Exhibit 99.1

CNB FINANCIAL CORPORATION | 2010 ANNUAL REPORT HIGHLIGHTS

2

TABLE OF

CONTENTS

| | | | |

Consolidated Financial Highlights | | | 4 | |

| |

Message to Shareholders | | | 5 | |

| |

Executive Management and Board of Directors | | | 8 | |

| |

Officers | | | 9 | |

| |

Shareholder Information | | | 11 | |

3

Consolidated Financial Highlights

(in thousands, except per share data)

| | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | % Change | |

FOR THE YEAR | | | | | | | | | | | | |

Interest Income | | $ | 61,147 | | | $ | 55,870 | | | | 9.4 | % |

| | | |

Interest Expense | | | 19,056 | | | | 18,468 | | | | 3.2 | % |

Net Interest Income | | | 42,091 | | | | 37,402 | | | | 12.5 | % |

Non-interest Income | | | 9,650 | | | | 7,950 | | | | 21.4 | % |

Non-interest Expense | | | 31,798 | | | | 30,021 | | | | 5.9 | % |

Net Income | | | 11,316 | | | | 8,512 | | | | 32.9 | % |

Operating Earnings* | | | 12,773 | | | | 10,100 | | | | 26.5 | % |

| | | |

Net Income Return on: | | | | | | | | | | | | |

Average Assets | | | 0.87 | % | | | 0.79 | % | | | 10.1 | % |

Average Equity | | | 11.62 | % | | | 12.86 | % | | | (9.6 | %) |

| | | |

AT YEAR END | | | | | | | | | | | | |

| | | |

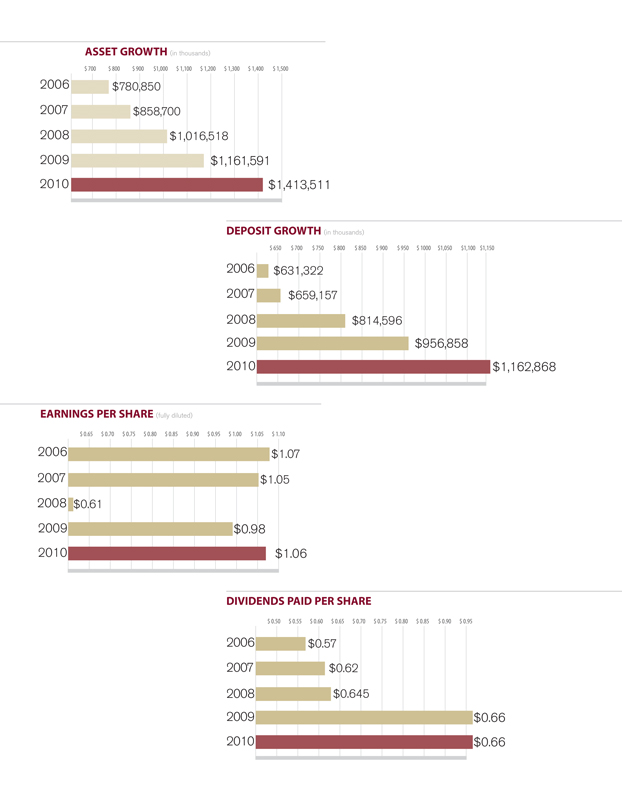

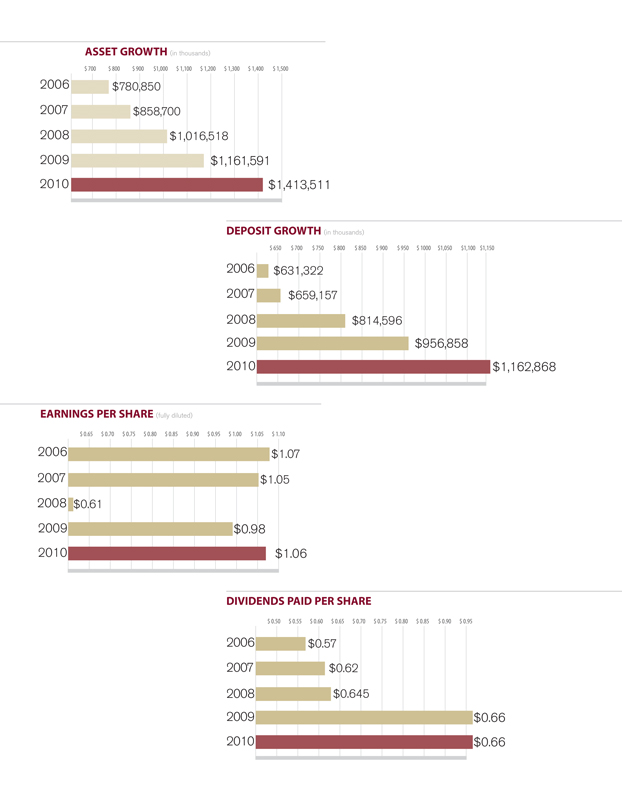

Assets | | $ | 1,413,511 | | | $ | 1,161,591 | | | | 21.7 | % |

Loans, net of unearned | | | 794,562 | | | | 715,142 | | | | 11.1 | % |

Deposits | | | 1,162,868 | | | | 956,858 | | | | 21.5 | % |

Shareholders’ Equity | | | 109,645 | | | | 69,409 | | | | 58.0 | % |

Wealth Assets Under Management (at market value) | | | 327,575 | | | | 304,068 | | | | 7.7 | % |

| | | |

PER SHARE DATA | | | | | | | | | | | | |

| | | |

Net Income, diluted | | $ | 1.06 | | | $ | 0.98 | | | | 8.2 | % |

Dividends | | | 0.66 | | | | 0.66 | | | | 0.0 | % |

Book Value | | | 8.96 | | | | 7.92 | | | | 13.1 | % |

Market Value | | | 14.81 | | | | 15.99 | | | | (7.4 | %) |

| * | 2010 and 2009 operating earnings amounts are shown before effect of $1,457 and $1,588 (after tax) non-cash charges due to write-downs of other-than-temporarily impaired securities. |

4

MESSAGE TO

SHAREHOLDERS

To Our Shareholders, Customers, Employees & Friends:

Twelve months ago, I shared the optimism CNB Financial Corporation felt as the economy showed signs of recovery during the last quarter of 2009. CNB was in an excellent position to help the communities we serve to grow again after many months of recession. Through strategies executed during 2010, CNB is now in an even better position to allow for economic growth to continue.

In April of 2010, CNB’s Board of Directors decided to pursue a common stock offering. The additional capital was necessary primarily as a result of the outstanding growth that CNB had experienced beginning in 2007 as assets grew from $781 million to $1.2 billion. In addition to the growth, we believe that the solid growth potential will continue into 2011 and 2012. Finally, the uncertainty surrounding increased regulation created a need across the financial services industry for higher levels of common equity. The end result was a highly successful capital raise of $34.5 million. The market was very receptive to CNB’s continuing story of positive balance sheet growth coupled with solid core earnings and stable asset quality.

The successful common stock offering was one of the ways our capital improved. CNB’s continued strong earnings in 2010 added to our capital position. Our Corporation reported record earnings of $11.3 million, or $1.06 per share, an increase of 32.9% over the prior year earnings of $8.5 million. The 2010 earnings allowed for our equity to grow by an additional $5 million after dividends were paid to our shareholders. CNB continues to remain well above all regulatory capital ratios.

A significant contribution to our increased earnings was the large growth in earning assets during 2010. Loans grew 11.1% while investments increased 45% over 2009 levels. This growth was critical to increasing our overall earnings as the net interest margin declined from 4.0% in 2009 to 3.7% for 2010. Many factors contributed to the reduction of the margin, but the foremost cause is lower yields within our securities portfolio caused by the historically low interest rate cycle that we have been experiencing since early 2009. As we are able to move more assets into the loan portfolio, the margin will begin to improve.

Our earning asset growth was driven by the third consecutive year of excellent core deposit gathering. Total deposits grew $206 million or 21.5% during the year. With our strong equity position, CNB remains aggressive in the acquisition of new customers. Our permanent ERIEBANK Meadville store opened in May of 2010, while CNB Bank opened a new office in Kylertown in September, bringing our franchise to a total of 28 banking locations in the state of Pennsylvania. The new locations are proving valuable to our strategy of gaining core deposit relationships.

CNB FINANCIAL CORPORATION | 2010 ANNUAL REPORT HIGHLIGHTS

5

6

Message to Shareholderscontinued…

Asset quality continued to be an issue for the financial services industry during 2010, and CNB was not immune. The ratio of net charge-offs to average loans increased this year to 0.56% as compared to 0.49% in 2009. This was primarily due to a $1.8 million charge to one loan during the fourth quarter. Management does not expect any further charge on the remaining $6.0 million loan balance. Overall, CNB’s asset quality improved during the year as nonperforming assets decreased as a percentage of loans to 1.66% from 1.90% at December 31, 2009. These ratios remain very favorable as compared to our peer group and a true testament to our credit standards and underwriting.

As we look forward to 2011 and beyond, I would like to thank all of our long-term shareholders that have enjoyed CNB’s growth and prosperity through the years as well as welcome all of our new shareholders that helped us execute a successful capital raise this year. With this strength, CNB’s team is looking forward to all of the opportunities in our region that will come as the economy continues to rebuild.

|

|

| Joseph B. Bower, Jr. |

| President and Chief Executive Officer |

CNB FINANCIAL CORPORATION | 2010 ANNUAL REPORT HIGHLIGHTS

7

EXECUTIVE MANAGEMENT

& BOARD OF DIRECTORS

| | | | |

| Corporate Officers, CNB Financial Corporation |

| | |

| Joseph B. Bower, Jr. | | Charles R. Guarino | | |

| President & Chief Executive Officer | | Treasurer & Principal Financial Officer | | |

| | |

| Richard L. Greslick, Jr. | | Vincent C. Turiano | | |

| Secretary | | Assistant Secretary | | |

|

| Executive Officers, CNB Bank |

| | |

| Joseph B. Bower, Jr. | | Charles R. Guarino | | |

| President & Chief Executive Officer | | Vice President & Chief Financial Officer | | |

| | |

| Mark D. Breakey | | Richard L. Sloppy | | |

| Executive Vice President & Chief Credit Officer | | Executive Vice President & Chief Lending Officer | | |

| | |

| Richard L. Greslick, Jr. | | Vincent C. Turiano | | |

| Senior Vice President/ Administration | | Senior Vice President/ Operations | | |

| | |

| Board of Directors | | | | |

| CNB Financial Corporation and CNB Bank |

| | |

| Dennis L. Merrey | | Robert W. Montler | | Richard B. Seager |

Chairman of the Board Retired, Formerly President, Clearfield Powdered Metals, Inc. (Manufacturer) | | President & Chief Executive Officer, Lee Industries and Keystone Process Equipment (Manufacturers) | | President and Chief Executive Officer, Beacon Light Behavioral Health Systems (Health Services) |

| | |

| Joseph B. Bower, Jr. | | Deborah Dick Pontzer | | Peter F. Smith |

President and Chief Executive Officer, CNB Financial Corporation; President and Chief Executive Officer, CNB Bank | | Economic Development and Workforce Specialist, Office of Congressman Glenn Thompson | | Attorney at Law |

| | |

| Robert E. Brown | | Jeffrey S. Powell | | DIRECTOR EMERITUS |

Vice President, E. M. Brown, Inc. (Reclamation, Auto Dealer and Concrete Supplier) | | President, J.J. Powell, Inc. (Petroleum Distributor) | | L. E. Soult, Jr. |

| | |

| William F. Falger | | Charles H. Reams | | |

Retired, Formerly President and Chief Executive Officer, CNB Financial Corporation, CNB Bank | | President, C.H. Reams & Associates, Inc. (Insurance) | | |

| | |

| | James B. Ryan | | |

| | Retired, Formerly Vice President of Sales, Marketing, Windfall Products, Inc. (Manufacturer) | | |

8

OFFICERS

| | | | |

| Administrative Services | | | | |

| | |

| Mary Ann Conaway | | Carolyn B. Smeal | | Shannon L. Irwin |

Vice President, Human Resources | | Assistant Vice President/Operations | | Human Resources Officer |

| | |

| Edward H. Proud | | Susan M. Warrick | | Susan B. Kurtz |

Vice President, Information Systems | | Assistant Vice President/Operations | | Customer Service Officer |

| | |

| Thomas J. Ammerman, Jr. | | Brian W. Wingard | | Dennis J. Sloppy |

| Assistant Vice President/Security | | Assistant Vice President/Controller | | Information Systems Officer |

| | |

| Donna J. Collins | | Carol J. Cossick | | BJ Sterndale |

| Assistant Vice President/Compliance | | Assistant Controller | | Training Officer |

| | |

| Leanne D. Kassab | | Thomas W. Grice | | Brenda L. Terry |

| Assistant Vice President/Marketing | | Network Administration Officer | | Banking Officer |

| | |

| Branch Division | | | | |

| | |

| Vickie L. Baker | | Denise J. Greene | | Douglas M. Shaffer |

Assistant Vice President, Regional Branch Administration, Bradford Main Street Office | | Community Office Manager, DuBois Office | | Community Office Manager, Punxsutawney Office |

| | |

| Ruth Anne Ryan-Catalano | | Francine M. Papa | | Susan J. Shimmel |

Assistant Vice President, Regional Branch Administration, Industrial Park Road Office, Clearfield | | Community Office Manager, Ridgway Office | | Community Office Manager, Old Town Road Office, Clearfield |

| | |

| Mary A. Baker | | Larry A. Putt | | Theresa L. Swanson |

Assistant Vice President, Northern Cambria Office | | Banking Officer, Clearfield | | Community Office Manager, Warren Office |

| | |

| Deborah M. Young | | Mary Ann Roney | | Gregory R. Williams |

Assistant Vice President, Washington Street Office, St. Marys | | Banking Officer, Bradford | | Banking Officer, Clearfield |

| | |

| Lending Division | | | | |

| | |

| Robert S. Berezansky | | Charles C. Shrader | | James C. Davidson |

Senior Vice President, Corporate Lending | | Vice President, Commercial Banking, Warren | | Mortgage Lending Officer |

| | |

| James M. Baker | | Joseph H. Yaros | | Cory Johnston |

Vice President, Commercial Banking, DuBois | | Vice President, Commercial Banking Bradford | | Credit Administration Officer |

| | |

| Michael E. Haines | | Gregory M. Dixon | | Paul A. McDermott |

Vice President, Commercial Banking, St. Marys | | Vice President/Credit Administration | | Collections Officer |

| | |

| Robin L. Hay | | David W. Ogden | | Jennifer L. Mowery |

Vice President, Commercial Banking | | Vice President, Credit Administration | | Staff Commercial Lender Johnstown |

| | |

| Jeffrey A. Herr | | Christopher L. Stott | | Eileen F. Ryan |

Vice President, Commercial Banking, Philipsburg | | Vice President, Retail Lending | | Assistant Vice President/Mortgage Lending |

| | |

| | Michael C. Sutika | | Steven C. Tunall |

| | Vice President, Commercial Banking | | Commercial Banking, Kane |

|

| Wealth & Asset Management Services |

| | |

| Todd M. Abrams | | Natalie R. Barnett | | Eric A. Johnson |

Senior Vice President/Managing Director, Wealth & Asset Management | | Financial Consultant, Wealth Management | | Trust Officer |

| | |

| Craig C. Ball | | Calvin R. Thomas, Jr. | | Glenn R. Pentz |

Vice President, Wealth Management | | Vice President, Trust Officer | | Trust Officer |

CNB FINANCIAL CORPORATION | 2010 ANNUAL REPORT HIGHLIGHTS

9

OFFICERS

& AFFILIATES

| | | | |

| ERIEBANK, a Division of CNB Bank |

| David J. Zimmer | | John M. Schulze | | Katie J. Jones |

| President | | Vice President | | Community Office Manager, Harborcreek Office |

| | |

| Donald W. Damon | | William J. Vitron, Jr. | | Abby L. Mouyard |

| Senior Vice President | | Vice President, Wealth Management | | Community Office Manager, Main Office |

| | |

| Steven M. Cappellino | | Carla M. LaBoda | | Paul D. Sallie |

Senior Vice President, Meadville Office | | Regional Retail Administrator, Asbury Office | | Private Banking Officer |

| | |

| William L. DeLuca, Jr. | | Kelly S. Buck | | Timothy Roberts |

| Senior Vice President | | Community Office Manager, Downtown Office | | Commercial Lending Officer |

| | |

| Betsy Bort | | Matthew V. Feleppa | | |

| Vice President | | Community Office Manager, Meadville Office | | |

| | |

| Scott O. Calhoun | | | | |

| Vice President | | | | |

|

| ERIEBANK Regional Board of Directors |

| | |

| Joseph B. Bower, Jr. | | Thomas L. Doolin | | James E. Spoden |

President and Chief Executive Officer, CNB Financial Corporation, CNB Bank | | President, New Age Business Solutions, LLC (Consulting) | | Esquire, MacDonald Illig Jones & Britton, LLP (Law office) |

| | |

| Mark D. Breakey | | David K. Galey | | David J. Zimmer |

| Executive Vice President & Chief Credit Officer | | Treasurer, Chief Financial Officer, Greenleaf Corporation (Manufacturing) | | President, ERIEBANK |

| | |

| Harry E. Brown | | Thomas Kennedy | | |

Vice President, Specialty Bar Products, EBC Industries (Manufacturing) | | President, Professional Development Associates, Inc. (Real estate developer) | | |

| | |

| Gary L. Clark | | Charles H. Reams | | |

Vice President, Chief Financial Officer and Chief Administrative Officer, Snap-tite, Inc. (Manufacturing) | | President, C. H. Reams & Associates, Inc. (Insurance) | | |

| | | | | | |

Holiday Financial Services Corporation, a Subsidiary of CNB Financial Corporation |

| | | |

| | Board of Directors & Corporate Officers | | Administrative Services | | |

| | | |

| | Joseph B. Bower, Jr. | | Joseph P. Strouse | | |

| | Director & President | | Vice President | | |

| | | |

| | Richard L. Greslick, Jr. | | Jonathan L. Holler | | |

| | Director & Secretary | | Assistant Vice President | | |

| | | |

| | Charles R. Guarino | | | | |

| | Director & Treasurer | | | | |

| | | | | | |

| CNB Securities Corporation, a Subsidiary of CNB Financial Corporation, Wilmington, DE |

| | | |

| | Board of Directors | | Corporate Officers | | |

| | | |

| | Brian W. Wingard | | Richard L. Greslick, Jr. | | |

| | Director | | President | | |

| | | |

| | Glenn R. Pentz | | Donald R. McLamb, Jr. | | |

| | Director | | Treasurer, Wilmington Trust SP Services, Inc. | | |

| | | |

| | Donald R. McLamb, Jr. | | Elizabeth F. Bothner | | |

| | Wilmington Trust SP Services, Inc. | | Secretary, Wilmington Trust SP Services, Inc. | | |

10

SHAREHOLDER

INFORMATION

Annual Meeting

The Annual Meeting of the Shareholders of CNB Financial Corporation will be held Tuesday, April 19, 2011 at 2:00 p.m. at the Corporation’s Headquarters in Clearfield, PA.

Corporate Address

CNB Financial Corporation

1 S. Second Street

P.O. Box 42

Clearfield, PA 16830

(814) 765-9621

Stock Transfer Agent & Registrar

Registrar and Transfer Company

10 Commerce Drive

Cranford, NJ 07016

(908) 497-2300

Form 10-K

Shareholders may obtain a copy of the Annual Report to the Securities and Exchange Commission on Form 10-K by writing to:

CNB Financial Corporation

1 S. Second Street

P.O. Box 42

Clearfield, PA 16830

ATTN: Shareholder Relations

Quarterly Share Data

For information regarding the Corporation’s quarterly share data, please refer to page 27 in the 2010 Form 10-K.

Market Makers

The following firms have chosen to make a market in the stock of the Corporation. Inquiries concerning their services should be directed to:

Boenning & Scattergood, Inc.

1700 Market Street, Ste 1420

Philadelphia, PA 19103

(800) 842-8928

RBC Capital Markets

Three World Financial Center

200 Vesey Street, 9th Floor

New York, NY 10281

(212) 428-6200

Corporate Profile

CNB Financial Corporation is a leader in providing integrated financial solutions which creates value for both consumers and businesses. These solutions encompass checking, savings, time and deposit accounts, Private Banking, loans and lines of credit (real estate, commercial, industrial, residential and consumer), credit cards, cash management, online banking, electronic check deposit, merchant credit card processing, on-site banker and accounts receivable handling. In addition, the Corporation provides wealth and asset management services, retirement plans and other employee benefit plans.

CNB Bank

A subsidiary of CNB Financial Corporation, CNB is a regional independent community bank in North Central Pennsylvania with approximately 303 employees who make customer service more responsive and reliable. For over 145 years, the Bank has strived to be more customer-driven than its competitors thus building long-term customer relationships by being reliable and competitively priced.

CNB continually seeks innovative ways to execute a personal, quality customer service strategy and prides itself for being first-to-market many of these innovations. To satisfy customers’ financial needs and expectations, it offers a variety of delivery channels, which includes 22 full-service offices, 20 ATMs, 1 loan production office, telephone banking (1-866-224-7314), Internet banking (www.bankcnb.com) and a centralized customer service center (1-800-492-3221).

ERIEBANK

Headquartered in Erie, Pennsylvania, ERIEBANK is a division of CNB Bank. Presently, there are five full service locations which house its commercial, retail and Private Banking divisions.

Holiday Financial Services

Another subsidiary of CNB Financial Corporation, Holiday Financial Services, a consumer loan company, currently has eight conveniently located offices in Bellefonte, Bradford, Clearfield, Erie, Hollidaysburg, Northern Cambria, Ridgway and Sidman, Pennsylvania.

The common stock of the Corporation trades on the NASDAQ National Market under the symbol CCNE.

CNB FINANCIAL CORPORATION | 2010 ANNUAL REPORT HIGHLIGHTS

11

| | |

| CNB Financial Corporation | | |

| 1 South Second Street | | |

| P.O. Box 42 | | |

| Clearfield, PA 16830 | | |

| 800-492-3221 | | |

| www.bankcnb.com | | |