- SWN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

425 Filing

Southwestern Energy (SWN) 425Business combination disclosure

Filed: 12 Aug 20, 11:11am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 12, 2020

SOUTHWESTERN ENERGY COMPANY

(Exact name of registrant as specified in its charter)

| Delaware | 001-08246 | 71-0205415 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

10000 Energy Drive

Spring, TX 77389

(Address of principal executive office)(Zip Code)

(832) 796-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, Par Value $0.01 | SWN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 | Entry into a Material Definitive Agreement. |

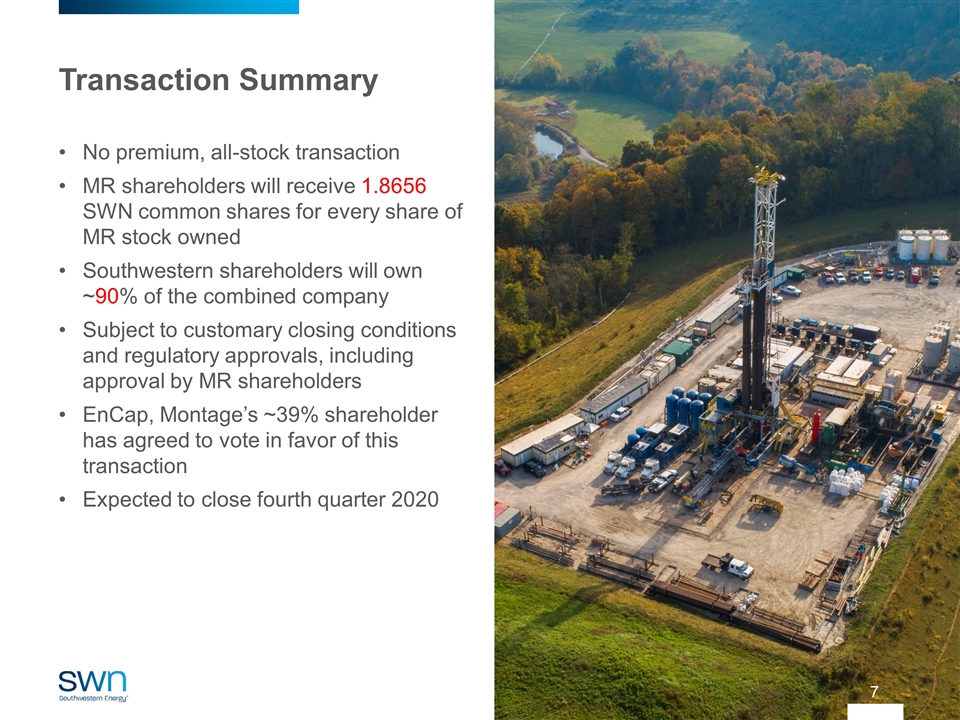

On August 12, 2020, Southwestern Energy Company (the “Company” or “Southwestern”) and Montage Resources Corporation, a Delaware corporation (“Montage”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which the Company will acquire all of the outstanding shares of common stock, par value $0.01 per share, of Montage (each, a “Montage Common Share”) in exchange for 1.8656 shares of common stock, par value $0.01 per share, of the Company (each, a “Southwestern Common Share”) per share of Montage common stock. Upon the terms and subject to the conditions of the Merger Agreement, Montage will merge with and into Southwestern, with Southwestern continuing as the surviving company (the “Merger”).

Under the terms of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each Montage Common Share issued and outstanding immediately prior to the Effective Time will be cancelled and extinguished and automatically converted into the right to receive 1.8656 Southwestern Common Shares. No fractional Southwestern Common Shares will be issued in the Merger, and holders of Montage Common Shares will, instead, receive cash in lieu of fractional Southwestern Common Shares, if any. The implied value of the aggregate merger consideration is $213 million based on the per share closing trading price of Southwestern Common Shares on August 11, 2020.

Pursuant to the terms of the Merger Agreement, as of immediately prior to the Effective Time, by virtue of the occurrence of the Effective Time and without any action on the part of the holder thereof, each award of restricted stock units relating to Montage Common Shares that vests based on continued service to Montage granted pursuant to a Montage equity plan (other than Montage PSU Awards (defined below)) (“Montage RSU Award”) that is outstanding immediately prior to the Effective Time shall be converted into an award (an “Assumed RSU Award”), with respect to a number of Southwestern Common Shares equal to the product obtained by multiplying (i) the applicable number of Montage Common Shares subject to such Montage RSU Award immediately prior to the Effective Time by (ii) the Exchange Ratio. For each holder of a Montage RSU Award, any fractional shares resulting from the conversion of his or her Montage RSU Awards shall be rounded to the nearest whole share. Except as otherwise provided in the Merger Agreement, each Assumed RSU Award shall continue to have, and shall be subject to, the same terms and conditions (including time vesting conditions and, if applicable, any accelerated vesting in connection with a termination of service) that applied to the underlying Montage RSU Award immediately prior to the Effective Time, except that Southwestern (x) may modify terms rendered inoperative by reason of the transactions contemplated by the Merger Agreement or for such other immaterial administrative or ministerial changes as in the reasonable and good faith determination of Southwestern are appropriate to effectuate the administration of the Assumed RSU Award, and (y) may settle the Assumed RSU Award upon vesting in Southwestern Common Shares or cash.

The Merger Agreement provides that Montage shall take all necessary and appropriate actions so that, prior to the Effective Time, each then outstanding award of restricted stock units which would, if the relevant performance and other vesting conditions are met, result in the issuance of Montage Common Shares to the holder of such restricted stock unit award granted under a Montage equity plan (“Montage PSU Award”) shall be terminated and vested in accordance with its terms; provided, however, that the number of Montage Common Shares deliverable with respect to a Montage PSU Award in connection with such termination and vesting shall be determined by the Compensation Committee of the Montage Board pursuant to the terms of the applicable Montage PSU Award as in effect on the date of the Merger Agreement and Montage (including the Montage board of directors and any delegate thereof) shall not use discretion to increase the amount of consideration payable with respect to any Montage PSU Award in connection with such termination and vesting, and provided further that Southwestern may elect to settle the Montage PSU Award in cash instead of Southwestern Common Shares.

The Merger Agreement provides that Montage shall take all necessary and appropriate actions so that prior to the Effective Time each award of restricted shares of Montage common stock (“Montage Restricted Stock Award”) granted to Montage non-employee director shall vest. Montage Common Shares attributable to such Montage Restricted Stock Awards shall be treated in the manner set forth in the Merger Agreement upon the Effective Time.

Southwestern and Montage has each made customary representations and warranties and agreed to customary covenants in the Merger Agreement. The Merger is subject to various closing conditions, including, but not limited to, (i) the approval of the Merger Agreement by the holders of a majority of the outstanding Montage Common Shares entitled to vote, (ii) the absence of any law, order or injunction prohibiting the Merger, (iii) the expiration or earlier termination of the waiting period under the Hart–Scott–Rodino Antitrust

2

Improvements Act of 1976, as amended, (iv) the Securities and Exchange Commission (the “SEC”) having declared effective Southwestern’s Registration Statement on Form S-4 filed in connection with the Merger, (v) the accuracy of each party’s representations and warranties, and (vi) each party’s compliance with its covenants and agreements contained in the Merger Agreement.

The Merger Agreement contains certain termination rights for both the Company and Montage, including if the Merger is not consummated by February 12, 2021, and further provides that, upon termination of the Merger Agreement under certain circumstances, Montage may be required to pay the Company a termination fee equal to $9.7 million.

The foregoing description of certain terms of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which will be filed as an exhibit to a future current report of the Company. It is not intended to provide any other factual information about the Company, Montage or their respective subsidiaries and affiliates. The Merger Agreement contains representations and warranties by each of the parties to the Merger Agreement, which were made only for purposes of the Merger Agreement and as of dates specified therein. The representations, warranties and covenants in the Merger Agreement (i) were made solely for the benefit of the parties to the Merger Agreement; (ii) may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts; and (iii) may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the Company, Montage or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the Company’s or Montage’s public disclosures.

Support Agreement

Contemporaneously with the execution of the Merger Agreement, Southwestern and certain Montage stockholders affiliated with EnCap Investments L.P. (“EnCap”) entered into a support agreement (the “Support Agreement”), which provides for, among other things, EnCap’s agreement to vote all of the Montage Common Shares held as of such date (i) in favor of the adoption of the Merger Agreement, (ii) against any alternative proposal, and (iii) against any amendment of Montage’s certificate of incorporation or bylaws or other proposal that would delay, impede, frustrate, prevent or nullify the Merger or Merger Agreement or change in any manner the voting rights of any outstanding stock of Montage. As of August 12, 2020, EnCap is the beneficial owner of approximately 39% of the outstanding shares of Montage.

The Support Agreement is attached hereto as Exhibit 10.1 and is incorporated into this Item 1.01 by reference. The foregoing summary has been included to provide investors and security holders with information regarding the terms of the Support Agreement and is qualified in its entirety by the terms and conditions of the Support Agreement. It is not intended to provide any other factual information about the parties or their respective subsidiaries and affiliates. The Support Agreement contains representations and warranties by each of the parties to the Support Agreement, which were made only for purposes of the Support Agreement and as of specified dates. The representations, warranties and covenants in the Support Agreement were made solely for the benefit of the parties to the Support Agreement; may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Support Agreement instead of establishing these matters as facts; and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Support Agreement, which subsequent information may or may not be fully reflected in Southwestern’s or Montage’s public disclosures.

3

| Item 7.01 | Regulation FD Disclosure |

In addition, on August 12, 2020, Southwestern and Montage issued a joint press release announcing entry into the Merger Agreement. The press release is attached hereto as Exhibit 99.1 and incorporated into this Item 7.01 by reference herein.

Attached as Exhibit 99.2 to this report is an investor presentation regarding the Merger, which is incorporated into this Item 7.01 herein.

The information set forth in this Item 7.01 and the attached Exhibit 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

| Item 8.01 | Other Events |

Included in this filing as Exhibit 99.3 are the audited consolidated financial statements of Montage for the periods described in Item 9.01(a) below, the notes related thereto and the report of an independent registered public accounting firm. The unaudited condensed consolidated financial statements of Montage for the periods described in Item 9.01(a) below and the notes related thereto are included in this filing as Exhibit 99.4.

| Item 9.01 | Financial Statement and Exhibits. |

| (a) | Financial Statements |

| • | Audited consolidated financial statements of Montage and its subsidiaries comprised of the consolidated balance sheets as of December 31, 2019 and 2018, and the related consolidated statements of operations and comprehensive income (loss), changes in stockholders’ equity and cash flows for each of the years in the three-year period ended December 31, 2019, and the related notes to the consolidated financial statements, attached as Exhibit 99.1 hereto. |

| • | Unaudited condensed consolidated financial statements of Montage and its subsidiaries comprised of the condensed consolidated balance sheets as of June 30, 2020 and December 31, 2019, and the related condensed consolidated statements of operations and comprehensive income (loss), stockholders’ equity and cash flows for the sixth months ended June 30, 2020 and 2019, and the related notes to the unaudited condensed consolidated financial statements, attached as Exhibit 99.2 hereto. |

| (d) | Exhibits |

| 10.1 | Support Agreement, dated as of August 12, 2020, by and among certain stockholders affiliated with EnCap Investments L.P. and Southwestern Energy Company. | |

| 23.1 | Consent of Grant Thornton LLP. | |

| 99.1 | Joint Press Release issued August 12, 2020 by Southwestern Energy Company and Montage Resources Corporation. | |

| 99.2 | Investor Presentation. | |

| 99.3 | Historical audited consolidated financial statements of Montage Resources Corporation. | |

| 99.4 | Historical unaudited condensed consolidated financial statements of Montage Resources Corporation. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

4

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and information in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “predict,” “budget,” “should,” “would,” “could,” “attempt,” “appears,” “forecast,” “outlook,” “estimate,” “continue,” “project,” “projection,” “goal,” “model,” “target,” “potential,” “may,” “will,” “objective,” “guidance,” “outlook,” “effort,” “are likely” and other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us.

The forward-looking statements contained in this document are largely based on our expectations for the future, which reflect certain estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions, operating trends, and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. As such, management’s assumptions about future events may prove to be inaccurate. For a more detailed description of the risks and uncertainties involved, see “Risk Factors” in our most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings. We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events, changes in circumstances, or otherwise. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. Management cautions you that the forward-looking statements contained in this communication are not guarantees of future performance, and we cannot assure you that such statements will be realized or that the events and circumstances they describe will occur. Factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements herein include, but are not limited to: the timing and extent of changes in market conditions and prices for natural gas, oil and natural gas liquids, including regional basis differentials and the impact of reduced demand for our production and products in which our production is a component due to governmental and societal actions taken in response to the COVID-19 pandemic; our ability to fund our planned capital investments; a change in our credit rating, an increase in interest rates; the extent to which lower commodity prices impact our ability to service or refinance our existing debt; the impact of volatility in the financial markets or other global economic factors, including the impact of COVID-19; difficulties in appropriately allocating capital and resources among our strategic opportunities; the timing and extent of our success in discovering, developing, producing and estimating reserves; our ability to maintain leases that may expire if production is not established or profitably maintained; our ability to realize the expected benefits from recent acquisitions and the Merger (defined below) between the Company and Montage; our ability to enter into an amendment to our credit agreement to permit the assumption of the senior notes of Montage in the Merger; the consummation of or failure to consummate the Merger and the timing thereof; costs in connection with the Merger; integration of operations and results subsequent to the Merger; our ability to transport our production to the most favorable markets or at all; the impact of government regulation, including changes in law, the ability to obtain and maintain permits, any increase in severance or similar taxes, and legislation or regulation relating to hydraulic fracturing, climate and over-the-counter derivatives; the impact of the adverse outcome of any material litigation against us or judicial decisions that affect us or our industry generally; the effects of weather; increased competition; the financial impact of accounting regulations and critical accounting policies; the comparative cost of alternative fuels; credit risk relating to the risk of loss as a result of non-performance by our counterparties; and any other factors listed in the reports we have filed and may file with the SEC that are incorporated by reference herein.

All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement.

ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT

In connection with the Merger, Southwestern will file with the SEC a registration statement on Form S-4 to register the shares of the Company’s common stock to be issued in the Merger. The registration statement will include the proxy statement of Montage and a prospectus of Southwestern, as well as other relevant documents regarding the Merger. The definitive proxy statement/prospectus will be mailed to Montage’s stockholders and will contain important information about the Merger and related matters. INVESTORS AND SECURITY HOLDERS OF THE COMPANY AND MONTAGE ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY WHEN IT BECOMES AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO THE MERGER BECAUSE IT WILL CONTAIN

5

IMPORTANT INFORMATION ABOUT THE MERGER AND THE PARTIES TO THE MERGER. The definitive proxy Statement/Prospectus and other relevant materials (when they become available) and any other documents filed by Southwestern with the SEC may be obtained free of charge at the SEC’s website, at www.sec.gov. These documents may also be obtained free of charge from the Company by requesting them by mail at Investor Relations, 10000 Energy Drive, Spring, Texas 77389, or by telephone at (832) 796-4068. The documents filed by Montage with the SEC may be obtained free of charge at Montage’s website at www.montageresources.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Montage by requesting them by mail at Investor Relations, 122 W. John Carpenter Fwy, Suite 300, Irving, TX 75039, or by telephone at (469) 444-1736.

PARTICIPANTS IN THE SOLICITATION

The Company, Montage and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Montage’s stockholders with respect to the Merger. Information about the Company’s directors and executive officers is available in the Company’s Annual Report on Form 10-K for the fiscal year ended 2019 filed with the SEC on February 27, 2020 and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on April 9, 2020. Information concerning the ownership of Montage’s securities by Montage’s directors and executive officers is included in their SEC filings on Forms 3, 4 and 5, and additional information regarding the names, affiliations and interests of such individuals is available in Montage’s Annual Report on Form 10-K for the fiscal year ended 2019 filed with the SEC on March 10, 2020 and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on April 28, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement, the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Merger when they become available. Stockholders, potential investors and other readers should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

NO OFFER OR SOLICITATION

This communication is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SOUTHWESTERN ENERGY COMPANY | ||||||

| By: | /s/ Julian M. Bott | |||||

| Julian M. Bott | ||||||

| Executive Vice President and Chief Financial Officer | ||||||

| Dated: August 12, 2020 | ||||||

Exhibit 10.1

SUPPORT AGREEMENT

THIS SUPPORT AGREEMENT (this “Agreement”) is dated as of August 12, 2020, by and among each stockholder of Montage Resources Corporation, a Delaware corporation (the “Company”), set forth on Schedule A hereto (each, a “Stockholder” and collectively, the “Stockholders”), and Southwestern Energy Company, a Delaware corporation (“Parent”).

W I T N E S S E T H:

WHEREAS, concurrently with the execution and delivery of this Agreement, Parent and the Company are entering into an Agreement and Plan of Merger, dated as of the date hereof (as the same may be amended or supplemented, the “Merger Agreement”), providing that, among other things, upon the terms and subject to the conditions set forth in the Merger Agreement, the Company will be merged with Parent (the “Merger”), and each outstanding share of common stock, par value $0.01 per share, of the Company (“Company Common Stock”) will be converted into the Merger Consideration;

WHEREAS, each Stockholder beneficially owns such number of shares of Company Common Stock set forth opposite such Stockholder’s name on Schedule A hereto (collectively, such shares of Company Common Stock are referred to herein as the “Subject Shares”); and

WHEREAS, as a condition and inducement to Parent to enter into the Merger Agreement, Parent has required that the Stockholders enter into this Agreement.

NOW, THEREFORE, to induce Parent to enter into, and in consideration of its entering into, the Merger Agreement, and in consideration of the promises and the representations, warranties and agreements contained herein and therein, the parties, intending to be legally bound hereby, agree as follows:

1. Representations and Warranties of each Stockholder. Each Stockholder hereby represents and warrants to Parent, severally and not jointly, as of the date hereof as follows:

(a) Due Organization. Such Stockholder is an entity duly formed under the laws of its jurisdiction of formation and is validly existing and in good standing under the laws thereof.

(b) Authority; No Violation. Such Stockholder has full organizational power and authority to execute and deliver this Agreement and to perform its obligations hereunder. The execution and delivery of this Agreement and the performance of its obligations hereunder have been duly and validly approved by the governing authority of such Stockholder and no other organizational proceedings on the part of such Stockholder are necessary to approve this Agreement and to perform its obligations hereunder. This Agreement has been duly and validly executed and delivered by such Stockholder and (assuming due authorization, execution and delivery by Parent) this Agreement constitutes a valid and binding obligation of such Stockholder, enforceable against such Stockholder in accordance with its terms, except that such enforceability (i) may be limited by bankruptcy, insolvency, moratorium or other similar laws affecting or relating to the enforcement of creditors’ rights generally and (ii) is subject to general principles of equity and the discretion of the court before which any proceedings seeking injunctive relief or specific performance may be brought. Neither the execution and delivery of this Agreement by such Stockholder, nor the consummation by such Stockholder of the transactions contemplated hereby, nor compliance by such Stockholder with any of the terms or provisions hereof, will (x) violate any provision of the governing documents of such Stockholder, (y) violate any statute, code, ordinance, rule, regulation, judgment, order, writ, decree or injunction applicable to such Stockholder, or any of its properties or assets, or (z) violate, conflict with, result in a breach of any provision of or the loss of any benefit under, constitute a default (or an event which, with notice or lapse of time, or both, would constitute a default) under, result in the termination of or a right of termination or cancellation under, accelerate the performance required by, or result in the creation of any lien, claim, mortgage, encumbrance, pledge, deed of trust, security interest, equity or charge of any kind (each, a “Lien”) upon any of the Subject Shares pursuant to any of the terms, conditions or provisions of any note, bond, mortgage, indenture, deed of trust, license, lease, agreement or other instrument or obligation to which such Stockholder is a party, or by which it or any of its properties or assets may be bound or affected, except, in the case of this clause (z), for such matters that would not, individually or in the aggregate, impair the ability of such Stockholder to perform its obligations under this Agreement.

(c) The Subject Shares. As of the date of this Agreement, such Stockholder is the beneficial owner of and, together with the applicable controlling entity or entities of such Stockholder set forth on Schedule A hereto (as applicable, the “Controlling Entities”), has the sole right to vote and dispose of the Subject Shares set forth opposite such Stockholder’s name on Schedule A hereto, free and clear of any Liens whatsoever, except for any Liens which arise hereunder, in each case except as disclosed in any Schedule 13D filed by such Stockholder prior to the date hereof. None of the Subject Shares is subject to any voting trust or other similar agreement, arrangement or restriction, except as contemplated by this Agreement. Without limiting the generality of

2

the foregoing, (i) there are no agreements or arrangements of any kind, contingent or otherwise, obligating such Stockholder to sell, transfer (including by tendering into any tender or exchange offer), assign, grant a participation interest in, option, pledge, hypothecate or otherwise dispose of or encumber, including by operation of law or otherwise (each, a “Transfer”), or cause to be Transferred, any of the Subject Shares, other than a Transfer, such as a hedging or derivative transaction, with respect to which such Stockholder (and/or its Controlling Entities) retains its Subject Shares and the sole right to vote, dispose of and exercise dissenters’ rights with respect to its Subject Shares during the Applicable Period, and (ii) no Person has any contractual or other right or obligation to purchase or otherwise acquire any of the Subject Shares. Other than the Subject Shares, such Stockholder does not own any equity interests or other equity-based securities in the Company or any of its Subsidiaries.

(d) Absence of Litigation. There is no litigation, suit, claim, action, proceeding or investigation pending, or to the knowledge of such Stockholder, threatened against such Stockholder, or any property or asset of such Stockholder, before any Governmental Entity that seeks to delay or prevent the consummation of the transactions contemplated by this Agreement.

(e) No Consents Required. No consent of, or registration, declaration or filing with, any Person or Governmental Entity is required to be obtained or made by or with respect to such Stockholder in connection with the execution, delivery and performance of this Agreement and except for any applicable requirements and filings with the SEC, if any, under the Exchange Act and except where the failure to obtain such consents, approvals, authorizations or permits, or to make such filings or notifications, would not prevent or delay the performance by such Stockholder of such Stockholder’s obligations under this Agreement in any material respect.

(f) Reliance. Such Stockholder understands and acknowledges that Parent is entering into the Merger Agreement in reliance upon such Stockholder’s execution and delivery of this Agreement.

(g) Stockholder Has Adequate Information. Such Stockholder is a sophisticated seller with respect to the Subject Shares and has adequate information concerning the business and financial condition of Parent to make an informed decision regarding the Merger and the transactions contemplated thereby and has independently and without reliance upon Parent and based on such information as such Stockholder has deemed appropriate, made its own analysis and decision to enter into this Agreement. Such Stockholder acknowledges that Parent has not made and does not make any

3

representation or warranty, whether express or implied, of any kind or character except as expressly set forth in the Merger Agreement and this Agreement. Notwithstanding the foregoing, and for the elimination of doubt, Stockholder is not waiving and is expressly preserving any claims that might arise in connection with the Registration Statement contemplated to be filed in connection with the Merger.

2. Representations and Warranties of Parent. Parent hereby represents and warrants to each Stockholder as of the date hereof as follows:

(a) Due Organization. Parent is a corporation duly incorporated under the laws of the State of Delaware and is validly existing and in good standing under the laws thereof.

(b) Authority; No Violation. Parent has full corporate power and authority to execute and deliver this Agreement. The execution and delivery of this Agreement have been duly and validly approved by the Board of Directors of Parent and no other corporate proceedings on the part of Parent are necessary to approve this Agreement. This Agreement has been duly and validly executed and delivered by Parent and (assuming due authorization, execution and delivery by the Stockholder) this Agreement constitutes a valid and binding obligation of Parent, enforceable against Parent in accordance with its terms except that such enforceability (i) may be limited by bankruptcy, insolvency, moratorium or other similar laws affecting or relating to the enforcement of creditors’ rights generally and (ii) is subject to general principles of equity and the discretion of the court before which any proceedings seeking injunctive relief or specific performance may be brought. Neither the execution and delivery of this Agreement by Parent, nor the consummation by Parent of the transactions contemplated hereby, nor compliance by Parent with any of the terms or provisions hereof, will (x) violate any provision of the governing documents of Parent or the certificate of incorporation, bylaws or similar governing documents of any of Parent’s Subsidiaries, (y) violate any statute, code, ordinance, rule, regulation, judgment, order, writ, decree or injunction applicable to the Parent or any of Parent’s Subsidiaries, or any of their respective properties or assets, or (z) violate, conflict with, result in a breach of any provision of or the loss of any benefit under, constitute a default (or an event which, with notice or lapse of time, or both, would constitute a default) under, result in the termination of or a right of termination or cancellation under, accelerate the performance required by, or result in the creation of any Lien upon any of the respective properties or assets of Parent or any of Parent’s Subsidiaries under, any of the terms, conditions or provisions of any note, bond, mortgage, indenture, deed of trust, license, lease, agreement or other instrument or obligation to which Parent or any of Parent’s Subsidiaries is a party, or by which they or any of their respective properties or assets may be bound or affected.

4

3. Covenants of Each Stockholder. Each Stockholder, severally and not jointly, agrees as follows; provided that all of the following covenants shall apply solely to actions taken by such Stockholder in its capacity as a stockholder of the Company:

(a) Agreement to Vote Subject Shares. During the Applicable Period (as defined below), at any meeting of the stockholders of the Company, however called, or at any postponement or adjournment thereof, or in any other circumstance upon which a vote or other approval of all or some of the stockholders of the Company is sought, such Stockholder shall, and shall cause any holder of record of its Subject Shares on any applicable record date to, vote: (i) in favor of adoption of the Merger Agreement and approval of any other matter that is required to be approved by the stockholders of the Company in order to effect the Merger; (ii) against any merger agreement or merger (other than the Merger Agreement and the Merger), consolidation, combination, sale or transfer of a material amount of assets, reorganization, recapitalization, dissolution, liquidation or winding up of or by the Company or any of its Subsidiaries that is prohibited by the Merger Agreement, unless such transaction is approved in writing by Parent, or any Alternative Proposal, and (iii) against any amendment of the Company’s certificate of incorporation or bylaws or other proposal or transaction involving the Company or any of its Subsidiaries, which amendment or other proposal or transaction would in any manner delay, impede, frustrate, prevent or nullify the Merger, the Merger Agreement or any of the transactions contemplated by the Merger Agreement or change in any manner the voting rights of any outstanding class of capital stock of the Company. During the Applicable Period, such Stockholder (and/or its Controlling Entities) shall retain at all times the right to vote all of its Subject Shares in such Stockholder’s sole discretion and without any other limitation on those matters other than those set forth in this Section 3(a) that are at any time or from time to time presented for consideration to the Company’s stockholders generally. During the Applicable Period, in the event that any meeting of the stockholders of the Company is held, such Stockholder shall (or shall cause the holder of record on any applicable record date to) appear at such meeting or otherwise cause all of its Subject Shares to be counted as present thereat for purposes of establishing a quorum. During the Applicable Period, such Stockholder further agrees not to commit or agree, and to cause any record holder of its Subject Shares not to commit or agree, to take any action inconsistent with the foregoing during the Applicable Period. “Applicable Period” means the period from and including the date of this Agreement to and including the date of the termination of this Agreement.

5

(b) No Transfers. Except as provided in the last sentence of this Section 3(b), such Stockholder agrees not to, and to cause any record holder of its Subject Shares, not to, in any such case directly or indirectly, during the Applicable Period (i) Transfer or enter into any agreement, option or other arrangement (including any profit sharing arrangement) with respect to the Transfer of, any of its Subject Shares (or any interest therein) to any Person, other than the exchange of its Subject Shares for Merger Consideration in accordance with the Merger Agreement or (ii) grant any proxies, or deposit any of its Subject Shares into any voting trust or enter into any voting arrangement, whether by proxy, voting agreement or otherwise, with respect to its Subject Shares, other than pursuant to this Agreement. Subject to the last sentence of this Section 3(b), such Stockholder further agrees not to commit or agree to take, and to cause any record holder of any of its Subject Shares not to commit or agree to take, any of the foregoing actions during the Applicable Period. Notwithstanding the foregoing, such Stockholder shall have the right to (a) Transfer its Subject Shares to an Affiliate if and only if such Affiliate shall have agreed in writing, in a manner acceptable in form and substance to Parent, (i) to accept such Subject Shares subject to the terms and conditions of this Agreement, and (ii) to be bound by this Agreement as if it were “the Stockholder” for all purposes of this Agreement; provided, however, that no such transfer shall relieve such Stockholder from its obligations under this Agreement with respect to any Subject Shares or (b) Transfer its Subject Shares in a transaction, such as a hedging or derivative transaction, with respect to which such Stockholder retains the sole right to vote its Subject Shares during the Applicable Period; provided that no such transaction shall (x) in any way limit any of the obligations of such Stockholder under this Agreement, or (y) have any adverse effect on the ability of the Stockholder to perform its obligations under this Agreement.

(c) Reserved.

(d) Adjustment to Subject Shares. In case of a stock dividend or distribution, or any change in the Company Common Stock by reason of any stock dividend or distribution, split-up, recapitalization, combination, exchange of shares or the like, the term “Subject Shares” shall be deemed to refer to and include the Subject Shares as well as all such stock dividends and distributions and any securities into which or for which any or all of the Subject Shares may be changed or exchanged or which are received in such transaction.

6

(e) Non-Solicitation. Except to the extent that the Company or the Company Board is permitted to do so under the Merger Agreement, but subject to any limitations imposed on the Company or the Company Board under the Merger Agreement, such Stockholder agrees, solely in its capacity as a stockholder of the Company, that it shall not, and shall cause its Affiliates and its and their respective agents and representatives not to, directly or indirectly, (i) initiate, solicit, knowingly encourage or knowingly facilitate (including by way of furnishing information) any Alternative Proposal, (ii) participate or engage in any discussions or negotiations with, or disclose any non-public information or data relating to the Company or any of its Subsidiaries to any Person that has made an Alternative Proposal, (iii) approve, endorse or recommend (or publicly propose to approve, endorse or recommend) any Alternative Proposal or (iv) enter into any letter of intent, term sheet, memorandum of understanding, merger agreement, acquisition agreement, exchange agreement or any other agreement with respect to an Alternative Proposal. Each Stockholder will, and will cause its Affiliates and its and their respective investment bankers, attorneys, accountants and other representatives to, immediately cease and cause to be terminated any discussions or negotiations with any Person conducted heretofore with respect to any Alternative Proposal. Nothing contained in this Section 3(e) shall prevent any Person affiliated with such Stockholder who is a director or officer of the Company or designated by such Stockholder as a director of officer of the Company from taking actions in his capacity as a director or officer of the Company, including taking any actions permitted under Section 5.3 of the Merger Agreement.

4. Assignment; No Third-Party Beneficiaries. Except as provided herein, neither this Agreement nor any of the rights, interests or obligations hereunder shall be assigned by any of the parties without the prior written consent of the other parties hereto, except that Parent may assign, it its sole discretion, any or all of its rights, interest and obligations hereunder to any direct or indirect wholly owned Subsidiary of Parent. Subject to the preceding sentence, this Agreement will be binding upon, inure to the benefit of and be enforceable by the parties hereto and their respective successors and assigns. Except as otherwise expressly provided herein, this Agreement (including the documents and instruments referred to herein) is not intended to confer upon any Person other than the parties hereto any rights or remedies hereunder; provided, however, that the Company is an intended third-party beneficiary of the agreement of the Stockholders set forth in Section 3(c) hereof.

5. Termination. This Agreement and the covenants and agreements set forth in this Agreement shall automatically terminate (without any further action of the parties) upon the earliest to occur of: (a) the termination of the Merger Agreement in accordance with its terms; (b) the Effective Time; (c) the date of any modification, waiver or amendment to the Merger Agreement effected without such Stockholder’s consent that (y) decreases the amount or changes the form of consideration payable to all of the stockholders of the Company pursuant to the terms of the Merger Agreement as in effect on the date of this Agreement or (z) otherwise materially

7

adversely affects the interests of such Stockholder; (d) the mutual written consent of the parties hereto; and (e) the Termination Date. In the event of termination of this Agreement pursuant to this Section 5, this Agreement shall become void and of no effect with no liability on the part of any party; provided, however, that no such termination shall relieve any party from liability for any breach hereof prior to such termination.

6. General Provisions.

(a) Amendments. This Agreement may not be amended except by an instrument in writing signed on behalf of each of the parties hereto.

(b) Notice. All notices and other communications hereunder shall be in writing and shall be deemed given if delivered personally, email (upon receipt), telecopied (which is confirmed) or sent by overnight courier (providing proof of delivery) at the following addresses (or at such other address for a party as specified by like notice; provided that notices of a change of address will be effective only upon receipt thereof):

(i) If to the Stockholders, to:

EnCap Investments L.P.

1100 Louisiana, Suite 4900

Houston, Texas 77002

Facsimile: (713) 659-6130

Attention: Doug Swanson; Mark Burroughs, Jr.

Email: dswanson@encapinvestments.com;

mburroughs@encapinvestments.com

With copies (which shall not constitute notice) to:

Vinson & Elkins LLP

1001 Fannin, Suite 2500

Houston, Texas 77002

Attention: W. Matthew Strock; Stephen M. Gill

Facsimile: (713) 615-5650; (713) 615-5956

Email: mstrock@velaw.com; sgill@velaw.com

8

(ii) If to Parent, to:

Southwestern Energy Company

10000 Energy Drive

Spring, TX 77389

Attention: General Counsel

With copies (which shall not constitute notice) to:

Skadden, Arps, Slate, Meagher & Flom LLP

1000 Louisiana St., Suite 6800

Houston, TX 77002

Attention: Frank E. Bayouth

Eric C. Otness

Facsimile: (713) 655-5200

(c) Interpretation. When a reference is made in this Agreement to a Section, such reference shall be to a Section to this Agreement unless otherwise indicated. The headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement. Wherever the words “include,” “includes” or “including” are used in this Agreement, they shall be deemed to be followed by the words “without limitation.” The phrases “the date of this Agreement,” “the date hereof” and terms of similar import, unless the context otherwise requires, shall be deemed to refer to August 12, 2020.

(d) Counterparts. This Agreement may be executed in counterparts, all of which shall be considered one and the same agreement and shall become effective when counterparts have been signed by each of the parties hereto and delivered to the other parties hereto, it being understood that all parties hereto need not sign the same counterpart.

(e) Entire Agreement. This Agreement (including the documents and the instruments referred to herein) constitutes the entire agreement and supersedes all prior agreements and understandings, both written and oral, among the parties hereto with respect to the subject matter hereof.

9

(f) Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of Delaware regardless of the laws that might otherwise govern under applicable principles of conflicts of law thereof or of any other jurisdiction.

(g) Severability. If any term, provision, covenant or restriction herein, or the application thereof to any circumstance, shall, to any extent, be held by a court of competent jurisdiction to be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions herein and the application thereof to any other circumstances, shall remain in full force and effect, shall not in any way be affected, impaired or invalidated, and shall be enforced to the fullest extent permitted by law, and the parties hereto shall reasonably negotiate in good faith a substitute term or provision that comes as close as possible to the invalidated and unenforceable term or provision, and that puts each party hereto in a position as nearly comparable as possible to the position each such party would have been in but for the finding of invalidity or unenforceability, while remaining valid and enforceable.

(h) Waiver. Any provisions of this Agreement may be waived at any time by the party that is entitled to the benefits thereof. Any agreement on the part of a party hereto to any such extension or waiver shall be valid only if set forth in a written instrument signed on behalf of such party, but such extension or waiver or failure to insist on strict compliance with an obligation, covenant, agreement or condition shall not operate as a waiver of, or estoppel with respect to, any subsequent or other failure.

(i) Further Assurances. Each Stockholder will, from time to time, (i) at the request of Parent take, or cause to be taken, all actions, and do, or cause to be done, and assist and cooperate with the other parties hereto in doing, all things reasonably necessary, proper or advisable to carry out the intent and purposes of this Agreement and (ii) execute and deliver, or cause to be executed and delivered, such additional or further consents, documents and other instruments as Parent may reasonably request for the purpose of effectively carrying out the intent and purposes of this Agreement.

(j) Publicity. Except as otherwise required by law (including securities laws and regulations) and the regulations of any national stock exchange, so long as this Agreement is in effect, the Stockholder shall not issue or cause the publication of any press release or other public announcement with respect to, or otherwise make any public statement concerning, the transactions contemplated by this Agreement or the Merger Agreement, without the consent of Parent, which consent shall not be unreasonably withheld.

10

(k) Capitalized Terms. Capitalized terms used but not defined herein shall have the meanings set forth in the Merger Agreement. Notwithstanding the foregoing, the term “Affiliate” as used in Section 3(e) of this Agreement shall not include any portfolio company of EnCap Investments L.P. or its affiliated investment funds, other than the Company and its Subsidiaries, and except for any portfolio company taking any action that would otherwise be prohibited by Section 3(e) at the direction or encouragement of any Stockholder or Controlling Entity.

7. Stockholder Capacity. Each Stockholder signs solely in its capacity as the beneficial owner of its Subject Shares and nothing contained herein shall limit or affect any actions taken by any officer, director, partner, Affiliate or representative of such Stockholder who is or becomes an officer or a director of the Company in his or her capacity as an officer or director of the Company, and none of such actions in such capacity shall be deemed to constitute a breach of this Agreement. Each Stockholder signs individually solely on behalf of itself and not on behalf of any other Stockholder.

8. Enforcement. The parties hereto agree that irreparable damage would occur in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached and that money damages would not be a sufficient remedy of any such breach. It is accordingly agreed that, in addition to any other remedy to which they are entitled at law or in equity, the parties hereto shall be entitled to specific performance and injunctive or other equitable relief, without the necessity of proving the inadequacy of money damages. Notwithstanding the foregoing, Parent agrees that with respect to any damage claim that might be brought against any Stockholder, any of its Affiliates under this Agreement, and without regard to whether such claim sounds in contract, tort or any other legal or equitable theory of relief, that damages are limited to actual damages and expressly waive any right to recover special damages, including, without limitation, lost profits as well as any punitive or exemplary damages. In the event of any litigation over the terms of this Agreement, the prevailing party in any such litigation shall be entitled to reasonable attorneys’ fees and costs incurred in connection with such litigation. The parties hereto further agree that any action or proceeding relating to this Agreement or the transactions contemplated hereby shall be brought and determined in the Court of Chancery of the State of Delaware (or, if the Court of Chancery of the State of Delaware declines to accept jurisdiction over a particular matter, the Superior Court of the State of Delaware (Complex Commercial Division) or, if subject matter jurisdiction over the matter that is the subject of the action or proceeding is vested exclusively in the federal courts of the United States of America, the federal court of the United States of America sitting in the district of Delaware) and any appellate court from any thereof. In addition, each of the parties hereto (a) consents that each party hereto irrevocably submits to the exclusive jurisdiction and venue of such courts listed in this Section 8 in the event any dispute

11

arises out of this Agreement or any of the transactions contemplated hereby, (b) agrees that each party hereto irrevocably waives the defense of an inconvenient forum and all other defenses to venue in any such court in any such action or proceeding, and (c) waives any right to trial by jury with respect to any claim or proceeding related to or arising out of this Agreement or any of the transactions contemplated hereby. EACH PARTY HERETO HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LITIGATION OR PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. EACH PARTY HERETO CERTIFIES AND ACKNOWLEDGES THAT (I) NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE ANY OF SUCH WAIVER, (II) IT UNDERSTANDS AND HAS CONSIDERED THE IMPLICATIONS OF SUCH WAIVER, (III) IT MAKES SUCH WAIVER VOLUNTARILY, AND (IV) IT HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 8.

9. No Ownership Interest. Nothing contained in this Agreement shall be deemed to vest in Parent or any other Person any direct or indirect ownership or incidence of ownership of, or with respect to, any Subject Shares. Subject to the restrictions and requirements set forth in this Agreement, all rights, ownership and economic benefits of and relating to the Subject Shares shall remain vested in and belong to each Stockholder, and this Agreement shall not confer any right, power or authority upon Parent or any other Person to direct the Stockholder in the voting of any of the Subject Shares (except as otherwise specifically provided for herein).

[Remainder of the page intentionally left blank]

12

IN WITNESS WHEREOF, this Agreement has been executed and delivered as of the date first written above.

| SOUTHWESTERN ENERGY COMPANY | ||

| By: | /s/ Bill Way | |

| Name: | Bill Way | |

| Title: | President & Chief Executive Officer | |

[Signature Page to Project Mercury Support Agreement]

| ENCAP ENERGY CAPITAL FUND VIII CO-INVESTORS, L.P. | ||

| By: | EnCap Equity Fund VIII GP, L.P., | |

| its general partner | ||

| By: | EnCap Investments L.P., | |

| its general partner | ||

| By: | EnCap Investments GP, L.L.C., | |

| its general partner | ||

| By: | /s/ Douglas E. Swanson, Jr. | |

| Name: | Douglas E. Swanson, Jr. | |

| Title: | Managing Director | |

| ENCAP ENERGY CAPITAL FUND VIII, L.P. | ||

| By: | EnCap Equity Fund VIII GP, L.P., | |

| its general partner | ||

| By: | EnCap Investments L.P., | |

| its general partner | ||

| By: | EnCap Investments GP, L.L.C., | |

| its general partner | ||

| By: | /s/ Douglas E. Swanson, Jr. | |

| Name: | Douglas E. Swanson, Jr. | |

| Title: | Managing Director | |

| ENCAP ENERGY CAPITAL FUND IX, L.P. | ||

| By: | EnCap Equity Fund IX GP, L.P., | |

| its general partner | ||

| By: | EnCap Investments L.P., | |

| its general partner | ||

| By: | EnCap Investments GP, L.L.C., | |

| Its general partner | ||

| By: | /s/ Douglas E. Swanson, Jr. | |

| Name: | Douglas E. Swanson, Jr. | |

| Title: | Managing Director | |

| TPR RESIDUAL ASSETS, LLC | ||

| By: | Excalibur Resources Holdings, LLC, | |

| its sole member | ||

| By: | EnCap Energy Capital Fund IX, L.P., | |

its sole member | ||

| By: | EnCap Equity Fund IX GP, L.P., | |

| its general partner | ||

| By: | EnCap Investments L.P., | |

| its general partner | ||

| By: | EnCap Investments GP, L.L.C., | |

| its general partner | ||

| By: | /s/ Douglas E. Swanson, Jr. | |

| Name: | Douglas E. Swanson, Jr. | |

| Title: | Managing Director | |

[Signature Page to Project Mercury Support Agreement]

Schedule A

Name of Stockholder | No. Shares of Company Common Stock | |||

EnCap Energy Capital Fund VIII Co-Investors, L.P.(1) | 2,694,673 | |||

EnCap Energy Capital Fund VIII, L.P.(1) | 3,979,173 | |||

EnCap Energy Capital Fund IX, L.P.(1) | 4,856,485 | |||

TPR Residual Assets, LLC(2) | 2,521,573 | |||

| (1) | EnCap Energy Capital Fund VIII, L.P., a Texas limited partnership (“EnCap Fund VIII”), EnCap Energy Capital Fund IX, L.P., a Texas limited partnership (“EnCap Fund IX”), EnCap Energy Capital Fund VIII Co-Investors, L.P., a Texas limited partnership (“EnCap Fund VIII Co-Invest” and together with EnCap Fund VIII and EnCap Fund IX, the “EnCap Funds”), collectively directly hold the remaining shares of common stock. EnCap Partners GP, LLC (“EnCap Partners GP”) is the sole general partner of EnCap Partners, LP (“EnCap Partners”), which is the managing member of EnCap Investments Holdings, LLC (“EnCap Holdings”), which is the sole member of EnCap Investments Holdings Blocker, LLC (“EnCap Holdings Blocker”). EnCap Holdings Blocker is the sole member of EnCap Investments GP, L.L.C. (“EnCap Investments GP”), which is the sole general partner of EnCap Investments L.P. (“EnCap Investments LP”). EnCap Investments LP is the sole general partner of EnCap Equity Fund VIII GP, L.P. (“EnCap Fund VIII GP”) and EnCap Equity Fund IX GP, L.P. (“EnCap Fund IX GP”). EnCap Fund VIII GP is the sole general partner of each of EnCap Fund VIII and EnCap Fund VIII Co-Invest. EnCap Fund IX GP is the sole general partner of EnCap Fund IX. Therefore, EnCap Partners GP may be deemed to share the right to direct the voting and disposition of the Subject Shares held by the EnCap Funds. |

| (2) | TPR Residual Assets, LLC (“TPR Residual”) is member-managed by EnCap Fund IX. As a result, EnCap Fund IX may be deemed to have the power to vote or direct the vote or to dispose or direct the disposition of the shares owned by TPR Residual. |

A-1

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our report dated March 10, 2020 with respect to the consolidated financial statements of Montage Resources Corporation included in the Current Report on Form 8-K of Southwestern Energy Company. We consent to the incorporation by reference of the aforementioned report in the Registration Statement of Southwestern Energy Company on Form S-3 (File No. 333-238633) and to the use of our name as it appears under the caption “Experts.”

/s/ GRANT THORNTON LLP

Pittsburgh, Pennsylvania

August 12, 2020

Exhibit 99.1

NEWS RELEASE

SOUTHWESTERN ENERGY ANNOUNCES AGREEMENT TO

ACQUIRE MONTAGE RESOURCES

At-market, all-stock, in-basin acquisition delivers step change in free cash flow,

captures synergies and is accretive to all key financial metrics

SPRING, Texas – August 12, 2020…Southwestern Energy Company (NYSE: SWN) and Montage Resources Corporation (NYSE: MR) today announced that they have entered into a definitive merger agreement under which Southwestern Energy will acquire Montage Resources in an all-stock transaction. Based on the 3-day average closing share prices of the companies as of August 11, 2020 and under the terms of the agreement, Montage Resources shareholders will receive 1.8656 shares of Southwestern for each Montage Resources share. The transaction is expected to close in the fourth quarter of 2020, subject to customary closing conditions, including the approval of the Montage Resources shareholders.

Highlights include:

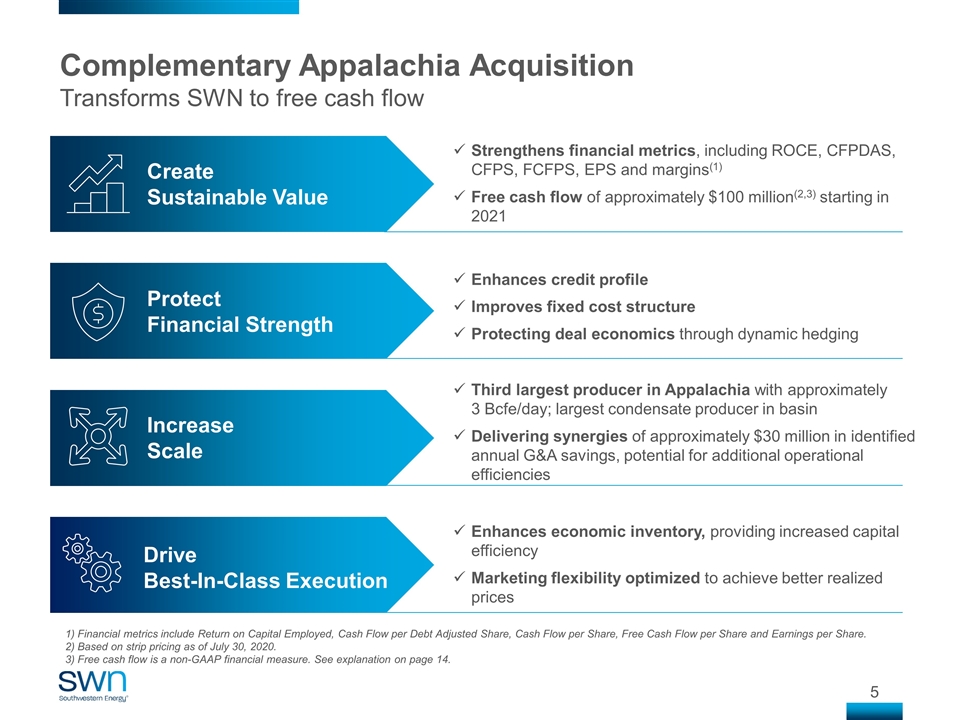

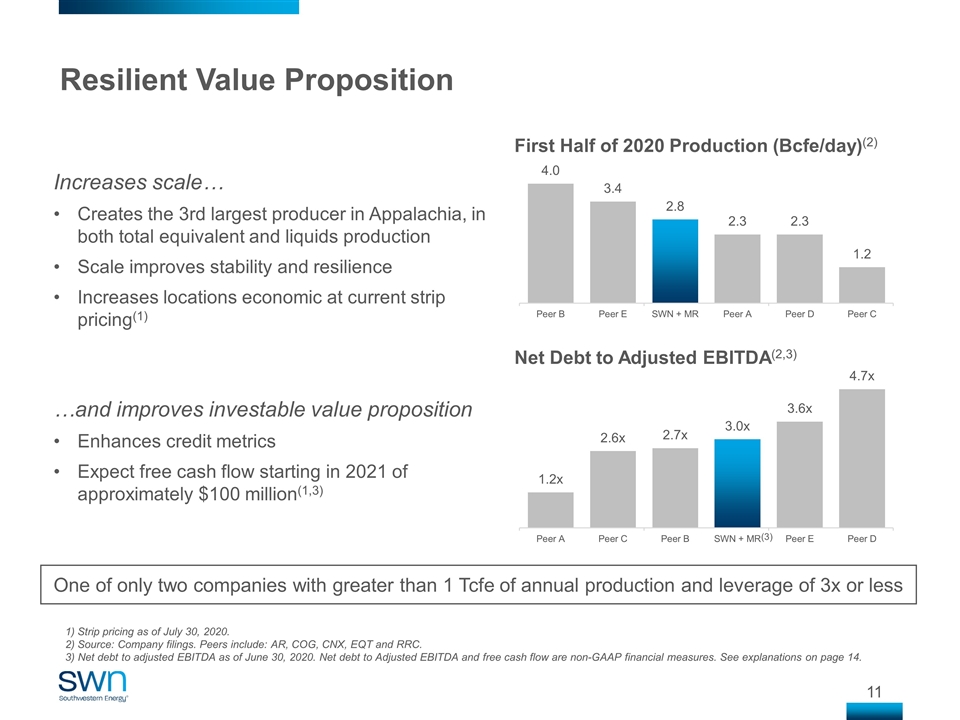

| • | Represents a step change in free cash flow; approximately $100 million annual free cash flow beginning in 2021 based on current strip pricing; |

| • | Accretive to per share financial metrics as well as leverage, margin and returns; |

| • | Anticipated synergies of approximately $30 million in annual G&A savings captured following the transaction close, in addition to operational efficiencies; |

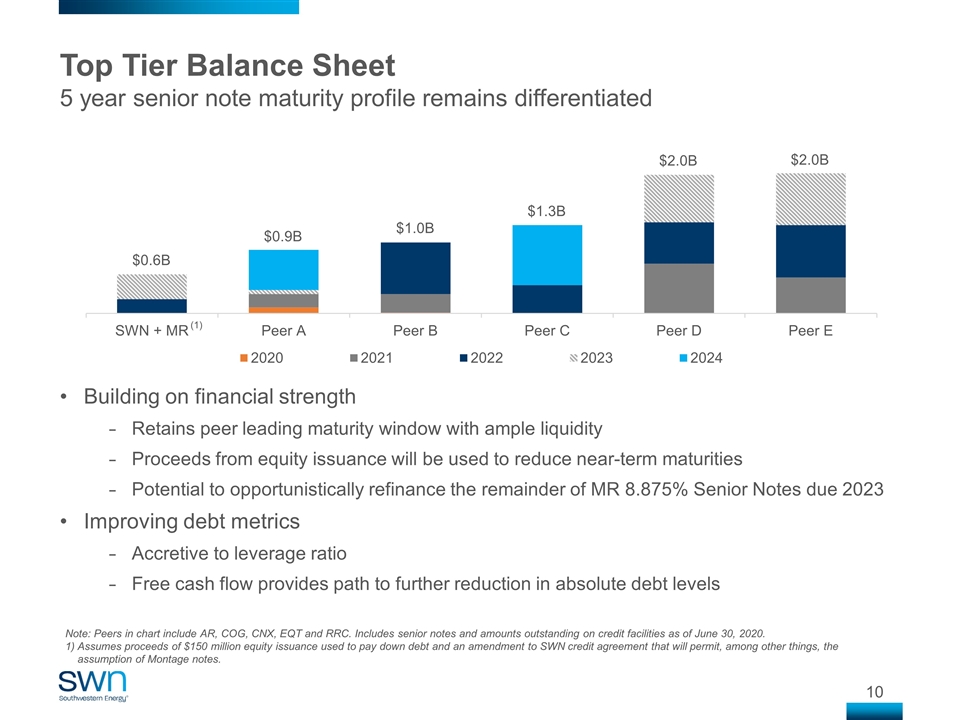

| • | Maintains peer leading maturity runway and strong balance sheet; |

| • | Combined company will be the third largest producer in Appalachia, expected total equivalent production of approximately 3 Bcfe per day; and |

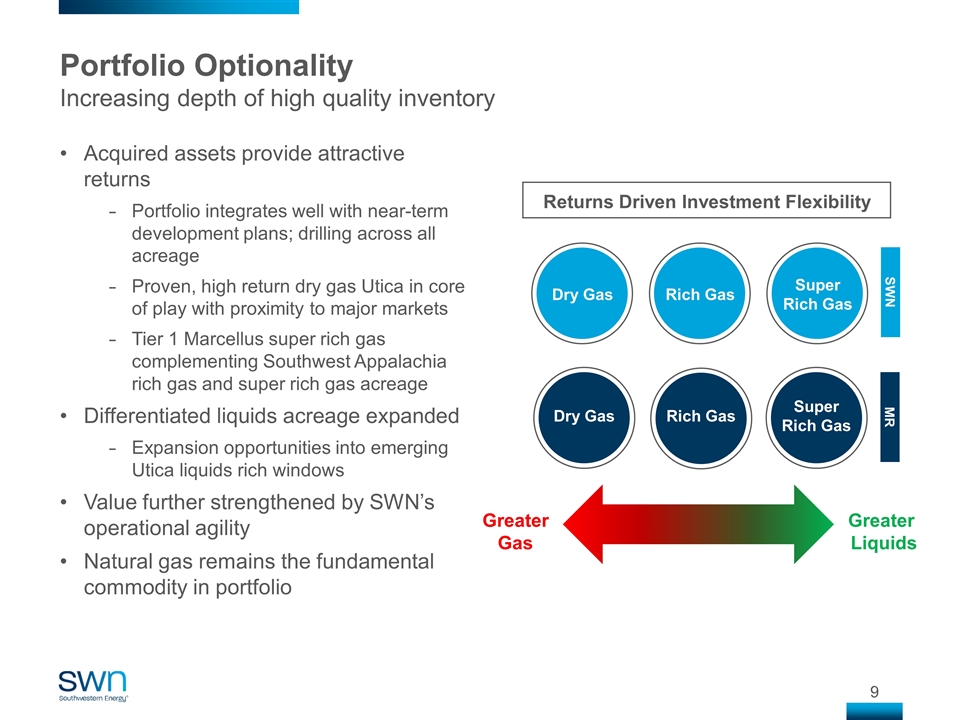

| • | Enhances economic inventory, with investment opportunities in proven, high-return Marcellus super rich and core Utica dry gas windows. |

“This is an exciting step for Southwestern as we expand our Appalachia footprint with the high-quality assets of Montage. As we have consistently stated, we are firm believers in the benefits of value-creating consolidation. This transaction further solidifies the Company’s position as a premier Appalachia operator and provides additional scale and synergies strengthened by our leading operational execution. Consistent with our strategy, this transaction is expected to deliver increased free cash flow, improved returns and long-term value to shareholders,” said Bill Way, Southwestern Energy President and Chief Executive Officer.

Way continued, “This acquisition is expected to deliver on all criteria of an accretive, value-adding transaction for the shareholders of both Southwestern Energy and Montage Resources. Southwestern Energy has consistently and methodically taken steps to enhance its resilience over the last few years, and this transaction solidifies that path and delivers on the commitment to responsibly manage the balance sheet and return to free cash flow.”

John Reinhart, President and CEO of Montage Resources, commented, “This transaction creates a compelling opportunity for both Southwestern Energy and Montage Resources shareholders to benefit from the strength of the consolidated company. The combination creates a Company of substantial scale with capabilities to enhance cash flow generation and a strong balance sheet that provides opportunities for enhanced shareholder value creation. We appreciate all of the great work by Montage employees in forming a very attractive business that will continue to build upon the success of Southwestern Energy.”

Concurrently, Southwestern also commenced a registered underwritten public offering of 55,000,000 shares of its common stock, with the proceeds expected to be used to retire a portion of Montage Resources’ 8.875% Senior Notes due 2023. The remaining portion of the Montage notes outstanding have the potential to be refinanced opportunistically.

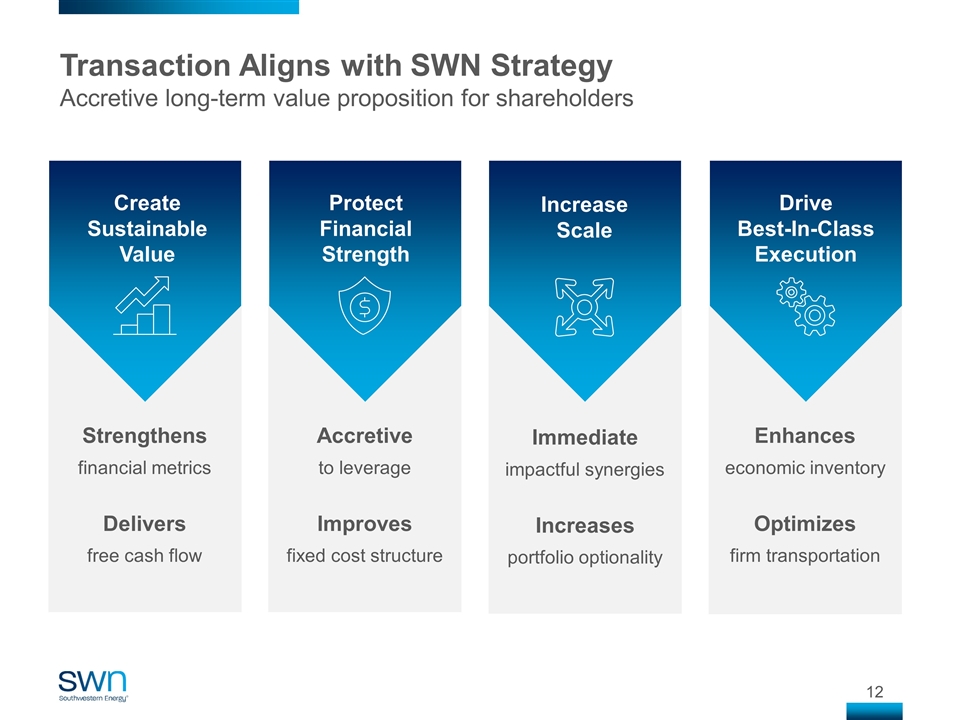

This transaction delivers on the key strategic objectives that Southwestern Energy has been targeting:

| • | No premium transaction |

| • | Enhances free cash flow |

| • | Improves leverage ratio |

| • | Capture of tangible synergies |

| • | In-basin assets where technical and operating expertise can be leveraged |

| • | High-quality inventory included in go forward development plans |

| • | Retains peer leading maturity runway |

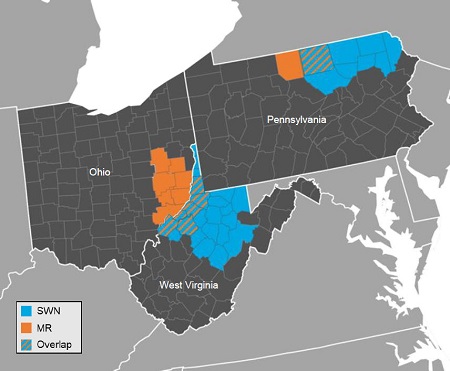

SWN + MR Acreage Position by County

2

Certain key metrics of the new combined enterprise are shown below.

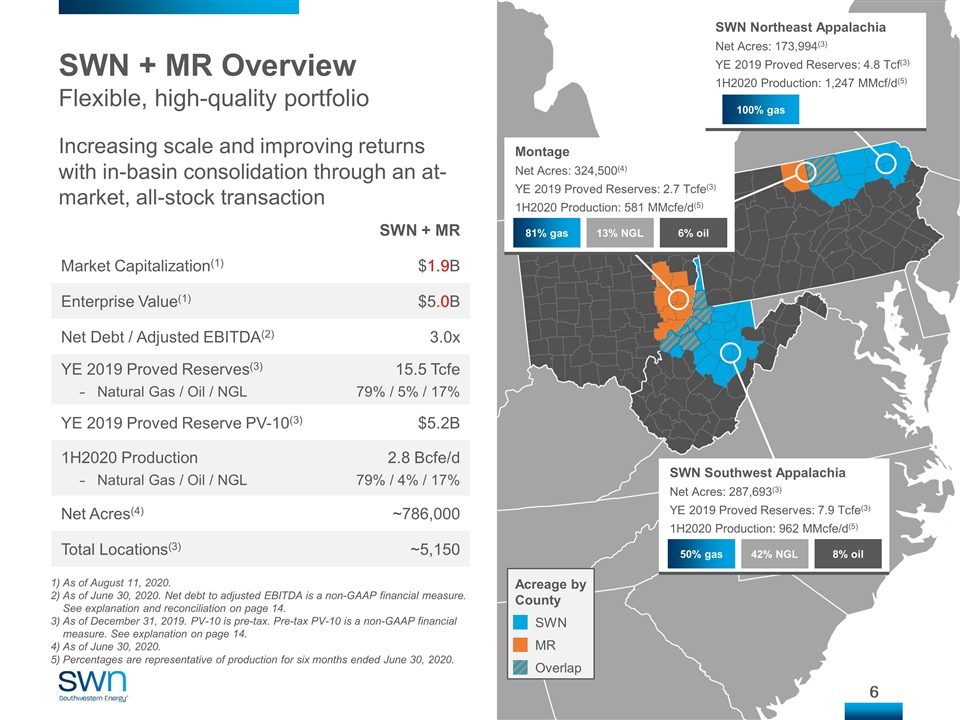

| SWN | MR | SWN + MR | ||||||||||

Production (for the quarter ended June 30, 2020) | ||||||||||||

Natural Gas (Bcf) | 158 | 42 | 200 | |||||||||

Oil/Condensate (MBbls) | 1,083 | 440 | 1,523 | |||||||||

NGLs (MBbls) | 6,111 | 974 | 7,085 | |||||||||

|

|

|

|

|

| |||||||

Total Production (Bcfe) | 201 | 50 | 251 | |||||||||

Net Acres(1) | ||||||||||||

Northeast Appalachia | 173,994 | 34,900 | 208,894 | |||||||||

Southwest Appalachia | 287,693 | 289,600 | 577,293 | |||||||||

|

|

|

|

|

| |||||||

Total Net Acres | 461,687 | 324,500 | 786,187 | |||||||||

Proved Reserves (as of December 31, 2019) | ||||||||||||

Natural Gas (Bcf) | 8,630 | 2,138 | 10,768 | |||||||||

Oil/Condensate (MMBbls) | 72.9 | 30.3 | 103.2 | |||||||||

NGLs (MMBbls) | 608.8 | 68.4 | 677.2 | |||||||||

|

|

|

|

|

| |||||||

Total Proved Reserves (Bcfe) | 12,721 | 2,730 | 15,451 | |||||||||

Net Debt / Adjusted EBITDA (as of June 30, 2020)(2) | ||||||||||||

Total Debt ($MM) | $ | 2,457 | $ | 670 | $ | 3,127 | ||||||

Less: Cash ($MM) | (10 | ) | (9 | ) | (19 | ) | ||||||

|

|

|

|

|

| |||||||

Net Debt ($MM) (non-GAAP) | $ | 2,447 | $ | 661 | $ | 3,108 | ||||||

Adjusted EBITDA ($MM)(3) (non-GAAP) | 780 | 271 | 1,051 | |||||||||

|

|

|

|

|

| |||||||

Net Debt / Adjusted EBITDA (non-GAAP) | 3.1 | x | 2.4 | x | 3.0 | x | ||||||

| (1) | Net acres for Southwestern Energy and Montage Resources as of December 31, 2019 and June 30, 2020, respectively. |

| (2) | The balances of the combined companies are based solely on historical information, and may not be indicative of the pro forma financial information relating to the combined company once available. |

| (3) | For the twelve months ended June 30, 2020. Montage’s comparative financial non-GAAP metric as defined in its public filings is EBITDAX |

Advisors

Citi and Goldman Sachs & Co. LLC are acting as financial advisors and Skadden, Arps, Slate, Meagher & Flom LLP is acting as legal advisor to Southwestern. Barclays is acting as financial advisor and Norton Rose Fulbright LLP is acting as legal advisor to Montage Resources. Vinson & Elkins LLP is acting as legal advisor to EnCap Investments, L.P.

Conference Call

Southwestern Energy will host a conference call today at 10:00 a.m. Central to discuss this transaction. To participate, dial US toll-free 877-879-1183, or international 412-902-6703 and enter access code 1383175. A live webcast will also be available at ir.swn.com.

About Southwestern Energy

Southwestern Energy Company is an independent energy company engaged in natural gas, natural gas liquids and oil exploration, development, production and marketing.

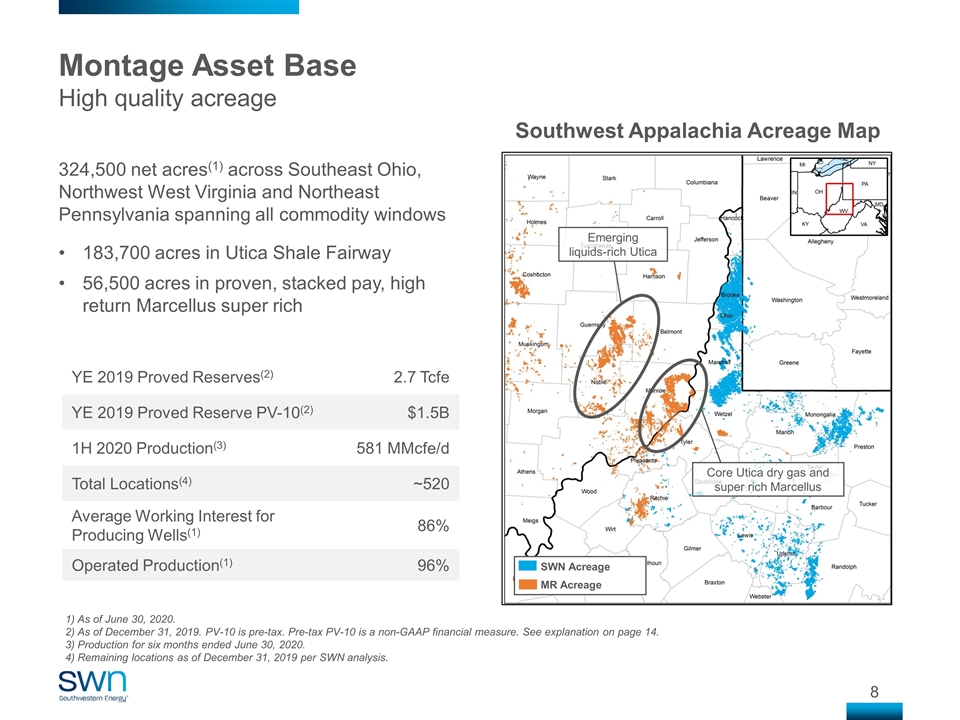

About Montage Resources

Montage Resources is an exploration and production company with approximately 195,000 net effective core undeveloped acres currently focused on the Utica and Marcellus Shales of Southeast Ohio, West Virginia and North Central Pennsylvania.

3

Investor Contacts

Brittany Raiford

Director, Investor Relations

(832) 796-7906

brittany_raiford@swn.com

Bernadette Butler

Investor Relations Advisor

(832) 796-6079

bernadette_butler@swn.com

Forward Looking Statement

Certain statements and information in this news release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could,” “attempt,” “appears,” “forecast,” “outlook,” “estimate,” “project,” “potential,” “may,” “will,” “are likely” and other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. Examples of forward-looking statements in this release include, but are not limited to, statements regarding expected generation of free cash flow, benefits to the combined company’s financial metrics, anticipated synergies, expected production, the expected closing of the merger and the proposed retirement of Montage’s senior notes with proceeds from the announced equity offering. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. The forward-looking statements contained in this document are largely based on our expectations for the future, which reflect certain estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions, operating trends, and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control. As such, management’s assumptions about future events may prove to be inaccurate. For a more detailed description of the risks and uncertainties involved, see “Risk Factors” in our most recently filed Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings. We do not intend to publicly update or revise any forward-looking statements as a result of new information, future events, changes in circumstances, or otherwise. These cautionary statements qualify all forward-looking statements attributable to us, or persons acting on our behalf. Management cautions you that the forward-looking statements contained in this presentation are not guarantees of future performance, and we cannot assure you that such statements will be realized or that the events and circumstances they describe will occur. Factors that could cause actual results to differ materially from those anticipated or implied in the forward-looking statements herein include, but are not limited to: the timing and extent of changes in market conditions and prices for natural gas, oil and natural gas liquids (“NGLs”), including regional basis differentials and the impact of reduced demand for our production and products in which our production is a component due to governmental and societal actions taken in response to the COVID-19 pandemic; our ability to fund our planned capital investments; a change in our credit

4

rating, an increase in interest rates and any adverse impacts from the discontinuation of the London Interbank Offered Rate; the extent to which lower commodity prices impact our ability to service or refinance our existing debt; the impact of volatility in the financial markets or other global economic factors, including the impact of COVID-19; difficulties in appropriately allocating capital and resources among our strategic opportunities; the timing and extent of our success in discovering, developing, producing and estimating reserves; our ability to maintain leases that may expire if production is not established or profitably maintained; our ability to realize the expected benefits from recent acquisitions and the Proposed Transaction (defined below) between the Company and Montage Resources Corporation (“Montage”); our ability to enter into an amendment to our credit agreement to permit the assumption of the senior notes of Montage in the merger; the consummation of or failure to consummate the Proposed Transaction and the timing thereof; costs in connection with the Proposed Transaction; integration of operations and results subsequent to the Proposed Transaction; our ability to transport our production to the most favorable markets or at all; the impact of government regulation, including changes in law, the ability to obtain and maintain permits, any increase in severance or similar taxes, and legislation or regulation relating to hydraulic fracturing, climate and over-the-counter derivatives; the impact of the adverse outcome of any material litigation against us or judicial decisions that affect us or our industry generally; the effects of weather; increased competition; the financial impact of accounting regulations and critical accounting policies; the comparative cost of alternative fuels; credit risk relating to the risk of loss as a result of non-performance by our counterparties; and any other factors listed in the reports we have filed and may file with the SEC that are incorporated by reference herein. All written and oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary statement.

Use of Non-GAAP Information

This news release contains non-GAAP financial measures, such as net cash flow, free cash flow, net debt and adjusted EBITDA, including certain key statistics and estimates. We report our financial results in accordance with accounting principles generally accepted in the United States of America (“GAAP”). However, management believes certain non-GAAP performance measures may provide users of this financial information additional meaningful comparisons between current results and the results of our peers and of prior periods. Please see the Appendix for definitions of the non-GAAP financial measures that are based on reconcilable historical information.

Additional Information and Where To Find It

In connection with the proposed acquisition by the Company of Montage (the “Proposed Transaction”), the Company will file with the SEC a registration statement on Form S-4 to register the shares of the Company’s common stock to be issued in connection with the Proposed Transaction. The registration statement will include a document that serves as a prospectus of the Company and a proxy statement of Montage (the “proxy statement/prospectus”), and each party will file other documents regarding the Proposed Transaction with the SEC. INVESTORS AND SECURITY HOLDERS OF THE COMPANY AND MONTAGE ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS, INCLUDING ANY

5

AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, AND ANY OTHER RELEVANT DOCUMENTS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, MONTAGE, THE PROPOSED TRANSACTION AND RELATED MATTERS. A definitive proxy statement/prospectus will be sent to Montage’s stockholders when it becomes available. Investors and security holders will be able to obtain copies of the registration statement and the proxy statement/prospectus and other documents containing important information about the Company and Montage free of charge from the SEC’s website or from the Company or Montage when it becomes available. The documents filed by the Company with the SEC may be obtained free of charge at the Company’s website at www.swn.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from the Company by requesting them by mail at Investor Relations, 10000 Energy Drive, Spring, Texas 77389, or by telephone at (832) 796-4068. The documents filed by Montage with the SEC may be obtained free of charge at Montage’s website at www.montageresources.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of charge from Montage by requesting them by mail at Investor Relations, 122 W. John Carpenter Fwy, Suite 300, Irving, TX 75039, or by telephone at (469) 444-1736.

Participants in the Solicitation

The Company, Montage and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Montage’s stockholders with respect to the Proposed Transaction. Information about the Company’s directors and executive officers is available in the Company’s Annual Report on Form 10-K for the fiscal year ended 2019 filed with the SEC on February 27, 2020 and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on April 9, 2020. Information concerning the ownership of Montage’s securities by Montage’s directors and executive officers is included in their SEC filings on Forms 3, 4 and 5, and additional information regarding the names, affiliations and interests of such individuals is available in Montage’s Annual Report on Form 10-K for the fiscal year ended 2019 filed with the SEC on March 10, 2020 and its definitive proxy statement for the 2020 annual meeting of shareholders filed with the SEC on April 28, 2020. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statement, the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the Proposed Transaction when they become available. Stockholders, potential investors and other readers should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

Registration Statement

The Company has filed a registration statement (including a prospectus and the related Preliminary Prospectus Supplement) with the SEC for the offering of common stock to which this communication relates. Before you invest, you should read the prospectus in

6