Exhibit 99.1

TABLE OF CONTENTS

| | |

Consolidated Financial Highlights | | 3 |

| |

Message to Shareholders | | 4 |

| |

Executive Management and Board of Directors | | 7 |

| |

Officers | | 8 |

| |

Shareholder Information | | 10 |

CNB FINANCIAL CORPORATION |||||2011 ANNUAL REPORT HIGHLIGHTS 2

Consolidated Financial Highlights(in thousands, except per share data)

| | | | | | | | | | | | |

FOR THE YEAR | | 2011 | | | 2010 | | | %

Change | |

| | | |

Interest Income | | $ | 65,712 | | | $ | 61,147 | | | | 7.5 | % |

Interest Expense | | | 17,579 | | | | 19,056 | | | | (7.8 | %) |

Net Interest Income | | | 48,133 | | | | 42,091 | | | | 14.4 | % |

Non-interest Income | | | 10,719 | | | | 9,650 | | | | 11.1 | % |

Non-interest Expense | | | 33,282 | | | | 31,798 | | | | 4.7 | % |

Net Income | | | 15,104 | | | | 11,316 | | | | 33.5 | % |

| | | |

Net Income Return on: | | | | | | | | | | | | |

Average Assets | | | 1.00 | % | | | 0.87 | % | | | 14.9 | % |

Average Equity | | | 12.36 | % | | | 11.62 | % | | | 6.4 | % |

| | | |

AT YEAR END | | | | | | | | | |

| | | |

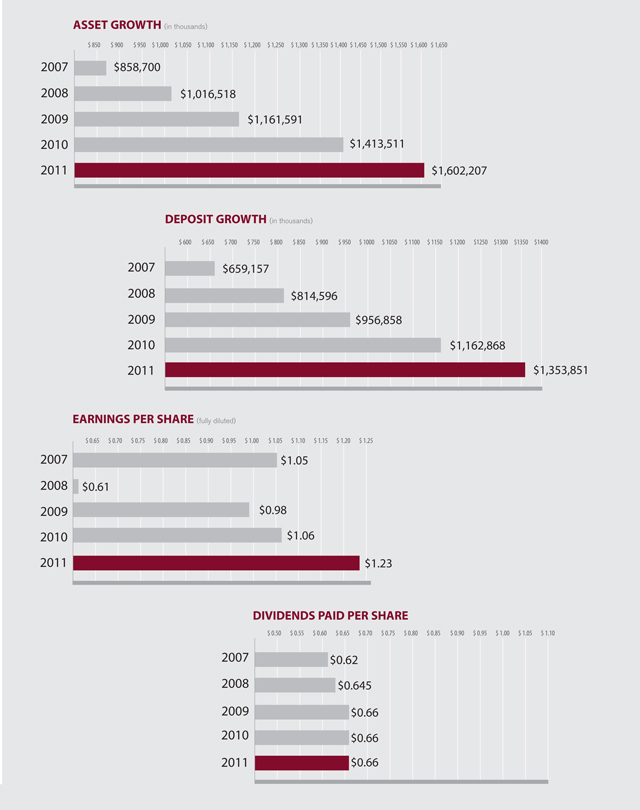

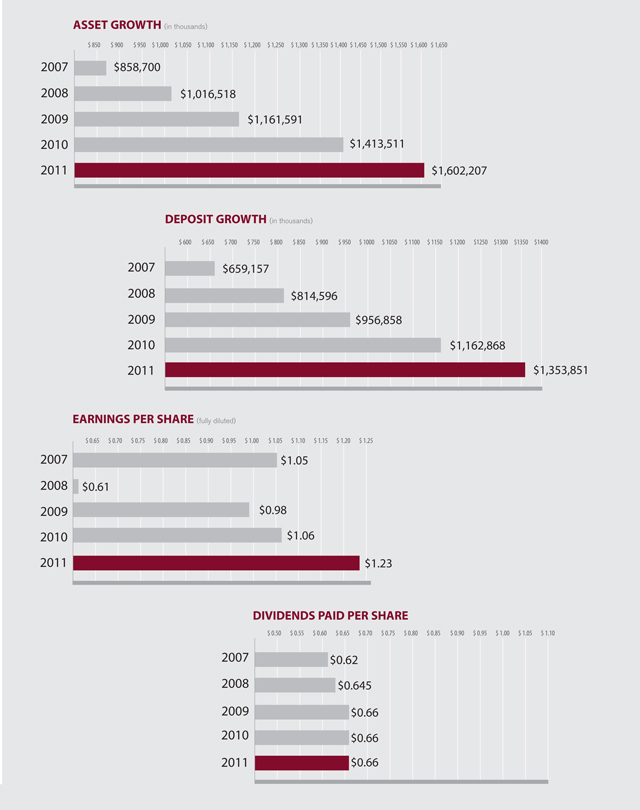

Assets | | $ | 1,602,207 | | | $ | 1,413,511 | | | | 13.3 | % |

Loans, net of unearned | | | 849,883 | | | | 794,562 | | | | 7.0 | % |

Deposits | | | 1,353,851 | | | | 1,162,868 | | | | 16.4 | % |

Shareholders’ Equity | | | 131,889 | | | | 109,645 | | | | 20.3 | % |

Trust Assets Under Management (at market value) | | | 336,285 | | | | 327,575 | | | | 2.7 | % |

| | | |

PER SHARE DATA | | | | | | | | | |

| | | |

Net Income, diluted | | $ | 1.23 | | | $ | 1.06 | | | | 16.0 | % |

Dividends | | | 0.66 | | | | 0.66 | | | | 0.0 | % |

Book Value | | | 10.66 | | | | 8.96 | | | | 19.0 | % |

Market Value | | | 15.78 | | | | 14.81 | | | | 6.5 | % |

3

MESSAGE TO SHAREHOLDERS

To Our Shareholders, Customers, Employees & Friends:

CNB achieved a 33% growth in earnings in 2011 for the second consecutive year. Similar to 2010, the 2011 earnings growth was driven by a significant increase in earning assets. The strategy employed by CNB of growing core deposits and expanding existing customer relationships has been the primary factor in our growth and profitability. The acquisition of a large number of core customers during the past four years will lead to a larger number of opportunities when loan demand returns.

Along with the growth in earning assets, the improvement in asset quality has positioned the Corporation well entering 2012. While we continued to build the allowance for loan losses from 1.36% of total loans at December 31, 2010 to 1.48% of total loans at December 31, 2011, net charge-offs as a percentage of average loans decreased from 0.56% in 2010 to 0.38% in 2011. The focus on strong underwriting has carried CNB through difficult economic times and should continue to provide a benefit during the years of economic recovery in the future.

The past year brought several major changes in our market area. A decision to concentrate our efforts on community-based relationships brought about the closing of our Johnstown loan production office as its focus had been primarily on large corporate lending. We opened a loan production office staffed by three seasoned commercial lenders August 2011 in Indiana, PA, to focus on building relationships throughout Indiana County. Also, the retail oriented design created in 2006 that offers a more personal banking experience that was implemented in our ERIEBANK division has been brought to CNB Bank for the first time in a remodel of our downtown Bradford location.

For much of the United States, the recovery from this recession has been very slow. Our market area has not been immune to this; however the recessionary effects on Western and Central Pennsylvania were not as pronounced as in other areas of the country. CNB Financial Corporation was able to significantly grow deposits again in 2011, but lending opportunities have continued to lag behind due to economic uncertainty. Because loan demand has been fairly stagnant for most financial institutions, new loan requests and maintaining existing business are becoming increasingly competitive. This economic environment will continue to put pressure on our net interest margin as asset yields continue to decline.

CNB FINANCIAL CORPORATION |||||2011 ANNUAL REPORT HIGHLIGHTS 4

5

MESSAGE TO SHAREHOLDERS

Message to Shareholderscontinued…

The rapid pace of regulation has been very challenging for the financial industry. No decline in the regulatory burden is expected for the foreseeable future. This will cause some significant compliance challenges for most community banks. CNB accepts this challenge and will comply with the intent of the laws while continuing our practice of making products understandable and affordable to the consumer.

This year marked the retirement of Robert E. Brown from our Board of Directors. Bob served for 28 years as a Director of the Corporation. On behalf of the Board and management, I would like to thank him for his many years of service and wish him well in all of his future endeavors.

As always, we are proud to report CNB Financial Corporation’s 2011 financial condition and results of operations to you, and we look forward to a prosperous 2012.

Joseph B. Bower, Jr.

President and Chief Executive Officer

CNB FINANCIAL CORPORATION |||||2011 ANNUAL REPORT HIGHLIGHTS 6

EXECUTIVE MANAGEMENT

& BOARD OF DIRECTORS

Corporate Officers, CNB Financial Corporation

| | | | |

| Joseph B. Bower, Jr. | | Brian W. Wingard | | |

| President & Chief Executive Officer | | Interim Treasurer & Principal Financial Officer |

| | |

| Richard L. Greslick, Jr. | | Vincent C. Turiano | | |

| Secretary | | Assistant Secretary | | |

| | |

| Executive Officers, CNB Bank | | | | |

| | |

| Joseph B. Bower, Jr. | | Brian W. Wingard | | |

| President & Chief Executive Officer | | Interim Chief Financial Officer | | |

| | |

| Mark D. Breakey | | Richard L. Sloppy | | |

| Executive Vice President & Chief Credit Officer | | Executive Vice President & Chief Lending Officer | | |

| | |

| Richard L. Greslick, Jr. | | Vincent C. Turiano | | |

| Senior Vice President/ Administration | | Senior Vice President/ Operations | | |

| | |

| Board of Directors | | | | |

| CNB Financial Corporation and CNB Bank | | |

| | |

| Dennis L. Merrey | | Robert W. Montler | | James B. Ryan |

| Chairman of the Board Retired, Formerly President, Clearfield Powdered Metals, Inc. (Manufacturer) | | President & Chief Executive Officer, Lee Industries and Keystone Process Equipment (Manufacturers) | | Retired, Formerly Vice President of Sales, Marketing, Windfall Products, Inc. (Manufacturer) |

| | |

| Joseph B. Bower, Jr. | | Joel E. Peterson | | Richard B. Seager |

| President and Chief Executive Officer, CNB Financial Corporation; President and Chief Executive Officer, CNB Bank | | President, Clearfield Wholesale Paper (Wholesaler) | | President and Chief Executive Officer, Beacon Light Behavioral Health Systems (Health Services) |

| | |

| William F. Falger | | Deborah Dick Pontzer | | Peter F. Smith |

| Retired, Formerly President and Chief Executive Officer, CNB Financial Corporation, CNB Bank | | Economic Development and Workforce Specialist, Office of Congressman Glenn Thompson | | Attorney at Law |

| | | | DIRECTOR EMERITUS |

| Richard L. Greslick, Jr. | | Jeffrey S. Powell | | L. E. Soult, Jr. |

| Secretary, CNB Financial Corporation; Senior Vice President/ Administration, CNB Bank | | President, J.J. Powell, Inc. (Petroleum Distributor) | | |

| | | |

| | | | |

| | Charles H. Reams | | |

| | President, C.H. Reams & Associates, Inc. (Insurance) | | |

7

OFFICERS

| | | | |

| Administrative Services | | | | |

| | |

| Mary Ann Conaway | | Leanne D. Kassab | | Susan B. Kurtz |

| Vice President, Human Resources | | Assistant Vice President, Marketing | | Customer Service Officer |

| | |

| Edward H. Proud | | Carolyn B. Smeal | | Dennis J. Sloppy |

| Vice President, Information Systems | | Assistant Vice President, Operations | | Information Systems Officer |

| | |

| Susan M. Warrick | | Carol J. Cossick | | BJ Sterndale |

| Vice President, Operations | | Assistant Controller | | Training Officer |

| | |

| Thomas J. Ammerman, Jr. | | Thomas W. Grice | | Brenda L. Terry |

| Assistant Vice President, Security | | Network Administration Officer | | Banking Officer |

| | |

| Donna J. Collins | | Shannon L. Irwin | | |

| Assistant Vice President, Compliance | | Human Resources Officer | | |

| | |

| Branch Division | | | | |

| | |

| Vickie L. Baker | | Denise J. Greene | | Douglas M. Shaffer |

| Assistant Vice President, Regional Branch Administration, Bradford Main Street Office | | Community Office Manager, DuBois Office | | Community Office Manager, Punxsutawney Office |

| | |

| Ruth Anne Ryan-Catalano | | Francine M. Papa | | Susan J. Shimmel |

Assistant Vice President, Regional Branch Administration, Industrial Park Road Office, Clearfield | | Community Office Manager, Ridgway Office | | Community Office Manager, Old Town Road Office, Clearfield |

| | |

| | |

| Mary A. Baker | | Larry A. Putt | | Theresa L. Swanson |

| Assistant Vice President, Northern Cambria Office | | Banking Officer, Clearfield | | Community Office Manager, Warren Office |

| | |

| Deborah M. Young | | Mary Ann Roney | | Gregory R. Williams |

| Assistant Vice President, Washington Street Office, St. Marys | | Banking Officer, Bradford | | Banking Officer, Clearfield |

Lending Division | | | | |

| | |

| Jeffrey W. Alabran | | Joseph H. Yaros | | Eileen F. Ryan |

| Senior Vice President, Commercial Lending, Indiana | | Vice President, Commercial Banking Bradford | | Assistant Vice President, Mortgage Lending |

| | |

| James M. Baker | | David W. Ogden | | James C. Davidson |

| Vice President, Commercial Banking, DuBois | | Vice President, Credit Administration | | Mortgage Lending Officer |

| | |

| Gregory M. Dixon | | Christopher L. Stott | | Cory Johnston |

| Vice President, Commercial Banking | | Vice President, Retail Lending | | Credit Administration Officer |

| | |

| Michael E. Haines | | Michael C. Sutika | | Paul A. McDermott |

| Vice President, Commercial Banking, St. Marys | | Vice President, Commercial Banking | | Collections Officer |

| | |

| Robin L. Hay | | Gregory Noon | | Steven C. Tunall |

| Vice President, Commercial Banking | | Assistant Vice President, Commercial Banking, Warren | | Commercial Banking, Kane |

| | |

| Jeffrey A. Herr | | C. Brett Stewart | | |

| Vice President, Commercial Banking, Philipsburg | | Assistant Vice President, Commercial Lending, Indiana | | |

Wealth & Asset Management Services | | | | |

| | |

| Todd M. Abrams | | Craig C. Ball | | Eric A. Johnson |

| Senior Vice President, Managing Director, Wealth & Asset Management | | Vice President, Wealth Management | | Trust Officer |

| | |

| Andrew Roman | | Shawn Amblod | | Glenn R. Pentz |

| Vice President, Wealth & Asset Management | | Financial Consultant, Wealth Management | | Trust Officer |

| | |

| Calvin R. Thomas, Jr. | | R. Michael Love | | |

| Vice President, Trust Officer | | Financial Consultant, Wealth Management | | |

| | |

| | | | |

| | | | |

| | | | |

CNB FINANCIAL CORPORATION |||||2011 ANNUAL REPORT HIGHLIGHTS 8

OFFICERS

& AFFILIATES

| | | | |

| ERIEBANK, a Division of CNB Bank | | | | |

| | |

| David J. Zimmer | | John M. Schulze | | Katie J. Jones |

| President | | Vice President | | Community Office Manager, Harborcreek

Office |

| | |

| Donald W. Damon | | William J. Vitron, Jr. | | Abby L. Williams |

| Senior Vice President | | Vice President, Wealth Management | | Community Office Manager, Main Office |

| | |

| Steven M. Cappellino | | Carla M. LaBoda | | Paul D. Sallie |

| Senior Vice President, Meadville Office | | Assistant Vice President, Regional Retail Administrator, Asbury Office | | Private Banking Officer |

| | |

| William L. DeLuca, Jr. | | Kelly S. Buck | | Timothy Roberts |

| Senior Vice President | | Community Office Manager, Downtown Office | | Commercial Lending Officer

|

| | |

| Betsy Bort | | Mary J. Taormina | | Julie L. Martin |

| Vice President | | Community Office Manager, Meadville Office | | Operations Officer |

| | |

| Scott O. Calhoun | | | | |

| Vice President | | | | |

ERIEBANK Regional Board of Directors | | | | |

| | |

| Joseph B. Bower, Jr. | | Thomas L. Doolin | | Thomas Kennedy |

| President and Chief Executive Officer, CNB Financial Corporation, CNB Bank | | President, New Age Business Solutions, LLC (Consulting) | | President, Professional Development

Associates, Inc. (Real estate developer) |

| | |

| Mark D. Breakey | | David K. Galey | | Charles H. Reams |

| Executive Vice President & Chief Credit Officer | | Treasurer, Chief Financial Officer, Greenleaf Corporation (Manufacturing) | | President,C.H. Reams & Associates, Inc.

(Insurance) |

| | |

| Harry E. Brown | | Richard L. Greslick, Jr. | | James E. Spoden |

| Vice President, Specialty Bar Products, EBC Industries (Manufacturing) | | Senior Vice President/ Administration | | Esquire, MacDonald Illig Jones & Britton,

LLP (Law office) |

| | |

| Gary L. Clark | | Charles Hagerty | | David J. Zimmer |

Vice President, Chief Financial Officer and Chief Administrative Officer, Snap-tite, Inc. (Manufacturing) | | President, Hamot Health Foundation (Health Services) | | President, ERIEBANK |

| | | |

| | | | |

| | | | |

Holiday Financial Services Corporation, a Subsidiary of CNB Financial Corporation

| | | | |

| | Board of Directors & Corporate Officers | | Administrative Services |

| | |

| | Joseph B. Bower, Jr. | | Joseph P. Strouse |

| | Director & President | | Vice President |

| | |

| | Richard L. Greslick, Jr. | | Jonathan L. Holler |

| | Director & Secretary | | Assistant Vice President |

CNB Securities Corporation, a Subsidiary of CNB Financial Corporation, Wilmington, DE

| | | | |

| | Board of Directors | | Corporate Officers |

| | |

| | Brian W. Wingard | | Richard L. Greslick, Jr. |

| | Director | | President |

| | |

| | Glenn R. Pentz | | Donald R. McLamb, Jr. |

| | Director | | Treasurer, Wilmington Trust SP Services, Inc. |

| | |

| | Donald R. McLamb, Jr. | | Elizabeth F. Bothner |

| | Wilmington Trust SP Services, Inc. | | Secretary, Wilmington Trust SP Services, Inc |

9

Annual Meeting

The Annual Meeting of the Shareholders of CNB Financial Corporation will be held Tuesday, April 17, 2012 at 2:00 p.m. at the Corporation’s Headquarters in Clearfield, PA.

Corporate Address

CNB Financial Corporation

1 S. Second Street

P.O. Box 42

Clearfield, PA 16830

(814) 765-9621

Stock Transfer Agent & Registrar

Registrar and Transfer Company

10 Commerce Drive

Cranford, NJ 07016

(908) 497-2300

Form 10-K

Shareholders may obtain a copy of the Annual Report to the Securities and Exchange Commission on Form 10-K by writing to:

CNB Financial Corporation

1 S. Second Street

P.O. Box 42

Clearfield, PA 16830

ATTN: Shareholder Relations

Quarterly Share Data

For information regarding the Corporation’s quarterly share data, please refer to page 28 in the 2011 Form 10-K.

Market Makers

The following firms have chosen to make a market in the stock of the Corporation. Inquiries concerning their services should be directed to:

Boenning & Scattergood, Inc.

1700 Market Street, Ste 1420

Philadelphia, PA 19103

(800) 842-8928

RBC Capital Markets

Three World Financial Center

200 Vesey Street, 9th Floor

New York, NY 10281

(212) 428-6200

Corporate Profile

CNB Financial Corporation is a leader in providing integrated financial solutions which create value for both consumers and businesses. These solutions encompass checking, savings, time and deposit accounts, Private Banking, loans and lines of credit (real estate, commercial, industrial, residential and consumer), credit cards, cash management, online banking, electronic check deposit, merchant credit card processing, on-site banker and accounts receivable handling. In addition, the Corporation provides wealth and asset management services, retirement plans and other employee benefit plans.

CNB Bank

A subsidiary of CNB Financial Corporation, CNB is a regional independent community bank in North Central Pennsylvania with approximately 316 employees who make customer service more responsive and reliable. For over 145 years, the Bank has strived to be more customer-driven than its competitors and to build long-term customer relationships by being reliable and competitively priced. CNB continually seeks innovative ways to execute a personal, quality-driven customer service strategy and prides itself for being first-to-market many of these innovations. To satisfy customers’ financial needs and expectations, it offers a variety of delivery channels, which includes 22 full-service offices, 20 ATMs, 1 loan production office, telephone banking (1-866-224-7314), Internet banking (www.bankcnb.com) and a centralized customer service center (1-800-492-3221).

ERIEBANK

Headquartered in Erie, Pennsylvania, ERIEBANK is a division of CNB Bank. Presently, there are five full service locations which house its commercial, retail and Private Banking divisions.

Holiday Financial Services

Another subsidiary of CNB Financial Corporation, Holiday Financial Services, a consumer loan company, currently has eight conveniently located offices in Bellefonte, Bradford, Clearfield, Duncansville, Erie, Northern Cambria, Ridgway and Sidman, Pennsylvania.

The common stock of the Corporation trades on the NASDAQ National Market under the symbol CCNE.

CNB FINANCIAL CORPORATION |||||2011 ANNUAL REPORT HIGHLIGHTS 10