Edward A. Spehar | Director, Vice President and Chief Financial Officer |

/s/ Kristine Toscano* Kristine Toscano | Vice President and Chief Accounting Officer |

/s/ Gianna H. Figaro-Sterling* Gianna H. Figaro-Sterling | Vice President and Controller |

*By: /s/ Michele H. Abate Michele H. Abate, Attorney-In-Fact January 9, 2023 |