UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03931

Clipper Fund, Inc.

(Exact name of registrant as specified in charter)

9601 Wilshire Boulevard, Suite 800

Beverly Hills, California 90210

(Address of principal executive offices) (Zip code)

James H. Gipson

9601 Wilshire Boulevard, Suite 800

Beverly Hills, California 90210

(Name and address of agent for service)

Copy to:

Michael Glazer, Esq.

c/o Paul, Hastings, Janofsky & Walker LLP

515 South Flower Street

Los Angeles, California 90071

(213) 683-6207

Registrant’s telephone number, including area code: 800-776-5033

Date of fiscal year end: December 31, 2004

Date of reporting period: December 31, 2004

Item 1: Report to Shareholders

Dear Shareholder:

Last year was more notable for news than returns. Equity returns in general were good by very long-term standards, probably better than what reasonably may be expected from today's valuation levels:

| | 4th Qtr.* | 2004 | 5 Years |

Clipper FundSM | 8.5% | 5.9% | 12.6% |

| | | | |

S&P 500 Index1 | 9.2% | 10.9% | -2.3% |

Morningstar Large Value Peer Group2 | 9.3% | 12.9% | 4.4% |

* Not annualized.

Riding to Hounds

"The unspeakable in full pursuit of the uneatable" was Oscar Wilde's description of fox hunting, a repellant practice that for centuries was viewed as mostly acceptable and often fashionable. No more. To the great relief of foxes, riding to hounds now is banned in Britain. The actual practice remains the same, but social attitudes and legal restrictions have changed around it.

The same principle applies to many areas of corporate America, particularly financial services. Activities which were regarded as ancient and ordinary now are verboten. Market timing, once very fashionable (the "portfolio insurance" fad of the 1980s was a complicated form of market timing), has become the mutual fund counterpart of an unmentionable social disease. Contingent commissions for insurance brokers, long known to industry participants, suddenly went from acceptable to awful. The issue here is not practices that were clearly illegal or immoral at the time, but ones that remained the same while business and legal standards to judge them changed abruptly.

"Eliot Spitzer on line one" is not a call many executives would welcome. He, a newly-energized Securities & Exchange Commission, and a more active Congress (e.g., Sarbanes-Oxley) are changing the standards of acceptable behavior (Editorial: Some of those changes are for the better). Individuals and companies caught in this moral wind shear are as perplexed as they are punished. Sometimes that punishment in the stock market creates opportunities for investors.

Lightning Strikes Twice

Marsh & McLennan provides two examples of abruptly changing standards of acceptable behavior. Two years ago, its Putnam investment management subsidiary was front and center in the furor over market timing. A number of clients and shareholders left Putnam as the company changed its management and its practices to conform to current standards. As Marsh's stock price weakened, we took a small position in it.

Lightning struck the same company twice. Marsh is the world's largest insurance broker, and its brokerage operations were charged with bid rigging, an improper practice that appears to have been confined to a small segment of its operations. More significantly for shareholders, contingent commissions (acting as a paid broker for both buyer and seller, a long established practice in other areas such as residential real estate) were declared unacceptable. While Marsh struggled to revamp its business revenue model, its stock price swooned. We bought more stock at lower prices because we believed the stock market had overreacted to some very real negative news.

When the negatives are in the news it is easy to overlook the positives. Marsh is a high return, cash generating company. Its position as the world's largest insurance broker is one that would be very difficult and costly to replicate. The company's three major businesses (insurance brokerage, investment management and consulting) all are good ones. The company also has a good long-term record of using its excess cash generated to benefit shareholders in the form of generous dividends and share repurchase. In short, it is the kind of company we like to own once the current problems are behind it.

What to Do if Your Stock Is in the News

It depends on the change in two numbers--stock price and business value. Three examples illustrate:

Tyco was our most controversial stock two years ago. We bought a small amount after the stock price declined on news of corporate problems. The news became worse in terms of the misbehavior of its CEO Dennis Kozlowski, whose personal actions had little effect on the company's long-term business prospects. Our estimate of value declined modestly, the stock price fell dramatically, and we responded by buying significantly more shares. More recently we trimmed the size of our position as the stock price quadrupled off its bottom.

Pfizer presents a different set of facts. It is the largest drug maker and one of the last surviving members of a near-extinct species, a company with an AAA credit rating. The major long-term concern revolves around research productivity, but last quarter a new fear arose--Pfizer's Cox-2 pain relievers (Celebrex and Bextra) were found to have possible cardiac side effects in high doses. Those drugs constitute less than 10% of company sales and the stock price declined by about as much. We responded to the modest changes in price and value with a moderate increase in the size of our position.

Fannie Mae presents a still different set of facts. The company has been controversial, partially for reasons that seem to be more personal and political than fundamental to its value. Fannie's stock price has been remarkably non-reactive; it has oscillated around $70 with almost metronomic regularity for years. For reasons partially unrelated to the public controversy (we believe Fannie's future profitability will be somewhat lower), we lowered our value moderately. Fannie still seems to be a cheap stock, but not to the degree it seemed to us one year ago.

Controversy creates opportunity. Sometimes. At other times the controversy reflects a permanent change in business value. Distinguishing between opportunity and risk is a difficult process with no guarantee of success. The stocks mentioned above illustrate some of our efforts to increase your return in controversial situations. The reasons mentioned below suggest why returns for most investors will be more modest in future years.

"Desirous of Losing Money"

Breaking with central banker tradition of speaking in obscure terms that intimidate the listener rather than illuminate the subject, Alan Greenspan was crystal clear, "Rising interest rates have been advertised for so long and in so many places that anyone who has not appropriately hedged this position by now obviously is desirous of losing money." As the federal funds rate goes up from its record low of 1%, it is worth considering what other events of the recent past have been so unreasonably good that investors should not expect to see them repeated in the future:

The basic discount rate for long-term assets--the long U.S. Treasury bond--has declined from 15% to 5% during the last 20 years. One consequence has been a rise in price/earnings multiples for stocks and real estate. This significant component of return is clearly in the past; interest rates cannot decline another 1000 basis points from here because they cannot go below zero.

Corporate net profit margins have risen to an all-time high of 7% for Standard and Poor's Industrials. As with the team that wins the Super Bowl, this kind of lifetime peak experience is appreciated but is seldom repeated on an annual basis.

Inflation, once a double-digit danger to economic stability and a major source of uncertainty, now seems tame.

These events, and others, have created unusually good returns for investors for twenty years. That fact does not require future returns to be unusually bad, but it does suggest they will be more modest in the future than they have been in the past. This is not a prediction that the pot at the end of the rainbow is filled with mud, only that there is likely to be less gold than the experience of the last two decades suggests.

Management's Discussion of Fund Performance

For a concentrated value manager, the discussion of particular stocks is most relevant to understanding performance. In addition to the equities mentioned above, some generalizations may be helpful too. Health care provided both a plus (Johnson & Johnson) and minus (Tenet). Freddie Mac helped; Fannie Mae did not. The supermarkets declined; our drug chain gained. Notable also were the groups in the S&P 500 Index that we had little or no exposure to that fared well: utilities, energy and information technology.

Your large cash position held back relative performance, so that is worth a separate note. In contrast to two years ago when we found more stocks to buy, last year we found more stocks to sell as they rose to our estimates of intrinsic value. Real estate investment trusts, a major holding until recently, were bid up in price by investors in pursuit of the yield they offered. We remain willing to take calculated risks in buying long-term assets, but willingness is not opportunity. For most long-term assets, particularly equities, investors currently are not being well paid to assume those risks. We look forward to better opportunities in the future, but cannot predict when that day will come.

Sincerely,

Your Portfolio Management Team

/s/ James H. Gipson

James H. Gipson

Chairman & President

Michael C. Sandler

Bruce G. Veaco

Douglas W. Grey

Nugroho "Dédé" Soeharto

Peter J. Quinn

Kelly M. Sueoka

January 26, 2005

Forward-Looking Statement Disclosure

As mutual fund managers, one of our responsibilities is to communicate with shareholders in an open and direct manner. In so far as some of our opinions and comments in our letters to shareholders are based on current management expectations, they are considered "forward-looking statements" which may or may not be accurate over the long term. While we believe we have a reasonable basis for our comments and we have confidence in our opinions, actual results may differ materially from those we anticipate. You can identify forward-looking statements by words such as "believe," "expect," "may," "anticipate," and other similar expressions when discussing prospects for particular portfolio holdings and/or the markets, generally. We cannot, however, assure future results and disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise. Further, information provided in this report should not be considered a recommendation to purchase or sell any particular security.

This report is submitted for the general information of the shareholders of the Clipper FundSM. For prospective investors in the Fund, this material must be preceded or accompanied by a prospectus. You may obtain a current copy of the prospectus, which explains management fees, expenses, and risks, by calling 1-800-776-5033 or by visiting Clipper's website (www.clipperfund.com). Please read the prospectus carefully before investing.

| | Investment Portfolio | | | | |

| | December 31, 2004 | | | | |

Common Stocks | | | | | | |

| | | | | | |

Shares | | | | Market Value | | % |

| | Advertising | | | | |

8,826,000 | | The Interpublic Group of Companies, Inc.* | $ | 118,268,400 | | 1.6% |

| | | | | | |

| | Computer Services | | | | |

15,755,700 | | Electronic Data Systems Corporation | | 363,956,670 | | 5.0% |

| | | | | | |

| | Energy | | | | |

28,310,400 | | El Paso Corporation | | 294,428,160 | | 4.1% |

| | | | | | |

| | Food & Tobacco | | | | |

6,701,400 | | Altria Group Inc. | | 409,455,540 | | 5.7% |

6,617,600 | | Kraft Foods, Inc. Class A | | 235,652,736 | | 3.3% |

3,429,700 | | The Coca-Cola Company | | 142,778,411 | | 2.0% |

| | | | 787,886,687 | | 11.0% |

| | | | | | |

| | Health Care | | | | |

11,502,400 | | Pfizer Inc | | 309,299,536 | | 4.3% |

19,189,400 | | Tenet Healthcare Corporation* | | 210,699,612 | | 2.9% |

4,005,000 | | HCA Inc. | | 160,039,800 | | 2.2% |

3,376,800 | | Wyeth | | 143,817,912 | | 2.0% |

1,704,300 | | Johnson & Johnson | | 108,086,706 | | 1.5% |

| | | | 931,943,566 | | 12.9% |

| | | | | | |

| | Industrial & Electrical Equipment | | | | |

8,299,300 | | Tyco International Ltd. | | 296,616,982 | | 4.1% |

2,120,000 | | Pitney Bowes Inc. | | 98,113,600 | | 1.4% |

| | | | 394,730,582 | | 5.5% |

| | | | | | |

| | Insurance & Financial Services | | | | |

13,479,000 | | Marsh & McLennan Companies Inc | | 443,459,100 | | 6.2% |

7,075,200 | | American Express Company | | 398,829,024 | | 5.5% |

2,774,160 | | Old Republic International Corporation | | 70,186,248 | | 1.0% |

| | | | 912,474,372 | | 12.7% |

| | | | | | |

| | Mortgage Finance | | | | |

9,882,200 | | Freddie Mac | | 728,318,140 | | 10.1% |

5,702,300 | | Fannie Mae | | 406,060,783 | | 5.6% |

| | | | 1,134,378,923 | | 15.7% |

| | | | | | |

| | Retailing | | | | |

5,608,100 | | CVS Corporation | | 252,757,067 | | 3.5% |

8,750,400 | | The Kroger Co.* | | 153,482,016 | | 2.1% |

6,439,900 | | Safeway Inc.* | | 127,123,626 | | 1.8% |

| | | | 533,362,709 | | 7.4% |

| | | | | | |

| | Securities Industry | | | | |

2,784,400 | | Merrill Lynch & Co., Inc. | | 166,423,588 | | 2.3% |

| | | | | | |

| | Other | | | | |

3,706,000 | | Time Warner Inc.* | | 72,044,640 | | 1.0% |

| | Total Common Stocks (Cost $4,918,293,911) | | 5,709,898,297 | | 79.2% |

| | | | | | |

Short Term Investments | | | | |

| | | | | | |

Par Value | | | | Value | | % |

| | | | | | |

| | US Treasury Bill | | | | |

208,000,000 | | 0.00%, due 02/17/05 | | 207,491,648 | | 2.9% |

| | | | | | |

| | US Treasury Bill | | | | |

230,000,000 | | 0.00%, due 04/21/05 | | 228,392,300 | | 3.1% |

| | | | | | |

| | US Treasury Bill | | | | |

975,500,000 | | 0.00%, due 05/26/05 | | 966,129,347 | | 13.4% |

| | | | | | |

| | State Street Repurchase Agreements (Note 1 and 2) | | | | |

98,633,000 | | 1.75%, dated 12/31/04, due 01/03/05 | | 98,633,000 | | 1.4% |

| | | | | | |

| | Total Short Term Investments (Cost $1,500,973,323) | | 1,500,646,295 | | 20.8% |

| | | | |

Total Investment Portfolio (Cost $6,419,267,234) | | 7,210,544,592 | | 100.0% |

| | | | |

Cash and Receivables less Liabilities | | (2,414,320) | | 0.0% |

| | | | | | |

Net Assets | | | $ | 7,208,130,272

| | 100.0%

|

* Non-income producing securities. | | | | |

________________________ | | | | |

See notes to financial statements. | | | | |

| | | | | | |

| | | | | |

Statement of Assets and Liabilities |

December 31, 2004 |

| | | | | |

Assets: | | | | |

| Investment Portfolio: | | | | |

| Investment securities, at market value (identified cost: $6,419,267,234) | | | $ | 7,210,544,592 |

| Cash | | | | 747 |

| | | | | 7,210,545,339 |

| Receivable for: | | | | |

| Fund shares sold | | | | 8,535,137 |

| Dividends and interest | | | | 8,215,771 |

| Directed commission recapture (Note 6) | | | | 40,211 |

| Prepaid expenses | | | | 6,050 |

| | | | | 16,797,169 |

| | | | | 7,227,342,508 |

Liabilities: | | | | |

| Payable for: | | | | |

| Fund shares repurchased | | | | 12,217,803 |

| Accrued expenses (Including $6,043,684 due adviser) | | | | 6,993,633 |

| Taxes payable | | | | 800 |

| | | | | 19,212,236 |

| | | | |

Net Assets: (equivalent to $89.68 per share on 80,374,288 shares

of Capital Stock outstanding--200,000,000 shares authorized) | | | $ | 7,208,130,272 |

| | | | | |

Components of Net Assets: | | | | |

| Paid-in Capital | | | $ | 6,416,145,396 |

| Undistributed appreciation of investments (Note 4) | | | | 791,277,358 |

| Undistributed net investment income | | | | 710,646 |

| Distribution in excess of realized capital gains | | | | (3,128) |

| Net assets at December 31, 2004 | | | $ | 7,208,130,272

|

| | | | | |

| ________________________ | | | | |

| See notes to financial statements. | | | | |

| | | | | |

Statement of Operations |

Year Ended December 31, 2004 |

| | | | | |

Investment Income: | | | | |

| Dividends | | | $ | 97,008,127 |

| Interest | | | | 25,989,100 |

| Total Investment Income | | | | 122,997,227 |

| | | | | |

Expenses: | | | | |

| Management fee (Note 5) | $ | 69,420,087 | | |

| Transfer agent | | 6,250,804 | | |

| Shareholder Communications | | 1,052,619 | | |

| Custodian and accounting | | 748,320 | | |

| Printing | | 188,128 | | |

| Registration fees | | 147,399 | | |

| Legal | | 89,996 | | |

| Insurance | | 83,849 | | |

| Investment Company Institute dues | | 47,135 | | |

| Directors' fees (Note 5) | | 30,000 | | |

| Auditing | | 29,499 | | |

| Administration fess | | 11,254 | | |

| Taxes | | 800 | | |

| Miscellaneous | | 3,796 | | |

| | | 78,103,686 | | |

| Reduction of Expenses (Note 6) | | (347,559) | | |

| Total Expenses | | | | 77,756,127 |

| Net Investment Income | | | | 45,241,100 |

| | | | | |

Net Realized and Unrealized Gain on Investments: | | | | |

| Realized gain on investments (excluding short-term investments): | | | | |

| Proceeds from investments sold | | 3,801,272,148 | | |

| Cost of investments sold | | 3,581,997,487 | | |

| Net realized gain on investments (Note 3 and 4) | | | | 219,274,661 |

| Unrealized appreciation of investments: | | | | |

| Beginning of year | | 656,849,494 | | |

| End of year (Note 4) | | 791,277,358 | | |

| Increase in unrealized appreciation of investments | | | | 134,427,864 |

| Net realized and unrealized gain on investments | | | | 353,702,525 |

Net Increase in Net Assets Resulting from Operations | | | $ | 398,943,625

|

| | | | | |

| ________________________ | | | | |

| See notes to financial statements. | | | | |

| | | | | |

| | | | | |

Statements of Changes in Net Assets |

| | | | | |

| | | Year Ended December 31, |

| | | 2004 | | 2003 |

Increase in Net Assets: | | | | |

| Operations: | | | | |

| Net investment income | $ | 45,241,100 | $ | 55,612,851 |

| Net realized gain on investments (Note 3 and 4) | | 219,274,661 | | 124,424,256 |

| Net unrealized appreciation of investments | | 134,427,864 | | 897,802,781 |

| Net increase in net assets resulting from operations | | 398,943,625 | | 1,077,839,888 |

| | | | | |

| Distributions to Shareholders from: | | | | |

| Net investment income | | (44,530,454) | | (56,058,541) |

| Net realized capital gain | | (219,274,661) | | (124,424,734) |

| Decrease in net assets resulting from distributions | | (263,805,115) | | (180,483,275) |

| | | | | |

| Capital Stock Transactions: | | | | |

| Capital Stock sold | | | | |

| (17,562,184 and 28,887,751 shares, respectively) | | 1,528,270,835 | | 2,261,554,658 |

| Capital Stock purchased by reinvestment of dividends | | | | |

| and distributions (2,883,614 and 2,025,240 shares, respectively) | | 252,954,787 | | 173,583,282 |

| Cost of Capital Stock redeemed | | | | |

| (19,233,077 and 17,801,437 shares, respectively) | | (1,671,721,090) | | (1,371,251,318) |

| Increase in net assets resulting from Capital Stock transactions | | 109,504,532 | | 1,063,886,622 |

| Total increase in net assets | | 244,643,042 | | 1,961,243,235 |

| | | | | |

| Net Assets: | | | | |

| Beginning of year (includes $0 and $408,697 of undistributed | | | | |

| net investment income, respectively) | | 6,963,487,230 | | 5,002,243,995 |

| End of year (includes $710,646 and $0 of | | | | |

| undistributed net investment income, respectively) | $ | 7,208,130,272

| $ | 6,963,487,230

|

| | | | | |

| ________________________ | | | | |

| See notes to financial statements. | | | | |

Financial Highlights |

| | | | | | | | | | | | |

| | | | Year Ended December 31, |

| | | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 |

Per Share Data: | | | | | | | | | | |

| Net asset value,

beginning of year | | $ 87.97 | | $75.73 | | $83.53 | | $79.25 | | $65.28 |

| | | | | | | | | | | | |

| Income (loss) from investment operations: Net investment income | | 0.58 | | 0.72 | | 1.05 | | 1.08 | | 1.83 |

| | | | | | | | | | | |

| Net realized and unrealized

gain (loss) on investments | | 4.51 | | 13.87 | | (5.65) | | 7.03 | | 22.40 |

| | | | | | | | | | | | |

| Total income (loss) from

investment operations | | 5.09 | | 14.59 | | (4.60) | | 8.11 | | 24.23 |

| | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | |

| Dividends from net

investment income (Note 4) | | (0.57) | | (0.73) | | (1.05) | | (1.08) | | (1.86) |

| | | | | | | | | | | | |

| Distributions of

Return of Capital | | - | | - | | - | | - | | (0.02) |

| | | | | | | | | | | | |

| Distributions from net realized gain on investments (Note 4) | | (2.81) | | (1.62) | | (2.15) | | (2.75) | | (8.38) |

| | | | | | | | | | | | |

| Net asset value, end of year | | $89.68

| | $87.97

| | $75.73

| | $83.53

| | $79.25

|

| | | | | | | | | | | | |

| Total Return | | 5.9% | | 19.3% | | (5.5%) | | 10.3% | | 37.4% |

| | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | |

| Net assets ($000,000's), end of year | | $7,208 | | $6,963 | | $5,002 | | $2,685 | | $1,366 |

| | | | | | | | | | | | |

| Ratio of expenses to

average net assets (Note 6): | | | | | | | | | | |

| Gross of expense reduction | | 1.12% | | 1.13% | | 1.12% | | 1.12% | | 1.11% |

| Net of expense reduction | | 1.12% | | 1.12% | | 1.07% | | 1.08% | | 1.09% |

| | | | | | | | | | | |

| Ratio of net investment income

to average net assets | | 0.65% | | 0.98% | | 1.60% | | 1.72% | | 2.88% |

| | | | | | | | | | | | |

| Portfolio turnover rate | | 16% | | 25% | | 48% | | 23% | | 46% |

| | | | | | | | | | | | |

| Number of shares outstanding

at end of year (000's) | | 80,374 | | 79,162 | | 66,050 | | 32,144 | | 17,241 |

| | | | | | | | | | | | |

| ________________________ | | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

Notes to Financial Statements

December 31, 2004

NOTE 1 -- Clipper FundSM (the "Fund") is registered under the Investment Company Act of 1940, as amended (the "Investment Company Act"), as a non-diversified open-end management investment company. The Fund's investment objective is long-term capital growth and capital preservation achieved primarily by investing in equity securities that are considered by Pacific Financial Research, Inc. (the "Adviser") to have long-term capital appreciation potential. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America:

| (a) Security valuation -- Investments in securities traded on a national securities exchange are valued at the last sale price on such exchange on the business day as of which such value is being determined. Securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the last reported bid price. If no bid price is quoted on such day, then the security is valued by such method as the Board of Directors of the Fund shall determine in good faith to reflect its fair value. Discounts and premiums are accreted and amortized over the life of the respective securities. Short term investments are stated at amortized cost, which approximates current market value. Securities for which market quotations are not readily available are valued at fair value as determined in good faith based upon guidelines established by the Board of Directors. |

| (b) Security transactions and related investment income -- Security transactions are recorded by the Fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums, and original issue discounts on fixed income securities are amortized daily over the expected life of the security. |

| (c) Repurchase agreements -- In connection with transactions in repurchase agreements, it is the Fund's policy that its custodian take possession of the underlying collateral securities, and to have legally segregated in the Federal Reserve Book Entry System or to have segregated within the custodian's vault, all securities held as collateral for repurchase agreements. The market value of the underlying securities is required to be at least 102% of the resale price at the time of purchase. If the seller of the agreement defaults and the value of the collateral declines, or if the seller enters an insolvency proceeding, realization of the value of the collateral by the Fund may be delayed or limited. |

| (d) Dividends and distributions to shareholders -- Dividends and distributions to shareholders are recorded on the ex-dividend date. |

| (e) Federal income taxes -- The Fund intends to comply with the requirements of the Internal Revenue Code, as amended, applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no Federal income tax provision is required. |

| (f) Use of estimates -- The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements. Actual results could differ from those estimates. |

| (g) Guarantees -- In the normal course of business the Fund enters into contracts that contain a variety of representations which provide general indemnifications. The Fund's maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss to be remote. |

NOTE 2 -- As of December 31, 2004, the Fund held State Street Bank and Trust Company ("State Street") repurchase agreements, collateralized by U.S. Government Agency Notes due February 15, August 4, and November 15, 2005. The market value of the underlying securities is required to be at least 102% of the resale price at the time of purchase. At December 31, 2004, that market value amounted to $100,613,845.

NOTE 3 -- Purchases and sales of investment securities (excluding short term securities and U. S. Government Obligations) for the year ended December 31, 2004, were $1,081,277,979 and $3,801,272,148, respectively. The cost of securities held is the same for Federal income tax and financial reporting purposes. Realized gains or losses are based on the specific identification method

NOTE 4 -- During the year ended December 31, 2004, the Fund realized net capital gains of $219,274,661 from securities transactions for Federal income tax and financial reporting purposes. Distributions to shareholders are based on net investment income and net realized gains determined on a tax basis, which are the same for financial reporting purposes. The fiscal year in which amounts are distributed may differ from the year in which the net investment income and net realized gains are recorded by the Fund. During the year ended December 31, 2004, the Fund reclassified $34,342 of prior year return of capital distributions against Paid-in Capital to align financial reporting with tax reporting. As of December 31, 2004, the components of distributable earnings on a tax basis were as follows:

| Undistributed net ordinary income | $ | 710,646 | | |

| Undistributed long-term gains | | - | | |

| Gross unrealized appreciation | $ | 1,074,278,074 | | |

| Gross unrealized depreciation | $ | 283,000,716 | | |

The tax character of distributions paid was as follows: | | 2004 | | 2003 |

| From ordinary income including short-term capital gains | $ | 60,592,939 | $ | 127,504,438 |

| From long-term capital gains | $ | 203,212,176 | $ | 52,978,837 |

NOTE 5 -- The Adviser's management fee is equal to 1% per annum of the Fund's average daily net asset value. The management fee is accrued daily in computing the net asset value per share. Each Fund Director who is not affiliated with the Adviser and does not otherwise meet the definition of "interested person" under section 2(a)(19) of the Investment Company Act ("Independent Directors") is compensated by the Fund at the rate of $2,500 per quarter.

NOTE 6 -- During the year ended December 31, 2004, the Fund directed portfolio transactions totaling $403,762,900 to certain brokers which had agreed to credit portions of their commissions to offset Fund operating expenses. The brokerage commissions in connection with those transactions totaled $471,888, of which $347,559 was used to reduce certain Fund operating expenses.

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of Clipper FundSM:

In our opinion, the accompanying statement of assets and liabilities, including the investment portfolio, and the related statements of operations and changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Clipper FundSM (the "Fund") at December 31, 2004, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the three years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Fund's management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2004 by correspondence with the custodian, provide a reasonable basis for our opinion. The financial highlights for the years ended December 31, 2001 and 2000 were audited by other independent accountants whose report, dated January 18, 2002, expressed an unqualified opinion on those highlights.

PricewaterhouseCoopers LLP

Los Angeles, CA

January 26, 2005

(Unaudited) |

Graphic Presentation of Portfolio Holdings |

This graph depicts the Fund's portfolio holdings, excluding short-term investments and U. S. Government securities, as of December 31, 2004, by industry sectors and as compared to the same industry sectors of the S&P 500 Index. The S&P 500 Index is an unmanaged capitalization weighted index of the common stocks of 500 major US corporations.

(Unaudited) |

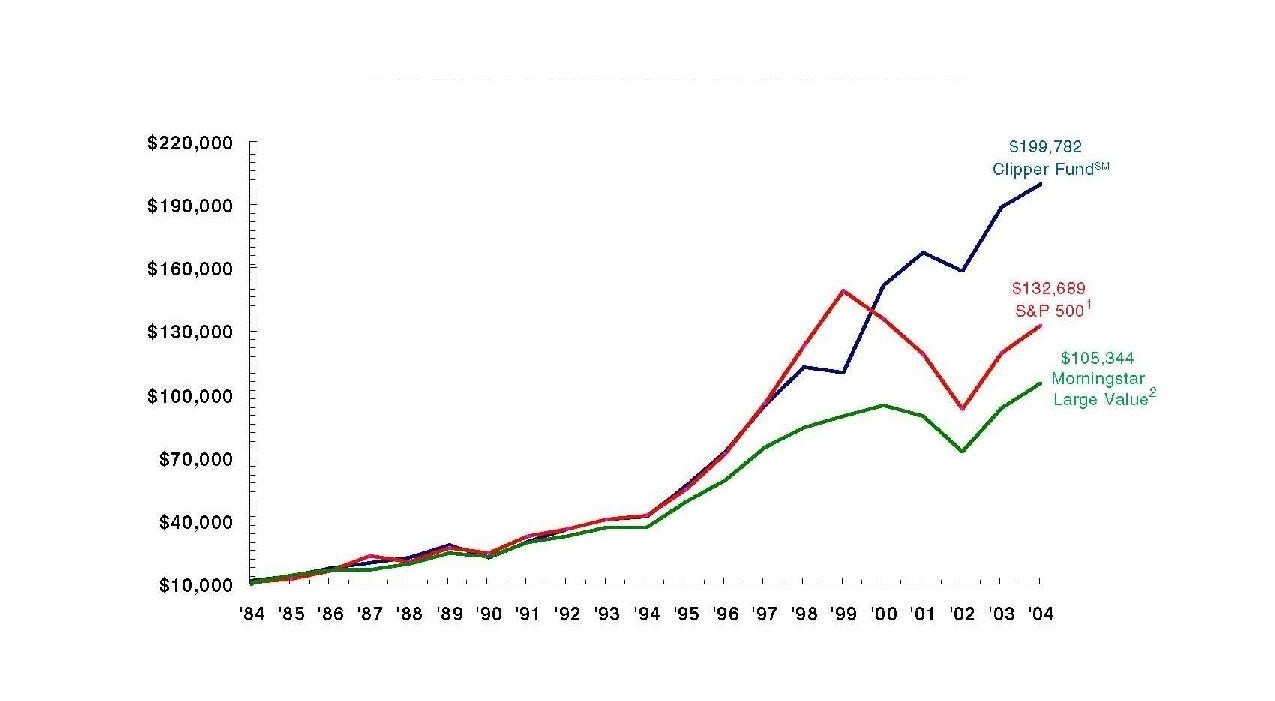

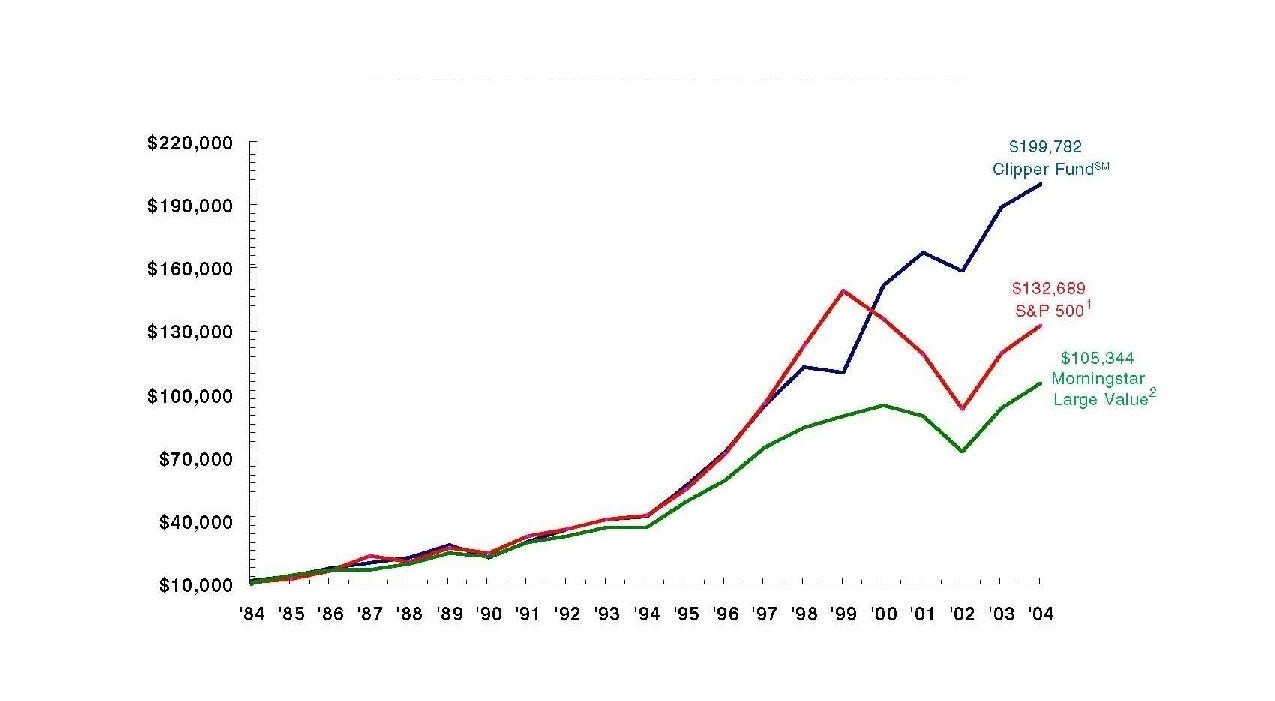

Change in Value of $10,000 Initial Investment

Data presented from Fund Inception (February 29, 1984) through December 31, 2004 |

Average Annual Total Return

For the periods ended December 31, 2004 |

| | 1 yr | 3 yrs | 5 yrs | 10 yrs | 15 yrs | Since Inception* |

Clipper FundSM | 5.9% | 6.1% | 12.6% | 16.9% | 14.2% | 15.5% |

S&P 500 Index1 | 10.9% | 3.6% | -2.3% | 12.1% | 11.0% | 13.2% |

Morningstar Large Value Peer Group2 | 12.9% | 5.6% | 4.4% | 11.4% | 9.5% | 11.7% |

* Inception Date: February 29, 1984

Performance Disclosure

Past performance is no guarantee of future results. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and currently may be lower or higher than the performance data quoted above.

The Fund's total returns include reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions.

While PFR believes that the Fund's holdings are value stocks, there can be no assurance that others will consider them as such. Further, investing in value stocks presents the risk that value stocks may fall out of favor with investors and underperform growth stocks during given periods. Because Clipper FundSM is non-diversified, the performance of each holding will have a greater impact on the Fund's total return, and may make the Fund's return more volatile than a more diversified fund. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual stocks.

1 The S&P 500 Index is an unmanaged capitalization weighted index of the common stocks of 500 major US corporations. Index returns include dividends and/or interest income and, unlike Fund returns, do not reflect fees or expenses. In addition, unlike the Fund, which periodically maintains a significant cash position, the S&P 500 Index is fully invested.

2 The Morningstar Large Value Funds Peer Group comprises those actively managed large value mutual funds monitored by Morningstar; the Peer Group is unmanaged and as of December 31, 2004, included 1,134 mutual funds. The Peer Group returns reflect deductions for fees and expenses.

Investors cannot directly invest in an index.

(Unaudited) |

Understanding Your Fund's Expenses |

Shareholder Expense Example

As a shareholder of the Fund, you incur ongoing costs including management fees, shareholder services fees and other Fund expenses. The examples below are intended to help you understand your ongoing costs of investing in the Fund and help you compare these with the ongoing costs of investing in other mutual funds.

Actual Expenses

The first line in the table shows the actual account values and actual Fund expenses you would have paid on a $1,000 investment in the Fund from July 1, 2004 through December 31, 2004. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual Fund returns and expenses. To estimate the expenses you paid over the period, simply divide your account by $1,000 (for example $8,600 account value divided by $1,000 = 8.6) and multiply the result by the number in the Expenses Paid During Period column as shown below for the Fund.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs and do not reflect sales loads, of which the Fund has none. Therefore, the second line of the table is useful in comparing ongoing costs of the Fund with similar costs of different funds.

| | Beginning

Account Value 6/30/04 | Ending

Account Value 12/31/04 | Expenses Paid

During Period*

7/1/04-12/31/04 |

Actual | $1,000.00 | $1,060.00 | $5.79 |

Hypothetical (5% return before expenses) | $1,000.00 | $1,019.53 | $5.66 |

* Expenses are equal to the Fund's annualized expense ratio of 1.12% multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

(Unaudited) |

Shareholder Tax Information |

The following information will assist you in determining the tax status of the information contained in your Form 1099-DIV, which has been be mailed to you directly. We suggest that you consult a professional tax advisor to determine how this information may apply to your specific tax situation.

Distribution

The Ex-Dividend date was December 20, 2004. The per share amounts were as follows:

| | | Amount |

Net Investment Income | $ | 0.56966 |

Short-Term Capital Gains | | 0.20549 |

Long-Term Capital Gains | | 2.59967 |

Total | $ | 3.37482

|

Short-Term Capital Gains

Short-term capital gain distributions are included in Box (1a), Form 1099-DIV along with income dividends and are taxable as ordinary income.

Income Dividends

Effective January 1, 2003, certain dividends received by the Fund during 2004 qualify for a reduced tax rate. The amount of qualified dividends paid to you during 2004 is reported in Box (1b), Form 1099-DIV. The percentage rate used to calculate the amount is as follows:

Qualified Dividend........................73.3% Box (1b), Form 1099-DIVNon Qualified Dividend................26.7% **The Total Ordinary Dividends reported in Box (1a), Form 1099-DIV include both the Net Investment Income and the Short Term Capital Gains. To be able to apply the percentage qualifying for the reduced tax rate, subtract the Short Term Capital Gains from the Ordinary Income total.

Corporate Dividends

- Corporate Dividends Received Deduction..................................65.7%

Federal Obligations

(Unaudited) |

Quarterly Portfolio Schedule |

The Fund files with the Securities and Exchange Commission ("SEC") a complete schedule of its portfolio holdings, as of the last day of the first and third quarters of its fiscal year, on Form N-Q. The filings are available on the SEC's website at www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. (Call 1-800-SEC-0330 for information on the operation of the Public Reference Room.) The same information is also available on the Fund's website at www.clipperfund.com.

Shareholder Privacy Notice

Clipper FundSM collects nonpublic personal information about you from the following sources:

- Information we receive from you on applications or other forms; and

- Information about your transactions with others, such as your financial advisor, or other such intermediary.

Clipper FundSM will not disclose any nonpublic personal information about you or your account(s) to anyone unless one of the following conditions is met:

- Clipper FundSM receives your prior written consent;

- Clipper FundSM believes the recipient is your authorized representative;

- Clipper FundSM is permitted by law to disclose the information to the recipient in order to service your account(s); or

- Clipper FundSM is required by law to disclose information to the recipient.

If you decide to close your account(s), Clipper FundSM will adhere to the privacy policies and practices as described in this notice.

If you hold shares of Clipper FundSM through a financial intermediary, such as a broker-dealer, bank or trust company, the privacy policy of your financial intermediary will also govern how your nonpublic personal information will be shared with other parties.

Clipper FundSM restricts access to your personal and account information to those employees who need to know that information to service your account(s). We maintain physical, electronic, and procedural safeguards to guard your nonpublic personal information.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available upon request, free of charge, by contacting the Fund at 800-776-5033 or on the Fund's website at www.clipperfund.com.

Information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, 2004, is available upon request, free of charge, by contacting the Fund at 800-776-5033 or on the SEC's website at www.sec.gov.

Supplemental Code Of Ethics

A copy of the Fund's Code of Ethics for Principal Executive and Senior Financial Officers, Amended and Restated as of January 1, 2005, is available on the Fund's website at www.clipperfund.com.

Proxy Results

On March 26, 2004, the Annual Shareholders' meeting for Clipper FundSM was held. At the meeting, shareholders were asked to approve a slate of four (4) directors to serve for the coming year.

Elected as directors of the Fund were F. Otis Booth, Jr., James H. Gipson, Lawrence P. McNamee and Norman B. Williamson.

Votes were cast as follows:

| | For | Against | Withheld | Broker

Non-Votes |

| | | | | |

F. Otis Booth, Jr. | 58,260,750 | - | 561,079 | - |

James H. Gipson | 58,295,771 | - | 526,058 | - |

Lawrence P. McNamee | 58,300,656 | - | 521,173 | - |

Norman B. Williamson | 58,291,770 | - | 530,559 | - |

(Unaudited) |

Information Regarding the Directors and Officers |

Name,

Address,

and Age | Position(s)

Held with

Fund | Term of Office

and Length of

Time Served | Principal

Occupation(s)

During Past

5 Years | Number of

Portfolios

Overseen in

Fund Complex | Other

Directorships

Held |

| |

James H. Gipson *

9601 Wilshire Blvd. #800

Beverly Hills, CA 90210

(62) | President, Chairman of the Board, and Director | One year and inception | President, Chairman of the Board, and Portfolio Manager, PFR | One | None |

| | | | | | |

F. Otis Booth, Jr. **

9601 Wilshire Blvd. #800

Beverly Hills, CA 90210

(80) | Director (independent) | One year and inception. | Private investor. | One | None |

| | | | | | |

Norman B. Williamson**

9601 Wilshire Blvd. #800

Beverly Hills, CA 90210

(72) | Director (independent) | One year and inception | Private investor. | One | None |

| | | | | | |

Lawrence P. McNamee**

9601 Wilshire Blvd. #800

Beverly Hills, CA 90210

(69) | Director (independent) | One year and inception | Retired Educator | One | None |

| | | | | | |

Michael C. Sandler

9601 Wilshire Blvd. #800

Beverly Hills, CA 90210

(49) | Vice President | One year and inception | Vice President, Director, and Portfolio Manager, PFR | One | None |

| | | | | | |

Michael Kromm

9601 Wilshire Blvd. #800

Beverly Hills, CA 90210

(59) | Secretary, Treasurer | One year and

since 1991 | Operations Officer, PFR | One | None |

| | | | | | |

Leora R. Weiner

9601 Wilshire Blvd. #800

Beverly Hills, CA 90210

(34) | Vice President and Chief Compliance Officer | One year,

since 2004 | Corporate Counsel and Chief Compliance Officer , PFR, 2004 - present; Senior Securities Compliance Examiner, 2000-2004 | One | None |

* By virtue of his affiliation with the Adviser, Mr. Gipson is an "interested person" of the Fund as that term is defined in section 2(a)(19) of the Investment Company Act.

The Independent Directors do not own shares of the Adviser or its parent company, Old Mutual (US) Holdings, Inc.

Additional information about the Fund's directors is included in the Statement of Additional Information and is available upon request, free of charge, by contacting the Fund at 800-776-5033.

CLIPPER FUNDSM | |

9601 Wilshire Boulevard, Suite 800 | |

Beverly Hills, California 90210 | |

Telephone (800) 776-5033 | |

Shareholder Services | |

& Audio Response (800) 432-2504 | |

Internet: www.clipperfund.com | |

| |

INVESTMENT ADVISER | |

Pacific Financial Research, Inc.

Internet: www.pfr.biz | |

| |

DIRECTORS |

ANNUAL REPORT

December 31, 2004 |

F. Otis Booth, Jr. |

James H. Gipson |

Norman B. Williamson |

Professor Lawrence P. McNamee |

|

TRANSFER & DIVIDEND PAYING AGENT |

Boston Financial Data Services |

Post Office Box 219152 |

Kansas City, Missouri 64121-9152 |

(800) 432-2504 |

|

Overnight Address |

330 W. 9th Street, 3rd Fl. |

Kansas City, MO 64105 |

|

ADMINISTRATION & CUSTODIAN |

State Street Bank and Trust Company |

|

COUNSEL |

Paul, Hastings, Janofsky & Walker LLP |

|

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

PricewaterhouseCoopers LLP |

|

Investment Company File No. 811-3931 |

|

This report is not authorized for distribution to prospective investors unless accompanied by a current prospectus. |

CF 4QTR 1204

Item 2: Code of Ethics

Clipper Fund, Inc. (the “Fund”) has adopted an amended and restated Code of Ethics for Principal Executive and Senior Financial Officers (the “Code”) that applies to the Fund’s principal executive officer and principal financial officer (the “Covered Officers”), a copy of which is attached hereto as an exhibit pursuant to Item 12(a)(1). A copy of the Code is also available on the Fund’s internet website, at www.clipperfund.com. The Fund’s Code was amended and restated effective January 1, 2005, in part to strengthen reporting requirements for the Covered Officers by requiring them to notify the Audit Committee of the Fund’s Board of Directors of any violations of the Code.

Item 3: Audit Committee Financial Expert

The Fund’s Board of Directors has determined that the Fund does not have an audit committee financial expert serving on the Board’s Audit Committee. The Board concluded that none of the independent Directors qualified based on their understanding of the legal requirements for classification of an “audit committee financial expert.” However, the Board concluded that the members of the Audit Committee had sufficient business and financial experience to understand the Fund’s accounting and auditing issues, which it believes to be relatively straightforward.

Item 4: Principal Accountant Fees and Services

Audit Fees: For the Fund’s 2003 and 2004 fiscal years, aggregate fees billed and to be billed by PricewaterhouseCoopers LLP (“PwC”) for the audit of the Fund’s annual financial statements and services that are normally provided by PwC in connection with statutory and regulatory filings or engagements for those fiscal years were $29,500 and $38,700, respectively.

Audit-Related Fees: PwC did not provide any audit-related services to the Fund other than those reported above in the fiscal years 2003 and 2004.

Tax Fees: PwC did not provide any tax services to the Fund for its 2003 fiscal year. Aggregate fees to be billed by PwC for preparation of the Fund’s federal and state income tax returns, review of the Fund’s excise tax distribution calculation and preparation of its excise tax returns for the Fund’s 2004 fiscal year are expected to be approximately $5,500.

All Other Fees: PwC did not provide any other services to the Fund in the fiscal years 2003 and 2004.

The Fund’s Audit Committee Charter requires pre-approval by the Audit Committee of 1) all audit and permissible non-audit services to be provided to the Fund by its independent accountants, including fees, and 2) its independent accountants’ engagements for non-audit services with the Fund’s investment adviser and any affiliate of the Fund’s investment adviser that provides ongoing services to the Fund, if the engagement relates directly to the operations and financial reporting of the Fund. All of the services listed above were pre-approved by the Audit Committee.

For the 2003 and 2004 fiscal years, aggregate fees billed by PwC to Pacific Financial Research, Inc. (“PFR”), the Fund’s investment adviser, for AIMR-PPS® performance verification were $15,000 and $17,000, respectively. The Audit Committee of the Fund’s Board of Directors considered these non-audit services provided to PFR in reviewing PwC’s independence when providing services to the Fund.

The aggregate non-audit fees billed by PwC for services rendered to the Fund and PFR in the Fund’s 2003 and 2004 fiscal years were $15,000 and $22,500, respectively.

Item 6: Schedule of Investments

The Fund’s Schedule I – Investments in securities of unaffiliated issuers is included as part of the report to shareholders filed under Item 1 of this Form.

Item 10: Submission of Matters to a Vote of Security Holders

The Fund has made no changes to the procedures by which shareholders may recommend nominees to the Fund’s Board of Directors since the Fund last provided disclosure in response to this Item on Form N-CSR.

Item 11: Controls and Procedures

(a) The Fund’s principal executive officer and principal financial officer have evaluated the Fund’s disclosure controls and procedures (as defined in Rule 30a-2(c) under the Investment Company Act of 1940, as amended (the “Act”)) as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, and concluded that such disclosure controls and procedures are effective.

(b) There have been no changes in the Fund’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Fund’s internal control over financial reporting.

Item 12(a)(1): Exhibits

Attached as Exhibit 12(a)(1) is the Fund’s amended and restated Code of Ethics for Principal Executive and Senior Financial Officers referred to in Item 2.

Item 12(a)(2): Certifications

Attached as Exhibit 12(a)(2) are the certifications of the principal executive and principal financial officers required by Rule 30a-2 of the Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | | CLIPPER FUND

|

| By (Signature and Title)* | | /s/ James H. Gipson

James H. Gipson, Chairman & President

|

| Date | | March 4, 2005 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | | /s/ James H. Gipson

James H. Gipson, Chairman & President

|

| Date | | March 4, 2005

|

| By (Signature and Title)* | | /s/ Michael Kromm

Michael Kromm, Secretary & Treasurer

|

| Date | | March 8, 2005

|

* Print the name and title of each signing officer under his or her signature.

EXHIBIT 12(a)(1)

CLIPPER FUND, INC.

CODE OF ETHICS FOR PRINCIPAL EXECUTIVE AND

SENIOR FINANCIAL OFFICERS

AMENDED AND RESTATED AS OF JANUARY 1, 2005

I. Covered Officers / Purpose of the Code

| | This Code of Ethics (the “Code”) shall apply to the Principal Executive Officer and Principal Financial Officer (the “Covered Officers,” each of whom is named in Exhibit A attached hereto) of Clipper Fund, Inc. (the “Fund”), consistent with and in furtherance of their fiduciary duties, and for the purpose of promoting: |

| | • | honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| | • | full, fair, accurate, timely and understandable disclosure in reports and documents that the Fund files with, or submits to, the Securities and Exchange Commission (“SEC”) and in other public communications made by the Fund; |

| | • | compliance with applicable laws and governmental rules and regulations; |

| | • | the prompt internal reporting of violations of the Code to an appropriate person or persons identified in the Code; and |

| | • | accountability for adherence to the Code. |

Each Covered Officer should adhere to a high standard of business ethics and should be sensitive to situations that may give rise to actual as well as apparent conflicts of interest.

II. Covered Officers Should Handle Ethically Actual and Apparent Conflicts of Interest

Overview. A “conflict of interest” occurs when a Covered Officer’s private interest has the potential to interfere with the interests of, or his or her service to, the Fund. For example, a conflict of interest would arise if a Covered Officer, or a member of his or her family, receives improper personal benefits as a result of his or her position with the Fund. Covered Officers must avoid conduct that conflicts, or appears to conflict, with their duties to the Fund. All Covered Officers should conduct themselves such that any reasonable observer would have no grounds for belief that a conflict of interest has not been appropriately addressed and resolved. Covered Officers are not permitted to self-deal or otherwise to use their positions with the Fund to further their own or any other related person’s business opportunities.

This Code does not, and is not intended to, repeat or replace the programs and procedures or codes of ethics of the Fund’s investment adviser.

Although typically not presenting an opportunity for improper personal benefit, conflicts may arise from, or as a result of, the contractual relationship between the Fund and its investment adviser, of which the Covered Officers are also officers or employees. As a result, this Code recognizes that the Covered Officers will, in the normal course of their duties (whether formally on behalf of the Fund, the investment adviser, or both), be involved in establishing policies and implementing decisions that will

have different effects on the Fund and its service providers. The participation of the Covered Officers in such activities is inherent in the contractual relationship between the Fund and its service providers and is consistent with the performance by the Covered Officers of their duties as officers of the Fund. Thus, if performed in conformity with the provisions of the Investment Company Act of 1940, as amended (“Investment Company Act”), and the Investment Advisers Act of 1940, as amended (“Investment Advisers Act”), such activities will be deemed to have been handled ethically.

The following list provides examples of conflicts of interest under the Code, but Covered Officers should keep in mind that these examples are not exhaustive. The overarching principle is that the personal interest of a Covered Officer should be properly disclosed to the Fund and resolved by persons who do not have a personal interest.

* * * *

Each Covered Officer must not:

| | • | use his or her personal influence or personal relationship improperly to influence investment decisions or financial reporting by the Fund whereby the Covered Officer would benefit personally; |

| | • | cause the Fund to take action, or fail to take action, for the improper personal benefit of the Covered Officer; or |

| | • | retaliate against any other Covered Officer or any employee of the Fund or its affiliated persons for reports that are made in good faith of actual or of potential violations by the Fund or such affiliated persons of applicable rules and regulations. |

| | Each Covered Officer must discuss certain material conflict of interest situations with the Audit Committee of the Fund’s Board of Directors (the “Audit Committee”).1 Examples of such situations include: |

| | • | service as a director on the board of a publicly traded company; |

| | • | accepting directly or indirectly investment opportunities, gifts or other gratuities from individuals conducting or seeking to conduct business with the Fund or the Fund’s investment adviser. However, Covered Officers may accept gifts in aggregate amounts not exceeding $100 per person or entity per year, and may attend business meals, sporting events and other entertainment events at the expense of a person or entity as long as the expense is reasonable and both the person or entity providing the meal or the entertainment and the Covered Officer(s) are present; |

| | • | any direct or indirect ownership interest in, financial relationships with, or any consulting or employment relationship with, any of the Fund’s service providers, other than its investment adviser; and |

| | • | a direct or indirect financial interest in commissions, transaction charges or spreads paid by the Fund for effecting portfolio transactions or for selling or redeeming shares. |

_______________________

1 The Fund’s Audit Committee comprises the three Directors who are not “interested persons” of the Fund, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “Independent Directors”).

III. Disclosure and Compliance

| | • | Each Covered Officer should familiarize himself or herself with the disclosure requirements generally applicable to the Fund. |

| | • | Each Covered Officer should not knowingly misrepresent, or cause others to misrepresent, facts about the Fund to other parties, including but not limited to, the Fund’s Board of Directors and its independent registered public accounting firm, and to governmental regulators and self-regulatory organizations. |

| | • | Each Covered Officer should, to the extent appropriate within his or her area of responsibility, consult with other officers and employees of the Fund and its service providers with the goal of promoting full, fair, accurate, timely and understandable disclosure in the reports and documents that the Fund files with, or submits to, the SEC and in other public communications made by the Fund. |

| | • | It is the responsibility of each Covered Officer to promote and encourage professional integrity in all aspects of the Fund’s operations. |

IV. Reporting and Accountability

Each Covered Officer must:

| | • | upon adoption of this Code (or thereafter as applicable, upon becoming a Covered Officer), sign and return a report in the form of Exhibit B to the person named in Exhibit A affirming that he has received, read and understands the Code; |

| | • | annually sign and return a report in the form of Exhibit C to the person named in Exhibit A affirming that he or she has complied with the requirements of the Code; and |

| | • | notify the Audit Committee promptly if he or she knows of any violation of this Code. Failure to do so is itself a violation of this Code. |

The Audit Committee is responsible for applying this Code to specific situations in which questions are presented under it and has the authority to interpret this Code in any particular situation including any approvals or waivers sought by the Covered Officers.2

The Audit Committee will follow these procedures in investigating and enforcing this Code:3

| | • | The Audit Committee will take all appropriate actions to investigate any potential violations reported to the Committee. |

| | • | If, after such investigation, the Audit Committee believes that no violation has occurred, the Audit Committee is not required to take any further action. |

_______________________

2 The Audit Committee, may, in its sole discretion, consult with the Fund’s legal counsel or Chief Compliance Officer, who also serves as the investment adviser’s General Counsel and Chief Compliance Officer, in connection with any such questions and interpretations.

3 The Audit Committee may, in its sole discretion, instruct the Fund’s legal counsel, Chief Compliance Officer or other qualified persons to carry out, subject to the Committee’s continuing oversight, any such investigations.

| | • | Any matter that the Audit Committee believes is a violation of this Code will be reported to the full Board. |

| | • | If the Board concurs that a violation has occurred, it will consider appropriate action, which may include review of, and appropriate modifications to, applicable policies and procedures; notification to the appropriate personnel of the Fund’s investment adviser or its board; and possible dismissal of the Covered Officer as an officer of the Fund. |

| | • | The Audit Committee will be responsible for granting waivers of provisions of this Code, as appropriate.4 |

| | • | Any changes to or waivers of this Code will, to the extent required, be disclosed as provided by SEC rules. |

V. Other Policies and Procedures

This Code shall be the sole code of ethics adopted by the Fund for purposes of Section 406 of the Sarbanes-Oxley Act of 2002 and the rules and forms applicable to registered investment companies thereunder. Insofar as other policies or procedures of the Fund or the Fund’s investment adviser govern or purport to govern the behavior or activities of the Covered Officers who are subject to this Code, they are superseded by this Code to the extent that they overlap or conflict with the provisions of this Code. The Fund’s and the investment adviser’s code of ethics pursuant to Rule 17j-1 under the Investment Company Act and Rule 204A-1 under the Investment Advisers Act, respectively, and the investment adviser’s other policies and procedures are separate requirements applying to the Covered Officers and others, and are not part of this Code.

VI. Amendments

Any amendments to this Code, other than amendments to Exhibit A, must be approved or ratified by a majority vote of the Board, including a majority of the Independent Directors.

VII. Confidentiality

All reports and records prepared or maintained pursuant to this Code will be considered confidential and shall be maintained and protected accordingly. Except as otherwise required by law or this Code, such matters shall not be disclosed to anyone other than the Fund’s Board, Chief Compliance Officer, and legal counsel to the Fund, the Independent Directors and the investment adviser.

VIII. Internal Use

The Code is intended solely for internal use by the Fund and does not constitute an admission, by or on behalf of the Fund, as to any fact, circumstance or legal conclusion.

_______________________

4 Item 2 of Form N-CSR defines “waiver” as “the approval by the registrant of a material departure from provision of the code of ethics” and “implicit waiver,” which must also be disclosed, as “the registrant’s failure to take action within a reasonable period of time regarding a material departure from a provision of the code of ethics that has been made known to an executive officer of the registrant.”

| APPROVED: | JUNE 9, 2003 |

| AMENDED AND RESTATED: | JUNE 9, 2003 |

EXHIBIT A

Persons Covered by this Code of Ethics:

James H. Gipson (Principal Executive Officer)

Michael Kromm (Principal Financial Officer)

Recipient of reports under Article IV

Leora R. Weiner (Chief Compliance Officer)

EXHIBIT B

INITIAL CERTIFICATION FORM

This is to certify that I have read and understand the Code of Ethics for Principal Executive and Senior Financial Officers of Clipper Fund, Inc., dated _______________, and that I recognize that I am subject to the provisions thereof and will comply with the policy and procedures stated therein.

Please sign your name here:

Please print your name here:

Please date here:

EXHIBIT C

ANNUAL CERTIFICATION FORM

This is to certify that I have read and understand the Code of Ethics for Principal Executive and Senior Financial Officers of Clipper Fund, Inc. dated _______________, (the “Code”) and that I recognize that I am subject to the provisions thereof and will comply with the policy and procedures stated therein.

This is to further certify that I have complied with the requirements of the Code during the period of _____________ through ______________.

Please sign your name here:

Please print your name here:

Please date here:

EXHIBIT 12(a)(2)

CERTIFICATIONS

I, James H. Gipson, certify that:

1. I have reviewed this report on Form N-CSR of Clipper Fund, Inc. (the “Fund”);

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the Fund as of, and for, the periods presented in this report;

4. The Fund’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the Fund and have:

a. designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Fund, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b. designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c. evaluated the effectiveness of the Fund’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and

d. disclosed in this report any change in the Fund’s internal control over financial reporting that occurred during the Fund’s second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Fund’s internal control over financial reporting; and

5. The Fund’s other certifying officer and I have disclosed to the Fund’s auditors and the Audit Committee of the Fund’s Board of Directors:

a. all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Fund’s ability to record, process, summarize, and report financial information; and

b. any fraud, whether or not material, that involves management or other employees who have a significant role in the Fund’s internal control over financial reporting.

| Date March 4, 2005 | |

|

| | | /s/ James H. Gipson

James H. Gipson

Chairman & President

|

| | |

I, Michael Kromm, certify that:

1. I have reviewed this report on Form N-CSR of Clipper Fund, Inc. (the “Fund”);

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations, changes in net assets, and cash flows (if the financial statements are required to include a statement of cash flows) of the Fund as of, and for, the periods presented in this report;

4. The Fund’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) and internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) for the Fund and have:

a. designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the Fund, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b. designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c. evaluated the effectiveness of the Fund’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of a date within 90 days prior to the filing date of this report based on such evaluation; and

d. disclosed in this report any change in the Fund’s internal control over financial reporting that occurred during the Fund’s second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Fund’s internal control over financial reporting; and

5. The Fund’s other certifying officer and I have disclosed to the Fund’s auditors and the Audit Committee of the Fund’s Board of Directors:

a. all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Fund’s ability to record, process, summarize, and report financial information; and

b. any fraud, whether or not material, that involves management or other employees who have a significant role in the Fund’s internal control over financial reporting.

| Date March 8, 2005 | |

|

| | | /s/ Michael Kromm

Michael Kromm

Secretary & Treasurer

|

| | |

EXHIBIT 12(b)

CERTIFICATIONS

This certification is provided pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, 18 U.S.C. § 1350, and accompanies the report on Form N-CSR for the period ended December 31, 2004 of Clipper Fund, Inc. (the “Company”).

I, James H, Gipson, the chief executive officer of the Company, certify that:

(i) the Form N-CSR fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m(a) or 78o(d)); and

(ii) the information contained in the Form N-CSR fairly presents, in all material respects, the financial condition and results of operations of the Company.

| Date March 4, 2005 | |

|

| | | /s/ James H. Gipson

James H. Gipson

Chairman & President

|

| | |

This certification is provided pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, 18 U.S.C. § 1350, and accompanies the report on Form N-CSR for the period ended December 31, 2004 of Clipper Fund, Inc. (the “Company”).

I, Michael Kromm, the chief financial officer of the Company, certify that:

(i) the Form N-CSR fully complies with the requirements of Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (15 U.S.C. 78m(a) or 78o(d)); and

(ii) the information contained in the Form N-CSR fairly presents, in all material respects, the financial condition and results of operations of the Company.

| Date March 8, 2005 | |

|

| | | /s/ Michael Kromm

Michael Kromm

Secretary & Treasurer

|

| | |