2014 Annual Shareholders Meeting

2014 Annual Shareholders MeetingForward Looking Statements

This presentation contains forward-looking statements relating to the financial condition, results of operations and business of LNB Bancorp, Inc., including certain plans, expectations, goals and statements which are subject to numerous assumptions, risks and uncertainties. Actual results could differ materially from those indicated by such statements for a variety of reasons. Among the important factors that could cause actual results to differ materially from those indicated are movements in interest rates, changes in the mix of the Company’s business, competitive pressures, changes in general economic conditions, the nature, extent and timing of governmental actions and reforms and the risk factors detailed in the Company’s 2013 Annual Report on Form 10-K and subsequent current and periodic reports and registration statements filed with the Securities and Exchange Commission. All forward-looking statements included in this presentation are based on information available as of the date hereof. LNB Bancorp, Inc. undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this presentation.

2013 Performance TARP Preferred Shares Redeemed Commitment to Growth Dividend Update Community Involvement 2014 First Quarter Results Today’s Discussion

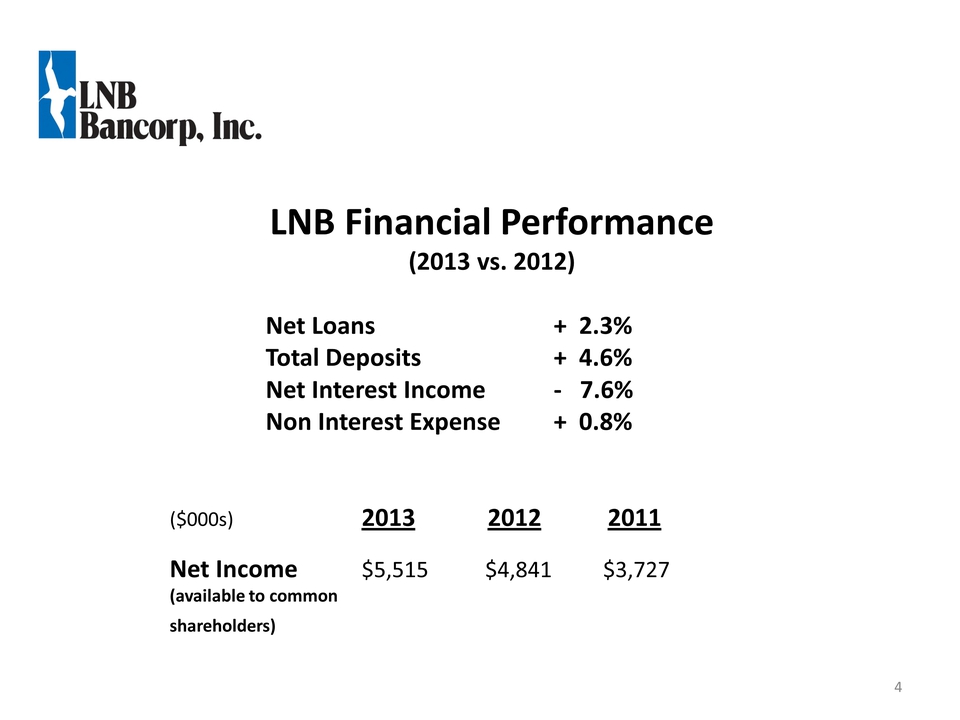

LNB Financial Performance (2013 vs. 2012) Net Loans + 2.3% Total Deposits + 4.6% Net Interest Income - 7.6% Non Interest Expense + 0.8% ($000s) 2013 2012 2011 Net Income $5,515 $4,841 $3,727 (available to common shareholders)4

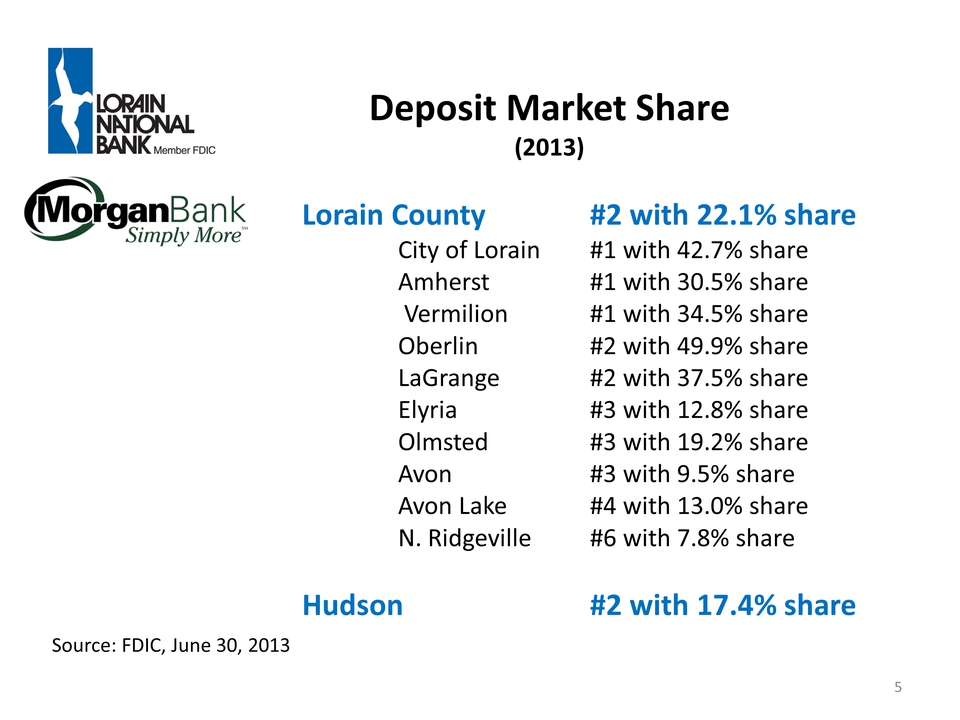

Deposit Market Share (2013) Lorain County #2 with 22.1% share City of Lorain #1 with 42.7% share Amherst #1 with 30.5% share Vermilion #1 with 34.5% share Oberlin #2 with 49.9% share LaGrange #2 with 37.5% share Elyria #3 with 12.8% share Olmsted #3 with 19.2% share Avon #3 with 9.5% share Avon Lake #4 with 13.0% share N. Ridgeville #6 with 7.8% share Hudson #2 with 17.4% share 5 Source: FDIC, June 30, 2013

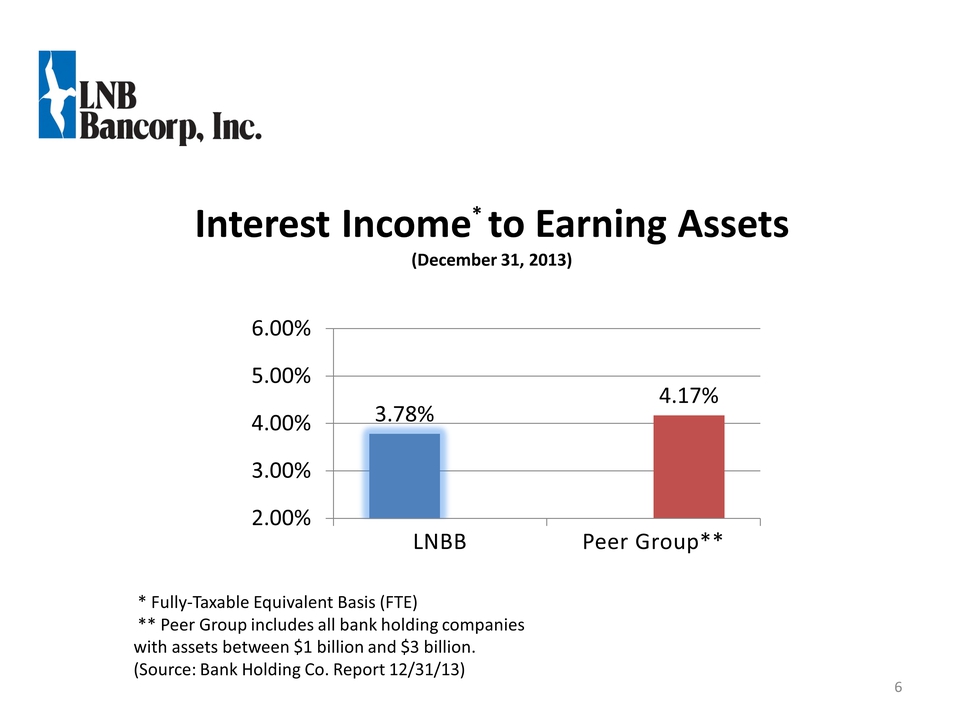

3.78% 4.17% 2.00% 3.00% 4.00% 5.00% 6.00% Interest Income* to Earning Assets (December 31, 2013) Other Placeholder: 6 * Fully-Taxable Equivalent Basis (FTE) ** Peer Group includes all bank holding companies with assets between $1 billion and $3 billion. (Source: Bank Holding Co. Report 12/31/13)

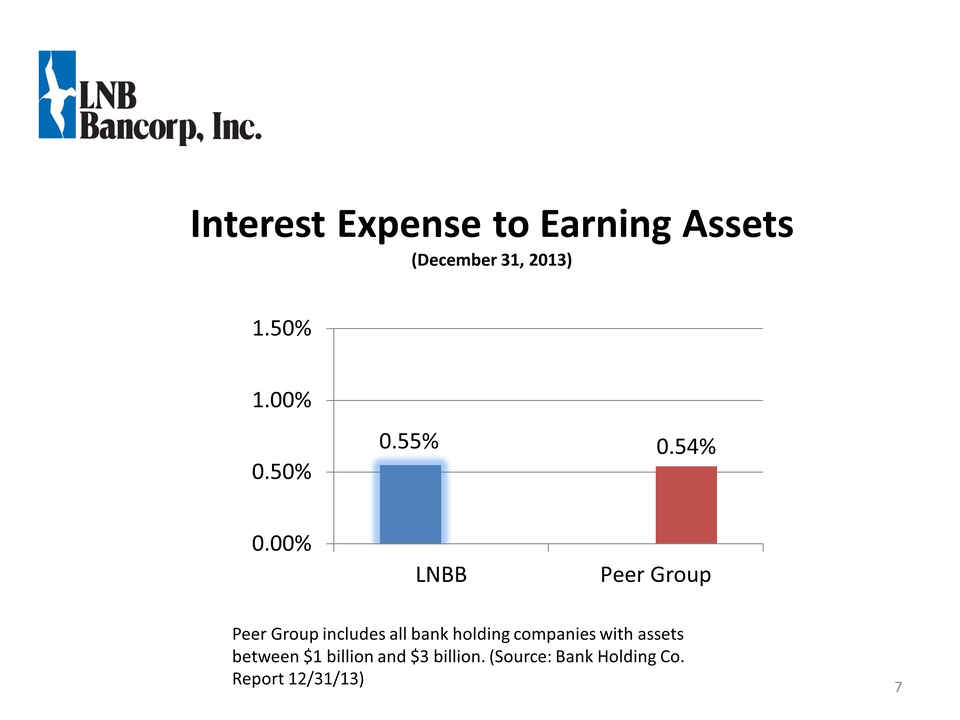

0.55% 0.54% 0.00% 0.50% 1.00% 1.50% LNBB Interest Expense to Earning Assets (December 31, 2013) Other Placeholder: 7 Peer Group includes all bank holding companies with assets between $1 billion and $3 billion. (Source: Bank Holding Co. Report 12/31/13)

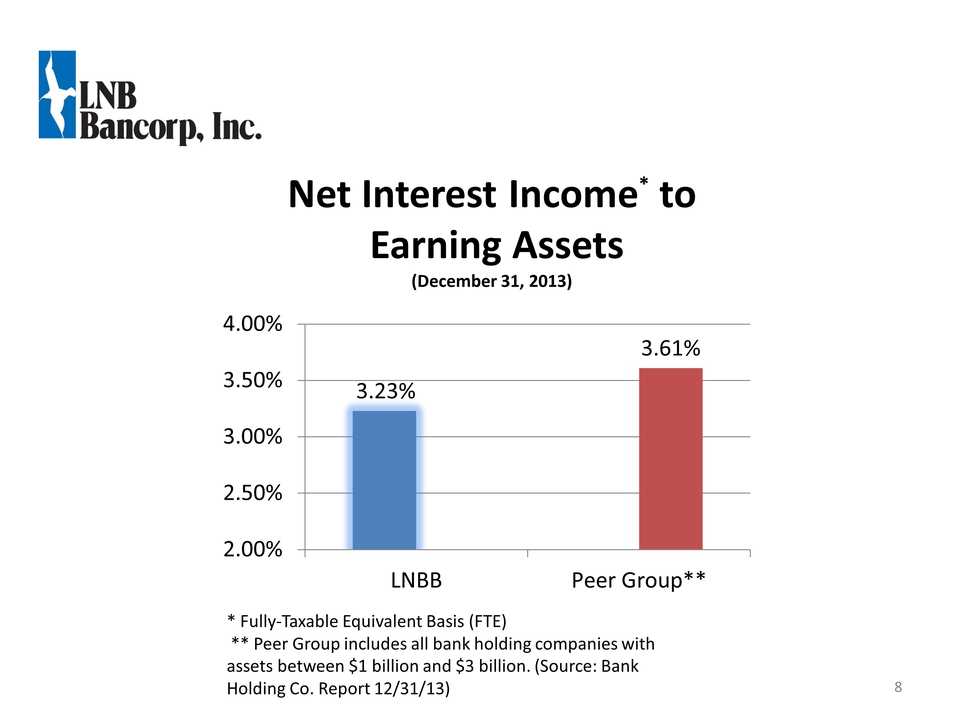

Net Interest Income* to Earning Assets (December 31, 2013) 3.23% 3.61% 2.00% 2.50% 3.00% 3.50% 4.00% LNBB Net Interest Income* to Earning Assets (December 31, 2013) Other Placeholder: 8 * Fully-Taxable Equivalent Basis (FTE) ** Peer Group includes all bank holding companies with assets between $1 billion and $3 billion. (Source: Bank Holding Co. Report 12/31/13)

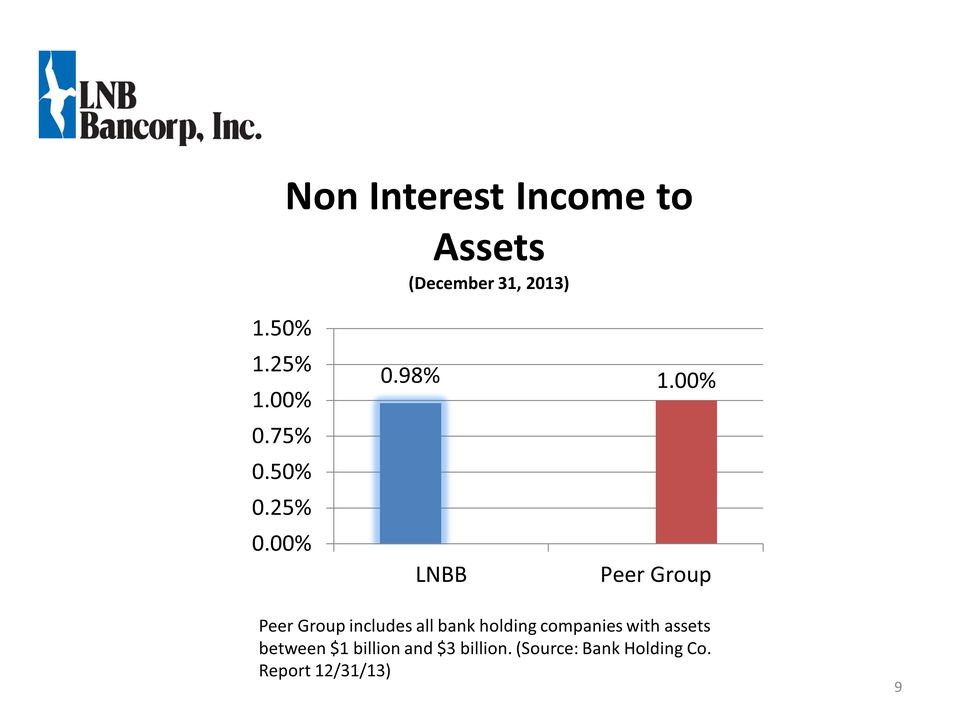

0.98% 1.00% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50% LNBB Non Interest Income to Assets (December 31, 2013) Other Placeholder: 9 Peer Group includes all bank holding companies with assets between $1 billion and $3 billion. (Source: Bank Holding Co. Report 12/31/13)

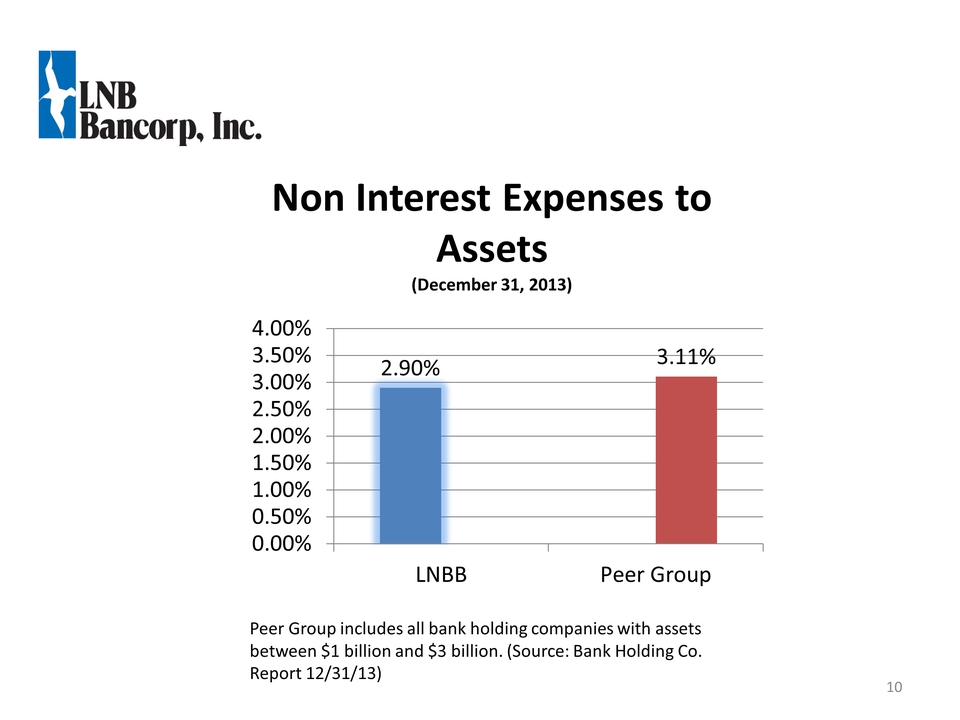

2.90% 3.11% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% LNBB Non Interest Expenses to Assets (December 31, 2013) Other Placeholder: 10 Peer Group includes all bank holding companies with assets between $1 billion and $3 billion. (Source: Bank Holding Co. Report 12/31/13)

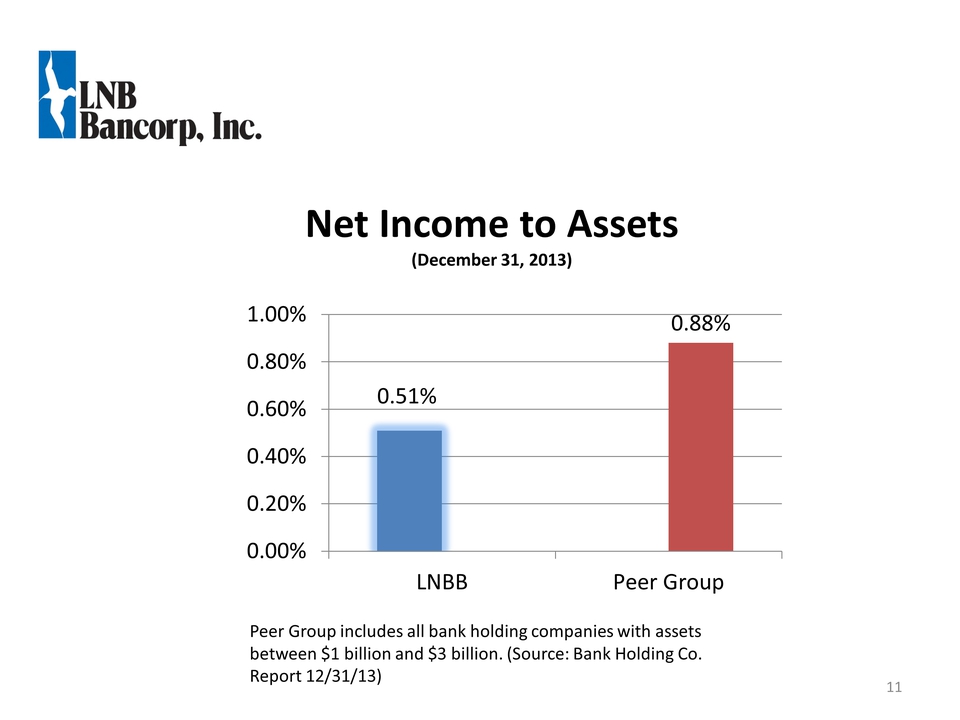

0.51% 0.88% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% LNBB Net Income to Assets (December 31, 2013) 11 Peer Group includes all bank holding companies with assets between $1 billion and $3 billion. (Source: Bank Holding Co. Report 12/31/13)

Credit Quality 12

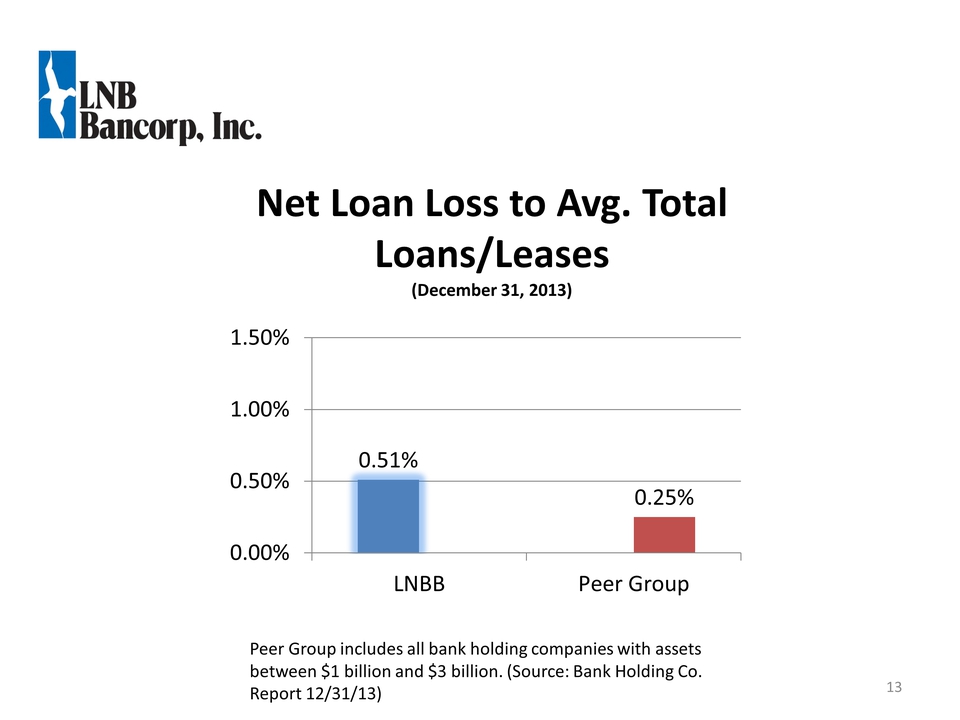

0.51% 0.25% 0.00% 0.50% 1.00% 1.50% LNBB Net Loan Loss to Avg. Total Loans/Leases (December 31, 2013) Other Placeholder: 13 Peer Group includes all bank holding companies with assets between $1 billion and $3 billion. (Source: Bank Holding Co. Report 12/31/13)

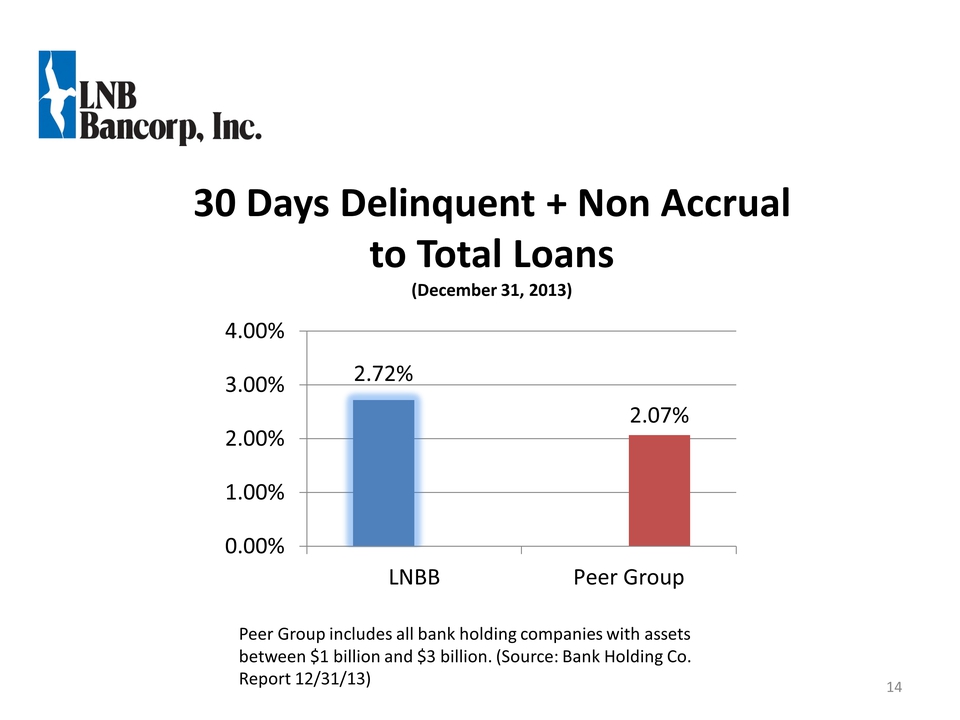

0.00% 1.00% 2.00% 3.00% 4.00% 2.72% 2.07% LNBB 30 Days Delinquent + Non Accrual to Total Loan (December 31, 2013) 14 Peer Group includes all bank holding companies with assets between $1 billion and $3 billion. (Source: Bank Holding Co. Report 12/31/13)

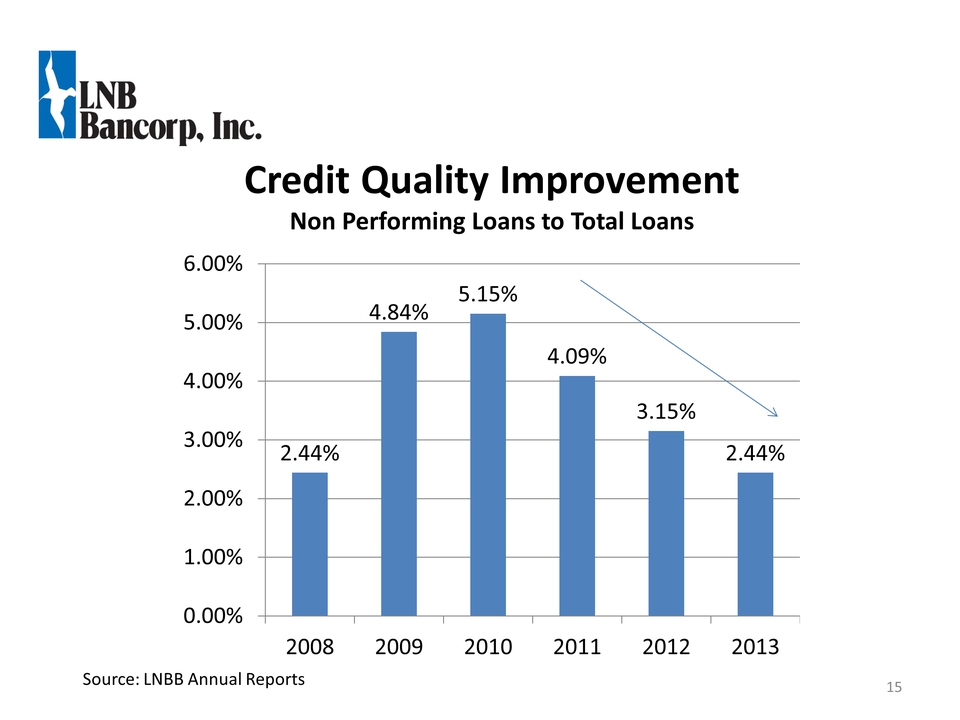

Credit Quality Improvement Non Performing Loans to Total Loans 15 2.44% 4.84% 5.15% 4.09% 3.15% 2.44% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 2008 2009 2010 2011 2012 2013 Credit Quality Improvement Non Performing Loans to Total Loans Other Placeholder: 15 Source: LNBB Annual Reports

Today’s Discussion TARP Preferred Shares Redeemed Other Placeholder: 16

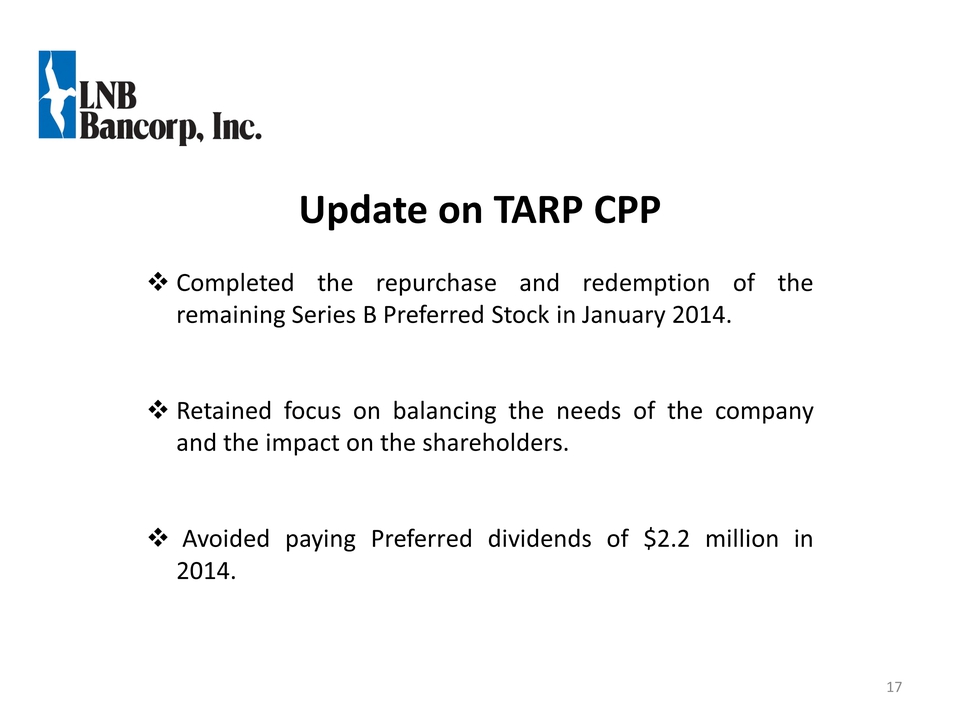

Other Placeholder: 17 Completed the repurchase and redemption of the remaining Series B Preferred Stock in January 2014. Retained focus on balancing the needs of the company and the impact on the shareholders. Avoided paying Preferred dividends of $2.2 million in 2014. Update on TARP CPP

Today’s Discussion Commitment to Growth 18

Commitment to Growth New SBA Lending Group Sourcing business loans from Medical, Dental, Veterinarian and Funeral Home operations in: Ohio, Indiana, Michigan, Virginia, West Virginia, New York, Kentucky, Illinois, Tennessee Started in 4Q 2013 Contributed $12.6 million in loan production through March 31st 4 loan officers and 1 credit underwriter Other Placeholder: 19

Today’s Discussion Dividend Update 20

Dividend Update Other Placeholder: 21 Board conducts regular reviews of bank’s earnings and capital requirements. The factors that are considered in making a dividend determination are: Regulatory capital requirements Ability to meet capital obligations Federal Reserve policy preference for dividends to be paid out of current operating earnings. Any decision to increase common stock dividend would weigh all factors and balance the need to maintain a strong capital position with the objectives of building shareholder value and protecting the interests of our shareholders.

Today’s Discussion Community Involvement 22

Activities in the Community Other Placeholder: 23 1,500+ hours of volunteer time Clothe-a-Child Catholic Charities Second Harvest Food Drive Special Olympics Girl Scouts of NEO Employees volunteering at Second Harvest Food Bank

Activities in the Community Other Placeholder: 24 Main Street Vermilion Amer. Heart Assoc. Walk Leukemia & Lymphoma Society Lorain Schools Main Street Oberlin Blessing House Neighborhood Alliance Lorain Co. & Summit Co. Habitat for Humanity Hudson Community Foundation Lorain Youth Baseball

Today’s Discussion First Quarter 2014 Results 25

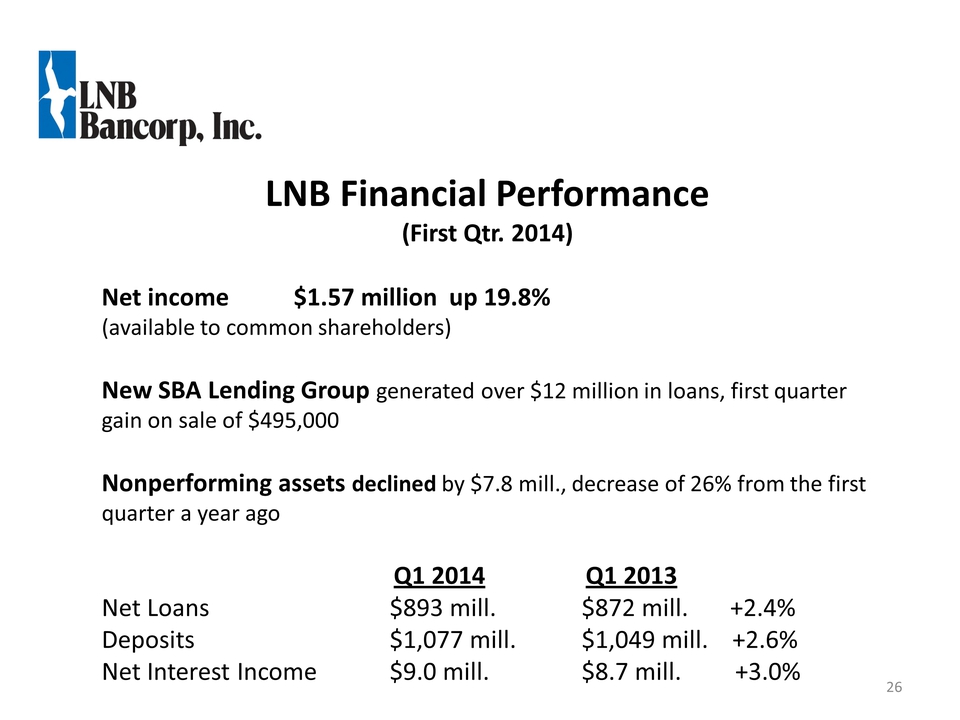

LNB Financial Performance (First Qtr. 2014) Net income $1.57 million up 19.8% (available to common shareholders) New SBA Lending Group generated over $12 million in loans, first quarter gain on sale of $495,000 Nonperforming assets declined by $7.8 mill., decrease of 26% from the first quarter a year ago Q1 2014 Q1 2013 Net Loans $893 mill. $872 mill. +2.4% Deposits $1,077 mill. $1,049 mill. +2.6% Net Interest Income $9.0 mill. $8.7 mill. +3.0% 26

Questions? 27

Honoring Jim Kidd Creation of the “James Kidd Scholarship in Allied Health” at Lorain County Community College. Initial funding and 5 year pledge from LNB totaling $50,000. Preference for scholarships to students with a 3.0 GPA or better, who are studying a health field and plan to continue studies in medicine. First scholarship to be awarded in 2015. Open to additional contributions from friends, family and the community.