| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

�� Issuer Free Writing Prospectus

Relating to S-3 Registration Statement

Filed Pursuant to Rule 433

Registration Nos. 333-188745

and 333-188745-01

July 17, 2013

Ohio Phase-In-Recovery Funding LLC

Issuing Entity

$267,408,000

Senior Secured Phase-In-Recovery Bonds

Transaction Summary

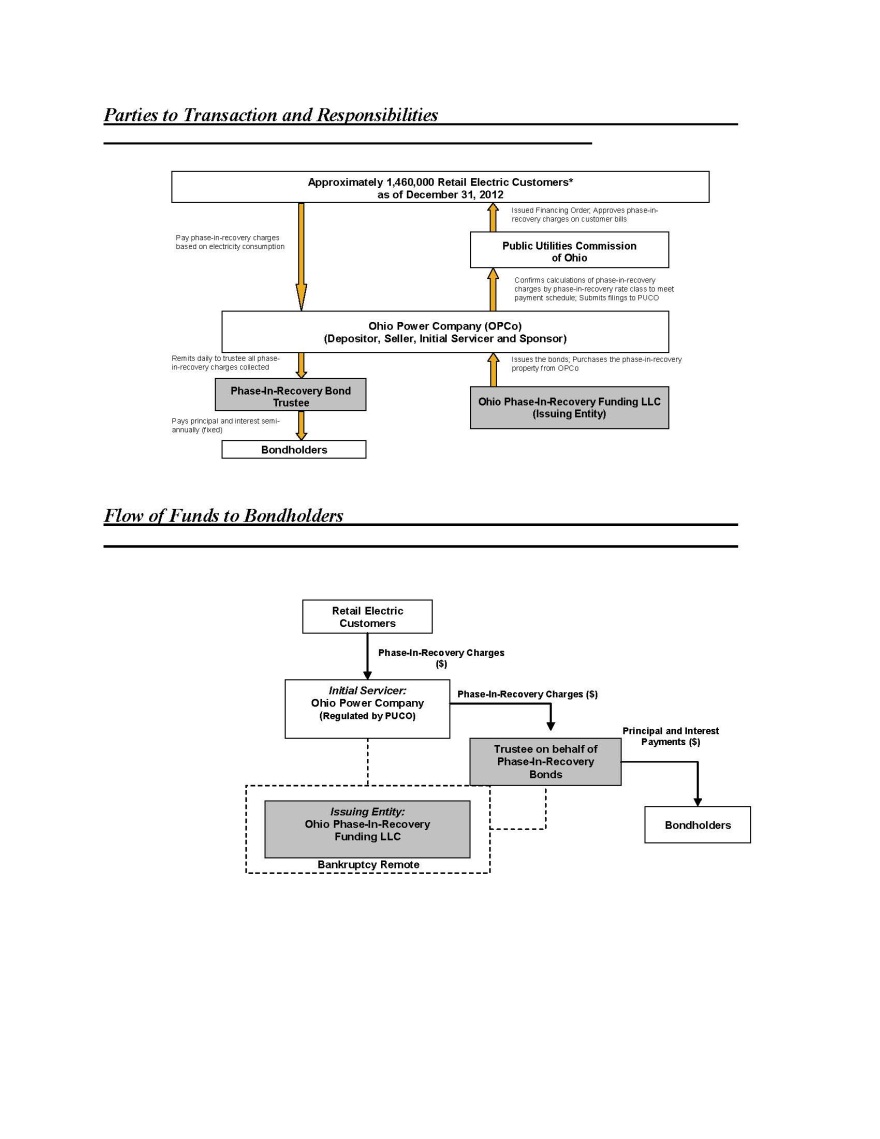

Ohio Phase-In-Recovery Funding LLC (the “Issuing Entity”) is issuing $267,408,000 of Senior Secured Phase-In-Recovery Bonds (the “Bonds”) in two tranches. The Bonds are senior secured obligations of the Issuing Entity supported by Phase-In-Recovery Property which includes the right to a special, irrevocable nonbypassable charge (“Phase-In-Recovery Charge”) imposed on retail electric customers of Ohio Power Company (“OPCo”) based on their consumption of electricity as discussed below. The Securitization Law (as defined herein) mandates that Phase-In-Recovery Charges be adjusted annually, and the Public Utilities Commission of Ohio (the “PUCO”) requires that adjustments or “true-ups” occur semi-annually (or, if there are any Bonds outstanding following the scheduled final payment date for the latest maturing tranche, quarterly), if necessary, in each case to ensure the expected recovery of amounts sufficient to timely provide all scheduled payments of principal and interest on the Bonds and other ongoing financing costs (the “True-up Mechanism”). True-up adjustments may also occur more frequently as described below.

Ohio legislation found at Section 4928.23 through Section 4928.2318 of the Revised Code of the State of Ohio (as amended, the “Securitization Law”) authorizes electric distribution utilities to recover certain costs deferred as regulatory assets in PUCO proceedings (“Phase-In Costs”) through the issuance of phase-in-recovery bonds. On March 20, 2013, the PUCO issued a financing order (the “Financing Order”) relating to the Bonds. The Financing Order was subsequently amended by further order of the PUCO on April 10, 2013, and became final and non-appealable on June 10, 2013. Pursuant to the Financing Order, OPCo established the Issuing Entity as a bankruptcy remote special purpose subsidiary company to acquire the Phase-In-Recovery Property and to issue the Bonds.

In the Financing Order, the PUCO authorized a Phase-In-Recovery Charge to be imposed on all retail electric customers of OPCo and its successors (approximately 1,460,000 customers as of December 31, 2012) to pay principal of and interest on the Bonds and other approved ongoing financing costs of the offering. OPCo, as servicer, will collect Phase-In-Recovery Charges on behalf of the Issuing Entity and remit the Phase-In-Recovery Charges to the Trustee under the indenture pursuant to which the Bonds will be issued.

The Bonds are not a liability of OPCo or any of its affiliates (other than the Issuing Entity). The Bonds are not a debt or general obligation of the State of Ohio, the PUCO or any other governmental agency or instrumentality, and are not a debt or pledge of the State of Ohio or of any county, municipal corporation or any other political subdivision of the State of Ohio.

This Preliminary Term Sheet has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any Bonds in any jurisdiction where such offer or sale is prohibited. Please read the important information and qualifications beginning on page 14 of this Preliminary Term Sheet.

| Joint Bookrunning Managers |

| Citigroup | | RBC Capital Markets |

| Co-Managers |

| PNC Capital Markets LLC | RBS | Wells Fargo Securities |

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

$267,408,000

Ohio Phase-In-Recovery Funding LLC

Issuing Entity

Senior Secured Phase-In-Recovery Bonds

Summary of Terms

Anticipated Fixed Rate Bond Offering

Tranche1 | Expected Weighted Average Life (Years) 2 | Expected Size3($) | Scheduled Final Payment Date | Legal Final Maturity Date4 | Scheduled Sinking Fund Payments Begin | No. of Scheduled Semi-annual Sinking Fund Payments |

| A-1 | 2.25 | $164,000,000 | July 1, 2017 | July 1, 2018 | July 1, 2014 | 7 |

| A-2 | 5.08 | $103,408,000 | July 1, 2019 | July 1, 2020 | July 1, 2017 | 5 |

Issuing Entity and Capital Structure | Ohio Phase-In-Recovery Funding LLC, a special purpose Delaware limited liability company. Ohio Power Company (“OPCo”) is our sole member and owns all of our equity interests. The Issuing Entity has no commercial operations. The Issuing Entity was formed solely to purchase and own Phase-In-Recovery Property, to issue the Bonds and to perform activities incidental thereto. In addition to the Phase-In-Recovery Property, the Issuing Entity will be capitalized with an upfront cash deposit equity contribution of 0.5% of the Bonds’ initial principal amount issued (held in the capital subaccount) and will have an excess funds subaccount to retain, until the next payment date, any amounts collected and remaining on a payment date after all payments on the Bonds and all ongoing financing costs (subject to the cap provided in the Financing Order) have been made. | |

_________________________________

2 The weighted average lives assume a closing date of August 1, 2013. 3 Tranche sizes are preliminary and subject to change. 4 The legal final maturity date is the date by which the principal must be repaid to prevent a default.

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

Depositor, Seller, Sponsor and Initial Servicer |

OPCo, an Ohio corporation, is a regulated electric utility under the laws of Ohio providing service in that state. At December 31, 2012, OPCo provided electric service to approximately 1,460,000 metered retail electric customers covering a service territory of approximately 10,375 square miles. OPCo is an operating subsidiary of American Electric Power Company, Inc. (“AEP”), a public utility holding company based in Columbus, Ohio. The Bonds do not constitute a debt, liability or other legal obligation of OPCo or AEP. OPCo, acting as the initial servicer, and any successor or assignee servicer, will service the Phase-In-Recovery Property securing the Bonds under a servicing agreement with the Issuing Entity. | |

| | | |

| Securities Offered | Senior secured bonds listed above scheduled to pay principal semi-annually and sequentially in accordance with the expected sinking fund schedule. See “Expected Sinking Fund Schedule.” | |

| | | |

| Expected Ratings | “Aaa(sf)”/ “AAA(sf)” by Moody’s and S&P, respectively. | |

| | | |

Payment Dates and Interest Accrual |

Interest payable semi-annually, January 1st and July 1st. Interest will be calculated at a fixed rate on a 30/360 basis. The first scheduled payment date is July 1, 2014.

| |

| | | |

| | Interest is due on each payment date and principal is due upon the Final Maturity Date for each tranche. | |

| | | |

| Optional Redemption | None. Non-call for the life of the Bonds. | |

| | | |

| Minimum Denomination | $100,000, or integral multiples of $1,000 in excess thereof, except that one Bond of each tranche may be of a smaller denomination. | |

| | | |

| Average Life Profile | Prepayment is not permitted. Extension is possible but the risk is statistically remote. | |

| | | |

| Credit/Security | Pursuant to the Financing Order, the irrevocable right to impose, charge and collect a nonbypassable consumption-based Phase-In-Recovery Charge from OPCo’s retail electric customers (approximately 1,460,000 customers as of December 31, 2012). Phase-In-Recovery Charges are set and periodically adjusted, as discussed below, to collect amounts sufficient to pay principal of and interest on the Bonds on a timely basis and other ongoing financing costs. See also “Issuing Entity and Capital Structure” and “Statutory True-up Adjustment Mechanism for Payment of Scheduled Principal and Interest.” | |

| | | |

| Phase-In-Recovery Property | The Phase-In-Recovery Property securing the Bonds is not a pool of receivables. It consists of all of OPCo’s property, rights and interests established pursuant to the Financing Order that will be transferred to the Issuing Entity in connection with the issuance of the Bonds, including the irrevocable right to impose, charge and collect nonbypassable Phase-In-Recovery Charges and the right to implement the True-Up Adjustment Mechanism and any revenues, receipts, collections, rights to payment, payments, moneys, claims, or other proceeds arising from the rights and interests created under the Financing Order. Upon the sale of the Phase-In-Recovery Property to the Issuing Entity and the pledge to the Trustee under the indenture, the Phase-In-Recovery Property will constitute a present property right created by the Securitization Law and the Financing Order that is protected by the state pledge in the Securitization Law described below. | |

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

| Nonbypassable Phase-In-Recovery Charges | The Securitization Law mandates and the Financing Order requires the imposition and the collection of Phase-In-Recovery Charges from all existing and future retail electric customers of OPCo that receive electric delivery service from OPCo or its successors, including customers that purchase electric generation service from a competitive retail electric provider or which subsequently receive retail electric distribution from another utility operating in the same service area, including by succession, assignment, transfer or merger. A “successor” to OPCo under the Securitization Law includes any entity that succeeds by operation of law to the rights and obligations of OPCo pursuant to any bankruptcy, reorganization, restructuring, or other insolvency proceeding, any merger, acquisition, or consolidation, or any sale or transfer of assets, regardless of whether any of these occur as a result of a restructuring of the electric power industry or otherwise. In connection with the issuance of the Bonds, OPCo has sold the right to impose, charge and collect such Phase-In-Recovery Charges to the Issuing Entity. | |

| | | |

| Statutory True-up Adjustment Mechanism for Payment of Scheduled Principal and Interest |

The Securitization Law and the Financing Order mandate that Phase-In-Recovery Charges on retail electric customers be adjusted at least annually to correct any overcollections or undercollections to ensure that the Phase-In-Recovery Charges will generate sufficient funds to timely pay all scheduled payments of principal and interest and any other amounts due in connection with the Bonds for the twelve-month period following such adjustment. In addition, the Financing Order requires that, after the first annual true-up adjustment, Phase-In-Recovery Charges on retail electric customers thereafter be adjusted semi-annually (or, if there are Bonds outstanding following the scheduled final payment date for the latest maturing tranche, quarterly), if the servicer forecasts that the revenues in respect of the Phase-In-Recovery Property will be insufficient to make all scheduled payments of principal, interest and other ongoing financing costs on a timely basis during the current or next succeeding payment period, or if such true-up adjustment is needed to replenish draws on the capital subaccount. Also, true-up adjustments will occur more frequently if the servicer determines that a true-up adjustment is necessary to ensure the expected recovery of amounts sufficient to pay scheduled principal and interest and other ongoing financing costs on a timely basis.

Although certain of the ongoing financing costs recoverable through the Phase-In-Recovery Charges are subject to an annual cap, there is no “cap” on the level of Phase-In-Recovery Charges that may be imposed on retail electric customers, to pay on a timely basis scheduled principal and interest on the Bonds and the capped amount of the ongoing financing costs. Such Phase-In-Recovery Charges may continue to be imposed and collected until the Bonds are paid in full, without any specified time limit. Through the True-Up Adjustment Mechanism, which adjusts for undercollections of Phase-In-Recovery Charges due to any reason, retail electric customers share in the liabilities of all other retail electric customers for the payment of Phase-In-Recovery Charges. | |

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

| State Pledge | The State of Ohio has pledged in the Securitization Law to bondholders, any assignees, and any financing parties under the Financing Order that it will not take or permit any action that impairs the value of the Phase-In-Recovery Property for which recovery is authorized under the Financing Order or revises the Phase-In Costs authorized for recovery under the Financing Order, or, except for the specified true-up adjustments to correct any overcollections or undercollections, reduce, alter or impair the Phase-In-Recovery Charges that are imposed, charged, collected, or remitted for the benefit of the bondholders, any assignee, and any financing parties until all principal and interest in respect of the Bonds, all financing costs, and all amounts to be paid to an assignee or financing party under certain agreements entered into in connection with the Bonds are paid or performed in full. Ohio has both a voter initiative and a referendum process. The time for challenging the Securitization Law through a referendum has expired, but the right of voters in Ohio to enact laws by initiative can be exercised at any time, provided a lengthy process is followed and successfully concluded. Constitutional protections against actions that violate the State Pledge should apply whether legislation is passed by the Ohio General Assembly or is brought about by a voter initiative. | |

| | | |

| Tax Treatment | Fully taxable; treated as debt of OPCo for U.S. federal income tax purposes. | |

| | | |

| Type of Offering | SEC registered. | |

| | | |

| ERISA Eligible | Yes, as described in the prospectus. | |

| | |

| Initial Phase-In-Recovery Charge as a Percentage of Customer’s Total Electricity Bill |

The initial phase-in-recovery charge for the Bonds is expected to represent between 1% and 2% of the total bill received by an average 1,000 kWh residential retail electric customer of OPCo as of August 1, 2013. |

| | | |

| Structuring Bookrunner | Citigroup Global Markets Inc. |

| | | |

| Joint Bookrunner | RBC Capital Markets, LLC |

| | | |

| Co-Managers | PNC Capital Markets LLC, RBS Securities Inc. and Wells Fargo Securities, LLC |

| | | |

| Trustee | U.S. Bank National Association |

| | | |

| Expected Settlement | August 1, 2013, settling flat. DTC, Clearstream and Euroclear. |

| | | |

| Use of Proceeds | Used to pay the expenses of the issuance and sale of the Bonds and to purchase the Phase-In-Recovery Property from OPCo. OPCo will use the sales price of the Phase-In-Recovery Property to redeem, repay or retire existing debt. |

| | | |

| More Information | For a complete discussion of the proposed transaction, please read the prospectus and the accompanying prospectus supplement when available. |

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

| * | Includes all individuals, corporations, other business entities, the State of Ohio and other federal, state and local governmental entities who are retail electric customers of OPCo. During the twelve months ended December 31, 2012, approximately 39% of OPCo’s total retail deliveries were to industrial customers, approximately 30% were to commercial customers and approximately 31% were to residential customers. During this period, deliveries to the State of Ohio and other federal, state and local governmental entities comprised approximately 2% of OPCo’s retail deliveries. |

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

Key Questions and Answers on Statutory True-Up Mechanism

| Q1: | Could the Financing Order be rescinded or altered or the PUCO fail to act to implement the True-up Mechanism? |

A: Not without the PUCO violating the State Pledge stated in the Securitization Law and recited by the PUCO in the Financing Order. The Securitization Law provides that the Financing Order is irrevocable. In the Financing Order, the PUCO pledged not to impair the value of the Phase-In-Recovery Property for which recovery is authorized under the Financing Order or revise the Phase-In Costs authorized for recovery under the Financing Order or, except for the specified true-up adjustments, reduce, alter, or impair the Phase-In-Recovery Charges that are imposed, charged, collected, or remitted for the benefit of the bondholders, any assignee, and any financing party, until all principal of and interest on the Bonds, all financing costs, and amounts payable under ancillary agreements are paid in full.

| Q2: | Could the Securitization Law be repealed or altered in a manner that will impair the value of the security or prevent timely repayment of the Bonds? |

A: Not without the State of Ohio violating the State Pledge. The State of Ohio has pledged in the Securitization Law to bondholders, any assignees, and any financing parties under the Financing Order that it will not take or permit any action that impairs the value of the Phase-In-Recovery Property for which recovery is authorized under the Financing Order or revises the Phase-In Costs authorized for recovery under the Financing Order, or, except for the specified true-up adjustments to correct any overcollections or undercollections, reduce, alter or impair the Phase-In-Recovery Charges that are imposed, charged, collected, or remitted for the benefit of the bondholders, any assignee, and any financing parties until all principal and interest in respect of the Bonds, all financing costs, and all amounts to be paid to an assignee or financing party under certain agreements entered into in connection with the Bonds are paid or performed in full.

Ohio has both an initiative and a referendum process. The time for challenging the Securitization Law through referendum has expired, but the right of voters in Ohio to enact laws by initiative can be exercised at any time, provided a lengthy process is followed and successfully concluded. Constitutional protections against actions that violate the State Pledge should apply whether legislation is passed by the Ohio General Assembly or is brought about by a voter initiative.

| Q3: | Are there any circumstances, or any reason, in which the True-up Adjustment Mechanism would not be applied to customer bills, e.g., economic recession, temporary power shortages, blackouts, bankruptcy of the parent company? |

A: No. Once the Bonds are issued, the provisions of the irrevocable Financing Order that relate to the Bonds (including the True-up Mechanism) are unconditional. True-up adjustments will commence shortly after the first anniversary of the issuance date of the Bonds, and thereafter will occur at least annually or more frequently under certain circumstances, and will continue to be implemented until all principal of and interest on the Bonds and all approved ongoing financing costs have been paid or otherwise collected. Such adjustments will be designed to eliminate the cumulative historical, and any projected, differences between the scheduled periodic payment and the amount of Phase-In-Recovery Charge remittances to the Trustee, using the servicer’s most recent forecast of base distribution revenues and its most current estimates of ongoing financing costs. The calculation of the Phase-In-Recovery Charges will reflect any customer defaults or charge-offs and payment lags between the billing and collection of Phase-In-Recovery Charges, based upon the servicer’s most recent experience regarding collection of Phase-In-Recovery Charges.

The PUCO must be given at least 15 days’ notice prior to making any true-up adjustment during which period it may confirm the mathematical accuracy of the servicer’s adjustment. Unless suspended by the PUCO, a true-up adjustment filed with the PUCO will go into effect on a bills rendered basis on a date which is no earlier than 15 days subsequent to the date of submission. In the event any correction to a true-up adjustment due to mathematical errors in the calculation of the adjustment or otherwise is necessary, the PUCO may order that the correction be made to such adjustment or that the error be remedied in a future true-up adjustment so as not to delay the implementation of the requested true-up adjustment.

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

Under the Securitization Law, a true-up adjustment filed with the PUCO shall be deemed approved, and the adjustments shall go into immediate effect, if not approved by the PUCO within 60 days after the request is submitted.

Q4: Can customers avoid paying Phase-In-Recovery Charges if they switch electricity providers?

A: No. The Securitization Law provides that the Phase-In-Recovery Charges are nonbypassable and, through the True-up Mechanism, all retail electric customers cross share in the liabilities of all other retail electric customers for the payment of Phase-In-Recovery Charges. “Nonbypassable” as set forth in the Securitization Law and the Financing Order means that a retail electric customer or other person obligated to pay Phase-In-Recovery Charges may not avoid payment of such charges and that each such customer that purchases electric generation service from a competitive retail electric service provider or subsequently receives retail electric distribution service from another electric distribution utility operating in the same service area, including by succession, assignment, transfer, or merger, must pay the Phase-In-Recovery Charges so long as the Bonds are outstanding. If, however, a municipality were to acquire some or all of OPCo’s electric distribution facilities through the power of eminent domain and form a municipal utility, the Phase-In-Recovery Charges would not continue to apply to customers who switch service to such municipal utility.

Q5: Is there any cap or limit on the amount of the Phase-In-Recovery Charges for any customer?

A: No. Although certain of the ongoing financing costs recoverable through the Phase-In-Recovery Charges are subject to an annual cap, there is no “cap” on the level of Phase-In-Recovery Charges that may be imposed on retail electric customers, to pay on a timely basis scheduled principal of and interest on the Bonds and the capped amount of the other ongoing financing costs. Such Phase-In-Recovery Charges may continue to be imposed and collected until the Bonds and all approved ongoing financing costs are paid in full, without any specified time limit. Through the True-Up Adjustment Mechanism, which adjusts for undercollections of Phase-In-Recovery Charges due to any reason, retail electric customers share in the liabilities of all other retail electric customers for the payment of Phase-In-Recovery Charges.

Q6: What happens if, for any reason, electricity usage and, as a result, related Phase-In-Recovery Charges, are less than projected at any time over the life of the Bonds?

A: The Phase-In-Recovery Charges paid by retail electric customers will be increased to ensure payment of the Bonds pursuant to the True-Up Adjustment Mechanism.

Q7: What if customers leave OPCo’s service territory or fail to pay the Phase-In-Recovery Charges?

A: In the event retail electric customers leave OPCo’s service territory or fail to pay the Phase-In-Recovery Charges or receive power from a municipal electric distribution utility and undercollections result or are projected to result, the True-Up Adjustment Mechanism allows OPCo to recalculate the subsequent Phase-In-Recovery Charges such that those retail electric customers who do pay will make up the difference.

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

Expected Sinking Fund Schedule*

| | Semi-Annual | | | Tranche A-1 Scheduled Principal Payment | | | | Tranche A-2 Scheduled Principal Payment | |

| | Tranche Size on Closing Date | | | $164,000,000 | | | | $103,408,000 | |

| | | | | | | | | | |

| | 7/1/2014 | | | 34,566,812 | | | | - | |

| | 1/1/2015 | | | 22,133,434 | | | | - | |

| | 7/1/2015 | | | 23,240,149 | | | | - | |

| | 1/1/2016 | | | 22,746,673 | | | | - | |

| | 7/1/2016 | | | 23,120,256 | | | | - | |

| | 1/1/2017 | | | 22,457,425 | | | | - | |

| | 7/1/2017 | | | 15,735,251 | | | | 8,168,054 | |

| | 1/1/2018 | | | - | | | | 22,884,124 | |

| | 7/1/2018 | | | - | | | | 24,206,300 | |

| | 1/1/2019 | | | - | | | | 23,434,909 | |

| | 7/1/2019 | | | - | | | | 24,714,614 | |

| | Total Payments | | | $164,000,000 | | | | $103,408,000 | |

_________________________________

* Preliminary; subject to change. May not total due to rounding.

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

Expected Amortization Schedule*

| | Semi-Annual | | | | | | | | |

| | Closing Date | | | $164,000,000 | | | | $103,408,000 | |

| | 7/1/2014 | | | 129,433,188 | | | | 103,408,000 | |

| | 1/1/2015 | | | 107,299,755 | | | | 103,408,000 | |

| | 7/1/2015 | | | 84,059,605 | | | | 103,408,000 | |

| | 1/1/2016 | | | 61,312,932 | | | | 103,408,000 | |

| | 7/1/2016 | | | 38,192,676 | | | | 103,408,000 | |

| | 1/1/2017 | | | 15,735,251 | | | | 103,408,000 | |

| | 7/1/2017 | | | - | | | | 95,239,946 | |

| | 1/1/2018 | | | - | | | | 72,355,822 | |

| | 7/1/2018 | | | - | | | | 48,149,523 | |

| | 1/1/2019 | | | - | | | | 24,714,614 | |

| | 7/1/2019 | | | - | | | | - | |

_________________________________

* Preliminary; subject to change. May not total due to rounding.

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

Statutory True-up Adjustment Mechanism for Payment of Scheduled Principal and Interest

The Securitization Law mandates that the Phase-In-Recovery Charges will be adjusted at least annually to correct any overcollections or undercollections during the preceding period to ensure that the Phase-In-Recovery Charges will generate sufficient funds to timely pay all scheduled payments of principal and interest and any other amounts due in connection with the Bonds for the twelve-month period following such adjustment. In addition, the Financing Order requires that, after the first annual true-up adjustment, Phase-In-Recovery Charges on retail electric customers thereafter be adjusted semi-annually (or, if there are Bonds outstanding following the scheduled final payment date for the latest maturing tranche, quarterly), if the servicer forecasts that the revenues in respect of the Phase-In-Recovery Property will be insufficient to make all scheduled payments of principal, interest and other ongoing financing costs on a timely basis during the current or next succeeding payment period, or if such true-up adjustments are needed to replenish draws on the capital subaccount. Also, true-up adjustments will occur more frequently if the servicer determines that a true-up adjustment is necessary to ensure the expected recovery of amounts sufficient to pay scheduled principal and interest and other ongoing financing costs on a timely basis.

The following describes the mechanics for implementing the Mandatory Annual, Semi-Annual and Interim True-up Mechanisms on retail electric customers based on their consumption of electricity. (See also “Key Questions and Answers on Statutory True-up Mechanism” beginning on page 7.)

MANDATORY ANNUAL TRUE-UPS FOR PAYMENT OF SCHEDULED PRINCIPAL AND INTEREST

| STEP 1: | Each year, OPCo, as servicer, computes the total dollar requirement for the Bonds for the upcoming six and twelve month periods, which includes scheduled principal and interest payments and all ongoing financing costs (subject to the annual cap), adjusted to correct any undercollection or overcollection. |

| STEP 2: | OPCo forecasts consumption by customers to determine the forecasted base distribution revenues for upcoming six and twelve month periods. |

| STEP 3: | OPCo divides the total dollar requirement for the upcoming six-month or twelve-month period by the forecasted base distribution revenues for such period, and uses the higher of the two percentages to determine the percentage of base distribution revenues that should be used to calculate the customer’s Phase-In-Recovery Charge. |

| STEP 4: | OPCo must make a true-up filing with the PUCO, specifying such adjustments to the Phase-In-Recovery Charges as may be necessary, regardless of the reason for the difference between forecasted and required collections. The PUCO will confirm the mathematical accuracy of the adjustment calculation within 15 days and, unless suspended by the PUCO, adjustments to the Phase-In-Recovery Charges will go into effect on a bills rendered basis on a date no earlier than 15 days subsequent to the date of the submission. If the PUCO determines a correction is necessary, the PUCO may order that the correction be made to the true-up adjustment or be remedied in a future true-up adjustment so as not to delay implementation of the true-up filing. Under the Securitization Law, a true-up adjustment filed with the PUCO shall be deemed approved, and the adjustments shall go into immediate effect if not approved by the PUCO within 60 days after the request is submitted. |

MANDATORY SEMI-ANNUAL TRUE-UPS FOR PAYMENT OF SCHEDULED PRINCIPAL AND INTEREST

After the first annual true-up adjustment, OPCo, as servicer, must seek a true-up adjustment once every six months (or quarterly following the scheduled final payment date for the latest maturing tranche) if the servicer forecasts that Phase-In-Recovery Charge collections will be insufficient to make all scheduled payments of principal, interest, and other amounts in respect of the Bonds on a timely basis during the upcoming six and twelve month periods or are necessary to replenish the capital subaccount for the Bonds to its required level. The methodology for calculating semi-annual true-up adjustments is otherwise the same as that used to calculate mandatory annual true-up adjustments.

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

INTERIM TRUE-UPS FOR PAYMENT OF SCHEDULED PRINCIPAL AND INTEREST

Additionally, OPCo, as servicer, will also implement an additional true-up adjustment at any time during the term of the Bonds after the first annual true-up adjustment if the servicer determines that a true-up adjustment is necessary to ensure the expected recovery of amounts sufficient to pay scheduled principal and interest and other ongoing financing costs on a timely basis. The methodology for calculating interim true-up adjustments would otherwise be similar to that used to calculate mandatory annual true-up adjustments and mandatory semi-annual true-up adjustments.

AVERAGE LIFE PROFILE OF THE BONDS

Severe stress cases on electricity consumption result in no measurable change in the weighted average life of each tranche of the Bonds.

| Weighted Average Life Sensitivity |

| | | -5% (1.54 Standard Deviations from Mean) | | -15% (5.41 Standard Deviations from Mean) |

| | Expected Weighted Average Life (Years) | | | | | | | | |

| A-1 | | 2.25 | | 2.25 | | 0 | | 2.29 | | 17 |

| A-2 | | 5.08 | | 5.08 | | 0 | | 5.13 | | 18 |

_____________________________

| * Number is rounded to whole days. |

For the purposes of preparing the above chart, the following assumptions, among others, have been made: (i) the forecast error stays constant over the life of the Bonds and is equal to an overestimate of electricity consumption of -5.0% (1.54 standard deviations from mean) or -15% (5.41 standard deviations from mean), (ii) the servicer makes timely and accurate filings to true-up the Phase-In-Recovery Charges semi-annually, (iii) customer charge-off rates are held constant at 0.728% for the residential class, 0.129% for the commercial class and 0.056% for the industrial class, (iv) retail electric customers remit all Phase-In-Recovery Charges 30 days after such Phase-In-Recovery Charges are billed, (v) operating expenses are equal to projections, (vi) there is no acceleration of the final maturity date of the Bonds; (vii) a permanent loss of all retail electric customers has not occurred; and (viii) the Closing Date is August 1, 2013. There can be no assurance that the weighted average lives of the Bonds will be as shown.

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

Glossary

| “Security” | All assets held by the Trustee for the benefit of the holders of the Bonds, including the amounts deposited in the Capital Subaccount and the collections of Phase-In-Recovery Charges held by the Trustee. The Issuing Entity’s principal asset securing the Bonds is the Phase-In-Recovery Property. The Phase-In-Recovery Property is not a receivable, and the principal credit supporting the Bonds is not a pool of receivables. It is the irrevocable right to impose, charge and collect nonbypassable Phase-In-Recovery Charges and is a present property right created by the Securitization Law and the Financing Order and expressly protected by the State of Ohio’s pledge not to take or permit any action that would impair its value. |

| | |

| “Sinking Fund” | The amortization method providing for sequential payments of scheduled principal of each tranche of the Bonds. Please see “Expected Sinking Fund Schedule.” |

| | |

| “Phase-In-Recovery Charges” | Phase-In-Recovery Charges are statutorily-created, nonbypassable, consumption-based charges authorized to be imposed on all of OPCo’s retail electric customers and those of any successors. Phase-In-Recovery Charges are irrevocable and will be collected by the servicer, through a nonbypassable mechanism, directly from such retail customers, or, if a municipal corporation, township or county elects to aggregate retail electric loads of its residents, from such municipal corporation, township or county acting as a billing and collection agent on behalf of OPCo with respect to such residents. The Securitization Law provides that no such aggregation shall result in less than the full and timely imposition, charging, collection and adjustment of the Phase-In-Recovery Charges. If a municipality were to acquire some or all of OPCo’s electric distribution facilities by eminent domain while the Bonds remain outstanding, and as a result of such an acquisition, were to provide electric distribution services to a retail electric customer, the Phase-In-Recovery Charges would not continue to apply to that retail electric customer. There is no “cap” on the level of Phase-In-Recovery Charges that may be imposed on retail electric customers to timely pay scheduled principal and interest on the Bonds and all approved ongoing financing costs. However, there is an annual “cap” on certain ongoing financing costs that may be recovered through Phase-In-Recovery Charges. |

| | |

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

The Issuing Entity and OPCo have filed a registration statement (including a prospectus and prospectus supplement) (Registration Nos. 333-188745 and 333-188745-01) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents the Issuing Entity has filed with the SEC for more complete information about the Issuing Entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. You can also obtain copies of the registration statement from the SEC upon payment of prescribed charges, or you can examine the registration statement free of charge at the SEC’s offices at 100 F Street, N.E., Washington, D.C. 20549. Alternatively, the Issuing Entity, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll free at 1-877-858-5407.

This Preliminary Term Sheet is not required to contain all information that is required to be included in the prospectus and the prospectus supplement that will be prepared for the securities offering to which this Preliminary Term Sheet relates. The prospectus and the prospectus supplement contain material information not contained herein, and the prospective purchasers are referred to the prospectus and prospectus supplement, including the final prospectus and prospectus supplement. This Preliminary Term Sheet is not an offer to sell or a solicitation of an offer to buy these securities in any state where such offer, solicitation or sale is not permitted.

The information in this Preliminary Term Sheet is preliminary, and may be superseded by an additional term sheet provided to you prior to the time you enter into a contract of sale. This Preliminary Term Sheet is being delivered to you solely to provide you with information about the offering of the securities referred to herein. The securities are being offered when, as and if issued. In particular, you are advised that these securities, and the Phase-In-Recovery Charges securing them, are subject to modification or revision (including, among other things, the possibility that one or more tranches of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the securities may not be issued that have the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the securities and the underlying transaction having the characteristics described in these materials.

Neither the SEC nor any state securities commission has approved or disapproved of the Bonds or determined if this Preliminary Term Sheet is truthful or complete. Any representation to the contrary is a criminal offense.

Price and availability of the Bonds are subject to change without notice.

Neither the State of Ohio nor the PUCO is acting as an agent for OPCo or the Issuing Entity or any of their affiliates in connection with the sale of the Bonds.

A contract of sale will come into being no sooner than the date on which the relevant tranche of the Bonds has been priced and we have confirmed the allocation of securities to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us. You may withdraw your offer to purchase securities at any time prior to our acceptance of your offer.

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this Preliminary Term Sheet is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

OFFERING RESTRICTIONS IN CERTAIN JURISDICTIONS

NOTICE TO RESIDENTS OF SINGAPORE

THIS PRELIMINARY TERMSHEET HAS NOT BEEN REGISTERED AND WILL NOT BE REGISTERED AS A PROSPECTUS WITH THE MONETARY AUTHORITY OF SINGAPORE, AND THE PHASE-IN-RECOVERY BONDS WILL BE OFFERED PURSUANT TO EXEMPTIONS UNDER THE SECURITIES AND FUTURES ACT, CHAPTER 289 OF SINGAPORE (THE “SECURITIES AND FUTURES ACT”). ACCORDINGLY, THE PHASE-IN-RECOVERY BONDS MAY NOT BE OFFERED OR SOLD OR MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE NOR MAY THIS PRELIMINARY TERMSHEET OR ANY OTHER DOCUMENT OR MATERIAL IN CONNECTION WITH THE OFFER OR SALE, OR INVITATION FOR SUBSCRIPTION OR PURCHASE, OF PHASE-IN-RECOVERY BONDS BE CIRCULATED OR DISTRIBUTED WHETHER DIRECTLY OR INDIRECTLY TO ANY PERSON IN SINGAPORE OTHER THAN (I) TO AN INSTITUTIONAL INVESTOR UNDER SECTION 274 OF THE SECURITIES AND FUTURES ACT, (II) TO A RELEVANT PERSON PURSUANT TO SECTION 275(1) OF THE SECURITIES AND FUTURES ACT, OR ANY PERSON PURSUANT TO SECTION 275(1A) OF THE SECURITIES AND FUTURES ACT, AND IN ACCORDANCE WITH THE CONDITIONS, SPECIFIED IN SECTION 275 OF THE SECURITIES AND FUTURES ACT, OR (III) OTHERWISE PURSUANT TO, AND IN ACCORDANCE WITH THE CONDITIONS OF, ANY OTHER APPLICABLE PROVISION OF THE SECURITIES AND FUTURES ACT.

WHERE THE PHASE-IN-RECOVERY BONDS ARE SUBSCRIBED OR PURCHASED UNDER SECTION 275 OF THE SECURITIES AND FUTURES ACT BY A RELEVANT PERSON WHICH IS:

(A) A CORPORATION (WHICH IS NOT AN “ACCREDITED INVESTOR” AS DEFINED IN SECTION 4 OF THE SECURITIES AND FUTURES ACT) THE SOLE BUSINESS OF WHICH IS TO HOLD INVESTMENTS AND THE ENTIRE SHARE CAPITAL OF WHICH IS OWNED BY ONE OR MORE INDIVIDUALS, EACH OF WHOM IS AN ACCREDITED INVESTOR; OR

(B) A TRUST (WHERE THE TRUSTEE IS NOT AN ACCREDITED INVESTOR) WHOSE SOLE PURPOSE IS TO HOLD INVESTMENTS AND EACH BENEFICIARY OF THE TRUST IS AN INDIVIDUAL WHO IS AN ACCREDITED INVESTOR,

SHARES, DEBENTURES AND UNITS OF SHARES AND DEBENTURES OF THAT CORPORATION OR THE BENEFICIARIES’ RIGHTS AND INTEREST HOWEVER DESCRIBED, IN THAT TRUST SHALL NOT BE TRANSFERABLE WITHIN SIX MONTHS AFTER THAT CORPORATION OR THAT TRUST HAS ACQUIRED THE FOREGOING SECURITIES PURSUANT TO OFFER MADE UNDER SECTION 275 OF THE SECURITIES AND FUTURES ACT EXCEPT:

(1) TO AN INSTITUTIONAL INVESTOR (FOR CORPORATIONS, UNDER SECTION 274 OF THE SECURITIES AND FUTURES ACT) OR TO A RELEVANT PERSON DEFINED IN SECTION 275(2) OF THE SECURITIES AND FUTURES ACT, OR TO ANY PERSON PURSUANT TO AN OFFER THAT IS MADE ON TERMS THAT SUCH SECURITIES OF THAT CORPORATION OR SUCH RIGHTS AND INTEREST IN THAT TRUST ARE ACQUIRED AT A CONSIDERATION OF NOT LESS THAN US$200,000 (OR ITS EQUIVALENT IN ANY FOREIGN CURRENCY) FOR EACH TRANSACTION, WHETHER SUCH AMOUNT IS TO BE PAID FOR IN CASH OR BY EXCHANGE OF SECURITIES OR OTHER ASSETS, AND FURTHER FOR CORPORATIONS, IN ACCORDANCE WITH THE CONDITIONS SPECIFIED IN SECTION 275 OF THE SECURITIES AND FUTURES ACT;

(2) WHERE NO CONSIDERATION IS OR WILL BE GIVEN FOR THE TRANSFER; OR

(3) WHERE THE TRANSFER IS BY OPERATION OF LAW.

NOTICE TO RESIDENTS OF THE PEOPLE’S REPUBLIC OF CHINA

THE PHASE-IN-RECOVERY BONDS SHALL NOT BE OFFERED OR SOLD IN THE PEOPLE’S REPUBLIC OF CHINA, EXCLUDING HONG KONG, MACAU AND TAIWAN, (THE “PRC”) AS PART OF THE INITIAL DISTRIBUTION OF THE PHASE-IN-RECOVERY BONDS.

THIS PRELIMINARY TERMSHEET DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN THE PRC TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE THE OFFER OR SOLICITATION IN THE PRC.

THE PRC DOES NOT REPRESENT THAT THIS PRELIMINARY TERMSHEET MAY BE LAWFULLY DISTRIBUTED, OR THAT ANY PHASE-IN-RECOVERY BONDS MAY BE LAWFULLY OFFERED, IN COMPLIANCE WITH ANY APPLICABLE REGISTRATION OR OTHER REQUIREMENTS IN THE PRC, OR PURSUANT TO AN EXEMPTION AVAILABLE THEREUNDER, OR ASSUME ANY RESPONSIBILITY FOR FACILITATING ANY SUCH DISTRIBUTION OR OFFERING. IN

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

PARTICULAR, NO ACTION HAS BEEN TAKEN BY THE ISSUING ENTITY WHICH WOULD PERMIT A PUBLIC OFFERING OF ANY PHASE-IN-RECOVERY BONDS OR THE DISTRIBUTION OF THIS PRELIMINARY TERMSHEET IN THE PRC. ACCORDINGLY, THE PHASE-IN-RECOVERY BONDS ARE NOT BEING OFFERED OR SOLD WITHIN THE PRC BY MEANS OF THIS PRELIMINARY TERMSHEET OR ANY OTHER DOCUMENT. NEITHER THIS PRELIMINARY TERMSHEET NOR ANY ADVERTISEMENT OR OTHER OFFERING MATERIAL MAY BE DISTRIBUTED OR PUBLISHED IN THE PRC, EXCEPT UNDER CIRCUMSTANCES THAT WILL RESULT IN COMPLIANCE WITH ANY APPLICABLE LAWS AND REGULATIONS. THE PRC SHALL NOT BE RESPONSIBLE OR LIABLE FOR ANY APPROVALS, REGISTRATION OR FILING PROCEDURES REQUIRED BY THE PRC INVESTORS IN CONNECTION WITH THEIR SUBSCRIPTIONS UNDER THIS PROSPECTUS SUPPLEMENT UNDER THE LAWS OF THE PRC AS WELL AS ANY OTHER REQUIREMENTS UNDER OTHER FOREIGN LAWS.

NOTICE TO RESIDENTS OF JAPAN

THE PHASE-IN-RECOVERY BONDS HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE ACT OF JAPAN (ACT NO. 25 OF 1948, AS AMENDED, THE “FINANCIAL INSTRUMENTS AND EXCHANGE ACT”), AND EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT WILL NOT OFFER OR SELL ANY OF THE PHASE-IN-RECOVERY BONDS, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED HEREIN MEANS ANY PERSON RESIDENT OF JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO, OR FOR THE BENEFIT OF OTHERS FOR REOFFERING OR RESALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO A RESIDENT OF JAPAN, EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH THE FINANCIAL INSTRUMENTS AND EXCHANGE ACT AND ANY OTHER APPLICABLE LAWS, REGULATIONS AND MINISTERIAL GUIDELINES AND REGULATIONS OF JAPAN.

NOTICE TO RESIDENTS OF HONG KONG

EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT OFFERED OR SOLD AND WILL NOT OFFER OR SELL IN HONG KONG, BY MEANS OF ANY DOCUMENT, ANY PHASE-IN-RECOVERY BONDS OTHER THAN (A) TO “PROFESSIONAL INVESTORS” AS DEFINED IN THE SECURITIES AND FUTURES ORDINANCE (CAP. 571) OF HONG KONG AND ANY RULES MADE UNDER THAT ORDINANCE; OR (B) IN OTHER CIRCUMSTANCES WHICH DO NOT RESULT IN THE DOCUMENT BEING A “PROSPECTUS” AS DEFINED IN THE COMPANIES ORDINANCE (CAP. 32) OF HONG KONG OR WHICH DO NOT CONSTITUTE AN OFFER TO THE PUBLIC WITHIN THE MEANING OF THAT ORDINANCE; AND IT HAS NOT ISSUED OR HAD IN ITS POSSESSION FOR THE PURPOSES OF ISSUE, AND WILL NOT ISSUE OR HAVE IN ITS POSSESSION FOR THE PURPOSES OF ISSUE, WHETHER IN HONG KONG OR ELSEWHERE, ANY ADVERTISEMENT, INVITATION OR DOCUMENT RELATING TO THE PHASE-IN-RECOVERY BONDS, WHICH IS DIRECTED AT, OR THE CONTENTS OF WHICH ARE LIKELY TO BE ACCESSED OR READ BY, THE PUBLIC OF HONG KONG (EXCEPT IF PERMITTED TO DO SO UNDER THE SECURITIES LAWS OF HONG KONG) OTHER THAN WITH RESPECT TO PHASE-IN-RECOVERY BONDS WHICH ARE OR ARE INTENDED TO BE DISPOSED OF ONLY TO PERSONS OUTSIDE HONG KONG OR ONLY TO “PROFESSIONAL INVESTORS” AS DEFINED IN THE SECURITIES AND FUTURES ORDINANCE (CAP. 571) AND ANY RULES MADE UNDER THAT ORDINANCE.

NOTICE TO RESIDENTS OF THE EUROPEAN ECONOMIC AREA

IN RELATION TO EACH MEMBER STATE OF THE EUROPEAN ECONOMIC AREA WHICH HAS IMPLEMENTED THE PROSPECTUS DIRECTIVE (EACH, A “RELEVANT MEMBER STATE”), EACH OF THE UNDERWRITERS HAS REPRESENTED AND AGREED THAT WITH EFFECT FROM AND INCLUDING THE DATE ON WHICH THE PROSPECTUS DIRECTIVE IS IMPLEMENTED IN THAT RELEVANT MEMBER STATE (THE “RELEVANT IMPLEMENTATION DATE”) IT HAS NOT MADE AND WILL NOT MAKE AN OFFER OF THE PHASE-IN-RECOVERY BONDS TO THE PUBLIC IN THAT RELEVANT MEMBER STATE PRIOR TO THE PUBLICATION OF A PROSPECTUS IN RELATION TO THE PHASE-IN-RECOVERY BONDS WHICH HAS BEEN APPROVED BY THE COMPETENT AUTHORITY IN THAT MEMBER STATE OR, WHERE APPROPRIATE, APPROVED IN ANOTHER RELEVANT MEMBER STATE AND PUBLISHED AND NOTIFIED TO THE COMPETENT AUTHORITY IN THAT RELEVANT MEMBER STATE, ALL IN ACCORDANCE WITH THE PROSPECTUS DIRECTIVE AS IMPLEMENTED IN THAT RELEVANT MEMBER STATE OR FOLLOWING, IN EITHER CASE, TWELVE MONTHS AFTER SUCH PUBLICATION, EXCEPT THAT IT MAY, WITH EFFECT FROM AND INCLUDING THE RELEVANT IMPLEMENTATION DATE, MAKE AN OFFER OF SUCH PHASE-IN-RECOVERY BONDS TO THE PUBLIC IN THAT RELEVANT MEMBER STATE:

(A) SOLELY TO QUALIFIED INVESTORS (AS DEFINED IN THE PROSPECTUS DIRECTIVE);

(B) TO FEWER THAN 100 NATURAL OR LEGAL PERSONS (OR, IF THE RELEVANT MEMBER STATE HAS IMPLEMENTED THE RELEVANT PROVISION OF THE 2010 AMENDING DIRECTIVE, 150 NATURAL OR LEGAL PERSONS) OTHER THAN QUALIFIED INVESTORS AS DEFINED IN THE PROSPECTUS DIRECTIVE, SUBJECT TO OBTAINING THE PRIOR CONSENT OF THE REPRESENTATIVE OF THE UNDERWRITERS FOR ANY SUCH OFFER; OR

| Ohio Power Company | | Preliminary | | |

| Ohio Phase-In-Recovery Funding LLC | | Term Sheet | | July 17, 2013 |

| | | | | |

(C) IN ANY OTHER CIRCUMSTANCES FALLING WITHIN ARTICLE 3(2) OF THE PROSPECTUS DIRECTIVE,

PROVIDED THAT NO SUCH OFFER OF THE PHASE-IN-RECOVERY BONDS SHALL REQUIRE THE ISSUING ENTITY OR ANY UNDERWRITER TO PUBLISH A PROSPECTUS PURSUANT TO ARTICLE 3 OF THE PROSPECTUS DIRECTIVE OR SUPPLEMENT A PROSPECTUS PURSUANT TO ARTICLE 16 OF THE PROSPECTUS DIRECTIVE.

FOR PURPOSES OF THIS PROVISION, THE EXPRESSION AN “OFFER OF THE PHASE-IN-RECOVERY BONDS TO THE PUBLIC” IN RELATION TO ANY PHASE-IN-RECOVERY BONDS IN ANY RELEVANT MEMBER STATE MEANS THE COMMUNICATION IN ANY FORM AND BY ANY MEANS OF SUFFICIENT INFORMATION ON THE TERMS OF THE OFFER AND THE PHASE-IN-RECOVERY BONDS TO BE OFFERED SO AS TO ENABLE AN INVESTOR TO DECIDE TO PURCHASE OR SUBSCRIBE FOR THE PHASE-IN-RECOVERY BONDS, AS THE SAME MAY BE VARIED IN THAT MEMBER STATE BY ANY MEASURE IMPLEMENTING THE PROSPECTUS DIRECTIVE IN THAT MEMBER STATE, THE EXPRESSION “PROSPECTUS DIRECTIVE” MEANS DIRECTIVE 2003/71/EU AND INCLUDES ANY RELEVANT IMPLEMENTING MEASURE OR AMENDING MEASURE IN EACH RELEVANT MEMBER STATE AND THE EXPRESSION “2010 AMENDING DIRECTIVE” MEANS DIRECTIVE 2010/73/EU.

NOTICE TO RESIDENTS OF UNITED KINGDOM

EACH OF THE UNDERWRITERS HAS REPRESENTED AND AGREED THAT (I) IT HAS ONLY COMMUNICATED OR CAUSED TO BE COMMUNICATED AND WILL ONLY COMMUNICATE OR CAUSE TO BE COMMUNICATED AN INVITATION OR INDUCEMENT TO ENGAGE IN INVESTMENT ACTIVITY (WITHIN THE MEANING OF SECTION 21 OF THE FINANCIAL SERVICES AND MARKETS ACT 2000, AS AMENDED (THE “FSMA”)) RECEIVED BY IT IN CONNECTION WITH THE ISSUE OR SALE OF THE PHASE-IN-RECOVERY BONDS IN CIRCUMSTANCES IN WHICH SECTION 21(1) OF THE FSMA DOES NOT APPLY TO THE ISSUING ENTITY; AND (II) IT HAS COMPLIED AND WILL COMPLY WITH ALL APPLICABLE PROVISIONS OF THE FSMA WITH RESPECT TO ANYTHING DONE BY IT IN RELATION TO THE PHASE-IN-RECOVERY BONDS IN, FROM OR OTHERWISE INVOLVING THE UNITED KINGDOM.