On 9 July 2002, Mr Geaney and Mr Lynch resigned as chairman and vice-chairman of the board, respectively, as well as from their respective positions as officers of Elan. Under the terms of the agreements signed on 9 July 2002, Mr Geaney and Mr Lynch will continue as employees of Elan as senior advisers to the chairman until 31 July 2004 at their then current base salaries and shall be entitled to continue to receive the pension and other benefits to which they were then entitled. They are not entitled to any future bonuses. The remuneration paid to them after 9 July 2002 is shown under payments to former directors below.

On 12 February 2002, Elan entered into a consultancy agreement with Mr Groom. On 1 April 2002, EPI entered into a consultancy agreement with Dr Selkoe. Dr Selkoe is also a party to a consultancy agreement with Athena Neurosciences. For additional information regarding these consultancy agreements, please refer to “Service Contracts” in this Directors’ Report.

Dr Selkoe received $25,000 and $50,000 from Elan in 2003 and 2002, respectively, under consultancy agreements. Mr Groom received $200,000 in 2002 under a consultancy agreement. Effective 1 July 2003, the consultancy agreement was cancelled and the Company and Mr Groom entered into a pension agreement of $200,000 per annum payable until 16 May 2008.

DIRECTORS’ REPORT

Board of Directors and Senior Management of the Company

Directors

Garo H. Armen, PhD (51) was appointed a director of Elan in February 1994 and was appointed chairman of Elan in July 2002. He has been chairman and chief executive officer of Antigenics, Inc. (“Antigenics”) since its initial public offering in February 2000 and held the same positions in its predecessor, Antigenics, LLC since its formation in 1994. Previously, Dr Armen was with Dean Witter Reynolds as a senior vice president of research and with E.F. Hutton & Company as first vice president, research.

Brendan E. Boushel(73) was appointed a director of Elan in January 1980. From 1966 until his retirement in 1994, Mr Boushel was a partner in the Irish law firm of T.T.L. Overend McCarron & Gibbons. Mr Boushel also holds a number of private company directorships.

Laurence G. Crowley(67) was appointed a director of Elan in March 1996. He is governor (chairman) of the Bank of Ireland. He is presently chairman of PJ Carroll & Co. and is a director of a number of private companies.

William F. Daniel(1) (52) was appointed a director of Elan in February 2003. He has served as the Company’s secretary since December 2001, having joined Elan in March 1994 as group financial controller. In July 1996, he was appointed group vice president, finance, group controller and principal accounting officer. From 1990 to 1992, Mr Daniel was financial director of Xtravision, plc.

Alan R. Gillespie, C.B.E. PhD(53) was appointed a director of Elan in March 1996. He is chairman of Ulster Bank Limited. From November 1999 until November 2002, he was chief executive officer of CDC Group, plc and was previously a managing director of Goldman Sachs International.

Ann Maynard Gray(58) was appointed a director of Elan in February 2001. She was formerly president of Diversified Publishing Group of Capital Cities/ABC, Inc. Ms Gray is a director of Duke Energy Corporation and The Phoenix Companies, Inc., and is a trustee of J.P. Morgan Funds.

John Groom(65) was appointed a director of Elan in July 1996 and served as president and chief operating officer from then until his retirement in January 2001. Mr Groom was president, chief executive officer and director of Athena Neurosciences prior to its acquisition by Elan in 1996. Mr Groom serves on the boards of Neuronyx Inc., Ligand, CV Therapeutics and Amarin.

Kieran McGowan(60) was appointed a director of Elan in December 1998. From 1990 until his retirement in December 1998, he was chief executive of IDA Ireland. He is chairman of the Governing Authority of University College Dublin and is a director of CRH, plc, Irish Life and Permanent, plc, United Drug, plc, Enterprise Ireland, An Post National Lottery Company Ltd., and a number of private companies.

Kevin M. McIntyre, MD(68) was appointed a director of Elan in February 1984. He is an associate clinical professor of medicine at Harvard Medical School and has served as a consultant to the National Academy of Sciences.

Kyran McLaughlin(59) was appointed a director of Elan in January 1998. Since 1985, he has been head of equities and corporate finance at Davy Stockbrokers, Ireland’s largest stockbroker firm. He is a director of Ryanair Holdings, plc and is a director of a number of private companies.

G. Kelly Martin(1) (45) was appointed a director of Elan in February 2003 following his appointment as president and chief executive officer. He was formerly president of the International Private Client Group and a member of the executive management and operating committee of Merrill Lynch & Co., Inc. He spent over 20 years at Merrill Lynch & Co., Inc. in a broad array of operating and executive responsibilities on a global basis.

Dennis J. Selkoe, MD(60) was appointed a director of Elan in July 1996, following Elan’s acquisition of Athena Neurosciences, where he served as a director since July 1995. Dr Selkoe was a founder of, and consultant to, Athena Neurosciences. Dr Selkoe, a neurologist, is a professor of neurology and neuroscience at Harvard Medical School. He also serves as co-director of the Center for Neurologic Disease at The Brigham and Women’s Hospital.

The Honorable Richard L. Thornburgh(71) was appointed a director of Elan in March 1996. He served as governor of Pennsylvania for two terms and as attorney general of the United States from 1988 to 1991. He is presently of counsel to the law firm of Kirkpatrick & Lockhart LLP in Washington, D.C. He was appointed lead independent director of the Company in May 2002.

74

Daniel P. Tully(72) was appointed a director of Elan in February 1999. He is a chairman emeritus of Merrill Lynch & Co., Inc., where he served as chairman of the board from 1993 to 1997, and was its chief executive officer from 1992 to 1996. He served as vice chairman of the NYSE from 1994 to 1995, vice chairman of the American Stock Exchange from 1984 to 1986 and chairman of the board of governors of the National Association of Securities Dealers from 1996 to 1997.

Officers serve at the discretion of the board of directors. Directors of Elan are compensated with fee payments and stock options (with additional payments where directors are members of board committees) and are reimbursed for travel expenses to and from board meetings.

(1) Member of executive management committee.

Senior Management

Paul Breen(1)(47) is executive vice president, global services and operations. He joined Elan in July 2001. Prior to joining Elan, he was vice president and joint managing director of Pfizer Pharmaceuticals Ireland. Prior thereto, he was vice president and managing director of Warner-Lambert Company’s Irish operations.

Nigel Clerkin(30) was appointed senior vice president, finance and group controller in January 2004, having previously held a number of financial and strategic planning positions since joining Elan in January 1998. He is also the Company’s principal accounting officer. Mr Clerkin is a chartered accountant and a graduate of Queen’s University Belfast.

Shane Cooke(1) (41) joined Elan as executive vice president and chief financial officer in July 2001. Prior to joining Elan, Mr Cooke was chief executive of Pembroke Capital Limited, an aviation leasing company, and prior to that held a number of senior positions in finance in the banking and aviation industries. Mr Cooke is a chartered accountant and a graduate of University College Dublin.

Jean Duvall(1) (42) was appointed executive vice president and general counsel in May 2003, having held a number of senior legal positions at Elan, most recently senior vice president, legal affairs of EPI. Prior to joining Athena Neurosciences in 1994, she held positions at Alza Corporation and at the law firm of Morgan and Finnegan.

Lars Ekman,(1)MD, PhD(54) was appointed executive vice president and president, global R&D and corporate strategy for Elan in June 2003. Previously, Dr Ekman held the position of president, research and development since joining the company in January 2001. Prior to joining Elan, he was evp, research and development at Schwarz Pharma AG since 1997. From 1984 to 1997, Dr Ekman was employed in a variety of senior scientific and clinical functions at Pharmacia (now Pfizer). Dr Ekman is a board certified surgeon with a PhD in experimental biology and has held several clinical and academic positions in both the United States and Europe. He obtained his PhD and MD from the University of Gothenburg, Sweden.

Arthur Falk, PhD(59) joined Elan as executive vice president, corporate compliance, in May 2001. Dr Falk has 30 years experience in analytical research, quality and compliance within the pharmaceutical industry. Prior to joining Elan, he was the vice president, corporate quality, safety and environmental affairs and managing compliance officer for the worldwide operations of the Warner-Lambert Company.

Jack Laflin(56) joined Elan as executive vice president, human resources, in January 2003. Mr Laflin was most recently vice president, human resources, at Invensys, plc based in London. Prior thereto, he held senior positions in Kulicke and Soffa Industries, Inc, ALG Group, Harris Corporation and with the General Electric Company.

Ivan Lieberburg, MD, PhD(54) is executive vice president and chief medical officer of Elan, where he has held a number of senior positions, most recently senior vice president of research. Prior to joining Athena Neurosciences in 1987, Dr Lieberburg held faculty positions at the Albert Einstein College of Medicine and Mt. Sinai School of Medicine in New York.

No director or officer has a family relationship with any other director or officer.

(1) Member of executive management committee.

Compensation of Directors and Officers

For the year ended 31 December 2003, all executive officers and directors as a group (19 persons) received total compensation of $7.2 million.

75

DIRECTORS’ REPORT

Elan reimburses officers and directors for their actual business-related expenses. For the year ended 31 December 2003, an aggregate of $0.3 million was set aside or accrued by Elan to provide pension, retirement and other similar benefits for directors and officers. Elan maintains certain health and medical benefit plans for its employees in which Elan’s officers participate along with other employees generally.

For additional information on pension benefits for Elan employees, please refer to Note 28 to the Consolidated Financial Statements, and to pages 174 to 176.

Transactions with Directors

There were no transactions with directors during the year ended 31 December 2003 other than as outlined in Note 27 to the Consolidated Financial Statements.

Significant Shareholdings

As of 31 December 2003, Capital Research and Management Company (“Capital Research”) owned 45,382,000 Elan ADSs representing approximately 11.7% of the issued share capital of the Company. Capital Research held approximately 11.6% and 9% of the share capital of the Company at 31 December 2002 and 2001 respectively. Fidelity Management and Research Company (“Fidelity Management”) held approximately 5% of the issued share capital of the Company at 31 December 2001. At 31 March 2004, Fidelity Management had increased their shareholding to 31,486,620 ADSs representing approximately 8.1% of the issued share capital. Save for these interests, the Company is not aware of any person who, directly or indirectly, holds 3% or more of the issued share capital. Neither Capital Research nor Fidelity Management have voting rights different from other shareholders.

The following table sets forth certain information regarding the beneficial ownership of Ordinary Shares at 31 March 2004 by all directors and officers of Elan as a group (either directly or by virtue of ownership of Elan ADSs):

Name of Owner or Identity of Group | | No. of

Shares | | Percent of

Class(1) | |

| |

| |

| |

All directors and officers as a group (18 persons)(2) | | 5.6 million | | 1.4 | % |

| (1) | Based on 388.7 million Ordinary Shares outstanding on 31 March 2004 and 3.0 million Ordinary Shares issuable upon the exercise of currently exercisable options held by directors and officers as a group as of 31 March 2004. |

| (2) | Includes 3.0 million Ordinary Shares issuable upon exercise of currently exercisable options held by directors and officers of Elan as a group as of 31 March 2004. |

No options were exercised by executive officers during the year ended 31 December 2003. Options outstanding at 31 December 2003 are exercisable at various dates between January 2004 and November 2013.

There were no options exercised by executive officers to acquire Elan ADSs in the period from 31 December 2003 to 31 March 2004.

Elan, to its knowledge, is not directly or indirectly owned or controlled by another entity or by any government. Elan does not know of any arrangements, the operation of which might result in a change of control of Elan.

Statement of Directors’ Responsibilities

The following statement, which should be read in conjunction with the Auditors’ Report set out on pages 83 and 84 of this Annual Report, is made with a view to distinguishing for shareholders the respective responsibilities of the directors and of the auditors in relation to the financial statements.

Irish company law requires the directors to ensure that financial statements are prepared for each financial year which give a true and fair view of the state of affairs of Elan Corporation, plc and of the Group and of the profit or loss for that year.

With regard to the financial statements on pages 85 to 178 of this Annual Report, the directors have determined that it is appropriate that they continue to be prepared on a going concern basis and consider that in their preparation:

76

| • | Suitable accounting policies have been selected and applied consistently; |

| • | Judgements and estimates that are reasonable and prudent have been made; and |

| • | Applicable accounting standards have been followed. |

The directors have a responsibility for ensuring that proper books of account are kept which disclose with reasonable accuracy at any time the financial position of the Group and of Elan Corporation, plc and which enable them to ensure that the financial statements comply with the Companies Acts (the “Companies Acts”), 1963 to 2003, and all regulations to be construed as one with those Acts. They also have general responsibility for taking such steps as are reasonably open to them to safeguard the assets of the Group and to prevent and detect fraud and other irregularities.

Service Contracts

Save as set out below, there are no service contracts in existence between any of the directors and Elan.

| • | On 1 July 2003, Elan entered into a pension agreement with Mr Groom, a director of Elan, whereby Elan shall pay a pension of $200,000 per annum, monthly in arrears, until 16 May 2008 in respect of his former senior executive roles in Elan and in Athena Neurosciences, Inc. |

| • | On 7 January 2003, Elan and EPI entered into an agreement with Mr Martin such that Mr Martin was appointed president and chief executive officer of Elan effective 3 February 2003. Mr Martin’s annual salary under this agreement is $798,000. He is eligible for an annual bonus in a target amount equal to his salary depending on the achievement of established performance goals. Mr Martin was granted an initial option to purchase 1,000,000 Ordinary Shares with an exercise price of $3.85 and vesting in three equal instalments on 31 December 2003, 31 December 2004 and 31 December 2005. In accordance with the terms of his contract, in October 2003, Mr Martin was granted an additional option to purchase 1,000,000 Ordinary Shares with an exercise price of $5.28, equal to the fair market value of the shares on the date of grant, vesting on the same basis and dates as the initial option grant. |

Commencing in 2004, Mr Martin will be considered for additional option grants during the term of the agreement consistent with Elan’s annual option grant practices.

The agreement continues until 31 December 2005 and can be extended for a further year on each anniversary of that date thereafter unless 90 days notice is given by Elan or Mr Martin prior to the applicable anniversary date. In general, if Mr Martin’s employment is involuntarily terminated (other than for cause or disability) or Mr Martin leaves for good reason, Elan will continue to pay his salary and target bonus for the following two years and his outstanding options will immediately accelerate and remain outstanding for the following two years. If, during the first two years of the agreement, Elan undergoes a change in control and Mr Martin is involuntarily terminated, then Mr Martin will receive the benefits outlined in the preceding sentence and a lump sum payment in an amount equal to $5.0 million if the change of control occurs in the first year of the term, or $3.0 million if it occurs in the second year of the term.

Mr Martin is eligible to participate in the pension, medical, disability and life insurance plans applicable to senior executives in accordance with the terms of those plans. He may also receive financial planning and tax support and advice from the provider of his choice at a reasonable and customary annual cost.

| • | On 1 July 1986, Athena Neurosciences entered into a consultancy agreement with Dr Selkoe whereby Dr Selkoe agreed to provide certain consultancy services in the field of AD for a fee to be fixed annually, together with the reimbursement for all reasonable travel and other expenses incurred. The consultancy agreement renews automatically, unless notice of termination is provided 60 days prior to the anniversary date. No such notice has been provided. |

| • | On 1 April 2002, EPI entered into a consultancy agreement with Dr Selkoe whereby Dr Selkoe agreed to provide certain consultancy services, including services in the field of immunological approaches to the treatment of AD for a period of one year for a fee not to exceed $12,000. |

Accounting Records

The directors believe that they have complied with Section 202 of the Companies Act, 1990 with regard to books of account by employing financial personnel with appropriate expertise and by providing adequate resources to the financial function. The books of account of Elan Corporation, plc are maintained at its office in Monksland, Athlone, County Westmeath, Ireland.

77

Directors’ Report

Political Donations

There were no political contributions which require disclosure under the Electoral Act, 1997.

Subsidiary Companies

For additional information regarding significant subsidiary and associated undertakings, please refer to Note 32 to the Consolidated Financial Statements.

Auditors

In accordance with Section 160(2) of the Companies Act, 1963, the auditors, KPMG, Chartered Accountants, will continue in office.

On behalf of the board, 23 April 2004

Garo Armen, chairman | | Kelly Martin, president and chief executive officer |

78

CORPORATE GOVERNANCE

Policies

Elan is committed to the adoption and maintenance of the highest standards of corporate governance and compliance. The Company complies with the provisions of The Combined Code which was adopted by the London Stock Exchange in June 1998 and by the Irish Stock Exchange in December 1998. One of the requirements of The Combined Code is that listed companies make a statement in relation to how they have complied with this code. A revised Combined Code on Corporate Governance (the “Revised Code”) was issued in July 2003 and compliance is required for annual reports commencing in November 2003. The Company is studying the Revised Code and believes it is in compliance with the Revised Code.

In May 2002, following a review with external legal counsel, the board of directors adopted a set of corporate governance guidelines (“the Guidelines”) and restructured the existing three board committees into four board committees, the executive committee, audit committee, compensation committee (now the leadership development and compensation committee), and nominating committee and adopted a written charter for each committee (collectively the “Committee Charters”). The Guidelines and the Committee Charters were revised and updated in November 2003 to incorporate the requirements of the Sarbanes Oxley Act, 2002, the revised listing rules of the NYSE and certain measures agreed as part of the settlement of the derivative action (see Note 25 on pages 133 to 134). In addition, in November 2003 the Company adopted a code of conduct (the “Code of Conduct”) that applies to all employees of the Company, including its principal executive officer, principal financial officer and principal accounting officer. The Guidelines, the Committee Charters and the Code of Conduct are available on the Company’s website, www.elan.com, under "Governance". Any amendments to or waivers from the Code of Conduct will also be posted to the Company’s website.

The Board

The roles of chairman and chief executive officer are separated. Under the Company’s Corporate Governance Guidelines, it has committed that two-thirds of the board will be independent by 30 June 2004. The board currently includes 10 independent, non-executive directors who constitute in excess of two-thirds of the board. The Company decided to adopt a definition of independence based on the rules of the NYSE, the exchange on which the majority of the Company’s shares are traded. In addition, the board has appointed the Honorable Richard L. Thornburgh as lead independent director, in accordance with the provisions of The Combined Code and best corporate governance practice in the United States, the U.K. and Ireland.

The board regularly reviews its responsibilities and those of its committees and management. The board meets regularly throughout the year, and all of the directors have full and timely access to the information necessary to enable them to discharge their duties. The board has reserved certain matters to its exclusive jurisdiction, thereby maintaining control of the Company and its future direction. All directors are appointed by the board, as nominated by its nominating committee, and subsequently elected by the shareholders. Procedures are in place where directors and committees, in furtherance of their duties, may take independent professional advice, if necessary, at the Company’s expense. The board has delegated authority over certain areas of the Company’s activities to four standing committees, as more fully described below. The board held 19 meetings during 2003.

Executive Committee

The executive committee exercises the authority of the board during the interval between board meetings, except to the extent that the board has delegated authority to another committee or to other persons, or has reserved authority to itself or as limited by Irish law. The members of the committee are Dr Armen, chairman, Mr Crowley, Ms Gray, Mr Martin, Mr McLaughlin and Mr Tully. The executive committee held 5 formal meetings during 2003.

Audit Committee

The audit committee, composed entirely of non-executive directors, helps the board in its general oversight of the Company’s accounting and financial reporting practices, internal controls and audit functions, and is directly responsible for the appointment, compensation and

79

CORPORATE GOVERNANCE

oversight of the work of Elan’s independent auditors. The audit committee periodically reviews the effectiveness of the system of internal control. It monitors the adequacy of internal accounting practices, procedures and controls, and reviews all significant changes in accounting policies. The committee meets regularly with the internal and external auditors and addresses all issues raised and recommendations made by them. The members of the committee are Mr McLaughlin, chairman, Dr Gillespie and Mr McGowan. The audit committee held 10 formal meetings during 2003.

The Company’s board of directors does not have an “audit committee financial expert,” within the meaning of such phrase under applicable regulations of the SEC, serving on its audit committee. The board of directors believes that all members of its audit committee are financially literate, experienced in business matters, capable of analysing and evaluating the Company’s financial statements, understanding internal controls and procedures for financial reporting purposes and understanding audit committee functions. The board of directors expects to seek an appropriate individual to serve on the board of directors and the audit committee who will meet the requirements necessary to be an “audit committee financial expert.”

Consistent with SEC policies regarding auditor independence, the audit committee has responsibility for appointing, setting compensation and overseeing the work of the independent auditor. In recognition of this responsibility, the audit committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent auditor. Prior to engagement of the independent auditor for the next year’s audit, management will submit a list of services and related fees expected to be rendered during that year within each of four categories of services to the audit committee for approval: audit services; audit-related services; tax services; and other fees.

Prior to engagement, the audit committee pre-approves independent auditor services within each category. The fees are budgeted and the audit committee requires the independent auditor and management to report actual fees versus the budget periodically throughout the year by category of service. During the year, circumstances may arise when it may become necessary to engage the independent auditor for additional services not contemplated in the original pre-approval categories. In those instances, the audit committee requires specific pre-approval before engaging the independent auditor.

The audit committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the audit committee at its next scheduled meeting.

Leadership Development and Compensation Committee

The leadership development and compensation committee (the “LDCC”), composed entirely of non-executive directors, reviews the compensation philosophy and policies of the Company with respect to executive compensation, fringe benefits and other compensation matters. The committee determines the compensation of the chief executive officer and other executive directors and reviews the compensation of the other members of the executive management. The committee also administers the Company’s share option plans. The members of the committee are Dr McIntyre, chairman, Mr Crowley, Ms Gray and Mr Tully. The LDCC committee held 9 formal meetings during 2003. For more information, see “Report of the Leadership Development and Compensation Committee”.

Nominating Committee

The nominating committee, composed entirely of non-executive directors, reviews on an ongoing basis the membership of the board of directors and of the board committees and the performance of the directors. It recommends new appointments to fill any vacancy that is anticipated or arises on the board of directors. It reviews and recommends changes in respect of the functions of the various committees of the board. The members of the committee are Mr Thornburgh, chairman, Ms Gray, Mr McGowan, Mr McLaughlin and Mr Tully. The nominating committee held 1 formal meeting during 2003.

Relations with Shareholders

Elan communicates regularly with its shareholders throughout the year, including following the release of quarterly and annual results, and after major developments. Company general meetings and analyst briefings are webcast and are available on the Company’s website (www.elan.com). All shareholders are given adequate notice of the Annual General Meeting.

80

Internal Control

The board of directors has overall responsibility for the Group’s system of internal control and for monitoring its effectiveness. Management is responsible for the planning and implementation of the system of internal control and ensuring that these controls apply throughout the Group. The system of internal control is designed to provide reasonable, but not absolute, assurance against material misstatement or loss.

The key procedures that have been established to provide effective internal control include:

| • | A clear focus on business objectives is set by the board having considered the risk profile of the Group through; |

| • | A formalised risk reporting system. Significant business risks are addressed at each board meeting; |

| • | A clearly defined organisational structure under the day to day direction of its chief executive officer. Defined lines of responsibility and delegation of authority have been established within which the Group’s activities can be planned, executed, controlled and monitored to achieve the strategic objectives which the board has adopted for Elan; |

| • | A comprehensive system for reporting financial results to the board. This includes a budgeting system with an annual budget approved by the board. The board compares actual results with budgeted results regularly. Management accounts are prepared on a timely basis. They include a profit and loss account, balance sheet, cash flow and capital expenditure report, together with an analysis of performance of key operating divisions and subsidiaries; |

| • | A system of management and financial reporting, treasury management and project appraisal. Management is responsible for reporting to the board on its progress in achieving objectives. The system of reporting covers trading activities, operational issues, financial performance, working capital, cash flow and asset management. This reporting happens in a timely and regular manner. In this context, progress is monitored against annual budgets and longer term objectives; and |

| • | The establishment of corporate compliance and internal audit departments which review key systems and controls. |

The directors reviewed the Group’s system of internal control and also examined the full range of risks affecting the Group and the appropriateness of the internal control structures to manage and monitor these risks. This process involved a confirmation that appropriate systems of internal control were in place throughout the financial year and up to the date of signing of these financial statements. It also involved an assessment of the ongoing process for the identification, management and control of the individual risks and of the role of the various Group Risk Management Functions and the extent to which areas of significant challenges facing the Group are understood and are being addressed. No material unaddressed issues emerged from this assessment. The directors confirm that they have reviewed, in accordance with the Turnbull Guidance, the effectiveness of the Group’s systems of internal control for the year ended 31 December 2003.

Going Concern

The directors, having made inquiries, believe that Elan has adequate resources to continue in operational existence for the foreseeable future and that it is appropriate to continue to adopt the going concern basis in preparing the financial statements.

Disclosure Controls and Procedures

The Company has put in place disclosure controls and procedures (“Disclosure Controls”) which are designed to ensure that information required to be disclosed in the Company’s reports filed under the Securities Exchange Act of 1934, as amended (the “1934 Act”), such as its Annual Report on Form 20-F, is recorded, processed, summarised and reported within the time periods specified in the SEC rules and forms. Disclosure Controls are also designed to ensure that the information is accumulated and communicated to the Company’s management, including Mr Martin and Mr Cooke, as appropriate, to allow timely decisions regarding required disclosure.

Based upon their evaluation of the Company’s Disclosure Controls, Mr Martin and Mr Cooke have concluded that the Company’s Disclosure Controls are effective in alerting management, including Mr Martin and Mr Cooke, in a timely manner, to material information required to be disclosed in Elan’s reports filed with the Securities and Exchange Commission.

Report of the Leadership Development and Compensation Committee

The terms of reference for the committee are to determine the compensation, terms and conditions of employment of the chief executive officer and other executive directors and to review the recommendations of the chief executive officer with respect to the

81

CORPORATE GOVERNANCE

remuneration and terms and conditions of employment of the Company’s senior management. The committee also exercises all the powers of the board of directors to issue Ordinary Shares on the exercise of share options and to generally administer the Company’s share option plans.

The chief executive officer attends meetings of the committee except when his own remuneration is being considered.

Each member of the committee is nominated to serve for a three year term subject to a maximum of two terms of continuous service.

For additional information regarding directors’ remuneration, shareholdings and share options, please refer to Note 5 to the Consolidated Financial Statements and “Directors’ Interests”, “Directors’ Options” and “Directors’ Remuneration” in the Directors’ Report.

Remuneration Policy

The Company’s policy on executive directors’ remuneration is to set remuneration levels which are appropriate for its senior executives having regard to their substantial responsibilities, their individual performance and the performance of the Company as a whole. It is the policy of the committee to set remuneration levels after a review of remuneration packages of executives in the pharmaceutical industry. During 2003, the committee took external advice from independent benefit consultants on executive remuneration. In framing remuneration policy, consideration has been given to Section B of the Code of Best Practice of The Combined Code as issued by the London and Irish Stock Exchanges.

The typical elements of the remuneration package for executive directors include basic salary and benefits, annual cash incentive bonus, pensions and participation in share option plans.

It is the policy of the committee to grant options to management to encourage identification with shareholders’ interests and to link performance to the long term share price performance of the Company.

Executive Directors’ Basic Salary

The basic salaries of executive directors are reviewed annually having regard to personal performance, company performance and market practice.

Annual Cash Incentive Bonus

An annual cash incentive bonus, which is not pensionable, is paid on the recommendation of the committee to executive directors. Bonus determination is not based on specific financial or operational targets, but on individual and company performance.

Share Option Plans

It is the policy of the committee, in common with other companies operating in the pharmaceutical industry, to award share options to management and employees. The options generally vest between one and five years. These plans do not contain any performance conditions.

Directors’ Service Contracts

See Directors’ Report.

The compensation committee is pleased to submit this report to Elan’s shareholders on these matters.

Composition of Leadership Development and Compensation Committee

Leadership Development and Compensation Committee

Kevin M. McIntyre, Chairman | | Ann Maynard Gray | |

Laurence G. Crowley | | Daniel P. Tully | |

82

INDEPENDENT AUDITORS’ REPORT

To the Members of Elan Corporation, plc

We have audited the financial statements on pages 85 to 178.

Respective Responsibilities of Directors and Auditors in Relation to the Annual Report and Form 20-F

The directors are responsible for having the Annual Report and Form 20-F prepared. As described on pages 76 to 77, this includes responsibility for preparing the financial statements in accordance with applicable Irish Law and accounting standards; the directors have also presented additional information under U.S. requirements. Our responsibilities, as independent auditors, are established in Ireland by statute, the Auditing Practices Board, the Listing Rules of the Irish Stock Exchange and by our profession’s ethical guidance.

We report to you our opinion as to whether the financial statements give a true and fair view and are properly prepared in accordance with the Companies Acts. As also required by the Companies Acts, we state whether we have obtained all the information and explanations we require for our audit, whether the Company’s balance sheet agrees with the books of account and report to you our opinion as to whether:

| • | the Company has kept proper books of account; |

| • | the directors’ report is consistent with the financial statements; and |

| • | at the balance sheet date, a financial situation existed that may require the Company to hold an extraordinary general meeting on the grounds that the net assets of the Company, as shown in the financial statements, are less than half of its share capital. |

We also report to you if, in our opinion, information specified by law or by the Listing Rules regarding directors’ remuneration and transactions with the Group is not disclosed.

We review whether the statement on page 79 reflects the Company’s compliance with the seven provisions of The Combined Code specified for our review by the Irish Stock Exchange, and we report if it does not. We are not required to consider whether the board’s statements on internal control cover all risks and controls, or form an opinion on the effectiveness of the Group’s corporate governance procedures or its risk and control procedures.

We read the other information contained in the Annual Report and Form 20-F, including the corporate governance statement, and consider whether it is consistent with the audited financial statements. We consider the implications for our report if we become aware of any apparent misstatements or material inconsistencies with the financial statements.

Basis of Audit Opinion

We conducted our audit in accordance with Auditing Standards issued by the Auditing Practices Board. An audit includes examination, on a test basis, of evidence relevant to the amounts and disclosures in the financial statements. It also includes an assessment of the significant estimates and judgements made by the directors in the preparation of the financial statements, and of whether the accounting policies are appropriate to the Group’s circumstances, consistently applied and adequately disclosed.

We planned and performed our audit so as to obtain all the information and explanations which we considered necessary in order to provide us with sufficient evidence to give reasonable assurance that the financial statements are free from material misstatement, whether caused by fraud or other irregularity or error. In forming our opinion, we also evaluated the overall adequacy of the presentation of information in the financial statements.

Fundamental Uncertainty

In forming our opinion, we considered the disclosures in note 25 to the financial statements relating to the Company and certain of its former and current officers and directors being named as defendants in a putative class action in the U.S. District Court for the Southern

83

INDEPENDENT AUDITORS’ REPORT

District of New York, and the Company being the subject of an investigation by the SEC’s Division of Enforcement which commenced on or about 12 February 2002. Elan is unable to predict or determine the outcome of the class action or the SEC investigation or reasonably to estimate the amounts or range of loss, if any, with respect to the resolution of the class action or the SEC investigation. The possible outcome or resolution of the SEC investigation or the class action could require Elan to make substantial payments. Our opinion is not qualified in this respect.

Opinion

In our opinion, the financial statements give a true and fair view of the state of affairs of the Group and the Company as at 31 December 2003 and of the loss of the Group for the year then ended, and have been properly prepared in accordance with the Companies Acts, 1963 to 2003, and all Regulations to be construed as one with those Acts.

Accounting principles generally accepted in Ireland vary in certain significant respects from accounting principles generally accepted in the United States. Information relating to the nature and effect of such differences is presented in Note 33 to the Consolidated Financial Statements.

We have obtained all the information and explanations we considered necessary for the purposes of our audit. In our opinion, proper books of account have been kept by the Company. The balance sheet of the Company is in agreement with the books of account.

In our opinion, the information given in the Directors’ Report on pages 70 to 78 is consistent with the financial statements.

The net assets of the Company, as stated in the balance sheet on page 90 are more than half of the amount of its called-up share capital and, in our opinion, on that basis there did not exist at 31 December 2003 a financial situation which, under Section 40(1) of the Companies (Amendment) Act, 1983, would require the convening of an extraordinary general meeting of the Company.

KPMG

Chartered Accountants

Registered Auditors

Dublin, Ireland

23 April 2004

The above opinion is provided in compliance with Irish requirements. An opinion complying with auditing standards generally accepted in the United States will be included in the Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission.

84

FINANCIAL STATEMENTS

Consolidated Profit and Loss Account

| | Year Ended 31 December | |

| |

| |

| | Notes | | 2003

$m

Before

Exceptional

Items | | 2003

$m

Exceptional

Items | | 2003

$m

Total | | 2002

$m

Before

Exceptional

Items | | 2002

$m

Exceptional

Items | | 2002

$m

Total | | 2001

$m

Before

Exceptional

Items | | 2001

$m

Exceptional

Items | | 2001

$m

Total | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Revenue—continuing operations | | 3 | | | 445.3 | | | — | | | 445.3 | | | 550.1 | | | 172.5 | | | 722.6 | | | 1,057.5 | | | 233.4 | | | 1,290.9 | |

Revenue—discontinued | | 6 | | | 316.8 | | | — | | | 316.8 | | | 610.4 | | | — | | | 610.4 | | | 455.4 | | | (5.6 | ) | | 449.8 | |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Total revenue | | 2 | | | 762.1 | | | — | | | 762.1 | | | 1,160.5 | | | 172.5 | | | 1,333.0 | | | 1,512.9 | | | 227.8 | | | 1,740.7 | |

Cost of sales | | 3 | | | 342.6 | | | 6.9 | | | 349.5 | | | 417.0 | | | 66.1 | | | 483.1 | | | 364.0 | | | 22.8 | | | 386.8 | |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Gross profit/(loss) | | | | | 419.5 | | | (6.9 | ) | | 412.6 | | | 743.5 | | | 106.4 | | | 849.9 | | | 1,148.9 | | | 205.0 | | | 1,353.9 | |

Selling, general and administrative expenses | | 3 | | | 470.3 | | | 546.0 | | | 1,016.3 | | | 835.4 | | | 1,788.0 | | | 2,623.4 | | | 697.5 | | | 1,084.2 | | | 1,781.7 | |

Research and development expenses | | 3 | | | 307.6 | | | 23.8 | | | 331.4 | | | 402.6 | | | 114.7 | | | 517.3 | | | 323.3 | | | 78.6 | | | 401.9 | |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Operating (loss)/profit—continuing operations | | | | | (383.1 | ) | | (432.9 | ) | | (816.0 | ) | | (486.1 | ) | | (1,369.9 | ) | | (1,856.0 | ) | | 131.6 | | | (635.5 | ) | | (503.9 | ) |

Operating loss—acquisitions | | | | | — | | | — | | | — | | | — | | | — | | | — | | | (3.3 | ) | | — | | | (3.3 | ) |

Operating profit/(loss)—discontinued | | 6 | | | 24.7 | | | (143.8 | ) | | (119.1 | ) | | (8.4 | ) | | (426.4 | ) | | (434.8 | ) | | (0.2 | ) | | (322.3 | ) | | (322.5 | ) |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Operating (loss)/profit | | 2 | | | (358.4 | ) | | (576.7 | ) | | (935.1 | ) | | (494.5 | ) | | (1,796.3 | ) | | (2,290.8 | ) | | 128.1 | | | (957.8 | ) | | (829.7 | ) |

Share of (losses)/profits of associates | | | | | (8.1 | ) | | — | | | (8.1 | ) | | 6.0 | | | — | | | 6.0 | | | 10.3 | | | — | | | 10.3 | |

Loss on sale of securities/guarantee | | 3 | | | — | | | — | | | — | | | — | | | (217.0 | ) | | (217.0 | ) | | — | | | — | | | — | |

Gain on disposal of businesses | | 3 | | | — | | | 293.3 | | | 293.3 | | | — | | | 77.9 | | | 77.9 | | | — | | | — | | | — | |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

(Loss)/profit on ordinary activities before interest and tax | | | | | (366.5 | ) | | (283.4 | ) | | (649.9 | ) | | (488.5 | ) | | (1,935.4 | ) | | (2,423.9 | ) | | 138.4 | | | (957.8 | ) | | (819.4 | ) |

Net interest and other expense | | 3, 4 | | | (153.8 | ) | | (33.7 | ) | | (187.5 | ) | | (156.7 | ) | | (1,014.0 | ) | | (1,170.7 | ) | | (76.3 | ) | | 25.9 | | | (50.4 | ) |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

(Loss)/profit on ordinary activities before tax | | 5 | | | (520.3 | ) | | (317.1 | ) | | (837.4 | ) | | (645.2 | ) | | (2,949.4 | ) | | (3,594.6 | ) | | 62.1 | | | (931.9 | ) | | (869.8 | ) |

Tax on (loss)/profit on ordinary activities | | 7 | | | 22.0 | | | — | | | 22.0 | | | (19.8 | ) | | — | | | (19.8 | ) | | (17.4 | ) | | — | | | (17.4 | ) |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

(Loss)/profit on ordinary activities after tax | | | | | (498.3 | ) | | (317.1 | ) | | (815.4 | ) | | (665.0 | ) | | (2,949.4 | ) | | (3,614.4 | ) | | 44.7 | | | (931.9 | ) | | (887.2 | ) |

Minority interest | | 19 | | | — | | | — | | | — | | | (0.7 | ) | | — | | | (0.7 | ) | | — | | | — | | | — | |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Retained (loss)/profit for the year | | | | | (498.3 | ) | | (317.1 | ) | | (815.4 | ) | | (665.7 | ) | | (2,949.4 | ) | | (3,615.1 | ) | | 44.7 | | | (931.9 | ) | | (887.2 | ) |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Basic (loss)/earnings per Ordinary Share | | 8 | | $ | (1.40 | ) | $ | (0.89 | ) | $ | (2.29 | ) | $ | (1.90 | ) | $ | (8.44 | ) | $ | (10.34 | ) | $ | 0.13 | | $ | (2.77 | ) | $ | (2.64 | ) |

Diluted (loss)/earnings per Ordinary Share | | 8 | | $ | (1.40 | ) | $ | (0.89 | ) | $ | (2.29 | ) | $ | (1.90 | ) | $ | (8.44 | ) | $ | (10.34 | ) | $ | 0.12 | | $ | (2.77 | ) | $ | (2.64 | ) |

Weighted average number of Ordinary Shares outstanding (millions) | | | | | 356.0 | | | 356.0 | | | 356.0 | | | 349.7 | | | 349.7 | | | 349.7 | | | 336.0 | | | 336.0 | | | 336.0 | |

| |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

The accompanying notes are an integral part of these financial statements.

Garo Armen,chairman | G. Kelly Martin,president and chief executive officer |

85

FINANCIAL STATEMENTS

Consolidated Balance Sheet

| | Notes | | At 31 December

2003

$m | | At 31 December

2002

$m | |

| |

| |

| |

| |

Fixed Assets | | | | | | | |

Intangible assets | | 10 | | 1,252.4 | | 2,079.5 | |

Tangible assets | | 11 | | 372.2 | | 459.3 | |

Financial assets | | 12 | | 407.9 | | 734.6 | |

| |

| |

| |

| |

| | | | 2,032.5 | | 3,273.4 | |

| | | |

| |

| |

Current Assets | | | | | | | |

Stocks | | 13 | | 78.4 | | 149.8 | |

Debtors | | 14 | | 145.9 | | 186.6 | |

Financial assets | | 12 | | 86.6 | | 74.8 | |

Cash and liquid resources | | 30 | (c)/(i) | 828.0 | | 1,086.5 | |

| |

| |

| |

| |

| | | | 1,138.9 | | 1,497.7 | |

Convertible debt and guaranteed notes (amounts falling due within one year) | | 15 | | (471.4 | ) | (796.3 | ) |

Creditors (amounts falling due within one year) | | 16 | | (365.5 | ) | (798.8 | ) |

| |

| |

| |

| |

| | | | (836.9 | ) | (1,595.1 | ) |

| | | |

| |

| |

Net current assets/(liabilities) | | | | 302.0 | | (97.4 | ) |

| | | |

| |

| |

Total assets less current liabilities | | | | 2,334.5 | | 3,176.0 | |

Convertible debt and guaranteed notes (amounts falling due after one year) | | 15 | | (1,479.9 | ) | (1,480.4 | ) |

Creditors (amounts falling due after one year) | | 16 | | (29.2 | ) | (236.2 | ) |

| |

| |

| |

| |

Net assets | | 2 | | 825.4 | | 1,459.4 | |

| |

| |

| |

| |

Capital and Reserves | | | | | | | |

Called-up share capital | | 17 | | 22.0 | | 19.9 | |

Share premium account | | | | 5,558.8 | | 5,392.6 | |

Shares issuable | | | | 17.7 | | 18.0 | |

Capital conversion reserve fund | | | | 0.1 | | 0.1 | |

Equity adjustment from foreign currency translation | | | | (12.2 | ) | (25.0 | ) |

Profit and loss account | | 18 | | (4,761.0 | ) | (3,945.6 | ) |

| |

| |

| |

| |

Shareholders’ funds—equity | | | | 825.4 | | 1,460.0 | |

Minority equity interests | | 19 | | — | | (0.6 | ) |

| |

| |

| |

| |

Capital employed | | | | 825.4 | | 1,459.4 | |

| | | |

| |

| |

The accompanying notes are an integral part of these financial statements.

Garo Armen,chairman | G. Kelly Martin,president and chief executive officer |

86

Consolidated Statement of Cash Flows

| | | | Year Ended 31 December | |

| | | |

| |

| | Notes | | 2003

$m | | 2002

$m | | 2001

$m | |

| |

| |

| |

| |

| |

Cash Flow from Operating Activities | | 30 | (a) | (322.3 | ) | 259.6 | | 524.6 | |

| |

| |

| |

| |

| |

Returns on Investments and Servicing of Finance | | | | | | | | | |

Interest received | | | | 24.2 | | 44.8 | | 80.3 | |

Interest paid | | | | (281.9 | ) | (176.5 | ) | (138.4 | ) |

| | | |

| |

| |

| |

Cash outflow from returns on investments and servicing of finance | | | | (257.7 | ) | (131.7 | ) | (58.1 | ) |

| | | |

| |

| |

| |

Taxation | | | | (8.9 | ) | (18.6 | ) | (6.5 | ) |

| | | |

| |

| |

| |

Capital Expenditure and Financial Investment | | | | | | | | | |

Additions to property, plant and equipment | | | | (33.7 | ) | (170.2 | ) | (120.8 | ) |

Receipts from disposal of property, plant and equipment | | | | 27.9 | | 8.6 | | 2.0 | |

Payments to acquire intangible assets | | | | (144.8 | ) | (315.5 | ) | (286.7 | ) |

Receipts from disposal of intangible assets | | | | 0.5 | | 9.4 | | 11.2 | |

Payments to acquire Pharma Marketing/Autoimmune product royalty rights | | | | (297.6 | ) | (121.0 | ) | — | |

Redemption of investment in Autoimmune | | | | — | | 38.5 | | — | |

Sale of EPIL III investments in connection with the repayment of EPIL III debt | | | | — | | 148.0 | | — | |

Payment under guarantee in connection with EPIL III sale of investments | | | | — | | (141.6 | ) | — | |

Payments to acquire financial current assets | | | | — | | (1.0 | ) | (148.2 | ) |

Sale and maturity of financial current assets | | | | — | | 83.9 | | 143.3 | |

Payments to acquire financial fixed assets | | | | (13.9 | ) | (191.2 | ) | (624.3 | ) |

Receipts from disposal of financial fixed assets | | | | 329.3 | | 36.6 | | 76.2 | |

| | | |

| |

| |

| |

Cash outflow from capital expenditure and financial investment | | | | (132.3 | ) | (615.5 | ) | (947.3 | ) |

| | | |

| |

| |

| |

Acquisitions and Disposals | | | | | | | | | |

Cash paid on acquisitions | | 30 | (d) | — | | — | | (9.5 | ) |

Cash received on disposal of businesses | | 30 | (f) | 546.9 | | 361.3 | | — | |

Cash received on disposal of subsidiaries | | 30 | (g) | 46.1 | | 81.8 | | 41.9 | |

| |

| |

| |

| |

| |

Cash inflow from acquisitions and disposals | | | | 593.0 | | 443.1 | | 32.4 | |

| | | |

| |

| |

| |

Cash outflow before use of liquid resources and financing | | | | (128.2 | ) | (63.1 | ) | (454.9 | ) |

| | | |

| |

| |

| |

Management of Liquid Resources | | 30 | (b) | 14.5 | | 225.5 | | 106.8 | |

| |

| |

| |

| |

| |

Financing | | | | | | | | | |

Proceeds from issue of share capital | | | | 167.9 | | 5.7 | | 304.8 | |

Issue of loan notes | | | | 460.0 | | — | | 1,200.0 | |

Repurchase of LYONs | | | | (687.5 | ) | (126.9 | ) | — | |

Repayment of EPIL III debt | | | | — | | (160.0 | ) | — | |

Repayment of loans | | | | (83.2 | ) | (399.9 | ) | (555.7 | ) |

Bank borrowing | | | | — | | — | | 342.8 | |

| | | |

| |

| |

| |

Cash (outflow)/inflow from financing | | | | (142.8 | ) | (681.1 | ) | 1,291.9 | |

| | | |

| |

| |

| |

Net (decrease)/increase in cash | | 30 | (c) | (256.5 | ) | (518.7 | ) | 943.8 | |

| |

| |

| |

| |

| |

The accompanying notes are an integral part of these financial statements.

87

FINANCIAL STATEMENTS

Consolidated Statement of Cash Flows (continued)

| | | | Year Ended 31 December | |

| | | |

| |

| | Notes | | 2003

$m | | 2002

$m | | 2001

$m | |

| |

| |

| |

| |

| |

Reconciliation of Net Cash Flow to Movement in Net Debt | | | | | | | | | |

(Decrease)/increase in cash for the period | | | | (256.5 | ) | (518.7 | ) | 943.8 | |

Cash inflow from movement in liquid resources | | | | (14.5 | ) | (225.5 | ) | (106.8 | ) |

| | | |

| |

| |

| |

| | | | (271.0 | ) | (744.2 | ) | 837.0 | |

Other borrowing | | | | — | | — | | (347.4 | ) |

Repayment of loans | | | | 83.2 | | 559.9 | | 557.6 | |

Repurchase of LYONs | | | | 803.4 | | 149.8 | | — | |

Issue of loan notes | | | | (460.0 | ) | — | | (1,200.0 | ) |

| | | |

| |

| |

| |

Change in net debt resulting from cash flows | | | | 155.6 | | (34.5 | ) | (152.8 | ) |

| | | |

| |

| |

| |

Loans acquired with subsidiary undertaking | | | | — | | — | | (0.3 | ) |

Non-cash movement—translation differences | | | | 12.5 | | 11.2 | | (1.4 | ) |

Non-cash movement—notes | | | | (18.0 | ) | 8.1 | | 269.6 | |

Non-cash movement—other | | | | (1.2 | ) | (29.8 | ) | 1.1 | |

| | | |

| |

| |

| |

Decrease/(increase) in net debt | | 30 | (c) | 148.9 | | (45.0 | ) | 116.2 | |

| |

| |

| |

| |

| |

The accompanying notes are an integral part of these financial statements.

88

Consolidated Statement of Changes in Shareholders’ Funds

| | Number

of Shares

m | | Share

Capital

$m | | Share

Premium

$m | | Shares

Issuable

$m | | Capital

Conversion

$m | | Profit

and Loss

Account

$m | | Translation

Adjustment

$m | | Total

Amount

$m | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Balance at 31 December 2000 | | 322.5 | | 18.7 | | 4,750.9 | | 25.9 | | 0.1 | | 556.7 | | (36.8 | ) | 5,315.5 | |

Exercise of stock options and warrants | | 18.0 | | 0.8 | | 308.2 | | — | | — | | — | | — | | 309.0 | |

Exchange of 4.75% Exchangeable Notes | | 9.1 | | 0.4 | | 324.2 | | — | | — | | — | | — | | 324.6 | |

Stock issued as a result of acquisitions | | 0.2 | | — | | 7.3 | | (7.3 | ) | — | | — | | — | | — | |

Issue costs | | — | | — | | (4.3 | ) | — | | — | | — | | — | | (4.3 | ) |

Equity adjustment from foreign currency translation | | — | | — | | — | | — | | — | | — | | (3.1 | ) | (3.1 | ) |

Retained loss | | — | | — | | — | | — | | — | | (887.2 | ) | — | | (887.2 | ) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Balance at 31 December 2001 | | 349.8 | | 19.9 | | 5,386.3 | | 18.6 | | 0.1 | | (330.5 | ) | (39.9 | ) | 5,054.5 | |

Exercise of stock options and warrants | | 0.6 | | — | | 7.7 | | — | | — | | — | | — | | 7.7 | |

Stock issued as a result of acquisitions | | — | | — | | 0.6 | | (0.6 | ) | — | | — | | — | | — | |

Issue costs | | — | | — | | (2.0 | ) | — | | — | | — | | — | | (2.0 | ) |

Equity adjustment from foreign currency translation | | — | | — | | — | | — | | — | | — | | 14.9 | | 14.9 | |

Retained loss | | — | | — | | — | | — | | — | | (3,615.1 | ) | — | | (3,615.1 | ) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Balance at 31 December 2002 | | 350.4 | | 19.9 | | 5,392.6 | | 18.0 | | 0.1 | | (3,945.6 | ) | (25.0 | ) | 1,460.0 | |

Exercise of stock options and warrants | | 0.8 | | 0.1 | | 2.5 | | — | | — | | — | | — | | 2.6 | |

Stock issued as a result of acquisitions | | — | | — | | 0.3 | | (0.3 | ) | — | | — | | — | | — | |

Stock issued as a result of private offering | | 35.0 | | 2.0 | | 171.2 | | — | | — | | — | | — | | 173.2 | |

Issue costs | | — | | — | | (7.8 | ) | — | | — | | — | | — | | (7.8 | ) |

Equity adjustment from foreign currency translation | | — | | — | | — | | — | | — | | — | | 12.8 | | 12.8 | |

Retained loss | | — | | — | | — | | — | | — | | (815.4 | ) | — | | (815.4 | ) |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Balance at 31 December 2003 | | 386.2 | | 22.0 | | 5,558.8 | | 17.7 | | 0.1 | | (4,761.0 | ) | (12.2 | ) | 825.4 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Consolidated Statement of Total Recognised Gains and Losses

| | Year Ended 31 December | |

| |

| |

| | 2003

$m | | 2002

$m | | 2001

$m | |

| |

| |

| |

| |

Retained loss | | (815.4 | ) | (3,615.1 | ) | (887.2 | ) |

Equity adjustment from foreign currency translation | | 12.8 | | 14.9 | | (3.1 | ) |

| |

| |

| |

| |

Total recognised losses | | (802.6 | ) | (3,600.2 | ) | (890.3 | ) |

| |

| |

| |

| |

The accompanying notes are an integral part of these financial statements.

89

FINANCIAL STATEMENTS

Company Balance Sheet

| | Notes | | At 31 December

2003

$m | | At 31 December

2002

$m | |

| |

| |

| |

| |

Fixed Assets | | | | | | | |

Intangible assets | | 31 | | 76.1 | | 88.8 | |

Tangible assets | | 31 | | 14.4 | | 17.7 | |

Financial assets | | 31 | | 2,268.1 | | 2,699.2 | |

| |

| |

| |

| |

| | | | 2,358.6 | | 2,805.7 | |

| | | |

| |

| |

Current Assets | | | | | | | |

Debtors | | 31 | | 9.9 | | 19.4 | |

Cash and liquid resources | | | | 21.5 | | 182.8 | |

| | | |

| |

| |

| | | | 31.4 | | 202.2 | |

Creditors (amounts falling due within one year) | | 31 | | (888.5 | ) | (1,536.4 | ) |

| |

| |

| |

| |

Net current liabilities | | | | (857.1 | ) | (1,334.2 | ) |

| | | |

| |

| |

Total assets less current liabilities | | | | 1,501.5 | | 1,471.5 | |

Creditors (amounts falling due after one year) | | 31 | | (13.5 | ) | (12.1 | ) |

| |

| |

| |

| |

Net assets | | | | 1,488.0 | | 1,459.4 | |

| | | |

| |

| |

Capital And Reserves | | | | | | | |

Called-up share capital | | 17 | | 22.0 | | 19.9 | |

Share premium account | | | | 5,558.8 | | 5,392.6 | |

Shares issuable | | | | 17.7 | | 18.0 | |

Capital conversion reserve fund | | | | 0.1 | | 0.1 | |

Profit and loss account | | 18 | | (4,110.6 | ) | (3,971.2 | ) |

| |

| |

| |

| |

Shareholders’ funds—equity | | | | 1,488.0 | | 1,459.4 | |

| | | |

| |

| |

The accompanying notes are an integral part of these financial statements.

Garo Armen,chairman | G. Kelly Martin,president and chief executive officer |

90

NOTES RELATING TO FINANCIAL STATEMENTS

1 Significant Accounting Policies

The financial statements are prepared in U.S. dollars under the historical cost convention and in accordance with Irish GAAP and comply with the Financial Reporting Standards (“FRS”) of the Accounting Standards Board, as promulgated by the Institute of Chartered Accountants in Ireland. Where there are significant differences to U.S. GAAP, these have been described in Note 33 to the Consolidated Financial Statements.

The following accounting policies have been applied consistently in dealing with items which are considered material in relation to the Company’s financial statements.

a Basis of consolidation and presentation of financial information

The Consolidated Financial Statements include the accounts of Elan and all of its subsidiary undertakings and its share of profits or losses of associated undertakings. Associated undertakings are accounted for under the equity method of accounting. All significant intercompany profits, transactions and account balances have been eliminated.

The Company has made significant losses during the last three financial years. However, the directors, having made inquiries, believe that Elan has adequate resources to continue in operational existence for the foreseeable future and that it is appropriate to continue to adopt the going concern basis in preparing the financial statements.

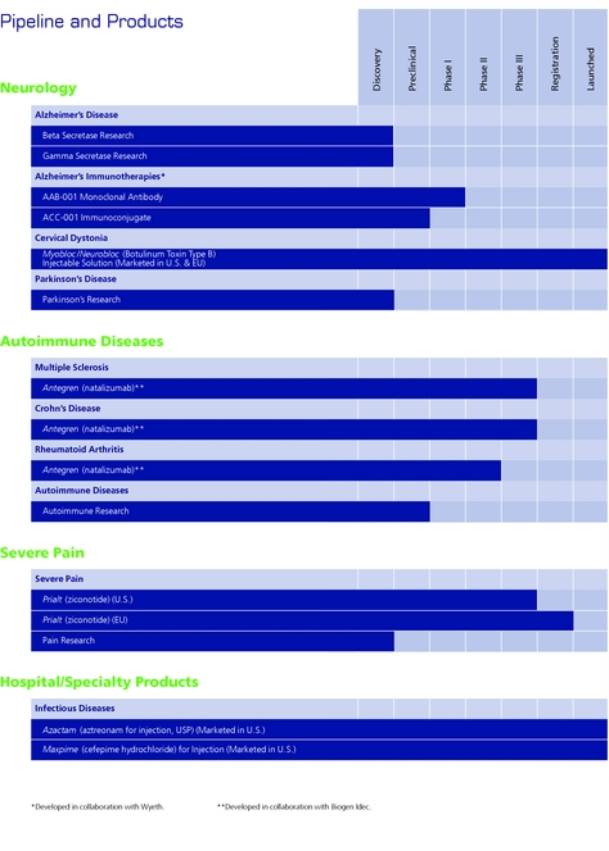

b Description of business

Elan, an Irish public limited company, is a neuroscience-based biotechnology company headquartered in Dublin, Ireland that is focused on discovering, developing, manufacturing and marketing advanced therapies in neurology, autoimmune diseases and severe pain.

On 12 February 2004, Elan announced the formal completion of its recovery plan. The recovery plan had been announced on 31 July 2002 to restructure Elan’s businesses, assets and balance sheet in order to enable it to meet its financial commitments. With the completion of the recovery plan, Elan will focus on three core therapeutic areas: neurology, autoimmune diseases and severe pain. During the course of the recovery plan, the Group was reorganised and two units were created: Core Elan and Elan Enterprises.

Core Elan is engaged in biopharmaceutical research and development activities, pharmaceutical commercial activities and pharmaceutical manufacturing activities. Biopharmaceutical research and development activities include the discovery and development of products in the therapeutic areas of neurology, autoimmune diseases and severe pain. Elan’s pharmaceutical commercial activities include the marketing of neurology/pain management products and hospital/specialty products. The Company’s initiatives in product development, optimisation, and manufacturing are encompassed by Global Services & Operations, which is focused on providing technology platforms that address the drug delivery challenges of the pharmaceutical industry.

With the completion of the recovery plan on 12 February 2004, Elan announced the end of operations for its Elan Enterprises business unit. Elan Enterprises was mainly comprised of Elan’s drug delivery businesses and other assets such as business ventures and non-core pharmaceutical products. Drug delivery activities have historically included the development, licensing and marketing of drug delivery products, technologies and services to pharmaceutical industry clients on a worldwide basis. Elan Enterprises divested many of these businesses and assets.

Since 1996, Elan has pursued collaborations with biotechnology, drug delivery and pharmaceutical companies through a programme referred to as “the business venture programme”. Elan has not entered into any new business ventures under the business venture programme since mid-2001. All business ventures have been terminated, restructured or are now inactive. As a consequence, Elan does not expect to provide any additional financing to the business ventures and business venture parents. See Note 26 to the Consolidated Financial Statements for a summary of the investments made and licence fees received from the business venture arrangements.

91

NOTES RELATING TO FINANCIAL STATEMENTS

Elan has in the past entered into risk-sharing arrangements. Please refer to Note 24 to the Consolidated Financial Statements for information on Elan’s risk-sharing arrangements. These arrangements have been terminated and Elan will not earn any revenues from these risk-sharing arrangements or upfront licence fees from business ventures in the future.

The composition of Elan’s revenue for 2003, 2002 and 2001 is described below in Note 1c to the Consolidated Financial Statements.

c Revenue

Elan’s revenues are derived from a number of different sources and are classified within the categories of product revenue and contract revenue. Revenue is shown net of value added tax and other sales taxes, trade discounts and rebates.

Product revenue includes (i) the sale of products, (ii) royalties, (iii) the sales of product rights and related inventory (referred to as product disposals and product rationalisations), and (iv) product co-promotion, marketing and similar activities.

The sale of products consists of the sale of pharmaceutical drugs and diagnostic products primarily to wholesalers and physicians. Royalties arise when Elan receives a percentage of revenue on a product marketed by a third party. Revenue from the sale of product rights and related inventory consists of the proceeds from the disposal of products, inventory and intellectual property less the unamortised cost of the related intangible assets. Revenue from product co-promotion, marketing and similar activities consists of the reimbursement of commercialisation expenses from Elan’s risk-sharing arrangements. Elan had two risk-sharing arrangements which were with Pharma Marketing and Autoimmune.

Product revenue from the sale of products is recognised when title passes, net of applicable estimated discounts, sales returns, rebates and charge-backs. Other product revenues are recognised based on the terms of the applicable contract. Estimated sales returns, pursuant to rights of return granted to the Company’s customers, are reflected as a reduction of revenue in the same period that the related sales are recorded. The sales returns provisions are based on actual experience, although in certain situations, for example, a new product launch or at patent expiry, further judgement may be required. These amounts are included in other current liabilities (rebates) or deducted from trade debtors (other discounts). Additionally, revenue is also recorded net of provision, made at the time of sale for estimated cash discounts, rebates and charge-backs. The Company enters into contracts with certain managed care organisations to provide access to the Company’s products. Based on a managed care organisation’s market share performance and utilisation of the Company’s products, the organisation receives rebates from the Company. In addition, the Company is bound by certain laws and regulations to provide product at a discounted rate to Medicaid recipients. Medicaid rebates are paid to each state in the United States based on claims filed by pharmacies that provide the Company’s products to Medicaid recipients at the reduced rate. Charge-backs are amounts paid to reimburse wholesalers for sales to third parties at reduced prices based on contracts the Company negotiates. Cash discounts are provided to customers that pay their invoice within a certain time period.

Contract revenue includes (i) licence fees, (ii) research revenue and (iii) contract revenue from risk-sharing arrangements. Contract revenue arises from contracts to perform research and development services on behalf of clients and/or technology licensing and business ventures. Contract revenue is recognised when earned and non-refundable, and when Elan has no future obligation with respect to the revenue, in accordance with the terms prescribed in the applicable contract.

Licence fees are up-front or milestone payments for intellectual property and technology owned by Elan. Research revenue consists of payments or milestones arising from research and development activities performed by Elan on behalf of third parties. Contract revenue from risk-sharing arrangements consists of the reimbursement of research and development costs by Pharma Marketing and Autoimmune.

The composition of Elan’s revenue for 2003, 2002 and 2001 was as follows:

| | 2003

$m | | 2002

$m | | 2001

$m | |

| |

| |

| |

| |

Product revenue | | 712.6 | | 1,204.5 | | 1,407.0 | |

Contract revenue | | 49.5 | | 128.5 | | 333.7 | |

| |

| |

| |

| |

Total revenue | | 762.1 | | 1,333.0 | | 1,740.7 | |

| |

| |

| |

| |

92

Product revenue can be further analysed as follows:

| | 2003

$m | | 2002

$m | | 2001

$m | |

| |

| |

| |

| |

Product Revenue | | | | | | | |

Retained products | | 286.2 | | 298.6 | | 454.1 | |

Divested products | | 426.4 | | 843.1 | | 795.2 | |

Risk-sharing arrangements | | — | | 62.8 | | 157.7 | |

| |

| |

| |

| |

| | 712.6 | | 1,204.5 | | 1,407.0 | |

| |

| |

| |

| |

Divested products includes products divested since the beginning of 2001, and products which are currently subject to divestment agreements. Retained products includes products that were not divested and that are not subject to divestment agreements. Included in divested product revenue for 2003, 2002 and 2001 were exceptional revenues of $Nil, $172.5 million and $231.4 million, respectively, arising from product disposals and rationalisations. These revenues represent the proceeds, net of the unamortised cost of the related intangible assets, arising from the disposal of products during 2002 and 2001.

Contract revenue can be further analysed as follows:

| | 2003

$m | | 2002

$m | | 2001

$m | |

| |

| |

| |

| |

Contract Revenue | | | | | | | |

Licence fees | | — | | 7.1 | | 173.6 | |

Risk-sharing arrangements | | — | | 37.2 | | 58.7 | |

Research revenues/milestones | | 49.5 | | 84.2 | | 101.4 | |

| |

| |

| |

| |

| | 49.5 | | 128.5 | | 333.7 | |

| |

| |

| |

| |

Contract revenue from business venture arrangements, consisting of up-front licence fees and research revenue, was as follows:

| | 2003

$m | | 2002

$m | | 2001

$m | |

| |

| |

| |

| |

Up-front licence fees | | — | | — | | 172.5 | |

Research revenue | | 3.7 | | 13.4 | | 15.0 | |

| |

| |

| |

| |

Total | | 3.7 | | 13.4 | | 187.5 | |

| |

| |

| |

| |

Elan made initial investments in the business venture arrangements of $Nil, $Nil and $229.2 million for 2003, 2002 and 2001, respectively. Elan made subsequent investments in the business venture parents of $7.1 million, $83.4 million and $92.2 million for 2003, 2002 and 2001, respectively. In addition, Elan expensed $3.0 million, $23.9 million and $24.6 million of subsequent funding to the business ventures in 2003, 2002 and 2001, respectively.

d Exceptional items

Exceptional items are those items that in management’s judgement are material items which derive from events or transactions that fall within the ordinary activities of the Group and which individually or, if of a similar type, in aggregate, need to be disclosed by virtue of their size or incidence.

The principal items classified as exceptional items include exceptional revenues recorded on the disposal of products and gains or losses recorded on the disposal of businesses, tangible and intangible asset impairments, purchase of royalty rights, severance and relocation costs, losses from litigation or regulatory actions including shareholders litigation and SEC investigation, and investment gains, losses and impairments (including those related to investments in business ventures and business venture parents). These items have been treated consistently from period to period. Management believes that disclosure of exceptional items is meaningful because it provides additional information in relation to these material items.

93

NOTES RELATING TO FINANCIAL STATEMENTS

e Discontinued operations

A discontinued operation is classified as an operation of the business which is (i) sold or terminated and the sale or termination has been completed during the year or within three months following the year end, (ii) the former activities have ceased permanently, (iii) the operation had a material effect on the nature and focus of the business and (iv) its financial results are clearly distinguishable.

f Tangible fixed assets and impairment

Tangible fixed assets are stated at cost less accumulated depreciation. Depreciation of tangible fixed assets is computed using the straight-line method based on estimated useful lives at the following annual rates:

| | % | |

Buildings | | 2.5–6.6 | |

Leasehold improvements | | Lease term | |

Plant and equipment | | 5–50 | |

The average depreciation rate for buildings is 3% and for plant and equipment is 12%.

Where events or circumstances are present which indicate that the carrying amount of a tangible asset may not be recoverable, the Company estimates the net realisable value (estimated sales proceeds less costs to sell) or the value in use (present value of future cash flows) expected to result from use of the asset and its eventual divestment. The recoverable amount is the higher of net realisable value and value in use. Where the recoverable amount is less than the carrying amount of the asset, the Company recognises an impairment loss which is charged to the profit and loss account. Otherwise, no loss is recognised.

g Intangible fixed assets and impairment

Patents, licences, acquired IP and goodwill are stated at the lower of cost or valuation. Patents and licences are amortised over their expected useful lives, which range between 2 years and 20 years. The average amortisation period for patents and licences is approximately 14 years. Goodwill arising on acquisitions since 1998 is capitalised and amortised to the profit and loss account over the period during which the benefits are expected to accrue, but in no case greater than 20 years. The average amortisation period for goodwill is 18 years. Prior to 1 January 1998, goodwill was written-off directly to consolidated reserves in the year of acquisition. Acquired IP arising on acquisitions is capitalised and amortised to the profit and loss account over its estimated useful economic life. The useful economic life commences upon generation of product revenue relating to the acquired IP.

Where events or circumstances are present which indicate that the carrying amount of an intangible asset may not be recoverable, the Company estimates the net realisable value (estimated sales proceeds less costs to sell) or the value in use (present value of future cash flows) expected to result from use of the asset and its eventual divestment. The recoverable amount is the higher of net realisable value and value in use. Where the recoverable amount is less than the carrying amount of the asset, the Company recognises an impairment loss which is charged to the profit and loss account. Otherwise, no loss is recognised.

h Stocks

Stocks are valued at the lower of cost or market value. Cost in the case of raw materials and supplies is calculated on a first-in, first-out basis and comprises the purchase price, including import duties, transport and handling costs and any other directly attributable costs, less trade discounts. Cost in the case of work-in-progress and finished goods comprises direct labour, material costs and attributable overheads.

i Research and development