Exhibit 99.2 FOURTH QUARTER AND YEAR-END 2024 EARNINGS CALL LEON TOPALIAN Chair, President and CEO STEVE LAXTON Executive Vice President and CFO January 28, 2024

FORWARD-LOOKING STATEMENTS Certain statements made in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. The words “anticipate,” “believe,” “expect,” “intend,” “may,” “project,” “will,” “should,” “could” and similar expressions are intended to identify forward-looking statements. These forward-looking statements reflect the Company’s best judgment based on current information, and although we base these statements on circumstances that we believe to be reasonable when made, there can be no assurance that future events will not affect the accuracy of such forward-looking information. The Company does not undertake any obligation to update these statements. The forward-looking statements are not guarantees of future performance, and actual results may vary materially from the projected results and expectations discussed in this presentation. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward- looking statements include, but are not limited to: (1) competitive pressure on sales and pricing, including pressure from imports and substitute materials; (2) U.S. and foreign trade policies affecting steel imports or exports; (3) the sensitivity of the results of our operations to general market conditions, and in particular, prevailing market steel prices and changes in the supply and cost of raw materials, including pig iron, iron ore and scrap steel; (4) the availability and cost of electricity and natural gas, which could negatively affect our cost of steel production or result in a delay or cancellation of existing or future drilling within our natural gas drilling programs; (5) critical equipment failures and business interruptions; (6) market demand for steel products, which, in the case of many of our products, is driven by the level of nonresidential construction activity in the United States; (7) impairment in the recorded value of inventory, equity investments, fixed assets, goodwill or other long- lived assets; (8) uncertainties and volatility surrounding the global economy, including excess world capacity for steel production, inflation and interest rate changes; (9) fluctuations in currency conversion rates; (10) significant changes in laws or government regulations affecting environmental compliance, including legislation and regulations that result in greater regulation of greenhouse gas emissions that could increase our energy costs, capital expenditures and operating costs or cause one or more of our permits to be revoked or make it more difficult to obtain permit modifications; (11) the cyclical nature of the steel industry; (12) capital investments and their impact on our performance; (13) our safety performance; (14) our ability to integrate businesses we acquire; (15) the impact of the COVID-19 pandemic, any variants of the virus, and any other similar public health situation; and (16) the risks discussed in “Item 1A. Risk Factors” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and elsewhere therein and in the other reports we file with the U.S. Securities and Exchange Commission. 2

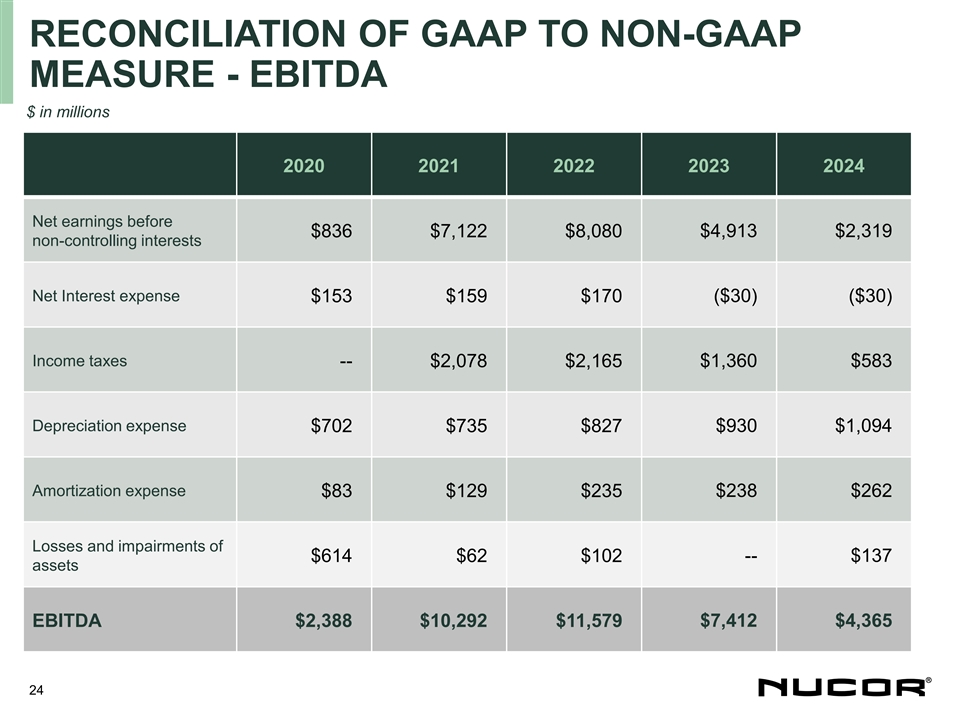

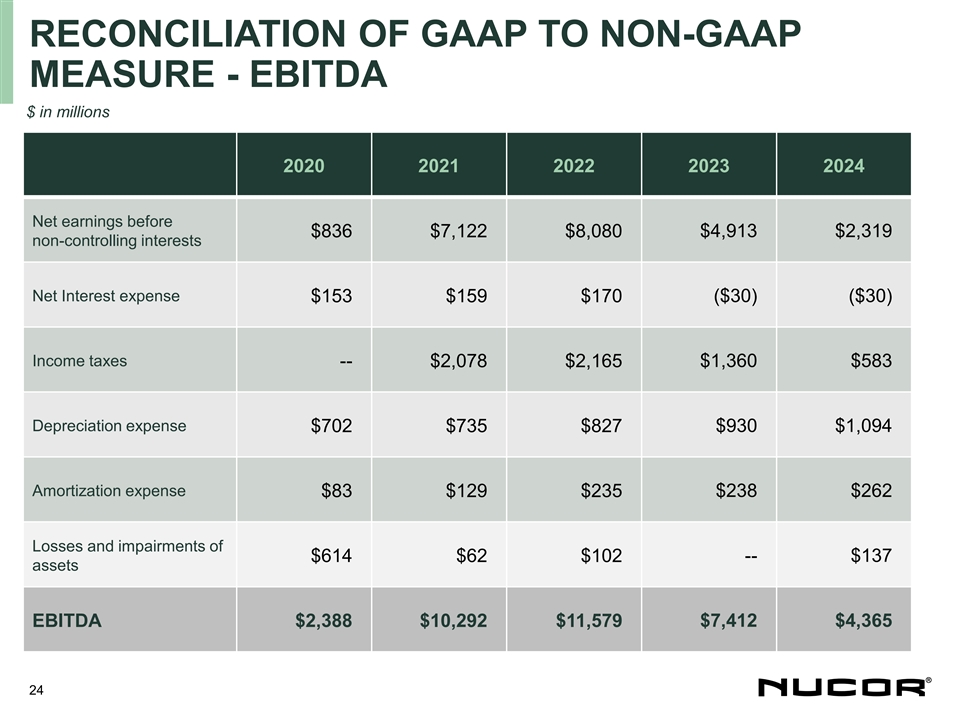

NON-GAAP FINANCIAL MEASURES The Company uses certain non-GAAP (Generally Accepted Accounting Principles) financial measures in this news release, including EBITDA and Free Cash Flow (FCF). Generally, a non-GAAP financial measure is a numerical measure of a company’s performance or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable financial measure calculated and presented in accordance with GAAP. We define EBITDA as net earnings before noncontrolling interests adding back the following items: interest expense, net; provision for income taxes; depreciation; amortization; and losses and impairments of assets. We define Free Cash Flow (FCF) as Cash Provided by Operating Activities less Capital Expenditures. Please note that other companies might define their non-GAAP financial measures differently than we do. Management presents the non-GAAP financial measures of EBITDA and FCF in this news release because it considers them to be an important supplemental measure of performance. Management believes that these non-GAAP financial measures provide additional insight for analysts and investors evaluating the Company’s financial and operational performance by providing a consistent basis of comparison across periods. Non-GAAP financial measures have limitations as an analytical tool. Investors are encouraged to review the reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures provided in this presentation, including in the accompanying tables located in the Appendix. 3

SPOTLIGHT ON SAFETY § I&I rate has improved each year since 2017 NUCOR INJURY & ILLNESS RATE and sits at lowest point in company history Annual OSHA Recordables per 200,000 hours/year § 42% improvement over the last 5 years § 26 Nucor divisions had zero recordable injuries in 2024 1.66 § Our challenge is to become the world’s 1.55 safest steel company, with all Nucor teammates returning home safely after every shift 1.33 1.11 1.04 0.95 0.77 0.79 2017 2018 2019 2020 2021 2022 2023 2024 4

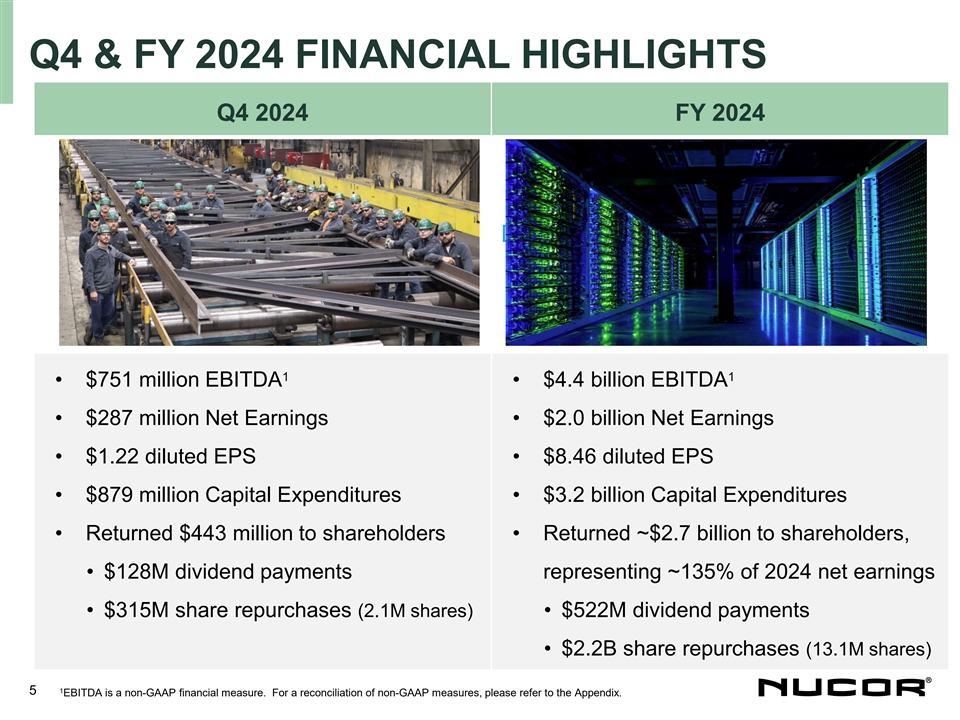

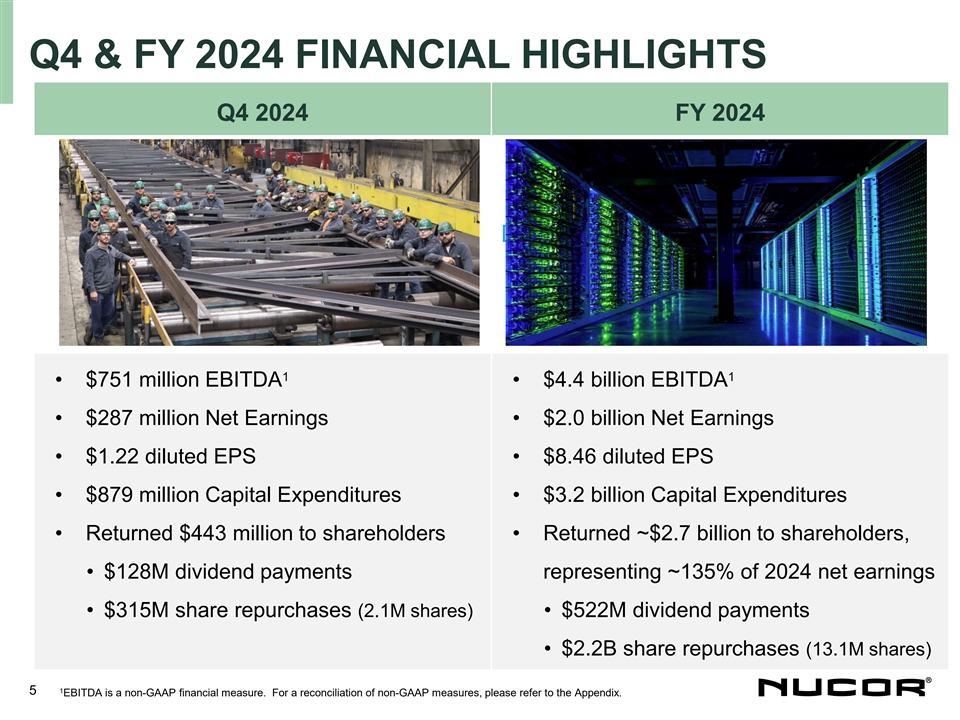

Q4 & FY 2024 FINANCIAL HIGHLIGHTS Q4 2024 FY 2024 Datacenter picture – emailed Carolyn Copenhaver 1 1 • $751 million EBITDA • $4.4 billion EBITDA • $287 million Net Earnings • $2.0 billion Net Earnings • $1.22 diluted EPS • $8.46 diluted EPS • $879 million Capital Expenditures • $3.2 billion Capital Expenditures • Returned $443 million to shareholders • Returned ~$2.7 billion to shareholders, • $128M dividend payments representing ~135% of 2024 net earnings • $315M share repurchases (2.1M shares) • $522M dividend payments • $2.2B share repurchases (13.1M shares) 1 5 EBITDA is a non-GAAP financial measure. For a reconciliation of non-GAAP measures, please refer to the Appendix.

ADVANCING OUR MISSION • Through 2024, have completed about two-thirds of ~$10B investment plan • Shifting mix to higher margin, value-added end products GROW THE CORE • Strategically targeting higher growth regions and underserved markets • Have yet to recognize the earnings potential of recently completed projects • Growing in steel-adjacent businesses with attractive FCF profile • Capitalizing on macro trends that intersect with the steel industry EXPAND BEYOND • Diversifying product mix to ultimately generate more consistent earnings • Targeting $700M+ annual run rate EBITDA (~$400M in 2024, annualized) • How we succeed matters; safety, health & well-being above all else • Inclusive, performance-based culture driving growth and innovation LIVE OUR CULTURE • Empowered teammates delivering world-class results • Industry leader in sustainability and committed to ongoing improvement 6

NUCOR’S CIRCULAR BUSINESS MODEL: VALUE CREATION OVER PAST FIVE YEARS 2020-2024 Returns to Shareholders SCOPE, SCALE and SUSTAINABILITY • Returned ~$12B to shareholders • Largest and most diversified representing ~57% of net earnings steel products company in the US • Repurchased 78 million shares Highly Efficient • Market leader in most products we make (23% reduction) Recycler & • Highly variable cost structure and low • Increased dividend by 36% Manufacturer GHG intensity (~6% annualized growth) Attractive Shareholder Returns 1 2020-2024 Cash Flows Significant • ~$36B EBITDA Cash Flow • ~$30B Operating Cash Flow Generation • ~$20B Free Cash Flow Growth Investments 2020-2024 Investments INDUSTRY LEADING CREDIT PROFILE • ~$10B CAPEX Strong • <25% Total Debt/Capitalization • ~$6B Acquisitions Balance 1 • <2x Total Debt/LTM EBITDA • Established four new Sheet • A-/A-/Baa1 credit ratings S&P/F/M Expand Beyond platforms 1 EBITDA and Free Cash Flow (FCF) are non-GAAP financial measures. 7 For reconciliation of non-GAAP measures, please refer to the Appendix.

NEW ADMINISTRATION PLACING GREATER EMPHASIS ON FAIR TRADE PRACTICES Section 232 coverage has narrowed significantly since implementation, with full duties applied to only 18% of 2024 total import volumes 29.1M 30 FAIR TRADE 18% Subject to full 25% duty under Section 232 HAS BEEN 20 26% Absolute Quota (Argentina, Brazil, Korea) WATERED DOWN… 20% Tariff-Rate Quota (EU, Japan, UK) 10 Exempt from Section 232 36% (Canada, Mexico, Australia, Ukraine) 0 2024 IMPORTS More needs to be done to restore the original intent of Fair-Trade protections, including: • Address import surges from Canada and Mexico … REQUIRING ACTION TO • Terminate alternative arrangements & apply tariffs RESTORE • Strengthen Buy America requirements ITS ORIGINAL • Enact Leveling the Playing Field Act 2.0 INTENT • Address circumvention practices that allow bad actors to take advantage of FTA benefits 8 millions of imported short tons

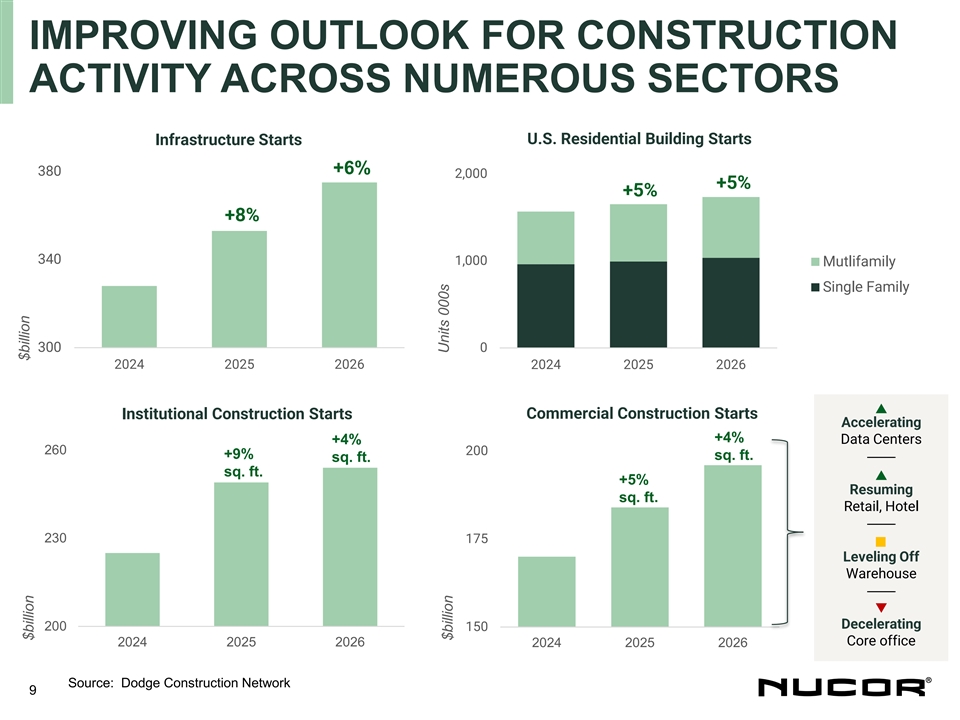

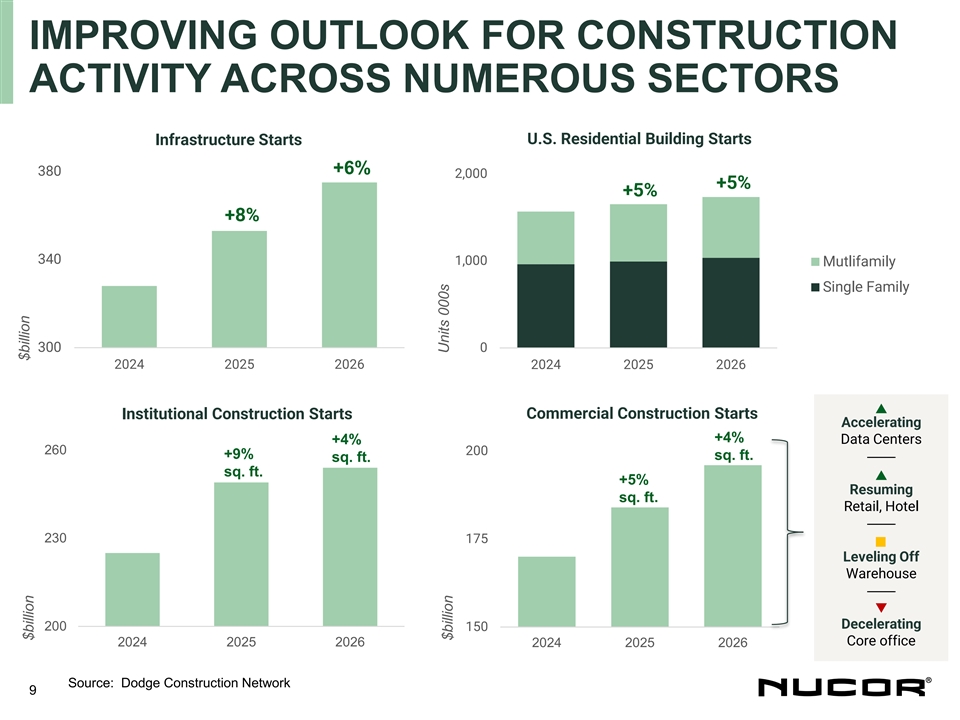

IMPROVING OUTLOOK FOR CONSTRUCTION ACTIVITY ACROSS NUMEROUS SECTORS U.S. Residential Building Starts Infrastructure Starts +6% 380 2,000 +5% +5% +8% 340 1,000 Mutlifamily Single Family 300 0 2024 2025 2026 2024 2025 2026 Commercial Construction Starts Institutional Construction Starts Accelerating +4% +4% Data Centers 260 200 +9% sq. ft. —— sq. ft. sq. ft. +5% Resuming sq. ft. Retail, Hotel —— 230 175 Leveling Off Warehouse —— Decelerating 200 150 Core office 2024 2025 2026 2024 2025 2026 Source: Dodge Construction Network 9 $billion $billion Units 000s $billion

CONSOLIDATED FINANCIAL RESULTS ($ in billions except per share data) 1 1 Diluted EPS EBITDA 2023 2023 2024 2024 $18.00 $7.41 $8.46 $4.37 $3.16 $1.36 $1.22 $0.75 Q4 2023 Q4 2024 Q4 2023 Q4 2024 2 Capital Expenditures Cash Returned to Shareholders 2023 2024 2023 2024 $2.74 $3.17 $2.10 $2.20 $0.88 $0.72 $0.44 $0.30 Q4 2023 Q4 2023 Q4 2024 Q4 2024 (1) EBITDA is a non-GAAP financial measure. For a reconciliation of non-GAAP measures, please refer to the Appendix (2) Cash Returned to Shareholders includes dividends and share repurchases 10

Q4 SEGMENT RESULTS (1) PRE-TAX SEGMENT EARNINGS Q4 2024 VS ADJUSTED Q3 2024 $millions $10 • Lower avg selling price STEEL $512 • Flat volumes overall MILLS $39 • Lower EBT/ton Q3 SEGMENT RESULTS $656 (2) $441 As Reported Adjusted • Lower avg selling price $17 $1,102 STEEL $57 • Lower volumes $354 $314 PRODUCTS $329 $588 $645 • Lower EBT/ton vs Q3 Adj $309 $309 $169 ($14) ($66) ($168) ($165) ($152) ($228) ($168) ($398) RAW • Flat avg selling price MATERIALS • Higher volumes Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q3 2024 Q4 2024 Rep. Adj. Steel Mills Steel Products Raw Materials Corporate/Eliminations (1) Total segment earnings before income taxes and non-controlling interests 11 (2) Adjusted to exclude $83 million impairment in Raw Materials and $40 million impairment in Steel Products taken in Q3 2024.

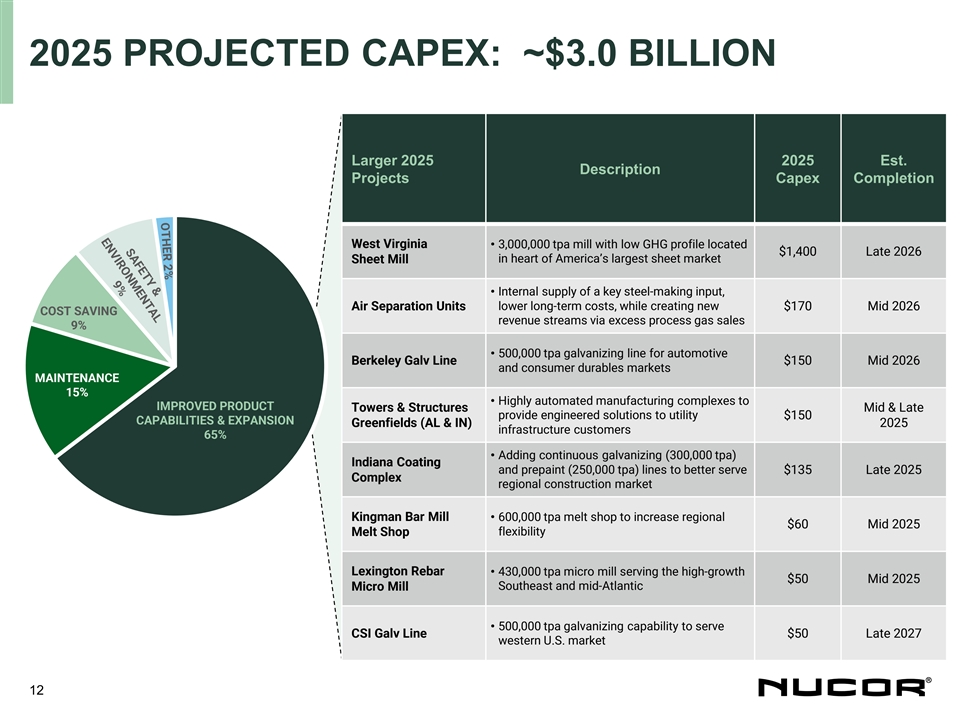

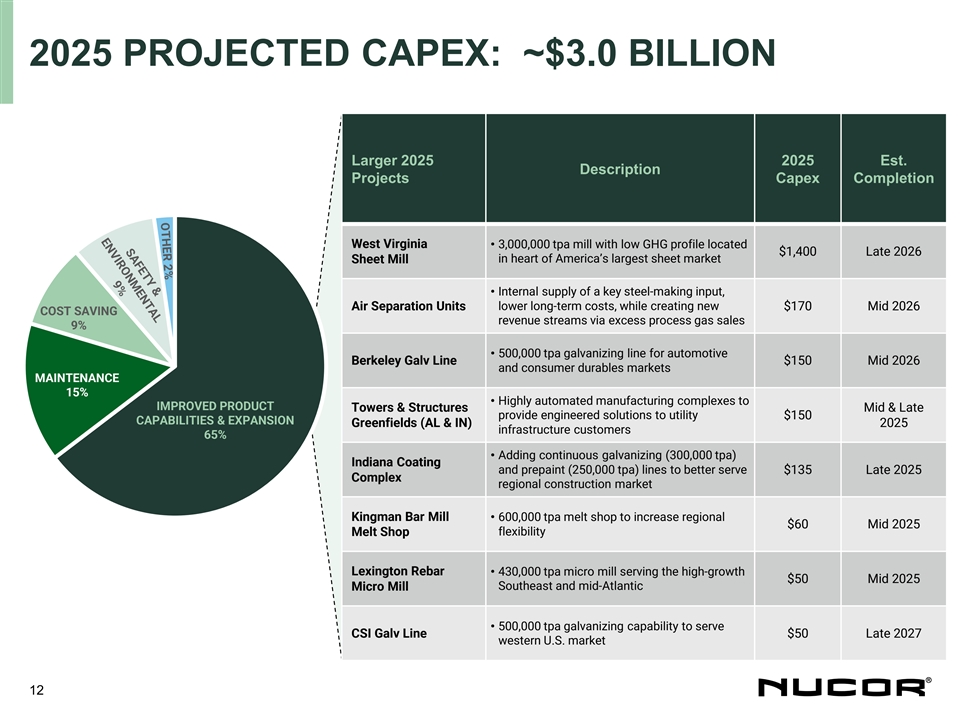

2025 PROJECTED CAPEX: ~$3.0 BILLION Larger 2025 2025 Est. Description Projects Capex Completion West Virginia • 3,000,000 tpa mill with low GHG profile located $1,400 Late 2026 in heart of America’s largest sheet market Sheet Mill • Internal supply of a key steel-making input, Air Separation Units lower long-term costs, while creating new $170 Mid 2026 COST SAVING revenue streams via excess process gas sales 9% • 500,000 tpa galvanizing line for automotive Berkeley Galv Line $150 Mid 2026 and consumer durables markets MAINTENANCE 15% • Highly automated manufacturing complexes to IMPROVED PRODUCT Towers & Structures Mid & Late provide engineered solutions to utility $150 CAPABILITIES & EXPANSION Greenfields (AL & IN) 2025 infrastructure customers 65% • Adding continuous galvanizing (300,000 tpa) Indiana Coating and prepaint (250,000 tpa) lines to better serve $135 Late 2025 Complex regional construction market Kingman Bar Mill • 600,000 tpa melt shop to increase regional $60 Mid 2025 Melt Shop flexibility Lexington Rebar • 430,000 tpa micro mill serving the high-growth $50 Mid 2025 Micro Mill Southeast and mid-Atlantic • 500,000 tpa galvanizing capability to serve CSI Galv Line $50 Late 2027 western U.S. market 12

BALANCED CAPITAL ALLOCATION CONTINUES CAPITAL ALLOCATION (2020-2024) Q4 ‘24 BALANCE SHEET SUMMARY 10,000 xLTM $USD in millions 1 as of December 31, 2024 Amount EBITDA % cap 8,000 Total Debt $6,950 1.6x 25% 6,000 Cash and Cash Equivalents $4,139 4,000 Net Debt $2,811 0.6x 2,000 Total Equity & Non-Controlling Int. $21,417 75% 0 Total Book Capitalization $28,367 100% 2020 2022 2023 2024 2021 2020 2021 2022 2023 2024 ANNUALIZED DIVIDEND PER SHARE YEAR-END SHARES OUTSTANDING Shares in millions $2.40 350 302 $2.20 $2.20 300 233 $2.00 250 $1.80 200 $1.62 $1.60 150 100 $1.40 50 $1.20 0 $1.00 2020 2021 2022 2023 2024 2021 2022 2023 2024 2025 1 EBITDA is a non-GAAP financial measure. For a reconciliation of non-GAAP measures, please refer to the Appendix. 13 2 Long-Term Debt includes Current Portion of Long-Term Debt and Finance Lease Obligations thousands of $USD

Q1 2025 OUTLOOK IMPACT ON Q1 SEGMENT EXPECTATIONS FOR Q1 vs Q4 EARNINGS VS Q4 • Higher volumes offset by lower realized Steel Mills pricing • Higher volumes offset by lower realized Steel Products pricing • Higher volumes at lower prices, primarily Raw Materials driven by lower DRI pricing Corp / Eliminations • Expected to increase Consolidated Pre- • Similar consolidated pre-tax earnings vs Q4 Tax Earnings • Flat to potentially lower as certain discrete Consolidated benefits (e.g., state taxes) not expected to Earnings reoccur in Q1 14

APPENDIX 15

MEDIUM-TERM OUTLOOK FOR KEY END MARKETS NUE Primary Markets and % of Total External Shipments (2024) HEAVY EQUIPMENT, TRADITIONAL CONSTRUCTION & AUTO & CONSUMER TRANSPORTATION, AND RENEWABLE INFRASTRUCTURE DURABLES LOGISTICS & OTHER ENERGY % NUE ‘24 Shipments: ~50% ~28% ~9% ~13% • Data Centers • Electric • Institutional Bldgs Transmission • Bridge & Highway • Advanced Mfg. Plants • Traditional Energy • Residential • Barge • Renewable Energy • Manufacturing • HVAC & Water Heaters • Warehouse • Light Vehicles • Rail • Appliances • Heavy Equipment • Truck & Trailer • Traditional Office • Agriculture 16 Market Outlook

CAPEX PLAN FUNDED WITH ROBUST OPERATING CASHFLOW AND HEALTHY BALANCE SHEET $3,000 FCF Line = Operating Cashflow minus Capex Annual Annual Annual Cash Period Operating (1) Capex FCF Balance Cashflow $2,500 2017 – 2019 $2.1B $1.0B $1.1B $1.4B (average) $2,000 2021 – 2023 $7.8B $1.9B $5.9B $4.9B (average) $1,500 2024 $4.0B $3.2B $0.8B $4.1B $1,000 Operating $500 Cashflow $0 -$500 Capex -$1,000 -$1,500 2017 2018 2019 2020 2021 2022 2023 2024 $millions QUARTERLY CAPEX QUARTERLY OPERATING CASH FLOW QUARTERLY FCF (1) Represents average year-end cash, cash equivalents and short-term investments during multi-year periods. For 2024, represents balance at end of Q4. 17

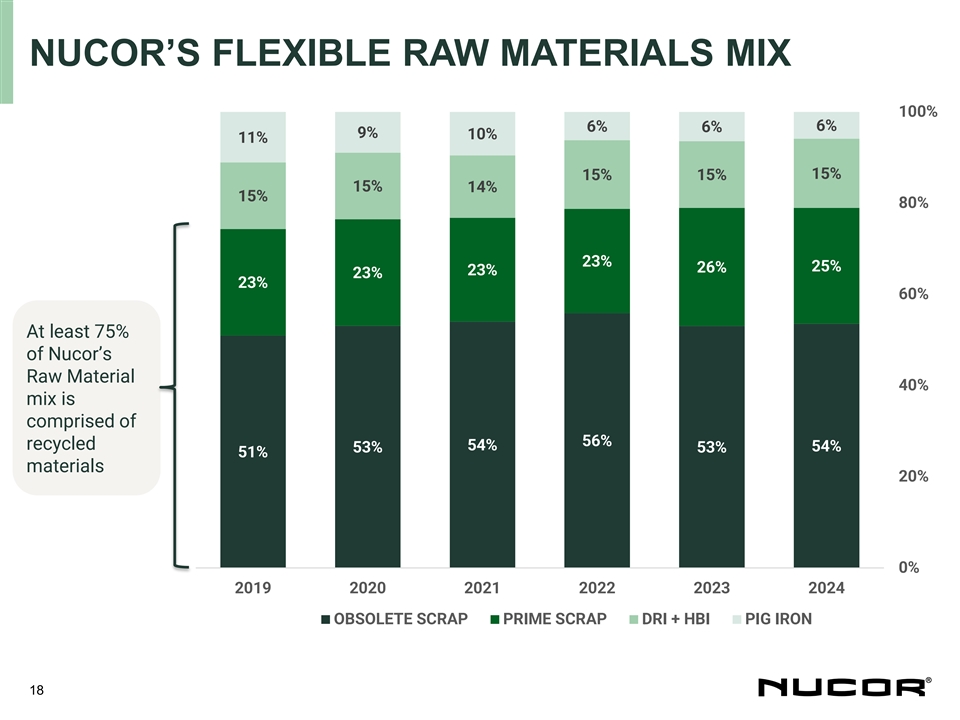

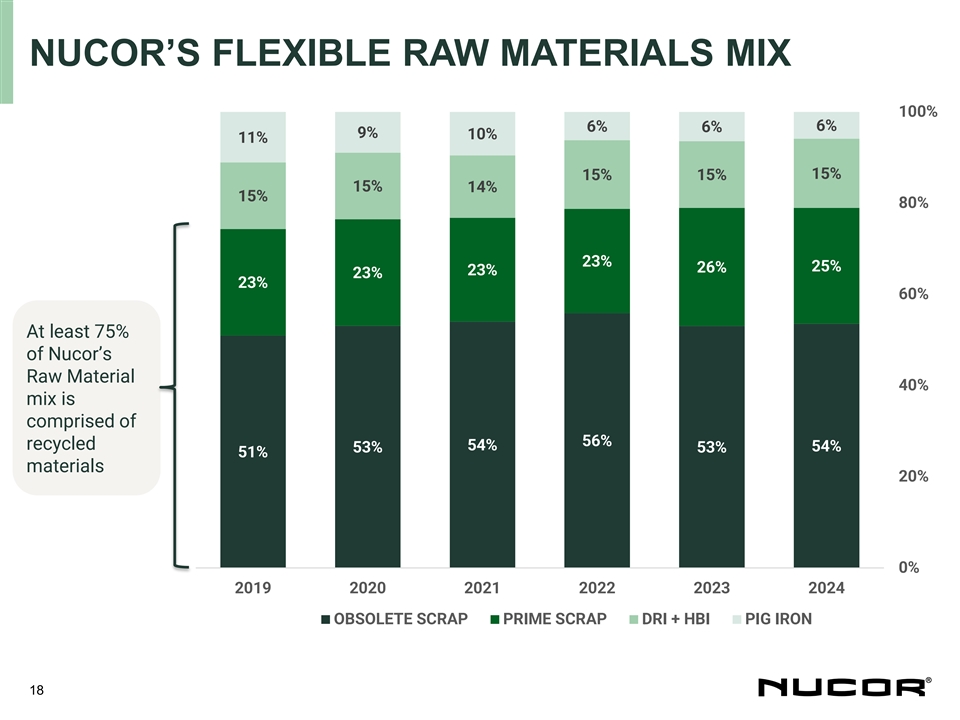

NUCOR’S FLEXIBLE RAW MATERIALS MIX 100% 6% 6% 6% 9% 10% 11% 15% 15% 15% 15% 14% 15% 80% 23% 25% 26% 23% 23% 23% 60% At least 75% of Nucor’s Raw Material 40% mix is comprised of 56% recycled 54% 54% 53% 53% 51% materials 20% 0% 2019 2020 2021 2022 2023 2024 OBSOLETE SCRAP PRIME SCRAP DRI + HBI PIG IRON 18

SEGMENT RESULTS: STEEL MILLS AND STEEL PRODUCTS STEEL MILLS $s in millions, tons in thousands % Change Versus Prior Shipments Q4 ’24 Q3 ‘24 Q4 ’23 Prior Qtr. Q4 2024 vs. Q3 2024 Year Sheet 2,837 -4% 1% 2,714 2,675 • Lower pricing was the primary driver of Bars 1,887 1,926 1,901 -2% -1% lower earnings in the segment, Structural 508 493 542 3% -6% compared to Q3 Plate 502 435 373 15% 35% • Slightly lower shipments across the Other Steel 28 39% 77% 39 22 group compared to prior quarter Total Shipments 5,650 5,719 5,513 -1% 2% 1 EBT $169 $309 $588 -45% -71% 1 EBT /Ton $30 $54 $107 -45% -72% STEEL PRODUCTS $s in millions, tons in thousands % Change Versus Prior Shipments Q4 ’24 Q3 ‘24 Q4 ’23 Prior Qtr. Q4 2024 vs. Q3 2024 Year Tubular 221 213 212 4% 4% • Joist & Deck 178 169 197 5% -10% Pricing was down primarily in Joist & Rebar Fabrication 239 278 251 -14% -5% Deck and Tubular Products Building Systems 57 60 63 -5% -10% • Overall lower shipments Other 273 291 288 -6% -5% Total Shipments 968 1,011 1,011 -4% -4% 1 EBT $329 $314 $656 5% -50% Exclude Impairment Charge -- $40 -- 1 Adj. EBT $329 $354 $656 -7% -50% 1 Adj. EBT /Ton $340 $350 $649 -3% -48% 19 1 EBT refers to Earnings (loss) before income taxes and noncontrolling interests as disclosed in relevant Nucor quarterly earnings news release

SEGMENT RESULTS: RAW MATERIALS RAW MATERIALS $s in millions, tons in thousands % Change Versus Q4 2024 vs. Q3 2024 Prior Production Q4 ‘24 Q3 ‘24 Q4 ’23 Prior Qtr. Year DRI 1,005 835 728 20% 38% • Higher volumes and relatively flat selling Scrap Processing 1,034 993 972 4% 6% prices 1 Total Production 2,039 1,828 1,700 12% 20% 2 EBT $57 ($66) ($14) 186% 507% Exclude Impairment Charge -- $83 -- 2 Adj. EBT $57 $17 ($14) 235% 507% 1 Total production excluding scrap brokerage activities. 2 EBT refers to Earnings (loss) before income taxes and noncontrolling interests as disclosed in relevant 20 Nucor quarterly earnings news release

QUARTERLY SALES AND EARNINGS DATA SALES TONS (THOUSANDS) TO OUTSIDE CUSTOMERS EARNINGS (LOSS) STEEL STEEL PRODUCTS BEFORE INCOME TAXES COMP. SALES OTHER TOTAL PRICE TOTAL STEEL STEEL REBAR TUBULAR BLDG STEEL STEEL RAW TOTAL NET SALES PER $ PER YEAR SHEET BARS BEAM* PLATE STEEL JOISTS DECK FAB PRODS SYSTEMS PRODS PRODS MATLS TONS ($ MILLIONS) TON ($) ($ 000’S) TON 2024 Q1 2,517 1,344 431 384 4,676 99 81 238 208 55 284 965 583 6,224 $8,137 $1,307 $1,111 $188 Q2 2,348 1,445 407 417 4,617 103 82 265 214 66 344 1,074 598 6,289 $8,077 $1,284 $831 $139 Q3 2,394 1,402 406 405 4,607 90 79 278 213 60 291 1,011 578 6,196 $7,444 $1,201 $335 $57 Q4 2,210 1,445 441 484 4,580 99 79 239 221 57 273 968 510 6,058 $7,076 $1,168 $332 $58 YEAR 9,469 5,636 1,685 1,690 18,480 391 321 1,020 856 238 1,192 4,018 2,269 24,767 $30,734 $1,241 $2,610 $111 2023 Q1 2,384 1,550 440 430 4,804 135 99 279 275 51 302 1,141 498 6,443 $8,709,980 $1,352 $1,501,697 $244 Q2 2,404 1,481 399 490 4,774 142 107 332 239 63 310 1,193 621 6,588 $9,523,256 $1,446 $1,924,061 $306 Q3 2,305 1,408 439 426 4,578 127 104 307 223 71 309 1,141 521 6,240 $8,775,734 $1,406 $1,468,333 $247 Q4 2,239 1,402 414 341 4,396 106 91 251 212 63 288 1,011 527 5,934 $7,704,531 $1,298 $990,676 $175 YEAR 9,332 5,841 1,692 1,687 18,552 510 401 1,169 949 248 1,209 4,486 2,167 25,205 $34,713,501 $1,377 $5,884,767 $245 21 *Beam includes all structural steel

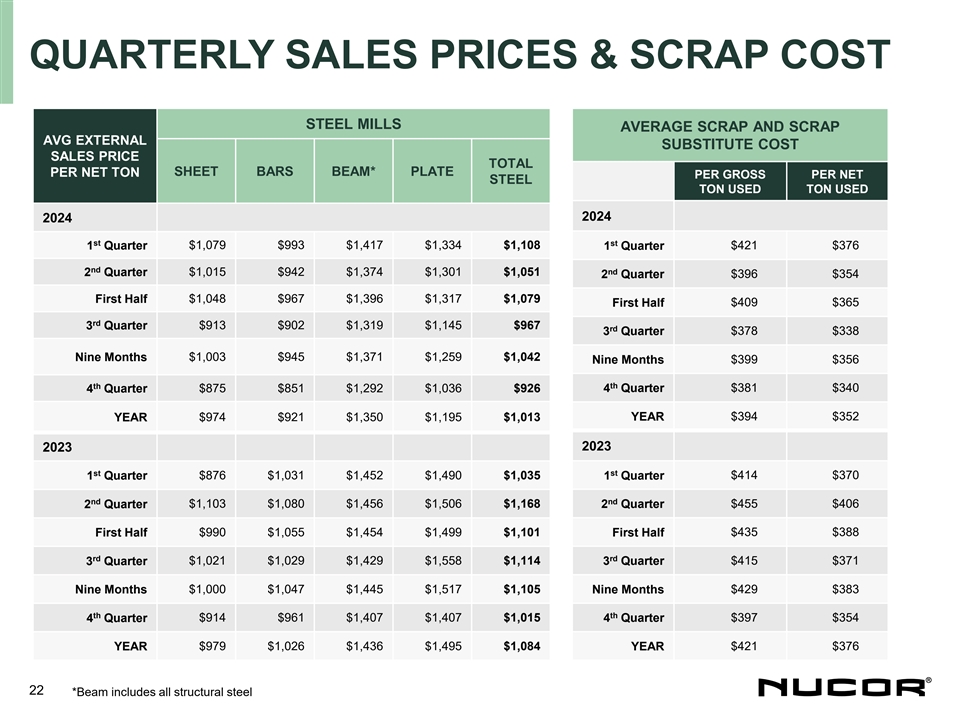

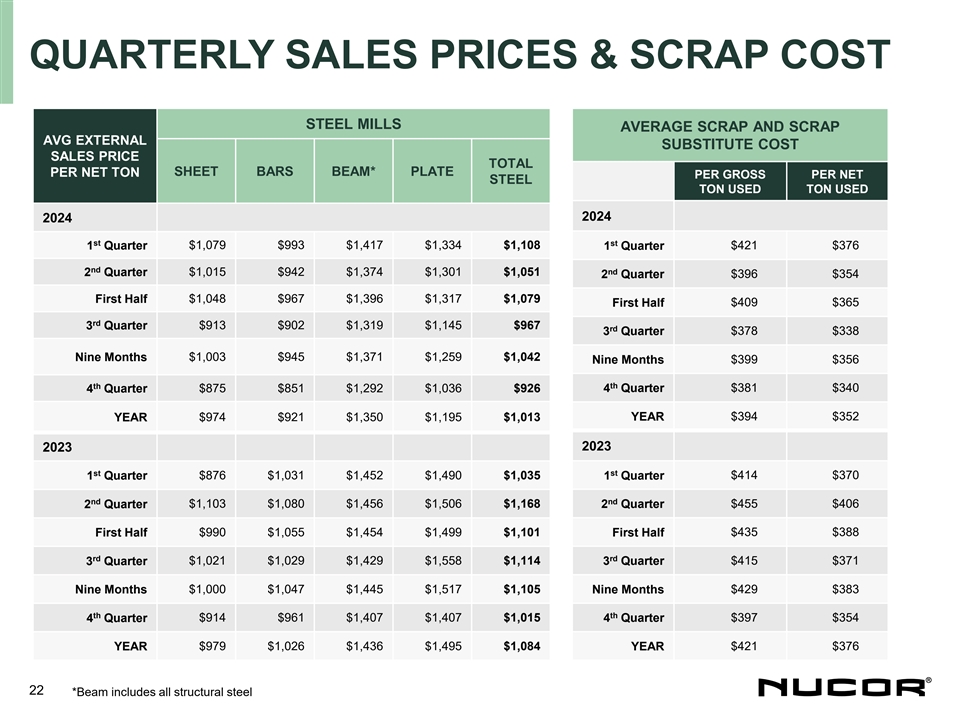

QUARTERLY SALES PRICES & SCRAP COST STEEL MILLS AVERAGE SCRAP AND SCRAP AVG EXTERNAL SUBSTITUTE COST SALES PRICE TOTAL SHEET BARS BEAM* PLATE PER NET TON PER GROSS PER NET STEEL TON USED TON USED 2024 2024 st st 1 Quarter $1,079 $993 $1,417 $1,334 $1,108 1 Quarter $421 $376 nd nd 2 Quarter $1,015 $942 $1,374 $1,301 $1,051 2 Quarter $396 $354 First Half $1,048 $967 $1,396 $1,317 $1,079 First Half $409 $365 rd 3 Quarter $913 $902 $1,319 $1,145 $967 rd $378 $338 3 Quarter Nine Months $1,003 $945 $1,371 $1,259 $1,042 Nine Months $399 $356 th th $875 $851 $1,292 $1,036 $926 4 Quarter $381 $340 4 Quarter $394 $352 YEAR $974 $921 $1,350 $1,195 $1,013 YEAR 2023 2023 st st 1 Quarter $876 $1,031 $1,452 $1,490 $1,035 1 Quarter $414 $370 nd nd 2 Quarter $1,103 $1,080 $1,456 $1,506 $1,168 2 Quarter $455 $406 $990 $1,055 $1,454 $1,499 $1,101 $435 $388 First Half First Half rd rd 3 Quarter $1,021 $1,029 $1,429 $1,558 $1,114 3 Quarter $415 $371 Nine Months $1,000 $1,047 $1,445 $1,517 $1,105 Nine Months $429 $383 th th $914 $961 $1,407 $1,407 $1,015 $397 $354 4 Quarter 4 Quarter YEAR $979 $1,026 $1,436 $1,495 $1,084 YEAR $421 $376 22 *Beam includes all structural steel

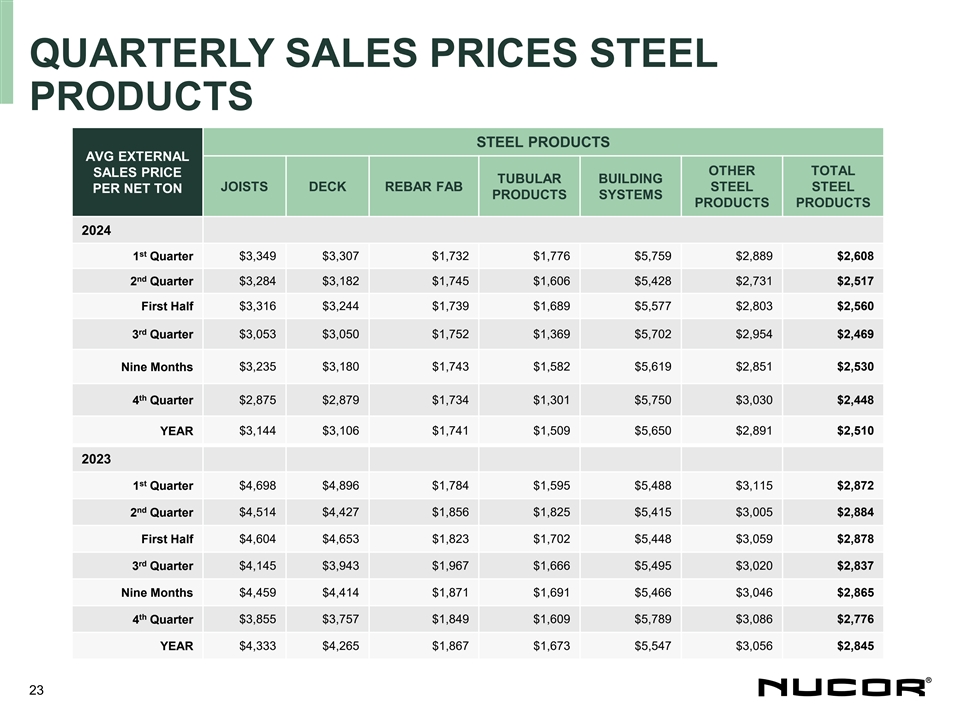

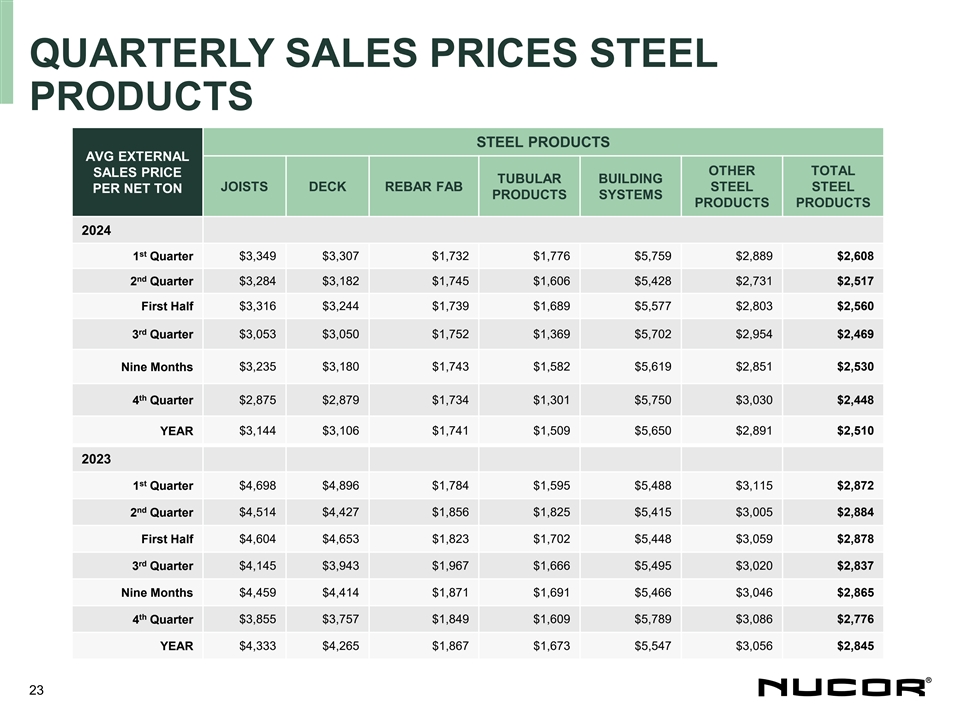

QUARTERLY SALES PRICES STEEL PRODUCTS STEEL PRODUCTS AVG EXTERNAL OTHER TOTAL SALES PRICE TUBULAR BUILDING JOISTS DECK REBAR FAB STEEL STEEL PER NET TON PRODUCTS SYSTEMS PRODUCTS PRODUCTS 2024 st 1 Quarter $3,349 $3,307 $1,732 $1,776 $5,759 $2,889 $2,608 nd 2 Quarter $3,284 $3,182 $1,745 $1,606 $5,428 $2,731 $2,517 First Half $3,316 $3,244 $1,739 $1,689 $5,577 $2,803 $2,560 rd 3 Quarter $3,053 $3,050 $1,752 $1,369 $5,702 $2,954 $2,469 Nine Months $3,235 $3,180 $1,743 $1,582 $5,619 $2,851 $2,530 th 4 Quarter $2,875 $2,879 $1,734 $1,301 $5,750 $3,030 $2,448 $3,144 $3,106 $1,741 $1,509 $5,650 $2,891 $2,510 YEAR 2023 st $4,698 $4,896 $1,784 $1,595 $5,488 $3,115 $2,872 1 Quarter nd $4,514 $4,427 $1,856 $1,825 $5,415 $3,005 $2,884 2 Quarter $4,604 $4,653 $1,823 $1,702 $5,448 $3,059 $2,878 First Half rd 3 Quarter $4,145 $3,943 $1,967 $1,666 $5,495 $3,020 $2,837 Nine Months $4,459 $4,414 $1,871 $1,691 $5,466 $3,046 $2,865 th 4 Quarter $3,855 $3,757 $1,849 $1,609 $5,789 $3,086 $2,776 YEAR $4,333 $4,265 $1,867 $1,673 $5,547 $3,056 $2,845 23

RECONCILIATION OF GAAP TO NON-GAAP MEASURE - EBITDA $ in millions 2020 2021 2022 2023 2024 Net earnings before $836 $7,122 $8,080 $4,913 $2,319 non-controlling interests Net Interest expense $153 $159 $170 ($30) ($30) Income taxes $1,360 $583 -- $2,078 $2,165 Depreciation expense $702 $735 $827 $930 $1,094 Amortization expense $83 $129 $235 $238 $262 Losses and impairments of $614 $62 $102 -- $137 assets EBITDA $2,388 $10,292 $11,579 $7,412 $4,365 24

RECONCILIATION OF GAAP TO NON-GAAP MEASURE – FREE CASH FLOW (FCF) $ in millions 2020 2021 2022 2023 2024 CASH PROVIDED BY OPERATING $2,697 $6,231 $10,072 $7,112 $3,979 ACTIVITIES CAPITAL EXPENDITURES ($1,543) ($1,622) ($1,948) ($2,214) ($3,173) FREE CASH FLOW $1,154 $4,609 $8,124 $4,898 $806 25