UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-03940

BNY Mellon Strategic Funds, Inc.

(Exact Name of Registrant as Specified in Charter)

c/o BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, New York 10286

(Address of Principal Executive Offices) (Zip Code)

Deirdre Cunnane, Esq.

240 Greenwich Street

New York, New York 10286

(Name and Address of Agent for Service)

Registrant's Telephone Number, including Area Code: (212) 922-6400

Date of fiscal year end: 12/31

Date of reporting period: 06/30/24

The following N-CSR relates only to the Registrant's series listed below and does not relate to any series of the Registrant with a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR will be filed for any series with a different fiscal year end, as appropriate.

BNY Mellon Active MidCap Fund

FORM N-CSR

Item 1. Reports to Stockholders.

| | |

BNY Mellon Active MidCap Fund | SEMI-ANNUAL

SHAREHOLDER

REPORT JUNE 30, 2024 |

| | |

Class A – DNLDX

This semi-annual shareholder report contains important information about BNY Mellon Active MidCap Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class A* | $50 | 0.98%** |

| | |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

** | Annualized |

KEY FUND STATISTICS (AS OF 6/30/24)

| | | |

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$434 | 241 | 31.53% |

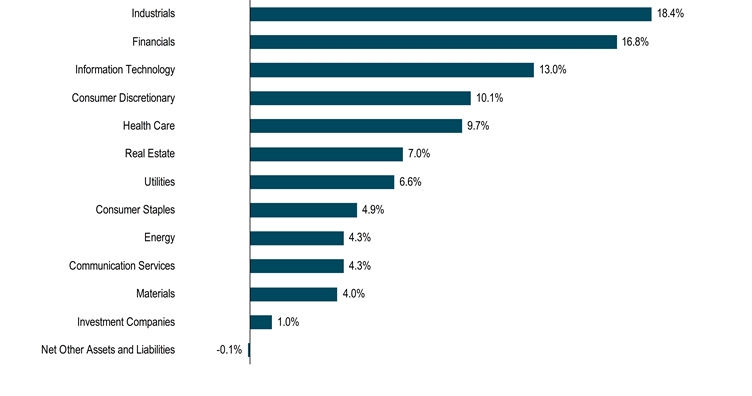

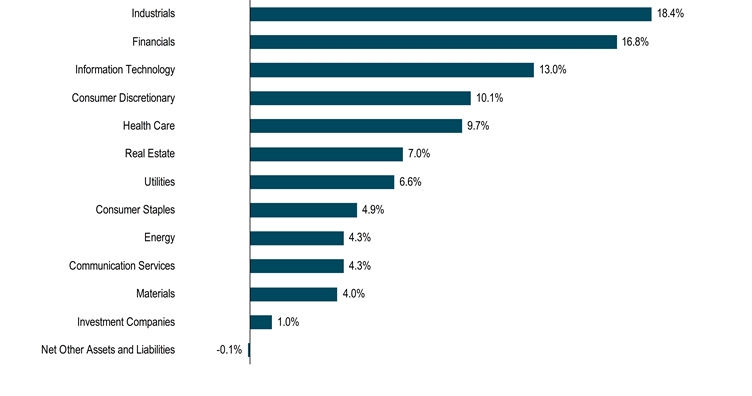

Portfolio Holdings (as of 6/30/24)

Top Ten Holdings (Based on Net Assets)*

![LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1) LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1)](https://capedge.com/proxy/N-CSRS/0001741773-24-003594/img_6dea2ae4de0d4f2.jpg)

* Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Sector Allocation (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit im.bnymellon.com/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10281

Code-0085SA0624 |

|

| | |

BNY Mellon Active MidCap Fund | SEMI-ANNUAL

SHAREHOLDER

REPORT JUNE 30, 2024 |

| | |

Class C – DNLCX

This semi-annual shareholder report contains important information about BNY Mellon Active MidCap Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class C* | $88 | 1.74%** |

| | |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

** | Annualized |

KEY FUND STATISTICS (AS OF 6/30/24)

| | | |

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$434 | 241 | 31.53% |

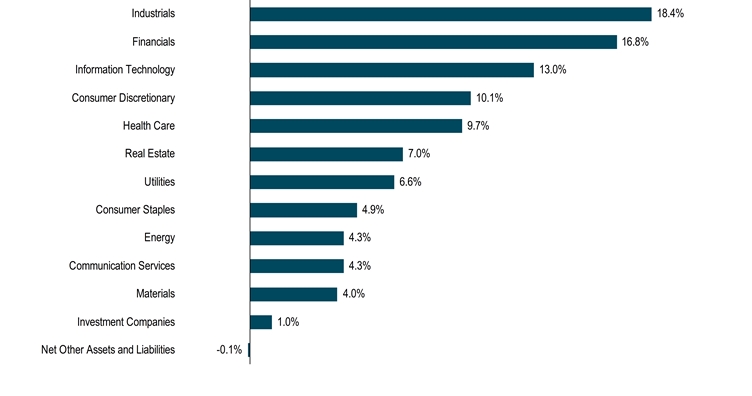

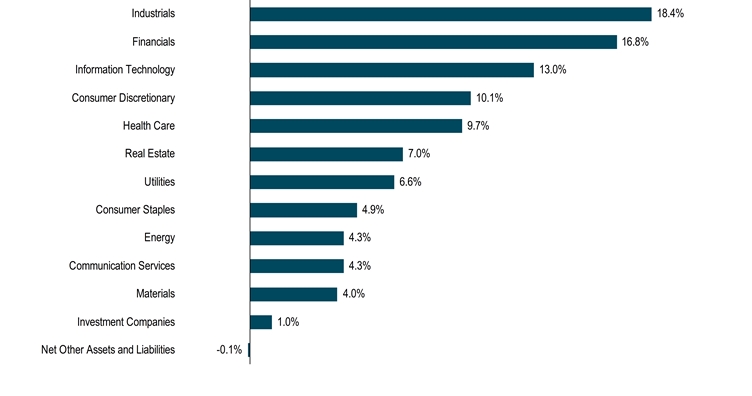

Portfolio Holdings (as of 6/30/24)

Top Ten Holdings (Based on Net Assets)*

![LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1) LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1)](https://capedge.com/proxy/N-CSRS/0001741773-24-003594/img_aaef57828aa94f2.jpg)

* Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Sector Allocation (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit im.bnymellon.com/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10281

Code-0271SA0624 |

|

| | |

BNY Mellon Active MidCap Fund | SEMI-ANNUAL

SHAREHOLDER

REPORT JUNE 30, 2024 |

| | |

Class I – DNLRX

This semi-annual shareholder report contains important information about BNY Mellon Active MidCap Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class I* | $37 | 0.73%** |

| | |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

** | Annualized |

KEY FUND STATISTICS (AS OF 6/30/24)

| | | |

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$434 | 241 | 31.53% |

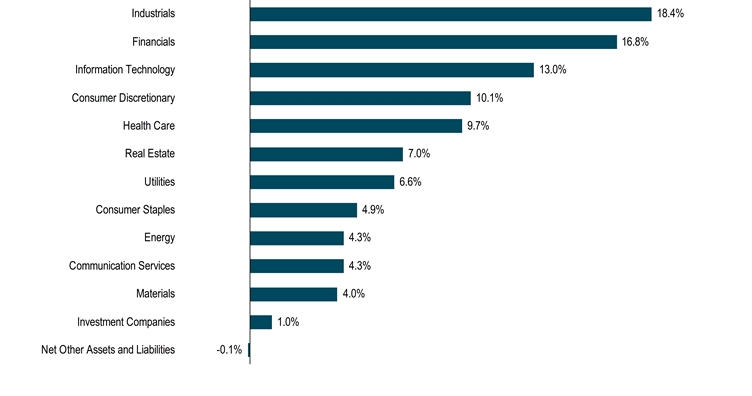

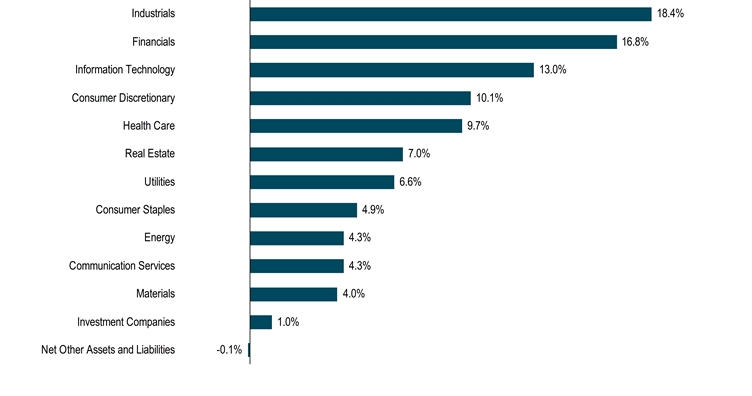

Portfolio Holdings (as of 6/30/24)

Top Ten Holdings (Based on Net Assets)*

![LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1) LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1)](https://capedge.com/proxy/N-CSRS/0001741773-24-003594/img_b8498b5e77144f2.jpg)

* Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Sector Allocation (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit im.bnymellon.com/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10281

Code-0272SA0624 |

|

| | |

BNY Mellon Active MidCap Fund | SEMI-ANNUAL

SHAREHOLDER

REPORT JUNE 30, 2024 |

| | |

Class Y – DNLYX

This semi-annual shareholder report contains important information about BNY Mellon Active MidCap Fund (the “Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at im.bnymellon.com/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bnymellon.com.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| | | |

Share Class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

Class Y* | $38 | 0.75%** |

| | |

* | During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

** | Annualized |

KEY FUND STATISTICS (AS OF 6/30/24)

| | | |

Fund Size (Millions) | Number of Holdings | Portfolio Turnover |

$434 | 241 | 31.53% |

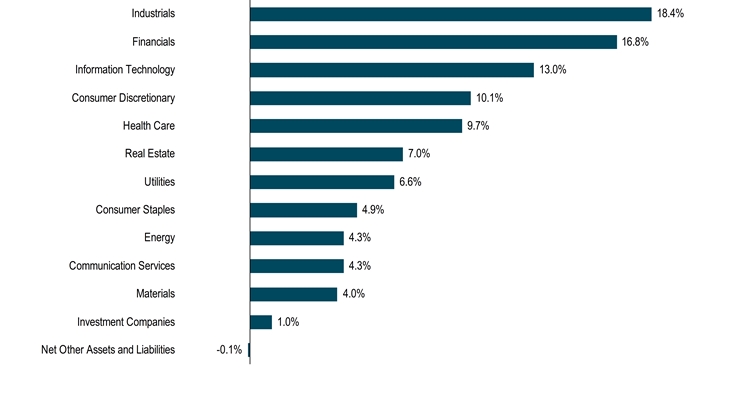

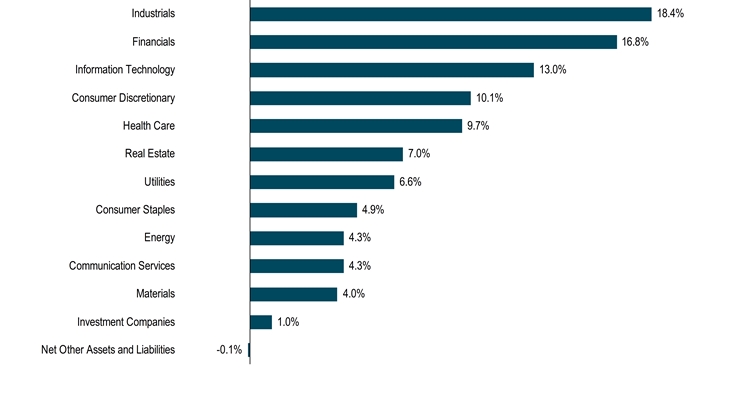

Portfolio Holdings (as of 6/30/24)

Top Ten Holdings (Based on Net Assets)*

![LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1) LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1)](https://capedge.com/proxy/N-CSRS/0001741773-24-003594/img_25dadd8ee8de4f2.jpg)

* Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

| | | |

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value | |

|

Sector Allocation (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information, portfolio holdings and proxy voting information, please visit im.bnymellon.com/literaturecenter.

| | |

© 2024 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, NewYork, NY 10281

Code-0011SA0624 |

|

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

Not applicable.

BNY Mellon Active MidCap Fund

| |

SEMI-ANNUAL FINANCIALS AND OTHER INFORMATION June 30, 2024 |

| | |

Class | Ticker |

A | DNLDX |

C | DNLCX |

I | DNLRX |

Y | DNLYX |

| |

IMPORTANT NOTICE – CHANGES TO ANNUAL AND SEMI-ANNUAL REPORTS The Securities and Exchange Commission (the “SEC”) has adopted rule and form amendments which have resulted in changes to the design and delivery of annual and semi-annual fund reports (“Reports”). Reports are now streamlined to highlight key information. Certain information previously included in Reports, including financial statements, no longer appear in the Reports but will be available online within the Semi-Annual and Annual Financials and Other Information, delivered free of charge to shareholders upon request, and filed with the SEC. |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.im.bnymellon.com and sign up for eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager(s) only through the end of the period covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon Family of Funds. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

Please note the Semi-Annual Financials and Other Information only contains Items 7-11 required in

Form N-CSR. All other required items will be filed with the SEC.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

BNY Mellon Active MidCap Fund

Statement of Investments

June 30, 2024 (Unaudited)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.1% | | | | | |

Automobiles & Components - .8% | | | | | |

Adient PLC | | | | 36,809 | a | 909,550 | |

Aptiv PLC | | | | 40,021 | a | 2,818,279 | |

| | | | | 3,727,829 | |

Banks - 2.0% | | | | | |

Fifth Third Bancorp | | | | 137,849 | | 5,030,110 | |

First Citizens Bancshares, Inc., Cl. A | | | | 985 | | 1,658,356 | |

Popular, Inc. | | | | 11,596 | | 1,025,434 | |

Zions Bancorp NA | | | | 26,395 | | 1,144,751 | |

| | | | | 8,858,651 | |

Capital Goods - 15.0% | | | | | |

A.O. Smith Corp. | | | | 26,600 | | 2,175,348 | |

Acuity Brands, Inc. | | | | 7,711 | | 1,861,744 | |

Advanced Drainage Systems, Inc. | | | | 5,161 | | 827,773 | |

Armstrong World Industries, Inc. | | | | 13,310 | | 1,507,224 | |

Axon Enterprise, Inc. | | | | 7,184 | a | 2,113,820 | |

Carlisle Cos., Inc. | | | | 8,376 | | 3,394,039 | |

Donaldson Co., Inc. | | | | 19,877 | | 1,422,398 | |

EMCOR Group, Inc. | | | | 17,828 | | 6,508,646 | |

Ferguson PLC | | | | 13,431 | | 2,600,913 | |

Fortune Brands Innovations, Inc. | | | | 25,791 | | 1,674,868 | |

Generac Holdings, Inc. | | | | 29,276 | a | 3,870,873 | |

Ingersoll Rand, Inc. | | | | 42,665 | | 3,875,689 | |

ITT, Inc. | | | | 23,041 | | 2,976,436 | |

Kennametal, Inc. | | | | 54,987 | | 1,294,394 | |

Lincoln Electric Holdings, Inc. | | | | 14,954 | | 2,820,923 | |

Masco Corp. | | | | 24,571 | | 1,638,149 | |

MSC Industrial Direct Co., Inc., Cl. A | | | | 10,760 | | 853,376 | |

Parker-Hannifin Corp. | | | | 6,408 | | 3,241,230 | |

Simpson Manufacturing Co., Inc. | | | | 9,054 | | 1,525,871 | |

Textron, Inc. | | | | 17,553 | | 1,507,101 | |

The AZEK Company, Inc. | | | | 26,690 | a | 1,124,450 | |

The Middleby Corp. | | | | 7,467 | a | 915,529 | |

The Timken Company | | | | 20,821 | | 1,668,387 | |

Trane Technologies PLC | | | | 11,492 | | 3,780,064 | |

United Rentals, Inc. | | | | 4,888 | | 3,161,216 | |

Vertiv Holdings Co., Cl. A | | | | 21,488 | | 1,860,216 | |

W.W. Grainger, Inc. | | | | 4,271 | | 3,853,467 | |

Watts Water Technologies, Inc., Cl. A | | | | 6,562 | | 1,203,274 | |

| | | | | 65,257,418 | |

Commercial & Professional Services - 3.0% | | | | | |

Broadridge Financial Solutions, Inc. | | | | 6,985 | | 1,376,045 | |

Clarivate PLC | | | | 113,872 | a,b | 647,932 | |

Dayforce, Inc. | | | | 23,787 | a | 1,179,835 | |

Jacobs Solutions, Inc. | | | | 31,219 | | 4,361,606 | |

Paychex, Inc. | | | | 22,916 | | 2,716,921 | |

Paycom Software, Inc. | | | | 4,823 | | 689,882 | |

3

Statement of Investments (Unaudited) (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.1% (continued) | | | | | |

Commercial & Professional Services - 3.0% (continued) | | | | | |

Robert Half, Inc. | | | | 30,029 | | 1,921,255 | |

| | | | | 12,893,476 | |

Consumer Discretionary Distribution & Retail - 3.6% | | | | | |

AutoZone, Inc. | | | | 494 | a | 1,464,265 | |

Bath & Body Works, Inc. | | | | 24,027 | | 938,254 | |

Best Buy Co., Inc. | | | | 12,437 | | 1,048,315 | |

eBay, Inc. | | | | 42,644 | | 2,290,836 | |

Etsy, Inc. | | | | 22,022 | a | 1,298,858 | |

Kohl's Corp. | | | | 31,600 | | 726,484 | |

O'Reilly Automotive, Inc. | | | | 2,022 | a | 2,135,353 | |

Ross Stores, Inc. | | | | 24,052 | | 3,495,237 | |

The Gap, Inc. | | | | 35,806 | | 855,405 | |

Williams-Sonoma, Inc. | | | | 4,545 | b | 1,283,372 | |

| | | | | 15,536,379 | |

Consumer Durables & Apparel - 3.0% | | | | | |

Carter's, Inc. | | | | 12,495 | | 774,315 | |

Crocs, Inc. | | | | 6,536 | a | 953,864 | |

D.R. Horton, Inc. | | | | 8,127 | | 1,145,338 | |

Deckers Outdoor Corp. | | | | 1,735 | a | 1,679,393 | |

Helen of Troy Ltd. | | | | 8,168 | a | 757,500 | |

PulteGroup, Inc. | | | | 11,081 | | 1,220,018 | |

Ralph Lauren Corp. | | | | 9,603 | | 1,681,101 | |

Skechers USA, Inc., Cl. A | | | | 16,945 | a | 1,171,238 | |

Tapestry, Inc. | | | | 31,827 | | 1,361,877 | |

TopBuild Corp. | | | | 3,974 | a | 1,531,063 | |

Whirlpool Corp. | | | | 7,859 | | 803,190 | |

| | | | | 13,078,897 | |

Consumer Services - 2.7% | | | | | |

Boyd Gaming Corp. | | | | 9,519 | | 524,497 | |

Chipotle Mexican Grill, Inc. | | | | 35,650 | a | 2,233,472 | |

Darden Restaurants, Inc. | | | | 4,544 | | 687,598 | |

Expedia Group, Inc. | | | | 12,157 | a | 1,531,660 | |

Grand Canyon Education, Inc. | | | | 17,504 | a | 2,448,985 | |

MGM Resorts International | | | | 41,884 | a | 1,861,325 | |

Royal Caribbean Cruises Ltd. | | | | 15,246 | a | 2,430,670 | |

| | | | | 11,718,207 | |

Consumer Staples Distribution & Retail - 1.7% | | | | | |

Dollar Tree, Inc. | | | | 6,427 | a | 686,211 | |

Performance Food Group Co. | | | | 17,726 | a | 1,171,866 | |

Sprouts Farmers Market, Inc. | | | | 22,816 | a | 1,908,787 | |

The Kroger Company | | | | 21,100 | | 1,053,523 | |

US Foods Holding Corp. | | | | 45,062 | a | 2,387,385 | |

| | | | | 7,207,772 | |

Energy - 4.3% | | | | | |

ChampionX Corp. | | | | 51,709 | | 1,717,256 | |

Cheniere Energy, Inc. | | | | 4,072 | | 711,908 | |

CNX Resources Corp. | | | | 46,952 | a,b | 1,140,934 | |

Diamondback Energy, Inc. | | | | 6,900 | | 1,381,311 | |

Halliburton Co. | | | | 96,605 | | 3,263,317 | |

Matador Resources Co. | | | | 20,087 | | 1,197,185 | |

Murphy Oil Corp. | | | | 41,822 | | 1,724,739 | |

4

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.1% (continued) | | | | | |

Energy - 4.3% (continued) | | | | | |

Phillips 66 | | | | 48,611 | | 6,862,415 | |

Valaris Ltd. | | | | 8,916 | a,b | 664,242 | |

| | | | | 18,663,307 | |

Equity Real Estate Investment Trusts - 7.0% | | | | | |

Brixmor Property Group, Inc. | | | | 144,060 | c | 3,326,345 | |

BXP, Inc. | | | | 21,430 | c | 1,319,231 | |

Douglas Emmett, Inc. | | | | 61,585 | b,c | 819,696 | |

EastGroup Properties, Inc. | | | | 11,785 | c | 2,004,628 | |

Essex Property Trust, Inc. | | | | 11,757 | c | 3,200,255 | |

First Industrial Realty Trust, Inc. | | | | 46,582 | c | 2,213,111 | |

Host Hotels & Resorts, Inc. | | | | 38,528 | c | 692,733 | |

Invitation Homes, Inc. | | | | 48,237 | c | 1,731,226 | |

Kilroy Realty Corp. | | | | 56,462 | c | 1,759,921 | |

Lamar Advertising Co., Cl. A | | | | 12,785 | c | 1,528,191 | |

Mid-America Apartment Communities, Inc. | | | | 28,492 | c | 4,063,244 | |

NNN REIT, Inc. | | | | 69,963 | c | 2,980,424 | |

Sabra Health Care REIT, Inc. | | | | 24,591 | c | 378,701 | |

Simon Property Group, Inc. | | | | 27,928 | c | 4,239,470 | |

| | | | | 30,257,176 | |

Financial Services - 7.5% | | | | | |

Ameriprise Financial, Inc. | | | | 8,833 | | 3,773,369 | |

Apollo Global Management, Inc. | | | | 15,424 | | 1,821,112 | |

Coinbase Global, Inc., Cl. A | | | | 7,130 | a | 1,584,500 | |

Discover Financial Services | | | | 18,353 | | 2,400,756 | |

Euronet Worldwide, Inc. | | | | 17,210 | a | 1,781,235 | |

FactSet Research Systems, Inc. | | | | 1,465 | | 598,116 | |

Federated Hermes, Inc. | | | | 65,938 | | 2,168,041 | |

Global Payments, Inc. | | | | 8,057 | | 779,112 | |

Jack Henry & Associates, Inc. | | | | 8,200 | | 1,361,364 | |

LPL Financial Holdings, Inc. | | | | 6,173 | | 1,724,119 | |

MSCI, Inc. | | | | 5,500 | | 2,649,625 | |

OneMain Holdings, Inc. | | | | 20,948 | | 1,015,769 | |

Rithm Capital Corp. | | | | 147,392 | c | 1,608,047 | |

SEI Investments Co. | | | | 16,055 | | 1,038,598 | |

Synchrony Financial | | | | 27,311 | | 1,288,806 | |

T. Rowe Price Group, Inc. | | | | 57,636 | | 6,646,007 | |

XP, Inc., Cl. A | | | | 32,803 | a | 577,005 | |

| | | | | 32,815,581 | |

Food, Beverage & Tobacco - 2.4% | | | | | |

Celsius Holdings, Inc. | | | | 22,630 | a | 1,291,947 | |

Freshpet, Inc. | | | | 6,137 | a | 794,066 | |

Hormel Foods Corp. | | | | 70,537 | | 2,150,673 | |

McCormick & Co., Inc. | | | | 18,823 | | 1,335,304 | |

Molson Coors Beverage Co., Cl. B | | | | 35,040 | | 1,781,083 | |

The Hershey Company | | | | 17,605 | | 3,236,327 | |

| | | | | 10,589,400 | |

Health Care Equipment & Services - 4.9% | | | | | |

Align Technology, Inc. | | | | 5,690 | a | 1,373,737 | |

Cardinal Health, Inc. | | | | 11,235 | | 1,104,625 | |

Cencora, Inc. | | | | 3,692 | | 831,808 | |

Chemed Corp. | | | | 2,851 | | 1,546,896 | |

5

Statement of Investments (Unaudited) (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.1% (continued) | | | | | |

Health Care Equipment & Services - 4.9% (continued) | | | | | |

DexCom, Inc. | | | | 23,201 | a | 2,630,529 | |

Doximity, Inc., Cl. A | | | | 24,312 | a,b | 680,007 | |

Henry Schein, Inc. | | | | 13,072 | a | 837,915 | |

IDEXX Laboratories, Inc. | | | | 7,479 | a | 3,643,769 | |

Inspire Medical Systems, Inc. | | | | 3,941 | a,b | 527,424 | |

Insulet Corp. | | | | 4,773 | a | 963,191 | |

Molina Healthcare, Inc. | | | | 3,052 | a | 907,360 | |

Option Care Health, Inc. | | | | 19,692 | a | 545,468 | |

Penumbra, Inc. | | | | 3,408 | a | 613,338 | |

ResMed, Inc. | | | | 12,246 | | 2,344,129 | |

Teladoc Health, Inc. | | | | 71,024 | a | 694,615 | |

Teleflex, Inc. | | | | 4,190 | | 881,283 | |

Veeva Systems, Inc., Cl. A | | | | 5,922 | a | 1,083,785 | |

| | | | | 21,209,879 | |

Household & Personal Products - .8% | | | | | |

Reynolds Consumer Products, Inc. | | | | 78,420 | | 2,194,192 | |

The Clorox Company | | | | 10,176 | | 1,388,719 | |

| | | | | 3,582,911 | |

Insurance - 7.2% | | | | | |

Aflac, Inc. | | | | 12,735 | | 1,137,363 | |

Arch Capital Group Ltd. | | | | 28,589 | a | 2,884,344 | |

Assurant, Inc. | | | | 6,055 | | 1,006,644 | |

Cincinnati Financial Corp. | | | | 16,571 | | 1,957,035 | |

Everest Group Ltd. | | | | 3,809 | | 1,451,305 | |

Globe Life, Inc. | | | | 26,693 | | 2,196,300 | |

Kinsale Capital Group, Inc. | | | | 2,963 | b | 1,141,585 | |

Loews Corp. | | | | 77,842 | | 5,817,911 | |

Markel Group, Inc. | | | | 1,000 | a | 1,575,660 | |

Primerica, Inc. | | | | 10,628 | | 2,514,372 | |

RenaissanceRe Holdings Ltd. | | | | 3,054 | | 682,600 | |

The Hartford Financial Services Group, Inc. | | | | 48,427 | | 4,868,851 | |

Unum Group | | | | 31,469 | | 1,608,381 | |

W.R. Berkley Corp. | | | | 24,465 | | 1,922,460 | |

White Mountains Insurance Group Ltd. | | | | 396 | | 719,710 | |

| | | | | 31,484,521 | |

Materials - 4.0% | | | | | |

Berry Global Group, Inc. | | | | 11,337 | b | 667,182 | |

Cabot Corp. | | | | 12,128 | | 1,114,442 | |

Cleveland-Cliffs, Inc. | | | | 49,194 | a | 757,096 | |

DuPont de Nemours, Inc. | | | | 7,062 | | 568,420 | |

Eagle Materials, Inc. | | | | 17,513 | | 3,808,377 | |

Element Solutions, Inc. | | | | 40,167 | | 1,089,329 | |

Greif, Inc., Cl. A | | | | 14,363 | | 825,442 | |

NewMarket Corp. | | | | 1,609 | | 829,552 | |

Nucor Corp. | | | | 17,326 | | 2,738,894 | |

PPG Industries, Inc. | | | | 22,246 | | 2,800,549 | |

RPM International, Inc. | | | | 19,222 | | 2,069,825 | |

| | | | | 17,269,108 | |

Media & Entertainment - 4.3% | | | | | |

Electronic Arts, Inc. | | | | 22,129 | | 3,083,234 | |

Fox Corp., Cl. A | | | | 31,762 | | 1,091,660 | |

6

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.1% (continued) | | | | | |

Media & Entertainment - 4.3% (continued) | | | | | |

Match Group, Inc. | | | | 54,430 | a | 1,653,583 | |

Omnicom Group, Inc. | | | | 13,805 | | 1,238,308 | |

Pinterest, Inc., Cl. A | | | | 21,204 | a | 934,460 | |

Roku, Inc. | | | | 16,836 | a | 1,008,981 | |

Spotify Technology SA | | | | 10,158 | a | 3,187,479 | |

The New York Times Company, Cl. A | | | | 37,110 | | 1,900,403 | |

The Trade Desk, Inc., Cl. A | | | | 41,381 | a | 4,041,682 | |

Ziff Davis, Inc. | | | | 8,164 | a | 449,428 | |

| | | | | 18,589,218 | |

Pharmaceuticals, Biotechnology & Life Sciences - 4.9% | | | | | |

Agilent Technologies, Inc. | | | | 43,562 | | 5,646,942 | |

Azenta, Inc. | | | | 8,562 | a | 450,532 | |

Bruker Corp. | | | | 8,802 | | 561,656 | |

Charles River Laboratories International, Inc. | | | | 5,918 | a | 1,222,540 | |

Elanco Animal Health, Inc. | | | | 18,800 | a | 271,284 | |

Exelixis, Inc. | | | | 32,534 | a | 731,039 | |

ICON PLC | | | | 3,684 | a | 1,154,823 | |

IQVIA Holdings, Inc. | | | | 10,799 | a | 2,283,341 | |

Medpace Holdings, Inc. | | | | 4,523 | a | 1,862,798 | |

Mettler-Toledo International, Inc. | | | | 1,282 | a | 1,791,710 | |

Sarepta Therapeutics, Inc. | | | | 6,914 | a | 1,092,412 | |

Waters Corp. | | | | 3,295 | a | 955,945 | |

West Pharmaceutical Services, Inc. | | | | 9,478 | | 3,121,958 | |

| | | | | 21,146,980 | |

Semiconductors & Semiconductor Equipment - 2.8% | | | | | |

Amkor Technology, Inc. | | | | 49,082 | | 1,964,262 | |

Enphase Energy, Inc. | | | | 2,244 | a | 223,749 | |

First Solar, Inc. | | | | 3,097 | a | 698,250 | |

Monolithic Power Systems, Inc. | | | | 4,817 | | 3,958,033 | |

Rambus, Inc. | | | | 15,502 | a | 910,898 | |

Skyworks Solutions, Inc. | | | | 40,719 | | 4,339,831 | |

| | | | | 12,095,023 | |

Software & Services - 6.7% | | | | | |

Akamai Technologies, Inc. | | | | 11,078 | a | 997,906 | |

Ansys, Inc. | | | | 5,584 | a | 1,795,256 | |

AppLovin Corp., Cl. A | | | | 13,774 | a | 1,146,272 | |

Cadence Design Systems, Inc. | | | | 5,430 | a | 1,671,082 | |

CrowdStrike Holdings, Inc., Cl. A | | | | 9,481 | a | 3,633,024 | |

DocuSign, Inc. | | | | 27,818 | a | 1,488,263 | |

EPAM Systems, Inc. | | | | 3,212 | a | 604,209 | |

Fortinet, Inc. | | | | 8,773 | a | 528,749 | |

Gartner, Inc. | | | | 4,000 | a | 1,796,240 | |

Globant SA | | | | 5,947 | a | 1,060,112 | |

HubSpot, Inc. | | | | 4,315 | a | 2,544,944 | |

MongoDB, Inc. | | | | 4,927 | a | 1,231,553 | |

Palantir Technologies, Inc., Cl. A | | | | 136,006 | a | 3,445,032 | |

Pegasystems, Inc. | | | | 17,802 | | 1,077,555 | |

RingCentral, Inc., Cl. A | | | | 27,705 | a | 781,281 | |

Smartsheet, Inc., Cl. A | | | | 24,633 | a | 1,085,823 | |

Synopsys, Inc. | | | | 1,770 | a | 1,053,256 | |

Teradata Corp. | | | | 25,567 | a | 883,596 | |

7

Statement of Investments (Unaudited) (continued)

| | | | | | | | |

| |

Description | | | | Shares | | Value ($) | |

Common Stocks - 99.1% (continued) | | | | | |

Software & Services - 6.7% (continued) | | | | | |

Twilio, Inc., Cl. A | | | | 6,200 | a | 352,222 | |

Verisign, Inc. | | | | 5,339 | a | 949,274 | |

Zoom Video Communications, Inc., Cl. A | | | | 16,504 | a | 976,872 | |

| | | | | 29,102,521 | |

Technology Hardware & Equipment - 3.5% | | | | | |

Amphenol Corp., Cl. A | | | | 99,786 | | 6,722,583 | |

Arista Networks, Inc. | | | | 2,311 | a | 809,959 | |

CDW Corp. | | | | 1,800 | | 402,912 | |

Ciena Corp. | | | | 17,145 | a | 826,046 | |

HP, Inc. | | | | 27,643 | | 968,058 | |

IPG Photonics Corp. | | | | 10,604 | a | 894,872 | |

Littelfuse, Inc. | | | | 6,287 | | 1,606,894 | |

NetApp, Inc. | | | | 22,225 | | 2,862,580 | |

| | | | | 15,093,904 | |

Transportation - .4% | | | | | |

Delta Air Lines, Inc. | | | | 29,669 | | 1,407,497 | |

Hertz Global Holdings, Inc. | | | | 130,752 | a,b | 461,555 | |

| | | | | 1,869,052 | |

Utilities - 6.6% | | | | | |

ALLETE, Inc. | | | | 11,981 | | 747,015 | |

American Water Works Co., Inc. | | | | 13,008 | | 1,680,113 | |

Avangrid, Inc. | | | | 22,898 | | 813,566 | |

Consolidated Edison, Inc. | | | | 28,022 | | 2,505,727 | |

Constellation Energy Corp. | | | | 41,028 | | 8,216,678 | |

Edison International | | | | 9,678 | | 694,977 | |

New Jersey Resources Corp. | | | | 37,006 | | 1,581,636 | |

OGE Energy Corp. | | | | 25,908 | | 924,916 | |

ONE Gas, Inc. | | | | 32,948 | | 2,103,730 | |

Pinnacle West Capital Corp. | | | | 41,682 | | 3,183,671 | |

Public Service Enterprise Group, Inc. | | | | 32,125 | | 2,367,612 | |

Spire, Inc. | | | | 24,541 | | 1,490,375 | |

UGI Corp. | | | | 67,199 | | 1,538,857 | |

Vistra Corp. | | | | 8,523 | | 732,808 | |

| | | | | 28,581,681 | |

Total Common Stocks (cost $364,173,366) | | | | 430,628,891 | |

| | | 1-Day

Yield (%) | | | | | |

Investment Companies - .9% | | | | | |

Registered Investment Companies - .9% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $3,736,636) | | 5.42 | | 3,736,636 | d | 3,736,636 | |

8

| | | | | | | | |

| |

Description | | 1-Day

Yield (%) | | Shares | | Value ($) | |

Investment of Cash Collateral for Securities Loaned - .1% | | | | | |

Registered Investment Companies - .1% | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares

(cost $281,310) | | 5.42 | | 281,310 | d | 281,310 | |

Total Investments (cost $368,191,312) | | 100.1% | | 434,646,837 | |

Liabilities, Less Cash and Receivables | | (.1%) | | (357,563) | |

Net Assets | | 100.0% | | 434,289,274 | |

a Non-income producing security.

b Security, or portion thereof, on loan. At June 30, 2024, the value of the fund’s securities on loan was $7,508,390 and the value of the collateral was $7,745,411, consisting of cash collateral of $281,310 and U.S. Government & Agency securities valued at $7,464,101. In addition, the value of collateral may include pending sales that are also on loan.

c Investment in real estate investment trust within the United States.

d Investment in affiliated issuer. The investment objective of this investment company is publicly available and can be found within the investment company’s prospectus.

| | | | | | | |

Affiliated Issuers | | | |

Description | Value ($)

12/31/2023 | Purchases ($)† | Sales ($) | Value ($)

6/30/2024 | Dividends/

Distributions ($) | |

Registered Investment Companies - .9% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - .9% | 931,013 | 20,098,382 | (17,292,759) | 3,736,636 | 50,912 | |

Investment of Cash Collateral for Securities Loaned - .1% | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund, Institutional Shares - .1% | 694,652 | 15,415,555 | (15,828,897) | 281,310 | 24,086 | †† |

Total – 1.0% | 1,625,665 | 35,513,937 | (33,121,656) | 4,017,946 | 74,998 | |

† Includes reinvested dividends/distributions.

†† Represents securities lending income earned from the reinvestment of cash collateral from loaned securities, net of fees and collateral investment expenses, and other payments to and from borrowers of securities.

See notes to financial statements.

9

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2024 (Unaudited)

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $7,508,390)—Note 1(c): | | | |

Unaffiliated issuers | 364,173,366 | | 430,628,891 | |

Affiliated issuers | | 4,017,946 | | 4,017,946 | |

Dividends and securities lending income receivable | | 446,063 | |

Receivable for shares of Common Stock subscribed | | 24,821 | |

Tax reclaim receivable—Note 1(b) | | 2,513 | |

Prepaid expenses | | | | | 37,895 | |

| | | | | 435,158,129 | |

Liabilities ($): | | | | |

Due to BNY Mellon Investment Adviser, Inc. and affiliates—Note 3(c) | | 328,700 | |

Liability for securities on loan—Note 1(c) | | 281,310 | |

Payable for shares of Common Stock redeemed | | 154,637 | |

Directors’ fees and expenses payable | | 4,587 | |

Other accrued expenses | | | | | 99,621 | |

| | | | | 868,855 | |

Net Assets ($) | | | 434,289,274 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 346,725,878 | |

Total distributable earnings (loss) | | | | | 87,563,396 | |

Net Assets ($) | | | 434,289,274 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 416,093,342 | 785,512 | 17,117,774 | 292,646 | |

Shares Outstanding | 7,123,426 | 15,659 | 291,874 | 5,156 | |

Net Asset Value Per Share ($) | 58.41 | 50.16 | 58.65 | 56.76 | |

| | | | | |

See notes to financial statements. | | | | | |

10

STATEMENT OF OPERATIONS

Six Months Ended June 30, 2024 (Unaudited)

| | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $6,009 foreign taxes withheld at source): | |

Unaffiliated issuers | | | 3,439,603 | |

Affiliated issuers | | | 50,912 | |

Income from securities lending—Note 1(c) | | | 24,086 | |

Total Income | | | 3,514,601 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 1,648,565 | |

Shareholder servicing costs—Note 3(c) | | | 676,529 | |

Professional fees | | | 45,992 | |

Registration fees | | | 31,523 | |

Directors’ fees and expenses—Note 3(d) | | | 20,345 | |

Custodian fees—Note 3(c) | | | 15,665 | |

Prospectus and shareholders’ reports | | | 15,155 | |

Chief Compliance Officer fees—Note 3(c) | | | 14,228 | |

Loan commitment fees—Note 2 | | | 5,093 | |

Distribution fees—Note 3(b) | | | 3,475 | |

Miscellaneous | | | 29,749 | |

Total Expenses | | | 2,506,319 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (320,902) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (40,600) | |

Net Expenses | | | 2,144,817 | |

Net Investment Income | | | 1,369,784 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments | 19,964,941 | |

Net change in unrealized appreciation (depreciation) on investments | (602,529) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 19,362,412 | |

Net Increase in Net Assets Resulting from Operations | | 20,732,196 | |

| | | | | | |

See notes to financial statements. | | | | | |

11

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | | | | | | |

| | | | Six Months Ended

June 30, 2024 (Unaudited) | | Year Ended

December 31, 2023 | |

Operations ($): | | | | | | | | |

Net investment income | | | 1,369,784 | | | | 3,086,118 | |

Net realized gain (loss) on investments | | 19,964,941 | | | | 8,357,931 | |

Net change in unrealized appreciation

(depreciation) on investments | | (602,529) | | | | 53,250,152 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 20,732,196 | | | | 64,694,201 | |

Distributions ($): | |

Distributions to shareholders: | | | | | | | | |

Class A | | | (4,863,666) | | | | (7,035,071) | |

Class C | | | (11,273) | | | | (14,960) | |

Class I | | | (233,474) | | | | (359,950) | |

Class Y | | | (15) | | | | (22) | |

Total Distributions | | | (5,108,428) | | | | (7,410,003) | |

Capital Stock Transactions ($): | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 1,880,046 | | | | 5,698,030 | |

Class C | | | 38,157 | | | | 25,943 | |

Class I | | | 1,628,903 | | | | 3,284,638 | |

Class Y | | | 291,767 | | | | - | |

Distributions reinvested: | | | | | | | | |

Class A | | | 4,612,694 | | | | 6,655,557 | |

Class C | | | 11,273 | | | | 14,960 | |

Class I | | | 227,386 | | | | 353,428 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (20,450,693) | | | | (33,405,920) | |

Class C | | | (536,905) | | | | (477,219) | |

Class I | | | (1,958,066) | | | | (4,165,597) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (14,255,438) | | | | (22,016,180) | |

Total Increase (Decrease) in Net Assets | 1,368,330 | | | | 35,268,018 | |

Net Assets ($): | |

Beginning of Period | | | 432,920,944 | | | | 397,652,926 | |

End of Period | | | 434,289,274 | | | | 432,920,944 | |

Capital Share Transactions (Shares): | |

Class Aa,b | | | | | | | | |

Shares sold | | | 31,909 | | | | 110,236 | |

Shares issued for distributions reinvested | | | 75,383 | | | | 122,092 | |

Shares redeemed | | | (350,273) | | | | (642,430) | |

Net Increase (Decrease) in Shares Outstanding | (242,981) | | | | (410,102) | |

Class Cb | | | | | | | | |

Shares sold | | | 766 | | | | 585 | |

Shares issued for distributions reinvested | | | 214 | | | | 324 | |

Shares redeemed | | | (10,606) | | | | (10,794) | |

Net Increase (Decrease) in Shares Outstanding | (9,626) | | | | (9,885) | |

Class Ia | | | | | | | | |

Shares sold | | | 27,674 | | | | 63,222 | |

Shares issued for distributions reinvested | | | 3,704 | | | | 6,491 | |

Shares redeemed | | | (33,313) | | | | (79,798) | |

Net Increase (Decrease) in Shares Outstanding | (1,935) | | | | (10,085) | |

Class Y | | | | | | | | |

Shares sold | | | 5,138 | | | | - | |

| | | | | | | | | |

a | During the period ended June 30, 2024, 2,420 Class A shares representing $139,210 were exchange for 2,407 Class I shares. | |

b | During the period ended December 31, 2023, 209 Class C shares representing $8,909 were automatically converted to 180 Class A shares. | |

See notes to financial statements. | | | | | | | | |

12

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Net asset value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period, reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day of the period. Net asset value total return includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions.

| | | | | | | |

| | | |

Six Months Ended | |

| | June 30, 2024 | Year Ended December 31, |

Class A Shares | (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | 56.34 | 49.01 | 61.87 | 57.91 | 54.75 | 48.11 |

Investment Operations: | | | | | | |

Net investment incomea | .18 | .39 | .32 | .37 | .35 | .21 |

Net realized and unrealized

gain (loss) on investments | 2.56 | 7.89 | (8.86) | 14.57 | 4.41 | 7.94 |

Total from Investment Operations | 2.74 | 8.28 | (8.54) | 14.94 | 4.76 | 8.15 |

Distributions: | | | | | | |

Dividends from

net investment income | (.02) | (.42) | (.36) | (.30) | (.39) | (.25) |

Dividends from

net realized gain on investments | (.65) | (.53) | (3.96) | (10.68) | (1.21) | (1.26) |

Total Distributions | (.67) | (.95) | (4.32) | (10.98) | (1.60) | (1.51) |

Net asset value, end of period | 58.41 | 56.34 | 49.01 | 61.87 | 57.91 | 54.75 |

Total Return (%)b | 4.82c | 16.96 | (14.21) | 26.66 | 9.18 | 16.95 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to

average net assets | 1.15d | 1.15 | 1.14 | 1.13 | 1.16 | 1.13 |

Ratio of net expenses to

average net assets | .98d | .97 | .92 | .78 | .94 | 1.12 |

Ratio of net investment income

to average net assets | .61d | .75 | .60 | .56 | .70 | .39 |

Portfolio Turnover Rate | 31.53c | 57.46 | 83.99 | 90.53 | 88.91 | 81.43 |

Net Assets, end of period ($ x 1,000) | 416,093 | 415,054 | 381,157 | 477,538 | 409,572 | 425,315 |

a Based on average shares outstanding.

b Exclusive of sales charge.

c Not annualized.

d Annualized.

See notes to financial statements.

13

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | |

| | Six Months Ended | |

| | June 30, 2024 | Year Ended December 31, |

Class C Shares | (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | 48.64 | 42.38 | 54.14 | 52.02 | 49.44 | 43.74 |

Investment Operations: | | | | | | |

Net investment (loss)a | (.03) | (.01) | (.09) | (.19) | (.10) | (.25) |

Net realized and unrealized

gain (loss) on investments | 2.20 | 6.80 | (7.71) | 12.99 | 3.89 | 7.21 |

Total from Investment Operations | 2.17 | 6.79 | (7.80) | 12.80 | 3.79 | 6.96 |

Distributions: | | | | | | |

Dividends from

net realized gain on investments | (.65) | (.53) | (3.96) | (10.68) | (1.21) | (1.26) |

Net asset value, end of period | 50.16 | 48.64 | 42.38 | 54.14 | 52.02 | 49.44 |

Total Return (%)b | 4.42c | 16.07 | (14.87) | 25.51 | 8.17 | 15.94 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to

average net assets | 2.10d | 2.06 | 2.03 | 2.02 | 2.09 | 2.02 |

Ratio of net expenses to

average net assets | 1.74d | 1.71 | 1.71 | 1.67 | 1.87 | 2.01 |

Ratio of net investment (loss)

to average net assets | (.14)d | (.01) | (.19) | (.33) | (.22) | (.51) |

Portfolio Turnover Rate | 31.53c | 57.46 | 83.99 | 90.53 | 88.91 | 81.43 |

Net Assets, end of period ($ x 1,000) | 786 | 1,230 | 1,490 | 2,241 | 2,109 | 2,646 |

a Based on average shares outstanding.

b Exclusive of sales charge.

c Not annualized.

d Annualized.

See notes to financial statements.

14

| | | | | | | |

| | | |

| | Six Months Ended | |

| | June 30, 2024 | Year Ended December 31, |

Class I Shares | (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | 56.62 | 49.37 | 62.45 | 58.44 | 55.31 | 48.52 |

Investment Operations: | | | | | | |

Net investment incomea | .25 | .52 | .45 | .51 | .46 | .32 |

Net realized and unrealized

gain (loss) on investments | 2.59 | 7.94 | (8.92) | 14.70 | 4.43 | 8.03 |

Total from Investment Operations | 2.84 | 8.46 | (8.47) | 15.21 | 4.89 | 8.35 |

Distributions: | | | | | | |

Dividends from

net investment income | (.16) | (.68) | (.65) | (.52) | (.55) | (.30) |

Dividends from

net realized gain on investments | (.65) | (.53) | (3.96) | (10.68) | (1.21) | (1.26) |

Total Distributions | (.81) | (1.21) | (4.61) | (11.20) | (1.76) | (1.56) |

Net asset value, end of period | 58.65 | 56.62 | 49.37 | 62.45 | 58.44 | 55.31 |

Total Return (%) | 4.96b | 17.25 | (14.00) | 26.91 | 9.40 | 17.21 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to

average net assets | .94c | .95 | .93 | .92 | .96 | .93 |

Ratio of net expenses to

average net assets | .73c | .73 | .68 | .57 | .74 | .92 |

Ratio of net investment income

to average net assets | .87c | 1.00 | .84 | .77 | .91 | .59 |

Portfolio Turnover Rate | 31.53b | 57.46 | 83.99 | 90.53 | 88.91 | 81.43 |

Net Assets, end of period ($ x 1,000) | 17,118 | 16,636 | 15,004 | 20,137 | 19,515 | 24,057 |

a Based on average shares outstanding.

b Not annualized.

c Annualized.

See notes to financial statements.

15

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | |

| | | | |

| | Six Months Ended | | |

| | June 30, 2024 | Year Ended December 31, |

Class Y Shares | (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | 54.84 | 47.86 | 60.64 | 56.94 | 53.82 | 47.75 |

Investment Operations: | | | | | | |

Net investment incomea | .24 | .51 | .48 | .55 | .47 | .36 |

Net realized and unrealized gain

(loss) on investments | 2.49 | 7.68 | (8.65) | 14.35 | 4.41 | 7.80 |

Total from Investment Operations | 2.73 | 8.19 | (8.17) | 14.90 | 4.88 | 8.16 |

Distributions: | | | | | | |

Dividends from

net investment income | (.16) | (.68) | (.65) | (.52) | (.55) | (.83) |

Dividends from

net realized gain on investments | (.65) | (.53) | (3.96) | (10.68) | (1.21) | (1.26) |

Total Distributions | (.81) | (1.21) | (4.61) | (11.20) | (1.76) | (2.09) |

Net asset value, end of period | 56.76 | 54.84 | 47.86 | 60.64 | 56.94 | 53.82 |

Total Return (%) | 4.93b | 17.22 | (13.92) | 27.10 | 9.63 | 17.12 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses

to average net assets | .87c | .85 | .84 | .83 | .85 | .84 |

Ratio of net expenses

to average net assets | .75c | .75 | .66 | .48 | .63 | .84 |

Ratio of net investment

income to average net assets | .85c | 1.00 | .91 | .85 | .96 | .68 |

Portfolio Turnover Rate | 31.53b | 57.46 | 83.99 | 90.53 | 88.91 | 81.43 |

Net Assets, end of period ($ x 1,000) | 293 | 1 | 1 | 1 | 1 | 1 |

a Based on average shares outstanding.

b Not annualized.

c Annualized.

See notes to financial statements.

16

NOTES TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1—Significant Accounting Policies:

BNY Mellon Active MidCap Fund (the “fund”) is a separate diversified series of BNY Mellon Strategic Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering five series, including the fund. The fund’s investment objective is to seek to maximize capital appreciation. BNY Mellon Investment Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY”), serves as the fund’s investment adviser. Newton Investment Management North America, LLC (the “Sub-Adviser” or “NIMNA”), an indirect wholly-owned subsidiary of BNY and an affiliate of the Adviser, serves as the fund’s sub-adviser. NIMNA has entered into a sub-sub-investment advisory agreement with its affiliate, Newton Investment Management Limited (“NIM”), which enables NIM to provide certain advisory services to the Sub-Adviser for the benefit of the fund, including, but not limited to, portfolio management services. NIM is subject to the supervision of NIMNA and the Adviser. NIM is also an affiliate of the Adviser. NIM, located at 160 Queen Victoria Street, London, EC4V,4LA, England, was formed in 1978. NIM is an indirect subsidiary of BNY.

BNY Mellon Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s shares. The fund is authorized to issue 270 million shares of $.001 par value Common Stock. The fund currently has authorized four classes of shares: Class A (90 million shares authorized), Class C (15 million shares authorized), Class I (65 million shares authorized) and Class Y (100 million shares authorized). Class A and Class C shares are sold primarily to retail investors through financial intermediaries and bear Distribution and/or Shareholder Services Plan fees. Class A shares generally are subject to a sales charge imposed at the time of purchase. Class A shares bought without an initial sales charge as part of an investment of $1 million or more may be charged a contingent deferred sales charge (“CDSC”) of 1.00% if redeemed within one year. Class C shares are subject to a CDSC imposed on Class C shares redeemed within one year of purchase. Class C shares automatically convert to Class A shares eight years after the date of purchase, without the imposition of a sales charge. Class I shares are sold primarily to bank trust departments and other financial service providers (including BNY and its affiliates), acting on behalf of customers having a qualified trust or an investment account or relationship at such institution, and bear no Distribution or Shareholder Services Plan fees. Class Y shares are sold at net asset value per share generally to institutional investors, and bear no Distribution or Shareholder Services Plan fees. Class I and Class Y shares are offered without a front-end sales charge or CDSC. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

17

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

The Company’s Board of Directors (the “Board”) has designated the Adviser as the fund’s valuation designee to make all fair value determinations with respect to the fund’s portfolio investments, subject to the Board’s oversight and pursuant to Rule 2a-5 under the Act.

Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depositary Receipts and futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to accurately reflect fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For securities where observable inputs are limited, assumptions about market activity and risk are used and such securities are generally categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of June 30, 2024 in valuing the fund’s investments:

18

| | | | | | | |

| | Level 1-Unadjusted Quoted Prices | Level 2- Other Significant Observable Inputs | | Level 3-Significant Unobservable Inputs | Total | |

Assets ($) | | |

Investments in Securities:† | | |

Equity Securities - Common Stocks | 430,628,891 | - | | - | 430,628,891 | |

Investment Companies | 4,017,946 | - | | - | 4,017,946 | |

† See Statement of Investments for additional detailed categorizations, if any.

(b) Foreign taxes: The fund may be subject to foreign taxes (a portion of which may be reclaimable) on income, stock dividends, realized and unrealized capital gains on investments or certain foreign currency transactions. Foreign taxes are recorded in accordance with the applicable foreign tax regulations and rates that exist in the foreign jurisdictions in which the fund invests. These foreign taxes, if any, are paid by the fund and are reflected in the Statement of Operations, if applicable. Foreign taxes payable or deferred or those subject to reclaims as of June 30, 2024, if any, are disclosed in the fund’s Statement of Assets and Liabilities.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with BNY, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Adviser, or U.S. Government and Agency securities. Any non-cash collateral received cannot be sold or re-pledged by the fund, except in the event of borrower default. The securities on loan, if any, are also disclosed in the fund’s Statement of Investments. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, BNY is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended June 30, 2024, BNY earned $3,284 from the lending of the fund’s portfolio securities, pursuant to the securities lending agreement.

For financial reporting purposes, the fund elects not to offset assets and liabilities subject to a securities lending agreement, if any, in the Statement of Assets and Liabilities. Therefore, all qualifying transactions are presented on a gross basis in the Statement of Assets and Liabilities. As of June 30, 2024, the fund had securities lending and the impact of netting of assets and liabilities and the offsetting of collateral pledged or received, if any, based on contractual netting/set-off provisions in the securities lending agreement are detailed in the following table:

| | | | | | | |

| | | Assets ($) | | Liabilities ($) | |

Securities Lending | | 7,508,390 | | - | |

Total gross amount of assets and

liabilities in the Statement

of Assets and Liabilities | | 7,508,390 | | - | |

Collateral (received)/posted not offset

in the Statement of

Assets and Liabilities | | (7,508,390) | 1 | - | |

Net amount | | - | | - | |

1 | The value of the related collateral received by the fund normally exceeded the value of the securities loaned by the fund pursuant to the securities lending agreement. In addition, the value of collateral may include pending sales that are also on loan. See Statement of Investments for detailed information regarding collateral received for open securities lending. |

(d) Affiliated issuers: Investments in other investment companies advised by the Adviser are considered “affiliated” under the Act.

19

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

(e) Market Risk: The value of the securities in which the fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific economic sectors, industries or segments of the market. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed-income markets may negatively affect many issuers, which could adversely affect the fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide.

(f) Dividends and distributions to shareholders: Dividends and distributions are recorded on the ex-dividend date. Dividends from net investment income and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended June 30, 2024, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended June 30, 2024, the fund did not incur any interest or penalties.

Each tax year in the three-year period ended December 31, 2023 remains subject to examination by the Internal Revenue Service and state taxing authorities.

The tax character of distributions paid to shareholders during the fiscal year ended December 31, 2023 was as follows: ordinary income $3,266,080 and long-term capital gains $4,143,923. The tax character of current year distributions will be determined at the end of the current fiscal year.

NOTE 2—Bank Lines of Credit:

The fund participates with other long-term open-end funds managed by the Adviser in a $738 million unsecured credit facility led by Citibank, N.A. (the “Citibank Credit Facility”) and a $300 million unsecured credit facility provided by BNY (the “BNY Credit Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions (each, a “Facility”). The Citibank Credit Facility is available in two tranches: (i) Tranche A is in an amount equal to $618 million and is available to all long-term open-ended funds, including the fund, and (ii) Tranche B is an amount equal to $120 million and is available only to BNY Mellon Floating Rate Income Fund, a series of BNY Mellon Investment Funds IV, Inc. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for Tranche A of the Citibank Credit Facility and the BNY Credit Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended June 30, 2024, the fund did not borrow under the Facilities.

NOTE 3—Management Fee, Sub-Advisory Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with the Adviser, the management fee is computed at the annual rate of .75% of the value of the fund’s average daily net assets and is payable monthly. The Adviser has contractually agreed, from January 1, 2024 until May 1, 2025, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 Distribution Plan fees, Shareholder Services Plan fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75% of the value of the fund’s average daily net assets. On or after May 1, 2025, the Adviser may terminate this waiver agreement at any time. The reduction in expenses, pursuant to the undertaking, amounted to $320,902 during the period ended June 30, 2024.

Pursuant to a sub-investment advisory agreement between the Adviser and the Sub-Adviser, the Adviser pays the Sub-Adviser a monthly fee at an annual rate of .36% of the value of the fund’s average daily net assets.

20

During the period ended June 30, 2024, the Distributor retained $1,291 from commissions earned on sales of the fund’s Class A shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. The Distributor may pay one or more Service Agents in respect of advertising, marketing and other distribution services, and determines the amounts, if any, to be paid to Service Agents and the basis on which such payments are made. During the period ended June 30, 2024, Class C shares were charged $3,475 pursuant to the Distribution Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended June 30, 2024, Class A and Class C shares were charged $527,098 and $1,158, respectively, pursuant to the Shareholder Services Plan.

The fund has an arrangement with BNY Mellon Transfer, Inc., (the “Transfer Agent”), a subsidiary of BNY and an affiliate of the Adviser, whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset Transfer Agent fees. For financial reporting purposes, the fund includes transfer agent net earnings credits, if any, as an expense offset in the Statement of Operations.

The fund has an arrangement with The Bank of New York Mellon (the “Custodian”), a subsidiary of BNY and an affiliate of the Adviser, whereby the fund will receive interest income or be charged overdraft fees when cash balances are maintained. For financial reporting purposes, the fund includes this interest income and overdraft fees, if any, as interest income in the Statement of Operations.

The fund compensates the Transfer Agent, under a transfer agency agreement, for providing transfer agency and cash management services for the fund. The majority of Transfer Agent fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended June 30, 2024, the fund was charged $71,463 for transfer agency services. These fees are included in Shareholder servicing costs in the Statement of Operations. These fees were partially offset by earnings credits of $40,600.

The fund compensates the Custodian, under a custody agreement, for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended June 30, 2024, the fund was charged $15,665 pursuant to the custody agreement.

During the period ended June 30, 2024, the fund was charged $14,228 for services performed by the fund’s Chief Compliance Officer and his staff. These fees are included in Chief Compliance Officer fees in the Statement of Operations.

The components of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of: Management fee of $268,695, Distribution Plan fees of $481, Shareholder Services Plan fees of $86,015, Custodian fees of $10,162, Chief Compliance Officer fees of $4,920 and Transfer Agent fees of $23,028, which are offset against an expense reimbursement currently in effect in the amount of $64,601.

(d) Each board member of the fund also serves as a board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and meeting attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended June 30, 2024, amounted to $138,295,228 and $159,131,999, respectively.

At June 30, 2024, accumulated net unrealized appreciation on investments was $66,455,525, consisting of $86,224,975 gross unrealized appreciation and $19,769,450 gross unrealized depreciation.

At June 30, 2024, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes (see the Statement of Investments).

21

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment

Companies. (Unaudited)

N/A

22

Item 9. Proxy Disclosures for Open-End Management Investment Companies. (Unaudited)

N/A

23

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies. (Unaudited)

Each board member also serves as a board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets. Directors fees paid by the fund are within Item 7. Statement of Operations as Directors’ fees and expenses.

24

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract. (Unaudited)

N/A

25

This page intentionally left blank.

26

| | |

© 2024 BNY Mellon Securities Corporation Code-0085NCSRSA0624 |

|

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 13. Portfolio Managers for Closed-End Management Investment Companies.

Not applicable.

Item 14. Purchases of Equity Securities By Closed-End Management Investment Companies and Affiliated Purchasers.

Not applicable.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no materials changes to the procedures applicable to Item 15.

Item 16. Controls and Procedures.

(a) The Registrant's principal executive and principal financial officers have concluded, based on their evaluation of the Registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the Registrant's disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the Registrant on Form N-CSR is recorded, processed, summarized and reported within the required time periods and that information required to be disclosed by the Registrant in the reports that it files or submits on Form N-CSR is accumulated and communicated to the Registrant's management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no changes to the Registrant's internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 18. Recovery of Erroneously Awarded Compensation.

Not applicable.

Item 19. Exhibits.

(a)(1) Not applicable.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) Not applicable.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

BNY Mellon Strategic Funds, Inc.

By: /s/ David J. DiPetrillo

David J. DiPetrillo

President (Principal Executive Officer)

Date: August 13, 2024

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

By: /s/ David J. DiPetrillo

David J. DiPetrillo

President (Principal Executive Officer)

Date: August 13, 2024

By: /s/ James Windels

James Windels

Treasurer (Principal Financial Officer)

Date: August 19, 2024

EXHIBIT INDEX

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940. (EX-99.CERT)

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940. (EX-99.906CERT)

1.91.61.51.51.51.31.31.21.110.1144.34.34.96.679.710.11316.818.41.91.61.51.51.51.31.31.21.110.1144.34.34.96.679.710.11316.818.41.91.61.51.51.51.31.31.21.110.1144.34.34.96.679.710.11316.818.41.91.61.51.51.51.31.31.21.110.1144.34.34.96.679.710.11316.818.4

![LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1) LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1)](https://capedge.com/proxy/N-CSRS/0001741773-24-003594/img_6dea2ae4de0d4f2.jpg)

![LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1) LargestHoldingsData(Constellation Energy Corp.:1.9,Phillips 66:1.6,[Amphenol Corp., Cl. A]:1.5,[T. Rowe Price Group, Inc.]:1.5,[EMCOR Group, Inc.]:1.5,Loews Corp.:1.3,[Agilent Technologies, Inc.]:1.3,Fifth Third Bancorp:1.2,[The Hartford Financial Services Group, Inc.]:1.1,[Jacobs Solutions, Inc.]:1)](https://capedge.com/proxy/N-CSRS/0001741773-24-003594/img_aaef57828aa94f2.jpg)