Exhibit 99

Creating Shareholder Value

Ohio Casualty Corporation

September 2005

Welcome/Purpose of Today’s Meeting

Dennis McDaniel

Vice President – Investor Relations

Forward Looking Statements

Certain of the statements contained in these materials, including all financial forecasts and projections, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Forward-looking statements are typically identified herein by words or phrases such as “expect,” “project,” “forecast,” “plan,” “goal,” and similar expressions of future or conditional verbs such as “will,” “should,” and “would.” Future premium levels, loss experience, operating expenses and profits are all influenced by a number of factors, including those identified below, all of which are inherently difficult to forecast. Consequently, actual results may differ materially from those included in the forward-looking statements. Among the factors that could cause actual results to differ materially from the forward-looking statements are the following:

General Industry Factors

Pricing environment for the Corporation’s insurance products and general competition

Changes in governmental regulation

Acts of war and terrorist activities

Fluctuations in interest rates and performance of the financial markets

General economic and market conditions

Corporation-Specific Factors

Ability of the Corporation to successfully execute its Corporate Strategic Plan

Ability of the Corporation to maintain appropriate lines of credit

Ability of the Corporation to achieve and maintain planned price increases for its insurance products

Ability of the Corporation to achieve and maintain planned expense savings

Ability of the Corporation to retain key employees and agents having the experience and skills necessary to execute the Corporation’s Strategic Plan

Ability of the Corporation to attain planned benefits from technology initiatives

Ability of the Corporation to maintain sufficient financial strength ratings

Adequacy of the Corporation’s property and casualty reserves

Catastrophe losses and other adverse claims experience

Availability and pricing of reinsurance

Litigation and administrative proceedings

Other factors that could cause actual results to differ include those matters set forth in the Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004 as well as those matters set forth in the Corporation’s subsequent periodic filings with the Securities and Exchange Commission. The Corporation disclaims any obligation or intention to publicly update or revise any of the forward-looking statements contained in these materials, whether as a result of new information, future events or otherwise.

Introductions & Progress

On Our Strategic Plan

Dan Carmichael

Chief Executive Officer

Agenda

Strategic Overview Dan Carmichael

Operations Review

Competitive Position and Trends Mike Michael

Commercial Lines Mike Sullivan

Personal Lines Derrick Shannon

Specialty Lines John Busby

Lunch with Management and Agents

Technology John Kellington

Agents’ Roundtable Tom Cassady – USI Midwest

Bill Dillhoff – Kneflin-Dillhoff-Hils & Kruse

Jack Massey – Putnam Agency

Investments Paul Gerard

Financial Highlights Mike Winner

Concluding Remarks/Discussion Dan Carmichael

Execution Against Successful Strategy

A Year Ago, We Promised

Achieve improved profitability

Focus organization on process improvements

Deliver superior easy to use processes

Earn higher financial ratings

Deliver greater shareholder value

Results Since Then

95.5% CR 6 points better than 1H04, 1st half ‘05 operating net up 44%

Expense ratio run rate approx. 32%, cost structure initiatives continuing

P.A.R.I.S.SM delivering results, rollout continues

S&P rating improved, capital continues to strengthen

Cash dividend restored, share repurchase program authorized, stock price up 29% * since 9/14/04

Our Main Challenge: Growth

A Year Ago,

We Also Promised

Above-market real growth

More sophisticated pricing of risks

Grow within independent agent and broker distribution channel

Results Since Then

New COO Mike Michael adding financial services marketing depth, focused on accelerating growth

Sophisticated pricing/predictive modeling initiatives rolling out in Commercial Lines

Completed in-depth analysis of our agency/broker profile and relationships. Developing plans for 2006 implementation.

Then and Now

Greater Scale and Strength

Surplus

$812M

$929M

Equity

$1,117M

$1,411M

Restructured and Reduced Debt

Debt

$215M

Short

$200M

Long

Debt / Capital Ratio

16.5%

12.5%

Better Leverage and Flexibility

Operating Leverage

1.9X

1.6X

Holding Co. Liquidity

$44M

$250M

Improved Underwriting Profitability

Combined Ratio

118.4%

95.5%

GAAP basis

Expense Ratio

34.4%

31.5%

New management began in December 2000.

12/31/2000

6/30/2005

Positioned For Future Success

Since 2000, we have substantially repositioned 23% of our book of business

Retention ratios remain strong, with adequate pricing

2005 reflects benefits of expense reduction initiatives

Overall reserve adequacy has been demonstrated, and investment portfolio is high quality

Strong capitalization and financial flexibility at holding company

Effective, highly efficient workforce, down 37% from 2000

P.A.R.I.S.SM technology is leading-edge, agent-focused, easy to use

9

Operations Review

Ohio Casualty Corporation

Building On Our Successes

Mike Michael

Chief Operating Officer

11

A Banker???

What does he know about insurance??

12

Industry Comparison

Commercial Banks and P&C Insurance

Commoditized

Competitive

Consolidating

Yet the sector has produced very attractive returns

13

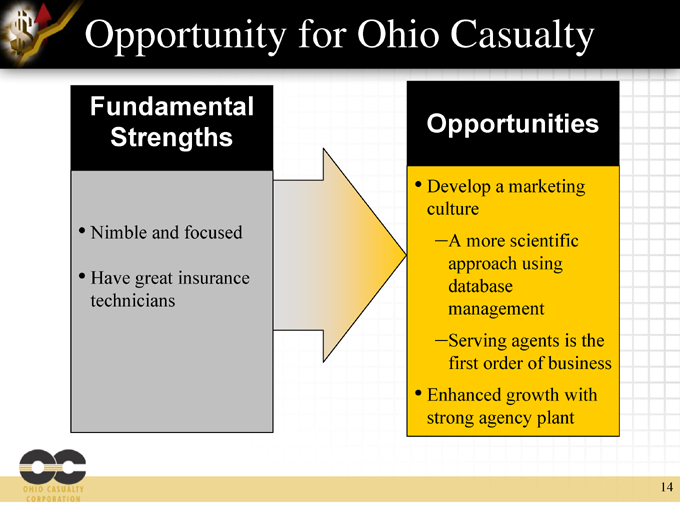

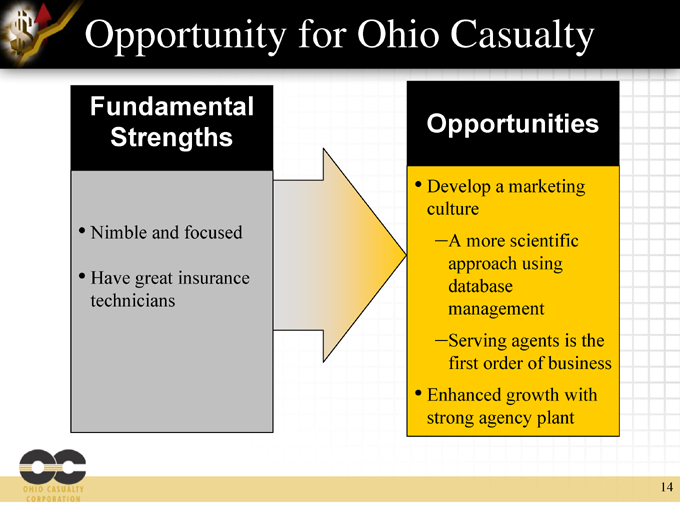

Opportunity for Ohio Casualty

Fundamental

Strengths

Nimble and focused

Have great insurance technicians

Opportunities

Develop a marketing culture

A more scientific approach using database management

Serving agents is the first order of business

Enhanced growth with strong agency plant

14

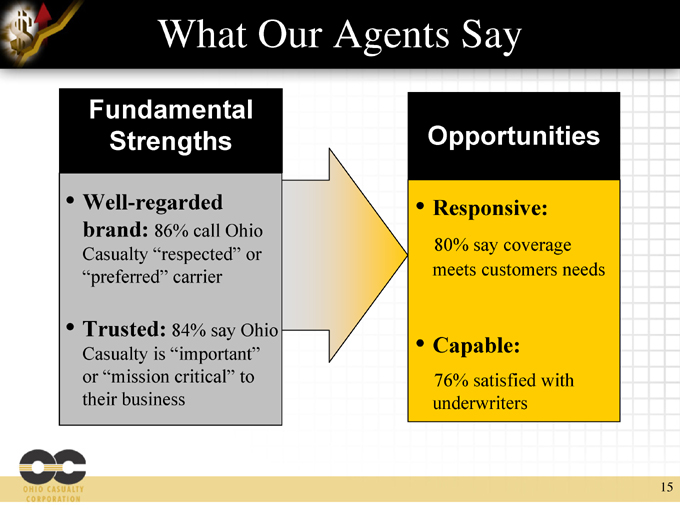

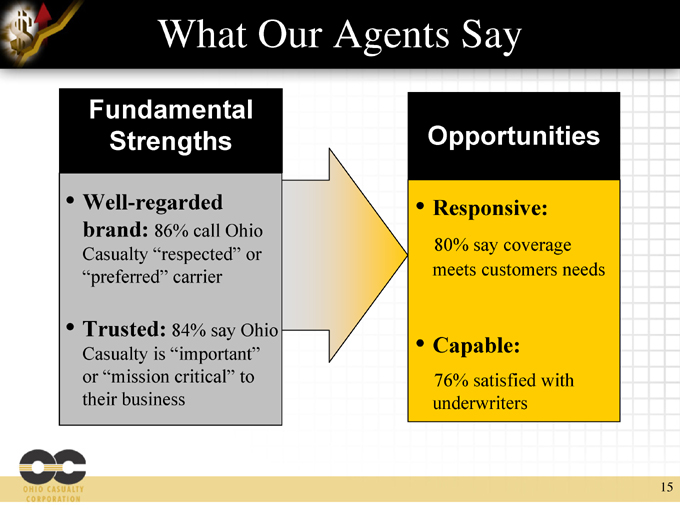

What Our Agents Say

Fundamental

Strengths

Well-regarded brand: 86% call Ohio Casualty “respected” or “preferred” carrier

Trusted: 84% say Ohio Casualty is “important” or “mission critical” to their business

Opportunities

Responsive:

80% say coverage meets customers needs

Capable:

76% satisfied with underwriters

15

Establishing A Marketing Culture

Become “mission critical” partner for more agents, raising average premium volume per agent

Better agency segmentation, recognizing agency life cycle

Strengthen ties with key agents

Develop a world-class marketing operation

Apply technology both for easy use by agents and improved targeted marketing

Walk the talk—align management practices with selling, growth, and service

16

Commercial Lines Overview

Presented by:

Mike Sullivan

Senior Vice President, Commercial Lines

17

Operating Results Improving

Commercial Lines Combined Ratio

Calendar Year Statutory Basis

116.2%

115.1%

112.3%

99.3%

103.3%

Expense Ratio

Loss + LAE Ratio

36.4

36.3

36.4

34.3

32.8

79.8

78.8

75.9

65.0

70.5

2001

2002

2003

2004

1H05

Accident year combined ratio: 100.0% 103.7% 100.3% 99.1%

Workers’ compensation adverse prior year reserve development added 5.7 points to the 1H05 calendar year combined ratio above.

Accident years 2005 and 2004 evaluated as of June 30, 2005. Accident years 2003 and 2002 evaluated as of December 31, 2004.

18

Competitive Environment

Current Trends

Carriers are focused on renewal retention

Price decreases are common on medium and large accounts

Competition is intense for new business

Service, agency automation, and relationships can be leveraged

Our Price Adequacy and Profitability Actions

Pricing goals are communicated to underwriters at policy/account level

Monthly reports monitor performance to goal at various levels of detail

Reinsurers say our pricing controls are among the best

Enhanced underwriting quality control process

19

Growth Initiatives

Leverage underwriter-agency relationships

Incentives for underwriting staff

Agency segmentation and improved agency management

Agency automation to make it easier for agents

Policy quote, issuance, and endorsement capabilities through P.A.R.I.S. ExpressSM

Rapid quote

Navigation improvements

Commercial Lines Service Center

Increased pricing sophistication

20

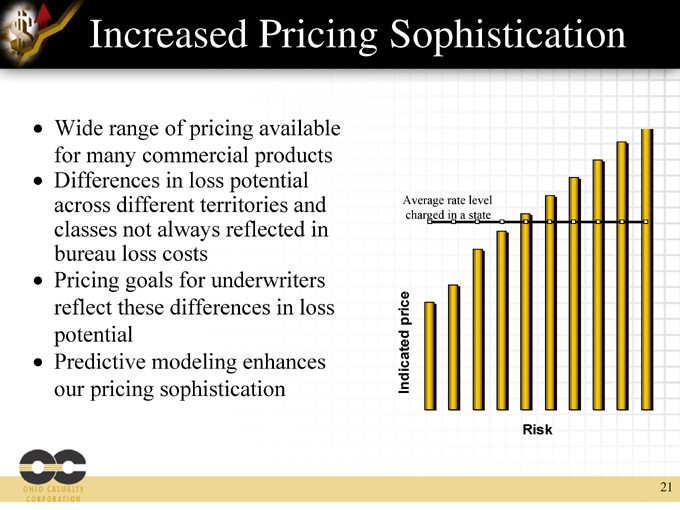

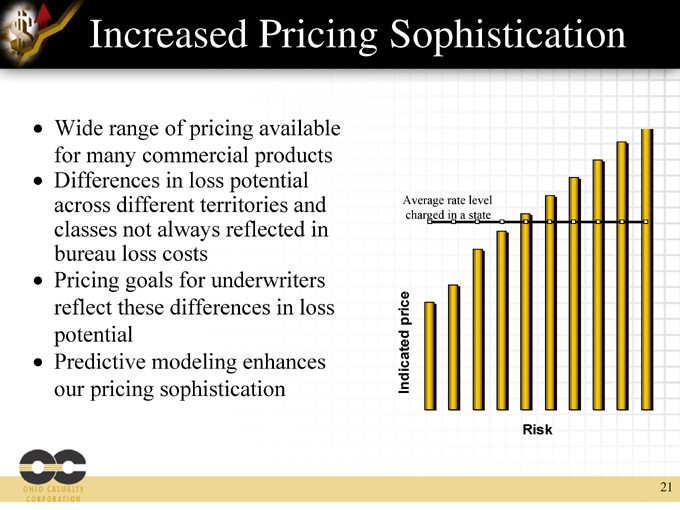

Increased Pricing Sophistication

Wide range of pricing available for many commercial products

Differences in loss potential across different territories and classes not always reflected in bureau loss costs

Pricing goals for underwriters reflect these differences in loss potential

Predictive modeling enhances our pricing sophistication

Average rate level

charged in a state

Indicated price

Risk

21

Personal Lines Overview

Presented by:

Derrick Shannon

Senior Vice President, Personal Lines

22

Operating Results Improving

Personal Lines Combined Ratio

Calendar Year Statutory Basis

Expense Ratio

Loss + LAE Ratio

119.2%

114.1%

105.6%

97.6%

80.9%

33.7

29.6

27.1

28.9

24.1

85.5

84.5

78.5

68.7

56.8

2001

2002

2003

2004

1H05

Accident year combined ratio: 111.5% 101.4% 95.5% 89.0%

NJ personal auto transfer and guaranty fee impact on combined ratios above: 2001 +6.3 points, 2004 +3.2 points, 2005 -2.2 points.

Accident years 2005 and 2004 evaluated as of June 30, 2005. Accident years 2003 and 2002 evaluated as of December 31, 2004.

23

Competitive Environment

Industry pricing has remained rational

Moderate pricing decreases as declining frequency continues

Some evidence of substantial pricing decreases by class

Pricing sophistication has increased

Industry underwriting appetite increased due to rate adequacy

Increased incentives and advertising to spark growth

Workflow solutions have become increasingly important

Resurgence of reliance on comparative raters

Improved proprietary interfaces

24

Growth Initiatives

Focus on agency workflow to increase quote volume

Partner with comparative raters to ensure accurate quoting

Expand solutions allowing agents to work from their agency management systems

Expand underwriting appetite through improved pricing sophistication

Expand breadth of product to meet more consumers’ needs

Additional use of targeted incentives

Emphasis on marketing effectiveness

Price Adequacy and Profitability Actions

Pricing discipline through trend analysis

Predictive modeling/class plan reviews

25

Expanding Agency Workflow Solutions

Comparative Raters

Real time

Web-based

Upload/Download

Given relatively stable conversion rates, increased quote volume means increased premium volume

26

Specialty Lines Overview

Presented by:

John Busby

Executive Vice President & Chief Operating Officer, Specialty Lines

27

Positive Operating Results

Specialty Lines Combined Ratio

Calendar Year Statutory Basis

Expense Ratio

Loss + LAE Ratio

90.8%

94.0%

77.2%

97.2%

87.6%

38.4

44.1

43.5

49.7

36.4

52.4

49.9

33.7

47.5

51.2

2001

2002

2003

2004

1H05

Accident year combined ratio: 87.1% 88.5% 102.9% 93.7%

Bond calendar year combined ratio: 81.7% 68.1% 78.9% 76.8%

Reinsurance ceded premium adjustments reflected in ratios above: 2002 $5.3 million return ceded premium for bonds, 2003 $3.5 million

additional ceded premium for commercial umbrella, 2004 $6.1 million additional ceded premium for commercial umbrella.

Accident years 2005 and 2004 evaluated as of June 30, 2005. Accident years 2003 and 2002 evaluated as of December 31, 2004.

28

Competitive Environment

Bonds:

Contract Surety—four companies have left the market this year, underwriting standards maintained, focus on quality accounts with appropriate work program size

Commercial Surety—competition reasonable for license, public official, probate bonds

Financial Institution—extremely price competitive

Commercial Umbrella:

Regional carriers—expanding their umbrella appetite

National carriers—very aggressive pricing

Business switching back to retailers from wholesalers

Terms and conditions holding firm as pricing declines for several but not all business classifications

29

Bonds:

Identify potential new agent appointments, target agents for increased production

Automate agency bond issuance to enhance excellent service

Leverage local presence—20 strategically located offices

Commercial Umbrella:

Additional cross-selling for Commercial Lines accounts as business shifts to retail agents

Increasing price sophistication and product offerings

Emphasis on marketing/sales/relationship-building

Growth Initiatives

30

Price Adequacy and Profitability

Bonds:

Experienced staff—average bond manager has > 25 years

Loss ratio averaged 15.1% for past 15 years

Stable underwriting appetite with appropriate field authority

Commercial Umbrella:

Focus on low to medium severity with appropriate attachment points

Underwriting audit controls including reinsurer reviews

31

Katrina Update

Rapid claims response

Loss estimate

Ohio Casualty Corporation

32

Operations

Questions and Answers

33

Luncheon

Ohio Casualty Corporation

Technology Update

Ohio Casualty Corporation

Responding to Agents’ Needs

John Kellington

Senior Vice President & Chief Technology Officer

36

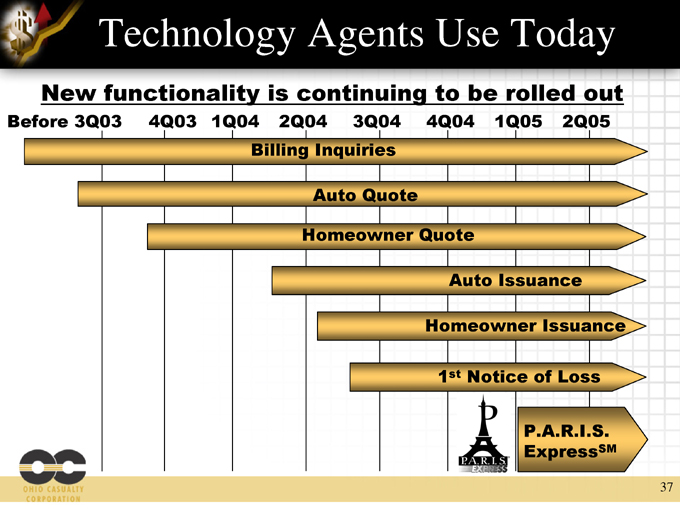

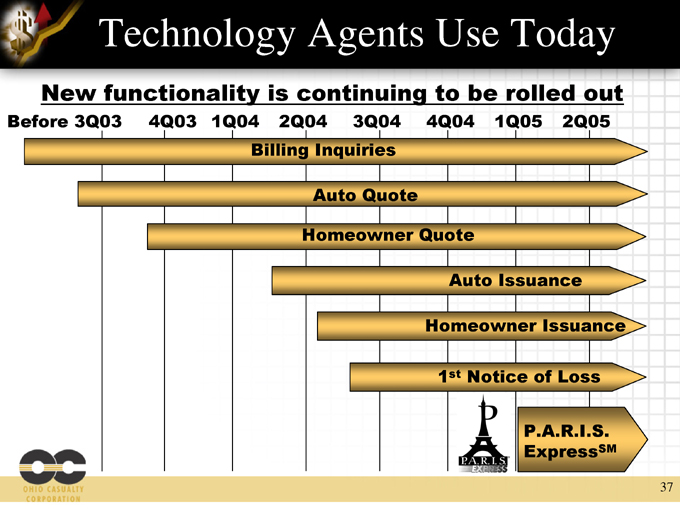

Technology Agents Use Today

New functionality is continuing to be rolled out

Before 3Q03

4Q03

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

Billing Inquiries

Auto Quote

Homeowner Quote

Homeowner Issuance

1st Notice of Loss

Auto Issuance

P.A.R.I.S.

ExpressSM

37

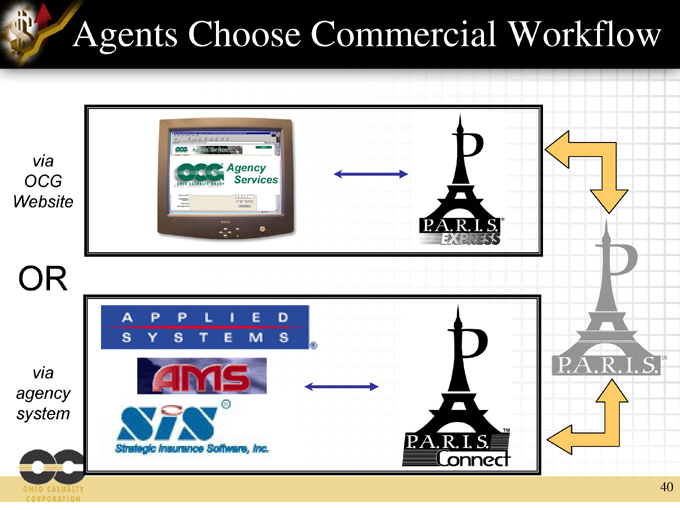

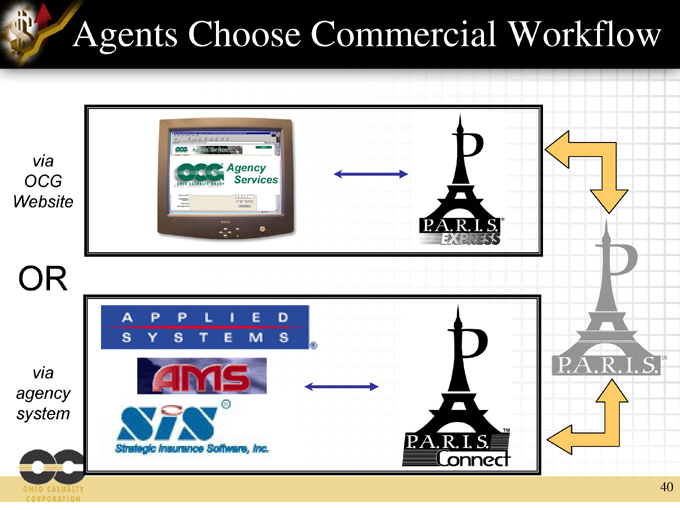

P.A.R.I.S.SM Access Via Our Website

P.A.R.I.S. ExpressSM provides P.A.R.I.S.SM functionality to the agents via the OCG Website

Currently quotes new business for businessowners, workers’ compensation, commercial auto, artisans, and inland marine

Issuance and endorsements is in pilot for businessowners, workers’ compensation and commercial auto

38

Transparent Connection for Agents

P.A.R.I.S. ConnectTM leverages P.A.R.I.S.SM functionality to provide interface capabilities to the agents via the agents management system

Currently quotes new business for businessowners & workers’ compensation for Applied users

Development under way for commercial auto and AMS users

39

Agents Choose Commercial Workflow

via OCG Website

OR

via agency system

40

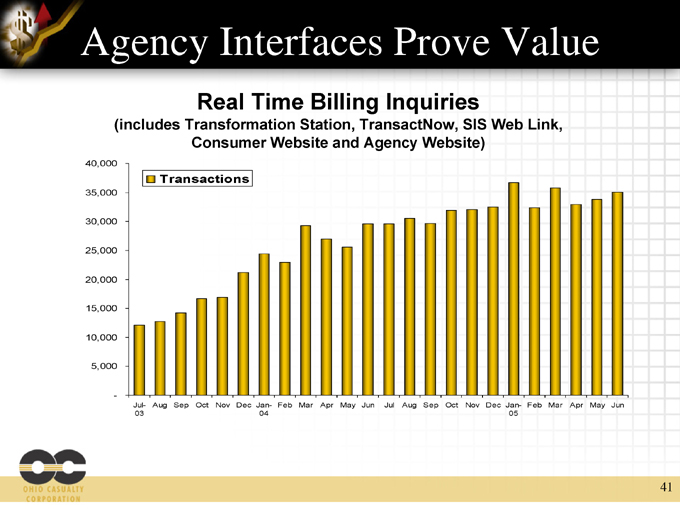

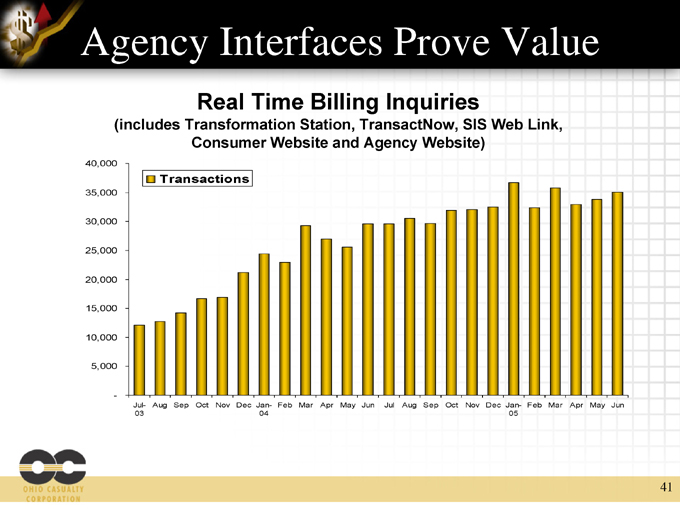

Agency Interfaces Prove Value

Real Time Billing Inquiries

(includes Transformation Station, TransactNow, SIS Web Link,

Consumer Website and Agency Website)

-

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

Jul-03

Aug

Sep

Oct

Nov

Dec

Jan-04

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan-05

Feb

Mar

Apr

May

Jun

Transactions

41

Agency Interfaces Prove Value

Personal Lines SEMCI

(Quoting and Issuance)

-

500

1,000

1,500

2,000

2,500

3,000

3,500

Jul-03

Aug

Sep

Oct

Nov

Dec

Jan-04

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan-05

Feb

Mar

Apr

May

Jun

Transactions

42

Best-practices Focus to Ensure Success

Software Industry Risks

In the Software Industry:

74% of all new projects fail

66% of all successful projects have significant cost and time over-runs

Failed projects result in:

Zero results for resource (dollars) investment

Missed business opportunities

Missed opportunity for other potential impact projects

Minimizing Our Exposure

Heavy emphasis on rigid project management disciplines

Enterprise prioritization of major projects

Implementation of structured development methodologies

Implementation of architectural governance and design patterns

“OCG Approved” software environments and platforms

Skill development and resource management

43

Our Technology At Work

Video Clip

How our technology is being used in our agencies’ offices

Ohio Casualty Corporation

Agents’ Roundtable

Ohio Casualty Corporation

Agents’ Perspectives

Panel of Independent Agents

Tom Cassady – USI Midwest

Bill Dillhoff – Kneflin-Dillhoff-Hils & Kruse Inc.

Jack Massey – Putnam Agency Inc.

46

Financial Update

Ohio Casualty Corporation

Maximizing Risk-Adjusted Returns

Paul Gerard

Senior Vice President, Investments

48

Solid Investment Strategy

Overall Strategy

Remain fully invested ($20-40 million in operating cash)

Optimize after-tax income with disciplined risk profile

Balanced cash flow distribution across the curve

Fixed Income

“A” or better average rating

Bond duration of 5.3 years @ 6/30/05

Superior relative value in short-term taxables and intermediate/long-term tax-exempts

Equities

Maintaining target of 35-45% of surplus

Long-term focus on companies with strong market positions

49

Quality with Tax-Exempt Emphasis

Total fixed income portfolio $3.8 billion

Fixed Income Credit Quality

NAIC 3 2.1%

NAIC 2 16.2%

NAIC 4 .3%

NAIC 1 81.4%

Total invested assets $4.2 billion

Invested Asset Allocation

Other 4%

Equity 9%

Mortgage & Asset Backed 16%

Tax Exempt 29%

Investment Grade Corporate 42%

Market value as of 6-30-05

50

Performance Attributes

Book yield focus

Duration and convexity considerations

Portfolio quality

Asset allocation

Maximizing after-tax investment income

Benchmark comparisons

51

Keys to Investment Success

Risk management processes in place, focused on credit analysis and portfolio modeling

Modeling operating cash flows and liability duration drive investment portfolio duration management

Ongoing review of tax position and strategies

Focus on maximizing risk-adjusted returns

52

Financial Highlights

Presented by:

Mike Winner

Executive Vice President & Chief Financial Officer

53

Strong Balance Sheet

Cash/securities at holding company of $250 million* for financial flexibility

High quality diversified investment portfolio

Reinsurance program with security emphasis

Diversified group of highly rated reinsurers

Funds held for reinsurance treaties secures 24%* of reinsurance recoverable

Favorable reserve development

$ millions

$2.5

$10.2

$3.1

$5.9

$3.8

$2.9

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

54

Outstanding Capital Adequacy

A.M. Best Capital Adequacy Ratio (BCAR) of 222.7% as of 12-31-04

Implied balance sheet strength rating is A++

A.M. Best Financial Strength rating also considers operating performance and business profile—ours has improved

S&P Capital Adequacy Ratio is 181.2%

Assessment of capital adequacy is extremely strong (quantitatively equivalent to AAA)

55

Parent Company Capital Strategy

Objectives:

Long-term common stock appreciation

Growth in EPS, ROE, and book value

Increase in price-to-book multiple

Underwriting profit to drive growth in capital, 10-12% ROE

Significant liquidity and ready access to capital

Conservative operating and financial leverage

Prudent approach to share repurchase and dividends

56

Recent Capital Management Actions

Initiated buyback program for up to 4 million shares

Renewed revolving credit agreement with borrowing capacity of $80 million

Reinstated dividend with yield of approximately 1%

Redeemed convertible debt, reducing dilution impact from 8.9 million shares to 1.3 million shares

Debt to total capital restored to 12.5%, near the low end of the range among selected peer companies

57

Execution Reflected In Results

Operating EPS*

36%

131%

275%

62%

68%

83%

** 31%

11%

Quarter over quarter Increase

$0.50

$0.28

$0.13

$0.12

$0.21

$0.38

$0.30

$0.45

$0.34

$0.64

$0.55

$0.59

4Q02

1Q03

2Q03

3Q03

4Q03

1Q04

2Q04

3Q04

4Q04

1Q05

2Q05

* | | Non-GAAP financial measure; see explanation and reconciliation in Ohio Casualty Corporation press release |

dated July 26, 2005. EPS for 2003 restated for adoption of EITF 04-8.

** Adjusted $.09 for after-tax charge related to retirement of convertible debt.

58

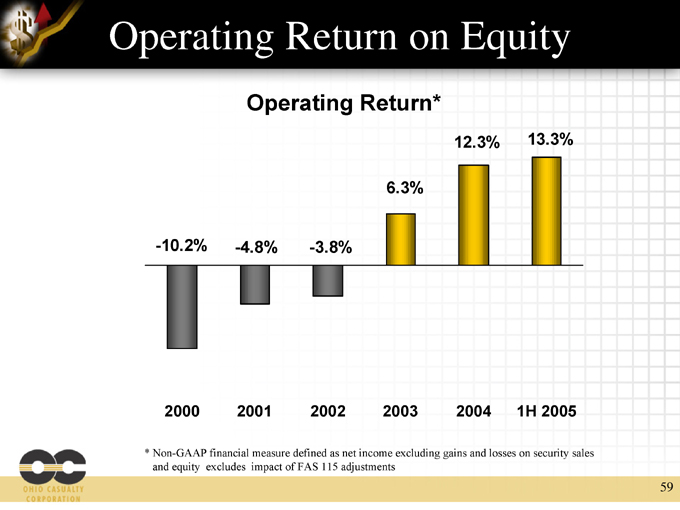

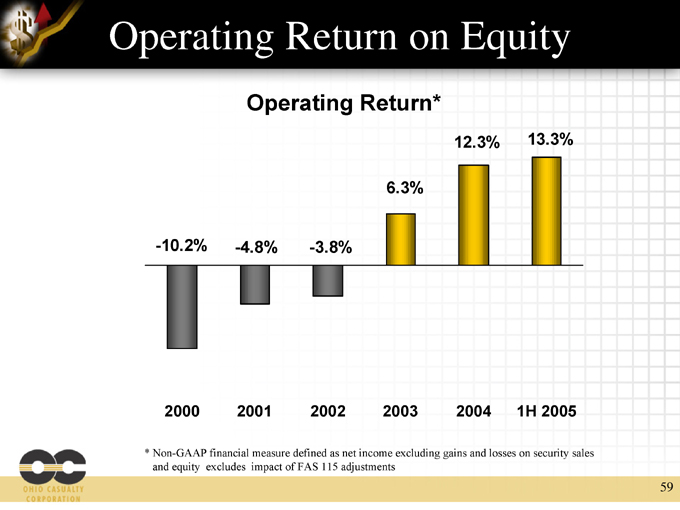

Operating Return*

Operating Return on Equity

-10.2%

-4.8%

-3.8%

6.3%

12.3%

13.3%

2000

2001

2002

2003

2004

1H 2005

* Non-GAAP financial measure defined as net income excluding gains and losses on security sales and equity excludes impact of FAS 115 adjustments

59

Narrowing the Gap

* | | As of June 30, 2005. Gross premiums written is on a rolling twelve month basis. |

Combined Ratio Improvement

YTD 2005 vs. Year 2000

23.3 Points

Ohio Casualty

15.2 Points

Selected Competitors

Selected competitors include CINF, ERIE, HGIC,HIG, SAFC, SIGI, STA, STFC.

Gross Premiums Written/Employee

Employee Count $517K $596K $733K $721K

2002 2003 2004 2005*

60

Expense Initiatives

2005 performance reflects positive impact of prior efforts

Process re-engineering

Benefit plan savings

Claims legal savings

Additional efforts under way

Procurement

Centralized processing

Efficiency from technology

Staff reductions of 37% since 2000

3,470 Employees

2,170 Employees

2000

2005

61

Overall Financial Excellence

Track record of consistently improving operating profitability

Significantly improved loss ratio since 2000

Permanent benefits from expense reduction initiatives

Investment in proven, industry-leading technology

Highly rated capital adequacy, strong loss reserves, conservative investment portfolio, ready access to capital markets

62

Where We’re Headed

Ohio Casualty Corporation

Conclusion/Discussion

Dan Carmichael

64

What’s Next for Ohio Casualty?

Management Remains Confident of Success

Cost reductions will continue to benefit future results

Targeted marketing, pricing sophistication and continued underwriting/pricing discipline for profitable growth

Superior service and technology attract and retain top agents, gain more of their business

Continued emphasis on improving financial strength, increasing book value

Reinstatement of shareholder dividend supports confident view of the future for Ohio Casualty Corporation

65

Price/Book Value per share

1.2

1.2

1.5

1.5

1.6

1.7

OCAS

CINF

SIGI

HIG

SAFC

STFC

A top market performer (up 101% since 2002), but only 1.2 times book vs. comparable average* of 1.5X

Midwest values, Midwest market focus

Results prove we can execute

Dedicated to maximizing shareholder return

* | | For selected competitors shown; all data as of 9-9-05 |

Still A Great Opportunity

66

Questions and Answers

67