QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

Alliance Pharmaceutical Corp. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

ALLIANCE PHARMACEUTICAL CORP.

6175 Lusk Boulevard

San Diego, California 92121

Notice of the Annual Meeting of Stockholders

to be held November 12, 2002

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Alliance Pharmaceutical Corp. (the "Corporation") will be held at 10:00 a.m., local time, on Tuesday, November 12, 2002, at the Wyndham Hotel, located at 5976 Lusk Boulevard, San Diego, California 92121, for the following purposes:

1. To elect eight directors of the Corporation.

2. To transact such other business as may properly come before the meeting, or any adjournment thereof.

Stockholders of record at the close of business on September 23, 2002, shall be entitled to notice of, and to vote at, the meeting.

| Dated: | | San Diego, California

September 26, 2002 |

IMPORTANT: PLEASE FILL IN, DATE, SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY IN THE POSTAGE-PAID ENVELOPE PROVIDED TO ASSURE THAT YOUR SHARES ARE REPRESENTED AT THE MEETING.

ALLIANCE PHARMACEUTICAL CORP.

6175 Lusk Boulevard

San Diego, California 92121

PROXY STATEMENT

GENERAL INFORMATION

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors of Alliance Pharmaceutical Corp. (the "Corporation") to be voted at the Annual Meeting of Stockholders to be held on Tuesday, November 12, 2002, at 10:00 a.m., local time, at the Wyndham Hotel, located at 5976 Lusk Boulevard, San Diego, California 92121, and at any adjournment or adjournments thereof (the "Meeting") for the purposes set forth in the accompanying Notice of the Annual Meeting of Stockholders.

The mailing address of the principal executive offices of the Corporation is 6175 Lusk Boulevard, San Diego, California 92121 (telephone number 858/410-5200). The enclosed proxy and this proxy statement are being first sent to stockholders of the Corporation on or about October 5, 2002.

The Board of Directors has fixed the close of business on September 23, 2002 as the record date for the determination of stockholders of the Corporation entitled to receive notice of, and vote at, the Meeting. At the close of business on the record date, an aggregate of 17,368,849 shares of common stock, par value $.01 per share, of the Corporation (the "Common Stock") were issued and outstanding and entitled to one vote on each matter to be voted upon at the Meeting.

All votes will be tabulated by the inspector of election appointed for the Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions will be counted towards the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are not counted for the purpose of determining the presence or absence of a quorum.

SOLICITATION AND REVOCATION

PROXIES IN THE FORM ENCLOSED ARE SOLICITED BY, OR ON BEHALF OF, THE BOARD OF DIRECTORS OF THE CORPORATION. STOCKHOLDERS ARE URGED TO SIGN THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY. THE PERSONS NAMED IN THE PROXY HAVE BEEN DESIGNATED AS PROXIES BY THE BOARD OF DIRECTORS. Shares represented by properly executed proxies received by the Corporation will be voted at the Meeting in the manner specified therein or, if no specification is made, FOR the election of the directors, as described in this proxy statement.

Any proxy given by a stockholder pursuant to this solicitation may be revoked by the stockholder at any time before it is exercised, by written notification delivered to the Secretary of the Corporation, by voting in person at the Meeting, or by executing another proxy bearing a later date.

Proxies will be solicited by mail. They may also be solicited by officers and regular employees of the Corporation personally, by telephone or otherwise, but such persons will not be specifically compensated for such services. Banks, brokers, nominees, and other custodians and fiduciaries will be reimbursed for their reasonable out-of-pocket expenses in forwarding soliciting material to their principals, the beneficial owners of Common Stock. The costs of soliciting proxies will be borne by the Corporation.

1

It is expected that the following business will be considered at the Meeting and action taken thereon:

1. ELECTION OF DIRECTORS

Eight directors are to be elected at the Meeting to hold office until the next annual meeting of stockholders and until the election and qualification of their respective successors. The Board of Directors has nominated Pedro Cuatrecasas, M.D., Carroll O. Johnson, Stephen M. McGrath, Donald E. O'Neill, Helen M. Ranney, M.D., Duane J. Roth, Theodore D. Roth, and Jean G. Riess, Ph.D., all of whom are currently directors of the Corporation. Directors are elected by a plurality vote.

Unless otherwise specified in the accompanying proxy, the shares voted pursuant thereto will be cast for these nominees. If, for any reason, any of the nominees should be unable to accept nomination or election, it is intended that such proxy will be voted for the election, in his or her place, of a substituted nominee who would be recommended by management. Management, however, has no reason to believe that any nominee will be unable to serve as a director.

The Board of Directors recommends a vote FOR each named nominee.

Set forth below is certain information with respect to each nominee as of August 31, 2002:

Duane J. Roth. Mr. Roth is 52 and has served as a director of the Corporation since 1985. He has served as Chief Executive Officer of the Corporation since 1985 and as Chairman since October 1989. Prior to joining the Corporation, Mr. Roth served as President of Analytab Products, Inc., an American Home Products company involved in manufacturing and marketing medical diagnostics, pharmaceuticals and devices. For the previous ten years, he was employed in various sales, marketing and general management capacities with Ortho Diagnostic Systems, Inc., a Johnson & Johnson company, which is a manufacturer of diagnostic and pharmaceutical products. Mr. Roth's brother, Theodore D. Roth, is President and Chief Operating Officer of the Corporation.

Theodore D. Roth. Mr. Roth is 51 and served as Executive Vice President and Chief Financial Officer of the Corporation from November 1987 to May 1998, when he was appointed President and Chief Operating Officer. For more than ten years prior to joining the Corporation, he was General Counsel of SAI Corporation, a company in the business of operating manufacturing concerns, and General Manager of Holland Industries, Inc., a manufacturing company. Mr. Roth received his J.D. from Washburn University and an LL.M. in Corporate and Commercial Law from the University of Missouri in Kansas City. He is the brother of Duane J. Roth, the Chairman and Chief Executive Officer of the Corporation.

Pedro Cuatrecasas, M.D. Dr. Cuatrecasas is 66 and was elected as a director of the Corporation in August 1996. He has over 20 years of experience in the pharmaceutical industry. Dr. Cuatrecasas retired from the positions of Vice President of Warner-Lambert Company and President, Parke-Davis Pharmaceutical Research on December 31, 1996, positions he had held since 1989. During the previous four years, he had been Senior Vice President of Research and Development and Director of Glaxo, Inc. For the prior ten years, he was Vice President of Research, Development and Medical and Director of Burroughs Wellcome Company. Dr. Cuatrecasas is a member of the National Academy of Sciences and the Institute of Medicine. He is currently a director of Metabolex, Inc. and an independent consultant in pharmaceutical research. He received his M.D. from Washington University School of Medicine.

Carroll O. Johnson. Mr. Johnson is 69 and has served as a director of the Corporation since 1989. He has been President of Research Management, Inc. ("RMI") since 1985, an independent contract research organization that provides services to the pharmaceutical industry in the implementation of clinical trials. Previously, he served for 25 years in various research, sales and

2

marketing positions with several pharmaceutical companies, including Pharmacia Laboratories, Inc., where he created a national sales force, that introduced three major products.

Stephen M. McGrath. Mr. McGrath is 67 and has served as a director of the Corporation since 1989. In May 1998, he retired as Executive Vice President of CIBC World Markets, Inc. and as the Director of its Corporate Finance Department. For the eleven years prior to his employment by CIBC Oppenheimer in 1983, he held various executive positions with Warner-Lambert Company. Before joining Warner-Lambert, Mr. McGrath was Controller and Assistant Treasurer of Sterling Drug, Inc. and a certified public accountant for Price Waterhouse & Co.

Donald E. O'Neill. Mr. O'Neill is 76 and has served as a director of the Corporation since 1991. He retired from Warner-Lambert Company in 1991 after 20 years of service. During his tenure, he held various managerial positions, including President of the Parke-Davis Group, President of the Health Technologies Group and President—International Operations. At the time of his retirement from Warner-Lambert, he held the offices of Executive Vice President of the company, and President and Chairman of its International Operations, and was a member of Warner-Lambert's board of directors.

Helen M. Ranney, M.D. Dr. Ranney is 82 and has served as a director of the Corporation since 1991. She is ProfessorEmerita, Department of Medicine, University of California at San Diego, having served as Chairman of the Department from 1973 through 1986. From 1986 through 1991, she was Distinguished Physician of the U.S. Department of Veterans Affairs. She formerly was Professor of Medicine at Albert Einstein College of Medicine (New York) and at the State University of New York, Buffalo. Dr. Ranney is a member of many professional societies, including the National Academy of Sciences, the Institute of Medicine, the Association of American Physicians (past President), and the American Society of Hematology (past President). She has more than 150 publications, primarily relating to blood and blood disorders. Dr. Ranney served on the Board of Directors of Squibb Corp. prior to its merger with Bristol-Myers. She received her M.D. from the College of Physicians and Surgeons, Columbia University.

Jean G. Riess, Ph.D. Professor Riess is 65 and has served as a director of the Corporation since 1989. Until his retirement in 1996, he had been the Director of Laboratoire de Chimie Moléculaire at the University of Nice for over 20 years. He has been an active researcher since receiving a Ph.D. from the University of Strasbourg, with numerous patents and over 300 publications. For more than 20 years, Dr. Riess has focused on chemistry related to perfluorochemical emulsions for medical application. He has directed research in synthesis of tailored perfluorochemicals, in emulsion technology, in synthesis of fluorinated surfactants, in the physical chemistry of emulsion stabilization, and in surfactant self-aggregation.

Compensation of Directors

Directors do not receive cash compensation for attendance at Board of Directors' meetings or committee meetings. Non-qualified stock options are awarded to non-employee directors of the Corporation pursuant to the Formula Stock Option Plan for Non-employee Directors of the Corporation (the "Directors' Formula Option Plan"). Options under the Directors' Formula Option Plan are granted under and subject to the Corporation's 1991 Stock Option Plan and 2000 Stock Option Plan. The options have a term of ten years from the date of grant and are exercisable at a price per share equal to the fair market value of a share of Common Stock on the date of grant. Each non-employee director (i) upon his or her initial election, shall automatically be granted an option to acquire 5,000 shares of Common Stock which shall be exercisable in four installments of 1,250 shares each with the first installment being at his or her initial election and the remaining installments becoming exercisable on the date of each annual meeting of the Board of Directors of the Corporation thereafter that such person is a director, until fully exercisable, and (ii) upon the third annual meeting following his or her initial election and each annual meeting thereafter that such person remains a

3

non-employee director, shall automatically be granted an option to acquire 1,500 shares of Common Stock. Except as otherwise described above, all options are immediately exercisable in full on the date of grant.

On November 6, 2001, each non-employee director also received a special grant under the 2000 Stock Option Plan of options to acquire 10,000 shares of common stock. The options are exercisable immediately at an exercise price of $3.10.

Other Transactions

The following affiliations exist between the Corporation and certain directors:

In December 2001, the Corporation renewed a one-year research services agreement with RMI for $2,000 per month, plus $500 per day for each day per month in excess of four days Mr. Johnson devotes to consulting for the Corporation. Mr. Johnson is the president and owner of RMI. RMI received $24,000 for consulting services in the fiscal year ended June 30, 2002.

Dr. Ranney receives $2,000 per month and office space for providing consulting services to the Corporation.

In July 2001, a subsidiary of the Corporation renewed a one-year consulting agreement with Dr. Riess, which paid him $124,000 during the fiscal year ended June 30, 2002. The agreement has been renewed for an additional year.

As previously reported, in connection with the Corporation's $15.1 million private placement financing in October 2001, the Corporation paid Roth Capital Partners ("RCP") a placement fee of8.5% of the gross proceeds ($1.28 million). RCP also provides financial advisory services to the Corporation from time to time. Byron Roth, the president, chief executive officer and a principal stockholder of RCP, is the brother of Duane J. Roth, Chief Executive Officer and director of the Corporation and Theodore D. Roth, President, Chief Operating Officer and director of the Corporation.

Committees of the Board of Directors and Meeting Attendance

The standing committees of the Board of Directors consist of an Executive Committee, a Compensation Committee, an Audit Committee, and a Nominating Committee. The Executive Committee was established to act when the full Board of Directors is unavailable. It has all the authority of the Board between meetings of the entire Board as to matters, which have not been specifically delegated to other committees of the Board, except the authority that by law cannot be delegated by the Board of Directors. The members of the Executive Committee are Drs. Cuatrecasas and Ranney and Mr. D. Roth. The Compensation Committee advises and makes recommendations to the Board of Directors regarding matters relating to the compensation of directors, officers, and senior management. The members of the Compensation Committee are Drs. Cuatrecasas and Ranney and Messrs. O'Neill and McGrath. The Audit Committee advises and makes recommendations to the Board concerning the internal controls of the Corporation, the independent auditors of the Corporation, and other matters relating to the financial activities of the Corporation. The current members of the Audit Committee are Messrs. Johnson and McGrath. No members of the Corporation's Audit Committee are officers of the Corporation and all are independent directors under currently applicable rules. The Nominating Committee has the authority to nominate members of the Board of Directors to the entire Board for consideration. The Nominating Committee will consider nominees recommended by stockholders, which should be submitted to the Nominating Committee, in writing, prior to June 30, to be considered for the next Annual Meeting. The members of the Nominating Committee are Dr. Riess and Mr. Johnson.

4

During the fiscal year ended June 30, 2002, there were four regular and one special meetings of the Board of Directors. The Audit Committee held three meetings, the Compensation Committee held two meetings, the Nominating Committee held one meeting and the Executive Committee did not meet. Each Board member attended more than 75% of the meetings of the Board and all of the meetings of the committee(s) of which he or she is a member.

Audit Committee Report

The Audit Committee oversees the Corporation's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed the audited financial statements in the Corporation's Annual Report on Form 10-K for the year ended June 30, 2002 with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of the Corporation's audited financial statements with generally accepted accounting principles, their judgments as to the quality, not just the acceptability, of the Corporation's accounting principles and any other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. In addition, the Audit Committee has discussed with the independent auditors the auditors' independence from management and the Corporation, including the matters in the written disclosures required by the Independence Standards Board. The Audit Committee received from Ernst & Young LLP written disclosure and the letter regarding its independence as required by Independence Standards Board Standard No. 1. The Audit Committee also discussed with the independent auditors the matters required by the Statement on Auditing Standards No. 61 and considered the compatibility of non-audit services with the auditor's independence.

The Audit Committee discussed with the independent auditors the overall scope and plans for their audit. The Audit Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of internal controls, and the overall quality of the Corporation's financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Annual Report on Form 10-K for the year ended June 30, 2002 for filing with the Securities and Exchange Commission (the "SEC").

Stephen M. McGrath, Audit Committee Chairman

Carroll O. Johnson, Audit Committee Member

Relationship with Independent Auditors

Ernst & Young LLP served as independent auditors for the Corporation for the fiscal year end ended June 30, 2002. The following table sets forth the fees billed by Ernst & Young LLP for services performed during the fiscal year ended June 30, 2002:

| Audit fees | | $ | 91,500 |

| Audit related fees | | $ | 23,052 |

| Financial information design and implementation fees | | | -0- |

| All other fees | | | -0- |

Audit related services included accounting consultations and SEC registration statements.

5

The Audit Committee believes that all services rendered to the Corporation by Ernst & Young LLP were compatible with maintaining Ernst & Young's independence.

Representatives of Ernst & Young LLP are expected to be present at the Meeting, will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Corporation's directors, executive officers and persons who own more than 10% of a registered class of the Corporation's equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Corporation. Officers, directors and greater than 10% stockholders are required by SEC regulations to furnish the Corporation with copies of all Section 16(a) forms they file.

To the Corporation's knowledge, based solely on a review of the copies of such reports furnished to the Corporation during the fiscal year ended June 30, 2002, one report, covering one open market stock purchase, was filed late on behalf of Mr. Johnson.

6

OWNERSHIP OF VOTING SECURITIES BY CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of the Corporation's voting securities as of August 31, 2002 as to (i) each of the directors and nominees for director, (ii) each of the executive officers listed in the Summary Compensation Table, (iii) each person known by the Corporation to own more than 5% of any class of the Corporation's outstanding voting securities, and (iv) all directors and executive officers of the Corporation as a group:

Common Stock

Name and Address (1)

| | Amount and Nature of

Beneficial Ownership (2)

| | Percentage of

Class (3)

| |

|---|

| Duane J. Roth | | 307,128 | (4) | 1.75 | % |

| Pedro Cuatrecasas, M.D. | | 44,600 | (5) | * | |

| Carroll O. Johnson | | 28,900 | (6) | * | |

| Stephen M. McGrath | | 130,961 | (7) | * | |

| Donald E. O'Neill | | 35,600 | (8) | * | |

| Helen M. Ranney, M.D. | | 31,580 | (9) | * | |

| Jean G. Riess, Ph.D. | | 65,214 | (10) | * | |

| Theodore D. Roth | | 113,060 | (11) | * | |

| Howard C. Dittrich, M.D. | | 20,000 | (12) | * | |

| N. Simon Faithfull, M.D., Ph.D. | | 45,239 | (13) | * | |

| David H. Klein, Ph.D. | | 34,434 | (14) | * | |

| All directors and executive officers as a group (19 persons) | | 994,733 | | 5.64 | % |

- *

- Indicates ownership of less than 1% of outstanding shares.

- (1)

- The address of each of the executive officers, directors and nominees for director is c/o Alliance Pharmaceutical Corp., 6175 Lusk Boulevard, San Diego, California 92121.

- (2)

- Each person listed or included in the group has sole voting power and sole investment power with respect to the shares owned by such person, except as indicated below.

- (3)

- Shares subject to options and warrants exercisable within 60 days are deemed to be outstanding for percentage calculations with respect to the person holding such options and warrants.

- (4)

- Consists of (i) 86,742 shares owned by Mr. D. Roth, (ii) 185,750 shares subject to options granted by the Corporation under its 1991 Stock Option Plan ("the 1991 Plan"), (iii) 4,400 shares subject to options granted by the Corporation under its 2000 Stock Option Plan ("the 2000 Plan"), (iv) 28,571 shares subject to warrants, and (v) 1,665 shares owned by Mr. Roth's spouse.

- (5)

- Consists of (i) 14,600 shares owned by Dr. Cuatrecasas, (ii) 20,000 shares subject to options granted by the Corporation under the 1991 Plan, and (iii) 10,000 shares subject to options granted by the Corporation under the 2000 Plan.

- (6)

- Consists of (i) 1,000 shares owned by Mr. Johnson, (ii) 17,900 shares subject to options granted by the Corporation under the 1991 Plan, and (iii) 10,000 shares subject to options granted by the Corporation under the 2000 Plan.

- (7)

- Consists of (i) 63,123 shares owned by Mr. McGrath, (ii) 35,238 shares subject to warrants, (iii) 22,600 shares subject to options granted by the Corporation under the 1991 Plan, and (iv) 10,000 shares subject to options granted by the Corporation under the 2000 Plan.

7

- (8)

- Consists of (i) 5,000 shares owned by Mr. O'Neill, (ii) 20,200 shares subject to options granted by the Corporation under the 1991 Plan, (iii) 10,000 shares subject to options granted by the Corporation under the 2000 Plan, and (iv) 400 shares owned by Mr. O'Neill's spouse.

- (9)

- Consists of (i) 1,380 shares owned by Dr. Ranney, (ii) 20,200 shares subject to options granted by the Corporation under the 1991 Plan, and (iii) 10,000 shares subject to options granted by the Corporation under the 2000 Plan.

- (10)

- Consists of (i) 15,947 shares owned by Dr. Riess, (ii) 39,267 shares subject to options granted by the Corporation under the 1991 Plan, and (iii) 10,000 shares subject to options granted by the Corporation under the 2000 Plan.

- (11)

- Consists of (i) 4,900 shares owned by Mr. T. Roth and(ii) 108,160 shares subject to options granted by the Corporation under the 1991 Plan.

- (12)

- Consists of 7,500 shares subject to options granted to Dr. Dittrich by the Corporation under the 2000 Plan and (ii) 12,500 shares subject to options granted by the Corporation under its 2001 Stock Option Plan (the "2001 Plan").

- (13)

- Consists of (i) 5,339 shares owned by Dr. Faithfull, (ii) 30,950 shares subject to options granted by the Corporation under the 1991 Plan, and (iii) 8,950 shares subject to options granted by the Corporation under the 2001 Plan.

- (14)

- Consists of (i) 1,000 shares owned by Dr. Klein, (ii) 20,484 shares subject to options granted by the Corporation under the 1991 Plan, and (iii) 12,950 shares subject to options granted by the Corporation under the 2001 Plan.

8

EXECUTIVE COMPENSATION

The following table sets forth information concerning annual and long-term compensation for the Corporation's Chief Executive Officer and the other four highest paid executive officers (collectively, the "Named Executive Officers") for the year ended June 30, 2002, as well as the total compensation paid to each individual for the Corporation's two previous fiscal years:

Summary Compensation Table

| |

|---|

| |

| | Annual Compensation

| | Long-Term

Compensation

Awards

| |

| |

|---|

Name and

Principal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other Annual Compensation($)(a)

| | Securities Underlying Options/ SARs(#)

| | All Other Compensation($)

| |

|---|

Duane J. Roth (k)

Chairman and

Chief Executive Officer | | 2002

2001

2000 | | 472,850

454,250

416,000 | | —

200,000

85,000 |

(b)

| —

—

— | | 85,000

44,000

38,800 | | 18,199

15,041

11,822 | (c)

(d)

(e) |

Theodore D. Roth (k)

President and

Chief Operating Officer | | 2002

2001

2000 | | 351,260

337,462

310,000 | | —

110,000

47,000 |

(b)

| —

—

— | | 70,000

40,000

29,400 | | 6,990

5,525

3,859 | (f)

(g)

(h) |

Howard C. Dittrich (i)

Senior Vice President,

Clinical Research

and Regulatory Affairs | | 2002

2001

2000 | | 275,192

119,231

— | | —

—

— | | —

—

— | | 50,000

15,000

— | | —

—

— | |

N. Simon Faithfull (k)

Vice President, Medical

Affairs Development | | 2002

2001

2000 | | 231,541

222,635

214,000 | | —

55,000

25,000 |

(b)

| —

—

— | | 25,000

9,000

10,000 | | —

—

— | |

David H. Klein (j)

Senior Vice President,

Pharmaceutical R&D | | 2002

2001

2000 | | 233,827

225,000

— | | —

12,500

— |

(b)

| —

—

— | | 35,000

12,000

15,000 | | —

—

— | |

- (a)

- Perquisites and other personal benefits for specific officers are only reported in specific years where such compensation exceeds the lower of 10% of annual salary and bonus, or $50,000.

- (b)

- Bonuses shown in fiscal year 2001 were determined with respect to fiscal year 2000 and paid in August 2000. The Board of Directors has determined that, as in fiscal year 2001, there will be no executive bonuses for fiscal year 2002.

- (c)

- This represents the present value of the economic benefit to Mr. D. Roth for the portion of the total premium ($100,000) paid by the Corporation during 2002 with respect to a split-dollar insurance agreement.

- (d)

- This represents the present value of the economic benefit to Mr. D. Roth for the portion of the total premium ($100,000) paid by the Corporation during 2001 with respect to a split-dollar insurance agreement.

- (e)

- This represents the present value of the economic benefit to Mr. D. Roth for the portion of the total premium ($100,000) paid by the Corporation during 2000 with respect to a split-dollar insurance agreement.

- (f)

- This represents the present value of the economic benefit to Mr. T. Roth for the portion of the total premium ($60,000) paid by the Corporation during 2002 with respect to a split-dollar insurance agreement.

- (g)

- This represents the present value of the economic benefit to Mr. T. Roth for the portion of the total premium ($60,000) paid by the Corporation during 2001 with respect to a split-dollar life insurance agreement.

- (h)

- This represents the present value of the economic benefit to Mr. T. Roth for the portion of the total premium ($60,000) paid by the Corporation during 2000 with respect to a split-dollar life insurance agreement.

- (i)

- Dr. Dittrich was hired by the Corporation in January of 2001.

- (j)

- Dr. Klein became a named executive officer during fiscal 2001. Dr. Klein was previously employed with the Corporation but retired in January 1999. During the period from retirement in January 1999 until his rehiring in June 2000, Dr. Klein served as a consultant to the Corporation and received payments of $62,500 in 1999 and $29,000 in 2000.

- (k)

- Subsequent to June 30, 2002, the salary for this officer was reduced by 25%.

9

Employment Arrangements

The Corporation maintains a key man life insurance policy on Duane Roth providing a death benefit of $4 million to the Corporation. The Corporation entered into a split-dollar insurance agreement as of November 11, 1998 with Duane Roth. Pursuant to the agreement, the Corporation and Duane Roth will share in the premium costs of a universal life insurance policy that pays a death benefit of not less that $8 million upon the death of Duane Roth. The Corporation pays the government table (PS-58) cost for $4 million of key person life coverage and is the beneficiary for this coverage. Mr. Roth contributes the government table (PS-58) cost for his share of the balance of the coverage. The portion of each annual premium that equals the annual increase in the cash value of the policy is also contributed by the Corporation. The Corporation can cause the agreement to be terminated and the policy to be surrendered at any time upon 30 days prior notice. Upon surrender of the policy or payment of the death benefit thereunder, the Corporation is also entitled to repayment of an amount equal to the cumulative premiums previously paid by the Corporation minus the cumulative amount allocated to the $4 million of key person coverage, with all remaining payments to be paid to Duane Roth or his beneficiaries. The Corporation has not paid any premiums on this insurance policy since December 2001, and currently does not intend to do so in the future.

The Corporation maintains a key man life insurance policy on Theodore D. Roth providing a death benefit of $4 million to the Corporation. The Corporation entered into a split-dollar insurance agreement as of November 11, 1998 with Theodore Roth. Pursuant to the agreement, the Corporation and Theodore Roth will share in the premium costs of a universal life insurance policy that pays a death benefit of not less that $4 million upon the death of Theodore Roth. The Corporation pays the government table (PS-58) cost for $4 million of key person life coverage and is the beneficiary for this coverage. Mr. Roth contributes the government table (PS-58) cost for his share of the balance of the coverage. The portion of each annual premium that equals the annual increase in the cash value of the policy is also contributed by the Corporation. The Corporation can cause the agreement to be terminated and the policy to be surrendered at any time upon 30 days prior notice. Upon surrender of the policy or payment of the death benefit thereunder, the Corporation is also entitled to repayment of an amount equal to the cumulative premiums previously paid by the Corporation minus the cumulative amount allocated to the $4 million of key person coverage, with all remaining payments to be paid to Theodore Roth or his beneficiaries. The Corporation has not paid any premiums on this insurance policy since December 2001, and currently does not intend to do so in the future.

Stock Option Grants and Exercises

The Corporation has granted options to its executive officers under its 1983 Incentive Stock Option Plan (which plan expired on October 1, 1993), its 1983 Non-Qualified Stock Option Program (which plan expired on February 24, 1999), its 1991 Stock Option Plan (which plan expired on November 7, 2001), its 2000 Stock Option Plan, and its 2001 Stock Option Plan. No stock appreciation rights ("SARs") have been granted by the Corporation.

10

The following table sets forth certain information concerning options granted during fiscal 2002 to the Named Executive Officers:

Option/SAR Grants in Last Fiscal Year

|

|---|

| | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (1)

|

|---|

Name

| | Securities

Underlying

Options/SARs

Granted (#) (2)

| | % of Total

Options/

SARs Granted

to Employees

in Fiscal Year

| | Exercise or

Base Price

($/Share) (4)

| | Expiration

Date

| | 5% ($)

| | 10% ($)

|

|---|

| Duane J. Roth | | 85,000 | (3) | 11.3 | % | 3.10 | | 11/6/11 | | 165,700 | | 420,000 |

| Theodore D. Roth | | 70,000 | (3) | 9.3 | % | 3.10 | | 11/6/11 | | 136,500 | | 345,800 |

| Howard C. Dittrich | | 50,000 | (3) | 6.6 | % | 3.10 | | 11/6/11 | | 97,500 | | 247,000 |

| N. Simon Faithfull | | 25,000 | (3) | 3.3 | % | 3.10 | | 11/6/11 | | 48,700 | | 123,500 |

| David H. Klein | | 35,000 | (3) | 4.7 | % | 3.10 | | 11/6/11 | | 68,200 | | 172,900 |

- (1)

- The dollar amounts under these columns are the result of calculations assuming that the price of Common Stock on the date of grant of the options increases at the hypothetical 5% and 10% rates set by the SEC and therefore are not intended to forecast possible future appreciation, if any, in the Corporation's stock price.

- (2)

- All options granted in 2002 to the Named Executive Officers were non-qualified stock options.

- (3)

- Options are exercisable in increments of 25% on date of issuance, 20% on each of the next three anniversaries, and 15% on the fourth anniversary.

- (4)

- The exercise price per share of the options granted represented at least the fair market value of the underlying shares on the date of grant. Options may be exercised by (i) paying the Corporation at least the par value of the shares of Common Stock being acquired, with the remainder of the exercise price to be borrowed from the Corporation, or (ii) by surrendering shares of Common Stock in payment of the exercise price and applicable withholding taxes. The Stock Option Plans provide that loans by the Corporation to pay the exercise price shall mature within five years (or earlier, in the event of a termination of employment or of a consultancy), shall be secured by the shares of Common Stock purchased, shall provide for quarterly payments of interest at such rate as the Board of Directors may determine, and are in such form and contain such other provisions as the Board of Directors may determine from time to time. As of August 29, 2002, the effective date of the Sarbanes-Oxley Act of 2002, the loans are no longer available to directors and officers of the Corporation.

The following table summarizes options exercised during fiscal 2002 and presents the value of unexercised options held by the Named Executive Officers at fiscal year end:

Aggregated Option/SAR Exercises in Last Fiscal Year and Fiscal Year-End Option/SAR Values

|

|---|

| | Shares Acquired on

Exercise (#)

| | Value

Realized ($)

| | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year End (#) Exercisable (E)/ Unexercisable (U)

| | Value of Unexercised In-The-Money Options/SARs at Fiscal Year End ($) Exercisable (E)/ Unexercisable (U)

|

|---|

| Duane J. Roth | | — | | — | | 218,721

103,350 | | (E)

(U) | | 0

0 | | (E)

(U) |

Theodore D. Roth |

|

— |

|

— |

|

108,160

88,500 |

|

(E)

(U) |

|

0

0 |

|

(E)

(U) |

Howard C. Dittrich |

|

—

— |

|

—

— |

|

20,000

45,000 |

|

(E)

(U) |

|

0

0 |

|

(E)

(U) |

N. Simon Faithfull |

|

— |

|

— |

|

39,900

29,550 |

|

(E)

(U) |

|

0

0 |

|

(E)

(U) |

David H. Klein |

|

— |

|

— |

|

33,434

37,216 |

|

(E)

(U) |

|

0

0 |

|

(E)

(U) |

11

Compensation Committee Report

The Compensation Committee of the Board of Directors (the "Committee") has provided the following report:

The Committee is composed entirely of outside, non-employee directors. The Committee determines the base salaries and the amount of bonus awards to be paid to the executive officers of the Corporation. In addition, the Committee recommends the number of the Corporation's stock option grants that should be made to executive officers and other employees of the Corporation. The following is a summary of policies of the Committee that affect the compensation paid to executive officers, as reflected in the tables and text set forth elsewhere in the proxy statement.

Executive Compensation Policy and Components of Compensation

The Committee's fundamental executive compensation philosophy is to enable the Corporation to attract and retain key executive personnel and to motivate those executives to achieve the Corporation's objectives. The Corporation is still in its research and development phase and has not yet achieved profitability. Therefore, traditional methods of evaluating executive performance, such as sales and profit levels, return on equity, and stock price, are inappropriate. Accordingly, assessment of each executive's performance is based upon attainment of his or her specific objectives in relation to the Corporation's overall annual strategic goals. The Committee may in its discretion apply different measures of performance for future fiscal years. However, it is presently contemplated that all compensation decisions will be designed to further the fundamental executive compensation philosophy described above.

Each executive officer's compensation package is reviewed annually and is comprised of three components: base salary, bonus, and stock option grants. In addition, executive officers of the Corporation are eligible to participate in all benefit programs generally available to other employees.

Base Salary

In setting the base salary levels of each executive officer, the Committee considers the base salaries of executive officers in comparable positions in other similarly situated biotechnology/pharmaceutical development companies. In setting levels, the Corporation currently targets the 75th percentile of the relevant labor market. Factors considered include company size, stage of development of a company's products, and geographical location. The Committee also considers the individual experience level and actual performance of each executive officer in view of the Corporation's needs and objectives. Salary decisions are determined in a structured annual review by the Committee with input from the Chief Executive Officer. Subsequent to June 30, 2002, the salaries of certain executive officers were reduced by 25%.

Bonuses

The Board of Directors has determined that, as in fiscal year 2001, there will be no cash bonuses for officers for fiscal year 2002.

Long-Term Stock-Based Incentive Compensation

Generally, the Corporation's Board of Directors or, if appointed, a stock option committee, approves annual grants of stock options to each of the Corporation's executive officers based upon recommendations from the Committee. The grants are designed to align the interest of each executive officer with those of the stockholders and provide each individual with a significant incentive to manage the Corporation from the perspective of an owner with an equity stake in the business. Each grant generally allows the officer to acquire shares of the Corporation's Common Stock at a fixed price per

12

share (the market price on the grant date) over a specified period of time (up to ten years), thus providing a return to the executive officer only if the market price of the shares appreciates over the option term. The size of the option grant to each executive officer generally is set as the Committee deems appropriate in order to retain and motivate key executive officers as well as to provide them with the perspective of the Corporation's stockholders in assessing corporate results. The grants also take into account comparable awards to individuals in similar positions at biotechnology/pharmaceutical development companies as reflected in external surveys, the individual's potential for future responsibility and promotion over the option term, the individual's personal performance in recent periods, and the risk attached to the future growth of the pharmaceutical industry. In making comparisons in the industry, the Corporation targets the 75th percentile of the relevant labor market.

The Committee, at its discretion, has the authority to utilize compensation consultants to assist in defining the relevant labor market for executive compensation and to recommend annual salary and bonus increases.

Duane J. Roth, Chief Executive Officer, although not a member of the Committee, assisted the Committee in developing the compensation packages awarded to executive officers other than himself.

CEO Compensation

In setting the compensation payable to the Corporation's Chief Executive Officer, the Committee sought to be competitive with other biotechnology/pharmaceutical development companies. In making comparisons, the Corporation targeted the 75th percentile of the relevant labor market. The Committee established Duane Roth's base salary based on an evaluation of his personal performance and the objective of having his base salary keep pace with salaries being paid to similarly situated chief executive officers. With respect to his base salary, it is the Committee's intent to provide him with a level of stability and certainty each year and not have this particular component of compensation affected to any significant degree by Corporation performance factors. The remaining component of his 2002 fiscal year compensation, however, was dependent upon performance and provided no dollar guarantees.

Section 162(m)

Section 162(m) of the Internal Revenue Code limits the deductibility by a publicly held corporation of compensation paid in a taxable year to the Chief Executive Officer and any other executive officer whose compensation is required to be reported in the Summary Compensation Table to $1 million. For the 2001 taxable year, the Corporation did not reach and, therefore was not affected by, this limitation.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee is a former or current officer or employee of the Corporation or any of its subsidiaries.

Members of the Compensation Committee of the Board of Directors

Donald E. O'Neill, Chairman |

|

Dr. Helen M. Ranney |

Dr. Pedro Cuatrecasas |

|

Stephen M. McGrath |

13

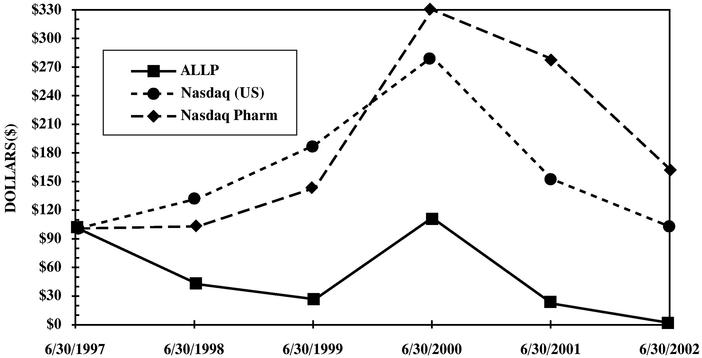

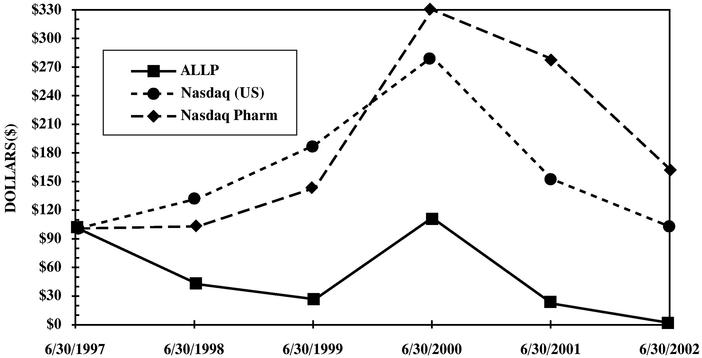

Stock Performance Graph

The following graph compares the cumulative total stockholder return to the Corporation's stockholders during the five-year period ended June 30, 2002, as well as with that of an overall stock market index (Nasdaq) and a published industry index (Nasdaq Pharmaceutical):

2. OTHER BUSINESS

Management knows of no other matters that may be presented to the Meeting. However, if any other matter properly comes before the Meeting, it is intended that proxies in the accompanying form will be voted in accordance with the judgment of the persons named therein.

FUTURE PROPOSALS BY STOCKHOLDERS

Any proposal which a stockholder of the Corporation wishes to have included in the proxy statement and proxy relating to the Corporation's 2003 Annual Meeting, pursuant to the provisions of Rule 14a-8 under the Securities Exchange Act of 1934, must be received by the Corporation at its executive offices no later than May 16, 2003, and must otherwise comply with the requirements of Rule 14a-8. Stockholder proposals submitted outside the processes of Rule 14a-8 will also be considered untimely if submitted after May 16, 2003. The address of the Corporation's executive office is 6175 Lusk Boulevard, San Diego, California 92121.

INFORMATION INCORPORATED BY REFERENCE

Audited financial statements, management's discussion and analysis of financial condition and results of operations, and quantitative and qualitative disclosures about market risk are incorporated by reference herein to the Annual Report to Stockholders accompanying this proxy statement.

ANNUAL REPORT ON FORM 10-K

The Corporation will furnish, without charge, a copy of its most recent Annual Report to the SEC on Form 10-K, including the financial statements, to each person solicited hereunder who mails a written request therefor to Alliance Pharmaceutical Corp., 6175 Lusk Boulevard, San Diego, California 92121, Attention: Tim T. Hart, Vice President and Chief Financial Officer. The Corporation will also furnish, upon the payment of a reasonable fee to cover reproduction and mailing expenses, a copy of all exhibits to such Annual Report on Form 10-K.

14

It is important that your shares be represented at the Meeting. If you are unable to be present in person, you are respectfully requested to sign the enclosed proxy and return it in the enclosed stamped, addressed envelope as promptly as possible.

| Dated: | | San Diego, California

September 26, 2002 |

15

PROXY

ALLIANCE PHARMACEUTICAL CORP.

2002 Annual Meeting of Stockholders to be held November 12, 2002

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned, revoking any proxy heretofore given, hereby appoints Carroll O. Johnson, Stephen M. McGrath and Duane J. Roth, and each of them the proxies of the undersigned with full power of substitution, with respect to all of the shares of stock of ALLIANCE PHARMACEUTICAL CORP., a New York corporation (the "Corporation"), which the undersigned is entitled to vote at the Corporation's Annual Meeting of Stockholders to be held at 10:00 a.m., San Diego time at on Tuesday, November 12, 2002, and at any adjournment thereof.

(Continued, and to be marked, dated and signed, on the reverse side)

SEE REVERSE

SIDE

DETACH HERE

- ý

- Please mark

vote as in this

example

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR ALL NOMINEES LISTED IN PROPOSAL 1 AND FOR PROPOSAL 2.

- 1.

- ELECTION OF DIRECTORS: To elect the eight (8) nominees for Director listed below.

- o

- FOR ALL NOMINEES LISTED BELOW

(Instruction: to withhold authority to vote for any individual nominee, strike a line through the nominee's name in the list below.) Nominees:

| Dr. Pedro Cuatrecasas | | Theodore D. Roth |

Carroll O. Johnson |

|

Stephen M. McGrath |

Donald E. O'Neill |

|

Dr. Helen M. Ranney |

Dr. Jean G. Riess |

|

Duane J. Roth |

- 2.

- In their discretion, upon any other matters which may properly come before the meeting or any adjournment thereof.

Receipt of the Notice of Annual Meeting and of the Proxy Statement and Annual Report to Stockholders of the Corporation is hereby acknowledged.

- 3.

- PLEASE DATE, SIGN AND RETURN THIS PROXY PROMPTLY USING THE ENCLOSED ENVELOPE.

Your signature should appear the same as your name appears hereon. If signing as attorney, executor, administrator, trustee or guardian, please indicate the capacity in which signing. When signing as joint tenants, all parties to the joint tenancy must sign. When the proxy is given by a corporation, it should be signed by an authorized officer.

Signature Date

QuickLinks

GENERAL INFORMATIONSOLICITATION AND REVOCATION1. ELECTION OF DIRECTORSThe Board of Directors recommends a vote FOR each named nominee.OWNERSHIP OF VOTING SECURITIES BY CERTAIN BENEFICIAL OWNERS AND MANAGEMENTCommon StockMembers of the Compensation Committee of the Board of Directors2. OTHER BUSINESSFUTURE PROPOSALS BY STOCKHOLDERSALLIANCE PHARMACEUTICAL CORP.(Continued, and to be marked, dated and signed, on the reverse side)