| | |

| | | Exhibit 13

Nucor Corporation

2004 Form 10-K |

FINANCIALHIGHLIGHTS (dollar amounts in thousands, except per share data)

| | | | | | | | | | | |

| | | 2004

| | | 2003

| | | % CHANGE

| |

FOR THE YEAR | | | | | | | | | | | |

Net sales | | $ | 11,376,828 | | | $ | 6,265,823 | | | 82 | % |

Earnings: | | | | | | | | | | | |

Earnings before income taxes | | | 1,731,276 | | | | 66,877 | | | 2489 | % |

Provision for income taxes | | | 609,791 | | | | 4,096 | | | 14,787 | % |

| | |

|

|

| |

|

|

| | | |

Net earnings | | | 1,121,485 | | | | 62,781 | | | 1,686 | % |

Per share: | | | | | | | | | | | |

Basic(1) | | | 7.08 | | | | 0.40 | | | 1,670 | % |

Diluted(1) | | | 7.02 | | | | 0.40 | | | 1,655 | % |

Dividends per share(1) | | | 0.47 | | | | 0.40 | | | 18 | % |

Percentage of net earnings to net sales | | | 9.9 | % | | | 1.0 | % | | 884 | % |

Return on average equity | | | 38.7 | % | | | 2.7 | % | | 1,333 | % |

Capital expenditures | | | 285,925 | | | | 215,408 | | | 33 | % |

Depreciation | | | 383,305 | | | | 364,112 | | | 5 | % |

Sales per employee | | | 1,107 | | | | 637 | | | 74 | % |

AT YEAR END | | | | | | | | | | | |

Working capital | | $ | 2,109,158 | | | $ | 990,965 | | | 113 | % |

Property, plant and equipment | | | 2,818,307 | | | | 2,817,135 | | | — | |

Long-term debt | | | 923,550 | | | | 903,550 | | | 2 | % |

Stockholders’ equity | | | 3,455,985 | | | | 2,342,077 | | | 48 | % |

Per share(1) | | | 21.67 | | | | 14.90 | | | 45 | % |

Shares outstanding(1) | | | 159,512 | | | | 157,180 | | | 1 | % |

Employees | | | 10,600 | | | | 9,900 | | | 7 | % |

| (1) | Per share amounts and shares outstanding have been restated to reflect the two-for-one stock split effective October 15, 2004. |

FORWARD-LOOKING STATEMENTSCertain statements made in this annual report are forward-looking statements that involve risks and uncertainties. These forward-looking statements reflect the Company’s best judgment based on current information, and although we base these statements on circumstances that we believed to be reasonable when made, there can be no assurance that future events will not affect the accuracy of such forward-looking information. As such, the forward-looking statements are not guarantees of future performance, and actual results may vary materially from the results and expectations discussed in this report. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward-looking statements include, but are not limited to: (1) the sensitivity of the results of our operations to prevailing steel prices and the changes in the supply and cost of raw materials, including scrap steel; (2) availability and cost of electricity and natural gas; (3) market demand for steel products; (4) competitive pressure on sales and pricing, including pressure from imports and substitute materials; (5) uncertainties surrounding the global economy, including excess world capacity for steel production; (6) U.S. and foreign trade policy affecting steel imports or exports; (7) significant changes in government regulations affecting environmental compliance; (8) the cyclical nature of the domestic steel industry; (9) capital investments and their impact on our performance; and (10) our safety performance.

All forward-looking statements speak only as of the date of this report or, in the case of any document incorporated by reference, the date of that document. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on the Company’s behalf are qualified by the cautionary statements in this section. The Company does not undertake any obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this report.

| | | | |

STEEL MILLS SEGMENT

BAR MILLS Products: Steel bars, angles and other products for automotive, construction, farm machinery, metal buildings, furniture and recreational equipment. Darlington, South Carolina Norfolk, Nebraska Jewett, Texas Plymouth, Utah Auburn, New York (Nucor Steel Auburn, Inc.) Birmingham, Alabama (Nucor Steel Birmingham, Inc.) Kankakee, Illinois (Nucor Steel Kankakee, Inc.) Jackson, Mississippi (Nucor Steel Jackson, Inc.) Seattle, Washington (Nucor Steel Seattle, Inc.) SHEET MILLS Products: Flat-rolled steel for automotive, appliances, pipes and tubes, construction and other industries. Crawfordsville, Indiana Hickman, Arkansas Berkeley County, South Carolina Decatur, Alabama (Nucor Steel Decatur, LLC) NUCOR-YAMATO STEEL COMPANY Products: Super-wide flange steel beams, pilings and heavy structural steel products for fabricators, construction companies, manufacturers and steel service centers. Blytheville, Arkansas | | BEAM MILL Products: Wide flange steel beams, pilings and heavy structural steel products for fabricators, construction companies, manufacturers and steel service centers. Berkeley County, South Carolina PLATE MILLS Products: Steel plate for manufacturers of heavy equipment, rail cars, ships, barges, refinery tanks, pipe and tube, pressure vessels, construction and others. Hertford County, North Carolina Tuscaloosa, Alabama (Nucor Steel Tuscaloosa, Inc.) STEEL PRODUCTS SEGMENT

VULCRAFT Products: Steel joists, joist girders and steel deck for buildings. Florence, South Carolina Norfolk, Nebraska Fort Payne, Alabama Grapeland, Texas St. Joe, Indiana Brigham City, Utah Chemung, New York (Vulcraft of New York, Inc.) | | COLD FINISH Products: Cold finished steel bars for shafting and precision machined parts. Norfolk, Nebraska Darlington, South Carolina Brigham City, Utah Oak Creek, Wisconsin (Nucor Cold Finish Wisconsin, Inc.) BUILDING SYSTEMS Products: Metal buildings and metal building components for commercial, industrial and institutional building markets. Waterloo, Indiana Swansea, South Carolina Terrell, Texas FASTENER Products: Steel hexhead cap screws, structural bolts and hex bolts for automotive, machine tools, farm implements, construction and military applications. St. Joe, Indiana NUCON STEEL Products: Load bearing light gauge steel framing systems for the commercial and residential construction markets. Denton, Texas Dallas, Georgia CORPORATE OFFICE

Charlotte, North Carolina |

STEEL MILLS SEGMENT

BAR MILLS, SHEET MILLS, STRUCTURAL MILLS AND PLATE MILLS

Nucor operates scrap-based steel mills in seventeen facilities. These mills utilize modern steelmaking techniques and produce steel at a cost competitive with steel manufactured anywhere in the world.

BAR MILLS

Nucor has nine bar mills located in South Carolina, Nebraska, Texas, Utah, New York, Alabama, Illinois, Mississippi and Washington that produce bars, angles and light structural shapes in carbon and alloy steels. These products have wide usage, including automotive, construction, farm equipment, metal buildings, furniture and recreational equipment. Four of the bar mills were constructed by Nucor between 1969 and 1981. Over the years, Nucor has completed extensive capital projects to keep these facilities modernized, including a modernization of the rolling mill at the Nebraska facility, a new melt shop at the Texas facility, and a new finishing end at the South Carolina facility. In 2001, Nucor purchased substantially all of the assets of Auburn Steel Company, Inc.’s steel bar facility in Auburn, New York, which currently has the capacity to produce up to 470,000 tons of merchant and special bar quality (SBQ) steel shapes and rebar. In 2002, Nucor completed the acquisition of substantially all the assets of Birmingham Steel Corporation (“Birmingham Steel”). The four bar mills acquired from Birmingham Steel can produce in excess of 2,200,000 tons annually. The total capacity of our nine bar mills is approximately 6,300,000 tons per year.

SHEET MILLS

The sheet mills produce flat-rolled steel for automotive, appliances, pipes and tubes, construction and other industries. The four sheet mills are located in Indiana, Arkansas, South Carolina and Alabama. Nucor constructed three of the sheet mills between 1989 and 1996. The constructed sheet mills utilize thin slab casters to produce hot rolled sheet. In 2002, Nucor’s wholly owned subsidiary, Nucor Steel Decatur, LLC, purchased substantially all the assets of Trico Steel Company, LLC (“Trico”). This sheet mill is located in Decatur, Alabama, and has an annual capacity of approximately 1,900,000 tons, initially expanding our sheet capacity by 30%. In the third quarter of 2004, Nucor Steel Decatur, LLC purchased the adjacent cold rolling mill of Worthington Industries, Inc. (“Worthington”). All four of our sheet mills are now equipped with cold rolling mills for further processing of hot rolled sheet. The three greenfield constructed mills are also equipped with galvanizing lines. The total capacity of the four sheet mills is about 9,100,000 tons per year.

STRUCTURAL MILLS

The structural mills produce wide flange steel beams, pilings and heavy structural steel products for fabricators, construction companies, manufacturers and steel service centers. In 1988, Nucor and Yamato Kogyo, one of Japan’s major producers of wide-flange beams, completed construction of a beam mill located near Blytheville, Arkansas. Nucor owns a 51% interest in Nucor-Yamato Steel Company. During 1999, Nucor started operations at its 700,000 tons-per-year steel beam mill in South Carolina. Both mills use a special continuous casting method that produces a beam blank closer in shape to that of the finished beam than traditional methods. Current annual production capacity of our two structural mills is approximately 3,200,000 tons.

PLATE MILLS

Nucor operates two plate mills. Nucor completed construction of its first plate mill, located in North Carolina, in 2000 with the competitive advantages of new, more efficient production technology. This mill produces plate for manufacturers of heavy equipment, rail cars, ships, barges, refinery tanks and others. During the third quarter of 2004, Nucor’s wholly owned subsidiary, Nucor Steel Tuscaloosa, Inc., purchased substantially all the assets of Corus Tuscaloosa. The Tuscaloosa mill has an annual capacity of 800,000 tons, and complements our product offering with thinner gauges of coiled and cut-to-length plate used in the pipe and tube, pressure vessel, transportation and construction industries. Current annual production capacity of our two plate mills is approximately 2,100,000 tons.

OPERATIONS

Nucor’s steel mills are among the most modern and efficient mills in the United States. Recycled steel scrap and other metallics are melted in electric arc furnaces and poured into continuous casting systems. Highly sophisticated rolling mills convert the billets, blooms and slabs into rebar, angles, rounds, channels, flats, sheet, beams, plate and other products.

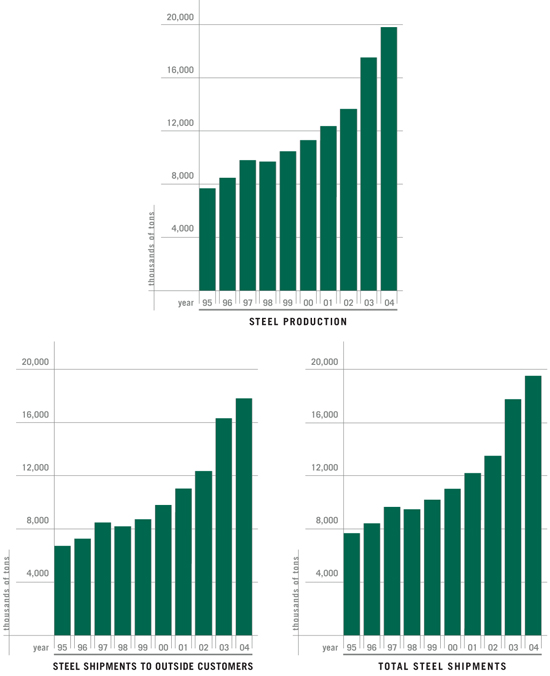

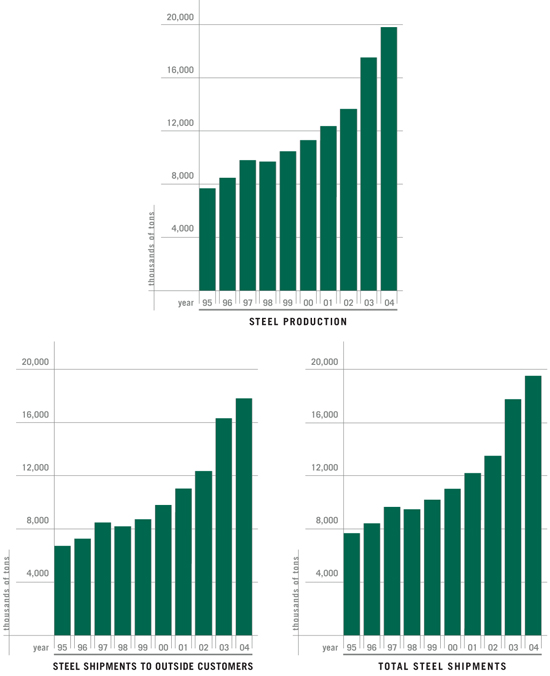

Production in 2004 was a record 19,737,000 tons, a 13% increase from 17,441,000 tons in 2003. Annual production capacity has grown from 120,000 tons in 1970 to a present total of about 20,700,000 tons.

The operations in the rolling mills are highly automated and require fewer operating employees than older mills. All Nucor steel mills have high productivity, which results in employment costs of approximately 8% of the sales dollar. This is lower than the employment costs of integrated steel companies producing comparable products. Employee turnover in all mills is extremely low. All employees have a significant part of their compensation based on their productivity. Production employees work under group incentives that provide increased earnings for increased production. This additional compensation is paid weekly.

Steel mills are large consumers of electricity and gas. Total energy costs were essentially flat from 2003 to 2004, as productivity gains offset higher unit gas and electricity costs. Because of the high efficiency of Nucor steel mills, these energy costs were less than 10% of the sales dollar in 2004 and 2003.

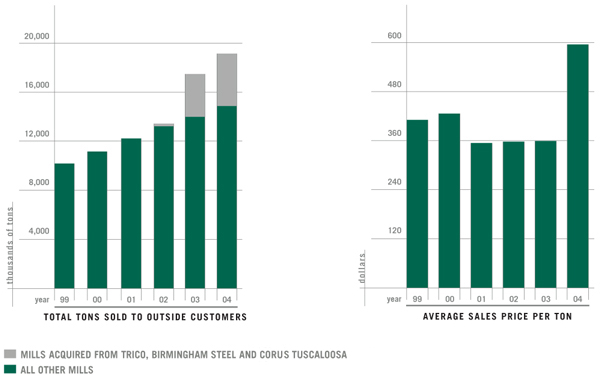

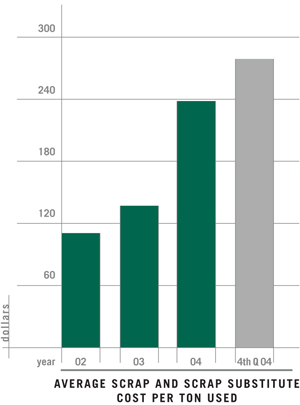

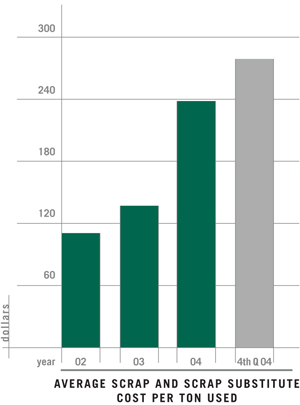

Scrap and scrap substitutes are the most significant element in the total cost of steel production. The average cost of scrap and scrap substitutes used increased 74% to $238 per ton in 2004 from $137 per ton in 2003. A raw material surcharge implemented in 2004 has allowed Nucor to maintain operating margins and meet our commitment to customers in spite of highly volatile scrap and scrap substitute costs.

MARKETS AND MARKETING

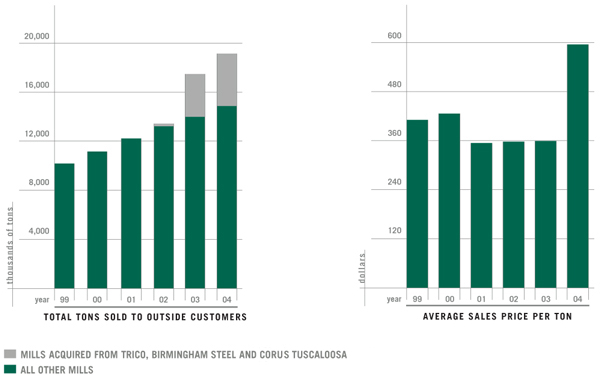

Approximately 90% of the seventeen steel mills’ production in 2004 was sold to outside customers and the balance was used internally by the Vulcraft, Cold Finish, Building Systems and Fastener divisions. Steel sales to outside customers in 2004 were a record 17,787,000 tons, 9% higher than the 16,263,000 tons in 2003.

Our steel mill customers are primarily manufacturers, steel service centers and fabricators. The sheet mills continue to build long-term relationships with contract customers who purchase more value-added products. We enter 2005 with 60-65% of our sheet mill volume committed to contract customers. Contract terms are typically six to twelve months in length with various renewal dates. These contracts are non-cancelable agreements with a pricing formula that varies based on raw material costs. Long term, the sheet mills will continue to pursue profitable contract business.

TRADE ISSUES

Nucor’s continued involvement in trade issues is a critical part of our efforts to support the long-term success of our steel-making operations. Unfairly traded, illegally dumped steel imports have devastated the U.S. steel industry and its workers. In 2002, the Bush Administration implemented Section 201 to help the domestic steel industry recover from the illegal and predatory trading practices of foreign competitors. In December 2003, the Administration chose to prematurely end the temporary steel safeguard tariffs; however, we are optimistic about the Administration’s commitment to the vigorous enforcement of U.S. trade laws and the President’s promise to work with Congress to achieve a long-term solution to illegal dumping and other unfair trade practices that necessitated Section 201. Nucor actively supports several organizations that promote free and fair trade and that oppose currency manipulation.

NEWER FACILITIES AND EXPANSIONS

In February 2002, Nucor announced that over $200.0 million would be spent on three bar mill capital projects over the next three years. During 2003, modernization of the rolling mill at our Nebraska facility and the installation of a new finishing end at our South Carolina bar mill were completed. During 2004, the Nucor team completed the last of these projects – a new melt shop at our Texas facility. All three of these projects were completed on time and on budget. Through 2004, these three bar mills have continued to lower their conversion costs, increase their yields and productivity, and improve product consistency.

In July 2002, Nucor’s wholly owned subsidiary, Nucor Steel Decatur, LLC, purchased substantially all the assets of Trico for a purchase price of $117.7 million. This 1,900,000-ton sheet mill, located in Decatur, Alabama, began operations in 1997 but had been shut down as the result of bankruptcy. The purchase strategy called for a major renovation of the facility, including: the scrap handling system, both electric arc furnaces, the alloy system, the water systems, the tunnel furnace, rolling mill gearing and the finished coil handling equipment. Capital expenditures for this facility have exceeded $100.0 million from acquisition through 2004. Nucor Steel Decatur continues to grow its capacity and is targeting 2,100,000 tons of hot rolled production for 2005.

In December 2002, we completed the acquisition of substantially all the assets of Birmingham Steel for a cash purchase price of approximately $615.0 million, including $116.9 million in inventory and receivables. Primary assets purchased were four operating steel mills that produce rebar and other bar products and have combined annual capacity of more than 2,200,000 tons. The compatibility of the four purchased bar mills has helped to facilitate a smooth transition and integration process. These four bar mills, the largest acquisition in Nucor’s history, made significant operating profit contributions in 2003 and 2004.

In late 2003, the sheet mill in Berkeley County, South Carolina, completed construction and began trials of a vacuum degasser. The degasser has allowed Nucor to expand this facility’s product capacity into deep drawing steel grades. We expect to continue advancement and participation in more value-added business in the automotive, appliance, lawn and garden, and heating-ventilation-air conditioning markets in 2005.

During the third quarter of 2004, Nucor purchased substantially all of the assets of Corus Tuscaloosa for a cash purchase price of approximately $89.4 million. This plate mill has an annual capacity of about 800,000 tons and complements the product offering of our Hertford County plate mill with thinner gauges of coiled and cut-to-length plate. This acquisition was immediately accretive to earnings and made a significant operating contribution in 2004.

Also in the third quarter of 2004, Nucor purchased certain cold rolling assets from Worthington, located adjacent to our Decatur, Alabama sheet mill, for a cash purchase price of approximately $80.3 million. The purchased assets include all of the buildings, a pickle line, four-stand tandem mill, temper mill and annealing furnaces. This modern 1,000,000-ton cold mill with 600,000 tons of annealing capacity was constructed in 1998 and complements our strategy to serve value-added customers in the Southeast market.

In September 2004, Nucor exercised its option to acquire the assets of an idled direct reduced iron (“DRI”) plant located in Louisiana. We have begun dismantling and refurbishing this DRI plant for relocation to Trinidad and to expand annual capacity to 1,800,000 metric tons per year. The Trinidad site will benefit from a low cost supply of natural gas and favorable logistics for receipt of Brazilian iron ore and shipment of DRI to the United States. This new entity will be named Nu-Iron Unlimited (“Nu-Iron”) and has a capital budget of approximately $225.0 million. Nu-Iron is expected to begin operations in early 2006.

COMMERCIALIZATION OF NEW TECHNOLOGIES

In April 2002, Nucor entered a joint venture with The Rio Tinto Group, Mitsubishi Corporation and Chinese steel maker Shougang Corporation to construct a commercial HIsmelt®plant in Kwinana, Western Australia. The HIsmelt process converts iron ore fines and coal fines to liquid metal, eliminating the need for a blast furnace, sinter/pellet plants and coke ovens. Nucor has a 25% interest in the joint venture that owns the HIsmelt commercial plant. Construction is nearing completion and cold commissioning of about 75% of the plant is in progress. Production is now scheduled to begin in the second quarter of 2005. This plant will have an initial annual capacity of 800,000 metric tons and is expandable to over 1,500,000 metric tons at a very attractive capital cost.

Nucor began operations of its 100% owned Castrip® facility in Crawfordsville, Indiana, in May 2002. This facility uses the breakthrough technology of strip casting, to which Nucor holds exclusive rights in the United States and Brazil. Strip casting involves the direct casting of molten steel into final shape and thickness without further hot or cold rolling. This process allows lower investment and operating costs, reduced energy consumption and smaller scale plants than can be economically built with current technology. This process also reduces the overall environmental impact of producing steel by generating significantly lower emissions, particularly NOx. In early 2005, Nucor announced that the Castrip process had achieved commercial viability and that a second Nucor location for a Castrip operation was being sought in the United States. Nucor also announced plans to establish at least one joint venture partner overseas in 2005 to utilize the Castrip technology.

In April 2003, Nucor entered a joint venture with Companhia Vale do Rio Doce (“CVRD”) to construct and operate an environmentally friendly pig iron project in northern Brazil. The project, named Ferro Gusa Carajás S.A. (“Ferro Gusa”), will utilize two conventional mini-blast furnaces to produce about 380,000 metric tons of pig iron per year in its initial phase, using iron ore from CVRD’s Carajás mine in northern Brazil. The charcoal source will be exclusively from eucalyptus trees grown in a cultivated forest of 82,000 acres with the total forest encompassing approximately 200,000 acres in northern Brazil. The cultivated forest removes more carbon dioxide from the atmosphere than the blast furnace emits. Production is expected to begin in the third quarter of 2005. It is anticipated that Nucor will purchase all of the production of the plant.

The Ferro Gusa project, together with the Nu-Iron and HIsmelt projects discussed above, represent the initial steps in Nucor’s raw materials strategy to control about one-third of our iron units consumption. At our current consumption rate, achieving this strategic goal will require between 6,000,000 and 7,000,000 tons per year of high quality scrap substitutes.

STEEL PRODUCTS SEGMENT

VULCRAFT

is the nation’s largest producer of open-web steel joists, joist girders and steel deck, which are used for building construction.

OPERATIONS

Steel joists and joist girders are produced and marketed nationally through seven Vulcraft facilities located in South Carolina, Nebraska, Alabama, Texas, Indiana, Utah and New York. Current annual production capacity is more than 685,000 tons. In 2004, Vulcraft produced 522,000 tons of steel joists and joist girders, an increase of 4% from the 503,000 tons produced in 2003.

Material costs, primarily steel, were 53% of the joist sales dollar in 2004 (56% in 2003). Vulcraft obtained 99% of its steel requirements for joists and joist girders from the Nucor bar mills in both 2004 and 2003. Freight costs for joists and joist girders were less than 10% of the sales dollar in 2004 and 2003. Vulcraft maintains an extensive fleet of trucks to ensure and control on-time delivery.

The Vulcraft facilities in South Carolina, Nebraska, Alabama, Texas, Indiana and New York produce steel deck. Current deck annual production capacity is approximately 430,000 tons. Vulcraft steel deck sales increased 3% from 353,000 tons in 2003 to 364,000 tons in 2004. Coiled sheet steel was about 54% of the steel deck sales dollar in 2004 (66% in 2003). In 2004 and 2003, Vulcraft obtained 99% of its steel requirements for steel deck production from the Nucor sheet mills. For 2004 and 2003, freight costs for deck were less than 10% of the sales dollar.

Production employees of Vulcraft work with a group incentive system that provides increased compensation each week for increased performance.

MARKETS AND MARKETING

Steel joists, joist girders and steel decking are used extensively as part of the roof and floor support systems in manufacturing buildings, retail stores, shopping centers, warehouses, schools, churches, hospitals and, to a lesser extent, in multi-story buildings and apartments. Building support systems using joists, joist girders and steel deck are frequently more economical than other systems.

Steel joists and joist girder sales are obtained by competitive bidding. Vulcraft quotes on a significant percentage of the domestic buildings using steel joists and joist girders as part of the support systems. In 2004, Vulcraft supplied more than 40% of total domestic sales of steel joists. Steel deck is specified in the majority of buildings using steel joists and joist girders. In 2004, Vulcraft supplied more than 30% of total domestic sales of steel deck.

Sales of steel joists, joist girders and steel deck are dependent on the non-residential building construction market.

COLD FINISH AND FASTENER

Nucor manufactures a variety of products using steel from Nucor mills.

COLD FINISH

Nucor Cold Finish is the largest producer of cold finished bars in the United States and has facilities in Nebraska, South Carolina, Utah and Wisconsin. Three of these facilities were originally constructed by Nucor between 1978 and 1983 and are located in Nebraska, South Carolina and Utah. In February 2005, Nucor purchased the assets of Fort Howard Steel, Inc.’s operations in Oak Creek, Wisconsin. This facility has approximately 140,000 tons of annual capacity. The total capacity of the four facilities is approximately 490,000 tons per year.

These facilities produce cold drawn and turned, ground and polished steel bars that are used extensively for shafting and precision machined parts. Nucor Cold Finish produces rounds, hexagons, flats and squares in carbon, alloy and leaded steels. These bars, in turn, are purchased by the automotive, farm machinery, hydraulic, appliance and electric motor industries, as well as by service centers. Nucor Cold Finish bars are used in tens of thousands of products. A few examples include anchor bolts, farm machinery, hydraulic cylinders, and shafting for air conditioner compressors, ceiling fan motors, garage door openers, electric motors and lawn mowers.

All four facilities are among the most modern in the world and use in-line electronic testing to ensure outstanding quality. Nucor Cold Finish obtains most of its steel from the Nucor bar mills. This factor, along with the efficient facilities using the latest technology, results in a highly competitive cost structure.

| | |

In 2004, sales of cold finished steel products were a record 271,000 tons, an

increase of 14% from 2003’s 237,000 tons. The total cold finish market is

estimated to be approximately 2,000,000 tons. The Wisconsin facility

represents a continuation of our successful value-added strategy and expands

our presence in the Midwest market. Nucor Cold Finish anticipates opportunities

for significant increases in sales and earnings during the next several years. FASTENER Nucor Fastener’s state-of-the-art steel bolt-making facility in Indiana produces

standard steel hexhead cap screws, hex bolts, structural bolts and custom-

engineered fasteners. Fasteners are used in a broad range of markets,

including automotive, machine tools, farm implements, construction and military

applications. Annual capacity is more than 75,000 tons, which is less than an estimated 10%

of the total market for these products. The modern facility allows Nucor

Fastener to maintain competitive pricing in a market currently dominated by

foreign suppliers. This operation is highly automated and has fewer employees

than comparable facilities. Nucor Fastener obtains much of its steel from the

Nucor bar mills. | |

|

BUILDING SYSTEMS AND LIGHT GAUGE STEEL FRAMING

Nucor manufactures metal buildings and steel framing systems for commercial, industrial and residential construction markets.

BUILDING SYSTEMS

Nucor Building Systems produces metal building systems and components in Indiana, South Carolina and Texas. The annual capacity is more than 145,000 tons. The size of the buildings that can be produced ranges from less than 500 square feet to more than 1,000,000 square feet.

Complete metal building packages can be customized and combined with other materials such as glass, wood and masonry to produce a cost-effective, aesthetically pleasing building designed for customers’ special requirements. The buildings are sold primarily through an independent builder distribution network in order to provide fast-track, customized solutions for building owners.

Building systems sales in 2004 were a record 113,000 tons, an increase of 49% from the 76,000 tons sold in 2003. The primary markets are commercial, industrial and institutional buildings, including distribution centers, automobile dealerships, retail centers, schools, warehouses and manufacturing facilities. Nucor Building Systems obtains a significant portion of its steel requirements from the Nucor bar and sheet mills.

| | |

LIGHT GAUGE STEEL FRAMING Nucon Steel specializes in load bearing light gauge steel framing systems for

the commercial and residential construction markets with fabrication facilities in

Texas and Georgia. Nucon also sells its proprietary products through a growing

network of independent authorized fabricators located throughout the United

States. In 2004, Nucon introduced two new low cost automated fabrication systems for

residential construction: the NuWall automated wall panel system and the

NuTruss automated truss system. Nucon uses these new systems in its

residential wall panel and truss fabrication facility in Texas and has formed a

separate group within Nucon to sell and license the systems to third parties.

Nucor plans to continue to aggressively broaden Nucon Steel’s opportunities

through geographic expansion and the introduction of new products. | |

|

| | | | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | |

| | | 16 | | |

OVERVIEW

Nucor is a domestic manufacturer of steel and steel products whose customers are located primarily in the United States. Additionally, Nucor is the nation’s largest recycler. Nucor reports its results in two segments, steel mills and steel products.

Principal products from the steel mills segment are hot-rolled steel (angles, rounds, flats, channels, sheet, wide-flange beams, pilings, billets, blooms, beam blanks and plate) and cold-rolled steel. Principal products from the steel products segment are steel joists and joist girders, steel deck, cold finished steel, steel fasteners, metal building systems and light gauge steel framing. Hot-rolled steel is manufactured principally from scrap, utilizing electric arc furnaces, continuous casting and automated rolling mills. Cold-rolled steel, cold finished steel, steel joists and joist girders, and steel fasteners are manufactured by further processing of hot-rolled steel. Steel deck is manufactured from cold-rolled steel. In 2004, approximately 90% of the steel mills segment production was sold to non-affiliated customers; the remainder was used internally by the steel products segment.

During the last five years, Nucor’s sales have increased 174% from $4.16 billion in 1999 to $11.38 billion in 2004. Average sales price per ton has increased 45% from $409 in 1999 to $595 in 2004. Total tons sold have increased 88% from 10,176,000 tons in 1999 to 19,109,000 tons in 2004. This growth has been generated through acquisitions, optimization of existing operations, and development of traditional greenfield projects using new technologies.

| | | | | | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | | |

| | | 17 | | | | |

| | |

Nucor achieved record sales and net earnings in 2004 due to historically high selling prices, margins and shipments. In fact, Nucor’s results for the first half of 2004 exceeded the previous record annual earnings, as did both the third and the fourth quarters. In addition to Nucor’s traditional strategy of growing by developing greenfield projects and continually improving existing operations, Nucor’s focus over the past several years has included growing profitably through acquisitions. In December 2002, Nucor purchased substantially all of the assets of Birmingham Steel Corporation (“Birmingham Steel”), the largest acquisition in Nucor’s history. The Birmingham mills made significant contributions to Nucor’s sales and net earnings in 2003 and 2004. With remarkably similar cultures and excellent conversion costs, we expect continued attractive earnings growth from the four acquired bar mills. In July 2002, Nucor acquired the assets of Trico Steel Company, LLC (“Trico”), in Decatur, Alabama. Although we experienced equipment problems early in 2003, which resulted in a prolonged start-up period, we overcame these issues and generated an operating profit at this sheet mill in 2004. In August 2004, Nucor purchased certain assets of Worthington Industries, Inc.’s (“Worthington”) cold rolling mill adjacent to this sheet mill. This facility provides expanded value-added products to our customers in the Southeast. | |  |

In February 2004, Nucor purchased a one-half interest in Harris Steel, Inc., a wholly owned subsidiary of Harris Steel Group, Inc. This rebar fabricator complements Nucor’s value-added steel products offerings. Harris Steel, Inc. has fabricating facilities located in Arizona, California, Massachusetts, Nevada, Pennsylvania and Washington. These facilities purchase steel from Nucor at market prices. In July 2004, Nucor’s wholly owned subsidiary, Nucor Steel Tuscaloosa, Inc., purchased substantially all of the steelmaking assets of Corus Tuscaloosa. The facility is a coiled plate mill that manufactures pressure vessel steel coil, discrete plate and cut-to-length plate products. This acquisition made a significant operating contribution in the second half of 2004.

In 2003, the prices of scrap steel and other raw materials surged dramatically, negatively affecting our profitability. Nucor’s average scrap cost per ton purchased increased $65 (57%) from December 2002 to December 2003 and increased $99 (55%) from December 2003 to December 2004. To address this unprecedented escalation in the price of our raw materials, Nucor announced a raw material sales price surcharge on its products in January 2004. This surcharge has helped offset the impact of significantly higher scrap prices and has ensured that Nucor is able to purchase the raw materials needed to fill our customers’ orders. We expect to continue to be able to collect the surcharge in 2005.

COMPARISON OF 2004 TO 2003

NET SALES

Net sales for 2004 increased 82% to $11.38 billion, compared with $6.27 billion in 2003. The average sales price per ton increased 66% from $359 in 2003 to $595 in 2004, while total shipments to outside customers increased 9%. In the steel mills segment, net sales to external customers increased 86% from $5.45 billion in 2003 to $10.11 billion in 2004. Approximately 85% of the increase was due to higher average selling prices resulting from increased demand for our products, which affected base prices, and the implementation of a raw materials surcharge to address historically high scrap costs. The remaining 15% of the sales increase was due to higher sales volume resulting from increased demand and the additional production capacity obtained from the acquisition of assets from Corus Tuscaloosa and Worthington in the second half of 2004 and the ramp-up of production at Nucor Steel Decatur, LLC throughout the year. Net sales to external customers in the steel products segment were $819.7 million in 2003, compared with $1.27 billion in 2004, an increase of 55%. Approximately 75% of the increase was due to higher average selling prices and approximately 25% of the increase was due to increased volume, reflecting an improved non-residential construction market.

Nucor established new annual tonnage records in the steel mills segment for total steel shipments and steel shipments to outside customers in 2004. Total steel shipments, including those to the steel products segment, increased 10% to 19,464,000 tons in 2004, compared with 17,656,000 tons in the previous year. Steel sales to outside customers increased 9% to 17,787,000 tons in 2004, compared with 16,263,000 tons in 2003. In the steel products segment, production and shipment volumes increased over the prior year across all major product lines. Steel joist production for 2004 was 522,000 tons, compared with 503,000 tons in the previous year. Steel deck sales were 364,000 tons, compared with 353,000 tons in 2003. Cold finished steel sales were a record 271,000 tons in 2004, compared with 237,000 tons in the previous year.

| | | | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | |

| | | 18 | | |

| | |

COST OF PRODUCTS SOLD The major component of cost of products sold is raw material costs. The average volume of raw materials used increased 12% from 2003 to 2004, consisting of an increase of 12% in the steel mills segment and an increase of 14% in the steel products segment. The average price of raw materials increased 67% from 2003 to 2004. The average price of raw materials in the steel mills segment and the steel products segment increased 71% and 24%, respectively, from 2003 to 2004. The average scrap and scrap substitute cost per ton used in our steel mills segment was $238 in 2004, an increase of 74% from $137 in 2003. By the fourth quarter of 2004, the average scrap and scrap substitute cost per ton used had increased to $278. The average scrap cost per ton purchased increased $99 (55%) from December 2003 to December 2004. As a result of the increases in the cost of scrap and scrap substitutes, Nucor incurred a charge to value inventories using the last-in, first-out (“LIFO”) method of accounting of $375.9 million in 2004 (including a LIFO charge of $36.7 million for Nucor-Yamato Steel Company, of which Nucor owns 51%), compared with a charge of $115.0 million in 2003 (including a LIFO charge of $17.6 million for Nucor-Yamato Steel Company). | |

|

Another significant component of cost of products sold for the steel mills segment is energy costs, since steel mills are large consumers of electricity and natural gas. Total energy costs per ton were flat from 2003 to 2004 as higher natural gas prices of approximately 8% were offset by increased production efficiency at our steel mills. These energy costs were less than 10% of the sales dollar in 2004 and 2003 and we expect that they will remain at this level in 2005. Nucor hedges a portion of its exposure to the variability of future cash flows for forecasted natural gas purchases over various time periods not exceeding three years. In addition, Nucor has entered into natural gas purchase contracts that commit Nucor to purchase $50.5 million, $2.4 million and $1.8 million of natural gas for production in 2005, 2006 and 2007, respectively.

In December 2000, Nucor entered into a consent decree with the United States Environmental Protection Agency (“USEPA”) and certain states in order to resolve alleged environmental violations. Under the terms of this decree, Nucor is conducting testing at some of its facilities, performing corrective action where necessary, and piloting certain pollution control technologies.

During 2003 and 2004, Nucor revised estimates for environmental reserves as additional information became available and projects were completed. Nucor made approximately $19.0 million in cash payments for remedial efforts during 2003 and reduced reserves by approximately $8.3 million. In 2004, Nucor made approximately $.4 million in cash payments for remedial efforts and reduced reserves by approximately $10.0 million. The most significant components of the decreases in 2003 and 2004 related to an agreement with the USEPA that certain technologies identified in the consent decree are not feasible and a favorable court ruling that implicated additional potentially responsible parties for the cleanup of an off-site waste-recycling facility.

GROSS MARGIN

Gross margins increased from 4% in 2003 to 20% in 2004. In addition to the events and trends discussed above, gross margins improved due to the turnaround achieved at our sheet mill in Decatur, Alabama and the plate mill in Hertford County, North Carolina, and to the acquisitions we made in the third quarter of 2004. Nucor defines pre-operating and start-up costs, all of which are expensed, as the losses attributable to facilities or major projects that are either under construction or in the early stages of operation. Once these facilities or projects have attained a utilization rate that is consistent with our similar operating facilities, they are no longer considered by Nucor to be in start-up. Pre-operating and start-up costs of new facilities decreased to $28.8 million in 2004, compared with $117.5 million in 2003. In 2004, these costs primarily related to the continuing start-up of the Castrip®facility at our sheet mill in Crawfordsville, Indiana. In 2003, these costs primarily related to the start-up of the sheet mill in Decatur, Alabama, and the Castrip facility. Late in 2004, the Castrip process achieved commercial viability, and the costs associated with this facility will not be included in start-up costs in 2005.

MARKETING, ADMINISTRATIVE AND OTHER EXPENSES

The major components of marketing, administrative and other expenses are freight and profit sharing costs. Unit freight costs increased 2% from 2003 to 2004. Profit sharing costs, which are based upon and fluctuate with pre-tax earnings, increased approximately fifteenfold from 2003 to 2004. In 2004, profit sharing costs included $172.3 million for contributions to a

| | | | | | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | | |

| | | 19 | | | | |

Profit Sharing and Retirement Savings Plan for qualified employees, compared with $8.9 million in 2003. In addition, profit sharing costs in 2004 included over $21.0 million in extraordinary bonuses paid to employees for the achievement of record earnings during the year. All employees except for senior officers received two special cash bonuses of $1,000 each in July and November in addition to their regular profit-sharing payments.

INTEREST EXPENSE

Net interest expense is detailed below (in thousands):

| | | | | | | | |

| Year Ended December 31, | | 2004 | | | 2003 | |

Interest expense | | $ | 29,335 | | | $ | 27,152 | |

Interest income | | | (6,983 | ) | | | (2,525 | ) |

| | |

|

|

| |

|

|

|

Interest expense, net | | $ | 22,352 | | | $ | 24,627 | |

| | |

|

|

| |

|

|

|

| | | | | | | | | |

Interest expense, net of interest income, decreased from 2003 to 2004 primarily due to an increase in average short-term investments, partially offset by an increase in average long-term debt.

MINORITY INTERESTS

Minority interests represent the income attributable to the minority partners of Nucor’s joint venture, Nucor-Yamato Steel Company. Income attributable to minority interests increased from $23.9 million in 2003 to $80.9 million in 2004. Cash distributions to minority interests increased from $63.3 million in 2003 to $84.9 million in 2004. Under the partnership agreement, the minimum amount of cash to be distributed each year to the partners of Nucor-Yamato Steel Company is the amount needed by each partner to pay applicable U.S. federal and state income taxes. In some years, such as 2004 and 2003, the amount of cash distributed to minority interests exceeds amounts allocated to minority interests based on mutual agreement of the general partners; however, the cumulative amount of cash distributed to partners is less than the cumulative net earnings of the partnership.

OTHER INCOME

In 2004 and 2003, Nucor sold equipment resulting in pre-tax gains of $1.6 million and $4.4 million, respectively. In 2003, Nucor received $7.1 million, related to graphite electrodes anti-trust settlements. Producers of graphite electrodes, which are used by Nucor to deliver energy in electric arc furnaces, have entered into several settlement agreements with their customers as the result of a price fixing investigation by the Department of Justice that became public in 1997. No settlements were received in 2004 and we do not expect to receive any further graphite electrodes settlements.

Subsequent to year-end, Nucor expects to receive $9.2 million for settlement of legal claims related to environmental matters.

PROVISION FOR INCOME TAXES

Nucor had an effective tax rate of 35.22% in 2004 compared with 6.12% in 2003. The higher tax rate in 2004 is primarily due to the effect of increased pre-tax earnings, partially offset by the resolution of certain tax issues in the second half of 2004. In 2004 and 2003, Nucor recorded refundable state income tax credits of $10.4 million and $10.5 million, respectively.

NET EARNINGS

Net earnings were 39% of average equity in 2004, compared with 3% in 2003. The increase in 2004 net earnings resulted primarily from increased shipments, higher average selling prices, increased margins and decreased pre-operating and start-up costs accompanied by the successful integration of recent acquisitions. The increase in net earnings was partially offset by increased scrap costs, increased LIFO charges, increased profit-sharing costs and an increase in the effective tax rate.

COMPARISON OF 2003 TO 2002

NET SALES

Net sales for 2003 increased 30% to $6.27 billion, compared with $4.80 billion in 2002. The average sales price per ton increased less than 1% from $357 in 2002 to $359 in 2003, while total shipments to outside customers increased 30%. In the steel mills segment, net sales to external customers increased 34% from $4.06 billion in 2002 to $5.45 billion in 2003, primarily due to the additional production capacity obtained from the acquisitions of the assets of Trico and Birmingham Steel in 2002. Excluding the increases resulting from these acquisitions, total net sales to external customers increased 10% from 2002 to 2003. Net sales to external customers in the steel products segment were $739.2 million in 2002, compared with $819.7 million in 2003, an increase of 11%. This increase was primarily due to increased volume reflecting an improved non-residential construction market.

| | | | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | |

| | | 20 | | |

In the steel mills segment, total steel shipments increased 31% to 17,656,000 tons in 2003, compared with 13,438,000 tons in the previous year. Steel sales to outside customers increased 32% to 16,263,000 tons in 2003, compared with 12,314,000 tons in 2002. In the steel products segment, steel joist production for 2003 was 503,000 tons, compared with 462,000 tons in the previous year. Steel deck sales were 353,000 tons, compared with 330,000 tons in 2002. Cold finished steel sales were 237,000 tons in 2003, compared with 226,000 tons in the previous year.

COST OF PRODUCTS SOLD

The average volume of raw materials used increased 24% from 2002 to 2003, consisting of an increase of 27% in the steel mills segment and an increase of 5% in the steel products segment. The average price of raw materials increased 19% from 2002 to 2003. The average price of raw materials in the steel mills segment and the steel products segment increased 21% and 5%, respectively, from 2002 to 2003. The average scrap and scrap substitute cost per ton used in our steel mills segment was $137 in 2003, an increase of 25% from $110 in 2002.

Nucor incurred a charge to value inventories using the LIFO method of accounting of $115.0 million in 2003 (including a LIFO charge of $17.6 million for Nucor-Yamato Steel Company, of which Nucor owns 51%), compared with a charge of $34.3 million in 2002 (including a LIFO charge of $50,000 for Nucor-Yamato Steel Company).

Total energy costs increased approximately $4 per ton from 2002 to 2003; however, because of the high efficiency of Nucor steel mills, these energy costs were less than 10% of the sales dollar in 2003 and 2002.

Nucor made approximately $6.0 million in cash payments for environmental remedial efforts during 2002 and made approximately $22.9 million in net reductions to environmental reserves. In 2003, Nucor made approximately $19.0 million in cash payments for remedial efforts and reduced reserves by approximately $8.3 million. The most significant components of the decreases in environmental reserves in 2002 and 2003 related to an agreement with the USEPA that certain technologies identified in the consent decree are not feasible and a favorable court ruling that implicated additional potentially responsible parties for the cleanup of an off-site waste-recycling facility.

GROSS MARGIN

Gross margins decreased from 10% in 2002 to 4% in 2003. In addition to the net sales and cost of products sold factors discussed above, gross margins were affected by pre-operating and start-up costs at several Nucor facilities. Pre-operating and start-up costs of new facilities increased 39% to $117.5 million in 2003, compared with $84.4 million in 2002. In 2003, these costs primarily related to the start-up of the sheet mill in Decatur, Alabama, and the Castrip facility at our sheet mill in Crawfordsville, Indiana. In 2002, these costs were attributable to the start-up of the Castrip facility, the Vulcraft facility in Chemung, New York, and Nucor Steel Decatur, LLC.

MARKETING, ADMINISTRATIVE AND OTHER EXPENSES

Unit freight costs decreased 1% from 2002 to 2003. Profit sharing costs, which are based upon and fluctuate with pre-tax earnings, decreased 40% from 2002 to 2003.

INTEREST EXPENSE

Net interest expense is detailed below(in thousands):

| | | | | | | | |

| Year Ended December 31, | | 2003 | | | 2002 | |

Interest expense | | $ | 27,152 | | | $ | 22,918 | |

Interest income | | | (2,525 | ) | | | (8,632 | ) |

| | |

|

|

| |

|

|

|

Interest expense, net | | $ | 24,627 | | | $ | 14,286 | |

| | |

|

|

| |

|

|

|

| | | | | | | | | |

Interest expense, net of interest income, increased from 2002 to 2003 primarily due to an increase in average long-term debt and a decrease in average short-term investments. In 2003, Nucor redeemed $61.3 million aggregate principal amount of fixed rate industrial revenue bonds and reissued debt in the form of new variable rate industrial revenue bonds in like principal amount. The variable rates of these reissued bonds are currently several percentage points lower than the fixed rates of the redeemed bonds.

MINORITY INTERESTS

Income attributable to minority interests decreased from $79.5 million in 2002 to $23.9 million in 2003. Cash distributions to minority interests decreased from $146.7 million in 2002 to $63.3 million in 2003.

| | | | | | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | | |

| | | 21 | | | | |

OTHER INCOME

In 2003 and 2002, Nucor received $7.1 million and $29.9 million, respectively, related to graphite electrodes anti-trust settlements. In 2003, Nucor realized a pre-tax gain on the sale of equipment of $4.4 million.

PROVISION FOR INCOME TAXES

Nucor had an effective tax rate of 6.12% in 2003 compared with 29.55% in 2002. The lower tax rate in 2003 is primarily due to state income tax credits, resolution of certain tax issues and the effect of reduced pre-tax earnings. In 2003 and 2002, Nucor recorded refundable state income tax credits of $10.5 million and $16.2 million, respectively.

NET EARNINGS

Net earnings were 3% of average equity in 2003, compared with 7% in 2002. The decrease in 2003 net earnings resulted primarily from higher scrap and energy costs, increased LIFO charges, increased pre-operating and start-up costs, less benefit from decreases in environmental reserves, increased interest expense and decreased other income. The decrease in net earnings was partially offset by decreased profit-sharing costs and a decrease in the effective tax rate.

LIQUIDITY AND CAPITAL RESOURCES

Cash flows provided by operating activities provide us with a significant source of liquidity. When needed, we also have external short-term financing sources available including the issuance of commercial paper and borrowings under our bank credit facilities. We also issue long-term debt from time to time. Our strong financial position and our industry-high credit rating provide us with flexibility and significant capacity to obtain additional capital on a cost-effective basis.

We anticipate that cash flows from operations and our existing borrowing capacity will be sufficient to fund expected normal operating costs, working capital, dividends and capital expenditures for our existing facilities. Any future significant acquisitions could require additional financing from external sources.

During 2004, cash and short-term investments increased 122% from $350.3 million to $779.0 million and working capital increased 113% from $991.0 million to $2.11 billion. The current ratio was 3.0 in 2004 compared to 2.6 in 2003. Approximately $71.1 million and $134.7 million of the cash and short-term investments position at December 31, 2004 and 2003, respectively, was held by our 51%-owned joint venture, Nucor-Yamato Steel Company. We have a simple capital structure with no off-balance sheet arrangements or relationships with unconsolidated special purpose entities. Nucor uses derivative financial instruments from time to time, primarily to manage the exposure to price risk related to natural gas purchases used in the production process and to manage exposure to changes in interest rates on outstanding debt instruments.

| | | | |

| | | | | (in thousands) |

| December 31, | | 2004 | | 2003 |

Cash and short-term investments | | $ 779,049 | | $350,332 |

Cash and short-term investments held by Nucor-Yamato | | 71,081 | | 134,700 |

Working capital | | 2,109,158 | | 990,965 |

Current ratio | | 3.0 | | 2.6 |

| | | | | |

OPERATING ACTIVITIES

Nucor generated cash provided by operating activities of $1.03 billion in 2004 compared with $494.6 million in 2003, an increase of 108%. This increase was the result of the eighteenfold increase in net earnings, which was partially offset by changes in operating assets and liabilities (exclusive of acquisitions and dispositions) that used cash of $574.3 million in 2004 compared with $26.1 million in 2003. Accounts receivable increased $354.9 million in 2004 due to significantly higher steel prices and increased sales volume. Our inventories increased $635.6 million in 2004 primarily due to higher quantities to support the increased sales levels and higher purchase costs. Similarly, accounts payable increased $130.6 million due to increased inventory purchases and higher steel prices. Salaries, wages and related accruals increased $228.2 million in 2004 primarily due to increased profit sharing costs and bonuses attributable to the record earnings.

| | | | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | |

| | | 22 | | |

INVESTING ACTIVITIES

Our business is capital intensive; therefore, cash used in investing activities primarily represents capital expenditures for new facilities, the expansion and upgrading of existing facilities, and the acquisition of the assets of other companies. Cash used in investing activities increased to $534.9 million in 2004 compared with $267.6 million in 2003. Capital expenditures for new facilities and expansion of existing facilities increased to $285.9 million in 2004 compared with $215.4 million in 2003.

In July 2004, Nucor’s wholly owned subsidiary, Nucor Steel Tuscaloosa, Inc., purchased substantially all of the steelmaking assets of Corus Tuscaloosa for a cash price of approximately $89.4 million. In August 2004, Nucor’s wholly owned subsidiary, Nucor Steel Decatur, LLC, purchased certain assets of Worthington’s cold rolling mill in Decatur, Alabama, for a cash purchase price of approximately $80.3 million. In March 2003, Nucor’s wholly owned subsidiary, Nucor Steel Kingman, LLC, purchased substantially all of the assets of the Kingman, Arizona, steel facility of North Star Steel for approximately $35.0 million. Existing cash and short-term investments funded these acquisitions in 2004 and 2003.

Nucor expects to continue to pursue profitable growth through acquisitions. Subsequent to year-end, Nucor purchased the assets of Fort Howard Steel, Inc.’s operations in Oak Creek, Wisconsin, for a cash purchase price of $44.2 million.

Nucor’s investment in affiliates increased from $22.1 million in 2003 to $82.5 million in 2004 primarily due to the purchase of a one-half interest in Harris Steel, Inc. for $21.0 million and additional capital contributions for the HIsmelt®project of $46.4 million.

FINANCING ACTIVITIES

Cash used in financing activities decreased to $66.1 million in 2004 compared with $95.7 million in 2003. In 2004, Nucor issued $20.0 million aggregate principal amount of variable rate industrial revenue bonds due 2020. In 2003, Nucor issued $25.0 million aggregate principal amount of variable rate industrial revenue bonds due 2038 and retired $16.0 million aggregate principal amount of fixed rate industrial revenue bonds. During 2004 and 2003, Nucor terminated interest rate swap agreements that resulted in gains of $4.8 million and $2.3 million, respectively, that will be amortized over the remaining life of the debt as an adjustment to interest expense.

The percentage of long-term debt to total capital (long-term debt plus minority interests plus stockholders’ equity) was 20% and 26% at year-end 2004 and 2003, respectively.

Nucor has an unsecured revolving credit facility that provides for up to $425.0 million in revolving loans. The credit facility consists of (a) a $125.0 million 364-day revolver maturing in September 2005 with an option to convert amounts outstanding under this facility to a 364-day term loan, and (b) a $300.0 million multi-currency revolver maturing in October 2007. No borrowings were outstanding under the credit facility at December 31, 2004.

Nucor’s directors have approved the purchase of up to 30.0 million shares of Nucor common stock. There were no repurchases during 2004 or 2003. Since the inception of the stock repurchase program in 1998, a total of approximately 21.5 million shares have been repurchased at a cost of about $444.5 million.

MARKET RISK

All of Nucor’s industrial revenue bonds have variable interest rates that are adjusted weekly or annually. These industrial revenue bonds represent 43% of Nucor’s long-term debt outstanding at December 31, 2004. The remaining 57% of Nucor’s long-term debt is at fixed rates. Future changes in interest rates are not expected to significantly impact earnings. From time to time, Nucor makes use of interest rate swaps to manage interest rate risk. As of December 31, 2004, there were no such contracts outstanding. Nucor’s investment practice is to invest in securities that are highly liquid with short maturities. As a result, we do not expect changes in interest rates to have a significant impact on the value of our investment securities.

Nucor also uses derivative financial instruments from time to time to manage the exposure to price risk related to natural gas purchases used in the production process. Nucor, generally, does not enter into derivative instruments for any purpose other than hedging the cash flows associated with specific volumes of commodities that will be purchased and processed in future periods and hedging the exposures related to changes in the fair value of outstanding fixed rate debt instruments. Nucor recognizes all derivative instruments in the consolidated balance sheets at fair value.

Nucor has ventures in Brazil and Australia that will begin operations in 2005. Accordingly, Nucor is exposed to the effects of currency fluctuations in those countries. Nucor presently does not hedge its exposure to foreign currency risk.

| | | | | | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | | | |

| | | 23 | | | | |

CONTRACTUAL OBLIGATIONS AND OTHER COMMERCIAL COMMITMENTS

The following table sets forth our contractual obligations and other commercial commitments as of December 31, 2004, not including related interest expense, if any, for the periods presented(in thousands).

| | | | | | | | | | | | | | | |

| | | Payments Due By Period |

| Contractual Obligations | | Total | | Less than 1 year | | 1-3 years | | 4-5 years | | After 5 years |

Long-term debt | | $ | 923,550 | | $ | — | | $ | 1,250 | | $ | 180,400 | | $ | 741,900 |

Operating leases | | | 4,048 | | | 1,574 | | | 2,383 | | | 89 | | | 2 |

Raw material purchase commitments(1) | | | 605,271 | | | 578,308 | | | 11,625 | | | 7,750 | | | 7,588 |

Utility purchase commitments(1) | | | 221,498 | | | 100,664 | | | 78,861 | | | 17,140 | | | 24,833 |

Other unconditional purchase obligations(2) | | | 96,322 | | | 78,290 | | | 11,760 | | | 4,167 | | | 2,105 |

Other long-term obligations(3) | | | 109,243 | | | 3,751 | | | 5,811 | | | 3,793 | | | 95,888 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

Total contractual obligations | | $ | 1,959,932 | | $ | 762,587 | | $ | 111,690 | | $ | 213,339 | | $ | 872,316 |

| | |

|

| |

|

| |

|

| |

|

| |

|

|

| | | | | | | | | | | | | | | | |

| (1) | Nucor enters into contracts for the purchase of scrap and scrap substitutes, electricity, natural gas and other raw materials and related services. These contracts include multi-year commitments and minimum annual purchase requirements and are valued at prices in effect on December 31, 2004, or according to the contract language. These contracts are part of normal operations and are reflected in historical operating cash flow trends. We do not believe such commitments will adversely affect our liquidity position. |

| (2) | Other unconditional purchase obligations include commitments for capital expenditures on operating machinery and equipment. |

| (3) | Other long-term obligations include amounts associated with Nucor’s early retiree medical benefits and management compensation. |

DIVIDENDS

Nucor has increased its cash dividend every year since it began paying dividends in 1973. We increased dividends twice in 2004, paying at the rate of $0.10 per share in the first quarter, $0.105 per share in the second and third quarters and $0.13 per share in the fourth quarter. On February 24, 2005, Nucor’s board of directors announced an increase in the base dividend to $0.15 per share and a supplemental dividend of $0.25 payable on May 11, 2005 to stockholders of record on March 31, 2005 for a total dividend of $0.40 per share. This additional dividend is the first installment of a total estimated supplemental dividend of $1.00 per share to be paid over four consecutive quarters.

OUTLOOK

Nucor’s objective is to maintain a strong balance sheet while pursuing profitable growth. Nucor expects to obtain additional capacity through expansions at our existing steel mills, greenfield construction utilizing advantageous new technologies, and future acquisitions. Capital expenditures are currently projected to be approximately $415.0 million in 2005, an increase of 45% over 2004. This expected increase in capital expenditures is primarily due to the relocation of the direct reduced iron plant acquired in 2004 from Louisiana to Trinidad and costs for the refurbishment of this facility. Funds provided from operations, existing credit facilities and new borrowings are expected to be adequate to meet future capital expenditure and working capital requirements for existing operations. Nucor believes that it has the financial ability to borrow significant additional funds and still maintain reasonable leverage in order to finance major acquisitions.

Manufacturing steel will continue to be a key factor in Nucor’s future performance. In the steel mills segment, total steel production is anticipated to increase over the next several years from the 19,737,000 tons produced in 2004. We expect that demand in non-residential construction will remain strong throughout 2005 as the economy continues to recover. Although scrap prices remain at historically high levels, higher average selling prices, achieved through increased demand and the raw material surcharge implemented in 2004, will provide appropriate margins for our products. This surcharge will continue to ensure that we will be able to purchase the scrap needed to fill our customers’ needs.

Nucor continues to build market leadership positions in attractive downstream steel products businesses. We anticipate that the continued improvement in non-residential building will increase sales and the volume supplied by Vulcraft and Nucor Building Systems in 2005. Cold Finish sales will increase as additional capacity from our recent acquisition expands our presence in the Midwest market. The positive impact of increased volume on earnings will be mitigated by the increased cost of raw materials for this segment.

| | | | |

| | | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | |

| | | 24 | | |

We recognize that uncertainty in external factors such as raw materials costs, growth rate of the economy, and the level of imports will have a significant impact on our results. In 2005, we will work towards our goal of controlling one-third of our raw material supply. Based on our current consumption rate, this would represent between six and seven million tons per year of high-quality scrap substitutes. While we cannot control these outside forces, Nucor will continue to be on the forefront of anticipating and addressing the issues that this uncertainty in external factors raises for us and other steel producers.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at year-end, and the reported amount of revenues and expenses during the year. On an ongoing basis, we evaluate our estimates, including those related to the valuation allowances for receivables; the carrying value of property, plant and equipment; reserves for environmental obligations; and income taxes. Our estimates are based on historical experience and various other assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Accordingly, actual costs could differ materially from these estimates under different assumptions or conditions.

We believe the following critical accounting policies affect our significant judgments and estimates used in the preparation of our consolidated financial statements.

ALLOWANCES FOR DOUBTFUL ACCOUNTS

We maintain allowances for doubtful accounts for estimated losses resulting from the inability of our customers to make required payments. If the financial condition of our customers were to deteriorate, resulting in an impairment of their ability to make payments, additional allowances may be required.

ASSET IMPAIRMENTS

We evaluate the impairment of our property, plant and equipment on an individual asset basis or by logical groupings of assets. Asset impairments are recognized whenever changes in circumstances indicate that the carrying amounts of those productive assets exceed their projected undiscounted cash flows. When it is determined that an impairment exists, the related assets are written down to estimated fair market value.

ENVIRONMENTAL REMEDIATION

We are subject to environmental laws and regulations established by federal, state and local authorities, and make provision for the estimated costs related to compliance. Undiscounted remediation liabilities are accrued based on estimates of known environmental exposures. The accruals are reviewed periodically and, as investigations and remediation proceed, adjustments are made as we believe are necessary. The accruals are not reduced by possible recoveries from insurance carriers or other third parties. Our measurement of environmental liabilities is based on currently available facts, present laws and regulations, and current technology.

INCOME TAXES

We account for income taxes in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 109, “Accounting for Income Taxes.” We estimate our actual current tax expense and assess temporary differences that exist due to differing treatments of items for tax and financial statement purposes. These differences result in the recognition of deferred tax assets and liabilities. The deferred tax assets and liabilities are measured using tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the period in which the change is enacted. We assess the realizability of deferred tax assets on an ongoing basis by considering whether it is more likely than not that some portion of the deferred tax assets will not be realized. If it is more likely than not, in our judgment, that the deferred tax assets will not be realized, we provide a valuation allowance.

RECENT ACCOUNTING PRONOUNCEMENTS

In December 2004, the Financial Accounting Standards Board issued SFAS No. 123(R), “Share Based Payment,” which requires all share-based payments to employees, including grants of employee stock options, to be recognized in the financial statements based on their fair values. The provisions of this statement become effective for Nucor’s fiscal quarter beginning July 3, 2005. Management is currently evaluating the financial statement impact of the adoption of SFAS 123(R).

| | | | |

| | | SIX-YEAR FINANCIAL REVIEW | | |

| | | 28 | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | (dollar amounts in thousands, except per share data) | |

| | | 2004 | | | 2003 | | | 2002 | | | 2001 | | | 2000 | | | 1999 | |

| FOR THE YEAR | | | | | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 11,376,828 | | | $ | 6,265,823 | | | $ | 4,801,777 | | | $ | 4,333,707 | | | $ | 4,756,521 | | | $ | 4,158,293 | |

Costs, expenses and other: | | | | | | | | | | | | | | | | | | | | | | | | |

Cost of products sold | | | 9,128,872 | | | | 5,996,547 | | | | 4,332,277 | | | | 3,914,278 | | | | 3,929,182 | | | | 3,531,896 | |

Marketing, administrative and other expenses | | | 415,030 | | | | 165,369 | | | | 175,589 | | | | 150,666 | | | | 183,175 | | | | 154,774 | |

Interest expense (income) | | | 22,352 | | | | 24,627 | | | | 14,286 | | | | 6,525 | | | | (816 | ) | | | (5,095 | ) |

Minority interests | | | 80,894 | | | | 23,950 | | | | 79,472 | | | | 103,069 | | | | 151,462 | | | | 85,783 | |

Other income | | | (1,596) | | | | (11,547 | ) | | | (29,900 | ) | | | (20,200 | ) | | | — | | | | — | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | 9,645,552 | | | | 6,198,946 | | | | 4,571,724 | | | | 4,154,338 | | | | 4,263,003 | | | | 3,767,358 | |

Earnings before income taxes | | | 1,731,276 | | | | 66,877 | | | | 230,053 | | | | 179,369 | | | | 493,518 | | | | 390,935 | |

Provision for income taxes | | | 609,791 | | | | 4,096 | | | | 67,973 | | | | 66,408 | | | | 182,610 | | | | 146,346 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net earnings | | | 1,121,485 | | | | 62,781 | | | | 162,080 | | | | 112,961 | | | | 310,908 | | | | 244,589 | |

Net earnings per share: | | | | | | | | | | | | | | | | | | | | | | | | |

Basic(1) | | | 7.08 | | | | 0.40 | | | | 1.04 | | | | 0.73 | | | | 1.90 | | | | 1.40 | |

Diluted(1) | | | 7.02 | | | | 0.40 | | | | 1.04 | | | | 0.73 | | | | 1.90 | | | | 1.40 | |

Dividends per share(1) | | | 0.47 | | | | 0.40 | | | | 0.38 | | | | 0.34 | | | | 0.30 | | | | 0.26 | |

Percentage of net earnings to net sales | | | 9.9 | % | | | 1.0 | % | | | 3.4 | % | | | 2.6 | % | | | 6.5 | % | | | 5.9 | % |

Return on average equity | | | 38.7 | % | | | 2.7 | % | | | 7.2 | % | | | 5.2 | % | | | 14.2 | % | | | 11.3 | % |

Capital expenditures | | | 285,925 | | | | 215,408 | | | | 243,598 | | | | 261,146 | | | | 415,405 | | | | 374,718 | |

Depreciation | | | 383,305 | | | | 364,112 | | | | 307,101 | | | | 289,063 | | | | 259,365 | | | | 256,637 | |

Sales per employee | | | 1,107 | | | | 637 | | | | 528 | | | | 531 | | | | 619 | | | | 568 | |

| | | | | | |

| AT YEAR END | | | | | | | | | | | | | | | | | | | | | | | | |

Current assets | | $ | 3,174,948 | | | $ | 1,620,560 | | | $ | 1,415,362 | | | $ | 1,373,666 | | | $ | 1,379,529 | | | $ | 1,538,509 | |

Current liabilities | | | 1,065,790 | | | | 629,595 | | | | 591,536 | | | | 484,159 | | | | 558,068 | | | | 531,031 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Working capital | | | 2,109,158 | | | | 990,965 | | | | 823,826 | | | | 889,507 | | | | 821,461 | | | | 1,007,478 | |

Cash provided by operating activities | | | 1,029,718 | | | | 494,620 | | | | 497,220 | | | | 495,115 | | | | 820,755 | | | | 604,834 | |

Current ratio | | | 3.0 | | | | 2.6 | | | | 2.4 | | | | 2.8 | | | | 2.5 | | | | 2.9 | |

Property, plant and equipment | | | 2,818,307 | | | | 2,817,135 | | | | 2,932,058 | | | | 2,365,655 | | | | 2,329,421 | | | | 2,180,419 | |

Total assets | | | 6,133,207 | | | | 4,492,353 | | | | 4,381,001 | | | | 3,759,348 | | | | 3,710,868 | | | | 3,718,928 | |

Long-term debt | | | 923,550 | | | | 903,550 | | | | 878,550 | | | | 460,450 | | | | 460,450 | | | | 390,450 | |

Percentage of debt to capital | | | 20.3 | % | | | 26.4 | % | | | 26.0 | % | | | 15.6 | % | | | 15.9 | % | | | 13.4 | % |

Stockholders’ equity | | | 3,455,985 | | | | 2,342,077 | | | | 2,322,990 | | | | 2,201,461 | | | | 2,130,952 | | | | 2,262,248 | |

Per share(1) | | | 21.67 | | | | 14.90 | | | | 14.86 | | | | 14.15 | | | | 13.73 | | | | 12.98 | |

Shares outstanding(1) | | | 159,512 | | | | 157,180 | | | | 156,360 | | | | 155,630 | | | | 155,166 | | | | 174,267 | |

Stockholders | | | 82,000 | | | | 61,000 | | | | 64,000 | | | | 47,000 | | | | 51,000 | | | | 55,000 | |

Employees | | | 10,600 | | | | 9,900 | | | | 9,800 | | | | 8,400 | | | | 7,900 | | | | 7,500 | |

| (1) | Per share amounts and shares outstanding have been restated to reflect the two-for-one stock split effective October 15, 2004. |

| | | | | | |

| | | MANAGEMENT’S REPORT AND REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | | |

| | | 29 | | | | |

MANAGEMENT’S REPORT

on internal control over financial reporting

Nucor’s management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f) under the Securities and Exchange Act of 1934, as amended.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of Nucor’s internal control over financial reporting as of December 31, 2004. In making this assessment, management used criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) inInternal Control-Integrated Framework.

Based on its assessment, management concluded that Nucor’s internal control over financial reporting was effective as of December 31, 2004. PricewaterhouseCoopers LLP, an independent registered public accounting firm, has audited management’s assessment of Nucor’s internal control over financial reporting as stated in their report which is included herein.

REPORTOF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PricewaterhouseCoopers LLP

March 1, 2005

To the Board of Directors and Stockholders of

Nucor Corporation

We have completed an integrated audit of Nucor Corporation’s 2004 consolidated financial statements and of its internal control over financial reporting as of December 31, 2004 and audits of its 2003 and 2002 consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Our opinions, based on our audits, are presented below.

CONSOLIDATED FINANCIAL STATEMENTS