Exhibit 99.1

ROGERS COMMUNICATIONS INC.

ANNUAL INFORMATION FORM

(for the fiscal year ended December 31, 2014)

February 13, 2015

ROGERS COMMUNICATIONS INC.

ANNUAL INFORMATION FORM INDEX

The following is an index of the Annual Information Form (“AIF”) of Rogers Communications Inc. referencing the requirements of Form 51-102F2 and Form 52-110F1 of the Canadian Securities Administrators. Certain parts of this Annual Information Form are contained in Rogers Communications Inc.’s Management’s Discussion and Analysis for the fiscal year ended December 31, 2014 (“MD&A”), and Rogers Communications Inc.’s 2014 Annual Audited Consolidated Financial Statements, each of which is filed on SEDAR at sedar.com and incorporated herein by reference as noted below.

| | | | | | | | |

| | | Page reference / incorporated

by reference from | |

| | | Annual

Information Form | | | 2014

MD&A | |

Item 1 — Cover Page | | | p. 1 | | | | | |

| Item 2 — Index | | | p. 2 | | | | | |

Item 3 — Corporate Structure | | | | | | | | |

3.1 — Name, Address and Incorporation | | | p. 3 | | | | | |

3.2 — Intercorporate Relationships | | | pgs. 4-7 | | | | | |

Item 4 — General Development of the Business | | | | | | | | |

4.1 — Three Year History | | | pgs. 8-14 | | | | | |

4.2 — Significant Acquisitions | | | p. 15 | | | | | |

Item 5 — Narrative Description of the Business | | | | | | | | |

5.1 — About Rogers Communications Inc. | | | p. 16 | | | | p. 26 | |

— Understanding Our Business | | | | | | | p. 29 | |

— Products and Services | | | | | | | pgs. 29-30 | |

— Competition | | | | | | | pgs. 30-31 | |

— Industry Trends | | | | | | | p. 32 | |

— Our Strategy | | | | | | | p. 33 | |

— Capability to Deliver Results | | | | | | | pgs. 37-39 | |

— Employees | | | | | | | p. 52 | |

— Properties, Trademarks, Environmental and Other Matters | | | p. 15 | | | | | |

5.2 — Risk Factors | | | p. 16 | | | | pgs. 67-73 | |

Item 6 — Dividends | | | | | | | | |

6.1 — Dividends | | | p. 16 | | | | p. 62 | |

Item 7 — Description of Capital Structure | | | | | | | | |

7.1 — General Description of Capital Structure | | | p. 16 | | | | | |

7.2 — Constraints | | | p. 17 | | | | | |

7.3 — Ratings | | | p. 17 | | | | | |

Item 8 — Market for Securities | | | | | | | | |

8.1 — Trading Price and Volume | | | p. 18 | | | | | |

8.2 — Prior Sales | | | p. 18 | | | | | |

Item 9 — Escrowed Securities and Securities Subject to Contractual Restriction on Transfer | | | p. 18 | | | | | |

Item 10 — Directors and Officers | | | pgs. 19-26 | | | | | |

Item 11 — Promoters | | | p. 26 | | | | | |

Item 12 — Legal Proceedings and Regulatory Actions | | | p. 26 | | | | | |

12.1 — Legal Proceedings | | | p. 26 | | | | pgs. 72-73 | |

12.2 — Regulatory Actions | | | p. 26 | | | | | |

Item 13 — Interest of Management and Others in Material Transactions | | | p. 26 | | | | | |

Item 14 — Transfer Agents and Registrars | | | p. 26 | | | | | |

Item 15 — Material Contracts | | | p. 26 | | | | | |

Item 16 — Interests of Experts | | | | | | | | |

16.1 — Name of Experts | | | p. 26 | | | | | |

16.2 — Interests of Experts | | | p. 26 | | | | | |

Item 17 — Audit Committee | | | | | | | | |

17.1 — Audit Committee Mandate | | | pgs. 27-32 | | | | | |

17.2 — Composition of the Audit Committee | | | p. 32 | | | | | |

17.3 — Relevant Education and Experience | | | p. 32 | | | | | |

17.4 — Reliance on Certain Exemptions | | | p. 32 | | | | | |

17.5 — Reliance on the Exemption in Subsection 3.3(2) or Section 3.6 | | | p. 32 | | | | | |

17.6 — Reliance on Section 3.8 | | | p. 32 | | | | | |

17.7 — Audit Committee Oversight | | | p. 32 | | | | | |

17.8 — Pre-Approval Policies and Procedures | | | p. 33 | | | | | |

17.9 — External Auditor Service Fee | | | p. 33 | | | | | |

Item 18 — Additional Information | | | | | | | | |

18.1 — Additional Information | | | p. 34 | | | | | |

2

ITEM 3 — CORPORATE STRUCTURE

Item 3.1 — Name, Address and Incorporation

Rogers Communications Inc. is a diversified public Canadian communications and media company. RCI was amalgamated under theBusiness Corporations Act(British Columbia). The registered office is located at 2900-550 Burrard Street, Vancouver, British Columbia, V6C 0A3 and the head office is located at 333 Bloor Street East, 10th Floor, Toronto, Ontario, M4W 1G9.

We, us, our, Rogers and the Company refer to Rogers Communications Inc. and our subsidiaries. RCI refers to the legal entity Rogers Communications Inc., not including our subsidiaries. RCI also holds interests in various investments and ventures.

FOUR BUSINESS SEGMENTS

For the purposes of this AIF, we report our results of operations in four segments as at December 31, 2014:

| | |

| Wireless | | Wireless telecommunications operations for Canadian consumers and businesses |

| |

| Cable | | Cable telecommunications operations, including Internet, television and telephony (phone) for Canadian consumers and businesses |

| |

| Business Solutions | | Network connectivity through our fibre network and data centre assets to support a range of voice, data, networking, hosting and cloud-based services for small, medium and large Canadian businesses, governments, and on a wholesale basis to other telecommunications providers |

| |

| Media | | A diversified portfolio of media properties, including television and radio broadcasting, specialty channels, digital media, multi-platform shopping, publishing, and sports media and entertainment |

3

Item 3.2 — Intercorporate Relationships

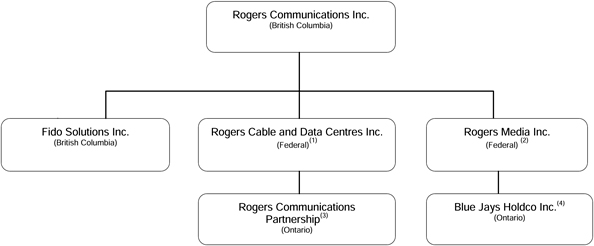

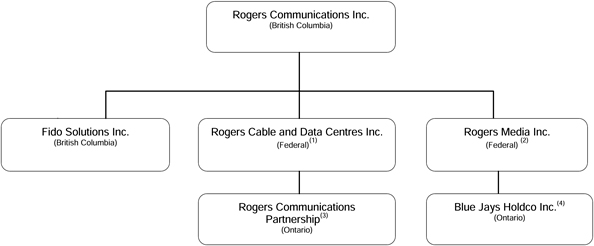

The following summary organization chart illustrates the structure of the principal subsidiaries of RCI, and indicates the jurisdiction of organization of each entity shown as at January 1, 2015.

| (1) | Formed by the amalgamation of Mountain Cablevision Limited, Rogers Data Centres Inc. and Source Cable Limited effective January 1, 2015. |

| (2) | Formed by the amalgamation of a number of our media companies, including Rogers Media Inc., Rogers Broadcasting Limited, Rogers Publishing Limited and Rogers Sportsnet Inc. effective January 1, 2015. |

| (3) | Fido Solutions Inc. (“Fido”) holds an 11% interest in Rogers Communications Partnership (“RCP”) and Rogers Cable and Data Centres Inc. holds an 89% interest in RCP. |

| (4) | Blue Jays Holdco Inc., through its subsidiaries, holds a 100% interest in the Toronto Blue Jays Baseball Club (“Blue Jays”) and Rogers Centre. |

4

OVERVIEW

ROGERS IS CANADA’S LARGEST PROVIDER OF WIRELESS COMMUNICATIONS SERVICES

As at December 31, 2014, we had:

| | • | | approximately 9.5 million subscribers |

| | • | | approximately 35% subscriber share and 35% revenue share of the Canadian wireless market. |

ONE OF CANADA’S LEADING PROVIDERS OF HIGH-SPEED INTERNET, CABLE TELEVISION AND PHONE SERVICES

As at December 31, 2014, we had:

| | • | | 2.0 million high-speed Internet subscribers |

| | • | | 2.0 million Television subscribers – approximately 30% of Canadian cable television subscribers |

| | • | | 1.2 million Phone subscribers |

| | • | | a network that passes approximately 4 million homes in Ontario, New Brunswick and Newfoundland. |

LEADING-EDGE WIRELINE TELECOM AND DATA NETWORKING SERVICES TO CANADIAN BUSINESSES

| | • | | sells to small, medium and large enterprises and governments |

| | • | | sells to other carriers on a wholesale basis |

| | • | | 7,800 on-net fibre connected buildings |

| | • | | fibre passes close to an additional 23,000 near-net buildings. |

DIVERSIFIED CANADIAN MEDIA COMPANY

We have a broad portfolio of media properties, which most significantly includes:

| | • | | category-leading television and radio broadcasting properties |

| | • | | multi-platform televised and online shopping |

| | • | | publishing including Next Issue Canada |

| | • | | sports media and entertainment |

| | • | | exclusive 12-year NHL Agreement |

Products and Services

Wireless

Rogers is a Canadian leader in innovative wireless network technologies and services. We provide wireless services under the Rogers, Fido and chatr brands, and provide consumers and businesses with the best and latest wireless devices, services and applications including:

| | • | | mobile and fixed high speed Internet access; |

| | • | | wireless voice and enhanced voice features; |

| | • | | global voice and data roaming; |

| | • | | machine-to-machine solutions; |

| | • | | advanced business solutions; |

| | • | | Rogers AnyPlace TV; and |

Cable

Our cable network provides a leading and innovative selection of high-speed broadband Internet access, digital television and online viewing, phone and advanced home Wi-Fi services to consumers and businesses.

Television services include on-demand, personal video recorders (PVRs) and Whole Home PVRs; regular and time-shifted programming; digital specialty channels; and Rogers Anyplace TV and Anyplace TV Home Edition for viewing televised content on smartphones, tablets and personal computers.

5

Phone services include residential and small business local telephony service, calling features such as voicemail, call waiting, and long-distance.

Business Solutions

Our services that meet the increasing demands of today’s critical business applications include:

| | • | | voice, data networking, Internet protocol (IP) and Ethernet services over multiservice customer access devices that allow customers to scale and add services, such as private networking, Internet, IP voice and cloud solutions, which blend seamlessly to grow with their business requirements; |

| | • | | optical wave, Internet, Ethernet and multi-protocol label switching services, providing scalable and secure metro and wide area private networking that enable and interconnect critical business applications for businesses that have one or many offices, data centres or points of presence (as well as cloud applications) across Canada; and |

| | • | | extensive wireless and cable access networks services for primary, bridging and back-up connectivity. |

Media

Our portfolio of Media assets reaches Canadians coast-to-coast.

In Television, we operate several conventional and specialty television networks:

| | • | | City network, which together with affiliated stations, has broadcast distribution to approximately 80% of Canadian households; |

| | • | | OMNI multicultural broadcast television stations; |

| | • | | Specialty channels that include Outdoor Life Network, FX (Canada), FXX (Canada) and G4 Canada; |

| | • | | Sportsnet’s four regional stations, Sportsnet ONE, Sportsnet 360 and Sportsnet World; |

| | • | | The Shopping Channel, Canada’s only nationally televised shopping channel which generates a significant and growing portion of its revenues from online sales; and |

| | • | | VICE Canada, a joint agreement between Rogers and VICE Media that will produce and deliver Canadian-made news and entertainment programming across mobile, web and TV platforms starting in 2015. |

In Radio, we operate more than 50 AM and FM radio stations in markets across Canada, including popular radio brands such as 98.1 CHFI, 680 News, Sportsnet 590 The FAN, KISS 92.5, JACK FM and SONiC.

Our Publishing services and products include:

| | • | | many well-known consumer magazines such as Maclean’s, Chatelaine, Flare, Hello! Canada and Canadian Business; |

| | • | | a leading position in marketing, medical, financial, and trade publications; |

| | • | | a broad digital presence with a number of online publications that continue the extension of content across new platforms; and |

| | • | | Next Issue Canada, our digital magazine service which offers unlimited access to a catalogue of nearly 150 premium Canadian and US magazine titles. |

Our NHL Agreement, beginning with the 2014-2015 NHL season, allows us to deliver unprecedented coverage of professional hockey across television, smartphones, tablets and Internet streaming, including Rogers NHL GameCentre LIVE with more than 1,000 regular season games streamed wirelessly and online.

In Sports Entertainment, we own the Toronto Blue Jays, Canada’s only Major League Baseball (MLB) team, and the Rogers Centre event venue, which hosts the Toronto Blue Jays’ home games and other professional league games, concerts, trade shows and special events.

Our online and mobile digital media platforms include digital advertising across websites and mobile platforms, digital content subscriptions, and e-commerce solutions.

Other

Other services we offer to consumers and businesses include:

| | • | | local digital services: |

| | • | | OutRank, an online marketing and advertising tool for small businesses; |

| | • | | Vicinity, an automated loyalty program for small businesses; |

| | • | | Zoocasa, an online real estate platform with advanced online tools and information from industry experts for buyers and sellers; and |

6

| | • | | Rogers Alerts, a program provided at no charge to Rogers wireless customers that delivers location-based mobile offers from participating retailers. |

| | • | | Rogers Smart Home Monitoring, an innovative home security and automation system; |

| | • | | Rogers First Rewards Loyalty Program, which allows Rogers customers to earn loyalty points on Wireless and Cable products; and |

| | • | | Rogers First Rewards MasterCard, a no annual fee credit card that allows customers to earn Rogers First Rewards points on credit card spending. |

Other Investments

We hold interests in a number of associates and joint ventures, some of which include:

| | • | | our 37.5% ownership interest in Maple Leaf Sports & Entertainment Ltd. (MLSE), which owns the Toronto Maple Leafs, the Toronto Raptors, the Toronto FC, and the Toronto Marlies, as well as various associated real estate holdings; |

| | • | | our joint venture in shomi, a new subscription video-on-demand streaming service available both online and via cable set top boxes with a library of over 11,000 hours of movies and past seasons of some of the most popular TV shows; and |

| | • | | our joint operation, Inukshuk Wireless Partnership, created to operate a national fixed wireless telecommunications network to be used by the partners of the joint operation and their subsidiaries. |

Widespread Product Distribution

Wireless

We distribute our wireless products nationally using various channels including:

| | • | | an extensive independent dealer network; |

| | • | | company-owned Rogers, Fido and Chatr retail stores; |

| | • | | major retail chains and convenience stores; |

| | • | | partnered distribution channels, such as WOW! mobile boutique; |

| | • | | customer self-serve using rogers.com, fido.ca, chatrwireless.com, ecommerce sites; and |

| | • | | Rogers call centres and outbound telemarketing. |

Cable

We distribute our cable products using various channels including:

| | • | | company-owned Rogers retail stores; |

| | • | | customer self-serve using rogers.com; |

| | • | | Rogers call centres, outbound telemarketing, door-to-door agents; |

| | • | | major retail chains; and |

| | • | | an extensive network of third party retail locations. |

Business Solutions

Our sales team sells Business Solutions services to Canadian business and public sector telecom customers. An extensive network of third-party channel distributors deal with IT integrators, consultants, local service providers and other indirect sales relationships. This diverse approach gives greater breadth of coverage and allows for strong sales growth for next generation services.

7

ITEM 4 — GENERAL DEVELOPMENT OF THE BUSINESS

Item 4.1 — Three Year History

Recent Developments

2015 Year to Date Developments

| | • | | In January 2015, we announced an increase of 5% in the annual dividend from $1.83 to $1.92 per Class A Voting and Class B Non-Voting share. The new annual dividend of $1.92 per share will be paid in quarterly amounts of $0.48 per each outstanding Class A Voting and Class B Non-Voting share beginning with the quarterly dividend that will be paid on April 1, 2015. |

| | • | | Effective January 1, 2015, the amended terms of the accounts receivable securitization program increased the maximum potential proceeds under the program to $1.05 billion and extended the term of the program to January 1, 2018. |

2014 Highlights

For revenue and other financial information on the two most recently completed financial years, see the section entitled 2014 Financial Results in 2014 MD&A.

| | • | | Issued $2.1 billion of senior notes at historically low rates for Rogers, consisting of $250 million three year floating rate senior notes, $400 million five year 2.80% senior notes, $600 million ten year 4.00% senior notes, and US$750 million ($832 million) thirty year 5.00% senior notes. |

| | • | | In February 2014, we renewed our normal course issuer bid (NCIB) for our Class B Non-Voting shares for another year. The 2014 NCIB gave us the right to buy up to an aggregate $500 million or 35,780,234 Class B Non-Voting shares of RCI, whichever is less, at any time between February 25, 2014 and February 24, 2015. We did not purchase any shares for cancellation in 2014 and we do not currently intend to renew our NCIB beyond the February 24, 2015 expiry. |

| | • | | Ended the year with approximately $2.8 billion of available liquidity, comprised of $0.2 billion cash on hand, $2.5 billion available under our bank credit facility and $0.1 billion available under our $0.9 billion accounts receivable securitization program. |

| | • | | Increased our annualized dividend rate in February 2014 by 5% to $1.83 per Class A Voting and Class B Non-Voting share and paid a quarterly dividend of $0.4575 per each outstanding Class A Voting and Class B Non-Voting share during 2014. |

| | • | | Unveiled Rogers 3.0, a multi-year, seven-point plan in May 2014 that reflects feedback from thousands of customers, employees, shareholders and a number of other stakeholders. The plan builds on Rogers unrivaled asset mix and the underlying strengths of the Company to improve customer experience, reaccelerate growth and better capitalize on opportunities for growth and innovation. |

| | • | | Completed a structural reorganization under the Rogers 3.0 plan to enhance service, accountability and agility by structuring teams around our customers and removing management layers to ensure that senior leadership is closer to customers and front-line employees. We hired executive leaders with significant experience to fill key senior management roles and have begun executing our new Rogers 3.0 plan. SeeItem 10 – Directors and Officers below for the details of the new executive officers. |

| | • | | On November 4, 2014, we acquired Source Cable Limited, a small television, Internet, and phone service provider for $156 million. The Source Cable footprint is situated adjacent to existing Rogers cable systems in Southwestern Ontario and is expected to enable numerous synergies. |

Overhaul the customer experience

| | • | | Launched Roam Like Home, a simple and cost effective way for Wireless customers to use the Internet, make calls, send texts and emails in the US with their Rogers Share Everything Plan, letting them access their Canadian wireless plans while they are in the US. |

| | • | | Launched suretap wallet, an advanced new mobile commerce application that lets customers use their smartphones to safely store eligible payment cards and make payments at tens of thousands of retailers across Canada. |

8

| | • | | Reduced annual customer complaints by more than 30% from the previous year as reported by the federal Commissioner for Complaints for Telecommunications Services (CCTS) in its annual report. The report registers the number of complaints made by customers of major telecom service providers. |

| | • | | Announced an agreement under which Rogers will own 50% of Glentel Inc. (Glentel), including its several hundred Canadian wireless retail distribution outlets, subject to regulatory approval and completion of BCE Inc.’s (BCE) acquisition of Glentel. |

Drive growth in the business market

| | • | | Expanded data centre operations to 15 locations across Canada with Business Solutions opening Alberta’s first Tier III certified data centre giving business customers reliable, secure data services. |

| | • | | Vicinity was awarded Product of the Year for the Rewards / Financial Services Programs category by Product of the Year, the world’s largest consumer-voted award for product innovation. Rogers Vicinity is an automated loyalty program offering small businesses and their customers access to loyalty programs and awards. |

| | • | | Introduced Rogers Check-In, a new service capability that allows small business customers to quickly and easily review their account at any time with a Small Business Specialist to ensure they have the right services for their business needs. |

| | • | | Launched Rogers Talks, a series of free events across Canada for small businesses in conjunction with Small Business Month (October). Experts in social media, marketing and sales were on hand to talk about how technology can help small business owners grow. |

Invest in and develop our people

| | • | | Recognized as one of Canada’s top employers for the second straight year by Canada’s Top 100 Employers, a national competition now entering its 16th year which looks at more than 3,250 Canadian employers. In addition, Rogers was for the first time named to the elite top 10 list of the best companies to work for in Canada and was recognized as one of Canada’s Best Diversity Employers by Canada’s Top 100 Employers 2015. |

| | • | | Named one of Canada’s ‘Top Employers for Young People’, for a fifth consecutive year. Judges noted that Rogers provides exciting and challenging work, a broad range of career opportunities, a strong total rewards package and a chance to work with the best and the brightest in the industry. The judging panel also highlighted Rogers’ unique support of new grads through rotational programs that develop breadth of hands on experience. |

Deliver compelling content everywhere

| | • | | Deployed Rogers’ 2014-2015 NHL national broadcast schedule, delivering double the number of games on free over-the-air TV and twice as many Hockey Night in Canada Saturday night games than ever before across 9 networks. We built and launched a $4.5 million state-of-the-art NHL Studio, are bringing the NHL to 25 communities across Canada with Rogers Hometown Hockey, and grew the NHL on-air broadcast team to include the biggest TV names in the game. |

| | • | | Reaching 22 million Canadians, Hockey Night in Canada continues to be the most-watched sporting event in Canada in a typical week with viewership between October and December 2014 up 12% from last year since the national NHL rights were acquired by Rogers, as reported by Numeris using Cumulative Reach. Audiences on Scotiabank Wednesday Night Hockey on Sportsnet are up 14% this year, while Rogers Hometown Hockey on City has increased the network’s audiences on Sunday nights by 50%, as reported by Numeris for the period between October to December 2014 using Average Minute Audience. Since the start of the NHL season, audiences on Sportsnet ONE are up 33% and up 40% on Sportsnet 360. |

| | • | | Launched Rogers NHL GameCentre LIVE with more than 1,000 regular season games streamed wirelessly and online, available on smartphones, tablets and computers, and with significantly enhanced features. Rogers NHL GameCentre LIVE is available to all Canadians and was offered free on an introductory basis to Rogers wireless data and Internet customers. Within Rogers NHL GameCentre LIVE is GamePlus, which streams unique camera angles, on-demand replays and more interviews. Exclusively available to Rogers customers, with GamePlus fans can watch several different camera feeds and review big plays from up to seven different angles. Sportsnet.ca’s weekly unique |

9

| | visitors have increased 76%, page views are up 53% and video starts have increased 94% as fans are consuming more digital hockey content. |

| | • | | Launched shomi, an exciting new subscription video-on-demand streaming service available on mobile, tablet, online, and through our cable set-top boxes. shomi provides online and televised entertainment with the most popular shows on TV today, iconic series from the past, fan-favourite films and a library of kids programming. Available to Rogers and Shaw Television or Internet customers, shomi has an easy to use interface and more personalized selections for customers. shomi is a joint venture equally owned by Rogers and Shaw Communications Inc. |

| | • | | Launched Sportsnet NOW, a 24/7, live HD-quality stream of all seven of Sportsnet’s TV channels. Designed to keep sports fans connected to their favourite teams, players, and Sportsnet programming, Sportsnet NOW is available on mobile devices and computers for free with a Sportsnet TV subscription. |

| | • | | Partnered with VICE Media in a joint agreement to deliver Canadian-made news and entertainment programming across mobile, web and TV platforms in 2015. VICE Canada properties will include a state-of-the-art multimedia production facility in Toronto that will produce content for use globally, the VICE TV Network, mobile content and VICE’s network of Canadian digital properties. |

| | • | | Introduced Canada’s first 24-hour network dedicated to baseball, MLB Network, on Rogers digital cable. In addition, Sportsnet signed an 8-year multi-platform broadcast rights extension with MLB Properties and MLB Advanced Media to show live and in-progress games and highlights within Canada. |

| | • | | Expanded Next Issue offerings by adding People Magazine, National Geographic, Travel + Leisure, and Food & Wine to the digital newsstand. Next Issue now delivers nearly 150 of North America’s premium magazine titles. |

| | • | | Reached a three-year regional broadcast rights agreement with the NHL’s Montreal Canadiens. Combined with the national package, Sportsnet will deliver all 82 English-language Canadiens games this season, making more Canadiens games available nationally than ever before. |

Focus on innovation and network leadership

| | • | | Secured “beachfront” spectrum consisting of two 12 MHz blocks of contiguous, paired lower 700 MHz band spectrum covering the vast majority of the Canadian population. This prime spectrum was the most sought after and is the spectrum Rogers went into the auction intending to win for its customers. Our $3.3 billion investment was in line with recent 700 MHz spectrum transactions in the US. We have now deployed this spectrum in rural and urban communities in Ontario, British Columbia, Alberta, Quebec, New Brunswick, Nova Scotia and Prince Edward Island delivering a the ultimate mobile video experience to Rogers customers while carrying wireless signals deep into basements, elevators and in buildings with thick concrete walls. |

| | • | | Continued our expansion of Canada’s first wireless LTE 4G broadband network. Our network covered approximately 84% of the Canadian population as at December 31, 2014. We continued to offer a large selection of LTE devices and became the first carrier in North America, and one of the first in the world, to offer international LTE roaming to wireless customers. |

| | • | | First Canadian carrier to launch LTE-Advanced, now available in various communities across Canada. This next evolution of LTE wireless technology combines Rogers’ 700 MHz and AWS spectrum, so customers can download and live stream high quality video in more places on mobiles and tablets. LTE-Advanced was launched in Vancouver, Edmonton, Calgary, Windsor, London, Hamilton, Toronto, Kingston, Moncton, Fredericton, Halifax and Saint John. |

| | • | | Signed a Partner Market agreement with Vodafone to become its partner in Canada. The agreement extends Vodafone’s international experience, innovation and scale to Rogers in the Canadian market to generate a number of revenue, cost saving and product opportunities. |

| | • | | Recognized for the second straight year by PCMag.com, Rogers’ LTE network was named in September 2014 as the fastest downstream mobile network in Canada. PCMag.com also recognized Rogers as Canada’s fastest broadband Internet service provider. |

10

Go to market as One Rogers

| | • | | We streamlined the organization to allow us to be more agile and ensure senior leadership is closer to customers and front-line employees. We’ve aligned to go to market with our products and services in more disciplined and coordinated ways. We are using more cross-functional, multi-departmental teams from all parts of the business on go-to-market projects as we’ve demonstrated this year with our 12-year NHL Agreement. |

2013 Highlights

| | • | | Guy Laurence joined Rogers in December 2013, as our new President and Chief Executive Officer, succeeding Nadir Mohamed who retired from Rogers. Mr. Laurence brings 30 years of global experience in the telecommunications and media industries. |

| | • | | We completed the strategic acquisition of Mountain Cablevision Ltd., Shaw Communications’ (Shaw) cable system in Hamilton, Ontario. |

| | • | | We completed the strategic acquisitions of Blackiron Data ULC and Pivot Data Centres. |

| | • | | We finalized our purchase of Score Media Inc. (“theScore”), Canada’s third largest specialty sports channel, for $167 million. We later rebranded theScore as Sportsnet 360. |

| | • | | Rogers First Rewards, a new loyalty program allowing customers to earn points on their eligible purchases and redeem them online for a wide selection of Rogers products and services, was launched in the Greater Toronto Area, Ottawa, Kingston, Sudbury and other cities throughout Ontario. We also received regulatory approval to launch a Rogers credit card which augments this loyalty program and will accelerate the rate at which customers earn points. |

| | • | | We increased our annualized dividend rate in February 2013 by 10% to $1.74 per Class A Voting and Class B Non-Voting share. The annual dividend of $1.74 per share was paid in quarterly amounts of $0.435 per each outstanding Class A Voting and Class B Non-Voting share. We paid $876 million in dividends to shareholders during 2013. |

| | • | | On February 21, 2013, the Toronto Stock Exchange (“TSX”) had accepted a notice of RCI’s intention to renew our NCIB for our Class B Non-Voting shares for a further one-year period commencing February 25, 2013 and ending February 24, 2014. The notice provides that during such one-year period we may purchase on the TSX, the New York Stock Exchange (“NYSE”), and/or alternative trading systems up to the lesser of 35.8 million Class B Non-Voting shares and that number of Class B Non-Voting shares that can be purchased under the NCIB for an aggregate purchase price of $500 million. During 2013, we purchased 546,674 Class B Non-Voting shares for cancellation under the NCIB for a purchase price of $22 million, all of which were made through the facilities of the TSX in June 2013. |

| | • | | We issued and fully hedged the foreign exchange risk associated with the US$2.5 billion of ten and thirty year senior notes at some of the lowest coupon rates ever achieved for Rogers corporate debt, in two separate offerings comprising: |

| | • | | US$500 million of 3.00% senior notes due 2023 and US$500 million of 4.50% senior notes due 2043 |

| | • | | US$850 million of 4.10% senior notes due 2023 and US$650 million of 5.45% senior notes due 2043 |

| | • | | Our wireless offerings and pricing tiers were simplified, reducing complexity and service times for our sales and support teams and adding customer value. These innovations include Canada’s first complete wireless Share Everything plan which allows individuals, families and small businesses to share wireless data, unlimited nationwide talk and text and calling features across 1 to 10 wireless devices. |

| | • | | Our “worry free” $7.99 per day US wireless data roaming plan was launched, with twice daily the data capacity (50 MB) typically used daily by consumers for wireless Internet, as well as enhanced voice, text and data roaming value packages. |

| | • | | A hybrid wireless home and small business phone solution was launched, that operates on our national wireless network. The service is available in regions outside Rogers’ cable territories and offers a traditional home or office phone service and features without the need for a landline or Internet connection. |

11

| | • | | The M2M World Alliance, an organization comprised of eight leading international mobile operators including Rogers, demonstrated a single global SIM card which makes it easier to deploy connected devices in multiple countries and is expected to drive further growth for our machine-to-machine (“M2M”) business. |

| | • | | Next generation TV experience was unveiled with NextBox 3.0 giving viewers access to record up to eight HD programs at one time and store up to 240 hours of HD content. The NextBox 3.0 experience includes whole home PVR capability and becomes a wireless TV experience allowing viewers to navigate their cable guide, use a virtual remote, set PVR recordings and live stream channels all from a tablet or smartphone while at home or away. |

| | • | | Rogers was named both the fastest broadband Internet service provider and the fastest wireless network in Canada in October 2013 by PCMag.com, a leading US based technology website. |

| | • | | SamKnows, an independent broadband performance company, stated through in-home testing in May 2013 that we delivered, on average, 100% or more of our advertised download speeds on our most popular Internet packages, better than most providers in the US and Europe that were tested. |

| | • | | MLB Network, a 24-hour network dedicated exclusively to baseball was launched on Rogers digital television, marking the first time this network is available in Canada. MLB Network’s year-round programming features live games, news, highlights, and the game’s top analysts. |

| | • | | Our TV experience was significantly enriched with the launch of our Recommendations App for NextBox, giving customers access to personalized live, rental, on-demand and previously recorded program recommendations displayed on their TV screens. A Canadian cable industry first, the application recommends similar programs based on what customers are viewing, helping Canadians to explore and uncover more programming that appeals to their individual tastes. |

| | • | | SIP Trunking, a new IP-based voice solution was announced for enterprises designed to complement our fibre-based Internet and WAN connectivity services. Merging voice services with a business data network, SIP Trunking solutions dynamically allocate bandwidth as needed to support voice and/or data needs depending upon capacity requirements during peak hours and also provide a platform for next generation IP-based video, mobile and productivity applications and services. |

| | • | | Exclusive NHL 12-year licensing agreement to broadcast national NHL games beginning with the 2014-2015 NHL season was signed. The agreement grants Rogers the exclusive distribution of all national regular season and playoff games within Canada, in multiple languages, across all platforms. At the same time, we executed separate agreements to sublicence certain of these broadcasting rights to TVA Sports and CBC. |

| | • | | Sportsnet announced a 10-year partnership extension with the Vancouver Canucks through the 2022-2023 NHL season, continuing a 14-year network tradition as the regional television broadcaster of Canucks hockey. The new agreement features a comprehensive suite of multimedia rights including television, online and mobile, delivering up to 60 regular season Vancouver Canucks games each season. At the time Sportsnet was also the official regional television broadcast rights holder for the Toronto Maple Leafs, Calgary Flames and Edmonton Oilers. |

| | • | | Media closed our agreement to acquire Metro 14 Montreal for $10 million on February 4, 2013, and relaunched the station as City Montreal, expanding the City broadcast TV network into the largest market in Quebec and increasing the City television network reach to over 80% of Canadian households. |

| | • | | Next Issue Canada, an innovative, all-you-can-read subscription digital magazine service that provides consumers with exclusive and unlimited access to a catalogue of more than 100 premium Canadian and US titles was launched. Next Issue Canada delivers access to our leading publishing brands alongside many of the most popular US magazine titles. |

| | • | | The Shopping Channel launched a brighter, easier, and more engaging multi-channel retail experience and a refreshed on-air and online look, an all-new mobile app, special-themed programming and improved shipping. The leading interactive and only national Canadian multi-channel retailer also added on-air social media engagement, new leading brands and more celebrity guest appearances. |

12

| | • | | Sportsnet announced an eight-year multi-platform broadcast rights extension with MLB Properties and MLB Advanced Media to show live and in-progress regular season and playoff baseball games and highlights within Canada. |

2012 Highlights

| | • | | In October 2012, Media completed the purchase of 100% of the outstanding shares of Score Media Inc. for $167 million. The shares of Score Media were transferred to an interim CRTC-approved trust which was responsible for the independent management of the business in the normal course of operations until CRTC final approval was obtained and we acquired the control of Score Media. Score Media owns theScore Television Network, a national specialty TV service providing sports news, information, highlights and live event programming across Canada. |

| | • | | On August 22, 2012, along with BCE Inc., we completed the joint acquisition of a net 75% equity interest in Maple Leaf & Sports Entertainment (“MLSE”) from the Ontario Teachers’ Pension Plan. MLSE is one of Canada’s largest sports and entertainment companies which owns and operates the Air Canada Centre, the NHL’s Toronto Maple Leafs, the NBA’s Toronto Raptors, the MLS’ Toronto FC, the AHL’s Toronto Marlies and other real estate and entertainment assets. Rogers’ net cash investment was $540 million, representing a 37.5% equity interest in MLSE. |

| | • | | On February 22, 2012, we increased the annualized dividend rate by 11% from $1.42 to $1.58 per Class A Voting and Class B Non-Voting share. The annual dividend of $1.58 per share was paid in quarterly amounts of $0.395 per each outstanding Class A Voting and Class B Non-Voting share. We paid $803 million in dividends to shareholders during 2012. |

| | • | | On February 22, 2012, we renewed our prior NCIB to repurchase Class B Non-Voting shares of RCI for a further one-year period. This allowed us to purchase up to the lesser of 36.8 million Class B Non-Voting shares, representing approximately 10% of the then-issued and outstanding Class B Non-Voting shares, and that number of Class B Non-Voting shares that could be purchased under the NCIB for an aggregate purchase price of $1.0 billion. During 2012, we purchased for cancellation 9,637,230 Class B Non-Voting shares for $350 million. All of these shares were purchased directly under the NCIB. |

| | • | | Issued $1.1 billion of debt securities consisting of $500 million of 3.0% Senior Notes due 2017 (the “2017 Notes”) and $600 million of 4.0% Senior Notes due 2022 (the “2022 Notes”). The net proceeds from the offering were used to repay amounts outstanding under Rogers’ bank credit facility and for general corporate purposes, including funding Rogers’ investment in MLSE. |

| | • | | Entered into an accounts receivable securitization program on December 31, 2012, further supplementing our liquidity and sources of secured funding by up to $900 million and the initial funding was received on January 14, 2013. |

| | • | | Entered into a five-year $2.0 billion syndicated bank credit facility that will mature in July 2017. It replaced Rogers’ prior bank credit facility that was scheduled to expire in July 2013. |

| | • | | Wireless expanded Canada’s first LTE 4G broadband network to cover approximately 60% of the population of the country, and continued to offer the largest selection of LTE devices of any carrier in Canada. |

| | • | | Together with CIBC, Rogers pioneered the first point-of-sale mobile credit card solution in Canada. The service allows Canadians to pay for purchases with their CIBC credit card wirelessly using the secure SIM card inside an NFC-enabled Rogers BlackBerry. This historic first – enabled by Rogers’ innovative network platform – has put Canada on the world stage as a leader in mobile commerce innovation. |

| | • | | Wireless introduced the “FLEXtab” wireless device upgrade program. It gives postpaid customers more flexibility than ever to opt for an early wireless device upgrade by simply paying a prorated portion of the unamortized subsidy at any point during their contract term. |

| | • | | Wireless redesigned and simplified its wireless offers and pricing tiers, reducing the complexity and service times for our sales and support teams. These new plans offer unlimited voice and text and a range of wireless data usage and device sharing options to meet the needs of our increasingly data-centric customer base. |

| | • | | Wireless launched another industry first, Rogers One Number, an IP-based service that allows Canadians to extend their Rogers Wireless phone number to their computer, tablet or home phone. Available exclusively to Rogers |

13

| | Wireless customers, the unique service lets customers text, talk and video chat with other Rogers One Number users from their various devices, all using their Rogers Wireless cellular number. This seamless, easy-to-use solution is simplifying how Canadians connect with family and friends. |

| | • | | Rogers and Wavefront opened the doors to a new Rogers Wireless Innovation Centre in Vancouver. The Centre will support current and emerging developers to get to market faster with innovative applications for connected devices to strengthen the wireless developer ecosystem in Canada, as well as educate companies about the benefits of M2M technology. |

| | • | | Wireless announced an alliance with international mobile operators KPN, NTT Docomo, SingTel, Telefónica, Telstra and Vimpelcom to co-operate on global M2M business initiatives. The intent is to support a single, global platform that multinational customers can leverage to enable connected devices in multiple countries to better manage operations and reduce costs. Rogers is Canada’s M2M leader, committed to providing the enterprise tools and platforms for rapid delivery of next generation M2M connectivity across industries and market segments. |

| | • | | Wireless announced an alliance with Axeda Corporation that will accelerate the deployment and reduce the complexity around the development of M2M solutions in Canada. Rogers and SAP announced plans to deploy enterprise mobile applications that leverage the SAP mobile platform. This exclusive new offering will help simplify the way organizations mobilize their workforce, giving employees real-time access to enterprise mobile applications on tablets and smartphones that are traditionally used on desktop computers. |

| | • | | Cable unveiled NextBox 2.0, a suite of new features and functionality for the Rogers’ home television entertainment experience that gives customers control over where, when and how they view their favourite live and recorded programming. During the year, Cable further enhanced the NextBox 2.0 platform with the new Rogers Anyplace TV Home edition application for tablets. It provides a seamless TV and internet experience allowing customers to watch TV anywhere in their home, across multiple devices. Rogers was the first Canadian telecommunications company to offer an integrated remote PVR management and live TV streaming experience on tablets. |

| | • | | Cable demonstrated its commitment to bringing leading Internet experiences to Canadians by increasing speeds across approximately 90% of its footprint, including doubling the speed of our Ultimate tier to 150 Mbps. Cable continues to make significant network investments to deliver the fastest Internet speeds available to the most homes. |

| | • | | RBS announced the availability of SIP Trunking, a new IP-based voice solution for enterprises designed to complement its fibre-based Internet and WAN connectivity services. By merging voice services with a business data network, SIP Trunking solutions dynamically allocates bandwidth as needed to support voice and/or data needs depending upon capacity requirements during peak hours and also provide a platform for next generation IP-based video, mobile and productivity applications and services. |

| | • | | Media launched the City Saskatchewan television station following the acquisition of Saskatchewan Communications Network, marking another step in City’s geographic expansion towards a national footprint. Media also announced that City and Jim Pattison Broadcast Group signed long-term affiliate agreements that will deliver City programming to audiences on all three of Pattison’s television stations in western Canada. |

| | • | | Media advanced Rogers’ strategy of delivering highly sought-after sports content anywhere, anytime, on any platform by strengthening the value of its sports brand, Sportsnet, which is further enhanced by Rogers’ 37.5% investment in MLSE. |

14

Item 4.2 — Significant Acquisitions

N/A

ITEM 5 — NARRATIVE DESCRIPTION OF THE BUSINESS

PROPERTIES, TRADEMARKS, ENVIRONMENTAL AND OTHER MATTERS

In most instances, the Company, through its subsidiaries, owns the assets essential to its operations. The major fixed assets are transmitters, microwave systems, antennae, buildings and electronic transmission, receiving and processing accessories and other wireless network equipment (including switches, radio channels, base station equipment, microwave facilities and cell equipment); coaxial and fibre optic cables, set-top terminals and cable modems, electronic transmission, receiving, processing, digitizing and distributing equipment, IP routers, data storage servers and network management equipment, microwave equipment and antennae; and radio and television broadcasting equipment (including television cameras, television and radio production facilities and studios). The operating systems and software related to these assets are either owned by the Company or are used under license.

The Company also leases various distribution facilities from third parties, including space on utility poles and underground ducts for the placement of some of the cable system. The Company either owns or leases land for the placement of hub sites and head-ends and space for other portions of the cable distribution system. The Company also leases premises and space on buildings for the placement of antenna towers. The Company either owns or leases the premises on which its switches are located. The Company has highly-clustered and technologically advanced broadband cable networks in the provinces of Ontario, New Brunswick and Newfoundland and Labrador.

The Company operates a North American transcontinental fibre-optic network extending over 44,000 route kilometres providing a significant North American geographic footprint connecting Canada’s largest markets while also reaching key U.S. markets for the exchange of data and voice traffic, also known as peering.

The Company owns or has licensed various brands and trademarks used in its businesses. Various of the Company’s trade names and properties are protected by trademark and/or copyright. The Company maintains customer lists for its businesses. The Company’s intellectual property, including its trade names, brands, properties and customer lists, is important to its operations.

In 2014, the Company spent approximately $694,476 relating to environmental protection and management requirements. Environmental protection and management requirements applicable to the Company’s operations are not expected to have a significant effect on the Company’s property, plant and equipment expenditures, earnings or its competitive position in the current or future fiscal years.

The Company has committed to material obligations under firm contractual arrangements, including commitments for future payments under long-term debt arrangements, capital lease obligations, operating lease arrangements and other commercial commitments. The information under the heading “Commitments and Other Contractual Obligations” contained on page 63 of our Management’s Discussion and Analysis for the year ended December 31, 2014 is incorporated herein by reference.

15

This section incorporates by reference the following sections contained in our Management’s Discussion and Analysis for the year ended December 31, 2014:

Item 5.1 — General — Business Overview

| | | | |

About Rogers Communications Inc. | | | p. 26 | |

Understanding Our Business | | | p. 29 | |

Wireless | | | p. 29 | |

Cable | | | p. 29 | |

Business Solutions | | | p. 29 | |

Media | | | p. 29 | |

Products and Services | | | p. 29 | |

Wireless | | | p. 29 | |

Cable | | | p. 29 | |

Business Solutions | | | p. 29 | |

Media | | | pgs. 29-30 | |

Other | | | p.30 | |

Other Investments | | | p. 30 | |

Competition | | | p. 30 | |

Wireless | | | p. 30 | |

Cable | | | p. 31 | |

Business Solutions | | | p. 31 | |

Media | | | p. 31 | |

Industry Trends | | | p. 32 | |

Our Strategy | | | p. 33 | |

Capability to Deliver Results | | | pgs. 37-39 | |

Wireless | | | p. 37 | |

Cable | | | p. 39 | |

Business Solutions | | | p. 39 | |

Media | | | p. 39 | |

Item 5.2 — Risk Factors

The following section is incorporated by reference herein: “Risks and Uncertainties Affecting our Business”, section contained on pages 67 to 73 of our Management’s Discussion and Analysis for the year ended December 31, 2014.

ITEM 6 — DIVIDENDS

Item 6.1 — Dividends

The information under the heading “Dividends” contained on page 62 of our Management’s Discussion and Analysis for the year ended December 31, 2014 is incorporated herein by reference.

ITEM 7 — DESCRIPTION OF CAPITAL STRUCTURE

Item 7.1 — General Description of Capital Structure

The information required under the heading General Description of Capital Structure is contained in the 2014 Annual Audited Financial Statements, Note 24 and is incorporated herein by reference.

Each Class A Voting share of RCI carries the right to fifty votes on a poll and may be voted at the meetings of shareholders of RCI. Holders of Class B Non-Voting shares and any series of preferred shares of the Company are entitled to receive notice of and to attend meetings of shareholders of RCI but, except as required by law, are not entitled to vote at such meetings.If an offer is made to purchase outstanding Class A Voting shares, there is no requirement under applicable law or the Company’s constating documents that an offer be made for the outstanding Class B Non-Voting shares and there is no other protection available to holders of Class B Non-Voting shares under the Company’s constating documents. If an offer is made to purchase both Class A Voting shares and Class B Non-Voting shares, the offer for the Class A Voting shares may be made on different terms than the offer made to the holders of Class B Non-Voting shares.

16

Item 7.2 — Constraints

Restrictions on the Transfer, Voting and Issue of Shares

We have ownership interests in several Canadian entities licenced or authorized to operate under applicable communications laws (the “Laws”) including the:

| | • | | Broadcasting Act(Canada) |

| | • | | Telecommunications Act(Canada) |

| | • | | Radiocommunication Act(Canada) |

The Laws have foreign ownership limits (the“Limits”) for various classes of licensed or authorized entities. You can obtain a copy of the Limits from our Secretary.

The Laws also impose a number of restrictions on changes in effective control of licencees or authorized entities, and the transfer of licences held by them. Our Articles of Amalgamation therefore impose restrictions on the issue and transfer of our shares and the exercise of voting rights to ensure that we and any Canadian corporation in which we have any interest are:

| | • | | qualified to hold or obtain any cable television, broadcasting or telecommunications licence or authorized to operate a similar entity under the Laws; and |

| | • | | not in breach of the Laws or any licences issued to us or to any of our Canadian subsidiaries, associates or affiliates under the Laws. |

If our Board of Directors (the Board) considers that our or our subsidiaries’ ability to hold and obtain licences, or to remain in compliance with the Laws, may be in jeopardy, the Board may invoke the restrictions in our Articles of Amalgamation on transfer, voting and issue of our shares.

Item 7.3 — Ratings

Credit ratings provide an independent measure of credit quality of an issue of securities, and can affect our ability to obtain short-term and long-term financing and the terms of the financing. If rating agencies lower the credit ratings on our debt, particularly a downgrade below investment grade, it could adversely affect our cost of financing and access to liquidity and capital.

We have engaged each of Fitch Ratings (Fitch), Moody’s Investors Service (Moody’s) and Standard & Poor’s Ratings Services (Standard & Poor’s) to rate our public debt issues. In February 2014, Standard & Poor’s affirmed RCI’s senior unsecured debt at BBB+ with a stable outlook, Moody’s affirmed its comparably equivalent rating of Baa1 with a stable outlook and Fitch affirmed its BBB+ rating with a negative outlook, revised from stable.

The table below shows the credit ratings on our borrowings received from the rating agencies as of December 31, 2014:

| | | | | | |

| | | Standard & Poor’s | | Fitch | | Moody’s |

| Corporate credit issuer default rating | | BBB+ with a stable outlook | | BBB+ with a negative

outlook | | Baa1, stable outlook |

| Senior unsecured debt | | BBB+ with a stable outlook | | BBB+ with a negative

outlook | | Baa1, stable outlook |

Ratings for debt instruments across the universe of composite rates range from AAA (Standard & Poor’s and Fitch) or Aaa (Moody’s) representing the highest quality of securities rated, to D (Standard & Poor’s), C (Moody’s) and Substantial Risk (Fitch) for the lowest quality of securities rated.

Credit ratings are not recommendations for investors to purchase, hold or sell the rated securities, nor are they a comment on market price or investor suitability. There is no assurance that a rating will remain in effect for a given period of time, or that a rating will not be revised or withdrawn entirely by a rating agency if it believes circumstances warrant it. The ratings on our senior debt provided by Standard & Poor’s, Fitch and Moody’s are investment grade ratings.

17

ITEM 8 — MARKET FOR SECURITIES

Class B Non-Voting shares (CUSIP # 775109200) are listed in Canada on the Toronto Stock Exchange under the symbol RCI.B and in the United States on the New York Stock Exchange under the symbol RCI. Class A Voting shares (CUSIP # 775109101) are listed on the Toronto Stock Exchange under the symbol RCI.A.

Item 8.1 — Trading Price and Volume

The following table sets forth, for the periods indicated, the reported high, low and close prices and volume traded on the Toronto Stock Exchange for Class B Non-Voting shares and Class A Voting shares.

RCI.B

| | | | | | | | | | | | | | | | |

Month | | High | | | Low | | | Close | | | Volume | |

2014/01 | | | 47.86 | | | | 46.30 | | | | 46.85 | | | | 18,912,852 | |

2014/02 | | | 46.07 | | | | 42.64 | | | | 42.80 | | | | 30,580,441 | |

2014/03 | | | 45.85 | | | | 42.68 | | | | 45.81 | | | | 25,430,601 | |

2014/04 | | | 46.25 | | | | 42.28 | | | | 43.53 | | | | 18,715,119 | |

2014/05 | | | 45.78 | | | | 43.50 | | | | 43.82 | | | | 14,099,254 | |

2014/06 | | | 44.70 | | | | 42.69 | | | | 42.94 | | | | 15,602,252 | |

2014/07 | | | 43.05 | | | | 41.17 | | | | 42.58 | | | | 17,323,670 | |

2014/08 | | | 44.56 | | | | 41.96 | | | | 44.32 | | | | 14,317,431 | |

2014/09 | | | 44.87 | | | | 41.85 | | | | 41.92 | | | | 17,538,862 | |

2014/10 | | | 44.01 | | | | 41.67 | | | | 42.38 | | | | 16,622,702 | |

2014/11 | | | 45.84 | | | | 42.19 | | | | 45.77 | | | | 16,449,324 | |

2014/12 | | | 45.87 | | | | 43.97 | | | | 45.17 | | | | 22,077,182 | |

RCI.A

| | | | | | | | | | | | | | | | |

Month | | High | | | Low | | | Close | | | Volume | |

2014/01 | | | 49.46 | | | | 47.79 | | | | 47.79 | | | | 35,864 | |

2014/02 | | | 48.25 | | | | 44.51 | | | | 45.53 | | | | 33,569 | |

2014/03 | | | 47.85 | | | | 45.40 | | | | 47.85 | | | | 36,509 | |

2014/04 | | | 48.00 | | | | 44.10 | | | | 45.06 | | | | 20,604 | |

2014/05 | | | 47.97 | | | | 44.88 | | | | 44.88 | | | | 24,218 | |

2014/06 | | | 46.99 | | | | 43.99 | | | | 44.30 | | | | 27,455 | |

2014/07 | | | 45.13 | | | | 43.35 | | | | 44.48 | | | | 29,734 | |

2014/08 | | | 45.97 | | | | 43.35 | | | | 45.64 | | | | 35,951 | |

2014/09 | | | 46.50 | | | | 43.22 | | | | 43.22 | | | | 16,647 | |

2014/10 | | | 45.12 | | | | 42.55 | | | | 44.61 | | | | 25,807 | |

2014/11 | | | 47.45 | | | | 44.10 | | | | 47.45 | | | | 19,121 | |

2014/12 | | | 47.30 | | | | 44.66 | | | | 45.80 | | | | 19,456 | |

Item 8.2 — Prior Sales

N/A

ITEM 9 — ESCROWED SECURITIES AND SECURITIES SUBJECT TO CONTRACTUAL RESTRICTION ON TRANSFER

N/A

18

ITEM 10 — DIRECTORS AND OFFICERS

The following is a list of directors and executive officers of the Company as of December 31, 2014, indicating their municipality, province or state and country of residence and their principal occupation(s) within the five preceding years. Each director is elected at the annual meeting of shareholders to serve until the next annual meeting or until a successor is duly elected unless, prior thereto, he or she resigns or his or her office becomes vacant by death or other cause under applicable law. Officers are appointed by, and serve at the discretion of, the Board.

| | |

Name | | Position |

| Alan D. Horn, CPA, CA (2)(6)(7)(9) | | Director and Chairman and member of the Advisory Committee of the Rogers Control Trust |

| Philip B. Lind, C.M. (9) | | Director, Vice Chairman and member of the Advisory Committee of the Rogers Control Trust |

| J. Guy Laurence | | Director and President and Chief Executive Officer |

| Anthony Staffieri, FCPA, FCA | | Chief Financial Officer |

| Mike Adams | | Executive Vice President, Advisor to the CEO |

| Dale Hooper | | Chief Brand Officer |

| Frank Boulben (10) | | Chief Strategy Officer and Interim President, Consumer Business Unit |

| Deepak Khandelwal | | Chief Customer Officer |

| Nitin Kawale | | President, Enterprise Business Unit |

| Jacob Glick | | Chief Corporate Affairs Officer |

| Edward S. Rogers (2)(3)(7)(8)(9) | | Director, Deputy Chairman and Chair of the Rogers Control Trust |

| Keith W. Pelley | | President, Media Business Unit |

| Robert F. Berner | | Chief Technology Officer and Interim Chief Information Officer |

| David P. Miller | | Chief Legal Officer and Secretary |

| James M. Reid | | Chief Human Resources Officer |

| Melinda M. Rogers (3)(6)(7)(8)(9) | | Director and Vice-Chair of the Rogers Control Trust |

| C. William D. Birchall (1)(3)(7) | | Director |

| Stephen A. Burch (1)(5) | | Director |

| John H. Clappison, FCPA, FCA (1)(6)(4) | | Director |

| Thomas I. Hull (2)(4)(5)(7)(9) | | Director and member of the Advisory Committee of the Rogers Control Trust |

| John A. MacDonald (1)(3)(5) | | Director |

| Isabelle Marcoux (4)(5) | | Director |

| The Hon. David R. Peterson, P.C., Q.C. (6)(3) | | Director |

| Loretta A. Rogers (8)(9) | | Director and member of the Advisory Committee of the Rogers Control Trust |

| Martha L. Rogers (8)(9) | | Director and member of the Advisory Committee of the Rogers Control Trust |

| Charles Sirois (2)(4)(7) | | Lead Director |

| (1) | Denotes member of Audit Committee. |

| (2) | Denotes member of Executive Committee. |

| (3) | Denotes member of the Nominating Committee |

| (4) | Denotes member of the Corporate Governance Committee. |

| (5) | Denotes member of the Human Resources Committee. |

| (6) | Denotes member of the Pension Committee. |

| (7) | Denotes member of the Finance Committee. |

19

| (8) | Each of Edward S. Rogers, Loretta A. Rogers, Martha L. Rogers and Melinda M. Rogers are immediate family members of each other and members of the family of the late Ted Rogers. For additional information, please see “Outstanding Shares and Main Shareholders” in RCI’s 2014 Information Circular available on SEDAR at sedar.com. |

| (9) | Voting control of RCI is held by the Rogers Control Trust. See “Outstanding Shares and Main Shareholders” in RCI’s 2014 Information Circular available on SEDAR at sedar.com. Each of the individuals that are noted above as holding positions with the Rogers Control Trust have held such positions since December 2008. |

| (10) | Mr. Boulben holds the title Interim President, Consumer Business Unit until April 6, 2015 when he will be succeeded by Dirk Woessner. |

Alan D. Horn, CPA, CA,resides in Toronto, Ontario, Canada and has served as Chairman of the Board of the Corporation and President and Chief Executive Officer of Rogers Telecommunications Limited and certain private companies which control the Corporation since March 2006. In addition, Mr. Horn was appointed a director of Rogers Bank on April 24, 2013. Mr. Horn was Vice President, Finance and Chief Financial Officer of the Corporation from September 1996 to March 2006 and he served as President and Chief Operating Officer of Rogers Telecommunications Limited from 1990 to 1996. Mr. Horn was Acting President and Chief Executive Officer of the Company from October 2008 to March 2009. He is also a director of Fairfax Financial Holdings Limited and CCL Industries Inc. Mr. Horn is a Chartered Accountant (and Chartered Professional Accountant). Mr. Horn received a B.Sc. with First Class Honours in Mathematics from the University of Aberdeen, Scotland.

Philip B. Lind, C.M.,resides in Toronto, Ontario, Canada and has been a director of RCI since February 1979. Mr. Lind is non-executive Vice Chairman of RCI and was Executive Vice President, Regulatory until his retirement in December 2014. Mr. Lind joined Rogers in 1969 as Programming Chief and has served as Secretary of the Board and Senior Vice President, Programming and Planning. Mr. Lind is also a director of Brookfield Asset Management Inc., the Council for Business and the Arts, the Vancouver Art Gallery and the Art Gallery of Ontario. Mr. Lind is a former member of the Board of the National Cable Television Association in the U.S. and is a former Chairman of the Canadian Cable Television Association. He is also Chairman of the Board of the CCPTA (Channel 17, WNED) and a director of the Atlantic Salmon Federation and The U.S. Cable Center, Denver. Mr. Lind holds a B.A. (Political Science and Sociology) from the University of British Columbia and a M.A. (Political Science), University of Rochester. In 2002, he received a Doctor of Laws, honoris causa, from the University of British Columbia. In 2002, Mr. Lind was appointed to the Order of Canada. In 2012 Mr. Lind was inducted into the U.S. Cable Hall of Fame, the third Canadian to be so honoured.

J. Guy Laurence, resides in Toronto, Ontario, Canada and became Director, President and Chief Executive Officer on December 2, 2013. During his first year, he restructured the Company around the customer, introduced the multi-year Rogers 3.0 strategy, and began delivering key commercial activities to re-establish Rogers leadership position. He joined the company from Vodafone where he was Chief Executive Officer of Vodafone UK. Mr. Laurence first joined Vodafone in 2000, holding a number of increasingly senior roles before becoming Chief Executive Officer of Vodafone Netherlands in 2005 and then Chief Executive Officer of Vodafone UK in 2008. He previously held senior leadership positions at a number of international media companies including MGM Studios, United Cinemas and Chrysalis Records. Mr. Laurence intrinsically understands the changing media landscape and how media assets can create value for an integrated communications company.

Anthony Staffieri, FCPA, FCA,resides in Maple, Ontario, Canada and has been the Company’s Chief Financial Officer since April 2012. Prior to joining Rogers, Mr. Staffieri was Senior Vice President, Finance for Bell Canada Enterprises. He joined BCE in 2005 from Celestica International Inc., where he served in various senior financial roles from 1999 to 2005. Mr. Staffieri was a Partner with PricewaterhouseCoopers, where he began his career, leaving the firm in 1999 to join the executive leadership team of his then client Celestica. Mr. Staffieri serves as a board member for several of the Company’s subsidiaries and affiliates including Rogers Bank, the Toronto Blue Jays and MLSE. He also serves as a board member for the Mackenzie Health Foundation. He is a Fellow Chartered Accountant (and Fellow Chartered Professional Accountant) and holds a Bachelor of Business Administration degree from the Schulich School of Business.

Mike Adams, resides in Toronto, Ontario, Canada and was Executive Vice President, Operations and Service from 2009 until he became acting Chief Customer Officer in May 2014. Mr. Adams is currently Executive Vice President, Advisor to the CEO. Mr. Adams also served as Executive Vice President and Chief Operating Officer for Rogers Cable commencing in 2004. He is a member of the Institute of Electrical Electronics Engineers, Inc. (IEEE) and Society of Cable Telecommunication Engineers (SCTE). He received his Bachelor of Science with Honours in

20

Engineering at Northeastern University and his Master of Science in Engineering at the Massachusetts Institute of Technology.

Dale Hooper, resides in Toronto, Ontario, Canada and has served as our Chief Brand Officer since May 2014. He leads brand strategy, consumer insight, and all advertising and creative for the Rogers, Fido, and chatr brands, as well as all Rogers Media brands. Previously, Mr. Hooper was Senior Vice President, Marketing & Consumer Insights at Rogers Media from February 2011. Prior to joining Rogers, Mr. Hooper served in senior roles at PepsiCo Beverages Canada from 2008, including Vice-President of Marketing & Insights from January 2008 to February 2011. Mr. Hooper also serves on the Board of Canadian Sports Institute Ontario and is a member of the Laurentian University School of Sports Administration Advisory Committee.

Frank Boulben, resides in New York, USA and has served as our Chief Strategy Officer since May 2014 and is Interim President, Consumer Business Unit until April 2015. He is responsible for corporate strategy, new business development and innovation, and wholesale operations. Prior to joining Rogers, Mr. Boulben was Chief Marketing Officer at BlackBerry from May 2012 to November 2013. He joined BlackBerry from LightSquared where he served as EVP, Strategy, Marketing and Sales from March 2010 to April 2012. Prior to moving to North America to join LightSquared, Mr. Boulden was Global Director Commercial Strategy at Vodafone from March 2007 to March 2010 and EVP Brand and Consumer Marketing for Orange Group from January 2004 to February 2007. Mr. Boulben also served as Board Member and Chairman of the Strategy Committee of the GSMA from November 2004 to November 2006.

Deepak Khandelwal, resides in Oakville, Ontario, Canada and has served as our Chief Customer Officer since November 2014. Mr. Khandelwal is responsible for all customer experience functions. Mr. Khandelwal joined Rogers from Google Inc. where he was VP, Global Customer Experience. He joined Google in 2010 as Head of Special Projects – Global Advertiser Operations and then, from October 2010 to January 2012, served as VP, Global Advertiser Operations. Prior to Google Mr. Khandelwal worked at McKinsey & Company from 1994 to 2010 becoming a Principal in 2001. Mr. Khandelwal holds an M.B.A. from Ivey Business School (Western University) and a Bachelor of Science degree in Electrical Engineering from the University of Saskatchewan.

Nitin Kawale, resides in Toronto, Ontario, Canada and has served as our President, Enterprise Business Unit since December 2014. Mr. Kawale is responsible for the delivery of the company’s enterprise business strategy and commercial plan covering Small and Medium Business, enterprise and public sector customers. Mr. Kawale joined Rogers from Cisco Systems Canada Co where he held the position of President since 2008 with responsibility for all aspects of the Canadian operation. Mr. Kawale joined Cisco in 1995 serving in a variety of domestic and international roles. He holds a Bachelor of Applied Science degree from the University of Toronto.

Jacob Glick, resides in Ottawa, Ontario, Canada and has served as our Chief Corporate Affairs Officer since November 2014. Mr. Glick is responsible for leading the Corporate Affairs team, including regulatory affairs, public policy, government relations, internal and external communications, and social media. Mr. Glick joined Rogers from Google Inc., where he led Google’s global Central Public Policy and Government Relations team. Mr. Glick started at Google Canada Corp in December 2007 where he served in various senior positions including establishing and leading Google Canada’s Public Policy and Government Relations team. Prior to joining Google, he was General Counsel & Director of Policy Development and Corporate Secretary at Canadian Internet Registration Authority from June 2005 to December 2007.

Edward S. Rogers,resides in Toronto, Ontario, Canada and has been a director of RCI since May 1997. He is the representative controlling shareholder of RCI. Mr. Rogers is also the Deputy Chairman of the Board of Directors for RCI and is Chairman of the Finance Committee, Chairman of the Nominating Committee and Chairman of the Executive Committee. He is also Chairman of the Rogers Bank, Chairman of The Toronto Blue Jays and is on the Board of Directors of Maple Leaf Sports & Entertainment, CableLabs and The Toronto Sick Kids Foundation. Mr. Rogers was previously Executive Vice President, Emerging Business and Corporate Development from 2009 to 2014. He served as President and Chief Executive Officer of Rogers Cable from 2003 to 2009 and Senior Vice-President, Planning and Strategy of the Company from 2000 to 2002. Mr. Rogers served as Vice President and General Manager, GTA, Rogers Cable Inc. from 1998 to 2000; and served as Vice President and General Manager, Paging, Data and Emerging Technologies of Rogers Wireless Inc. from 1996 to 1998. He worked for Comcast Corporation, Philadelphia from 1993 to 1996. Mr. Rogers served on the Economic Council of Canada from 2010 to 2013.

Keith W. Pelley, resides in Toronto, Ontario, Canada and has served as President, Media Business Unit since September 2010. Prior to joining Rogers, Mr. Pelley was Executive Vice President of Strategic Planning at CTVglobemedia and President of Canada’s Olympic Broadcast Media Consortium. Previously, Mr. Pelley was the President and Chief Executive Officer of the Toronto Argonauts CFL team and the President of Canadian sports channel TSN. Mr. Pelley

21

serves on the Board of Own the Podium (OTP), Jays Care Foundation and the Holland Bloorview Kids Rehabilitation Hospital Foundation.

Robert F. Berner,resides in Toronto, Ontario, Canada and has been our Chief Technology Officer since April 2006 and Interim Chief Information Officer since October 2014. He was appointed Senior Vice President and Chief Technology Officer of Wireless in 1998, prior to which Mr. Berner served as Vice President and Chief Technology Officer from 1996 to 1998. Mr. Berner has been employed with Rogers since 1985.

David P. Miller,resides in Toronto, Ontario, Canada and was appointed our Chief Legal Officer and Secretary in February 2007. He was previously Vice President, General Counsel of RCI since 1987 and Secretary of RCI since 2002.

James M. Reid,resides in Toronto, Ontario, Canada and was appointed Chief Human Resources Officer in August 2011. Prior to joining Rogers, Mr. Reid was Head of Global Human Resources at both Husky Injection Molding Systems and MDS Inc. Mr. Reid also served as an officer and pilot in the Canadian Armed Forces.

Melinda M. Rogers,resides in Toronto, Ontario, Canada and has been a director of RCI since May 2002. Ms. Rogers served as Senior Vice President, Strategy and Development from 2006 to 2014. She has been the Founder of Rogers Venture Partners since September 2011. Ms. Rogers joined RCI in 2000 as Vice President, Venture Investments and has also served as Vice President, Strategic Planning & Venture Investments from 2004 to 2006. In addition, Ms. Rogers has served as a board member and advisor for a number of companies. She is currently the Chairman of the Jays Care Foundation, and is a director of The Governing Council of the University of Toronto, and Next Issue Media. Prior to joining Rogers, Ms. Rogers was a Product Manager for Excite@Home, Redwood City, California. Ms. Rogers holds a B.A., University of Western Ontario and an M.B.A. from Joseph L. Rotman School of Business at the University of Toronto.

C. William D. Birchall,resides in Toronto, Ontario, Canada and has been a director of RCI since June 2005. Mr. Birchall serves as a director and Vice Chairman of Barrick Gold Corporation and Chairman of Barrick International Banking Corporation, a subsidiary of Barrick Gold Corporation. Mr. Birchall served as Vice Chairman of TrizecHahn Corporation from 1996 to 2001. Mr. Birchall is a Fellow of the Institute of Chartered Accountants of England and Wales.

Stephen A. Burch, is an American citizen who resides in Owings Mills, Maryland, United States of America and has been a director of RCI since April 2009. Mr. Burch is Chairman of the Board of the University of Maryland Medical Systems. Mr. Burch served as President and Chief Executive Officer of Virgin Media (formerly NTL, Inc.) in the United Kingdom from 2006 to 2007. Mr. Burch served in various capacities at Comcast Cable Communications, most recently as President of the Atlantic Division from 1987 to 2005. Mr. Burch serves on various public service boards and educational institutions. He has a JD from Gonzaga University.

John H. Clappison, FCPA, CPA,resides in Toronto, Ontario, Canada and has been a director of RCI since June 2006. In addition, Mr. Clappison was appointed a director of Rogers Bank on April 24, 2013. Mr. Clappison was associated with PricewaterhouseCoopers from 1968. From 1990 to December 2005, Mr. Clappison was the Greater Toronto Area Managing Partner of PricewaterhouseCoopers. Mr. Clappison serves as a director of Sun Life Financial Inc. and Cameco Corporation. Mr. Clappison is a Chartered Accountant (and Chartered Professional Accountant) and a Fellow of the Institute of Chartered Accountants of Ontario.

Thomas I. Hull,resides in Toronto, Ontario, Canada and has been a director of RCI since February 1979. Mr. Hull has been Chairman and Chief Executive Officer of The Hull Group of Companies, an insurance brokerage firm, since 1954. Mr. Hull is a graduate of the Insurance Co. of North America College of Insurance and Risk Management. Mr. Hull is a life member of the Canadian Association of Insurance and Financial Advisors and past president of the Life Underwriters’ Association of Toronto.

John A. MacDonald, resides in Toronto, Ontario, Canada and has been a director of RCI since April 2012. Mr. MacDonald was President, Enterprise Division of MTS Allstream when he retired in December of 2008. In November 2002, Mr. MacDonald joined AT&T Canada as President and Chief Operating Officer. The company was re-branded Allstream in 2003 and was subsequently acquired by MTS the following year. Previously Mr. MacDonald served as President and Chief Executive Officer of Leitch Technology Corp. Prior to that, he was with Bell Canada from 1994 to 1999, serving first as Executive Vice President, Business Development and Chief Technology Officer before becoming President and COO in 1998. Mr. MacDonald began his career in 1977 at NBTel, the major supplier of telecommunications services in New Brunswick, rising to the post of President and Chief Executive Officer in 1994. Mr. MacDonald currently is also a director of Magor Corporation. Mr. MacDonald was previously a director of Rogers Cable. Mr. MacDonald holds a

22

B.Sc. in electrical engineering from Dalhousie University and a B.A., Engineering from the Technical University of Nova Scotia.