August 26, 2014

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Attn: Pamela Long, Assistant Director

Re: Aemetis, Inc.

Registration Statement on Form S-3

Filed July 3, 2014

File No. 333-197259

Form 10-K for the Fiscal Year Ended December 31, 2013

Filed March 11, 2014

Form 10-Q for the Fiscal Quarter Ended March 31, 2014

Filed May 15, 2014

File No. 0-51354

Dear Ms. Long:

This letter is being submitted by Aemetis, Inc. (the “Company”) in response to the comments received from the Staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) by the letter dated July 30, 2014 regarding the Company’s filings referenced above. This letter is being submitted together with Amendment No. 1 to the Registration Statement on Form S-3 filed with the Commission on July 3, 2014 (“Amendment No. 1”).

For your convenience, the numbering of the paragraphs below corresponds to the numbering of the Staff’s letter and we have included each of the Staff's comments in bold before each of the Company’s responses.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 2 | |

Registration Statement on Form S-3

General

| 1. | We note that in your latest quarterly report, Form 10-Q for the period ending March 31, 2014, you disclose that one your subsidiaries, Universal Biofuels Pvt. Ltd. (UBPL), is currently in default of its loan with the State Bank of India. General Instruction I.A.5.i of Form S-3 states that in order for a registrant to be eligible to use Form S-3, neither the registrant nor its subsidiaries can be in default on indebtedness in the period following the filing of the last annual report, which in this case would be your filed Form 10-K for the fiscal year ending December 31, 2013. Please provide us with your analysis of your ability to register securities on Form S-3 at this time. For additional guidance, please see Question 115.16 of Securities Act Forms Compliance and Disclosure Interpretations. |

Response:

General Instruction I.A.5.i provides that a registrant can use Form S-3 if neither the registrant nor any of its consolidated or unconsolidated subsidiaries have, since the end of the last fiscal year for which certified financial statements of the registrant and its consolidated subsidiaries were included in a report filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, defaulted on any installment or installments on indebtedness for borrowed money, which defaults in the aggregate are material to the financial position of the registrant and its consolidated and unconsolidated subsidiaries, taken as a whole. Question 115.16 of the Staff’s Securities Act Forms Compliance and Disclosure Interpretations provides that a registrant can use Form S-3 after a default, even if the default has not been cured, “provided that the company has filed a Form 10-K including audited financial statements covering the period in which the material event of default or failure to pay preferred dividends occurred.”

We believe that the Company is compliant with General Instruction I.A.5.i of Form S-3 because the Company has filed annual reports on Form 10-K for each of the years in which the default has occurred and continued, which annual reports included audited financial statements.

Specifically, the Company’s subsidiary UBPL first received notice of an event of default under the Agreement of Loan for Overall Limit dated as of June 26, 2008 with the State Bank of India on October 7, 2009 for failure to make an installment payment on the loan due in June 2009. The State Bank of India accelerated the loan and declared all amounts thereunder to be due and payable by October 10, 2009. Following such acceleration, the Company has accrued interest at the default rate and has classified the entire loan amount as current. UBPL subsequently received another notice from the State Bank of India on March 10, 2011, again declaring an event of default resulting from UBPL’s failure to make payments due commencing in June 2009 and again demanding repayment of the entire outstanding indebtedness under the loan. This default was subjected to the Company’s audits and disclosed in the Company’s annual reports on Form 10-K for the fiscal years ended December 31, 2009, 2010, 2011, 2012 and 2013. Thus, as permitted by Question 115.16, while the payment default has not been cured, it has been through multiple audits and reflected in multiple annual reports on Form 10-K, so the Company remains eligible to use Form S-3.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 3 | |

| 2. | Due to the fact that you affected a 1-for-10 reverse stock split on May 15, 2014 which is not reflected in your Form 10-K for the year ended December 31, 2013, and the fact that your Form 10-K is incorporated by reference into the current registration statement, please revise your filing to present selected financial data that includes relevant per share information for all required periods, with the reverse stock split prominently disclosed. |

In response to the Staff’s comment, the Company has revised its disclosure on page 3 of the Amendment No. 1 to present the following selected financial data that includes relevant per share information, in light of the reverse stock split, with the reverse stock split prominently disclosed:

Selected consolidated financial data

The following tables set forth selected consolidated financial data for the periods ended or as of the dates indicated. Such historical consolidated financial data should be read in conjunction with the information set forth in our Annual Report on Form 10-K for the year ended December 31, 2013, filed with the SEC on March 11, 2014 (“Current 10-K”) and incorporated herein by reference.

The statement of operations data presented below for each of the years in the three-year period ended December 31, 2013, and the balance sheet data as of December 31, 2012 and 2013, are derived from the audited “Consolidated Financial Statements” contained in our Current 10-K, as adjusted for the reverse stock split which took effect May 15, 2014. Our historical results are not necessarily indicative of the results to be expected for any future periods.

(in thousands, except for loss per share and shares outstanding)

| | Year Ended December 31 |

| | | 2013 | | | 2012 | | | 2011 | |

| Statement of Operations Data | | | | | | | | | |

| Sales | | $ | 177,514 | | | $ | 189,048 | | | $ | 141,858 | |

| Cost of goods sold | | | 159,220 | | | | 197,975 | | | | 137,216 | |

| Gross profit | | | 18,294 | | | | (8,927 | ) | | | 4,642 | |

| | | | | | | | | | | | | |

| Research and development expenses | | | 539 | | | | 620 | | | | 577 | |

| Selling, general and administrative expenses | | | 15,275 | | | | 11,613 | | | | 8,571 | |

| | | | | | | | | | | | | |

| Operating income (loss) | | $ | 2,480 | | | $ | (21,161 | ) | | $ | (4,505 | ) |

| Interest expense | | | 27,984 | | | | 26,727 | | | | 13,561 | |

| Net loss | | | (24,437 | ) | | | (4,282 | ) | | | (18,296 | ) |

| Loss per common share – basic and diluted* | | $ | (1.28 | ) | | $ | (0.28 | ) | | $ | (1.77 | ) |

| Weighted average shares outstanding – basic and diluted* | | $ | 19,100,892 | | | | 15,102,397 | | | | 10,353,664 | |

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 4 | |

| | | Year Ended December 31 |

| | | 2013 | | | 2012 | |

| Balance Sheet Data | | | | |

| Total assets | | $ | 97,142 | | | $ | 96,872 | |

| Current Liabilities | | | 36,117 | | | | 57,835 | |

| Long-term debt | | | 73,792 | | | | 35,522 | |

| Total Stockholder’s Equity (Deficit) | | $ | (12,767 | ) | | | 3,515 | |

* The loss per common share and weighted average shares outstanding for all periods presented reflect the one-for-ten reverse split, which took effect May 15, 2014.

Description of Rights, page 22

| 3. | We note your disclosure here, as well as in the legal opinion, that in addition to issuing rights to purchase your debt securities, common stock and preferred stock—which are securities covered by this registration statement—you may also issue rights to purchase “other securities.” Please revise to describe all of the classes of securities to which the rights relate, as they must be identified in the registration statement. If any such securities are not covered by the registration statement, please tell us why registration under the Securities Act is not required. |

Response:

In response to the Staff’s comment, the Company has revised its disclosure on pages 22 and 23 of the Amendment No. 1 to clarify that the Company is only registering rights to purchase our debt securities, common stock and preferred stock. Further, McDonald Carano Wilson LLP has revised page 1 of its opinion on Exhibit 5.1 to the Amendment No. 1 to clarify that the Company is only registering rights to purchase our debt securities, common stock and preferred stock.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 5 | |

Exhibit 5.1 – Opinion of McDonald Carano Wilson LLP

| 4. | We note that the opinions in Exhibit 5.1 are limited to the State of Nevada. With respect to debt securities, counsel must opine on the laws of the state governing the indenture, which is the State of New York. Please see Section II.B.1.e of Division of Corporation Finance Staff Legal Bulletin No. 19 for more information. |

Response:

In response to the Staff’s comment, Shearman & Sterling LLP has provided an opinion on the validity of the debt securities with respect to matters of New York law, which opinion the Company has included as Exhibit 5.2 to the Amendment No. 1.

| 5. | We note that counsel’s opinion states that the units may be composed of securities that you are registering and “other securities.” Please revise to describe all of the classes of securities to which the units may consist of. Additionally, we note that “other securities” are not disclosed in Description of Units on page 24 of the registration statement. Please ensure that the information disclosed in your registration statement and legal opinion is consistent. |

Response:

In response to the Staff’s comment, McDonald Carano Wilson LLP has revised page 1 of its opinion on Exhibit 5.1 to the Amendment No. 1 to clarify that the Company is only registering units composed of any combination of our debt securities, common stock, preferred stock and warrants.

Form 10-K for the Fiscal Year Ended December 31, 2013

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 18

Results of Operations, page 21

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 6 | |

| 6. | Please revise future filings to quantify and discuss the reasons for fluctuations in consolidated and segment gross profit margins between periods. |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will quantify and discuss the reasons for fluctuations in consolidated and segment gross profit margins between periods in future filings. In response to the Staff’s comment, we incorporated on page 27 of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2014, filed with the Commission on August 7, 2014 (the “Current 10-Q”), the following tabular and narrative disclosure regarding our gross profit margins, including the reasons for fluctuations thereof in each of our reporting segments and our consolidated results, for the three months ended June 30, 2014 and 2013:

Gross Profit

Three Months Ended June 30 (in thousands)

| | | 2014 | | | 2013 | | | Inc/(dec) | | | %change | |

| North America | | $ | 11,286 | | | $ | 1,108 | | | $ | 10,178 | | | | 918.6 | % |

| India | | | 67 | | | | 2,643 | | | | (2,576 | ) | | | -97.5 | % |

| Total | | $ | 11,353 | | | $ | 3,751 | | | $ | 7,602 | | | | 202.7 | % |

North America. Gross profit increased by 918.6% due to an entire quarter of production in the three months ended June 30, 2014 compared to only two months of production in the three months ended June 30, 2013. In addition, corn prices decreased by 27% and ethanol prices also decreased by 5% in the three months ended June 30, 2014 compared to the same period in the prior year.

India. The decrease of 97.5% in gross profit was attributable to the decrease of 72.3% in overall revenues in addition to only one international shipment of distilled biodiesel and regular sales of biodiesel and refined glycerin in the three months ended June 30, 2014 compared to one large domestic sale of biodiesel besides other biodiesel sales, refined glycerin, crude and refined palm oil in the three months ended June 30, 2013.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 7 | |

Further in response to the Staff’s comment, we incorporated on page 30 of the Current 10-Q the following similar disclosure for the six months ended June 30, 2014 and 2013:

Gross Profit

Six Months Ended June 30 (in thousands)

| | | 2014 | | | 2013 | | | Inc/(dec) | | | %change | |

| North America | | $ | 26,957 | | | $ | 569 | | | $ | 26,388 | | | | 4637.6 | % |

| India | | | 20 | | | | 3,429 | | | | (3,409 | ) | | | -99.4 | % |

| Total | | $ | 26,977 | | | $ | 3,998 | | | $ | 22,979 | | | | 574.8 | % |

North America. Gross profit increased due to production and sales of ethanol for 181 days for the six months ended June 30, 2014 compared to the production and sales of ethanol for 88 days in the six months ended June 30, 2013. In addition, corn prices decreased by 42% in the six months ended June 30, 2014 compared to the same period in the prior year.

India. The decrease of 99.4% in gross profit was attributable to the decrease in 79.3% in overall revenues in addition to only one international shipment of distilled biodiesel besides regular domestic biodiesel and refined glycerin sales in the six months ended June 30, 2014 compared to several shipments of international sales of biodiesel and one large domestic sale of biodiesel besides refined glycerin and crude/refined palm oil sales in the six months ended June 30, 2013.

The Company intends to include appropriate disclosure in accordance with the Staff’s comment in future filings.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 8 | |

| 7. | Please expand your discussion in future filings to quantify and discuss the reasons for fluctuations in consolidated SG&A as a percentage of revenue between periods. |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will expand its disclosure in future filings to quantify and discuss the reasons for fluctuations in consolidated SG&A as a percentage of revenue between periods. In response to the Staff’s comment, we incorporated on pages 27 and 28 of the Current 10-Q the following tabular and narrative disclosure regarding our SG&A expenses, including the reasons for fluctuations thereof, for the three months ended June 30, 2014 and 2013:

SG&A

Three Months Ended June 30 (in thousands)

| | | 2014 | | | 2013 | | | Inc/(dec) | | | %change | |

| North America | | $ | 3,238 | | | $ | 2,909 | | | $ | 329 | | | | 11.3 | % |

| India | | | 211 | | | | 1,075 | | | | (864 | ) | | | -80.4 | % |

| Total | | $ | 3,449 | | | $ | 3,984 | | | | (535 | ) | | | -13.4 | % |

Selling, General and Administrative Expenses (SG&A). SG&A expenses consist primarily of salaries and related expenses for employees, marketing expenses related to sales of ethanol and WDG in North America and biodiesel and other products in India, as well as professional fees, other corporate expenses, and related facilities expenses.

North America. SG&A expenses as a percentage of revenue in the second quarter of 2014 decreased to 6.0% as compared to 8.0% in the corresponding quarter of 2013. Given most of our SG&A expenses are fixed, only marketing fee expense is impacted along with sales. The second quarter decrease as a percentage of revenue is due to reclassification of $0.7 million fixed costs from cost of goods sold to SG&A in the second quarter of 2013 due to the plant being idle in the first month offset by the increase in professional fees of $0.6 million, marketing expenses of $0.3 million and travel and other utilities of $0.1 million for the quarter ended June 30, 2014.

India. Our single largest expense in SG&A comes from operational support fees paid to Secunderabad Oils Limited as part of an operating profit sharing arrangement. SG&A expenses as a percentage of revenue in the second quarter of 2014 decreased to 6% as compared to 9% in the corresponding quarter in 2013. The decrease was due to a decrease in sales activity resulting in a decrease in operating support charges by $0.5 million.

Further in response to the Staff’s comment, we incorporated on page 31 of the Current 10-Q similar disclosure for the six months ended June 30, 2014 and 2013.

The Company intends to include appropriate disclosure in accordance with the Staff’s comment in future filings.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 9 | |

| 8. | Please expand your discussion in future filings to quantify and discuss the reasons for fluctuations in your effective interest rates between periods, including the impact of related amortization expense. |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will expand our discussion in future filings to quantify and discuss the reasons for fluctuations in our effective interest rates between periods, including the impact of related amortization expense.

The Company respectfully advises the Staff that, to provide clarity between the stated interest rate and the effective interest rate, we have provided on the face of the Consolidated Condensed Statements of Operations and Comprehensive Income / (Loss) in our annual report on Form 10-K for the year ended December 31, 2013 and our quarterly reports on Form 10-Q for the quarters ended March 31, 2014 and June 30, 2014, the three principal components of interest expense. Interest expense is separated into three line items: (i) interest expense consisting of the coupon rate of the underlying security, (ii) amortization expense related to debt issuance costs amortized in the current period, and (iii) the charge for extinguishment of debt as a result of applying the provisions of the Financial Accounting Standards Board’s Accounting Standards Codification (“ASC”) 470-50 Debt –Modification and Extinguishment.

Additionally, in our quarterly report on Form 10-Q for the quarter ended March 31, 2014, filed with the Commission on May 15, 2014, we expanded upon the explanations for changes in interest expense compared to the disclosures made in the three months ended March 31, 2014, as follows:

Other Income/Expense. Other income (expense) consisted primarily of interest, amortization and extinguishment expense attributable to debt facilities acquired by our parent company, our subsidiaries Universal Biofuels Pvt. Ltd., International Biofuels, Inc., Aemetis Advanced Fuels Keyes, Inc., Aemetis Facilities Keyes, Aemetis Technologies, AE Advanced Fuels and interest accrued on the judgment obtained by Cordillera Fund, UBS and Kiefer. The debt facilities include stock or warrants issued as fees. The fair value of stock and warrants are amortized as amortization expense, except when the extinguishment accounting method is applied, in which case refinanced debt costs are recorded as extinguishment expense. In addition, the other income (expense) consists of scrap sales from Universal Biofuels Pvt. Ltd., and gain or loss on sale of equipment in the North America entities.

North America. Interest expense was higher in the quarter ended March 31, 2014 due to a higher average debt balance during the current period resulting from amendment and waiver fees and accrued interest added to the debt balance throughout 2013. The decrease in amortization expense is due to debt issuance costs present during the prior period becoming fully amortized in 2013. The debt extinguishment costs were higher in 2013 as there were multiple sub debt notes that were amended in the 2013 period causing a larger loss on extinguishment, while only one sub debt note was refinanced in January 2014.

India. Interest expense decreased as a result of principal and interest payments of $0.1 million and $1.5 million for SBI term loan and working capital loan respectively during the quarter ended March 31, 2014 while utilization of working capital went down by 51% to $0.5 million. The decrease in other income was caused primarily by a decrease in foreign exchange gains as there were international sales in the quarter ended March 31, 2013, but not in the quarter ended March 31, 2014.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 10 | |

We have incorporated similar disclosure on page 28 of our Current 10-Q and intend to include appropriate disclosure in accordance with the Staff’s comment in future filings.

Liquidity and Capital Resources, page 23

Liquidity, page 23

| 9. | We note your risk factor on page 14 where you state “we are a holding company and there are significant limitations on our ability to receive distributions from our subsidiaries.” In this regard, please revise future filings to discuss any material restrictions on your ability to transfer funds from your operating subsidiaries and the potential impact on your liquidity. |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will revise such risk factor in future filings to discuss any material restrictions on our ability to transfer funds from our operating subsidiaries and the potential impact on our liquidity. In response to the Staff’s comment, we incorporated on page 37 of the Current 10-Q the following revised risk factor with an expanded discussion of the material restrictions on our ability to transfer funds from our operating subsidiaries and the potential impact on our liquidity:

We are a holding company and there are significant limitations on our ability to receive distributions from our subsidiaries.

We conduct substantially all of our operations through subsidiaries and are dependent on cash distributions, dividends or other intercompany transfers of funds from our subsidiaries to finance our operations. Our subsidiaries have not made significant distributions to the Company and may not have funds available for dividends or distributions in the future. The ability of our subsidiaries to transfer funds to us will be dependent upon their respective abilities to achieve sufficient cash flows after satisfying their respective cash requirements, including subsidiary-level debt service on their respective credit agreements. Our current credit agreement, the Third Eye Capital Note Purchase Agreement, as amended from time to time, described in the Notes to Consolidated Condensed Financial Statements, requires us to obtain the prior consent of Third Eye Capital, as the Administrative Agent of the Note holders, to make cash distributions or any intercompany fund transfers. The ability of our Indian operating subsidiary to transfer funds to us is restricted by Indian laws and maybe adversely affected by US tax laws. Under Indian laws, our capital contributions, or future capital contributions, to our Indian operation cannot be remitted back to the US. Remittance of funds by our Indian subsidiary to us may subject us to significant tax liabilities under US tax laws.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 11 | |

If the amount of such cash distributions or fund transfers from our subsidiaries, together with the capital we raise from financing activities, are not sufficient to satisfy our ongoing working capital and corporate overhead requirements, even to the extent that we reduce our operations accordingly, our liquidity will be adversely affected.

The Company intends to include appropriate disclosure in accordance with the Staff’s comment in future filings.

Consolidated Financial Statements, page 45

Consolidated Statements of Operations and Comprehensive Loss, page 48

| 10. | Please tell us the facts and circumstances related to the loss on extinguishment of debt of $9,068,868 you recorded during the year ended December 31, 2012. |

Response:

On July 6, 2012, we amended and restated the Note Purchase Agreement (as amended and restated, the “Note Purchase Agreement”) with Third Eye Capital Corporation (“Third Eye Capital”) in order to finance our acquisition of a name-plate 55 million gallon per year ethanol and distiller’s grain production plant located in Keyes, California (the “Keyes Plant”) from Cilion, Inc. Immediately prior to entering into the Note Purchase Agreement, our only debt obligations to Third Eye Capital were a term note with a $7.3 million balance (the “Old Note”) and a revenue participation arrangement with an $8.6 million balance (the “Revenue Participation Loan”). The financing arrangement under the Note Purchase Agreement added a term loan of $15.0 million (the “Acquisition Term Loan”), a term loan of $10.0 million to convert the Revenue Participation Loan to a note, and a revolving loan in an aggregate principal amount of $18.0 million (the “Revolving Credit Facility”). As part of the Cilion acquisition financing, the Old Note was exchanged for a new term note for $7.4 million (the “New Note”). In addition to cash from the Acquisition Term Loan, we issued to Cilion shareholders 15 million shares of our common stock valued at a market value of $0.78 per share. We also paid a placement fee and extension fees to Third Eye Capital totaling $4.8 million in connection with the acquisition financing.

The Note Purchase Agreement triggered an analysis of the accounting treatment of debt modification and restructuring relating to the exchange of the Old Note for the New Note, the modification of the terms of the Revenue Participation Loan, and the incurrence of the Acquisition Term Loan and Revolving Credit Facility from the same lender as part of the acquisition of the Keyes Plant. Troubled debt restructuring accounting is applied when: (i) the borrower is experiencing financial difficulty and (ii) the lender is granting a concession. We considered these criteria, and because the financing arrangement under the Note Purchase Agreement did not involve the granting of a concession by Third Eye Capital, we did not apply troubled debt restructuring accounting. We considered the application of debt modification or extinguishment accounting for the Note Purchase Agreement using the guidance of ASC 470 (470-5-40-6 through 12). In order to determine if the Note Purchase Agreement falls under modification or extinguishment accounting, we assessed if the existing loans and terms were substantially different from the new loans and terms. In order to determine the differences between the new and existing loans, the following cash flow test decision tree was utilized:

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 12 | |

We calculated the cash flows of the New Note and the Revenue Participation Loan in connection with this test. We did not include the Revolving Credit Facility or the Acquisition Term Loan in our calculations for the cash flow test. The Revolving Credit Facility was not subject to the cash flow test because it is a line of credit subject to different guidance on debt modifications for lines of credit. The Acquisition Term Loan was not subject to the cash flow test because it was a new loan and not considered to be part of the modification of the existing loans. Because the New Note and the Revenue Participation Loan have a prepayment option, cash flows were calculated assuming a prepayment as well. We used the cash flow comparison that resulted in the smallest change as the indicator when we applied the cash flow test for determination of modification or extinguishment accounting. We calculated the effective interest rate under the terms of the old debt instruments and used such rate for the cash flow test. The value of the shares issued and fees paid to Third Eye Capital were included in our calculation of the cash flows from the loans under the new terms. The market value of such shares was discounted for lack of marketability. We calculated the smallest change between the present value of the cash flows from loans with new terms and the present value of the remaining cash flows from loans with old terms as 12%. This determination required us to apply extinguishment accounting for the Note Purchase Agreement.

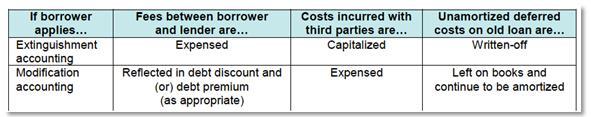

The extinguishment loss was determined by accounting for fees and costs incurred as part of the Note Purchase Agreement in accordance with the guidance of ASC 470-50-40-17 and 18 for extinguishment accounting, as summarized in the following table:

Accordingly, we applied extinguishment accounting by recording the new debt at its fair value utilizing the discounted cash flow method, for which we obtained a third party opinion to determine the appropriate interest rate. Accordingly, we recognized $9.1 million of extinguishment loss for the year ended December 31, 2012.

1. Nature of Activities and Summary of Significant Accounting Policies, page 51

Revenue recognition, page 51

| 11. | Please tell us and revise future filings to explain the nature and magnitude of the non-monetary transactions where you recognize revenue, including how you determine the fair value of the goods you receive. |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will revise future filings to explain the nature and magnitude of any non-monetary transactions where we recognize revenue, including how we determine the fair value of the goods we receive.

On June 1, 2013, the Company’s Indian subsidiary UBPL entered into an agreement that provided for the processing and conversion of 12,000 metric tons of raw material for a fixed fee per ton payable in cash, plus the right to retain all crude glycerin produced during such conversion. The agreement provided for delivery of the raw material by the counterparty, return of the processed material to the counterparty, and the retention of all by-products for future sale by UBPL. Retaining the by-product provided non-monetary financial consideration to UBPL for the conversion of material from its raw to refined form as part of the contract. The retention of the crude glycerin by-product as an in-kind payment was then further treated as revenue and profit from the agreement by recording the crude glycerin at its current market value. Crude glycerin is a commodity with regular trading in the local markets. Accordingly, we recorded the in-kind payment of crude glycerin as both inventory and revenue at the existing market quoted value, and made appropriate disclosures in our significant accounting policy footnote on page 51 of our Current 10-K.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 13 | |

This transaction specifically recognized inventory and revenue in the amount of $499,046 and $215,891 for the quarters ended June 30, 2013 and September 30, 2013, respectively, resulting in the recording of total revenue from this transaction of $715,937, or approximately 2% of UBPL’s total revenue and 0.4% of the Company’s consolidated revenues for the year ended December 31, 2013. This transaction represents our only non-monetary transaction during the fiscal year ended December 31, 2013. Therefore, while we believe such amounts are immaterial, we have incorporated on page 8 of the Current 10-Q the following revised summary of our revenue recognition policies in response to the Staff’s comment:

Revenue recognition. The Company recognizes revenue when there is persuasive evidence of an arrangement, delivery has occurred, the price is fixed or determinable and collection is reasonably assured. The Company records revenues based upon the gross amounts billed to its customers. Revenue from nonmonetary transactions, principally in-kind by-products received in exchange for material processing where the by-product is contemplated by contract to provide value, is recognized at the quoted market price of those goods received or by-products.

The Company intends to include appropriate disclosure in accordance with the Staff’s comment in future filings.

| 12. | We note disclosures related to your sales of ethanol and WDG to J.D. Heiskell and their subsequent sales of ethanol to Kinergy Marketing and WDG to A.L. Gilbert, including the fact that pricing provisions are based on agreements between you and Kinergy Marketing and A.L. Gilbert. Please tell us and revise future filings to explain why your sales of ethanol and WDG involve an intermediary and clarify if you record revenue upon delivery to J.D. Heiskell or to Kinergy Marketing and A.L. Gilbert. If you record revenue upon delivery to J.D. Heiskell, please explain to us how you determined your policy is appropriate, specifically address J.D. Heiskell’s obligation to pay you for your products if they are unable to delivery to or obtain payment from Kinergy Marketing or A.L. Gilbert. |

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 14 | |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will revise future filings to explain why our sales of ethanol and Wet Distillers Grain involve an intermediary and clarify when we record revenue with respect to such arrangements.

We have entered into a series of agreements whereby J.D. Heiskell received legal ownership of inventory at the point of transfer into the finished goods tank. This point of transfer is further confirmed through the lease by J.D. Heiskell of the finished goods tank at our Keyes Plant. Accordingly, when the Keyes Plant transfers ethanol from the production tanks into the finished goods tank, legal title to the product transfers to J.D. Heiskell and, on the following day, J. D. Heiskell pays the company for the value of the product transferred. The daily price is determined based on the daily market price as published by the Oil Producers Information Service, adjusted for certain transportation, marketing and contract incentives. Although J.D. Heiskell regularly pays us for the ethanol produced, it further sells the ethanol to Kinergy Marketing. J.D. Heiskell has the right to transfer the inventory to its own ethanol marketing company and further sell the product to purchasers other than Kinergy Marketing in the event of a default under the agreement.

Accordingly, a persuasive arrangement with J.D. Heiskell exists in the form of the written agreement with detailed terms. Delivery has occurred based on the transfer of legal title into a leased tank in the case of ethanol and the physical transfer of product to A.L. Gilbert in the case of distillers grains. The price is determinable based on the mechanism for establishing a daily price using the Oil Producer Information Service for ethanol and a monthly negotiated price with A.L. Gilbert. Collection is reasonably assured based on the daily settlement procedure in the working capital agreement. Using this revenue recognition analysis, we determined that sufficient indicators are present to permit revenue recognition at the point of transfer into the finished goods tank as revenue was determined to be realizable and earned in accordance with ASC 605-10. The above referenced agreements were disclosed as Exhibits 10.64, 10.65 and 10.66 to our annual report on Form 10-K for the fiscal year ended December 31, 2011, filed with the Commission on October 31, 2012.

We entered into the arrangement with J.D. Heiskell to provide J.D. Heiskell a security interest for their funding of working capital related to corn being processed by the Keyes Plant. J.D. Heiskell’s primary interest in this arrangement is to secure legal title to the finished product at the end of the production process. Kinergy Marketing and A.L. Gilbert have customer relationships in their respective industries and contract for the sale of both ethanol and distillers grains. These organizations also supply the logistical services associated with the transportation of product from our plant to the end customer. At the end of every month, we settle any differences between the price received by Kinergy Marketing and A. L. Gilbert compared to the price paid to us by J.D. Heiskell for any estimated differences between the daily benchmarks and the amounts received from customers.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 15 | |

We recognize revenue on a gross basis based on a preponderance of factors in favor of this treatment as outlined in the Gross vs Net Reporting guidance of ASC 605-45-2 to 605-45-19. Specifically, the Company met the following criteria allowing us to record revenue at gross level: (i) we provide products that are desirable to the customer, (ii) we are the primary obligor in the arrangement; (iii) we accept general inventory and margin risk, (iv) we have title to the inventory until it is transferred to the finished goods tank; (v) we have latitude in establishing price as provided in our arrangements with J.D. Heiskell, Kinergy Marketing and A.L. Gilbert, (vi) we bear the credit risk in the arrangement as we have to pay our suppliers regardless of what price we get for our sales; (vii) we are responsible for meeting the specifications and quality of the ethanol and Wet Distillers Grain at the national standards.

Further in response to the Staff’s comment, we incorporated on page 22 of the Current 10-Q the following revised disclosure regarding such arrangements with J.D. Heiskell, Kinergy Marketing and A.L. Gilbert:

Working Capital Arrangement. In May 2013 we extended the annual Grain Procurement and Working Capital Agreement with J.D. Heiskell that has been in place since March 2011. Pursuant to the agreement we agreed to procure whole yellow corn and grain sorghum (also called “milo”) from J.D. Heiskell. The Company has the ability to obtain grain from other sources subject to certain conditions, however, in the past all of our grain purchases have been from Heiskell. Title and risk of loss of the corn pass to the Company when the corn is deposited into the weigh bin. The term of the Agreement expires on December 31, 2014 and is automatically renewed for additional one-year terms. Heiskell further agrees to sell all ethanol to Kinergy Marketing or other marketing purchaser designated by the Company and all WDG and condensed distillers solubles to A.L. Gilbert. Our relationships with J.D. Heiskell, Kinergy Marketing, and A.L. Gilbert are well established and the Company believes that the relationships are beneficial to all parties involved in utilizing the distribution logistics, reaching out to widespread customer base, managing inventory, and building working capital relationships. Revenue is recognized upon delivery of ethanol to the J. D. Heiskell as revenue recognition criteria has been met and any performance required of the Company subsequent to the sale to J.D. Heiskell is inconsequential. These agreements are ordinary purchase and sale agency agreements for an ethanol plant.

The Company intends to include appropriate disclosure in accordance with the Staff’s comment in future filings.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 16 | |

Property, Plant and Equipment, page 52

| 13. | Please tell us and revise future filings to disclose the range and/or weighted average useful lives for each material asset class included in property, plant and equipment here or in note 3. |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will revise future filings to disclose the range of useful lives for each material asset class included in property, plant and equipment. In response to the Staff’s comment, we incorporated on page 13 of the Current 10-Q the following disclosure:

Depreciation on the items of the property, plant, and equipment is calculated using the straight-line method to allocate their depreciable amounts over their estimated useful lives as follows:

| | | Years | |

| Plant and Buildings | | | 20-30 | |

| Machinery & Equipment | | | 5-7 | |

| Furniture & Fixtures | | | 3-5 | |

The Company intends to include appropriate disclosure in accordance with the Staff’s comment in future filings.

| 14. | We note you acquired a significant amount of property, plant and equipment in your acquisition of Cilion. Please revise future filings to clarify that property, plant and equipment acquired in an acquisition is recorded at fair value at the purchase date. |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will revise future filings to clarify that property, plant and equipment acquired in an acquisition is recorded at fair value at the purchase date. In response to the Staff’s comment, we incorporated on page 9 of the Current 10-Q the following disclosure:

Property, Plant and Equipment. Property, plant and equipment are carried at cost less accumulated depreciation after assets are placed in service and are comprised primarily of buildings, furniture, machinery, equipment, land, and plants in North America and India. When property, plant and equipment are acquired as part of an acquisition, the items are recorded at fair value on the purchase date. It is the Company policy to depreciate capital assets over their estimated useful lives using the straight-line method.

The Company intends to include appropriate disclosure in accordance with the Staff’s comment in future filings.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 17 | |

| | |

| 15. | Please fully explain to us how you determined the fair value of the property, plant and equipment you acquired from Cilion. Please specifically address why the gain on bargain purchase you recognized was so significant relative to the purchase price. Please also address if you have performed any subsequent impairment analysis for the assets you acquired and, if applicable, tell us the significant assumptions you used. |

Response:

To arrive at the fair value of the net assets acquired from Cilion, the Company engaged an independent third party appraisal company to assess the fair value of net assets for the purpose of financial statement reporting. Based on the findings of the appraisal, a fair value of $76.0 million was allocated to the net tangible and identifiable intangible assets, and an assumption of $1.1 million of liabilities. In exchange for receipt of these assets and liabilities, the Company provided total consideration of $32.6 million in fair value which consisted of $16.5 million of cash, shares with a market value of $12.5 million and a promissory note with a fair value of $3.6 million.

The accounting guidance contained in ASC 805-30-25 provides for the recognition of a gain from bargain purchase where the fair value of the assets acquired exceeds the consideration transferred as part of the business combination transaction. Accordingly, the gain recorded from the bargain purchase of $42.3 million was determined as the difference between the net tangible asset value of $74.9 million less the consideration provided of $32.6 million.

Since guidance in Topic 805 indicates that a bargain purchase is expected to be a rare occurrence, we also reassessed the valuation of net assets and the overall factors giving rise to the bargain purchase. We believe the sellers placed a perceived value on the stock consideration that was higher than the present share market price at the acquisition date (the value assigned to the stock consideration), thereby giving rise to the bargain purchase accounting treatment. A more detailed explanation and accounting of the transaction, including bargain purchase considerations, was included in Footnote 13 – Acquisitions, Divestitures and Material Agreements – to the consolidated financial statements on pages 74 and 75 of the annual report on Form 10-K for the fiscal year ended December 31, 2012, filed with the Commission on April 16, 2013.

We evaluated these long-lived assets for impairment as of December 31, 2013 and 2012 to determine if events or changes in circumstances indicate that their carrying amounts may not be recoverable. Our evaluation was based on future cash flow projections which included assumptions that are customary to our industry, that are consistent with prior operating performance and that reflect realistic prospects for growth based on our plans for further development of the business. Our future cash flows based on the these assumptions provided a cumulated projected cash flow that exceeded the carry value of the related asset. We also considered other environmental factors that would indicate impairment of value. Based on the evaluation, we determined no assets required an impairment adjustment as of December 31, 2013 and 2012. In addition, subsequent to the purchase date, on a semi-annual basis as required by our senior lender, an appraisal of the fair value of the plant has been obtained to test a loan to value covenant. Based on our review of these appraisals and the monitoring of the covenant by our senior lender, the fair value of the plant has exceeded the book value of the recorded asset.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 18 | |

California Ethanol Producer Incentive Program, page 52

| 16. | Please tell us and revise future filings to clarify the maximum potential amount you could be required to reimburse as a result of the California Ethanol Producer Incentive Program. |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will revise future filings to clarify the maximum potential amount we could be required to reimburse as a result of the California Ethanol Producer Incentive Program. In response to the Staff’s comment, we incorporated on page 9 of the Current 10-Q the following risk factor:

California Ethanol Producer Incentive Program – The Company is eligible to participate in the California Ethanol Producer Incentive Program (“CEPIP”). Under the CEPIP an eligible California ethanol facility may receive up to $3 million in cash per plant per year of operations through 2013 when current production corn crush spreads, measured as the difference between specified ethanol and corn index prices, drop below $0.55 per gallon. The California Energy Commission determines on an annual basis the funding allocated to the program. No funds were allocated to this program during the government’s 2012 fiscal year. For any month in which a payment is made by the CEPIP, the Company may be required to reimburse the funds within the subsequent five years from each payment date, if the corn crush spreads exceed $1.00 per gallon. Since these funds are provided to subsidize current production costs and encourage eligible facilities to either continue production or start up production in low margin environments, the Company records the proceeds, if any, as a credit to cost of goods sold. The Company will assess the likelihood of reimbursement in future periods as corn crush spreads approach $1.00 per gallon. If it becomes likely that amounts may be reimbursable by the Company, the Company will accrue a liability for such payment and recognize the costs as an increase in cost of goods sold. With respect to CEPIP payments received and applied as reductions to cost of goods sold, the Company recorded none three and six months ended June 30, 2014 and 2013, respectively. During the six months ended June 30, 2014, the strength of the crush spread resulted in the accrual and obligation to repay CEPIP funding in the amount of $1.8 million, the entire remaining amount of funds received from the program. As of June 30, 2014 and December 31, 2013, the Company carried an obligation of $1.5 million and $0.1 million. As a result of the current accrual, there are no further contingent liabilities related to this program.

The Company intends to include appropriate disclosure in accordance with the Staff’s comment in future filings.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 19 | |

Commitments and Contingencies, page 53

| 17. | We note both your Form 10-K for the fiscal year ended December 31, 2013 and Form 10-Q for the period ended March 31, 2014 include disclosures related to legal proceedings. Please confirm to us that you have concluded a material loss is not reasonably possible or explain to us why these matters are not disclosed in the notes to your financial statements. |

Response:

Our disclosures related to legal proceedings in our Form 10-K for the fiscal year ended December 31, 2013 and our Form 10-Q for the period ended March 31, 2014 included three matters: a loan with the State Bank of India, a collection matter involving UBS Securities and a lawsuit brought by GS Cleantech. The Company respectfully advises the Staff that the State Bank of India loan is disclosed in Note 5, Notes Payable, to our Consolidated Financial Statements on page 57 of the Current 10-K, in which we indicate that the loan value, including accrued interest at both the regular and incremental default rate, has been recorded as a liability on the financial statements. The collection matter involving UBS Securities is in the form of a judgment, which has been accrued for the full amount of the judgment. The GS Cleantech matter is currently in the discovery phase with summary judgment motions due to the court during the fourth quarter of 2014, and as such we are unable to predict the outcome, and the amount of damages that may be awarded to GS Cleantech, if any, cannot be estimated at this time.

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will revise future quarterly filings, beginning with the quarterly report on Form 10-Q for the period ending September 30, 2014, to add disclosure regarding the GS Cleantech matter in the notes to our financial statements with disclosure similar to the following, as appropriate:

On August 4, 2013, GS Cleantech Corporation (GS Cleantech), a subsidiary of Greenshift Corporation, filed a complaint against the Company alleging the Company's operation of a corn oil extraction process licensed by the Company infringes patent rights claimed by GS Cleantech. GS Cleantech seeks royalties, damages and potentially triple damages associated with the alleged infringement, as well as attorney's fees from the Company. The Company has filed an answer and counterclaims claiming invalidity of the patents, noninfringement, and inequitable conduct. The Company is not currently able to predict the outcome of the litigation with any degree of certainty.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 20 | |

Form 10-Q for the Fiscal Quarter Ended March 31, 2014

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 24

| 18. | Please revise future quarterly filings to quantify volumes sold and average selling prices for each material product on a comparative basis. |

Response:

The Company acknowledges the Staff’s comment and respectfully advises the Staff that it will revise future quarterly filings to quantify volumes sold and average selling prices for each material product on a comparative basis. In response to the Staff’s comment, we incorporated on page 26 of the Current 10-Q the following enhanced disclosure:

North America. For the three months ended June 30, 2014, we generated 76% of revenue from sales of ethanol, 22% from sales of WDG, and 2% from sales of corn oil and condensed distillers solubles. During the three months ended June 30, 2014 plant production averaged 108% of nameplate capacity. The increase in revenues between the three months ended June 30, 2014 and 2013 reflects the period from April 1, 2013 to April 23, 2013 when the plant was idle compared to a full quarter of operation during the period from April 1, 2014 through June 30, 2014. In addition, the ethanol sales volume rose by 34% to 14.9 million gallons while the average ethanol price decreased 5% to $2.74 per gallon during the quarter ended June 30, 2014 compared to quarter ended June 30, 2013. The average price of WDG rose 16% to $115 per ton while the WDG sales volume increased 27% to 101.9 thousand tons during the quarter ended June 30, 2014 compared to the quarter ended June 30, 2013.

India. The decrease in revenues was primarily attributable to international sales for biodiesel and one large domestic order for biodiesel during the period ended June 30, 2013 compared to first international shipment of distilled biodiesel and base level sales of biodiesel and refined glycerin into domestic markets during the period ended June 30, 2014. For the three months ended June 30, 2014, we generated 88% of sales from methyl ester/ biodiesel and 12% of sales from refined glycerin compared to the three months ended June 30, 2013 when we generated 64% from sales of methyl ester/ biodiesel, 6% from refined glycerin, and 30% from sale and trade of other products. In addition, the biodiesel sales volume decreased by 241% to 3.1 thousand metric tons while the price increased slightly by 7% to $921 per metric ton and the sales volume of refined glycerin decreased by 206% to 4 hundred metric tons while the average price of glycerin increased by 5% to $964 per metric ton.

The Company intends to include appropriate disclosure in accordance with the Staff’s comment in future filings.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 21 | |

Item 4. Controls and Procedures, page 29

Changes in Internal Controls over Financial Reporting, page 30

| 19. | We note that at December 31, 2013, management concluded that your disclosure controls and procedures and internal controls over financial reporting were not effective. However, as of March 31, 2014, management has concluded that your disclosure controls and procedures are effective. In this regard, please tell us how you remediated the material weaknesses you previously identified in your Form 10-K for the fiscal year ended December 31, 2013 and explain why you believe no additional disclosures are required. Also, based on the disclosures in your Form 10-K, please more fully explain to us the nature of the audit adjustments you disclosed, including how you determined they were recorded in the appropriate period. |

Response:

Our assessment of internal controls over financial reporting and the related identification of a material weakness was made for the entirety of the year ended December 31, 2013. During the first and second quarters of 2013, eight adjustments were identified by our auditors, principally in the areas of debt, warrant, placement agent costs and inventory accounting with the write off of debt discount in connection with the Third Eye Capital debt and the recording of an extinguishment charge in connection with a modification of subordinated debt as the most significant adjustments. The two most significant adjustments resulted from the application of the complex debt modification and extinguishment accounting literature. All identified adjustments proposed by our auditors were recorded as part of the financial records of the company. Although no specific controls were identified as ineffective, we believed that the Company’s accounting policy and internal control staff required a higher level of expertise and education. Accordingly, during the second quarter we hired a consultant to assist us with one area of difficulty, and subsequently, in the third quarter, we hired the consultant as our full-time SEC Reporting and Accounting Manager. As a result of this hire, the current Corporate Controller moved to another area of the Company, and our SEC Reporting and Accounting Manager was able to reduce the number of accounting adjustments significantly. We respectfully advise the Staff that we disclosed this hire as a remedial measure on page 34 of our quarterly report on Form 10-Q for the quarter ended September 30, 2013, filed with the Commission on November 5, 2013. Had our assessment of internal controls over financial reporting been focused solely on the fourth quarter of 2013, we would have concluded that there was no material weakness in our internal controls over financial reporting. However, because our assessment covered the entire year, we reported the material weakness at the end of the year.

United States Securities and Exchange Commission Pamela Long August 26, 2014 Page 22 | |

During the first quarter of 2014, we engaged an outside firm to assess our internal control documentation, provide an updated risk assessment, and commence with a formal testing program of our internal control structure.

The Company acknowledges that:

- the Company is responsible for the adequacy and accuracy of the disclosures in its filings;

- Staff comments or changes to disclosures in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and

- the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any authorized person acting under the federal securities laws of the United States.

We trust that you will find the foregoing responsive to the comments of the Staff. Comments or questions regarding this letter may be directed to the undersigned at (408) 213-0925 or to Celeste Ferber, Esq., outside counsel to the Company, at (650) 838-3741.

| | Sincerely,

/s/ Todd Waltz Chief Financial Officer |

cc: Celeste Ferber, Esq.

Shearman & Sterling LLP