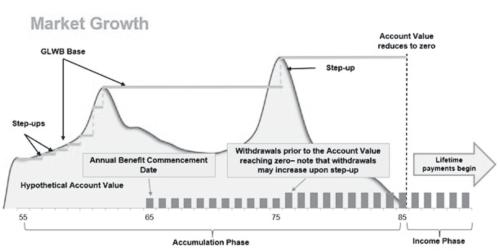

The GLWB rider guarantees that you will receive lifetime income regardless of

market performance. Specifically, the GLWB provides Annual Benefit Payments

based on a percentage of your GLWB Base. The GLWB rider is automatically

included with your Contract, and we charge an annual fee for this benefit

(regardless of whether or not you utilize the benefit). This Rider Charge is equal

to the Rider Fee Rate, a percentage specified in the GLWB Supplement and will

not change with respect to your specific Contract.

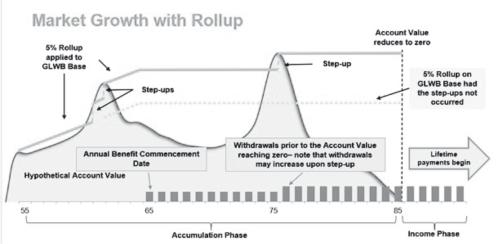

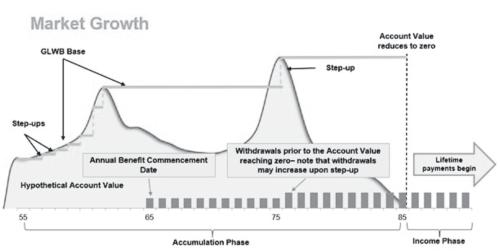

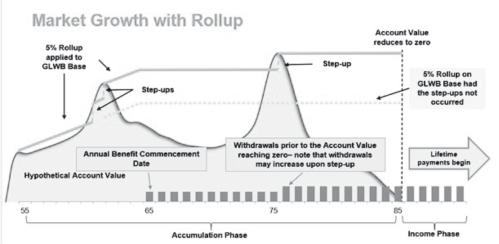

We offer two variations of the GLWB rider: Market Growth and Market Growth

with Rollup. When you purchase the Contract, you must choose either Market

Growth or Market Growth with Rollup. The Withdrawal Rates, Lifetime

Guarantee Rates, and availability of a Rollup Rate will vary depending on the

variation you choose. Market Growth with Rollup will generally have lower

Withdrawal Rates and Lifetime Guarantee Rates than Market Growth.

The initial GLWB Base is equal to your Purchase Payment. On each Contract

Anniversary, the GLWB Base can increase.

•For Market Growth with Rollup, the increase occurs through a Rollup Rate

(on each Contract Anniversary for the first 10 Contract Years if you have

not taken a withdrawal in that Contract Year) and an Automatic Step-Up (if

the Account Value exceeds the GLWB Base after we apply the Rollup).

On and after the Annual Benefit Commencement Date, you can withdraw up to

the Annual Benefit Payment in a Contract Year without impacting your GLWB

Base and Net Purchase Payment Amount. If you take an Early Withdrawal or an

Excess Withdrawal, your GLWB Base and Net Purchase Payment Amount will be

reduced in the same proportion (i.e., the same percentage) that these

withdrawals reduce your Account Value. These reductions could be significant.

The GLWB rider cannot be cancelled but will be terminated under certain

circumstances. See “Operation of the GLWB—Termination of the GLWB Rider.”

The GLWB base cannot be withdrawn in a lump sum or paid as a death benefit.

The Rider Charge, Withdrawal Rates, Lifetime Guarantee Rates, Lifetime

Withdrawal Age, Earliest Annual Benefit Commencement Date, allocation

options available after the Annuity Benefit Commencement Date, and, if

applicable, Rollup Rate (collectively the “GLWB Terms”) are disclosed in the

GLWB Supplement. We cannot change these terms for your Contract once it is

issued.

Your financial professional will give you a copy of the prospectus with the GLWB

Supplement when you apply for a Contract. The GLWB Supplement does not

change for a given purchaser once issued. You should not purchase the

Contract without first obtaining the current GLWB Supplement.

Once a GLWB Supplement is effective, it will remain in effect until it is

superseded at any time when we publish a new GLWB Supplement. If we make

any changes, we will supplement the prospectus at least seven calendar days

before they take effect on our website at https://

www.brighthousefinancial.com/products/annuities/

shield-level-pay-plus-annuities/. The GLWB Supplement is also filed on EDGAR

at www.sec.gov pursuant to Rule 424(b)(2) under the Securities Act of 1933,

as a 424B2 form type filing (File Number 333-276763). You can contact us to

receive the GWLB Supplement applicable to your Contract by calling our

Annuity Service Office at the toll-free telephone number provided in this

prospectus.