Mutual fund advisory services provided by Delaware Management Company, a series of Delaware Management

Business Trust, which is a registered investment advisor.

Portfolio management review

Delaware Minnesota Municipal Bond Funds

September 10, 2007

The managers of Delaware Tax-Free Minnesota Fund, Delaware Tax-Free Minnesota Intermediate Fund, and Delaware Minnesota High-Yield Municipal Fund provided the answers to the questions below as a review of the Funds’ activities over the 12-month period ended Aug. 31, 2007.

Please see page 53 to learn about the portfolio managers. Bonds mentioned throughout the portfolio manager review are rated by either Moody’s or Standard & Poor’s unless otherwise noted.

Q: What was the market environment for tax-free investments during the fiscal year ended Aug. 31, 2007?

A: Based on changing projections for inflation during the year, the Federal Reserve’s future policy with regard to interest rates remained a topic of speculation among fixed income investors who monitored the economy for the onset of weakness during the year. The closely watched 10-year Treasury yield was 4.74% at the start of the fiscal year, drifted above 5.00% in late spring and early summer of 2007, and finished at 4.54% on Aug. 31, 2007 (source: U.S. Treasury Department).

Despite economic weakness in the first quarter of 2007, the U.S. sustained moderate growth during the year, and the Fed kept its short-term interest rate target at 5.25% throughout the period.

In the latter half of the fiscal year, a significant change in investor sentiment occurred across all fixed income markets, brought on largely by the rising number of defaults in the U.S. subprime mortgage market. As some homeowners defaulted on mortgage payments, investors generally moved away from fixed income securities of lower credit quality, including those backed by mortgages. Investors generally lost confidence in riskier assets such as high yield bonds, which had been market leaders for several quarters, and began to favor higher-quality fixed income investments.

This general flight by investors toward higher-quality fixed income investments began in the first quarter of 2007, and picked up significantly during summer months as subprime mortgage defaults and their negative effects on several large hedge funds made news. While subprime mortgages do not affect the municipal bond market directly per se, we believe the generally turbulent market in the summer of 2007 was felt by all bond investors in some way.

In previous markets where credit was tightening and liquidity was squeezed, municipal bonds had always experienced increased demand. While the flight to quality trade has generally favored the Treasury market first, municipals had followed closely behind due to the relatively high quality of municipal bonds. As such, we would normally expect the municipal bond market to follow any strong performance of ultra-safe U.S. Treasurys at times when credit and liquidity concerns are influencing investors, leading them to higher-quality assets.

In this credit crunch of 2007, however, the Treasury market rallied and municipal bonds did not follow. We believe that this was due to nontraditional buyers of municipal bonds, who have greatly influenced the market in recent years. Over the past several years, active buying by these investors, including banks, hedge funds, and corporations that are more interested in total return opportunity than tax-exempt income, had helped propel the municipal market in spite of record or near record new issue supply. However, during this most recent credit crunch, as the bond markets “repriced” risk and investors sought safer assets, many of these nontraditional investors were sellers of municipal bonds, putting downward pressure on our market. One reason for their reversal may have been that nontraditional investors found themselves unable to sell mortgage-backed securities when trying to adjust their investment portfolios.

Q: What other factors have influenced the municipal bond market or your strategy?

A: While state revenue trends remained positive through the first half of 2007, the pace of growth thereafter slowed. The deepening housing slump and tighter liquidity for business and consumer sectors have created a volatile market. Nationally, state budgets face pressure to increase

The views expressed are current as of the date of this report and are subject to change.

(continues) 1

Portfolio management review

spending in areas such as education and Medicaid, which already comprise a majority of state expenditures.

In addition, the costs of employee and retiree healthcare are presenting new challenges. Other post-employment benefits may soon claim a fixed portion of some states’ budgets, depending on funding decisions (source: Moody’s). The future of the states’ fiscal health will depend on economic performance, sustained structural balance and progress in re-building financial/ budget reserves.

New issues of municipal bonds increased to $261.3 billion for the first 7 months of 2007, putting it on pace to set a record for a calendar year. The increase is being driven by both new money financing and by bonds issued to refinance outstanding municipal bonds. Healthcare, education, and housing bonds continued to be drivers when it came to the volume of municipal bonds available in the marketplace.

An important aspect of the “repricing of risk” is that it has been indiscriminate of actual credit fundamentals. For example, in general, we favor the demographics of education bonds and those that we own may have credit strengths ranging from solid financials to strong issue covenants to good student demand. There is important credit-rating analysis that goes into evaluating these bonds on a daily basis, and we believe this is one of our team’s strengths. However, when the market is punishing all but the highest-rated securities, these bonds may be at some risk of deterioration even when they are still fundamentally strong credits.

We generally believe that our investment strategy, which is based on security-by-security analysis and the free exchange of information among team members, is well suited to provide value over market cycles. Another important point about our process this year is that we remained focused on keeping our funds well diversified across sectors, and individual positions not too large. While diversification itself cannot protect from loss in a declining market, we believe this standard practice is valuable in all markets, but particularly so in volatile markets, as we have experienced in recent months.

Q: What financial conditions prevailed in the Minnesota debt market?

A: Minnesota has a fundamentally strong and stable economy, which has been relatively sluggish in the past two years, lagging the nation somewhat after years of exceeding the nation (Source: Moody’s). In the 12 months ending March 2007, the state’s non-farm payroll increased 0.7% compared to national growth of 1.4% (source: Nelson A. Rockefeller State Revenue Report #68). As of June 2007, the state’s unemployment rate of 4.5% was similar to the national unemployment rate of 4.6% (source: U.S. Department of Labor).

For the first nine months of fiscal 2007, tax revenues were up 1.9% (source: Nelson A. Rockefeller State Revenue Report #68). The state’s General Fund ended fiscal 2006 at $838.8 million, a significant increase over 2005 ( source: 2006 Minnesota CAFR). The fiscal 2006-2007 biennium should end with approximately $2 billion in reserves. Most of the spending increases are going toward K-12 education, health and human services, and public safety (source: Minnesota Department of Finance).

Through the first 7 months of 2007, national issuance increased 26.1% while in Minnesota issuance increased 48.3% during the same time period to total $4.3 billion (Source: Bond Buyer).

Delaware Tax Free Minnesota Fund

Q: How did the Fund perform versus its benchmark index and peer group?

A: Delaware Tax-Free Minnesota Fund returned +1.58% at net asset value and - -3.00% at maximum offer price (both figures represent Class A shares with distributions reinvested) for the year ended Aug. 31, 2007. The Fund’s performance benchmark, the Lehman Brothers Municipal Bond Index, returned +2.30%. Its peer group, as measured by the Lipper Minnesota Municipal Debt Funds Average, returned +1.08% (source: Lipper). For the complete, annualized performance of Delaware Tax-Free Minnesota Fund, please see the table on page 6.

2

Q: What affected Fund performance?

A: In general, short and intermediate-term bonds performed fairly well during the year. Pre-refunded bonds (bonds where the interest is paid from the proceeds of a new bond issue, held in escrow in U.S. Treasury securities) were generally strong performers across the board at a national level. Partly due to the weakening credit environment, healthcare and higher education bonds tended to be underperformers by comparison, as were bonds in the IDR/PCR sector (industrial development revenue bonds and pollution control revenue bonds).

Three of the top five performing bonds were pre-refunded during the year. For example, a Rochester MN Multifamily Housing revenue bond issued for Wedum Shorewood (a continuing care retirement community) was refunded, taking it from a bond with a long maturity (2036) to one being called in 2 years (2009) and improving the bond’s credit quality from a non-rated bond secured by revenues from a retirement facility to a “Aaa” equivalent bond secured by escrowed U.S. Treasury securities. The shortened duration and improved credit quality provided the boost to the bond’s price.

The other top two out of five performers in the Fund were high coupon housing bonds. Often, housing bonds with high coupons tend to lag the market in times of falling interest rates and hold up better during periods of rising rates. As spreads widened and rates rose, the prices on these bonds held firm, even though their final maturities were in 2020 and 2029.

The Fund’s worst performers were credit bonds, which experienced greater price volatility as their prices dropped below par. With each upward tick in interest rates, the price of these bonds declined more rapidly than when priced above par. The weaker relative performance of these bonds was a combination of the widening of credit spreads (the difference between yields of bonds with various credit qualities) and the impact of the “crossover.” As the bond’s price “crosses over,” thus moving from above to below its par value, the bond gets priced based on its stated maturity date rather than based on its call date. The maturity date provides a longer time horizon and the price becomes more volatile as a result. A revenue bond rated Baa2 by Moody’s Investors Service, issued by Minnesota St. Higher Education Facilities for Augsburg College, was one example.

On April 13, 2007, Delaware Tax-Free Minnesota Insured Fund was merged into the portfolio. This event increased our exposure to very high-quality securities for a time, and increased the Fund’s total assets.

Delaware Tax-Free Minnesota Intermediate Fund

Q: How did the Fund perform versus its benchmark index and peer group?

A: Delaware Tax-Free Minnesota Intermediate Fund returned +1.80% at net asset value and -1.02% at maximum offer price (both figures represent Class A shares with distributions reinvested) for the year ended Aug. 31, 2007. The Fund’s performance benchmark, the Lehman Brothers Municipal Bond 3-15 Year Index, returned +2.97%. Its peer group, as measured by the Lipper Other States Intermediate Municipal Debt Funds Average, returned +1.42% (source: Lipper). For the complete, annualized performance of Delaware Tax-Free Minnesota Intermediate Fund, please see the table on page 8.

Q: What affected Fund performance?

A: There were several types of bonds that generated the top performance for the Fund: pre-refunded bonds, short-term bonds and high-coupon housing bonds. One of the pre-refunded bonds generated a significant price increase. The refunding of the bond from a long maturity (2020) to its short call (2010) eliminated any curve exposure and its credit quality was improved from a “Baa2” bond secured by college revenues to a “Aaa” equivalent bond secured by escrowed U.S. Treasury securities. The shortened duration and improved credit quality provided the boost to the bond’s price.

Two short bonds performed well because they had less exposure to rising interest rates. For example, a Hibbing, MN Economic Development bond maturing in 2008 was a top performer as its price was nearly unchanged for the year. Finally, there was a high coupon housing bond among the best performers. Often, housing bonds

(continues) 3

Portfolio management review

with high coupons will lag the market in times of falling interest rates and hold up better during periods of rising rates. As spreads widened and rates rose, this bond’s price held firm, even though its final maturity was in 2021.

The Fund’s worst performers were credit-related bonds which experienced greater price volatility as their prices dropped below par. With each upward tick in interest rates, the price of these bonds declined more rapidly as discounts than they did when priced above par. The weaker relative performance of these bonds was a combination of the widening of credit spreads and the impact of the “crossover. ” As the bond’s price “crosses over, ” thus moving from above to below its par value, the bond gets priced based on its stated maturity date rather than based on its call date. The maturity date provides a longer time horizon and the price becomes more volatile as a result. A BBB- rated Northfield Minnesota Hospital revenue bond was one of these bonds. It started the fiscal year with a premium price, which reflected the price sensitivity of its 2016 call date. As interest rates rose and credit spreads widened, the price of this bond moved below par and each subsequent downward move reflected the sensitivity of its 2021 final maturity date.

Delaware Minnesota High-Yield Municipal Bond Fund

Q: How did the Fund perform versus its benchmark index and peer group?

A: Delaware Minnesota High-Yield Municipal Bond Fund returned +0.71% at net asset value and -3.86% at maximum offer price (both figures represent Class A shares with distributions reinvested) for the year ended Aug. 31, 2007. The Fund’s performance benchmark, the Lehman Brothers Municipal Bond Index, returned +2.30%. Its peer group, as measured by the Lipper Minnesota Municipal Debt Funds Average, returned +1.08% (source: Lipper). For the complete, annualized performance of Delaware Minnesota High-Yield Municipal Bond Fund, please see the table on page 10.

Q: What affected Fund performance?

A: Bonds that were pre-refunded during the year and high coupon housing bonds were among the top performers for the fund. Two of the top five performing bonds were pre-refunded during the year, which provided a significant price increase for the bond. For example, a Rochester MN Multifamily Housing revenue bond issued for Wedum Shorewood (a continuing care retirement community) was refunded, taking it from a bond with a long maturity (2036) to one being called in 2 years (2009) and improving the bond’s credit quality from a non-rated bond secured by revenues from a retirement facility to a “Aaa” equivalent bond secured by escrowed U.S. Treasury securities. The shortened duration and improved credit quality provided the boost to the bond’s price. The other top three out of five performers in the Fund were high-coupon housing bonds. Often, housing bonds with high coupons tend to lag the market in times of falling interest rates and hold up better during periods of rising rates. As spreads widened and rates rose, the prices on these bonds held firm, even though their final maturities were out beyond 20 years.

The Fund’s worst performers were credit related bonds which experienced greater price volatility as their prices dropped below par. With each upward tick in interest rates, the price of these bonds declined more rapidly as discounts than they did when priced above par. The weaker relative performance of these bonds was a combination of the widening of credit spreads and the impact of the “crossover. ” As the bond’s price “crosses over, ” thus moving from above to below its par value, the bond gets priced based on its stated maturity date rather than based on its call date. The maturity date provides a longer time horizon and the price becomes more volatile as a result. A BBB-rated Northfield Minnesota Hospital revenue bond was one of these bonds. It started the fiscal year with a premium price, which reflected the price sensitivity of its 2016 call date. As interest rates rose and credit spreads widened, the price of this bond moved below par and each subsequent downward move reflected the sensitivity of its 2031 final maturity date.

4

Fixed Income Glossary

Basis point: 1/100 of a percentage point, or 0.01%. Basis points are often used to measure changes in, or differences between, yields.

Bond: A debt security, like an IOU, issued by a company, municipality, or government agency. In return for lending money to the issuer, a bond buyer generally receives fixed periodic interest payments and repayment of the loan amount on a specified maturity date.

Bond ratings: Evaluations of creditworthiness by independent agencies such as Moody’s, Standard & Poor’s, and Fitch. Ratings may range from Aaa or AAA (highest quality) to D (lowest quality). Bonds rated Baa/BBB or better are considered investment grade. Bonds rated Ba/BB or lower are noninvestment grade and commonly known as junk bonds, or high yield bonds.

Callable bond: A bond that may be redeemed at the request of the issuer prior to the stated maturity date.

Coupon rate: The interest rate that is paid to the investor over the life of the bond.

Duration: A measurement of a fixed income investment’s sensitivity to changes in interest rates. The larger the number, the greater the likely price change for a given change in interest rates.

Federal funds rate: The percentage of interest that banks charge to lend money to each other. The rates change daily, and are a good indication of general interest rate trends.

Maturity: The length of time until a bond issuer must repay the underlying loan principal to the bondholder.

Par value: The face value of a bond. It is also referred to as the principal value. When a bond reaches maturity, the holder receives this value, regardless of what was paid for the bond.

Pre-refunded bonds: Bonds that have been refinanced and are secured by U.S. Treasury bonds, held in an escrow account.

Tax-exempt bond: Exempt from federal or state income tax, state taxes, or local property tax.

Treasury yield curve: This is a curve on a graph that depicts the difference between short- and long-term bond yields across the duration spectrum. It is used as a benchmark for other debt in the market, such as mortgage rates or bank lending rates. It is also used to assess broad market trends, as well as potential changes in economic output and growth.

Municipal Bond-specific Terms

Legacy bonds: Bonds bought in previous periods that have been held in the portfolio.

Municipal bonds: Bonds issued by every level of municipality in order to raise capital for day-to-day activities and special specific projects. The bonds pay interest that is typically exempt from federal income taxes and is also generally exempt from state and local income taxes.

Primary market: The broker-controlled, new-issue market. When a municipal bond is purchased in the primary market, the proceeds go to the municipality.

Secondary markets: Known as the aftermarket, or resale market. A bond exchange occurs between a buying investor and a selling investor, not from the issuer. Interest payments from the municipality are passed on to the new owner.

5

Performance summary

Delaware Tax-Free Minnesota Fund

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The Delaware Tax-Free Minnesota Fund prospectus contains this and other important information about the investment company. Please request a prospectus through your financial advisor or by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Fund. Funds that invest in bonds may lose their value as interest rates rise, and an investor may lose principal.

Effective July 16, 2007, portfolio management responsibilities for the Fund changed. Current managers are listed in this report. Please see the prospectus, as supplemented, which contains important information regarding the investment manager for the Fund.

| Fund performance | | | | |

| Average annual total returns | | | | |

| Through Aug. 31, 2007 | 1 year | 5 years | 10 years | Lifetime |

| Class A (Est. Feb. 27, 1984) | | | | |

| Excluding sales charge | +1.58% | +4.38% | +4.82% | +7.19% |

| Including sales charge | -3.00% | +3.42% | +4.34% | +6.98% |

| | | | | |

| Class B (Est. March 11, 1995) | | | | |

| Excluding sales charge | +0.82% | +3.60% | +4.19% | +4.92% |

| Including sales charge | -3.08% | +3.34% | +4.19% | +4.92% |

| | | | | |

| Class C (Est. May 4, 1994) | | | | |

| Excluding sales charge | +0.73% | +3.59% | +4.04% | +4.60% |

| Including sales charge | -0.24% | +3.59% | +4.04% | +4.60% |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

An expense limitation was in effect for all classes during the periods shown in the Fund performance chart above and in the Performance of a $10,000 investment chart on the next page. Performance would have been lower had the expense limitation not been in effect.

The Fund offers Class A, B, and C shares. Class A shares are sold with a maximum front-end sales charge of up to 4.50% and an annual distribution and service fee of up to 0.25% of average daily net assets.

Class B shares are sold with a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after eight years.

Effective at the close of business on May 31, 2007, no new or subsequent investments will be allowed in Class B shares of the Delaware Investments® Family of Funds, except through a reinvestment of dividends or capital gains or permitted exchanges. Please see the prospectus supplement for additional information.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Please see the fee table in the prospectus and your financial professional for a more complete explanation of sales charges.

Management has contracted to reimburse expenses and/or waive its management fees through Dec. 31, 2007, as described in the most recent prospectus. The most recent prospectus designated Fund’s net expense ratios for Class A, B, and C shares as 1.19%, 1.94%, and 1.94%, respectively. Total operating expenses for Class A, B, and C shares were designated as 1.20%, 1.95%, and 1.95% (per prospectus supplement), respectively.

6

The performance table on the previous page and the graph below do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in a specific state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

| Fund basics |

| As of August 31, 2007 |

| |

| Fund objective |

| The Fund seeks a high a level of current income exempt from federal income tax, and from the Minnesota state personal income tax, as is consistent with preservation of capital. |

| |

| Total Fund net assets |

| $621 million |

| |

| Number of holdings |

| 202 |

| Fund start date | | |

| February 27, 1984 | | |

| |

| | Nasdaq symbols | CUSIPs |

| Class A | DEFFX | 928918101 |

| Class B | DMOBX | 928928696 |

| Class C | DMOCX | 928918408 |

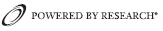

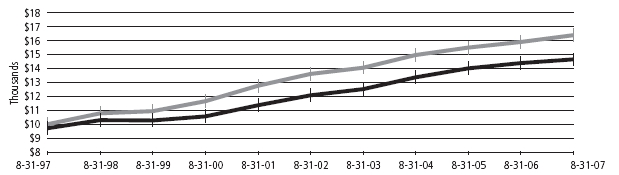

Performance of a $10,000 Investment

Average annual total returns from Aug. 31, 1997, through Aug. 31, 2007

| | Starting value (Aug. 31, 1997) | Ending value (Aug. 31, 2007) |

| Lehman Brothers Municipal Bond Index | $10,000 | $16,738 |

| Delaware Tax-Free Minnesota Fund — Class A Shares | $9,550 | $15,274 |

Chart assumes $10,000 invested on Aug. 31, 1997, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions.

Performance of other Fund classes will vary due to different charges and expenses.

The chart also assumes $10,000 invested in the Lehman Brothers Municipal Bond Index as of Aug. 31, 1997. Lehman Brothers Municipal Bond Index is an unmanaged index that generally tracks the performance of municipal bonds. An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Past performance is not a guarantee of future results.

(continues) 7

Performance summary

Delaware Tax-Free Minnesota Intermediate Fund

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The Delaware Tax-Free Minnesota Intermediate Fund prospectus contains this and other important information about the investment company. Please request a prospectus through your financial advisor or by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Fund. Funds that invest in bonds may lose their value as interest rates rise, and an investor may lose principal.

Effective July 16, 2007, portfolio management responsibilities for the Fund changed. Current managers are listed in this report. Please see the prospectus, as supplemented, which contains important information regarding the investment manager for the Fund.

| Fund performance | | | | |

| Average annual total returns | | | | |

| Through Aug. 31, 2007 | 1 year | 5 years | 10 years | Lifetime |

| Class A (Est. Oct. 27, 1985) | | | | |

| Excluding sales charge | +1.80% | +3.92% | +4.19% | +5.26% |

| Including sales charge | -1.02% | +3.35% | +3.90% | +5.13% |

| | | | | |

| Class B (Est. Aug. 15, 1995) | | | | |

| Excluding sales charge | +0.94% | +3.05% | +3.76% | +4.05% |

| Including sales charge | -1.02% | +3.05% | +3.76% | +4.05% |

| | | | | |

| Class C (Est. May 4, 1994) | | | | |

| Excluding sales charge | +0.94% | +3.05% | +3.32% | +3.69% |

| Including sales charge | -0.04% | +3.05% | +3.32% | +3.69% |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

An expense limitation was in effect for all classes during the periods shown in the Fund performance chart above and in the Performance of a $10,000 investment chart on the next page. Performance would have been lower had the expense limitation not been in effect.

The Fund offers Class A, B, and C shares. Class A shares are sold with a maximum front-end sales charge of up to 2.75% and an annual distribution and service fee of up to 0.25%, but such fees are currently subject to a contractual cap of 0.15% of average daily net assets through Dec. 31, 2007.

Class B shares are sold with a contingent deferred sales charge that declines from 2.00% to zero depending on the period of time the shares are held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately five years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after five years.

Effective at the close of business on May 31, 2007, no new or subsequent investments will be allowed in Class B shares of the Delaware Investments® Family of Funds, except through a reinvestment of dividends or capital gains or permitted exchanges. Please see the prospectus supplement for additional information.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Please see the fee table in the prospectus and your financial professional for a more complete explanation of sales charges.

Management has contracted to reimburse expenses and/or waive its management fees through Dec. 31, 2007, as described in the most recent prospectus. The most recent prospectus designated Fund’s net expense ratios for Class A, B, and C shares as 0.75%, 1.60%, and 1.60%, respectively. Total operating expenses for Class A, B, and C shares were designated as 0.97%, 1.72%, and 1.72%, respectively.

8

The performance table on the previous page and the graph below do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in a specific state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

Fund basics

As of August 31, 2007

| Fund objective |

| The Fund seeks to provide investors with preservation of capital and, secondarily, current income exempt from federal income tax, and from the Minnesota state personal income tax, by maintaining a dollar-weighted average effective portfolio maturity of 10 years or less. |

| |

| Total Fund net assets |

| $55 million |

| |

| Number of holdings |

| 51 |

| Fund start date | | |

| October 27, 1985 | | |

| |

| | Nasdaq symbols | CUSIPs |

| Class A | DXCCX | 928930106 |

| Class B | DVSBX | 928928399 |

| Class C | DVSCX | 928930205 |

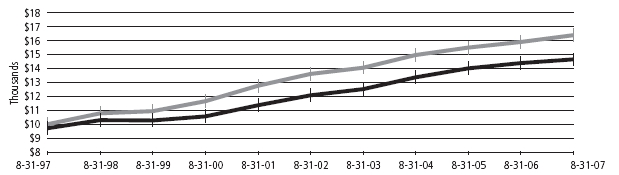

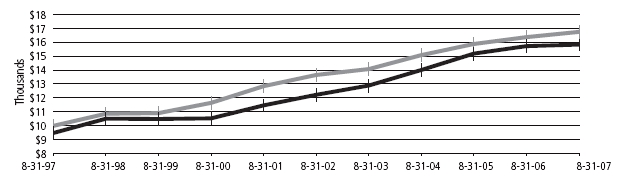

Performance of a $10,000 Investment

Average annual total returns from Aug. 31, 1997, through Aug. 31, 2007

| | Starting value (Aug. 31, 1997) | Ending value (Aug. 31, 2007) |

| Lehman Brothers 3-15 Year Municipal Bond Index | $10,000 | $16,381 |

| Delaware Tax-Free Minnesota Intermediate Fund — | | |

| | Class A Shares | $9,725 | $14,644 |

Chart assumes $10,000 invested on Aug. 31, 1997, and includes the effect of a 2.75% front-end sales charge and the reinvestment of all distributions.

Performance of other Fund classes will vary due to different charges and expenses.

The chart also assumes $10,000 invested in the Lehman Brothers Municipal Bond 3–15 Year Index as of Aug. 31, 1997. Lehman Brothers Municipal Bond 3–15 Year Index is an unmanaged index that generally tracks the performance of municipal bonds with maturities of 3 to 15 years. An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Past performance is not a guarantee of future results.

(continues) 9

Performance summary

Delaware Minnesota High-Yield Municipal Bond Fund

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The Delaware Minnesota High-Yield Municipal Bond Fund prospectus contains this and other important information about the investment company. Please request a prospectus through your financial advisor or by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Fund. Funds that invest in bonds may lose their value as interest rates rise, and an investor may lose principal.

Effective July 16, 2007, portfolio management responsibilities for the Fund changed. Current managers are listed in this report. Please see the prospectus, as supplemented, which contains important information regarding the investment manager for the Fund.

| Fund performance | | | | |

| Average annual total returns | | | | |

| Through Aug. 31, 2007 | 1 year | 5 years | 10 years | Lifetime |

| Class A (Est. June 4, 1996) | | | | |

| Excluding sales charge | +0.71% | +5.28% | +5.20% | +5.66% |

| Including sales charge | -3.86% | +4.31% | +4.72% | +5.23% |

| | | | | |

| Class B (Est. June 12, 1996) | | | | |

| Excluding sales charge | -0.13% | +4.47% | +4.55% | +5.31% |

| Including sales charge | -4.00% | +4.22% | +4.55% | +5.31% |

| | | | | |

| Class C (Est. June 7, 1996) | | | | |

| Excluding sales charge | -0.04% | +4.49% | +4.42% | +4.89% |

| Including sales charge | -1.01% | +4.49% | +4.42% | +4.89% |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

An expense limitation was in effect for all classes during the periods shown in the Fund performance chart above and in the Performance of a $10,000 investment chart on the next page. Performance would have been lower had the expense limitation not been in effect.

The Fund offers Class A, B, and C shares. Class A shares are sold with a maximum front-end sales charge of up to 4.50% and an annual distribution and service fee of up to 0.25% of average daily net assets.

Class B shares are sold with a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held. Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets. Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after eight years.

Effective at the close of business on May 31, 2007, no new or subsequent investments will be allowed in Class B shares of the Delaware Investments® Family of Funds, except through a reinvestment of dividends or capital gains or permitted exchanges. Please see the prospectus supplement for additional information.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

Please see the fee table in the prospectus and your financial professional for a more complete explanation of sales charges.

Management has contracted to reimburse expenses and/or waive its management fees through Dec. 31, 2007, as described in the most recent prospectus. The most recent prospectus designated Fund’s net expense ratios for Class A, B, and C shares as 0.89%, 1.64%, and 1.64%, respectively. Total operating expenses for Class A, B, and C shares were designated as 1.00%, 1.75%, and 1.75%, respectively.

The performance table above and the graph on the next page do not reflect the deduction of taxes the shareholder would pay on Fund distributions or redemptions of Fund shares.

10

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in a specific state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

High yielding noninvestment grade bonds involve higher risk than investment grade bonds. Adverse conditions may affect the issuer’s ability to pay interest and principal on these securities.

Fund basics

As of August 31, 2007

| Fund objective |

| The Fund seeks as high a level of current income exempt from federal income tax, and from the Minnesota state personal income tax, primarily through investment in medium- and lower-grade municipal obligations. |

| |

| Total Fund net assets |

| $143 million |

| |

| Number of holdings |

| 118 |

| Fund start date | | |

| June 4, 1996 | | |

| |

| | Nasdaq symbols | CUSIPs |

| Class A | DVMHX | 928928316 |

| Class B | DVMYX | 928928290 |

| Class C | DVMMX | 928928282 |

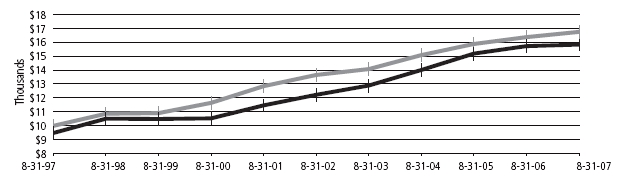

Performance of a $10,000 Investment

Average annual total returns from Aug. 31, 1997, through Aug. 31, 2007

| | Starting value (Aug. 31, 1997) | Ending value (Aug. 31, 2007) |

| Lehman Brothers Municipal Bond Index | $10,000 | $16,738 |

| Delaware Minnesota High-Yield Municipal Bond Fund — | | |

| | Class A Shares | $9,550 | $15,839 |

Chart assumes $10,000 invested on Aug. 31, 1997, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions.Performance of other Fund classes will vary due to different charges and expenses.

The chart also assumes $10,000 invested in the Lehman Brothers Municipal Bond Index as of Aug. 31, 1997. Lehman Brothers Municipal Bond Index is an unmanaged index that generally tracks the performance of municipal bonds. An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Past performance is not a guarantee of future results.

11

Disclosure of Fund expenses

For the period March 1, 2007 to August 31, 2007

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period March 1, 2007 to August 31, 2007.

Actual Expenses

The first section of the tables shown, “Actual Fund Return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the tables shown, “Hypothetical 5% Return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect. The expenses shown in each table assume reinvestment of all dividends and distributions.

*“Expenses Paid During Period” are equal to the Funds’ annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

Delaware Tax-Free Minnesota Fund

Expense Analysis of an Investment of $1,000

| | | | | | | | Expenses |

| | Beginning | | Ending | | | | Paid During |

| | Account | | Account | | Annualized | | Period |

| | Value | | Value | | Expense | | 3/1/07 to |

| | 3/1/07 | | 8/31/07 | | Ratio | | 8/31/07* |

| Actual Fund Return | | | | | | | |

| Class A | $1,000.00 | | $987.60 | | 1.22% | | $6.11 |

| Class B | 1,000.00 | | 983.90 | | 1.97% | | 9.85 |

| Class C | 1,000.00 | | 983.10 | | 1.97% | | 9.85 |

| Hypothetical 5% Return (5% return before expenses) | | |

| Class A | $1,000.00 | | $1,019.05 | | 1.22% | | $ 6.21 |

| Class B | 1,000.00 | | 1,015.27 | | 1.97% | | 10.01 |

| Class C | 1,000.00 | | 1,015.27 | | 1.97% | | 10.01 |

| | | | | | | | |

| The expenses in the table above includes interest and related expenses which include, but are not limited to interest expense, remarketing fees, liquidity fees, and trustees’ fees in connection with the Fund’s participation in inverse floater programs. See Notes 1 and 7 in “Notes to Financial Statements.” |

Delaware Tax-Free Minnesota Intermediate Fund

Expense Analysis of an Investment of $1,000

| | | | | | | | Expenses |

| | Beginning | | Ending | | | | Paid During |

| | Account | | Account | | Annualized | | Period |

| | Value | | Value | | Expense | | 3/1/07 to |

| | 3/1/07 | | 8/31/07 | | Ratio | | 8/31/07* |

| Actual Fund Return | | | | | | | |

| Class A | $1,000.00 | | $993.10 | | 0.75% | | $3.77 |

| Class B | 1,000.00 | | 988.90 | | 1.60% | | 8.02 |

| Class C | 1,000.00 | | 988.90 | | 1.60% | | 8.02 |

| Hypothetical 5% Return (5% return before expenses) | | |

| Class A | $1,000.00 | | $1,021.42 | | 0.75% | | $3.82 |

| Class B | 1,000.00 | | 1,017.14 | | 1.60% | | 8.13 |

| Class C | 1,000.00 | | 1,017.14 | | 1.60% | | 8.13 |

12

Delaware Minnesota High-Yield Municipal Bond Fund

Expense Analysis of an Investment of $1,000

| | | | | | | | Expenses |

| | Beginning | | Ending | | | | Paid During |

| | Account | | Account | | Annualized | | Period |

| | Value | | Value | | Expense | | 3/1/07 to |

| | 3/1/07 | | 8/31/07 | | Ratio | | 8/31/07* |

| Actual Fund Return | | | | | | | |

| Class A | $1,000.00 | | $973.90 | | 0.88% | | $4.38 |

| Class B | 1,000.00 | | 969.40 | | 1.63% | | 8.09 |

| Class C | 1,000.00 | | 970.30 | | 1.63% | | 8.09 |

| Hypothetical 5% Return (5% return before expenses) | | |

| Class A | $1,000.00 | | $1,020.77 | | 0.88% | | $4.48 |

| Class B | 1,000.00 | | 1,016.99 | | 1.63% | | 8.29 |

| Class C | 1,000.00 | | 1,016.99 | | 1.63% | | 8.29 |

13

Sector allocations and credit quality breakdowns

As of August 31, 2007

Sector designations may be different than the sector designations presented in other Fund materials.

Delaware Tax-Free Minnesota Fund

| | Percentage |

| Sector | of Net Assets |

| Municipal Bonds | 104.14% | |

| Corporate-Backed Revenue Bonds | 4.20% | |

| Education Revenue Bonds | 6.17% | |

| Electric Revenue Bonds | 8.13% | |

| Escrowed to Maturity Bonds | 6.15% | |

| Health Care Revenue Bonds | 26.38% | |

| Housing Revenue Bonds | 6.80% | |

| Lease Revenue Bonds | 3.37% | |

| Local General Obligation Bonds | 14.32% | |

| Pre-Refunded Bonds | 20.53% | |

| Special Tax Revenue Bonds | 1.78% | |

| State General Obligation Bonds | 4.08% | |

| Transportation Revenue Bonds | 0.58% | |

| Water & Sewer Revenue Bonds | 1.65% | |

| Short-Term Investments | 1.99% | |

| Money Market Instrument | 0.12% | |

| Variable Rate Demand Notes | 1.87% | |

| Total Value of Securities | 106.13% | |

| Liabilities Net of Receivables and Other Assets | (6.13% | ) |

| Total Net Assets | 100.00% | |

| | |

| Credit Quality Breakdown | | |

| (as a % of fixed income investments) | | |

| AAA | 49.33% | |

| AA | 13.21% | |

| A | 18.39% | |

| BBB | 10.70% | |

| BB | 1.08% | |

| Not Rated | 7.29% | |

| Total | 100.00% | |

Delaware Tax-Free Minnesota Intermediate Fund

| | Percentage |

| Sector | of Net Assets |

| Municipal Bonds | 96.30% | |

| Corporate-Backed Revenue Bonds | 3.27% | |

| Education Revenue Bonds | 7.41% | |

| Electric Revenue Bonds | 1.87% | |

| Escrowed to Maturity Bonds | 2.05% | |

| Health Care Revenue Bonds | 23.04% | |

| Housing Revenue Bonds | 8.25% | |

| Lease Revenue Bonds | 5.58% | |

| Local General Obligation Bonds | 14.64% | |

| Pre-Refunded Bonds | 15.39% | |

| Special Tax Revenue Bonds | 4.17% | |

| State General Obligation Bonds | 9.19% | |

| Transportation Revenue Bonds | 1.44% | |

| Short-Term Investments | 2.60% | |

| Money Market Instrument | 1.15% | |

| Variable Rate Demand Note | 1.45% | |

| Total Value of Securities | 98.90% | |

| Receivables and Other Assets Net of Liabilities | 1.10% | |

| Total Net Assets | 100.00% | |

| | |

| Credit Quality Breakdown | | |

| (as a % of fixed income investments) | | |

| AAA | 37.98% | |

| AA | 14.09% | |

| A | 18.83% | |

| BBB | 18.39% | |

| Not Rated | 10.71% | |

| Total | 100.00% | |

14

Delaware Minnesota High-Yield Municipal Bond Fund

| | Percentage |

| Sector | of Net Assets |

| Municipal Bonds | 96.85% | |

| Corporate-Backed Revenue Bonds | 3.59% | |

| Education Revenue Bonds | 7.79% | |

| Electric Revenue Bonds | 6.66% | |

| Health Care Revenue Bonds | 34.60% | |

| Housing Revenue Bonds | 14.63% | |

| Lease Revenue Bonds | 1.93% | |

| Local General Obligation Bonds | 10.66% | |

| Pre-Refunded Bonds | 8.84% | |

| Special Tax Revenue Bonds | 3.09% | |

| State General Obligation Bonds | 3.64% | |

| Transportation Revenue Bonds | 1.42% | |

| Short-Term Investments | 2.44% | |

| Total Value of Securities | 99.29% | |

| Receivables and Other Assets Net of Liabilities | 0.71% | |

| Total Net Assets | 100.00% | |

| | |

| Credit Quality Breakdown | | |

| (as a % of fixed income investments) | | |

| AAA | 18.61% | |

| AA | 14.94% | |

| A | 22.71% | |

| BBB | 16.13% | |

| BB | 1.22% | |

| Not Rated | 26.39% | |

| Total | 100.00% | |

15

Statements of net assets

Delaware Tax-Free Minnesota Fund

August 31, 2007

| | Principal | | |

| | Amount | | Value |

| Municipal Bonds – 104.14% | | | |

| Corporate-Backed Revenue Bonds – 4.20% | | |

| Cloquet Pollution Control Revenue | | | |

| Refunding (Potlatch Project) | | | |

| 5.90% 10/1/26 | $ 6,500,000 | | $ 6,531,460 |

| Laurentian Energy Authority I | | | |

| Cogeneration Revenue Series A | | | |

| 5.00% 12/1/21 | 8,000,000 | | 7,955,040 |

| Sartell Environmental Improvement | | | |

| Revenue Refunding | | | |

| (International Paper) Series A | | | |

| 5.20% 6/1/27 | 7,265,000 | | 7,031,866 |

| Seaway Port Authority of Duluth | | | |

| Industrial Development | | | |

| Dock & Wharf Revenues | | | |

| (Cargill Project) Series E | | | |

| 6.125% 11/1/14 | 4,500,000 | | 4,552,470 |

| | | | 26,070,836 |

| Education Revenue Bonds – 6.17% | | | |

| Minnesota State Colleges | | | |

| & Universities Revenue Fund | | | |

| Series A | | | |

| 5.00% 10/1/22 (FSA) | 5,135,000 | | 5,269,075 |

| 5.00% 10/1/29 (MBIA) | 5,665,000 | | 5,829,795 |

| Minnesota Higher Education | | | |

| Facilities Authority Revenue | | | |

| (Augsburg College) | | | |

| Series 6-C 5.00% 5/1/20 | 1,250,000 | | 1,242,388 |

| Series 6-J1 5.00% 5/1/36 | 2,225,000 | | 2,081,977 |

| Minnesota State Higher Education | | | |

| Facilities Authority Revenue | | | |

| (College of St. Benedict) | | | |

| Series 4-G 6.20% 3/1/16 | 1,000,000 | | 1,001,050 |

| (St. Catherine College) | | | |

| Series 5-N1 | | | |

| 5.00% 10/1/18 | 2,200,000 | | 2,233,418 |

| 5.25% 10/1/22 | 1,500,000 | | 1,525,335 |

| 5.375% 10/1/32 | 1,000,000 | | 1,007,680 |

| St. Cloud Housing & | | | |

| Redevelopment Authority | | | |

| Revenue (State University | | | |

| Foundation Project) | | | |

| 5.00% 5/1/23 | 2,000,000 | | 2,045,360 |

| University of Minnesota | | | |

| &15.50% 7/1/21 | 10,500,000 | | 11,667,284 |

| &25.75% 7/1/18 | 3,840,000 | | 4,366,099 |

| | | | 38,269,461 |

| Electric Revenue Bonds – 8.13% | | | |

| Chaska Electric Revenue Refunding | | | |

| (Generating Facilitates) Series A | | | |

| 5.00% 10/1/30 | 3,000,000 | | 3,018,690 |

| Minnesota State Municipal Power | | | |

| Agency Electric Revenue | | | |

| 5.00% 10/1/35 | 3,000,000 | | 3,012,750 |

| Series A 5.00% 10/1/34 | 6,250,000 | | 6,277,499 |

| Series A 5.125% 10/1/29 | 3,000,000 | | 3,051,540 |

| Northern Municipal Power Agency | | | |

| Electric System Revenue | | | |

| &3Series 32 5.25% 1/1/13 (FSA) | 9,170,000 | | 9,527,400 |

| ^Capital Appreciation Series A | | | |

| 5.85% 1/1/09 (AMBAC) | 3,815,000 | | 3,628,256 |

| Refunding Series B | | | |

| 4.75% 1/1/20 (AMBAC) | 2,500,000 | | 2,529,175 |

| Puerto Rico Electric Power | | | |

| Authority Revenue Refunding | | | |

| Series GG 4.75% 7/1/21 (FSA) | 1,000,000 | | 1,015,020 |

| Southern Minnesota Municipal | | | |

| Power Agency Supply | | | |

| System Revenue | | | |

| &45.25% 1/1/14 (AMBAC) | 4,000,000 | | 4,313,040 |

| &55.25% 1/1/15 (AMBAC) | 5,900,000 | | 6,389,730 |

| Series A | | | |

| ^Capital Appreciation | | | |

| 4.44%% 1/1/25 (MBIA) | 5,000,000 | | 2,182,550 |

| 5.25% 1/1/15 (AMBAC) | 3,000,000 | | 3,249,030 |

| Western Minnesota Municipal | | | |

| Power Agency Revenue | | | |

| 5.00% 1/1/36 (FSA) | 2,250,000 | | 2,299,523 |

| | | | 50,494,203 |

| Escrowed to Maturity Bonds – 6.15% | | | |

| Dakota/Washington Counties | | | |

| Housing & Redevelopment | | | |

| Authority Single Family | | | |

| Residential Mortgage Revenue | | | |

| 8.15% 9/1/16 | | | |

| (MBIA) (GNMA) (AMT) | 405,000 | | 524,151 |

| (Anoka) 8.45% 9/1/19 | | | |

| (GNMA) (AMT) | 9,000,000 | | 12,351,870 |

| (Bloomington Mortgage) | | | |

| Refunding Series B | | | |

| 8.375% 9/1/21 (GNMA) | | | |

| (FHA) (VA) (AMT) | 14,115,000 | | 19,721,759 |

| Southern Minnesota Municipal | | | |

| Power Agency Supply System | | | |

| Revenue Refunding Series B | | | |

| 5.50% 1/1/15 (AMBAC) | 990,000 | | 1,044,391 |

| University of Minnesota Series A | | | |

| 5.50% 7/1/21 | 2,000,000 | | 2,222,300 |

| Western Minnesota Municipal | | | |

| Power Agency Supply Revenue | | | |

| Series A | | | |

| 6.60% 1/1/10 | 1,275,000 | | 1,318,669 |

| 9.75% 1/1/16 (MBIA) | 715,000 | | 988,159 |

| | | | 38,171,299 |

| Health Care Revenue Bonds – 26.38% | | | |

| Aitkin Health Care Facilities | | | |

| Revenue Refunding | | | |

| (Riverwood Health Care | | | |

| Center) 5.60% 2/1/32 | 1,500,000 | | 1,422,600 |

16

| | Principal | | |

| | Amount | | Value |

| Municipal Bonds (continued) | | | |

| Health Care Revenue Bonds (continued) | | | |

| Apple Valley Economic | | | |

| Development Authority Health | | | |

| Care Revenue (Augustana | | | |

| Home St. Paul Project) Series A | | | |

| 6.00% 1/1/40 | $ 2,700,000 | | $ 2,678,022 |

| Bemidji Health Care Facilities First | | | |

| Mortgage Revenue (North | | | |

| Country Health Services) | | | |

| 5.00% 9/1/24 (RADIAN) | 740,000 | | 719,606 |

| Bloomington Housing & | | | |

| Redevelopment Authority | | | |

| Revenue (Senior Summerhouse | | | |

| Bloomington Project-PHM) | | | |

| 6.125% 5/1/35 | 3,420,000 | | 3,440,281 |

| Breckenridge Catholic | | | |

| Health Initiatives Series A | | | |

| 5.00% 5/1/30 | 2,500,000 | | 2,511,775 |

| Buffalo Health Care Revenue | | | |

| Refunding (Central Minnesota | | | |

| Senior Housing Project) | | | |

| Series A 5.50% 9/1/33 | 1,270,000 | | 1,182,980 |

| Duluth Economic Development | | | |

| Authority Health Care Facilities | | | |

| Revenue Benedictine Health | | | |

| System (St. Mary’s Hospital) | | | |

| 5.25% 2/15/28 | 8,500,000 | | 8,555,250 |

| 5.25% 2/15/33 | 10,000,000 | | 10,026,899 |

| 5.50% 2/15/23 | 1,000,000 | | 1,029,490 |

| Maple Grove Health Care Facilities | | | |

| Revenue (North Memorial | | | |

| Health Care) | | | |

| 5.00% 9/1/29 | 1,000,000 | | 974,610 |

| 5.00% 9/1/35 | 5,850,000 | | 5,616,000 |

| Maple Grove Health Care System | | | |

| Revenue (Maple Grove | | | |

| Hospital) 5.25% 5/1/37 | 4,000,000 | | 4,014,760 |

| Minneapolis Health Care | | | |

| Facilities Revenue (Jones-Harrison | | | |

| Residence Project) | | | |

| 5.60% 10/1/30 | 1,550,000 | | 1,481,351 |

| Minneapolis Health Care | | | |

| System Revenue | | | |

| (Allina Health Systems) | | | |

| Series A 5.75% 11/15/32 | 17,300,000 | | 17,826,784 |

| (Fairview Health Services) | | | |

| Series D | | | |

| 5.00% 11/15/30 (AMBAC) | 2,500,000 | | 2,530,875 |

| 5.00% 11/15/34 (AMBAC) | 10,750,000 | | 10,839,224 |

| Minneapolis/St. Paul Housing | | | |

| & Redevelopment Authority | | | |

| Health Care System Revenue | | | |

| (Allina Health System) | | | |

| 5.00% 11/15/13 (AMBAC) | 6,490,000 | | 6,496,295 |

| (Health Partners Obligation | | | |

| Group Project) | 650,000 | | 660,537 |

| 5.625% 12/1/22 | | | |

| 5.875% 12/1/29 | 1,000,000 | | 1,022,160 |

| Minnesota Agricultural | | | |

| & Economic Development | | | |

| Board Revenue | | | |

| (Benedictine Health Systems) | | | |

| 5.75% 2/1/29 | 1,895,000 | | 1,861,705 |

| (Fairview Health Care System) | | | |

| Series A | | | |

| 5.75% 11/15/26 (MBIA) | 180,000 | | 184,162 |

| 6.375% 11/15/29 | 15,000 | | 15,756 |

| Northfield Hospital Revenue | | | |

| 5.375% 11/1/26 | 3,785,000 | | 3,691,889 |

| Northfield Housing | | | |

| & Redevelopment Authority | | | |

| Revenue Refunding (Northfield | | | |

| Retirement Project) | | | |

| Series A 5.375% 12/1/36 | 1,000,000 | | 914,220 |

| Prior Lake Senior Housing Revenue | | | |

| (Shepherds Path Senior | | | |

| Housing) Series B | | | |

| 5.70% 8/1/36 | 2,000,000 | | 1,903,000 |

| 5.75% 8/1/41 | 1,000,000 | | 960,250 |

| Rochester Health Care | | | |

| Facilities Revenue | | | |

| (Mayo Clinic) 5.00% 11/15/36 | 7,000,000 | | 7,051,100 |

| (Mayo Foundation) Series B | | | |

| 5.50% 11/15/27 | 700,000 | | 713,594 |

| &6Series A 5.50% 11/15/27 | 4,200,000 | | 4,281,564 |

| &7Series B 5.50% 11/15/27 | 16,750,000 | | 17,075,284 |

| Shakopee Health Care Facilities | | | |

| Revenue (St. Francis Regional | | | |

| Medical Center) | | | |

| 5.10% 9/1/25 | 2,000,000 | | 1,925,900 |

| 5.25% 9/1/34 | 7,000,000 | | 6,674,990 |

| Sherburne County Health Care | | | |

| Facilities Revenue (Guardian | | | |

| Angels Health Services) | | | |

| 5.55% 10/1/36 | 1,500,000 | | 1,404,255 |

| St. Louis Park Health Care Facilities | | | |

| Revenue (Park Nicollet Health | | | |

| Services) Series B | | | |

| 5.25% 7/1/30 | 9,420,000 | | 9,491,874 |

| 5.50% 7/1/25 | 2,000,000 | | 2,061,220 |

| St. Paul Housing & Redevelopment | | | |

| Authority Health Care Facilities | | | |

| Revenue (Health Partners | | | |

| Obligation Group Project) | | | |

| 5.25% 5/15/36 | 8,000,000 | | 7,673,280 |

| St. Paul Housing & Redevelopment | | | |

| Authority Hospital Revenue | | | |

| (Health East Project) | | | |

| 6.00% 11/15/35 | 4,340,000 | | 4,442,511 |

| Series A 5.70% 11/1/15 | 1,300,000 | | 1,318,317 |

(continues) 17

Statements of net assets

Delaware Tax-Free Minnesota Fund

| | Principal | | |

| | Amount | | Value |

| Municipal Bonds (continued) | | | |

| Health Care Revenue Bonds (continued) | | | |

| St. Paul Housing & Redevelopment | | | |

| Authority Multifamily Housing | | | |

| Revenue Refunding (Marion | | | |

| Center Project) Series A | | | |

| 5.30% 11/1/30 | $ 500,000 | | $ 456,160 |

| 5.375% 5/1/43 | 500,000 | | 447,170 |

| Stillwater Health Care Revenue | | | |

| (Health System Obligation | | | |

| Group) 5.00% 6/1/35 | 1,000,000 | | 957,270 |

| Washington County Housing | | | |

| & Redevelopment Authority | | | |

| Revenue (Health East Project) | | | |

| 5.50% 11/15/27 | 1,000,000 | | 987,310 |

| Willmar (Rice Memorial | | | |

| Hospital Project) | | | |

| 5.00% 2/1/22 (FSA) | 1,000,000 | | 1,036,600 |

| 5.00% 2/1/25 (FSA) | 1,000,000 | | 1,026,420 |

| Woodbury Economic Development | | | |

| Authority Housing Revenue | | | |

| (Senior Summerhouse | | | |

| Woodbury Project) Series B | | | |

| 5.75% 6/1/41 | 2,250,000 | | 2,160,923 |

| | | | 163,746,223 |

| Housing Revenue Bonds – 6.80% | | | |

| Brooklyn Center Multifamily | | | |

| Housing Revenue Refunding | | | |

| (Shingle Creek) 5.40% 5/20/43 | | | |

| (GNMA) (AMT) | 1,000,000 | | 1,001,940 |

| Dakota County Housing | | | |

| & Redevelopment Authority | | | |

| Single Family Mortgage | | | |

| Revenue 5.85% 10/1/30 | | | |

| (GNMA) (FNMA) (AMT) | 201,000 | | 203,004 |

| Hopkins Multifamily Housing | | | |

| Revenue (Hopkins Renaissance | | | |

| Project) (HUD Section 8) | | | |

| 6.375% 4/1/20 | 1,000,000 | | 1,021,720 |

| @Hutchinson Multifamily | | | |

| Housing Revenue (Evergreen | | | |

| Apartments Project) (HUD | | | |

| Section 8) 5.75% 11/1/28 | 845,000 | | 802,809 |

| Minneapolis Multifamily | | | |

| Housing Revenue | | | |

| (Bottineau Commons Project) | | | |

| 5.45% 4/20/43 (GNMA) (AMT) | 1,500,000 | | 1,523,805 |

| (Grant Street Apartments | | | |

| Project) Series A | | | |

| 7.25% 11/1/29 | 750,000 | | 781,350 |

| (Seward Towers Project) | | | |

| 5.00% 5/20/36 (GNMA) | 8,000,000 | | 8,047,761 |

| (Sumner Field) Series A | | | |

| 5.50% 11/20/26 (GNMA) (AMT) | 965,000 | | 979,099 |

| (Trinity Apartments) | | | |

| (HUD Section 8) Series A | | | |

| 6.75% 5/1/21 | 1,715,000 | | 1,784,440 |

| Minnesota Housing Finance | | | |

| Agency Rental Housing | | | |

| Revenue Series C-2 | | | |

| 5.95% 2/1/15 (AMBAC) | 1,642,000 | | 1,643,970 |

| Minnesota State Housing Finance | | | |

| Agency (Residential Housing) | | | |

| Series A 5.30% 7/1/19 | 520,000 | | 534,279 |

| Series B 5.35% 1/1/33 (AMT) | 2,955,000 | | 2,967,470 |

| •Series D 4.80% 7/1/38 (AMT) | 2,500,000 | | 2,329,975 |

| Series I | | | |

| 4.85% 7/1/38 (AMT) | 2,000,000 | | 1,875,700 |

| 5.15% 7/1/38(AMT) | 5,550,000 | | 5,452,764 |

| Series M 4.875% 7/1/37 (AMT) | 4,500,000 | | 4,237,065 |

| (Single Family Mortgage) | | | |

| Series J 5.90% 7/1/28 (AMT) | 460,000 | | 466,196 |

| @Park Rapids Multifamily Revenue | | | |

| (The Court Apartments | | | |

| Project-Section 8) 6.30% 2/1/20 | 2,770,000 | | 2,770,554 |

| St. Cloud Housing & | | | |

| Redevelopment Authority | | | |

| Multifamily Housing Revenue | | | |

| (Sterling Heights Apartments | | | |

| Project) 7.55% 4/1/39 (AMT) | 1,000,000 | | 1,024,040 |

| St. Louis Park Residential Single | | | |

| Family Mortgage Revenue | | | |

| Series A 7.25% 4/20/23 | | | |

| (GNMA) | 13,000 | | 13,172 |

| Washington County Housing | | | |

| & Redevelopment Authority | | | |

| Governmental Revenue (Briar | | | |

| Pond) Series C 7.25% 8/20/34 | 945,000 | | 896,418 |

| White Bear Lake Multifamily | | | |

| Revenue Refunding | | | |

| (Lake Square) Series A | | | |

| 5.875% 2/1/15 (FHA) | 955,000 | | 973,947 |

| Willmar Housing & Redevelopment | | | |

| Authority Multifamily Revenue | | | |

| (Highland Apartments) (HUD | | | |

| Section 8) 5.85% 6/1/19 | 885,000 | | 876,398 |

| | | | 42,207,876 |

| Lease Revenue Bonds – 3.37% | | | |

| Minneapolis Special School | | | |

| District #001 Series A | | | |

| 5.00% 2/1/18 (FSA) | 1,545,000 | | 1,602,814 |

| 5.00% 2/1/19 (FSA) | 1,535,000 | | 1,592,440 |

| 5.00% 2/1/20 (FSA) | 1,690,000 | | 1,753,240 |

| Puerto Rico Public Buildings | | | |

| Authority Revenue (Guaranteed | | | |

| Government Facilities) Series D | | | |

| 5.25% 7/1/36 | 1,070,000 | | 1,084,723 |

| St. Paul Port Authority Lease | | | |

| Revenue (Cedar Street Office | | | |

| Building Project) | | | |

| 5.00% 12/1/22 | 2,500,000 | | 2,567,100 |

| 5.25% 12/1/27 | 3,840,000 | | 3,948,633 |

18

| | Principal | | |

| | Amount | | Value |

| Municipal Bonds (continued) | | | |

| Lease Revenue Bonds (continued) | | | |

| St. Paul Port Authority Lease | | | |

| Revenue (Cedar Street Office | | | |

| Building Project) (continued) | | | |

| Series 3-12 5.125% 12/1/27 | $3,000,000 | | $ 3,070,920 |

| (Robert Street Office Building | | | |

| Project) Series 3-11 | | | |

| 4.75% 12/1/23 | 2,000,000 | | 2,016,540 |

| 5.00% 12/1/27 | 2,500,000 | | 2,557,025 |

| Series 9 5.25% 12/1/27 | 725,000 | | 748,244 |

| | | | 20,941,679 |

| Local General Obligation Bonds – 14.32% | | |

| Cambridge Independent School | | | |

| District #911 Series A | | | |

| 4.75% 2/1/30 (MBIA) | 1,035,000 | | 1,032,837 |

| Dakota County Community | | | |

| Development Agency | | | |

| (Senior Housing Facilities | | | |

| 5.00% 1/1/21 | 1,275,000 | | 1,306,072 |

| Farmington Independent | | | |

| School District #192 Series B | | | |

| 5.00% 2/1/27 (FSA) | 10,705,000 | | 11,001,528 |

| Hennepin County Regional | | | |

| Railroad Authority | | | |

| 5.00% 12/1/31 | 4,030,000 | | 4,058,492 |

| Lakeville Independent School | | | |

| District #194 Series A | | | |

| 4.75% 2/1/22 (FSA) | 7,850,000 | | 7,982,743 |

| ^Mahtomedi Independent | | | |

| School District #832 Capital | | | |

| Appreciation Series B | | | |

| 5.90% 2/1/14 (MBIA) | 1,540,000 | | 1,191,775 |

| Metropolitan Council Waste | | | |

| Water Treatment Series B | | | |

| 5.00% 12/1/21 | 1,200,000 | | 1,250,400 |

| Minneapolis Library | | | |

| 5.00% 12/1/25 | 1,500,000 | | 1,532,505 |

| Minneapolis Tax Increment | | | |

| Revenue Refunding | | | |

| (St. Anthony Falls Project) | | | |

| 5.75% 2/1/27 | 1,000,000 | | 1,000,210 |

| Mounds View Independent | | | |

| School District #621 Series A | | | |

| 5.00% 2/1/20 (MBIA) | 2,970,000 | | 3,070,089 |

| New Brighton Tax Increment | | | |

| Series A | | | |

| 5.00% 2/1/26 (MBIA) | 1,185,000 | | 1,226,807 |

| 5.00% 2/1/27 (MBIA) | 1,000,000 | | 1,033,730 |

| 5.00% 2/1/28 (MBIA) | 1,000,000 | | 1,033,730 |

| Osseo Independent School | | | |

| District #279 Series A | | | |

| 5.00% 2/1/21 (FSA) | 3,570,000 | | 3,693,665 |

| Prior Lake Independent School | | | |

| District #719 (School Building) | | | |

| Series B 5.00% 2/1/19 (FSA) | 3,145,000 | | 3,291,557 |

| Ramsey County State Aid Series C | | | |

| 5.00% 2/1/28 | 1,060,000 | | 1,087,496 |

| Robbinsdale Independent School | | | |

| District #281 | | | |

| 5.00% 2/1/21 (FSA) | 1,310,000 | | 1,355,378 |

| Rockford Independent School | | | |

| District #883 | | | |

| &8Series A 5.625% 2/1/23 (FSA) | 7,020,000 | | 7,310,453 |

| &9Series B 5.600% 2/1/21 (FSA) | 3,210,000 | | 3,340,968 |

| ^Rosemount Independent | | | |

| School District #196 Capital | | | |

| Appreciation Series B | | | |

| 5.80% 4/1/09 (FSA) | 1,860,000 | | 1,752,380 |

| 5.85% 4/1/10 (FSA) | 2,240,000 | | 2,031,904 |

| 5.931% 4/1/11 (FSA) | 2,600,000 | | 2,268,708 |

| 5.961% 4/1/12 (FSA) | 1,850,000 | | 1,551,947 |

| 6.008% 4/1/13 (FSA) | 1,915,000 | | 1,538,875 |

| ^Sartell Independent School | | | |

| District #748 Capital | | | |

| Appreciation Refunding | | | |

| Series B | | | |

| 5.976% 2/1/13 (MBIA) | 540,000 | | 435,623 |

| 6.10% 2/1/15 (MBIA) | 1,075,000 | | 793,501 |

| 6.15% 2/1/16 (MBIA) | 1,750,000 | | 1,233,715 |

| South Washington County | | | |

| Independent School District #833 | | | |

| &10Series 34-A | | | |

| 5.60% 2/1/20 (MBIA) | 6,880,000 | | 7,160,704 |

| &11Series 34-B | | | |

| 5.60% 2/1/21 (MBIA) | 7,290,000 | | 7,587,432 |

| St. Peter’s Hospital Series A | | | |

| 5.00% 9/1/24 (MBIA) | 1,905,000 | | 1,931,460 |

| Todd Morrison Cass & Wadena | | | |

| Counties United Hospital | | | |

| District (Health Care | | | |

| Facilities-Lakewood) | 2,000,000 | | 1,935,500 |

| 5.00% 12/1/21 | | | |

| 5.00% 12/1/34 | 1,000,000 | | 910,720 |

| 5.125% 12/1/24 | 1,000,000 | | 964,410 |

| | | | 88,897,314 |

| §Pre-Refunded Bonds – 20.53% | | | |

| Big Lake Independent School | | | |

| District #727 Series A | | | |

| 5.00% 2/1/17-10 (FSA) | 1,040,000 | | 1,068,163 |

| 5.00% 2/1/20-10 (FSA) | 1,000,000 | | 1,027,080 |

| Bloomington Independent | | | |

| School District #271 Series B | | | |

| 5.00% 2/1/17-10 | 5,300,000 | | 5,443,524 |

| Centennial Independent School | | | |

| District #012 Series A | | | |

| 5.00% 2/1/18-12 (FSA) | 1,270,000 | | 1,331,125 |

| Chaska Electric Revenue Series A | | | |

| 6.00% 10/1/25-10 | 1,000,000 | | 1,067,160 |

(continues) 19

Statements of net assets

Delaware Tax-Free Minnesota Fund

| | Principal | | |

| | Amount | | Value |

| Municipal Bonds (continued) | | | |

| §Pre-Refunded Bonds (continued) | | | |

| Dakota County Capital | | | |

| Improvement Series A | | | |

| 4.75% 2/1/26-11 | $ 1,000,000 | | $ 1,007,640 |

| ^Farmington Independent School | | | |

| District #192 Series B | | | |

| Capital Appreciation | | | |

| 5.34% 2/1/21-12 (FSA) | 1,500,000 | | 751,440 |

| Capital Appreciation | | | |

| 5.424% 2/1/20-12 (FSA) | 1,650,000 | | 874,088 |

| Hopkins Housing | | | |

| & Redevelopment Authority | | | |

| (Public Works & Fire Station) | | | |

| Series A 5.00% 2/1/23-13 | | | |

| (MBIA) | 1,210,000 | | 1,281,354 |

| ^Lakeville Independent School | | | |

| District #194 Capital | | | |

| Appreciation Series B | | | |

| 5.45 % 2/1/19-10 (FSA) | 8,000,000 | | 4,454,240 |

| Little Canada Multifamily | | | |

| Housing Revenue (Alternative | | | |

| Development-Montreal Courts | | | |

| Apartments Project) Series A | 1,150,000 | | 1,154,175 |

| 6.10% 12/1/17-07 | | | |

| 6.25% 12/1/27-07 | 2,900,000 | | 2,916,037 |

| Marshall Medical Center Gross | | | |

| Revenue (Weiner Memorial | | | |

| Medical Center Project) | | | |

| 6.00% 11/1/28-09 | 1,000,000 | | 1,039,890 |

| Minneapolis Community | | | |

| Development Agency Series G-3 | �� | | |

| 5.45% 12/1/31-11 | 2,000,000 | | 2,135,960 |

| Minneapolis Health Care | | | |

| System Revenue (Fairview | | | |

| Health Services) Series A | | | |

| 5.625% 5/15/32-12 | 16,925,000 | | 18,450,111 |

| Minneapolis Tax Increment | | | |

| Revenue Series E | | | |

| 5.00% 3/1/13-09 | 6,265,000 | | 6,387,168 |

| Minneapolis/St. Paul Metropolitan | | | |

| Airports Commission Revenue | | | |

| Series A | | | |

| 5.00% 1/1/22-08 (AMBAC) | 3,440,000 | | 3,488,538 |

| 5.125% 1/1/25-09 (FGIC) | 100,000 | | 102,831 |

| 5.25% 1/1/32-11 (FGIC) | 5,000,000 | | 5,244,700 |

| Series C | | | |

| 5.125% 1/1/20-11 (FGIC) | 2,000,000 | | 2,090,100 |

| 5.25% 1/1/32-11 (FGIC) | 8,845,000 | | 9,277,873 |

| 5.50% 1/1/17-11 (FGIC) | 2,500,000 | | 2,641,775 |

| Minnesota Agricultural | | | |

| & Economic Development Board | | | |

| Revenue (Fairview Health Care | | | |

| System) Series A | 6,570,000 | | 6,726,300 |

| 5.75% 11/15/26-07 (MBIA) | | | |

| 6.375% 11/15/29-10 | 485,000 | | 528,078 |

| Minnesota Public Facilities | | | |

| Authority Water Pollution | | | |

| Control Revenue | | | |

| Series A 5.00% 3/1/20-10 | 3,000,000 | | 3,094,110 |

| Series B 4.75% 3/1/19-09 | 2,000,000 | | 2,031,180 |

| Morris Independent School District | | | |

| #769 Building 5.00% 2/1/24-13 | | | |

| (MBIA) | 4,875,000 | | 5,135,618 |

| Mounds View Independent | | | |

| School District #621 Series A | | | |

| 5.375% 2/1/24-11 (FGIC) | 6,170,000 | | 6,477,389 |

| Puerto Rico Public Buildings | | | |

| Authority Guaranteed | | | |

| Government Facilities Revenue | | | |

| Series D 5.25% 7/1/36-12 | 2,930,000 | | 3,116,495 |

| Rochester Electric Utilities Revenue | | | |

| 5.25% 12/1/30-10 | 4,915,000 | | 5,149,839 |

| Rochester Multifamily Housing | | | |

| Revenue (Wedum Shorewood | | | |

| Campus Project) | | | |

| 6.60% 6/1/36-09 | 3,890,000 | | 4,137,210 |

| Shakopee Public Utilities | | | |

| Commission Revenue | | | |

| 5.125% 2/1/26-09 (MBIA) | 2,850,000 | | 2,901,044 |

| Southern Minnesota Municipal | | | |

| Power Agency Supply Revenue | | | |

| Series A | | | |

| 5.75% 1/1/18-13 | 3,790,000 | | 4,141,257 |

| 5.75% 1/1/18-13 (AMBAC) | 670,000 | | 732,096 |

| 5.75% 1/1/18-13 (MBIA) | 1,000,000 | | 1,092,680 |

| ^Sauk Rapids Independent School | | | |

| District #047 Series B | | | |

| 5.983% 2/1/15-11 (FSA) | 2,700,000 | | 1,865,457 |

| 6.083% 2/1/17-11 (FSA) | 2,245,000 | | 1,372,773 |

| St. Michael Independent School | | | |

| District #885 | | | |

| 5.00% 2/1/20-12 (FSA) | 1,970,000 | | 2,064,816 |

| 5.00% 2/1/27-12 (FSA) | 3,435,000 | | 3,600,327 |

| | | | 127,401,641 |

| Special Tax Revenue Bonds – 1.78% | | | |

| ^Minneapolis Community | | | |

| Development Agency Tax | | | |

| Increment Capital Appreciation | | | |

| Revenue 6.674% 9/1/09 | | | |

| (MBIA) | 5,750,000 | | 5,333,010 |

| Puerto Rico Commonwealth | | | |

| Infrastructure Financing | | | |

| Authority Special Tax Revenue | | | |

| Series B 5.00% 7/1/46 | 4,000,000 | | 3,936,360 |

| Virgin Islands Public Finance | | | |

| Authority Revenue (Senior Lien | | | |

| Matching Fund Loan) Series A | | | |

| 5.25% 10/1/22 | 1,785,000 | | 1,812,328 |

| | | | 11,081,698 |

20

| | Principal | | | |

| | Amount | | Value | |

| Municipal Bonds (continued) | | | | |

| State General Obligation Bonds – 4.08% | | | |

| Minnesota State | | | | |

| 5.00% 11/1/20 (FSA) | $13,675,000 | | $ 14,128,600 | |

| 5.00% 8/1/21 | 2,400,000 | | 2,474,952 | |

| Puerto Rico Commonwealth Public | | | | |

| Improvement | | | | |

| Series A 5.00% 7/1/34 | 4,500,000 | | 4,476,645 | |

| Series B 5.00% 7/1/35 | 1,500,000 | | 1,489,860 | |

| Puerto Rico Commonwealth | | | | |

| Public Improvement Refunding | | | | |

| Series A 5.50% 7/1/19 (MBIA) | 1,500,000 | | 1,674,345 | |

| Puerto Rico Government | | | | |

| Development Bank Senior | | | | |

| Notes Series B 5.00% 12/1/14 | 1,000,000 | | 1,051,860 | |

| | | | 25,296,262 | |

| Transportation Revenue Bonds – 0.58% | | | | |

| Minneapolis/St. Paul Metropolitan | | | | |

| Airports Commission Revenue | | | | |

| Series A | | | | |

| 5.00% 1/1/22 (MBIA) | 2,000,000 | | 2,044,440 | |

| 5.25% 1/1/16 (MBIA) | 1,460,000 | | 1,537,833 | |

| | | | 3,582,273 | |

| Water & Sewer Revenue Bonds – 1.65% | | | |

| &12Minnesota Public Facilities | | | | |

| Authority II Water Pollution | | | | |

| Control Revenue 5.25% 3/1/18 | 10,000,000 | | 10,228,300 | |

| | | | 10,228,300 | |

| Total Municipal Bonds | | | | |

| (cost $630,269,539) | | | 646,389,065 | |

| | |

| | Number of | | | |

| | Shares | | | |

| Short-Term Investments – 1.99% | | | | |

| Money Market Instrument – 0.12% | | | | |

| Federated Minnesota Municipal | | | | |

| Cash Trust | 767,066 | | 767,066 | |

| | | | 767,066 | |

| | |

| | Principal | | | |

| | Amount | | | |

| •Variable Rate Demand Notes– 1.87% | | | | |

| Midwest Consortium of Municipal | | | | |

| Utilities Revenue (Assistant | | | | |

| Financing Project) Series B | | | | |

| 3.95% 10/1/35 | $1,715,000 | | 1,715,000 | |

| St. Paul Housing & Redevelopment | | | | |

| Authority Revenue | | | | |

| (Pur-Cretin-Derham | | | | |

| Hall Project) 3.97% 2/1/26 | 300,000 | | 300,000 | |

| University of Minnesota Weekly | | | | |

| Series A 4.05% 1/1/34 | 3,515,000 | | 3,515,000 | |

| University of Minnesota Series C | | | | |

| 4.05% 12/1/36 | 6,050,000 | | 6,050,000 | |

| | | | 11,580,000 | |

| Total Short-Term Investments | | | | |

| (cost $12,347,066) | | | 12,347,066 | |

| Total Value of Securities – 106.13% | | |

| (cost $642,616,605) | 658,736,131 | |

| Liabilities Net of Receivables and | | |

| Other Assets – (6.13%)* | (38,037,973 | ) |

| Net Assets Applicable to 51,010,649 | | |

| Shares Outstanding – 100.00% | $620,698,158 | |

| | |

| Net Asset Value – Delaware Tax-Free Minnesota Fund | | |

| Class A ($578,194,465 / 47,524,800 Shares) | | $12.17 | |

| Net Asset Value – Delaware Tax-Free Minnesota Fund | | |

| Class B ($15,674,188 / 1,287,318 Shares) | | $12.18 | |

| Net Asset Value – Delaware Tax-Free Minnesota Fund | | |

| Class C ($26,829,505 / 2,198,531 Shares) | | $12.20 | |

| | |