United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-3947

(Investment Company Act File Number)

Federated Hermes Short-Term Government Trust

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 02/28/21

Date of Reporting Period: 02/28/21

| Item 1. | Reports to Stockholders |

Share Class | Ticker | Institutional | FSGVX | Service | FSGIX | Y | FSGTX |

Federated Hermes Short-Term Government Fund

A Portfolio of Federated Hermes Short-Term Government Trust

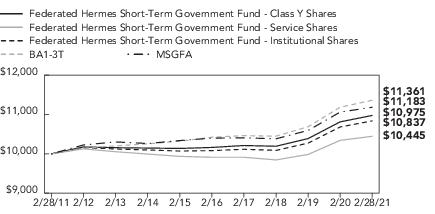

1 Year | 5 Years | 10 Years | |

Institutional Shares | 1.35% | 1.46% | 0.81% |

Service Shares | 1.00% | 1.05% | 0.44% |

Class Y Shares | 1.51% | 1.55% | 0.93% |

BA1-3T | 1.60% | 1.74% | 1.28% |

MSGFA | 1.38% | 1.61% | 1.29% |

Portfolio Composition | Percentage of Total Net Assets |

U.S. Treasuries | 49.4% |

Government Agencies | 46.1% |

Derivative Contracts2,3 | 0.0% |

Cash Equivalents4 | 4.2% |

Other Assets and Liabilities—Net5 | 0.3% |

TOTAL | 100% |

1 | See the Fund’s Prospectus and Statement of Additional Information for a description of the principal types of securities and derivative contracts in which the Fund invests. |

2 | Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund’s performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract’s significance to the portfolio. More complete information regarding the Fund’s direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

3 | Represents less than 0.1%. |

4 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

5 | Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

Securities With an Effective Maturity of: | Percentage of Total Net Assets |

Less than 1 Year | 14.4% |

1-3 Years | 61.3% |

Greater than 3 Years | 19.8% |

Derivative Contracts2, 3 | 0.0% |

Cash Equivalent4 | 4.2% |

Other Assets and Liabilities—Net5 | 0.3% |

Total | 100% |

1 | For callable investments, “effective maturity” is the unexpired period until the earliest date the investment is subject to prepayment or repurchase by the issuer (and market conditions indicate that the issuer will prepay or repurchase the investment). For all other investments “effective maturity” is the unexpired period until final maturity. |

2 | Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund’s performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract’s significance to the portfolio. More complete information regarding the Fund’s direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report. |

3 | Represents less than 0.1%. |

4 | Cash Equivalents include any investments in money market mutual funds and/or overnight repurchase agreements. |

5 | Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities. |

Principal Amount or Shares | Value | ||

U.S. TREASURIES— 49.4% | |||

U.S. Treasury Notes— 49.4% | |||

$5,000,000 | 0.125%, 2/15/2024 | $4,978,111 | |

5,000,000 | 1.375%, 2/15/2023 | 5,120,266 | |

5,000,000 | 1.500%, 1/15/2023 | 5,126,812 | |

8,000,000 | 1.500%, 3/31/2023 | 8,222,970 | |

4,000,000 | 1.625%, 12/15/2022 | 4,106,600 | |

5,000,000 | 1.750%, 2/28/2022 | 5,081,967 | |

5,000,000 | 1.750%, 6/15/2022 | 5,105,916 | |

6,000,000 | 1.750%, 6/30/2024 | 6,275,534 | |

5,000,000 | 1.875%, 9/30/2022 | 5,137,562 | |

6,000,000 | 2.250%, 4/15/2022 | 6,143,452 | |

TOTAL U.S. TREASURIES (IDENTIFIED COST $54,338,975) | 55,299,190 | ||

GOVERNMENT AGENCIES— 46.1% | |||

Federal Farm Credit System— 1.8% | |||

2,000,000 | 0.875%, 4/8/2024 | 2,014,082 | |

Federal Home Loan Bank System— 20.9% | |||

5,000,000 | 1.375%, 2/17/2023 | 5,121,461 | |

6,000,000 | 1.700%, 1/24/2024 | 6,078,647 | |

5,000,000 | 2.125%, 6/10/2022 | 5,125,679 | |

6,780,000 | 2.250%, 12/8/2023 | 7,155,758 | |

TOTAL | 23,481,545 | ||

Federal Home Loan Mortgage Corporation— 9.8% | |||

2,000,000 | 0.400%, 9/30/2024 | 1,993,393 | |

3,000,000 | 0.440%, 9/24/2024 | 2,994,066 | |

2,000,000 | 0.450%, 3/24/2025 | 1,988,467 | |

4,000,000 | 0.625%, 11/25/2025 | 3,982,901 | |

TOTAL | 10,958,827 | ||

Federal National Mortgage Association— 13.6% | |||

3,000,000 | 0.350%, 4/26/2024 | 2,995,658 | |

2,000,000 | 0.410%, 8/12/2024 | 1,997,247 | |

5,000,000 | 0.730%, 6/30/2025 | 5,003,101 | |

5,000,000 | 2.375%, 1/19/2023 | 5,209,626 | |

TOTAL | 15,205,632 | ||

TOTAL GOVERNMENT AGENCIES (IDENTIFIED COST $51,305,168) | 51,660,086 |

Principal Amount or Shares | Value | ||

INVESTMENT COMPANY— 4.2% | |||

4,635,228 | Federated Hermes Government Obligations Fund, Premier Shares, 0.01%1 (IDENTIFIED COST $4,635,228) | 4,635,228 | |

TOTAL INVESTMENT IN SECURITIES—99.7% (IDENTIFIED COST $110,279,371)2 | 111,594,504 | ||

OTHER ASSETS AND LIABILITIES - NET—0.3%3 | 383,035 | ||

TOTAL NET ASSETS—100% | $111,977,539 |

Description | Number of Contracts | Notional Value | Expiration Date | Value and Unrealized Depreciation |

Short Future: | ||||

4United States Treasury Notes 2-Year Short Futures | 50 | $11,038,281 | June 2021 | $(3,621) |

Federated Hermes Government Obligations Fund, Premier Shares | |

Value as of 2/29/2020 | $2,027,215 |

Purchases at Cost | $131,524,902 |

Proceeds from Sales | $(128,916,889) |

Change in Unrealized Appreciation/Depreciation | N/A |

Net Realized Gain/(Loss) | N/A |

Value as of 2/28/2021 | $4,635,228 |

Shares Held as of 2/28/2021 | 4,635,228 |

Dividend Income | $5,568 |

1 | 7-day net yield. |

2 | Also represents cost for federal tax purposes. |

3 | Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities. |

4 | Non-income-producing security. |

Valuation Inputs | ||||

Level 1— Quoted Prices | Level 2— Other Significant Observable Inputs | Level 3— Significant Unobservable Inputs | Total | |

Debt Securities: | ||||

U.S. Treasuries | $— | $55,299,190 | $— | $55,299,190 |

Government Agencies | — | 51,660,086 | — | 51,660,086 |

Investment Company | 4,635,228 | — | — | 4,635,228 |

TOTAL SECURITIES | $4,635,228 | $106,959,276 | $— | $111,594,504 |

Other Financial Instruments:1 | ||||

Liabilities | $(3,621) | $— | $— | $(3,621) |

TOTAL OTHER FINANCIAL INSTRUMENTS | $(3,621) | $— | $— | $(3,621) |

1 | Other financial instruments are futures contracts. |

Year Ended February 28 or 29, | |||||

2021 | 2020 | 2019 | 2018 | 2017 | |

Net Asset Value, Beginning of Period | $10.35 | $10.16 | $10.19 | $10.34 | $10.41 |

Income From Investment Operations: | |||||

Net investment income (loss) | 0.08 | 0.22 | 0.22 | 0.13 | 0.10 |

Net realized and unrealized gain (loss) | 0.06 | 0.19 | (0.04) | (0.16) | (0.06) |

Total From Investment Operations | 0.14 | 0.41 | 0.18 | (0.03) | 0.04 |

Less Distributions: | |||||

Distributions from net investment income | (0.09) | (0.22) | (0.21) | (0.12) | (0.11) |

Net Asset Value, End of Period | $10.40 | $10.35 | $10.16 | $10.19 | $10.34 |

Total Return1 | 1.35% | 4.11% | 1.82% | (0.29)% | 0.35% |

Ratios to Average Net Assets: | |||||

Net expenses2 | 0.42% | 0.45% | 0.45% | 0.46% | 0.48% |

Net investment income | 0.81% | 2.15% | 2.14% | 1.22% | 1.01% |

Expense waiver/reimbursement3 | 0.26% | 0.21% | 0.23% | 0.23% | 0.22% |

Supplemental Data: | |||||

Net assets, end of period (000 omitted) | $79,451 | $65,923 | $68,554 | $70,564 | $65,470 |

Portfolio turnover | 99% | 110% | 265% | 244% | 106% |

1 | Based on net asset value. |

2 | Amount does not reflect net expenses incurred by investment companies in which the Fund may invest. |

3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by investment companies in which the Fund may invest. |

Year Ended February 28 or 29, | |||||

2021 | 2020 | 2019 | 2018 | 2017 | |

Net Asset Value, Beginning of Period | $10.33 | $10.15 | $10.18 | $10.33 | $10.40 |

Income From Investment Operations: | |||||

Net investment income (loss) | 0.04 | 0.18 | 0.17 | 0.09 | 0.07 |

Net realized and unrealized gain (loss) | 0.06 | 0.18 | (0.03) | (0.16) | (0.07) |

Total From Investment Operations | 0.10 | 0.36 | 0.14 | (0.07) | — |

Less Distributions: | |||||

Distributions from net investment income | (0.04) | (0.18) | (0.17) | (0.08) | (0.07) |

Net Asset Value, End of Period | $10.39 | $10.33 | $10.15 | $10.18 | $10.33 |

Total Return1 | 1.00% | 3.58% | 1.42% | (0.67)% | 0.00% |

Ratios to Average Net Assets: | |||||

Net expenses2 | 0.86% | 0.86% | 0.85% | 0.85% | 0.83% |

Net investment income | 0.39% | 1.73% | 1.74% | 0.83% | 0.67% |

Expense waiver/reimbursement3 | 0.26% | 0.21% | 0.23% | 0.23% | 0.22% |

Supplemental Data: | |||||

Net assets, end of period (000 omitted) | $6,183 | $7,567 | $7,496 | $5,373 | $5,689 |

Portfolio turnover | 99% | 110% | 265% | 244% | 106% |

1 | Based on net asset value. |

2 | Amount does not reflect net expenses incurred by investment companies in which the Fund may invest. |

3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by investment companies in which the Fund may invest. |

Year Ended February 28 or 29, | |||||

2021 | 2020 | 2019 | 2018 | 2017 | |

Net Asset Value, Beginning of Period | $10.34 | $10.16 | $10.19 | $10.34 | $10.41 |

Income From Investment Operations: | |||||

Net investment income (loss) | 0.11 | 0.22 | 0.22 | 0.14 | 0.12 |

Net realized and unrealized gain (loss) | 0.05 | 0.19 | (0.03) | (0.16) | (0.07) |

Total From Investment Operations | 0.16 | 0.41 | 0.19 | (0.02) | 0.05 |

Less Distributions: | |||||

Distributions from net investment income | (0.10) | (0.23) | (0.22) | (0.13) | (0.12) |

Net Asset Value, End of Period | $10.40 | $10.34 | $10.16 | $10.19 | $10.34 |

Total Return1 | 1.51% | 4.09% | 1.91% | (0.18)% | 0.49% |

Ratios to Average Net Assets: | |||||

Net expenses2 | 0.36% | 0.36% | 0.36% | 0.36% | 0.34% |

Net investment income | 0.93% | 2.22% | 2.19% | 1.33% | 1.15% |

Expense waiver/reimbursement3 | 0.24% | 0.21% | 0.22% | 0.23% | 0.22% |

Supplemental Data: | |||||

Net assets, end of period (000 omitted) | $26,343 | $93,165 | $45,901 | $82,978 | $68,587 |

Portfolio Turnover | 99% | 110% | 265% | 244% | 106% |

1 | Based on net asset value. |

2 | Amount does not reflect net expenses incurred by investment companies in which the Fund may invest. |

3 | This expense decrease is reflected in both the net expense and the net investment income ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by investment companies in which the Fund may invest. |

Assets: | |

Investment in securities, at value including $4,635,228 of investments in an affiliated holding* (identified cost $110,279,371) | $111,594,504 |

Due from broker (Note 2) | 19,000 |

Income receivable | 368,554 |

Receivable for shares sold | 163,343 |

Total Assets | 112,145,401 |

Liabilities: | |

Payable for shares redeemed | 27,205 |

Payable for variation margin on futures contracts | 21,982 |

Income distribution payable | 4,655 |

Payable for investment adviser fee (Note 5) | 878 |

Payable for administrative fee (Note 5) | 718 |

Payable for transfer agent fees | 21,282 |

Payable for custodian fees | 4,182 |

Payable for portfolio accounting fees | 45,517 |

Payable for distribution services fee (Note 5) | 1,226 |

Payable for other service fees (Notes 2 and 5) | 5,271 |

Payable for share registration costs | 28,757 |

Accrued expenses (Note 5) | 6,189 |

Total Liabilities | 167,862 |

Net assets for 10,769,904 shares outstanding | $111,977,539 |

Net Assets Consist of: | |

Paid-in capital | $121,048,022 |

Total distributable earnings (loss) | (9,070,483) |

Total Net Assets | $111,977,539 |

Net Asset Value, Offering Price and Redemption Proceeds Per Share: | |

Institutional Shares: | |

Net asset value per share ($79,451,389 ÷ 7,640,730 shares outstanding), no par value, unlimited shares authorized | $10.40 |

Service Shares: | |

Net asset value per share ($6,183,464 ÷ 595,341 shares outstanding), no par value, unlimited shares authorized | $10.39 |

Class Y Shares: | |

Net asset value per share ($26,342,686 ÷ 2,533,833 shares outstanding), no par value, unlimited shares authorized | $10.40 |

* | See information listed after the Fund’s Portfolio of Investments. |

Investment Income: | |

Interest | $1,919,943 |

Dividends received from an affiliated holding* | 5,568 |

TOTAL INCOME | 1,925,511 |

Expenses: | |

Investment adviser fee (Note 5) | 458,804 |

Administrative fee (Note 5) | 119,805 |

Custodian fees | 10,517 |

Transfer agent fees | 104,217 |

Directors’/Trustees’ fees (Note 5) | 7,935 |

Auditing fees | 30,200 |

Legal fees | 9,888 |

Portfolio accounting fees | 80,048 |

Distribution services fee (Note 5) | 18,171 |

Other service fees (Notes 2 and 5) | 70,731 |

Share registration costs | 61,726 |

Printing and postage | 25,478 |

Miscellaneous (Note 5) | 37,902 |

TOTAL EXPENSES | 1,035,422 |

Waiver and Reimbursements: | |

Waiver/reimbursement of investment adviser fee (Note 5) | (369,539) |

Reimbursement of other operating expenses (Note 5) | (18,923) |

TOTAL WAIVER AND REIMBURSEMENTS | (388,462) |

Net expenses | 646,960 |

Net investment income | 1,278,551 |

Realized and Unrealized Gain (Loss) on Investments and Futures Contracts: | |

Net realized gain on investments | 2,025,281 |

Net realized gain on futures contracts | 404,696 |

Net change in unrealized appreciation of investments | (1,152,305) |

Net change in unrealized appreciation of futures contracts | (133,075) |

Net realized and unrealized gain (loss) on investments and futures contracts | 1,144,597 |

Change in net assets resulting from operations | $2,423,148 |

* | See information listed after the Fund’s Portfolio of Investments. |

Year Ended February 28 or 29 | 2021 | 2020 |

Increase (Decrease) in Net Assets | ||

Operations: | ||

Net investment income (loss) | $1,278,551 | $3,757,888 |

Net realized gain (loss) | 2,429,977 | 1,187,158 |

Net change in unrealized appreciation/depreciation | (1,285,380) | 1,994,215 |

CHANGE IN NET ASSETS RESULTING FROM OPERATIONS | 2,423,148 | 6,939,261 |

Distributions to Shareholders: | ||

Institutional Shares | (758,671) | (1,462,516) |

Service Shares | (31,007) | (125,679) |

Class Y Shares | (553,491) | (2,223,009) |

CHANGE IN NET ASSETS RESULTING FROM DISTRIBUTIONS TO SHAREHOLDERS | (1,343,169) | (3,811,204) |

Share Transactions: | ||

Proceeds from sale of shares | 106,132,155 | 177,963,619 |

Net asset value of shares issued to shareholders in payment of distributions declared | 1,266,912 | 3,627,501 |

Cost of shares redeemed | (163,155,968) | (140,015,877) |

CHANGE IN NET ASSETS RESULTING FROM SHARE TRANSACTIONS | (55,756,901) | 41,575,243 |

Change in net assets | (54,676,922) | 44,703,300 |

Net Assets: | ||

Beginning of period | 166,654,461 | 121,951,161 |

End of period | $111,977,539 | $166,654,461 |

Other Service Fees Incurred | |

Institutional Shares | $52,560 |

Service Shares | 18,171 |

TOTAL | $70,731 |

Fair Value of Derivative Instruments | ||

Liabilities | ||

Statement of Assets and Liabilities Location | Fair Value | |

Derivatives not accounted for as hedging instruments under ASC Topic 815 | ||

Interest rate contracts | Payable for variation margin on futures contracts | $3,621* |

* | Includes cumulative net depreciation of futures contracts as reported in the footnotes to the Portfolio of Investments. Only the current day’s variation margin is reported within the Statement of Assets and Liabilities. |

Amount of Realized Gain or (Loss) on Derivatives Recognized in Income | |

Futures Contracts | |

Interest rate contracts | $404,696 |

Change in Unrealized Appreciation or (Depreciation) on Derivatives Recognized in Income | |

Futures Contracts | |

Interest rate contracts | $(133,075) |

Year Ended 2/28/2021 | Year Ended 2/29/2020 | |||

Institutional Shares: | Shares | Amount | Shares | Amount |

Shares sold | 6,530,168 | $68,085,223 | 1,204,963 | $12,337,802 |

Shares issued to shareholders in payment of distributions declared | 66,904 | 698,620 | 128,668 | 1,319,017 |

Shares redeemed | (5,328,714) | (55,629,355) | (1,706,090) | (17,488,664) |

NET CHANGE RESULTING FROM INSTITUTIONAL SHARE TRANSACTIONS | 1,268,358 | $13,154,488 | (372,459) | $(3,831,845) |

Year Ended 2/28/2021 | Year Ended 2/29/2020 | |||

Service Shares: | Shares | Amount | Shares | Amount |

Shares sold | 106,641 | $1,112,152 | 105,138 | $1,080,952 |

Shares issued to shareholders in payment of distributions declared | 2,883 | 30,065 | 11,117 | 113,851 |

Shares redeemed | (246,414) | (2,570,361) | (122,293) | (1,251,856) |

NET CHANGE RESULTING FROM SERVICE SHARE TRANSACTIONS | (136,890) | $(1,428,144) | (6,038) | $(57,053) |

Year Ended 2/28/2021 | Year Ended 2/29/2020 | |||

Class Y Shares: | Shares | Amount | Shares | Amount |

Shares sold | 3,539,931 | $36,934,780 | 16,100,633 | $164,544,865 |

Shares issued to shareholders in payment of distributions declared | 51,547 | 538,227 | 213,991 | 2,194,633 |

Shares redeemed | (10,065,425) | (104,956,252) | (11,823,275) | (121,275,357) |

NET CHANGE RESULTING FROM CLASS Y SHARE TRANSACTIONS | (6,473,947) | $(67,483,245) | 4,491,349 | $45,464,141 |

NET CHANGE RESULTING FROM TOTAL FUND SHARE TRANSACTIONS | (5,342,479) | $(55,756,901) | 4,112,852 | $41,575,243 |

2021 | 2020 | |

Ordinary income | $1,343,169 | $3,811,204 |

Undistributed ordinary income | $20,131 |

Net unrealized appreciation | $1,315,133 |

Capital loss carryforwards | $(10,405,747) |

Short-Term | Long-Term | Total |

$10,405,747 | $— | $10,405,747 |

Administrative Fee | Average Daily Net Assets of the Investment Complex |

0.100% | on assets up to $50 billion |

0.075% | on assets over $50 billion |

Distribution Services Fees Incurred | |

Service Shares | $18,171 |

Purchases | $5,533,112 |

Sales | $31,116,484 |

April 22, 2021

Beginning Account Value 9/1/2020 | Ending Account Value 2/28/2021 | Expenses Paid During Period1 | |

Actual: | |||

Institutional Shares | $1,000 | $998.80 | $22.08 |

Service Shares | $1,000 | $996.60 | $4.26 |

Class Y Shares | $1,000 | $999.10 | $1.78 |

Hypothetical (assuming a 5% return before expenses): | |||

Institutional Shares | $1,000 | $1,022.71 | $22.11 |

Service Shares | $1,000 | $1,020.53 | $4.31 |

Class Y Shares | $1,000 | $1,023.01 | $1.81 |

1 | Expenses are equal to the Fund’s annualized net expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half-year period). The annualized net expense ratios are as follows: |

Institutional Shares | 0.42% |

Service Shares | 0.86% |

Class Y Shares | 0.36% |

2 | Actual and Hypothetical expenses paid during the period utilizing the Fund’s Institutional Shares current Fee Limit of 0.53% (as reflected in the Notes to Financial Statements, Note 5 under Expense Limitation), multiplied by the average account value over the period, multiplied by 181/365 (to reflect expenses paid as if they had been in effect throughout the most recent one-half-year period) would be $2.63 and $2.66, respectively. |

Name Birth Date Positions Held with Fund Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held and Previous Position(s) |

J. Christopher Donahue* Birth Date: April 11, 1949 President and Trustee Indefinite Term Began serving: July 1999 | Principal Occupations: Principal Executive Officer and President of certain of the Funds in the Federated Hermes Fund Family; Director or Trustee of the Funds in the Federated Hermes Fund Family; President, Chief Executive Officer and Director, Federated Hermes, Inc.; Chairman and Trustee, Federated Investment Management Company; Trustee, Federated Investment Counseling; Chairman and Director, Federated Global Investment Management Corp.; Chairman and Trustee, Federated Equity Management Company of Pennsylvania; Trustee, Federated Shareholder Services Company; Director, Federated Services Company. Previous Positions: President, Federated Investment Counseling; President and Chief Executive Officer, Federated Investment Management Company, Federated Global Investment Management Corp. and Passport Research, Ltd; Chairman, Passport Research, Ltd. |

Name Birth Date Positions Held with Fund Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held and Previous Position(s) |

John B. Fisher* Birth Date: May 16, 1956 Trustee Indefinite Term Began serving: May 2016 | Principal Occupations: Principal Executive Officer and President of certain of the Funds in the Federated Hermes Fund Family; Director or Trustee of certain of the Funds in the Federated Hermes Fund Family; Vice President, Federated Hermes, Inc.; President, Director/Trustee and CEO, Federated Advisory Services Company, Federated Equity Management Company of Pennsylvania, Federated Global Investment Management Corp., Federated Investment Counseling, Federated Investment Management Company; President of some of the Funds in the Federated Hermes Fund Family and Director, Federated Investors Trust Company. Previous Positions: President and Director of the Institutional Sales Division of Federated Securities Corp.; President and Director of Federated Investment Counseling; President and CEO of Passport Research, Ltd.; Director, Edgewood Securities Corp.; Director, Federated Services Company; Director, Federated Hermes, Inc.; Chairman and Director, Southpointe Distribution Services, Inc. and President, Technology, Federated Services Company. |

Name Birth Date Positions Held with Fund Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held, Previous Position(s) and Qualifications |

John T. Collins Birth Date: January 24, 1947 Trustee Indefinite Term Began serving: October 2013 | Principal Occupations: Director or Trustee, and Chair of the Board of Directors or Trustees, of the Federated Hermes Fund Family; formerly, Chairman and CEO, The Collins Group, Inc. (a private equity firm) (Retired). Other Directorships Held: Chairman of the Board of Directors, Director, KLX Energy Services Holdings, Inc. (oilfield services); former Director of KLX Corp. (aerospace). Qualifications: Mr. Collins has served in several business and financial management roles and directorship positions throughout his career. Mr. Collins previously served as Chairman and CEO of The Collins Group, Inc. (a private equity firm) and as a Director of KLX Corp. Mr. Collins serves as Chairman Emeriti, Bentley University. Mr. Collins previously served as Director and Audit Committee Member, Bank of America Corp.; Director, FleetBoston Financial Corp.; and Director, Beth Israel Deaconess Medical Center (Harvard University Affiliate Hospital). |

Name Birth Date Positions Held with Fund Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held, Previous Position(s) and Qualifications |

G. Thomas Hough Birth Date: February 28, 1955 Trustee Indefinite Term Began serving: August 2015 | Principal Occupations: Director or Trustee, Chair of the Audit Committee of the Federated Hermes Fund Family; formerly, Vice Chair, Ernst & Young LLP (public accounting firm) (Retired). Other Directorships Held: Director, Chair of the Audit Committee, Equifax, Inc.; Director, Member of the Audit Committee, Haverty Furniture Companies, Inc.; formerly, Director, Member of Governance and Compensation Committees, Publix Super Markets, Inc. Qualifications: Mr. Hough has served in accounting, business management and directorship positions throughout his career. Mr. Hough most recently held the position of Americas Vice Chair of Assurance with Ernst & Young LLP (public accounting firm). Mr. Hough serves on the President’s Cabinet and Business School Board of Visitors for the University of Alabama. Mr. Hough previously served on the Business School Board of Visitors for Wake Forest University, and he previously served as an Executive Committee member of the United States Golf Association. |

Maureen Lally-Green Birth Date: July 5, 1949 Trustee Indefinite Term Began serving: August 2009 | Principal Occupations: Director or Trustee of the Federated Hermes Fund Family; Adjunct Professor Emerita of Law, Duquesne University School of Law; formerly, Dean of the Duquesne University School of Law and Professor of Law and Interim Dean of the Duquesne University School of Law; formerly, Associate General Secretary and Director, Office of Church Relations, Diocese of Pittsburgh. Other Directorships Held: Director, CNX Resources Corporation (formerly known as CONSOL Energy Inc.). Qualifications: Judge Lally-Green has served in various legal and business roles and directorship positions throughout her career. Judge Lally-Green previously held the position of Dean of the School of Law of Duquesne University (as well as Interim Dean). Judge Lally-Green previously served as a member of the Superior Court of Pennsylvania and as a Professor of Law, Duquesne University School of Law. Judge Lally-Green was appointed by the Supreme Court of Pennsylvania to serve on the Supreme Court’s Board of Continuing Judicial Education and the Supreme Court’s Appellate Court Procedural Rules Committee. Judge Lally-Green also currently holds the positions on not for profit or for profit boards of directors as follows: Director and Chair, UPMC Mercy Hospital; Regent, Saint Vincent Seminary; Member, Pennsylvania State Board of Education (public); Director, Catholic Charities, Pittsburgh; and Director CNX Resources Corporation (formerly known as CONSOL Energy Inc.). Judge Lally-Green has held the positions of: Director, Auberle; Director, Epilepsy Foundation of Western and Central Pennsylvania; Director, Ireland Institute of Pittsburgh; Director, Saint Thomas More Society; Director and Chair, Catholic High Schools of the Diocese of Pittsburgh, Inc.; Director, Pennsylvania Bar Institute; Director, St. Vincent College; Director and Chair, North Catholic High School, Inc.; and Director and Vice Chair, Our Campaign for the Church Alive!, Inc. |

Name Birth Date Positions Held with Fund Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held, Previous Position(s) and Qualifications |

Thomas M. O’Neill Birth Date: June 14, 1951 Trustee Indefinite Term Began serving: August 2006 | Principal Occupations: Director or Trustee of the Federated Hermes Fund Family; Sole Proprietor, Navigator Management Company (investment and strategic consulting). Other Directorships Held: None. Qualifications: Mr. O’Neill has served in several business, mutual fund and financial management roles and directorship positions throughout his career. Mr. O’Neill serves as Director, Medicines for Humanity and Director, The Golisano Children’s Museum of Naples, Florida. Mr. O’Neill previously served as Chief Executive Officer and President, Managing Director and Chief Investment Officer, Fleet Investment Advisors; President and Chief Executive Officer, Aeltus Investment Management, Inc.; General Partner, Hellman, Jordan Management Co., Boston, MA; Chief Investment Officer, The Putnam Companies, Boston, MA; Credit Analyst and Lending Officer, Fleet Bank; Director and Consultant, EZE Castle Software (investment order management software); and Director, Midway Pacific (lumber). |

Madelyn A. Reilly Birth Date: February 2, 1956 Trustee Indefinite Term Began serving: November 2020 | Principal Occupations: Director or Trustee of the Federated Hermes Fund Family; Senior Vice President for Legal Affairs, General Counsel and Secretary of the Board of Trustees, Duquesne University. Other Directorships Held: None. Qualifications: Ms. Reilly has served in various business and legal management roles throughout her career. Ms. Reilly previously served as Director of Risk Management and Associate General Counsel, Duquesne University. Prior to her work at Duquesne University, Ms. Reilly served as Assistant General Counsel of Compliance and Enterprise Risk as well as Senior Counsel of Environment, Health and Safety, PPG Industries. |

P. Jerome Richey Birth Date: February 23, 1949 Trustee Indefinite Term Began serving: October 2013 | Principal Occupations: Director or Trustee of the Federated Hermes Fund Family; Management Consultant; Retired; formerly, Senior Vice Chancellor and Chief Legal Officer, University of Pittsburgh and Executive Vice President and Chief Legal Officer, CONSOL Energy Inc. (now split into two separate publicly traded companies known as CONSOL Energy Inc. and CNX Resources Corp.). Other Directorships Held: None. Qualifications: Mr. Richey has served in several business and legal management roles and directorship positions throughout his career. Mr. Richey most recently held the positions of Senior Vice Chancellor and Chief Legal Officer, University of Pittsburgh. Mr. Richey previously served as Chairman of the Board, Epilepsy Foundation of Western Pennsylvania and Chairman of the Board, World Affairs Council of Pittsburgh. Mr. Richey previously served as Chief Legal Officer and Executive Vice President, CONSOL Energy Inc. and CNX Gas Company; and Board Member, Ethics Counsel and Shareholder, Buchanan Ingersoll & Rooney PC (a law firm). |

Name Birth Date Positions Held with Fund Date Service Began | Principal Occupation(s) for Past Five Years, Other Directorships Held, Previous Position(s) and Qualifications |

John S. Walsh Birth Date: November 28, 1957 Trustee Indefinite Term Began serving: August 1999 | Principal Occupations: Director or Trustee of the Federated Hermes Fund Family; President and Director, Heat Wagon, Inc. (manufacturer of construction temporary heaters); President and Director, Manufacturers Products, Inc. (distributor of portable construction heaters); President, Portable Heater Parts, a division of Manufacturers Products, Inc. Other Directorships Held: None. Qualifications: Mr. Walsh has served in several business management roles and directorship positions throughout his career. Mr. Walsh previously served as Vice President, Walsh & Kelly, Inc. (paving contractors). |

Name Birth Date Positions Held with Fund Date Service Began | Principal Occupation(s) for Past Five Years and Previous Position(s) |

Lori A. Hensler Birth Date: January 6, 1967 TREASURER Officer since: April 2013 | Principal Occupations: Principal Financial Officer and Treasurer of the Federated Hermes Fund Family; Senior Vice President, Federated Administrative Services; Financial and Operations Principal for Federated Securities Corp.; and Assistant Treasurer, Federated Investors Trust Company. Ms. Hensler has received the Certified Public Accountant designation. Previous Positions: Controller of Federated Hermes, Inc.; Senior Vice President and Assistant Treasurer, Federated Investors Management Company; Treasurer, Federated Investors Trust Company; Assistant Treasurer, Federated Administrative Services, Federated Administrative Services, Inc., Federated Securities Corp., Edgewood Services, Inc., Federated Advisory Services Company, Federated Equity Management Company of Pennsylvania, Federated Global Investment Management Corp., Federated Investment Counseling, Federated Investment Management Company, Passport Research, Ltd., and Federated MDTA, LLC; Financial and Operations Principal for Federated Securities Corp., Edgewood Services, Inc. and Southpointe Distribution Services, Inc. |

Name Birth Date Positions Held with Fund Date Service Began | Principal Occupation(s) for Past Five Years and Previous Position(s) |

Peter J. Germain Birth Date: September 3, 1959 CHIEF LEGAL OFFICER, SECRETARY and EXECUTIVE VICE PRESIDENT Officer since: January 2005 | Principal Occupations: Mr. Germain is Chief Legal Officer, Secretary and Executive Vice President of the Federated Hermes Fund Family. He is General Counsel, Chief Legal Officer, Secretary and Executive Vice President, Federated Hermes, Inc.; Trustee and Senior Vice President, Federated Investors Management Company; Trustee and President, Federated Administrative Services; Director and President, Federated Administrative Services, Inc.; Director and Vice President, Federated Securities Corp.; Director and Secretary, Federated Private Asset Management, Inc.; Secretary, Federated Shareholder Services Company; and Secretary, Retirement Plan Service Company of America. Mr. Germain joined Federated Hermes, Inc. in 1984 and is a member of the Pennsylvania Bar Association. Previous Positions: Deputy General Counsel, Special Counsel, Managing Director of Mutual Fund Services, Federated Hermes, Inc.; Senior Vice President, Federated Services Company; and Senior Corporate Counsel, Federated Hermes, Inc. |

Stephen Van Meter Birth Date: June 5, 1975 CHIEF COMPLIANCE OFFICER AND SENIOR VICE PRESIDENT Officer since: July 2015 | Principal Occupations: Senior Vice President and Chief Compliance Officer of the Federated Hermes Fund Family; Vice President and Chief Compliance Officer of Federated Hermes, Inc. and Chief Compliance Officer of certain of its subsidiaries. Mr. Van Meter joined Federated Hermes, Inc. in October 2011. He holds FINRA licenses under Series 3, 7, 24 and 66. Previous Positions: Mr. Van Meter previously held the position of Compliance Operating Officer, Federated Hermes, Inc. Prior to joining Federated Hermes, Inc., Mr. Van Meter served at the United States Securities and Exchange Commission in the positions of Senior Counsel, Office of Chief Counsel, Division of Investment Management and Senior Counsel, Division of Enforcement. |

Robert J. Ostrowski Birth Date: April 26, 1963 Chief Investment Officer Officer since: May 2004 | Principal Occupations: Robert J. Ostrowski joined Federated Hermes, Inc. in 1987 as an Investment Analyst and became a Portfolio Manager in 1990. He was named Chief Investment Officer of Federated Hermes’ taxable fixed-income products in 2004 and also serves as a Senior Portfolio Manager. Mr. Ostrowski became an Executive Vice President of the Fund’s Adviser in 2009 and served as a Senior Vice President of the Fund’s Adviser from 1997 to 2009. Mr. Ostrowski has received the Chartered Financial Analyst designation. He received his M.S. in Industrial Administration from Carnegie Mellon University. |

Annual Evaluation of Adequacy and Effectiveness

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, PA 15086-7561

or call 1-800-341-7400.

CUSIP 31428M209

CUSIP 31428M308

| Item 2. | Code of Ethics |

(a) As of the end of the period covered by this report, the registrant has adopted a code of ethics (the "Section 406 Standards for Investment Companies - Ethical Standards for Principal Executive and Financial Officers") that applies to the registrant's Principal Executive Officer and Principal Financial Officer; the registrant's Principal Financial Officer also serves as the Principal Accounting Officer.

(c) There was no amendment to the registrant’s code of ethics described in Item 2(a) above during the period covered by the report.

(d) There was no waiver granted, either actual or implicit, from a provision to the registrant’s code of ethics described in Item 2(a) above during the period covered by the report.

(e) Not Applicable

(f)(3) The registrant hereby undertakes to provide any person, without charge, upon request, a copy of the code of ethics. To request a copy of the code of ethics, contact the registrant at 1-800-341-7400, and ask for a copy of the Section 406 Standards for Investment Companies - Ethical Standards for Principal Executive and Financial Officers.

Item 3. Audit Committee Financial Expert

The registrant's Board has determined that each of the following members of the Board's Audit Committee is an “audit committee financial expert,” and is "independent," for purposes of this Item: G. Thomas Hough and Thomas M. O'Neill.

| Item 4. | Principal Accountant Fees and Services |

(a) Audit Fees billed to the registrant for the two most recent fiscal years:

Fiscal year ended 2021 – $29,600

Fiscal year ended 2020 - $30,200

(b) Audit-Related Fees billed to the registrant for the two most recent fiscal years:

Fiscal year ended 2021 - $0

Fiscal year ended 2020 - $0

Amount requiring approval of the registrant’s audit committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, $0 and $0 respectively.

(c) Tax Fees billed to the registrant for the two most recent fiscal years:

Fiscal year ended 2021 - $0

Fiscal year ended 2020 - $0

Amount requiring approval of the registrant’s audit committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, $0 and $0 respectively.

(d) All Other Fees billed to the registrant for the two most recent fiscal years:

Fiscal year ended 2021 - $0

Fiscal year ended 2020 - $0

Amount requiring approval of the registrant’s audit committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, $0 and $0 respectively.

(e)(1) Audit Committee Policies regarding Pre-approval of Services.

The Audit Committee is required to pre-approve audit and non-audit services performed by the independent auditor in order to assure that the provision of such services do not impair the auditor’s independence. Unless a type of service to be provided by the independent auditor has received general pre-approval, it will require specific pre-approval by the Audit Committee. Any proposed services exceeding pre-approved cost levels will require specific pre-approval by the Audit Committee.

Certain services have the general pre-approval of the Audit Committee. The term of the general pre-approval is 12 months from the date of pre-approval, unless the Audit Committee specifically provides for a different period. The Audit Committee will annually review the services that may be provided by the independent auditor without obtaining specific pre-approval from the Audit Committee and may grant general pre-approval for such services. The Audit Committee will revise the list of general pre-approved services from time to time, based on subsequent determinations. The Audit Committee will not delegate to management its responsibilities to pre-approve services performed by the independent auditor.

The Audit Committee has delegated pre-approval authority to its Chairman for services that do not exceed a specified dollar threshold. The Chairman or Chief Audit Executive will report any such pre-approval decisions to the Audit Committee at its next scheduled meeting. The Committee will designate another member with such pre-approval authority when the Chairman is unavailable.

AUDIT SERVICES

The annual Audit services engagement terms and fees will be subject to the specific pre-approval of the Audit Committee. The Audit Committee will approve, if necessary, any changes in terms, conditions and fees resulting from changes in audit scope, registered investment company (RIC) structure or other matters.

In addition to the annual Audit services engagement specifically approved by the Audit Committee, the Audit Committee may grant general pre-approval for other Audit services, which are those services that only the independent auditor reasonably can provide. The Audit Committee has pre-approved certain Audit services; with limited exception, all other audit services must be specifically pre-approved by the Audit Committee.

AUDIT-RELATED SERVICES

Audit-related services are assurance and related services that are reasonably related to the performance of the audit or review of the RIC’s financial statements or that are traditionally performed by the independent auditor. The Audit Committee believes that the provision of Audit-related services does not impair the independence of the auditor, and has pre-approved certain audit-related services; all other audit-related services must be specifically pre-approved by the Audit Committee.

TAX SERVICES

The Audit Committee believes that the independent auditor can provide Tax services to the RIC such as tax compliance, tax planning and tax advice without impairing the auditor’s independence. However, the Audit Committee will not permit the retention of the independent auditor in connection with a transaction initially recommended by the independent auditor, the purpose of which may be tax avoidance and the tax treatment of which may not be supported in the Internal Revenue Code and related regulations. The Audit Committee has pre-approved certain Tax services; with limited exception, all tax services involving large and complex transactions must be specifically pre-approved by the Audit Committee.

ALL OTHER SERVICES

With respect to the provision of permissible services other than audit, review or attest services the pre-approval requirement is waived if:

| (1) | With respect to such services rendered to the Funds, the aggregate amount of all such services provided constitutes no more than five percent of the total amount of revenues paid by the audit client to its accountant during the fiscal year in which the services are provided; and, |

| (2) | With respect to such services rendered to the Fund’s investment adviser and any entity controlling, controlled by to under common control with the investment adviser such as affiliated non-U.S. and U.S. funds not under the Audit Committee’s purview and which do not fall within a category of service which has been determined by the Audit Committee not to have a direct impact on the operations or financial reporting of the RIC, the aggregate amount of all services provided constitutes no more than five percent of the total amount of revenues paid to the RIC’s auditor by the RIC, its investment adviser and any entity controlling, controlled by, or under common control with the investment adviser during the fiscal year in which the services are provided; and |

| (3) | Such services were not recognized by the issuer or RIC at the time of the engagement to be non-audit services; and |

| (4) | Such services are promptly brought to the attention of the Audit Committee and approved prior to the completion of the audit by the Audit Committee or by one or more members of the Audit Committee who are members of the Board of Directors to whom authority to grant such approvals has been delegated by the Audit Committee. |

The Audit Committee may grant general pre-approval to those permissible non-audit services which qualify for pre-approval and which it believes are routine and recurring services, and would not impair the independence of the auditor.

The Securities and Exchange Commission’s (the “SEC”) rules and relevant guidance should be consulted to determine the precise definitions of these services and applicability of exceptions to certain of the prohibitions.

PRE-APPROVAL FEE LEVELS

Pre-approval fee levels for all services to be provided by the independent auditor will be established annually by the Audit Committee. Any proposed services exceeding these levels will require specific pre-approval by the Audit Committee.

PROCEDURES

Requests or applications to provide services that require specific approval by the Audit Committee will be submitted to the Audit Committee by the Fund’s Principal Accounting Officer and/or the Chief Audit Executive of Federated Hermes, Inc., only after those individuals have determined that the request or application is consistent with the SEC’s rules on auditor independence.

(e)(2) Percentage of services identified in items 4(b) through 4(d) that were approved by the registrant’s Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X:

4(b)

Fiscal year ended 2021 – 0%

Fiscal year ended 2020 - 0%

Percentage of services provided to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were approved by the registrant’s Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X, 0% and 0% respectively.

4(c)

Fiscal year ended 2021 – 0%

Fiscal year ended 2020 – 0%

Percentage of services provided to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were approved by the registrant’s Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X, 0% and 0% respectively.

4(d)

Fiscal year ended 2021 – 0%

Fiscal year ended 2020 – 0%

Percentage of services provided to the registrant’s investment adviser and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were approved by the registrant’s Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X, 0% and 0% respectively.

| (f) | NA |

| (g) | Non-Audit Fees billed to the registrant, the registrant’s investment adviser, and certain entities controlling, controlled by or under common control with the investment adviser: |

Fiscal year ended 2021 - $62,038

Fiscal year ended 2020 - $439,920

| (h) | The registrant’s Audit Committee has considered that the provision of non-audit services that were rendered to the registrant’s adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence. |

| Item 5. | Audit Committee of Listed Registrants |

Not Applicable

| Item 6. | Schedule of Investments |

(a) The registrant’s Schedule of Investments is included as part of the Report to Stockholders filed under Item 1 of this form.

(b) Not Applicable; Fund had no divestments during the reporting period covered since the previous Form N-CSR filing.

| Item 7. | Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies |

Not Applicable

| Item 8. | Portfolio Managers of Closed-End Management Investment Companies |

Not Applicable

| Item 9. | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers |

Not Applicable

| Item 10. | Submission of Matters to a Vote of Security Holders |

No Changes to Report

| Item 11. | Controls and Procedures |

(a) The registrant’s President and Treasurer have concluded that the

registrant’s disclosure controls and procedures (as defined in rule 30a-3(c) under the Act) are effective in design and operation and are sufficient to form the basis of the certifications required by Rule 30a-(2) under the Act, based on their evaluation of these disclosure controls and procedures within 90 days of the filing date of this report on Form N-CSR.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in rule 30a-3(d) under the Act) during the registrant’s most recent fiscal half-year (the registrant’s second fiscal half-year in the case of an annual report) that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

| Item 12. | Disclosure of Securities Lending Activities for Closed-End Management Investment Companies |

Not Applicable

| Item 13. | Exhibits |

(a)(1) Code of Ethics- Not Applicable to this Report.

(a)(2) Certifications of Principal Executive Officer and Principal Financial Officer.

(a)(3) Not Applicable.

(b) Certifications pursuant to 18 U.S.C. Section 1350.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Registrant Federated Hermes Short-Term Government Trust

By /S/ Lori A. Hensler

Lori A. Hensler, Principal Financial Officer

Date April 22, 2021

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /S/ J. Christopher Donahue

J. Christopher Donahue, Principal Executive Officer

Date April 22, 2021

By /S/ Lori A. Hensler

Lori A. Hensler, Principal Financial Officer

Date April 22, 2021