Delaware Minnesota High-Yield Municipal Bond Fund Class A shares returned +3.63% at net asset value and -1.02% at maximum offer price (both returns include distributions reinvested) for the fiscal year ended Aug. 31, 2009. For the same period, the Fund’s benchmark, the Barclays Capital Municipal Bond Index, returned +5.67%. For complete annualized performance for Delaware Minnesota High-Yield Municipal Bond Fund, please see the table on page 13.

The 12-month period included one of the most difficult economic and investment climates the portfolio management team has ever seen, followed by a considerable recovery within the municipal bond market and across fixed income markets more broadly.

The financial markets’ troubles date back to 2007 and turmoil continued into the start of the reporting period in September 2008:

Several weeks into the period, the financial markets received a jolt with the bankruptcy of storied Wall Street investment bank Lehman Brothers. This event, followed soon after by the near bankruptcy (and ultimate federal bailout) of insurance giant American International Group (AIG), sent the markets

into a near panic. Stock and bond prices virtually collapsed, while credit became even less available. On the whole, businesses began to cut their capital spending, and large-scale job losses ensued.

By early 2009, both stock and bond valuations had fallen extremely from their historic highs, reflecting investors’ fears of an economic depression. Though the “worst-case scenarios” that many may have envisioned did not materialize, the U.S. economy did experience its most severe downturn in decades. Gross domestic product (GDP) — a widely used measure of economic activity — fell by 5.4% and 6.4% in the fourth quarter of 2008 and the first quarter of 2009, respectively. It was the country’s worst two-quarter economic performance in more than 50 years.

Within this environment, the Federal Reserve and federal government took a series of steps to loosen tight credit markets and avert a worst-case scenario for the economy. The Fed significantly expanded its balance sheet during the fiscal year. Notably, it employed one of the lesser-used tools that it has at its disposal, in purchasing hundreds of billions of dollars’ worth of longer-term U.S. Treasury debt as well as agency mortgage-backed securities. In December 2008, the Federal Open Market Committee (FOMC) cut the target federal funds rate to a range of zero to 0.25% — an all-time low. For its part, the federal government passed the Troubled Asset Relief Program (TARP), a $700 billion package designed to shore up financial institutions, in October 2008. Several months later, the Obama administration followed up with the American Recovery and Reinvestment Act of 2009, a nearly $800 billion economic stimulus package. (Source: Bloomberg.)

As the period came to a close, the economy was, if not improving, declining at a far slower pace, and, based on our research, many analysts were anticipating a near-term end to the long recession. During the second quarter of 2009, GDP fell by an estimated 1%. This figure was still weak, but it was the best economic performance seen in a year. (Source: Bloomberg.)

Minnesota economic environment

After five months of debates, Governor Pawlenty and the state Legislature failed to reach a final deal that left the state with a $2.675 billion shortfall for the fiscal year that runs from July 1, 2009, through June 30, 2010. The governor exercised an executive authority, called unallotment, to cut already authorized spending to balance the state’s budget when the Legislature is not in session. He plans to use this emergency power to resolve the deficit by employing a massive $1.77 billion accounting shift and slashing more than $900 million from state spending, including cuts to local governments, higher education, and health and human services. All of the allotment adjustments have been implemented except for reductions to fiscal 2011 local government aids, which are expected to be completed by mid-January 2010. (Source: Minnesota Management & Budget.)

The municipal bond market

In our view, the most notable trend within the municipal bond market during the period was the widening performance gap between higher-rated and lower-rated bonds. Demand remained strong for securities with the high (AA or better) credit ratings, for example, but was weak for those in all other rating categories, particularly securities rated BBB or below. As a result, lower-rated bonds

3

Portfolio management review

Delaware Minnesota Municipal Bond Funds

dramatically underperformed their higher-grade counterparts — especially in the first few months of the period when investor confidence was lowest.

This bifurcation, or divergence of performance, within the municipal market largely resulted from the continued financial troubles for monoline municipal bond insurers. For many years, these companies — which insure municipal bond principal and interest payments — received AAA ratings from the major credit rating agencies. As a result, many investors were willing to buy lower-quality bonds as long as they carried this AAA-rated insurance guarantee. Beginning in 2007, however, as credit conditions worsened, many of these monoline insurance companies saw their credit ratings cut dramatically.

Severe capitalization constraints within the investment banking community compounded the municipal markets’ problems during approximately the first half of the fiscal period. Once investment banks’ capital positions were compromised, most banks were less willing to provide liquidity to help bolster the municipal market.

With municipal bond yields high and their prices at historic lows (bond yields and prices move in opposite directions), investors slowly began to return to the tax-exempt bond market beginning in mid-December 2008. At first, they favored highly rated bonds generally associated with minimal credit risk. By the year’s second calendar quarter, as optimism about the economy grew, municipal bond issuance began to grow, and for the first time in months we began to see increased new supply that stemmed from lower-rated, higher-yielding deals.

In this environment, lower-rated bonds generally enjoyed more-favorable performance, and even rallied in the summer months. Credit spreads — which can be interpreted as the additional income paid to investors in exchange for investing in riskier bonds — narrowed sharply from their peak in early January, indicating some initial easing of the general risk aversion that characterized fixed income markets for so long.

Besides generally avoiding credit risk, many municipal bond investors sought to minimize interest rate risk as well during the period. This was indicated by the fact that the yield curve, or the difference in yield offered by shorter-dated AAA-rated general obligation bonds relative to comparable longer-dated issues, rose steadily during the fiscal period. In fact, it reached a high of nearly four percentage points in August 2009 — almost double the historical average. (Source: Barclays Capital.)

Tactical portfolio shifts

Entering the reporting period, we sought to take advantage of market conditions by positioning the Funds more conservatively. We were emphasizing higher-rated securities as well as those with intermediate maturities.

Beginning early in 2009 and continuing through the end of the fiscal period, we became somewhat more confident, as we perceived a positive shift in the outlook for municipal bonds. Believing that municipal bond investors were being unusually well compensated for taking on credit risk, we began to selectively invest more of the Funds’ assets in lower-rated, higher-yielding bonds. Where appropriate, we also sold some of our intermediate-dated holdings and increasingly focused on longer-dated

4

issues — an approach that enabled us to lock higher interest rates into the portfolios for an extended time.

Our approach during approximately the second half of the fiscal year (selectively investing across the credit spectrum) is more representative of how we manage the Funds during more-normalized market conditions. We are bottom-up investors, meaning that we evaluate securities one by one, based on thorough fundamental research to help ensure our comfort with the credit quality of each issuer. We believe that this approach may enable us to uncover value potential that investors with less experience or a less rigorous dedication to research might not be able to identify.

We believe this shift in Fund positioning was well timed. Early on, when the Funds emphasized higher-quality, intermediate-maturity debt, the securities we owned were often less effected by the worst of the market turmoil. As we gradually positioned the funds more aggressively in a more favorable investment environment, we generally benefited from having the types of fundamentally solid, yet higher-than-average yielding bonds that we have historically favored.

Notable sectors and securities

Many of the best-performing sectors in all three funds were those with a large proportion of high-quality bonds. For example, all of the portfolios benefited from their exposure to pre-refunded issues. These securities are found on the short end of the yield curve and have historically faced little if any credit risk. This is because they are backed by the invested debt proceeds of a second bond issue, which typically consists of U.S. Treasury securities. Given investors’ tremendous risk aversion during the period, Treasurys performed extremely well, boosting the performance of our pre-refunded holdings.

Other sectors with predominantly higher-quality issuance added to performance as well. In Delaware Tax-Free Minnesota Intermediate Fund and Delaware Minnesota High-Yield Municipal Bond Fund, for example, the water/sewer bond sector contributed to returns. Bonds from this category have generally been able to withstand the highly challenging economic environment as they are used to fund projects of an essential nature.

Delaware Tax-Free Minnesota Fund and Delaware Tax-Free Minnesota Intermediate Fund benefited from their allocation to state single-family housing bonds, which are exempt from the alternative minimum tax (AMT). These bonds were helped by their backing by federal agencies as well as from the relative scarcity of AMT-exempt bonds.

On the negative side, the industrial development revenue (IDR) bond category — which consists of corporate-backed bonds — was a notable source of underperformance. IDR bonds had a particularly negative impact on Delaware Tax-Free Minnesota Fund and Delaware Minnesota High-Yield Municipal Bond Fund. Bonds in this sector tend to be lower-rated, which on the whole for the year was a negative characteristic in the risk-averse municipal market of the period.

All three Funds saw negative performance from the healthcare sector, which includes two primary bond categories — hospitals and continuing care retirement communities (CCRCs). The difficult housing market combined with the broader economic

5

Portfolio management review

Delaware Minnesota Municipal Bond Funds

recession hurt CCRCs, as it has left fewer individuals able to afford residency in these facilities. Delaware Tax-Free Minnesota Fund’s position in Woodbury, Minn., CCRC holdings was a notable underperformer, while the Eventide CCRC in Moorhead, Minn., was a negative for Delaware Tax-Free Minnesota Intermediate Fund.

Even though the healthcare sector was a source of negative results overall, one of the best individual performers in Delaware Tax-Free Minnesota Fund and Delaware Minnesota High-Yield Municipal Bond Fund was an A-rated Minnesota hospital bond issue, Fairview Health Services. We added this credit to the Tax-Free Minnesota Fund in April 2009, and to the Minnesota High-Yield Municipal Bond Fund in October 2008. In both cases, we felt the issue was offering very attractive values for our shareholders. The bond’s price gained strongly as the period progressed.

Several individual land-transaction bonds — also commonly known as “dirt bonds” — also detracted from total returns. These securities, which help finance property developments, tended to struggle in the wake of the housing market’s boom and subsequent decline. Both Delaware Tax-Free Minnesota Fund and Delaware Minnesota High-Yield Municipal Bond Fund were significantly hurt by their holdings of bonds issued to fund Ivy Tower in Minneapolis. Many of Ivy Tower’s condominium units went unsold, as it was a victim of the poor housing market. Both Funds were also hurt by their positions in Saint Anthony Falls development bonds, another Minneapolis condo conversion project. These securities fell in value as investor pessimism about the land-transaction sector grew. However, we note that all of the condos in this project were fully sold, and we feel that the bonds were unfairly tarnished by the overall troubles in the sector.

6

| Performance summaries | |

Delaware Tax-Free Minnesota Fund | Aug. 31, 2009 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The Delaware Tax-Free Minnesota Fund prospectus contains this and other important information about the investment company. Please request a prospectus through your financial advisor or by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Fund. Funds that invest in bonds can lose their value as interest rates rise, and an investor can lose principal.

| Fund performance | | Average annual total returns through Aug. 31, 2009 |

| | 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. Feb 27, 1984) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | +5.04 | % | | | | +3.84 | % | | | | +4.95 | % | | | | +6.97 | % | |

| Including sales charge | | | +0.32 | % | | | | +2.90 | % | | | | +4.47 | % | | | | +6.78 | % | |

| Class B (Est. March 11, 1995) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | +4.26 | % | | | | +3.07 | % | | | | +4.32 | % | | | | +4.85 | % | |

| Including sales charge | | | +0.26 | % | | | | +2.81 | % | | | | +4.32 | % | | | | +4.85 | % | |

| Class C (Est. May 4, 1994) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | +4.25 | % | | | | +3.08 | % | | | | +4.18 | % | | | | +4.48 | % | |

| Including sales charge | | | +3.25 | % | | | | +3.08 | % | | | | +4.18 | % | | | | +4.48 | % | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for all classes during the periods shown in the Fund performance chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expenses” chart. (Note that all charts and graphs referred to in the “Performance summary” section of this report are found on pages 7 through 9.) Performance would have been lower had the expense limitation not been in effect.

7

Performance summaries

Delaware Tax-Free Minnesota Fund

The Fund offers Class A, B, and C shares. Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.25% of average daily net assets.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in a specific state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees from Jan. 1, 2009, through Dec. 31, 2009. Please see the most recent prospectus for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C |

| Total annual operating expenses | 1.11% | | 1.86% | | 1.86% |

| (without fee waivers) | | | | | |

| Net expenses1 | 1.10% | | 1.85% | | 1.85% |

| (including fee waivers, if any) | | | | | |

| Type of waiver | Contractual | | Contractual | | Contractual |

1 Total expenses and total expenses prior to fees waived and expenses paid indirectly includes interest and related expenses which include, but are not limited to, interest expense, remarketing fees, liquidity fees, and trustees’ fees in connection with the Delaware Tax-Free Minnesota Fund’s participation in inverse floater programs.

8

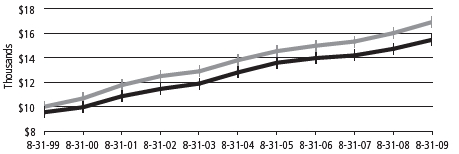

Performance of a $10,000 investment

Average annual total returns from Aug. 31, 1999, through Aug. 31, 2009

| For period beginning Aug. 31, 1999, through Aug. 31, 2009 | Starting value | Ending value |

| | Barclays Capital Municipal Bond Index | $10,000 | $16,924 |

| | Delaware Tax-Free Minnesota Fund — Class A Shares | $9,550 | $15,473 |

The chart assumes $10,000 invested in the Fund on Aug. 31, 1999, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summary” section of this report, which includes pages 7 through 9.

The chart also assumes $10,000 invested in the Barclays Capital Municipal Bond Index as of Aug. 31, 1999. The Barclays Capital Municipal Bond Index, formerly the Lehman Brothers Municipal Bond Index, measures the total return performance of the long-term, investment grade tax-exempt bond market.

An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

Past performance is not a guarantee of future results.

| Stock symbols and CUSIP numbers |

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DEFFX | | | 928918101 | |

| Class B | | | DMOBX | | | 928928696 | |

| Class C | | | DMOCX | | | 928918408 | |

9

| Performance summaries | |

| Delaware Tax-Free Minnesota Intermediate Fund | Aug. 31, 2009 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The Delaware Tax-Free Minnesota Intermediate Fund prospectus contains this and other important information about the investment company. Please request a prospectus through your financial advisor or by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Fund. Funds that invest in bonds can lose their value as interest rates rise, and an investor can lose principal.

| Fund performance | | Average annual total returns through Aug. 31, 2009 |

| | 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. Oct. 27, 1985) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | +4.67 | % | | | | +3.79 | % | | | | +4.58 | % | | | | +5.22 | % | |

| Including sales charge | | | +1.82 | % | | | | +3.21 | % | | | | +4.29 | % | | | | +5.10 | % | |

| Class B (Est. Aug. 15, 1995) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | +3.79 | % | | | | +2.91 | % | | | | +4.13 | % | | | | +4.16 | % | |

| Including sales charge | | | +1.79 | % | | | | +2.91 | % | | | | +4.13 | % | | | | +4.16 | % | |

| Class C (Est. May 4, 1994) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | +3.78 | % | | | | +2.91 | % | | | | +3.71 | % | | | | +3.72 | % | |

| Including sales charge | | | +2.78 | % | | | | +2.91 | % | | | | +3.71 | % | | | | +3.72 | % | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for all classes during the periods shown in the Fund performance chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expenses” chart. (Note that all charts and graphs referred to in the “Performance summary” section of this report are found on pages 10 through 12.) Performance would have been lower had the expense limitation not been in effect.

10

The Fund offers Class A, B, and C shares. Class A shares are sold with a maximum front–end sales charge of up to 2.75%, and have an annual distribution and service fee of up to 0.25% of average daily net assets.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 2.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately five years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten–year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately five years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in a specific state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees from Jan. 1, 2009, through Dec. 31, 2009. Please see the most recent prospectus for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C |

| Total annual operating expenses | 0.95% | | 1.70% | | 1.70% |

| (without fee waivers) | | | | | |

| Net expenses | 0.75% | | 1.60% | | 1.60% |

| (including fee waivers, if any) | | | | | |

| Type of waiver | Contractual | | Contractual | | Contractual |

11

Performance summaries

Delaware Tax-Free Minnesota Intermediate Fund

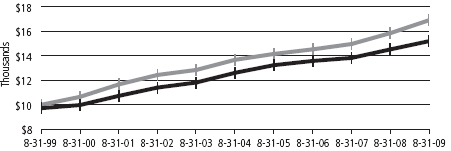

Performance of a $10,000 investment

Average annual total returns from Aug. 31, 1999, through Aug. 31, 2009

| For period beginning Aug. 31, 1999, through Aug. 31, 2009 | Starting value | Ending value |

| | Barclays Capital 3–15 Year Municipal Bond Index | $10,000 | $16,917 |

| | Delaware Tax-Free Minnesota Intermediate Fund — Class A Shares | $9,725 | $15,206 |

The chart assumes $10,000 invested in the Fund on Aug. 31, 1999, and includes the effect of a 2.75% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summary” section of this report, which includes pages 10 through 12.

The chart also assumes $10,000 invested in the Barclays Capital 3–15 Year Municipal Bond Index as of Aug. 31, 1999. The Barclays Capital 3–15 Year Municipal Bond Index, formerly the Lehman Brothers 3–15 Year Municipal Bond Index, measures the total return performance of investment grade, U.S. tax-exempt bonds with maturities from 2 to 17 years.

An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

Past performance is not a guarantee of future results.

| Stock symbols and CUSIP numbers |

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DXCCX | | | 928930106 | |

| Class B | | | DVSBX | | | 928928399 | |

| Class C | | | DVSCX | | | 928930205 | |

12

| Delaware Minnesota High-Yield Municipal Bond Fund | Aug. 31, 2009 |

The performance data quoted represent past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please obtain the performance data for the most recent month end by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com/performance. Current performance may be lower or higher than the performance data quoted.

You should consider the investment objectives, risks, charges, and expenses of the investment company carefully before investing. The Delaware Minnesota High-Yield Municipal Bond Fund prospectus contains this and other important information about the investment company. Please request a prospectus through your financial advisor or by calling 800 523-1918 or visiting our Web site at www.delawareinvestments.com. Read the prospectus carefully before you invest or send money.

A rise or fall in interest rates can have a significant impact on bond prices and the net asset value (NAV) of the Fund. Funds that invest in bonds can lose their value as interest rates rise, and an investor can lose principal.

| Fund performance | | Average annual total returns through Aug. 31, 2009 |

| | 1 year | | 5 years | | 10 years | | Lifetime |

| Class A (Est. June 4, 1996) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | +3.63 | % | | | | +3.70 | % | | | | +4.81 | % | | | | +5.26 | % | |

| Including sales charge | | | -1.02 | % | | | | +2.75 | % | | | | +4.33 | % | | | | +4.89 | % | |

| Class B (Est. June 12, 1996) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | +2.86 | % | | | | +2.92 | % | | | | +4.17 | % | | | | +4.96 | % | |

| Including sales charge | | | -1.10 | % | | | | +2.66 | % | | | | +4.17 | % | | | | +4.96 | % | |

| Class C (Est. June 7, 1996) | | | | | | | | | | | | | | | | | | | | |

| Excluding sales charge | | | +2.85 | % | | | | +2.94 | % | | | | +4.03 | % | | | | +4.48 | % | |

| Including sales charge | | | +1.86 | % | | | | +2.94 | % | | | | +4.03 | % | | | | +4.48 | % | |

Returns reflect the reinvestment of all distributions and any applicable sales charges as noted in the following paragraphs.

Performance for Class B and C shares, excluding sales charges, assumes either that contingent deferred sales charges did not apply or that the investment was not redeemed.

Expense limitations were in effect for all classes during the periods shown in the Fund performance chart and in the “Performance of a $10,000 investment” chart. The current expenses for each class are listed on the “Fund expenses” chart. (Note that all charts and graphs referred to in the “Performance summary” section of this report are found on pages 13 through 15.) Performance would have been lower had the expense limitation not been in effect.

13

Performance summaries

Delaware Minnesota High-Yield Municipal Bond Fund

The Fund offers Class A, B, and C shares. Class A shares are sold with a maximum front-end sales charge of up to 4.50%, and have an annual distribution and service fee of up to 0.25% of average daily net assets.

Class B shares may only be purchased through dividend reinvestment and certain permitted exchanges as described in the prospectus. Please see the prospectus for additional information on Class B purchase and sales charges. Class B shares have a contingent deferred sales charge that declines from 4.00% to zero depending on the period of time the shares are held.

Class B shares will automatically convert to Class A shares on a quarterly basis approximately eight years after purchase. They are also subject to an annual distribution and service fee of up to 1.00% of average daily net assets.

Ten-year and lifetime performance figures for Class B shares reflect conversion to Class A shares after approximately eight years.

Class C shares are sold with a contingent deferred sales charge of 1.00% if redeemed during the first 12 months. They are also subject to an annual distribution and service fee of 1.00% of average daily net assets.

The “Fund performance” table and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

Fixed income securities and bond funds can lose value, and investors can lose principal, as interest rates rise. They also may be affected by economic conditions that hinder an issuer’s ability to make interest and principal payments on its debt. High yielding, noninvestment grade bonds (junk bonds) involve higher risk than investment grade bonds.

The Fund may also be subject to prepayment risk, the risk that the principal of a fixed income security that is held by the Fund may be prepaid prior to maturity, potentially forcing the Fund to reinvest that money at a lower interest rate.

Substantially all dividend income derived from tax-free funds is exempt from federal income tax. Some income may be subject to the federal alternative minimum tax that applies to certain investors. Capital gains, if any, are taxable.

Funds that invest primarily in a specific state may be more susceptible to the economic, regulatory, and other factors of that state than funds that invest more broadly.

The Fund’s expense ratios, as described in the most recent prospectus, are disclosed in the following “Fund expense ratios” table. Delaware Investments has agreed to reimburse certain expenses and/or waive certain fees from Jan. 1, 2009, through Dec. 31, 2009. Please see the most recent prospectus for additional information on these fee waivers and/or reimbursements.

| Fund expense ratios | Class A | | Class B | | Class C |

| Total annual operating expenses | 0.97% | | 1.72% | | 1.72% |

| (without fee waivers) | | | | | |

| Net expenses | 0.89% | | 1.64% | | 1.64% |

| (including fee waivers, if any) | | | | | |

| Type of waiver | Contractual | | Contractual | | Contractual |

14

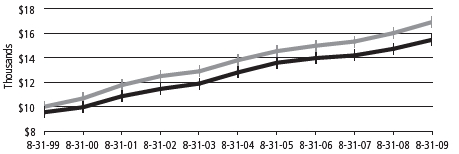

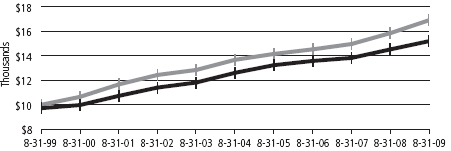

Performance of a $10,000 investment

Average annual total returns from Aug. 31, 1999, through Aug. 31, 2009

| For period beginning Aug. 31, 1999, through Aug. 31, 2009 | Starting value | Ending value |

| | Barclays Capital Municipal Bond Index | $10,000 | $16,924 |

| | Delaware Minnesota High-Yield Municipal Bond Fund — Class A Shares | $9,550 | $15,255 |

The chart assumes $10,000 invested in the Fund on Aug. 31, 1999, and includes the effect of a 4.50% front-end sales charge and the reinvestment of all distributions. Please note additional details on these fees in the “Performance summary” section of this report, which includes pages 13 through 15.

The chart also assumes $10,000 invested in the Barclays Capital Municipal Bond Index as of Aug. 31, 1999. The Barclays Capital Municipal Bond Index measures the total return performance of the long-term, investment grade tax-exempt bond market.

An index is unmanaged and does not reflect the costs of operating a mutual fund, such as the costs of buying, selling, and holding securities. You cannot invest directly in an index.

Performance of other Fund classes will vary due to different charges and expenses.

The “Fund performance” chart and the “Performance of a $10,000 investment” graph do not reflect the deduction of taxes the shareholders would pay on Fund distributions or redemptions of Fund shares.

Past perfromance is not a guarantee of future results.

| Stock symbols and CUSIP numbers |

| | Nasdaq symbols | | CUSIPs | |

| Class A | | | DVMHX | | | 928928316 | |

| Class B | | | DVMYX | | | 928928290 | |

| Class C | | | DVMMX | | | 928928282 | |

15

Disclosure of Fund expenses

For the period March 1, 2009 to August 31, 2009

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. These following examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period March 1, 2009 to August 31, 2009.

Actual expenses

The first section of the tables shown, “Actual Fund Return,” provides information about actual account values and actual expenses. You may use the information in this section of the table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second section of the tables shown, “Hypothetical 5% Return,” provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of each table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The Funds’ expenses shown in the tables reflect fee waivers in effect. The expenses shown in each table assume reinvestment of all dividends and distributions.

16

Delaware Tax-Free Minnesota Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 3/1/09 | | 8/31/09 | | Expense Ratio | | 3/1/09 to 8/31/09* |

| Actual Fund return |

| Class A | | $1,000.00 | | | $1,057.40 | | | 0.91% | | $4.72 | |

| Class B | | 1,000.00 | | | 1,053.40 | | | 1.66% | | 8.59 | |

| Class C | | 1,000.00 | | | 1,053.30 | | | 1.66% | | 8.59 | |

| Hypothetical 5% return (5% return before expenses) |

| Class A | | $1,000.00 | | | $1,020.62 | | | 0.91% | | $4.63 | |

| Class B | | 1,000.00 | | | 1,016.84 | | | 1.66% | | 8.44 | |

| Class C | | 1,000.00 | | | 1,016.84 | | | 1.66% | | 8.44 | |

Delaware Tax-Free Minnesota Intermediate Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 3/1/09 | | 8/31/09 | | Expense Ratio | | 3/1/09 to 8/31/09* |

| Actual Fund return | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,040.90 | | | 0.75% | | $3.86 | |

| Class B | | 1,000.00 | | | 1,036.40 | | | 1.60% | | 8.21 | |

| Class C | | 1,000.00 | | | 1,036.40 | | | 1.60% | | 8.21 | |

| Hypothetical 5% return (5% return before expenses) |

| Class A | | $1,000.00 | | | $1,021.42 | | | 0.75% | | $3.82 | |

| Class B | | 1,000.00 | | | 1,017.14 | | | 1.60% | | 8.13 | |

| Class C | | 1,000.00 | | | 1,017.14 | | | 1.60% | | 8.13 | |

17

Disclosure of Fund expenses

Delaware Minnesota High-Yield Municipal Bond Fund

Expense analysis of an investment of $1,000

| | Beginning | | Ending | | | | Expenses |

| | Account Value | | Account Value | | Annualized | | Paid During Period |

| | 3/1/09 | | 8/31/09 | | Expense Ratio | | 3/1/09 to 8/31/09* |

| Actual Fund return | | | | | | | | | | | |

| Class A | | $1,000.00 | | | $1,082.10 | | | 0.89% | | $4.67 | |

| Class B | | 1,000.00 | | | 1,076.90 | | | 1.64% | | 8.59 | |

| Class C | | 1,000.00 | | | 1,077.90 | | | 1.64% | | 8.59 | |

| Hypothetical 5% return (5% return before expenses) | | | | | | |

| Class A | | $1,000.00 | | | $1,020.72 | | | 0.89% | | $4.53 | |

| Class B | | 1,000.00 | | | 1,016.94 | | | 1.64% | | 8.34 | |

| Class C | | 1,000.00 | | | 1,016.94 | | | 1.64% | | 8.34 | |

*“Expenses Paid During Period” are equal to the Funds’ annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

18

| Sector allocations and credit quality breakdowns |

| Delaware Tax-Free Minnesota Fund | As of August 31, 2009 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Sector | Percentage of net assets |

| Municipal Bonds | 99.34 | % |

| Corporate-Backed Revenue Bonds | 3.79 | % |

| Education Revenue Bonds | 5.71 | % |

| Electric Revenue Bonds | 7.84 | % |

| Escrowed to Maturity Bonds | 9.23 | % |

| Health Care Revenue Bonds | 13.69 | % |

| Housing Revenue Bonds | 7.45 | % |

| Lease Revenue Bonds | 3.49 | % |

| Local General Obligation Bonds | 22.01 | % |

| Pre-Refunded Bonds | 17.98 | % |

| Special Tax Revenue Bonds | 3.69 | % |

| State General Obligation Bonds | 2.85 | % |

| Transportation Revenue Bonds | 1.13 | % |

| Water & Sewer Revenue Bonds | 0.48 | % |

| Short-Term Investments | 0.11 | % |

| Total Value of Securities | 99.45 | % |

| Receivables and Other Assets Net of Liabilities | 0.55 | % |

| Total Net Assets | 100.00 | % |

| |

| Credit quality breakdown (as a % of fixed income investments)* | | |

| AAA | 27.75 | % |

| AA | 30.00 | % |

| A | 22.71 | % |

| BBB | 10.39 | % |

| BB | 2.25 | % |

| Not Rated | 6.90 | % |

| Total | 100.00 | % |

*Bond ratings are determined by independent, nationally recognized statistical rating organizations.

19

| Sector allocations and credit quality breakdowns |

| Delaware Tax-Free Minnesota Intermediate Fund | As of August 31, 2009 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Sector | Percentage of net assets |

| Municipal Bonds | 97.93 | % |

| Corporate-Backed Revenue Bonds | 1.84 | % |

| Education Revenue Bonds | 10.32 | % |

| Electric Revenue Bonds | 5.63 | % |

| Escrowed to Maturity Bond | 1.36 | % |

| Health Care Revenue Bonds | 11.29 | % |

| Housing Revenue Bonds | 4.30 | % |

| Lease Revenue Bonds | 2.05 | % |

| Local General Obligation Bonds | 28.37 | % |

| Pre-Refunded Bonds | 9.36 | % |

| Special Tax Revenue Bonds | 9.49 | % |

| State General Obligation Bonds | 7.70 | % |

| Transportation Revenue Bonds | 1.46 | % |

| Water & Sewer Revenue Bonds | 4.76 | % |

| Short-Term Investment | 0.32 | % |

| Total Value of Securities | 98.25 | % |

| Receivables and Other Assets Net of Liabilities | 1.75 | % |

| Total Net Assets | 100.00 | % |

| |

| Credit quality breakdown (as a % of fixed income investments)* | | |

| AAA | 33.23 | % |

| AA | 34.29 | % |

| A | 17.67 | % |

| BBB | 7.81 | % |

| BB | 1.24 | % |

| Not Rated | 5.76 | % |

| Total | 100.00 | % |

*Bond ratings are determined by independent, nationally recognized statistical rating organizations.

20

| Delaware Minnesota High-Yield Muni Bond Fund | As of August 31, 2009 |

Sector designations may be different than the sector designations presented in other Fund materials.

| Sector | Percentage of net assets |

| Municipal Bonds | 97.94 | % |

| Corporate-Backed Revenue Bonds | 3.16 | % |

| Education Revenue Bonds | 8.99 | % |

| Electric Revenue Bonds | 6.32 | % |

| Health Care Revenue Bonds | 26.50 | % |

| Housing Revenue Bonds | 13.15 | % |

| Lease Revenue Bonds | 1.05 | % |

| Local General Obligation Bonds | 11.99 | % |

| Pre-Refunded Bonds | 9.62 | % |

| Special Tax Revenue Bonds | 7.95 | % |

| State General Obligation Bonds | 3.40 | % |

| Transportation Revenue Bond | 1.46 | % |

| Water & Sewer Revenue Bonds | 4.35 | % |

| Short-Term Investment | 0.04 | % |

| Total Value of Securities | 97.98 | % |

| Receivables and Other Assets Net of Liabilities | 2.02 | % |

| Total Net Assets | 100.00 | % |

| |

| Credit quality breakdown (as a % of fixed income investments)* | | |

| AAA | 17.32 | % |

| AA | 21.98 | % |

| A | 23.81 | % |

| BBB | 17.36 | % |

| BB | 2.87 | % |

| Not Rated | 16.66 | % |

| Total | 100.00 | % |

*Bond ratings are determined by independent, nationally recognized statistical rating organizations.

21

| Statements of net assets |

| Delaware Tax-Free Minnesota Fund | August 31, 2009 |

| | | Principal amount | | Value |

| Municipal Bonds – 99.34% | | | | | | |

| Corporate-Backed Revenue Bonds – 3.79% | | | | | | |

| | Cloquet Pollution Control Revenue Refunding | | | | | | |

| (Potlatch Project) 5.90% 10/1/26 | | $ | 6,500,000 | | $ | 4,700,670 |

| Laurentian Energy Authority I Cogeneration Revenue | | | | | | |

| Series A 5.00% 12/1/21 | | | 8,000,000 | | | 7,357,840 |

| Sartell Environmental Improvement Revenue Refunding | | | | | | |

| (International Paper) Series A 5.20% 6/1/27 | | | 7,265,000 | | | 6,279,430 |

| Seaway Port Authority of Duluth Industrial | | | | | | |

| Development Dock & Wharf Revenues | | | | | | |

| (Cargill Project) Series E 6.125% 11/1/14 | | | 4,500,000 | | | 4,518,090 |

| | | | | | | 22,856,030 |

| Education Revenue Bonds – 5.71% | | | | | | |

| Minnesota Colleges & Universities Revenue Fund Series A | | | | | | |

| 5.00% 10/1/22 (FSA) | | | 5,135,000 | | | 5,329,360 |

| 5.00% 10/1/28 | | | 8,900,000 | | | 9,529,942 |

| 5.00% 10/1/29 (NATL-RE) | | | 5,665,000 | | | 5,921,341 |

| Minnesota Higher Education Facilities Authority Revenue | | | | | | |

| (Augsburg College) | | | | | | |

| Series 6-C 5.00% 5/1/20 | | | 1,250,000 | | | 1,234,675 |

| Series 6-J1 5.00% 5/1/36 | | | 2,225,000 | | | 2,018,275 |

| (Bethel University) Series 6-R 5.50% 5/1/37 | | | 2,500,000 | | | 2,199,475 |

| (Carleton College) Series 6-T 5.00% 1/1/28 | | | 1,000,000 | | | 1,050,680 |

| (University of St. Thomas University) | | | | | | |

| Series 6-X 5.25% 4/1/39 | | | 5,000,000 | | | 5,118,750 |

| St. Cloud Housing & Redevelopment Authority Revenue | | | | | | |

| (State University Foundation Project) 5.00% 5/1/23 | | | 2,000,000 | | | 2,060,220 |

| | | | | | | 34,462,718 |

| Electric Revenue Bonds – 7.84% | | | | | | |

| Chaska Electric Revenue Refunding | | | | | | |

| (Generating Facilities) Series A 5.00% 10/1/30 | | | 3,000,000 | | | 3,028,050 |

| Minnesota Municipal Power Agency Electric Revenue | | | | | | |

| 5.00% 10/1/35 | | | 3,000,000 | | | 3,020,190 |

| Series A | | | | | | |

| 5.00% 10/1/34 | | | 6,250,000 | | | 6,297,125 |

| 5.125% 10/1/29 | | | 3,000,000 | | | 3,066,450 |

22

| | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | | |

| Electric Revenue Bonds (continued) | | | | | | |

| | Northern Municipal Power Agency Electric System | | | | | | |

| Revenue Refunding | | | | | | |

| Series A 5.00% 1/1/14 (ASSURED GTY) | | $ | 1,000,000 | | $ | 1,099,870 |

| 5.00% 1/1/16 (ASSURED GTY) | | | 3,000,000 | | | 3,334,470 |

| Series B 4.75% 1/1/20 (AMBAC) | | | 2,500,000 | | | 2,521,025 |

| Puerto Rico Electric Power Authority Revenue | | | | | | |

| Refunding Series GG 4.75% 7/1/21 (FSA) | | | 1,000,000 | | | 1,002,120 |

| Series TT 5.00% 7/1/37 | | | 2,500,000 | | | 2,339,600 |

| Series WW 5.50% 7/1/38 | | | 4,800,000 | | | 4,809,600 |

| Southern Minnesota Municipal Power Agency Supply | | | | | | |

| System Revenue Series A | | | | | | |

| 5.25% 1/1/14 (AMBAC) | | | 4,000,000 | | | 4,433,320 |

| 5.25% 1/1/15 (AMBAC) | | | 8,900,000 | | | 9,935,604 |

| ^Capital Appreciation | | | | | | |

| 4.44% 1/1/25 (NATL-RE) | | | 5,000,000 | | | 2,419,650 |

| | | | | | | 47,307,074 |

| Escrowed to Maturity Bonds – 9.23% | | | | | | |

| Dakota - Washington Counties Housing & | | | | | | |

| Redevelopment Authority Single Family | | | | | | |

| Residential Mortgage Revenue | | | | | | |

| 8.15% 9/1/16 (GNMA) (NATL-RE) (AMT) | | | 405,000 | | | 542,907 |

| (Anoka County) 8.45% 9/1/19 (GNMA) (AMT) | | | 9,000,000 | | | 12,792,690 |

| (Bloomington Mortgage) Refunding Series B | | | | | | |

| 8.375% 9/1/21 (GNMA) (FHA) (VA) (AMT) | | | 14,115,000 | | | 20,423,275 |

| Southern Minnesota Municipal Power Agency Supply | | | | | | |

| System Revenue Refunding Series B | | | | | | |

| 5.50% 1/1/15 (AMBAC) | | | 990,000 | | | 1,049,549 |

| University of Minnesota Series A | | | | | | |

| 5.50% 7/1/21 | | | 12,500,000 | | | 14,702,750 |

| 5.75% 7/1/18 | | | 3,840,000 | | | 4,732,723 |

| Western Minnesota Municipal Power Agency Supply | | | | | | |

| Revenue Series A | | | | | | |

| 6.60% 1/1/10 | | | 440,000 | | | 449,174 |

| 9.75% 1/1/16 (NATL-RE) | | | 715,000 | | | 993,600 |

| | | | | | | 55,686,668 |

23

Statements of net assets

Delaware Tax-Free Minnesota Fund

| | | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | | |

| Health Care Revenue Bonds – 13.69% | | | | | | |

| | Aitkin Health Care Facilities Revenue Refunding | | | | | | |

| (Riverwood Health Care Center) 5.60% 2/1/32 | | $ | 2,100,000 | | $ | 1,579,284 |

| Apple Valley Economic Development Authority Health | | | | | | |

| Care Revenue (Augustana Home St. Paul Project) | | | | | | |

| Series A 6.00% 1/1/40 | | | 2,700,000 | | | 2,030,211 |

| Bemidji Health Care Facilities First Mortgage Revenue | | | | | | |

| (North Country Health Services) | | | | | | |

| 5.00% 9/1/24 (RADIAN) | | | 740,000 | | | 691,774 |

| 5.00% 9/1/31 (RADIAN) | | | 500,000 | | | 442,145 |

| Breckenridge Catholic Health Initiatives | | | | | | |

| Series A 5.00% 5/1/30 | | | 2,500,000 | | | 2,518,450 |

| Maple Grove Health Care System Revenue | | | | | | |

| (Maple Grove Hospital) 5.25% 5/1/37 | | | 2,950,000 | | | 2,649,189 |

| Minneapolis Health Care Facility Revenue | | | | | | |

| (Jones-Harrison Residence Project) 5.60% 10/1/30 | | | 1,050,000 | | | 787,878 |

| Minneapolis Health Care System Revenue | | | | | | |

| (Fairview Health Services) | | | | | | |

| Series A 6.625% 11/15/28 | | | 3,000,000 | | | 3,311,610 |

| Series B 6.50% 11/15/38 (ASSURED GTY) | | | 1,140,000 | | | 1,287,265 |

| Series D | | | | | | |

| 5.00% 11/15/30 (AMBAC) | | | 2,500,000 | | | 2,414,225 |

| 5.00% 11/15/34 (AMBAC) | | | 10,750,000 | | | 10,090,379 |

| Minneapolis - St. Paul Housing & Redevelopment | | | | | | |

| Authority Health Care System Revenue | | | | | | |

| (Health Partners Obligation Group Project) | | | | | | |

| 5.875% 12/1/29 | | | 1,000,000 | | | 950,540 |

| Minnesota Agricultural & Economic | | | | | | |

| Development Board Revenue | | | | | | |

| (Benedictine Health Systems) 5.75% 2/1/29 | | | 1,895,000 | | | 1,466,541 |

| (Fairview Health Care System) | | | | | | |

| Un-Refunded Balance Series A | | | | | | |

| 5.75% 11/15/26 (NATL-RE) | | | 180,000 | | | 179,984 |

| 6.375% 11/15/29 | | | 15,000 | | | 15,224 |

| Northfield Hospital Revenue 5.375% 11/1/26 | | | 3,785,000 | | | 3,468,801 |

| Shakopee Health Care Facilities Revenue | | | | | | |

| (St. Francis Regional Medical Center) | | | | | | |

| 5.10% 9/1/25 | | | 2,000,000 | | | 1,845,520 |

| 5.25% 9/1/34 | | | 7,000,000 | | | 6,217,190 |

24

| | | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | | |

| Health Care Revenue Bonds (continued) | | | | | | |

| | Sherburne County Health Care Facilities Revenue | | | | | | |

| (Guardian Angels Health Services) 5.55% 10/1/36 | | $ | 1,500,000 | | $ | 1,073,220 |

| St. Cloud Health Care Revenue (Centracare Health | | | | | | |

| System Project) Series D Remarketing | | | | | | |

| 5.50% 5/1/39 (ASSURED GTY) | | | 6,000,000 | | | 6,132,660 |

| St. Louis Park Health Care Facilities Revenue Refunding | | | | | | |

| (Park Nicollet Health Services) Series C | | | | | | |

| 5.50% 7/1/23 | | | 3,000,000 | | | 3,075,690 |

| 5.75% 7/1/30 | | | 5,000,000 | | | 5,075,600 |

| St. Paul Housing & Redevelopment Authority Health Care | | | | | | |

| Facilities Revenue | | | | | | |

| (Allina Health System) Series A 5.00% 11/15/18 (NATL-RE) | | | 5,720,000 | | | 5,953,891 |

| (Health Partners Obligation Group Project) | | | | | | |

| 5.25% 5/15/36 | | | 7,900,000 | | | 6,788,469 |

| St. Paul Housing & Redevelopment Authority | | | | | | |

| Hospital Revenue (Health East Project) | | | | | | |

| 6.00% 11/15/30 | | | 4,000,000 | | | 3,339,640 |

| 6.00% 11/15/35 | | | 4,340,000 | | | 3,544,652 |

| Series A 5.70% 11/1/15 | | | 1,150,000 | | | 1,100,654 |

| St. Paul Housing & Redevelopment Authority | | | | | | |

| Multifamily Housing Revenue Refunding | | | | | | |

| (Marion Center Project) Series A | | | | | | |

| 5.30% 11/1/30 | | | 500,000 | | | 354,725 |

| 5.375% 5/1/43 | | | 500,000 | | | 341,550 |

| Stillwater Health Care Revenue (Health System | | | | | | |

| Obligation Group) 5.00% 6/1/35 | | | 1,000,000 | | | 887,530 |

| Washington County Housing & Redevelopment Authority | | | | | | |

| Revenue (Health East Project) 5.50% 11/15/27 | | | 1,000,000 | | | 831,120 |

| Willmar (Rice Memorial Hospital Project) | | | | | | |

| 5.00% 2/1/22 (FSA) | | | 1,000,000 | | | 1,065,770 |

| 5.00% 2/1/25 (FSA) | | | 1,000,000 | | | 1,027,710 |

| | | | | | | 82,539,091 |

| Housing Revenue Bonds – 7.45% | | | | | | |

| Brooklyn Center Multifamily Housing Revenue Refunding | | | | | | |

| (Shingle Creek) 5.40% 5/20/43 (GNMA) (AMT) | | | 1,000,000 | | | 987,670 |

| Dakota County Housing & Redevelopment Authority Single | | | | | | |

| Family Mortgage Revenue | | | | | | |

| 5.85% 10/1/30 (GNMA) (FNMA) (AMT) | | | 119,000 | | | 119,046 |

25

Statements of net assets

Delaware Tax-Free Minnesota Fund

| | | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | | |

| Housing Revenue Bonds (continued) | | | | | | |

| @ | Hutchinson Multifamily Housing Revenue | | | | | | |

| | (Evergreen Apartments Project) | | | | | | |

| 5.75% 11/1/28 (HUD Section 8) | | $ | 765,000 | | $ | 569,619 |

| Minneapolis Multifamily Housing Revenue | | | | | | |

| (Bottineau Commons Project) | | | | | | |

| 5.45% 4/20/43 (GNMA) (AMT) | | | 1,500,000 | | | 1,493,010 |

| (Grant Street Apartments Project) Series A 7.25% 11/1/29 | | | 750,000 | | | 698,970 |

| (Seward Towers Project) 5.00% 5/20/36 (GNMA) | | | 8,000,000 | | | 7,941,040 |

| (Sumner Field) Series A 5.50% 11/20/26 (GNMA) (AMT) | | | 905,000 | | | 915,815 |

| (Trinity Apartments) Refunding Series A | | | | | | |

| 6.75% 5/1/21 (HUD Section 8) | | | 1,575,000 | | | 1,452,985 |

| Minnesota Housing Finance Agency Rental Housing | | | | | | |

| Revenue Series C-2 5.95% 2/1/15 (AMBAC) | | | 1,495,000 | | | 1,497,885 |

| Minnesota Housing Finance Agency Residential Housing | | | | | | |

| Series A 5.30% 7/1/19 | | | 470,000 | | | 479,170 |

| Series B-1 5.35% 1/1/33 (AMT) | | | 2,750,000 | | | 2,720,878 |

| ŸSeries D 4.80% 7/1/38 (AMT) | | | 2,500,000 | | | 2,228,400 |

| Series I 4.85% 7/1/38 (AMT) | | | 2,000,000 | | | 1,799,640 |

| Series I 5.15% 7/1/38 (AMT) | | | 5,530,000 | | | 5,266,606 |

| Series L 5.10% 7/1/38 (AMT) | | | 9,910,000 | | | 9,312,129 |

| Series M 4.875% 7/1/37 (AMT) | | | 4,500,000 | | | 4,089,375 |

| Single Family Mortgage Series J 5.90% 7/1/28 (AMT) | | | 345,000 | | | 345,597 |

| @ | St. Cloud Housing & Redevelopment Authority | | | | | | |

| Multifamily Housing Revenue (Sterling Heights | | | | | | |

| Apartments Project) 7.55% 4/1/39 (AMT) | | | 1,000,000 | | | 818,580 |

| @ | Washington County Housing & Redevelopment | | | | | | |

| Authority Governmental Revenue Refunding | | | | | | |

| (Briar Pond Project) Series C 7.25% 8/20/34 | | | 925,000 | | | 724,580 |

| White Bear Lake Multifamily Revenue Refunding | | | | | | |

| (Lake Square) Series A 5.875% 2/1/15 (FHA) | | | 740,000 | | | 741,369 |

| Willmar Housing & Redevelopment Authority Multifamily | | | | | | |

| Housing Revenue (Highland Apartments) | | | | | | |

| 5.85% 6/1/19 (HUD Section 8) | | | 785,000 | | | 732,107 |

| | | | | | | 44,934,471 |

| Lease Revenue Bonds – 3.49% | | | | | | |

| Minneapolis Special School District #001 Series A | | | | | | |

| 5.00% 2/1/18 (FSA) | | | 1,545,000 | | | 1,639,940 |

| 5.00% 2/1/19 (FSA) | | | 1,535,000 | | | 1,629,326 |

| 5.00% 2/1/20 (FSA) | | | 1,690,000 | | | 1,793,851 |

26

| | | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | | |

| Lease Revenue Bonds (continued) | | | | | | |

| | Puerto Rico Public Buildings Authority Revenue | | | | | | |

| (Guaranteed Government Facilities) | | | | | | |

| Un-Refunded Balance Series D 5.25% 7/1/36 | | $ | 1,070,000 | | $ | 939,064 |

| St. Paul Port Authority Lease Revenue | | | | | | |

| (Cedar Street Office Building Project) | | | | | | |

| 5.00% 12/1/22 | | | 2,500,000 | | | 2,594,250 |

| 5.25% 12/1/27 | | | 3,840,000 | | | 3,966,950 |

| Series 3-12 5.125% 12/1/27 | | | 3,000,000 | | | 3,112,710 |

| (Robert Street Office Building Project) | | | | | | |

| Series 3-11 4.75% 12/1/23 | | | 2,000,000 | | | 2,059,720 |

| Series 3-11 5.00% 12/1/27 | | | 2,500,000 | | | 2,581,850 |

| Series 9 5.25% 12/1/27 | | | 725,000 | | | 748,969 |

| | | | | | | 21,066,630 |

| Local General Obligation Bonds – 22.01% | | | | | | |

| Anoka County Capital Improvement Series A | | | | | | |

| 5.00% 2/1/19 | | | 1,270,000 | | | 1,475,981 |

| 5.00% 2/1/22 | | | 500,000 | | | 561,630 |

| Big Lake Independent School District #727 Series A | | | | | | |

| 5.00% 2/1/17 (FSA) | | | 1,040,000 | | | 1,058,002 |

| 5.00% 2/1/20 (FSA) | | | 1,000,000 | | | 1,017,310 |

| Bloomington Independent School District #271 | | | | | | |

| Series B 5.00% 2/1/17 | | | 5,300,000 | | | 5,391,743 |

| Centennial Independent School District #012 | | | | | | |

| Series A 5.00% 2/1/18 (FSA) | | | 1,270,000 | | | 1,372,578 |

| Dakota County Capital Improvement Series A | | | | | | |

| 4.75% 2/1/26 | | | 1,000,000 | | | 1,013,780 |

| Dakota County Community Development Agency | | | | | | |

| (Senior Housing Facilities) 5.00% 1/1/21 | | | 1,275,000 | | | 1,315,405 |

| Farmington Independent School District #192 Series B | | | | | | |

| 5.00% 2/1/27 (FSA) | | | 10,705,000 | | | 11,306,727 |

| ^Capital Appreciation 5.34% 2/1/21 (FSA) | | | 1,500,000 | | | 880,125 |

| ^Capital Appreciation 5.424% 2/1/20 (FSA) | | | 1,650,000 | | | 1,021,119 |

| Hennepin County Regional Railroad Authority | | | | | | |

| 5.00% 12/1/31 | | | 4,030,000 | | | 4,073,524 |

| Lakeville Independent School District #194 | | | | | | |

| ^Capital Appreciation Series B 5.45% 2/1/19 (FSA) | | | 8,000,000 | | | 4,883,200 |

| Series A 4.75% 2/1/22 (FSA) | | | 6,850,000 | | | 7,113,246 |

27

Statements of net assets

Delaware Tax-Free Minnesota Fund

| | | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | | |

| Local General Obligation Bonds (continued) | | | | | | |

| ^ | Mahtomedi Independent School District #832 | | | | | | |

| | Capital Appreciation Series B 5.90% 2/1/14 (NATL-RE) | | $ | 1,540,000 | | $ | 1,384,783 |

| Metropolitan Council Minneapolis-St. Paul | | | | | | |

| Metropolitan Area Waste Water Treatment | | | | | | |

| Series B 5.00% 12/1/21 | | | 1,200,000 | | | 1,331,844 |

| Series C | | | | | | |

| 5.00% 3/1/16 | | | 2,440,000 | | | 2,837,232 |

| 5.00% 3/1/28 | | | 5,000,000 | | | 5,319,000 |

| Minneapolis Library 5.00% 12/1/25 | | | 1,500,000 | | | 1,561,500 |

| Morris Independent School District #769 Building | | | | | | |

| 5.00% 2/1/24 (NATL-RE) | | | 4,875,000 | | | 5,400,915 |

| Mounds View Independent School District #621 Series A | | | | | | |

| 5.00% 2/1/20 (NATL-RE) | | | 2,970,000 | | | 3,152,507 |

| 5.375% 2/1/24 (FGIC) | | | 6,170,000 | | | 6,524,035 |

| New Brighton Tax Increment Series A | | | | | | |

| 5.00% 2/1/27 (NATL-RE) | | | 1,000,000 | | | 1,065,580 |

| Osseo Independent School District #279 Series A | | | | | | |

| 5.00% 2/1/21 (FSA) | | | 3,570,000 | | | 3,789,377 |

| Prior Lake Independent School District #719 Series B | | | | | | |

| 5.00% 2/1/19 (FSA) | | | 3,145,000 | | | 3,404,714 |

| Ramsey County State Aid Series C 5.00% 2/1/28 | | | 1,060,000 | | | 1,098,987 |

| Robbinsdale Independent School District #281 | | | | | | |

| 5.00% 2/1/21 (FSA) | | | 1,310,000 | | | 1,397,181 |

| Rockford Independent School District #883 | | | | | | |

| 5.60% 2/1/21 (FSA) | | | 3,210,000 | | | 3,273,558 |

| 5.625% 2/1/23 (FSA) | | | 7,020,000 | | | 7,159,768 |

| ^ | Rosemount Independent School District #196 | | | | | | |

| Capital Appreciation Series B | | | | | | |

| 5.85% 4/1/10 (FSA) | | | 2,240,000 | | | 2,229,203 |

| 5.931% 4/1/11 (FSA) | | | 2,600,000 | | | 2,547,194 |

| 5.961% 4/1/12 (FSA) | | | 1,850,000 | | | 1,769,026 |

| 6.008% 4/1/13 (FSA) | | | 1,915,000 | | | 1,779,092 |

| ^ | Sartell Independent School District #748 | | | | | | |

| Capital Appreciation Refunding Series B | | | | | | |

| 5.976% 2/1/13 (NATL-RE) | | | 540,000 | | | 498,420 |

| 6.100% 2/1/15 (NATL-RE) | | | 1,075,000 | | | 901,796 |

| 6.15% 2/1/16 (NATL-RE) | | | 1,750,000 | | | 1,397,095 |

28

| | | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | | |

| Local General Obligation Bonds (continued) | | | | | | |

| ^ | Sauk Rapids Independent School District #047 Series B | | | | | | |

| | 5.983% 2/1/15 (FSA) | | $ | 2,700,000 | | $ | 2,085,372 |

| 6.083% 2/1/17 (FSA) | | | 2,245,000 | | | 1,534,592 |

| South Washington County Independent School | | | | | | |

| District #833 Series A | | | | | | |

| 4.75% 2/1/25 | | | 2,500,000 | | | 2,658,350 |

| 4.75% 2/1/26 | | | 3,600,000 | | | 3,807,036 |

| 4.75% 2/1/27 | | | 2,300,000 | | | 2,417,139 |

| 5.60% 2/1/20 (NATL-RE) | | | 6,880,000 | | | 7,016,224 |

| St. Michael Independent School District #885 | | | | | | |

| 5.00% 2/1/20 (FSA) | | | 1,970,000 | | | 2,129,117 |

| 5.00% 2/1/27 (FSA) | | | 3,435,000 | | | 3,712,445 |

| St. Peter’s Hospital Series A 5.00% 9/1/24 (NATL-RE) | | | 1,905,000 | | | 1,943,214 |

| Todd Morrison Cass & Wadena Counties United | | | | | | |

| Hospital District (Health Care Facilities-Lakewood) | | | | | | |

| 5.00% 12/1/21 | | | 2,000,000 | | | 2,069,880 |

| 5.125% 12/1/24 | | | 1,000,000 | | | 1,030,280 |

| | | | | | | 132,710,826 |

| §Pre-Refunded Bonds – 17.98% | | | | | | |

| Chaska Electric Revenue Series A 6.00% 10/1/25-10 | | | 1,000,000 | | | 1,057,940 |

| Duluth Economic Development Authority | | | | | | |

| Health Care Facilities Revenue | | | | | | |

| (Benedictine Health System - St. Mary’s Hospital) | | | | | | |

| 5.25% 2/15/33-14 | | | 10,000,000 | | | 11,403,000 |

| 5.50% 2/15/23-14 | | | 1,000,000 | | | 1,150,920 |

| Hopkins Housing & Redevelopment Authority | | | | | | |

| (Public Works & Fire Station) Series A | | | | | | |

| 5.00% 2/1/23-13 (NATL-RE) | | | 1,210,000 | | | 1,356,579 |

| Marshall Medical Center Gross Revenue (Weiner Memorial | | | | | | |

| Medical Center Project) 6.00% 11/1/28-09 | | | 1,000,000 | | | 1,008,760 |

| Minneapolis Health Care System Revenue | | | | | | |

| (Allina Health Systems) Series A 5.75% 11/15/32-12 | | | 17,300,000 | | | 19,744,143 |

| (Fairview Health Services) Series A 5.625% 5/15/32-12 | | | 16,925,000 | | | 19,098,170 |

| Minneapolis - St. Paul Metropolitan Airports | | | | | | |

| Commission Revenue | | | | | | |

| Series A 5.25% 1/1/32-11 (FGIC) | | | 5,000,000 | | | 5,298,950 |

| Series C 5.25% 1/1/32-11 (FGIC) | | | 8,845,000 | | | 9,373,843 |

29

Statements of net assets

Delaware Tax-Free Minnesota Fund

| | | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | |

| §Pre-Refunded Bonds (continued) | | | | | |

| Minnesota Agricultural & Economic Development Revenue | | | | | |

| (Fairview Health Care System) | | | | | |

| Series A 6.375% 11/15/29-10 | $ | 485,000 | | $ | 521,812 |

| Minnesota State 5.00% 11/1/20-10 (FSA) | | 13,675,000 | | | 14,334,135 |

| Rochester Electric Utilities Revenue 5.25% 12/1/30-10 | | 4,915,000 | | | 5,192,009 |

| Southern Minnesota Municipal Power Agency Supply | | | | | |

| Revenue Series A | | | | | |

| | 5.75% 1/1/18-13 | | 3,790,000 | | | 4,081,262 |

| 5.75% 1/1/18-13 (AMBAC) | | 670,000 | | | 721,490 |

| 5.75% 1/1/18-13 (NATL-RE) | | 1,000,000 | | | 1,076,850 |

| St. Louis Park Health Care Facilities Revenue | | | | | |

| (Park Nicollet Health Services) Series B | | | | | |

| 5.25% 7/1/30-14 | | 9,420,000 | | | 10,727,967 |

| 5.50% 7/1/25-14 | | 2,000,000 | | | 2,300,500 |

| | | | | | 108,448,330 |

| Special Tax Revenue Bonds – 3.69% | | | | | |

| Hennepin County Sales Revenue | | | | | |

| (Second Lien - Ballpark Project) Series B | | | | | |

| 5.00% 12/15/19 | | 2,100,000 | | | 2,375,499 |

| 5.00% 12/15/20 | | 1,000,000 | | | 1,120,350 |

| 5.00% 12/15/24 | | 1,150,000 | | | 1,251,626 |

| Minneapolis Tax Increment Revenue Refunding | | | | | |

| (St. Anthony Falls Project) 5.75% 2/1/27 | | 1,000,000 | | | 687,100 |

| Puerto Rico Commonwealth Highway & Transportation | | | | | |

| Authority Revenue Series K 5.00% 7/1/30 | | 5,605,000 | | | 5,010,309 |

| Puerto Rico Commonwealth Infrastructure Financing | | | | | |

| Authority Special Tax Revenue Series B 5.00% 7/1/46 | | 4,000,000 | | | 3,323,520 |

| Puerto Rico Sales Tax Financing Corporation | | | | | |

| Sales Tax Revenue First Subordinate Series A | | | | | |

| ·5.00% 8/1/39 | | 925,000 | | | 946,849 |

| 5.75% 8/1/37 | | 5,620,000 | | | 5,777,921 |

| Virgin Islands Public Finance Authority Revenue | | | | | |

| (Senior Lien-Matching Fund Loan) Series A | | | | | |

| 5.25% 10/1/22 | | 1,785,000 | | | 1,760,028 |

| | | | | | 22,253,202 |

30

| | | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | |

| State General Obligation Bonds – 2.85% | | | | | |

| Minnesota State | | | | | |

| 5.00% 10/1/15 | $ | 5,000,000 | | $ | 5,822,350 |

| 5.00% 8/1/21 | | 2,400,000 | | | 2,598,840 |

| Series A 5.00% 12/1/21 | | 5,000,000 | | | 5,755,450 |

| Puerto Rico Commonwealth Public Improvement | | | | | |

| Un-Refunded Balance | | | | | |

| Series A 5.00% 7/1/34 | | 1,670,000 | | | 1,473,257 |

| Series B 5.00% 7/1/35 | | 575,000 | | | 505,391 |

| Puerto Rico Government Development Bank | | | | | |

| Senior Notes Series B 5.00% 12/1/14 | | 1,000,000 | | | 1,014,580 |

| | | | | | 17,169,868 |

| Transportation Revenue Bonds – 1.13% | | | | | |

| Minneapolis - St. Paul Metropolitan Airports | | | | | |

| Commission Revenue Series A | | | | | |

| 5.00% 1/1/15 (AMT) | | 3,095,000 | | | 3,189,645 |

| | 5.00% 1/1/22 (NATL-RE) | | 2,000,000 | | | 2,045,420 |

| 5.25% 1/1/16 (NATL-RE) | | 1,460,000 | | | 1,550,520 |

| | | | | | 6,785,585 |

| Water & Sewer Revenue Bonds – 0.48% | | | | | |

| Minnesota Public Facilities Authority Drinking Water | | | | | |

| Revenue Series B 5.25% 3/1/13 | | 1,500,000 | | | 1,694,940 |

| Minnesota Public Facilities Authority Water Pollution | | | | | |

| Control Revenue Refunding Series B 5.00% 3/1/19 | | 1,000,000 | | | 1,170,032 |

| | | | | | 2,864,972 |

| Total Municipal Bonds (cost $582,181,593) | | | | | 599,085,465 |

| |

| | Number of shares | | | |

| Short-Term Investments – 0.11% | | | | | |

| Money Market Instrument – 0.09% | | | | | |

| Federated Minnesota Municipal Cash Trust | | 553,820 | | | 553,820 |

| | | | | | 553,820 |

| |

| | Principal amount | | | |

| Variable Rate Demand Note – 0.02% | | | | | |

| University of Minnesota Series C 0.20% 12/1/36 | $ | 100,000 | | | 100,000 |

| | | | | | 100,000 |

| Total Short-Term Investments (cost $653,820) | | | | | 653,820 |

31

Statements of net assets

Delaware Tax-Free Minnesota Fund

| | | | |

| Total Value of Securities – 99.45% | | | |

| | (cost $582,835,413) | $ | 599,739,285 | |

| Receivables and Other Assets | | | |

| Net of Liabilities – 0.55% | | 3,333,220 | |

| Net Assets Applicable to 49,484,763 | | | |

| Shares Outstanding – 100.00% | $ | 603,072,505 | |

| |

| Net Asset Value – Delaware Tax-Free Minnesota Fund | | | |

| Class A ($559,392,714 / 45,909,709 Shares) | | $12.18 | |

| Net Asset Value – Delaware Tax-Free Minnesota Fund | | | |

| Class B ($9,506,019 / 779,525 Shares) | | $12.19 | |

| Net Asset Value – Delaware Tax-Free Minnesota Fund | | | |

| Class C ($34,173,772 / 2,795,529 Shares) | | $12.22 | |

| |

| Components of Net Assets at August 31, 2009: | | | |

| Shares of beneficial interest (unlimited authorization – no par) | $ | 586,243,181 | |

| Distributions in excess of net investment income | | (144,872 | ) |

| Accumulated net realized gain on investments | | 70,324 | |

| Net unrealized appreciation of investments | | 16,903,872 | |

| Total net assets | $ | 603,072,505 | |

| ^ | Zero coupon security. The rate shown is the yield at the time of purchase. |

| · | Variable rate security. The rate shown is the rate as of August 31, 2009. |

| § | Pre-Refunded bonds. Municipal bonds that are generally backed or secured by U.S. Treasury bonds. For Pre-Refunded Bonds, the stated maturity is followed by the year in which the bond is pre-refunded. See Note 9 in “Notes to financial statements.” |

| @ | Illiquid security. At August 31, 2009, the aggregate amount of illiquid securities was $2,112,779, which represented 0.35% of the Fund’s net assets. See Note 9 in “Notes to financial statements.” |

32

| |

Summary of abbreviations:

AMBAC — Insured by the AMBAC Assurance Corporation

AMT — Subject to Alternative Minimum Tax

ASSURED GTY — Insured by the Assured Guaranty Corporation

FGIC — Insured by the Financial Guaranty Insurance Company

FHA — Insured by the Federal Housing Administration

FNMA — Federal National Mortgage Association Collateral

FSA — Insured by Financial Security Assurance

GNMA — Government National Mortgage Association Collateral

HUD — Housing and Urban Development

NATL-RE — Insured by the National Public Finance Guarantee Corporation

RADIAN — Insured by Radian Asset Assurance

VA — Veterans Administration Collateral |

| Net Asset Value and Offering Price Per Share – | | |

| Delaware Tax-Free Minnesota Fund | | |

| Net asset value Class A (A) | $ | 12.18 |

| Sales charge (4.50% of offering price) (B) | | 0.57 |

| Offering price | $ | 12.75 |

| (A) | Net asset value per share, as illustrated, is the amount which would be paid upon redemption or repurchase of shares. |

| (B) | See the current prospectus for purchases of $100,000 or more. |

See accompanying notes

33

| Statements of net assets | |

| Delaware Tax-Free Minnesota Intermediate Fund | August 31, 2009 |

| | | Principal amount | | Value |

| Municipal Bonds – 97.93% | | | | | |

| Corporate-Backed Revenue Bonds – 1.84% | | | | | |

| Laurentian Energy Authority I Cogeneration Revenue | | | | | |

| Series A 5.00% 12/1/21 | $ | 750,000 | | $ | 689,798 |

| Minneapolis Community Development Agency | | | | | |

| (Limited Tax Common Bond Fund) | | | | | |

| Series 4 6.20% 6/1/17 (AMT) | | 960,000 | | | 962,275 |

| | | | | | 1,652,073 |

| Education Revenue Bonds – 10.32% | | | | | |

| Minnesota Colleges & Universities Revenue Fund | | | | | |

| Series A 5.00% 10/1/28 | | 1,000,000 | | | 1,070,780 |

| Minnesota Higher Education Facilities Authority Revenue | | | | | |

| (Carleton College) Series 6-T 4.75% 1/1/23 | | 1,000,000 | | | 1,056,290 |

| (Macalester College) Series 6-P 4.25% 3/1/27 | | 750,000 | | | 744,510 |

| | (St. Johns University) Series 6-U | | | | | |

| 4.40% 10/1/21 | | 325,000 | | | 330,642 |

| 4.50% 10/1/23 | | 265,000 | | | 268,882 |

| (University of St. Thomas) | | | | | |

| Series 5-Y 5.25% 10/1/19 | | 1,590,000 | | | 1,685,432 |

| Series 6-X 5.00% 4/1/24 | | 1,000,000 | | | 1,048,810 |

| St. Cloud Housing & Redevelopment Authority Revenue | | | | | |

| (State University Foundation Project) 5.00% 5/1/23 | | 1,000,000 | | | 1,030,110 |

| University of Minnesota Series A 4.00% 4/1/15 | | 310,000 | | | 338,309 |

| University of Minnesota Special Purpose Revenue | | | | | |

| (State Supported Stadium Debt) 5.00% 8/1/18 | | 1,500,000 | | | 1,675,170 |

| | | | | | 9,248,935 |

| Electric Revenue Bonds – 5.63% | | | | | |

| Chaska Electric Revenue Refunding (Generating Facilities) | | | | | |

| Series A 5.25% 10/1/25 | | 1,000,000 | | | 1,030,900 |

| Northern Municipal Power Agency | | | | | |

| 5.00% 1/1/13 (ASSURED GTY) | | 1,200,000 | | | 1,309,008 |

| Series A | | | | | |

| 5.00% 1/1/14 (ASSURED GTY) | | 510,000 | | | 560,934 |

| 5.00% 1/1/15 (ASSURED GTY) | | 1,000,000 | | | 1,107,730 |

| Southern Municipal Power Agency Power Supply System | | | | | |

| Series A 5.25% 1/1/30 | | 1,000,000 | | | 1,034,990 |

| | | | | | 5,043,562 |

34

| | | Principal amount | | Value |

| Municipal Bonds (continued) | | | | | |

| Escrowed to Maturity Bond – 1.36% | | | | | |

| University of Minnesota Series A 5.75% 7/1/16 | $ | 1,000,000 | | $ | 1,217,320 |

| | | | | | 1,217,320 |

| Health Care Revenue Bonds – 11.29% | | | | | |

| Bemidji Health Care Facilities First Mortgage Revenue | | | | | |

| (North Country Health Services) | | | | | |

| 5.00% 9/1/31 (RADIAN) | | 650,000 | | | 574,789 |

| Glencoe Health Care Facilities Revenue (Glencoe Regional | | | | | |

| Health Services Project) 5.00% 4/1/31 | | 1,000,000 | | | 853,980 |

| Minneapolis Health Care System Revenue | | | | | |

| (Fairview Health Services) Series A 6.625% 11/15/28 | | 1,500,000 | | | 1,655,805 |

| Minneapolis-St. Paul Housing & Redevelopment Authority | | | | | |

| (Health Partners Obligation Group Project) | | | | | |

| | 6.00% 12/1/17 | | 850,000 | | | 872,296 |

| Moorhead Economic Development Authority Multifamily | | | | | |

| Housing Revenue Refunding | | | | | |

| (Eventide Lutheran Home Project) 4.70% 6/1/18 | | 475,000 | | | 394,459 |

| | St. Cloud Minnesota Health Care Revenue (Centracare | | | | | |

| Health System Project) 5.375% 5/1/31 (ASSURED GTY) | | 1,000,000 | | | 1,026,850 |

| St. Louis Park Health Care Facilities Revenue Refunding | | | | | |

| (Park Nicollet Health Services) Series C 5.625% 7/1/26 | | 1,500,000 | | | 1,529,670 |