UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811 - 3954 |

| |

| DREYFUS TAX EXEMPT CASH MANAGEMENT FUNDS | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Michael A. Rosenberg, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 1/31 | |

Date of reporting period: | 7/31/10 | |

| | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

Contents

| |

| The Funds | |

| Letter to Shareholders (Taxable) | 3 |

| Letter to Shareholders (Tax Exempt) | 5 |

| Understanding Your Fund’s Expenses | 7 |

| Comparing Your Fund’s Expenses | |

| With Those of Other Funds | 9 |

| Statements of Investments | 11 |

| Statements of Assets and Liabilities | 54 |

| Statements of Operations | 57 |

| Statements of Changes in Net Assets | 59 |

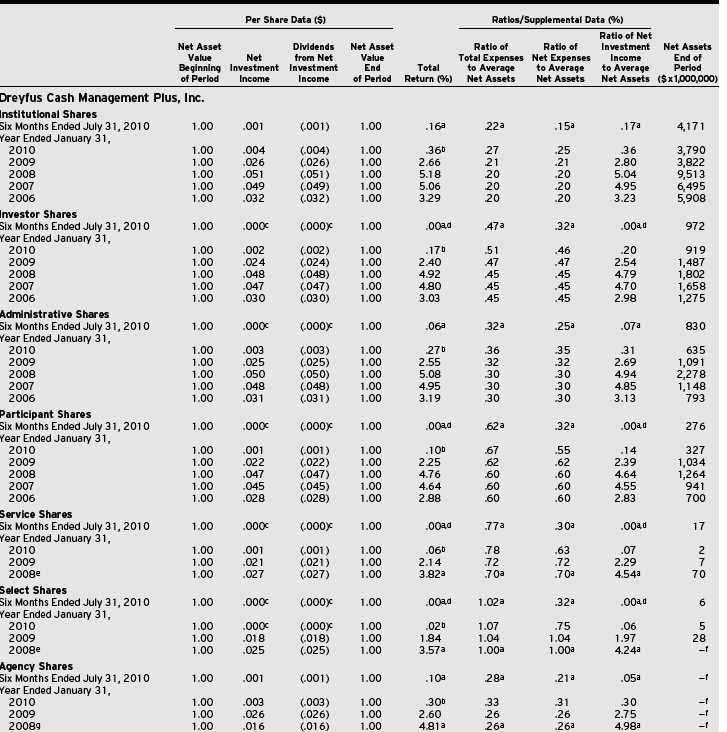

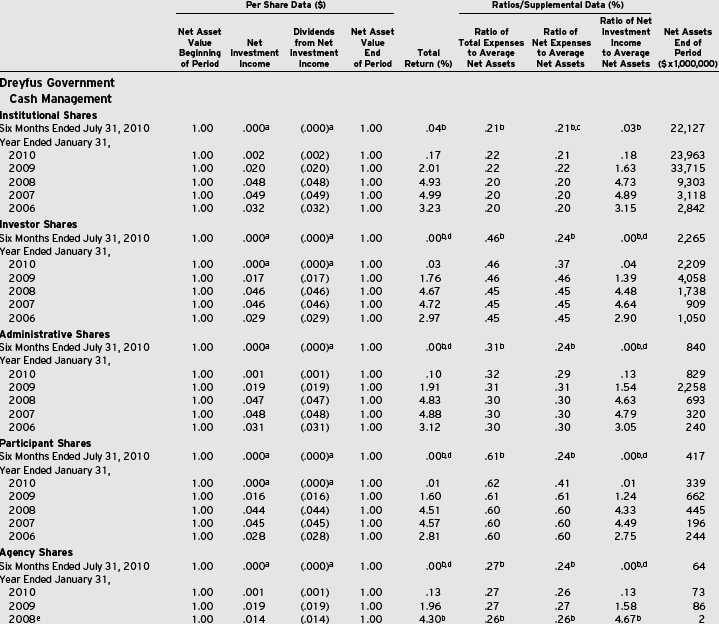

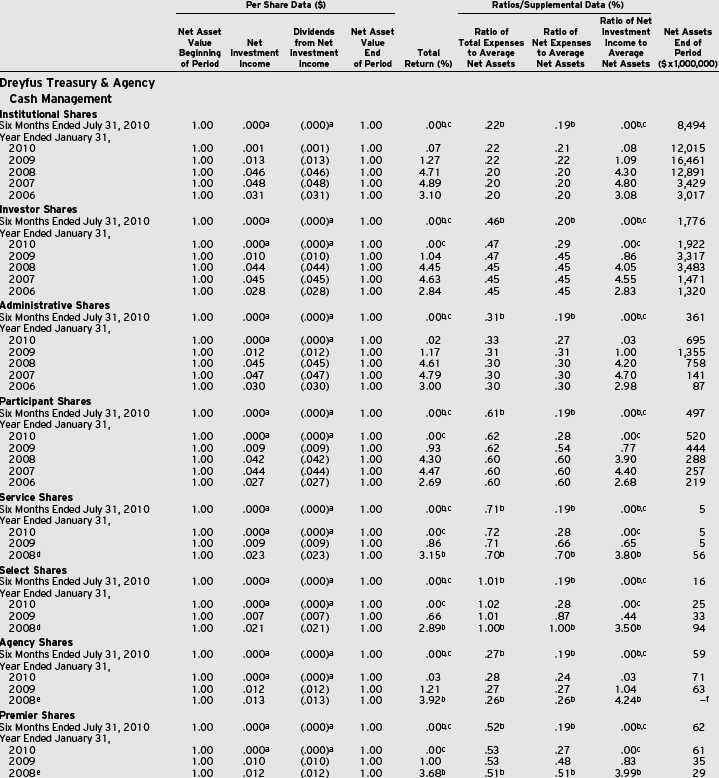

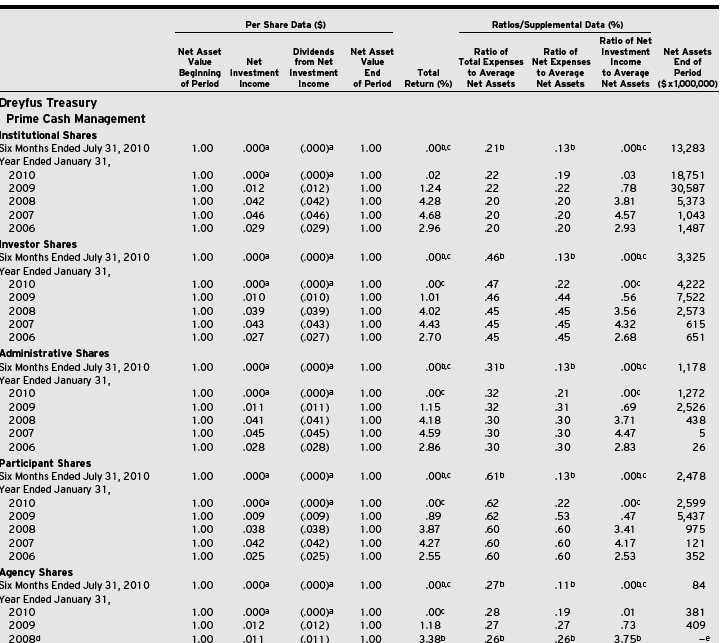

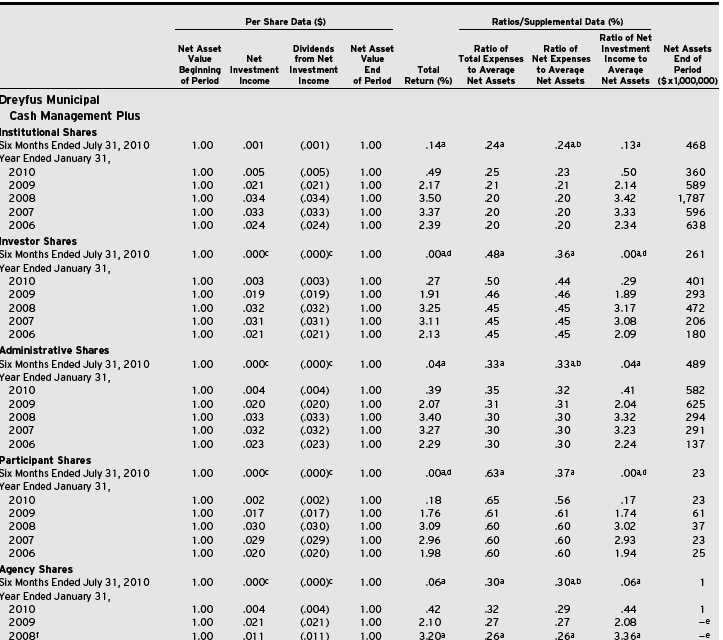

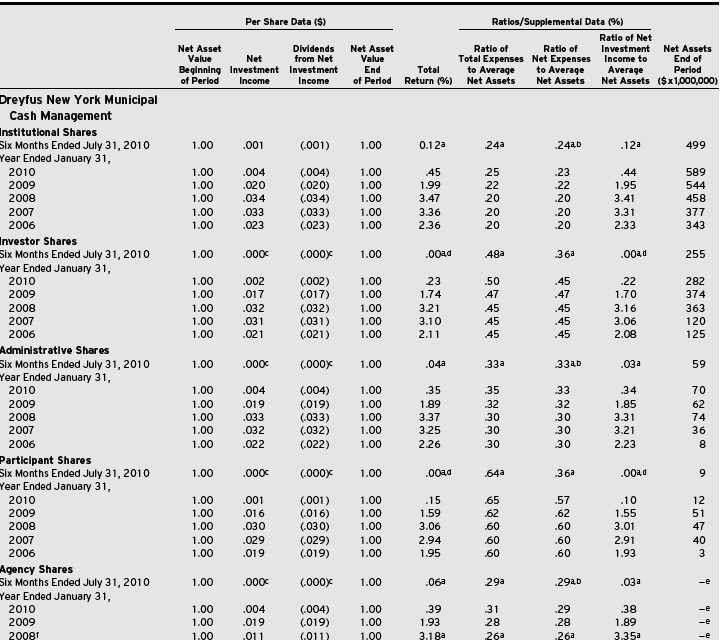

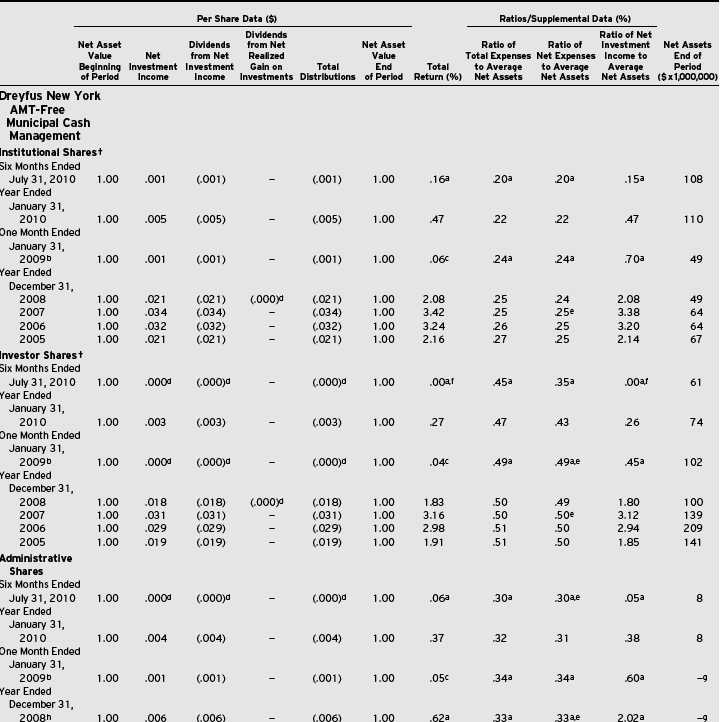

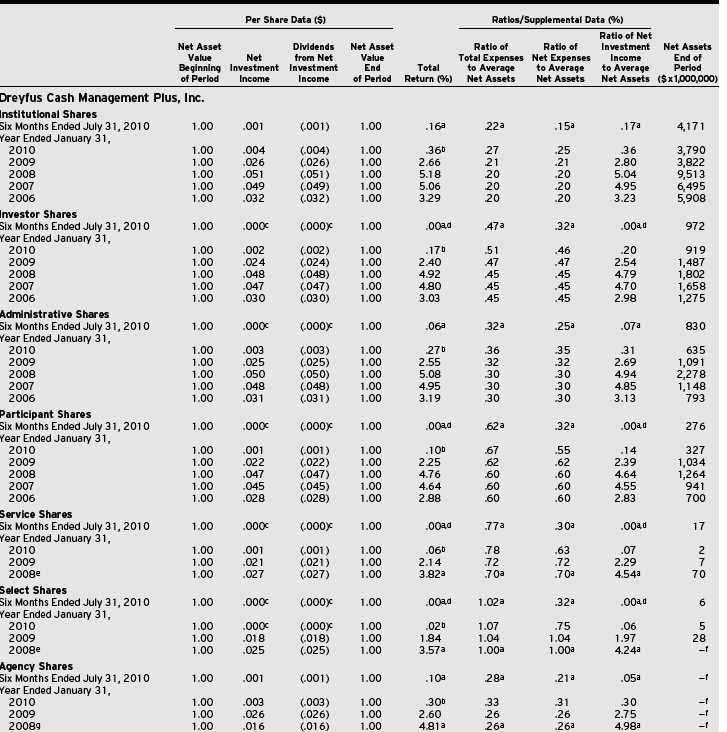

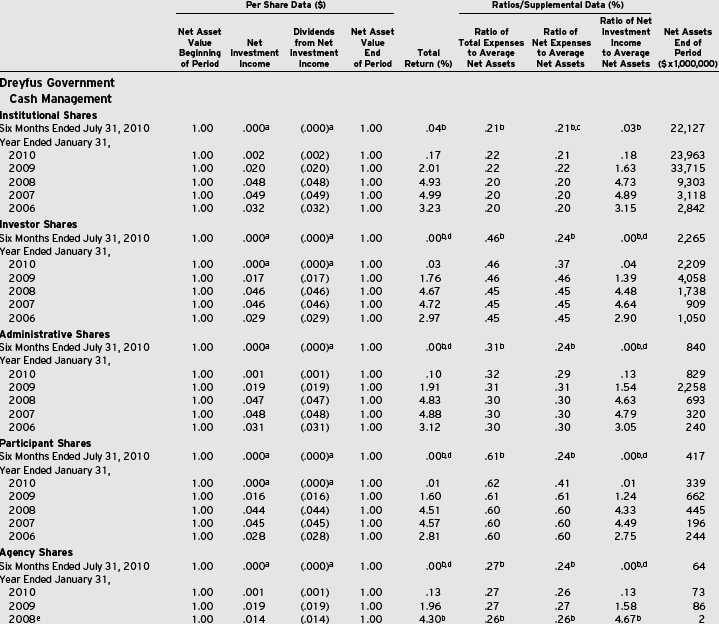

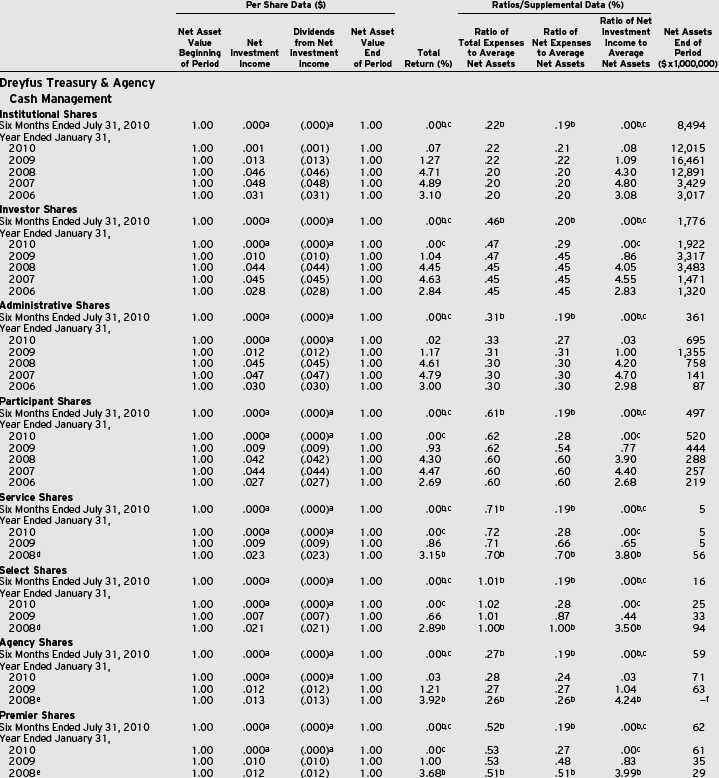

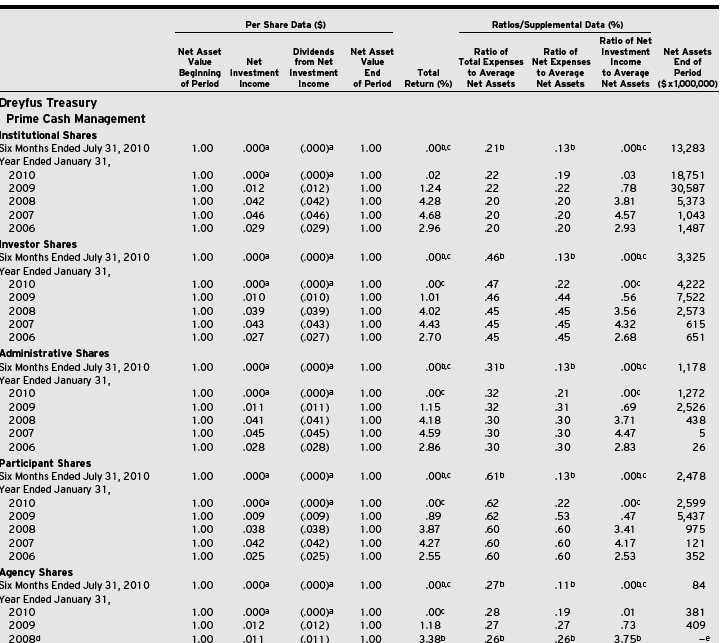

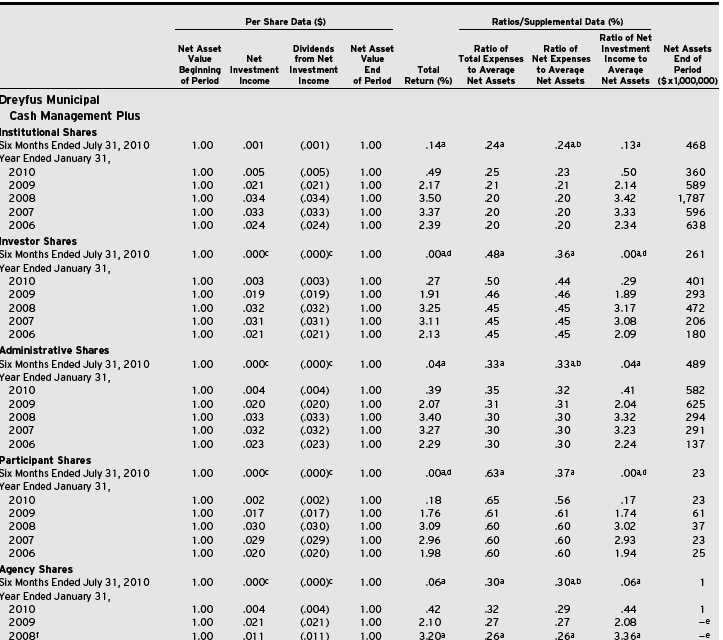

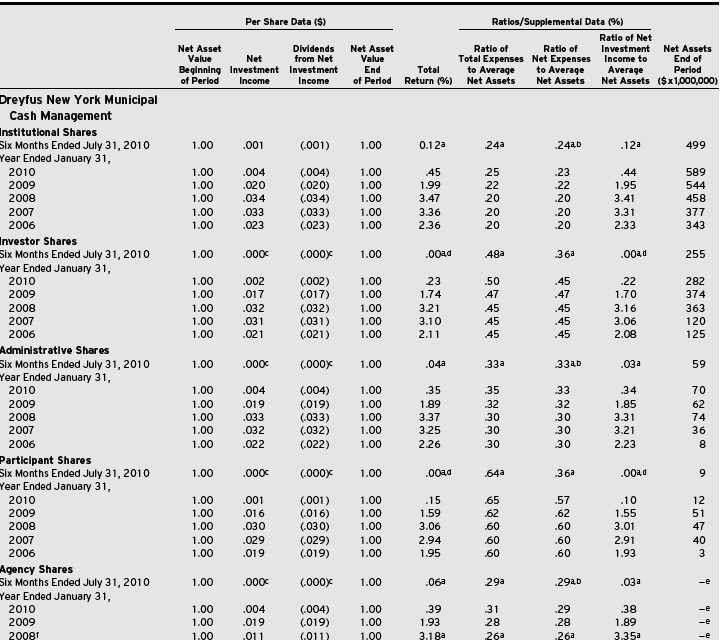

| Financial Highlights | 65 |

| Notes to Financial Statements | 77 |

| Proxy Results | 87 |

| Information About the Review | |

| and Approval of each Fund’s | |

| Management Agreement | 89 |

|

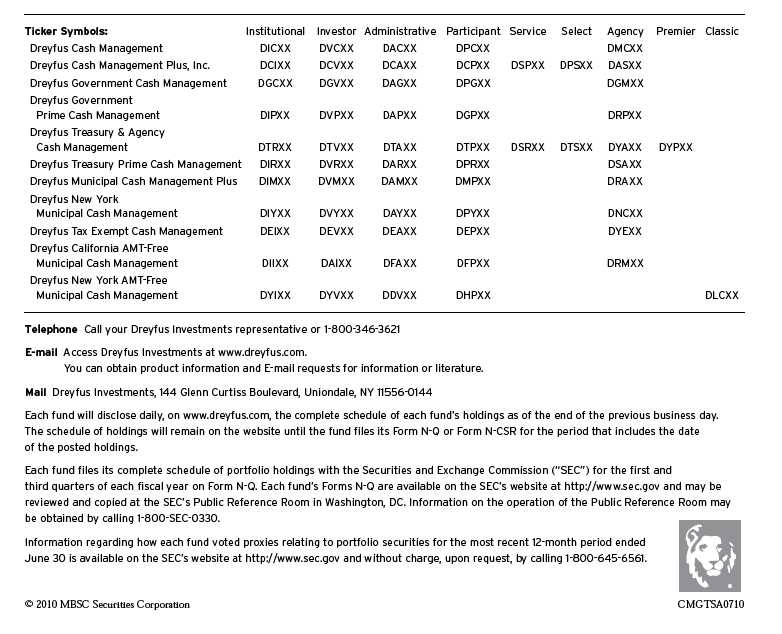

| For More Information |

| Back cover |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Dreyfus Cash Management Funds

The Funds

LETTER TO

SHAREHOLDERS

Dear Shareholders:

This semiannual report for Dreyfus Cash Management Funds (Taxable) covers the six-month period ended July 31, 2010. Over the reporting period, the six Dreyfus Cash Management Funds (Taxable) listed below produced the following annualized yields and, taking into account the effects of compounding, the following annualized effective yields:1,2

| | |

| | | Annualized |

| | Annualized | Effective |

| | Yield (%) | Yield (%) |

| Dreyfus Cash Management | | |

| Institutional Shares | 0.12 | 0.12 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.03 | 0.03 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.06 | 0.06 |

| Dreyfus Cash Management Plus, Inc. | |

| Institutional Shares | 0.17 | 0.17 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.07 | 0.07 |

| Participant Shares | 0.00 | 0.00 |

| Service Shares | 0.00 | 0.00 |

| Select Shares | 0.00 | 0.00 |

| Agency Shares | 0.11 | 0.11 |

| Dreyfus Government Cash Management | |

| Institutional Shares | 0.03 | 0.03 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.00 | 0.00 |

| Dreyfus Government Prime Cash Management | |

| Institutional Shares | 0.01 | 0.01 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.00 | 0.00 |

| Dreyfus Treasury & Agency Cash Management | |

| Institutional Shares | 0.00 | 0.00 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Service Shares | 0.00 | 0.00 |

| Select Shares | 0.00 | 0.00 |

| Agency Shares | 0.00 | 0.00 |

| Premier Shares | 0.00 | 0.00 |

| | |

| | | Annualized |

| | Annualized | Effective |

| | Yield (%) | Yield (%) |

| Dreyfus Treasury Prime Cash Management | |

| Institutional Shares | 0.00 | 0.00 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.00 | 0.00 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.00 | 0.00 |

Monetary Policy Unchanged in Muted Recovery

The reporting period began in the midst of an economic recovery that was fueled, in part, by an overnight federal funds rate that stood unchanged in a historically low range between 0.00% and 0.25%. As a result, money market yields remained near zero percent over the past six months.

In February 2010, the economic recovery appeared to remain on track. Retail sales had posted better-than-expected results just before the reporting period began, and job losses continued to moderate in February. In March, manufacturing activity rose for the eighth straight month, and it did so at the fastest rate in almost six years.

Nonetheless, U.S. GDP grew at a revised 3.7% annualized rate during the first quarter, a milder gain than similar stages of most previous recoveries. Moreover, the housing market continued to struggle, with existing home sales sliding –0.6% in March compared to the previous month.

In April and May, a sovereign debt crisis in Europe and inflationary pressures in China contributed to greater economic uncertainty worldwide, sparking heightened volatility in stock and bond markets. In the United States, the Consumer Price Index slid –0.1% in April, while retail sales and industrial production posted gains. However, government budget cutbacks in Europe created concerns that demand for goods and services, including those from U.S. companies, could suffer. Indeed, U.S. industrial production appeared to moderate in June, and pri-

LETTER TO SHAREHOLDERS (continued)

vate-sector job growth proved more anemic than many analysts expected.

In July,some positive data appeared to support analysts’ consensus view that the springtime slowdown was unlikely to lead to a double-dip recession. Industrial production posted a relatively robust 1.0% gain after June’s mild setback, and the manufacturing and service sectors of the U.S. economy expanded for the twelfth and seventh consecutive months, respectively. On the other hand, total nonfarm payroll employment fell by 131,000 jobs in July, reflecting the end of temporary hiring for the 2010 census and leaving the unemployment rate at 9.5%.

Also during the reporting period, the U.S. Securities and Exchange Commission (“SEC”) issued new regulations governing money market funds. These new regulations, many of which became effective in March 2010, had relatively little impact on the fund, which historically has been conservatively managed.

An Unwavering Focus on Quality

With few opportunities available in the short-term credit markets for significant levels of current income, it made little sense to incur the additional credit and interest-rate risks that longer-dated instruments typically entail. Therefore, we set the funds’ weighted average maturities in ranges that were roughly in line with or slightly longer than industry averages. As always, we focused exclusively on money market instruments meeting our stringent credit-quality criteria.

Although the mild economic recovery is maturing, inflationary pressures have remained low.The sub-par U.S. recovery, along with expectations of sustained economic weakness in Europe, has convinced many analysts that a shift to a more restrictive monetary policy is unlikely anytime soon.Therefore, as we have for some time, we intend to maintain the funds’ focus on credit quality and liquidity.

| |

| | An investment in the fund is not insured or guaranteed by the FDIC or |

| | any other government agency. Although the fund seeks to preserve the |

| | value of your investment at $1.00 per share, it is possible to lose money |

| | by investing in the fund. |

| | Short-term corporate, asset-backed securities holdings and municipal |

| | securities holdings (as applicable), while rated in the highest rating |

| | category by one or more NRSRO (or unrated, if deemed of comparable |

| | quality by Dreyfus), involve credit and liquidity risks and risk of |

| | principal loss. |

| 1 | Annualized effective yield is based upon dividends declared daily and |

| | reinvested monthly. Past performance is no guarantee of future results. |

| | Yields fluctuate. |

| 2 | Yields provided reflect the absorption of certain fund expenses by The |

| | Dreyfus Corporation pursuant to an undertaking, which is voluntary |

| | and temporary, not contractual, and can be terminated at any time |

| | without notice. Had these expenses not been absorbed, fund yields would |

| | have been lower, and in some cases, 7-day yields during the reporting |

| | period would have been negative absent the expense absorption. |

4

LETTER TO

SHAREHOLDERS

Dear Shareholder:

We are pleased to present the semiannual report for Dreyfus Cash Management Funds (Tax Exempt). For the six-month period ended July 31, 2010, the five tax-exempt money market portfolios that comprise Dreyfus Cash Management Funds (Tax Exempt) produced the following annualized yields and annualized effective yields:1,2

| | |

| | | Annualized |

| | Annualized | Effective |

| | Yield (%) | Yield (%) |

| Dreyfus Municipal Cash Management Plus | |

| Institutional Shares | 0.13 | 0.13 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.04 | 0.04 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.06 | 0.06 |

| Dreyfus New York Municipal Cash Management | |

| Institutional Shares | 0.13 | 0.13 |

| Investor Shares | 0.01 | 0.01 |

| Administrative Shares | 0.03 | 0.03 |

| Participant Shares | 0.01 | 0.01 |

| Agency Shares | 0.07 | 0.07 |

| Dreyfus Tax Exempt Cash Management | |

| Institutional Shares | 0.10 | 0.10 |

| Investor Shares | 0.01 | 0.01 |

| Administrative Shares | 0.03 | 0.03 |

| Participant Shares | 0.01 | 0.01 |

| Agency Shares | 0.04 | 0.04 |

| Dreyfus California AMT-Free Municipal Cash Management |

| Institutional Shares | 0.14 | 0.14 |

| Investor Shares | 0.00 | 0.00 |

| Administrative Shares | 0.04 | 0.04 |

| Participant Shares | 0.00 | 0.00 |

| Agency Shares | 0.08 | 0.08 |

| Dreyfus New York AMT-Free Municipal Cash Management |

| Institutional Shares | 0.16 | 0.16 |

| Investor Shares | 0.01 | 0.01 |

| Administrative Shares | 0.06 | 0.06 |

| Participant Shares | 0.01 | 0.01 |

| Classic Shares | 0.01 | 0.01 |

With the overnight federal funds rate remaining unchanged in a range between 0.00% and 0.25% throughout the reporting period, yields of tax-exempt money market instruments stayed at historically low levels. However, municipal money market instruments generally provided yields that were more competitive than historical norms with the nominal yields produced by taxable money market funds.

Money Market Yields Hovered Near Historical Lows

Although unemployment remained stubbornly high, manufacturing activity continued to rebound early in the reporting period, helping to bolster confidence among consumers, businesses and investors. Still, the economic recovery throughout the reporting period proved to be milder than most previous recoveries. Indeed, the domestic economic growth rate, while still positive,moderated in the second quarter compared to the first quarter of the year.

The U.S. and global economies were constrained by several new influences during the reporting period, including turmoil in European sovereign debt markets and inflationary pressures in China.These developments added to ongoing economic concerns regarding lackluster consumer spending in the United States. In light of these challenges, the Federal Reserve Board (the “Fed”) retained the aggressively accommodative monetary policy it first established in December 2008.

In the municipal securities market, the supply of variable-rate demand notes and tender option bonds remained relatively low, due mainly to tighter lending restrictions and credit-rating downgrades. Instead, issuers continued to turn to longer-term bonds, including taxable securities through the federally subsidized Build America Bonds program. Meanwhile, demand for tax-exempt money market instruments remained robust, putting additional downward pressure on already low tax-exempt money market yields.

Finally, most states and municipalities continued to face fiscal challenges stemming from reduced tax receipts and greater demand for services, limiting the supply of instruments meeting our investment criteria. The states of California and NewYork both struggled

LETTER TO SHAREHOLDERS (continued)

with substantial revenue shortfalls, and while New York enacted a balanced budget a few days after the reporting period’s end, California’s state legislature so far has been unable to agree on measures to reduce spending and/or boost revenues.

In-House Research Supported Credit Quality

The in-depth, independent research conducted by our credit analysts into the issuers we consider led us to retain our focus on direct, high-quality municipal obligations during the reporting period. As we have for some time, we favored instruments backed by pledged tax appropriations or revenues from facilities providing essential services. We generally shied away from instruments issued by entities that depend heavily on state aid. We also avoided instruments that our credit analysts believe may be subject to credit-rating downgrades, including some that came to market with elevated yields to compensate investors for higher risks.

We set the funds’ weighted average maturities in ranges that were roughly in line with industry averages, which remained well below historical averages in the low interest-rate environment. In addition, we prepared the funds for new government regulations that took effect during the reporting period, including a reduction in the funds’ maximum weighted average maturity from 90 days to 60 days.

Safety and Liquidity Remain Paramount

The Fed repeatedly has indicated that it is likely to keep short-term interest rates near historical lows for an extended period.Therefore, we believe the prudent course continues to be an emphasis on preservation of capital and liquidity.

However, we expect the supply of newly issued tax-exempt money market instruments to trend higher in the months ahead, which could support higher yields. We also are mindful that, when the Fed eventually begins to raise the federal funds rate, a relatively defensive maturity-management strategy may enable the funds to capture higher yields more quickly as they become available.

| |

| | An investment in the funds is not insured or guaranteed by the |

| | FDIC or any other government agency. Although the funds seek to |

| | preserve the value of your investment at $1.00 per share, it is |

| | possible to lose money by investing in the funds. |

| | Short-term corporate, asset-backed securities holdings and municipal |

| | securities holdings (as applicable), while rated in the highest rating |

| | category by one or more NRSRO (or unrated, if deemed of |

| | comparable quality by Dreyfus), involve credit and liquidity risks |

| | and risk of principal loss. |

| 1 | Annualized effective yield is based upon dividends declared daily and |

| | reinvested monthly. Past performance is no guarantee of future results. |

| | Yields fluctuate. For the national funds, income may be subject to state |

| | and local taxes. For the NewYork and California funds, income may be |

| | subject to state and local taxes for out-of-state residents. For each non- |

| | AMT-Free fund, some income may be subject to the federal alternative |

| | minimum tax (AMT). |

| 2 | Yields provided reflect the absorption of certain fund expenses by The |

| | Dreyfus Corporation pursuant to an undertaking, which is voluntary |

| | and temporary, not contractual, and can be terminated at any time |

| | without notice. Had these expenses not been absorbed, funds’ yields |

| | would have been lower, and in some cases, 7-day yields during the |

| | reporting period would have been negative absent the expense absorption. |

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemptions fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund's prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in each class of each fund from February 1, 2010 to July 31, 2010. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | |

| Expenses and Value of a $1,000 Investment | | | | | | | |

| assuming actual returns for the six months ended July 31, 2010 | | | | | | |

| | Institutional | Investor | Administrative | Participant | Service | Select | Agency | Premier | Classic |

| Dreyfus Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.04 | $ 1.59 | $ 1.49 | $ 1.64 | — | — | $ 1.34 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.60 | $1,000.00 | $1,000.10 | $1,000.00 | �� | — | $1,000.30 | — | — |

| Dreyfus Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Plus, Inc. | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ .74 | $ 1.59 | $ 1.24 | $ 1.59 | $ 1.49 | $ 1.59 | $ 1.04 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.80 | $1,000.00 | $1,000.30 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.50 | — | — |

| Dreyfus | | | | | | | | | |

| Government Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.04 | $ 1.19 | $ 1.19 | $ 1.19 | — | — | $ 1.19 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.20 | $1,000.00 | $1,000.00 | $1,000.00 | — | — | $1,000.00 | — | — |

| Dreyfus | | | | | | | | | |

| Government Prime | | | | | | | | | |

| Cash Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ .99 | $ 1.04 | $ 1.04 | $ 1.04 | — | — | $ .99 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | — | — | $1,000.00 | — | — |

| Dreyfus Treasury & | | | | | | | | | |

| Agency Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ .94 | $ .99 | $ .94 | $ .94 | $ .94 | $ .94 | $ .94 | $ .94 | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | — |

| Dreyfus | | | | | | | | | |

| Treasury Prime | | | | | | | | | |

| Cash Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ .64 | $ .64 | $ .64 | $ .64 | — | — | $ .55 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.00 | $1,000.00 | $1,000.00 | $1,000.00 | — | — | $1,000.00 | — | — |

| Dreyfus | | | | | | | | | |

| Municipal Cash | | | | | | | | | |

| Management Plus | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.19 | $ 1.79 | $ 1.64 | $ 1.83 | — | — | $ 1.49 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.70 | $1,000.00 | $1,000.20 | $1,000.00 | — | — | $1,000.30 | — | — |

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited) (continued)

| | | | | | | | | |

| Expenses and Value of a $1,000 Investment (continued) | | | | | | |

| assuming actual returns for the six months ended July 31, 2010 | | | | | | |

| | Institutional | Investor | Administrative | Participant | Service | Select | Agency | Premier | Classic |

| Dreyfus | | | | | | | | | |

| New York | | | | | | | | | |

| Municipal Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.19 | $ 1.79 | $ 1.64 | $ 1.79 | — | — | $ 1.44 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.60 | $1,000.00 | $1,000.20 | $1,000.00 | — | — | $1,000.30 | — | — |

| Dreyfus | | | | | | | | | |

| Tax Exempt Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.14 | $ 1.54 | $ 1.49 | $ 1.54 | — | — | $ 1.29 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.50 | $1,000.10 | $1,000.10 | $1,000.10 | — | — | $1,000.20 | — | — |

| Dreyfus California | | | | | | | | | |

| AMT-Free | | | | | | | | | |

| Municipal Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.19 | $ 1.93 | $ 1.69 | $ 1.88 | — | — | $ 1.49 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.70 | $1,000.00 | $1,000.20 | $1,000.00 | — | — | $1,000.40 | — | — |

| Dreyfus New York | | | | | | | | | |

| AMT-Free | | | | | | | | | |

| Municipal Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ .99 | $ 1.74 | $ 1.49 | $ 1.74 | — | — | — | — | $ 1.69 |

| Ending value | | | | | | | | | |

| (after expenses) | $1,000.80 | $1,000.00 | $1,000.30 | $1,000.00 | — | — | — | — | $1,000.00 |

|

| † Expenses are equal to Dreyfus Cash Management’s annualized expense ratio of .21% for Institutional Shares, .32% for Investor Shares, .30% for Administrative Shares, .33% for |

| Participant Shares and .27% for Agency Shares, Dreyfus Cash Management Plus, Inc 15% for Institutional Shares, .32% for Investor Shares, .25% for Administrative Shares, .32% |

| for Participant Shares, .30% for Service Shares, .32% for Select Shares and .21% for Agency Shares, Dreyfus Government Cash Management .21% for Institutional Shares, .24% for |

| Investor Shares, .24% for Administrative Shares, .24% for Participant Shares and .24% for Agency Shares, Dreyfus Government Prime Cash Management .20% for Institutional |

| Shares, .21% for Investor Shares, .21% for Administrative Shares, .21% for Participant Shares and .20% for Agency Shares, Dreyfus Treasury & Agency Cash Management .19% for |

| Institutional Shares, .20% for Investor Shares, .19% for Administrative Shares, .19% for Participant Shares, 19% for Service Shares, .19% for Select Shares, .19% for Agency Shares |

| and .19% for Premier Shares, Dreyfus Treasury Prime Cash Management .13% for Institutional Shares, .13% for Investor Shares, .13% for Administrative Shares, .13% for |

| Participant Shares and .11% for Agency Shares, Dreyfus Municipal Cash Management Plus .24% for Institutional Shares, .36% for Investor Shares, .33% for Administrative Shares, |

| .37% for Participant Shares and .30% for Agency Shares, Dreyfus NewYork Municipal Cash Management .24% for Institutional Shares, .36% for Investor Shares, .33% for |

| Administrative Shares, .36% for Participant Shares and .29% for Agency Shares, Dreyfus Tax Exempt Cash Management .23% for Institutional Shares, .31% for Investor Shares, |

| .30% for Administrative Shares, .31% for Participant Shares and .26% for Agency Shares, Dreyfus California AMT-Free Municipal Cash Management .24% for Institutional Shares, |

| .39% for Investor Shares, .34% for Administrative Shares, .38% for Participant Shares and .30% for Agency Shares, Dreyfus NewYork AMT-Free Municipal Cash Management |

| .20% for Institutional Shares, .35% for Investor Shares, .30% for Administrative Shares, .35% for Participant Shares and .34% for Classic shares; multiplied by the respective fund’s |

| average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

8

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund's expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return.You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | |

| Expenses and Value of a $1,000 Investment | | | | | | | |

| assuming a hypothetical 5% annualized return for the six months ended July 31, 2010 | | | | |

| | Institutional | Investor | Administrative | Participant | Service | Select | Agency | Premier | Classic |

| Dreyfus Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.05 | $ 1.61 | $ 1.51 | $ 1.66 | — | — | $ 1.35 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,023.75 | $1,023.21 | $1,023.31 | $1,023.16 | — | — | $1,023.46 | — | — |

| Dreyfus Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Plus, Inc. | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ .75 | $ 1.61 | $ 1.25 | $ 1.61 | $ 1.51 | $ 1.61 | $ 1.05 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,024.05 | $1,023.21 | $1,023.55 | $1,023.21 | $1,023.31 | $1,023.21 | $1,023.75 | — | — |

| Dreyfus | | | | | | | | | |

| Government Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.05 | $ 1.20 | $ 1.20 | $ 1.20 | — | — | $ 1.20 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,023.75 | $1,023.60 | $1,023.60 | $1,023.60 | — | — | $1,023.60 | — | — |

| Dreyfus | | | | | | | | | |

| Government Prime | | | | | | | | | |

| Cash Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.00 | $ 1.05 | $ 1.05 | $ 1.05 | — | — | $ 1.00 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,023.80 | $1,023.75 | $1,023.75 | $1,023.75 | — | — | $1,023.80 | — | — |

| Dreyfus Treasury & | | | | | | | | | |

| Agency Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ .95 | $ 1.00 | $ .95 | $ .95 | $ .95 | $ .95 | $ .95 | $ .95 | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,023.85 | $1,023.80 | $1,023.85 | $1,023.85 | $1,023.85 | $1,023.85 | $1,023.85 | $1,023.85 | — |

| Dreyfus | | | | | | | | | |

| Treasury Prime | | | | | | | | | |

| Cash Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ .65 | $ .65 | $ .65 | $ .65 | — | — | $ .55 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,024.15 | $1,024.15 | $1,024.15 | $1,024.15 | — | — | $1,024.25 | — | — |

| Dreyfus | | | | | | | | | |

| Municipal Cash | | | | | | | | | |

| Management Plus | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.20 | $ 1.81 | $ 1.66 | $ 1.86 | — | — | $ 1.51 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,023.60 | $1,023.01 | $1,023.16 | $1,022.96 | — | — | $1,023.31 | — | — |

COMPARING YOUR FUND’S EXPENSES WITH THOSE OF OTHER FUNDS (Unaudited) (continued)

| | | | | | | | | |

| Expenses and Value of a $1,000 Investment (continued) | | | | | | |

| assuming a hypothetical 5% annualized return for the six months ended July 31, 2010 | | | | | |

| | Institutional | Investor | Administrative | Participant | Service | Select | Agency | Premier | Classic |

| Dreyfus | | | | | | | | | |

| New York | | | | | | | | | |

| Municipal Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.20 | $ 1.81 | $ 1.66 | $ 1.81 | — | — | $ 1.45 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,023.60 | $1,023.01 | $1,023.16 | $1,023.01 | — | — | $1,023.36 | — | — |

| Dreyfus | | | | | | | | | |

| Tax Exempt Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.15 | $ 1.56 | $ 1.51 | $ 1.56 | — | — | $ 1.30 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,023.65 | $1,023.26 | $1,023.31 | $1,023.26 | — | — | $1,023.51 | — | — |

| Dreyfus California | | | | | | | | | |

| AMT-Free | | | | | | | | | |

| Municipal Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.20 | $ 1.96 | $ 1.71 | $ 1.91 | — | — | $ 1.51 | — | — |

| Ending value | | | | | | | | | |

| (after expenses) | $1,023.60 | $1,022.86 | $1,023.11 | $1,022.91 | — | — | $1,023.31 | — | — |

| Dreyfus New York | | | | | | | | | |

| AMT-Free | | | | | | | | | |

| Municipal Cash | | | | | | | | | |

| Management | | | | | | | | | |

| Expenses paid | | | | | | | | | |

| per $1,000† | $ 1.00 | $ 1.76 | $ 1.51 | $ 1.76 | — | — | — | — | $ 1.71 |

| Ending value | | | | | | | | | |

| (after expenses) | $1,023.80 | $1,023.06 | $1,023.31 | $1,023.06 | — | — | — | — | $1,023.11 |

|

| † Expenses are equal to Dreyfus Cash Management’s annualized expense ratio of .21% for Institutional Shares, .32% for Investor Shares, .30% for Administrative Shares, .33% for |

| Participant Shares and .27% for Agency Shares, Dreyfus Cash Management Plus, Inc 15% for Institutional Shares, .32% for Investor Shares, .25% for Administrative Shares, .32% |

| for Participant Shares, .30% for Service Shares, .32% for Select Shares and .21% for Agency Shares, Dreyfus Government Cash Management .21% for Institutional Shares, .24% for |

| Investor Shares, .24% for Administrative Shares, .24% for Participant Shares and .24% for Agency Shares, Dreyfus Government Prime Cash Management .20% for Institutional |

| Shares, .21% for Investor Shares, .21% for Administrative Shares, .21% for Participant Shares and .20% for Agency Shares, Dreyfus Treasury & Agency Cash Management .19% for |

| Institutional Shares, .20% for Investor Shares, .19% for Administrative Shares, .19% for Participant Shares, 19% for Service Shares, .19% for Select Shares, .19% for Agency Shares |

| and .19% for Premier Shares, Dreyfus Treasury Prime Cash Management .13% for Institutional Shares, .13% for Investor Shares, .13% for Administrative Shares, .13% for |

| Participant Shares and .11% for Agency Shares, Dreyfus Municipal Cash Management Plus .24% for Institutional Shares, .36% for Investor Shares, .33% for Administrative Shares, |

| .37% for Participant Shares and .30% for Agency Shares, Dreyfus NewYork Municipal Cash Management .24% for Institutional Shares, .36% for Investor Shares, .33% for |

| Administrative Shares, .36% for Participant Shares and .29% for Agency Shares, Dreyfus Tax Exempt Cash Management .23% for Institutional Shares, .31% for Investor Shares, |

| .30% for Administrative Shares, .31% for Participant Shares and .26% for Agency Shares, Dreyfus California AMT-Free Municipal Cash Management .24% for Institutional Shares, |

| .39% for Investor Shares, .34% for Administrative Shares, .38% for Participant Shares and .30% for Agency Shares, Dreyfus NewYork AMT-Free Municipal Cash Management |

| .20% for Institutional Shares, .35% for Investor Shares, .30% for Administrative Shares, .35% for Participant Shares and .34% for Classic shares; multiplied by the respective fund’s |

| average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

10

STATEMENT OF INVESTMENTS

July 31, 2010 (Unaudited)

| | |

| | Principal | |

| Dreyfus Cash Management | Amount ($) | Value ($) |

| Negotiable Bank Certificates of Deposit—46.3% | | |

| Banco Bilbao Vizcaya Argentaria | | |

| 0.43%, 8/16/10 | 55,000,000 a | 55,000,000 |

| Banco Bilbao Vizcaya Argentaria (Yankee) | | |

| 0.55%, 8/2/10 | 340,500,000 | 340,500,095 |

| Banco Santander SA (Yankee) | | |

| 0.75%—0.80%, 8/9/10—8/16/10 | 1,050,000,000 | 1,050,000,000 |

| Bank of Tokyo-Mitsubishi Ltd. (Yankee) | | |

| 0.40%—0.55%, 8/6/10—10/1/10 | 1,060,500,000 | 1,060,500,000 |

| Barclays Bank (Yankee) | | |

| 0.50%—0.70%, 8/23/10—1/18/11 | 835,000,000 | 835,000,000 |

| BNP Paribas (Yankee) | | |

| 0.60%, 9/2/10—10/12/10 | 950,000,000 | 950,000,000 |

| Canadian Imperial Bank of Commerce (Yankee) | | |

| 0.36%, 8/6/10 | 300,000,000 | 300,000,000 |

| Citibank N.A. | | |

| 0.35%, 8/25/10 | 500,000,000 | 500,000,000 |

| Credit Agricole CIB (Yankee) | | |

| 0.40%—0.66%, 8/6/10—10/8/10 | 1,300,000,000 | 1,300,000,000 |

| Fortis Bank SA/NV (Yankee) | | |

| 0.61%, 10/4/10 | 350,500,000 | 350,500,000 |

| ING Bank (London) | | |

| 0.52%, 10/25/10 | 160,000,000 | 160,000,000 |

| Lloyds TSB Bank (Yankee) | | |

| 0.50%, 8/19/10 | 670,000,000 | 670,000,000 |

| Natixis (Yankee) | | |

| 0.70%, 10/4/10—10/7/10 | 1,195,500,000 | 1,195,500,000 |

| Rabobank Nederland (Yankee) | | |

| 0.50%, 1/24/11 | 250,000,000 | 250,000,000 |

| Royal Bank of Scotland PLC (Yankee) | | |

| 0.50%—0.60%, 8/12/10—9/7/10 | 1,400,000,000 | 1,400,000,000 |

| Societe Generale (Yankee) | | |

| 0.40%—0.53%, 8/6/10—10/18/10 | 1,000,000,000 | 1,000,000,000 |

| Sumitomo Mitsui Banking Corporation (Yankee) | | |

| 0.54%, 9/7/10 | 300,000,000 b | 300,000,000 |

| UBS (Yankee) | | |

| 0.33%—0.75%, 8/5/10—1/27/11 | 1,150,000,000 | 1,150,000,000 |

| Unicredit Bank AG (Yankee) | | |

| 0.75%, 10/12/10 | 200,000,000 | 200,000,000 |

| Westpac Capital Corp. | | |

| 0.40%, 8/10/10 | 250,000,000 a | 250,000,000 |

| Total Negotiable Bank Certificates of Deposit | | |

| (cost $13,317,000,095) | | 13,317,000,095 |

| |

| Commercial Paper—8.2% | | |

| Abbey National NA | | |

| 0.20%, 8/2/10 | 250,000,000 | 249,998,611 |

| ANZ International Ltd. | | |

| 0.53%, 9/15/10 | 50,000,000 b | 49,966,875 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | |

| | Principal | |

| Dreyfus Cash Management (continued) | Amount ($) | Value ($) |

| |

| Commercial Paper (continued) | | |

| Bank of New Zealand | | |

| 0.51%, 8/20/10 | 250,000,000 | 249,932,708 |

| General Electric Capital Corp. | | |

| 0.30%—0.31%, 8/9/10—8/24/10 | 450,000,000 | 449,963,431 |

| General Electric Capital Services Inc. | | |

| 0.31%, 8/24/10 | 125,000,000 | 124,975,243 |

| NRW Bank | | |

| 0.49%—0.50%, 8/23/10—10/13/10 | 630,500,000 b | 630,189,521 |

| Skandinaviska Enskilda Banken AB | | |

| 0.59%, 10/13/10 | 100,000,000 b | 99,880,361 |

| Societe Generale N.A. Inc. | | |

| 0.50%—0.64%, 10/4/10—11/1/10 | 240,000,000 | 239,714,333 |

| Westpac Banking | | |

| 0.49%, 8/7/10 | 125,000,000 a,b | 125,008,888 |

| Westpac Securities NZ Ltd. | | |

| 0.35%, 8/6/10 | 150,000,000 b | 149,992,708 |

| Total Commercial Paper | | |

| (cost $2,369,622,679) | | 2,369,622,679 |

| |

| Asset-Backed Commercial Paper—4.9% | | |

| Atlantis One Funding Corp. | | |

| 0.20%—0.51%, 8/2/10—9/7/10 | 950,000,000 b | 949,916,930 |

| CHARTA | | |

| 0.50%, 8/23/10 | 35,000,000 b | 34,989,306 |

| CIESCO | | |

| 0.30%, 8/5/10 | 80,000,000 b | 79,997,333 |

| CRC Funding LLC | | |

| 0.30%—0.31%, 8/5/10—8/9/10 | 340,000,000 b | 339,981,556 |

| Total Asset-Backed Commercial Paper | | |

| (cost $1,404,885,125) | | 1,404,885,125 |

| |

| Corporate Notes—5.3% | | |

| Bank of America Securities LLC | | |

| 0.36%, 8/2/10 | 625,000,000 | 625,000,000 |

| Barclays Bank | | |

| 0.78%, 8/26/10 | 400,000,000 a | 400,000,000 |

| Credit Suisse | | |

| 0.68%, 8/19/10 | 500,000,000 a | 500,000,000 |

| Total Corporate Notes | | |

| (cost $1,525,000,000) | | 1,525,000,000 |

| |

| Short-Term Bank Notes—2.4% | | |

| Bank of America N.A. | | |

| 0.60%, 1/21/11 | 300,000,000 | 300,000,000 |

| Chase Bank USA NA | | |

| 0.35%, 8/13/10 | 400,000,000 | 400,000,000 |

| Total Short-Term Bank Notes | | |

| (cost $700,000,000) | | 700,000,000 |

12

| | |

| | Principal | |

| Dreyfus Cash Management (continued) | Amount ($) | Value ($) |

| |

| Time Deposits—16.8% | | |

| Allied Irish Banks (Grand Cayman) | | |

| 0.65%, 8/2/10 | 500,000,000 | 500,000,000 |

| Bank of Ireland (Dublin) | | |

| 0.65%, 8/2/10 | 350,000,000 | 350,000,000 |

| Commerzbank (Grand Cayman) | | |

| 0.22%, 8/2/10 | 1,000,000,000 | 1,000,000,000 |

| DZ Bank AG (Grand Cayman) | | |

| 0.22%, 8/2/10 | 700,000,000 | 700,000,000 |

| KBC Bank (Grand Cayman) | | |

| 0.16%, 8/2/10 | 500,000,000 | 500,000,000 |

| Landesbank Hessen-Thuringen | | |

| Girozentrale (Grand Cayman) | | |

| 0.22%, 8/2/10 | 200,000,000 | 200,000,000 |

| Nordea Bank Finland (Grand Cayman) | | |

| 0.20%, 8/2/10 | 400,000,000 | 400,000,000 |

| State Street Bank and Trust Co. (Grand Cayman) | | |

| 0.17%, 8/2/10 | 794,000,000 | 794,000,000 |

| Svenska Handelsbanken (Grand Cayman) | | |

| 0.19%, 8/2/10 | 400,000,000 | 400,000,000 |

| Total Time Deposits | | |

| (cost $4,844,000,000) | | 4,844,000,000 |

| |

| |

| U.S. Government Agencies—5.2% | | |

| Federal Home Loan Bank | | |

| 0.30%, 8/19/11 | 500,000,000 a | 500,000,000 |

| Federal Home Loan Mortgage Corp. | | |

| 0.51%, 10/16/10 | 1,000,000,000 a,c | 1,000,000,000 |

| Total U.S. Government Agencies | | |

| (cost $1,500,000,000) | | 1,500,000,000 |

| |

| |

| Repurchase Agreements—10.9% | | |

| Citigroup Global Markets Holdings Inc. | | |

| 0.36%, dated 7/30/10, due 8/2/10 in the amount of | | |

| $150,004,500 (fully collateralized by $170,332,848 | | |

| Corporate Bonds, 0%-12.75%, due 1/15/12-3/25/35, | | |

| value $156,215,414) | 150,000,000 | 150,000,000 |

| Credit Agricole | | |

| 0.20%, dated 7/30/10, due 8/2/10 in the amount of | | |

| $600,010,000 (fully collateralized by $464,593,000 | | |

| Federal Home Loan Mortgage Corp., 1.45%, due 8/3/10, | | |

| value $466,267,471 and $145,302,000 Federal National | | |

| Mortgage Association, 1.50%, due 6/1/12, value $145,732,578) | 600,000,000 | 600,000,000 |

| Credit Suisse Securities LLC | | |

| 0.20%-0.21%, dated 7/30/10, due 8/2/10 in the amount of | | |

| $270,004,558 (fully collateralized by $47,720,000 Federal Home | | |

| Loan Bank, 0%, due 8/2/10-9/29/10, value $47,715,847, $23,700,000 | | |

| Federal National Mortgage Association, 0%, due 11/22/10, | | |

| value $23,685,780 and $204,600,000 U.S. Treasury Bills, | | |

| due 7/28/11, value $204,002,574) | 270,000,000 | 270,000,000 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | |

| | Principal | |

| Dreyfus Cash Management (continued) | Amount ($) | Value ($) |

| |

| Repurchase Agreements (continued) | | |

| Deutsche Bank Securities Inc. | | |

| 0.20%-0.27%, dated 7/30/10, due 8/2/10 in the amount of | | |

| $1,100,018,917 (fully collateralized by $102,013,302 | | |

| Commercial Paper, 0%, due 8/2/10-9/1/10, value $102,000,000, | | |

| $158,906,000 Federal Farm Credit Bank, 1.375%-5.125%, | | |

| due 10/17/12-8/25/16, value $173,221,581, $634,387,000 | | |

| Federal Home Loan Bank, 0%-5.25%, due 9/30/10-6/17/13, | | |

| value $655,891,335 and $182,357,000 Federal National Mortgage | | |

| Association, 3%-4.875%, due 5/18/12-10/29/14, value $190,887,441) | 1,100,000,000 | 1,100,000,000 |

| HSBC USA Inc. | | |

| 0.33%, dated 7/30/10, due 8/2/10 in the amount of $80,002,200 | | |

| (fully collateralized by $88,827,000 Corporate Bonds, 0%-8.62%, | | |

| due 4/1/11-12/30/49, value $82,435,357) | 80,000,000 | 80,000,000 |

| RBC Capital Markets | | |

| 0.335%, dated 7/30/10, due 8/2/10 in the amount of $440,012,283 | | |

| (fully collateralized by $185,000,000 Certificates of Deposit, 0%-7%, | | |

| due 8/13/10-12/21/39, value $184,246,010, $80,962,044 Commercial | | |

| Paper, 0%, due 8/10/10-8/17/10, value $80,953,990 and $180,998,227 | | |

| Corporate Bonds, 1.69%-6.63%, due 4/1/11-12/15/65, value $185,446,213) | 440,000,000 | 440,000,000 |

| RBS Securities, Inc. | | |

| 0.21%, dated 7/30/10, due 8/2/10 in the amount of $500,008,750 | | |

| (fully collateralized by $458,050,000 U.S. Treasury Bonds, 4.625%, | | |

| due 2/15/40, value $510,002,418) | 500,000,000 | 500,000,000 |

| Total Repurchase Agreements | | |

| (cost $3,140,000,000) | | 3,140,000,000 |

| |

| Total Investments (cost $28,800,507,899) | 100.0% | 28,800,507,899 |

| |

| Cash and Receivables (Net) | .0% | 755,183 |

| |

| Net Assets | 100.0% | 28,801,263,082 |

|

| a Variable rate security—interest rate subject to periodic change. |

| b Securities exempt from registration under Rule 144A of the Securities Act of 1933.These securities may be resold in transactions exempt from registration, normally to qualified |

| institutional buyers. At July 31, 2010, these securities amounted to $2,759,923,478 or 9.6% of net assets. |

| c On September 7, 2008, the Federal Housing Finance Agency (“FHFA”) placed Federal National Mortgage Association and Federal Home Loan Mortgage Corporation into |

| conservatorship with FHFA as the conservator. As such, the FHFA will oversee the continuing affairs of these companies. |

| | | |

| Portfolio Summary (Unaudited)† | | | |

| |

| | Value (%) | | Value (%) |

| Banking | 79.1 | Asset-Backed/Multi-Seller Programs | 1.6 |

| Repurchase Agreements | 10.9 | Foreign/Governmental | 1.2 |

| U.S. Government Agencies | 5.2 | | |

| Finance | 2.0 | | 100.0 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

14

STATEMENT OF INVESTMENTS

July 31, 2010 (Unaudited)

| | |

| | Principal | |

| Dreyfus Cash Management Plus, Inc. | Amount ($) | Value ($) |

| Negotiable Bank Certificates of Deposit—42.1% | | |

| Banco Bilbao Vizcaya Argentaria (Yankee) | | |

| 0.55%, 8/2/10 | 200,000,000 | 200,000,056 |

| Banco Santander SA (Yankee) | | |

| 0.75%, 8/16/10 | 175,000,000 | 175,000,000 |

| Barclays Bank (Yankee) | | |

| 0.70%, 1/19/11 | 250,000,000 | 250,000,000 |

| Canadian Imperial Bank of Commerce (Yankee) | | |

| 0.36%, 8/6/10 | 200,000,000 | 200,000,000 |

| Citibank N.A. | | |

| 0.35%, 8/25/10 | 50,000,000 | 50,000,000 |

| Credit Agricole CIB (Yankee) | | |

| 0.40%, 8/6/10 | 250,000,000 | 250,000,000 |

| DZ Bank AG (Yankee) | | |

| 0.40%, 8/2/10 | 190,500,000 | 190,500,000 |

| Fortis Bank SA/NV (Yankee) | | |

| 0.45%, 10/22/10 | 100,000,000 | 100,000,000 |

| ING Bank (London) | | |

| 0.50%—0.52%, 8/23/10—10/25/10 | 250,000,000 | 250,000,000 |

| Lloyds TSB Bank (Yankee) | | |

| 0.50%—0.53%, 8/19/10—10/8/10 | 250,000,000 | 250,000,000 |

| Natixis (Yankee) | | |

| 0.70%, 10/4/10—10/7/10 | 150,000,000 | 150,000,000 |

| Royal Bank of Scotland PLC (Yankee) | | |

| 0.50%—0.51%, 8/12/10—10/25/10 | 250,000,000 | 250,000,000 |

| Societe Generale (Yankee) | | |

| 0.40%—0.53%, 8/6/10—10/18/10 | 125,000,000 | 125,000,000 |

| UBS (Yankee) | | |

| 0.75%, 1/27/11 | 200,000,000 | 200,000,000 |

| Total Negotiable Bank Certificates of Deposit | | |

| (cost $2,640,500,056) | | 2,640,500,056 |

| |

| Commercial Paper—21.5% | | |

| Abbey National North America LLC | | |

| 0.20%, 8/2/10 | 100,000,000 | 99,999,444 |

| ANZ International Ltd. | | |

| 0.53%, 9/15/10 | 250,000,000 a | 249,834,375 |

| BPCE | | |

| 0.40%, 8/4/10 | 100,000,000 | 99,996,667 |

| Commonwealth Bank of Australia | | |

| 0.48%, 9/1/10 | 150,000,000 a | 149,938,000 |

| Fortis Funding LLC | | |

| 0.65%, 9/13/10 | 150,000,000 a | 149,883,542 |

| General Electric Capital Corp. | | |

| 0.31%, 8/24/10 | 250,000,000 | 249,950,486 |

| Societe Generale N.A. Inc. | | |

| 0.50%—0.64%, 10/4/10—11/1/10 | 150,000,000 | 149,815,333 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | |

| | Principal | |

| Dreyfus Cash Management Plus, Inc. (continued) | Amount ($) | Value ($) |

| |

| Commercial Paper (continued) | | |

| Westpac Securities NZ Ltd. | | |

| 0.35%—0.52%, 8/6/10—9/3/10 | 200,000,000 a | 199,926,069 |

| Total Commercial Paper | | |

| (cost $1,349,343,916) | | 1,349,343,916 |

| |

| |

| Asset-Backed Commercial Paper—6.4% | | |

| Atlantis One Funding Corp. | | |

| 0.20%, 8/2/10 | 100,000,000 a | 99,999,444 |

| CHARTA | | |

| 0.50%, 8/23/10 | 100,000,000 a | 99,969,445 |

| Govco | | |

| 0.50%, 8/17/10 | 200,000,000 a | 199,955,556 |

| Total Asset-Backed Commercial Paper | | |

| (cost $399,924,445) | | 399,924,445 |

| |

| |

| Corporate Note—4.4% | | |

| Bank of America Securities LLC | | |

| 0.36%, 8/2/10 | | |

| (cost $275,000,000) | 275,000,000 | 275,000,000 |

| |

| |

| Time Deposits—7.2% | | |

| Commerzbank (Grand Cayman) | | |

| 0.22%, 8/2/10 | 250,000,000 | 250,000,000 |

| Nordea Bank Finland (Grand Cayman) | | |

| 0.20%, 8/2/10 | 200,000,000 | 200,000,000 |

| Total Time Deposits | | |

| (cost $450,000,000) | | 450,000,000 |

| |

| |

| Repurchase Agreements—18.2% | | |

| Barclays Capital, Inc. | | |

| 0.21%, dated 7/30/10, due 8/2/10 in the amount of $93,001,628 | | |

| (fully collateralized by $92,134,800 U.S. Treasury Notes, 3.13%, | | |

| due 5/15/19, value $94,860,037) | 93,000,000 | 93,000,000 |

| BNP Paribas | | |

| 0.19%, dated 7/30/10, due 8/2/10 in the amount of $200,003,167 | | |

| (fully collateralized by $171,462,900 U.S. Treasury Inflation Protected | | |

| Securities, 1.63%-3.88%, due 1/15/18-4/15/29, value $204,000,034) | 200,000,000 | 200,000,000 |

| Citigroup Global Markets Holdings Inc. | | |

| 0.36%, dated 7/30/10, due 8/2/10 in the amount of $100,003,000 | | |

| (fully collateralized by $191,351,396 Corporate Bonds, 0%-7.55%, | | |

| due 7/6/11-5/25/45, value $103,000,000) | 100,000,000 | 100,000,000 |

| Deutsche Bank Securities Inc. | | |

| 0.27%, dated 7/30/10, due 8/2/10 in the amount of $100,002,250 | | |

| (fully collateralized by $102,015,317 Commercial Paper, 0%, | | |

| due 8/9/10-8/18/10, value $102,000,000) | 100,000,000 | 100,000,000 |

16

| | |

| | Principal | |

| Dreyfus Cash Management Plus, Inc. (continued) | Amount ($) | Value ($) |

| |

| Repurchase Agreements (continued) | | |

| HSBC USA Inc. | | |

| 0.33%, dated 7/30/10, due 8/2/10 in the amount of $100,002,750 | | |

| (fully collateralized by $101,460,000 Corporate Bonds, 0%-2.80%, | | |

| due 4/22/13-12/2/14, value $103,002,779) | 100,000,000 | 100,000,000 |

| JPMorgan Chase & Co. | | |

| 0.33%, dated 7/30/10, due 8/2/10 in the amount of $250,006,875 | | |

| (fully collateralized by $360,068,000 Corporate Bonds, 0%-10.25%, | | |

| due 6/15/11-12/25/42, value $258,238,967) | 250,000,000 | 250,000,000 |

| RBC Capital Markets | | |

| 0.335%, dated 7/30/10, due 8/2/10 in the amount of $150,004,188 | | |

| (fully collateralized by $305,844,489 Corporate Bonds, 0%-13.24%, | | |

| due 9/14/12-8/1/75, value $154,500,000) | 150,000,000 | 150,000,000 |

| TD Securities (USA) LLC | | |

| 0.22%, dated 7/30/10, due 8/2/10 in the amount of $150,002,750 | | |

| (fully collateralized by $151,272,100 U.S. Treasury Notes, 1.38%-2%, | | |

| due 9/30/10-11/15/12, value $153,000,031) | 150,000,000 | 150,000,000 |

| Total Repurchase Agreements | | |

| (cost $1,143,000,000) | | 1,143,000,000 |

| |

| Total Investments (cost $6,257,768,417) | 99.8% | 6,257,768,417 |

| |

| Cash and Receivables (Net) | .2% | 13,495,342 |

| |

| Net Assets | 100.0% | 6,271,263,759 |

|

| a Securities exempt from registration under Rule 144A of the Securities Act of 1933.These securities may be resold in transactions exempt from registration, normally to qualified |

| institutional buyers. At July 31, 2010, these securities amounted to $1,149,506,431 or 18.3% of net assets. |

| | | |

| Portfolio Summary (Unaudited)† | | | |

| |

| | Value (%) | | Value (%) |

| Banking | 76.0 | Asset-Backed/Multi-Seller Programs | 1.6 |

| Repurchase Agreements | 18.2 | | |

| Finance | 4.0 | | 99.8 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

STATEMENT OF INVESTMENTS

July 31, 2010 (Unaudited)

| | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Government Cash Management | Purchase (%) | Amount ($) | Value ($) |

| |

| U.S. Government Agencies—62.3% | | | |

| Federal Farm Credit Bank: | | | |

| 8/4/10 | 0.40 | 25,000,000 a | 24,945,910 |

| 2/6/12 | 0.44 | 80,000,000 a | 79,887,892 |

| Federal Home Loan Bank: | | | |

| 8/2/10 | 0.39 | 197,500,000 a | 197,500,000 |

| 8/2/10 | 0.44 | 500,000,000 a | 500,000,000 |

| 8/23/10 | 0.32 | 971,250,000 a | 971,191,493 |

| 10/15/10 | 0.44 | 650,000,000 a | 649,685,971 |

| 10/15/10 | 0.45 | 32,900,000 | 32,897,591 |

| 10/15/10 | 0.48 | 1,000,000,000 a | 1,000,000,000 |

| 10/22/10 | 0.19 | 20,000,000 | 19,991,344 |

| 10/28/10 | 0.35 | 100,000,000 | 100,023,366 |

| 11/2/10 | 0.22 | 225,000,000 | 227,281,978 |

| 11/10/10 | 0.32 | 879,000,000 | 878,886,301 |

| 11/10/10 | 0.32 | 25,000,000 | 24,996,707 |

| 11/15/10 | 0.47 | 50,000,000 | 50,082,812 |

| 12/15/10 | 0.28 | 96,492,000 | 96,389,933 |

| 12/22/10 | 0.25 | 200,000,000 | 199,801,389 |

| 1/18/11 | 0.42 | 200,000,000 | 200,296,811 |

| 1/19/11 | 0.24 | 518,000,000 | 517,409,480 |

| 5/25/11 | 0.25 | 560,000,000 a | 560,000,000 |

| 5/27/11 | 0.25 | 500,000,000 a | 500,000,000 |

| 8/17/11 | 0.30 | 500,000,000 a | 499,894,527 |

| Federal Home Loan Mortgage Corp.: | | | |

| 8/19/10 | 0.38 | 305,810,000 a,b | 305,529,552 |

| 9/21/10 | 0.22 | 250,000,000 b | 249,922,083 |

| 10/19/10 | 0.24 | 500,000,000 b | 499,736,667 |

| 10/25/10 | 0.27 | 25,000,000 b | 24,984,063 |

| 10/26/10 | 0.26 | 301,410,000 b | 301,224,929 |

| 10/27/10 | 0.28 | 336,000,000 b | 335,772,640 |

| 11/2/10 | 0.27 | 421,000,000 b | 420,709,207 |

| 11/16/10 | 0.31 | 500,000,000 b | 499,539,306 |

| 11/17/10 | 0.25 | 250,000,000 b | 249,812,500 |

| 11/23/10 | 0.32 | 352,000,000 b | 351,648,880 |

| 12/6/10 | 0.28 | 300,000,000 b | 299,708,958 |

| 12/8/10 | 0.26 | 150,000,000 b | 149,860,250 |

| 12/8/10 | 0.28 | 150,000,000 b | 149,852,188 |

| 12/21/10 | 0.30 | 200,000,000 b | 199,763,333 |

| Federal National Mortgage Association: | | | |

| 9/1/10 | 0.30 | 1,000,000,000 b | 999,741,667 |

| 9/20/10 | 0.25 | 975,000,000 b | 974,661,458 |

| 10/18/10 | 0.26 | 360,000,000 b | 359,797,200 |

| 10/20/10 | 0.27 | 50,000,000 b | 49,970,000 |

| 10/25/10 | 0.27 | 500,000,000 b | 499,681,250 |

| 11/15/10 | 0.33 | 550,000,000 b | 549,465,583 |

| 11/15/10 | 0.38 | 137,731,000 b | 140,222,120 |

| 12/20/10 | 0.25 | 250,000,000 b | 249,755,208 |

| 12/22/10 | 0.25 | 218,000,000 b | 217,783,514 |

| 12/29/10 | 0.25 | 376,442,000 b | 376,056,637 |

| 1/18/11 | 0.30 | 250,000,000 b | 249,645,833 |

| Total U.S. Government Agencies | | | |

| (cost $16,036,008,531) | | | 16,036,008,531 |

18

| | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Government Cash Management (continued) | Purchase (%) | Amount ($) | Value ($) |

| |

| Asset-Backed Commercial Paper—6.5% | | | |

| Straight-A Funding LLC | | | |

| 8/2/10 | 0.30 | 125,000,000 c | 124,998,958 |

| 8/2/10 | 0.39 | 550,000,000 c | 549,994,042 |

| 9/1/10 | 0.43 | 125,000,000 c | 124,953,715 |

| 9/1/10 | 0.43 | 100,000,000 c | 99,962,972 |

| 9/7/10 | 0.41 | 194,000,000 c | 193,918,251 |

| 9/9/10 | 0.40 | 106,000,000 c | 105,954,067 |

| 10/4/10 | 0.36 | 150,000,000 c | 149,904,000 |

| 10/25/10 | 0.33 | 321,805,000 c | 321,554,260 |

| Total Asset-Backed Commercial Paper | | | |

| (cost $1,671,240,265) | | | 1,671,240,265 |

| |

| |

| Repurchase Agreements—30.8% | | | |

| Banc of America Securities LLC | | | |

| dated 7/30/10, due 8/2/10 in the amount of $700,011,083 | | | |

| (fully collateralized by $194,183,600 U.S. Treasury Bonds, 4.38%, | | | |

| due 5/15/40, value $205,647,292 and $466,244,500 U.S. Treasury Notes, | | | |

| 1.38%-5.13%, due 6/30/11-2/15/17, value $508,352,756) | 0.19 | 700,000,000 | 700,000,000 |

| Barclays Capital, Inc. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $876,015,330 | | | |

| (fully collateralized by $850,873,400 U.S. Treasury Notes, | | | |

| 2.13%-3.38%, due 6/30/13-12/31/16, value $893,520,015) | 0.21 | 876,000,000 | 876,000,000 |

| BNP Paribas | | | |

| dated 7/30/10, due 8/2/10 in the amount of $1,200,019,000 | | | |

| (fully collateralized by $1,166,281,000 U.S. Treasury Notes, | | | |

| 1%-5%, due 7/31/11-3/31/16, value $1,224,000,110) | 0.19 | 1,200,000,000 | 1,200,000,000 |

| Citigroup Global Markets Holdings Inc. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $100,001,750 | | | |

| (fully collateralized by $44,159,500 U.S. Treasury Inflation Protected | | | |

| Securities, 3.50%, due 1/15/11, value $56,218,691 and $44,835,000 | | | |

| U.S. Treasury Notes, 1.38%, due 2/15/13, value $45,781,344) | 0.21 | 100,000,000 | 100,000,000 |

| Credit Agricole | | | |

| dated 7/30/10, due 8/2/10 in the amount of $900,015,000 | | | |

| (fully collateralized by $645,000,000 Federal Home Loan Bank, | | | |

| 0.35%-0.54%, due 2/1/11-7/8/11, value $646,029,450 and | | | |

| $272,571,000 Federal National Mortgage Association, 0%, | | | |

| due 4/26/11-4/29/11, value $271,971,344) | 0.20 | 900,000,000 | 900,000,000 |

| Credit Suisse Securities LLC | | | |

| dated 7/30/10, due 8/2/10 in the amount of $900,015,000 (fully | | | |

| collateralized by $753,775,900 U.S. Treasury Inflation Protected | | | |

| Securities, 1.88%-2.38%, due 7/15/13-1/15/17, value $918,004,272) | 0.20 | 900,000,000 | 900,000,000 |

| Deutsche Bank Securities Inc. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $1,000,016,667 (fully | | | |

| collateralized by $138,794,100 U.S. Treasury Bills, due 10/7/10-12/23/10, | | | |

| value $138,726,546, $251,038,900 U.S. Treasury Bonds, 4.63%-8.75%, | | | |

| due 5/15/17-2/15/40, value $335,865,235 and $522,364,800 U.S. Treasury | | | |

| Notes, 0.75%-5.75%, due 8/15/10-7/31/14, value $545,408,332) | 0.20 | 1,000,000,000 | 1,000,000,000 |

| Goldman, Sachs & Co. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $36,000,420 (fully collateralized | | | |

| by $36,419,200 U.S. Treasury Notes, 1.13%, due 6/30/11, value $36,720,027) | 0.14 | 36,000,000 | 36,000,000 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Government Cash Management (continued) | Purchase (%) | Amount ($) | Value ($) |

| |

| Repurchase Agreements (continued) | | | |

| Morgan Stanley | | | |

| dated 7/30/10, due 8/2/10 in the amount of $300,005,000 | | | |

| (fully collateralized by $299,526,600 U.S. Treasury Inflation | | | |

| Protected Securities, 0.50%, due 4/15/15, value $306,000,045) | 0.20 | 300,000,000 | 300,000,000 |

| RBC Capital Markets | | | |

| dated 7/30/10, due 8/2/10 in the amount of $450,007,500 (fully | | | |

| collateralized by $74,858,000 U.S. Treasury Bonds, 9.25%, due 2/15/16, | | | |

| value $107,050,803 and $340,633,300 U.S. Treasury Notes, 1%-7.13%, | | | |

| due 9/30/11-2/15/23, value $351,949,239) | 0.20 | 450,000,000 | 450,000,000 |

| RBS Securities, Inc. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $200,003,333 (fully | | | |

| collateralized by $7,450,000 International Bank for Reconstruction and | | | |

| Development, 2%, due 4/2/12, value $7,653,873, $162,205,000 | | | |

| International Finance Corp., 2%, due 10/29/12, value $163,548,953 and | | | |

| $31,940,000 U.S. Treasury Notes, 1.88%, due 6/15/12, value $32,798,396) | 0.20 | 200,000,000 | 200,000,000 |

| Societe Generale | | | |

| dated 7/30/10, due 8/2/10 in the amount of $1,000,015,833 (fully | | | |

| collateralized by $10,000,000 Federal Home Loan Mortgage Corp., 4.50%, | | | |

| due 5/20/25, value $10,227,300, $50,216,000 Federal National Mortgage | | | |

| Association, 4%-5%, due 4/22/22-11/26/29, value $50,984,616, $33,992,000 | | | |

| U.S. Treasury Inflation Protected Securities, 2.38%, due 1/15/25, value | | | |

| $42,938,616, $375,127,300 U.S. Treasury Notes, 1.75%-3.13%, | | | |

| due 4/15/13-4/30/17, value $389,915,176 and $1,014,500,000 | | | |

| U.S. Treasury Strips, due 8/15/16-5/15/37, value $525,934,368) | 0.19 | 1,000,000,000 | 1,000,000,000 |

| UBS Securities LLC | | | |

| dated 7/30/10, due 8/2/10 in the amount of $250,004,167 (fully collateralized | | | |

| by $255,503,000 U.S. Treasury Bills, due 1/6/11-7/28/11, value $255,001,114) | 0.20 | 250,000,000 | 250,000,000 |

| Total Repurchase Agreements | | | |

| (cost $7,912,000,000) | | | 7,912,000,000 |

| |

| Total Investments (cost $25,619,248,796) | | 99.6% | 25,619,248,796 |

| |

| Cash and Receivables (Net) | | .4% | 93,980,223 |

| |

| Net Assets | | 100.0% | 25,713,229,019 |

|

| a Variable rate security—interest rate subject to periodic change. |

| b On September 7, 2008, the Federal Housing Finance Agency (“FHFA”) placed Federal National Mortgage Association and Federal Home Loan Mortgage Corporation into |

| conservatorship with FHFA as the conservator. As such, the FHFA will oversee the continuing affairs of these companies. |

| c Securities exempt from registration under Rule 144A of the Securities Act of 1933.These securities may be resold in transactions exempt from registration, normally to qualified |

| institutional buyers. At July 31, 2010, these securities amounted to $1,671,240,265 or 6.5% of net assets. |

| | | |

| Portfolio Summary (Unaudited)† | | | |

| |

| | Value (%) | | Value (%) |

| Repurchase Agreements | 30.8 | Asset-Backed/Commercial Paper | 6.5 |

| Federal Home Loan Bank | 28.1 | Federal Farm Credit Bank | .4 |

| Federal National Mortgage Association | 18.1 | | |

| Federal Home Loan Mortgage Corp. | 15.7 | | 99.6 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

20

STATEMENT OF INVESTMENTS

July 31, 2010 (Unaudited)

| | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Government Prime Cash Management | Purchase (%) | Amount ($) | Value ($) |

| |

| U.S. Government Agencies—93.1% | | | |

| Federal Farm Credit Bank: | | | |

| 8/6/10 | 0.40 | 328,000,000 a | 328,037,573 |

| 8/9/10 | 0.18 | 15,000,000 | 14,999,400 |

| 8/10/10 | 0.21 | 25,000,000 | 24,998,687 |

| 8/23/10 | 0.32 | 100,000,000 a | 99,929,572 |

| 8/27/10 | 0.34 | 412,000,000 a | 411,982,637 |

| 9/28/10 | 0.25 | 50,000,000 | 49,979,861 |

| 12/15/10 | 0.32 | 50,000,000 | 49,939,556 |

| 12/17/10 | 0.21 | 25,500,000 a | 25,499,026 |

| 1/5/11 | 0.21 | 30,000,000 a | 29,998,696 |

| 2/6/12 | 0.44 | 75,000,000 a | 74,894,899 |

| Federal Home Loan Bank: | | | |

| 8/2/10 | 0.06 | 334,000,000 | 333,999,443 |

| 8/2/10 | 0.44 | 250,000,000 a | 250,000,000 |

| 8/5/10 | 0.11 | 130,175,000 | 130,173,409 |

| 8/10/10 | 0.11 | 99,275,000 | 99,272,270 |

| 8/18/10 | 0.18 | 300,000,000 | 299,975,208 |

| 9/15/10 | 0.16 | 50,000,000 | 49,990,313 |

| 9/17/10 | 0.15 | 100,000,000 | 99,980,417 |

| 9/29/10 | 0.19 | 300,000,000 | 299,909,042 |

| 10/15/10 | 0.19 | 249,500,000 | 249,403,323 |

| 10/22/10 | 0.19 | 80,000,000 | 79,965,378 |

| 11/10/10 | 0.28 | 125,000,000 | 124,998,106 |

| 11/24/10 | 0.32 | 287,000,000 | 287,155,308 |

| 11/26/10 | 0.32 | 100,000,000 | 99,994,277 |

| 12/9/10 | 0.31 | 150,000,000 | 149,999,893 |

| 12/10/10 | 0.27 | 77,715,000 | 78,957,041 |

| 12/17/10 | 0.25 | 16,345,000 | 16,551,928 |

| 12/22/10 | 0.26 | 200,000,000 | 199,797,417 |

| 1/18/11 | 0.36 | 200,000,000 | 200,352,645 |

| Total U.S. Government Agencies | | | |

| (cost $4,160,735,325) | | | 4,160,735,325 |

| |

| |

| U.S. Treasury Bills—6.7% | | | |

| 8/26/10 | | | |

| (cost $299,967,708) | 0.16 | 300,000,000 | 299,967,708 |

| |

| Total Investments (cost $4,460,703,033) | | 99.8% | 4,460,703,033 |

| |

| Cash and Receivables (Net) | | .2% | 7,946,795 |

| |

| Net Assets | | 100.0% | 4,468,649,828 |

| |

| a | Variable rate security—interest rate subject to periodic change. |

| | | |

| Portfolio Summary (Unaudited)† | | | |

| | Value (%) | | Value (%) |

| Federal Home Loan Bank | 68.3 | U.S. Treasury Bills | 6.7 |

| Federal Farm Credit Bank | 24.8 | | 99.8 |

|

| † Based on net assets. |

| See notes to financial statements. |

STATEMENT OF INVESTMENTS

July 31, 2010 (Unaudited)

| | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Treasury & Agency Cash Management | Purchase (%) | Amount ($) | Value ($) |

| U.S. Treasury Bills—22.4% | | | |

| 8/12/10 | 0.13 | 700,000,000 | 699,971,583 |

| 9/9/10 | 0.20 | 250,000,000 | 249,945,833 |

| 10/7/10 | 0.26 | 430,000,000 | 429,795,929 |

| 10/14/10 | 0.24 | 500,000,000 | 499,758,472 |

| 12/2/10 | 0.20 | 400,000,000 | 399,726,667 |

| 1/13/11 | 0.20 | 250,000,000 | 249,776,563 |

| Total U.S. Treasury Bills | | | |

| (cost $2,528,975,047) | | | 2,528,975,047 |

| |

| U.S. Treasury Notes—47.0% | | | |

| 8/2/10 | 0.11 | 1,357,000,000 | 1,357,095,089 |

| 8/16/10 | 0.27 | 240,000,000 | 240,381,896 |

| 8/31/10 | 0.31 | 350,000,000 | 350,588,217 |

| 9/15/10 | 0.26 | 225,000,000 | 225,989,858 |

| 9/30/10 | 0.21 | 1,093,100,000 | 1,096,297,451 |

| 11/1/10 | 0.21 | 225,615,000 | 226,330,857 |

| 11/15/10 | 0.30 | 170,000,000 | 172,069,990 |

| 11/30/10 | 0.24 | 485,000,000 | 486,615,813 |

| 12/15/10 | 0.30 | 225,000,000 | 228,390,929 |

| 12/31/10 | 0.25 | 380,000,000 | 380,967,332 |

| 5/31/11 | 0.27 | 300,000,000 | 311,392,206 |

| 8/1/11 | 1.89 | 200,000,000 | 209,011,929 |

| Total U.S. Treasury Notes | | | |

| (cost $5,285,131,567) | | | 5,285,131,567 |

| |

| Repurchase Agreements—30.2% | | | |

| Banc of America Securities LLC | | | |

| dated 7/30/10, due 8/2/10 in the amount of $50,000,833 | | | |

| (fully collateralized by $51,821,925 Government National | | | |

| Mortgage Association, 4.50%-5%, due 7/15/39-8/15/39, | | | |

| value $51,000,000) | 0.20 | 50,000,000 | 50,000,000 |

| Barclays Capital, Inc. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $657,011,498 | | | |

| (fully collateralized by $102,054,800 U.S. Treasury Bills, | | | |

| due 9/9/10-1/13/11, value $102,000,022 and $486,232,800 | | | |

| U.S. Treasury Notes, 4.50%-4.75%, due 2/15/17-8/15/17, | | | |

| value $568,140,077) | 0.21 | 657,000,000 | 657,000,000 |

| BNP Paribas | | | |

| dated 7/30/10, due 8/2/10 in the amount of $800,012,667 | | | |

| (fully collateralized by $79,806,300 U.S. Treasury Bills, | | | |

| due 1/13/11, value $79,739,263 and $719,020,100 | | | |

| U.S. Treasury Notes, 1%-2%, due 12/31/11-11/30/13, | | | |

| value $736,260,798) | 0.19 | 800,000,000 | 800,000,000 |

22

| | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Treasury & Agency Cash Management (continued) | Purchase (%) | Amount ($) | Value ($) |

| |

| Repurchase Agreements (continued) | | | |

| Credit Agricole | | | |

| dated 7/30/10, due 8/2/10 in the amount of $500,008,333 (fully collateralized | | | |

| by $51,063,500 U.S. Treasury Bills, due 8/19/10-7/28/11, value $50,947,243, | | | |

| $7,863,000 U.S. Treasury Bonds, 4.38%-4.63%, due 2/15/40-5/15/40, | | | |

| value $8,661,828, $10,000,000 U.S. Treasury Inflation Protected Securities, | | | |

| 0.63%, due 4/15/13, value $10,559,515 and $417,732,700 U.S. Treasury Notes, | | | |

| 0.88%-4.88%, due 2/28/11-5/15/20, value $439,831,417) | 0.20 | 500,000,000 | 500,000,000 |

| Credit Suisse Securities LLC | | | |

| dated 7/30/10, due 8/2/10 in the amount of $100,001,667 | | | |

| (fully collateralized by $94,235,000 U.S. Treasury Bonds, | | | |

| 4.50%, due 5/15/38, value $102,002,174) | 0.20 | 100,000,000 | 100,000,000 |

| Deutsche Bank Securities Inc. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $100,001,667 | | | |

| (fully collateralized by $404,529,376 Government National Mortgage | | | |

| Association, 4%-7%, due 4/15/19-6/15/50, value $102,000,000) | 0.20 | 100,000,000 | 100,000,000 |

| HSBC USA Inc. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $400,006,000 (fully | | | |

| collateralized by $37,589,000 U.S. Treasury Bonds, 8.13%, due 5/15/21, | | | |

| value $55,305,072 and $334,911,000 U.S. Treasury Notes, 1.75%-4.13%, | | | |

| due 8/15/12-4/15/13, value $352,699,747) | 0.18 | 400,000,000 | 400,000,000 |

| JPMorgan Chase & Co. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $200,003,167 | | | |

| (fully collateralized by $244,572,959 Government National Mortgage | | | |

| Association, 4%-12%, due 5/15/13-4/15/52, value $204,000,216) | 0.19 | 200,000,000 | 200,000,000 |

| RBC Capital Markets | | | |

| dated 7/30/10, due 8/2/10 in the amount of $200,003,333 (fully | | | |

| collateralized by $25,790,000 U.S. Treasury Bills, due 9/23/10, | | | |

| value $25,783,578 and $170,358,600 U.S. Treasury Notes, | | | |

| 1.38%-4.75%, due 2/28/11-3/31/16, value $178,216,516) | 0.20 | 200,000,000 | 200,000,000 |

| RBS Securities, Inc. | | | |

| dated 7/30/10, due 8/2/10 in the amount of $400,006,667 | | | |

| (fully collateralized by $392,826,700 U.S. Treasury Notes, | | | |

| 1.75%-3%, due 3/31/14-2/28/17, value $408,003,914) | 0.20 | 400,000,000 | 400,000,000 |

| Total Repurchase Agreements | | | |

| (cost $3,407,000,000) | | | 3,407,000,000 |

| |

| Total Investments (cost $11,221,106,614) | | 99.6% | 11,221,106,614 |

| |

| Cash and Receivables (Net) | | .4% | 47,668,489 |

| |

| Net Assets | | 100.0% | 11,268,775,103 |

| | | |

| Portfolio Summary (Unaudited)† | | | |

| | Value (%) | | Value (%) |

| U.S. Treasury Notes | 47.0 | U.S. Treasury Bills | 22.4 |

| Repurchase Agreements | 30.2 | | 99.6 |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

STATEMENT OF INVESTMENTS

July 31, 2010 (Unaudited)

| | | |

| | Annualized | | |

| | Yield on | | |

| | Date of | Principal | |

| Dreyfus Treasury Prime Cash Management | Purchase (%) | Amount ($) | Value ($) |

| U.S. Treasury Bills—76.2% | | | |

| 8/5/10 | 0.16 | 1,371,000,000 | 1,370,975,512 |

| 8/12/10 | 0.13 | 2,935,000,000 | 2,934,883,492 |

| 8/19/10 | 0.14 | 485,000,000 | 484,965,465 |

| 8/26/10 | 0.15 | 594,000,000 | 593,936,903 |

| 9/2/10 | 0.16 | 950,000,000 | 949,868,000 |

| 9/9/10 | 0.13 | 1,300,000,000 | 1,299,823,958 |

| 9/16/10 | 0.12 | 1,326,000,000 | 1,325,798,999 |

| 9/23/10 | 0.16 | 2,060,000,000 | 2,059,515,715 |

| 9/30/10 | 0.21 | 1,343,000,000 | 1,342,530,067 |

| 10/28/10 | 0.15 | 1,000,000,000 | 999,633,333 |

| 12/30/10 | 0.19 | 700,000,000 | 699,456,820 |

| 1/13/11 | 0.20 | 1,000,000,000 | 999,106,250 |

| 1/27/11 | 0.20 | 437,000,000 | 436,576,292 |

| Total U.S. Treasury Bills | | | |

| (cost $15,497,070,806) | | | 15,497,070,806 |

| |

| U.S. Treasury Notes—27.6% | | | |

| 8/2/10 | 0.12 | 860,000,000 | 860,060,109 |

| 8/16/10 | 0.18 | 573,000,000 | 573,924,956 |

| 8/16/10 | 0.19 | 765,000,000 | 766,743,522 |

| 8/31/10 | 0.17 | 490,000,000 | 490,877,844 |

| 9/15/10 | 0.14 | 723,000,000 | 726,295,680 |

| 9/30/10 | 0.16 | 1,546,000,000 | 1,550,639,749 |

| 10/15/10 | 0.14 | 75,000,000 | 75,630,203 |

| 11/30/10 | 0.16 | 400,000,000 | 401,430,692 |

| 1/31/11 | 0.22 | 176,000,000 | 176,543,777 |

| Total U.S. Treasury Notes | | | |

| (cost $5,622,146,532) | | | 5,622,146,532 |

| |

| Total Investments (cost $21,119,217,338) | | 103.8% | 21,119,217,338 |

| Liabilities, Less Cash and Receivables | | (3.8%) | (770,600,072) |

| Net Assets | | 100.0% | 20,348,617,266 |

| | | |

| Portfolio Summary (Unaudited)† | | | |

| | Value (%) | | Value (%) |

| U.S. Treasury Bills | 76.2 | U.S. Treasury Notes | 27.6 |

| | | | 103.8 |

|

| † Based on net assets. |

| See notes to financial statements. |

24

STATEMENT OF INVESTMENTS

July 31, 2010 (Unaudited)

| | | | |

| | Coupon | Maturity | Principal | |

| Dreyfus Municipal Cash Management Plus | Rate (%) | Date | Amount ($) | Value ($) |

| |

| Short-Term Investments—99.5% | | | | |

| Alabama—1.7% | | | | |

| Macon Trust Various Certificates (Spanish Fort Redevelopment | | | | |

| Authority, Revenue (Spanish Fort Town Center)) (Liquidity | | | | |

| Facility; Bank of America and LOC; Bank of America) | 0.40 | 8/7/10 | 20,750,000 a,b | 20,750,000 |

| Arizona—2.4% | | | | |

| Arizona Health Facilities Authority, Revenue | | | | |

| (La Loma Village) (LOC; Banco Santander) | 0.49 | 8/7/10 | 9,700,000 a | 9,700,000 |

| JPMorgan Chase Putters and Drivers Trust (Salt River Project | | | | |

| Agricultural Improvement and Power District, Salt River Project | | | | |

| Electric System Revenue) (Liquidity Facility; JPMorgan Chase Bank) | 0.28 | 8/7/10 | 8,500,000 a,b | 8,500,000 |

| Maricopa County Industrial Development Authority, MFHR (San Clemente | | | | |

| Apartments Project) (Liquidity Facility; FNMA and LOC; FNMA) | 0.34 | 8/7/10 | 1,010,000 a | 1,010,000 |

| Maricopa County Industrial Development Authority, | | | | |

| MFHR, Refunding (San Clemente Apartments Project) | | | | |

| (Liquidity Facility; FNMA and LOC; FNMA) | 0.29 | 8/7/10 | 7,600,000 a | 7,600,000 |

| Yavapai County Industrial Development Authority, HR (Northern | | | | |

| Arizona Healthcare System) (LOC; Banco Bilbao Vizcaya Argentaria) | 0.38 | 8/7/10 | 3,400,000 a | 3,400,000 |

| California—2.1% | | | | |

| California Infrastructure and Economic Development Bank, | | | | |

| Revenue (California Academy of Sciences, San Francisco, | | | | |

| California) (LOC; Allied Irish Banks) | 1.25 | 8/1/10 | 5,000,000 a | 5,000,000 |

| California Statewide Communities Development Authority, | | | | |

| MFHR (Liquidity Facility; FHLMC and LOC; FHLMC) | 0.37 | 8/7/10 | 13,995,000 a,b | 13,995,000 |

| Los Angeles Department of Water and Power, Revenue, CP | | | | |

| (Liquidity Facility; Banco Bilbao Vizcaya Argentaria) | 0.55 | 8/19/10 | 7,500,000 | 7,500,000 |

| Colorado—2.7% | | | | |

| Colorado, Revenue, TRAN (Education Loan Program) | 1.50 | 8/12/10 | 21,000,000 | 21,007,674 |

| Colorado Housing and Finance Authority, EDR | | | | |

| (Popiel Properties, LLC Project) (LOC; Wells Fargo Bank) | 0.54 | 8/7/10 | 2,915,000 a | 2,915,000 |

| Colorado Housing and Finance Authority, | | | | |

| EDR (Wanco Inc. Project) (LOC; U.S. Bank NA) | 0.54 | 8/7/10 | 2,635,000 a | 2,635,000 |

| Erie, COP (Lease Purchase Agreement) (LOC; Key Bank) | 1.00 | 8/7/10 | 4,070,000 a | 4,070,000 |

| Southglenn Metropolitan District, Special Revenue (LOC; BNP Paribas) | 0.30 | 8/7/10 | 2,950,000 a | 2,950,000 |

| Connecticut—.6% | | | | |

| Connecticut Health and Educational Facilities Authority, Revenue | | | | |

| (Yale University Issue) (Liquidity Facility; Wells Fargo Bank) | 0.28 | 8/7/10 | 7,300,000 a,b | 7,300,000 |

| District of Columbia—5.2% | | | | |

| District of Columbia, Revenue, CP | | | | |

| (National Academy of Sciences) (LOC; Bank of America) | 0.37 | 10/19/10 | 10,000,000 | 10,000,000 |

| Metropolitan Washington Airports Authority, Airport System | | | | |

| Revenue (Liquidity Facility; Landesbank Baden-Wurttemberg) | 0.45 | 8/7/10 | 15,000,000 a | 15,000,000 |

| Metropolitan Washington Airports Authority, Airport System | | | | |

| Revenue (Liquidity Facility; Landesbank Baden-Wurttemberg) | 0.45 | 8/7/10 | 25,000,000 a | 25,000,000 |

| Metropolitan Washington Airports Authority, | | | | |

| Airport System Revenue (LOC; Wachovia Bank) | 0.32 | 8/7/10 | 14,700,000 a | 14,700,000 |

| Florida—10.0% | | | | |

| Broward County Housing Finance Authority, MFHR | | | | |

| (Cypress Grove Apartments Project) (LOC; FNMA) | 0.33 | 8/7/10 | 13,230,000 a | 13,230,000 |

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | |

| Dreyfus Municipal | Coupon | Maturity | Principal | |

| Cash Management Plus (continued) | Rate (%) | Date | Amount ($) | Value ($) |

| Short-Term Investments (continued) | | | | |

| Florida (continued) | | | | |

| Citizens Property Insurance Corporation, | | | | |

| High-Risk Account Senior Secured Revenue | 2.00 | 4/21/11 | 20,000,000 | 20,102,432 |

| Escambia County Health Facilities Authority, Healthcare | | | | |

| Facilities Revenue, Refunding (Azalea Trace, Inc. | | | | |

| Obligated Group) (LOC; Bank of America) | 0.36 | 8/1/10 | 19,695,000 a | 19,695,000 |

| Florida Local Government Finance Commission, | | | | |

| Pooled Loan Program Revenue, CP (LOC; Bank of America) | 0.35 | 9/14/10 | 21,905,000 | 21,905,000 |

| Florida Local Government Finance Commission, | | | | |

| Pooled Loan Program Revenue, CP (LOC; Wachovia Bank) | 0.39 | 9/14/10 | 13,151,000 | 13,151,000 |

| Florida Local Government Finance Commission, | | | | |

| Pooled Loan Program Revenue, CP (LOC; Wachovia Bank) | 0.45 | 9/14/10 | 13,130,000 | 13,130,000 |

| Greater Orlando Aviation Authority, Airport Facility Revenue | | | | |

| (FlightSafety International Inc. Project) (Insured; | | | | |

| Berkshire Hathaway Assurance Corporation) | 0.25 | 8/7/10 | 6,700,000 a | 6,700,000 |

| Orange County Health Facilities Authority, HR | | | | |

| (Orlando Regional Healthcare System) | | | | |

| (Insured; Assured Guaranty Municipal Corp. | | | | |

| and Liquidity Facility; Dexia Credit Locale) | 0.43 | 8/1/10 | 15,850,000 a | 15,850,000 |

| Georgia—3.2% | | | | |