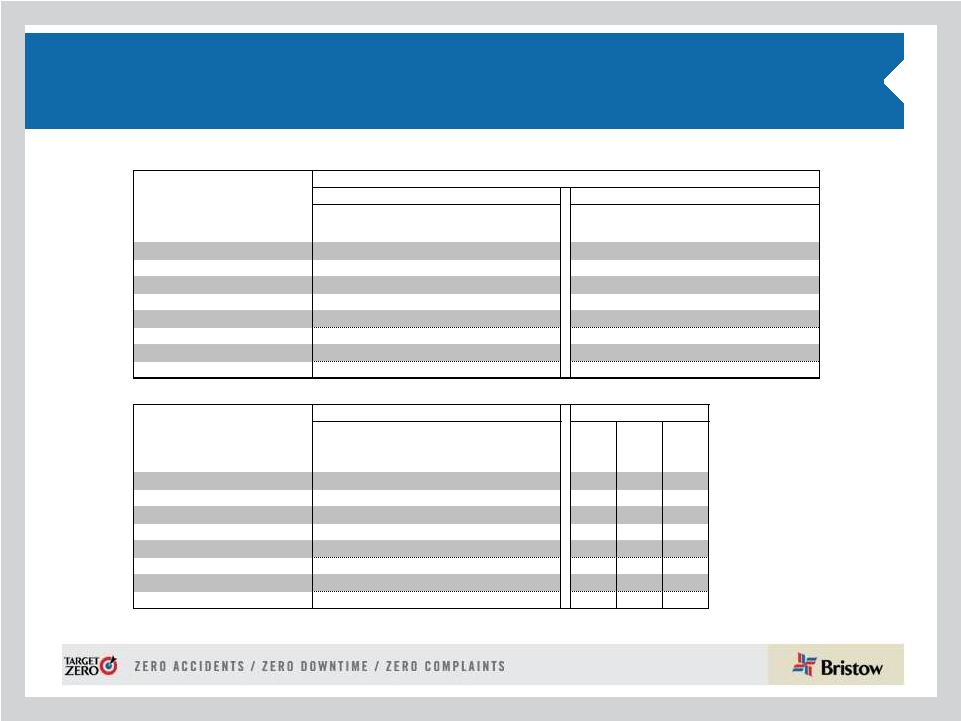

35 GAAP Reconciliation Three Months Ended Nine Months Ended December 31, December 31, 2012 2011 2012 2011 (In thousands) Adjusted operating income $ 66,724 $ 46,418 $ 160,000 $ 119,900 Gain (loss) on disposal of assets 7,396 (2,865) 819 (3,060) Special items — — 622 (27,287) Operating income $ 74,120 $ 43,553 $ 161,441 $ 89,553 Adjusted EBITDAR $ 109,223 $ 81,769 $ 277,950 $ 220,029 Gain (loss) on disposal of assets 7,396 (2,865) 819 (3,060) Special items (14,932) — (14,310) (24,610) Depreciation and amortization (24,867) (22,709) (69,560) (70,848) Rent expense (17,604) (12,836) (49,160) (30,897) Interest expense (14,742) (9,756) (32,113) (28,170) Provision for income taxes (7,788) (7,118) (22,310) (11,779) Net income $ 36,686 $ 26,485 $ 91,316 $ 50,665 Adjusted net income $ 42,632 $ 27,790 $ 101,304 $ 71,089 Gain (loss) on disposal of assets (i) 6,101 (2,258) 658 (2,482) Special items (i) (12,341) — (12,240) (19,319) Net income attributable to Bristow Group $ 36,392 $ 25,532 $ 89,722 $ 49,288 Adjusted diluted earnings per share $ 1.17 $ 0.76 $ 2.77 $ 1.93 Gain (loss) on disposal of assets (i) 0.17 (0.06) 0.02 (0.07) Special items (i) (0.34) — (0.33) (0.53) Diluted earnings per share 1.00 0.70 2.45 1.34 (i) These amounts are presented after applying the appropriate tax effect to each item and dividing by the weighted average shares outstanding during the related period to calculate the earnings per share impact. |