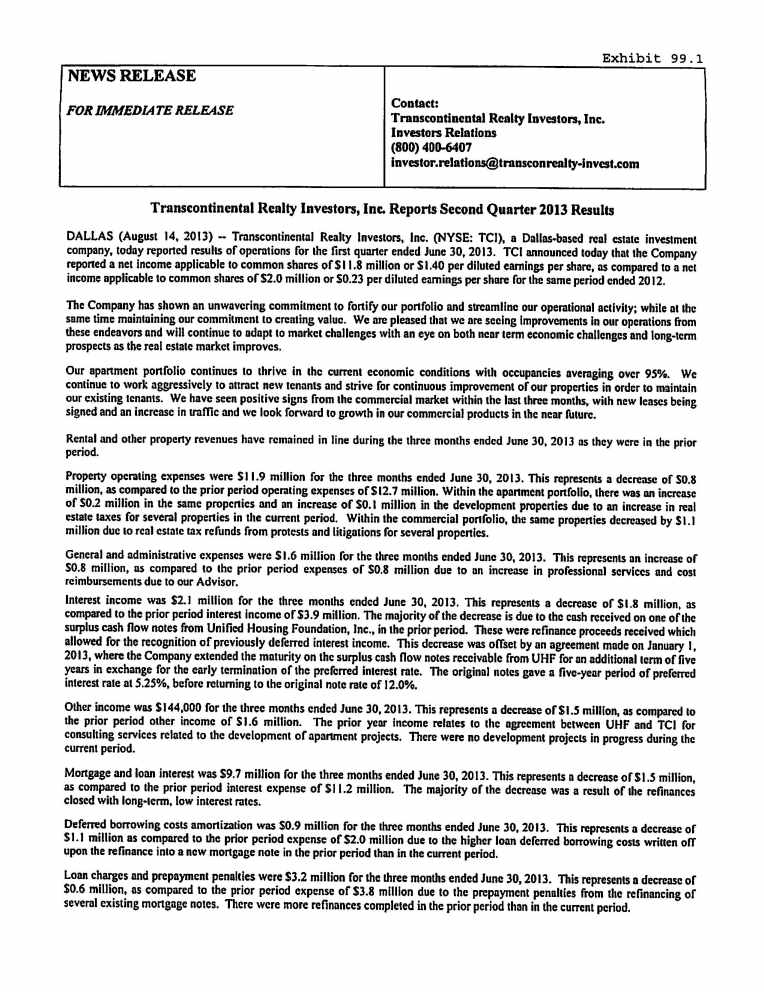

| TRANSCONTINENTAL REALTY INVESTORS, INC. | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | |

| (unaudited) | |

| | | For the Three Months Ended | | | For the Six Months Ended | |

| | | June 30, | | | June 30, | |

| | | 2013 | | | 2012 | | | 2013 | | | 2012 | |

| | | (dollars in thousands, except share and per share amounts) | |

| Revenues: | | | | | | | | | | | | |

Rental and other property revenues (including $166 and $167 for the three months and $331 and $335 for the six months ended 2013 and 2012 respectively from related parties) | | $ | 26,340 | | | $ | 26,421 | | | $ | 52,285 | | | $ | 52,221 | |

| | | | | | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | | | | | |

Property operating expenses (including $185 and $236 for the three months and $405 and $500 for the six months ended 2013 and 2012 respectively from related parties) | | | 11,915 | | | | 12,717 | | | | 24,354 | | | | 24,932 | |

| Depreciation and amortization | | | 5,412 | | | | 4,947 | | | | 10,250 | | | | 9,930 | |

General and administrative (including $839 and $682 for the three months and $1,544 and $1,345 for the six months ended 2013 and 2012 respectively from related parties) | | | 1,616 | | | | 771 | | | | 3,441 | | | | 3,213 | |

| Provision on impairment of notes receivable and real estate assets | | | - | | | | - | | | | - | | | | - | |

| Advisory fee to related party | | | 2,071 | | | | 2,217 | | | | 4,209 | | | | 4,521 | |

| Total operating expenses | | | 21,014 | | | | 20,652 | | | | 42,254 | | | | 42,596 | |

| | | | | | | | | | | | | | | | | |

| Operating income | | | 5,326 | | | | 5,769 | | | | 10,031 | | | | 9,625 | |

| | | | | | | | | | | | | | | | | |

| Other income (expense): | | | | | | | | | | | | | | | | |

Interest income (including $2,149 and $3,866 for the three months and $4,140 and $7,091 for the six months ended 2013 and 2012 respectively from related parties) | | | 2,119 | | | | 3,869 | | | | 4,296 | | | | 7,098 | |

Other income (including $0 and $1,500 for the three months and $0 and $3,000 for the six months ended 2013 and 2012 respectively from related parties) | | | 144 | | | | 1,592 | | | | 180 | | | | 3,312 | |

Mortgage and loan interest (including $439 and $1,107 for the three months and $487 and $1,861 for the six months ended 2013 and 2012 respectively from related parties) | | | (9,654 | ) | | | (11,207 | ) | | | (19,246 | ) | | | (22,398 | ) |

| Deferred borrowing costs amortization | | | (946 | ) | | | (1,957 | ) | | | (3,378 | ) | | | (2,852 | ) |

| Loan charges and prepayment penalties | | | (3,226 | ) | | | (3,769 | ) | | | (7,209 | ) | | | (6,162 | ) |

| Loss on the sale of investments | | | - | | | | (16 | ) | | | - | | | | (118 | ) |

| Earnings from unconsolidated joint ventures and investees | | | 15 | | | | 9 | | | | 22 | | | | (63 | ) |

| Total other expenses | | | (11,548 | ) | | | (11,479 | ) | | | (25,335 | ) | | | (21,183 | ) |

| | | | | | | | | | | | | | | | | |

| Loss before gain on land sales, non-controlling interest, and taxes | | | (6,222 | ) | | | (5,710 | ) | | | (15,304 | ) | | | (11,558 | ) |

| Gain (loss) on land sales | | | - | | | | 4,738 | | | | (48 | ) | | | 5,160 | |

| Loss from continuing operations before tax | | | (6,222 | ) | | | (972 | ) | | | (15,352 | ) | | | (6,398 | ) |

| Income tax benefit | | | 6,427 | | | | 1,200 | | | | 8,574 | | | | 1,654 | |

| Net income (loss) from continuing operations | | | 205 | | | | 228 | | | | (6,778 | ) | | | (4,744 | ) |

| Discontinued operations: | | | | | | | | | | | | | | | | |

| Income (loss) from discontinued operations | | | 290 | | | | 1,927 | | | | 231 | | | | (364 | ) |

| Gain on sale of real estate from discontinued operations | | | 18,074 | | | | 1,502 | | | | 24,265 | | | | 5,091 | |

| Income tax expense from discontinued operations | | | (6,427 | ) | | | (1,200 | ) | | | (8,574 | ) | | | (1,654 | ) |

| Net income from discontinued operations | | | 11,937 | | | | 2,229 | | | | 15,922 | | | | 3,073 | |

| Net income (loss) | | | 12,142 | | | | 2,457 | | | | 9,144 | | | | (1,671 | ) |

| Net income attributable to non-controlling interest | | | (115 | ) | | | (175 | ) | | | (226 | ) | | | (254 | ) |

| Net income (loss) attributable to Transcontinental Realty Investors, Inc. | | | 12,027 | | | | 2,282 | | | | 8,918 | | | | (1,925 | ) |

| Preferred dividend requirement | | | (277 | ) | | | (277 | ) | | | (551 | ) | | | (554 | ) |

| Net income (loss) applicable to common shares | | $ | 11,750 | | | $ | 2,005 | | | $ | 8,367 | | | $ | (2,479 | ) |

| | | | | | | | | | | | | | | | | |

| Earnings per share - basic | | | | | | | | | | | | | | | | |

| Loss from continuing operations | | $ | (0.02 | ) | | $ | (0.03 | ) | | $ | (0.90 | ) | | $ | (0.66 | ) |

| Income from discontinued operations | | | 1.42 | | | | 0.26 | | | | 1.89 | | | | 0.37 | |

| Net income(loss) applicable to common shares | | $ | 1.40 | | | $ | 0.23 | | | $ | 0.99 | | | $ | (0.29 | ) |

| | | | | | | | | | | | | | | | | |

| Earnings per share - diluted | | | | | | | | | | | | | | | | |

| Loss from continuing operations | | $ | (0.02 | ) | | $ | (0.03 | ) | | $ | (0.90 | ) | | $ | (0.66 | ) |

| Income from discontinued operations | | | 1.42 | | | | 0.26 | | | | 1.89 | | | | 0.37 | |

| Net income(loss) applicable to common shares | | $ | 1.40 | | | $ | 0.23 | | | $ | 0.99 | | | $ | (0.29 | ) |

| | | | | | | | | | | | | | | | | |

| Weighted average common share used in computing earnings per share | | | 8,413,469 | | | | 8,413,469 | | | | 8,413,469 | | | | 8,413,469 | |

| Weighted average common share used in computing diluted earnings per share | | | 8,413,469 | | | | 8,413,469 | | | | 8,413,469 | | | | 8,413,469 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Amounts attributable to Transcontinental Realty Investors, Inc. | | | | | | | | | | | | | | | | |

| Income (loss) from continuing operations | | $ | 90 | | | $ | 53 | | | $ | (7,004 | ) | | $ | (4,998 | ) |

| Income from discontinued operations | | | 11,937 | | | | 2,229 | | | | 15,922 | | | | 3,073 | |

| Net income (loss) | | $ | 12,027 | | | $ | 2,282 | | | $ | 8,918 | | | $ | (1,925 | ) |