Exhibit 99.2

Highly Confidential

Subject to Material Revision

Attorney Work Product

Settlement Communication Subject to FRE 408, TRE 408 and TCPRC 154.073

Term Sheet and Summary of Conditions provided by the Cooperation Group Lenders to the Company on January 19, 2018

Introduction

The numbers on the following pages show the consideration that the Cooperation Group would propose be distributed to (1) all creditors of iHeart and its subsidiaries, other than holders of PGNs and term loans and (2) all equity interests in iHeart, pursuant to a plan of reorganization for iHeart and all of its subsidiaries (the “Plan”), where:

| 1. | The classification of creditors and interest holders in the Plan is acceptable to the Cooperation Group, |

| 2. | The treatment of each class in the Plan is acceptable to the Cooperation Group (among other things, classes of claims represented by Legacy Notes and the 14% Notes due 2021, and classes of equity interests shall receive distributions only if such classes vote to accept the Plan), |

| 3. | All classes of creditors and interest holders accept the Plan and the Cooperation Group receives assurances satisfactory to it that all classes of creditors and interest holders will accept the Plan sufficiently in advance of proceedings in a Bankruptcy Court to assure that (a) there are genuine and material savings in administrative expenses and (b) the business is not disrupted by bankruptcy related litigation. This proposal is sensible only if these benefits are realized. If such assurances are not forthcoming from creditors or interest holders in any class, the proposed distributions to such class will be reduced. |

| 4. | The company agrees, in form and substance satisfactory to the Cooperation Group, that if milestones to be negotiated are not met thus jeopardizing the achievement of the benefits described in the preceding point, the Cooperation Group will be permitted to file a plan of reorganization of its choosing, |

| 5. | All other terms and conditions of the Plan and all exhibits to the Plan shall be in form and substance satisfactory to the Cooperation Group in its sole and absolute discretion, and |

| 6. | This proposal is not a legally binding offer or agreement—any agreement must be evidenced by definitive documentation that is executed by all relevant parties. |

| | |

| Term Sheets | | Highly Confidential Subject to Material Revision Attorney Work Product Settlement Communication Subject to FRE 408, TRE 408 and TCPRC 154.073 |

| | | | |

| | | Company Proposal1 (January 10, 2018) | | Cooperation Group (January 19, 2018) |

| Structure / Implementation | | • Pre-packaged / Pre-arranged bankruptcy | | • Same |

| | |

| ABL | | • Remains outstanding and / or refinanced at closing | | • Same |

| | |

| Term Loans and PGNs | | Debt Consideration • $5.50bn new debt at recapitalized iHeart • 5-7 year maturity • Collateral in substantially all assets of recapitalized iHeart Equity Consideration • 88.3% equity in recapitalized iHeart • 100.0% of iHeart’s ownership in Outdoor2 | | Debt Consideration • $5,575mm new debt at recapitalized iHeart • Same • Same Equity Consideration • 93.5% equity in recapitalized iHeart • Same |

| | |

| Junior Stakeholders | | • $250mm new debt at recapitalized iHeart • 11.7% equity in recapitalized iHeart | | • $175mm new debt at recapitalized iHeart • 6.5% equity in recapitalized iHeart • 10% warrants struck at $6.5bn equity value of iHeart |

| | |

| Management | | • MIP to be negotiated | | • Same |

| | |

| Other | | • Full and mutual releases • Treatment of Intercompany Note to be discussed | | • Same |

| 1 | Tax analysis of proposed structure still under review by Kirkland & Ellis and the Company. |

| 2 | Reflects iHeartMedia’s ownership in Outdoor (e.g., 100% = 89.5% direct ownership). Assumes public stub remains outstanding. |

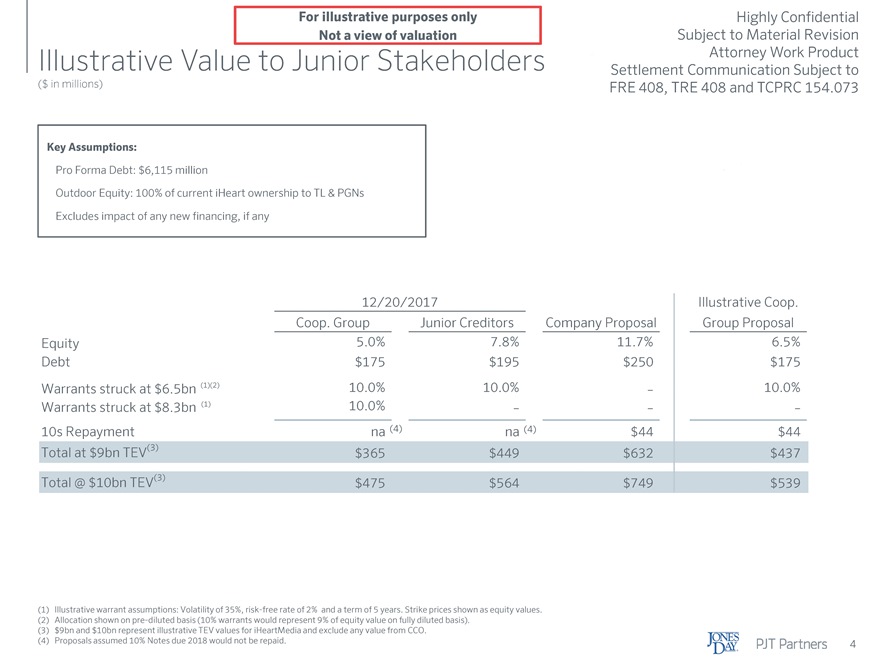

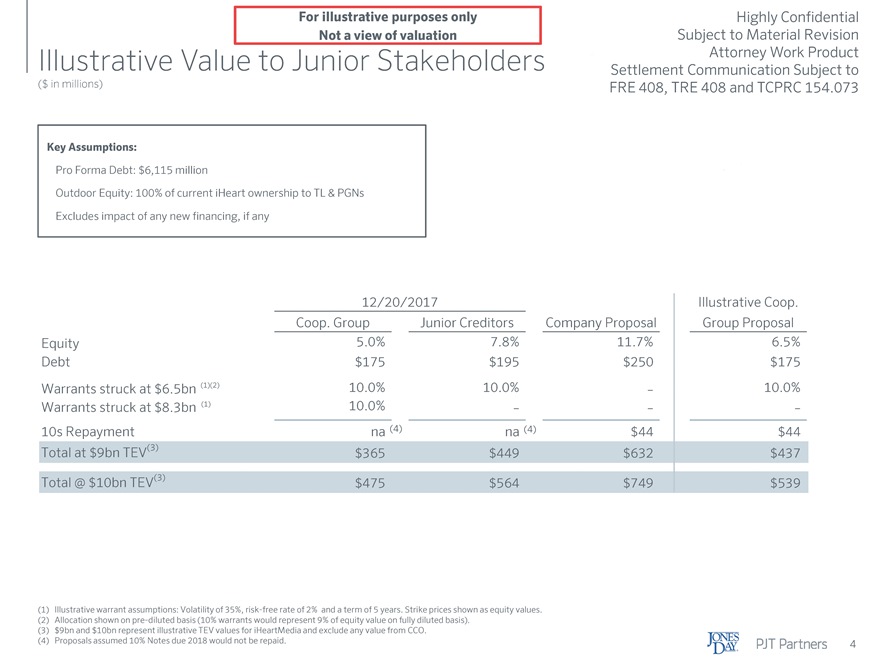

Highly Confidential Subject to Material Revision Attorney Work Product Settlement Communication Subject to FRE 408, TRE 408 and TCPRC 154.073 For illustrative purposes only Not a view of valuation Illustrative Value to Junior Stakeholders ($ in millions) Key Assumptions: Pro Forma Debt: $6,115 million Outdoor Equity: 100% of current iHeart ownership to TL & PGNs Excludes impact of any new financing, if any 12/20/2017 Illustrative Coop. Coop. Group Junior Creditors Company Proposal Group Proposal Equity $5.1440% $7.2248% 11.$3387% $6.1885% Debt $175 $195 $250 $175 Warrants struck at $6.5bn (1)(2) 10.0%27 10.0%30 – 10.0%30 Warrants struck at $8.3bn (1) 10.0%19 – – – 10s Repayment na (4) na (4) $44 $44 Total at $9bn TEV(3) $365 $449 $632 $437 Total @ $10bn TEV(3) $475 $564 $749 $539 (1) Illustrative warrant assumptions: Volatility of 35%, risk-free rate of 2% and a term of 5 years. Strike prices shown as equity values. (2) Allocation shown on pre-diluted basis (10% warrants would represent 9% of equity value on fully diluted basis). (3) $9bn and $10bn represent illustrative TEV values for iHeartMedia and exclude any value from CCO. (4) Proposals assumed 10% Notes due 2018 would not be repaid. PJT Partners 4