Exhibit 99.1

Investor Presentation

February 2017

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the financial condition, liquidity, results of operations, future performance, and business of CNB Financial Corporation. These forward-looking statements are intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that are not historical facts. Forward-looking statements include statements with respect to beliefs, plans, objectives, goals, expectations, anticipations, estimates, and intentions that are subject to significant risks and uncertainties, and are subject to change based on various factors (some of which are beyond our control). Forward-looking statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook,” or similar expressions, or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Such known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from the statements include, but are not limited to: (i) changes in general business, industry or economic conditions, or competition; (ii) changes in any applicable law, rule, regulation, policy, guideline, or practice governing or affecting financial holding companies and their subsidiaries or with respect to tax or accounting principles or otherwise; (iii) adverse changes or conditions in capital and financial markets; (iv) changes in interest rates; (v) higher-than-expected costs or other difficulties related to integration of combined or merged businesses; (vi) the inability to realize expected cost savings or achieve other anticipated benefits in connection with business combinations and other acquisitions; (vii) changes in the quality or composition of our loan and investment portfolios; (viii) adequacy of loan loss reserves; (ix) increased competition; (x) loss of certain key officers; (xi) continued relationships with major customers; (xii) deposit attrition; (xiii) rapidly changing technology; (xiv) unanticipated regulatory or judicial proceedings and liabilities and other costs; (xv) changes in the cost of funds, demand for loan products, or demand for financial services; (xvi) other economic, competitive, governmental, or technological factors affecting our operations, markets, products, services, and prices; and (xvii) our success at managing the foregoing items. Such developments could have an adverse impact on our financial position and our results of operations.

The forward-looking statements are based upon management’s beliefs and assumptions. Any forward-looking statement made herein speaks only as of the date of this presentation. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments ,or otherwise, except as may be required by law.

2

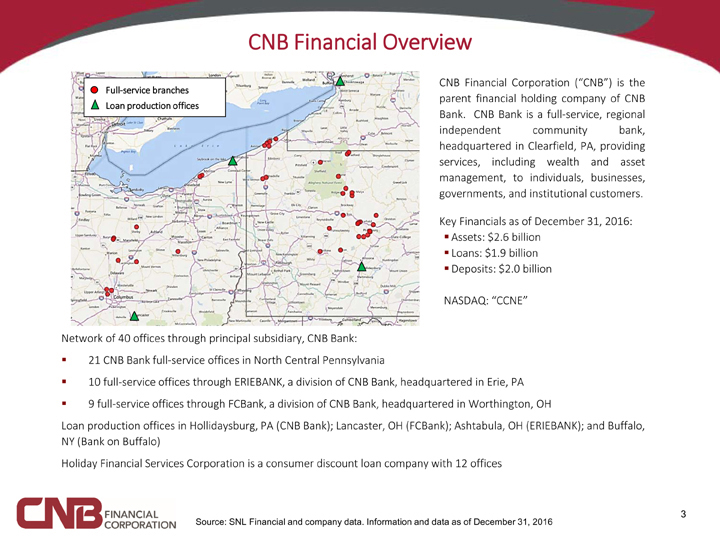

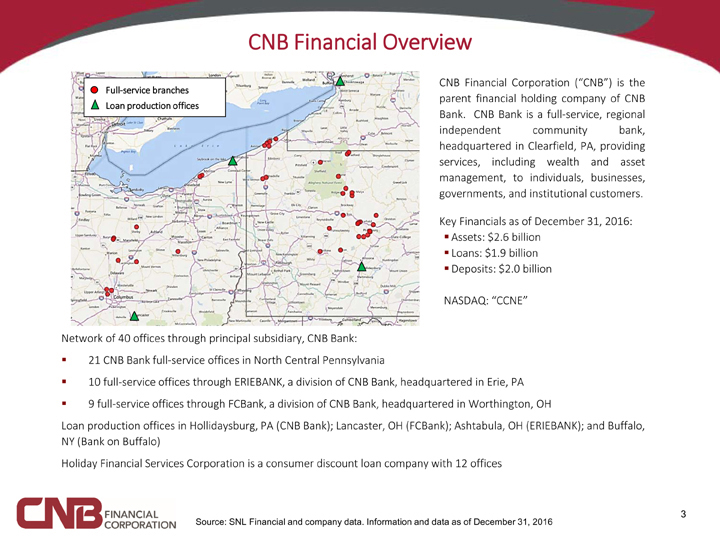

CNB Financial Overview

CNB Financial Corporation (“CNB”) is the parent financial holding company of CNB Bank. CNB Bank is a full-service, regional independent community bank, headquartered in Clearfield, PA, providing services, including wealth and asset management, to individuals, businesses, governments, and institutional customers.

Key Financials as of December 31, 2016: ?Assets: $2.6 billion ?Loans: $1.9 billion ?Deposits: $2.0 billion

NASDAQ: “CCNE”

Network of 40 offices through principal subsidiary, CNB Bank: ? 21 CNB Bank full-service offices in North Central Pennsylvania

? 10 full-service offices through ERIEBANK, a division of CNB Bank, headquartered in Erie, PA ? 9 full-service offices through FCBank, a division of CNB Bank, headquartered in Worthington, OH

Loan production offices in Hollidaysburg, PA (CNB Bank); Lancaster, OH (FCBank); Ashtabula, OH (ERIEBANK); and Buffalo, NY (Bank on Buffalo) Holiday Financial Services Corporation is a consumer discount loan company with 12 offices

Source: SNL Financial and company data. Information and data as of December 31, 2016

3

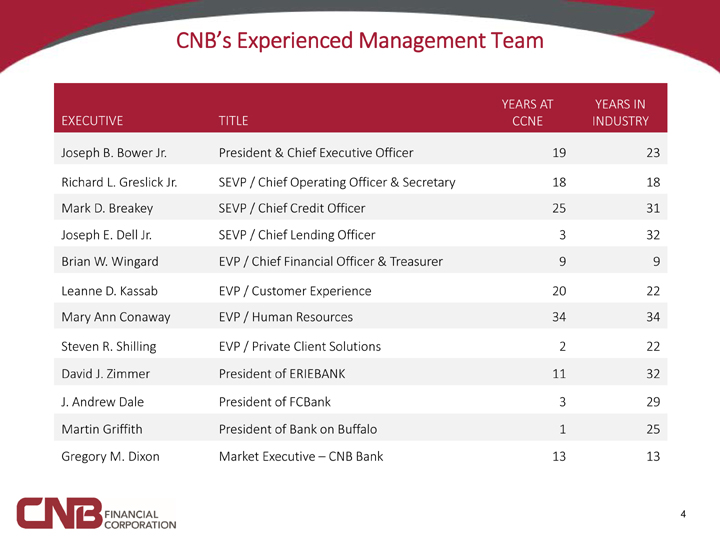

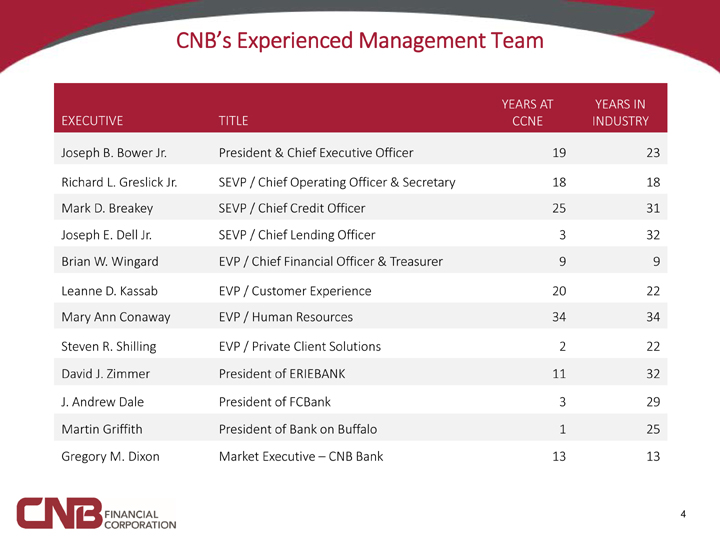

CNB’s Experienced Management Team

EXECUTIVE TITLE CCNE INDUSTRY

Joseph B. Bower Jr. President & Chief Executive Officer 19 23 Richard L. Greslick Jr. SEVP / Chief Operating Officer & Secretary 18 18 Mark D. Breakey SEVP / Chief Credit Officer 25 31 Joseph E. Dell Jr. SEVP / Chief Lending Officer 3 32 Brian W. Wingard EVP / Chief Financial Officer & Treasurer 9 9 Leanne D. Kassab EVP / Customer Experience 20 22 Mary Ann Conaway EVP / Human Resources 34 34 Steven R. Shilling EVP / Private Client Solutions 2 22 David J. Zimmer President of ERIEBANK 11 32 J. Andrew Dale President of FCBank 3 29 Martin Griffith President of Bank on Buffalo 1 25 Gregory M. Dixon Market Executive – CNB Bank 13 13

4

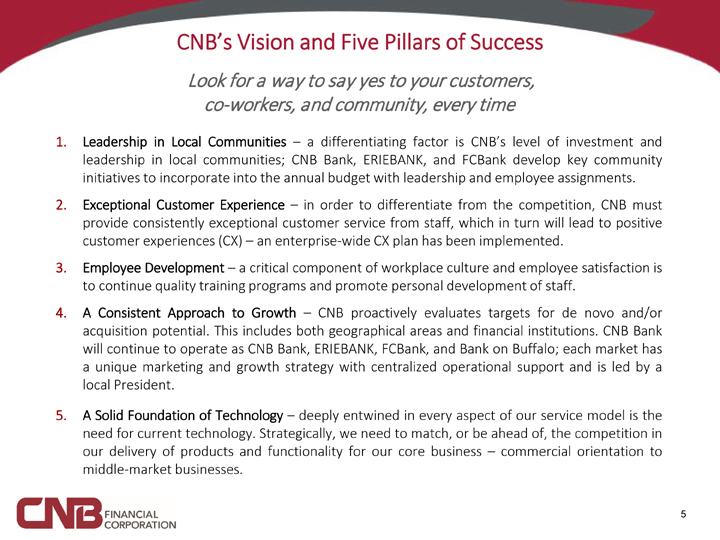

CNB’s Vision and Five Pillars of Success

Look for a way to say yes to your customers, co-workers, and community, every time

1. Leadership in Local Communities – a differentiating factor is CNB’s level of investment and leadership in local communities; CNB Bank, ERIEBANK, and FCBank develop key community initiatives to incorporate into the annual budget with leadership and employee assignments.

2. Exceptional Customer Experience – in order to differentiate from the competition, CNB must provide consistently exceptional customer service from staff, which in turn will lead to positive customer experiences (CX) – an enterprise-wide CX plan has been implemented.

3. Employee Development – a critical component of workplace culture and employee satisfaction is to continue quality training programs and promote personal development of staff.

4. A Consistent Approach to Growth – CNB proactively evaluates targets for de novo and/or acquisition potential. This includes both geographical areas and financial institutions. CNB Bank will continue to operate as CNB Bank, ERIEBANK, FCBank, and Bank on Buffalo; each market has a unique marketing and growth strategy with centralized operational support and is led by a local President.

5. A Solid Foundation of Technology – deeply entwined in every aspect of our service model is the need for current technology. Strategically, we need to match, or be ahead of, the competition in our delivery of products and functionality for our core business – commercial orientation to middle-market businesses.

5

History of CNB Financial

1984: Forms 2016: 1865: County 2010: Joseph Bower CNB Financial Subordinated Debt National Bank 2006: Conversion becomes CEO after th Corporation 2015: 150 raise of $50 million of Clearfield to a state banking retirement of William holding Anniversary established charter Falger company Celebration

1865 1934 1984 2005 2006 2008 2009 2010 2013 2015 2016

1934: Reorganizes 2010: Common 2013: 2005: Acquisition of through a stock Equity raise of

ERIEBANK is FC Banc Corp. 2016: Acquisition of offering to existing $34.5 million formed headquartered Lake National Bank depositors in Bucyrus, headquartered in Ohio, with $360 Mentor, Ohio, with million in assets $153 million in assets Opened Loan Production Office in Buffalo, New York

6

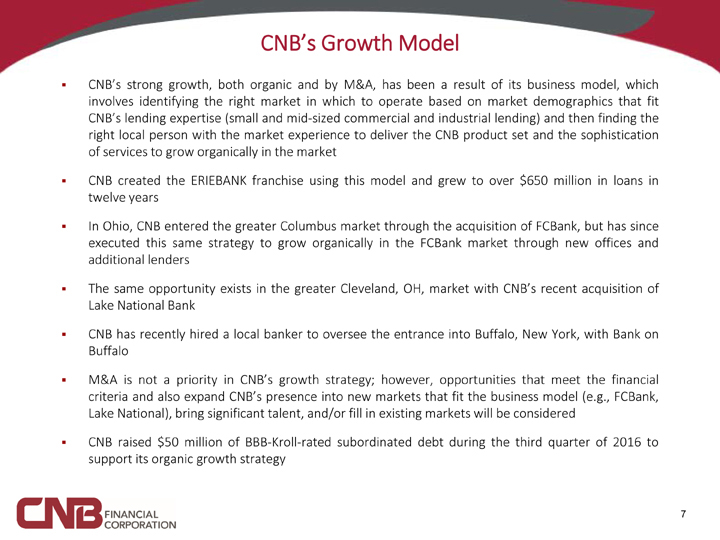

CNB’s Growth Model

CNB’s strong growth, both organic and by M&A, has been a result of its business model, which involves identifying the right market in which to operate based on market demographics that fit CNB’s lending expertise (small and mid-sized commercial and industrial lending) and then finding the right local person with the market experience to deliver the CNB product set and the sophistication of services to grow organically in the market CNB created the ERIEBANK franchise using this model and grew to over $650 million in loans in twelve years In Ohio, CNB entered the greater Columbus market through the acquisition of FCBank, but has since executed this same strategy to grow organically in the FCBank market through new offices and additional lenders The same opportunity exists in the greater Cleveland, OH, market with CNB’s recent acquisition of Lake National Bank CNB has recently hired a local banker to oversee the entrance into Buffalo, New York, with Bank on Buffalo M&A is not a priority in CNB’s growth strategy; however, opportunities that meet the financial criteria and also expand CNB’s presence into new markets that fit the business model (e.g., FCBank, Lake National), bring significant talent, and/or fill in existing markets will be considered CNB raised $50 million of BBB-Kroll-rated subordinated debt during the third quarter of 2016 to support its organic growth strategy

7

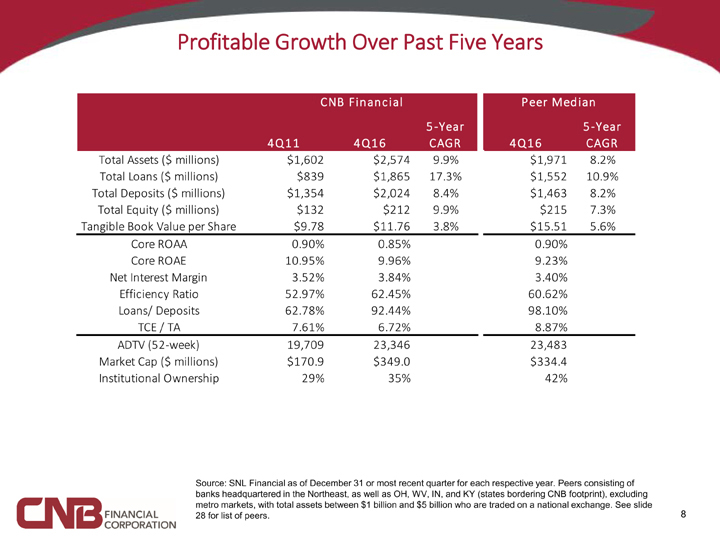

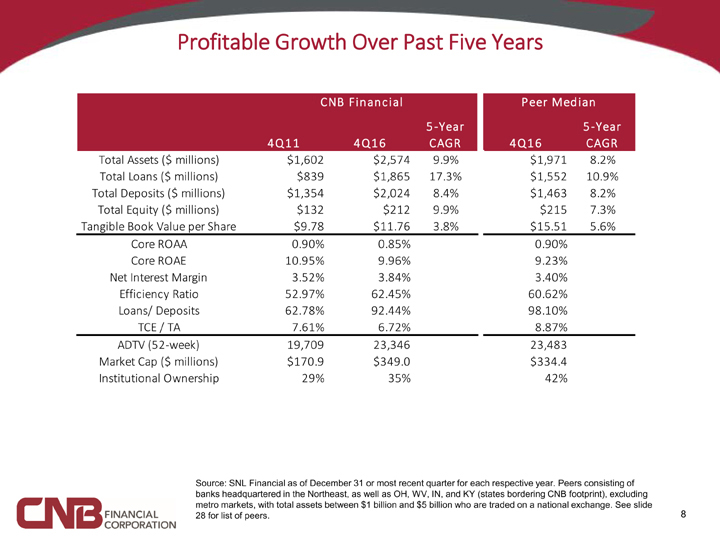

Profitable Growth Over Past Five Years

CNB Financial Peer Median

5-Year 5-Year 4Q11 4Q16 CAGR 4Q16 CAGR

Total Assets ($ millions) $1,602 $2,574 9.9% $1,971 8.2% Total Loans ($ millions) $839 $1,865 17.3% $1,552 10.9% Total Deposits ($ millions) $1,354 $2,024 8.4% $1,463 8.2% Total Equity ($ millions) $132 $212 9.9% $215 7.3% Tangible Book Value per Share $9.78 $11.76 3.8% $15.51 5.6% Core ROAA 0.90% 0.85% 0.90% Core ROAE 10.95% 9.96% 9.23% Net Interest Margin 3.52% 3.84% 3.40% Efficiency Ratio 52.97% 62.45% 60.62% Loans/ Deposits 62.78% 92.44% 98.10% TCE / TA 7.61% 6.72% 8.87% ADTV (52-week) 19,709 23,346 23,483 Market Cap ($ millions) $170.9 $349.0 $334.4 Institutional Ownership 29% 35% 42%

Source: SNL Financial as of December 31 or most recent quarter for each respective year. Peers consisting of banks headquartered in the Northeast, as well as OH, WV, IN, and KY (states bordering CNB footprint), excluding metro markets, with total assets between $1 billion and $5 billion who are traded on a national exchange. See slide 28 for list of peers.

8

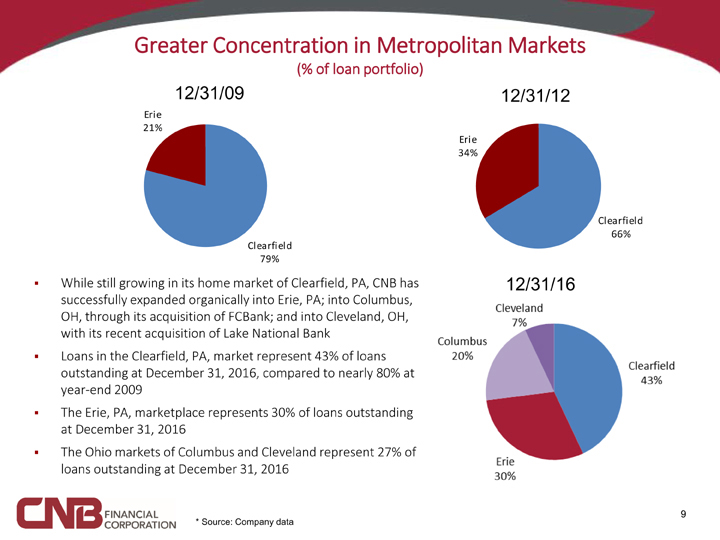

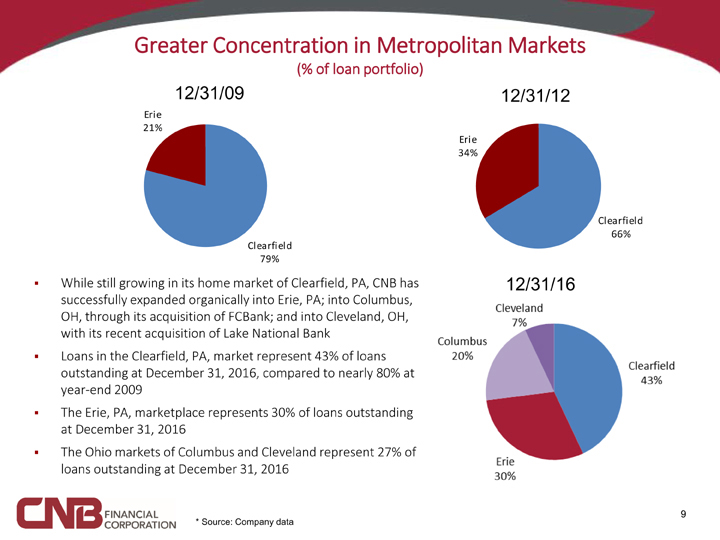

Greater Concentration in Metropolitan Markets

(% of loan portfolio)

12/31/09 12/31/12

Erie 21%

Erie 34%

Clearfield 66%

Clearfield 79%

? While still growing in its home market of Clearfield, PA, CNB has 12/31/16 successfully expanded organically into Erie, PA; into Columbus, OH, through its acquisition of FCBank; and into Cleveland, OH, with its recent acquisition of Lake National Bank ? Loans in the Clearfield, PA, market represent 43% of loans outstanding at December 31, 2016, compared to nearly 80% at year-end 2009 ? The Erie, PA, marketplace represents 30% of loans outstanding at December 31, 2016 ? The Ohio markets of Columbus and Cleveland represent 27% of loans outstanding at December 31, 2016

* Source: Company data

9

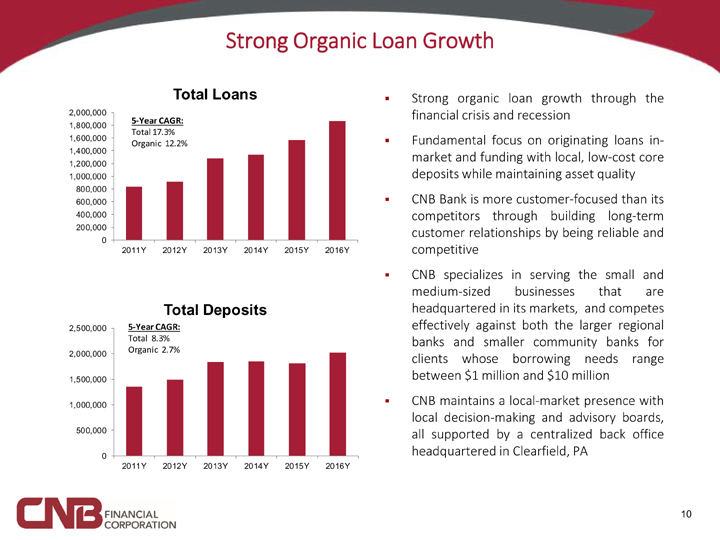

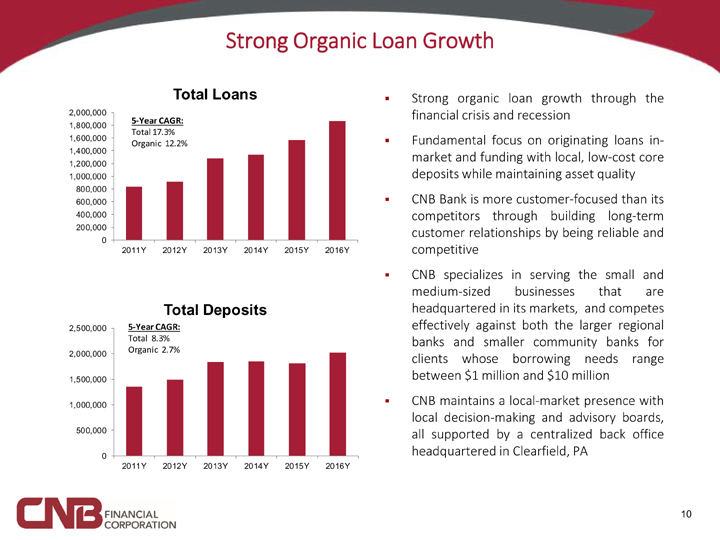

Strong Organic Loan Growth

0 0

Total Loans

2,000,000

5-Year CAGR:

1,800,000

Total 17.3%

1,600,000

Organic 12.2%

1,400,000 1,200,000 1,000,000 800,000 600,000 400,000 200,000 0

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 0

0 0

Total Deposits

2,500,000 5-Year CAGR:

Total 8.3% 2,000,000 Organic 2.7%

1,500,000 1,000,000 500,000

0

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 0

Strong organic loan growth through the financial crisis and recession Fundamental focus on originating loans in-market and funding with local, low-cost core deposits while maintaining asset quality CNB Bank is more customer-focused than its competitors through building long-term customer relationships by being reliable and competitive CNB specializes in serving the small and medium-sized businesses that are headquartered in its markets, and competes effectively against both the larger regional banks and smaller community banks for clients whose borrowing needs range between $1 million and $10 million CNB maintains a local-market presence with local decision-making and advisory boards, all supported by a centralized back office headquartered in Clearfield, PA

10

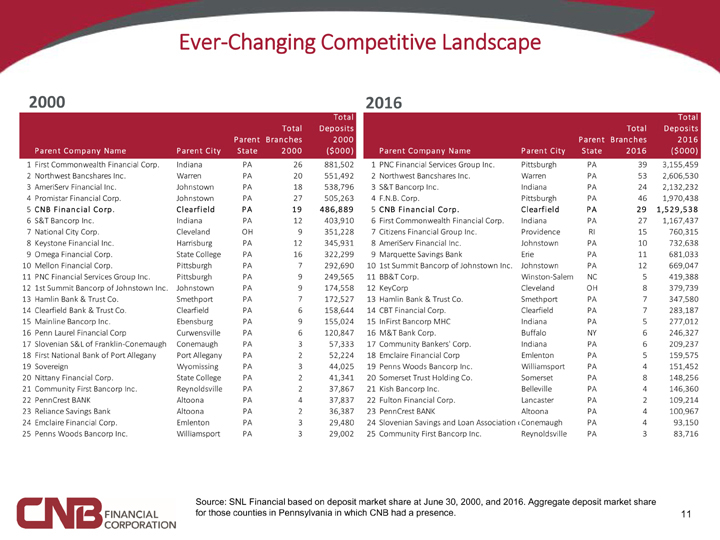

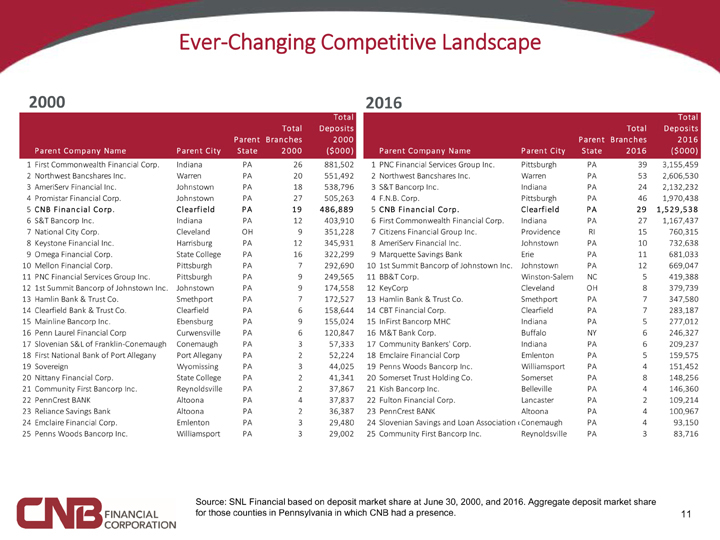

Ever-Changing Competitive Landscape

2000

Total Total Deposits Parent Branches 2000 Parent Company Name Parent City State 2000 ($000)

1 First Commonwealth Financial Corp. Indiana PA 26 881,502

2 Northwest Bancshares Inc. Warren PA 20 551,492

3 AmeriServ Financial Inc. Johnstown PA 18 538,796

4 Promistar Financial Corp. Johnstown PA 27 505,263

5 CNB Financial Corp. Clearfield PA 19 486,889

6 S&T Bancorp Inc. Indiana PA 12 403,910

7 National City Corp. Cleveland OH 9 351,228

8 Keystone Financial Inc. Harrisburg PA 12 345,931

9 Omega Financial Corp. State College PA 16 322,299

10 Mellon Financial Corp. Pittsburgh PA 7 292,690

11 PNC Financial Services Group Inc. Pittsburgh PA 9 249,565

12 1st Summit Bancorp of Johnstown Inc. Johnstown PA 9 174,558

13 Hamlin Bank & Trust Co. Smethport PA 7 172,527

14 Clearfield Bank & Trust Co. Clearfield PA 6 158,644

15 Mainline Bancorp Inc. Ebensburg PA 9 155,024

16 Penn Laurel Financial Corp Curwensville PA 6 120,847

17 Slovenian S&L of Franklin-Conemaugh Conemaugh PA 3 57,333

18 First National Bank of Port Allegany Port Allegany PA 2 52,224

19 Sovereign Wyomissing PA 3 44,025

20 Nittany Financial Corp. State College PA 2 41,341

21 Community First Bancorp Inc. Reynoldsville PA 2 37,867

22 PennCrest BANK Altoona PA 4 37,837

23 Reliance Savings Bank Altoona PA 2 36,387

24 Emclaire Financial Corp. Emlenton PA 3 29,480

25 Penns Woods Bancorp Inc. Williamsport PA 3 29,002

2016

Total Total Deposits Parent Branches 2016 Parent Company Name Parent City State 2016 ($000)

1 PNC Financial Services Group Inc. Pittsburgh PA 39 3,155,459

2 Northwest Bancshares Inc. Warren PA 53 2,606,530

3 S&T Bancorp Inc. Indiana PA 24 2,132,232

4 F.N.B. Corp. Pittsburgh PA 46 1,970,438

5 CNB Financial Corp. Clearfield PA 29 1,529,538

6 First Commonwealth Financial Corp. Indiana PA 27 1,167,437

7 Citizens Financial Group Inc. Providence RI 15 760,315

8 AmeriServ Financial Inc. Johnstown PA 10 732,638

9 Marquette Savings Bank Erie PA 11 681,033

10 1st Summit Bancorp of Johnstown Inc. Johnstown PA 12 669,047

11 BB&T Corp. Winston-Salem NC 5 419,388

12 KeyCorp Cleveland OH 8 379,739

13 Hamlin Bank & Trust Co. Smethport PA 7 347,580

14 CBT Financial Corp. Clearfield PA 7 283,187

15 InFirst Bancorp MHC Indiana PA 5 277,012

16 M&T Bank Corp. Buffalo NY 6 246,327

17 Community Bankers’ Corp. Indiana PA 6 209,237

18 Emclaire Financial Corp Emlenton PA 5 159,575

19 Penns Woods Bancorp Inc. Williamsport PA 4 151,452

20 Somerset Trust Holding Co. Somerset PA 8 148,256

21 Kish Bancorp Inc. Belleville PA 4 146,360

22 Fulton Financial Corp. Lancaster PA 2 109,214

23 PennCrest BANK Altoona PA 4 100,967

24 Slovenian Savings and Loan Association Conemaugh PA 4 93,150

25 Community First Bancorp Inc. Reynoldsville PA 3 83,716

Source: SNL Financial based on deposit market share at June 30, 2000, and 2016. Aggregate deposit market share for those counties in Pennsylvania in which CNB had a presence.

11

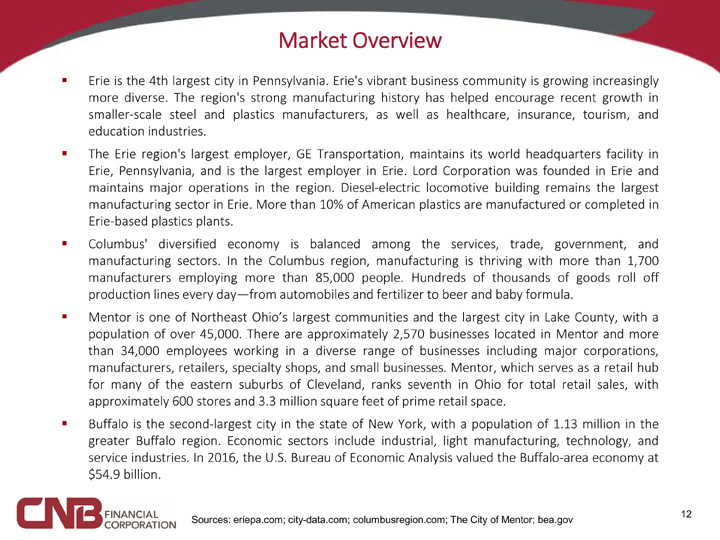

Market Overview

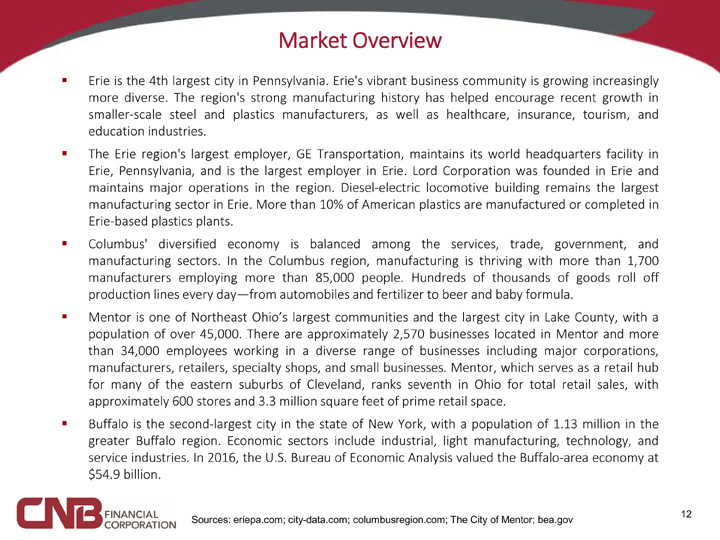

Erie is the 4th largest city in Pennsylvania. Erie’s vibrant business community is growing increasingly more diverse. The region’s strong manufacturing history has helped encourage recent growth in smaller-scale steel and plastics manufacturers, as well as healthcare, insurance, tourism, and education industries.

The Erie region’s largest employer, GE Transportation, maintains its world headquarters facility in Erie, Pennsylvania, and is the largest employer in Erie. Lord Corporation was founded in Erie and maintains major operations in the region. Diesel-electric locomotive building remains the largest manufacturing sector in Erie. More than 10% of American plastics are manufactured or completed in Erie-based plastics plants.

Columbus’ diversified economy is balanced among the services, trade, government, and manufacturing sectors. In the Columbus region, manufacturing is thriving with more than 1,700 manufacturers employing more than 85,000 people. Hundreds of thousands of goods roll off production lines every day—from automobiles and fertilizer to beer and baby formula.

Mentor is one of Northeast Ohio’s largest communities and the largest city in Lake County, with a population of over 45,000. There are approximately 2,570 businesses located in Mentor and more than 34,000 employees working in a diverse range of businesses including major corporations, manufacturers, retailers, specialty shops, and small businesses. Mentor, which serves as a retail hub for many of the eastern suburbs of Cleveland, ranks seventh in Ohio for total retail sales, with approximately 600 stores and 3.3 million square feet of prime retail space.

Buffalo is the second-largest city in the state of New York, with a population of 1.13 million in the greater Buffalo region. Economic sectors include industrial, light manufacturing, technology, and service industries. In 2016, the U.S. Bureau of Economic Analysis valued the Buffalo-area economy at $54.9 billion.

Sources: eriepa.com; city-data.com; columbusregion.com; The City of Mentor; bea.gov

12

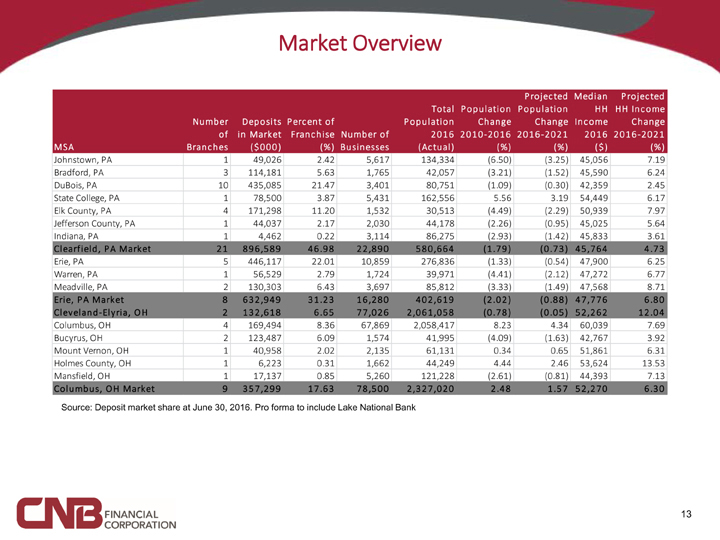

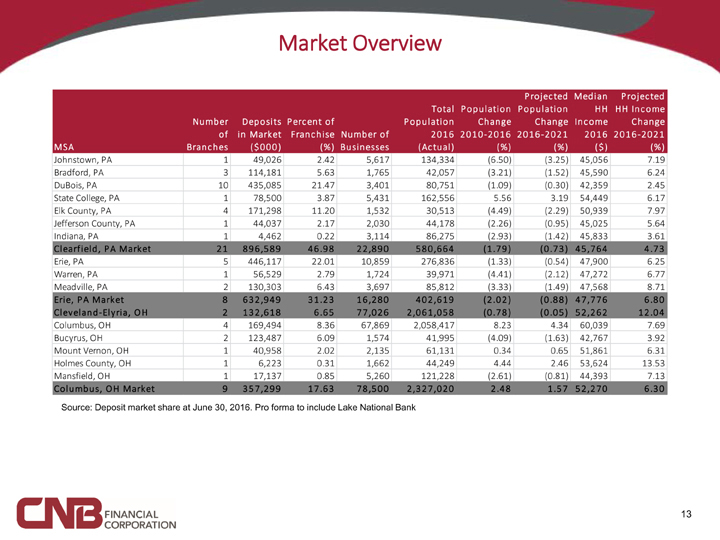

Market Overview

Projected Median Projected Total Population Population HH HH Income Number Deposits Percent of Population Change Change Income Change of in Market Franchise Number of 2016 2010-2016 2016-2021 2016 2016-2021 MSA Branches ($000) (%) Businesses (Actual) (%) (%) ($) (%) Johnstown, PA 1 49,026 2.42 5,617 134,334 (6.50) (3.25) 45,056 7.19 Bradford, PA 3 114,181 5.63 1,765 42,057 (3.21) (1.52) 45,590 6.24 DuBois, PA 10 435,085 21.47 3,401 80,751 (1.09) (0.30) 42,359 2.45 State College, PA 1 78,500 3.87 5,431 162,556 5.56 3.19 54,449 6.17 Elk County, PA 4 171,298 11.20 1,532 30,513 (4.49) (2.29) 50,939 7.97 Jefferson County, PA 1 44,037 2.17 2,030 44,178 (2.26) (0.95) 45,025 5.64 Indiana, PA 1 4,462 0.22 3,114 86,275 (2.93) (1.42) 45,833 3.61 Clearfield, PA Market 21 896,589 46.98 22,890 580,664 (1.79) (0.73) 45,764 4.73 Erie, PA 5 446,117 22.01 10,859 276,836 (1.33) (0.54) 47,900 6.25 Warren, PA 1 56,529 2.79 1,724 39,971 (4.41) (2.12) 47,272 6.77 Meadville, PA 2 130,303 6.43 3,697 85,812 (3.33) (1.49) 47,568 8.71 Erie, PA Market 8 632,949 31.23 16,280 402,619 (2.02) (0.88) 47,776 6.80 Cleveland-Elyria, OH 2 132,618 6.65 77,026 2,061,058 (0.78) (0.05) 52,262 12.04 Columbus, OH 4 169,494 8.36 67,869 2,058,417 8.23 4.34 60,039 7.69 Bucyrus, OH 2 123,487 6.09 1,574 41,995 (4.09) (1.63) 42,767 3.92 Mount Vernon, OH 1 40,958 2.02 2,135 61,131 0.34 0.65 51,861 6.31 Holmes County, OH 1 6,223 0.31 1,662 44,249 4.44 2.46 53,624 13.53 Mansfield, OH 1 17,137 0.85 5,260 121,228 (2.61) (0.81) 44,393 7.13 Columbus, OH Market 9 357,299 17.63 78,500 2,327,020 2.48 1.57 52,270 6.30

Source: Deposit market share at June 30, 2016. Pro forma to include Lake National Bank

13

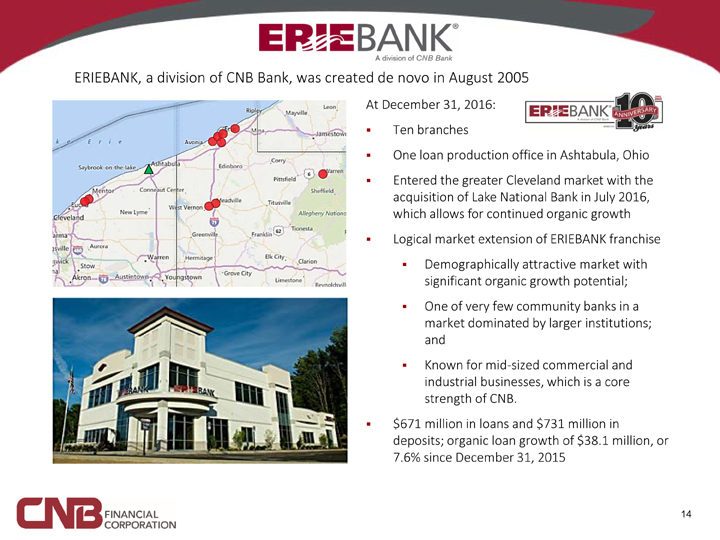

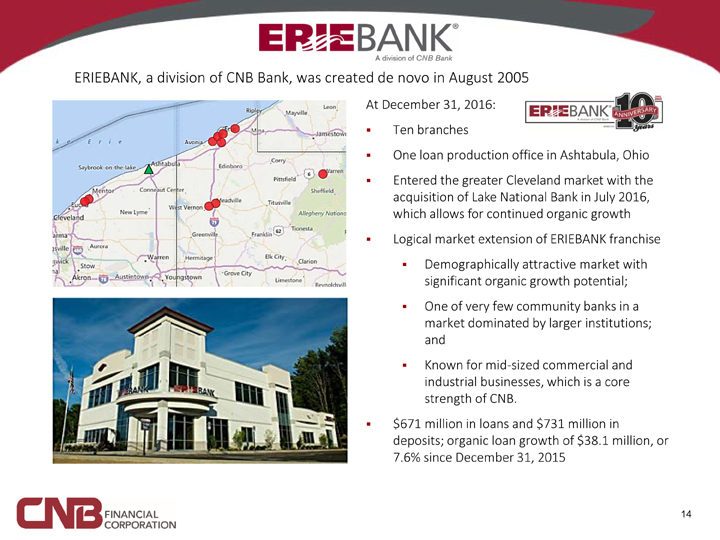

ERIEBANK, a division of CNB Bank, was created de novo in August 2005

At December 31, 2016: Ten branches

One loan production office in Ashtabula, Ohio Entered the greater Cleveland market with the acquisition of Lake National Bank in July 2016, which allows for continued organic growth Logical market extension of ERIEBANK franchise Demographically attractive market with significant organic growth potential; One of very few community banks in a market dominated by larger institutions; and Known for mid-sized commercial and industrial businesses, which is a core strength of CNB.

$671 million in loans and $731 million in deposits; organic loan growth of $38.1 million, or 7.6% since December 31, 2015

14

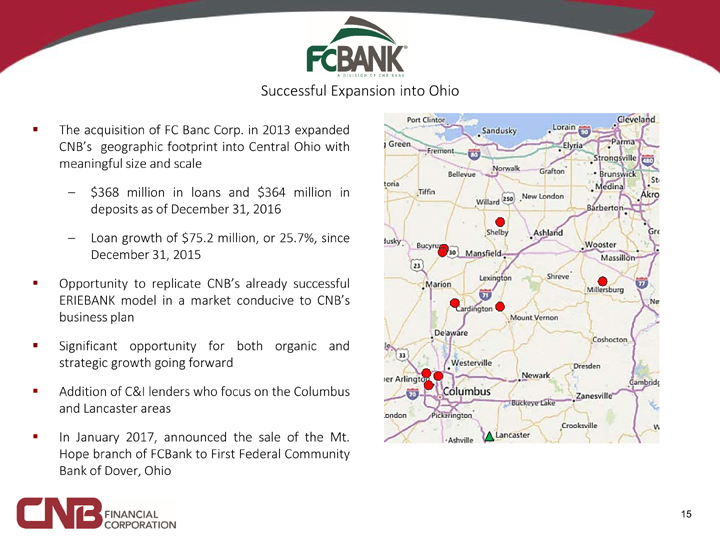

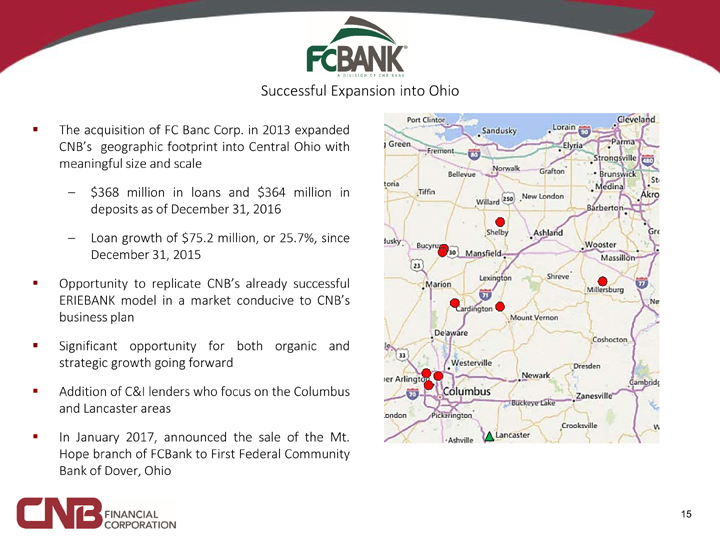

Successful Expansion into Ohio

The acquisition of FC Banc Corp. in 2013 expanded CNB’s geographic footprint into Central Ohio with meaningful size and scale

– $368 million in loans and $364 million in deposits as of December 31, 2016

– Loan growth of $75.2 million, or 25.7%, since December 31, 2015 Opportunity to replicate CNB’s already successful ERIEBANK model in a market conducive to CNB’s business plan Significant opportunity for both organic and strategic growth going forward Addition of C&I lenders who focus on the Columbus and Lancaster areas In January 2017, announced the sale of the Mt. Hope branch of FCBank to First Federal Community Bank of Dover, Ohio

15

Building Infrastructure to Support Future Growth

CNB has experienced significant growth, doubling its size since December 31, 2009; assets have grown from $1.2 billion to $2.6 billion between December 31, 2009, and December 31, 2016 The rapid increase in assets through the growth in number of customers led management to analyze its infrastructure to determine how much growth it could continue with the current complement of staff As a result, CNB made numerous infrastructure, personnel, and other investments during 2015 and early 2016 to facilitate its continued growth:

– A building project was completed that added approximately 15,000 square feet of space to the existing headquarters to better leverage its facilities, technology, and personnel. This new, modern facility allows CNB to house our back-office staff to operate into the foreseeable future;

– CNB added staff, which included both customer-facing personnel, such as business development and wealth management officers, as well as support department personnel; and

– Upgraded its core processing system, which involved some non-recurring costs in 2015 ($108 thousand) and 2016 ($1.7 million).

– Developed several career-based training programs that are offered internally, including our own leadership program.

With these investments, CNB now has the infrastructure in place to support continued growth

16

Customer-Efficient, Cost-Effective Retail Delivery

CNB’s office network has evolved to more customer-friendly stores providing customers with a one-on-one experience

Offices are staffed with a well-trained team that can handle all of a customer’s needs, from account openings to customer service

CNB recently completed an upgrade of its core processing system, along with most of its other electronic offerings, including enhancements to mobile and eBanking solutions to provide the most up-to-date services to its customers

17

Financial Information

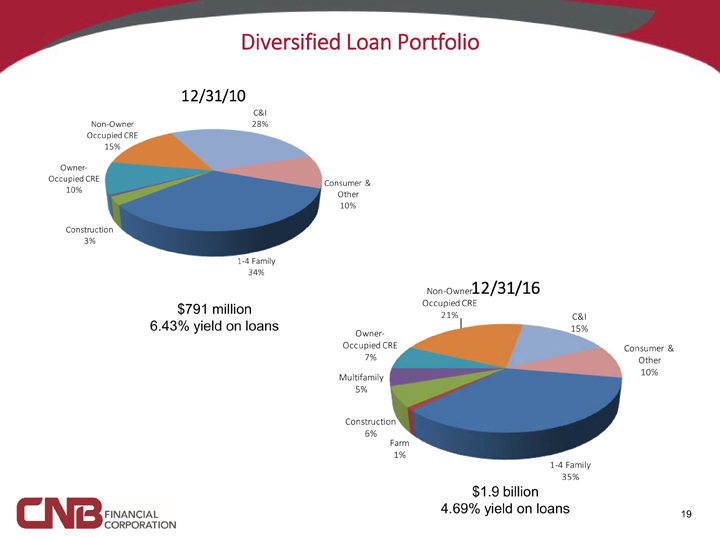

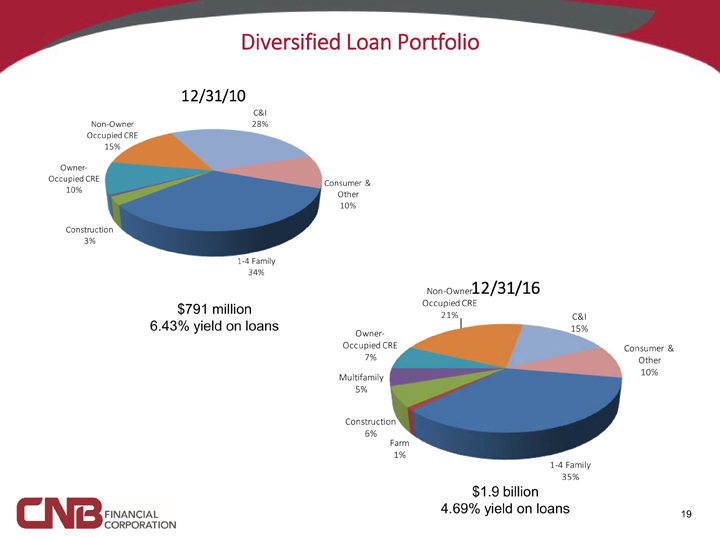

Diversified Loan Portfolio

12/31/10

C&I Non-Owner 28% Occupied CRE

15%

Owner-

Occupied CRE Consumer & 10% Other 10%

Construction 3%

1-4 Family 34%

Non-Owner12/31/16

$791 million Occupied CRE

21% C&I

6.43% yield on loans 15%

Owner-

Occupied CRE Consumer &

7% Other 10% Multifamily 5%

Construction

6% Farm 1%

1-4 Family 35%

$1.9 billion

4.69% yield on loans

19

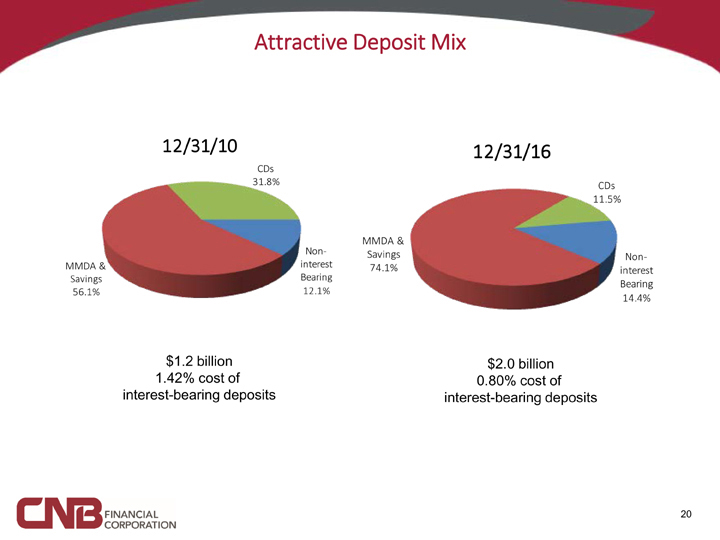

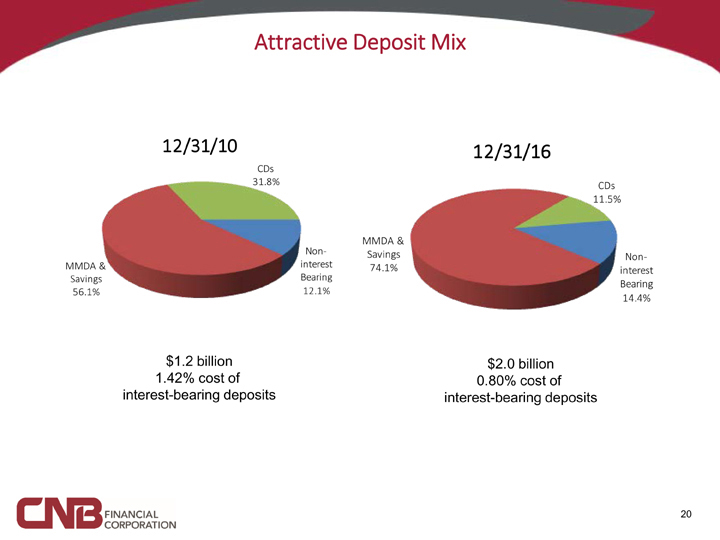

Attractive Deposit Mix

12/31/10 12/31/16

CDs

31.8% CDs 11.5%

Non- MMDA & interest Savings Non-MMDA & 74.1% interest

Savings Bearing

Bearing

56.1% 12.1%

14.4%

$1.2 billion $2.0 billion

1.42% cost of 0.80% cost of interest-bearing deposits interest-bearing deposits

20

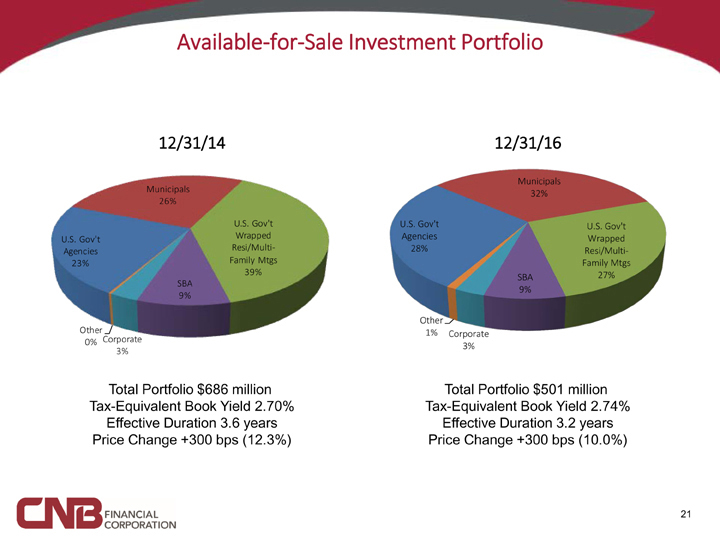

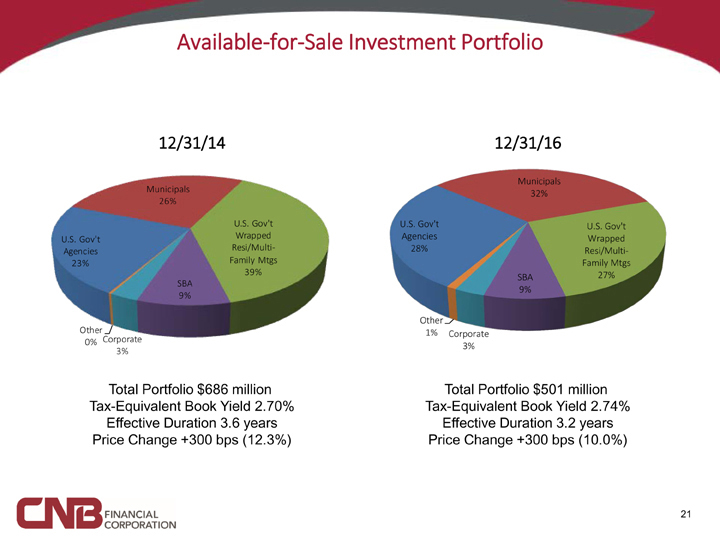

Available-for-Sale Investment Portfolio

12/31/14

Municipals 26%

U.S. Gov’t U.S. Gov’t Wrapped Agencies Resi/Multi-23% Family Mtgs 39% SBA

9%

OtherCorporate

0% 3%

Total Portfolio $686 million Tax-Equivalent Book Yield 2.70% Effective Duration 3.6 years Price Change +300 bps (12.3%)

12/31/16

Municipals 32%

U.S. Gov’t U.S. Gov’t Agencies Wrapped 28% Resi/Multi-Family Mtgs SBA 27% 9%

Other

1% Corporate 3%

Total Portfolio $501 million Tax-Equivalent Book Yield 2.74% Effective Duration 3.2 years Price Change +300 bps (10.0%)

21

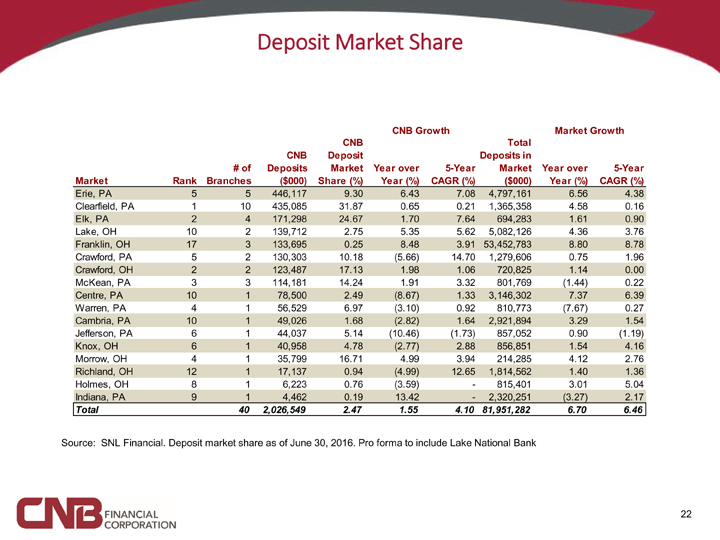

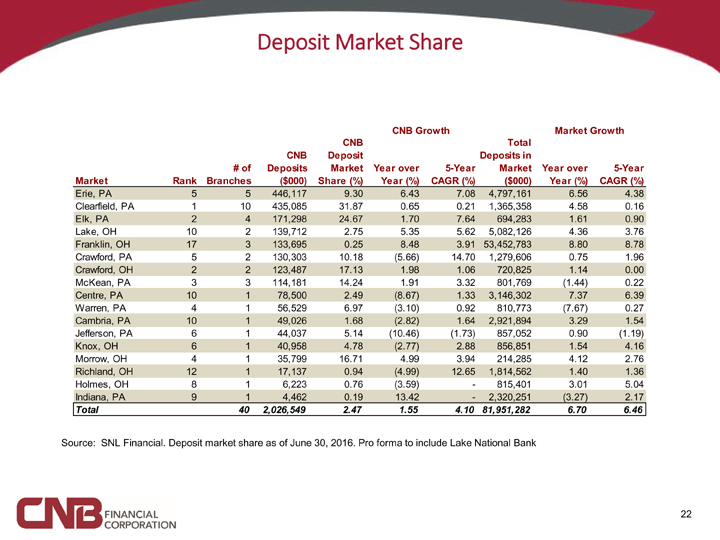

Deposit Market Share

CNB Growth Market Growth CNB Total CNB Deposit Deposits in # of Deposits Market Year over 5-Year Market Year over 5-Year Market Rank Branches ($000) Share (%) Year (%) CAGR (%) ($000) Year (%) CAGR (%)

Erie, PA 5 5 446,117 9.30 6.43 7.08 4,797,161 6.56 4.38 Clearfield, PA 1 10 435,085 31.87 0.65 0.21 1,365,358 4.58 0.16 Elk, PA 2 4 171,298 24.67 1.70 7.64 694,283 1.61 0.90 Lake, OH 10 2 139,712 2.75 5.35 5.62 5,082,126 4.36 3.76 Franklin, OH 17 3 133,695 0.25 8.48 3.91 53,452,783 8.80 8.78 Crawford, PA 5 2 130,303 10.18 (5.66) 14.70 1,279,606 0.75 1.96 Crawford, OH 2 2 123,487 17.13 1.98 1.06 720,825 1.14 0.00 McKean, PA 3 3 114,181 14.24 1.91 3.32 801,769 (1.44) 0.22 Centre, PA 10 1 78,500 2.49 (8.67) 1.33 3,146,302 7.37 6.39 Warren, PA 4 1 56,529 6.97 (3.10) 0.92 810,773 (7.67) 0.27 Cambria, PA 10 1 49,026 1.68 (2.82) 1.64 2,921,894 3.29 1.54 Jefferson, PA 6 1 44,037 5.14 (10.46) (1.73) 857,052 0.90 (1.19) Knox, OH 6 1 40,958 4.78 (2.77) 2.88 856,851 1.54 4.16 Morrow, OH 4 1 35,799 16.71 4.99 3.94 214,285 4.12 2.76 Richland, OH 12 1 17,137 0.94 (4.99) 12.65 1,814,562 1.40 1.36 Holmes, OH 8 1 6,223 0.76 (3.59)—815,401 3.01 5.04 Indiana, PA 9 1 4,462 0.19 13.42—2,320,251 (3.27) 2.17

Total 40 2,026,549 2.47 1.55 4.10 81,951,282 6.70 6.46

Source: SNL Financial. Deposit market share as of June 30, 2016. Pro forma to include Lake National Bank

22

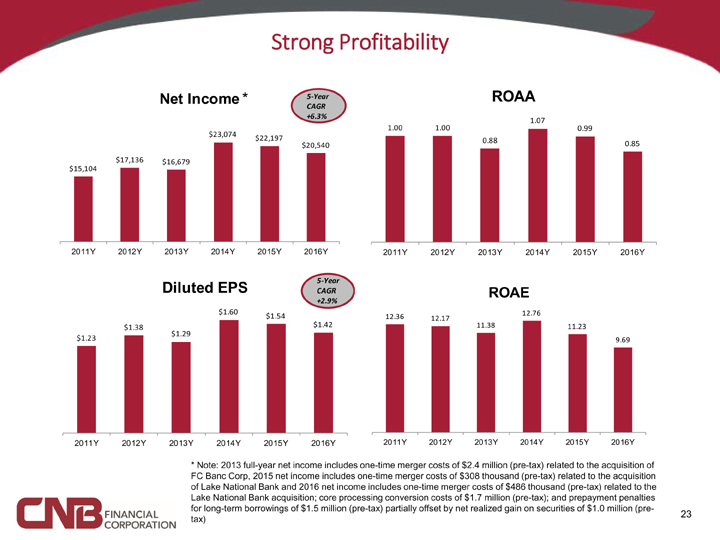

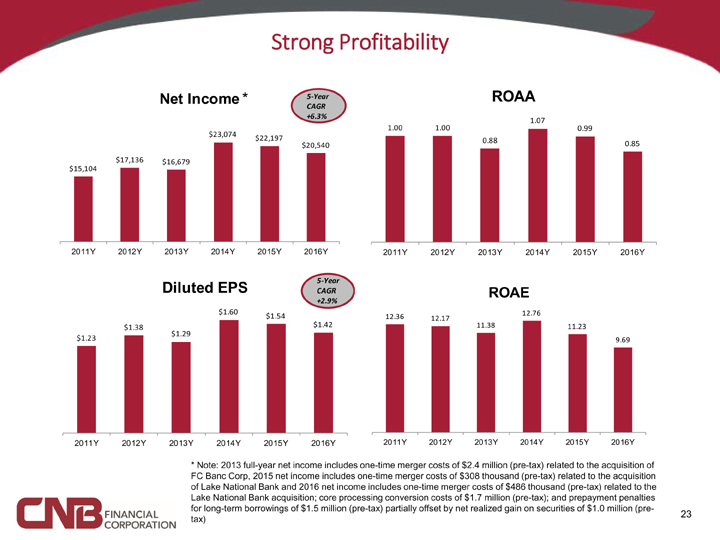

Strong Profitability

0 0 0

Net Income * 5-Year ROAA

CAGR +6.3%

1.07

1.00 1.00 0.99 $23,074 $22,197

0.88 0.85 $20,540 $17,136 $16,679 $15,104

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 0

0 0

5-Year 0 0

Diluted EPS CAGR ROAE

+2.9% $1.60 12.76 $1.54 12.36 12.17 $1.38 $1.42 11.38 11.23 $1.29 $1.23 9.69

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 0

* Note: 2013 full-year net income includes one-time merger costs of $2.4 million (pre-tax) related to the acquisition of FC Banc Corp, 2015 net income includes one-time merger costs of $308 thousand (pre-tax) related to the acquisition of Lake National Bank and 2016 net income includes one-time merger costs of $486 thousand (pre-tax) related to the Lake National Bank acquisition; core processing conversion costs of $1.7 million (pre-tax); and prepayment penalties for long-term borrowings of $1.5 million (pre-tax) partially offset by net realized gain on securities of $1.0 million (pre-tax)

23

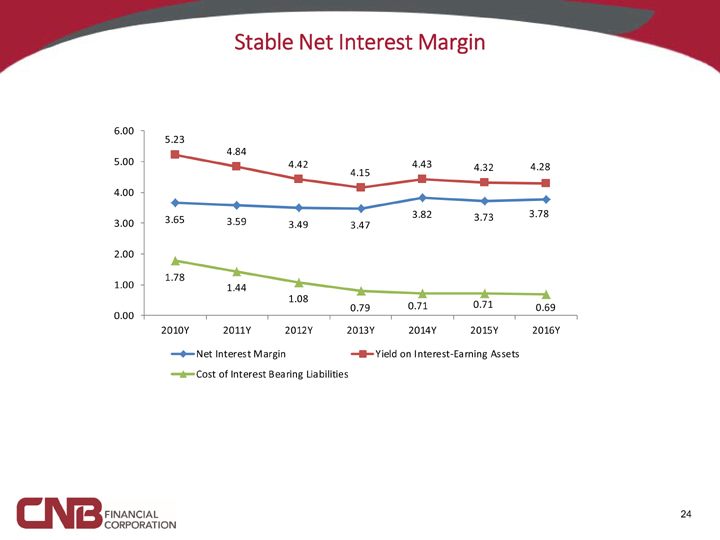

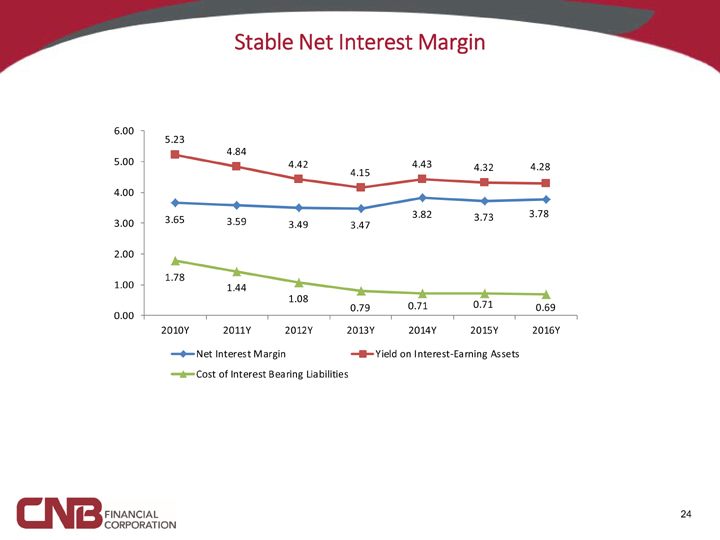

Stable Net Interest Margin

6.00

5.23

5.00 4.84

4.42 4.43 4.32 4.28

4.15

4.00

3.82 3.73 3.78

3.00 3.65 3.59 3.49

3.47

2.00

1.78

1.00 1.44

1.08

0.79 0.71 0.71 0.69

0.00

2010Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y Net Interest Margin Yield on Interest-Earning Assets Cost of Interest Bearing Liabilities

24

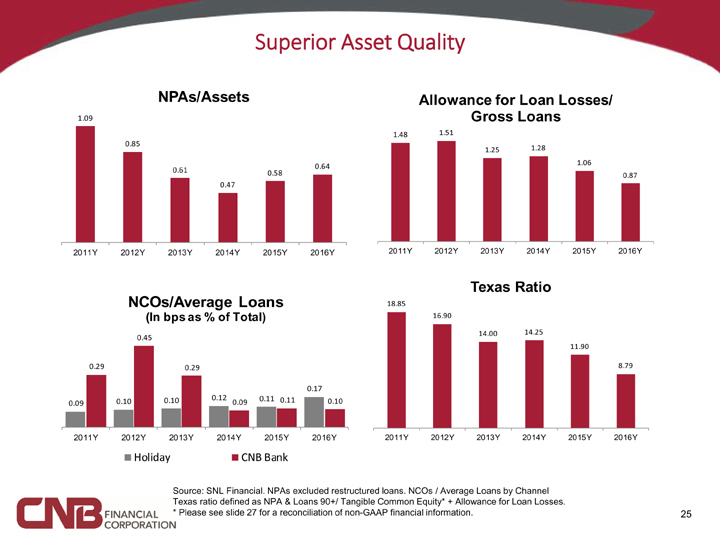

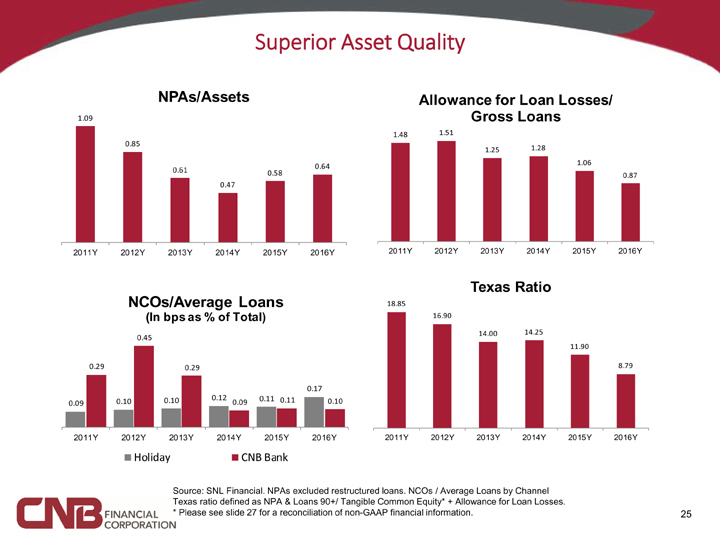

Superior Asset Quality

0 0

NPAs/Assets Allowance for Loan Losses/ 1.09 Gross Loans

1.48 1.51

0.85

1.25 1.28

0.61 0.64 1.06

0.58 0.87 0.47

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 0

0 Texas Ratio

NCOs/Average Loans 18.85

(In bps as % of Total) 16.90

14.00 14.25

0.45

11.90

0.29 0.29 8.79

0.17 0.10 0.10 0.12 0.11 0.11 0.10 0.09 0.09

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y

Holiday CNB Bank

0 0

Source: SNL Financial. NPAs excluded restructured loans. NCOs / Average Loans by Channel Texas ratio defined as NPA & Loans 90+/ Tangible Common Equity* + Allowance for Loan Losses.

* Please see slide 27 for a reconciliation of non-GAAP financial information.

25

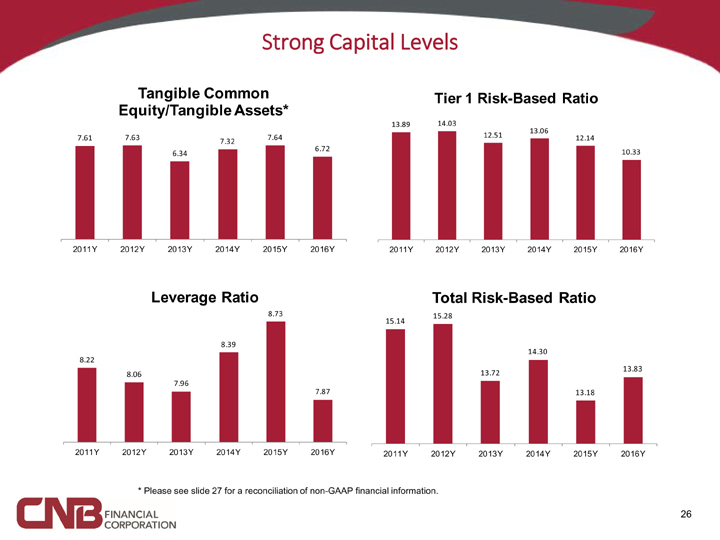

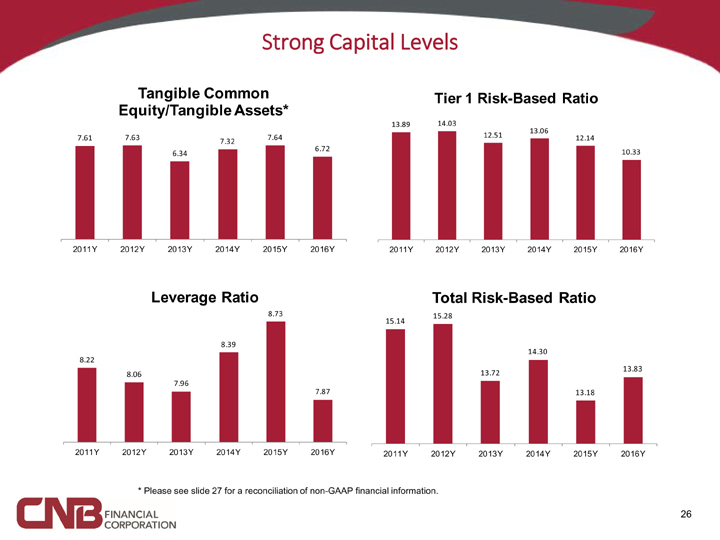

Strong Capital Levels

0 0

0 0

Tangible Common Tier 1 Risk-Based Ratio

Equity/Tangible Assets*

13.89 14.03 13.06

7.61 7.63 7.64 12.51 12.14

7.32

6.72 10.33

6.34

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y

0 0

0 0 0

Leverage Ratio Total Risk-Based Ratio

8.73 15.28 15.14

8.39

8.22 14.30

13.83

8.06 13.72

7.96 7.87

13.18

2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 2011Y 2012Y 2013Y 2014Y 2015Y 2016Y 0

* Please see slide 27 for a reconciliation of non-GAAP financial information.

26

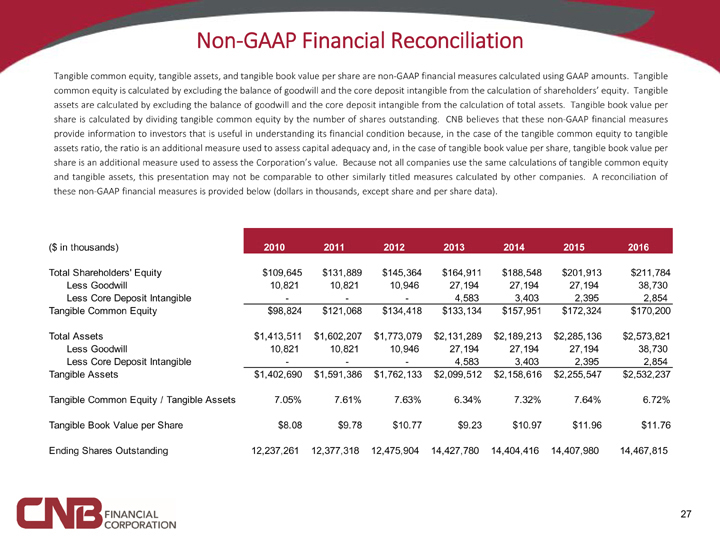

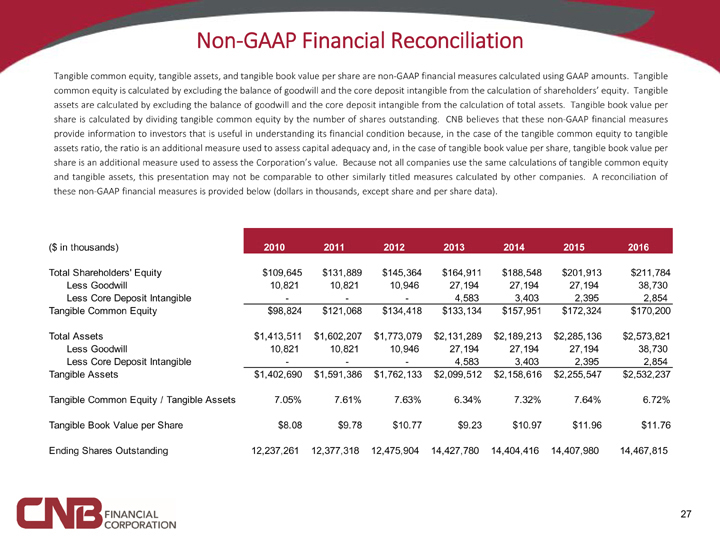

Non-GAAP Financial Reconciliation

Tangible common equity, tangible assets, and tangible book value per share are non-GAAP financial measures calculated using GAAP amounts. Tangible common equity is calculated by excluding the balance of goodwill and the core deposit intangible from the calculation of shareholders’ equity. Tangible assets are calculated by excluding the balance of goodwill and the core deposit intangible from the calculation of total assets. Tangible book value per share is calculated by dividing tangible common equity by the number of shares outstanding. CNB believes that these non-GAAP financial measures provide information to investors that is useful in understanding its financial condition because, in the case of the tangible common equity to tangible assets ratio, the ratio is an additional measure used to assess capital adequacy and, in the case of tangible book value per share, tangible book value per share is an additional measure used to assess the Corporation’s value. Because not all companies use the same calculations of tangible common equity and tangible assets, this presentation may not be comparable to other similarly titled measures calculated by other companies. A reconciliation of these non-GAAP financial measures is provided below (dollars in thousands, except share and per share data).

($ in thousands) 2010 2011 2012 2013 2014 2015 2016

Total Shareholders’ Equity $109,645 $131,889 $145,364 $164,911 $188,548 $201,913 $211,784 Less Goodwill 10,821 10,821 10,946 27,194 27,194 27,194 38,730 Less Core Deposit Intangible — — — 4,583 3,403 2,395 2,854 Tangible Common Equity $98,824 $121,068 $134,418 $133,134 $157,951 $172,324 $170,200

Total Assets $1,413,511 $1,602,207 $1,773,079 $2,131,289 $2,189,213 $2,285,136 $2,573,821 Less Goodwill 10,821 10,821 10,946 27,194 27,194 27,194 38,730 Less Core Deposit Intangible — — — 4,583 3,403 2,395 2,854 Tangible Assets $1,402,690 $1,591,386 $1,762,133 $2,099,512 $2,158,616 $2,255,547 $2,532,237

Tangible Common Equity / Tangible Assets 7.05% 7.61% 7.63% 6.34% 7.32% 7.64% 6.72% Tangible Book Value per Share $8.08 $9.78 $10.77 $9.23 $10.97 $11.96 $11.76 Ending Shares Outstanding 12,237,261 12,377,318 12,475,904 14,427,780 14,404,416 14,407,980 14,467,815

27

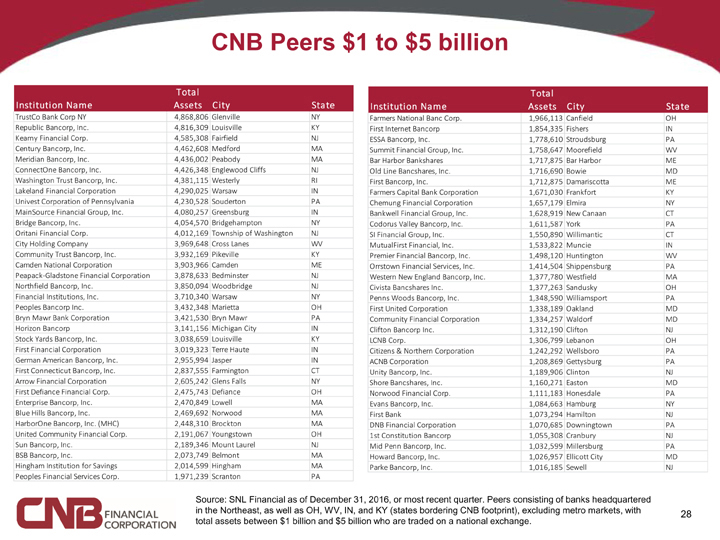

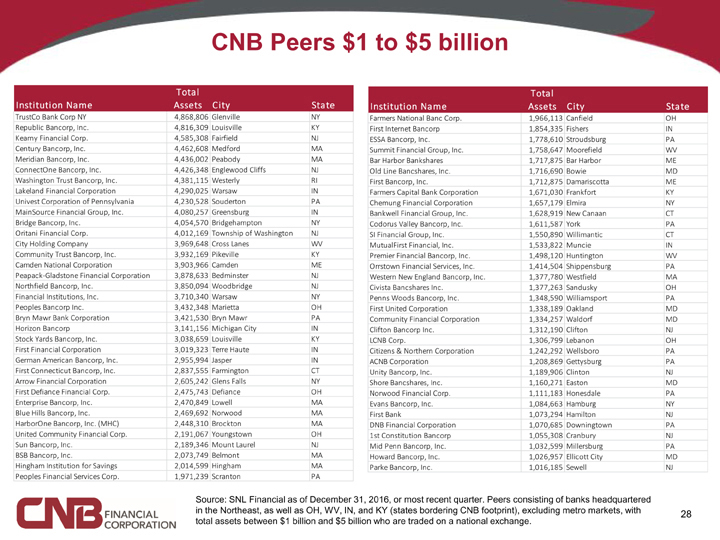

CNB Peers $1 to $5 billion

Total

Institution Name Assets City State

TrustCo Bank Corp NY 4,868,806 Glenville NY Republic Bancorp, Inc. 4,816,309 Louisville KY Kearny Financial Corp. 4,585,308 Fairfield NJ Century Bancorp, Inc. 4,462,608 Medford MA Meridian Bancorp, Inc. 4,436,002 Peabody MA ConnectOne Bancorp, Inc. 4,426,348 Englewood Cliffs NJ Washington Trust Bancorp, Inc. 4,381,115 Westerly RI Lakeland Financial Corporation 4,290,025 Warsaw IN Univest Corporation of Pennsylvania 4,230,528 Souderton PA MainSource Financial Group, Inc. 4,080,257 Greensburg IN Bridge Bancorp, Inc. 4,054,570 Bridgehampton NY Oritani Financial Corp. 4,012,169 Township of Washington NJ City Holding Company 3,969,648 Cross Lanes WV Community Trust Bancorp, Inc. 3,932,169 Pikeville KY Camden National Corporation 3,903,966 Camden ME Peapack-Gladstone Financial Corporation 3,878,633 Bedminster NJ Northfield Bancorp, Inc. 3,850,094 Woodbridge NJ Financial Institutions, Inc. 3,710,340 Warsaw NY Peoples Bancorp Inc. 3,432,348 Marietta OH Bryn Mawr Bank Corporation 3,421,530 Bryn Mawr PA Horizon Bancorp 3,141,156 Michigan City IN Stock Yards Bancorp, Inc. 3,038,659 Louisville KY First Financial Corporation 3,019,323 Terre Haute IN German American Bancorp, Inc. 2,955,994 Jasper IN First Connecticut Bancorp, Inc. 2,837,555 Farmington CT Arrow Financial Corporation 2,605,242 Glens Falls NY First Defiance Financial Corp. 2,475,743 Defiance OH Enterprise Bancorp, Inc. 2,470,849 Lowell MA Blue Hills Bancorp, Inc. 2,469,692 Norwood MA HarborOne Bancorp, Inc. (MHC) 2,448,310 Brockton MA United Community Financial Corp. 2,191,067 Youngstown OH Sun Bancorp, Inc. 2,189,346 Mount Laurel NJ BSB Bancorp, Inc. 2,073,749 Belmont MA Hingham Institution for Savings 2,014,599 Hingham MA Peoples Financial Services Corp. 1,971,239 Scranton PA

Total

Institution Name Assets City State

Farmers National Banc Corp. 1,966,113 Canfield OH First Internet Bancorp 1,854,335 Fishers IN ESSA Bancorp, Inc. 1,778,610 Stroudsburg PA Summit Financial Group, Inc. 1,758,647 Moorefield WV Bar Harbor Bankshares 1,717,875 Bar Harbor ME Old Line Bancshares, Inc. 1,716,690 Bowie MD First Bancorp, Inc. 1,712,875 Damariscotta ME Farmers Capital Bank Corporation 1,671,030 Frankfort KY Chemung Financial Corporation 1,657,179 Elmira NY Bankwell Financial Group, Inc. 1,628,919 New Canaan CT Codorus Valley Bancorp, Inc. 1,611,587 York PA SI Financial Group, Inc. 1,550,890 Willimantic CT MutualFirst Financial, Inc. 1,533,822 Muncie IN Premier Financial Bancorp, Inc. 1,498,120 Huntington WV Orrstown Financial Services, Inc. 1,414,504 Shippensburg PA Western New England Bancorp, Inc. 1,377,780 Westfield MA Civista Bancshares Inc. 1,377,263 Sandusky OH Penns Woods Bancorp, Inc. 1,348,590 Williamsport PA First United Corporation 1,338,189 Oakland MD Community Financial Corporation 1,334,257 Waldorf MD Clifton Bancorp Inc. 1,312,190 Clifton NJ LCNB Corp. 1,306,799 Lebanon OH Citizens & Northern Corporation 1,242,292 Wellsboro PA ACNB Corporation 1,208,869 Gettysburg PA Unity Bancorp, Inc. 1,189,906 Clinton NJ Shore Bancshares, Inc. 1,160,271 Easton MD Norwood Financial Corp. 1,111,183 Honesdale PA Evans Bancorp, Inc. 1,084,663 Hamburg NY First Bank 1,073,294 Hamilton NJ DNB Financial Corporation 1,070,685 Downingtown PA 1st Constitution Bancorp 1,055,308 Cranbury NJ Mid Penn Bancorp, Inc. 1,032,599 Millersburg PA Howard Bancorp, Inc. 1,026,957 Ellicott City MD Parke Bancorp, Inc. 1,016,185 Sewell NJ

Source: SNL Financial as of December 31, 2016, or most recent quarter. Peers consisting of banks headquartered in the Northeast, as well as OH, WV, IN, and KY (states bordering CNB footprint), excluding metro markets, with total assets between $1 billion and $5 billion who are traded on a national exchange.

28