84 87 90 164 30 52 230 228 229 Discussion Materials ANNUAL shareholder MEETING Presentation APRIL 18, 2023 164 30 52 164 30 52 164 30 52 Exhibit 99.1

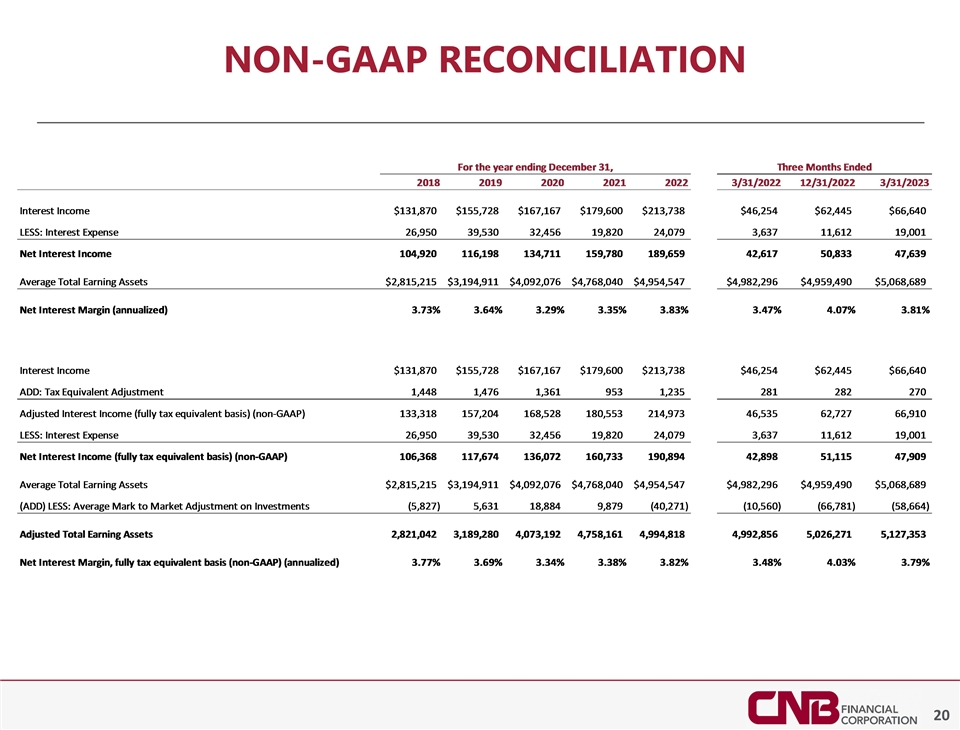

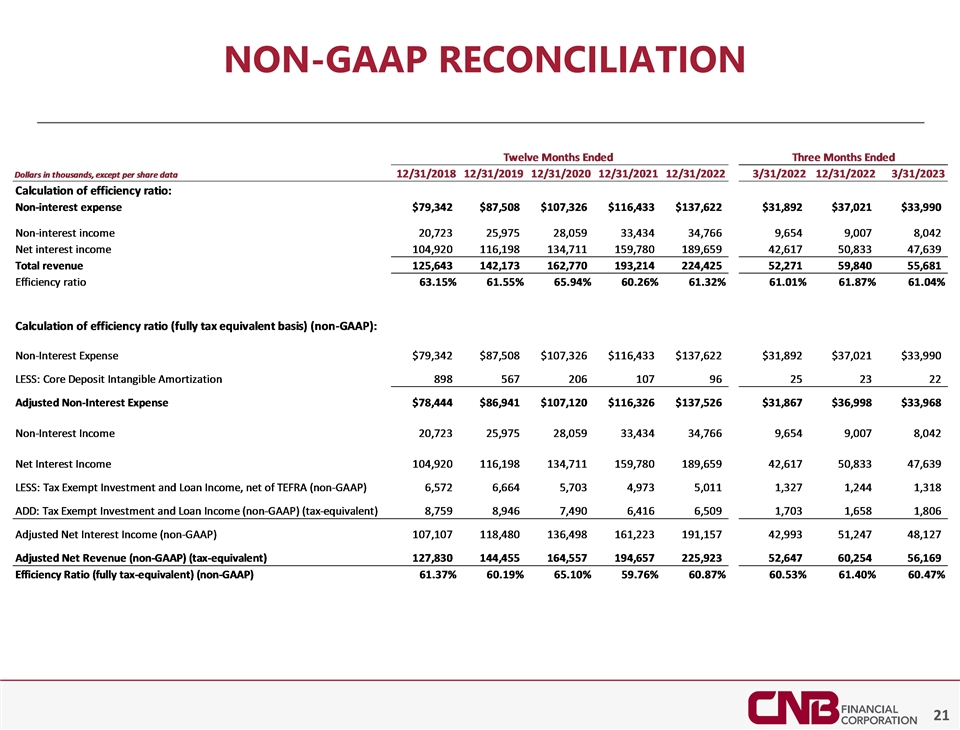

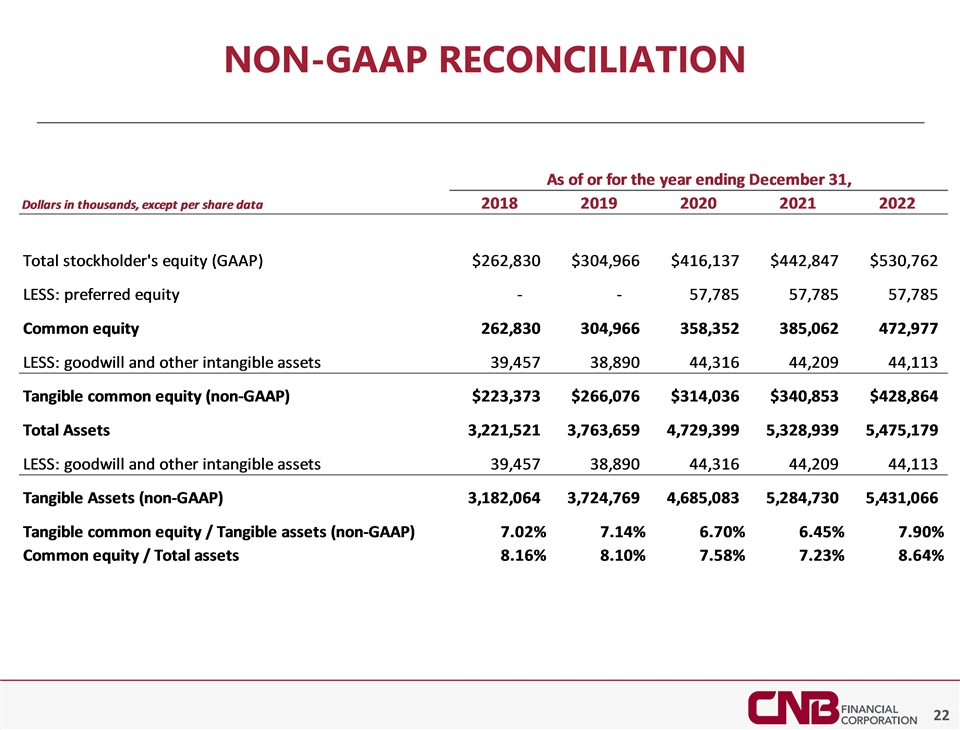

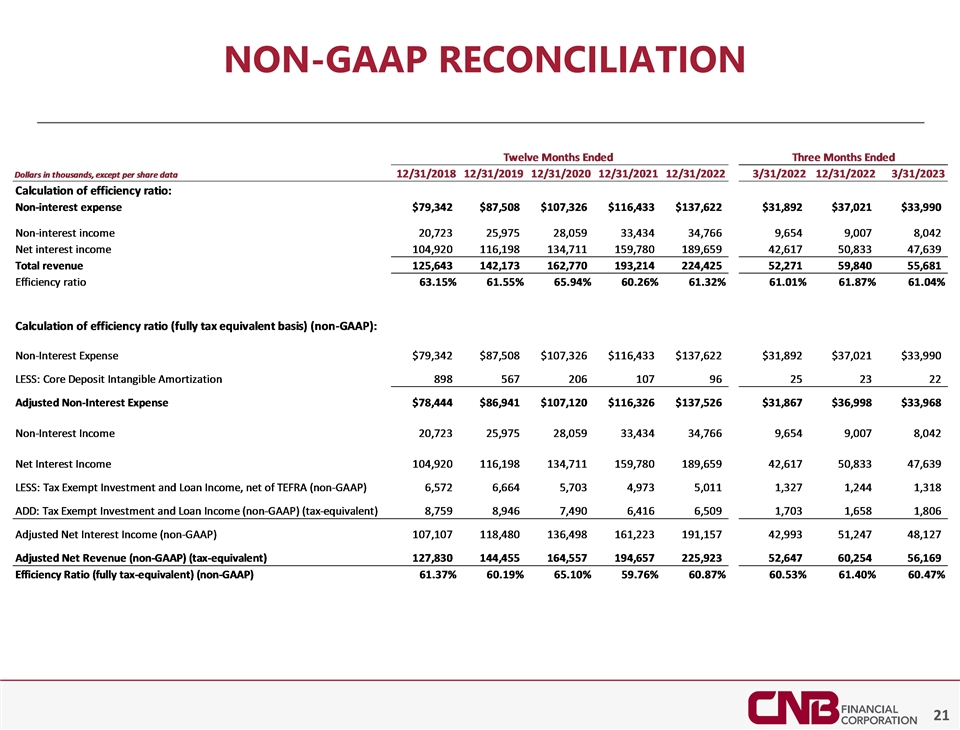

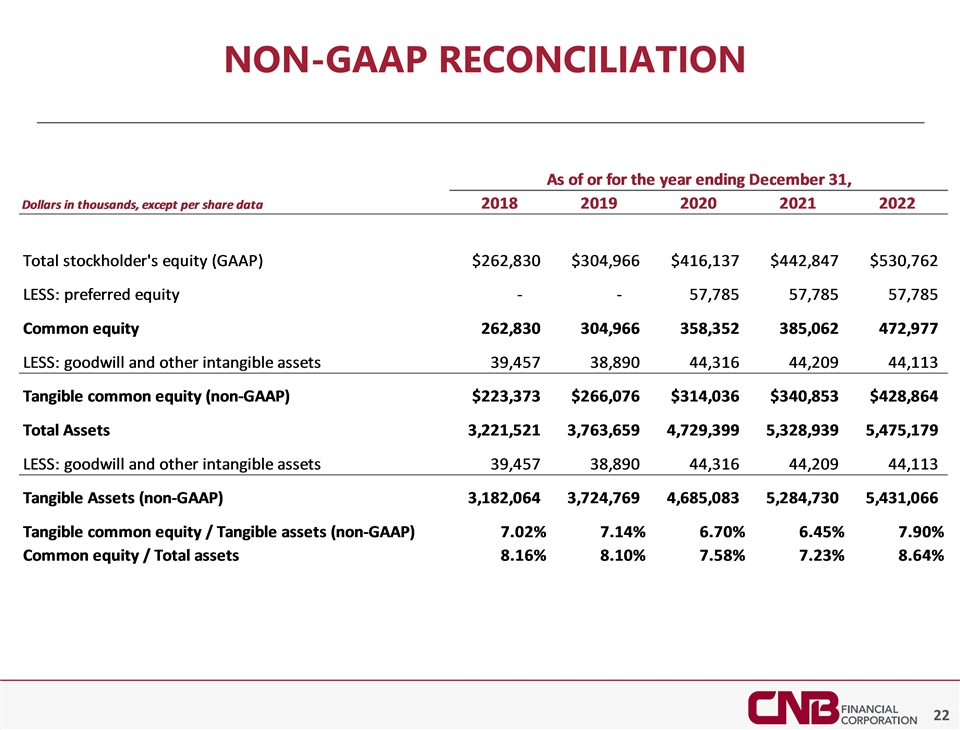

Certain Important information CAUTION REGARDING FORWARD LOOKING STATEMENTS This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to CNB’s financial condition, liquidity, results of operations, future performance and business. These forward-looking statements are intended to be covered by the safe harbor for "forward-looking statements" provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are those that are not historical facts. Forward-looking statements include statements with respect to beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions that are subject to significant risks and uncertainties and are subject to change based on various factors (some of which are beyond CNB’s control). Forward-looking statements often include the words "believes," "expects," "anticipates," "estimates," "forecasts," "intends," "plans," "targets," "potentially," "probably," "projects," "outlook" or similar expressions or future conditional verbs such as "may," "will," "should," "would" and "could." CNB’s actual results may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Such known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from the statements, include, but are not limited to, (i) adverse changes or conditions in capital and financial markets, including actual or potential stresses in the banking industry; (ii) changes in interest rates; (iii) the duration and scope of a pandemic, including the lingering impacts of the COVID-19 pandemic, and the local, national and global impact of a pandemic; (iv) changes in general business, industry or economic conditions or competition; (v) changes in any applicable law, rule, regulation, policy, guideline or practice governing or affecting financial holding companies and their subsidiaries or with respect to tax or accounting principles or otherwise; (vi) higher than expected costs or other difficulties related to integration of combined or merged businesses; (vii) the effects of business combinations and other acquisition transactions, including the inability to realize our loan and investment portfolios; (viii) changes in the quality or composition of our loan and investment portfolios; (ix) adequacy of loan loss reserves; (x) increased competition; (xi) loss of certain key officers; (xii) deposit attrition; (xiii) rapidly changing technology; (xiv) unanticipated regulatory or judicial proceedings and liabilities and other costs; (xv) changes in the cost of funds, demand for loan products or demand for financial services; and (xvi) other economic, competitive, governmental or technological factors affecting our operations, markets, products, services and prices. For more information about factors that could cause actual results to differ from those discussed in the forward-looking statements, please refer to the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of and the forward-looking statement disclaimers in CNB’s annual and quarterly reports filed with the SEC. The forward-looking statements contained herein are based upon management’s beliefs and assumptions. Any forward-looking statement made herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. CNB undertakes no obligation to publicly update or revise any forward-looking statements included in this presentation, whether as a result of new information, future events or otherwise, except to the extent required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed might not occur and you should not put undue reliance on any forward-looking statements. NON-GAAP FINANCIAL MEASURES This report contains references to financial measures that are not defined in GAAP. Management uses non-GAAP financial information in its analysis of the Corporation’s performance. Management believes that these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results of operations with prior periods and show the effects of significant gains and charges in the periods presented. The Corporation’s management believes that investors may use these non-GAAP measures to analyze the Corporation’s financial performance without the impact of unusual items or events that may obscure trends in the Corporation’s underlying performance. This non-GAAP data should be considered in addition to results prepared in accordance with GAAP, and is not a substitute for, or superior to, GAAP results. Limitations associated with non-GAAP financial measures include the risks that persons might disagree as to the appropriateness of items included in these measures and that different companies might calculate these measures differently. Non-GAAP measures reflected within the presentation include: Tangible common equity/tangible assets, Net interest margin (fully tax equivalent basis) and Efficiency ratio (fully tax equivalent).

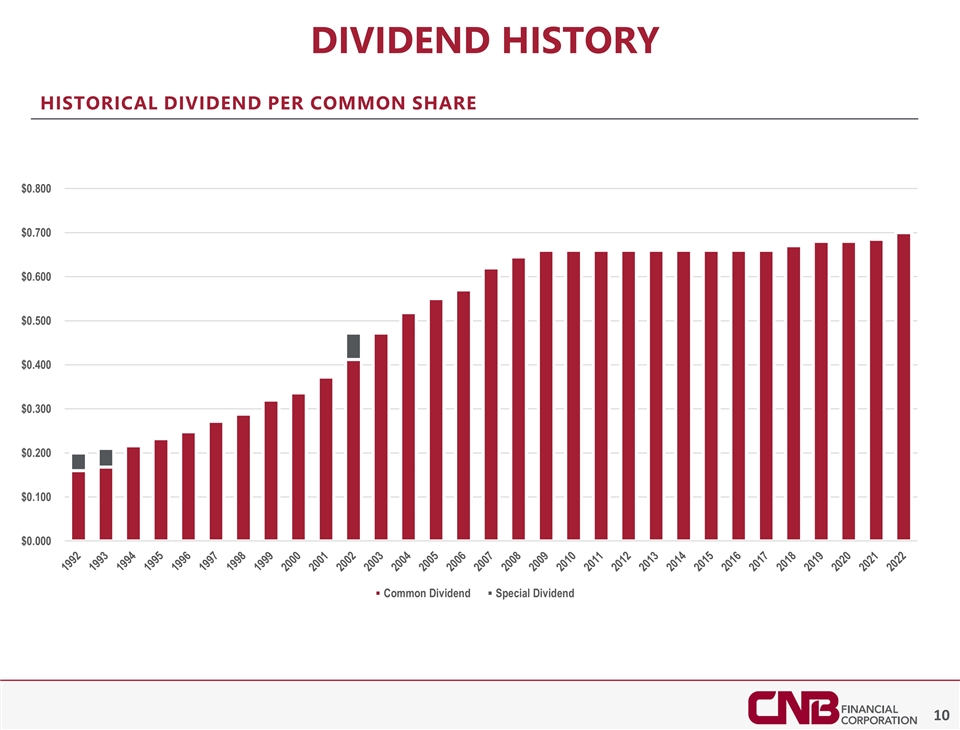

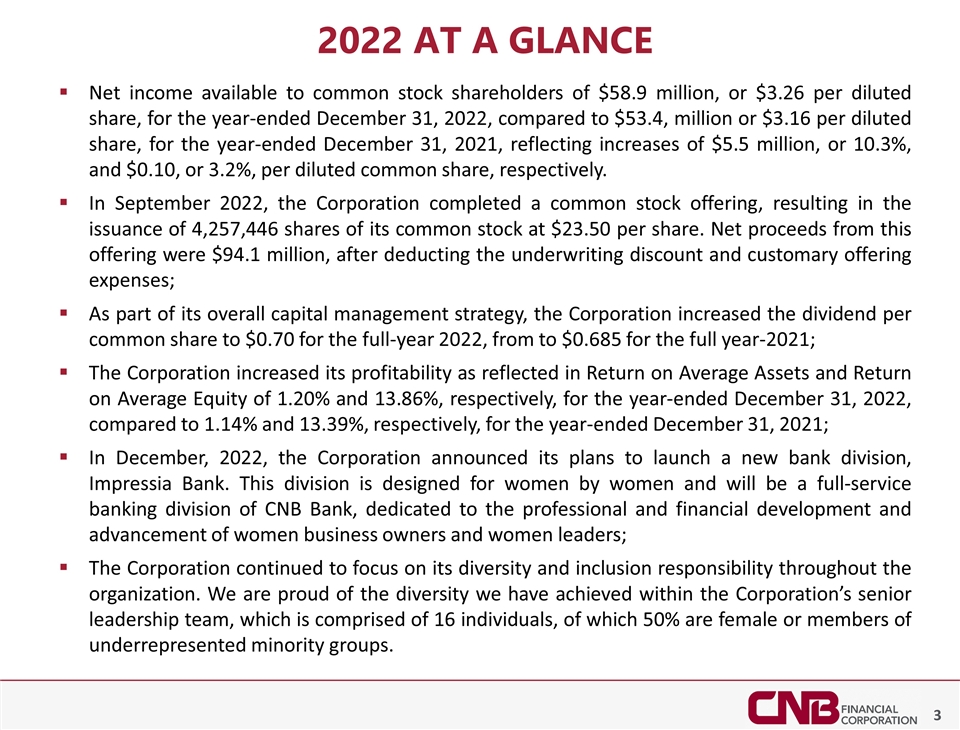

2022 at a glance Net income available to common stock shareholders of $58.9 million, or $3.26 per diluted share, for the year-ended December 31, 2022, compared to $53.4, million or $3.16 per diluted share, for the year-ended December 31, 2021, reflecting increases of $5.5 million, or 10.3%, and $0.10, or 3.2%, per diluted common share, respectively. In September 2022, the Corporation completed a common stock offering, resulting in the issuance of 4,257,446 shares of its common stock at $23.50 per share. Net proceeds from this offering were $94.1 million, after deducting the underwriting discount and customary offering expenses; As part of its overall capital management strategy, the Corporation increased the dividend per common share to $0.70 for the full-year 2022, from to $0.685 for the full year-2021; The Corporation increased its profitability as reflected in Return on Average Assets and Return on Average Equity of 1.20% and 13.86%, respectively, for the year-ended December 31, 2022, compared to 1.14% and 13.39%, respectively, for the year-ended December 31, 2021; In December, 2022, the Corporation announced its plans to launch a new bank division, Impressia Bank. This division is designed for women by women and will be a full-service banking division of CNB Bank, dedicated to the professional and financial development and advancement of women business owners and women leaders; The Corporation continued to focus on its diversity and inclusion responsibility throughout the organization. We are proud of the diversity we have achieved within the Corporation’s senior leadership team, which is comprised of 16 individuals, of which 50% are female or members of underrepresented minority groups.

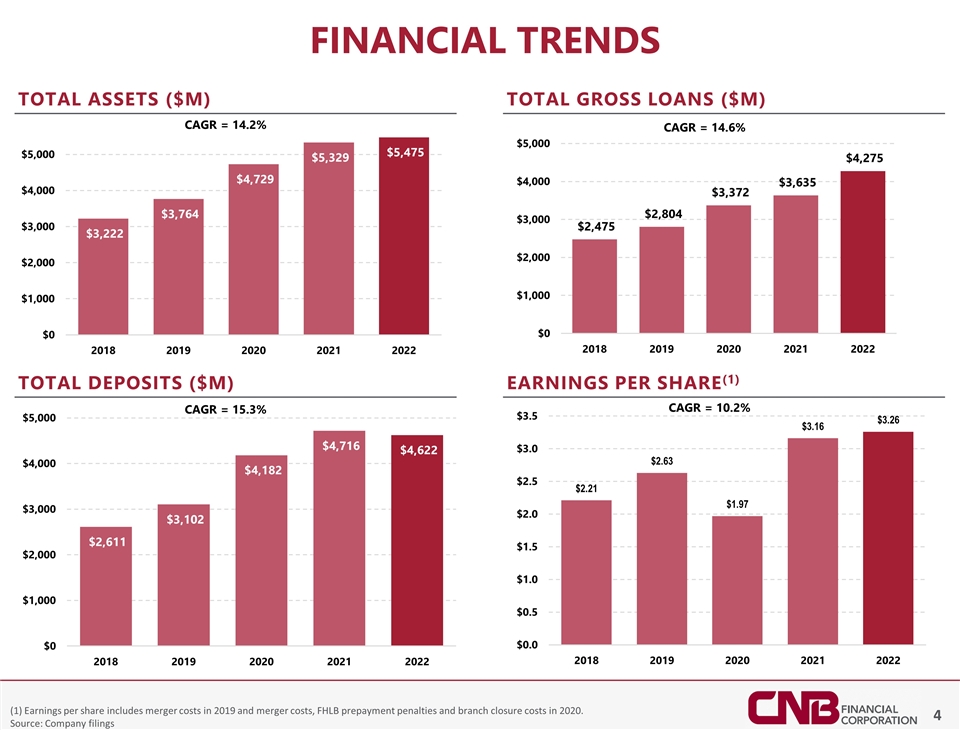

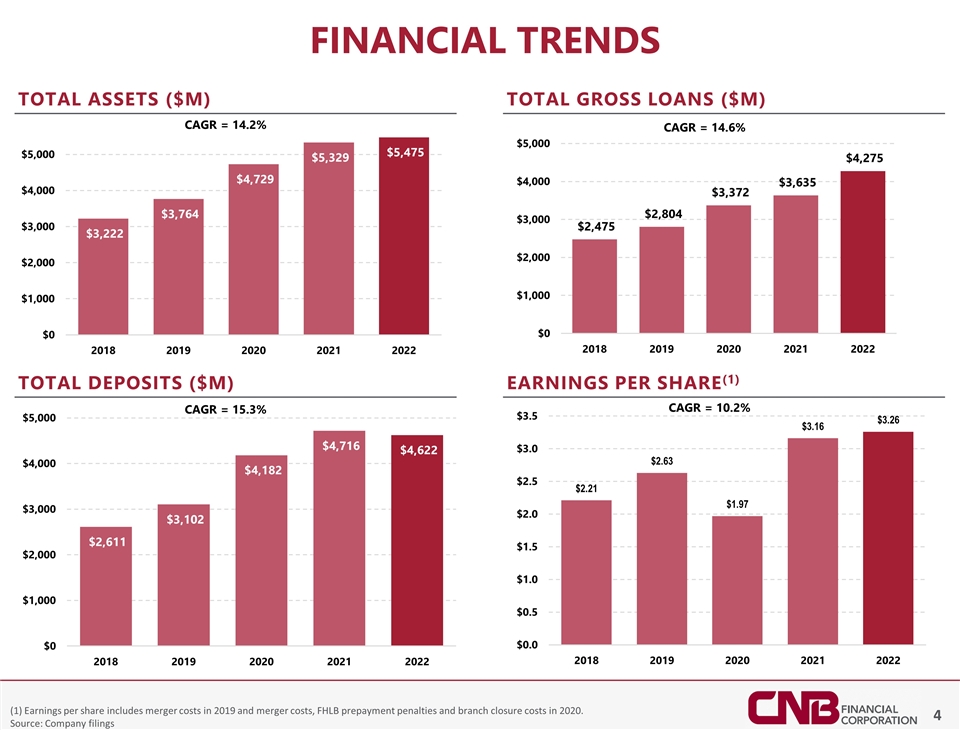

(1) Earnings per share includes merger costs in 2019 and merger costs, FHLB prepayment penalties and branch closure costs in 2020. Source: Company filings Financial trends Total Assets ($M) Total Gross Loans ($M) Total Deposits ($M) Earnings per share(1) CAGR = 14.2% CAGR = 14.6% CAGR = 15.3% CAGR = 10.2%

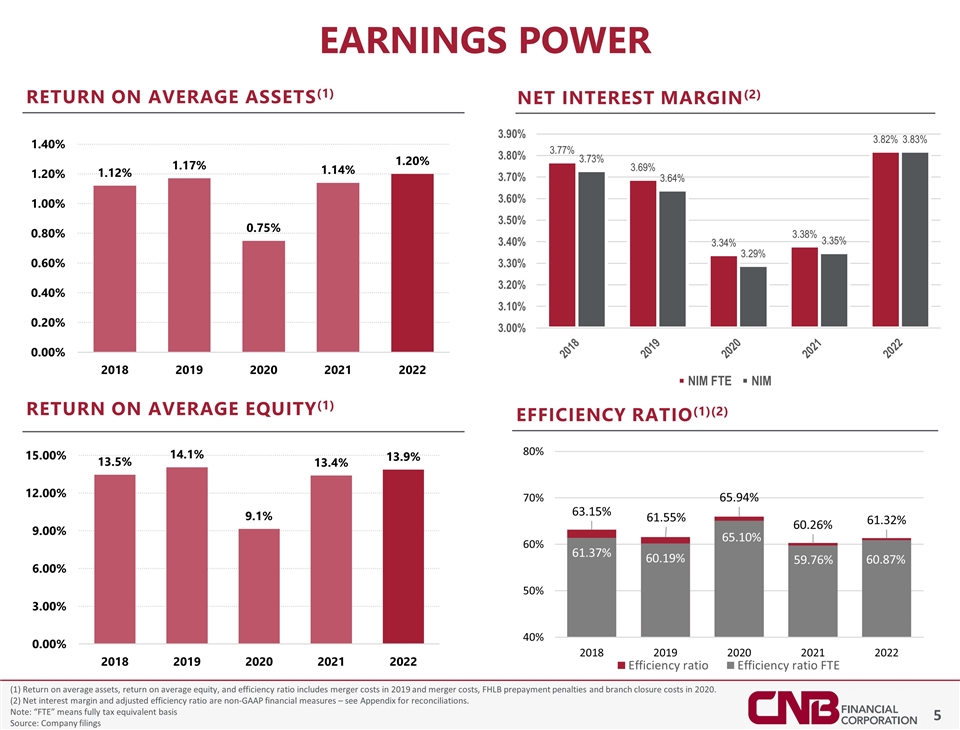

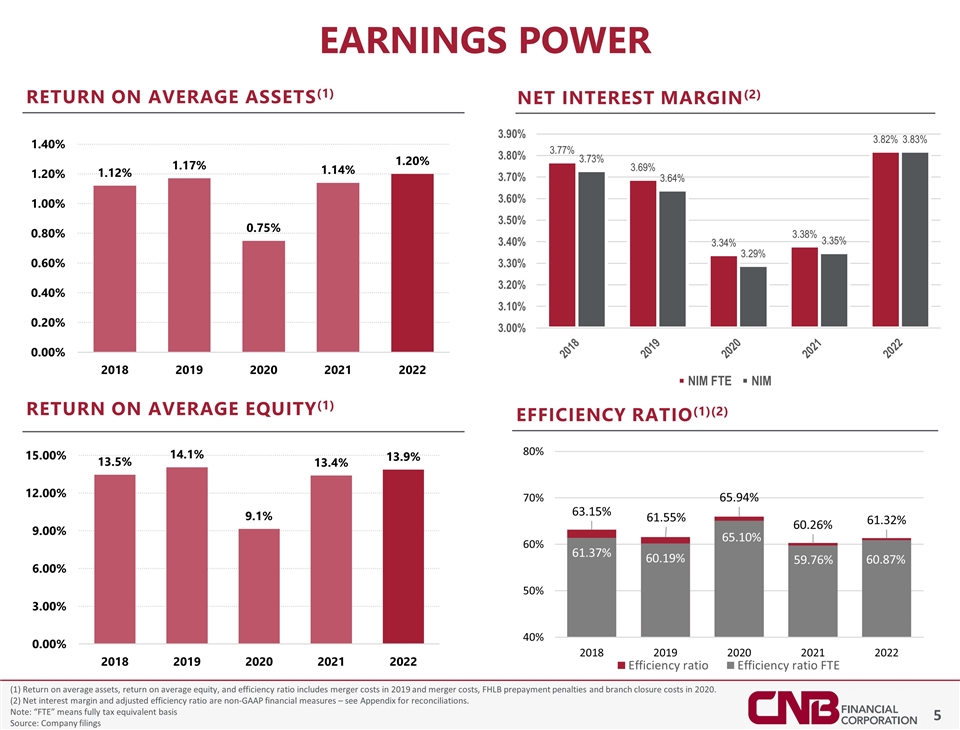

(1) Return on average assets, return on average equity, and efficiency ratio includes merger costs in 2019 and merger costs, FHLB prepayment penalties and branch closure costs in 2020. (2) Net interest margin and adjusted efficiency ratio are non-GAAP financial measures – see Appendix for reconciliations. Note: “FTE” means fully tax equivalent basis Source: Company filings Earnings power Return on average equity(1) Return on average assets(1) Efficiency Ratio(1)(2) Net Interest Margin(2)

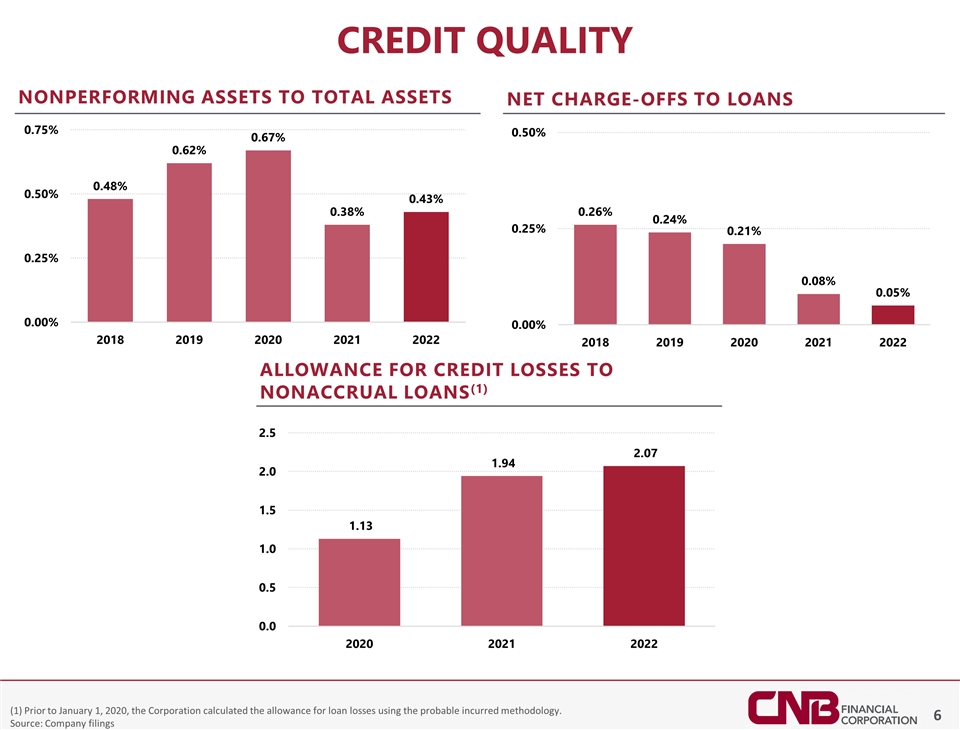

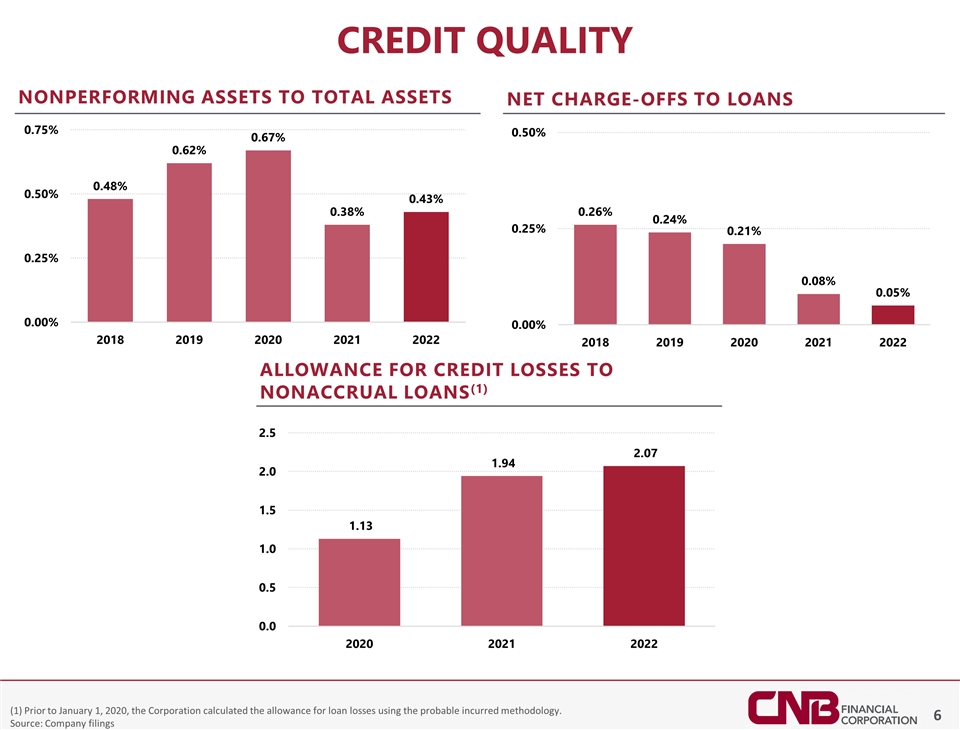

Credit quality NONPERFORMING ASSETS TO TOTAL ASSETS NET CHARGE-OFFS TO LOANS ALLOWANCE FOR CREDIT LOSSES to NONACCRUAL LOANS(1) (1) Prior to January 1, 2020, the Corporation calculated the allowance for loan losses using the probable incurred methodology. Source: Company filings

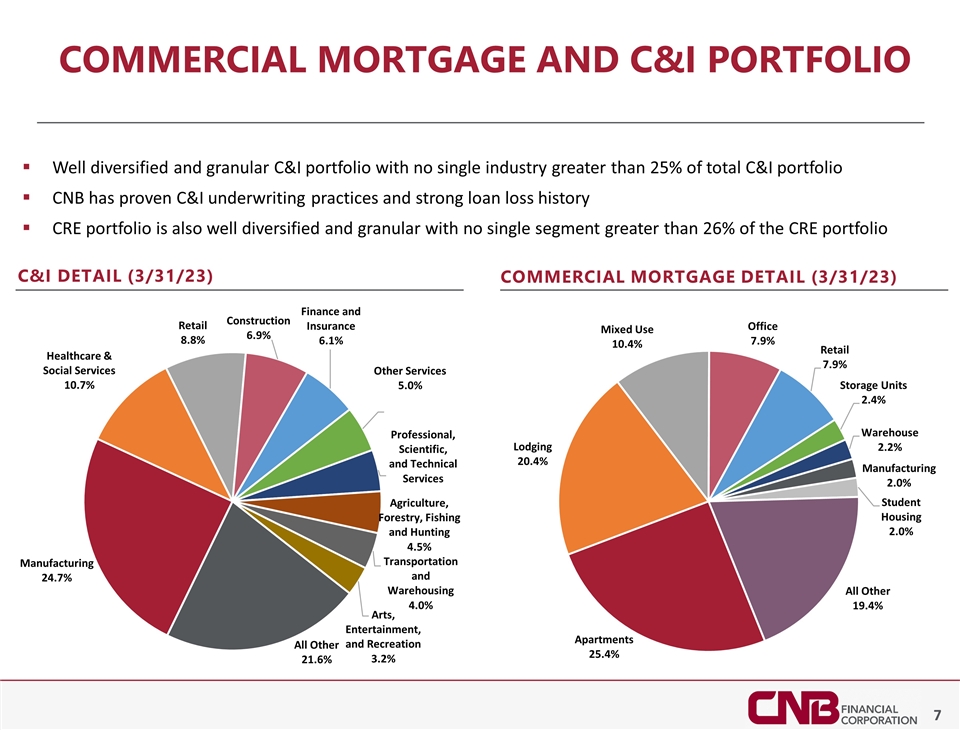

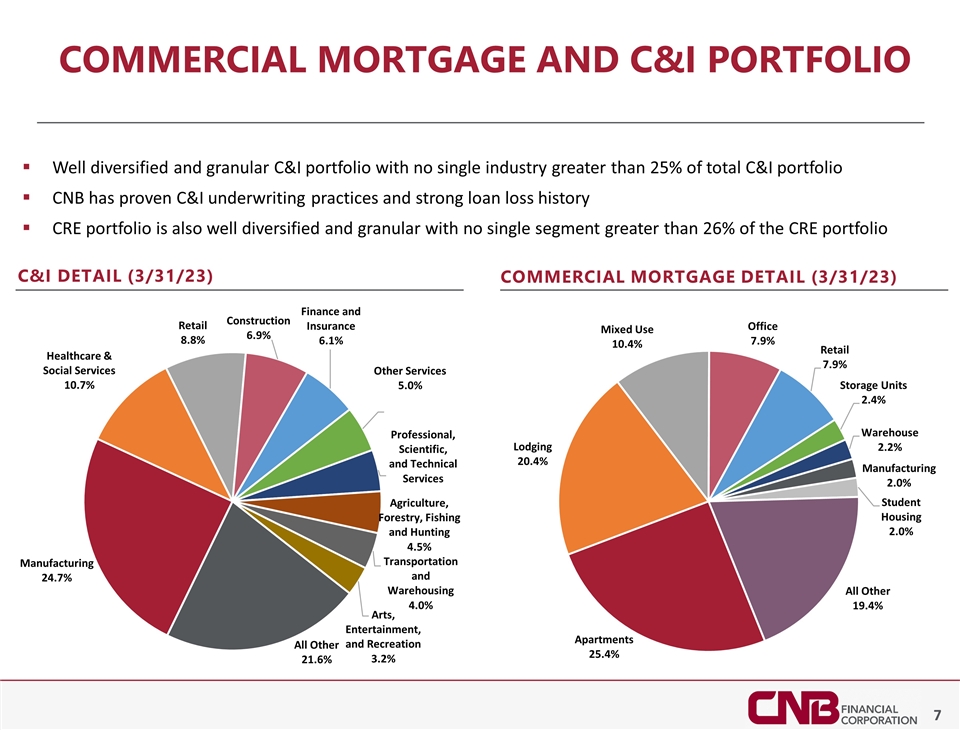

Commercial mortgage and C&I portfolio Well diversified and granular C&I portfolio with no single industry greater than 25% of total C&I portfolio CNB has proven C&I underwriting practices and strong loan loss history CRE portfolio is also well diversified and granular with no single segment greater than 26% of the CRE portfolio C&I Detail (3/31/23) Commercial mortgage detail (3/31/23)

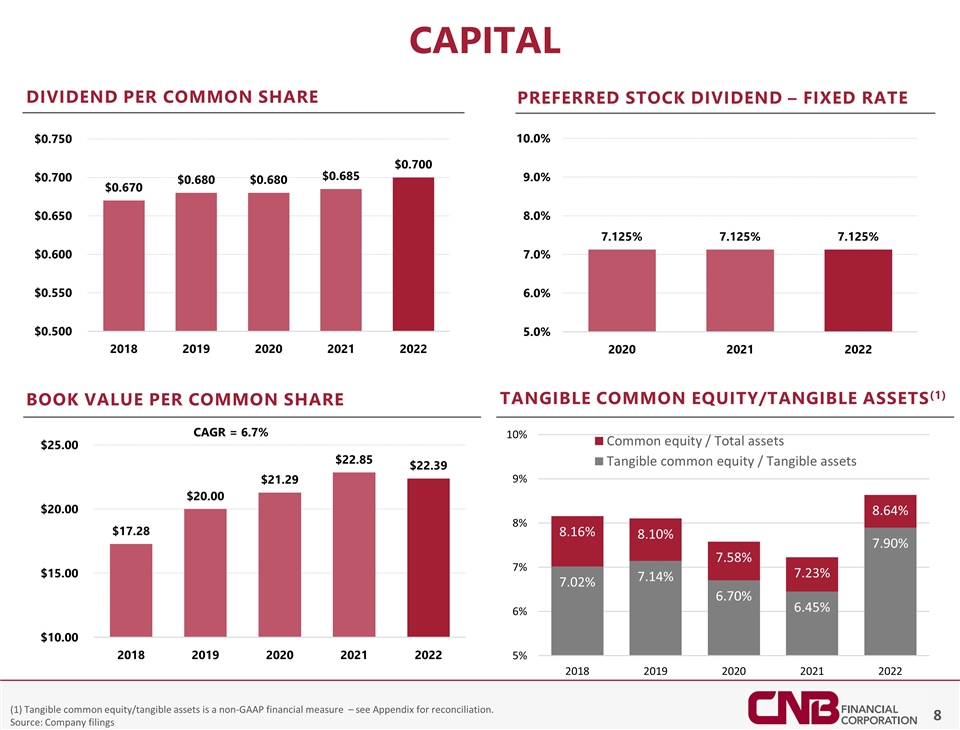

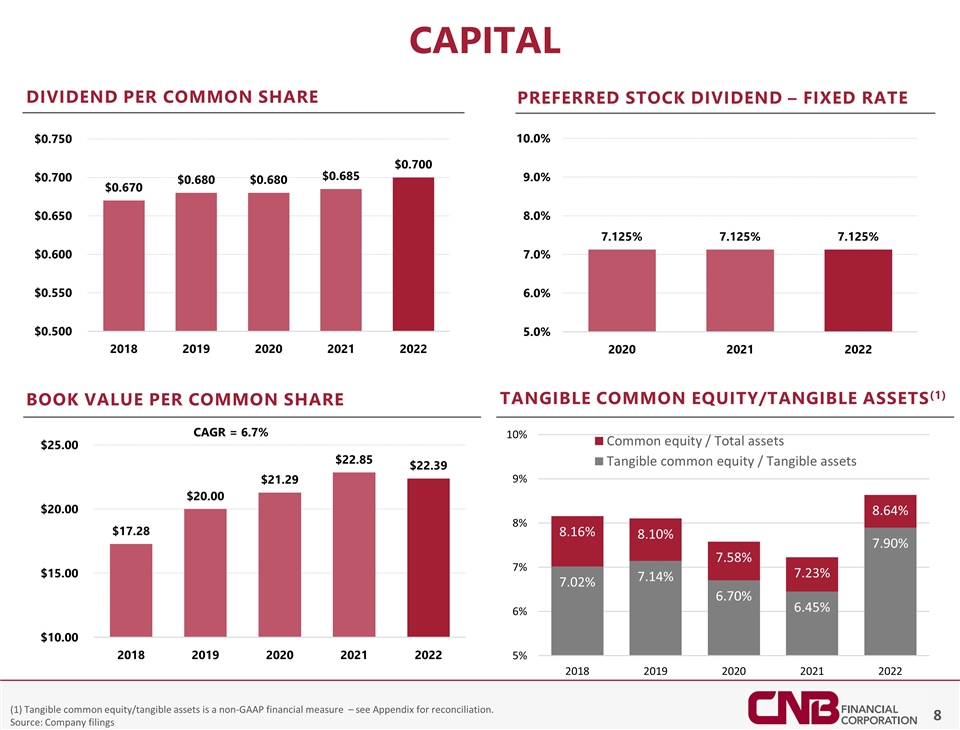

(1) Tangible common equity/tangible assets is a non-GAAP financial measure – see Appendix for reconciliation. Source: Company filings Capital book value per common share DIVIDEND PER COMMON SHARE Tangible common Equity/Tangible assets(1) Preferred Stock dividend – fixed rate CAGR = 6.7%

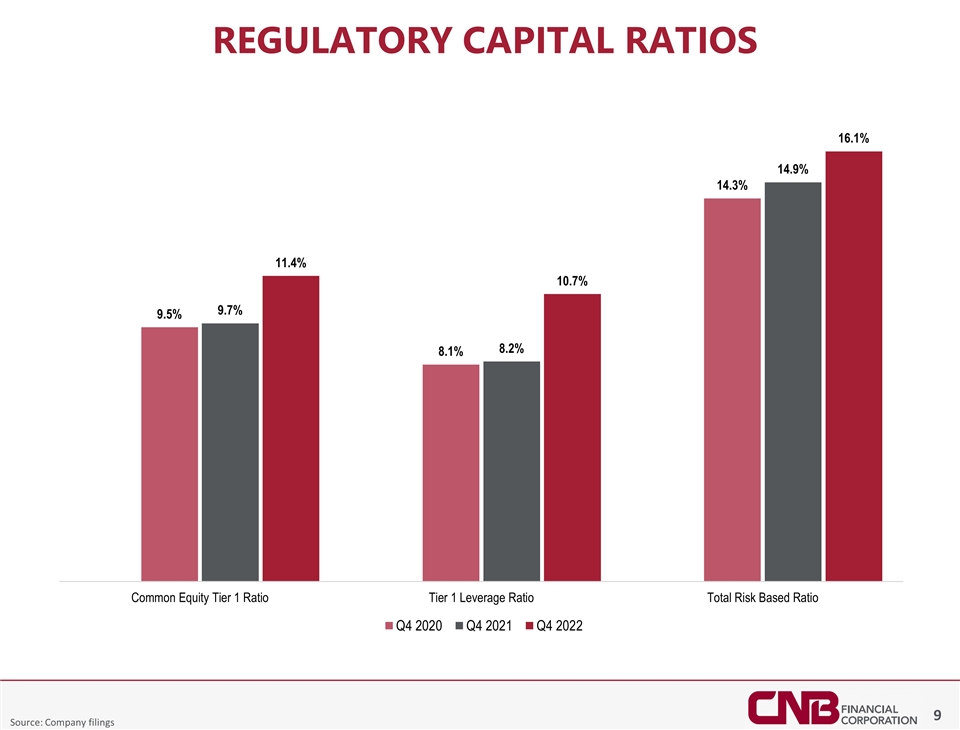

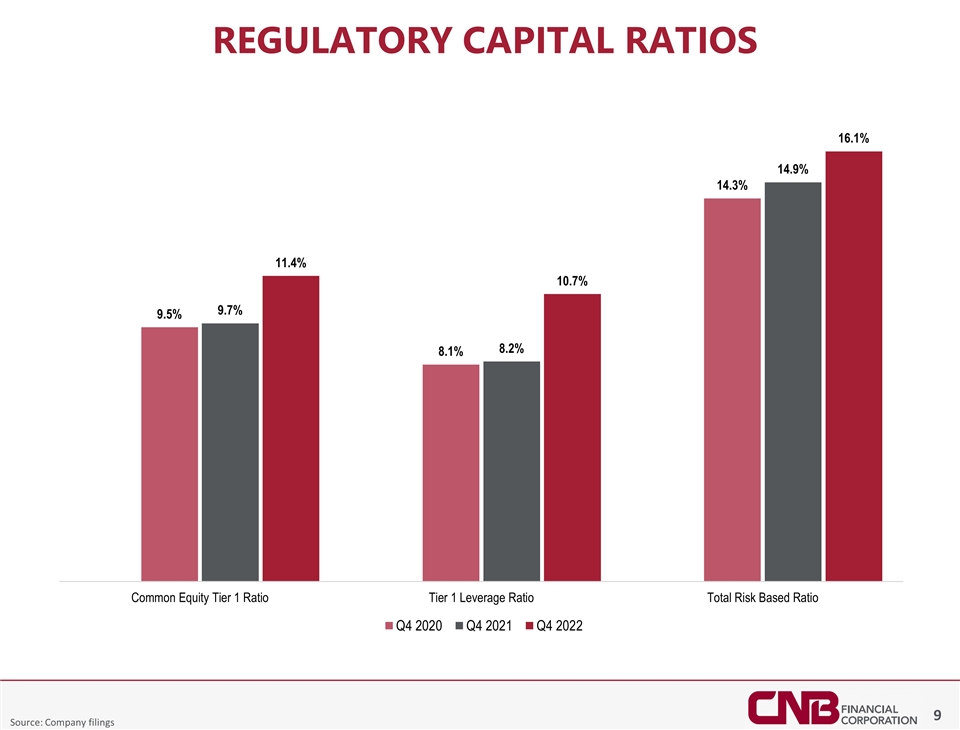

Regulatory Capital ratios Source: Company filings

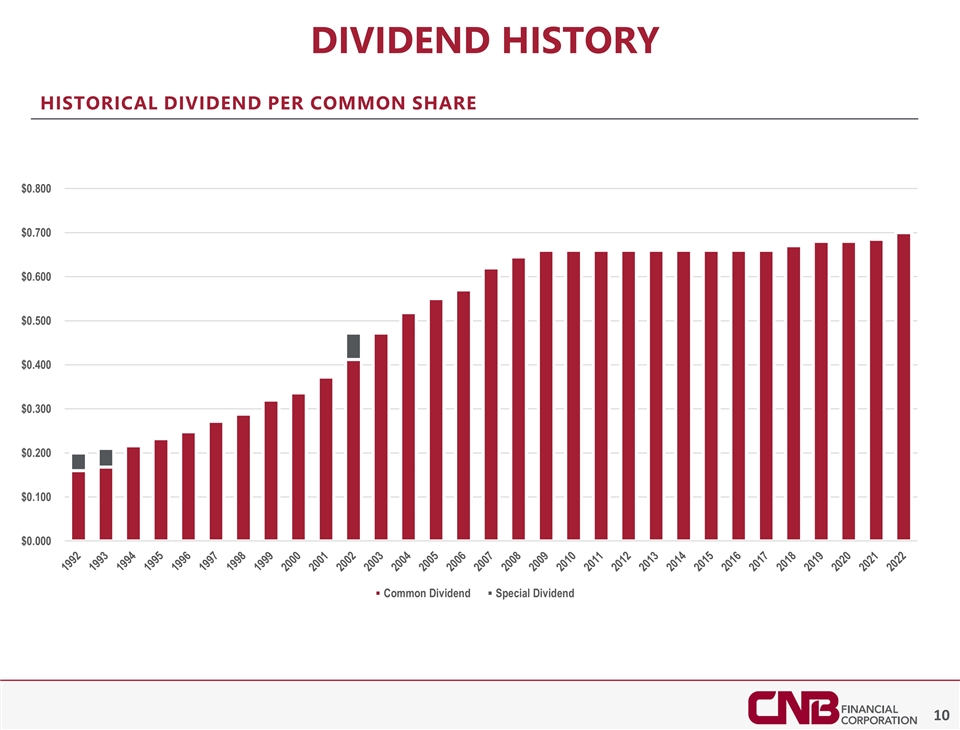

Dividend History Historical dividend per common share

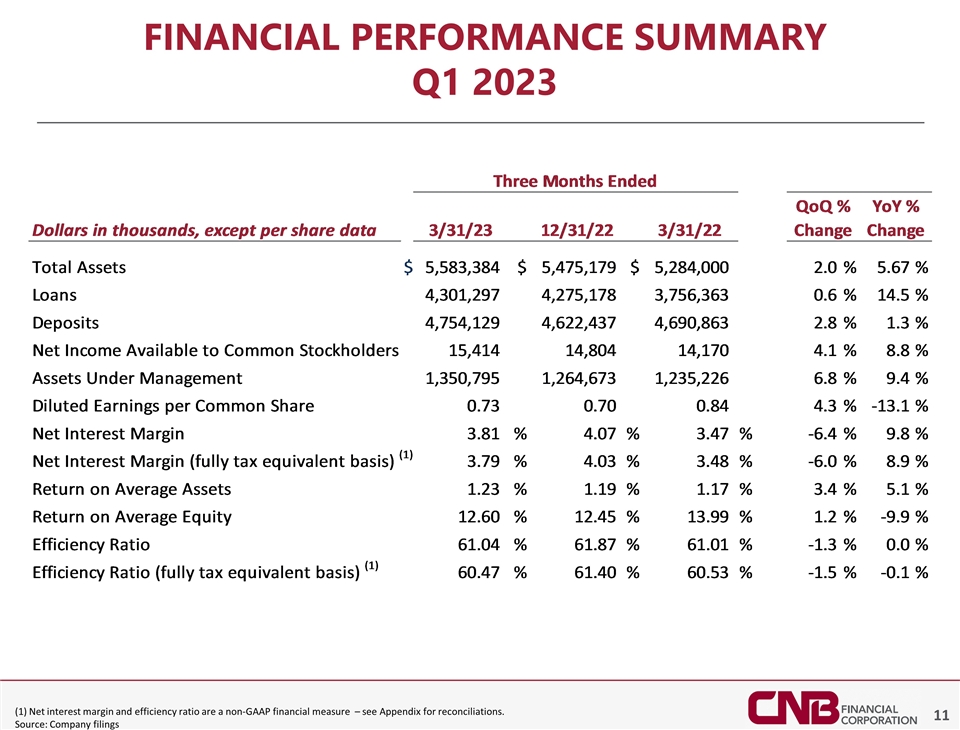

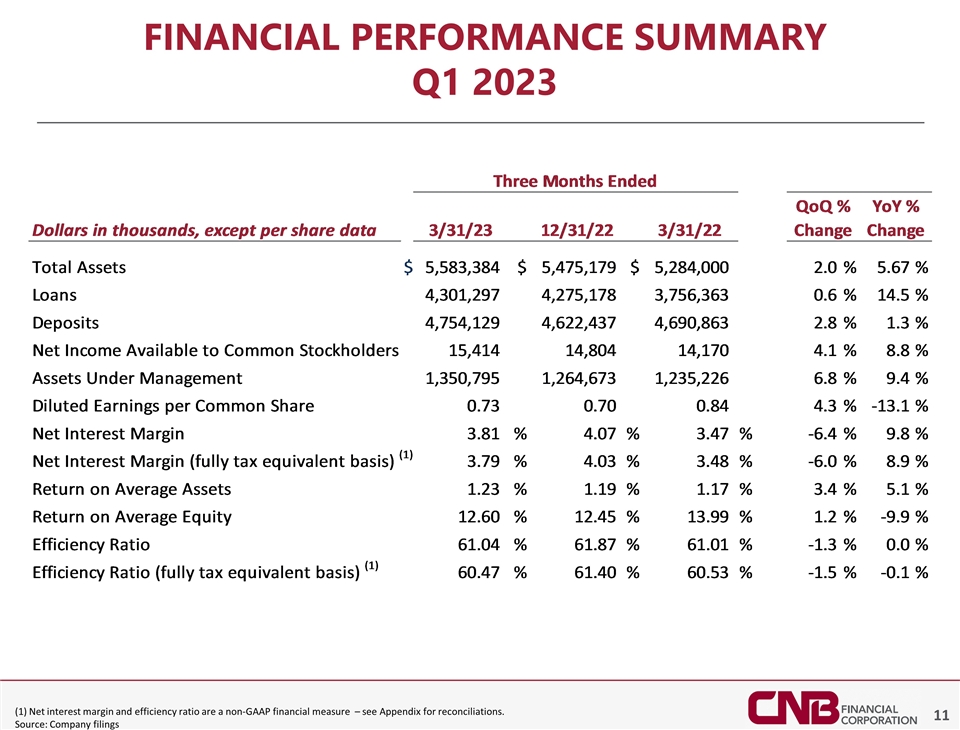

Financial performance summary Q1 2023 (1) Net interest margin and efficiency ratio are a non-GAAP financial measure – see Appendix for reconciliations. Source: Company filings

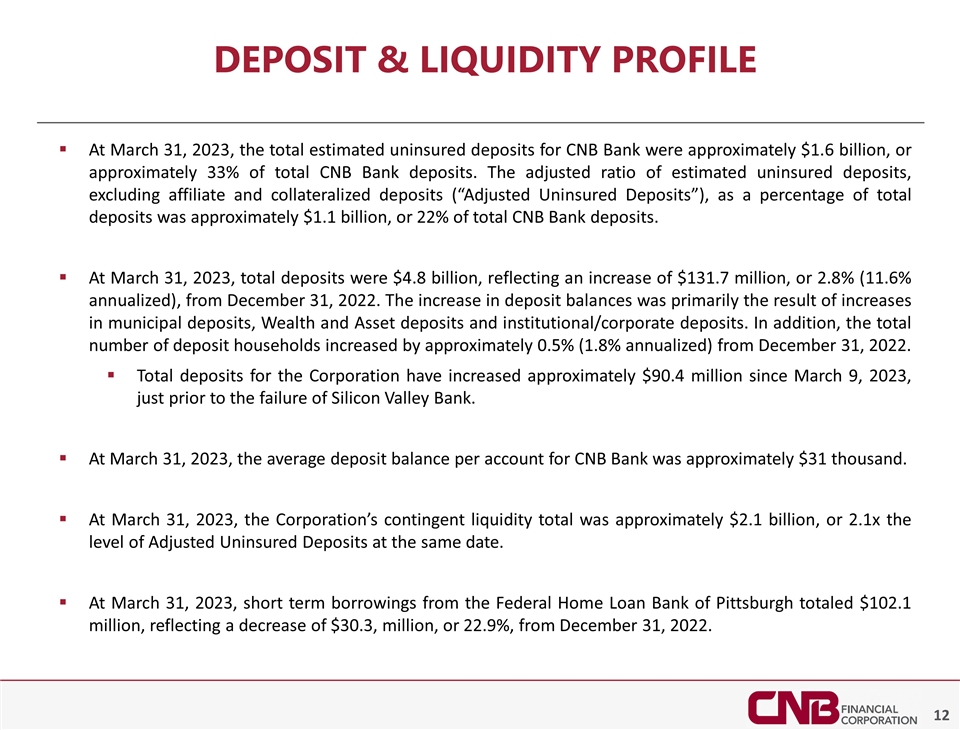

Deposit & liquidity profile At March 31, 2023, the total estimated uninsured deposits for CNB Bank were approximately $1.6 billion, or approximately 33% of total CNB Bank deposits. The adjusted ratio of estimated uninsured deposits, excluding affiliate and collateralized deposits (“Adjusted Uninsured Deposits”), as a percentage of total deposits was approximately $1.1 billion, or 22% of total CNB Bank deposits. At March 31, 2023, total deposits were $4.8 billion, reflecting an increase of $131.7 million, or 2.8% (11.6% annualized), from December 31, 2022. The increase in deposit balances was primarily the result of increases in municipal deposits, Wealth and Asset deposits and institutional/corporate deposits. In addition, the total number of deposit households increased by approximately 0.5% (1.8% annualized) from December 31, 2022. Total deposits for the Corporation have increased approximately $90.4 million since March 9, 2023, just prior to the failure of Silicon Valley Bank. At March 31, 2023, the average deposit balance per account for CNB Bank was approximately $31 thousand. At March 31, 2023, the Corporation’s contingent liquidity total was approximately $2.1 billion, or 2.1x the level of Adjusted Uninsured Deposits at the same date. At March 31, 2023, short term borrowings from the Federal Home Loan Bank of Pittsburgh totaled $102.1 million, reflecting a decrease of $30.3, million, or 22.9%, from December 31, 2022.

Looking into 2023 CNB Bank expects to expand its Centre County presence into State College, PA, by establishing a Commercial Lending, Private Banking and Wealth Management office in the third quarter of 2023, shortly followed by the establishment of a full-service branch office in the fourth quarter of 2023. Ridge View Bank opened its first branch in Salem, VA and expects to open a second branch in Smith Mountain Lake, VA in the second quarter of 2023 (as pictured below). We expect to break ground on a third branch and regional office in Roanoke, VA in the summer of 2023. BankOnBuffalo is expanding into the Rochester, NY market with a new Loan Production and W&A office in Victor, NY expected to open in the second quarter of 2023. FCBank is on track to open a new branch in May located in Westerville, OH, which is in the Columbus, OH metro. ERIEBank is expanding its presence in the greater Cleveland metro with new branch locations in Woodmere, OH, which opened in the first quarter of 2023, and Westlake, OH, which is scheduled to open this summer.

Impressia Bank This women-focused commercial bank will begin within the existing geographic footprint of each of CNB Bank’s five other divisions, then strategically expand beyond those borders utilizing an online presence. Extending beyond traditional business banking offerings, Impressia Bank clients will have access to resources related to accelerating their business, developing appropriate business strategies, and establishing a community of women who support one another.

Bank on Wheels The first of its kind operated by any financial institution in Western New York, BankOnWheels is a full-service, yet fully mobile bank branch, which will enable the bank to deliver essential banking services to communities with little or no access to such services today. The BankOnWheels will rotate between three locations in the cities of Buffalo and Niagara Falls, NY, with plans to serve additional locations in the future

Financial literacy The Corporation expanded its efforts surrounding its financial literacy outreach in 2022, conducting five Financial Reality Fairs and 120 other financial literacy events in various regions throughout the footprint we serve. The fairs teach real-life budgeting skills to high school students, many of whom are in low-to-moderate income households. Over 1,200 volunteer hours and $30,000 to support the Corporation’s efforts in this area.

Parade street ERIEBank, a division of CNB Bank is working with the East Side Renaissance team to help revitalize and redevelop a four-block corridor of Parade Street, in Erie, PA to better serve the needs of the community and draw more economic activity back to this neglected section of the city. The Bank is following the lead of a committee of community leaders and partners to help us understand the needs of the neighborhood. We aspire to be part of the neighborhood, not just a bank in the neighborhood. Plans include a community office and financial education center on the corner of 10th and Parade St. to serve as a community hub for the neighborhood. This will be used to provide banking services to a neighborhood that has lacked easily available and reliable financial products and services and educate our community in financial literacy. “ERIEBANK is a true believer in what the East Side Renaissance promises for the future economic success of Erie and the Parade Street corridor, and we look forward to helping residents and local businesses with our special hands-on approach to business and personal banking,” said Dave Zimmer, President of ERIEBANK.

Thank you for attending our 2023 annual shareholder meeting.

Appendix

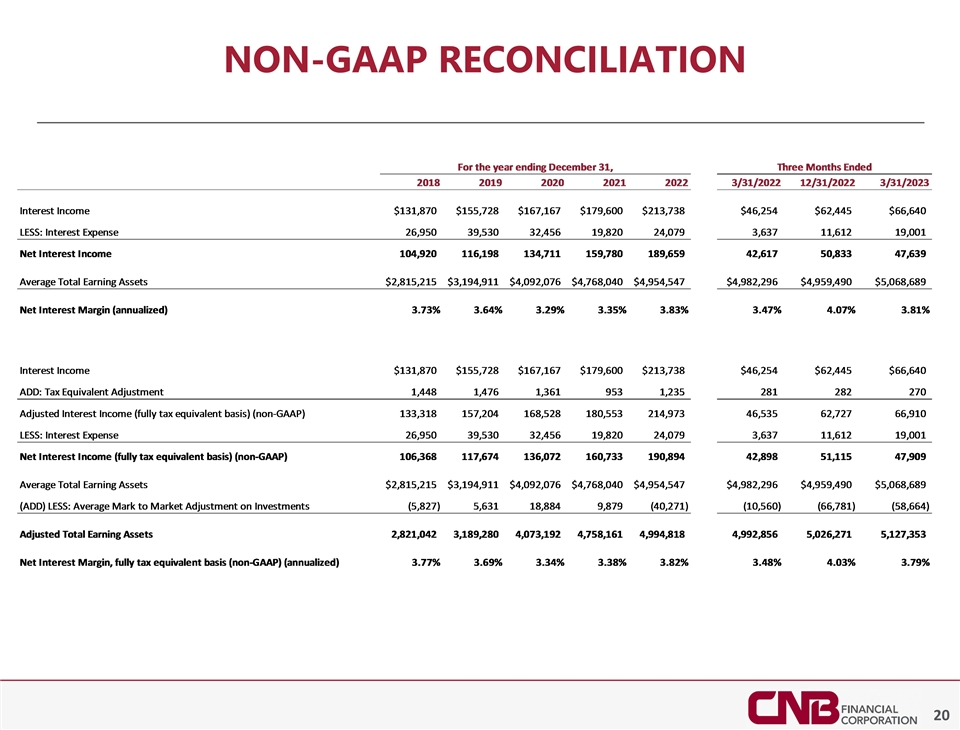

Non-gaap reconciliation

Non-gaap reconciliation

Non-gaap reconciliation